8 minute read

How to Use the Exness Trading Calculator

The Exness trading calculator is a powerful tool designed to help traders understand the financial impact of their trades, ensuring effective capital management. To use the Exness trading calculator, simply input key trade details, such as the currency pair, trade size, and account currency. The calculator will provide crucial information like pip value, spread costs, and swap fees for both long and short positions. By calculating the pip value, traders can easily assess price movements and estimate potential profit or net profit based on different account types and leverage options. The calculator also allows traders to estimate swap rates for overnight positions, providing a clear picture of how market movements affect trade outcomes. Whether you're trading forex or other financial instruments, using the Exness calculator helps manage risk, calculate capital allocation, and make informed trading decisions, ultimately enhancing trading performance.

What is the Exness Trading Calculator?

The Exness trading calculator is a tool designed to help traders calculate important trading details such as pip value, trade size, margin requirements, and swap fees for various financial instruments, including forex and CFD trading. This powerful tool is integrated within the Exness platform, providing traders with a quick and easy way to assess the financial impact of their trades.

Key Features of Exness Trading Calculator:

Pip Value Calculation: Calculates the value of one pip for your selected currency pair.

Swap Fees: Helps calculate the swap fees for overnight positions based on the currency pair.

Profit and Loss Estimations: Estimates potential profits or losses based on your trade details and position size.

Capital Allocation: Assists traders in planning capital allocation strategies based on risk tolerance.

How to Access and Use the Exness Trading Calculator

Using the Exness trading calculator is simple. Here's a step-by-step guide:

Step 1: Log in to Your Exness Account

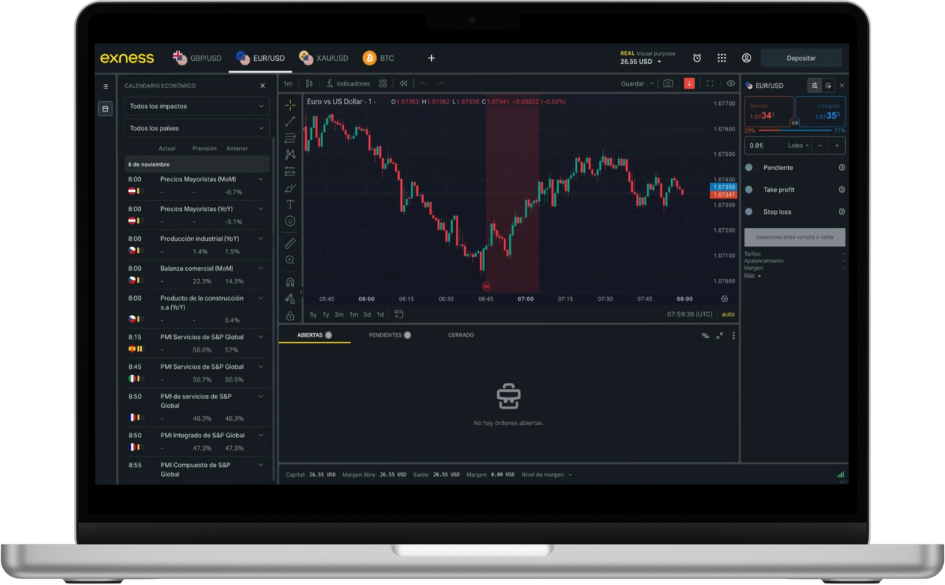

To access the Exness trading calculator, you first need to log in to your Exness account. Once logged in, navigate to the Trading Tools section on the platform or the Exness mobile app.

Step 2: Choose the Instrument and Account Type

Select the currency pair or trading instrument you want to trade. Then, choose your account currency from the available options. The calculator will adjust its parameters to reflect the account type (standard, pro, etc.) and the financial instrument you’re trading.

Step 3: Input the Trade Details

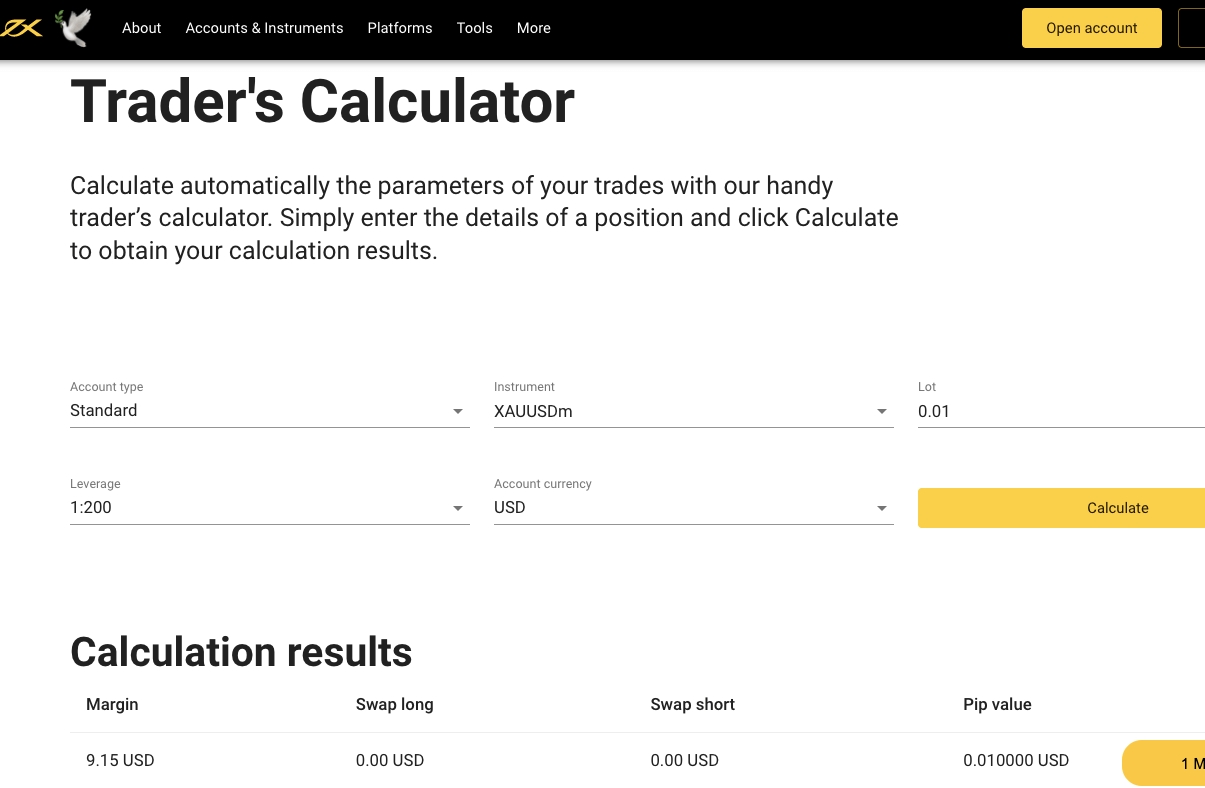

Now, input your trade size (the number of lots you plan to trade), leverage options, and stop loss or take profit levels. The calculator will then provide an estimation of your pip value, spread cost, swap fees, and margin requirements.

Step 4: Analyze the Results

Once you input the trade details, the Exness trading calculator will display the potential profit, margin requirements, risk tolerance, and leverage options. This information will give you a clear understanding of the financial aspects of the trade, allowing you to make informed decisions.

Key Calculations the Exness Trading Calculator Can Perform

The Exness trading calculator helps traders manage financial aspects by calculating several key parameters for each trade. Here are some of the most important calculations it performs:

Pip Value Calculation

The pip value is a crucial calculation for determining how much a single pip movement will affect the profit or loss in your trade. This value varies depending on the currency pair, trade size, and account currency. The calculator will automatically provide you with the pip value based on the details you enter.

Example: For a EUR/USD trade with a standard lot size (100,000 units), the pip value will be approximately $10. However, this can vary depending on the account currency and leverage you choose.

Swap Fees (Overnight Positions)

When holding a position overnight, swap fees are charged or credited to your account. The Exness trading calculator helps you calculate these fees for both long and short positions. These fees are based on the interest rate differential between the two currencies involved in the currency pair.

Example: If you open a long position on EUR/USD, the swap fee will depend on the interest rate for the EUR and USD. The calculator will provide you with the swap long and swap short fees.

Margin Requirements

Before opening a position, Exness requires you to have sufficient capital in your account to cover the margin. The calculator helps you determine the required margin based on your leverage and trade size.

Example: If you're using 100:1 leverage and want to trade 1 standard lot of EUR/USD, the required margin will be $1,000. The calculator will display this value before you confirm the trade.

Trading Costs (Spread and Commission)

The Exness trading calculator can help you estimate the trading costs associated with your trade, including the spread cost and any applicable broker fees. This is useful for calculating the net profit or loss based on the total costs incurred.

Example: If the spread for EUR/USD is 1.5 pips, and you’re trading 1 standard lot, your spread cost would be $15. The calculator will add this cost to your overall trading fees.

Why the Exness Trading Calculator is Essential for Traders

The Exness trading calculator is an invaluable tool for traders looking to optimize their capital allocation and manage trading risks effectively. By using the calculator, traders can easily calculate important parameters such as pip value, swap fees, and spread cost, which directly affect the trade outcomes and overall profitability. The calculator takes into account various calculation parameters, including account currency, leverage options, and position size, enabling traders to make informed trading decisions. By inputting key trade details, such as the currency pair, trade entry, and account type, the Exness trading calculator provides clear estimations of potential profit, net profit, and the financial impact of the trade, helping traders plan their positions and optimize their investment capital.

For both experienced traders and beginners, the Exness calculator offers crucial insights into market movements, allowing traders to assess the financial aspects of each trade, including broker fees, margin requirements, and swap short or swap long fees. It also helps determine the capital required for executing a long position or short position based on the leverage options selected. This powerful tool not only simplifies the trading process but also supports effective capital management by ensuring traders stay within their risk tolerance. With customizable trading instruments, the Exness trading platform provides a comprehensive profit calculator that reflects market conditions, allowing traders to understand how one pip movement can impact their profits and potential earnings. By using the Exness trading calculator, traders can stay ahead of price moves and gain a clear understanding of how to allocate their capital efficiently in various financial markets.

How the Exness Trading Calculator Improves Risk Management

Risk management is a crucial component of successful trading, and the Exness trading calculator is an effective tool to help manage it. The calculator enables traders to estimate potential losses, understand margin requirements, and plan capital allocation strategies according to their risk tolerance. With access to important financial aspects like trading costs, spread costs, and swap rates, traders can gain a clear understanding of the financial impact before entering a trade. This advanced functionality of the calculator empowers traders, whether novice or experienced, to plan their positions relative to their overall investment capital and avoid losing more than they can afford.

Why Use the Exness Trading Calculator?

The Exness trading calculator offers several advantages for traders looking to optimize their trading performance and capital allocation. By providing key calculations, it helps traders:

Manage risk by estimating potential losses and understanding margin requirements.

Improve decision-making by calculating pip value, swap fees, and spread costs.

Develop effective capital management strategies to ensure that your investments align with your risk tolerance.

Stay informed of the financial impact of each trade, allowing you to track your profit levels and make informed trading decisions.

Conclusion

The Exness trading calculator is a powerful tool that simplifies the process of making informed trading decisions. Whether you’re new to forex trading or an experienced trader, it helps you manage key financial aspects such as pip value, swap fees, margin requirements, and trading costs. By using this tool, you can ensure better capital management, risk control, and optimize your trading strategies. Start using the Exness calculator today and gain a clear understanding of your trade details to enhance your trading performance.

Frequently Asked Questions (FAQs)

How accurate is the Exness Trading Calculator?

The Exness trading calculator provides highly accurate results based on the details you input, such as account type, trade size, and currency pair. It’s designed to give you a clear understanding of your financial transactions before placing a trade.

Can the Exness Trading Calculator help with risk management?

Yes, the calculator allows you to estimate potential losses and helps you plan your capital allocation effectively, ensuring that you don't exceed your risk tolerance.

Do I need an Exness account to use the calculator?

While the calculator is available to Exness clients, you need to have an account to access it on the Exness platform or app.

What parameters affect the results of the Exness Trading Calculator?

Key parameters like trade size, leverage, currency pair, and account currency will affect the pip value, swap fees, and margin requirements provided by the calculator.

Can I use the Exness Trading Calculator for cryptocurrency trading?

Yes, the Exness trading calculator supports a wide range of trading instruments, including cryptocurrency pairs, allowing you to estimate trading costs and potential profits for crypto trading.