7 minute read

Which Countries are Supported by Exness?

Exness is a global forex broker that offers services to traders from many countries around the world. However, due to regulatory requirements, there are some regions where Exness cannot offer its services, such as Iran, North Korea, and other regions under sanctions. For the rest of the world, Exness supports a wide range of countries and regions, providing access to multi-asset financial services and forex trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). With substantial monthly liquidity and the ability to trade a variety of currency pairs, Exness offers robust trading environments for both retail investors and professional traders. Traders from the British Virgin Islands, Northern Mariana Islands, and Marshall Islands are some examples of countries supported by Exness, benefiting from deep liquidity and professional liquidity solutions.

As a regulated broker, Exness complies with financial services authorities in several regions and offers services to retail clients and institutional investors alike. This includes countries under financial service providers (FSP), ensuring client funds are well-managed with client fund segregation for security. Traders worldwide can open Exness accounts with multiple account currencies, choose their trading style, and utilize risk management strategies. Additionally, Exness offers educational resources like the Exness demo account, allowing beginner traders to practice and improve their trading skills before entering the live markets. Traders union team also highlights Exness' commitment to providing superior trading experiences with enhanced pricing and minimal or no slippage. Exness' financial market access is highly valued for its advanced trading tools, technical analysis, and trading signals, making it a popular choice for forex trading across many regions.

Exness: A Global Forex Broker

Exness offers its services to retail clients and professional traders across a broad array of countries. The broker operates in numerous jurisdictions, offering multi-asset financial services for those looking to trade in the forex market, CFD trading, and other financial instruments. Exness has established a strong presence in the financial sector, with a commitment to providing competitive trading conditions, including enhanced pricing, substantial monthly liquidity, and minimal or no slippage.

Exness’s robust trading environment ensures traders can access liquid financial markets and real-time trading data across multiple asset classes. While the broker offers a wide range of account types and trading platforms, traders should be aware of the regulatory framework that governs Exness’s operations in different regions. Exness is regulated by multiple financial services authorities globally, including those in the British Virgin Islands, Cyprus, and the United Kingdom. However, there are certain countries where Exness cannot offer its services due to regulatory restrictions.

Supported Countries by Exness

Exness accepts clients from a variety of countries, offering a broad range of professional traders and retail investor accounts. Countries where Exness provides services include:

European Union Countries: Exness supports many EU countries, where it is regulated by the Cyprus Securities and Exchange Commission (CySEC). These countries include Spain, Italy, Germany, France, and others within the EU jurisdiction.

Asian Countries: Exness also provides services to Asian countries like India, China, and Indonesia, ensuring that local traders can access Exness’s advanced trading platforms such as MT4 and MT5 for forex trading and CFD trading.

Middle Eastern Countries: Exness serves traders from countries like the United Arab Emirates, Saudi Arabia, and Qatar, offering tailored trading strategies and trading tools for local markets.

African Countries: Traders from several African countries such as South Africa, Kenya, and Nigeria also have access to Exness’s trading services, benefiting from low trading costs, competitive spreads, and advanced market analysis.

Exness also offers its services to traders in the United States, although certain restrictions may apply to residents in some states due to regulatory constraints.

Countries Not Supported by Exness

While Exness provides services to traders worldwide, there are several countries where Exness does not offer its financial services. These restrictions are often due to regulatory requirements or limitations imposed by the financial services authorities in specific jurisdictions. Some of the countries not supported by Exness include:

North Korea: Due to international sanctions and restrictions, Exness does not accept traders from North Korea.

Iran: Due to economic sanctions, Exness does not offer services to traders based in Iran.

United States: Exness does not provide its services to residents of the United States, as the company is not registered with the Securities and Exchange Commission (SEC) in the U.S. and does not meet the financial regulatory requirements for American clients.

Other Restricted Countries: Exness also cannot provide services in countries under sanctions by international bodies like the UN, EU, or US, including Syria, Cuba, and Sudan.

Start Trading: Open Exness Account or Visit Website

How Does Exness Work with Regulatory Bodies?

Exness operates under the strict oversight of multiple financial services authorities across the globe. The broker is regulated by the Financial Conduct Authority in the UK, ensuring that it meets high standards of financial compliance. In addition, Exness is registered in the British Virgin Islands (BVI) and regulated by the International Financial Services Commission (IFSC), offering a secure and trustworthy environment for traders from countries where it is authorized to operate.

Exness UK Ltd operates in compliance with UK regulations and adheres to the standards set by the Financial Conduct Authority (FCA). Exness also offers services to retail clients in countries where it has received express written permission from local regulatory bodies. The broker’s client fund segregation, combined with its robust risk management strategies, ensures that traders’ funds are protected in accordance with the financial regulations of the regions it serves.

Exness Trading Platform and Account Types

Exness offers a wide variety of trading accounts, including Standard accounts, Zero Spread accounts, and Pro accounts, with each designed to meet the needs of different traders. The Exness trading platform provides access to a diverse range of trading instruments and financial markets, including forex pairs, commodities, and cryptocurrencies.

Exness is also known for its user-friendly trading platforms, advanced tools, and access to market analysis, which helps traders make informed decisions. Whether you are a beginner trader or an experienced trader, Exness provides the trading conditions needed to succeed in the financial markets. The broker also offers copy trading options, allowing retail clients to follow professional traders’ strategies.

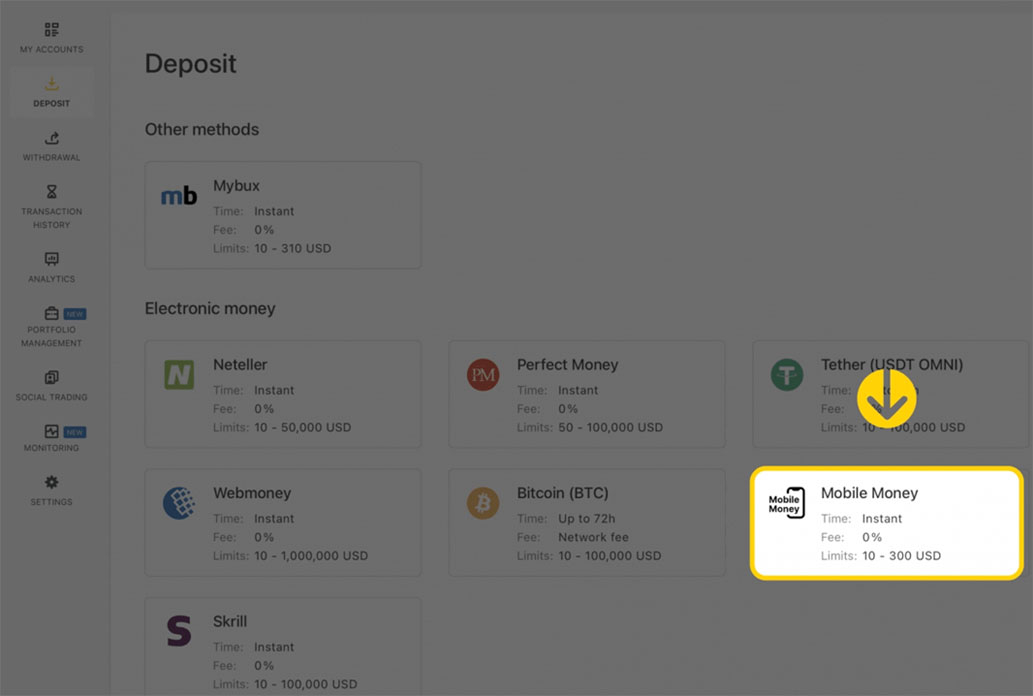

Exness Payment Systems and Deposit Methods

Exness provides a variety of payment systems and deposit methods, making it easy for international traders to fund their accounts. Bank wire transfers, e-wallets, and credit cards are all accepted, with minimal withdrawal fees and no hidden fees. The broker’s fast deposit and withdrawal methods make it convenient for traders to manage their funds effectively.

Start Trading: Open Exness Account or Visit Website

Exness also offers segregated client accounts, ensuring that traders’ funds are kept separate from the broker’s operational funds for added security. For traders using the Exness demo account, these payment options also allow them to practice trading without the risk of losing real money.

Frequently Asked Questions (FAQ)

Which countries are supported by Exness?

Exness provides services to most countries, including the UK, EU, Asia, and Africa, with certain restrictions in countries like Iran, North Korea, and the US.

Can I trade XAUUSD on Exness?

Yes, you can trade XAUUSD on Exness’s Zero Spread Account, which offers zero spreads with a fixed commission fee.

Is Exness regulated?

Yes, Exness is regulated by multiple financial authorities, including the FCA in the UK, the Cyprus Securities, and the Financial Conduct Authority (FCA).

What is the minimum deposit on Exness?

The minimum deposit on Exness depends on the account type, starting as low as $1 for Standard accounts.