15 minute read

Is forex trading profitable in Kenya? A Comprehensive Guide

from Exness

by Exness_Blog

Introduction to Forex Trading

Definition of Forex Trading

Forex trading, or foreign exchange trading, is the process of buying and selling currencies in a global marketplace. This decentralized market operates without a central exchange, enabling transactions to occur electronically over-the-counter (OTC). The primary aim of forex trading is to profit from fluctuations in currency values, driven by various factors including economic indicators, geopolitical events, and changes in market sentiment. This intricate system allows traders to speculate on currency movements, taking advantage of both rising and falling markets.

Top 4 Best Forex Brokers in Kenya

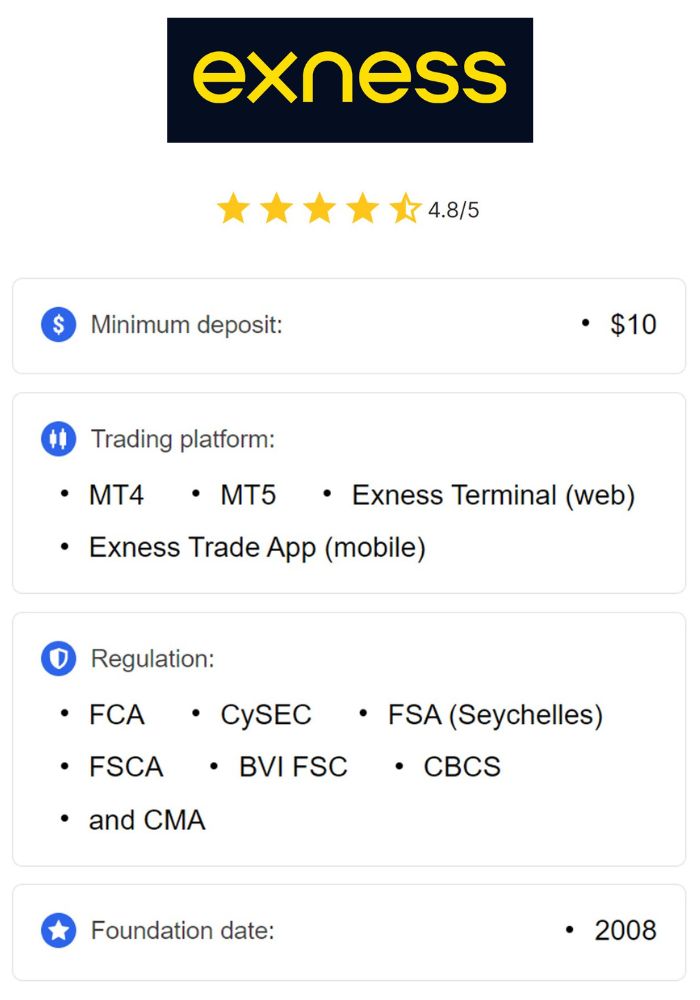

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

The Evolution of Forex Trading Globally

The evolution of forex trading has been marked by significant technological advancements and regulatory changes. Originally dominated by large financial institutions and banks, the forex market has expanded to include retail traders due to the rise of online trading platforms. These platforms have made trading more accessible, allowing individuals to engage in the market from their homes or on-the-go via mobile apps. As a result, the forex market has grown into one of the largest and most liquid financial markets globally, with daily trading volumes surpassing $6 trillion. This transformation has changed the landscape of trading, providing diverse opportunities for participants at all levels.

The Forex Market Overview

Structure of the Forex Market

The structure of the forex market consists of various participants, including central banks, commercial banks, financial institutions, corporations, and retail traders. Major banks act as market makers, facilitating currency transactions and providing liquidity to the market. Retail traders usually access the market through brokers, who offer trading platforms that allow them to buy and sell currencies. The forex market operates continuously for 24 hours a day, five days a week, across major financial centers such as London, New York, Tokyo, and Sydney. This continuous operation creates a dynamic environment where prices fluctuate rapidly, providing traders with numerous opportunities to capitalize on market movements.

Major Currency Pairs and Their Importance

Currency pairs in the forex market consist of two currencies traded against each other, where the first currency is known as the base currency and the second as the quote currency. The most widely traded currency pairs include the EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), and USD/JPY (US Dollar/Japanese Yen). These pairs are essential for traders due to their high liquidity and volatility, which create opportunities for profit. Understanding the dynamics of these major currency pairs is crucial for developing effective trading strategies, as they often respond to various economic indicators, political events, and market sentiment, affecting their price movements.

How Forex Trading Works

Forex trading operates on the principle of speculating on the price movements of currency pairs. Traders analyze market trends, economic data, and geopolitical events to make informed decisions. When a trader believes that the base currency will appreciate relative to the quote currency, they buy the currency pair; conversely, if they anticipate a decline, they sell it. Leverage is a significant aspect of forex trading, allowing traders to control larger positions with a smaller amount of capital. This can amplify profits but also increases the risk of losses, making it essential for traders to employ effective risk management strategies and maintain a disciplined approach to their trading activities.

The Legal Landscape for Forex Trading in Kenya

Regulatory Bodies Governing Forex Trade

In Kenya, forex trading is regulated by several bodies to ensure fair practices and protect investors. The Capital Markets Authority (CMA) is the primary regulator overseeing the financial markets, including forex trading. The CMA establishes rules and regulations for forex brokers operating in Kenya, ensuring they adhere to strict standards. Additionally, the Central Bank of Kenya (CBK) plays a crucial role in overseeing the stability of the currency market and implementing monetary policy. These regulatory frameworks are designed to foster a transparent trading environment, minimizing the risks associated with forex trading.

Legal Requirements for Forex Traders

To engage in forex trading in Kenya, traders must comply with specific legal requirements set by regulatory bodies. First, they must choose a licensed forex broker that is registered with the CMA. This ensures that the broker adheres to regulatory standards and protects the interests of traders. Additionally, traders may be required to provide identification and proof of address when opening trading accounts. It is also crucial for traders to understand the tax implications of forex trading in Kenya, as profits made from trading may be subject to taxation. Compliance with these legal requirements is essential for operating within the bounds of the law and ensuring a secure trading experience.

Importance of Compliance with Local Laws

Compliance with local laws and regulations is vital for forex traders in Kenya for several reasons. Firstly, it protects traders from fraudulent activities and unregulated brokers that could result in significant financial losses. Secondly, adherence to legal requirements fosters a transparent trading environment, enhancing trust between traders and brokers. Finally, compliance ensures that traders can operate legally, avoiding potential legal issues or penalties that may arise from non-compliance. By prioritizing compliance, traders can build a solid foundation for their trading activities, ultimately contributing to their long-term success in the forex market.

Understanding Profitability in Forex Trading

Factors Influencing Profitability

Profitability in forex trading is influenced by various factors, including market conditions, trader skills, and economic indicators. Market conditions, such as volatility and liquidity, play a significant role in determining trading opportunities. Higher volatility can lead to more significant price movements, which can be advantageous for traders. Additionally, a trader's skills and experience significantly impact their ability to analyze market trends, make informed decisions, and implement effective trading strategies. Understanding economic indicators, such as interest rates, inflation, and employment data, is also crucial, as these factors can influence currency values and overall market sentiment.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Risk Management Strategies

Effective risk management strategies are essential for achieving profitability in forex trading. Traders should implement techniques such as setting stop-loss orders to limit potential losses and using position sizing to manage their capital effectively. Diversifying trading positions can also mitigate risks, as it reduces exposure to any single currency or market event. Additionally, traders should maintain a risk-reward ratio that aligns with their trading goals, ensuring that potential profits justify the risks taken. By prioritizing risk management, traders can protect their capital and enhance their chances of long-term success in the forex market.

Impact of Market Volatility

Market volatility is a double-edged sword in forex trading, presenting both opportunities and challenges. High volatility can lead to substantial price swings, creating opportunities for traders to profit from rapid movements. However, increased volatility also amplifies risks, making it essential for traders to exercise caution. Understanding the factors that contribute to market volatility, such as economic releases, geopolitical events, and market sentiment, allows traders to navigate these fluctuations more effectively. By developing strategies that account for volatility, traders can enhance their ability to capitalize on favorable market conditions while managing potential risks.

The Role of Brokers in Forex Trading

Types of Forex Brokers

Forex brokers serve as intermediaries between traders and the forex market, facilitating currency transactions. There are several types of forex brokers, including market makers, ECN (Electronic Communication Network) brokers, and STP (Straight Through Processing) brokers. Market makers set their own prices and provide liquidity by offering buy and sell quotes, while ECN brokers connect traders directly to the interbank market, allowing for competitive pricing. STP brokers execute trades directly without dealing with them, providing transparency in pricing. Understanding the differences between these broker types is crucial for traders to choose one that aligns with their trading preferences and strategies.

Choosing a Reputable Broker in Kenya

Selecting a reputable forex broker in Kenya is critical for a successful trading experience. Traders should consider several factors when choosing a broker, including regulatory compliance, trading platform features, and customer support. Ensuring that the broker is licensed by the Capital Markets Authority (CMA) provides confidence in their operations and adherence to local regulations. Additionally, traders should evaluate the trading platform’s functionality, ease of use, and available tools for analysis. Reading reviews and seeking recommendations can also help traders identify brokers with a solid reputation and reliable service, ultimately enhancing their trading journey.

The Importance of Trading Platforms

Trading platforms are vital tools for forex traders, as they provide the necessary interface to execute trades, analyze market data, and manage accounts. A good trading platform should offer real-time market information, advanced charting tools, and customizable features that suit individual trading styles. Additionally, mobile compatibility allows traders to access the market on the go, ensuring they can capitalize on opportunities as they arise. Understanding the features and functionalities of different trading platforms enables traders to select one that enhances their trading efficiency and effectiveness, contributing to their overall success in the forex market.

Skills Required for Successful Forex Trading

Technical Analysis Skills

Technical analysis is a critical skill for forex traders, involving the study of historical price movements and chart patterns to forecast future trends. Traders use various tools, such as indicators, trend lines, and candlestick patterns, to analyze market data and identify potential entry and exit points. Developing proficiency in technical analysis enables traders to make informed decisions based on market behavior rather than relying solely on emotions. By mastering this skill, traders can enhance their ability to navigate the complexities of the forex market, improving their chances of achieving profitability.

Fundamental Analysis Understanding

In addition to technical analysis, a solid understanding of fundamental analysis is essential for successful forex trading. Fundamental analysis involves evaluating economic indicators, political events, and other macroeconomic factors that influence currency values. Traders should be aware of key reports, such as GDP data, employment figures, and central bank announcements, as these can significantly impact market sentiment and currency movements. By incorporating fundamental analysis into their trading strategies, traders can gain a comprehensive understanding of market dynamics, enabling them to make more informed trading decisions.

Emotional Discipline and Patience

Emotional discipline and patience are often overlooked but crucial skills for forex traders. The forex market can be highly volatile, leading to rapid price fluctuations that can evoke strong emotional responses. Successful traders maintain discipline by adhering to their trading plans and strategies, avoiding impulsive decisions driven by fear or greed. Patience is equally important, as traders must wait for the right opportunities to present themselves rather than forcing trades. By cultivating emotional discipline and patience, traders can improve their decision-making processes, ultimately enhancing their potential for success in the forex market.

Investment Strategies in Forex Trading

Day Trading vs. Swing Trading

Day trading and swing trading are two popular investment strategies in forex trading, each with its unique approach and timeframes. Day trading involves executing multiple trades within a single day, capitalizing on short-term price movements. Day traders often rely on technical analysis and real-time market data to make quick decisions, seeking to close all positions before the market closes to avoid overnight risks. In contrast, swing trading focuses on capturing longer-term price movements, with trades held for several days or weeks. Swing traders analyze both technical and fundamental factors, allowing them to ride price trends while avoiding the stresses of daily trading.

Scalping Techniques

Scalping is a high-frequency trading strategy that involves making numerous trades over short timeframes, often just a few minutes. Scalpers aim to profit from small price movements, taking advantage of market inefficiencies. This technique requires a strong understanding of market dynamics, quick decision-making skills, and effective risk management. Scalpers often utilize tight stop-loss orders to minimize potential losses and ensure that their profits accumulate over time. While scalping can be profitable, it demands significant time commitment and discipline, making it suitable for traders who thrive in fast-paced environments.

Long-Term Investing Approaches

Long-term investing in forex trading involves holding positions for extended periods, often driven by fundamental analysis and economic outlooks. Long-term traders seek to capitalize on broader market trends and macroeconomic developments, focusing on the overall direction of currency pairs rather than short-term fluctuations. This strategy allows traders to withstand market volatility and reduces the impact of noise created by daily price movements. Successful long-term investors often incorporate a thorough understanding of economic indicators, geopolitical events, and central bank policies into their trading strategies, enabling them to make informed decisions based on long-term trends.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Challenges Faced by Forex Traders in Kenya

Common Mistakes Made by New Traders

New traders often encounter various challenges when entering the forex market, leading to common mistakes that can impact their profitability. One frequent mistake is over-leveraging, where traders use excessive leverage without understanding the associated risks. This can result in significant losses, especially during volatile market conditions. Additionally, many new traders fail to develop a comprehensive trading plan, leading to impulsive decisions driven by emotions. Educating themselves about the market, understanding their risk tolerance, and establishing a well-defined trading strategy can help new traders avoid these pitfalls and improve their chances of success.

Psychological Barriers to Successful Trading

Psychological barriers play a significant role in the success or failure of forex traders. Emotions such as fear, greed, and anxiety can cloud judgment and lead to impulsive decision-making. For instance, fear of missing out (FOMO) can push traders to enter positions without proper analysis, while greed may cause them to hold onto losing trades longer than necessary. Developing emotional resilience and a disciplined mindset is crucial for overcoming these barriers. Implementing practices such as keeping a trading journal, practicing mindfulness, and maintaining a clear focus on long-term goals can help traders manage their emotions effectively and improve their trading performance.

Economic Influences on Trading Outcomes

Economic factors significantly influence trading outcomes in the forex market. Economic indicators, such as inflation rates, interest rates, and employment data, directly impact currency values and market sentiment. Traders must stay informed about relevant economic news and events, as these can lead to sudden price movements. Additionally, geopolitical events, such as elections or international conflicts, can create uncertainty in the markets, affecting currency stability. By understanding these economic influences, traders can make informed decisions and develop strategies that account for potential market volatility.

Case Studies of Forex Trading in Kenya

Success Stories: Traders Who Made It Big

In Kenya, several traders have achieved remarkable success in forex trading, serving as inspiration for others in the industry. One notable success story is that of a trader who started with a small capital investment and employed a disciplined trading strategy focused on risk management and technical analysis. By consistently following their trading plan and adapting to market conditions, this trader was able to grow their account significantly over time. Their journey highlights the importance of education, persistence, and the ability to learn from both successes and failures in the trading world.

Lessons from Failed Forex Ventures

Conversely, there are also cautionary tales of traders who faced challenges and failures in the forex market. One common scenario involves traders who entered the market without adequate knowledge or preparation, leading to significant losses. Many of these traders often relied on tips and advice from unreliable sources rather than conducting their analysis. These experiences emphasize the importance of thorough research, understanding market dynamics, and developing a comprehensive trading strategy. Learning from the mistakes of others can help aspiring traders navigate the forex market more effectively and avoid common pitfalls.

The Future of Forex Trading in Kenya

Emerging Trends in the Forex Market

The future of forex trading in Kenya is shaped by emerging trends that are transforming the landscape. The increasing adoption of technology, such as algorithmic trading and artificial intelligence, is enhancing trading efficiency and decision-making. Additionally, the rise of mobile trading applications is making forex trading more accessible to a broader audience, particularly the younger generation. As more individuals engage in forex trading, there is likely to be a shift towards educational initiatives aimed at equipping traders with the necessary skills and knowledge to navigate the market successfully.

Technology’s Impact on Trading Practices

Technology is revolutionizing forex trading practices, providing traders with innovative tools and resources. Advanced trading platforms equipped with real-time data, automated trading features, and sophisticated analytical tools are enabling traders to make more informed decisions. Furthermore, social trading platforms are gaining popularity, allowing traders to share strategies and insights while learning from one another. As technology continues to evolve, it is expected to enhance the trading experience, making it easier for traders in Kenya to access the forex market and capitalize on emerging opportunities.

Conclusion

In conclusion, forex trading presents both opportunities and challenges for traders in Kenya. While the potential for profitability exists, it requires a thorough understanding of market dynamics, effective risk management strategies, and a commitment to continuous learning. By navigating the legal landscape, choosing reputable brokers, and developing essential trading skills, traders can position themselves for success in this dynamic market. As the forex landscape continues to evolve with technological advancements and emerging trends, those who adapt and stay informed will likely thrive in the ever-changing world of forex trading in Kenya.

Read more:

How to Start Forex Trading in Ethiopia