21 minute read

Exness Review Uganda: Legit, Safe, Is a good broker?

from Exness

by Exness_Blog

Introduction to Exness

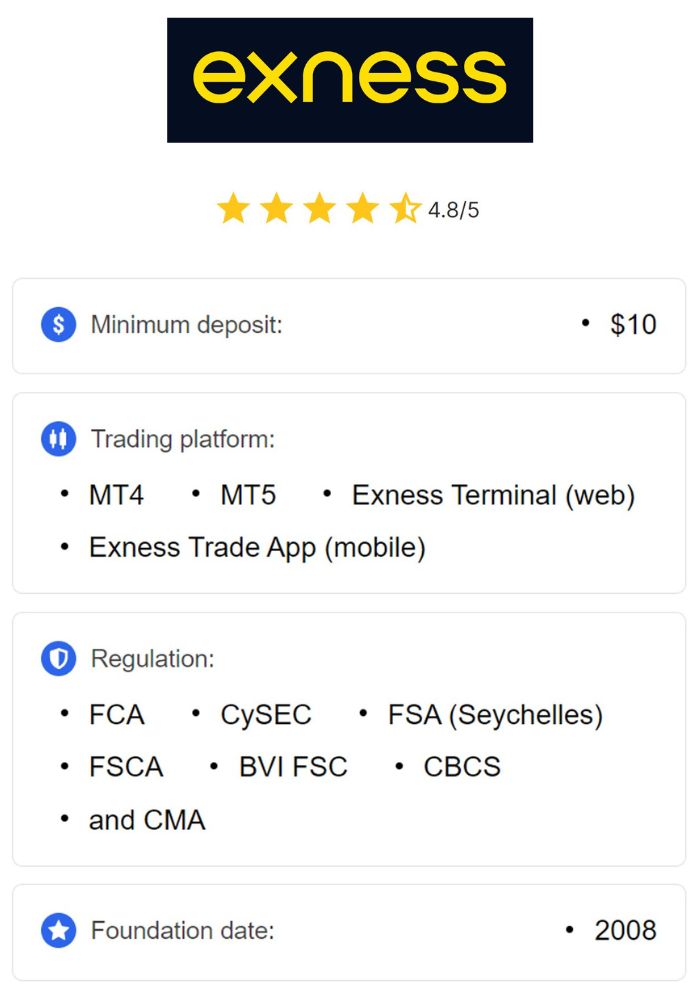

Overview of Exness

Exness is a globally recognized online brokerage that specializes in forex and CFD trading, offering clients access to a range of financial markets, including currencies, commodities, cryptocurrencies, and indices. Established in 2008, Exness has gained a strong reputation for its transparency, user-friendly platforms, and secure trading environment. Today, Exness is one of the leading brokers in the world, serving millions of traders across different countries, including Uganda.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness appeals to both beginners and professional traders by providing competitive trading conditions, low spreads, high leverage options, and robust customer support. For Ugandan traders, Exness presents an opportunity to trade on a reliable platform with global standards, making it a popular choice in the growing Ugandan forex market.

Brief History and Establishment

Founded by a team of financial and technology professionals, Exness was established with the mission of providing transparent and secure trading services to a global audience. Since its inception in 2008, Exness has expanded rapidly, securing licenses from major regulatory bodies and establishing a presence in numerous countries. The broker has become known for its commitment to client protection, advanced technology, and dedication to ethical trading practices.

Exness’s focus on regulatory compliance and cutting-edge trading technology has contributed significantly to its global growth, making it a preferred broker for traders worldwide. For Ugandan traders, Exness’s international credibility and commitment to security make it an appealing option.

Regulatory Framework

Licensing Information

Exness operates under multiple licenses from well-respected regulatory authorities, including the Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA) in the UK, and the Seychelles Financial Services Authority (FSA). These regulatory licenses impose strict guidelines on Exness, ensuring it operates with transparency and adheres to ethical trading practices. Although Exness is not directly regulated by the Ugandan Capital Markets Authority (CMA), its global regulatory status provides a layer of security for Ugandan clients.

Compliance with Ugandan Financial Regulations

While Exness does not hold a local license from the CMA in Uganda, it still operates in accordance with international financial regulations. For Ugandan traders, this means Exness adheres to global standards that prioritize client protection, data security, and transparent operations. While local regulation provides direct oversight within Uganda, Exness’s adherence to internationally recognized regulatory standards offers Ugandan traders peace of mind.

Global Regulatory Standards

Exness’s global regulatory licenses ensure compliance with rigorous standards, such as client fund segregation, regular audits, and adherence to anti-money laundering policies. By following these standards, Exness creates a secure and trustworthy environment for its clients, including those in Uganda. This international regulatory oversight reassures Ugandan traders that Exness operates with a high level of integrity and is accountable to independent third-party regulatory bodies.

Safety and Security Measures

Client Fund Protection

One of Exness’s top priorities is client fund safety. The broker employs segregated accounts, which means client funds are kept separate from the company’s operational funds. This measure ensures that client funds are not used for the broker’s expenses and remain secure even if Exness were to encounter financial issues. Additionally, Exness partners with top-tier banks to provide a secure and stable environment for traders’ funds.

Exness also participates in compensation schemes in certain jurisdictions, which provide additional protection for client funds. Although these schemes may not directly cover Ugandan traders, they add to the broker’s credibility and commitment to fund protection.

Data Security Protocols

Exness takes data security seriously, using advanced encryption to protect clients’ personal and financial information. With Secure Socket Layer (SSL) technology, all transactions and communications on Exness’s platform are encrypted to prevent unauthorized access. This level of security is essential in today’s digital trading environment, where data protection is a significant concern for traders worldwide.

Additionally, Exness complies with global data protection regulations, such as the General Data Protection Regulation (GDPR), which governs how client information is collected, stored, and processed. For Ugandan traders, this means that Exness is committed to safeguarding their personal information and maintaining high standards of data privacy.

Transparency in Operations

Exness is known for its transparency in operations, providing clear information about fees, commissions, and trading conditions. The broker ensures that clients are well-informed about costs and potential risks, helping traders make more informed decisions. For Ugandan traders, Exness’s commitment to transparency builds trust and confidence in the broker’s services, allowing them to trade with peace of mind.

Trading Platforms Offered

MetaTrader 4 Overview

Exness supports the MetaTrader 4 (MT4) platform, one of the most trusted and widely used trading platforms in the forex industry. Known for its reliability and user-friendly interface, MT4 offers a range of tools that allow traders to conduct technical analysis, implement automated trading through Expert Advisors (EAs), and manage trades efficiently. For Ugandan traders, MT4’s simplicity and effectiveness make it an ideal choice, especially for those who are new to forex trading.

MT4 includes essential charting capabilities, customizable indicators, and one-click trading functionality, making it a versatile platform for traders of all levels. It is available on desktop, web, and mobile, allowing traders to access their accounts and monitor the markets from anywhere.

MetaTrader 5 Overview

MetaTrader 5 (MT5) is an advanced trading platform that builds upon the features of MT4 with additional tools, more asset classes, and enhanced analytical capabilities. MT5 supports more timeframes, more pending order types, and additional technical indicators, making it highly suitable for experienced traders who want deeper market insights and advanced trading strategies.

MT5 also allows traders to trade a broader range of assets, making it ideal for multi-asset trading beyond just forex. With features like integrated economic calendars and more sophisticated order management, MT5 is particularly useful for professional Ugandan traders looking for expanded trading opportunities and more powerful trading tools.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Web and Mobile Trading Options

In addition to MT4 and MT5, Exness offers a Web Terminal for traders who prefer a browser-based trading experience. The Web Terminal is accessible without requiring software downloads, providing essential functionalities like real-time charts, technical analysis tools, and one-click trading. It is a convenient choice for traders who want a lightweight option and the flexibility to access their accounts from any computer with internet access.

For traders who prefer to trade on the go, Exness also provides a mobile app compatible with both iOS and Android devices. The app includes all essential features, such as order execution, real-time price tracking, technical indicators, and customizable alerts. The mobile trading app is particularly valuable for Ugandan traders who need to stay connected to the markets wherever they are, ensuring that they never miss out on trading opportunities.

Account Types Available

Standard Accounts

Exness offers Standard Accounts that are designed with simplicity and accessibility in mind, making them ideal for beginner traders. These accounts require a low minimum deposit and feature zero commission on trades, with slightly wider spreads. Standard Accounts provide a straightforward trading environment with competitive spreads, making them a popular choice among traders who prefer a commission-free model.

The Standard Account also includes access to all trading instruments and platforms supported by Exness, allowing Ugandan traders to explore various markets and trading strategies. For new traders, the Standard Account is an excellent way to get started without the complexities of commission-based trading.

Professional Accounts

For more experienced traders, Exness offers a range of Professional Accounts, including the Pro Account, Raw Spread Account, and Zero Account. These accounts are tailored to meet the needs of high-volume and professional traders who require lower spreads, faster execution speeds, and access to advanced trading conditions.

Pro Account: The Pro Account provides tight spreads with zero commission, making it suitable for traders who prioritize low trading costs but prefer not to pay commissions.

Raw Spread Account: This account type offers some of the tightest spreads starting from 0.0 pips, with a small commission per trade. It is ideal for scalpers and traders who require precision and minimal spreads.

Zero Account: The Zero Account provides extremely low spreads, especially on major forex pairs, with commission-based pricing. This account type is designed for traders who need ultra-tight spreads for trading strategies that rely on minimal price movement.

Professional Accounts give Ugandan traders the flexibility to choose an account type that aligns with their trading strategy, budget, and preference for either spread-based or commission-based pricing.

Comparative Analysis of Account Features

Each account type offered by Exness has unique features designed to cater to different trading styles. The Standard Account, with its zero-commission structure, is best suited for beginner traders and those who prefer a simplified trading experience. In contrast, Professional Accounts, with their lower spreads and commission options, cater to traders who are more focused on cost efficiency and advanced trading strategies.

This variety of accounts allows Ugandan traders to select the option that best fits their goals, whether they are looking for low spreads, zero commissions, or advanced trading conditions. Exness’s flexible account offerings ensure that traders can find an account that meets their needs, regardless of their experience level or trading strategy.

Trading Costs and Fees

Spreads and Commissions

Exness is known for its competitive spread structure, which varies depending on the account type and asset class. Standard Accounts offer a zero-commission model with slightly wider spreads, while Professional Accounts such as the Raw Spread and Zero Accounts provide tight spreads with a small commission per trade. For Ugandan traders, this flexibility means they can choose the most cost-effective option based on their trading volume and strategy.

The Raw Spread Account, for instance, offers spreads starting from as low as 0.0 pips on major currency pairs, with a commission fee that is transparent and easy to understand. The variety in spreads and commissions at Exness allows traders to optimize their trading costs and maximize their profitability.

Deposit and Withdrawal Fees

Exness generally does not charge fees for deposits and withdrawals, making it cost-effective for Ugandan traders to fund their accounts and access their earnings. However, certain payment providers may have their own transaction fees depending on the method chosen, so it’s always a good idea for traders to confirm any charges from their preferred payment provider. Exness’s commitment to low-cost transactions ensures that traders can efficiently manage their funds without unnecessary costs.

Inactivity Fees Explained

Exness does not charge inactivity fees, which is a considerable advantage for traders who may not trade frequently. This no-fee policy allows Ugandan traders to keep their accounts open without incurring extra charges, even if they take breaks from trading. This flexibility is especially beneficial for part-time traders and those who want the option to return to trading at their own pace.

Available Trading Instruments

Forex Currency Pairs

Exness offers a comprehensive range of forex currency pairs, making it ideal for traders interested in the forex market. Ugandan traders have access to major pairs such as EUR/USD, GBP/USD, and USD/JPY, which are highly liquid and often experience smaller spreads. Exness also offers minor pairs like EUR/GBP and AUD/JPY for those interested in less conventional but stable currency pairs.

In addition to majors and minors, Exness provides exotic pairs, including currencies from emerging markets, which offer higher volatility and the potential for larger profits. This variety allows Ugandan traders to diversify their portfolios and explore both stable and high-risk forex trading options, catering to different risk appetites and trading strategies.

CFDs on Commodities

Beyond forex, Exness offers Contracts for Difference (CFDs) on popular commodities, including gold, silver, crude oil, and natural gas. Commodities are an excellent way for traders to hedge against inflation and economic uncertainty, as they often move independently of the stock and forex markets. For Ugandan traders, commodities like gold are especially appealing, as they serve as safe-haven assets during times of market volatility.

By trading commodity CFDs, Ugandan traders can speculate on the price movements of these assets without actually owning them, which provides the flexibility to profit from both rising and falling markets. The variety in commodities enables traders to diversify further and take advantage of global economic trends.

Cryptocurrencies and Indices

Exness also provides CFD trading on cryptocurrencies and indices. Traders can access major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC), allowing them to participate in the fast-paced world of digital assets. Cryptocurrencies are known for their high volatility, which presents unique opportunities and risks. For Ugandan traders, trading crypto CFDs can be particularly beneficial, as they allow for speculation without the need for a digital wallet or additional security measures.

In addition to cryptocurrencies, Exness offers indices like the S&P 500, Nasdaq 100, and FTSE 100, which represent baskets of leading global stocks. Trading indices allows traders to gain exposure to overall market trends rather than individual stocks, providing a way to diversify with less volatility than single stock trading. This range of instruments provides Ugandan traders with ample options to build a diversified portfolio and explore different market dynamics.

Customer Support Services

Accessibility and Response Time

Exness offers 24/7 customer support to ensure that traders can get assistance whenever they need it. This continuous availability is crucial for Ugandan traders, who may need help outside of regular business hours or during time-sensitive trading situations. Exness provides multiple channels for support, including live chat, email, and phone, ensuring that traders can reach out in the way that’s most convenient for them.

The response time is generally quick, with live chat being one of the fastest ways to get immediate help. This efficient support structure is highly valued by traders, as quick resolutions to issues can make a significant difference in trading outcomes, especially during volatile market periods.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Availability of Multiple Communication Channels

Exness understands the importance of offering multiple communication options to meet traders’ diverse needs. In addition to live chat and email, Exness offers phone support and a comprehensive help center with FAQs and detailed guides. These resources provide Ugandan traders with a wide range of solutions to troubleshoot common issues, understand platform features, and learn more about trading with Exness.

For more complex issues that require direct support, the availability of phone support ensures traders can speak directly with knowledgeable representatives, while the help center is ideal for traders who prefer to resolve issues independently.

Multilingual Support for Ugandan Clients

To accommodate its global clientele, Exness provides multilingual support, including English, which is commonly spoken in Uganda. This ensures that Ugandan traders can communicate with customer service representatives comfortably and without language barriers. For traders who feel most confident discussing technical or account issues in English, Exness’s multilingual support offers an inclusive experience, reinforcing the broker’s commitment to serving a diverse trading community.

Educational Resources and Tools

Trading Academy Overview

Exness provides a Trading Academy designed to help both new and experienced traders improve their skills and knowledge. The academy includes a wide range of educational materials, from beginner courses covering the basics of forex trading to advanced tutorials on technical analysis, risk management, and trading psychology. For Ugandan traders, the Trading Academy is a valuable resource, offering structured learning paths that guide them from foundational concepts to more complex trading strategies.

This comprehensive resource helps Ugandan traders develop the confidence and competence they need to make informed trading decisions, regardless of their experience level.

Market Analysis and Insights

Exness offers daily market analysis reports, providing traders with insights into market trends, economic events, and technical indicators. The reports cover major currency pairs, commodities, indices, and cryptocurrencies, enabling Ugandan traders to stay updated on price movements and potential trading opportunities. Exness’s market analysis can help traders make more informed decisions, especially during periods of high volatility.

These insights are particularly useful for traders who want to stay updated on global economic factors that impact market performance. By using these resources, Ugandan traders can gain a deeper understanding of market trends, helping them build more robust trading strategies.

Webinars and Online Courses

To support ongoing education, Exness hosts regular webinars and offers online courses on various trading topics. The webinars are conducted by experienced analysts and cover essential areas such as technical analysis, market psychology, and effective trading strategies. These interactive sessions provide Ugandan traders with the opportunity to learn from professionals and ask questions in real-time.

Online courses are available for traders who prefer self-paced learning, with modules designed to address the needs of traders at every level. Exness’s commitment to education helps Ugandan traders continuously improve their trading skills and adapt to changing market conditions.

User Experience and Interface

Platform Usability

Exness is known for its user-friendly trading platforms, with intuitive designs that make navigation easy for traders of all levels. The layout is clean, with quick access to essential functions like charting tools, order management, and account information. This simplicity ensures that Ugandan traders can focus on their strategies without getting overwhelmed by complex interfaces.

The platform usability is particularly advantageous for beginners, who can quickly get accustomed to the layout, while experienced traders will appreciate the efficient access to advanced features. Exness’s commitment to simplicity and usability ensures a smooth trading experience, enhancing both productivity and efficiency.

Customization Options

Exness offers customization options on its platforms, allowing traders to tailor the interface to fit their personal preferences and trading style. Users can adjust chart types, choose from various timeframes, set up personalized alerts, and even create customized watchlists to track their favorite assets. For Ugandan traders, these customization options enable a personalized trading experience, making it easier to access essential information quickly and efficiently.

The flexibility to customize the platform is beneficial for all types of traders, whether they are day traders who need quick access to real-time data or swing traders who prefer a clean interface with minimal distractions.

Mobile App Functionality

The Exness mobile app provides a comprehensive trading experience on mobile devices, with features that mirror the desktop version, including charting tools, order execution, and market analysis. The mobile app is optimized for both iOS and Android devices, allowing Ugandan traders to stay connected to the markets and manage their trades from anywhere.

The app includes essential functionalities like one-click trading, real-time price updates, and customizable alerts, ensuring traders have the tools they need to make timely decisions. For Ugandan traders who need the flexibility to trade on the go, the Exness mobile app offers a seamless and efficient way to monitor the markets.

Payment Methods

Accepted Deposit Options

Exness supports a variety of payment methods to ensure Ugandan traders can fund their accounts conveniently. These methods include local bank transfers, credit and debit cards (Visa and MasterCard), Skrill, Neteller, and popular mobile payment solutions like M-Pesa. The diversity in payment options allows traders to select the method that best fits their needs, making deposits quick and hassle-free.

Most deposits are processed instantly, enabling Ugandan traders to start trading without delay. Exness’s commitment to accessible funding options makes it easier for traders to manage their accounts and focus on trading.

Withdrawal Process and Timescales

Exness is known for its fast and efficient withdrawal processes, with many withdrawal methods offering instant processing. For Ugandan traders, withdrawals can be made via the same methods used for deposits, including bank transfers and e-wallets. Instant withdrawals ensure that traders can access their funds promptly, enhancing the overall trading experience.

While most methods are instant, some may vary depending on the specific bank or provider, but Exness strives to minimize wait times. The transparent and straightforward withdrawal process allows Ugandan traders to access their earnings efficiently and without unnecessary delays.

Local Banking Solutions in Uganda

Exness understands the importance of local banking solutions and provides options like M-Pesa, which is widely used in Uganda. This localized approach simplifies the funding process for Ugandan traders, allowing them to deposit and withdraw in their local currency with ease. The integration of local banking methods demonstrates Exness’s commitment to providing a tailored experience that meets the needs of Ugandan clients.

Pros and Cons of Using Exness

Advantages for Ugandan Traders

Exness offers a number of benefits that make it an attractive choice for traders in Uganda:

Global Regulation: Exness operates under multiple regulatory licenses from respected authorities, including CySEC, FCA, and FSA. Although it is not directly regulated by Uganda’s Capital Markets Authority (CMA), its global oversight provides a level of trust and security that benefits Ugandan traders.

Diverse Trading Instruments: Exness offers a wide range of instruments, including forex pairs, commodities, indices, and cryptocurrencies, allowing Ugandan traders to diversify their portfolios and explore various markets.

Instant Withdrawals: Exness’s commitment to fast withdrawals is a standout feature, with many methods allowing for instant access to funds. For Ugandan traders, the availability of instant withdrawals enhances flexibility and financial control.

Low Transaction Costs: With competitive spreads and the option of commission-free accounts, Exness offers cost-effective trading conditions. This appeals to both beginners and experienced traders looking to optimize their profits.

User-Friendly Platforms: Exness’s integration of MetaTrader 4, MetaTrader 5, and proprietary web and mobile apps makes trading accessible and efficient. The platform’s simplicity, combined with customizable features, allows traders of all levels to tailor the experience to their preferences.

Educational Resources: Exness provides an extensive library of educational resources, including webinars, market insights, and tutorials, which are particularly useful for Ugandan traders looking to build their skills and stay informed on market trends.

Potential Drawbacks and Limitations

Despite its many advantages, Exness also has a few limitations that Ugandan traders should be aware of:

Absence of Local Regulation: While Exness is internationally regulated, it does not hold a license with Uganda’s CMA. For traders who prioritize local regulation, this may be a consideration. However, Exness’s global regulatory oversight provides a substantial level of safety.

High Leverage Risks: While Exness offers high leverage, which can increase potential profits, it also amplifies risks, particularly for new traders. Ugandan traders need to approach leverage with caution and have a solid understanding of risk management.

Occasional Delays During Peak Hours: Some users have reported slower platform performance during high-volume trading periods. While these instances are infrequent, they can impact traders who rely on real-time execution during major market events.

Community Feedback and Reviews

Testimonials from Ugandan Users

Exness has received positive feedback from many Ugandan traders, who praise the broker’s fast transaction processing, user-friendly platforms, and transparent trading conditions. For beginners, Exness’s educational resources and straightforward Standard Account are frequently highlighted as beneficial starting points. Additionally, experienced traders appreciate the variety of Professional Account options, which offer competitive spreads and advanced trading tools.

Overall, testimonials from Ugandan traders indicate satisfaction with Exness’s performance, especially regarding fund security, platform usability, and responsive customer support. Many traders find the instant deposit and withdrawal options particularly advantageous, as they allow for seamless account management.

Notable Criticisms and Praise

While the majority of feedback about Exness is positive, some Ugandan traders have pointed out areas for improvement. Occasional complaints include minor platform delays during peak trading hours and the lack of CMA regulation. However, Exness continues to receive praise for its commitment to transparency, efficient customer support, and low-cost trading conditions.

The majority of Ugandan traders view Exness as a reliable broker with a strong focus on user experience and accessibility. The combination of professional-grade accounts, secure trading conditions, and competitive spreads has positioned Exness as a favored choice for traders in Uganda.

Comparison with Other Brokers in Uganda

Similarities and Differences with Competitors

Exness shares several similarities with other brokers serving the Ugandan market, such as offering multiple trading platforms, a variety of account types, and a wide range of financial instruments. However, Exness stands out with its international regulatory status, fast transaction processing, and instant withdrawals, which some local brokers may not offer.

Another distinguishing factor is Exness’s commitment to educational resources. While other brokers also provide learning materials, Exness offers a comprehensive library that includes webinars, online courses, and real-time market analysis, providing valuable support for Ugandan traders aiming to improve their skills.

Market Position and Reputation

Exness has built a strong reputation globally, and it holds a competitive position in the Ugandan market due to its blend of international standards, secure trading conditions, and user-friendly platform features. While Exness may not hold a local license, its adherence to global regulatory standards and transparent operations have earned it a trustworthy reputation among Ugandan traders. The broker’s commitment to providing accessible and efficient services helps it maintain a solid market presence in Uganda, where forex trading is rapidly gaining popularity.

Conclusion

Exness is a reputable and globally recognized broker that offers a variety of features suitable for traders in Uganda. With its comprehensive selection of trading platforms, diverse financial instruments, and commitment to secure trading, Exness provides a high-quality experience for both beginner and professional traders. Although the broker does not have a local license with Uganda’s CMA, its international regulatory credentials and adherence to global standards make it a trusted choice for Ugandan traders.

The advantages of trading with Exness include fast and transparent transaction processes, competitive spreads, low fees, and a wealth of educational resources that support traders at every level. While there are minor limitations, such as occasional platform delays and the high leverage risks, Exness’s strengths far outweigh its weaknesses, making it an excellent choice for traders in Uganda looking for a secure and efficient trading experience.

For Ugandan traders seeking a broker with a balance of accessibility, flexibility, and robust security measures, Exness is a solid option worth considering. Whether you are new to forex trading or an experienced trader, Exness’s range of account types, educational support, and commitment to customer satisfaction make it a valuable partner in the dynamic world of forex trading.

Read more: