13 minute read

Exness account types and minimum deposit

from Exness

by Exness_Blog

Understanding the Exness account types and minimum deposit is crucial for anyone looking to navigate the world of trading with this broker. With various account offerings catering to different trader profiles, knowing what each type entails can significantly enhance your trading experience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

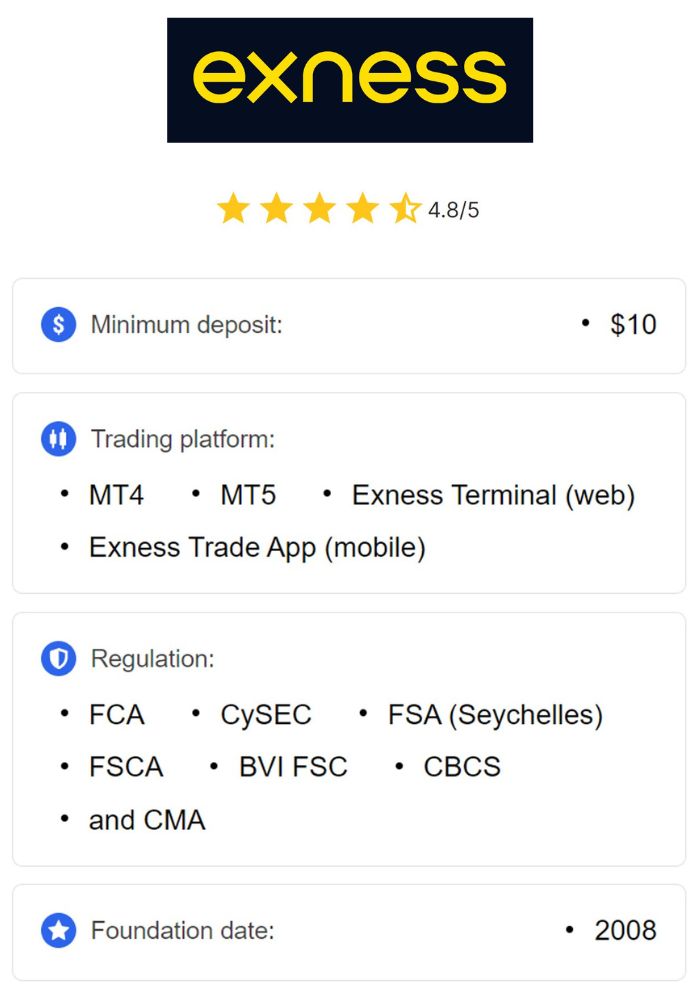

Exness has made a name for itself in the brokerage industry due to its robust trading platform and variety of account options. Founded in 2008, it has evolved into a globally recognized broker that serves millions of clients across multiple countries. What sets Exness apart from other brokers is its commitment to transparency, customer service, and technological innovation.

As more traders venture into the forex market, understanding the nuances of different account types becomes increasingly important. A trader's choice of account can dictate their experience, including aspects like leverage, spreads, and overall trading conditions. Therefore, grasping the features associated with each type is essential to align with individual trading strategies and risk tolerance.

Overview of Exness as a Broker

Exness provides an extensive range of trading instruments, including forex pairs, commodities, cryptocurrencies, and indices. Its user-friendly interface, coupled with advanced trading tools, makes it an appealing choice for both novice and experienced traders. The company is regulated by several reputable authorities, which adds a layer of security for its clients.

Moreover, Exness offers various platforms such as MetaTrader 4 and MetaTrader 5, allowing users to trade seamlessly across devices. With unique features like Instant Execution and a diverse range of account types, Exness caters to a broad spectrum of trading preferences.

Importance of Understanding Account Types

Choosing the right account type at Exness can significantly affect your trading performance. Different accounts come with distinct characteristics, influencing factors such as spread, commission fees, margin requirements, and leverage options. For instance, a lower minimum deposit requirement might attract beginners, but more seasoned traders may prefer accounts with tighter spreads or advanced features.

By understanding the available accounts, traders can align their financial strategies with their trading goals. Whether you are looking for a low-cost entry point or advanced trading capabilities, knowing what each account offers will enable you to make informed decisions.

Types of Accounts Offered by Exness

Exness provides several account types tailored to meet the varying needs of traders. Each account has unique features, making them suitable for different trading styles and strategies. However, selecting the best account type hinges on understanding these differences.

Standard Account

The Standard Account is often regarded as the go-to option for many traders, especially beginners. This account type offers a balance between affordability and access to various trading features. One of the primary advantages is the absence of a commission fee on trades, making it economically viable for those who want to minimize trading costs.

Standard Accounts typically have variable spreads, adding another layer of flexibility. The simplicity of this account type allows traders to focus more on their strategies rather than getting bogged down by complex account management.

Professional Account

For experienced traders, the Professional Account provides a more sophisticated trading environment. This account type is designed for traders who demand enhanced trading conditions, including smaller spreads and higher leverage options.

Traders opting for a Professional Account benefit from lower transaction costs, which can lead to increased profitability over time. Additionally, the Professional Account gives users access to advanced order types and priority execution, making it ideal for high-frequency trading strategies.

Cent Account

The Cent Account is specifically designed for traders who seek a safe environment to learn and experiment without risking substantial capital. It allows traders to start with smaller amounts, as the account balances are denominated in cents rather than dollars. This feature is particularly beneficial for beginners who want to develop their skills without the pressure of large investments.

Cent Accounts often mirror the functionalities of Standard Accounts regarding features, but with lower risks involved, making them a fantastic stepping stone for novice traders aiming to transition into more complex trading environments.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

ECN Account

The ECN Account is suited for professional traders or those who wish to take their trading to a more advanced level. This account type connects traders directly to liquidity providers, ensuring tight spreads and minimal slippage during trading.

One of the standout features of the ECN Account is the speed of trade execution. It’s tailored for those who utilize scalping or algorithmic trading strategies, where every millisecond counts. However, this account type typically requires a higher minimum deposit compared to others, reflecting its premium status within Exness's offerings.

Standard Account Features

Examining the features of the Standard Account reveals why it remains a popular choice among traders. Understanding its characteristics aids in determining whether it aligns with your trading goals.

Minimum Deposit Requirements

The Standard Account features a competitive minimum deposit requirement, allowing many traders to access the market without significant financial burden. This affordability empowers individuals who may not have large capital reserves but still aspire to trade.

Furthermore, the flexibility in funding methods contributes to the accessibility of the Standard Account. Traders can choose from various payment options to fund their accounts quickly and efficiently, making entry into the trading world seamless.

Leverage Options

Leverage plays a pivotal role in trading, and the Standard Account does not disappoint. With leverage options reaching up to 1:2000, traders can amplify their positions significantly. While leverage can increase potential gains, it also comes with inherent risks, necessitating a responsible approach.

It's essential for traders to understand the impact of leverage on their trading strategy, as higher leverage magnifies both profits and losses. Therefore, ensuring a well-thought-out strategy that suits one's risk appetite is vital when utilizing leveraged trading.

Professional Account Features

For those who opt for a Professional Account, a distinct set of features awaits. Designed for experienced traders, this account type offers superior trading conditions.

Minimum Deposit Requirements

The minimum deposit for a Professional Account is generally higher than that of the Standard Account. This reflects the advanced nature of the account’s features and the expectations of traders who select it. However, the benefits provided often justify the initial investment.

A greater starting capital opens doors to more significant trading opportunities and permits traders to engage in riskier strategies while managing their exposure effectively. Understanding the relationship between minimum deposit and potential returns is critical when deciding if this account type suits you.

Trading Conditions and Spread

Professional Accounts offer tight spreads, often starting from zero pips, depending on market conditions. This characteristic is particularly advantageous for scalpers and day traders who rely on quick trades to capitalize on small price movements.

Additionally, traders enjoy reduced commissions compared to the Standard Account, enhancing the overall profitability of their trades. The combination of tight spreads and lower costs creates a trading atmosphere conducive to maximizing returns.

Cent Account Features

Exploring the Cent Account reveals its appealing attributes, especially for those new to trading.

Minimum Deposit Requirements

With one of the lowest minimum deposit requirements, the Cent Account stands out as an excellent choice for beginners. This accessibility allows newcomers to dip their toes into the trading waters without the fear of substantial financial loss.

Additionally, the cent denomination means that traders can practice and refine their strategies with minimal risk. This feature encourages experimentation and learning, fostering a supportive environment for growth.

Ideal for Beginners

The Cent Account serves as an ideal launchpad for those venturing into trading for the first time. It offers all the necessary features of a Standard Account, yet with lower stakes. This aspect allows traders to make mistakes and learn from them without facing severe financial repercussions.

Moreover, the straightforward nature of the Cent Account promotes user confidence, making it easier for newbies to engage with the trading platform. As they gain experience and comfort with trading dynamics, they may consider transitioning to more advanced accounts.

ECN Account Features

The ECN Account presents a host of features tailored for serious traders seeking a high-performance trading environment.

Minimum Deposit Requirements

The ECN Account generally requires a higher minimum deposit compared to other account types. This requirement reflects its advanced trading capabilities, enabling traders to access global liquidity pools for better pricing.

While the upfront cost may seem daunting, the potential for profit when employing advanced trading strategies justifies the investment. Being prepared to commit sufficient capital is essential for those intending to leverage this account effectively.

Advantages for Experienced Traders

Experienced traders who require low latency and direct market access will find the ECN Account particularly advantageous. It ensures fast execution speeds, vital for strategies that depend on precise timing.

Additionally, the account provides access to professional trading tools and resources, further enhancing the trading experience. Traders can utilize advanced charting software and analytics to inform their strategies, increasing the likelihood of successful trades.

Comparison of Exness Account Types

To make an informed decision regarding which Exness account type is right for you, it's important to compare their key features.

Key Differences Between Account Types

While all account types offer unique advantages, the key differences lie in aspects like minimum deposit, spreads, leverage, and overall trading conditions. For example, the Standard Account is ideal for beginners due to its low minimum deposit and no commission fees, whereas the ECN Account caters to seasoned traders seeking advanced features.

The Professional Account falls in between, offering competitive spreads and lower commissions, while the Cent Account allows novices to explore trading without significant financial risk. Recognizing how each account aligns with your trading style and objectives can help you select the most appropriate option.

Best Use Cases for Each Account Type

Identifying the best use cases for each account type involves aligning your trading goals with the features offered. The Standard Account suits casual traders who prioritize simplicity, while the Professional Account is geared towards active traders focused on optimizing costs.

The Cent Account is perfect for beginners looking to build confidence, and the ECN Account appeals to expert traders implementing advanced strategies. Understanding your situation and objectives will guide your decisions and enhance your trading experience.

Minimum Deposit Overview

The minimum deposit is a critical consideration when selecting an Exness account type.

General Minimum Deposit Amounts

Each account type has its minimum deposit requirement, which varies based on the features offered. The Cent Account often has the lowest barrier to entry, while the ECN Account typically demands a larger initial investment.

Understanding these amounts enables traders to assess their financial readiness and make choices that align with their capabilities. It's wise to evaluate how much you can comfortably invest while considering your risk appetite and trading goals.

Factors Influencing Minimum Deposit

Several factors influence the minimum deposit requirements across different account types. Market conditions, regulatory standards, and the target audience play significant roles in determining these amounts. Moreover, the features associated with each account type also contribute to the minimum deposit landscape.

For instance, accounts offering advanced trading tools and lower transaction costs usually require higher deposits due to the increased value provided. Therefore, it’s essential to analyze the conditions and expectations linked to each account type before making any commitments.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Payment Methods for Deposits

Getting funds into your Exness account is straightforward, thanks to a wide array of payment methods available.

Supported Payment Methods

Exness supports numerous payment methods to facilitate easy deposits, including bank transfers, credit/debit cards, e-wallets, and cryptocurrency options. This flexibility ensures that traders can choose a method that best suits their preferences and operational capabilities.

Additionally, the diversity in payment options accommodates traders from various regions, enhancing their ability to fund their accounts seamlessly. The choice of payment method can also influence processing times and transaction fees, so familiarizing yourself with these details is advisable.

Processing Times for Deposits

Processing times vary based on the chosen payment method. While e-wallets and credit card deposits are often instantaneous, bank transfers may take longer to process. Understanding these timelines can help you plan your trading activity effectively.

Selecting a rapid deposit method can be particularly beneficial when market conditions are favorable, allowing you to seize opportunities swiftly. Keeping track of your funding methods ensures that you're always ready to act when the time is right.

Withdrawal Process at Exness

Withdrawing funds from your Exness account is equally crucial as depositing. Understanding the withdrawal process helps maintain financial control over your trading activities.

How to Withdraw Funds

Exness provides a user-friendly withdrawal process, enabling traders to request funds through the same payment method used for deposits. This consistency simplifies transactions and reduces complications.

It’s essential to follow the steps outlined by Exness carefully to ensure a smooth withdrawal experience. Familiarizing yourself with the required documentation and the general procedure can save time and prevent delays in accessing your funds.

Minimum Withdrawal Amounts

The minimum withdrawal amounts vary depending on the payment method selected. Generally, Exness maintains reasonable thresholds to accommodate traders of all levels. Knowing these limits in advance helps you manage your expectations regarding fund availability.

Being aware of both deposit and withdrawal limits fosters informed financial planning, allowing you to strategize your trading more effectively.

Choosing the Right Account Type

Selecting the right account type involves careful consideration of several factors.

Considerations for New Traders

New traders should prioritize accounts that offer low-risk entry and ample learning resources. The Cent Account is often considered the most suitable option for beginners, as it allows for small trades while acclimatizing to the trading environment.

Furthermore, traders should assess the educational materials and customer support available through each account type. Having access to quality resources can significantly influence a trader's development and success in the market.

Tips for Experienced Traders

For seasoned traders, focusing on account features that align with specific trading strategies is paramount. Experienced traders might favor the Professional or ECN accounts for their advanced functionality and lower trading costs.

Additionally, keeping abreast of market trends and adjusting account selections accordingly can enhance trading effectiveness. Engaging with fellow traders through forums and online communities can provide valuable insights into the practical implications of each account type.

Frequently Asked Questions about Exness Account Types

Understanding common inquiries surrounding Exness account types can clarify any lingering doubts.

Common Queries on Account Features

Many traders wonder about the specifics related to spreads, commission charges, and leverage options for each account type. Addressing these questions early on can help traders make informed decisions when choosing their account.

In addition, clarifications on unique features, such as mobile trading capabilities and automation options, can enrich a trader's understanding and improve their overall experience with Exness.

Clarifications on Minimum Deposit Rules

Traders frequently seek information on the minimum deposit requirements and any circumstances that may alter them. Exness provides clear guidelines on these matters, ensuring transparency and consistency for all users.

Understanding these rules equips traders with knowledge vital for effective financial planning and account management.

Conclusion

Navigating the Exness account types and minimum deposit landscape is essential for anyone aiming to succeed in the trading world. By thoroughly understanding the various accounts, their specific features, and the associated minimum deposit requirements, traders can tailor their strategies to align with their financial goals.

From beginners taking their first steps in trading to experienced professionals refining their strategies, Exness offers something for everyone. Ultimately, making an informed choice regarding account selection is a cornerstone of a successful trading journey.

Read more: