15 minute read

Does Exness work in France? Regulated, Registered, Legal?

from Exness

by Exness_Blog

Exness is a well-known forex broker offering competitive trading conditions and user-friendly platforms. For traders in France, it's important to understand whether Exness is regulated, registered, and legal to use. In this article, we will examine Exness' regulatory status in France, its legal standing, and the services it offers to French traders. We will also explore the advantages, challenges, and key features of trading with Exness in France, helping you make an informed decision about your trading options.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Overview of Exness

Introduction to Exness

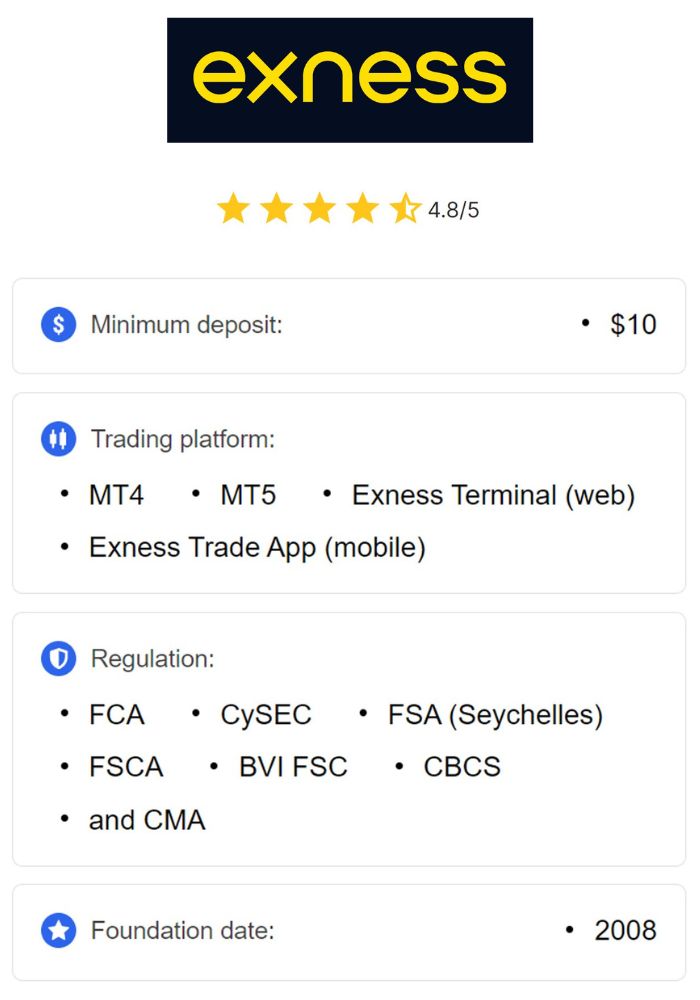

Exness is a globally recognized forex and financial services broker, offering a range of services to individual traders and institutions alike. Founded in 2008, Exness has grown to become one of the largest forex brokers in the world, with a focus on providing transparent, secure, and efficient trading solutions. The broker offers services in multiple languages and supports traders from various countries, including France.

Exness has earned a reputation for its user-friendly platform, competitive spreads, and a broad range of trading instruments. As more and more traders in France seek reliable online brokers, Exness is frequently considered as a potential option due to its extensive market offerings and robust regulatory framework. This article explores whether Exness is legally registered and regulated to operate in France, and how French traders can benefit from its services.

Company's Background and History

Exness was established in 2008 with the goal of providing an innovative trading experience for retail and institutional investors. With its headquarters in Cyprus, the company has quickly expanded its presence worldwide, providing access to the forex market via advanced trading platforms and a wide range of trading instruments.

Over the years, Exness has built a strong reputation within the financial services industry by focusing on providing customers with competitive trading conditions, such as low spreads, high leverage, and quick execution times. The company operates under multiple licenses from various regulatory bodies worldwide, ensuring compliance with international standards and offering a secure trading environment to clients from different countries, including France.

Regulatory Status of Exness

Overview of Financial Regulations in France

In France, forex and financial markets are heavily regulated to ensure transparency, protect investors, and maintain the integrity of financial transactions. The main regulatory authority overseeing financial markets in France is the Autorité des Marchés Financiers (AMF), which is responsible for regulating and supervising the financial industry, including brokers and investment firms. The AMF's role is to ensure that all market participants adhere to French laws, ensuring investor protection and financial stability.

The AMF works alongside other European Union (EU) regulatory bodies to enforce rules and regulations, such as those set forth by the European Securities and Markets Authority (ESMA). These regulations aim to protect traders and investors while promoting fair and transparent trading practices across the EU, including in France.

Exness' Regulatory Bodies

Exness operates under several regulatory authorities worldwide, including top-tier regulators such as the FCA (Financial Conduct Authority) in the UK, CySEC (Cyprus Securities and Exchange Commission), and ASIC (Australian Securities and Investments Commission). These regulators impose strict guidelines on brokers, ensuring they operate transparently and in the best interests of traders.

However, Exness is not directly regulated by the AMF in France. Instead, Exness operates within the broader regulatory framework of the EU, which allows it to provide services to French traders while ensuring compliance with relevant EU regulations. This includes adherence to the Markets in Financial Instruments Directive (MiFID II), which standardizes financial markets across EU member states and ensures that brokers like Exness follow the necessary protocols for protecting traders and investors.

Is Exness Registered in France?

Licensing Information

While Exness is not specifically licensed by the AMF, it is authorized to operate in France under its European regulatory licenses, particularly from CySEC and the FCA. These licenses provide Exness with the ability to offer forex trading services to French residents while complying with EU regulations. Exness also abides by the MiFID II regulations, ensuring that the broker is in full compliance with European financial laws.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The MiFID II directive ensures that brokers like Exness adhere to rigorous standards concerning transparency, investor protection, and market integrity. For French traders, this means that Exness is legally able to offer its services, despite not being directly regulated by the AMF.

Compliance with French Laws

Exness complies with the legal framework in France, primarily by following EU regulations, which are in place to ensure that brokers provide transparent and fair trading services. French traders using Exness benefit from these regulations, which are designed to protect their rights and ensure a secure trading environment.

Although Exness is not registered directly with the AMF, the company's operations are legally recognized in France due to its adherence to EU regulations. This means that French traders can use Exness with confidence, knowing that the broker is fully regulated and that their funds are protected under European law.

Legal Considerations for Trading with Exness in France

Legal Framework for Forex Trading in France

Forex trading in France is legal, and individuals are allowed to trade on global markets through registered brokers like Exness. However, it is essential for traders to understand the regulatory landscape before engaging in trading activities. France’s financial markets are regulated by the AMF, which ensures that brokers follow the country’s laws and regulations. Since Exness operates under the EU framework, it complies with the required legal standards, which means it is legal for French traders to use Exness as their broker.

Consumer Protection Laws

French traders are protected under consumer protection laws that apply to financial services. These laws ensure that traders can access fair and transparent information about the risks involved in trading and that brokers like Exness provide clear terms and conditions. Exness is obligated to provide traders with risk disclosures, fair pricing, and secure trading conditions.

Furthermore, the European Investor Compensation Scheme (ICS) provides additional protection to traders in the EU, ensuring that traders’ funds are protected in the unlikely event of a broker’s insolvency. This is an important safeguard for French traders using Exness.

Exness’ Services Available to French Traders

Types of Accounts Offered

Exness offers various types of accounts to suit the needs of traders at different levels. French traders can choose from accounts that offer flexible leverage, tight spreads, and different trading conditions. The most common types of accounts include:

Standard Accounts: Ideal for beginners or casual traders, these accounts offer low spreads and a straightforward trading experience.

Professional Accounts: Designed for more experienced traders, these accounts offer higher leverage and more advanced trading conditions.

ECN Accounts: Suitable for institutional traders, these accounts provide direct market access with lower spreads and faster execution.

Each account type is tailored to meet the specific needs of traders in France, ensuring they can choose the most suitable option based on their experience and trading goals.

Trading Instruments Available

Exness provides a wide range of trading instruments to French traders, including:

Forex Pairs: Major, minor, and exotic currency pairs.

Commodities: Gold, silver, and other precious metals.

Indices: Popular stock indices from around the world.

Cryptocurrencies: Bitcoin, Ethereum, and other digital currencies.

Stocks: Shares of major global companies.

French traders can diversify their portfolios by accessing these instruments, giving them the flexibility to trade across different asset classes.

Advantages of Using Exness in France

Competitive Spreads and Leverage

Exness is highly regarded for its competitive spreads and flexible leverage options, which make it an attractive option for traders in France. The broker offers tight spreads on major currency pairs, which can significantly reduce the cost of trading. This is especially beneficial for day traders or those who rely on short-term price movements to generate profits. In addition to tight spreads, Exness offers leverage up to 1:2000 for certain account types, which gives traders the ability to control larger positions with a smaller initial investment. This high leverage is particularly appealing to experienced traders who are looking to maximize their potential returns while managing risk.

However, it is essential for traders to understand that high leverage also comes with increased risk. Although the potential for larger profits is greater, the risk of losses is similarly magnified. Therefore, traders should use leverage cautiously and ensure they have proper risk management strategies in place.

User-Friendly Trading Platform

One of the standout features of Exness is its user-friendly trading platform. Exness provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are among the most popular and widely used trading platforms in the forex industry. These platforms offer intuitive interfaces, advanced charting tools, technical analysis, and the ability to automate trades using Expert Advisors (EAs).

For traders in France, having access to MT4 and MT5 means they can enjoy a seamless trading experience with reliable execution speeds, easy access to real-time market data, and customizable features. Additionally, Exness's mobile trading apps for both Android and iOS allow French traders to manage their trades on the go, offering flexibility for those who want to stay connected to the market at all times.

Exness also offers a WebTrader version of its platform, which allows users to trade directly from a browser without the need to download any software. This makes it easier for traders who may not have access to their personal devices or who prefer a hassle-free trading experience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Disadvantages of Using Exness in France

Potential Drawbacks for French Traders

While Exness offers many benefits, there are a few potential drawbacks that traders in France should consider. One of the main concerns is the lack of direct regulation by the AMF (Autorité des Marchés Financiers). Although Exness operates under the CySEC (Cyprus Securities and Exchange Commission) and FCA (Financial Conduct Authority) licenses, some French traders may feel more comfortable with a broker that is directly regulated by French authorities.

Despite this, it is important to note that Exness complies with the MiFID II (Markets in Financial Instruments Directive) framework, which harmonizes financial regulation across the European Union. As such, Exness must adhere to strict standards set by these regulatory bodies, which ensures the protection of traders' funds and a high level of operational transparency.

Another potential issue is limited customer support during peak hours. While Exness does provide customer service in French, some traders have reported longer response times during busy periods. This could be a concern for traders who require immediate assistance for account-related or technical issues.

Customer Support Limitations

While Exness offers customer support in multiple languages, including French, some users have expressed concerns over the responsiveness and availability of support during high-demand times. As a global broker, Exness handles a large volume of customer inquiries, which can occasionally lead to delays in response times. Traders in France who require quick assistance with account-related issues may experience frustration during peak times.

Additionally, while Exness provides multiple channels of communication, including live chat, email, and phone support, not all support staff may be as knowledgeable or responsive as others. For French traders, it’s important to be aware that while Exness strives to provide top-notch customer service, delays or mixed experiences with support could occur from time to time.

User Experiences and Reviews

Feedback from French Traders

French traders who use Exness often have positive things to say about the broker, particularly its competitive trading conditions and transparent fee structure. Many traders praise Exness for its low spreads, high leverage options, and the ability to trade a wide variety of instruments, including currencies, commodities, stocks, and cryptocurrencies.

Traders also appreciate the user-friendly trading platforms provided by Exness, especially the accessibility of MT4 and MT5, which are known for their reliability and advanced features. For traders in France who are familiar with these platforms, the seamless integration with Exness makes for an excellent trading experience.

On the downside, some traders have expressed concerns over the customer service and the lack of a direct AMF regulation. However, most traders acknowledge that Exness complies with European Union regulations through its licensing with CySEC and the FCA, which reassures them that the broker operates within a secure and legally compliant framework.

Common Complaints and Praises

Among the most common praises for Exness are its fast execution speeds, competitive spreads, and flexible account types that cater to both beginner and professional traders. French traders appreciate the multi-currency payment options and the ability to deposit and withdraw in euros, making it easier to manage funds.

On the flip side, complaints generally focus on customer support delays, especially during high volume periods, and the fact that Exness is not regulated directly by the AMF in France. However, the company’s adherence to European regulatory standards mitigates these concerns for most traders.

Tax Implications for French Traders Using Exness

Understanding Capital Gains Tax in France

French traders must be aware of the capital gains tax laws that apply to forex trading. In France, any profits derived from forex trading are considered capital gains and are subject to taxation. The amount of tax you will pay depends on your total income and the duration of your investments.

French residents must report their forex trading profits on their annual tax returns. Traders should keep accurate records of their trades and any associated expenses to ensure they comply with French tax laws. Additionally, it is advisable for traders to consult with a local tax advisor to better understand their tax obligations when trading with Exness.

Reporting Requirements for Forex Trading

When reporting forex trading income, traders in France are required to disclose all profits and losses from their trading activities. Since Exness is an international broker, traders should ensure that they comply with the French tax authorities' reporting requirements for foreign-sourced income. Failure to do so may result in penalties or fines.

It's essential for French traders to keep track of the date, size, and nature of each trade, as well as the exchange rates used during transactions. Keeping thorough records will make the tax filing process smoother and help ensure that you are paying the correct amount of tax on your forex profits.

Security Measures Implemented by Exness

Data Protection Protocols

Exness prioritizes the security and privacy of its clients’ data. The broker employs state-of-the-art encryption technology to protect sensitive information and ensure that personal and financial data remains secure. This is especially important for French traders, who benefit from the EU’s General Data Protection Regulation (GDPR). GDPR ensures that Exness must adhere to strict data protection protocols, giving traders peace of mind that their personal data is handled with the highest level of security.

Fund Safety and Segregation

Exness also takes steps to safeguard client funds. Client funds are kept in segregated accounts, separate from the broker’s operating funds. This ensures that, in the event of the broker’s insolvency, traders' funds will be protected and refunded. Additionally, Exness participates in compensation schemes in some jurisdictions, providing an added layer of protection for traders.

How to Sign Up with Exness in France

Registration Process Explained

Signing up with Exness is straightforward and can be done entirely online. French traders can visit the Exness website, select the type of account they wish to open, and fill in the registration form. The process typically requires providing personal information, such as name, address, and contact details.

Traders are also required to submit identification documents for account verification. This step ensures that Exness complies with regulatory requirements and helps protect against fraud and money laundering.

Required Documentation

To complete the registration process, French traders will need to provide proof of identity and proof of address. Commonly accepted documents include:

Passport or national ID card

Utility bills or bank statements (to verify address)

Once these documents are submitted and verified, the trader can start funding their account and begin trading on the Exness platform.

Alternative Brokers for French Traders

Comparison with Other Popular Brokers

Although Exness is a well-regulated broker with competitive trading conditions, French traders may also want to consider other options. Brokers such as IG Group, Saxo Bank, and FXTM also operate in France and are regulated by the AMF. These brokers offer similar services and may appeal to traders looking for local regulation and direct oversight by French authorities.

When to Consider Alternatives

While Exness is a solid choice for many traders, some French traders may prefer brokers that are directly regulated by the AMF for added peace of mind. Additionally, those who place a high value on local customer support and French language services might want to explore other brokers that offer these advantages.

Conclusion

Exness is a globally reputable broker offering competitive trading conditions, advanced platforms, and a variety of trading instruments. While not directly regulated by the AMF in France, Exness operates within the framework of EU regulations, ensuring compliance with high standards for safety and transparency. French traders can enjoy a secure and efficient trading environment with Exness, although they should be aware of the potential risks associated with using a broker that is not registered locally.

For those who are comfortable with the European regulatory framework and appreciate Exness's services, it can be an excellent choice for forex trading. However, traders who prioritize direct French regulatory oversight or specific customer support needs may want to explore other brokers as alternatives. Regardless of your choice, it is important to understand the legal and regulatory context in France to ensure a safe and profitable trading experience.

Read more: