13 minute read

Is Exness Safe in Pakistan? Is it Legal?

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness as a Trading Platform

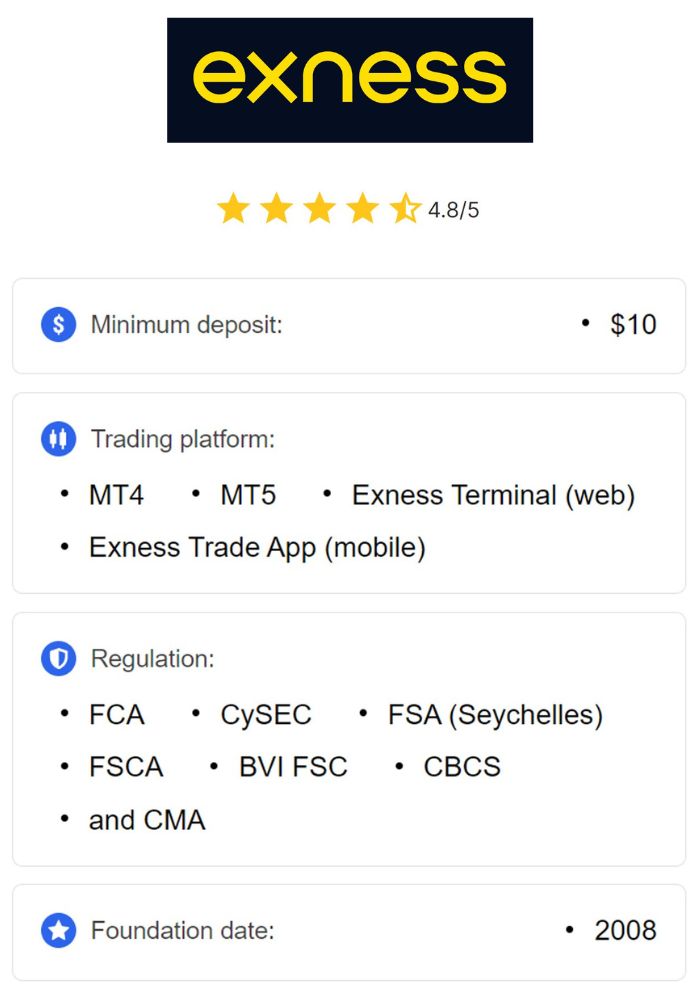

Exness is a globally recognized online trading platform, well-known for providing access to a wide variety of financial instruments, including forex, commodities, indices, and cryptocurrencies. Founded in 2008, Exness has gained substantial popularity among traders worldwide due to its user-friendly interface, excellent customer service, and a wide range of account types suitable for both novice and experienced traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The platform supports multiple languages and offers advanced trading tools like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its own proprietary web terminal. Traders can enjoy competitive spreads, low commission rates, and flexible leverage, which have contributed to Exness’s growing reputation in the trading community.

Exness’s commitment to customer satisfaction, transparency, and advanced technology has made it a trusted name in the online trading industry. However, for traders in specific countries, such as Pakistan, the safety and legal status of using Exness remains a key concern.

Key Features of Exness

Exness offers several features that cater to both novice and advanced traders. Some of the standout features include:

Multiple Account Types: Exness provides various account types such as Standard, Professional, and Cent Accounts. These options allow traders to choose accounts that best match their trading experience and capital.

Regulated by International Bodies: Exness is regulated by several international financial authorities, including the UK’s FCA (Financial Conduct Authority) and Cyprus’s CySEC (Cyprus Securities and Exchange Commission), which ensures a high level of credibility and safety for traders.

Wide Range of Trading Instruments: Traders on Exness can access a wide range of markets, including forex pairs, indices, commodities, and cryptocurrencies. This diversity allows traders to diversify their portfolios and manage risks better.

Competitive Spreads and Leverage: Exness offers competitive spreads and high leverage, providing flexibility to traders when executing their trades. This feature can be particularly attractive to Pakistani traders looking for opportunities to maximize their capital.

Educational Resources: Exness is committed to educating traders through webinars, tutorials, and other materials to improve their skills and make more informed decisions.

With such features in place, Exness aims to serve as a comprehensive trading platform for traders around the globe. However, the question remains: is it safe and legal for traders in Pakistan?

Understanding Forex Trading in Pakistan

Popularity of Forex Trading Among Pakistanis

Forex trading in Pakistan has grown significantly over the past few years. The popularity of trading foreign currencies stems from its potential to generate high returns in the international market. The advent of online trading platforms like Exness has made it easier for individuals to participate in the forex market from the comfort of their homes.

Pakistani traders are increasingly turning to forex due to the flexibility it offers, allowing them to trade 24/7 and leverage small amounts of capital. Many traders also view forex as a way to hedge against the local currency’s depreciation, especially in the face of economic challenges like inflation and devaluation.

Despite the rise in forex trading, the regulatory environment surrounding it remains somewhat complex. While there is a growing number of people engaging in forex trading, it is essential for traders to understand the legal framework governing this activity in Pakistan before proceeding with any investments.

Regulatory Environment for Forex Trading

The forex trading landscape in Pakistan is regulated by the Securities and Exchange Commission of Pakistan (SECP). The SECP oversees financial markets, ensuring that trading activities are conducted fairly and transparently. However, it is important to note that the SECP has not yet formally approved any foreign forex broker, including Exness, for operating directly within the country. This regulatory gap raises concerns for many traders.

The State Bank of Pakistan (SBP) also plays a role in regulating the flow of foreign exchange and enforces restrictions on the use of foreign currency accounts. Despite this, many Pakistani traders still use international brokers like Exness to access global forex markets.

Thus, while forex trading itself is not illegal, the absence of clear regulations for foreign brokers operating in Pakistan does create some ambiguity. Traders need to carefully consider the legal landscape before choosing to trade with platforms like Exness.

Legal Status of Exness in Pakistan

Registration and Licensing of Exness

Exness is a regulated and licensed broker that operates under multiple international regulatory authorities. It is authorized by regulatory bodies such as the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and others. These licenses and registrations ensure that Exness adheres to global financial standards, offering its clients protection against fraudulent practices and guaranteeing transparency in its operations.

However, Exness does not have a specific license from the Securities and Exchange Commission of Pakistan (SECP). This means that while Exness is regulated in various countries, it is not officially authorized to operate directly within Pakistan. Despite this, Pakistani traders still engage with the platform as it provides access to global forex markets and offers robust security and customer service.

Given that the SECP does not have specific regulations regarding foreign forex brokers, traders in Pakistan are generally free to trade with international brokers like Exness, but they should be cautious and well-informed about the legal implications.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Compliance with Local Laws

Exness does not specifically cater to the Pakistani market, but it does not prevent Pakistani traders from using its platform. As per local laws, forex trading is allowed, but the lack of a clear regulatory framework for foreign brokers operating in Pakistan means that traders are taking on some level of risk.

Traders should ensure they are not violating any local regulations, particularly when it comes to foreign currency accounts and international financial transactions. While using Exness, traders should comply with any regulations set by the State Bank of Pakistan regarding cross-border transactions. Additionally, Pakistani traders should ensure they are aware of the potential tax implications of trading with international brokers.

Safety Measures Implemented by Exness

Security of Client Funds

Exness prioritizes the security of client funds, which is one of the primary concerns for traders. The platform ensures that client funds are held in segregated accounts, meaning they are kept separate from the company’s operational funds. This separation adds an extra layer of protection, ensuring that client funds are not used for business purposes and are only accessible by the client.

Furthermore, Exness is regulated by top-tier authorities like the FCA and CySEC, which impose stringent financial regulations on the company to protect its clients. The implementation of these regulatory standards means that Exness adheres to practices that promote transparency and the safety of client funds.

Additionally, Exness offers negative balance protection, ensuring that traders cannot lose more money than they have in their accounts. This feature is crucial in volatile markets like forex, where leverage can amplify both profits and losses.

Data Protection and Privacy Policies

Exness takes the privacy and data protection of its clients seriously. The platform uses advanced encryption technologies to protect sensitive information, including personal and financial data, from cyber threats. Data encryption ensures that all communication between traders and the platform remains secure.

The company also complies with data protection laws in jurisdictions where it operates, including the European Union’s General Data Protection Regulation (GDPR). This regulation mandates strict measures to safeguard customer data, including the right to access and delete personal information upon request.

Exness’s commitment to data protection means that traders can trust the platform to handle their personal and financial information securely, reducing the risk of data breaches and identity theft.

Regulatory Bodies Governing Forex Brokers

Role of the Securities and Exchange Commission of Pakistan (SECP)

The Securities and Exchange Commission of Pakistan (SECP) is the primary regulatory body overseeing the financial markets in Pakistan, including stock exchanges, mutual funds, and insurance companies. While the SECP regulates domestic financial markets, it has yet to issue specific guidelines or licenses for foreign forex brokers.

Although forex trading itself is legal in Pakistan, the SECP has not specifically addressed how foreign brokers should operate in the country. This lack of regulation has created a grey area for traders looking to trade with international brokers like Exness. The SECP has, however, expressed concern over the use of unregulated forex platforms and has issued advisories to ensure that traders are aware of potential risks.

As Exness is not officially licensed by the SECP, Pakistani traders should proceed with caution and ensure they understand the risks associated with trading through unregulated foreign brokers.

International Regulators and Their Impact on Exness

Exness is regulated by several respected international authorities, such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulators ensure that Exness operates according to strict financial standards, protecting clients’ funds and providing a transparent trading environment.

International regulations also provide a level of trust for traders, even if their country of residence does not have direct regulatory oversight over Exness. These regulations guarantee that Exness maintains fair practices, segregates client funds, and operates with transparency.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

User Reviews and Feedback

Positive Experiences from Pakistani Traders

Many Pakistani traders have shared positive experiences when using Exness. They highlight the platform’s user-friendly interface, competitive spreads, and low fees as key factors that make it attractive for both beginners and experienced traders. Additionally, Exness’s customer support has received praise for being responsive and helpful, particularly in resolving any issues related to account management or withdrawals.

Traders have also appreciated the variety of educational resources Exness provides, helping them learn more about trading strategies, risk management, and technical analysis. These resources have been instrumental in helping Pakistani traders become more confident and successful in the forex market.

Common Concerns and Complaints

While the majority of feedback from Pakistani traders is positive, there are a few common concerns. Some traders have expressed frustration with the lack of a dedicated regulatory body for forex brokers in Pakistan, which leaves them uncertain about the legal standing of trading with foreign platforms like Exness.

Another concern is related to payment methods. Some traders have reported difficulty in funding their accounts using local Pakistani payment methods, though Exness offers several international payment options. Traders should be aware of the potential delays in deposit and withdrawal processes, especially when using third-party payment processors.

Comparing Exness with Other Forex Brokers

Advantages of Choosing Exness

Exness offers numerous advantages for Pakistani traders. Its user-friendly platform, low fees, and access to multiple markets make it an appealing choice for those looking to trade forex and other financial instruments. The platform also offers negative balance protection, ensuring that traders cannot lose more than their deposited amount, which adds a layer of safety.

Additionally, Exness is well-regulated by multiple international financial authorities, providing traders with confidence in the platform’s credibility and security. The availability of educational resources also sets Exness apart from many other brokers, making it easier for beginners to learn about forex trading and improve their skills.

Potential Drawbacks

One of the main drawbacks of using Exness in Pakistan is the lack of a clear regulatory framework for foreign forex brokers. While Exness is regulated internationally, there is no local regulatory authority in Pakistan overseeing its operations. This leaves traders with some uncertainty about the legal implications of using the platform.

Another potential drawback is the limited payment options available for Pakistani traders, especially when compared to other brokers who offer localized payment methods like bank transfers and mobile wallets. Traders in Pakistan may encounter some challenges when making deposits or withdrawals.

Evaluating Trading Conditions at Exness

Spreads and Fees Structure

Exness offers competitive spreads that vary depending on the account type and market conditions. For traders looking to minimize costs, the Standard Account is often the best choice due to its low spreads and no commission fees. However, traders with higher volumes may prefer the Professional Account, which offers tighter spreads at the cost of a small commission.

Exness also provides flexible leverage, allowing traders to control larger positions with a smaller capital investment. However, leverage comes with increased risk, and traders should exercise caution when using high leverage.

Leverage and Margin Requirements

Exness offers flexible leverage options ranging from 1:1 to 1:2000, depending on the account type and financial instrument being traded. This high leverage allows traders to control large positions with relatively small amounts of capital. However, it also amplifies both gains and losses, which means that traders must carefully manage their risk.

Customer Support Services

Availability and Accessibility

Exness provides excellent customer support, with various channels for assistance, including live chat, email, and phone support. The support team is available 24/5, ensuring that traders can get assistance during market hours. This accessibility is especially important for Pakistani traders who may need help with account setup, trading issues, or withdrawals.

Responsiveness and Efficiency

Exness is known for its quick response times and efficient customer service. Traders who have contacted the support team report that issues are resolved promptly, and representatives are knowledgeable and courteous. This level of customer service is a significant advantage for Pakistani traders who may have questions or need assistance in navigating the platform.

Educational Resources and Tools

Learning Materials Offered by Exness

Exness offers a wide range of educational resources to help traders improve their skills. The platform provides webinars, articles, and tutorials that cover topics such as market analysis, risk management, and trading strategies. These resources are valuable for Pakistani traders looking to deepen their knowledge and enhance their trading performance.

Importance of Education in Trading Success

Education plays a critical role in forex trading success. By offering comprehensive learning materials, Exness helps traders gain a deeper understanding of the forex market, enabling them to make more informed decisions. Whether traders are beginners or experienced, continuous learning is essential for adapting to changing market conditions and managing risks effectively.

Conclusion

Exness is a reputable and reliable forex broker that offers a secure trading platform for Pakistani traders. While the platform is well-regulated internationally and provides a range of features such as competitive spreads, high leverage, and educational resources, its legal status in Pakistan remains uncertain due to the lack of specific regulatory approval from the Securities and Exchange Commission of Pakistan (SECP). Traders should proceed with caution and stay informed about the legal implications of trading with foreign brokers.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Despite the regulatory uncertainties, Exness’s strong safety measures, excellent customer service, and educational resources make it an appealing choice for traders in Pakistan looking to engage in forex trading. As always, traders should ensure they are compliant with local laws and regulations before making any investments.

Read more: