14 minute read

XRP Future Price Prediction

XRP, the native cryptocurrency of the Ripple Network, has been one of the most discussed and volatile digital assets in the cryptocurrency market since its inception in 2012. As a payment protocol designed to enable fast and low-cost cross-border transactions, XRP is unique in its value proposition compared to other cryptocurrencies like Bitcoin and Ethereum. XRP has made significant strides with partnerships and adoption by major financial institutions; however, its price has been heavily influenced by regulatory challenges and market sentiment. Predicting its future price is difficult, given the volatility of the crypto market, but we can look at several key factors that will likely affect its price trajectory in the near and distant future.

What is XRP?

XRP is a digital asset and cryptocurrency designed for fast, low-cost transactions within the Ripple network. Ripple, the company behind XRP, created the cryptocurrency to serve as a bridge currency in cross-border payments, allowing for quicker and cheaper transfers between different fiat currencies. XRP is often compared to other cryptocurrencies like Bitcoin and Ethereum, but it is unique in that it is more focused on enabling payments and financial transactions rather than being used as a store of value or a medium for decentralized applications.

XRP is designed to work within the Ripple network, which is a blockchain-based system that facilitates real-time payments between financial institutions. Ripple's primary goal is to provide a faster, more efficient alternative to traditional payment networks like SWIFT. The key selling points of XRP are its speed and low cost—transactions on the XRP network are settled in seconds, with extremely low fees, making it an attractive option for cross-border remittance and international money transfers.

How XRP Works

Unlike other cryptocurrencies, XRP does not use a proof-of-work or proof-of-stake consensus mechanism. Instead, it uses a unique consensus algorithm called RippleNet's consensus protocol, which relies on a network of independent validators to approve transactions. Here's how the system works:

RippleNet and Validators:RippleNet is the decentralized network of independent validators that verify the legitimacy of transactions. Validators are entities that participate in the consensus process and help validate transactions, ensuring that only legitimate transfers are included in the ledger. This consensus protocol is faster and more energy-efficient than traditional proof-of-work systems, like Bitcoin’s.

Transaction Speed and Cost:One of the major advantages of XRP is its speed. A typical transaction on the XRP Ledger is confirmed in 4-5 seconds, much faster than Bitcoin or Ethereum, which can take minutes or even longer. Additionally, XRP transactions are extremely low cost, often costing just a fraction of a penny. This makes it ideal for cross-border payments, where traditional payment methods are often slow and expensive.

XRP as a Bridge Currency:XRP’s primary use case is as a bridge currency in international transactions. When two parties want to transfer funds but do not share a common currency, XRP can be used to facilitate the transaction. For example, if someone in the U.S. wants to send money to someone in Mexico, and the two parties do not have a shared currency, XRP can be used to complete the transfer. The sender exchanges their USD for XRP, and then the receiver can exchange the XRP for Mexican Pesos (MXN). This bridge mechanism significantly reduces the cost and time associated with traditional foreign exchange methods.

Ripple’s Role:Ripple, the company behind XRP, provides the software that enables financial institutions to connect to the XRP network. Ripple’s payment platform, called RippleNet, allows banks and payment providers to settle transactions instantly and securely across borders, with XRP being the bridge currency in the transaction. Ripple works with a wide range of institutions, including Santander, PNC, and American Express, helping them use XRP and Ripple’s technology to improve cross-border payment systems.

XRP Ledger:The XRP Ledger is an open-source, decentralized ledger that stores all transactions in XRP. It is designed to be highly scalable and can handle a large number of transactions per second. Unlike many other cryptocurrencies that use a public blockchain, the XRP Ledger operates with a more permissioned approach, where validators are hand-picked based on their reputation and trustworthiness. The XRP Ledger is also carbon-neutral, meaning it consumes significantly less energy than Bitcoin and Ethereum.

Start Trading: Open Exness Account or Visit Website

Factors Influencing XRP’s Price

The price of XRP is influenced by a combination of factors, some of which are specific to the cryptocurrency itself, while others are linked to broader market conditions, regulatory developments, and adoption rates. Understanding these factors is crucial for traders and investors looking to predict or analyze XRP’s price movements. Below are the key factors that impact XRP's price:

Market Sentiment

Market sentiment plays a significant role in the price movements of XRP, just like with other cryptocurrencies. Positive news or developments, such as new partnerships, adoption by financial institutions, or technological advancements, can create bullish sentiment, driving the price of XRP higher. Conversely, negative news, such as regulatory scrutiny or a decline in market confidence, can lead to price corrections or downward pressure. The cryptocurrency market is often driven by emotions and speculation, meaning that XRP’s price can be highly volatile in response to shifts in sentiment.

The influence of social media, public perceptions, and the sentiment of institutional investors or whales can also lead to price fluctuations in the short term. When large players in the market make moves, it can trigger significant price swings.

Regulatory Environment

One of the most important factors influencing XRP's price is the regulatory landscape surrounding it. XRP has faced legal challenges in the past, most notably the ongoing lawsuit filed by the U.S. Securities and Exchange Commission (SEC) in December 2020. The SEC alleges that XRP is a security and that Ripple Labs conducted an unregistered securities offering by selling XRP. The outcome of this case is crucial for the future of XRP, as a negative ruling could lead to delisting of XRP on major exchanges or regulatory restrictions that may hinder its adoption. This uncertainty has caused significant volatility in the price of XRP since the lawsuit was announced.

Additionally, global regulations related to cryptocurrencies and digital assets will continue to play a role in determining XRP’s value. If more countries adopt clear regulations for cryptocurrencies, including XRP, it could lead to greater institutional adoption and price growth. Conversely, regulatory crackdowns or restrictions could negatively impact XRP’s price and adoption.

Adoption and Partnerships

The level of adoption and the partnerships Ripple (the company behind XRP) forms are central to determining XRP’s long-term price potential. Ripple has made significant strides in partnering with financial institutions, payment providers, and banks across the globe to use XRP and Ripple’s technology for cross-border payments. Major partnerships with companies like Santander, American Express, and PNC have helped establish XRP as a legitimate solution for improving payment systems, particularly in the remittance market.

The wider adoption of Ripple’s technology and the increased use of XRP as a bridge currency for international payments can drive demand for XRP, pushing its price higher. As Ripple continues to secure new partnerships, particularly with central banks or large payment providers, the demand for XRP could increase significantly, resulting in upward price movement.

Technological Developments

Ripple is continually improving the XRP ledger and adding new features to enhance its scalability, speed, and efficiency. Any technological advancements that increase the utility or speed of XRP transactions could positively affect the price. For example, improvements in transaction speed, lower fees, and increased scalability would make XRP more attractive to both institutional and retail users.

Technological upgrades also play a role in ensuring that XRP stays competitive in the cross-border payments space, where competition from solutions like SWIFT GPI or central bank digital currencies (CBDCs) is increasing. If Ripple’s technology becomes the preferred choice for global payment systems, it could boost the price of XRP by creating additional demand for the token.

Competition

XRP faces competition from other cryptocurrencies and blockchain-based solutions targeting the cross-border payments market. Stellar (XLM), a project that shares some of Ripple’s goals, is often considered a direct competitor to XRP, especially given that both Ripple and Stellar were founded by the same person, Jed McCaleb. As competition increases from other projects aiming to revolutionize payments and remittances, XRP may face downward pressure on its price if these projects gain traction or better adoption from key financial players.

Furthermore, the growing interest in central bank digital currencies (CBDCs) could present competition for XRP as countries explore creating their own digital currencies for international payments. If more central banks adopt CBDCs, this could impact XRP’s use case and limit its market share in the cross-border payment space.

XRP Historical Price Trends and Performance

XRP, the cryptocurrency created by Ripple Labs, has experienced significant price fluctuations since its launch in 2012. While it is often recognized for its role as a bridge currency for cross-border payments, its price movements are influenced by various factors such as market sentiment, regulatory challenges, technological developments, and global adoption. Understanding XRP’s historical price trends is essential for gaining insight into its potential future performance.

Early Years and Initial Trading (2012 - 2016)

XRP was launched in 2012 by Ripple Labs and initially traded at a very low value, around $0.01 per XRP. In these early years, Ripple's technology and the use case for XRP were still in development, and its market presence was relatively small. The cryptocurrency market itself was in its infancy, and XRP was mainly used by early adopters and Ripple’s early partners, including financial institutions looking to explore the potential of blockchain technology.

During this period, XRP’s price remained fairly stable, with slow but steady increases as Ripple gained more recognition in the tech and financial sectors. By 2016, XRP’s price saw modest growth but still traded at under $0.10. Ripple’s primary focus during this period was building partnerships with banks, payment providers, and other financial institutions, which laid the foundation for the future growth of XRP’s utility.

The Bull Run and 2017 Surge

The year 2017 was a pivotal moment for XRP, as the entire cryptocurrency market saw an explosive rise in demand, driven by mainstream interest and a booming initial coin offering (ICO) market. XRP, like many other cryptocurrencies, benefited from this bullish trend, and its price surged dramatically.

Post-Bull Run and Price Correction (2018 - 2020)

After the peak in January 2018, XRP, along with the rest of the cryptocurrency market, experienced a major price correction throughout 2018 and into 2019. By mid-2018, XRP’s price had dropped to the $0.30 - $0.50 range, reflecting the overall cooling down of the market and the decline in investor optimism after the 2017 bull run.

In 2019, XRP continued to trade between $0.20 and $0.50, with occasional spikes and dips based on market events and Ripple’s business developments. The price was largely stagnant during this period, with some analysts attributing the lack of significant movement to the market’s uncertainty regarding the SEC lawsuit against Ripple Labs, which was filed in late 2020. Despite this, XRP’s partnerships and increasing adoption for cross-border payments allowed it to maintain a position in the top 10 cryptocurrencies by market cap.

The Impact of the SEC Lawsuit (2020 - Present)

The SEC lawsuit, filed against Ripple Labs in December 2020, accused the company of conducting an unregistered securities offering by selling XRP. The announcement of this legal challenge caused a significant decline in XRP’s price, as many exchanges delisted or paused trading of XRP due to the uncertainty surrounding the lawsuit. As a result, XRP’s price plummeted in the final months of 2020, dropping from around $0.60 in early December to under $0.20 in late December.

In 2021, XRP experienced price fluctuations as the lawsuit progressed, with positive legal developments pushing the price higher and negative news leading to further drops. Throughout 2021, XRP traded within a range of $0.50 to $1.80, often following the general market trends in the broader cryptocurrency market.

Despite the ongoing regulatory issues, XRP has remained one of the top 10 cryptocurrencies by market capitalization. The outcome of the SEC case will be a major factor in determining XRP's long-term price trajectory, as a favorable settlement or ruling could result in renewed investor confidence and a potential price surge. Conversely, an unfavorable ruling could lead to further price declines and regulatory hurdles.

XRP's Performance in 2021 and 2022

In 2021, XRP managed to maintain significant market relevance despite the ongoing legal challenges. The price saw some upward momentum during the general crypto market rally, with XRP reaching $1.80 in April 2021, driven by strong market sentiment and continued institutional interest in cryptocurrencies.

However, regulatory uncertainties surrounding the SEC lawsuit and the growing competition from other payment-focused cryptocurrencies and blockchain technologies kept XRP’s price from hitting new all-time highs. XRP's price fluctuated between $0.50 and $1.50 for most of 2021, reflecting the broader market dynamics and the lack of resolution on the legal front.

In 2022, XRP faced further challenges, with the market downturn caused by broader economic conditions, including the global cryptocurrency market crash. XRP’s price followed the downward trend of many other digital assets, dropping to below $0.40 by mid-2022, as investor sentiment was dampened.

Start Trading: Open Exness Account or Visit Website

Conclusion

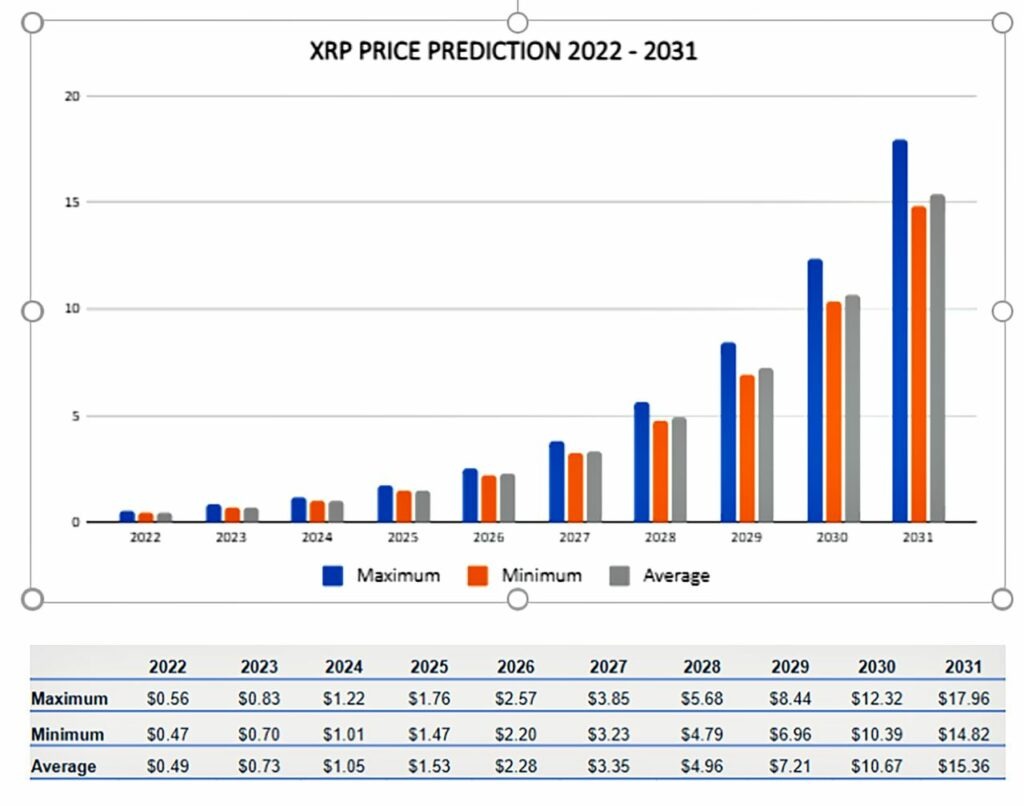

Predicting the future price of XRP is inherently challenging due to the various risks and uncertainties that impact its value. Factors such as regulatory developments, particularly the ongoing SEC lawsuit, the evolving market sentiment, and the increasing competition from other digital payment solutions or central bank digital currencies (CBDCs) all play a significant role in shaping XRP’s price trajectory. Additionally, technological innovations and Ripple’s strategic partnerships can create potential upside for XRP if they lead to broader adoption in the global payments industry.

However, the volatility of the cryptocurrency market, combined with the uncertainty surrounding Ripple’s legal battles and the potential supply issues related to XRP’s escrow releases, make it difficult to offer a clear price prediction. While XRP has shown resilience in the face of market challenges, its future price will depend largely on how these various factors unfold.

Ultimately, XRP remains a highly speculative investment. Traders and investors need to closely monitor developments in regulatory landscapes, Ripple’s technological progress, and global adoption trends, as these will play crucial roles in determining XRP's long-term price potential. Despite the challenges, XRP’s unique position in the cross-border payment space provides a strong case for its future growth, but risks remain that must be carefully considered by anyone looking to invest.

FAQs

What is XRP?

XRP is a cryptocurrency developed by Ripple Labs, designed to facilitate fast, low-cost cross-border payments between financial institutions and payment providers.

Why is XRP different from Bitcoin?

Unlike Bitcoin, which relies on mining and is primarily seen as a store of value, XRP uses a consensus protocol for transaction validation and is primarily used as a bridge currency for international payments.

How does XRP’s price fluctuate?

XRP’s price is influenced by market sentiment, regulatory news, global economic conditions, Ripple’s partnerships, and its legal status, especially regarding the ongoing SEC lawsuit.

What is the SEC lawsuit against Ripple?

The SEC lawsuit accuses Ripple Labs of conducting an unregistered securities offering by selling XRP. The outcome of this case could significantly impact XRP’s price and adoption.

How does XRP's technology work?

XRP operates on the XRP Ledger, a decentralized network of independent validators, using a unique consensus algorithm that enables fast and low-cost transactions compared to traditional cryptocurrencies.

What factors affect XRP’s adoption by financial institutions?

Ripple’s partnerships with banks, regulatory clarity, technological innovation, and demand for cross-border payments are key factors that influence XRP’s adoption in the financial sector.

Can XRP be a good investment?

While XRP has the potential for growth due to its use case in global payments, it also carries risks, particularly related to regulatory uncertainty and market volatility, making it a speculative investment.