10 minute read

Is Exness regulated in Uganda? Review Broker

from Exness

by Exness_Blog

Forex trading has surged in popularity across Africa, and Uganda is no exception. With growing internet access and a rising interest in financial markets, many Ugandans are exploring opportunities to trade currencies, commodities, and other assets online. Among the numerous forex brokers available, Exness stands out as a globally recognized name. But one question looms large for Ugandan traders: Is Exness regulated in Uganda? This article dives deep into Exness’s regulatory status, its operations in Uganda, and what it means for local traders looking for a safe and reliable trading platform in 2025.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

What Is Exness? An Overview of the Broker

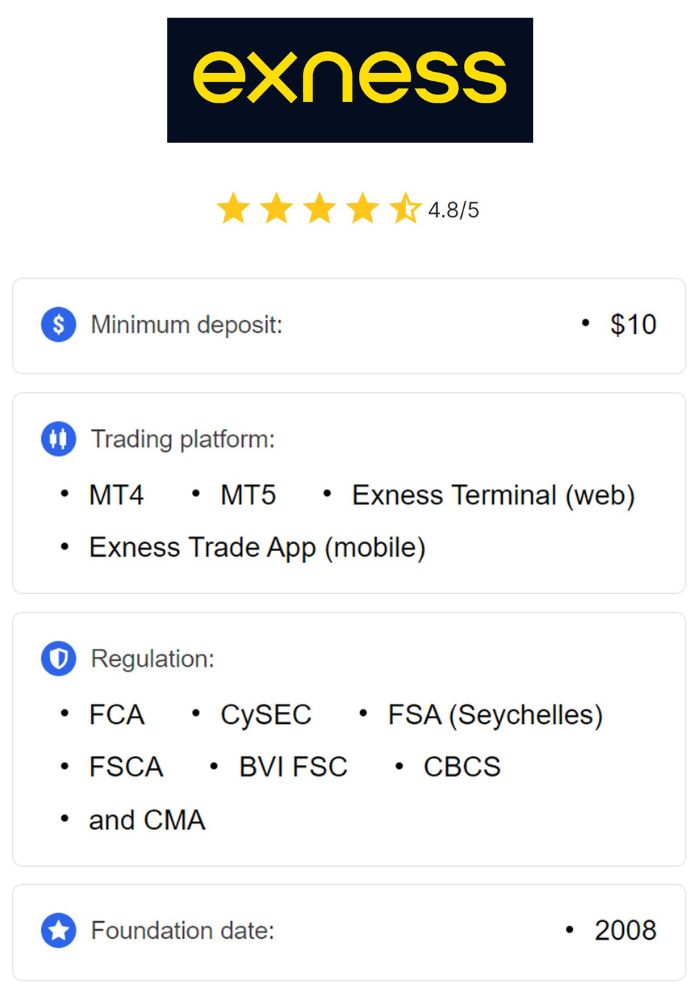

Before addressing the core question, let’s establish what Exness is and why it matters. Founded in 2008, Exness is a global forex and CFD (Contracts for Difference) broker headquartered in Cyprus. Over the years, it has built a reputation for offering competitive trading conditions, including tight spreads, fast execution speeds, and a wide range of financial instruments such as forex pairs, cryptocurrencies, stocks, indices, and commodities. With millions of clients worldwide, Exness has become a trusted name in the trading community.

Exness prides itself on transparency, innovation, and client satisfaction. It provides access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside its proprietary Exness Terminal and mobile apps. For Ugandan traders, these features are appealing, but the question of regulation remains critical. After all, regulation is the backbone of trust in the financial world.

The Importance of Regulation in Forex Trading

Why does regulation matter? In the forex market, where billions of dollars change hands daily, traders face risks ranging from market volatility to outright fraud. A regulated broker adheres to strict rules set by financial authorities, ensuring fair practices, transparency, and the safety of client funds. Key benefits of trading with a regulated broker include:

Fund Protection: Regulated brokers must segregate client funds from company assets, reducing the risk of misuse or loss in case of insolvency.

Transparency: They are required to provide clear information about fees, spreads, and trading conditions.

Dispute Resolution: Regulatory bodies offer mechanisms for traders to resolve issues with brokers.

Market Integrity: Regulation prevents unethical practices like price manipulation or hidden charges.

For Ugandan traders, choosing a regulated broker is a safeguard against scams, which are unfortunately common in emerging markets. So, where does Exness stand in this regard?

Forex Regulation in Uganda: The Local Landscape

To determine whether Exness is regulated in Uganda, we first need to understand the country’s regulatory framework. In Uganda, the financial sector is overseen by several institutions, primarily the Bank of Uganda (BOU) and the Capital Markets Authority (CMA).

Bank of Uganda (BOU): As the central bank, the BOU is responsible for monetary policy and the stability of the financial system. It regulates banks and certain financial institutions but does not directly oversee forex brokers.

Capital Markets Authority (CMA): Established under the Capital Markets Authority Act of 1996, the CMA regulates Uganda’s securities and capital markets. In 2017, it introduced guidelines for licensing forex brokers, aiming to bring oversight to the growing forex trading industry.

Despite these efforts, forex regulation in Uganda remains in its infancy. The CMA requires forex brokers to obtain a license to operate legally within the country, but enforcement is limited, and many international brokers serve Ugandan clients without local registration. This creates a gray area: while forex trading is legal in Uganda, the lack of robust local regulation means traders often rely on brokers’ international credentials.

Is Exness Regulated in Uganda? The Straight Answer

Here’s the crux of the matter: Exness is not directly regulated by the Capital Markets Authority (CMA) or any other Ugandan authority. However, this does not mean it operates illegally or unsafely in Uganda. Exness is a global broker regulated by multiple reputable international authorities, and it extends its services to Ugandan traders under these licenses. Let’s break this down.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness’s Global Regulatory Framework

Exness operates through several entities, each licensed by top-tier financial regulators worldwide. These include:

Cyprus Securities and Exchange Commission (CySEC): Based in Cyprus, Exness (Cy) Ltd is regulated by CySEC, a respected authority within the European Union. CySEC ensures compliance with the Markets in Financial Instruments Directive (MiFID II), offering high standards of client protection.

Financial Conduct Authority (FCA): In the UK, Exness (UK) Ltd is authorized by the FCA, one of the world’s most stringent regulators. The FCA enforces strict rules on fund segregation, transparency, and risk management.

Financial Services Authority (FSA) – Seychelles: Exness (SC) Ltd, the entity most relevant to Ugandan traders, holds a license from the FSA in Seychelles. While Seychelles is considered an offshore jurisdiction, the FSA imposes requirements for financial security and operational integrity.

Other Regulators: Exness is also licensed by the Financial Sector Conduct Authority (FSCA) in South Africa, the Central Bank of Curaçao and Sint Maarten (CBCS), and the Financial Services Commission (FSC) in Mauritius and the British Virgin Islands.

These licenses collectively ensure that Exness adheres to international standards for forex trading, even in countries like Uganda where it lacks a local license.

Exness in Uganda: Legal but Not Locally Regulated

Since Exness does not hold a CMA license, it is not directly regulated in Uganda. However, Ugandan laws do not prohibit residents from trading with offshore brokers like Exness. The CMA’s guidelines apply to brokers physically operating within Uganda or targeting Ugandan clients under a local entity. Exness, operating internationally, falls outside this scope but remains accessible to Ugandans via its offshore entity (Exness SC Ltd).

For practical purposes, this means:

Ugandan traders can legally open accounts with Exness.

They benefit from the broker’s international regulatory oversight rather than local Ugandan supervision.

How Does Exness Ensure Safety for Ugandan Traders?

Even without CMA regulation, Exness implements robust measures to protect its clients, including those in Uganda. Here’s how:

1. Segregation of Client Funds

Exness keeps client funds in separate accounts from its operational funds. This practice, mandated by its regulators, ensures that traders’ money is safe even if the company faces financial difficulties.

2. Negative Balance Protection

Exness offers negative balance protection, meaning traders cannot lose more than their deposited funds. This is especially valuable in volatile markets, protecting Ugandan traders from unexpected debt.

3. Compliance with AML and KYC Standards

To prevent fraud and money laundering, Exness enforces strict Anti-Money Laundering (AML) and Know Your Customer (KYC) policies. Ugandan traders must verify their identity and address before trading, adding a layer of security.

4. Transparent Operations

Exness publishes real-time data on spreads, execution speeds, and financial performance. This transparency builds trust and allows traders to make informed decisions.

5. Membership in the Financial Commission

Since 2021, Exness has been a member of the Financial Commission, an independent body that resolves disputes between brokers and traders. Clients can receive compensation of up to €20,000 in case of broker insolvency—a safety net for Ugandan traders.

Benefits of Trading with Exness in Uganda

For Ugandan traders, Exness offers several advantages that make it a compelling choice, regulated or not by the CMA:

Low Entry Barrier: Exness provides accounts with a minimum deposit as low as $1 for standard accounts, making it accessible to beginners.

High Leverage: With leverage up to 1:2000 (or unlimited in some cases), traders can amplify their potential profits, though this comes with higher risk.

Wide Range of Instruments: From forex to cryptocurrencies, Exness offers over 200 tradable assets.

Fast Withdrawals: Ugandan traders can withdraw funds instantly via mobile money, bank cards, or e-wallets, a rare feature among brokers.

Localized Support: Exness provides customer support in multiple languages, including English, which is widely spoken in Uganda.

Risks of Trading with an Unregulated Broker in Uganda

While Exness’s international licenses provide reassurance, trading with a broker not regulated by the CMA carries some risks:

Limited Local Recourse: If a dispute arises, Ugandan traders cannot appeal to the CMA for resolution and must rely on international regulators or the Financial Commission.

Regulatory Gaps: Offshore regulation (e.g., Seychelles) is less stringent than Tier-1 oversight (e.g., FCA or CySEC), potentially exposing traders to higher risks.

Unregulated Local Market: Uganda’s forex industry lacks comprehensive oversight, increasing the chance of encountering scams from unregulated local agents posing as brokers.

To mitigate these risks, traders should verify Exness’s credentials, use secure payment methods, and practice sound risk management.

How to Open an Exness Account in Uganda

Ready to trade with Exness? Here’s a step-by-step guide for Ugandan residents:

Visit the Exness Website: Go to Exness: Open An Account or Visit Brokers 🏆

Register: Provide your email, phone number, and country (Uganda).

Verify Your Identity: Upload a valid ID (e.g., passport or national ID) and proof of address (e.g., utility bill) for KYC compliance.

Choose an Account Type: Options include Standard, Pro, Raw Spread, and Zero accounts, each with different spreads and fees.

Deposit Funds: Use local payment methods like mobile money (MTN or Airtel), bank cards, or e-wallets like Skrill.

Start Trading: Download MT4, MT5, or the Exness app and begin your trading journey.

The process is quick, often taking less than 10 minutes, and Exness’s low deposit requirements make it beginner-friendly.

Exness vs. Locally Regulated Brokers in Uganda

How does Exness compare to brokers licensed by the CMA? Locally regulated brokers offer the advantage of direct oversight and legal recourse within Uganda. However, they are few in number, and their trading conditions—such as spreads, leverage, and platform features—may not match Exness’s offerings. Exness’s global reach, advanced technology, and competitive pricing give it an edge, even without local regulation.

Is Exness Safe for Ugandan Traders?

Safety is a top concern for any trader. Exness’s multi-layered regulatory framework, fund protection measures, and long-standing reputation suggest it is a safe choice. While it lacks CMA oversight, its international licenses from CySEC, FCA, and others provide a strong foundation of trust. Over 15 years of operation with millions of satisfied clients further bolster its credibility.

That said, safety also depends on the trader. Using strong passwords, enabling two-factor authentication, and avoiding over-leveraging are essential steps to protect your account.

The Future of Forex Regulation in Uganda

Uganda’s forex market is evolving. As trading grows, the CMA may strengthen its regulatory framework, potentially requiring international brokers like Exness to obtain local licenses. For now, Ugandan traders operate in a hybrid environment, balancing the benefits of global brokers with the limitations of local oversight.

Conclusion: Should You Trade with Exness in Uganda?

So, is Exness regulated in Uganda? Not directly by the CMA, but its international licenses from reputable authorities like CySEC, FCA, and FSA Seychelles ensure it meets high standards of safety and reliability. For Ugandan traders, Exness offers a robust platform with low costs, fast withdrawals, and a wide range of trading options—benefits that outweigh the absence of local regulation for many.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

If you’re considering Exness, weigh its global credentials against your need for local recourse. For most Ugandan traders, it’s a legitimate and trustworthy option in 2025. Ready to start? Open an account today and explore the world of forex trading with confidence.

Read more: