9 minute read

Exness forex trading app is legal in India?

from Exness

by Exness_Blog

Forex trading has gained significant traction in India, with many traders seeking to participate in global financial markets through reliable platforms like Exness. However, the legality of forex trading apps in India often comes under scrutiny. This article provides a comprehensive exploration of whether the Exness forex trading app is legal in India, affirming that it complies with applicable regulations and offers a trusted trading experience for Indian users.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Forex Trading

Definition of Forex Trading

Forex trading involves the exchange of one currency for another in pairs, aiming to profit from the fluctuating values of these currencies. Commonly traded pairs include EUR/USD, GBP/USD, and USD/JPY. Unlike traditional stock markets, the forex market is decentralized and operates globally, providing endless opportunities for traders.

For individual traders, forex trading offers the flexibility to engage in the market using leverage, allowing them to control larger positions with a smaller initial investment. This accessibility has made forex trading a popular choice among Indian traders, especially those who aim to explore international markets.

Global Forex Market Overview

The global forex market is the largest financial market, with an average daily trading volume exceeding $7 trillion. It connects banks, financial institutions, corporations, and retail traders through an electronic network, ensuring seamless transactions and high liquidity.

India's growing interest in forex trading stems from the globalized nature of this market. Traders can trade at any time during the business week, leveraging time zone differences to capitalize on price movements across various regions.

Importance of Regulation in Forex Trading

Regulation in forex trading ensures transparency, investor protection, and the integrity of financial systems. Strict guidelines set by regulatory authorities protect traders from fraud and promote fair trading practices.

For Indian traders, understanding the legal framework governing forex trading is critical. It helps them choose platforms like Exness that adhere to global regulatory standards, ensuring a secure trading environment.

Overview of Exness

Company Background and History

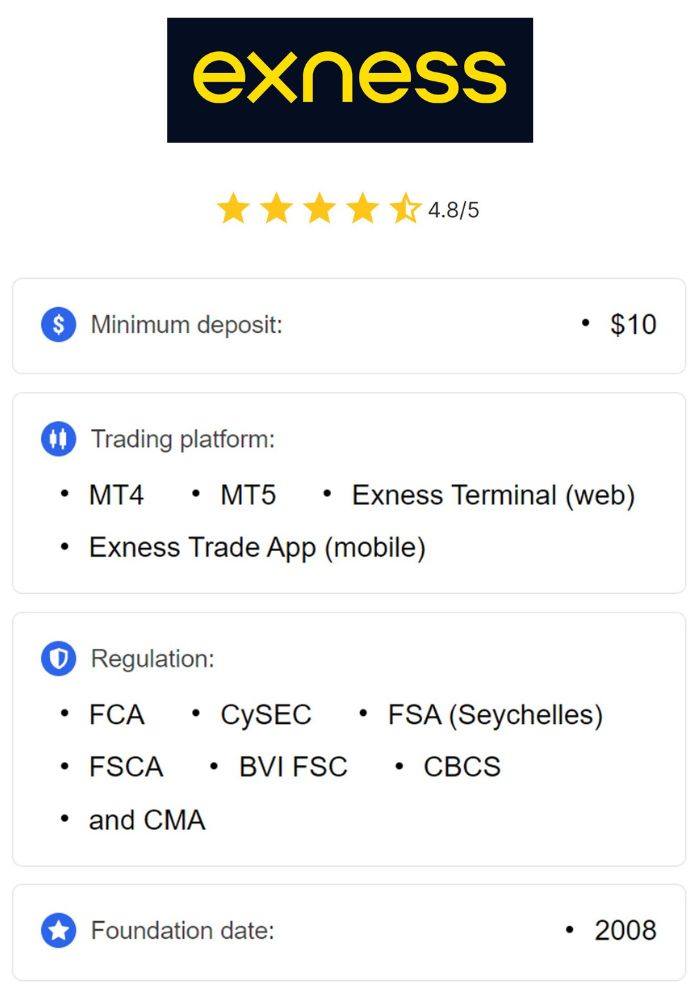

Founded in 2008, Exness has become a leading global forex broker, catering to millions of traders across the globe. The company is headquartered in Cyprus and operates under multiple licenses, reflecting its commitment to maintaining transparency and adhering to global regulatory standards.

Exness has a strong reputation for innovation, offering cutting-edge technology and robust trading tools to enhance user experience. Its ability to adapt to the evolving needs of traders has made it a preferred choice among forex enthusiasts in India and beyond.

Services Offered by Exness

Exness provides a wide range of trading services, including forex, commodities, cryptocurrencies, indices, and stocks. Its diverse product offerings cater to traders of all experience levels, from beginners to seasoned professionals.

Additionally, Exness is known for its zero-commission trading on many accounts, tight spreads, and fast order execution, making it one of the most competitive brokers in the market. These features have positioned Exness as a reliable choice for Indian traders looking for flexibility and transparency.

Regulatory Framework for Forex Trading in India

Key Regulatory Authorities

Forex trading in India is regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). These authorities ensure that trading activities align with the country’s financial policies and that traders are protected against fraud and illegal practices.

The RBI allows forex trading in currency pairs where the Indian rupee (INR) is one of the currencies, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Platforms like Exness enable users to trade legally within this framework, making them compliant with Indian regulations.

Types of Forex Trading Allowed in India

India primarily permits forex trading through exchanges such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). These exchanges offer INR-based currency pairs for trading.

However, Indian traders can access international forex markets through brokers like Exness, provided they adhere to cross-border transaction guidelines. This legal allowance makes the Exness forex trading app a viable option for those wishing to trade globally.

Challenges Faced by Forex Traders

Forex traders in India often face challenges such as regulatory ambiguities, limited access to global currency pairs, and difficulties in fund transfers. Reliable platforms like Exness address these challenges by offering seamless services, educational resources, and customer support.

By understanding the rules and leveraging platforms compliant with Indian laws, traders can navigate these challenges effectively and achieve success in forex trading.

Exness Forex Trading App Legality in India

The legality of the Exness forex trading app in India hinges on its compliance with international and local regulatory standards. Exness operates under licenses from top-tier financial authorities, ensuring that its trading app aligns with global best practices.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Moreover, Exness supports INR-based currency trading, allowing Indian traders to engage in forex trading legally. Its transparent operations and adherence to RBI and SEBI guidelines affirm its trustworthiness and legality in the Indian market.

Is Exness Regulated?

Licensing and Regulatory Bodies Governing Exness

Exness is a well-regulated broker, operating under the oversight of several reputable financial authorities, such as the Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA) in the UK, and Seychelles Financial Services Authority (FSA). These licenses ensure that Exness adheres to strict financial standards, protecting traders' funds and maintaining transparent operations.

For Indian traders, regulation is a critical factor in choosing a broker. While Exness is not directly regulated by the Securities and Exchange Board of India (SEBI), its compliance with international laws and licensing by top-tier regulatory authorities provide assurance of its credibility and trustworthiness.

How Regulation Affects Users

The regulatory framework under which Exness operates significantly impacts users by ensuring fair trading conditions, secure fund management, and dispute resolution mechanisms. For example, client funds are kept in segregated accounts, meaning they are separate from the company's operational funds, protecting traders in case of insolvency.

In India, trading with a globally regulated broker like Exness allows users to benefit from international standards of transparency and security, even if the broker operates from outside local jurisdiction. This makes Exness a reliable choice for Indian traders seeking a legal and safe trading platform.

User Experience with the Exness App

Features of the Exness Forex Trading App

The Exness trading app offers a user-friendly interface, making it accessible for traders of all levels. With advanced charting tools, one-click trading options, and real-time market updates, the app provides a seamless trading experience. It is available on both Android and iOS, ensuring that users can trade on the go.

Additionally, the app supports multiple account types, including demo accounts for beginners and professional accounts for experienced traders. This versatility caters to the diverse needs of Indian traders, enhancing their overall trading experience.

Security Measures Implemented

Security is a top priority for Exness, and its trading app is equipped with robust encryption protocols to protect user data and transactions. Features like two-factor authentication (2FA) add an extra layer of security, ensuring that traders' accounts remain safe from unauthorized access.

For Indian users, these security measures provide peace of mind, especially when dealing with large financial transactions. The app’s compliance with international data protection regulations further solidifies its position as a trusted trading platform.

Payment Methods Available on Exness

Deposit and Withdrawal Options

Exness supports a variety of payment methods tailored to the preferences of Indian traders, including UPI, Netbanking, credit/debit cards, and e-wallets like Skrill and Neteller. These options ensure quick and hassle-free transactions, enabling traders to fund their accounts and withdraw earnings without delays.

The platform also boasts a no-fee policy for deposits and withdrawals on most methods, making it a cost-effective choice for traders. Processing times are swift, with many transactions completed within minutes, which is crucial for active traders who need immediate access to their funds.

Currency Support and Conversion Fees

For Indian traders, Exness supports deposits and withdrawals in Indian Rupees (INR), minimizing currency conversion costs. This feature is particularly beneficial, as it reduces additional expenses and makes the platform more appealing for local traders.

By offering transparent transaction processes and avoiding hidden fees, Exness ensures a smooth financial experience for its Indian user base. This focus on affordability and accessibility has contributed to its popularity in India.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tax Implications for Forex Traders in India

Income Tax Considerations

Forex trading earnings are subject to taxation in India, classified under "Income from Other Sources" or "Capital Gains" depending on the nature of the trades. Traders must calculate their net profit after deducting expenses and report it in their annual income tax returns.

Platforms like Exness provide detailed transaction histories, making it easier for Indian traders to keep accurate financial records. Staying compliant with tax laws is essential to avoid penalties and ensure smooth trading operations.

Reporting Requirements for Forex Earnings

Indian traders are required to disclose their forex trading income to the Income Tax Department. Failure to report earnings accurately can result in legal complications. Therefore, it is advisable to consult with a tax advisor to understand the implications of forex trading profits.

By using a legal and regulated broker like Exness, Indian traders can confidently manage their earnings, knowing that the platform complies with international reporting standards and provides transparent transaction records.

Risks Associated with Forex Trading

Market Volatility

The forex market is inherently volatile, with prices fluctuating rapidly due to geopolitical events, economic data releases, and market sentiment. While volatility creates profit opportunities, it also increases the risk of substantial losses, especially for inexperienced traders.

Exness mitigates these risks by offering risk management tools, including stop-loss and take-profit orders. These features allow Indian traders to set predefined exit points, helping them manage their exposure to market volatility.

Potential for Losses

High leverage, while beneficial for increasing profit potential, can amplify losses if trades move against the trader. It is essential for Indian traders to understand leverage dynamics and use them cautiously to avoid significant financial setbacks.

Exness provides educational resources and demo accounts to help traders understand the risks associated with leverage and develop effective risk management strategies. This proactive approach empowers users to trade confidently and responsibly.

Conclusion

The Exness forex trading app is legal in India, operating under the framework of international regulations and offering features that align with the needs of Indian traders. From secure payment methods to advanced trading tools, Exness has established itself as a trusted platform in the country.

While traders must navigate challenges such as tax implications and market risks, Exness provides the resources, support, and transparency needed for a safe and profitable trading experience. For those seeking a reliable forex trading app in India, Exness stands out as a credible and legal choice.

Read more: