14 minute read

Does Exness work in Pakistan? Regulated, Registered, Legal?

from Exness

by Exness_Blog

In the fast-evolving world of forex trading, Exness has emerged as a prominent platform for traders seeking reliable and efficient services. With its competitive pricing, advanced trading tools, and global reputation, Exness is a popular choice among traders worldwide, including those in Pakistan. However, questions often arise regarding its regulation, registration, and overall legality in the Pakistani context. Understanding these aspects is crucial for traders to ensure their investments are secure and compliant with local laws. This comprehensive guide delves into Exness’s operations in Pakistan, shedding light on its regulatory status, benefits, and considerations for local traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Overview of Exness

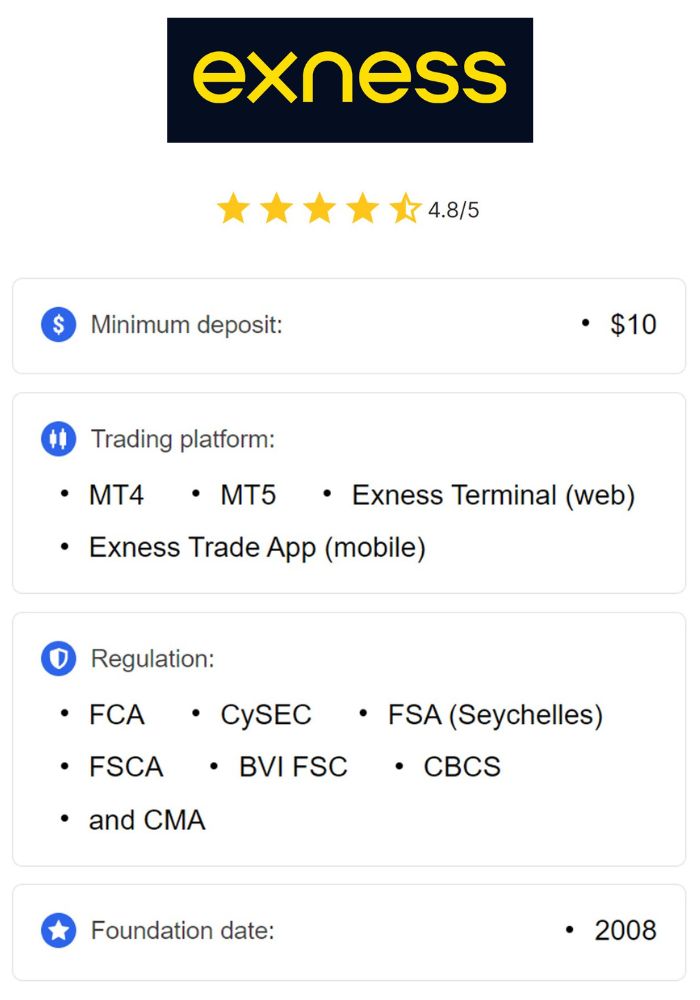

Exness is a globally recognized trading platform, offering services in forex, commodities, cryptocurrencies, indices, and stocks. Since its establishment in 2008, Exness has built a strong presence by providing innovative trading solutions to meet the diverse needs of its users. With millions of traders globally, the broker has gained a reputation for reliability, transparency, and advanced trading technology. Its operations are supported by a comprehensive range of financial instruments, competitive trading conditions, and an intuitive platform design, making it accessible for beginners and professionals alike.

One of Exness's standout features is its focus on accessibility and customer support. The platform ensures that traders from various countries, including Pakistan, have access to localized support and services. This emphasis on inclusivity, coupled with a commitment to maintaining high operational standards, has made Exness one of the most sought-after brokers in the financial trading industry.

History and Background of the Brokerage

Exness started with a mission to make online trading efficient and trustworthy for global users. Over the years, the broker has expanded its operations to cover major markets, adhering to strict regulatory standards and constantly upgrading its offerings to meet market demands. By blending technological advancements with a customer-centric approach, Exness has remained at the forefront of the forex industry.

In addition to its impressive growth, Exness has won numerous awards for its services and innovations. The company has continually adapted to global financial trends, including offering zero spread accounts, instant withdrawals, and multi-currency support. This adaptability highlights Exness's dedication to meeting the evolving expectations of traders while maintaining its reputation for integrity and excellence.

Regulatory Framework for Forex Trading in Pakistan

Role of SECP (Securities and Exchange Commission of Pakistan)

The Securities and Exchange Commission of Pakistan (SECP) plays a crucial role in maintaining the integrity of the country’s financial markets. As the primary regulatory body, the SECP oversees all trading activities, ensuring that they adhere to local laws and provide a safe environment for traders. For forex trading, the SECP establishes guidelines that brokers must follow, including transparency in transactions, proper disclosure of risks, and measures to prevent fraudulent activities.

For international brokers like Exness operating in Pakistan, the SECP acts as a watchdog to protect the interests of local traders. This oversight helps create a level playing field while ensuring that traders can access global markets without compromising their financial security. Pakistani traders are advised to work with brokers that adhere to SECP’s standards to mitigate risks associated with unregulated trading.

Overview of Forex Regulations in Pakistan

Forex trading is legal in Pakistan, provided it complies with the regulations set by the SECP. These regulations are designed to ensure transparency and accountability in the market. For instance, brokers are required to disclose all associated risks, offer segregated accounts for client funds, and provide fair trading conditions. Such measures help protect traders from unethical practices and market manipulation.

While international brokers are widely used, they must also align with local regulations to be considered compliant in Pakistan. Brokers like Exness, which operate under multiple global licenses, often go the extra mile to meet these requirements. Pakistani traders should verify the broker’s licensing and operational framework to ensure their funds' safety and the legality of their transactions.

Exness Registration and Regulation Status

Licensing Authorities for Exness

Exness operates under the regulatory oversight of several esteemed financial authorities. These include the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Commission (FSC) in various jurisdictions. These licenses reflect Exness's commitment to maintaining strict compliance with international financial standards, offering traders a safe and secure trading environment.

By adhering to the regulations of multiple jurisdictions, Exness ensures transparency in its operations. This multi-regulatory approach protects traders from potential risks while providing assurance that their funds and data are handled with the utmost care. For Pakistani traders, this regulatory compliance can provide additional confidence when choosing Exness as their preferred broker.

Comparison of Exness with Other Brokers

When compared to other brokers operating in Pakistan, Exness stands out for its strong regulatory framework and user-friendly platform. While many brokers may offer competitive spreads and leverage, Exness provides additional features like instant withdrawals, multi-currency accounts, and 24/7 customer support. These features make it a top choice for traders seeking reliability and convenience.

Moreover, Exness’s transparent pricing and lack of hidden fees give it a significant edge over less reputable brokers. Unlike some competitors who might exploit inexperienced traders with unfair terms, Exness’s operational model focuses on building trust and delivering value. This approach has made it a preferred platform for both beginners and seasoned traders in Pakistan.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Legal Considerations for Pakistani Traders

Legality of Forex Trading in Pakistan

Forex trading is legally permitted in Pakistan, but it is regulated under specific guidelines set by the SECP. The legal framework ensures that trading activities align with the country’s financial policies and protect traders from fraud. However, it is essential for traders to choose brokers that comply with these regulations. Trading through unregulated or unauthorized platforms can expose traders to legal and financial risks.

In the context of Exness, its international licenses and compliance with global financial standards make it a viable choice for Pakistani traders. Although Exness operates outside Pakistan, its adherence to international best practices ensures that it meets the requirements of a regulated broker. Traders should always verify the broker’s registration status and review its regulatory credentials to confirm its legitimacy.

Understanding Local Laws Concerning Online Trading

Pakistan's legal framework for forex trading emphasizes transparency, risk disclosure, and proper licensing. The SECP mandates that brokers operating in the country must follow strict guidelines to protect investors. While international brokers like Exness are not locally licensed by SECP, their global compliance frameworks can provide an additional layer of security for Pakistani traders.

Furthermore, local laws prohibit activities such as money laundering and tax evasion through forex trading platforms. Traders must ensure they report their income from forex trading accurately and comply with all tax regulations. Understanding these legal requirements is crucial to avoid potential legal complications and ensure smooth trading operations in Pakistan.

Benefits of Trading with Exness

Competitive Spreads and Leverage

One of Exness’s standout features is its competitive pricing model. The broker offers tight spreads, starting from as low as 0.0 pips on certain account types, which can significantly reduce trading costs. This feature is particularly beneficial for high-volume traders and scalpers who rely on minimal transaction costs to maximize profits.

In addition to tight spreads, Exness provides flexible leverage options, which can go as high as 1:2000 depending on the account type and asset being traded. This flexibility allows traders to amplify their positions, potentially increasing their returns. However, it also comes with risks, making proper risk management strategies essential.

User-Friendly Trading Platform Features

Exness’s trading platform is designed with user experience in mind. It offers seamless integration with popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are equipped with advanced charting tools, technical indicators, and automated trading options. These features make it easier for traders to analyze markets and execute trades efficiently.

The platform also includes features like instant withdrawals, multi-currency account options, and real-time trading data. For Pakistani traders, Exness provides localized support and payment methods, ensuring a smooth and accessible trading experience. The combination of advanced tools and user-friendly features makes Exness a reliable choice for both beginners and seasoned traders.

Risks Associated with Trading Forex in Pakistan

Market Volatility and Risk Management

Forex trading inherently involves high market volatility, which can lead to significant profits or losses. For traders in Pakistan, understanding these risks is critical to achieving long-term success. Market movements are influenced by factors such as global economic events, geopolitical tensions, and unexpected news. Without proper risk management, traders may face substantial losses.

To mitigate risks, Exness provides tools like stop-loss orders, take-profit levels, and margin calls. These features help traders manage their positions effectively and reduce exposure to unfavorable market conditions. Pakistani traders are encouraged to utilize these tools and continuously educate themselves about market dynamics to trade safely.

Importance of Due Diligence

Before choosing a broker, traders must conduct thorough due diligence to ensure they are working with a reliable platform. This involves verifying the broker’s regulatory status, reviewing user feedback, and understanding the trading conditions it offers. For Exness, its strong regulatory credentials and positive reputation make it a trustworthy choice for Pakistani traders.

Additionally, traders should invest time in understanding forex trading concepts and strategies. Exness provides educational resources to help new traders build their knowledge and confidence. Taking advantage of these resources can improve decision-making and minimize risks associated with forex trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Payment Methods Supported by Exness in Pakistan

Deposit Options Available

Exness supports a wide range of deposit methods tailored to meet the needs of Pakistani traders. These include local bank transfers, credit and debit cards, and popular e-wallets like Skrill and Neteller. The availability of multiple deposit options ensures convenience and flexibility for traders, enabling them to fund their accounts quickly and securely.

Moreover, Exness has a reputation for offering instant processing on many deposit methods. This feature eliminates delays, allowing traders to capitalize on market opportunities without waiting for funds to clear. The absence of deposit fees further adds to the platform’s appeal, making it a cost-effective option for traders in Pakistan.

Withdrawal Process and Fees

Exness’s withdrawal process is designed to be fast and hassle-free. Traders can withdraw their funds using the same method they used for deposits, ensuring a seamless transaction experience. Most withdrawals are processed instantly or within a few hours, which is a significant advantage for traders who need quick access to their profits.

The broker also maintains a transparent fee structure, with minimal or no charges on most withdrawal methods. Pakistani traders benefit from Exness’s commitment to keeping costs low, making it easier to maximize their returns. It’s important, however, for traders to review the specific terms and conditions related to their preferred payment method to avoid any surprises.

Customer Support and Resources

Availability of Local Language Support

Exness prioritizes accessibility by offering customer support in multiple languages, including Urdu. For Pakistani traders, this localized support is invaluable, as it allows them to communicate their queries and concerns without language barriers. Exness’s multilingual support team is available 24/7, ensuring that traders can resolve issues at any time, regardless of their location or trading hours.

In addition to live chat and email support, Exness also provides a comprehensive FAQ section that addresses common questions about account setup, payment methods, and trading conditions. This proactive approach to customer service enhances the overall trading experience and reflects Exness’s commitment to meeting the needs of its diverse user base.

Educational Resources for New Traders

Exness offers an array of educational resources tailored to traders of all skill levels. These include video tutorials, webinars, and articles covering topics like market analysis, risk management, and trading strategies. For beginners in Pakistan, these resources provide a solid foundation to understand the complexities of forex trading.

Experienced traders can also benefit from advanced content, such as insights into technical indicators and algorithmic trading. By equipping users with the necessary knowledge, Exness empowers them to make informed decisions and improve their trading outcomes. The broker’s focus on education demonstrates its dedication to supporting traders at every stage of their journey.

Exness Trading Account Types

Overview of Different Account Types Offered

Exness provides several account types to accommodate the diverse needs of its clients. The Standard Account is ideal for beginners, offering low minimum deposits and user-friendly features. For more experienced traders, the Raw Spread, Zero Spread, and Pro Accounts offer advanced trading conditions, including tighter spreads and faster execution speeds.

Each account type is designed with specific trading styles in mind. For instance, scalpers and day traders might prefer the Raw Spread Account for its minimal transaction costs, while long-term investors may benefit from the stability of the Pro Account. This variety ensures that traders can choose an account that aligns with their strategies and goals.

Choosing the Right Account for Your Needs

Selecting the right account type is crucial for a successful trading experience. Pakistani traders should consider factors such as their level of experience, trading style, and financial goals before opening an account. For beginners, the Standard Account provides an excellent starting point with straightforward features and low barriers to entry.

Experienced traders, on the other hand, might opt for advanced accounts that offer higher leverage and tighter spreads. Exness also provides demo accounts, allowing traders to practice and familiarize themselves with the platform before committing real funds. This flexibility ensures that every trader can find an account type that suits their specific needs.

User Experience and Reviews

Trader Feedback from Pakistan

Exness has garnered positive reviews from traders in Pakistan for its reliability, competitive pricing, and user-friendly platform. Many traders appreciate the availability of localized support and payment options, which make the platform accessible and convenient. The instant withdrawal feature is another standout aspect frequently praised by Pakistani users.

While most reviews highlight the platform’s strengths, some traders have noted challenges such as understanding advanced features or navigating the extensive range of account types. However, these concerns are often mitigated by the broker’s robust customer support and educational resources, which help users address any difficulties they encounter.

Analyzing Trustworthiness and Reputation

Exness has established a strong reputation in the global trading community, backed by its regulatory credentials and consistent track record of reliability. The broker’s transparent operational model, combined with its focus on customer satisfaction, reinforces its trustworthiness. For Pakistani traders, Exness’s compliance with international standards provides additional assurance of its credibility.

Moreover, independent reviews and ratings from trusted financial websites further validate Exness’s reputation as a secure and efficient trading platform. By consistently delivering quality services and prioritizing client safety, Exness has solidified its position as a trusted choice for traders worldwide.

Security Measures Implemented by Exness

Data Protection and Privacy Policies

Exness takes data security seriously, employing advanced encryption technologies to safeguard client information. The platform adheres to strict privacy policies, ensuring that personal and financial data remains confidential and protected from unauthorized access. This commitment to data security is crucial for Pakistani traders, who can trade with peace of mind knowing their information is secure.

Additionally, Exness complies with international data protection laws, such as the General Data Protection Regulation (GDPR). These standards reinforce the broker’s dedication to maintaining a secure trading environment, minimizing risks associated with cyber threats and data breaches.

Safeguarding Client Funds

To protect client funds, Exness uses segregated accounts, ensuring that traders’ deposits are kept separate from the company’s operating funds. This practice guarantees that client funds are not affected in the unlikely event of financial instability within the company.

Exness also collaborates with reputable banks and financial institutions to enhance fund security. Furthermore, the broker provides negative balance protection, ensuring that traders cannot lose more than their initial investment. These measures demonstrate Exness’s commitment to safeguarding client assets and maintaining trust in its services.

Conclusion on Exness’s Viability in Pakistan

Exness offers a robust trading platform that is well-suited to the needs of Pakistani traders. With its strong regulatory credentials, user-friendly features, and localized support, the broker provides a safe and efficient environment for forex trading. While there are risks associated with trading, Exness’s commitment to transparency, education, and security helps traders mitigate these challenges.

For Pakistani traders seeking a reliable broker with competitive conditions and advanced tools, Exness emerges as a top choice. By adhering to international standards and addressing the unique needs of the local market, Exness demonstrates its viability and trustworthiness as a leading forex broker in Pakistan.

Read more: