14 minute read

Does Exness charge commission? Review Broker

from Exness

by Exness_Blog

Overview of Exness

Introduction to Exness

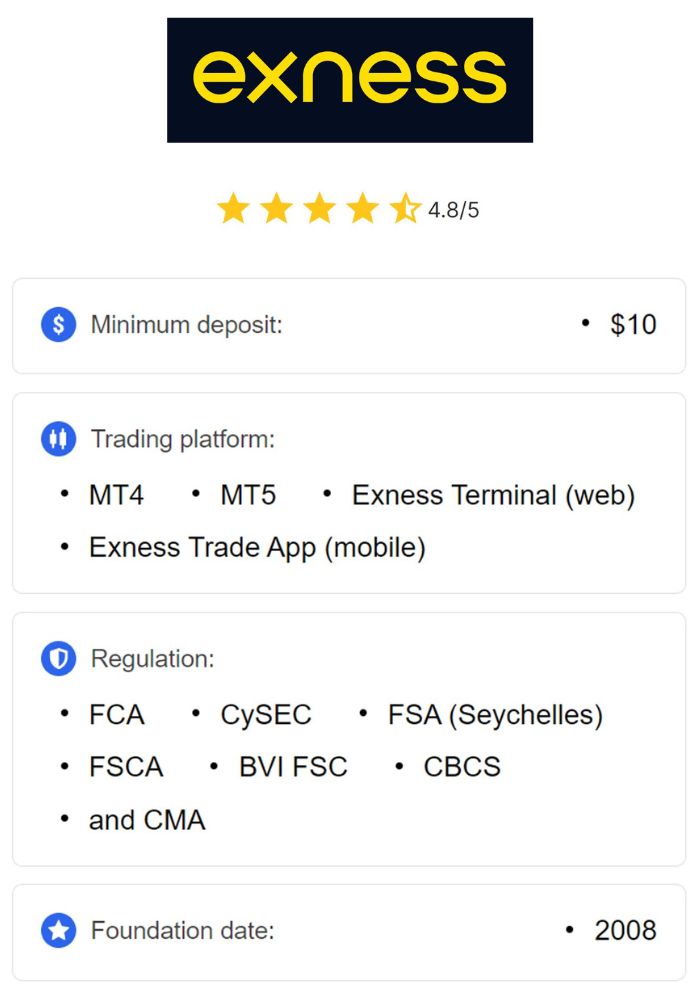

Exness is a well-known online brokerage firm offering a variety of financial services to traders across the globe. Established in 2008, the company has quickly become a prominent player in the online trading industry. Exness provides access to a wide range of trading instruments, including forex, commodities, stocks, and cryptocurrencies. With its easy-to-use platform and commitment to client satisfaction, Exness has gained a significant customer base and reputation for reliability in the trading world.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness caters to both novice and professional traders by offering various account types that suit different needs and trading strategies. The broker is also recognized for its transparent pricing and competitive trading conditions, which makes it an attractive choice for many traders seeking a straightforward trading experience.

History and Background

Exness was founded with the goal of providing a user-friendly and transparent trading experience for both beginner and experienced traders. Over the years, the company has expanded its reach, offering a wide range of financial instruments, from forex pairs to CFDs and cryptocurrencies. Exness has grown significantly since its inception, adapting its services to meet the evolving demands of traders.

The broker has developed a global presence, serving clients in over 180 countries. This expansion is backed by Exness' commitment to innovation, customer service, and the development of cutting-edge trading platforms. The company's focus on providing transparent services and competitive spreads has contributed to its growing reputation as a trusted broker.

Regulation and Licensing

Exness is regulated by several reputable financial authorities around the world, ensuring that it operates within the bounds of the law and offers a secure trading environment. These include regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority (FSA) in Seychelles, and the Financial Conduct Authority (FCA) in the United Kingdom.

The fact that Exness operates under the supervision of well-known regulatory authorities provides a high level of trust and security for its clients. These regulatory bodies ensure that the broker adheres to strict financial and operational standards, offering protection to traders and ensuring that Exness follows proper procedures in the handling of clients' funds and executing trades.

Understanding Trading Costs

Types of Trading Costs

Trading costs are an important aspect to consider when choosing a broker. These costs typically come in two main forms: commissions and spreads. Commissions are typically charged per trade, either as a flat fee or a percentage of the trade size. Spreads, on the other hand, represent the difference between the buying and selling price of an asset and are indirectly part of the cost of trading.

Other costs may include fees related to withdrawals, inactivity charges, and currency conversion costs. These costs can vary depending on the broker, account type, and trading conditions. Understanding these costs and how they impact your overall profitability is crucial for traders when selecting a trading platform.

Importance of Knowing Trading Costs

Understanding the full range of trading costs is essential for traders to manage their finances and make informed decisions. Costs such as commissions and spreads can significantly affect the profitability of trading strategies. While some brokers, like Exness, may offer commission-free accounts, they may charge a wider spread or offer other types of fees that can add up over time.

Being aware of these costs enables traders to optimize their strategies by factoring in the impact of these fees on potential profits. Additionally, by understanding the costs involved, traders can make comparisons between brokers and choose one that offers the best value for their trading style and objectives.

Commission Structure at Exness

Overview of Commissions

Exness does charge commissions on certain account types and trading instruments. However, many of Exness’ accounts, such as the Standard and Zero Spread accounts, are commission-free. Instead of charging a commission on each trade, Exness includes its fees within the spread, which can vary depending on the account type and asset being traded.

Exness provides traders with full transparency regarding its commission structure. For example, on the Professional or Raw Spread accounts, the broker charges a commission per lot traded. This is particularly beneficial for professional traders who prefer tight spreads and are willing to pay a commission in exchange for lower transaction costs.

Comparison with Other Brokers

Compared to many other brokers, Exness offers a relatively straightforward commission structure. Many brokers charge commissions and wider spreads, which can add up to higher costs for traders. Exness, on the other hand, allows traders to choose between commission-free accounts or accounts with low spreads and reasonable commission charges.

This flexibility allows traders to select the account type that best suits their trading needs. Whether you are a novice trader or a professional, Exness provides competitive pricing and options that can accommodate different trading strategies. Moreover, the transparency in its commission structure allows traders to clearly understand the costs involved in their trades.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Spreads vs. Commissions

What are Spreads?

A spread is the difference between the buying price (ask price) and the selling price (bid price) of a financial asset. In trading, the spread represents the cost of entering or exiting a trade. Brokers who do not charge commissions often earn their revenue from the spread, meaning the wider the spread, the higher the cost for traders.

Exness offers different types of spreads depending on the account type. For example, the Standard account typically has a wider spread, while the Raw Spread account offers tighter spreads but charges a commission per trade. Traders should evaluate the spread and commission structure to determine which account type offers the most cost-effective trading option for their needs.

How Spreads Affect Trading Costs

Spreads directly impact the cost of a trade. When a trader enters a position, the spread represents an immediate cost, as the trader must cover the difference between the bid and ask prices in order to make a profit. A narrower spread means lower transaction costs, which is particularly beneficial for day traders and scalpers who make frequent trades.

The spread can fluctuate depending on the volatility of the market, the asset being traded, and the account type. For instance, major currency pairs such as EUR/USD tend to have lower spreads, while more volatile assets like commodities or cryptocurrencies may have wider spreads. Understanding the dynamics of spreads and how they affect trading costs is crucial for traders when calculating their potential profits.

Why Choose Spreads Over Commissions?

Many traders prefer spreads over commissions because they offer a simpler way to understand trading costs. Spreads are usually included in the price of the asset, which makes it easier for traders to gauge the overall cost of entering and exiting a trade. Additionally, brokers who rely on spreads may not charge any additional fees, making it a cost-effective option for traders who prefer simplicity.

Choosing spreads over commissions is particularly advantageous for traders who engage in high-frequency trading, as they avoid paying additional costs on every single trade. On the other hand, traders who prefer more precise pricing may opt for accounts that charge a commission in exchange for tighter spreads, which may be more beneficial for their specific strategies.

Account Types Offered by Exness

Standard Accounts

Exness’ Standard accounts are ideal for beginners or those who prefer a simpler, more cost-effective approach to trading. These accounts offer commission-free trading, with the costs embedded within the spread. The Standard account is popular among traders who are new to forex or those who do not wish to deal with the complexity of commissions.

The spread for Standard accounts is typically wider compared to other account types, reflecting the fact that no commission is charged. Despite this, the account type offers good value for those who want to avoid extra fees while accessing a wide range of trading instruments.

Professional Accounts

Professional accounts at Exness are designed for experienced traders who are looking for more advanced features and lower spreads. Unlike Standard accounts, Professional accounts charge a commission per trade but offer much tighter spreads, making them more cost-effective for high-frequency traders or those who engage in more advanced strategies.

The commission charged on Professional accounts varies depending on the asset being traded and the volume of the trade. This account type provides a flexible and customizable trading environment for professional traders who are willing to pay a commission in exchange for reduced spread costs.

Key Differences in Fees

The main differences between the various Exness account types are the commission structure and the spread. While Standard accounts offer commission-free trading but wider spreads, Professional accounts have tighter spreads and charge a commission. Traders can choose the account type based on their trading style, frequency, and budget for trading costs.

Exness offers flexibility in its fee structure, allowing traders to select an account that best suits their needs. The choice between tighter spreads and commissions versus commission-free trading with wider spreads depends on the individual trader’s preferences and goals.

Trading Instruments and Their Costs

Forex Pair Commissions

Exness offers a wide range of forex pairs, each with its own commission and spread structure. Popular currency pairs like EUR/USD typically have lower spreads and no commission charges on Standard accounts. For more exotic or less liquid pairs, the spreads may be wider, and there may be additional charges depending on the account type.

On Professional accounts, traders can access tighter spreads but will incur a commission for each trade. This structure is particularly beneficial for traders who make large-volume trades or who focus on high-frequency strategies.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

CFDs and Their Associated Costs

Contracts for Difference (CFDs) allow traders to speculate on the price movements of various assets without owning the underlying asset. Exness offers a variety of CFDs, including those on commodities, indices, and stocks. Like forex pairs, CFDs can have different spreads and commission structures depending on the account type.

Traders using Professional accounts typically benefit from lower spreads on CFDs, but they will also incur a commission per trade. This makes Professional accounts a suitable choice for traders looking for tighter pricing on CFDs, especially when trading in high volumes or over short timeframes.

Cryptocurrency Trading Fees

Cryptocurrency trading at Exness is subject to a different fee structure. While some brokers charge higher fees for trading cryptocurrencies, Exness offers competitive spreads on major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. The fees for cryptocurrency trading depend on the account type and the market conditions at the time of the trade.

Exness allows traders to access cryptocurrency markets with minimal fees, which is attractive for those looking to trade in digital assets. The spread can fluctuate depending on the volatility of the cryptocurrency market, and traders should be aware of the associated costs when trading these volatile instruments.

Impact of Leverage on Costs

Understanding Leverage in Trading

Leverage allows traders to control larger positions with a smaller initial investment. Exness offers leverage up to 1:2000, which means traders can potentially increase their profit potential with smaller capital. However, higher leverage also amplifies the risk and potential trading costs, as traders may incur higher losses if the market moves against them.

Leverage can impact the overall costs of trading, as it influences the size of the positions traders can take and the associated margin requirements. Understanding how leverage works and its effect on costs is critical for traders, particularly when using higher leverage ratios.

How Leverage Influences Trading Expenses

Leverage can influence trading expenses in several ways. While leverage itself does not carry direct costs, the margin requirements associated with leveraged trades can affect how much capital a trader needs to keep in their account. Additionally, higher leverage increases the potential for large price movements, which can lead to higher costs, especially if the trader is using a margin account.

Excessive use of leverage can result in higher losses, making it important for traders to manage their leverage appropriately to minimize unnecessary costs. Traders should understand how leverage works and how it can impact their overall trading costs before engaging in highly leveraged trades.

Additional Fees to Consider

Withdrawal Fees

Exness charges a small fee for certain withdrawal methods, depending on the region and payment method used. These fees are typically a flat rate or a small percentage of the withdrawal amount. Traders should be aware of these fees when planning to withdraw their funds.

Withdrawal fees can vary between different payment methods, so it's essential for traders to check the fee structure for their chosen withdrawal method. The broker offers a range of payment options, including bank transfers, credit/debit cards, and e-wallets, each with its own associated fees.

Inactivity Fees

Exness also charges inactivity fees if an account remains dormant for an extended period. These fees are applied to accounts that do not conduct any trading activity or withdrawals for a certain period, typically six months. The inactivity fee is designed to encourage traders to maintain regular activity on their accounts.

Traders should be aware of inactivity fees, especially if they plan to leave their account unused for a long time. However, this fee is generally low, and traders can avoid it by ensuring that their accounts remain active.

Currency Conversion Fees

Currency conversion fees may apply when traders deposit or withdraw funds in currencies different from the base currency of their account. Exness charges a fee for currency conversion, which can be a small percentage of the transaction amount. Traders should keep this in mind when making deposits or withdrawals, especially if they trade with currencies that are not supported natively by the platform.

Currency conversion fees can add up over time, especially for international traders who deal with multiple currencies. Traders can minimize these fees by choosing accounts in their preferred currency and opting for withdrawal methods that support their local currency.

Customer Support for Fee Inquiries

Available Support Channels

Exness provides various customer support channels, including live chat, email, and phone support. Traders can reach out to the support team for inquiries regarding fees, commissions, or any other questions related to their accounts.

The customer support team at Exness is highly responsive and offers assistance in multiple languages, making it accessible to traders from around the world. Traders can rely on the support team to clarify any concerns related to trading costs, ensuring a smooth and transparent trading experience.

Common Questions Addressed by Support

Exness' customer support team frequently addresses common questions regarding commissions, spreads, and additional fees. Traders can inquire about specific fee structures related to their account types, asset classes, or withdrawal methods. This ensures that traders fully understand the costs they will incur before executing trades or making deposits and withdrawals.

The support team is also helpful in providing advice on the most cost-effective strategies for managing trading fees and commissions. Whether traders are new to the platform or experienced, Exness’ support ensures that all inquiries are addressed promptly.

User Experiences and Reviews

Trader Testimonials

Many traders have shared positive feedback about Exness' commission and fee structure. Many users appreciate the flexibility in account types and the transparency in pricing, which ensures that they fully understand the costs before making trades. The commission-free Standard accounts and the low commission fees on Professional accounts are particularly praised by traders looking for competitive pricing.

Common Concerns Regarding Commissions

Some traders have raised concerns about the additional fees for withdrawals and inactivity. While these fees are relatively low, they can be a source of frustration for traders who are not fully aware of them upfront. It's crucial for traders to read the terms and conditions carefully to avoid unexpected costs.

Conclusion

Exness offers a transparent and flexible commission structure for its traders, with both commission-free and commission-based accounts available. Understanding the differences in commission and spreads, as well as additional fees such as withdrawal and inactivity charges, is essential for traders to manage their costs effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness’ range of account types allows traders to select the best fee structure for their trading needs, whether they prefer tighter spreads or commission-free trading. By considering all costs and choosing the right account type, traders can optimize their profitability while trading on Exness.

Read more: