11 minute read

Is Exness Legal in India? Review Broker

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness as a Forex Broker

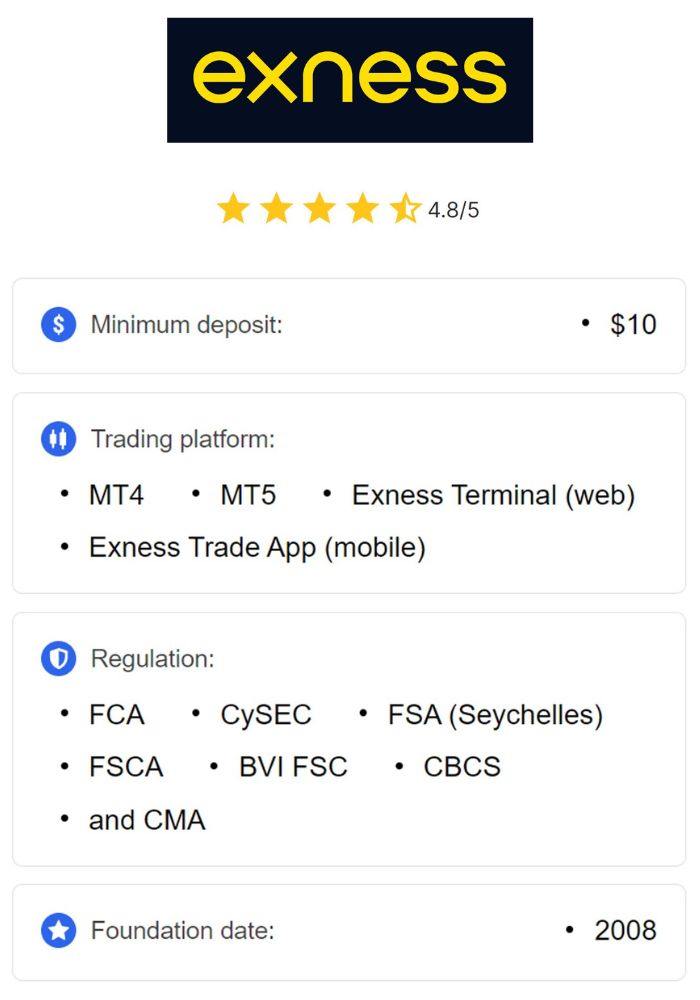

Exness is a prominent global forex and CFD (Contract for Difference) broker, founded in 2008. Since its inception, Exness has gained recognition for its transparent operations, robust trading platform, and wide range of trading products. Exness offers its clients access to various asset classes, including forex, commodities, indices, and cryptocurrencies. Its reputation has grown due to its regulatory compliance, competitive spreads, and customer-centric services.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Operating in multiple jurisdictions, Exness holds licenses from some of the world’s most prestigious financial regulators, ensuring that it meets stringent regulatory standards. This makes Exness a trusted choice for traders around the globe, including those in India. Despite being an international broker, Exness offers services tailored to the needs of Indian traders, including local language support and region-specific payment methods.

Key Features and Services Offered by Exness

Exness offers a wide array of features and services that attract traders of all levels. One of the key features is the availability of multiple trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely used by forex traders for their ease of use and comprehensive toolsets. These platforms allow traders to engage in technical analysis, automated trading, and risk management through sophisticated charting tools and indicators.

Exness also offers a variety of account types, such as the Standard account, Cent account, and Pro account, catering to both beginners and experienced traders. With competitive spreads, some accounts offering spreads as low as 0.0 pips, and high leverage options, Exness ensures its clients have favorable conditions for maximizing their trading potential.

Additionally, Exness is known for its fast and reliable execution speeds. The broker’s liquidity providers ensure quick order execution, minimizing slippage and offering the best possible prices for traders. The broker also provides a wealth of educational resources, including webinars, tutorials, and market analyses, to help traders enhance their skills and knowledge.

Regulatory Framework for Forex Trading in India

Understanding the Role of SEBI

In India, the Securities and Exchange Board of India (SEBI) plays a crucial role in regulating the country’s financial markets, including stocks, commodities, and derivatives. While SEBI oversees domestic trading activities, it does not have jurisdiction over forex trading unless it involves Indian Rupees (INR). SEBI’s primary responsibility is to ensure fair practices, transparency, and investor protection within India’s securities markets.

Forex trading in India is primarily governed by the Foreign Exchange Management Act (FEMA), which limits and regulates the types of currency pairs that can be traded. The role of SEBI, while significant for stock and commodity markets, does not extend to overseeing forex trading on international platforms, such as those offered by brokers like Exness.

Compliance with Indian Laws and Regulations

Although SEBI’s regulatory purview does not directly extend to forex trading, Indian traders must adhere to certain rules under FEMA. According to FEMA, residents of India are allowed to trade in currency pairs involving the INR, such as USD/INR, EUR/INR, and GBP/INR. However, trading in currency pairs involving non-INR currencies (e.g., EUR/USD or GBP/USD) directly on Indian exchanges is prohibited.

For Indian traders wishing to trade non-INR pairs, using offshore brokers like Exness is a common practice. While such brokers are not directly regulated by SEBI, they comply with international regulations to provide a safe and secure trading environment. Indian traders are required to ensure that their trading activities do not violate FEMA’s guidelines, which govern currency exchanges and forex transactions in the country.

Legitimacy of Exness in the Global Market

Licensing and Regulation of Exness

Exness is fully licensed and regulated by several top-tier financial authorities across the globe, which ensures that it adheres to stringent financial standards and practices. Among the key regulatory bodies overseeing Exness are the Financial Conduct Authority (FCA) of the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), and the South African Financial Sector Conduct Authority (FSCA). These licenses assure traders that Exness operates with transparency, maintains client fund segregation, and adheres to rigorous compliance standards.

In addition to holding licenses in various jurisdictions, Exness complies with anti-money laundering (AML) and know-your-customer (KYC) regulations, ensuring that it takes necessary precautions to prevent financial crimes. As an internationally regulated broker, Exness offers its clients a high level of security and trustworthiness.

Comparison with Other Forex Brokers

Exness’s global regulatory framework distinguishes it from many other forex brokers, especially those operating in regions with weaker regulatory oversight. Many brokers operating in India are either unlicensed or regulated by smaller financial authorities, which may not offer the same level of protection to traders as Exness’s regulators do.

Compared to other brokers, Exness offers more comprehensive regulation and a wider range of services. The broker’s adherence to international standards ensures its clients enjoy a higher level of safety, security, and financial integrity. This is one of the primary reasons why Exness has become a popular choice among traders globally, including in India.

Exness Operations in India

Availability of Exness Services for Indian Traders

Exness offers its full suite of trading services to Indian traders. While Exness is an offshore broker, it caters specifically to traders in India by providing them with access to its platform, customer support in Hindi, and local payment methods. Exness ensures that Indian traders can trade a wide variety of instruments, including currency pairs, commodities, and cryptocurrencies.

Indian traders can easily access the Exness trading platform by opening an account online, verifying their identity, and funding their account using a variety of payment methods, including local Indian payment systems like UPI, bank transfers, and other internationally recognized methods like credit/debit cards.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Payment Methods Supported by Exness in India

Exness supports several payment methods that make it easy for Indian traders to deposit and withdraw funds. Among the most popular methods are bank transfers, credit/debit cards, and e-wallets. The broker also supports instant deposits via UPI (Unified Payments Interface), a popular payment method in India, which enables traders to fund their accounts quickly and securely.

Withdrawals are processed in a similar manner, and Exness ensures that traders can access their funds with minimal delays. The broker’s efficient payment system and various withdrawal options help Indian traders manage their funds with ease and convenience.

Legal Considerations for Indian Traders

Trading Forex and CFDs in India

Forex trading and CFD trading are legal in India, provided traders follow the regulations set by the government. Indian residents are allowed to trade INR-based currency pairs on domestic exchanges, but trading in foreign currency pairs (such as EUR/USD or GBP/USD) is not permitted on Indian platforms. To engage in trading foreign currencies, Indian traders use offshore brokers like Exness, which offer access to global forex markets.

However, it is important for Indian traders to ensure that they are not violating any regulations under FEMA or participating in unauthorized currency trading. Trading forex with international brokers is legal as long as it adheres to the prescribed legal guidelines.

Implications of Indian Law on Forex Trading

The main legal implication for Indian traders engaging with offshore brokers like Exness is ensuring compliance with FEMA regulations. Although it is legal for Indian traders to use international brokers, they must adhere to the rule that only certain currency pairs involving the INR are allowed on Indian exchanges.

To avoid legal issues, traders should ensure that they are not participating in speculative forex trading or unauthorized transactions. Using reputable, regulated brokers like Exness helps mitigate risks associated with legal non-compliance.

Risks Associated with Trading on International Platforms

Market Volatility and Its Impact

Forex trading is inherently risky due to the volatility of the foreign exchange market. Exchange rates can fluctuate rapidly based on economic news, geopolitical events, and market sentiment. Indian traders using Exness are exposed to these fluctuations, which can lead to significant gains or losses. Volatility can particularly affect traders who use high leverage, as small price movements can result in large swings in their trading positions.

Traders need to exercise caution and use risk management strategies such as stop-loss orders and position sizing to protect themselves from market volatility. While Exness offers tools to help manage risk, the unpredictable nature of the forex market remains a challenge.

Withdrawal and Deposit Issues

While Exness generally offers efficient deposit and withdrawal methods, Indian traders should be aware of potential issues related to international transactions. Bank transfers or credit card payments may take a few days to process, depending on the payment method used. Furthermore, currency conversion fees may apply when withdrawing funds in INR.

Exness provides a reliable payment system, but traders should understand the timelines and costs associated with transferring funds internationally. Choosing a broker with efficient and transparent payment processing helps mitigate these issues.

User Experience and Customer Support

Trading Platform Usability

Exness offers a user-friendly trading platform, with both MT4 and MT5 available to its clients. The platforms are equipped with advanced charting tools, technical indicators, and customizable features to help traders make informed decisions. Indian traders benefit from the localized features, including language support in Hindi, and a simple interface that is easy to navigate.

The Exness platform is suitable for both beginner and experienced traders. Its seamless integration with multiple devices, including mobile and desktop, allows traders to stay connected and manage their trades from anywhere.

Availability of Customer Support for Indian Users

Exness provides 24/7 customer support in multiple languages, including Hindi. This makes it easier for Indian traders to get assistance in their preferred language. The support team can be reached via live chat, email, or phone, and they are known for being responsive and helpful in resolving issues.

Traders have access to a dedicated support team that can assist with technical issues, account inquiries, and transaction-related questions. Exness’s customer support is one of the reasons for its strong reputation in India.

Taxation and Reporting for Indian Traders

Tax Obligations for Forex Trading

In India, profits from forex trading are subject to taxation under the Income Tax Act. Forex trading profits are treated as income from business or profession and taxed accordingly. Traders must report their forex income and file tax returns to ensure compliance with Indian tax laws.

The tax rate on forex trading depends on whether it is categorized as short-term or long-term capital gains, or business income. Indian traders should consult with a tax professional to understand the specific tax implications of their forex trading activities.

Reporting Forex Income in India

Indian traders are required to report their forex trading income as part of their annual tax filing. The income from forex trading must be disclosed in the income tax return (ITR), and traders are required to keep records of their transactions, including profits and losses.

Failure to report forex income accurately can lead to penalties, so it is essential for traders to maintain proper documentation and follow the tax laws diligently.

Alternatives to Exness for Indian Traders

Comparison with Domestic Forex Brokers

While Exness offers several advantages for Indian traders, there are also domestic forex brokers available that cater to Indian residents. These brokers are regulated by SEBI and operate under Indian law. Domestic brokers may offer currency pairs involving the INR and allow for trading on Indian exchanges, but they may have fewer global instruments compared to international brokers like Exness.

Pros and Cons of Using Local vs. International Brokers

Local brokers may offer a more seamless experience in terms of compliance with Indian regulations and easier access to INR-based currency pairs. However, international brokers like Exness often provide access to a broader range of instruments, better liquidity, and competitive spreads.

The choice between a local or international broker depends on the trader’s preferences, risk tolerance, and trading objectives.

Conclusion

Exness is a legal and reputable option for Indian traders seeking access to global forex markets. While traders must comply with Indian regulations under FEMA and SEBI, there are no legal barriers to trading with offshore brokers like Exness, as long as they stay within the legal guidelines.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness’s global regulatory compliance, reliable trading platform, and excellent customer support make it a trusted choice for traders in India. However, traders should always be aware of market risks and ensure they are following all necessary tax reporting requirements.

Read more: