16 minute read

Is Exness legal in UAE?

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness as a Brokerage

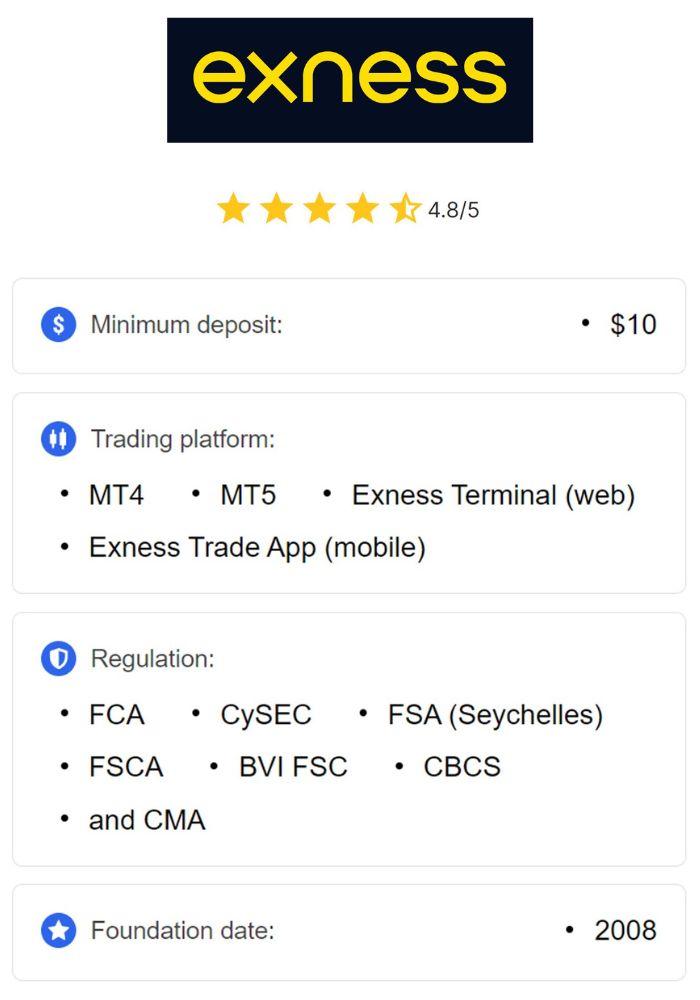

Exness is a globally recognized brokerage that offers trading services across forex, indices, commodities, and cryptocurrency markets. Founded in 2008, Exness has quickly gained popularity due to its innovative platform, user-friendly interface, and commitment to providing transparent trading conditions. With a mission to make trading accessible and reliable for people around the world, Exness caters to millions of clients in various countries, including the UAE. The platform provides robust trading options and features MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most respected platforms in the industry.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness has established a strong reputation in the market for its customer-oriented approach, offering flexible trading accounts, competitive spreads, high leverage options, and advanced tools for market analysis. These features make Exness appealing to traders of all levels, from beginners to experienced professionals. In addition to a comprehensive suite of trading instruments, Exness offers various account types that cater to different trading styles, such as Standard, Raw Spread, Zero, and Pro accounts, each with distinct benefits tailored to meet diverse trading needs.

Regulatory Background of Exness

Exness operates under a strict regulatory framework, being licensed by several top-tier financial authorities. These include the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) of Seychelles. Each of these licenses imposes high standards for client protection, transparency, and operational security. The FCA and CySEC, in particular, are known for their rigorous oversight, requiring brokers to follow stringent rules regarding fund segregation, financial audits, and AML (Anti-Money Laundering) compliance.

By adhering to these international standards, Exness reinforces its commitment to providing a secure and reliable trading environment. Although Exness does not hold a direct license from the UAE's regulatory authorities, the platform’s global regulatory compliance offers a significant level of security for traders in the UAE. This regulatory adherence assures traders that Exness operates with transparency and follows ethical business practices, which is essential for maintaining trust in a global market.

Understanding the Legal Framework in the UAE

Financial Regulatory Authorities in the UAE

The UAE’s financial sector is overseen by the Central Bank of the UAE (CBUAE) and the Securities and Commodities Authority (SCA). These institutions are responsible for implementing financial regulations, ensuring market stability, and protecting investors from potential financial fraud. The SCA, specifically, supervises and regulates the financial markets, ensuring that brokers adhere to fair and transparent trading practices. Brokers licensed by the SCA are subject to strict rules on fund security, AML measures, and regular audits, thereby providing a secure trading environment.

Forex trading in the UAE is permissible, but brokers must have the appropriate licensing from the SCA or CBUAE to operate fully within the UAE’s legal framework. For UAE residents, the presence of these regulatory bodies signifies that licensed brokers are held to the highest standards of transparency and security, ensuring a safe trading environment. The licensing process involves rigorous scrutiny of the broker’s operations, policies, and financial stability, which protects traders from unethical practices.

Importance of Licensing for Forex Brokers

Licensing is crucial for any forex broker, as it validates the broker's legitimacy and provides a layer of security for traders. A license from UAE regulatory bodies such as the SCA or CBUAE not only legitimizes a broker's operations but also ensures adherence to local financial laws. Licensed brokers are required to follow policies on client fund segregation, AML procedures, and transparency in operations. This regulatory oversight prevents conflicts of interest, unfair practices, and potential fraud.

For UAE-based traders, using a licensed broker provides additional peace of mind, as they know their funds are protected and that the broker operates within a legal framework. Regulated brokers are obligated to maintain high levels of transparency, provide detailed information about fees and trading conditions, and adhere to ethical practices. As a result, licensing not only benefits the trader but also contributes to the stability and trustworthiness of the UAE financial markets.

The Status of Exness in the UAE

Licenses Held by Exness

Exness holds several prominent licenses from international financial authorities, including the FCA in the UK, CySEC in Cyprus, and the FSA in Seychelles. While Exness does not possess a direct license from UAE regulatory authorities like the SCA or CBUAE, its licenses from globally respected regulators allow it to operate legally in multiple regions, including the UAE. These international licenses impose strict standards on Exness, ensuring it follows best practices in fund management, AML compliance, and transparent operations.

For UAE traders, Exness’s international licenses signify that it operates with a high degree of security and integrity, as these licenses are awarded only to brokers who demonstrate compliance with rigorous financial standards. Furthermore, Exness’s adherence to these regulations assures UAE clients of the platform’s commitment to ethical business practices, transparent pricing, and client fund protection, making it a viable option for those seeking a reliable broker.

Compliance with UAE Regulations

Though Exness lacks a direct UAE regulatory license, it operates in accordance with international standards set by its primary regulators. Exness’s services are accessible to UAE residents, with the company ensuring compliance with global guidelines on AML and fair trading practices. This international compliance allows Exness to offer a regulated and secure trading environment to UAE clients while following protocols that meet high regulatory standards.

For UAE-based traders, this means that Exness, while not directly regulated by local authorities, provides a secure trading environment through its international compliance. The company also offers features such as Arabic language support and Islamic (Sharia-compliant) accounts, catering specifically to the needs of its UAE client base. Exness’s transparent approach and adherence to global regulatory standards make it a popular choice among UAE traders who seek reliability in their broker.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Benefits of Trading with Regulated Brokers

Security of Funds

One of the primary advantages of trading with a regulated broker is the enhanced security of client funds. Regulated brokers, like Exness, are required to segregate client funds from their operating funds, ensuring that client assets remain protected even if the company encounters financial difficulties. This separation of funds is mandated by international regulations and provides an additional layer of security for traders.

Exness’s adherence to these standards gives UAE traders confidence that their funds are safe and secure. Additionally, as part of its regulatory compliance, Exness undergoes regular audits and financial checks to verify its financial health and operational integrity. This financial transparency ensures that clients’ investments are safeguarded, creating a sense of security for traders, especially those concerned with fund safety.

Transparency and Fair Practices

Regulated brokers operate under strict guidelines that promote transparency and fair trading practices. Exness is known for its transparent pricing, offering clients detailed information about spreads, fees, and trading conditions. This transparency enables traders to make informed decisions and understand the costs associated with trading on the platform. Additionally, regulated brokers are obligated to follow fair trading practices, which includes providing accurate, real-time data and executing trades fairly.

For UAE traders, Exness’s commitment to transparency and fairness enhances trust in the platform. By adhering to international standards and clearly communicating fees and trading conditions, Exness allows traders to navigate the platform confidently. This commitment to transparency is critical for building trust, as traders need to feel assured that their broker operates with integrity and prioritizes client interests.

Risks of Unregulated Trading Platforms

Lack of Consumer Protection

Unregulated trading platforms lack the oversight and accountability that regulated brokers must follow, which can leave traders vulnerable to unethical practices. Without regulatory protection, there is a higher risk of issues like unauthorized charges, improper handling of client funds, and manipulation of trading conditions. Regulated brokers, like Exness, are required to adhere to strict guidelines that protect clients from these risks, ensuring a fair and secure trading environment.

For UAE traders, choosing an unregulated platform could lead to complications with fund withdrawals, unfair fees, and even potential loss of investment. On the other hand, Exness’s adherence to regulatory requirements ensures that clients have access to a reliable and safe platform, minimizing risks associated with unregulated platforms. Regulatory oversight provides an added layer of security that unregulated brokers simply cannot offer.

Potential for Fraud and Scams

Unregulated platforms have a higher potential for fraudulent activities and scams. In the absence of regulatory oversight, such brokers may engage in unethical practices, such as inflating spreads, manipulating trades, or restricting withdrawals. Exness, as a regulated broker, is held to high standards that protect clients from such fraudulent practices. Regular audits and transparency requirements ensure that Exness operates ethically and in the best interest of its clients.

For UAE traders, using an unregulated broker poses significant financial risks, as there is no governing body to enforce fair practices or protect against fraud. In contrast, Exness’s regulatory licenses provide clients with reassurance that the company adheres to ethical standards. This regulatory compliance makes Exness a preferred choice for traders looking to avoid the risks associated with unregulated trading platforms.

User Experience: Exness in the UAE

Account Registration Process

Exness offers a straightforward and accessible registration process for UAE clients. To open an account, traders need to provide basic personal information and complete identity verification, a standard practice to ensure security and compliance. The process is intuitive, with clear instructions provided on each step, allowing users to set up their accounts quickly. Verification is typically processed within a few hours, allowing traders to begin trading almost immediately.

For UAE traders, the simplicity of Exness’s registration process makes it easy to get started. The platform supports Arabic language options, ensuring that local traders can navigate the process with ease. The verification process is designed to protect client information, aligning with Exness’s commitment to secure and transparent trading.

Available Trading Instruments

Exness provides UAE traders with a wide range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. This variety allows traders to diversify their portfolios and explore different markets according to their preferences and strategies. Exness continually expands its asset offerings to meet global demand, providing UAE traders with ample opportunities to trade various instruments within one platform.

The diverse range of trading instruments on Exness allows UAE clients to participate in global markets, tailoring their trades to suit market trends and personal strategies. Exness’s extensive options in both major and exotic forex pairs, alongside commodities and indices, offer UAE traders flexibility and the ability to adapt to market changes, enhancing the overall trading experience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Conditions Offered by Exness

Spreads and Leverage Options

Exness offers competitive spreads and flexible leverage options, which are crucial aspects that appeal to traders globally, including those in the UAE. Spreads on Exness range from tight, near-zero levels on specialized accounts to broader spreads on standard accounts, allowing traders to choose an account type that best matches their trading style and goals. This flexibility helps minimize trading costs for frequent traders and provides cost-effective options for those with different risk tolerances.

Leverage options are another significant benefit for Exness users, as the platform provides leverage levels that vary according to the type of asset and the trader’s chosen account. High leverage allows traders to maximize their trading positions with relatively small capital, which can increase potential profits. However, Exness also emphasizes the importance of responsible leverage use, particularly in volatile markets, providing guidance on managing leveraged positions effectively to minimize risk.

Deposit and Withdrawal Methods

Exness offers various deposit and withdrawal methods tailored to meet the needs of UAE clients. Traders can use bank transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and even cryptocurrencies. The platform's support for these local and international payment methods enhances convenience, making it easier for UAE-based traders to manage their funds effectively. Exness also boasts fast withdrawal times, often processing requests within hours, a feature highly appreciated by traders.

The flexibility in deposit and withdrawal options ensures that traders can manage their accounts without encountering significant delays or hidden fees. Exness is committed to transparency in transaction costs, offering fee-free deposits and withdrawals for most methods. The ease of fund transfers, combined with quick processing times, provides UAE traders with a hassle-free experience, allowing them to focus more on their trading strategies and less on administrative tasks.

Customer Support Services

Availability of Arabic Language Support

For traders in the UAE, language accessibility is an essential feature, and Exness meets this need by providing support in Arabic. This multilingual support allows traders who prefer Arabic to communicate comfortably with the support team, which can be especially helpful when dealing with complex queries or seeking guidance on specific trading issues. Having customer support in Arabic enhances the user experience, as traders can resolve their concerns quickly and effectively without language barriers.

Exness’s dedication to providing language support in Arabic shows its commitment to catering to the local market and building strong relationships with UAE-based clients. This language accessibility extends across multiple support channels, including live chat, email, and phone support, ensuring that traders can get assistance whenever they need it. The availability of Arabic support underscores Exness’s efforts to make trading accessible and convenient for its clients in the UAE and other Arabic-speaking regions.

Responsiveness and Service Quality

Exness is known for its high level of customer service responsiveness, a critical factor in the fast-paced world of forex trading. The support team is available 24/7, offering timely responses and efficient solutions to client queries. For UAE traders, this round-the-clock support ensures that they can get help regardless of time zones, especially when dealing with urgent issues related to transactions, platform functionality, or trading accounts.

The quality of Exness’s customer service is frequently praised in user reviews, with many clients noting that the support team is knowledgeable and quick to resolve issues. Exness also provides a comprehensive FAQ section and educational resources, allowing traders to find answers to common questions independently. The commitment to quality customer service enhances Exness’s reputation as a user-centric platform, fostering trust and reliability among UAE traders.

Exness vs Other Brokers in the UAE

Competitive Advantages of Exness

Exness stands out among brokers in the UAE due to its competitive spreads, high leverage options, and efficient platform. Compared to other brokers, Exness offers one of the lowest spreads, which can significantly reduce trading costs over time. Additionally, Exness’s flexible leverage options allow traders to maximize their trading potential without requiring substantial upfront capital. These features are particularly attractive to both beginner and experienced traders in the UAE, as they can adapt their trading strategies based on market conditions.

Another advantage Exness offers is its focus on technological innovation, including the use of advanced trading platforms like MT4, MT5, and a proprietary trading app. This technological edge enhances the overall trading experience, providing UAE traders with powerful tools to execute trades, analyze markets, and manage their accounts efficiently. Combined with a wide range of deposit and withdrawal methods, Exness has positioned itself as a top choice for traders seeking versatility and reliability.

Areas Where Exness May Fall Short

While Exness has many advantages, there are a few areas where it may not fully meet every trader’s expectations. One area of potential improvement is its regulatory status in the UAE. Unlike some competitors that hold direct licenses from the UAE’s Securities and Commodities Authority (SCA), Exness operates through international licenses, which may raise concerns for traders who prefer locally regulated brokers. Although Exness’s global licenses provide a high degree of security, some UAE clients may feel more comfortable with a broker regulated directly within the UAE.

Additionally, Exness’s high leverage offerings, while attractive to many, may pose challenges for inexperienced traders who are not familiar with leveraged trading. High leverage can amplify both gains and losses, making it essential for traders to use leverage cautiously. For those unfamiliar with leverage risks, it may be beneficial to start with lower leverage options or seek further guidance on risk management strategies available through Exness’s educational resources.

Case Studies and User Testimonials

Positive Experiences from Traders

Many traders in the UAE report positive experiences with Exness, citing factors such as low spreads, fast withdrawal times, and responsive customer support. One trader shared that Exness’s low trading fees allowed them to maximize profits on short-term trades, a critical advantage for those engaging in high-frequency trading strategies. Another user appreciated the speed of withdrawals, noting that funds were processed within hours, which allowed for smoother fund management.

These positive testimonials underscore Exness’s commitment to providing a seamless trading experience, from user-friendly interfaces to efficient customer service. UAE traders also praise Exness for its educational resources, which help newcomers understand the complexities of forex trading and learn to trade effectively. The combination of low costs, strong support, and educational resources makes Exness a preferred choice for both new and experienced traders in the region.

Common Complaints and Issues

Despite generally favorable reviews, some users have expressed concerns about specific aspects of the Exness platform. A few traders mentioned issues with occasional slippage, especially during periods of high market volatility. Slippage can impact trade outcomes by altering entry and exit points, which may affect profitability. Exness acknowledges that slippage can occur during volatile market conditions and advises traders to use tools like stop-loss orders to mitigate these risks.

Another common concern involves the complexity of the platform for beginners, as some users found the array of tools and features overwhelming at first. While Exness provides educational resources, new traders may benefit from additional guidance or simplified tutorials tailored to first-time users. Exness continues to work on enhancing user experiences by improving educational content and streamlining platform navigation, ensuring that traders of all levels can trade confidently.

Conclusion on the Status of Exness in the UAE

Exness has established itself as a prominent player in the global forex market, offering robust features, competitive trading conditions, and a commitment to client security. Although Exness does not hold a direct license from UAE regulatory authorities, it operates under internationally respected licenses from bodies such as the FCA and CySEC. This global regulatory oversight provides UAE traders with a high level of security, allowing them to trade confidently on the platform.

For UAE traders, Exness offers numerous benefits, including low spreads, flexible leverage, a variety of trading instruments, and dedicated Arabic language support. The platform’s focus on transparency, efficient fund management, and educational resources further enhances its appeal. While Exness faces some limitations due to its indirect regulatory status in the UAE, its overall service quality and dedication to compliance make it a strong option for traders in the region. For those seeking a secure, user-friendly trading environment with access to international markets, Exness remains a reliable choice in the UAE’s competitive forex landscape.

Read more:

Is Exness regulated in Uganda?