5 minute read

How to Withdraw Money from Exness?

Withdrawing money from your Exness account is a straightforward process, but it’s important to understand the steps, methods, and rules to ensure a smooth experience. This guide will cover everything you need to know, including withdrawal methods, limits, fees, and tips for successful withdrawals.

What You Need to Know Before Withdrawing Funds from Exness

Before withdrawing money from Exness, make sure you meet the necessary requirements. Use the same payment method you selected for depositing funds, as Exness requires consistency for security reasons. Ensure your account is fully verified, including submitting proof of identity and address, to avoid delays. Lastly, familiarize yourself with the minimum withdrawal amount for your chosen method and check for any applicable fees from Exness or your payment provider.

Start Trading: Open Exness Account or Visit Website

Step-by-Step Guide to Withdraw Money from Exness

Log in to Your Exness Personal AreaAccess your account on the Exness website or mobile app. Ensure you have your login credentials and two-factor authentication enabled.

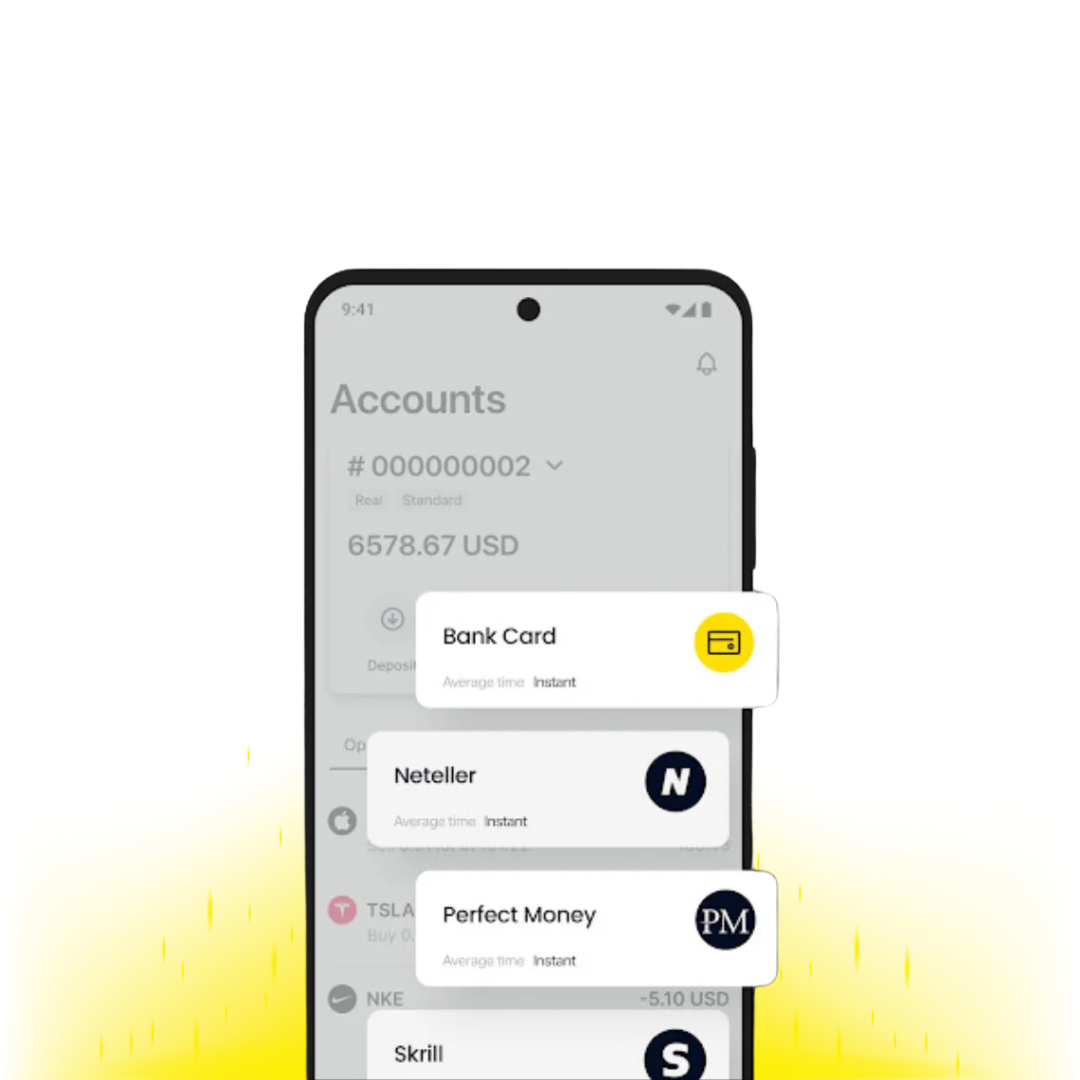

Navigate to the Withdrawal SectionIn your Personal Area, click on the “Withdrawal” tab to see all available withdrawal methods.

Select Your Preferred Payment MethodChoose the same payment method you used for depositing funds (e.g., bank transfer, e-wallet, or card).

Enter Withdrawal DetailsFill in the required details, such as the amount you want to withdraw, account number, and payment method information.

Submit the Withdrawal RequestConfirm the transaction by entering the verification code sent to your registered email or phone.

Wait for ProcessingWithdrawal processing times vary depending on the payment method. E-wallets are often processed within a few hours, while bank transfers may take 1-5 business days.

Available Withdrawal Methods on Exness

Exness supports various withdrawal options to suit traders worldwide. Common methods include:

Bank Transfers: Ideal for larger sums, though processing may take a few business days.

E-Wallets: Options like Skrill, Neteller, and WebMoney offer fast and secure withdrawals, often processed within a few hours.

Credit/Debit Cards: Withdraw funds directly to the same card you used for deposits.

Cryptocurrencies: For traders using crypto wallets, withdrawals can be processed in digital currencies.

Start Trading: Open Exness Account or Visit Website

Minimum Withdrawal Amounts and Limits

Exness has a minimum withdrawal amount for different payment methods. For example:

E-wallets: As low as $1.

Bank Transfers: Minimums vary depending on the bank.

Cards: Minimums typically align with the deposit method.

Always check the Exness website or contact customer support for the latest withdrawal limits.

Fees for Withdrawing Money from Exness

Exness generally does not charge fees for withdrawals. However, some payment providers may impose currency conversion fees or transaction charges. Always confirm with your payment provider to avoid surprises.

Common Issues When Withdrawing Funds

Traders may encounter a few common issues when withdrawing funds, but these can be resolved easily. Always use the same payment method for deposits and withdrawals to avoid mismatches. Double-check your account number and payment method details to ensure accuracy before submitting a withdrawal request. Make sure your account is fully verified, as incomplete verification can cause delays. If your withdrawal is taking longer than expected, reach out to Exness customer support for assistance.

Best Practices for Smooth Withdrawals

To ensure a hassle-free withdrawal process with Exness, start by verifying your account during the setup stage. Completing verification early, including providing proof of identity and address, helps prevent delays when withdrawing funds. Choose reliable payment methods like e-wallets, which typically offer faster processing times compared to traditional bank transfers, for quicker access to your funds.

Keep track of the withdrawal limits and any fees associated with your preferred method to avoid unexpected surprises. Understanding these details allows you to plan your transactions more effectively. If you encounter any issues or have questions, don’t hesitate to contact Exness customer support for prompt assistance. This proactive approach ensures smooth and efficient withdrawals every time.

Conclusion

Withdrawing money from Exness is a simple and reliable process when you follow the correct steps and choose the right payment methods. By understanding the platform’s requirements, fees, and processing times, traders can manage their financial transactions effectively and enjoy a seamless trading experience. For more information, visit the Exness website or contact their 24/7 customer support team.

FAQ

Can I withdraw funds to a different payment method?No, Exness requires you to use the same payment method for withdrawals as used for deposits.

How long does it take to withdraw money?Processing times vary. E-wallet withdrawals are usually completed within a few hours, while bank transfers may take 1-5 business days.

Are there fees for withdrawing funds?Exness typically does not charge withdrawal fees, but your payment provider may impose transaction or currency conversion fees.

What is the minimum withdrawal amount?The minimum withdrawal amount varies by method. For example, e-wallets may allow withdrawals as low as $1.

How do I resolve a delayed withdrawal?Double-check your withdrawal details and ensure your account is verified. If the issue persists, contact Exness customer support.