12 minute read

Is Exness Trading Legit? Review Broker

from Exness

by Exness_Blog

Overview of Exness Trading

Company Background and History

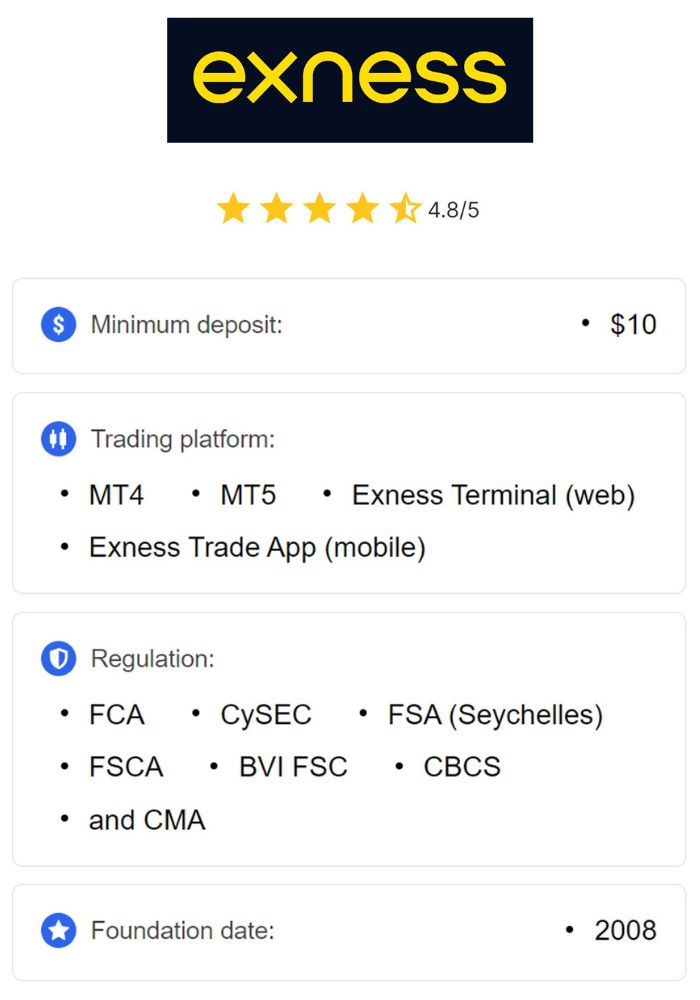

Exness is a well-established forex and online trading platform that has been operating since 2008. The company was founded by a group of financial experts and traders with the goal of providing retail traders with a reliable and user-friendly platform to trade a wide range of financial instruments. Over the years, Exness has built a strong reputation in the trading community and is known for its transparent business practices, competitive trading conditions, and strong customer support.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness started as a small operation, but due to its commitment to customer satisfaction and regulatory compliance, it has expanded globally. The company now serves clients from over 180 countries and offers a wide variety of trading services, including forex, commodities, indices, and cryptocurrencies. Its operations are underpinned by licenses and regulations from multiple jurisdictions, making it a reliable and trustworthy platform for traders.

Regulatory Compliance

Exness operates under the oversight of several regulatory authorities to ensure that it meets the highest standards of financial conduct. The company holds licenses from top-tier regulators, including the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA). These licenses ensure that Exness adheres to strict standards for transparency, customer protection, and financial stability.

The regulatory framework that Exness operates under is a key indicator of its legitimacy. Each regulatory body requires Exness to maintain proper financial practices, segregate client funds, provide transparent reporting, and ensure that its services are fair and secure for clients. This gives traders confidence that their investments and funds are being handled responsibly and in accordance with global standards.

Understanding the Exness Trading Platform

Types of Accounts Offered

Exness offers a range of account types to cater to the needs of different traders, whether they are beginners or experienced professionals. The account types available include:

Standard Account: Designed for new traders, this account offers competitive spreads and no commissions. It provides easy access to the forex market with a low minimum deposit requirement.

Pro Account: Aimed at more experienced traders, the Pro account offers tighter spreads and the ability to trade larger positions. It also allows traders to benefit from lower transaction costs.

ECN Account: This account type is designed for institutional clients or those who require the best available spreads and fast execution. It provides access to the interbank market, offering ultra-low spreads and a commission-based structure.

Zero Account: This account features zero spreads, with commission charges for each trade. It is designed for traders who want to execute high-frequency trades and take advantage of ultra-low transaction costs.

These different account types allow traders to choose an account that suits their trading style and capital. This flexibility makes Exness accessible to a wide range of traders.

Trading Instruments Available

Exness provides access to a broad range of financial instruments across multiple asset classes. Traders can choose from:

Forex: Exness offers over 100 currency pairs, including major, minor, and exotic currencies. These pairs offer liquidity, tight spreads, and the ability to trade at any time during the 24-hour forex market.

Commodities: Exness provides trading opportunities in commodities like oil, gold, and silver. These assets are popular among traders who want to diversify their portfolios and take advantage of market volatility.

Indices: Traders can also trade various global indices, such as the S&P 500, FTSE 100, and DAX 30. These instruments reflect the performance of major stock markets and are widely followed by traders.

Cryptocurrencies: Exness offers access to popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This makes it an attractive platform for traders interested in the growing digital asset market.

Stocks and ETFs: Exness also allows users to trade a variety of stocks and exchange-traded funds (ETFs), expanding the range of assets available to traders.

With such a diverse offering, Exness ensures that traders have a variety of markets to choose from, enabling them to diversify their portfolios and explore different trading opportunities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

User Interface and Experience

The Exness trading platform is designed to be user-friendly, offering both beginners and advanced traders an intuitive interface. The platform supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely regarded as the industry standard for forex trading platforms. These platforms offer advanced charting tools, technical analysis features, and automated trading options, allowing traders to execute trades quickly and efficiently.

Additionally, Exness has developed its own WebTrader, which is an online platform that offers fast and easy access to the markets without the need to download software. It can be accessed via any modern browser, making it convenient for traders who prefer not to install additional applications.

Overall, Exness’s trading platforms provide an easy-to-navigate environment, comprehensive trading tools, and fast execution speeds, ensuring a seamless experience for traders.

Security Measures at Exness

Data Protection and Encryption

Exness places a high priority on data security and protection. The company employs advanced encryption technologies, including SSL encryption, to safeguard sensitive information such as personal details, account information, and transaction data. This ensures that traders’ data is protected from unauthorized access, making Exness a secure platform for trading.

Exness’s security protocols comply with international standards, and the platform also implements two-factor authentication (2FA) for added security. This additional layer of protection ensures that only authorized individuals can access a trader's account, providing peace of mind.

Client Fund Segregation

To further ensure the safety of traders' funds, Exness segregates client funds from its own operational funds. This means that client deposits are held in separate accounts from the company’s own funds, reducing the risk of misuse or loss. In the event that Exness faces financial difficulty, client funds are protected and cannot be used to cover the company’s liabilities.

Segregation of client funds is a key aspect of financial regulation, and it is an essential measure to protect traders. Exness’s commitment to client fund segregation highlights the company’s dedication to maintaining a secure trading environment.

Trading Costs and Fees

Spread and Commission Structure

Exness offers competitive spreads across its various account types. The spread is the difference between the bid and ask price of a currency pair or financial instrument. For most major currency pairs, Exness offers tight spreads that ensure low transaction costs for traders. The broker operates a commission-free structure for most account types, though ECN accounts do carry commission fees based on the volume traded.

The spread and commission structure varies depending on the account type, with Pro and ECN accounts generally offering lower spreads but with commissions charged on trades. The Standard account, on the other hand, offers no commission but slightly wider spreads.

Deposit and Withdrawal Fees

Exness does not charge fees for deposits or withdrawals made through most methods, such as bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. However, fees may apply for specific payment methods or depending on the currency used for transactions.

Exness processes withdrawal requests promptly, typically within 24 hours. This fast processing time is one of the factors that sets Exness apart from other brokers, as many competitors may take longer to process withdrawals.

Customer Support Services

Availability and Contact Methods

Exness offers excellent customer support through various contact channels, including live chat, email, and telephone support. The support team is available 24/7, ensuring that traders can get assistance whenever they need it. Exness also provides a comprehensive FAQ section on its website, which answers many common questions about account setup, trading conditions, and platform features.

The availability of multiple contact methods and the 24/7 support make it easy for traders to reach Exness customer service, no matter where they are in the world.

Response Time and Effectiveness

Exness is known for its quick response times and effective customer service. Most traders report receiving prompt replies to their inquiries, and the support staff is often able to resolve issues on the first contact. This high level of responsiveness is crucial in the fast-paced world of trading, where delays can lead to missed opportunities or losses.

Traders can expect a high level of professionalism and knowledge from the Exness support team, making it a reliable resource for addressing any concerns.

User Experience and Reviews

Positive User Feedback

Exness has garnered positive feedback from many users across the globe. Traders appreciate the platform’s competitive trading conditions, reliable customer support, and robust security measures. Additionally, the platform’s ease of use, combined with access to a variety of trading instruments and educational resources, has earned it high ratings from traders of all experience levels.

Many users also praise Exness for its transparent business practices and the absence of hidden fees. This transparency is highly valued by traders, who appreciate knowing exactly what to expect from their trading experience.

Common Complaints and Issues

While Exness enjoys an overall positive reputation, some users have reported issues related to withdrawal processing times or slightly higher spreads on certain accounts. However, these issues are relatively rare and often resolved quickly by the support team.

Some traders also report occasional issues with the platform’s execution speeds, especially during periods of high market volatility. However, Exness generally provides stable and reliable execution under normal market conditions.

Educational Resources Provided by Exness

Trading Tutorials and Webinars

Exness offers a wide variety of educational resources, including tutorials, webinars, and video courses. These resources are designed to help traders improve their skills and enhance their trading strategies. The platform provides content for both beginners and advanced traders, covering topics such as technical analysis, fundamental analysis, and risk management.

Exness also offers live webinars, where experienced traders share insights and trading tips in real-time. These live sessions provide traders with an opportunity to ask questions and learn from experts.

Market Analysis and Insights

Exness provides traders with market analysis and insights to help them make informed trading decisions. The platform offers daily and weekly market updates, covering the latest economic news, trends, and analysis of key financial instruments. These insights are valuable for traders who want to stay informed about market conditions and adjust their trading strategies accordingly.

Exness Trading Strategies

Popular Trading Styles Among Users

Exness accommodates various trading styles, catering to both short-term and long-term traders. Scalping, where traders make numerous small trades throughout the day, is popular due to the platform's tight spreads and low costs. Day trading is also common, with traders opening and closing positions within the same day to capitalize on short-term market movements. Additionally, swing trading, where traders aim to capture trends over several days or weeks, is supported by Exness’s robust charting tools and technical analysis features.

Risk Management Techniques

Exness offers several risk management tools to help traders minimize potential losses. Stop-loss orders are widely used to limit downside risk by automatically closing a position when a predefined price level is reached. Additionally, take-profit orders allow traders to secure profits by closing a position when the price hits a certain level. Exness also offers negative balance protection, ensuring traders cannot lose more than their initial deposit, providing added security and peace of mind.

Comparison with Other Trading Platforms

Exness vs. Competitors

When compared to other trading platforms, Exness stands out in several key areas. One of the most notable features is its competitive spreads and low transaction costs, which are particularly attractive for traders who engage in frequent trading or scalping. Many competitors may charge higher fees, which can eat into profits, especially for high-frequency traders. Exness also offers fast execution speeds and high liquidity, making it a suitable choice for traders looking to enter and exit trades quickly.

In terms of regulation, Exness is licensed by several reputable financial authorities, ensuring a level of trustworthiness that some competitors may lack. While many brokers offer similar account types and trading instruments, Exness’s strong regulatory standing and focus on client security give it an edge over other brokers in the market.

Unique Features of Exness

Exness offers several unique features that differentiate it from its competitors. One of the most notable is its negative balance protection, which ensures traders cannot lose more than their initial deposit, offering peace of mind in volatile markets. Additionally, Exness provides segregated client funds, ensuring that traders' funds are held separately from the broker's operational funds, adding an extra layer of security.

Another standout feature is the platform's 24/7 customer support, which is available in multiple languages. This level of accessibility and support ensures that traders can get help whenever they need it, regardless of their time zone. These features, along with Exness’s user-friendly interface and range of account types, make it a highly attractive option for both beginner and experienced traders compared to other platforms in the industry.

Conclusion

Exness is a legitimate and trustworthy trading platform that offers a wide range of trading instruments, competitive fees, and excellent customer support. Its commitment to regulatory compliance, robust security measures, and transparency make it a safe choice for traders worldwide. While there may be occasional minor issues reported by users, Exness’s overall reputation and features position it as one of the top brokers in the industry.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Traders looking for a reliable and secure trading platform with a variety of account types, low transaction costs, and educational resources should consider Exness. It provides everything needed to succeed in the fast-paced world of forex and online trading.

Read more: