26 minute read

How to use Exness Trading App In India

from Exness

by Exness_Blog

How to use Exness Trading App In India is a crucial query for traders looking to harness the potential of financial markets through mobile trading. With the growing trend towards digital solutions for trading, understanding how to navigate and utilize the Exness Trading App can provide traders with a competitive edge in their trading journey. This guide will explore the various facets of using the Exness Trading App in India, from installation to executing trades and managing risks effectively.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness Trading App

In recent years, the landscape of trading has transformed significantly due to technological advancements. The advent of trading apps has made it possible for traders to engage with financial markets anytime and anywhere. One such popular platform is the Exness Trading App, which provides traders with a seamless experience and access to a diverse range of trading instruments.

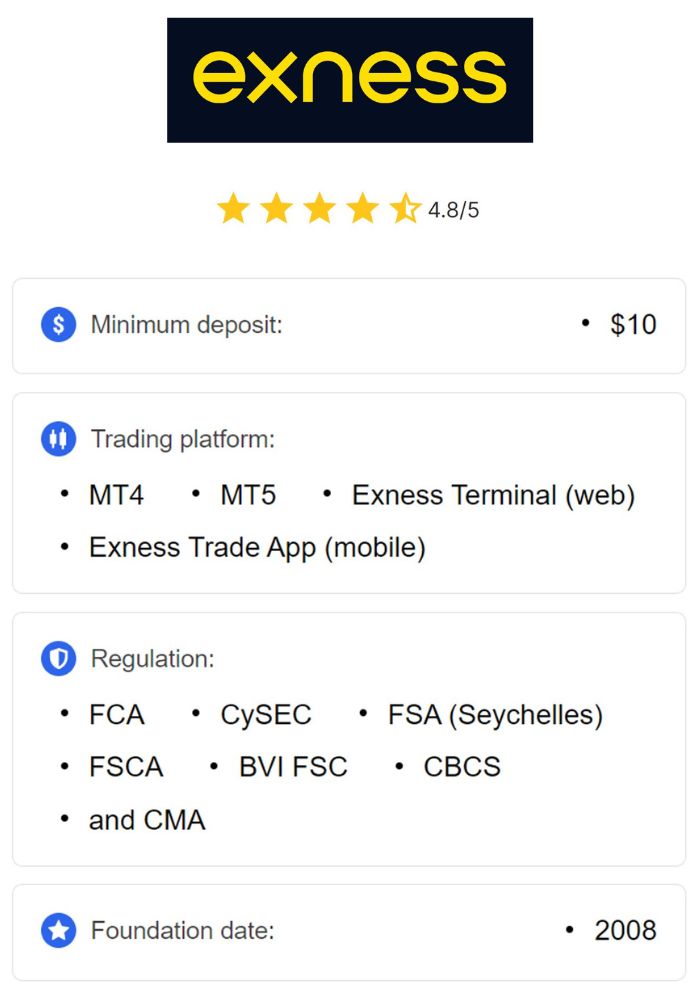

Overview of Exness

Exness is an established brokerage firm that has gained traction among traders worldwide by offering innovative trading solutions and efficient services. Established in 2008, Exness has built a reputation for transparency, reliability, and user-centric services. The firm operates under various regulatory authorities, ensuring that clients' funds are protected and that they comply with local laws.

The Exness Trading App embodies the company's commitment to providing a superior trading experience. It combines advanced technology with user-friendly features, allowing both novice and experienced traders to access the financial markets effortlessly. With its intuitive interface, real-time market data, and robust analytical tools, the app stands out as a valuable resource for traders in India.

Importance of Trading Apps in Modern Trading

As trading evolves, so do the tools available to traders. Traditional desktop trading platforms are gradually being replaced by mobile trading applications. The importance of trading apps like Exness lies in their ability to bring convenience and efficiency to the trading process. Traders can monitor their positions, execute trades, and analyze markets on the go, reducing the reliance on fixed locations.

Moreover, trading apps enable users to receive timely updates on market movements and relevant news, which can significantly impact trading decisions. This flexibility not only fosters a more dynamic trading approach but also empowers users to respond promptly to market changes. In essence, trading apps have become essential for anyone serious about trading in today’s fast-paced financial environment.

Getting Started with the Exness Trading App

Before diving into trading, it's important to ensure that you meet the necessary system requirements and know how to download the app on your device. The following section outlines everything you need to know to get started with the Exness Trading App.

System Requirements for the App

To use the Exness Trading App effectively, you'll need to ensure that your device meets certain specifications. The app is designed to be compatible with both Android and iOS devices, making it accessible to a wide range of users.

For Android users, the app requires Android version 5.0 or higher. While most modern smartphones meet this requirement, double-checking ensures optimal performance. On the other hand, iOS users should have iOS version 10.0 or above installed on their devices. A stable internet connection is also vital for real-time trading activities, as lagging connections can lead to missed opportunities.

Having sufficient storage space on your device is another key consideration. The Exness app is relatively lightweight, but keeping your device clutter-free can enhance overall performance. Once these prerequisites are confirmed, you can proceed to download the app and embark on your trading journey.

Downloading the Exness App on Android and iOS

Downloading the Exness Trading App is a straightforward process that can be completed in just a few steps. For Android users, the first step is to visit the Google Play Store. Simply search for "Exness Trading App" in the search bar. Once located, tap on the 'Install' button, and the app will begin downloading and installing on your device.

iOS users can find the Exness app in the Apple App Store. Similar to the Android process, search for "Exness Trading App," and once found, click on 'Get' to initiate the download and installation. Once installed, the app icon will appear on your home screen, allowing easy access to your trading account and all related features.

It's worth noting that as with any application, regular updates are essential to maintain functionality and security. Checking for updates periodically via your app store ensures that you benefit from the latest features and improvements.

Setting Up Your Exness Account

Having successfully downloaded the Exness Trading App, the next step is to set up your trading account. This includes creating a new account, verifying your identity, and understanding the different account types available to you.

Creating a New Account

Setting up a new account within the Exness Trading App is a simple yet critical step. Upon launching the app, you will be greeted with an option to create a new account. Follow the prompts to fill in your personal information accurately, including your name, email address, and phone number. Ensure that the information provided matches your official identification documents, as discrepancies can lead to verification issues later.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Once you've completed the initial registration form, check your email for a confirmation link from Exness. Clicking this link will validate your email address and complete the account creation process. After confirming your email, return to the app to continue the setup.

Verifying Your Identity

Identity verification is a crucial aspect of using the Exness Trading App. Regulatory authorities require brokers to verify the identity of their users to prevent fraudulent activities and protect clients’ accounts. To verify your account, you'll need to upload specific documents, such as a government-issued ID (e.g., passport or driver's license) and proof of residence (e.g., utility bill or bank statement).

Within the app, there is a dedicated section for uploading these documents. Once submitted, Exness typically processes verification requests swiftly—often within a few hours. However, during busy periods, it may take longer. Ensuring accurate and clear uploads can expedite the process and allow you to start trading sooner.

Understanding Account Types Available

Exness offers several account types catering to different trading styles and preferences. Familiarizing yourself with these options is essential for selecting the one that best aligns with your trading goals. Generally, standard accounts offer lower spreads, making them suitable for everyday traders. In contrast, professional accounts may feature tighter spreads and additional leverage, appealing to experienced traders seeking higher trading volumes.

Additionally, Exness provides demo accounts for those who want to practice trading without risking real money. This feature allows you to familiarize yourself with the app's functionalities and develop your trading strategy before committing actual funds. Understanding the nuances of each account type will empower you to make an informed decision when setting up your live trading account.

Navigating the Exness Trading App Interface

A key element of successful trading using the Exness Trading App lies in understanding how to navigate its interface effectively. The app is designed to be user-friendly, but exploring its main features and customizing your dashboard can greatly enhance your trading experience.

Overview of Main Features

The Exness Trading App is rich in features aimed at simplifying the trading process. Upon logging in, you will notice a clean layout that prominently displays market quotes, charts, and your portfolio. Key features include access to trade history, open positions, and current equity, allowing you to keep track of your trading activities easily.

Another notable feature is the integrated charting tools, which provide real-time price data and technical indicators. These tools help traders analyze market trends and make informed decisions based on historical price movements. Additionally, the app facilitates quick order execution, enabling users to place buy or sell orders seamlessly with the touch of a button.

Furthermore, the app houses an educational section, where users can access tutorials, webinars, and articles designed to enhance their trading knowledge. This integration promotes continuous learning and equips traders with the skills they need to succeed.

Customizing Your Dashboard

Customizing your dashboard within the Exness Trading App can create a more tailored trading experience. Users can adjust the layout to prioritize the features and information they find most useful. For instance, if you frequently monitor certain currency pairs, you can pin them to your dashboard for quick access.

Another customization option involves the arrangement of widgets, which can display real-time news, economic calendars, and market analyses. By configuring your dashboard to reflect your trading style, you can enhance your efficiency and responsiveness to market changes.

Moreover, taking some time to personalize notifications will ensure you stay updated on significant price movements and events impacting the financial markets. This proactive approach can improve your decision-making capabilities as you trade.

Using the Menu Options Effectively

The Exness Trading App comes equipped with a comprehensive menu that grants access to various functionalities. Familiarizing yourself with these menu options will allow you to navigate the app with confidence. Key sections within the menu include account management, market analysis, trading tools, and customer support.

For example, the market analysis section encompasses both fundamental and technical analyses, helping users gauge market sentiment and identify trading opportunities. Meanwhile, the account management option provides insight into your balance, deposits, withdrawals, and transaction history, enabling you to manage your funds efficiently.

Additionally, the customer support section offers quick solutions to common queries and access to live chat with support representatives. Knowing where to find assistance and resources can significantly enhance your overall trading experience on the Exness app.

Funding Your Exness Trading Account

Once your account is set up and you’re familiar with the app interface, the next step is funding your Exness trading account. Understanding the payment methods supported in India and the deposit process is crucial for getting started with live trading.

Payment Methods Supported in India

Exness recognizes the diverse needs of its clients and offers a variety of payment methods tailored for Indian traders. Popular options include local bank transfers, credit and debit cards, e-wallets, and cryptocurrencies. Utilizing these methods can facilitate swift and secure transactions, ensuring your funds are available for trading without delay.

Local bank transfers are often favored for their ease of use and direct transfer capability, while e-wallets like Paytm and Skrill provide added convenience for those preferring digital wallets. Each method comes with its own processing times and fees, so it’s important to choose one that aligns with your trading requirements.

Be sure to check the Exness website or the app’s payment section for the most current information regarding payment methods, as they may periodically update or introduce new options.

Step-by-Step Guide to Deposit Funds

Depositing funds into your Exness trading account is a straightforward process. Navigate to the "Deposit" section in the app, where you’ll be prompted to select your preferred payment method. After choosing the method, you'll need to enter the amount you wish to deposit.

Depending on the payment method selected, further instructions will be provided. For example, if you opt for a credit card, you’ll need to input your card details. Conversely, for bank transfers, instructions for completing the transfer from your bank will be given.

After confirming the transaction, your deposit request will be processed. Typically, deposits made via e-wallets are reflected almost instantly, whereas bank transfers may take a bit longer. It’s advisable to keep an eye on your account balance to confirm that the funds have been credited successfully.

Understanding Currency Conversion Fees

When trading on Exness, particularly for Indian traders dealing in foreign currencies, awareness of currency conversion fees is essential. Depending on the payment method and the currency you're trading in, you may incur conversion charges when depositing or withdrawing funds.

Exness provides information regarding applicable conversion rates and fees within the app, enabling you to anticipate and plan for these costs. Being mindful of these fees helps ensure that you maximize your trading capital while minimizing unnecessary expenses. Always review the detailed terms and conditions relating to currency conversions prior to executing transactions.

Learning How to Trade on the Exness App

With your account funded, it’s time to delve into the trading aspect of the Exness app. This section covers the different types of trades available, how to choose the right financial instruments, and the tools for analyzing market trends.

Types of Trades Offered

Exness caters to various trading styles by offering multiple types of trades. The primary categories include market orders, limit orders, and stop orders. Market orders entail buying or selling a financial instrument at the current market price, making them ideal for traders wanting immediate execution.

Limit orders, on the other hand, allow traders to specify a desired entry point for buying or selling. This type of order can be advantageous for those wishing to capitalize on price fluctuations without actively monitoring the market. Stop orders work similarly but are utilized to limit losses or lock in profits, triggering a market order once a specified price level is reached.

Understanding these trade types is essential for developing a resilient trading strategy and executing trades effectively in the app.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Choosing the Right Financial Instruments

Selecting the appropriate financial instruments is pivotal for achieving trading success. Exness provides access to a wide array of instruments, including forex pairs, commodities, indices, and cryptocurrencies. The choice of instruments should align with your trading strategy, risk tolerance, and market outlook.

For instance, forex might appeal to traders who prefer high liquidity and volatility, while commodities could attract those interested in tangible assets. Additionally, diversifying your portfolio across different asset classes can mitigate risk and enhance potential returns.

Utilizing the research and analysis tools within the app can provide valuable insights into each instrument. Keeping abreast of market trends and economic factors impacting these instruments helps refine your selection process.

Analyzing Market Trends

Effective market analysis is essential for making informed trading decisions on the Exness app. Traders can employ both fundamental and technical analysis techniques to assess market conditions. Fundamental analysis involves evaluating economic indicators, company earnings, and geopolitical events to forecast price movements.

Conversely, technical analysis focuses on studying historical price action and patterns through charts and indicators. The app's charting tools facilitate easy access to various technical indicators, such as moving averages, RSI, and MACD, allowing traders to recognize trends and signals effectively.

By combining both approaches, traders can gain a holistic understanding of market dynamics, enhancing their decision-making abilities. Continuous practice in analyzing market trends will improve proficiency over time.

Executing Trades on Exness

Once you’ve identified a trading opportunity, executing trades on the Exness app is a streamlined process. Understanding how to place your first trade, comprehend buy and sell orders, and utilize stop-loss and take-profit features are essential skills for effective trading.

Placing Your First Trade

Placing your first trade within the Exness Trading App requires you to navigate to the “Trade” section. Here, you can select the financial instrument you intend to trade. After choosing the instrument, you will be presented with options to specify whether you want to buy or sell.

When executing your trade, ensure you input the desired lot size, which reflects the volume of the trade. It's advisable to start with smaller lot sizes as you familiarize yourself with the app's functionalities and your chosen trading strategy. Once all parameters are set, simply confirm the trade to execute it.

The app will immediately reflect your position in the “Open Positions” tab, allowing you to monitor performance in real time. Remember, practice makes perfect, so consider utilizing a demo account for hands-on experience before venturing into live trading.

Understanding Buy and Sell Orders

Buy and sell orders are fundamental components of trading on Exness. A buy order indicates your intention to purchase an asset, anticipating its value will rise. Conversely, a sell order denotes your expectation that the asset's value will decline, prompting you to sell.

Grasping the mechanics behind these orders is vital for successful trading. When placing a buy order, ensure you conduct thorough analysis to validate your bullish sentiment. Similarly, when initiating a sell order, corroborate your expectations with sound reasoning and market indicators.

Being proficient in recognizing entry and exit points for both buy and sell orders is crucial for optimizing your trading results. Monitoring market conditions and staying attuned to price movements enhances your ability to capitalize on opportunities.

Utilizing Stop Loss and Take Profit Features

One of the most powerful tools available within the Exness Trading App is the ability to set stop-loss and take-profit levels. These features enable traders to manage risk and protect their investments effectively. A stop-loss order automatically sells your position when it reaches a predetermined price, limiting potential losses.

The take-profit feature, on the other hand, secures profits by closing your position once a specified profit level is attained. By incorporating both stop-loss and take-profit orders into your trading strategy, you can automate aspects of trade management, reducing emotional influence on your decisions.

Establishing appropriate stop-loss and take-profit levels stems from careful analysis of market conditions and your risk tolerance. Consistent practice in setting these levels can contribute positively to your overall trading performance.

Managing Your Trades

Effectively managing your trades is a vital component of successful trading on the Exness app. This section discusses how to monitor open positions, modify or close trades, and keep track of your trading history.

Monitoring Open Positions

The Exness Trading App enables traders to easily monitor their open positions. Within the app, you can view real-time updates on the performance of your trades, including current profit or loss figures. Staying vigilant about your positions allows you to react quickly to market changes, adjusting your strategy as necessary.

Regularly reviewing your open positions is essential, as it provides insights into trends and price movements. Consider implementing strategies such as trailing stops to lock in profits as the market moves in your favor. By doing so, you can optimize outcomes while minimizing potential losses.

Furthermore, maintaining a disciplined approach to monitoring your trades reduces the likelihood of emotional trading. Cultivating patience and restraint can enhance decision-making and ultimately lead to improved trading results.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Modifying or Closing Trades

If circumstances change or if your analysis indicates a shift in market dynamics, modifying or closing trades becomes necessary. The Exness Trading App offers a straightforward process for making adjustments to your positions. Simply navigate to the "Open Positions" section, select the trade you wish to modify, and choose your desired action.

For instance, you may decide to raise the stop-loss level to safeguard profits, or alternatively, you might choose to close a losing trade early to prevent further losses. Making these adjustments proactively demonstrates a strategic mindset and an understanding of market conditions.

It’s important to remember that closing a trade does not equate to failure. Each trade offers valuable lessons, and recognizing when to exit is a hallmark of a disciplined trader.

Keeping Track of Your Trading History

Tracking your trading history is an integral part of developing as a trader. The Exness app provides a comprehensive overview of past trades, detailing key information such as entry and exit points, profit/loss figures, and durations. Regularly analyzing this data can unveil patterns in your trading behavior, highlighting strengths and weaknesses.

Maintaining a trading journal to document your thoughts, strategies, and outcomes can further enhance your growth as a trader. Reflecting on past trades encourages self-awareness and fosters a continuous learning mindset, empowering you to refine your strategies over time.

Risk Management in Exness Trading

Navigating the financial markets involves inherent risks, making a robust risk management strategy imperative. This section emphasizes the importance of risk management, setting stop-loss and take-profit levels, and diversifying your trading portfolio.

Importance of Risk Management Strategies

Risk management is a cornerstone of successful trading. It involves identifying, assessing, and mitigating potential losses while maximizing gains. Practicing prudent risk management helps preserve your trading capital and minimizes the emotional toll associated with trading.

Effective strategies can include defining your risk-reward ratio for each trade, determining the maximum percentage of your account to risk per trade, and consistently applying these parameters across your trading endeavors. By prioritizing risk management, traders can approach trading with greater confidence and discipline.

Embracing risk management isn't about eliminating risk entirely; it's about managing it wisely. Developing resilience in the face of losses is crucial for long-term success in the trading arena.

Setting Stop Loss and Take Profit Levels

Establishing precise stop-loss and take-profit levels is fundamental for risk management in Exness trading. These orders serve as safeguards that automatically close your positions once specific price levels are reached.

When determining these levels, consider factors such as market volatility, support and resistance zones, and your overall trading strategy. Implementing well-thought-out stop-loss orders limits the extent of potential losses, while take-profit orders ensure that you lock in profits at desirable price points.

Remember, the placement of these orders should align with your analysis and risk tolerance. Avoid altering them impulsively based on fear or greed; instead, adhere to your predetermined strategy for consistent progress.

Diversification of Your Trading Portfolio

Diversifying your trading portfolio across different asset classes and instruments can significantly reduce risk. By not putting all your capital into a single investment, you spread exposure and mitigate the impact of adverse market movements.

Consider exploring various financial instruments available on the Exness app, such as forex pairs, commodities, indices, and cryptocurrencies. Each instrument responds differently to market conditions, and diversification enables you to capitalize on opportunities across multiple markets.

Moreover, regularly reassessing your portfolio composition is vital. As market dynamics shift, reallocating resources to maintain a balanced and diversified portfolio can enhance your overall stability and performance.

Utilizing Technical Analysis Tools

Technical analysis is a critical skill for traders looking to make informed decisions using the Exness Trading App. This section explores accessing charting tools, interpreting technical indicators, and incorporating trend analysis into trading decisions.

Accessing Charting Tools within the App

The Exness Trading App features a suite of charting tools designed to assist traders in analyzing price movements and identifying trading opportunities. To access these tools, navigate to the chart section after selecting your desired financial instrument.

The chart allows you to customize time frames, ranging from minutes to months, depending on your trading style. You can also switch between different chart types, such as line, bar, or candlestick charts, to suit your preference and analysis approach.

Leveraging these charting tools lays the foundation for effective technical analysis. A visual representation of price action can reveal trends, reversals, and patterns that inform your trading decisions.

Interpreting Technical Indicators

The Exness app integrates numerous technical indicators that enhance your analysis capabilities. Popular indicators include Moving Averages, Bollinger Bands, and Relative Strength Index (RSI), each providing unique insights into price movements and potential reversals.

When interpreting these indicators, it’s essential to understand their purpose and limitations. For instance, Moving Averages smooth out price fluctuations, helping identify overall trends, while RSI measures momentum and identifies overbought or oversold conditions.

Combining multiple indicators can improve the accuracy of your analysis. However, maintaining simplicity is key; relying on too many indicators can cloud your judgment. Strive to find a balance that enriches your market insights without becoming overwhelming.

Incorporating Trend Analysis in Trading Decisions

Trend analysis plays a pivotal role in trading decisions and can be seamlessly integrated into your approach using the Exness Trading App. Identifying prevailing trends—whether upward, downward, or sideways—allows traders to align their strategies accordingly.

Utilizing trend lines and channels on your charts can help visualize key price levels and potential breakout points. Recognizing whether a market is trending or consolidating can inform your entry and exit strategies, enhancing the probability of success.

Moreover, considering broader market sentiment and external factors influencing trends further strengthens your analysis. Combining technical analysis with fundamental insights provides a comprehensive approach to trading and increases the robustness of your decisions.

Understanding Fundamental Analysis

While technical analysis focuses on historical price movements, fundamental analysis examines economic factors that drive market behavior. This section discusses key economic indicators to watch and the impact of news and events on markets.

Key Economic Indicators to Watch

Economic indicators play a significant role in shaping market sentiment and influencing trading decisions. Common indicators include Gross Domestic Product (GDP), inflation rates, employment figures, and central bank interest rate decisions.

Monitoring these indicators allows traders to evaluate the health of economies and anticipate market reactions. For instance, positive employment data may bolster a country's currency, leading to potential trading opportunities.

Staying informed about scheduled releases of economic reports is crucial. The Exness app provides access to an economic calendar, enabling you to track upcoming events and their potential impact on the markets.

News and Events Impacting Markets

Geopolitical developments, corporate earnings announcements, and central bank policy changes can significantly affect market dynamics. Staying updated on news and events impacting the financial markets is essential for informed trading decisions.

The Exness app offers news feeds and alerts on major market events, allowing traders to react quickly to breaking news. Understanding how such events are likely to influence supply and demand dynamics can enhance your strategic approach.

Engaging with reputable financial news sources alongside the app's resources enables you to cultivate a comprehensive view of the markets. This awareness fosters better decision-making and prepares you for potential volatility.

Staying Updated: Markets and News

In trading, staying updated on market trends and developments is paramount. This section delves into following market trends and setting up notifications and alerts within the Exness app.

Following Market Trends

Proactively following market trends enables traders to identify emerging opportunities and adjust their strategies accordingly. Utilizing the Exness app's market analysis features allows you to stay informed about price movements, volume trends, and overall sentiment.

Regularly reviewing market charts, economic indicators, and news articles helps build context around market shifts. Engaging with online trading communities and forums can also yield valuable insights and perspectives from fellow traders.

Additionally, consider keeping a daily trading journal to note observations, strategies, and market behavior. Documenting your experiences reinforces learning and provides reference points for future trades.

Notifications and Alerts Setup

The Exness Trading App offers customizable notifications and alerts to keep traders informed about significant market events and price movements. Configuring these alerts ensures that you receive timely updates, which can prove invaluable in dynamic trading environments.

You can set alerts for specific price levels, economic news releases, and even updates on your open positions. Tailoring these notifications to your trading strategy allows you to remain engaged and responsive without constantly monitoring the app.

Embracing technology to automate notifications not only saves time but also enhances your ability to seize opportunities as they arise.

Exness Customer Support

Ensuring that you have access to reliable customer support is vital as you navigate the Exness Trading App. This section explores how to access help and support resources, as well as contacting customer support in India.

Accessing Help and Support Resources

The Exness Trading App provides a wealth of resources for users seeking support. Within the app, you can access a comprehensive FAQ section covering common queries and concerns. This resource is particularly helpful for addressing basic questions about account setup, trading procedures, and payment methods.

Additionally, Exness maintains an extensive online knowledge base that contains articles, tutorials, and guides designed to enhance your understanding of the app and trading concepts. Taking advantage of these resources can empower you to resolve issues independently and strengthen your trading acumen.

Contacting Customer Support in India

If you encounter challenges or require personalized assistance, reaching out to Exness customer support is a viable option. The app offers instant messaging support, enabling users to connect with representatives for real-time assistance.

Moreover, users can contact customer support via email or through the Exness website. The support team is generally responsive and knowledgeable, ready to assist with inquiries or issues related to your trading account, transactions, or technical difficulties.

When reaching out for support, clearly articulating your issue will facilitate a quicker resolution. Keeping records of communications can also be beneficial for reference in follow-up discussions.

Tips for Successful Trading on Exness

To succeed in trading using the Exness Trading App, adopting certain best practices can enhance your journey. This section outlines key tips for developing a trading plan, practicing with a demo account, and embracing continuous learning.

Developing a Trading Plan

A well-defined trading plan serves as a strategic roadmap for your trading endeavors. Your plan should outline your trading goals, risk tolerance, preferred trading style, and guidelines for entering and exiting trades.

Incorporating specific criteria for executing trades helps instill discipline and reduces impulsive decision-making. Regularly reviewing and refining your trading plan based on market conditions and personal experiences keeps your approach adaptable and relevant.

Having a clear trading plan also instills a sense of accountability, encouraging you to stick to your predetermined rules and reflect on your performance objectively.

Practicing with a Demo Account

The Exness Trading App offers a demo account feature, allowing users to practice trading in a risk-free environment. Utilizing this feature is highly recommended, especially for beginners and those transitioning from other platforms.

A demo account simulates real market conditions while employing virtual funds. This experience enables you to test trading strategies, familiarize yourself with the app, and gain confidence before committing real capital.

Practicing consistently within the demo environment fosters skill development and prepares you mentally for live trading scenarios. Treating the demo account as seriously as you would a live account cultivates a disciplined mindset.

Continuous Learning and Improvement

The financial markets are ever-evolving, necessitating a commitment to continuous learning. Engaging with educational resources, attending webinars, and participating in trading communities can significantly enhance your knowledge and expertise.

Keeping abreast of market trends, economic indicators, and trading strategies allows you to adapt your approach to changing conditions. Embrace a growth mindset and remain open to feedback and constructive criticism from peers or mentors.

Moreover, reflecting on your trading experiences and analyzing performance regularly contributes to your development as a trader. Emphasizing continual improvement ensures that you evolve alongside the dynamic nature of the markets.

Conclusion

In conclusion, understanding how to use the Exness Trading App in India equips traders with the tools and knowledge necessary to navigate the financial markets effectively. From downloading the app and setting up an account to executing trades and managing risks, this comprehensive guide has explored the multifaceted aspects of trading on the Exness platform.

As you embark on your trading journey, remember that success in trading is not solely about profits but also about cultivating discipline, adapting to market changes, and continuously learning. By leveraging the features of the Exness Trading App and implementing sound trading practices, you can enhance your trading experience and work towards achieving your financial goals.

Read more: