12 minute read

Is forex trading profitable in Dubai? A Comprehensive Guide

from Exness

by Exness_Blog

Introduction to Forex Trading

Definition of Forex Trading

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies in the global market. It is the largest financial market in the world, with an average daily trading volume exceeding $6 trillion. The forex market operates 24 hours a day, five days a week, due to the overlap of major financial centers across different time zones. Traders speculate on currency pairs, such as EUR/USD or GBP/JPY, attempting to profit from fluctuations in exchange rates, which can be influenced by various factors, including economic indicators, political events, and market sentiment.

Top 4 Best Forex Brokers in Dubai

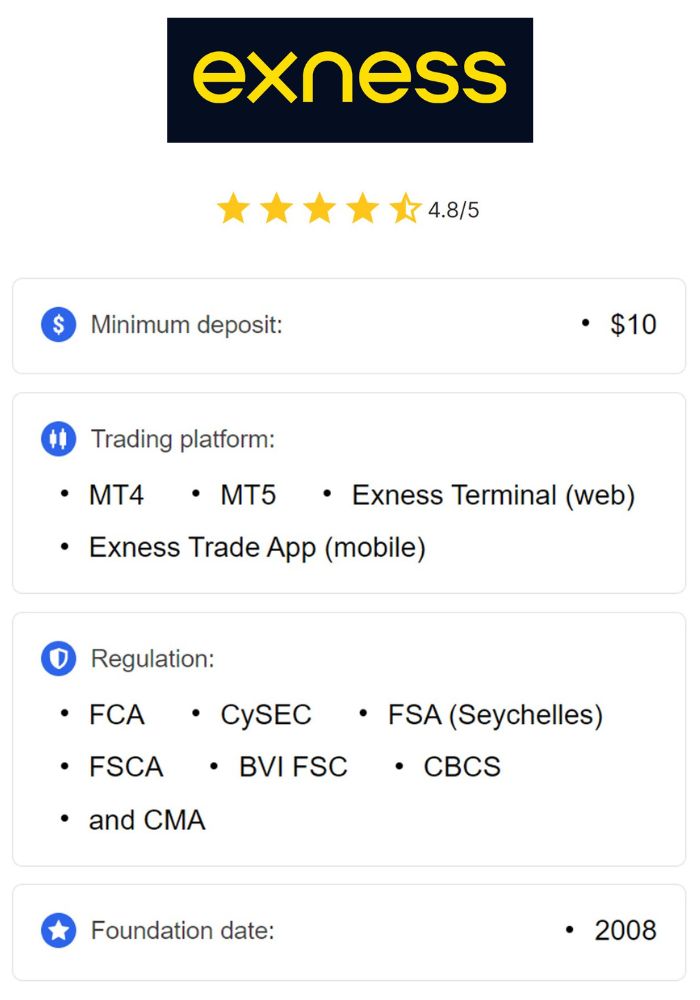

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Overview of the Forex Market

The forex market functions as a decentralized network, meaning it does not have a physical exchange or centralized location. Instead, it operates electronically over-the-counter (OTC) through a network of banks, brokers, and individual traders. Currencies are traded in pairs, with the first currency known as the base currency and the second as the quote currency. The forex market is highly liquid and accessible to retail traders, institutional investors, and corporations, providing ample opportunities for both short-term and long-term trading strategies.

The Forex Trading Landscape in Dubai

Regulatory Framework for Forex Trading

Dubai has established a well-regulated environment for forex trading through the Dubai Financial Services Authority (DFSA), which oversees financial services within the Dubai International Financial Centre (DIFC). The DFSA provides guidelines to protect investors and maintain market integrity. Additionally, the Central Bank of the UAE plays a role in regulating financial activities and ensuring compliance. Traders in Dubai are encouraged to work with brokers regulated by the DFSA or other reputable authorities, as this adds a layer of security and transparency to their trading activities.

Major Forex Brokers Operating in Dubai

Dubai hosts a range of both local and international forex brokers who offer diverse trading services to cater to various traders’ needs. Some prominent brokers operating in Dubai include FXTM, IG, and Saxo Bank. These brokers are known for their regulatory compliance, advanced trading platforms, and customer support. Choosing a reputable broker with a strong presence in Dubai is essential for traders, as it ensures access to secure trading platforms, transparent fee structures, and reliable customer service.

Market Accessibility and Trading Platforms

Dubai’s forex market is accessible through a variety of trading platforms, from desktop applications to mobile apps. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) provide user-friendly interfaces, advanced charting tools, and a wide range of technical indicators. Additionally, many brokers offer their own proprietary platforms with unique features tailored to enhance the trading experience. The availability of mobile trading apps allows traders in Dubai to manage their positions on the go, ensuring flexibility and real-time access to market data.

Potential Profitability of Forex Trading

Factors Influencing Profitability

Profitability in forex trading is influenced by several factors, including market conditions, trader skill level, and economic indicators. Key factors such as interest rates, inflation, and geopolitical events can impact currency values, presenting opportunities for profit. Additionally, a trader’s ability to analyze market trends, make informed decisions, and implement risk management strategies significantly affects their profitability. Traders in Dubai must stay informed about local and global economic developments to maximize their potential returns.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Risks Associated with Forex Trading

While forex trading offers potential for profit, it also carries inherent risks. Currency markets are highly volatile, meaning prices can fluctuate rapidly in response to market events. Leverage, commonly used in forex trading, allows traders to control larger positions with a smaller capital investment, amplifying both potential gains and losses. Traders in Dubai should be aware of these risks and employ strategies, such as setting stop-loss orders and using appropriate position sizes, to manage potential losses effectively.

Success Stories from Dubai Traders

Dubai is home to several successful forex traders who have achieved profitability through disciplined trading and continuous learning. These traders often attribute their success to a strong understanding of technical and fundamental analysis, as well as effective risk management. Many have shared their experiences and strategies through online forums, workshops, and mentorship programs, providing valuable insights for aspiring traders. These success stories underscore the importance of education, practice, and resilience in achieving long-term profitability in the forex market.

Strategies for Successful Forex Trading

Technical Analysis Techniques

Technical analysis is a widely used approach in forex trading, involving the study of historical price data and chart patterns to predict future price movements. Traders use various technical indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, to identify trends and potential entry and exit points. Mastering technical analysis techniques allows traders to make data-driven decisions and improve their trading accuracy.

Fundamental Analysis in Forex Trading

Fundamental analysis involves evaluating economic indicators, financial news, and geopolitical events that can impact currency values. For example, interest rate decisions by central banks, employment reports, and inflation data can influence market sentiment and currency prices. Traders who incorporate fundamental analysis into their strategies gain a comprehensive understanding of market dynamics and can make more informed decisions.

Risk Management Strategies

Effective risk management is essential for success in forex trading. Traders should establish risk tolerance levels and use techniques such as setting stop-loss orders, using proper position sizing, and diversifying trading positions. By prioritizing risk management, traders can protect their capital and enhance their chances of achieving consistent profitability in the forex market.

Education and Resources for Forex Traders

Online Courses and Webinars

Dubai offers a wealth of online courses and webinars that provide valuable insights into forex trading. Many brokers and educational platforms offer free or affordable resources, covering topics such as technical and fundamental analysis, risk management, and trading psychology. Participating in these programs equips traders with the tools and knowledge needed to succeed in the forex market.

Books and Publications on Forex Trading

Books and publications on forex trading offer in-depth insights into various trading strategies, market dynamics, and successful trading practices. Renowned traders and analysts have authored books that share valuable lessons and techniques for both novice and experienced traders. Reading widely on forex trading helps traders develop a comprehensive understanding of the market and refine their trading approaches.

Community and Networking Opportunities

Engaging with community forums, discussion groups, and networking events is beneficial for forex traders in Dubai. Connecting with other traders fosters a supportive learning environment, allowing individuals to share ideas, discuss strategies, and seek advice from more experienced traders. Building a network of like-minded peers can enhance traders’ knowledge, confidence, and overall performance in the forex market.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Challenges Faced by Forex Traders in Dubai

Market Volatility and Uncertainty

One of the primary challenges forex traders face in Dubai is dealing with the inherent volatility of the forex market. Currency prices can fluctuate significantly due to global economic changes, political events, or unexpected news, leading to substantial gains or losses in a short period. Dubai’s open economy and strong ties to global markets mean that local traders are highly exposed to these international fluctuations. Managing this volatility requires a deep understanding of market dynamics and the ability to react quickly to rapid price movements. Traders in Dubai need robust strategies and risk management practices to navigate these uncertain conditions.

Psychological Aspects of Trading

Forex trading can be mentally taxing, as it often requires making fast decisions under pressure, especially in volatile conditions. Emotional responses like fear and greed can impact a trader's ability to make rational choices. In Dubai, where forex trading is popular among both retail and institutional traders, maintaining psychological discipline is critical for long-term success. Traders must manage stress effectively, avoid emotional decision-making, and adhere to their trading plans to minimize impulsive reactions. Practicing mindfulness, setting realistic goals, and using techniques like journaling can help traders in Dubai maintain emotional resilience and improve their decision-making processes.

Legal and Compliance Issues

Navigating the regulatory landscape can be challenging for forex traders in Dubai. Although the Dubai Financial Services Authority (DFSA) provides a clear regulatory framework, not all brokers operating in Dubai are regulated by the DFSA. Traders must be cautious and select licensed brokers who comply with local regulations to avoid potential scams and ensure the security of their funds. Compliance with the DFSA’s regulations is essential, as non-compliance can lead to fines, account restrictions, or other legal consequences. Staying informed about regulatory updates and choosing reliable brokers are crucial steps for traders seeking a secure trading environment.

Comparing Forex Trading with Other Investment Options

Forex vs. Stocks

Forex and stock trading offer unique advantages and challenges. Forex trading is generally more accessible and operates 24 hours a day, providing flexibility for traders in Dubai to participate outside regular business hours. Additionally, the forex market typically offers higher liquidity and the option to leverage trades more effectively than the stock market. However, stock trading can offer more predictable patterns and often involves lower volatility than forex. Traders in Dubai should consider their risk tolerance, trading style, and time commitment when deciding between these investment avenues.

Forex vs. Real Estate

Real estate is a popular investment option in Dubai due to the city’s rapid development and demand for property. Unlike forex trading, which involves high liquidity and can yield returns within a short timeframe, real estate investments are long-term and involve significant capital and time commitments. Forex trading is often seen as a more accessible option with lower initial costs. However, real estate offers a tangible asset that can provide rental income and long-term appreciation. For Dubai-based investors, the choice between forex and real estate may depend on their financial goals, investment horizon, and preference for liquid or tangible assets.

Forex vs. Cryptocurrencies

Cryptocurrencies have become increasingly popular in Dubai, appealing to tech-savvy investors interested in alternative assets. Both forex and crypto markets operate 24/7 and share high volatility, but the forex market is much larger and generally less susceptible to extreme price swings than crypto. Forex trading also benefits from a more established regulatory framework, while cryptocurrency regulations are still developing in many regions, including Dubai. For traders in Dubai, forex may be a more stable and predictable option, while cryptocurrencies may appeal to those willing to take on higher risk for potentially higher rewards.

Tools and Technologies for Forex Trading

Trading Software and Apps

Advanced trading software and mobile apps have revolutionized forex trading, making it easier for traders in Dubai to monitor markets, execute trades, and analyze data. Popular platforms like MetaTrader 4, MetaTrader 5, and cTrader offer comprehensive charting tools, customizable interfaces, and automated trading options. Many brokers in Dubai offer proprietary apps tailored to meet the needs of their local clientele, providing real-time data and push notifications for market updates. Choosing a reliable trading platform with essential features can enhance a trader’s ability to respond to market changes effectively.

Automated Trading Systems

Automated trading systems, also known as trading robots or algorithms, are becoming popular among forex traders in Dubai. These systems use predefined criteria to execute trades automatically, removing emotional biases from trading decisions. Automated systems can analyze large volumes of data quickly, allowing traders to capitalize on opportunities even during off-hours. However, while automation offers advantages, it’s essential for traders to monitor and periodically adjust these systems to ensure they align with current market conditions.

Importance of Charting Tools

Charting tools are fundamental for forex traders, enabling them to visualize price movements and identify potential trends. Tools like candlestick charts, moving averages, and Fibonacci retracements provide traders with insights into market behavior. Many trading platforms offer advanced charting features that allow traders to customize indicators based on their strategies. For traders in Dubai, charting tools are invaluable for conducting both technical and fundamental analyses, helping them make well-informed decisions and optimize their trading outcomes.

The Impact of Economic Factors on Forex Trading

Influence of Global Economic Trends

Global economic trends significantly impact the forex market, influencing currency values and trading conditions. Factors such as global GDP growth, trade balances, inflation rates, and unemployment levels in major economies can lead to shifts in currency demand and volatility. Dubai, with its global connectivity and reliance on international trade, is particularly sensitive to these economic changes. Staying updated on global economic news and understanding how these trends affect currency pairs can help traders in Dubai make more informed trading decisions.

Role of Central Banks and Interest Rates

Central banks play a crucial role in forex trading by setting interest rates and implementing monetary policies that directly influence currency values. The U.S. Federal Reserve, the European Central Bank, and other major central banks frequently adjust interest rates, impacting currency pairs globally. In Dubai, traders must pay attention to these interest rate changes as they can lead to fluctuations in forex prices and affect trading strategies. A strong understanding of how central bank policies influence exchange rates is essential for traders looking to navigate the forex market effectively.

Conclusion

Forex trading in Dubai presents both opportunities and challenges. With a well-regulated environment, access to global markets, and advanced trading platforms, traders in Dubai have the potential to profit from the forex market. However, achieving profitability requires a comprehensive understanding of market dynamics, disciplined strategies, and a strong focus on risk management. By staying informed about economic trends, leveraging the right tools, and adhering to regulatory guidelines, traders in Dubai can position themselves for success in the competitive world of forex trading. As the market continues to evolve, those who embrace education, adapt to emerging trends, and practice disciplined trading will likely find forex trading to be a profitable venture in Dubai.

Read more:

Is forex trading legal in Mauritius?