6 minute read

Is Forex Trading Profitable in India? A Comprehensive Guide

Forex trading has emerged as a global financial opportunity, attracting millions of traders worldwide, including those in India. The ability to buy and sell foreign currencies and profit from exchange rate fluctuations has made Forex an appealing investment option. However, one of the most common questions among aspiring traders is: Is Forex trading profitable in India?

The answer is a resounding YES—Forex trading can be highly profitable in India, provided traders follow a disciplined approach, use the right strategies, and operate within the legal framework set by Indian regulators.

Top 4 Best Forex Brokers in Iran

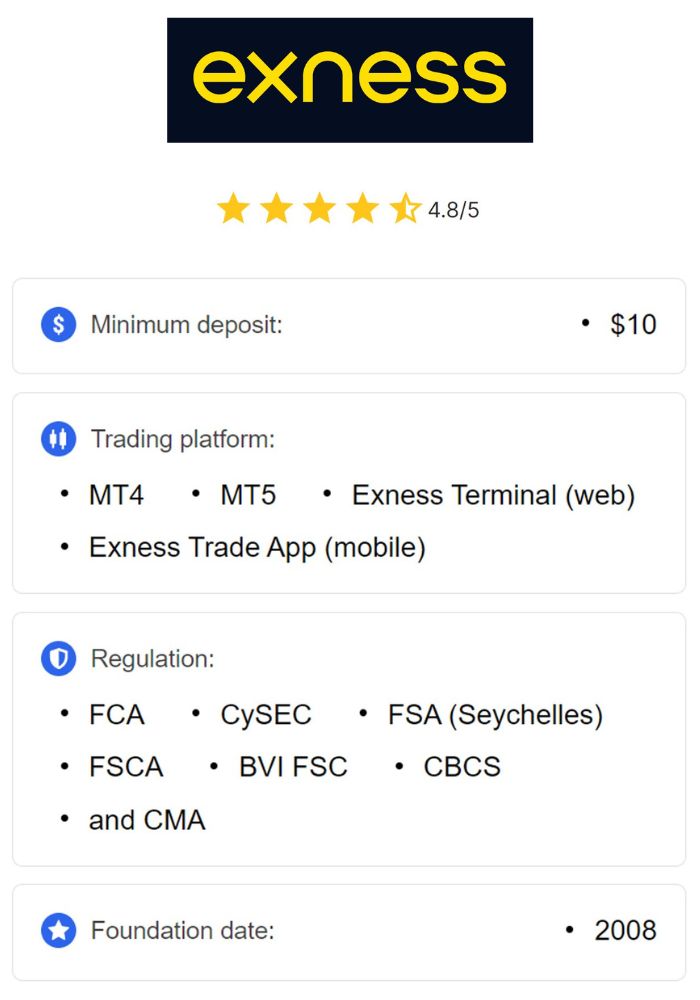

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this article, we will explore why Forex trading is profitable in India, how traders can maximize their earnings, and the key factors to consider to ensure long-term success in the Forex market.

Understanding Forex Trading in India

Before discussing profitability, it is essential to understand what Forex trading is and how it works in the Indian context.

What is Forex Trading?

Forex trading, or foreign exchange trading, is the act of buying and selling currency pairs to make a profit. Traders speculate on price movements, capitalizing on fluctuations in exchange rates between different currencies. The Forex market is the largest and most liquid financial market globally, with a daily trading volume exceeding $7.5 trillion.

How Forex Trading Works in India

Forex trading in India operates under strict regulations established by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). The regulatory framework is designed to protect investors while ensuring market stability.

In India, Forex trading is legal, but it is restricted to currency pairs involving the Indian Rupee (INR). The permitted pairs are:

USD/INR (US Dollar / Indian Rupee)

EUR/INR (Euro / Indian Rupee)

GBP/INR (British Pound / Indian Rupee)

JPY/INR (Japanese Yen / Indian Rupee)

Traders can engage in Forex trading through regulated Indian brokers that offer access to the Indian exchanges like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), where currency derivatives are traded.

Although international Forex trading (trading non-INR currency pairs) is restricted for retail traders due to RBI regulations, many traders still engage with international brokers using offshore accounts.

Why Forex Trading is Profitable in India

Forex trading presents significant profit potential for Indian traders due to several key factors. Here’s why Forex trading can be highly profitable in India:

1. High Liquidity Ensures Profit Opportunities

The Forex market is the most liquid financial market in the world, which means traders can enter and exit trades quickly without significant price slippage. Liquidity ensures that traders can capitalize on small price movements and make consistent profits.

2. 24/5 Market Availability

Unlike the stock market, which has fixed trading hours, Forex trading operates 24 hours a day, five days a week. Indian traders can trade Forex at any time, choosing trading sessions that align with major global markets (New York, London, Tokyo, and Sydney).

3. Leverage Increases Profit Potential

Most Forex brokers provide leverage, which allows traders to control large positions with a small investment. In India, SEBI regulates leverage for currency trading, but traders can still access up to 1:50 leverage, amplifying profit potential.

For example, with a capital of ₹10,000, a trader using 1:50 leverage can control positions worth ₹500,000, significantly increasing their potential earnings. However, higher leverage also increases risk, requiring effective risk management strategies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

4. Profiting in Both Rising and Falling Markets

Unlike the stock market, where traders primarily profit from rising stock prices, Forex traders can profit whether the market is going up or down. This flexibility increases trading opportunities and profitability.

For instance:

If a trader expects USD to strengthen against INR, they can buy USD/INR.

If a trader expects INR to strengthen against USD, they can sell USD/INR.

This bidirectional trading ability allows traders to profit from both bullish and bearish trends.

5. Automated and Algorithmic Trading

Many Indian traders use automated trading systems (algorithms) to execute trades based on pre-defined rules. AI-driven trading strategies allow traders to:

Reduce emotional decision-making.

Execute trades instantly based on market conditions.

Maximize profits by capturing multiple small price movements.

With algorithmic trading, traders can generate passive income while minimizing manual effort.

How to Maximize Profitability in Forex Trading

While Forex trading is profitable in India, success depends on knowledge, strategy, and risk management. Here are key ways to increase profitability and minimize losses:

1. Learn Forex Trading Basics

Before trading, it’s crucial to understand:

Market trends and technical analysis

Fundamental factors influencing currency values

Trading strategies and risk management principles

Many online platforms, brokers, and courses offer Forex education, helping traders build a solid foundation before risking real capital.

2. Develop a Profitable Trading Strategy

Successful traders follow a structured approach, using strategies such as:

Scalping (short-term trades for quick profits)

Day Trading (buying and selling within the same day)

Swing Trading (holding positions for days or weeks)

Position Trading (long-term investing based on economic trends)

The key to profitability is choosing a strategy that matches your risk tolerance and trading style.

3. Use Risk Management Techniques

Risk management is essential for long-term profitability. Some best practices include:✅ Setting Stop-Loss Orders to minimize losses.✅ Risking Only 1-2% of Capital Per Trade to avoid large drawdowns.✅ Diversifying Investments to reduce overall exposure.

4. Follow Market News and Economic Indicators

Forex markets are influenced by global economic events such as:

Interest Rate Decisions (RBI, Federal Reserve, ECB, etc.)

GDP Growth Rates

Inflation and Unemployment Reports

Geopolitical Events

By staying updated with economic news, traders can predict currency movements and adjust strategies accordingly.

5. Choose a SEBI-Regulated Broker

For Indian traders, using a regulated Forex broker ensures:✅ Transparent pricing and fair trading conditions.✅ Protection of funds under Indian financial laws.✅ Compliance with SEBI and RBI regulations.

Avoid unregulated brokers to minimize fraud risk and ensure a secure trading experience.

Real-Life Forex Trading Success Stories in India

Many traders in India have achieved consistent profitability in Forex trading. Some examples include:

📌 Retail Traders: Many part-time traders earn passive income by trading currency derivatives on NSE.

📌 Professional Traders: Experienced Forex traders use advanced strategies and proprietary trading systems to generate consistent profits.

📌 Institutions & Hedge Funds: Large financial institutions leverage Forex markets to hedge risks and optimize investment returns.

With the right skills and discipline, Forex trading can be a lucrative career in India.

Conclusion: Yes, Forex Trading is Profitable in India

Forex trading is indeed profitable in India, provided traders:✅ Follow a structured trading strategy✅ Manage risks effectively✅ Stay updated with market news✅ Use regulated brokers

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

While Forex trading carries risks, disciplined traders who invest time in learning and practicing can generate consistent profits.

If you are serious about Forex trading in India, start with small capital, master risk management, and develop a solid strategy. With patience and persistence, you can turn Forex trading into a profitable investment opportunity. 🚀

Read more: