12 minute read

Does Exness Work in India?

As forex and CFD trading continues to gain popularity around the world, more traders are seeking reliable platforms that provide competitive trading conditions, advanced tools, and user-friendly features. Exness, a globally recognized forex and CFD broker, is known for its fast execution, tight spreads, and flexibility. However, many Indian traders wonder if they can access and use Exness to pursue their trading goals.

In this article, we’ll explore whether Exness works in India, discussing its availability, regulatory status, trading conditions, and the specific services Exness offers to Indian traders. With India’s growing interest in forex and online trading, it’s essential to understand whether Exness is a suitable option for those looking to trade in the Indian market. We’ll also highlight key considerations such as deposit and withdrawal methods, customer support, and security to help you make an informed decision about using Exness in India.

Introduction to Exness

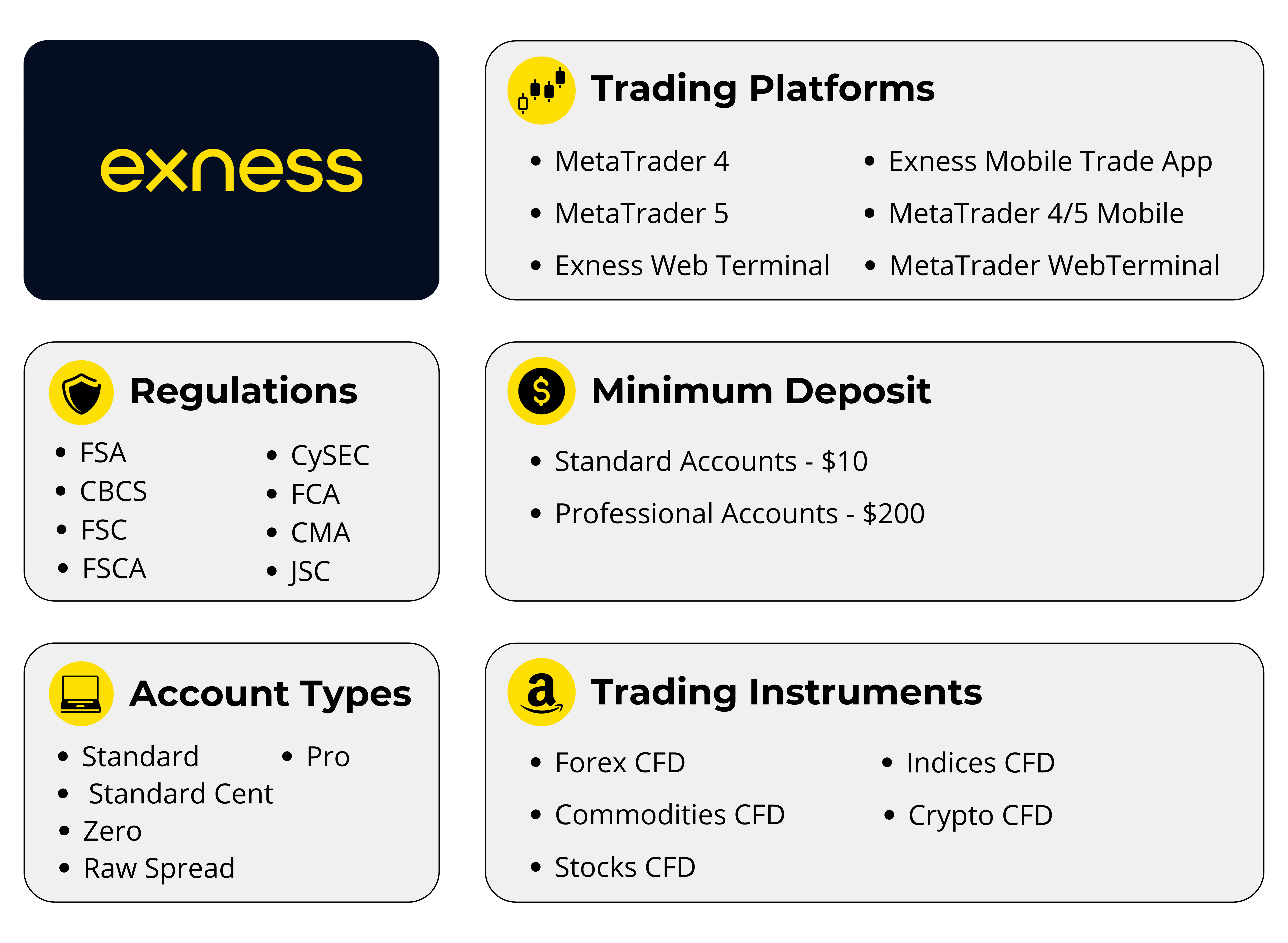

Exness is a leading global online broker that offers a range of financial instruments for trading, including forex, commodities, indices, cryptocurrencies, and stocks. Founded in 2008, Exness has quickly built a reputation for its transparent pricing, fast execution, and innovative trading solutions. It is trusted by thousands of traders worldwide, thanks to its commitment to providing a user-friendly platform, competitive trading conditions, and robust customer support.

With a focus on empowering traders, Exness offers a variety of account types, flexible leverage options, and advanced tools to suit both beginner and experienced traders. Whether you prefer trading on MetaTrader 4 (MT4) or MetaTrader 5 (MT5), Exness provides seamless access to these popular platforms with real-time data and low spreads.

Regulated in multiple jurisdictions and with a reputation for high security, Exness ensures a safe trading environment while allowing its clients to benefit from fast order execution and excellent liquidity. The broker’s dedication to customer satisfaction, transparency, and innovation makes it a strong choice for traders around the globe.

Start Trading: Open Exness Account or Visit Website

Exness' Availability in India

Exness is accessible to traders in India, providing a reliable and transparent trading environment for those looking to engage in forex, CFD, and cryptocurrency trading. The broker has made its platforms available to Indian residents, allowing them to take part in the global financial markets with ease. Below, we’ll explore the key aspects of Exness' availability in India, including its legal framework, supported trading platforms, and whether Indian traders can sign up and use Exness without any restrictions.

1. Is Exness Accessible for Indian Traders?

Yes, Exness works in India, and Indian traders can open accounts, deposit funds, and trade across various asset classes. The broker accepts clients from India and has made its platforms accessible for both novice and professional traders. Traders in India can use Exness to trade a wide range of instruments, such as forex pairs, commodities, indices, cryptocurrencies, and stocks.

However, it is important for Indian traders to ensure they are in compliance with India’s foreign exchange regulations when trading online. Although Exness itself is a legitimate and regulated broker, Indian traders should always ensure they understand the local regulations regarding online trading and forex transactions. This will help them make informed decisions about their investments.

2. Exness’ Regulatory Status in India

Exness is regulated in multiple jurisdictions, including top-tier regulatory bodies like the FCA (UK), CySEC (Cyprus), and FSCA (South Africa). However, Exness does not have a specific Indian regulatory license. This means that while Exness operates internationally, Indian traders do not have local regulation governing their accounts directly under Indian law.

While Indian residents are allowed to trade with international brokers like Exness, they must adhere to India’s foreign exchange regulations under the Foreign Exchange Management Act (FEMA). In most cases, Indian traders can use Exness to trade forex, but should be aware of legal requirements for remitting foreign exchange or withdrawing funds internationally.

3. Exness Platforms Available for Indian Traders

Exness offers access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most widely used trading platforms in the world. Both platforms are available to Indian traders, allowing them to trade on both desktop and mobile devices, making trading convenient and accessible from anywhere.

4. Exness' Customer Support for Indian Traders

Exness offers customer support in multiple languages, including English and Hindi, making it easier for Indian traders to receive assistance when needed. The support team can be reached via live chat, email, and phone, ensuring that traders can access help at any time. Exness also provides educational resources, including tutorials and webinars, to help Indian traders enhance their skills and improve their trading experience.

5. Exness’ Security and Trustworthiness in India

Exness is highly regarded for its security measures, ensuring the protection of client data and funds. Indian traders can trust Exness’ secure platforms, which are protected by SSL encryption, two-factor authentication (2FA), and other advanced security protocols. These features ensure that traders' accounts remain secure, and their transactions are processed safely.

Trading Conditions for Indian Traders

Exness offers highly competitive and flexible trading conditions that make it an attractive option for Indian traders. With a wide range of account types, low spreads, flexible leverage, and multiple payment options, Exness creates an environment that caters to both novice and experienced traders. Indian traders can access various markets, including forex, commodities, cryptocurrencies, and indices, with the security and support that Exness provides.

Exness provides multiple account types designed to suit the diverse needs of traders. For those just starting out or with a more conservative approach, the Standard Account offers low minimum deposit requirements and no commissions, making it an excellent choice for beginners. For traders who require tighter spreads and faster execution, Exness offers the Pro Account, which caters to more experienced traders. The Raw Spread Account is designed for advanced traders who need ultra-low spreads and are willing to pay a small commission for better execution, making it ideal for high-frequency traders or scalpers. Indian traders can choose from these accounts based on their trading style, risk appetite, and capital.

Start Trading: Open Exness Account or Visit Website

In terms of leverage, Exness offers flexible options with a maximum of up to 1:2000 depending on the account type and asset class. This high leverage allows Indian traders to control larger positions with relatively small amounts of capital. However, while leverage can magnify profits, it also increases potential risks, which means traders should always apply solid risk management strategies to avoid significant losses. Exness also keeps margin requirements relatively low, ensuring that traders can manage their positions effectively, even with smaller account sizes.

The broker's spreads and commissions are highly competitive. The Standard Account offers spreads starting from 0.3 pips on major forex pairs, with no commission attached, making it ideal for traders who prefer simple and cost-effective trading conditions. In contrast, the Pro Account and Raw Spread Account offer tighter spreads starting from 0.1 pips and 0.0 pips respectively, though commissions apply to the latter. These accounts are ideal for traders who rely on low transaction costs, particularly those who engage in short-term strategies like scalping or day trading. With Exness, Indian traders can benefit from both cost-effective and advanced trading conditions, depending on their individual needs.

Indian traders also have access to a wide range of payment methods for both deposits and withdrawals. Exness supports bank wire transfers, credit and debit cards (Visa, MasterCard), and e-wallets like Skrill, Neteller, and Perfect Money, which provide quick and easy ways to fund their accounts. While deposits are generally processed instantly, withdrawal times may vary depending on the chosen method, with e-wallets typically being faster. Exness offers a seamless experience for Indian traders when it comes to funding and withdrawing from their trading accounts, ensuring that traders can access their funds when needed.

Deposits and Withdrawals for Indian Traders

Exness offers a wide range of deposit and withdrawal methods that cater to Indian traders, ensuring they can fund their accounts and access their profits quickly and securely. Indian traders can choose from various payment methods, including traditional bank transfers, credit/debit cards, and popular e-wallets. Exness strives to make the process of depositing and withdrawing funds as seamless and efficient as possible, offering flexibility in terms of speed and payment options.

One of the most commonly used deposit methods for Indian traders is bank wire transfers. While this method is secure and reliable, it may take a few business days for the funds to be credited to an Exness account. This option is particularly useful for larger deposit amounts, and traders can easily use their local bank accounts to transfer funds to their trading accounts. For traders who prefer faster processing times, credit and debit cards such as Visa and MasterCard are also supported by Exness. These methods provide instant deposits, enabling Indian traders to start trading almost immediately after making a deposit. This quick deposit method is popular among those who need to fund their accounts without delays.

In addition to traditional bank transfers and credit cards, Exness also supports e-wallets such as Skrill, Neteller, and Perfect Money, which offer faster transaction speeds compared to bank transfers. E-wallets are particularly favored by traders for their convenience and speed, as deposits made via these methods are processed instantly, allowing traders to begin trading right away. Moreover, e-wallets also offer a convenient way to withdraw funds quickly. For Indian traders, e-wallets are one of the most efficient methods to manage their funds and avoid lengthy delays associated with other payment methods.

Exness also supports local payment methods, such as UPI (Unified Payments Interface), although availability may vary depending on the region. UPI has become one of the most popular payment options in India due to its simplicity and instant transfer capabilities. While not always directly available for Exness deposits, Indian traders can use third-party e-wallets that support UPI to facilitate their transactions.

Customer Support and Language Options

Exness offers comprehensive and accessible customer support for Indian traders, ensuring they receive the help they need when using the platform. Recognizing the diverse needs of its global client base, Exness provides multiple support channels to address issues quickly and efficiently. Whether you're a beginner seeking guidance or an experienced trader facing technical issues, Exness makes it easy for Indian traders to get in touch with a support representative through various channels, including live chat, email, and phone support.

The live chat option is one of the most efficient ways to get immediate assistance. Available 24/7, this feature allows Indian traders to connect with a customer service representative in real-time. It’s ideal for resolving urgent queries or technical problems quickly, ensuring minimal disruption to trading activities. Additionally, Exness provides email support for less time-sensitive issues, and traders can expect a detailed and helpful response within a few hours. For more personalized assistance, phone support is also available, offering traders the opportunity to discuss their concerns directly with a customer service agent.

Conclusion

Exness provides a comprehensive and trader-friendly experience for Indian users, offering a range of features that cater to both novice and experienced traders. From competitive trading conditions, including low spreads, flexible leverage, and multiple account types, to secure and efficient deposit and withdrawal methods, Exness ensures that Indian traders have access to the tools and resources needed to succeed in the global financial markets.

Start Trading: Open Exness Account or Visit Website

The broker's exceptional customer support, available in both English and Hindi, further enhances the overall experience. With multiple support channels—live chat, email, and phone support—Exness makes it easy for Indian traders to get assistance whenever needed. The availability of self-help resources such as the Help Center and educational materials ensures traders can resolve common issues independently, while professional assistance is always available for more complex concerns.

FAQs

Is Exness available for Indian traders?

Yes, Exness is available for Indian traders. Indian residents can open accounts, deposit funds, and trade on Exness' platform, which supports a variety of financial instruments, including forex, commodities, indices, and cryptocurrencies.

Can Indian traders use Exness in INR?

Exness supports trading in various currencies, but Indian traders may need to deposit and withdraw in USD or other major currencies. Currency conversion fees may apply when transferring funds from INR to the broker's supported currencies.

What account types does Exness offer to Indian traders?

Exness offers several account types, including Standard, Pro, and Raw Spread accounts. Indian traders can choose an account that best suits their experience level and trading style, with varying spreads and commission structures.

How can Indian traders deposit funds into their Exness accounts?

Indian traders can deposit funds into their Exness accounts using various payment methods, including bank wire transfers, credit/debit cards (Visa, MasterCard), and e-wallets like Skrill, Neteller, and Perfect Money.

How long does it take for Indian traders to withdraw funds from Exness?

Withdrawal times depend on the payment method. E-wallet withdrawals are usually processed within 24 hours, while bank wire transfers may take 3 to 5 business days. Credit and debit card withdrawals typically take 2 to 5 business days.

Is Exness regulated in India?

Exness is not regulated by Indian authorities but is regulated in several other jurisdictions such as the FCA (UK) and CySEC (Cyprus). Indian traders should be aware of India’s forex regulations when trading with Exness.

Does Exness offer customer support in Hindi?

Yes, Exness offers customer support in Hindi, in addition to English. Indian traders can contact the support team through live chat, email, or phone for assistance in their preferred language.