17 minute read

Is Forex Trading Profitable in India?

from Exness

by Exness Blog

The question, Is Forex Trading Profitable in India? is one that resonates with both seasoned investors and aspiring traders. The allure of potentially high returns attracts many individuals to this dynamic marketplace. However, understanding the complexities of Forex trading requires a deeper dive into its mechanics, market structure, economic implications, and individual strategies. In this comprehensive article, we will explore various facets of Forex trading in India and provide insights into whether it can be a profitable venture.

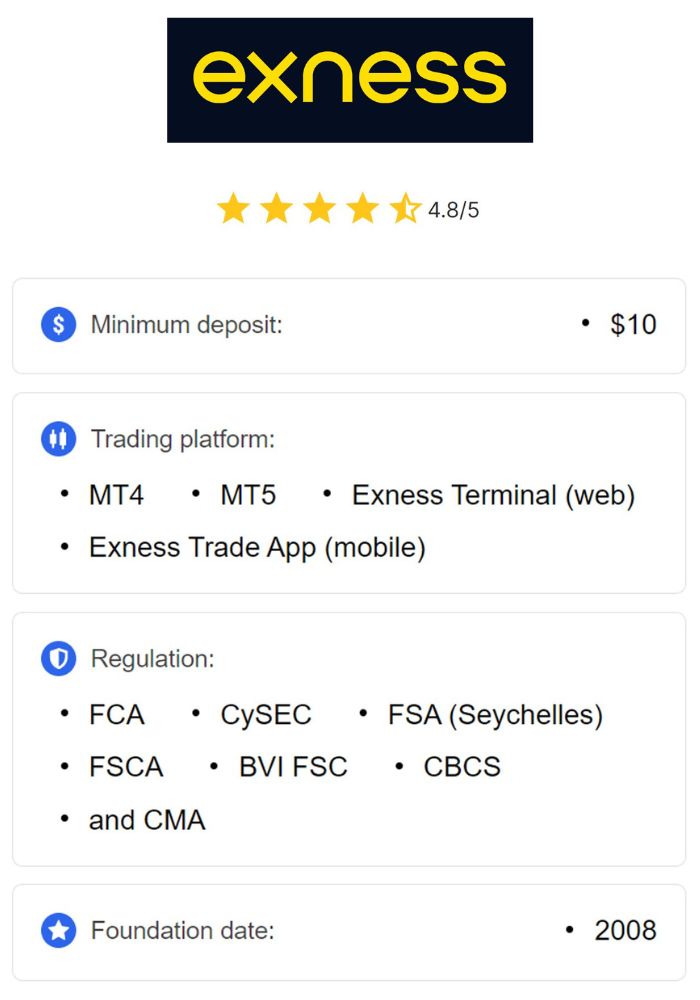

Top 4 Best Forex Brokers in India

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Introduction to Forex Trading

Forex, or foreign exchange trading, is the process of buying and selling currencies with the aim of making a profit from fluctuations in their exchange rates. Being the largest financial market globally, Forex operates 24 hours a day, five days a week, making it incredibly accessible for traders around the world, including those in India. As a decentralized market, Forex does not have a centralized exchange; instead, trading occurs over-the-counter (OTC) through electronic networks connecting buyers and sellers.

In recent years, Forex trading has gained immense popularity in India due to the advent of technology and online trading platforms. This has allowed retail traders to participate in this vast financial market more easily than ever before. Additionally, with the Indian economy becoming increasingly integrated with global markets, understanding Forex trading has become crucial for managing investments and currency exposure.

Overview of Forex Market

The Forex market is characterized by its immense liquidity, with trillions of dollars exchanged daily. It encompasses a myriad of participants, including central banks, financial institutions, corporations, hedge funds, and individual traders. Currency pairs are traded based on their relative values. For instance, when trading the EUR/USD pair, you are essentially speculating on the value of the Euro against the US Dollar.

There are several major currency pairs that dominate the Forex market, including the EUR/USD, USD/JPY, and GBP/USD. Each pair reflects how much of the second currency you need to purchase one unit of the first currency. Understanding these pairs and how they interact is essential for any trader looking to make informed decisions.

Importance of Forex Trading in Economic Context

Forex trading holds significant importance in the context of global economics. First and foremost, it facilitates international trade by allowing businesses to exchange currencies for goods and services. Companies involved in import-export activities rely heavily on Forex to manage currency risks, ensuring smooth operations across borders.

Furthermore, Forex markets contribute to the stability of financial systems worldwide. Efficient currency exchanges help maintain order in international trade while providing liquidity that can cushion against economic shocks. In times of crisis, such as political unrest or natural disasters, the Forex market acts as a mechanism for adjusting portfolios quickly to mitigate losses.

Understanding the economic impact of Forex trading helps grasp why it's an area of interest for so many traders and investors in India.

Understanding the Basics of Forex Trading

To navigate the Forex market effectively, traders must familiarize themselves with fundamental concepts and terminology associated with currency trading. A solid foundation will not only enhance trading skills but also improve decision-making processes.

Key Terminology Used in Forex

Terminology plays a critical role in mastering Forex trading. Here are some essential terms:

Currency Pair: Represents two currencies being traded against each other, such as USD/INR (US Dollar/Indian Rupee). The first currency is the base currency, and the second is the quote currency.

Pip: Short for "percentage in point," a pip is the smallest price move in currency trading, typically represented by the fourth decimal place.

Lot: The standard unit of trading in the Forex market. A standard lot is usually 100,000 units of the base currency.

Bid Price: The price at which a broker is willing to buy a currency pair from a trader.

Ask Price: Conversely, this is the price at which a broker is willing to sell a currency pair to a trader.

By mastering these terms, traders can better understand market movements and execute trades effectively.

How Forex Trading Works

Forex trading may seem daunting initially, but it follows a straightforward process once you get accustomed to the terminology and mechanics. The following steps outline how trading works in practice:

Opening a Trading Account: To start trading, an individual must open an account with a Forex broker. This involves submitting necessary documentation and choosing a trading platform that suits their requirements.

Choosing a Currency Pair: Traders select currency pairs based on market analysis, economic indicators, and personal trading strategies. Analyzing trends and historical data helps inform this choice.

Placing an Order: After selecting a currency pair, the trader places a buy or sell order via the trading platform. Traders specify the amount they wish to trade and the desired price level.

Monitoring the Trade: Active traders keep a close eye on their positions, utilizing real-time data and market news to manage risks and maximize potential profits.

Closing the Trade: Once targets are met or predetermined risk levels are hit, traders close their positions—either realizing profits or minimizing losses.

Having a clear understanding of how Forex trading works lays the groundwork for success in the market.

The Indian Forex Market Landscape

The Indian Forex market is a vibrant and dynamic space regulated by specific guidelines to ensure stability and transparency. Understanding the regulatory landscape and key players can help traders navigate this environment effectively.

Regulatory Framework Governing Forex Trading in India

The Reserve Bank of India (RBI) plays a pivotal role in regulating Forex trading within the country. Its policies and regulations are designed to maintain financial stability while safeguarding the interests of all market participants.

Foreign Exchange Management Act (FEMA): FEMA governs all foreign exchange transactions in India, defining permissible limits for individuals and businesses concerning foreign currency holdings and transactions.

Authorized Dealers (ADs): These institutions, licensed by the RBI, facilitate foreign exchange dealings. ADs include banks, financial institutions, and money changers, providing essential services to individuals and businesses engaging in Forex trading.

Exchange Rate Management: The RBI actively manages the exchange rate of the Indian Rupee against other currencies to prevent excessive volatility and control inflation. This management ensures macroeconomic stability, benefitting the broader economy.

Understanding the regulatory framework enables traders to comply with regulations and operate within legal boundaries.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Major Players in the Indian Forex Market

The Indian Forex market comprises several key players that contribute to its liquidity and efficiency:

Banks: Public and private sector banks play a significant role in facilitating Forex transactions for individuals and businesses, providing essential services such as remittances and hedging against currency risk.

Financial Institutions: Non-banking financial companies (NBFCs) and other financial institutions participate in the Forex market through specialized products and services catering to the needs of businesses.

Foreign Exchange Brokers: These intermediaries connect buyers and sellers, offering various services, including trading platforms, research, and analysis tools for retail and institutional clients.

Exporters and Importers: Businesses engaged in cross-border trade conduct substantial Forex transactions to settle payments and manage currency risks effectively.

As retail trading becomes increasingly popular, individual traders are now participating through online platforms, expanding the player landscape significantly.

Profitability Factors in Forex Trading

While many individuals aspire to profit from Forex trading, achieving consistent results requires a robust understanding of various profitability factors. Grasping these elements can help traders navigate the complexities of the market successfully.

Leverage and Margin Trading

Leverage is a powerful tool in Forex trading that allows traders to control larger positions with a smaller amount of capital. It amplifies potential profits, but it equally increases the possibility of losses. Therefore, using leverage prudently is crucial.

Margin trading refers to borrowing funds from a broker to enter trades larger than what the trader can afford with their own capital. The margin requirement represents the percentage of the trade value that the trader must deposit as collateral. While this approach can enhance returns, it also carries the risk of a margin call if the market moves unfavorably.

Traders should carefully assess their risk tolerance before utilizing leverage and ensure they possess effective risk management strategies to protect their capital.

Market Analysis Techniques: Fundamental vs. Technical Analysis

Successful Forex trading heavily relies on effective market analysis to identify profitable opportunities. Two primary analysis techniques exist:

Fundamental Analysis: This approach examines macroeconomic factors influencing currency values, such as interest rates, inflation, economic growth, and geopolitical situations. For instance, if a country's central bank raises interest rates, it might attract foreign investment, strengthening its currency.

Technical Analysis: Technical analysts focus on historical price data and patterns to forecast future price movements. Utilizing charts, indicators, and various tools, they analyze trends and support/resistance levels, believing past price behavior can offer valuable insights into future market trends.

Both analysis techniques can complement each other and improve a trader's decision-making process.

Impact of Global Events on Forex Prices

Global events often have a profound influence on currency values. Political instability, economic announcements, natural disasters, and changes in global sentiment can cause sudden price shifts, leading to increased volatility in the Forex market.

For example, the announcement of major economic data, such as employment figures or GDP growth rates, can trigger significant reactions in currency pairs. Traders need to stay informed about upcoming events and developments to position themselves advantageously and capitalize on potential opportunities.

Global events can introduce both risks and rewards, making it imperative for traders to remain vigilant and adaptable.

Risk Management in Forex Trading

Risk is an inherent part of Forex trading, and successful traders develop a keen ability to manage and mitigate these risks effectively. Implementing sound risk management strategies can safeguard capital and enhance overall trading performance.

Identifying Risks Associated with Forex Trading

Understanding the different types of risks associated with Forex trading is essential for developing effective risk management strategies:

Market Risk: The inherent risk that the market may move against a trader's position, resulting in losses. This type of risk is particularly heightened during periods of volatility.

Liquidity Risk: The possibility that a currency pair may not be easily tradable, preventing traders from exiting their positions swiftly.

Credit Risk: The risk of default by the broker or counterparty, which could lead to a loss of funds.

Operational Risk: The risk of errors in order execution or technical malfunctions impacting trading performance.

Leverage Risk: Utilizing excessive leverage can amplify losses, making it vital to use leverage judiciously.

By identifying these risks, traders can take preemptive measures to protect their capital.

Strategies for Effective Risk Management

Implementing effective risk management strategies is critical for long-term success in Forex trading. Some strategies include:

Setting Stop-Loss Orders: These orders automatically close a trade when it reaches a specified price level, limiting potential losses and preserving capital.

Diversification: Spreading investments across multiple currency pairs can minimize the impact of adverse movements in any single pair.

Position Sizing: Carefully managing the size of trades relative to total account equity helps limit risk exposure and avoids over-leveraging.

Utilizing Leverage Prudently: Minimizing leverage usage reduces the potential for amplified losses while still allowing traders to benefit from market movements.

Staying Updated on Market Conditions: Regularly monitoring market news and developments enables traders to make informed decisions and adjust their trading strategies accordingly.

Effective risk management is an ongoing process, requiring diligence, discipline, and adaptability on the part of traders.

Tools and Resources for Forex Traders

Various tools and resources are available for Forex traders to enhance their trading experience and improve their chances of success. Familiarizing oneself with these resources can provide a competitive edge in the market.

Trading Platforms Popular in India

Several trading platforms cater to Forex traders in India, each offering unique features and functionalities:

MetaTrader 4 (MT4): One of the most widely used platforms globally, MT4 provides advanced charting capabilities, technical indicators, and options for automated trading. Its user-friendly interface appeals to both beginners and experienced traders alike.

MetaTrader 5 (MT5): A successor to MT4, MT5 offers an expanded array of features, including improved charting tools, additional technical indicators, and enhanced order management capabilities. This platform caters to traders seeking more sophisticated analysis tools.

cTrader: Known for its fast execution speeds and user-friendly interface, cTrader is gaining popularity among Forex traders. It features advanced charting tools and offers flexible order management options.

TradingView: A web-based platform, TradingView emphasizes community engagement, allowing traders to share ideas and collaborate. Its extensive charting tools and analysis indicators make it a favorite among traders looking for social interaction and insightful market analysis.

These platforms provide traders with the necessary tools to analyze markets, execute trades, and develop strategies tailored to their trading styles.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Educational Resources Available for Aspiring Traders

Aspiring Forex traders should leverage educational resources to enhance their knowledge and skills. A plethora of materials exists, including:

Online Courses: Numerous websites offer comprehensive courses on Forex trading, covering everything from basic concepts to advanced strategies.

Webinars and Live Sessions: Many brokers and trading educators conduct webinars and live sessions that delve into various aspects of Forex trading, providing insights from industry professionals.

Books and E-books: A wealth of literature is available, covering diverse topics related to Forex trading, market analysis, psychology, and strategy development.

Forums and Community Groups: Engaging with fellow traders through forums and social media groups can provide valuable insights, tips, and support to novice traders navigating the Forex landscape.

Investing time in education can significantly improve a trader's chances of success in the highly competitive Forex market.

Common Myths About Forex Trading

Despite its growing popularity, Forex trading remains riddled with misconceptions and myths that can mislead aspiring traders. Debunking these myths is essential for setting realistic expectations and fostering a healthy trading mindset.

Debunking Misconceptions about Profitability

One prevalent myth surrounding Forex trading is the belief that it guarantees quick and easy profits. While it is true that Forex trading can yield substantial returns, it is also fraught with risks, uncertainties, and the potential for losses. The market’s volatility can result in abrupt changes in currency values, underscoring the importance of proper risk management and disciplined trading approaches.

Moreover, many aspiring traders are drawn to Forex due to the stories of overnight success shared online, leading them to believe that anyone can achieve similar results. In reality, successful trading requires dedication, continuous learning, and a deep understanding of market dynamics.

The Reality of Making Money in Forex Trading

The reality is that making money consistently in Forex trading demands time, effort, and skill. While some individuals do achieve financial success, the majority of traders face challenges and setbacks along the way. Developing a comprehensive trading plan, honing analytical skills, and cultivating emotional resilience are crucial components of sustained profitability.

Additionally, implementing effective risk management strategies is essential to protect against the inevitable losses that come with trading. Traders must approach the market with a realistic mindset, acknowledging that losses are part of the journey.

Understanding the myths and realities of Forex trading is critical for aspiring traders to build a solid foundation for their trading endeavors.

Success Stories and Case Studies

While navigating the Forex market can be challenging, there are numerous success stories and case studies that highlight the potential for profitability. Learning from the experiences of others can provide valuable insights and inspire traders to persevere.

Profiles of Successful Indian Forex Traders

Several Indian traders have made a name for themselves in the Forex market, showcasing their unique strategies and approaches. These individuals often attribute their success to diligent market analysis, disciplined trading practices, and continuous learning.

For instance, one successful trader emphasizes the importance of developing a personalized trading strategy based on thorough research and analysis. By understanding market fundamentals and employing risk management techniques, they achieved consistent profits over time.

Another trader highlights the significance of emotional discipline in trading. They share their journey of overcoming initial losses to develop a strong psychological mindset, ultimately leading to success in the Forex market.

Lessons Learned from Forex Trading Experiences

The experiences of successful traders often reveal common themes and lessons:

Patience and Persistence: Many successful traders stress the importance of patience in waiting for optimal trading opportunities while remaining persistent in refining their skills.

Continuous Learning: The Forex market is ever-evolving, and successful traders commit to lifelong learning. Staying informed about market trends, news, and economic developments is critical for sustained success.

Emotional Control: Managing emotions, especially fear and greed, is vital for maintaining discipline and adhering to trading plans during turbulent market conditions.

By studying the journeys of successful traders, aspiring individuals can gain insights into effective strategies and avoid common pitfalls.

Challenges Faced by Forex Traders in India

While Forex trading presents numerous opportunities, it also comes with its fair share of challenges. Understanding these challenges can empower traders to navigate the market more effectively.

Market Volatility and Its Effects

One of the primary challenges faced by Forex traders is market volatility. Currencies can experience rapid fluctuations in value due to various factors, including economic indicators, geopolitical events, and market sentiment. This volatility can lead to unexpected losses if traders fail to implement risk management strategies effectively.

Traders must develop the ability to adapt to changing market conditions and remain composed during volatile periods. Utilizing stop-loss orders, diversifying positions, and keeping abreast of market news can help mitigate the impact of volatility.

Psychological Challenges of Trading

The psychological aspect of Forex trading is often underestimated, yet it plays a pivotal role in a trader's decision-making process. Emotional biases such as fear, greed, and overconfidence can cloud judgment and lead to impulsive actions.

Many traders struggle with the fear of missing out (FOMO) when they see others profiting from trades, prompting them to act recklessly. Conversely, the fear of losses can lead to hesitation in executing trades or closing losing positions too late.

Developing emotional resilience and discipline is essential for overcoming these psychological challenges. Traders can employ techniques such as mindfulness exercises, journaling, or working with a mentor to foster emotional control and clarity.

Read more: Is Exness Legal in Dubai?

Future of Forex Trading in India

As the Indian economy continues to grow and integrate with global markets, the future of Forex trading in India appears promising. Emerging trends and technological advancements are shaping the landscape, creating new opportunities for traders.

Trends Shaping the Forex Market

Several key trends are influencing the Forex market in India:

Technological Advancements: The proliferation of online trading platforms and mobile applications has democratized access to Forex trading. Traders can execute trades, analyze data, and monitor markets seamlessly from their devices.

Increased Participation of Retail Traders: An influx of retail traders has led to greater market participation, contributing to enhanced liquidity and competitiveness in the Forex market.

Regulatory Developments: The evolving regulatory framework aims to provide more transparency and protection for traders, fostering confidence in the market.

Potential Opportunities for Indian Traders

The evolving Forex landscape presents several opportunities for Indian traders to capitalize on:

Emerging Currency Pairs: As globalization continues, emerging market currencies may present lucrative trading opportunities, offering diversification beyond traditional currency pairs.

Algorithmic Trading: The rise of algorithmic trading strategies allows traders to automate their trading processes, leveraging advanced algorithms to identify opportunities and execute trades efficiently.

Education and Skill Development: With an increasing focus on education, aspiring traders can access a wealth of resources to enhance their skills and knowledge, positioning themselves for success in the Forex market.

Embracing these trends and opportunities can set Indian traders on a path toward long-term profitability.

Conclusion: Is Forex Trading a Viable Investment Option in India?

In conclusion, the question Is Forex Trading Profitable in India? does not have a straightforward answer. While Forex trading presents tremendous opportunities for profit, it also comes with its share of risks and challenges. Success in the Forex market requires a combination of knowledge, discipline, and effective risk management strategies.

For aspiring traders in India, investing time in education, developing a comprehensive trading plan, and staying attuned to market conditions can pave the way for profitability. As the Indian Forex market continues to evolve, those who approach trading with a realistic mindset and a commitment to continuous improvement can position themselves for success in this dynamic and exciting financial landscape.