11 minute read

Is Exness Regulated in Nigeria? Review Broker

from Exness

by Exness_Blog

Forex trading has surged in popularity across Nigeria in recent years, driven by a growing interest in financial independence and the accessibility of online platforms. Among the many brokers vying for the attention of Nigerian traders, Exness stands out as a globally recognized name. But one question looms large for prospective users: Is Exness regulated in Nigeria? This article explores the regulatory status of Exness in Nigeria, delving into the broader context of forex trading regulations, the broker’s global credentials, and what it all means for traders in the country. Whether you’re a beginner or an experienced trader, understanding the regulatory landscape is key to making informed decisions. Let’s dive in.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

What Is Exness? An Overview of the Broker

Before addressing the question of regulation, it’s worth understanding who Exness is and why it’s a prominent name in the forex trading world. Founded in 2008, Exness is an online brokerage firm headquartered in Limassol, Cyprus. Over the past decade and a half, it has grown into one of the largest forex brokers globally, boasting millions of clients across more than 180 countries. The broker offers a wide range of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies, all accessible through popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Exness has built a reputation for competitive trading conditions, such as low spreads, high leverage (up to 1:2000), and fast execution speeds. It also emphasizes transparency by publishing financial reports audited by reputable firms like Deloitte. For Nigerian traders, Exness offers localized features, such as support for Naira-based accounts and payment methods tailored to the local market. But while these perks are appealing, the critical question remains: Does Exness operate under proper regulatory oversight in Nigeria?

The Importance of Regulation in Forex Trading

To answer whether Exness is regulated in Nigeria, we first need to understand why regulation matters in forex trading. The forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Its decentralized nature, however, makes it prone to risks like fraud, mismanagement of funds, and unethical practices by brokers. Regulation serves as a safeguard, ensuring that brokers adhere to strict standards of transparency, security, and fairness.

A regulated broker is accountable to an overseeing authority, which imposes rules on how client funds are handled, how trades are executed, and how disputes are resolved. For traders, this means greater peace of mind knowing their investments are protected. In Nigeria, where forex trading has become a viable income source for many, choosing a regulated broker is especially crucial given the lack of a robust local framework for overseeing international brokers.

Forex Trading Regulation in Nigeria: The Landscape

Nigeria’s financial regulatory environment is shaped by two primary institutions: the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC). Together, they oversee the country’s financial markets, but their roles in regulating forex trading differ significantly.

Central Bank of Nigeria (CBN): The CBN is the cornerstone of Nigeria’s financial system, responsible for monetary policy, currency stability, and overseeing foreign exchange transactions. While it doesn’t directly regulate forex brokers, it plays a pivotal role in controlling the flow of foreign currency in and out of the country. In recent years, the CBN has imposed restrictions on forex activities to stabilize the Naira, including limits on speculative trading and unofficial currency exchanges. These policies indirectly affect forex brokers operating in Nigeria.

Securities and Exchange Commission (SEC): The SEC is tasked with regulating Nigeria’s capital markets, including securities and investment schemes. It has some oversight over forex trading, particularly when it involves Nigerian-based brokers or investment firms. However, its jurisdiction is limited when it comes to international brokers like Exness, which operate outside Nigeria’s borders.

Here’s the catch: Nigeria lacks a dedicated regulatory body specifically for forex trading. Unlike countries such as the UK (with the Financial Conduct Authority) or the US (with the Commodity Futures Trading Commission), Nigeria has not established a comprehensive framework to license and monitor forex brokers. This creates a regulatory “grey area” for international platforms operating in the country. As a result, many Nigerian traders rely on brokers regulated by global authorities, raising the question of whether Exness fits this mold.

Is Exness Regulated in Nigeria? The Straight Answer

The short answer is no, Exness is not directly regulated in Nigeria. Exness does not hold a license from the Central Bank of Nigeria or the Securities and Exchange Commission. This isn’t surprising, given that Nigeria doesn’t have a specific licensing process for forex brokers, especially those based overseas. However, this doesn’t mean Exness operates without oversight or that it’s unsafe for Nigerian traders. To fully understand its status, we need to look at its global regulatory credentials.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness is regulated by several reputable international authorities, which provide a layer of security and accountability for its operations worldwide, including in Nigeria. These include:

Financial Conduct Authority (FCA) – United Kingdom: The FCA is one of the world’s most respected financial regulators, known for its stringent standards. Exness (UK) Ltd is licensed by the FCA under registration number 730729, though this entity primarily serves institutional clients rather than retail traders.

Cyprus Securities and Exchange Commission (CySEC) – Cyprus: CySEC oversees Exness (Cy) Ltd under license number 178/12. This regulation ensures compliance with European Union financial laws, including the Markets in Financial Instruments Directive (MiFID II). Like the FCA license, this applies to specific Exness entities and not necessarily retail clients in Nigeria.

Financial Sector Conduct Authority (FSCA) – South Africa: The FSCA regulates Exness ZA (Pty) Ltd under FSP number 51024. This is particularly relevant for African traders, as it demonstrates Exness’s commitment to compliance in the region.

Seychelles Financial Services Authority (FSA): Exness (SC) Ltd operates under FSA license SD025. This entity serves many retail clients globally, including those in Nigeria.

Other Licenses: Exness also holds licenses from the Central Bank of Curaçao and Sint Maarten (CBCS), the Financial Services Commission (FSC) in Mauritius and the British Virgin Islands, and the Capital Markets Authority (CMA) in Kenya.

For Nigerian traders, the most relevant entity is likely Exness (SC) Ltd, regulated by the FSA in Seychelles. While Seychelles is considered an offshore jurisdiction with less stringent rules than the FCA or CySEC, it still imposes requirements for client fund protection, transparency, and anti-money laundering (AML) compliance. So, while Exness isn’t regulated by Nigerian authorities, its global licenses provide a level of oversight that extends to its operations in Nigeria.

How Does Exness Ensure Safety for Nigerian Traders?

Regulation is just one piece of the puzzle. A broker’s safety measures and operational practices are equally important. Exness takes several steps to protect its clients, including those in Nigeria:

Segregated Accounts: Exness keeps client funds separate from its operational funds, ensuring that traders’ money isn’t used for the company’s expenses. This is a standard practice among regulated brokers and adds a layer of security.

Negative Balance Protection: Exness offers protection against negative balances, meaning traders can’t lose more than their deposited funds, even during volatile market conditions.

Regular Audits: The broker’s financial statements are audited by Deloitte, a globally respected firm, enhancing transparency and accountability.

Secure Payment Methods: Exness supports a variety of deposit and withdrawal options for Nigerian traders, including bank transfers, e-wallets, and local payment systems, all processed through encrypted channels.

Compliance with AML and KYC: Exness adheres to anti-money laundering and know-your-customer policies, requiring traders to verify their identity and address before trading. This helps prevent fraud and ensures a secure trading environment.

These measures demonstrate that, despite not being regulated locally, Exness prioritizes client safety and operates with a high degree of professionalism.

Exness vs. Locally Regulated Brokers: A Comparison

To put Exness’s status in perspective, let’s compare it to brokers that might be regulated by Nigerian authorities. Locally regulated brokers, such as those licensed by the SEC, must comply with Nigerian laws, maintain a physical presence in the country, and adhere to CBN forex restrictions. However, very few Nigerian-based forex brokers exist, and those that do often lack the global reach, advanced platforms, and competitive conditions offered by international brokers like Exness.

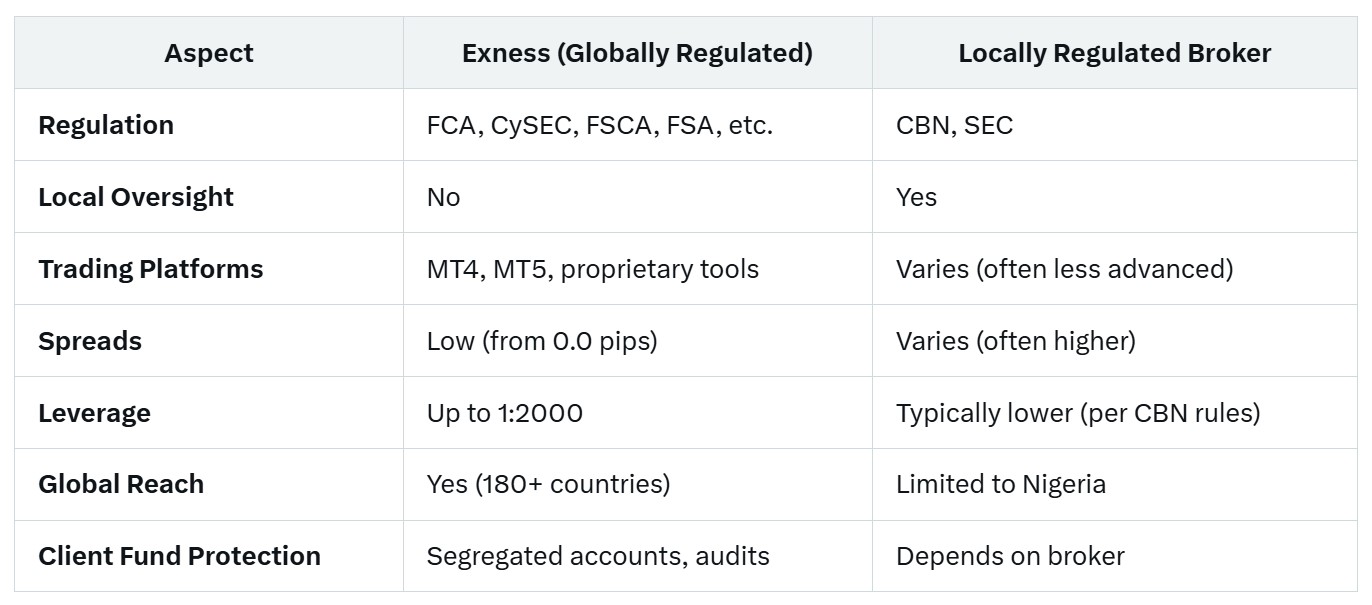

Here’s a quick comparison:

For Nigerian traders, the trade-off is clear: Exness offers superior trading conditions and global credibility, but it lacks direct local oversight. Locally regulated brokers may provide more familiarity and recourse under Nigerian law, but they often fall short in terms of technology and market access.

Why Nigerian Traders Choose Exness

Despite not being regulated in Nigeria, Exness remains a top choice for traders in the country. Here’s why:

Low Entry Barrier: Exness offers accounts with a minimum deposit as low as $1, making it accessible to beginners and those with limited capital—a key factor in Nigeria’s low-to-middle-income economy.

Naira-Based Accounts: Traders can open accounts in Nigerian Naira (NGN), avoiding currency conversion fees and simplifying transactions.

Fast Withdrawals: Exness is known for its instant withdrawal processing, a major advantage in a market where delays can erode trust.

Educational Resources: The broker provides webinars, guides, and market analysis tailored to Nigerian traders, helping them build skills and confidence.

Competitive Conditions: With tight spreads, high leverage, and no hidden fees, Exness appeals to both novice and seasoned traders looking to maximize profits.

These features, combined with its global reputation, explain why Exness has gained a strong foothold in Nigeria despite the absence of local regulation.

Risks of Trading with an Unregulated Broker in Nigeria

While Exness is regulated globally, its lack of a Nigerian license introduces some risks worth considering:

Limited Local Recourse: If a dispute arises, Nigerian traders can’t appeal to the CBN or SEC for resolution. They’d need to rely on the broker’s international regulators, which may be less accessible.

Regulatory Grey Area: Nigeria’s evolving forex laws could lead to future restrictions on international brokers, potentially affecting Exness’s operations.

Currency Restrictions: The CBN’s tight control over forex transactions could complicate deposits and withdrawals, though Exness mitigates this with local payment options.

For risk-averse traders, these factors might tilt the scales toward a locally regulated broker. However, Exness’s robust global oversight and track record largely offset these concerns for most users.

Is Exness Banned in Nigeria?

A related question that often arises is whether Exness is banned in Nigeria. There’s no evidence or official statement from the CBN or SEC indicating that Exness is prohibited from operating in the country. The broker continues to serve Nigerian clients without interruption, and its website remains accessible. However, traders should stay informed about regulatory updates, as Nigeria’s forex policies can shift in response to economic conditions.

How to Verify Exness’s Legitimacy

For those still unsure about Exness’s credibility, here are steps to verify its legitimacy:

Check Licenses: Visit the websites of the FCA, CySEC, FSCA, and FSA to confirm Exness’s registration details.

Review Audits: Look up Exness’s financial reports on its official site (www.exness.com) to assess its transparency.

Read User Reviews: Platforms like Medium, Trustpilot, and forex forums offer insights from real Nigerian traders.

Test with a Demo Account: Exness offers free demo accounts, allowing you to explore its platform risk-free before committing funds.

These steps can help you confirm that Exness is a legitimate broker, even without local regulation.

Conclusion: Should Nigerian Traders Use Exness?

So, is Exness regulated in Nigeria? No, it isn’t—not by local authorities like the CBN or SEC. However, its regulation by top-tier global bodies like the FCA, CySEC, FSCA, and FSA provides a strong foundation of trust and security. For Nigerian traders, Exness offers a compelling mix of accessibility, competitive conditions, and safety measures, making it a viable option despite the lack of local oversight.

Ultimately, the decision to trade with Exness depends on your priorities. If you value global credibility, advanced tools, and low costs, Exness is a standout choice. If local regulation and direct recourse are non-negotiable, you might explore Nigerian-based alternatives—though they’re few and far between. Whatever you choose, always trade responsibly, conduct thorough research, and stay updated on Nigeria’s evolving forex landscape.

Ready to explore Exness for yourself? Sign up for a demo account today and see if it’s the right fit for your trading journey.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Read more: