9 minute read

Is Exness Legit in India? Review Broker

from Exness

by Exness_Blog

In recent years, the world of online trading has experienced explosive growth. Many traders, particularly in emerging markets such as India, have turned to online platforms to invest in foreign exchange (forex), stocks, commodities, and other financial instruments. One of the most well-known trading platforms is Exness, which is considered by many as a reliable option for trading. However, Indian traders have often asked the important question: Is Exness legit in India?

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

This article aims to address the question of whether Exness is a legitimate trading platform in India by examining several key aspects of the platform, including its regulatory compliance, security measures, withdrawal process, and user experiences. We will also discuss the legal landscape for online forex trading in India and provide helpful insights for traders looking to use Exness as a broker.

Understanding Exness: A Trading Platform Overview

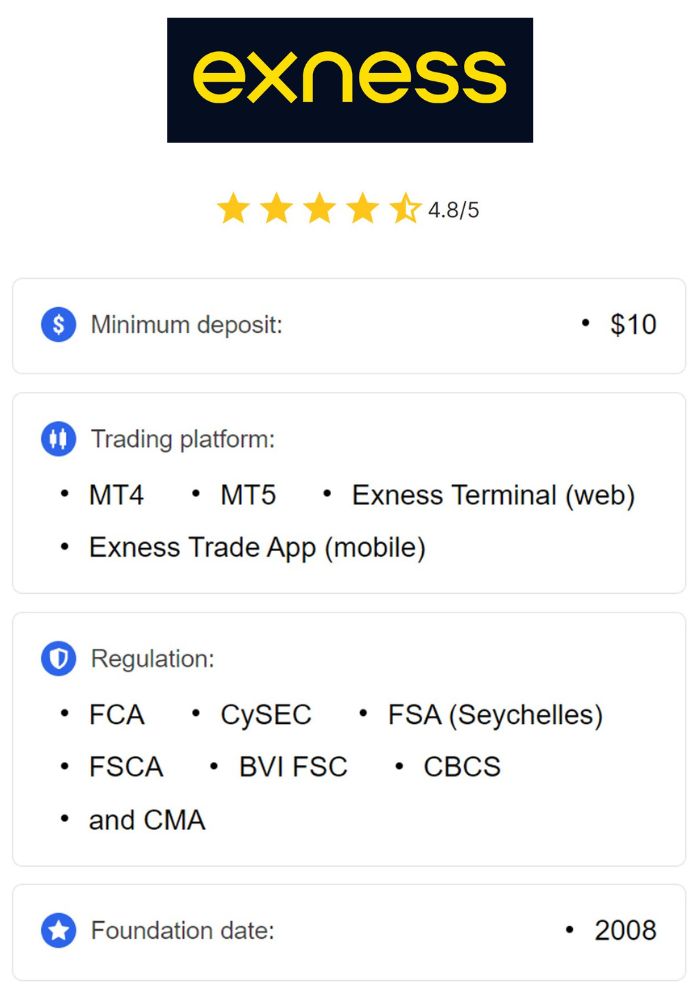

Exness is a global forex and CFD (Contract for Difference) broker that was established in 2008. The platform has grown rapidly and now serves traders in over 130 countries worldwide, including India. Exness is known for offering a wide range of trading instruments, including forex pairs, commodities, cryptocurrencies, and stock indices. The platform supports both beginner and advanced traders, providing a variety of account types, tools, and educational resources.

Exness Trading Services and Features

Exness provides a variety of features aimed at making the trading experience smooth and rewarding for users. Here are some of the key features that Exness offers:

Trading Instruments: Exness offers a broad range of instruments including forex, commodities, cryptocurrencies, and stock indices. Traders can access a diversified portfolio of assets and trade on global markets.

Low Spreads: Exness is known for its competitive spreads, especially in its Pro accounts, which are popular among professional traders.

Leverage: Exness offers high leverage, allowing traders to control larger positions with a smaller capital investment. Depending on the trader's country of residence and account type, the leverage offered can be as high as 1:2000.

MetaTrader 4 and 5: Exness provides access to popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are renowned for their robust features and user-friendly interfaces.

Mobile Trading: Exness also provides a mobile trading app, which allows traders to access their accounts and trade on the go.

Educational Resources: Exness offers a range of educational materials, including webinars, articles, and guides designed to help new traders improve their skills.

Is Exness Regulated and Licensed?

One of the most important factors when evaluating the legitimacy of any online broker is whether they are properly regulated. In the case of Exness, the broker is licensed and regulated by several well-known financial authorities, which adds a layer of credibility and security for traders.

Licenses and Regulatory Bodies

Exness operates under the regulatory supervision of several top-tier financial authorities:

Financial Conduct Authority (FCA) in the UK: The FCA is one of the most respected financial regulators globally, ensuring that Exness adheres to strict standards for financial markets and consumer protection.

Cyprus Securities and Exchange Commission (CySEC): Exness is also regulated by CySEC, which supervises financial services within the European Union. This regulation ensures that Exness complies with EU financial standards and provides traders with access to financial protections.

Australian Securities and Investments Commission (ASIC): Exness holds a license from ASIC, an Australian regulatory body known for its rigorous approach to financial regulation and market integrity.

FSA (Financial Services Authority) in Seychelles: Exness is also licensed by the FSA in Seychelles, which provides another layer of regulation for traders using the platform.

These licenses give Exness a reputation for being a reliable and compliant trading platform, ensuring that the company meets industry standards for transparency, client protection, and financial integrity.

How Safe Are Your Funds with Exness?

For any online broker, ensuring the safety of clients' funds is a priority. Exness follows industry best practices to protect its clients' funds and personal data, providing traders with peace of mind while trading.

Client Fund Protection

Exness adheres to the segregation of client funds, meaning that client deposits are kept in separate accounts from the broker's operational funds. This helps to ensure that, even in the event of financial difficulties, the broker cannot use client funds for any other purpose.

Secure Payment Systems

Exness uses secure payment systems for deposits and withdrawals, ensuring that transactions are processed with encryption to protect traders' sensitive information. Additionally, Exness is committed to following best practices in ensuring financial transactions are safe and transparent.

Two-Factor Authentication (2FA)

Exness also provides two-factor authentication (2FA) as an added layer of security for user accounts. This feature adds an extra level of protection against unauthorized access to your trading account.

Risk Management and Negative Balance Protection

Exness offers negative balance protection, ensuring that traders cannot lose more than the amount they have deposited in their accounts. This helps prevent situations where traders might face financial distress due to sudden market movements.

The Legality of Exness in India

India's forex trading regulations are governed by the Foreign Exchange Management Act (FEMA), which is administered by the Reserve Bank of India (RBI). While online forex trading is legal in India, there are restrictions on certain types of forex trading activities, particularly when using offshore brokers.

SEBI's Role in Regulating Forex Trading in India

India's primary financial regulatory body, SEBI (Securities and Exchange Board of India), does not directly regulate offshore forex brokers like Exness. While SEBI oversees the securities and stock market within India, it does not have jurisdiction over brokers operating outside the country.

Thus, while trading with Exness is not illegal, Indian traders need to be cautious. The Indian government has laws in place that restrict Indian residents from using foreign platforms for trading on certain assets like forex unless those platforms are compliant with local regulations.

However, there is no clear ban on using offshore platforms like Exness for trading forex. The legal concern arises if funds are transferred inappropriately or if traders engage in activities that go against India's foreign exchange laws.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Guidelines for Indian Traders Using Offshore Brokers

For Indian traders considering using Exness, it is essential to ensure that their trading activities remain within the legal framework. Some key points to keep in mind:

Ensure that all payments and withdrawals comply with Indian currency regulations.

Use caution when transferring large sums of money to or from India, as international wire transfers could be subject to scrutiny by the RBI.

Keep records of all transactions and report forex earnings in your income tax returns to avoid any potential tax-related issues.

Exness Withdrawal Process and Legality in India

A critical aspect of any online broker is the ease of withdrawing funds. For Indian traders, it's essential to understand whether they can safely withdraw funds from Exness and the associated legal implications.

Exness Withdrawal Methods for Indian Traders

Exness provides multiple withdrawal methods for Indian traders, including:

Bank Transfers: Indian traders can withdraw funds directly to their bank accounts via wire transfer. Bank transfers typically take several business days to process.

E-wallets: Payment providers such as Neteller and Skrill are available for withdrawals. These e-wallets allow for quicker processing of funds compared to traditional bank transfers.

Credit and Debit Cards: Traders can also withdraw funds to their credit or debit cards, though processing times may vary depending on the financial institution.

Each method has different fees and processing times, so it’s essential for traders to understand the costs associated with withdrawals.

Exness Withdrawal Fees and Processing Times

Exness itself does not charge withdrawal fees, but payment processors or banks may charge a fee for transactions. Additionally, withdrawal processing times can vary depending on the method used. For example:

Bank transfers may take 3-5 business days.

E-wallets can be processed within 24 hours.

Credit card withdrawals typically take 3-7 business days.

Indian traders should also consider that, depending on their location, the currency conversion fee could apply if they are withdrawing funds in a currency different from their local currency.

Withdrawal Legality in India

As long as traders comply with Indian regulations regarding foreign exchange, using Exness to withdraw funds is legal. However, it’s essential to be mindful of potential tax liabilities and ensure that transactions are fully documented and reported to the authorities.

User Experiences and Reviews of Exness in India

When evaluating the legitimacy of any trading platform, user feedback is essential. Reviews from Indian traders suggest that Exness generally provides a positive trading experience, but like all platforms, it has some drawbacks.

Positive User Experiences

Many Indian traders praise Exness for its fast withdrawals, responsive customer support, and transparent trading conditions. The platform is also highly regarded for offering competitive spreads and high leverage, which are attractive to active traders.

Users also appreciate Exness’s low deposit requirements and the user-friendly interface, making it accessible for both new and experienced traders.

Negative User Experiences

Some Indian traders have reported delays in withdrawals, particularly when using bank transfers. Additionally, there have been complaints about account verification issues, especially for first-time users. However, these issues are typically resolved once users submit the required documentation.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness vs Other Brokers in India

When comparing Exness with other brokers, several advantages stand out:

Regulatory Compliance: Exness is regulated by top-tier authorities such as the FCA, ASIC, and CySEC, offering higher transparency and accountability compared to some other brokers.

Range of Trading Instruments: Exness offers a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies, making it appealing to traders with various interests.

Customer Support: Exness is known for its responsive customer support, available 24/5 through live chat, email, and phone.

However, Indian traders should also consider other brokers such as IC Markets, FBS, or AvaTrade, which offer similar trading services and can also be considered reliable and safe for Indian traders.

Conclusion: Is Exness Legit in India?

Based on the information provided, Exness is a legitimate trading platform for Indian traders. It is properly regulated by top-tier financial authorities, and it follows best practices for securing client funds. While there are some legal complexities involved with trading on offshore platforms, Exness itself complies with international financial standards, making it a safe and reliable broker for Indian traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Indian traders should always ensure they understand local regulations, comply with tax reporting requirements, and choose appropriate withdrawal methods to avoid potential legal issues. Exness offers a robust platform with excellent features for traders, and as long as you follow the guidelines, you can trade with confidence on this platform.

Read more: