12 minute read

How to Trade the JP225 Index on Exness?

The JP225 Index, also known as the Nikkei 225, is one of the most prominent stock market indices in Japan. It tracks the performance of 225 leading companies listed on the Tokyo Stock Exchange, offering a broad representation of the Japanese economy. As a highly liquid and widely followed index, the JP225 provides numerous opportunities for traders looking to capitalize on price movements in the Asian market.

Exness, a trusted forex and CFD broker, provides a seamless platform for trading the JP225 index. Whether you are an experienced trader or a beginner, Exness offers a range of tools and features to enhance your trading experience. With low spreads, fast execution speeds, and access to advanced trading platforms like MetaTrader 4 and MetaTrader 5, Exness ensures that trading the JP225 is straightforward and efficient.

What is the JP225 Index?

The JP225 Index, commonly known as the Nikkei 225, is one of the most widely recognized stock market indices in Japan. It tracks the performance of 225 major companies listed on the Tokyo Stock Exchange (TSE). These companies represent a wide range of sectors, including technology, automotive, consumer goods, and finance, making the index a key barometer for the Japanese economy.

The Nikkei 225 is a price-weighted index, meaning that the weight of each constituent company in the index is determined by its share price rather than its market capitalization. This structure makes it unique compared to other major indices like the S&P 500, which is weighted by market cap.

Some of the notable companies included in the Nikkei 225 are Toyota, Sony, Honda, Nintendo, and Fast Retailing (Uniqlo's parent company). These firms are influential not only within Japan but also globally, contributing to the index's status as a critical indicator of Japan’s economic health.

How to Trade the JP225 Index on Exness?

Trading the JP225 Index (Nikkei 225) on Exness is a straightforward process that allows you to take advantage of price movements in one of Japan's most important market indices. Whether you're a beginner or an experienced trader, Exness provides the tools and support to make trading easier. Here’s a step-by-step guide to help you start trading the JP225 Index on Exness.

Step 1: Create an Exness Account

Before you can start trading the JP225 Index, you need to have an Exness trading account. Follow these steps to open an account:

Visit the Exness website and click on “Open Account”.

Complete the registration process by providing your personal details.

Select the account type that best suits your trading needs (e.g., Standard, Pro, or Raw Spread accounts).

Verify your identity and address, as per the KYC (Know Your Customer) requirements. This step helps ensure the safety and security of your account.

Once approved, you can access your Exness Personal Area (PA) and proceed to fund your account.

Step 2: Fund Your Account

To start trading, you’ll need to deposit funds into your Exness account. Exness offers several deposit options including:

Bank Transfers

Credit/Debit Cards

E-wallets (e.g., Skrill, Neteller, etc.)

Cryptocurrency Payments

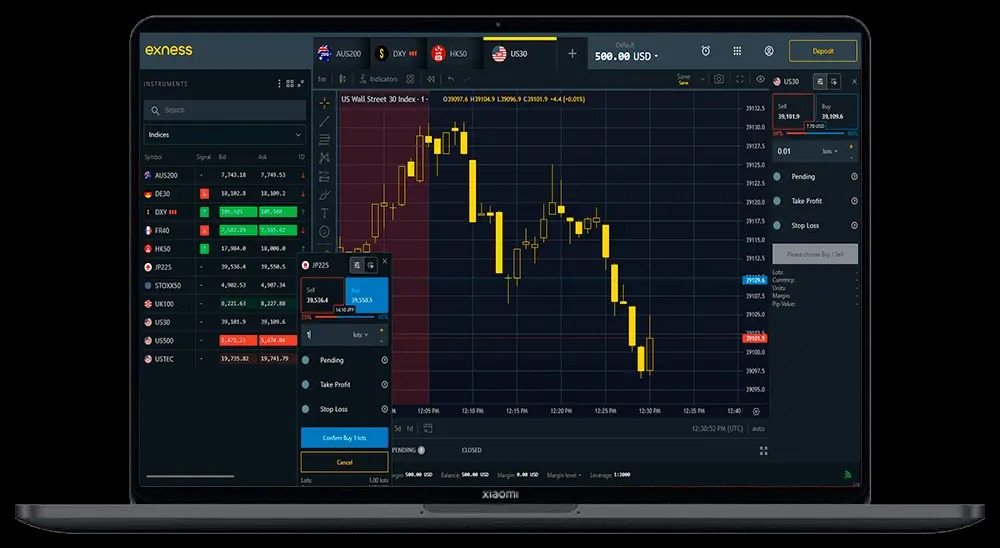

Step 3: Choose the JP225 Index on Your Trading Platform

Once your account is funded, you’ll need to access the Exness trading platform. Exness supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are user-friendly platforms that allow you to trade the JP225 Index.

Open the Platform: Download and install either MT4 or MT5 on your computer, or use the mobile app for trading on-the-go.

Log in to Your Account: Use the account credentials from your Exness Personal Area to log in to your platform.

Find the JP225 Index: Navigate to the Market Watch or Symbol List in your platform and search for the JP225 index (Nikkei 225). If it’s not visible, right-click on the Market Watch window, select Symbols, and add the JP225 index to your list.

Step 4: Opening a Position on the JP225 Index

Now that you’ve selected the JP225 Index, you can open a trade. Follow these steps:

Choose Buy or Sell: Depending on your market view, you can open a Buy position if you believe the price will rise, or a Sell position if you expect the price to fall.

Set Trade Parameters: In the New Order window, set your trade parameters:

Volume: Choose the lot size you want to trade (e.g., 1 lot, 0.5 lots).

Stop Loss and Take Profit: It’s essential to set your risk management levels by adding a Stop Loss (to limit potential losses) and a Take Profit (to lock in your profit at a specified level).

Order Type: You can place a Market Order to execute your trade instantly, or set a Pending Order to buy or sell at a specific price in the future.

Click Buy or Sell to open your position once you've set everything up.

Step 5: Managing Your Trade

Once your trade is open, it’s important to monitor and manage your position effectively:

Track Market Movements: Use technical indicators, charts, and market news within the Exness platform to track the performance of your trade.

Modify or Close Your Position: You can modify your trade by adjusting your Stop Loss, Take Profit, or order parameters. To close your trade early, right-click on the position and select Close Order.

Step 6: Risk Management

Trading indices like the JP225 Index can involve volatility. Therefore, it’s crucial to manage your risks effectively:

Leverage: Exness offers flexible leverage, allowing you to amplify your position. Be mindful of the increased risk that comes with higher leverage.

Stop-Out Protection: Exness offers Stop-Out Protection, which helps to avoid sudden account closures due to low margin levels. However, it’s always a good practice to monitor your margin levels closely.

Use Trading Tools: Exness also offers features like Trailing Stops and Alerts to help you manage your trades effectively.

Step 7: Review Your Trading Results

After closing a position, review your trade to analyze its outcome. This will help you refine your trading strategy and make better decisions in future trades.

Start Trading: Open Exness Account or Visit Website

Key Considerations when Trading the JP225 Index

Trading the JP225 Index (Nikkei 225) can be a profitable venture, but it also requires a deep understanding of the market and the factors that influence its movements. To enhance your trading strategy and minimize risks, it’s important to keep the following key considerations in mind:

Market Hours

The JP225 index is based on the performance of stocks listed on the Tokyo Stock Exchange (TSE), which operates during Japan’s trading hours. Here are the key times to be aware of:

Opening Hours: The TSE typically opens at 9:00 AM JST (Japan Standard Time) and closes at 3:00 PM JST, with a lunch break between 11:30 AM and 12:30 PM.

Volatility During Market Open and Close: Market hours can be volatile, with significant price movements occurring near the market open and close. Traders often capitalize on these fluctuations for short-term gains.

Overnight Trading: Since the Nikkei 225 is a global index, its performance can be influenced by overnight movements in global markets. Keep an eye on the Asian market hours, as well as other major international markets like the US and European markets, which can impact the Nikkei's direction.

Leverage and Margin

Leverage allows you to control a larger position with a smaller capital investment, but it also magnifies both potential profits and losses. Exness offers flexible leverage for trading the JP225 index, but it’s crucial to manage it carefully:

Choosing Leverage: Select a leverage ratio that aligns with your risk tolerance and trading strategy. Exness offers high leverage options, but high leverage can increase the risk of significant losses if the market moves against you.

Margin Calls and Stop-Out Levels: Be aware of the margin requirements for the JP225. If your account balance falls below the required margin level, you may face a margin call or automatic stop-out, which closes positions to prevent further losses. Use Stop-Out Protection offered by Exness to minimize the risk of liquidation during volatile market conditions.

Volatility and Risk

The JP225 index is known for its volatility, and its movements can be influenced by various factors, such as:

Economic Data: Economic releases from Japan, including GDP growth, inflation rates, and employment data, can significantly impact the performance of the JP225.

Geopolitical Events: Political instability or major events (e.g., elections, trade tensions) can cause sudden shifts in the index.

Corporate Earnings: The performance of the largest companies within the JP225, such as Toyota and Sony, can influence the overall direction of the index. Watch for quarterly earnings reports or any news impacting these firms.

Natural Disasters or Global Events: Earthquakes, typhoons, and natural disasters in Japan can have a temporary but strong effect on the Nikkei, impacting the index’s performance.

Economic and Political Factors

The performance of the JP225 index is closely tied to Japan's economic health and political stability. Be mindful of:

Monetary Policy: The Bank of Japan’s (BoJ) monetary policy decisions, such as interest rates or quantitative easing measures, can drive the index in different directions. A strong yen or weak yen can impact the performance of export-heavy companies like Honda and Toyota.

Global Market Influence: As a global financial hub, the Nikkei 225 is also influenced by developments in global markets, particularly in the US, China, and the EU. Be aware of how changes in US interest rates, trade tariffs, or economic sanctions can spill over into Japanese markets.

Risk Management Tools

Effective risk management is critical when trading volatile instruments like the JP225. Use the following tools to manage your risks:

Stop-Loss Orders: Always set stop-loss orders to limit your potential losses on a trade. This helps ensure that you exit the trade when the market moves against you.

Take-Profit Orders: Set take-profit levels to lock in profits when your trade reaches your desired target.

Trailing Stops: Use trailing stops to automatically adjust your stop-loss level as the price moves in your favor, securing more profits while protecting against market reversals.

Position Sizing: Be mindful of your position size to avoid overexposure. Avoid risking a large portion of your trading capital on a single trade, especially during periods of high volatility.

Start Trading: Open Exness Account or Visit Website

Why Trade JP225 on Exness?

Exness offers a comprehensive and user-friendly platform for trading the JP225 Index, making it an ideal choice for both novice and experienced traders. With ultra-fast execution speeds, traders can take advantage of even the smallest price movements on the Nikkei 225, ensuring they never miss an opportunity. The availability of low spreads and high liquidity further enhances the trading experience, keeping transaction costs low and ensuring that trades are executed quickly without slippage. Exness also provides flexible leverage, allowing traders to amplify their positions, but it is important to manage this leverage carefully, especially with volatile instruments like the JP225.

Exness supports traders with powerful tools and resources to maximize their success in the markets. MetaTrader 4 and MetaTrader 5 platforms offer advanced charting, technical indicators, and automated trading via Expert Advisors (EAs), making it easy to implement both manual and algorithmic trading strategies. Stop-Out Protection helps safeguard trades during volatile market conditions, providing an added layer of risk management. Combined with instant withdrawals, 24/7 customer support, and robust educational materials, Exness creates an environment that supports traders in every aspect of their journey, making it a trusted broker for trading the JP225 Index.

Conclusion

Trading the JP225 Index on Exness provides a seamless and efficient experience, backed by powerful tools, competitive trading conditions, and excellent support. Whether you are an experienced trader or just getting started, Exness offers everything you need to trade the Nikkei 225 with confidence, from fast execution and flexible leverage to low spreads and high liquidity. By following the simple steps of account creation, funding, selecting the JP225, and using proper risk management strategies, you can take advantage of the opportunities presented by this dynamic index. With Exness’s advanced platforms like MetaTrader 4 and MetaTrader 5, along with features like Stop-Out Protection and instant withdrawals, you are well-equipped to make informed and effective trades on the JP225 Index.

FAQ

What is the JP225 Index, and why should I trade it on Exness?

The JP225 Index, also known as the Nikkei 225, tracks the performance of 225 major companies listed on the Tokyo Stock Exchange. It is an important benchmark for Japan's economy. Trading the JP225 on Exness offers tight spreads, high liquidity, ultra-fast execution, and advanced tools like MetaTrader 4/5, which makes it a great choice for both beginner and experienced traders.

How can I open a trading account with Exness to trade the JP225 Index?

To start trading the JP225 Index, simply create an account with Exness by visiting their website and registering. Choose from various account types like Standard or Pro, verify your identity, and fund your account using one of the many available payment methods. Once your account is active, you can access the JP225 Index from your Exness trading platform.

What leverage is available for trading the JP225 Index on Exness?

Exness offers flexible leverage for trading the JP225 Index, allowing traders to adjust leverage based on their risk appetite and strategy. Leverage options can go up to 1:Unlimited, giving you the ability to control larger positions with less capital. However, always use leverage responsibly as it can magnify both potential profits and risks.

Can I trade the JP225 Index on mobile devices?

Yes, you can trade the JP225 Index on Exness through their mobile apps for MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are available for iOS and Android devices. The apps provide full access to all features, including real-time price data, charting tools, and order management, allowing you to trade on the go.

What risk management tools does Exness offer when trading the JP225 Index?

Exness offers several risk management features, including Stop-Loss and Take-Profit orders to help you manage potential losses and secure profits. Additionally, Exness provides Stop-Out Protection, which can delay or prevent stop-outs during volatile market conditions, and flexible leverage to manage your exposure to market movements effectively.

How can I withdraw my profits from trading the JP225 on Exness?

Exness provides instant withdrawals, allowing you to access your funds quickly. You can withdraw your profits using the same payment method you used for deposits, including options like e-wallets, bank cards, or cryptocurrency payments. Withdrawals are processed in seconds, even on weekends, with no extra fees for most payment methods.