18 minute read

Exness vs Fusion Markets Comparison: Which is better?

from Exness

by Exness_Blog

In the vast landscape of online trading, brokers play a pivotal role in shaping the experience of retail traders. A common query among traders seeking the right kind of brokerage is: Exness vs Fusion Markets Comparison: Which is better? This article aims to dissect various elements of both Exness vs Fusion Markets, providing insights that will aid in making informed decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness vs Fusion Markets

Understanding the core offerings of any broker is essential for traders looking to engage with financial markets. In this section, we will explore key aspects of both Exness vs Fusion Markets, shedding light on their backgrounds, market presence, and unique features.

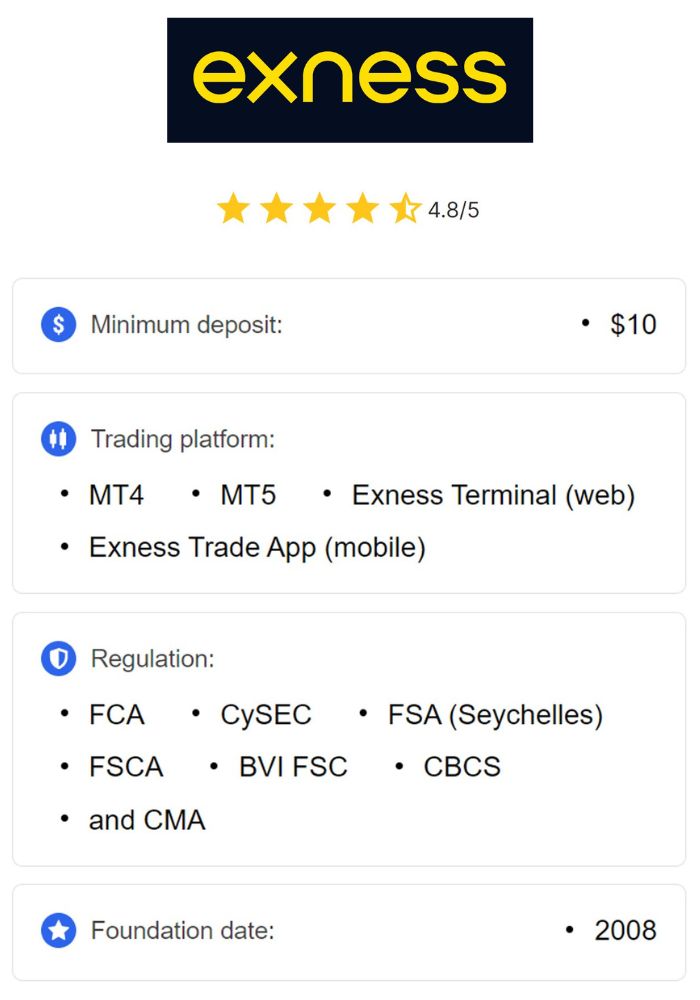

Overview of Exness

Exness has become synonymous with reliability and innovation since its inception in 2008. Headquartered in Cyprus, the broker offers a broad spectrum of trading services across various asset classes including forex, cryptocurrencies, commodities, and indices. Known for its user-friendly platform and low trading costs, Exness appeals to both beginner and experienced traders alike.

One of the standout features of Exness is its commitment to transparency. The broker provides detailed information about its operations, ensuring that clients are well-informed about spreads, commissions, and other trading conditions. Additionally, Exness supports multiple trading platforms, catering to the diverse needs of its clientele.

Overview of Fusion Markets

On the other side, Fusion Markets, established in 2017, is an Australian-based broker that has carved a niche for itself by prioritizing low-cost trading solutions without compromising on quality. Fusion Markets positions itself as a broker that leverages technology to provide clients with superior trading conditions.

With a focus on forex and CFDs, Fusion Markets attracts traders who value tight spreads and minimal commissions. The broker's operational model is designed to be transparent and straightforward, ensuring customers have a seamless trading experience. Fusion Markets also emphasizes customer support, offering various tools and resources to empower traders.

Regulation and Trustworthiness

When it comes to choosing a broker, regulation and trustworthiness are paramount concerns. Both Exness vs Fusion Markets claim to operate under regulatory frameworks, but the specifics differ considerably.

Regulatory Bodies for Exness

Exness operates under several regulatory authorities, ensuring compliance with international standards. It is regulated by the Financial Conduct Authority (FCA) in the United Kingdom as well as by the Cyprus Securities and Exchange Commission (CySEC). These recognitions instill confidence among traders regarding the safety of their funds.

Moreover, Exness follows strict guidelines for fund segregation, meaning that client funds are held separately from company funds. This practice enhances security, allowing traders to focus on their strategies rather than worrying about the safety of their capital.

Regulatory Bodies for Fusion Markets

Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC), one of the most respected financial regulatory bodies globally. ASIC oversight signifies a strong commitment to maintaining high ethical standards and ensures that Fusion Markets adheres to stringent compliance measures.

While being regulated under ASIC provides a solid foundation of trust, potential clients should always remain vigilant about the specific regulations applicable in their country of residence when engaging with any broker.

Comparison of Trust Scores

When comparing the two brokers' trust scores, it's important to consider not just the regulatory bodies but also the overall reputation within the trading community. Exness has earned a strong reputation, bolstered by years of operation and robust regulatory framework. In contrast, Fusion Markets, while newer, has established trust through its low-cost trading model and effective customer support.

Ultimately, both brokers present compelling arguments in terms of trustworthiness, though Exness may hold a slight edge due to its extensive regulatory cover and longer operational history.

Trading Platforms Offered

Choosing the right trading platform directly impacts a trader's success. In this segment, we will delve into the platforms offered by Exness vs Fusion Markets, examining their features and usability.

Exness Trading Platform Features

Exness primarily offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. Both platforms are industry-standard and come packed with features tailored for both novice and veteran traders.

MT4 is known for its simplicity and user-friendliness, making it an excellent choice for beginners. It provides essential tools for technical analysis, automated trading capabilities through Expert Advisors (EAs), and a plethora of indicators. MT5, on the other hand, builds upon MT4's foundation with enhanced features such as additional timeframes and advanced order types, appealing to more sophisticated traders.

Furthermore, Exness provides a web-based trading platform and mobile trading apps, enabling traders to manage their accounts conveniently from anywhere.

Fusion Markets Trading Platform Features

Fusion Markets also utilizes the MT4 and MT5 platforms, aligning itself with trader preferences for these robust systems. By offering these platforms, Fusion Markets ensures that traders have access to powerful analytical tools, comprehensive charting options, and the ability to implement automated strategies.

The interface of both MT4 and MT5 is highly customizable, allowing traders to tailor their workspace according to their trading style. Moreover, Fusion Markets places emphasis on speed and execution, promising quick trade fills which are crucial in the fast-paced world of forex.

User Experience and Interface

In terms of user experience, both Exness vs Fusion Markets have their strengths. Exness is often praised for its intuitive interface, which is particularly beneficial for newcomers. The layout is designed to minimize complexity and streamline the trading process.

Fusion Markets, while also offering a user-friendly experience, excels in providing detailed educational resources that help new traders acclimate to the trading environment. However, some users may find the platform slightly less visually appealing compared to Exness.

Overall, traders can expect smooth navigation and easy access to all necessary features on both platforms, yet the user experience may vary based on personal preference.

Account Types and Flexibility

Different trading styles necessitate varied account types. Understanding the distinctions between Exness vs Fusion Markets’ account offerings is critical for aligning personal trading strategies with broker capabilities.

Exness Account Types Explained

Exness offers a variety of account types, including Standard, Pro, and Zero accounts, each catering to different trading needs. The Standard account is designed for beginners, featuring no commission but wider spreads.

The Pro account targets more experienced traders looking for tighter spreads and lower fees. Meanwhile, the Zero account provides extremely tight spreads but charges a commission per trade. Such flexibility allows traders to select an account type that best aligns with their trading strategies and risk management plans.

Fusion Markets Account Types Explained

Similarly, Fusion Markets presents several account types, such as the Classic and Pro accounts. Its Classic account offers low spreads with no commission, making it suitable for retail traders. The Pro account, on the other hand, features even tighter spreads at the cost of a commission per trade, ideal for scalpers and day traders.

Both brokers emphasize providing flexibility through varying leverage options, making it easier for traders to tailor their accounts based on risk tolerance and trading volume.

Advantages of Each Broker's Account Options

Exness shines with its range of account types that cater to different experience levels and trading styles. The ability to switch between accounts based on trading strategy adds a layer of flexibility.

Fusion Markets, with its focus on ultra-low-cost trading, appeals specifically to cost-conscious traders, especially those operating on high volumes. Traders must assess their individual requirements and preferences to determine which broker’s account types align with their trading goals.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Spreads and Commissions

Of paramount concern to traders are the costs associated with trading, especially spreads and commissions. Here, we will analyze how Exness vs Fusion Markets stack up against each other.

Exness Spreads and Commission Structure

Exness is renowned for its competitive spreads across various account types. The Standard account offers spreads starting from 0.3 pips with no commission, while the Pro account features tighter spreads beginning at 0.1 pips, accompanied by a modest commission structure.

The Zero account stands out with extremely tight spreads, but traders should factor in commissions while evaluating cost-effectiveness. Overall, Exness maintains transparency about its pricing, allowing traders to make educated choices based on their trading frequency.

Fusion Markets Spreads and Commission Structure

Fusion Markets prides itself on offering some of the lowest spreads in the industry. Its Classic account has spreads starting from 0.0 pips, although a commission applies, while the Pro account offers similar advantages.

This pricing model is particularly attractive to scalpers and high-frequency traders who prioritize minimizing transaction costs. Fusion Markets emphasizes its low-cost trading ethos, which resonates well with clients focused on executing numerous trades throughout the day.

Cost Comparison for Traders

Comparing the spreads and commissions of both brokers reveals nuanced differences. While Exness does offer commendable pricing, Fusion Markets takes the lead in terms of consistently lower costs, particularly for high-volume traders. Ultimately, the decision will hinge on individual trading strategies, with traders needing to weigh the importance of spreads against the commission structure.

Leverage Options

Leverage plays a crucial role in online trading, providing traders the opportunity to control larger positions with smaller amounts of capital. In this section, we will look at the leverage options provided by each broker.

Leverage Offered by Exness

Exness is known for its generous leverage options, allowing traders to amplify their positions significantly. For standard account holders, leverage can go as high as 1:2000, depending on the asset class. This level of leverage enables traders to maximize their potential returns.

However, higher leverage also increases risk; thus, traders should carefully consider their risk management strategies. Exness promotes responsible trading practices by educating clients on leveraging effectively while managing exposure.

Leverage Offered by Fusion Markets

Fusion Markets also offers competitive leverage options, albeit slightly lower than Exness. The maximum leverage available on Fusion Markets reaches up to 1:500. Though this figure may seem conservative compared to Exness, it still provides ample opportunities for traders to enhance their positions.

The key takeaway is that while Exness provides greater leverage, traders should assess their risk appetite and trading strategies before choosing either broker’s offering.

Implications of Leverage on Trading

While leverage can magnify profits, it equally amplifies losses, creating a double-edged sword. Traders need to implement sound risk management techniques to navigate the challenges posed by high leverage. Understanding the implications of leverage is vital for traders to safeguard their capital and foster long-term profitability.

Traders should prioritize education on leveraging and ensure they have a clear exit strategy in place before entering leveraged positions.

Available Trading Instruments

A diverse range of trading instruments allows traders to diversify their portfolios and hedge risks effectively. In this part, we will analyze the available trading instruments offered by Exness vs Fusion Markets.

Forex Pairs Offered by Exness

Exness boasts a comprehensive selection of forex pairs, encompassing major, minor, and exotic currencies. This extensive offering equips traders with opportunities to capitalize on multiple currency movements and trends.

Whether a trader is interested in trading popular pairs like EUR/USD or niche pairs, Exness provides sufficient options to cater to various trading strategies. The availability of multiple currency pairs also enhances liquidity, which is a significant benefit in volatile markets.

Forex Pairs Offered by Fusion Markets

Fusion Markets also focuses heavily on forex trading, presenting an impressive array of currency pairs. The broker covers major and minor pairs while also offering access to less-traded exotic currencies.

This inclusive approach allows traders to exploit market volatility across different regions, thereby maximizing profit opportunities. The depth of Fusion Markets' forex offerings makes it a viable option for dedicated forex traders.

Other Asset Classes Available

Beyond forex, both brokers extend their reach into other asset classes. Exness offers trading in commodities, indices, stocks, and cryptocurrencies. Similarly, Fusion Markets provides access to CFDs across various asset classes, ensuring traders have diversified options for portfolio management.

In summary, both brokers excel in providing a wide range of trading instruments. However, Exness might have an edge with its broader array of non-forex offerings.

Deposit and Withdrawal Methods

Funding a trading account and withdrawing profits should be straightforward processes. Let's review the deposit and withdrawal methods available with Exness vs Fusion Markets.

Deposit Options with Exness

Exness offers an extensive selection of deposit methods, including credit/debit cards, bank transfers, e-wallets, and local payment systems. This variety ensures that clients worldwide can easily fund their accounts using preferred methods.

Additionally, Exness commonly implements instant deposits, meaning that traders can start trading immediately after funding their accounts. The ease of deposit options significantly enhances the overall trading experience.

Deposit Options with Fusion Markets

Fusion Markets also provides multiple deposit methods, ranging from bank wires to credit/debit cards and popular e-wallets. The broker aims to keep transactions simple and efficient, facilitating quick funding that allows traders to act without delays.

Fusion Markets typically processes deposits swiftly, ensuring minimal friction for traders eager to enter the market.

Withdrawal Process for Both Brokers

Both Exness vs Fusion Markets have made strides to ensure their withdrawal processes are user-friendly. Exness generally processes withdrawals quickly, often within hours, depending on the method chosen. This swift turnaround time is essential for traders wanting immediate access to their funds.

Fusion Markets, while also efficient, may take slightly longer for certain withdrawal methods. Nonetheless, the broker remains committed to transparency regarding withdrawal times, helping clients understand what to expect.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Customer Support and Resources

Robust customer support is imperative for any reputable broker. In this section, we will evaluate the customer support services and educational resources offered by both Exness vs Fusion Markets.

Exness Customer Support Services

Exness prides itself on offering exceptional customer support, providing assistance across multiple channels including live chat, email, and phone. With multilingual support available, traders from various backgrounds can receive prompt assistance in their preferred language.

Moreover, Exness has invested in an extensive FAQ section and a knowledge base that addresses common inquiries, enabling traders to find solutions independently. The availability of support 24/5 further enhances the trader experience.

Fusion Markets Customer Support Services

Fusion Markets, while a comparatively newer broker, has established a solid reputation for customer service. Similar to Exness, it offers support via live chat, email, and phone. Fusion Markets also emphasizes a proactive approach, encouraging clients to reach out with any questions or concerns.

Additional resources, such as webinars and articles, help traders gain valuable insights, enhancing their trading skills over time.

Educational Resources Provided

Both brokers recognize the importance of education in empowering traders. Exness offers a wealth of educational materials, including tutorials, articles, and videos covering various trading topics. This commitment to education aims to create knowledgeable traders who can make informed decisions.

Fusion Markets also excels in providing educational resources, with an emphasis on practical trading strategies. The broker engages clients through informative webinars and guides aimed at improving trading skills.

Ultimately, both Exness vs Fusion Markets offer valuable support and educational content, though Exness may have a slight advantage due to its more extensive library of resources.

User Reviews and Reputation

User reviews serve as a vital indicator of a broker’s reputation and overall performance. In this section, we will assess the general sentiment towards Exness vs Fusion Markets.

Overall User Sentiment for Exness

Exness enjoys a positive reputation among its users, highlighted by numerous favorable reviews praising its competitive spreads, diverse account types, and responsive customer support. Many traders appreciate the broker's transparency and ease of use, leading to high satisfaction rates.

However, some users have raised concerns about the occasional delays in withdrawals, although many reviews attribute this to external factors rather than issues with Exness itself. Overall, the sentiment leans heavily towards approval, indicating a trusted platform.

Overall User Sentiment for Fusion Markets

Fusion Markets has quickly garnered attention and praise within the trading community. Users commend the broker for its low-cost trading structure, user-friendly platform, and effective customer support. Many reviews highlight the broker's streamlined approach, emphasizing ease of access and low barriers for entry.

As with any broker, there are isolated criticisms, typically revolving around limitations in educational resources compared to more established competitors. Nevertheless, the general consensus reflects a growing reputation for Fusion Markets as a trustworthy, cost-effective trading option.

Key Strengths and Weaknesses from Users

Both brokers exhibit distinct strengths and weaknesses based on user feedback. Exness is lauded for its extensive account offerings, transparency, and reliable customer support, while drawbacks sometimes arise during peak withdrawal periods.

Conversely, Fusion Markets shines in its low-cost trading model and user-friendly interface but faces scrutiny regarding the breadth of its educational content.

When evaluating both brokers, it's essential to consider these strengths and weaknesses in alignment with individual trading preferences and priorities.

Trading Tools and Technology

The tools and technology provided by brokers can significantly enhance traders' efficiency and effectiveness. In this section, we will explore the tools available with Exness vs Fusion Markets.

Tools Available with Exness

Exness offers traders an array of analytical tools designed to assist in crafting informed trading strategies. Popular technical indicators, drawing tools, and charting options are readily available on both the MT4 and MT5 platforms.

Additionally, Exness provides advanced trading functionalities such as copy trading, allowing users to replicate the trades of successful traders. This feature empowers inexperienced traders to learn from more seasoned counterparts.

Tools Available with Fusion Markets

Fusion Markets also incorporates a suite of trading tools aimed at optimizing the trading experience. Clients have access to competitive research tools, including economic calendars and market analysis reports.

These tools help traders stay informed about market developments and adjust their strategies accordingly. Fusion Markets also promotes the use of automated trading through the MT4 and MT5 platforms, providing opportunities to execute trades based on set conditions.

Impact of Technology on Trading Efficiency

The implementation of advanced trading tools and technology has revolutionized trading efficiency. Both Exness vs Fusion Markets equip traders with the necessary resources to make real-time decisions, improving their capacity to navigate dynamic market conditions.

Moreover, the availability of mobile trading applications allows traders to monitor positions and execute trades on the go, adding an unparalleled level of convenience to the trading experience.

Promotions and Bonuses

Promotions and bonuses can entice traders to choose one broker over another. In this section, we will examine the current promotions offered by Exness vs Fusion Markets.

Current Promotions by Exness

Exness regularly runs promotional campaigns aimed at attracting new traders and rewarding loyal clients. These promotions can include deposit bonuses, cashback offers, and referral programs. By incentivizing trading activity, Exness seeks to enhance the overall trading experience while nurturing client relationships.

It’s crucial for traders to read the terms and conditions associated with these promotions, as understanding the requirements can optimize the benefits gained.

Current Promotions by Fusion Markets

Fusion Markets also provides various promotions, primarily focusing on cashback offers and competitive spreads. The broker encourages clients to take advantage of its low-cost trading model while enjoying potential rewards through promotional initiatives.

However, Fusion Markets tends to emphasize straightforward pricing models rather than elaborate bonus structures, reflecting its commitment to transparency and simplicity.

Evaluation of Bonus Offers

When assessing promotions and bonuses, traders should prioritize understanding the value derived relative to their trading objectives. Exness's diverse promotional offerings can attract retail traders looking for additional incentives, while Fusion Markets' simplicity may appeal to those favoring straightforward trading conditions.

Ultimately, the decision regarding which broker offers better promotions hinges on individual perspectives and trading styles.

Security Measures

In the realm of online trading, security measures are critical for protecting clients' funds and data. In this section, we'll explore the security protocols implemented by both Exness vs Fusion Markets.

Security Measures Implemented by Exness

Exness takes security seriously, employing industry-standard measures to safeguard clients' information and assets. The broker uses SSL encryption to secure transactions and protect sensitive data. Additionally, the segregation of client funds ensures that traders’ capital is stored separately from the company's operational funds.

Exness also follows rigorous KYC (Know Your Customer) protocols to verify the identity of all clients. This helps mitigate the risks associated with fraud and money laundering, fostering a safe trading environment.

Security Measures Implemented by Fusion Markets

Fusion Markets mirrors a strong commitment to security, implementing measures that include two-factor authentication (2FA) for added account protection. The broker also adheres to strict KYC procedures, ensuring that all client information is authenticated before granting access to trading accounts.

The use of SSL encryption further guarantees that data transmitted between clients and the broker remains confidential. As security breaches can severely damage a broker's reputation, Fusion Markets prioritizes safeguarding its clients' interests.

Importance of Security in Online Trading

Security cannot be overstated in online trading, as traders entrust brokers with their capital and personal information. High-profile breaches in the past underscore the significance of choosing a broker that actively employs robust security measures.

Both Exness vs Fusion Markets illustrate a commendable commitment to maintaining security, allowing traders to focus on their strategies without undue concern over the safety of their investments.

Conclusion

The query surrounding Exness vs Fusion Markets Comparison: Which is better? ultimately leads to a nuanced answer rooted in individual preferences. Both brokers possess distinct advantages and cater to diverse trading needs.

Exness stands out with its extensive range of account types, transparent pricing, and robust customer support, making it an ideal choice for beginners and seasoned traders alike. Conversely, Fusion Markets excels in offering competitive pricing, low-cost trading structures, and a customer-centric approach.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Traders must carefully assess their priorities—whether it be trading costs, account versatility, security, or educational resources—in order to select the broker that aligns with their trading aspirations. Ultimately, the choice between Exness vs Fusion Markets should be guided by thorough research and personal trading objectives, paving the way for a fulfilling trading journey.