21 minute read

Exness vs Pepperstone Comparison: Which is better?

from Exness

by Exness_Blog

In the dynamic world of forex trading, selecting the right broker can significantly influence a trader's success. In this Exness vs Pepperstone Comparison: Which is better?, we will delve deeply into various aspects of both brokers to provide you with a comprehensive understanding that will aid in making an informed decision.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction

Overview of Forex Trading Platforms

Forex trading has surged in popularity over recent years, attracting both retail and institutional traders. A crucial element in this landscape is the choice of trading platforms provided by brokerage firms. The effectiveness of these platforms can shape a trader's experience and ultimately determine their profitability.

Traders need to consider numerous factors when assessing a trading platform, including ease of use, the variety of available tools, and the ability to execute trades efficiently. This analysis becomes even more pertinent when weighing options like Exness vs Pepperstone, as the two offer distinct features that appeal to different trader profiles.

Importance of Choosing the Right Broker

Choosing the right forex broker is paramount for any trader, whether novice or seasoned. The right broker provides not only a smooth trading experience but also the necessary support and resources to thrive in the competitive trading environment. Factors such as regulatory compliance, account types, spreads, and customer service all play critical roles in this decision-making process.

As traders navigate their options, they must weigh the benefits and drawbacks of each broker against their unique trading styles and objectives. This comparison will help traders understand which broker aligns better with their goals, thus enhancing their overall trading proficiency.

Company Background

History of Exness

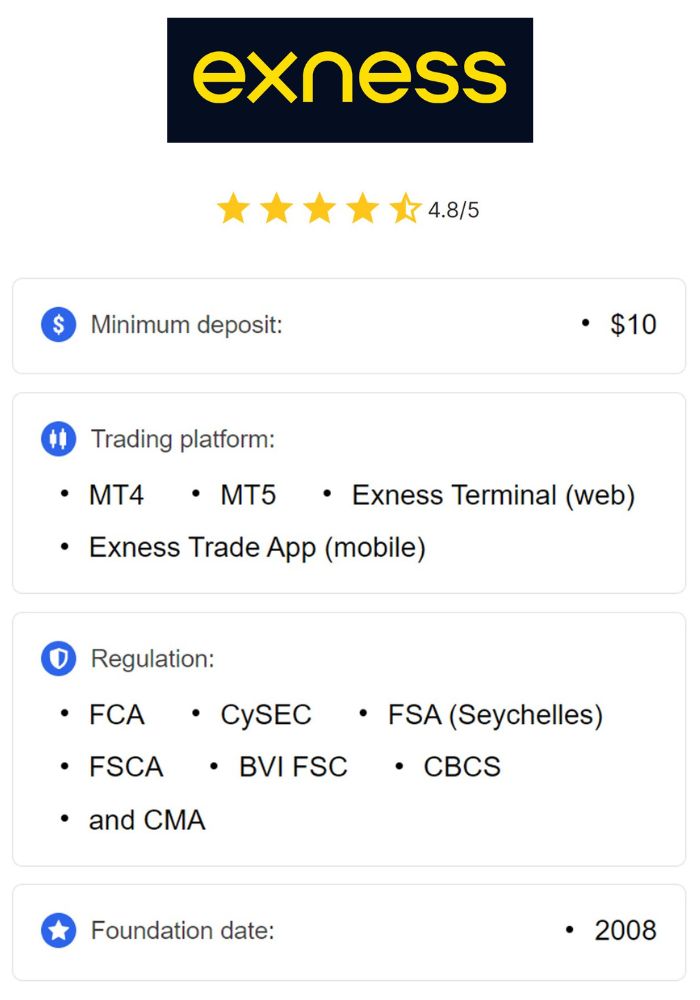

Exness was founded in 2008 and has since made significant strides in the forex trading industry. Originally established to cater to the growing demand for online forex trading, Exness quickly garnered attention due to its innovative approach to client services and technology. Over the years, it has evolved into a global trading powerhouse, offering a wide range of financial instruments and services to clients around the world.

One of Exness's key differentiators is its commitment to transparency. The company prides itself on maintaining a high level of openness in its operations, ensuring that clients are well-informed about the risks involved in trading. This focus on transparency has helped build trust among its user base, establishing Exness as a reputable name in the industry.

History of Pepperstone

Founded in 2010, Pepperstone emerged as a challenger in the forex trading space, emphasizing low-cost trading with exceptional execution speeds. The Australian-based broker quickly ascended through the ranks, primarily due to its focus on advanced technology and tailored trading solutions for both retail and institutional clients.

Pepperstone has earned recognition for its competitive pricing and a variety of account options that cater to diverse trading preferences. With a strong emphasis on customer satisfaction, the broker has built a loyal clientele and positioned itself as one of the most popular forex brokers globally. Its reputation for reliability and quality service is especially evident in its robust trading infrastructure, which supports seamless execution and minimal latency.

Regulatory Status

Regulatory Bodies Overseeing Exness

Exness operates under multiple regulatory frameworks, with licenses from several esteemed authorities. These include the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. Such regulatory oversight enhances Exness's credibility and ensures that it adheres to stringent operational guidelines designed to protect clients' interests.

The regulatory status of Exness instills confidence in traders, knowing that their funds are safeguarded under protective measures mandated by authoritative bodies. Furthermore, Exness conducts regular audits and maintains transparency in its dealings, thereby bolstering its reputation as a trustworthy broker.

Regulatory Bodies Overseeing Pepperstone

Similarly, Pepperstone is regulated by several reputable entities. The broker holds licenses from the Australian Securities and Investments Commission (ASIC) and the FCA in the UK. This multi-jurisdictional regulation underscores Pepperstone's commitment to maintaining high standards of compliance and consumer protection.

Being overseen by respected regulatory bodies means that Pepperstone is required to meet specific financial conditions, including maintaining sufficient capital reserves and segregating client funds from operational funds. This adds an additional layer of security for traders choosing to work with Pepperstone.

Comparisons in Compliance and Trustworthiness

When comparing the regulatory environments of Exness vs Pepperstone, both brokers demonstrate a strong commitment to compliance and senior oversight. The presence of regulations from leading authorities like the FCA and ASIC signifies adherence to best practices in the industry.

While both brokers enjoy a solid reputation, individual preferences may sway a trader toward one over the other based on personal experiences or specific requirements. Ultimately, both Exness vs Pepperstone can be deemed trustworthy options, with robust regulatory frameworks ensuring a degree of safety and security for traders.

Account Types Offered

Standard Accounts at Exness

Exness offers a range of account types aiming to accommodate a wide spectrum of traders. The standard account is designed for beginner traders seeking straightforward, commission-free trading with tight spreads. This account type allows users to access a vast array of financial instruments while enjoying the benefits of higher leverage.

Moreover, the standard account at Exness typically facilitates easy deposit and withdrawal procedures, enhancing the overall trading experience. Traders can focus on executing their strategies without getting bogged down by complicated account management processes.

Standard Accounts at Pepperstone

On the other hand, Pepperstone presents its own standard account structure, which similarly targets novice traders. While it offers competitive spreads, this account type comes with the potential for commissions depending on the chosen trading platform—MetaTrader 4 or cTrader.

Pepperstone’s standard accounts are known for their superior execution speeds and reliability, allowing traders to capitalize on fleeting market opportunities effectively. This focus on performance makes Pepperstone an appealing option for traders who prioritize speed and efficiency.

Comparison of Additional Account Types

Both brokers provide alternative account types for experienced traders looking for more tailored options. Exness features Pro accounts aimed at professional traders, which come with lower spreads but involve a commission fee structure. This flexibility enables seasoned traders to optimize their costs based on their trading frequency and style.

Conversely, Pepperstone offers Razor accounts, which are particularly attractive to scalpers and algorithmic traders due to their ultra-low spreads and fast execution. The choice between these different accounts ultimately depends on a trader's experience level and trading strategy.

Trading Instruments Available

Forex Pairs at Exness

Exness boasts a broad selection of forex pairs, providing traders with ample opportunities to engage in the currency markets. Major, minor, and exotic pairs are all available, catering to various trading preferences. The extensive range of options allows traders to diversify their portfolios and capitalize on market fluctuations across different currencies.

Moreover, Exness frequently updates its offerings, ensuring that clients have access to the latest trading opportunities, including emerging market currencies. This adaptability exemplifies Exness's commitment to meeting the evolving demands of its traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Forex Pairs at Pepperstone

Pepperstone also offers an impressive array of forex pairs, featuring similar major, minor, and exotic options. Traders can take advantage of competitive spreads across these pairs, which can further enhance their trading strategies. Additionally, the broker provides insights and educational content related to forex trading, empowering clients to make informed decisions regarding their trades.

The depth of liquidity provided by Pepperstone also plays a significant role in its appeal; traders can expect reliable executions and minimal slippage, particularly during high-volatility periods.

Other Asset Classes and Instruments

Beyond forex trading, both Exness vs Pepperstone allow access to various asset classes, including commodities, indices, cryptocurrencies, and shares. This diversification permits traders to broaden their investment horizons and hedge their bets across different markets.

Exness extends its offerings with a robust selection of CFDs, enabling traders to speculate on price movements without owning the underlying assets physically. Similarly, Pepperstone provides its clients with the opportunity to trade a wide range of instruments, enhancing their trading experience and potential profitability.

Trading Platforms

MetaTrader 4 and MetaTrader 5 Features

Both Exness vs Pepperstone support the widely-used trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are celebrated for their user-friendly interfaces, extensive charting capabilities, and robust analytical tools. Traders can benefit from automated trading functionalities, custom indicators, and expert advisors, which enhance their trading strategies.

While MT4 is ideal for forex traders, MT5 offers improved features, including more sophisticated order types and broader asset coverage. Both brokers ensure stable performance across these platforms, thereby catering to the needs of diverse trader types.

Proprietary Platforms and Tools

In addition to the MetaTrader suite, Exness has developed its proprietary platform, which focuses on delivering a seamless trading experience. This platform integrates advanced charting tools and real-time market analysis, facilitating informed trading decisions. The user-friendly interface makes it accessible for beginners while still providing the complexity needed for seasoned traders.

Pepperstone, on the other hand, places an emphasis on third-party integrations, allowing traders to utilize various platforms like cTrader and TradingView. This flexibility lets traders select the platform that best aligns with their strategies and preferences, thereby enhancing overall satisfaction.

User Experience on Different Platforms

User experience is a vital consideration when evaluating trading platforms. Exness's platform is designed with simplicity and functionality in mind, making navigation intuitive for traders of all levels. The responsive design ensures that users can easily switch between devices, whether trading from a desktop or mobile.

Pepperstone also prioritizes user experience, with its platforms designed for speed and efficiency. The ability to customize layouts and access advanced features contributes to an optimal trading environment. Overall, both brokers excel in providing excellent user experiences, albeit through different approaches.

Spreads and Commissions

Spread Structures at Exness

Exness is known for its competitive spread structures, especially within its standard account offerings. Traders can often find tight spreads that can lead to more favorable trading conditions, particularly during volatile market periods. This aspect of Exness’s pricing model can attract cost-sensitive traders aiming to maximize their profit margins.

For accounts that incur commissions, Exness offers even tighter spreads, making it an appealing choice for active traders who prefer transactional savings.

Spread Structures at Pepperstone

Pepperstone also boasts competitive spreads, particularly through its Razor accounts. With ultra-low spreads starting from zero pips, the broker appeals to scalpers and high-frequency traders who require efficient execution and minimal costs.

Although Pepperstone's standard account spreads may be slightly wider, the trade-off is often justified by its execution speed and reliability. Therefore, whether traders choose Exness or Pepperstone, both companies stand out for their competitive pricing strategies.

Comparative Analysis of Commissions

When evaluating commissions, it's essential to consider how they impact overall trading costs. Exness employs a commission-based model for its Pro accounts, which typically results in lower spreads but involves fees per trade executed. This structure is ideal for frequent traders keen on optimizing their expenses.

Conversely, Pepperstone charges commissions on its Razor accounts, with fees tied to the spread offered. Depending on the trading volume and frequency, traders should assess which model aligns with their practices, as either broker can provide value depending on individual trading styles.

Leverage Options

Leverage Available at Exness

Exness is known for offering high leverage ratios, sometimes reaching up to 1:2000 in certain regions. Such generous leverage options enable traders to amplify their positions significantly, potentially enhancing profits. However, high leverage also increases risk exposure, making it imperative for traders to employ disciplined risk management strategies.

This availability of high leverage is particularly appealing to those who understand the intricacies of forex trading and seek to maximize their potential returns.

Leverage Available at Pepperstone

Pepperstone provides competitive leverage options as well, generally offering ratios up to 1:500 for retail clients. This level of leverage is still substantial and permits traders to control larger positions than their initial deposit would otherwise allow.

Given the inherent risks associated with high leverage, both brokers advocate for responsible trading practices, encouraging clients to educate themselves on the potential downsides of leveraging their positions excessively.

Risks Associated with High Leverage

While high leverage can magnify gains, it can equally amplify losses. Traders must comprehend the risks involved before utilizing substantial leverage. The emotional stress that accompanies rapid fluctuations in account balances can be overwhelming for some, underscoring the importance of employing sound risk management practices.

Before choosing between Exness vs Pepperstone based on leverage, traders should reflect on their risk tolerance and trading experience. Understanding the complex nature of margin calls and the implications of leveraged trading is vital for long-term success.

Deposit and Withdrawal Methods

Funding Options at Exness

Exness offers a diverse array of deposit and withdrawal methods to facilitate seamless transactions. Clients can choose from traditional banking options, e-wallets, and cryptocurrency transfers, ensuring that funding their accounts is convenient and flexible.

Moreover, the processing times for deposits are typically instantaneous, while withdrawals are processed promptly, enhancing the overall trading experience. This level of accessibility addresses the concerns traders often have regarding the movement of their capital.

Funding Options at Pepperstone

Pepperstone follows suit with a variety of funding options, accommodating the needs of global clients. From credit cards to bank transfers and e-wallets, users have multiple avenues to deposit and withdraw funds.

Processing times for deposits are generally swift, although bank transfers may take longer. However, Pepperstone stands out for its commitment to ensuring that withdrawal requests are handled efficiently, which is crucial for traders who wish to retain control over their funds.

Processing Times and Fees

Both Exness vs Pepperstone maintain a transparent fee structure regarding deposits and withdrawals. Exness typically does not charge fees for many deposit methods, while some withdrawal methods may incur nominal fees.

Pepperstone also emphasizes transparency, informing clients about applicable fees and ensuring that there are no hidden costs. Understanding processing times and associated fees is vital for traders aiming to manage their budgets and cash flow effectively.

Customer Support Services

Customer Service Channels Offered by Exness

Customer support is a critical factor for many traders when selecting a broker. Exness provides various channels for customer service, including live chat, email, and phone support. The availability of multilingual assistance allows the broker to cater to a diverse global audience.

Support agents at Exness are generally prompt and knowledgeable, assisting clients with inquiries ranging from basic account setup to technical issues. Their commitment to customer service reinforces the broker’s reputation as a user-centric firm.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Customer Service Channels Offered by Pepperstone

Pepperstone also prioritizes customer support, offering live chat, phone, and email assistance. The broker is well-known for its responsive and helpful staff, who aim to resolve issues efficiently.

The team at Pepperstone is trained to address a variety of concerns, ranging from technical queries to account-related questions. This dedication to customer care ensures that clients receive timely support whenever needed.

Quality and Responsiveness of Support

While both Exness vs Pepperstone offer commendable customer support services, individual experiences may vary. Traders often report positive interactions with support teams from both brokers, indicating a general trend towards responsiveness and effectiveness in addressing client issues.

Ultimately, the quality of customer support can play a pivotal role in a trader's experience, particularly during challenging moments. Ensuring that brokers prioritize effective communication and problem resolution is vital for fostering a productive trading relationship.

Educational Resources

Trading Education at Exness

Exness recognizes the importance of education in shaping skilled traders. The broker offers a wealth of educational resources, including webinars, trading guides, and tutorials covering various topics. These materials cater to traders at all levels, helping them enhance their knowledge and understanding of the forex markets.

Furthermore, Exness frequently updates its educational content to reflect current market trends and shifts. This commitment to providing relevant information empowers traders to make informed decisions as they navigate their trading journeys.

Trading Education at Pepperstone

Pepperstone also emphasizes educational initiatives, providing clients with access to a variety of resources. The broker hosts webinars, trading articles, and video tutorials, focusing on technical and fundamental analysis, risk management, and trading psychology.

The availability of educational materials helps reinforce Pepperstone’s position as a broker that values trader development. By investing in educational resources, both Exness vs Pepperstone contribute to the success of their clients.

Tools for Beginner Traders

Both brokers understand the challenges faced by beginner traders and strive to equip them with the necessary tools for success. Exness offers dedicated sections on its website for novice traders, featuring foundational concepts and practical advice.

Pepperstone similarly provides beginner-focused resources, including courses that cover basic trading strategies and platform navigation. These tools are invaluable for traders starting their journeys and seeking to build their confidence and competence in the market.

Research and Analytical Tools

Research Offers from Exness

Research is an integral component of informed trading decisions. Exness provides traders with various research tools, including market analysis, economic calendars, and insights into global market trends. These resources help traders stay updated on events that may influence their trading strategies.

Additionally, the broker offers technical and fundamental analysis reports, equipping clients with valuable insights into market movements. The continuous provision of research materials underscores Exness's commitment to supporting traders in their decision-making processes.

Research Offers from Pepperstone

Pepperstone also delivers a suite of research tools to assist traders in developing informed strategies. The broker publishes daily market analyses, trading signals, and expert opinions to keep clients well-versed in current market conditions.

By offering a wealth of information, Pepperstone empowers traders to adapt their tactics according to emerging trends, creating a proactive rather than reactive trading mindset.

Importance of Analytical Tools in Trading

Utilizing research and analytical tools is crucial for traders aiming for consistent success. These resources enable traders to identify patterns, forecast potential market movements, and refine their strategies accordingly. Both Exness vs Pepperstone recognize the importance of providing these tools, understanding that educated traders tend to perform better in the long run.

Mobile Trading Experience

Mobile Apps Available for Exness

As mobile trading becomes increasingly popular, Exness has invested in developing a robust mobile trading app. The app mirrors the features of its desktop counterpart, allowing traders to execute orders, analyze charts, and manage their accounts on-the-go.

The user-friendly design of the Exness mobile app enhances accessibility for traders who prefer to remain connected to the markets even when away from their desks. This flexibility caters to the modern trader's lifestyle, ensuring they can react swiftly to market movements.

Mobile Apps Available for Pepperstone

Pepperstone also offers a dedicated mobile trading app that complements its desktop platforms. This app provides essential functionality for traders, including quick order placement and access to real-time market data.

With a focus on speed and usability, Pepperstone's mobile application allows traders to navigate the markets seamlessly, ensuring they do not miss out on lucrative opportunities due to being away from their desktops.

Comparison of Functionality and User Experience

Both Exness vs Pepperstone prioritize functionality in their mobile applications, delivering intuitive designs that cater to the needs of traders. However, individual preferences may influence the choice of which app to use, as some traders may find one platform’s layout more appealing than the other.

Overall, both brokers succeed in offering high-quality mobile trading experiences, enabling traders to remain connected to the markets regardless of their location.

Promotions and Bonuses

Current Promotions from Exness

Exness regularly runs promotions designed to attract new clients and reward existing ones. The broker often offers welcome bonuses for new accounts, as well as periodic promotional campaigns that incentivize trading activity.

These promotions enhance the overall trading experience for clients, allowing them to capitalize on additional resources as they explore the forex markets. By providing such incentives, Exness encourages traders to deepen their engagement with the platform.

Current Promotions from Pepperstone

Pepperstone also engages in promotional activities, although its focus tends to be more on providing value through trading conditions rather than outright bonuses. The broker occasionally offers referral programs and loyalty rewards to encourage client retention.

While these promotions may differ from those of Exness, Pepperstone remains committed to providing a competitive trading environment that attracts and retains clients.

Evaluation of Bonus Structures

When evaluating bonus structures, traders should consider how these incentives align with their trading strategies and goals. While bonuses can present valuable opportunities, it’s essential to understand the terms and conditions attached to them.

Both Exness vs Pepperstone offer unique promotional opportunities, catering to different trader preferences. Thus, assessing the value of these promotions within the context of individual trading practices is crucial for maximizing benefits.

Community and Reviews

User Reviews and Feedback for Exness

User reviews and feedback are essential for gauging a broker's reputation and service quality. Exness generally receives positive feedback for its transparency, competitive pricing, and responsive customer support. Many traders appreciate the breadth of educational resources available, which aids their trading development.

However, some reviews might highlight areas for improvement, such as withdrawal processing times during peak periods. These insights can offer prospective traders valuable perspectives on what to expect from the broker.

User Reviews and Feedback for Pepperstone

Similarly, Pepperstone enjoys a solid reputation among traders, receiving praise for its execution speeds, low spreads, and comprehensive educational offerings. Positive user feedback often revolves around the broker’s emphasis on customer service and its array of trading tools.

However, like Exness, Pepperstone may also face criticism related to specific features or services. Evaluating user experiences helps potential clients gain a clearer picture of what to anticipate when partnering with either broker.

Overall Reputation in the Trading Community

The overall reputation of both Exness vs Pepperstone within the trading community is largely favorable. Each broker has carved out a niche by prioritizing customer service, competitive pricing, and valuable educational resources.

New traders may benefit from conducting thorough research, reading reviews, and engaging with community discussions, thus gaining insights that can inform their final broker selection.

Pros and Cons

Advantages of Choosing Exness

Exness presents numerous advantages, including a broad range of account types catering to different trading styles, high leverage options, and a user-friendly trading platform. The broker's commitment to transparency and client education further adds to its appeal.

Another appealing feature is the extensive selection of financial instruments, giving traders the freedom to diversify their portfolios. Combined with efficient customer support, Exness proves to be a compelling choice for traders seeking flexibility and support.

Disadvantages of Choosing Exness

Despite its strengths, Exness may have limitations worth considering. Some traders express concerns about withdrawal processing times during peak activity, which could potentially hinder their liquidity.

Additionally, while the high leverage offered can be enticing, it may entice inexperienced traders to take excessive risks without fully understanding the consequences. As such, careful consideration is necessary when weighing the pros and cons.

Advantages of Choosing Pepperstone

Pepperstone excels in providing competitive pricing, notably through its Razor accounts with minimal spreads. The broker's reputation for fast execution speeds and a wide array of trading platforms also draws traders seeking efficiency.

Pepperstone's commitment to educational resources enriches the trading experience for beginners and experienced traders alike. The emphasis on community feedback and support fosters a sense of belonging among clients, making it an attractive option.

Disadvantages of Choosing Pepperstone

However, Pepperstone may not be perfect for everyone. Some traders may find that the commission structure associated with its accounts can eat into profitability, particularly for infrequent traders.

Moreover, while the broker offers a robust selection of trading tools, individuals who prefer proprietary platforms may feel less catered to compared to those who prioritize third-party integrations.

Final Verdict

Summary of Key Findings

Through this Exness vs Pepperstone Comparison: Which is better?, it is clear that both brokers offer unique advantages and are well-equipped to serve the needs of diverse trader profiles. Exness shines with its high leverage options and user-friendly platform, while Pepperstone impresses with competitive pricing and execution speeds.

In terms of regulatory compliance and customer support, both brokers maintain admirable reputations, providing traders with peace of mind. Ultimately, the choice between Exness vs Pepperstone will depend on individual preferences, trading styles, and priorities.

Recommendations Based on Trader Profiles

For novice traders seeking a more guided experience with a plethora of educational resources, Exness may be the preferable choice. Conversely, for more experienced traders focused on low-cost trading and rapid execution, Pepperstone may fit the bill.

Ultimately, the decision lies in understanding your own trading needs and aligning them with the features offered by each broker. Careful consideration and self-reflection are crucial elements in arriving at a choice that will facilitate a successful trading journey.

Conclusion

In conclusion, both Exness vs Pepperstone showcase their strengths and weaknesses, catering to different segments of the trading community. Through thorough examination of their offerings—from account types and trading platforms to customer support and educational resources—it becomes evident that both brokers can provide quality trading environments.

The question of which broker is better will inevitably depend on individual trader profiles, preferences, and goals. By carefully weighing the factors outlined in this comparison, traders can confidently decide which broker aligns best with their trading ambitions.

Read more: