16 minute read

Is Exness a Regulated Broker? Review Broker

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness

Exness is a global online broker that offers various financial products and services to traders around the world. Founded in 2008, Exness has become one of the most popular and reputable brokers in the online trading industry. The company offers access to a wide range of trading instruments, including forex, CFDs, and cryptocurrencies, through its proprietary trading platforms. Exness is known for its user-friendly interface, competitive spreads, and a variety of account types designed to suit both beginners and professional traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The broker’s services cater to traders in over 180 countries, providing multilingual customer support and a range of deposit and withdrawal methods. Exness prides itself on offering transparency, with no hidden fees and clear terms and conditions. Given the complexity of the financial markets, Exness’ ability to create a secure and trustworthy trading environment is one of the key factors that contribute to its global success.

History and Background of the Company

Exness was founded by a group of finance professionals who wanted to make trading accessible to a broader audience. The company quickly gained a reputation for providing reliable and transparent trading services. By focusing on both institutional and retail clients, Exness developed a range of account types and tools that suit different trading needs, including forex, stocks, commodities, and cryptocurrencies.

Throughout its history, Exness has expanded its reach globally, and its influence in the online trading sector has grown significantly. The company’s commitment to providing a secure and well-regulated trading environment has contributed to its success. In addition, Exness has focused on improving its platforms and customer service to provide traders with the best possible experience. Over time, Exness became known for its adherence to the highest standards of financial conduct and regulation, ensuring that its clients are always operating in a secure and transparent environment.

Understanding Regulation in Forex Trading

What is a Regulated Broker?

A regulated broker is one that operates under the supervision of financial authorities or regulatory bodies in the jurisdictions where it conducts business. Regulation is an essential component in the financial industry, as it ensures that brokers follow established rules, uphold financial integrity, and protect their clients. A regulated broker is required to meet certain standards regarding business practices, financial reporting, and risk management.

In the forex trading industry, regulation is especially important due to the high leverage involved and the volatile nature of the market. Regulatory bodies ensure that brokers handle client funds responsibly, prevent fraud, and provide a fair and transparent trading environment. They also establish mechanisms for resolving disputes between brokers and clients, which helps enhance the overall trust in the financial markets.

Importance of Regulation for Traders

For traders, choosing a regulated broker is crucial for ensuring the safety and security of their investments. Regulation provides several safeguards, including the protection of client funds, regular audits, and strict operational guidelines that brokers must follow. A regulated broker is typically required to segregate client funds from company funds, meaning that traders' money is protected in the event of a broker’s insolvency.

Additionally, regulation gives traders a sense of confidence, knowing that the broker is held accountable for its actions. In the event of a dispute, regulatory authorities can step in to provide solutions, ensuring that traders have access to appropriate channels for resolving issues. Regulatory oversight also helps prevent fraudulent activities, such as market manipulation or unauthorized use of client funds, which can severely impact traders’ financial well-being.

Regulatory Bodies Governing Forex Brokers

Major Financial Regulatory Authorities

There are several major financial regulatory authorities worldwide that oversee the operations of forex brokers. These regulatory bodies set standards for trading practices, ensure brokers meet capital requirements, and protect clients from fraudulent activities. Some of the most prominent regulatory authorities include:

Financial Conduct Authority (FCA): Based in the United Kingdom, the FCA is one of the most respected financial regulators. It oversees financial services, including forex brokers, and ensures that firms operate in a transparent and fair manner.

Cyprus Securities and Exchange Commission (CySEC): As a member of the European Union, CySEC regulates brokers operating within the EU. CySEC is known for its relatively relaxed regulatory framework compared to other authorities, but it still ensures that brokers meet essential standards.

Australian Securities and Investments Commission (ASIC): ASIC is one of the leading regulators in the Asia-Pacific region. It ensures that brokers in Australia operate in compliance with financial laws and regulations and protects the interests of retail traders.

Securities and Exchange Commission (SEC): The SEC is the primary financial regulatory body in the United States, overseeing forex and other financial markets. While it does not directly regulate forex brokers, it has a significant role in ensuring that brokers comply with federal securities laws.

Financial Services Authority (FSA) Seychelles: This is a common regulatory authority for brokers who wish to operate in the international market with more lenient regulatory requirements.

These regulatory bodies ensure that brokers adhere to high standards and provide a safe trading environment for their clients.

How Regulations Vary by Region

Regulations governing forex brokers vary depending on the region and the specific financial regulatory authority overseeing the market. Some regions have stricter regulatory frameworks than others, providing different levels of protection for traders. For example:

In the European Union, brokers must adhere to the Markets in Financial Instruments Directive (MiFID II), which ensures that brokers provide transparent pricing, fair treatment of clients, and secure handling of client funds.

In the United States, forex brokers must register with the Commodity Futures Trading Commission (CFTC) and be a member of the National Futures Association (NFA) to legally offer forex trading services.

Australia enforces the Australian Financial Services Licence (AFSL) to ensure that forex brokers meet the financial standards required to operate legally.

Seychelles and other offshore jurisdictions have more relaxed regulations, which often result in fewer client protections but can offer higher leverage options for traders.

As a result, traders need to be aware of the regulatory standards in their region and ensure they choose a broker that is licensed by a reputable authority in their jurisdiction.

Exness Licensing and Regulation

Regulatory Entities Associated with Exness

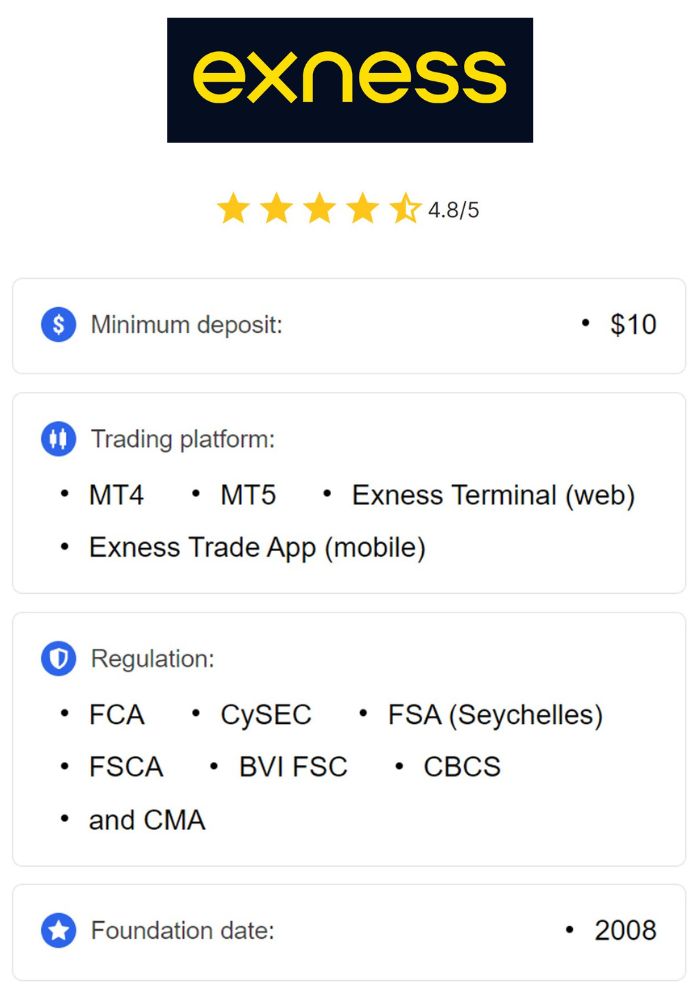

Exness operates under the supervision of several top-tier financial regulatory bodies. The broker holds licenses from authorities in multiple jurisdictions, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority (FSA) of Seychelles, and the Financial Conduct Authority (FCA) in the United Kingdom. These licenses ensure that Exness adheres to strict regulatory standards, providing transparency and security for its clients.

The broker is also authorized to offer financial services in other regions, including Europe, Asia, and the Middle East. Exness’ broad range of licenses demonstrates its commitment to maintaining high standards and operating under the scrutiny of respected financial regulators. This enables Exness to provide services to traders from different parts of the world while complying with regional regulatory requirements.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Types of Licenses Held by Exness

Exness holds several licenses that allow it to operate in different regions. Some of the most notable licenses held by Exness include:

CySEC License: The license from CySEC allows Exness to operate within the European Economic Area (EEA) and provide trading services to clients in the EU. This license ensures that Exness adheres to MiFID II regulations, which cover transparency, client protection, and fair trading practices.

FCA License: Exness is also regulated by the UK’s Financial Conduct Authority (FCA). This license is highly regarded in the financial industry and ensures that Exness follows the strict rules laid out by the FCA, including safeguarding client funds and providing transparent trading conditions.

FSA Seychelles License: Exness holds a license from the Financial Services Authority (FSA) of Seychelles, which allows the broker to operate internationally. This license is typically used for brokers who serve clients outside of the European Union or the United Kingdom and offers more flexible regulatory requirements.

FSCA License: In addition to its other licenses, Exness is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. This license ensures that Exness meets the legal requirements for offering financial services within South Africa.

These licenses give Exness a broad regulatory footprint, allowing the broker to offer services in many regions while maintaining compliance with the relevant financial laws.

Exness' Compliance with Regulatory Standards

Adherence to Financial Reporting Requirements

Exness adheres to strict financial reporting and auditing requirements, which are essential for maintaining regulatory compliance. As a regulated broker, Exness is required to provide regular reports to financial authorities regarding its operations, financial stability, and the handling of client funds.

The broker undergoes frequent audits by independent third-party firms to ensure that it remains in compliance with the necessary regulatory standards. These audits help to maintain transparency and provide traders with confidence in the broker’s ability to manage its operations responsibly.

Customer Fund Protection Policies

One of the most important aspects of regulatory compliance is the protection of client funds. Exness ensures that clients' funds are kept in segregated accounts, separate from the company’s own funds. This means that in the event of the broker’s insolvency, client funds are protected and will not be used to settle the broker’s debts.

Additionally, Exness follows strict anti-money laundering (AML) and know-your-customer (KYC) procedures to prevent fraudulent activities. These measures ensure that Exness complies with international financial regulations and provides a safe trading environment for all clients.

Exness and Client Trust

The Role of Regulation in Building Trust

Regulation plays a critical role in building trust between a broker and its clients. As a regulated broker, Exness must adhere to a set of rules designed to protect its clients and maintain the integrity of its operations. This includes ensuring that client funds are safeguarded, providing transparent pricing, and adhering to fair trading practices.

By being licensed by multiple reputable regulatory bodies, Exness builds a strong foundation of trust with its clients. Traders are more likely to feel secure when they know that the broker is subject to regulatory oversight, as it provides an extra layer of protection against potential misconduct or fraud.

Client Feedback on Safety and Security

Many Exness clients have expressed satisfaction with the broker's commitment to safety and security. Traders appreciate the broker's adherence to regulatory standards, as it provides peace of mind knowing that their funds are protected by strict regulations. The transparency in Exness' operations and the ability to easily access information about the broker's regulatory status further enhances client trust.

Exness’ customer support team is also responsive and helpful when clients have concerns regarding the safety of their funds. The broker’s transparent approach to regulation and compliance ensures that traders feel confident in their decision to trade with Exness.

Comparison with Other Forex Brokers

How Exness Stands Against Competitors

Compared to many other forex brokers, Exness stands out in terms of its regulatory compliance. The broker is licensed by several well-known authorities, including the FCA, CySEC, and FSA Seychelles, which gives it an edge in terms of trust and credibility.

Exness also offers a range of account types, trading instruments, and services that appeal to both beginner and professional traders. While many brokers offer similar services, Exness’ commitment to regulation and client protection sets it apart from others in the market.

Regulatory Status of Popular Forex Brokers

When compared to other popular brokers, Exness’ regulatory standing is strong. Many competitors only hold licenses in one or two jurisdictions, whereas Exness is regulated by multiple authorities worldwide. This gives traders more confidence that Exness is committed to meeting international regulatory standards.

While other brokers may operate in jurisdictions with more lenient regulatory requirements, Exness ensures that it complies with some of the most stringent regulations in the industry. This commitment to regulatory excellence helps Exness maintain a strong reputation in the forex trading community.

Risks of Trading with Unregulated Brokers

Potential Scams and Fraudulent Activities

Trading with an unregulated broker can expose traders to significant risks, including scams and fraudulent activities. Unregulated brokers are not held accountable by any financial authority, which makes it easier for them to engage in unethical practices, such as misappropriating client funds or manipulating the market.

Without regulation, traders have little recourse if something goes wrong. Unregulated brokers may also offer poor customer service, inadequate risk management measures, or lack proper security for client funds, which can lead to substantial financial losses.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Implications for Trader Losses

Trading with an unregulated broker can result in substantial losses for traders. Without the protections offered by regulatory bodies, traders have no assurance that their funds will be safeguarded or that the broker will adhere to fair trading practices. In extreme cases, traders may lose their entire investment due to the broker’s misconduct or insolvency.

By choosing a regulated broker like Exness, traders can mitigate these risks and enjoy a higher level of security for their trades and funds.

Advantages of Trading with a Regulated Broker

Enhanced Security Measures

Trading with a regulated broker like Exness provides traders with the peace of mind that their funds are protected under strict security protocols. Regulatory authorities require brokers to maintain a high level of security, including encryption of sensitive data and secure payment systems. This ensures that traders’ personal and financial information is safeguarded against cyber threats.

Furthermore, regulated brokers are mandated to implement robust measures for protecting client funds. Exness, for example, uses segregated accounts, ensuring that client funds are held separately from the broker's operational funds. In the unlikely event of a broker’s insolvency, this protection helps ensure that client funds remain safe and are not used to cover the broker's liabilities.

Dispute Resolution Mechanisms

A key benefit of trading with a regulated broker is the availability of dispute resolution mechanisms. Regulatory bodies often provide traders with access to independent ombudsmen or arbitration services in case of disputes with brokers. These services ensure that any conflicts are resolved fairly and impartially, offering traders a reliable avenue for addressing grievances.

In the case of Exness, traders can rely on these established channels for dispute resolution, knowing that any issues will be handled by an unbiased third party. This helps to prevent brokers from engaging in unfair practices and provides traders with the assurance that their concerns will be taken seriously and resolved in a transparent manner.

Limitations of Regulation

Regulatory Gaps in Different Jurisdictions

While regulation offers numerous benefits, it is important to note that regulatory standards can vary across different regions. Some countries have more stringent requirements than others, leaving certain jurisdictions with weaker protections for traders. This means that even with a regulated broker, traders might not always enjoy the same level of protection depending on the regulatory framework in place in their region.

For example, brokers licensed in offshore jurisdictions might not be subject to the same strict financial reporting or capital adequacy requirements as those regulated by top-tier authorities like the UK’s FCA or the US’ CFTC. As a result, traders may need to exercise extra caution when trading with brokers regulated in less-reputable regions, as their protection might not be as comprehensive.

Possible Conflicts of Interest

Despite the regulatory oversight, conflicts of interest can still arise in some cases. For instance, brokers may have incentives to encourage traders to take on higher risks or trade more frequently, as this can result in higher commissions and spreads. Although regulations typically require brokers to act in the best interest of clients, financial incentives can sometimes create situations where brokers might prioritize their own profits over the needs of traders.

Exness, like other regulated brokers, is required to manage these conflicts of interest by ensuring that their practices are transparent and aligned with clients' interests. This includes providing clear information about fees, commissions, and risks involved in trading. However, traders should still remain vigilant and be aware of any potential bias in the broker's services.

User Experience at Exness

Account Types and Services Offered

Exness offers a variety of account types designed to meet the needs of both novice and professional traders. Whether you're looking for a standard account with lower deposit requirements or a professional account with more advanced features, Exness provides options that cater to different trading styles. Each account type is tailored with specific benefits, such as lower spreads or access to higher leverage, allowing traders to choose what suits their trading goals best.

In addition to various account types, Exness provides a comprehensive range of trading services, including access to the forex, commodities, stocks, and cryptocurrency markets. The broker also offers different payment methods for deposits and withdrawals, ensuring that traders can easily manage their accounts. This flexibility in account offerings and services makes Exness a versatile choice for traders from all backgrounds.

Trading Platforms and Tools

Exness provides its clients with access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are known for their advanced charting capabilities, custom indicators, and automated trading options. These platforms are widely respected in the trading community and offer a variety of tools to enhance the trading experience.

Additionally, Exness offers a range of market analysis tools, including economic calendars, news feeds, and real-time data, to help traders make informed decisions. These tools, combined with the platform's ease of use and speed, ensure that traders can execute their strategies efficiently and stay updated with market developments.

Summary of Exness’ Regulatory Standing

Key Takeaways on Exness' Regulation

Exness is a highly regulated broker with licenses from multiple reputable financial authorities, including CySEC, FCA, and FSA Seychelles. This multi-jurisdictional regulation gives Exness the credibility and transparency necessary to attract traders from around the globe. The broker’s compliance with strict regulatory standards ensures that traders’ funds are safe and that their trading environment is fair and transparent.

Moreover, Exness' adherence to regulatory guidelines regarding financial reporting and client fund protection further strengthens its reputation as a trustworthy broker. For traders, this means that they can have confidence in the safety of their funds and the integrity of their trading activities.

Final Thoughts on Choosing a Broker

When selecting a forex broker, regulation is one of the most important factors to consider. A regulated broker like Exness provides the security and protection that traders need to trade with confidence. With its strong regulatory standing and commitment to compliance, Exness stands out as a reliable and trustworthy choice for traders seeking a safe and transparent trading environment. Choosing a broker that is licensed by reputable financial authorities is crucial for minimizing risks and ensuring a secure trading experience.

Conclusion

In conclusion, Exness is indeed a regulated broker with multiple licenses from respected financial authorities, making it a secure and trustworthy choice for traders worldwide. By operating under the supervision of these regulatory bodies, Exness ensures the safety of its clients' funds, adheres to financial reporting requirements, and provides a fair trading environment. Traders looking for a reliable and regulated broker can confidently choose Exness for their trading needs.

Read more: