11 minute read

Is forex trading profitable in Pakistan? A Comprehensive Guide

from Exness

by Exness_Blog

Understanding Forex Trading

Definition of Forex Trading

Forex trading, or foreign exchange trading, is the global marketplace for buying and selling currencies. It is one of the largest financial markets in the world, with an average daily trading volume exceeding $6 trillion. Forex trading operates on a decentralized basis, meaning there is no physical exchange or central marketplace; instead, it occurs electronically over-the-counter (OTC) through a network of banks, financial institutions, and individual traders. The primary aim of forex trading is to profit from changes in currency values, which fluctuate due to various factors such as economic indicators, geopolitical events, and market sentiment.

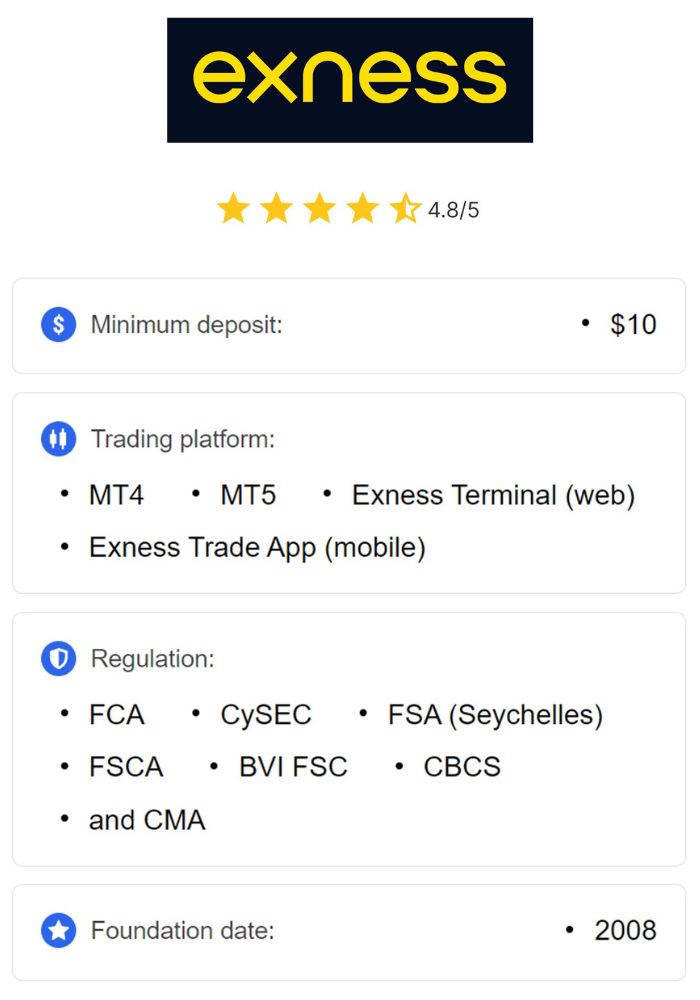

Top 4 Best Forex Brokers in Pakistan

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

How Forex Trading Works

Forex trading involves trading currency pairs, where one currency is exchanged for another. Each currency pair consists of a base currency and a quote currency. For instance, in the EUR/USD pair, the Euro is the base currency and the US Dollar is the quote currency. Traders speculate on the future price movements of these pairs, buying when they expect a currency to appreciate and selling when they anticipate a decline. The forex market operates 24 hours a day, five days a week, allowing traders to engage at any time.

Trading typically requires an account with a broker, who provides access to trading platforms that allow for the execution of trades, analysis of market trends, and management of open positions. Additionally, traders can use leverage to control larger positions than their initial capital would normally allow, increasing both potential profits and risks.

The Current State of Forex Trading in Pakistan

Legal Framework and Regulations

The forex market in Pakistan operates under the supervision of the State Bank of Pakistan (SBP) and the Securities and Exchange Commission of Pakistan (SECP). The SBP regulates all foreign exchange transactions and ensures compliance with national laws, while the SECP oversees investment and financial markets. In Pakistan, trading forex is legal, but there are specific guidelines and regulations that brokers must adhere to in order to provide trading services. Traders must ensure they are using licensed brokers to protect their investments and comply with local laws.

Despite the regulatory framework, some challenges remain, including a lack of clarity on specific regulations regarding retail forex trading. Traders should remain informed about the legal landscape and choose brokers who are transparent about their licensing and regulatory compliance.

Popularity Among Pakistani Traders

Forex trading has gained significant traction in Pakistan over the past few years, attracting both novice and experienced investors. The accessibility of online trading platforms has enabled many individuals to participate in the forex market with relative ease. Furthermore, the potential for high returns, coupled with the flexibility of trading hours, appeals to many traders seeking alternative investment opportunities.

Social media, online forums, and educational resources have also played a crucial role in popularizing forex trading in the country. As more traders share their experiences and strategies, the interest in forex trading continues to grow, contributing to a burgeoning community of forex enthusiasts in Pakistan.

Factors Influencing Profitability in Forex Trading

Market Volatility

Market volatility is a key factor that influences profitability in forex trading. High volatility can lead to substantial price swings, presenting traders with opportunities for profit. However, it also increases the risk of significant losses. In Pakistan, various factors contribute to currency volatility, including economic reports, geopolitical events, and changes in market sentiment. Traders must develop the ability to read market conditions and identify when volatility may present profitable opportunities or risks to avoid.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Economic Indicators

Economic indicators play a critical role in determining currency values and can significantly impact forex trading profitability. In Pakistan, key indicators include Gross Domestic Product (GDP) growth, inflation rates, unemployment figures, and trade balances. For example, a rising GDP suggests a healthy economy, which may strengthen the Pakistani Rupee (PKR) against other currencies. Conversely, high inflation can erode purchasing power and lead to currency depreciation. Traders must keep a close eye on these indicators and incorporate them into their trading strategies to make informed decisions.

Interest Rates and Currency Fluctuations

Interest rates are another influential factor in the forex market, affecting currency values and trading strategies. The State Bank of Pakistan sets the country's interest rates, and changes can lead to fluctuations in the PKR. Generally, higher interest rates attract foreign investment, increasing demand for the currency, while lower rates can lead to depreciation. Traders must understand the relationship between interest rates and currency values, as changes in monetary policy can create both opportunities and risks in the forex market.

Essential Skills for Successful Forex Trading

Technical Analysis

Technical analysis is an essential skill for forex traders, involving the study of price charts and patterns to forecast future price movements. Traders use various technical indicators, such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI), to identify trends and potential entry and exit points. Mastering technical analysis enables traders to make data-driven decisions based on historical price movements rather than relying solely on intuition.

Fundamental Analysis

Fundamental analysis focuses on evaluating economic, social, and political factors that can influence currency values. Traders analyze economic indicators, geopolitical events, and financial news to assess the health of an economy and predict currency movements. Understanding the fundamentals behind currency fluctuations is crucial for developing long-term trading strategies and making informed decisions.

Risk Management Strategies

Effective risk management is vital for successful forex trading. Traders should establish risk tolerance levels and employ strategies to protect their capital. Key risk management techniques include setting stop-loss orders to limit potential losses, diversifying trading positions, and maintaining a balanced risk-reward ratio. By prioritizing risk management, traders can enhance their chances of long-term profitability and minimize the impact of adverse market conditions.

Common Mistakes to Avoid in Forex Trading

Overleveraging

One of the most common mistakes traders make is overleveraging their positions. While leverage can amplify profits, it also increases the risk of significant losses. Many novice traders may not fully understand the implications of using high leverage, leading to margin calls and account liquidation. It is essential to use leverage responsibly and only trade with amounts that align with one’s risk tolerance and trading strategy.

Emotional Trading

Emotional trading can be detrimental to a trader’s success. Decisions driven by fear, greed, or frustration often lead to impulsive actions, resulting in losses. To avoid emotional trading, traders should develop a clear trading plan, adhere to their strategies, and remain disciplined even during volatile market conditions. Implementing techniques such as keeping a trading journal can help traders reflect on their emotional responses and improve decision-making.

Lack of a Trading Plan

Entering the forex market without a well-defined trading plan is a significant mistake. A trading plan outlines a trader’s goals, strategies, risk management techniques, and criteria for entering and exiting trades. Without a plan, traders may struggle to maintain consistency and discipline, leading to erratic trading behavior. Developing a comprehensive trading plan tailored to individual goals and risk tolerance is crucial for long-term success in forex trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tools and Resources for Forex Traders

Trading Platforms and Software

Choosing the right trading platform is critical for forex traders. A good trading platform should provide real-time market data, advanced charting tools, and a user-friendly interface. Popular trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, each offering unique features to enhance the trading experience. Traders should select a platform that aligns with their trading style and provides the necessary tools for analysis and execution.

Educational Resources

Aspiring forex traders can benefit from a wide range of educational resources to enhance their skills and knowledge. Online courses, webinars, and tutorials offer valuable insights into trading strategies, technical and fundamental analysis, and risk management. Many brokers and trading communities provide free or affordable educational content, allowing traders to learn at their own pace. Engaging with educational resources is essential for building a strong foundation in forex trading.

Success Stories of Forex Traders in Pakistan

Case Studies of Successful Traders

Many traders in Pakistan have achieved notable success in the forex market, demonstrating that profitability is attainable with the right approach. For example, a trader who initially faced challenges began by dedicating time to education and practicing with demo accounts. By focusing on disciplined trading and continuous learning, this trader was able to grow their account and transition to full-time trading. Their story serves as an inspiration to others, emphasizing the importance of perseverance and education in achieving success.

Lessons Learned from Their Experiences

Success stories often highlight valuable lessons learned from both victories and failures. Many successful traders emphasize the need for a solid trading plan, risk management, and emotional discipline. Conversely, traders who faced challenges often cite a lack of preparation, insufficient knowledge, or poor decision-making as key factors in their failures. Learning from both successful and unsuccessful trading experiences can provide aspiring traders with insights to enhance their own trading practices.

Challenges Faced by Forex Traders in Pakistan

Limited Access to Information

One of the significant challenges faced by forex traders in Pakistan is limited access to reliable information and market analysis. Many traders may struggle to find credible sources of data, which can hinder their ability to make informed decisions. Access to real-time market data, news updates, and analytical tools is crucial for successful trading. Traders must seek out reputable platforms and communities that provide accurate information to navigate the forex market effectively.

Regulatory Hurdles

While forex trading is legal in Pakistan, regulatory hurdles can pose challenges for traders. Some brokers may operate without proper licensing, making it essential for traders to conduct thorough research before selecting a broker. Additionally, changing regulations may impact trading conditions and access to specific services. Staying informed about regulatory developments and choosing licensed brokers can help traders mitigate risks and operate within legal frameworks.

Comparing Forex Trading with Other Investment Avenues in Pakistan

Stock Market vs. Forex Trading

When comparing forex trading with the stock market, each investment avenue offers distinct advantages and challenges. Forex trading provides high liquidity, 24/5 trading hours, and the ability to leverage positions. However, it also carries higher volatility and risks. On the other hand, the stock market tends to have more stability, but trading hours are limited, and liquidity may vary for smaller companies. Traders in Pakistan should consider their investment goals, risk tolerance, and preferred trading styles when choosing between these markets.

Real Estate Investment

Real estate investment is another popular avenue in Pakistan, offering long-term appreciation and rental income potential. Unlike forex trading, which can yield quick profits, real estate investments typically require significant capital and time to realize returns. However, real estate can serve as a stable and tangible asset, while forex trading carries higher risks associated with market fluctuations. Each investment avenue has its merits, and traders should assess their financial goals and risk appetite before making decisions.

Future Prospects of Forex Trading in Pakistan

Emerging Trends

The future of forex trading in Pakistan appears promising, with emerging trends that may shape the market landscape. The rise of fintech solutions is making trading more accessible, as mobile trading applications and automated trading systems gain popularity. Additionally, an increasing number of educational resources and community initiatives are helping traders improve their skills and knowledge. As awareness of forex trading continues to grow, the market is likely to expand further.

Potential for Growth

Pakistan's forex market has significant potential for growth as more individuals seek alternative investment opportunities. With a young and tech-savvy population, the demand for accessible trading platforms is expected to rise. As the regulatory framework matures, it may attract more foreign investment and enhance the credibility of local brokers. Traders in Pakistan who adapt to these changes and continue to develop their skills are likely to find new opportunities for profitability in the evolving forex landscape.

Conclusion

In conclusion, forex trading in Pakistan offers the potential for profitability, but it requires a thorough understanding of market dynamics, effective risk management strategies, and a commitment to continuous education. While there are challenges, such as regulatory hurdles and limited access to information, the growing popularity of forex trading suggests a bright future for traders in the country. By navigating the legal landscape, selecting reputable brokers, and honing essential trading skills, Pakistani traders can position themselves for success in the dynamic world of forex trading. As the market continues to evolve, those who stay informed and adapt to emerging trends will likely thrive in this exciting investment avenue.

Read more:

Is forex trading legal in Botswana?