10 minute read

Is Exness Allowed in Nigeria? Review Broker 2026

from Exness

by Exness_Blog

Overview of Exness

Introduction to Exness as a Trading Platform

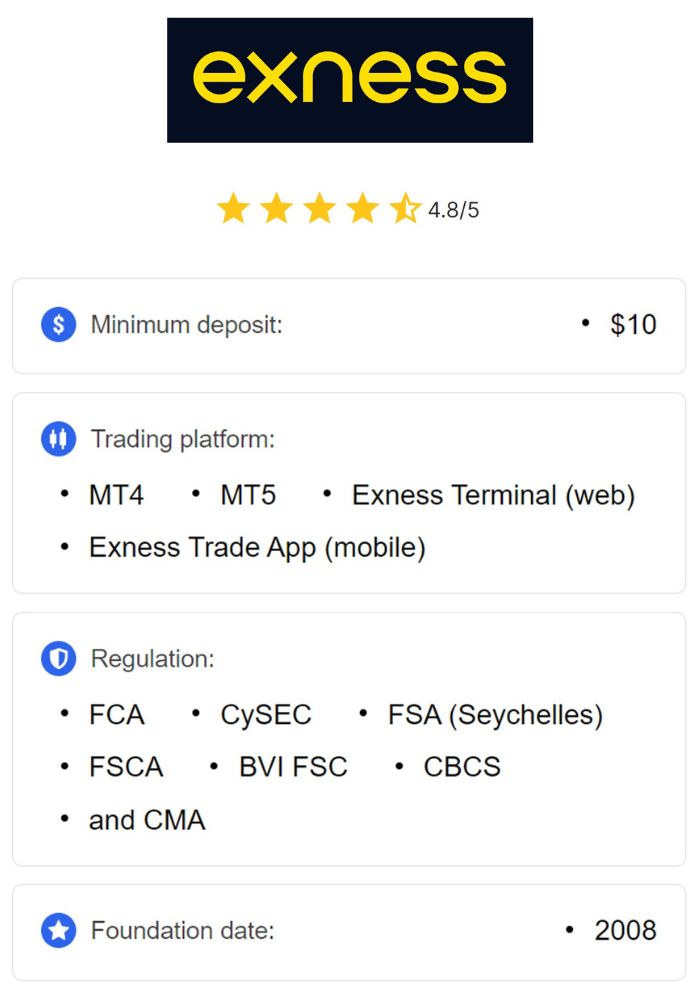

Exness is a globally recognized forex and CFD trading platform, established in 2008. It offers an extensive range of trading services, catering to both novice and professional traders. With its user-friendly interface, advanced tools, and commitment to transparency, Exness has become a preferred choice for millions of traders worldwide.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The platform provides access to various financial markets, including forex, stocks, indices, cryptocurrencies, and commodities. Its mission is to make trading accessible, secure, and profitable for traders from all walks of life. This commitment has contributed significantly to its reputation as a reliable and efficient broker.

Key Features and Offerings of Exness

Exness stands out for its innovative features and tailored offerings. Some key highlights include:

Wide Range of Accounts: From Standard accounts for beginners to Pro accounts for experienced traders, Exness accommodates diverse trading needs.

Low Spreads and Flexible Leverage: Traders benefit from tight spreads, starting from 0.0 pips, and leverage options that can go up to 1:2000 or higher, depending on the account type.

Advanced Trading Platforms: Exness supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with its proprietary WebTerminal for seamless trading.

Fast Deposits and Withdrawals: The platform supports instant transactions, ensuring minimal downtime for traders.

Comprehensive Educational Resources: Exness offers webinars, tutorials, and market analysis to help traders enhance their skills and knowledge.

Regulatory Environment in Nigeria

Overview of Financial Regulations in Nigeria

Nigeria’s financial market is regulated by key institutions such as the Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN). These bodies ensure the stability, transparency, and integrity of financial operations within the country.

Forex trading is a legitimate financial activity in Nigeria, provided that traders and brokers adhere to the regulations set forth by these authorities. This framework aims to protect investors and foster a competitive yet fair trading environment.

Role of the Securities and Exchange Commission (SEC)

The SEC serves as Nigeria’s primary regulatory authority for financial markets, including forex trading. It ensures that brokers operating within the country comply with global best practices and maintain ethical standards. Nigerian traders are encouraged to use brokers regulated by reputable international bodies to ensure their investments are secure.

Central Bank of Nigeria’s Position on Forex Trading

The CBN plays a significant role in managing Nigeria’s forex reserves and exchange rate policies. While the CBN does not regulate retail forex trading directly, it has issued guidelines on forex transactions to curb illegal activities and protect the country’s foreign exchange reserves. Nigerian traders using international brokers like Exness must ensure compliance with these guidelines to avoid potential issues.

Exness Licensing and Regulation

Licenses Held by Exness Globally

Exness operates under the regulation of multiple reputable authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). These licenses demonstrate Exness’s commitment to transparency, reliability, and ethical practices.

The platform adheres to stringent regulatory requirements, including fund segregation and regular audits, ensuring that traders’ funds are protected at all times.

Compliance with International Regulatory Standards

Exness complies with global standards, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These measures help prevent fraudulent activities and provide a secure trading environment. For Nigerian traders, these compliance standards serve as reassurance that Exness operates with integrity and professionalism.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness Services Available in Nigeria

Types of Accounts Offered for Nigerian Traders

Exness provides a variety of account types to meet the needs of Nigerian traders:

Standard Accounts: Ideal for beginners, offering low spreads and no commissions.

Professional Accounts: Designed for experienced traders, featuring tighter spreads and customizable trading conditions.

Each account type caters to different trading styles, whether you’re a day trader, scalper, or long-term investor.

Trading Instruments Available on Exness

Nigerian traders have access to a wide range of financial instruments, including:

Forex: Over 100 currency pairs, including majors, minors, and exotics.

Stocks and Indices: Popular global indices and blue-chip stocks.

Commodities: Precious metals, energy products, and agricultural goods.

Cryptocurrencies: Bitcoin, Ethereum, and other digital assets.

This diversity allows traders to diversify their portfolios and explore various market opportunities.

Payment Methods Supported by Exness in Nigeria

Exness supports multiple payment methods tailored for Nigerian users, including:

Bank Transfers: Deposits and withdrawals can be made via local Nigerian banks.

E-wallets: Options like Neteller, Skrill, and Perfect Money.

Cryptocurrencies: Bitcoin and other digital currencies for fast and secure transactions.

Most transactions are processed instantly, ensuring that traders can focus on trading without delays.

Advantages of Using Exness in Nigeria

Low Spreads and Leverage Options

One of the biggest advantages of trading with Exness is its competitive pricing. The platform offers some of the lowest spreads in the industry, starting from as low as 0.0 pips for certain account types. This feature significantly reduces trading costs and increases profitability, especially for high-volume traders.

In addition to low spreads, Exness provides flexible leverage options tailored to suit different trading styles. Nigerian traders can access leverage as high as 1:2000 or even unlimited leverage for some account types. While this amplifies potential profits, it also emphasizes the importance of responsible risk management.

User-Friendly Trading Platforms and Tools

Exness prioritizes user experience by offering intuitive trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary WebTerminal. These platforms are equipped with advanced tools like customizable charts, real-time price tracking, and automated trading capabilities.

For Nigerian traders new to the market, Exness ensures accessibility through a simple registration process and easy-to-navigate interfaces. Advanced users, on the other hand, can take advantage of technical indicators and sophisticated analytical tools to fine-tune their strategies.

Customer Support and Resources for Nigerian Traders

Exness provides dedicated customer support to cater to the needs of Nigerian traders. With multilingual assistance, including support in English and Hausa, Exness ensures clear communication and quick resolution of queries.

The platform also offers a wealth of educational resources, including webinars, video tutorials, and market analysis. These resources are especially beneficial for traders looking to enhance their skills and stay informed about global market trends.

Challenges Faced by Nigerian Traders on Exness

Internet Connectivity Issues and Their Impact on Trading

One common challenge for traders in Nigeria is inconsistent internet connectivity. Since forex trading requires real-time data and quick decision-making, a stable internet connection is crucial for success.

Exness has addressed this issue by optimizing its platforms to work efficiently even with slower connections. However, Nigerian traders are encouraged to invest in reliable internet service to minimize the risk of disruptions during trading sessions.

Potential Withdrawal Delays and Processing Times

Although Exness processes most transactions instantly, occasional delays may occur due to banking systems or third-party payment providers. Nigerian traders should be aware of potential processing times for withdrawals, especially when using local banks.

To mitigate these delays, Exness recommends using e-wallets or cryptocurrencies, which typically offer faster processing times compared to traditional banking methods.

Currency Exchange and Conversion Fees

Another challenge Nigerian traders might encounter is the cost of currency conversion. Since Exness operates in USD and other major currencies, Nigerian traders depositing or withdrawing in Naira may incur exchange fees.

To minimize these costs, traders can use multi-currency accounts or payment methods that support direct deposits in foreign currencies. Planning deposits and withdrawals strategically can also help reduce unnecessary expenses.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Popularity of Forex Trading in Nigeria

Growing Interest in Online Trading Among Nigerians

Forex trading has gained significant traction in Nigeria over the past decade. With a youthful population, increasing internet penetration, and rising awareness of online financial opportunities, more Nigerians are exploring forex as a viable income stream.

Platforms like Exness have further fueled this interest by providing accessible tools, low-cost trading options, and educational resources. For many Nigerians, forex trading represents a chance to diversify income sources and participate in global financial markets.

Influence of Social Media and Trading Communities

Social media platforms and online trading communities play a pivotal role in the growing popularity of forex trading in Nigeria. Influencers, mentors, and experienced traders often share their success stories and strategies, inspiring others to join the trading world.

Additionally, Exness has leveraged social media to engage with Nigerian traders, providing real-time updates, promotions, and market insights. This digital outreach helps traders stay informed and connected with the broader trading community.

Exness Customer Reviews and Reputation

Analysis of Customer Feedback from Nigerian Users

Exness has garnered a strong reputation among Nigerian traders for its reliability and transparency. Positive feedback often highlights its low trading costs, fast transaction processing, and user-friendly platforms.

However, some traders have raised concerns about withdrawal delays or currency conversion fees. While these issues are not unique to Exness, they underscore the importance of understanding broker policies and choosing payment methods wisely.

Comparison with Other Forex Brokers Operating in Nigeria

Compared to other brokers operating in Nigeria, Exness stands out for its competitive pricing, advanced platforms, and extensive educational resources. While brokers like HotForex and FXTM are also popular in the region, Exness’s instant withdrawal feature and high leverage options give it a unique edge.

Ultimately, choosing the right broker depends on individual preferences, trading goals, and the specific features offered by each platform.

Tips for Trading on Exness as a Nigerian Trader

Understanding Market Trends and Analysis Tools

To succeed in forex trading, Nigerian traders must develop a solid understanding of market trends and analysis techniques. Exness provides tools like economic calendars, charting software, and market news updates to help traders stay informed.

By combining fundamental analysis (examining economic indicators) with technical analysis (studying chart patterns), traders can make well-informed decisions and increase their chances of profitability.

Risk Management Strategies for Successful Trading

Effective risk management is essential for long-term success in forex trading. Nigerian traders should set stop-loss orders, diversify their portfolios, and avoid over-leveraging to minimize potential losses.

Exness offers features like negative balance protection and customizable leverage, enabling traders to manage their risk exposure effectively. Regularly reviewing trading strategies and adjusting them based on market conditions is also crucial for sustained success.

Navigating Legal and Tax Obligations in Nigeria

Nigerian traders must ensure compliance with local regulations and tax obligations. While forex trading is legal in Nigeria, traders are required to report their earnings and pay applicable taxes.

Keeping detailed records of trading activities and consulting with a tax professional can help traders fulfill their legal responsibilities without complications. Exness also provides transaction histories to assist traders in maintaining accurate financial records.

Conclusion

Exness has established itself as a reliable and accessible trading platform for Nigerian traders. With its competitive pricing, robust tools, and commitment to customer satisfaction, Exness continues to attract a growing number of users in Nigeria.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Despite challenges like internet connectivity and currency conversion fees, Exness’s strengths—such as instant withdrawals, multilingual support, and comprehensive educational resources—make it a standout choice in the Nigerian forex market.

As forex trading gains momentum in Nigeria, platforms like Exness play a vital role in empowering traders with the tools and knowledge needed to succeed. By adopting effective strategies, staying informed about market trends, and leveraging the features offered by Exness, Nigerian traders can unlock their full potential in the dynamic world of forex trading.

Read more: