AFEW SAMPLEPAGES

E BI L L I O N D O L L A R C E O

John D. Ca l l o s

E BI L L I O N D O L L A R C E O

John D. Ca l l o s

You know who they are; everyone knows.

In every organization, there are those who take shortcuts; they don’t pay attention in meetings; they rarely deliver on time or what they promised; they drop the ball and then blame others; they don’t follow up.

You know who they are; everyone knows.

They are pointless debaters and constantly resist most ideas, programs, or policies; nothing you do seems to be enough to make them happy. They openly disparage the company as cowardly for not taking outspoken, highly public positions on every polarizing social meme or cause célèbre. They bristle at any performance standards or deadlines and threaten to quit if they must account for their time. When they work from home, your people can’t reach them, and their productivity seems to plummet.

You know who they are; everyone knows.

These people are a drain on your organization’s most precious resource: time. They are not only unproductive, but they are also negatively impacting the productivity of others by disrupting the timelines on critical projects. Naturally, you must attempt to counsel them and get them help. But if these efforts fail, don’t make excuses for their poor performance and disruptive behavior. Don’t avoid the conversation; don’t kick the can down the road. Step up, address the performance issue, and stop protecting your poor performers.

The real question is this: why are you delaying taking action? Why are you avoiding the conversation?

You know that you are; everyone knows.

The essence of strategy is tradeoffs — making choices about what you won’t do in order to do other things uniquely well. Strategy is about choosing different ways of competing that are not necessarily good for every company, but are uniquely good for yours.

Competitive advantage comes from being different. For example: “How can we, by limiting what we do, by not entering every market, by limiting our product lineup, be unique?” Once decided, you and your team must be diligent enforcers of those strategic limits.

Some companies lack the discipline to limit themselves to competing in some segments while avoiding others. They react to myriad opportunities to broaden their offerings without considering the collective “strategic decay” caused by the dilution of time, focus, and resources.

There will always be shiny lures—great new ideas and distractions—pulling you and your team off course. Enforcing your strategic limits takes courage from the Board and the company’s leaders because egos may be bruised when projects are declined or delayed if they are not consistent with your overall strategy. It’s long been shown that less experienced managers tend to avoid conversations where they must reject a proposed new initiative. Often, they will support the addition of new projects even though they are a drain on resources and risk the company drifting from its strategic priorities. Managers should not be timid about keeping their people focused on the company’s strategic priorities.

Leaders must reconcile with trade-offs; they are willing to forgo keeping every customer happy if they’re unprofitable.

Leaders must be willing to pass on opportunities for growth if it’s not consistent with the strategy. This means that you and your managers will need the courage to say “no” to non-strategic initiatives, even ones that are exciting and may offer some additional opportunity for growth, because growth in a vacuum—growth at all costs—is rarely the core strategy.

I have done an enormous amount of work helping CEOs prepare for Board meetings. These are the core principles I espouse to make an effective and impactful Board presentation:

• Materials in Advance: send the pre-read materials at least a week in advance.

• Less is More: keep the presentation crisp, focused, and tight.

• Keep the End in Mind: most people talk way too much about their research process, background facts, and other options. The details should have already been provided in the pre-read. It’s a better practice to start with the recommendation, the answer, the proposal, or the solution, then move into the details if additional background is requested. This approach demonstrates confidence, respect for your audience, and ultimately, mastery of your subject.

• No Surprises: never surprise your Board with broad new initiatives, bad news, or big setbacks. It’s best to let them know in advance about your positions, recommendations, and results. In no case should your Board Chair ever be surprised; your Chair should be your first and primary contact, and they will make the decision as to whether they want to inform the full Board or various committees prior to the Board meeting.

• No Tap Dancing: tap dancing absolutely destroys your credibility. If you don’t have the answer, admit it. No one can reasonably expect their CEO to know every operational detail or obscure pending legislation in another region that might possibly have an impact on the business. It’s OK not to know everything. But it’s never OK to fake it! Simply acknowledge that you need to gather more facts and commit to getting them a prompt update.

• Close the Loop: when you commit to getting additional information back to anyone in the meeting, always follow through to confirm that they received your reply and ask them if they have any further questions.

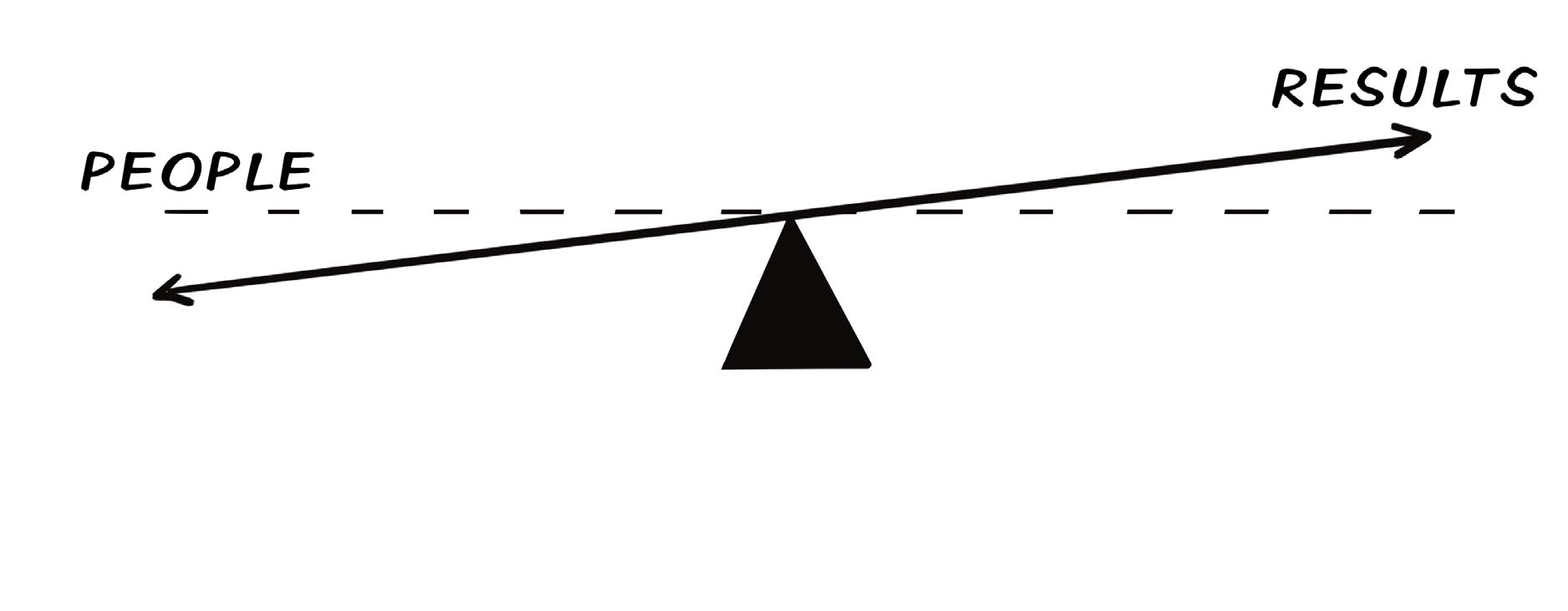

A child’s teeter-totter serves as this metaphor. The rigid plank between the two opposing seats is linked to a fulcrum in the center. As one side of the plank rises, the other side reacts proportionally in the opposite direction. I view this metaphor as mirroring what happens in organizations when they try to balance employee happiness with improving business results.

The more a company (or manager) focuses on results at all costs and increases the pressure on people, the more employee morale and engagement will decline. While increasing pressure on employees may result in a temporary boost to results, it is not sustainable, and it’s not the kind of environment that will attract new employees and enhance employee retention.

Similarly, if a company is too focused on workplace happiness, results can be impacted. An occasional employee event can boost morale and perhaps result in some minor productivity gains, but when motivational programs are over-dialed, productivity can decline while costs increase. Focusing too much attention on employee engagement scores, open beer taps, corporate chefs, a menagerie of office pets, and eliminating performance reviews to bolster self-esteem (I’ve seen all of this, and more) will lead to declining results. Many companies are now reeling-in these programs because the costbenefit equation didn’t work, and results suffered. Every company needs to find that elusive balance that works within their structure and culture.

There seems to be a fine line where the focus should be just a bit more on results than employee happiness. An attempt to cater to every possible whim and try to make everyone extremely happy will cause results to suffer. Similarly, a narrow focus on results at all costs will prove disappointing in the long run. It’s a delicate balance; just don’t let it get too far out of alignment in either direction.

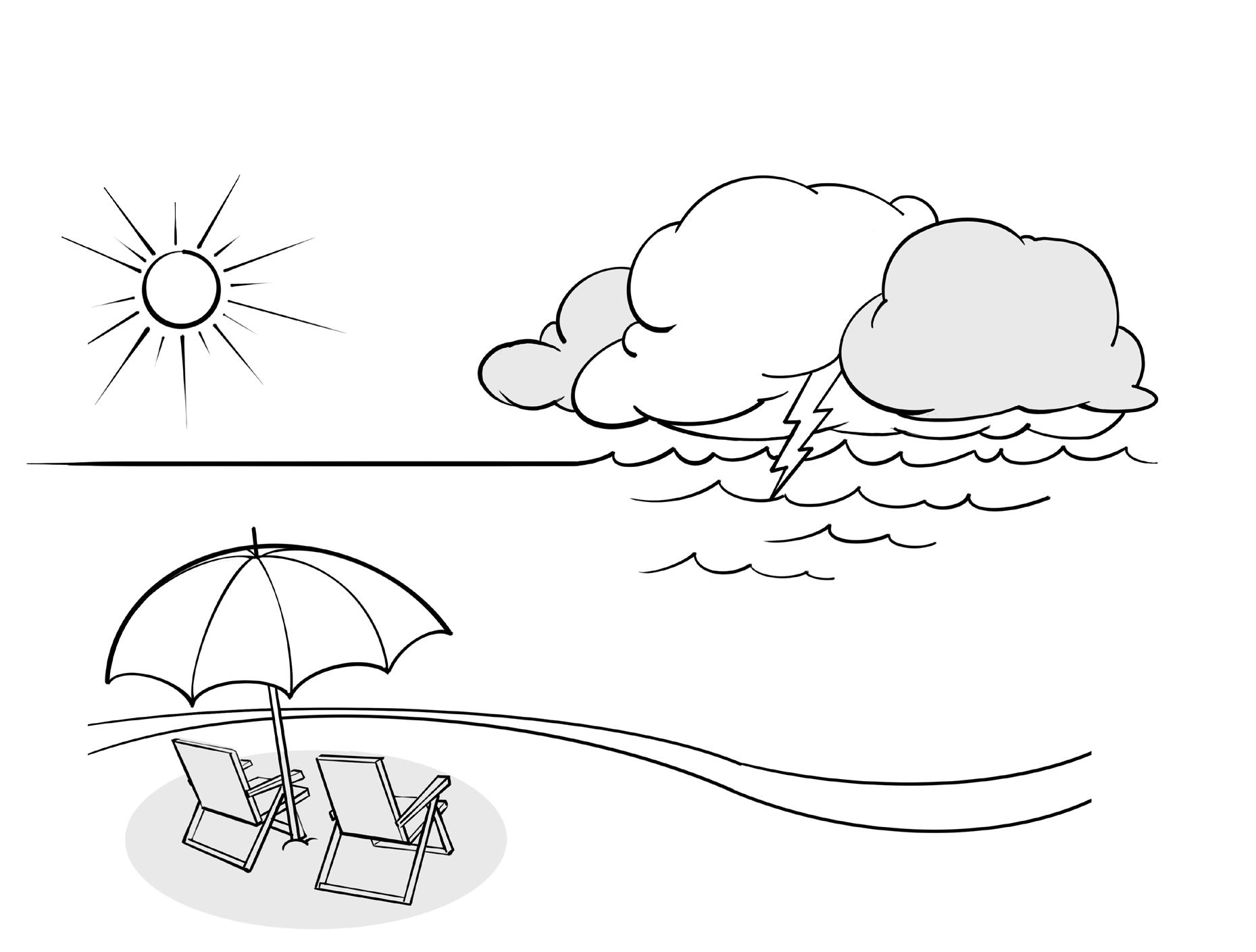

No one likes surprises, especially CEOs, Boards, VCs, and public markets. To minimize surprises and unanticipated setbacks, I strongly encourage a consistent review of “Horizon Issues.” Here’s the metaphor:

A ship’s captain sees storm clouds far on the horizon, yet overhead, the skies are clear. The clouds could harmlessly blow away, or they could attack with a fury and bring dangerous seas. As this metaphor is applied to business, I encourage executives to keep an eye on potential issues and obstacles, then monitor them to ensure that they are not caught off guard. This approach is no guarantee that nothing bad will ever happen or that you won’t get caught flat-footed sometimes, but it’s certainly a better approach than a frenetic reaction without a plan or forethought.

Most people are so busy that they don’t take the time to think ahead about things that could be deteriorating or slipping through the cracks. Ideally weekly, and certainly not less than monthly, assess Horizon Issues and note any changes or precautionary moves that may be prudent. For example, you have a very senior executive who seems to be slipping, dropping the ball, and not as visible. That’s a Horizon Issue that must be addressed. Another example: you are using an overseas contract manufacturer in a region of the world that’s getting a lot of geopolitical attention, and it’s certainly not positive; that’s absolutely a Horizon Issue!

Some will say that they just hire great people and let them worry about the details. I respond by explaining that one of the world’s most effective Billion Dollar CEOs, Jamie Dimon, of JPMorgan Chase, is widely known to grill his senior lieutenants to ensure that they’ve considered any number of disaster scenarios and have contingency plans; Jamie Dimon doesn’t like surprises. He was quoted at a financial conference, saying: “You know, there’s storm clouds out there. While conditions seem fine now, nobody knows if the hurricane is a minor one or Superstorm Sandy; you’d better brace yourself.”

This Billion Dollar CEO keeps his eye on Horizon Issues; you should too.

You hired your team, and they are all winners with a track record of success. Yes, some may have stumbled in prior roles, but they got back up, and that impressed you. That’s what winners do. They don’t pass the buck, they don’t engage in selfpity, and they don’t mope or complain. Rather, they push harder, dig deeper, and somehow just find a way, because your winners are wired differently. They go to extreme measures, and they exhibit grit, hustle, and boundless energy. They never want to disappoint you, the Board, their team, or themselves. However, when things veer off-track, as they always do, winners engage at an entirely different level. The hours don’t matter. Outside commitments are set aside, family time often suffers as even when they’re home, they are deep inside themselves trying to crack the code, solve the problem, and find a way to win. But there is a hidden trap you need to know about.

Winners don’t like making excuses or acknowledging crosswinds, so they just put their head down and push harder. They drive forward; even when the odds look terrible, they’re still fighting. The problem is that winners are often reluctant to ask for help or surface their concerns as they feel this may signal weakness. Moreover, to maintain the illusion of a positive attitude, they’ll tell you that everything is going great, even when it’s not. And by the time the issue finally reaches a crescendo, the point of no return, the 11th Hour, they will reluctantly acknowledge that despite their valiant efforts, they won’t be able to deliver.

The solution to minimizing 11th Hour surprises is to recognize the nature of your winners. You must find a face-saving way for them to surface concerns, crosswinds, or burgeoning issues, well in advance. Create an environment and the personal relationships where your people are encouraged and expected to acknowledge challenges or concerns before they morph into huge surprises that could impact your delivery milestones at the dreaded 11th Hour. This approach puts the entire company in a better position to win. And winners love that!

As the new CEO reviewed his financial projections with me, something just didn’t feel right. I noted a lack of confidence in the presentation, a certain level of anxiety. It turns out that the CEO was presenting recklessly aggressive “stretch goals” in his Board deck, the timelines of which certainly wouldn’t be met. He explained to me that he wanted to impress the Board, demonstrating that he was an optimistic go-getter. While stretch goals can sometimes motivate an internal team to accomplish remarkable objectives, I don’t ever support presenting stretch goals to your Board or investors.

Boards and investors need to have confidence in their CEO to execute and consistently deliver as planned. What Boards don’t want are surprises; especially negative surprises. And when you present stretch goals to your Board, you have very little to gain and a huge amount to lose. It’s a terrible risk-reward equation.

Later, when you come back to your Board to explain what happened, how the stars didn’t align as expected, and why you missed the plan, your Board may question your forecasting proficiency and look askance at your subsequent projections. So, if your Board pushes you to present a best-case scenario, be certain that everyone is crystal clear that this scenario is not your budget or plan, but rather a huge stretch, a best-case scenario only.

That’s not to suggest that I’d ever support sandbagging, which is a deliberate lowering of expectations with the hidden objective of producing greater-than-expected outcomes, often with the hope of earning outsized bonuses. I view sandbagging as weak and unethical. Moreover, it’s an insidious practice that can cascade throughout a company, leading to inaccurate, seesaw-like forecasts and eroding the Board’s confidence in your leadership, and perhaps, your integrity.

Just keep the projections reasonable. Provide the most likely case and back it up with your assumptions. No sandbagging and no stretch goals. Huge swings or surprises in either direction suggest ineffective planning, so keep your projections fair and reasonably achievable, and provide monthly and quarterly updates to minimize surprises in either direction.

There’s a breed of managers who boldly proclaim that they “hire great people and let them run fast.” Regrettably, I’ve seen this “hands-off” approach backfire too many times, resulting in big surprises and lots of extra work to fix problems and reel back ill-considered initiatives. Regardless of title or position, employees need direction and periodic feedback to ensure alignment around the organization’s top objectives. Remember, even CEOs must answer tough questions from their Board, so you are not alone.

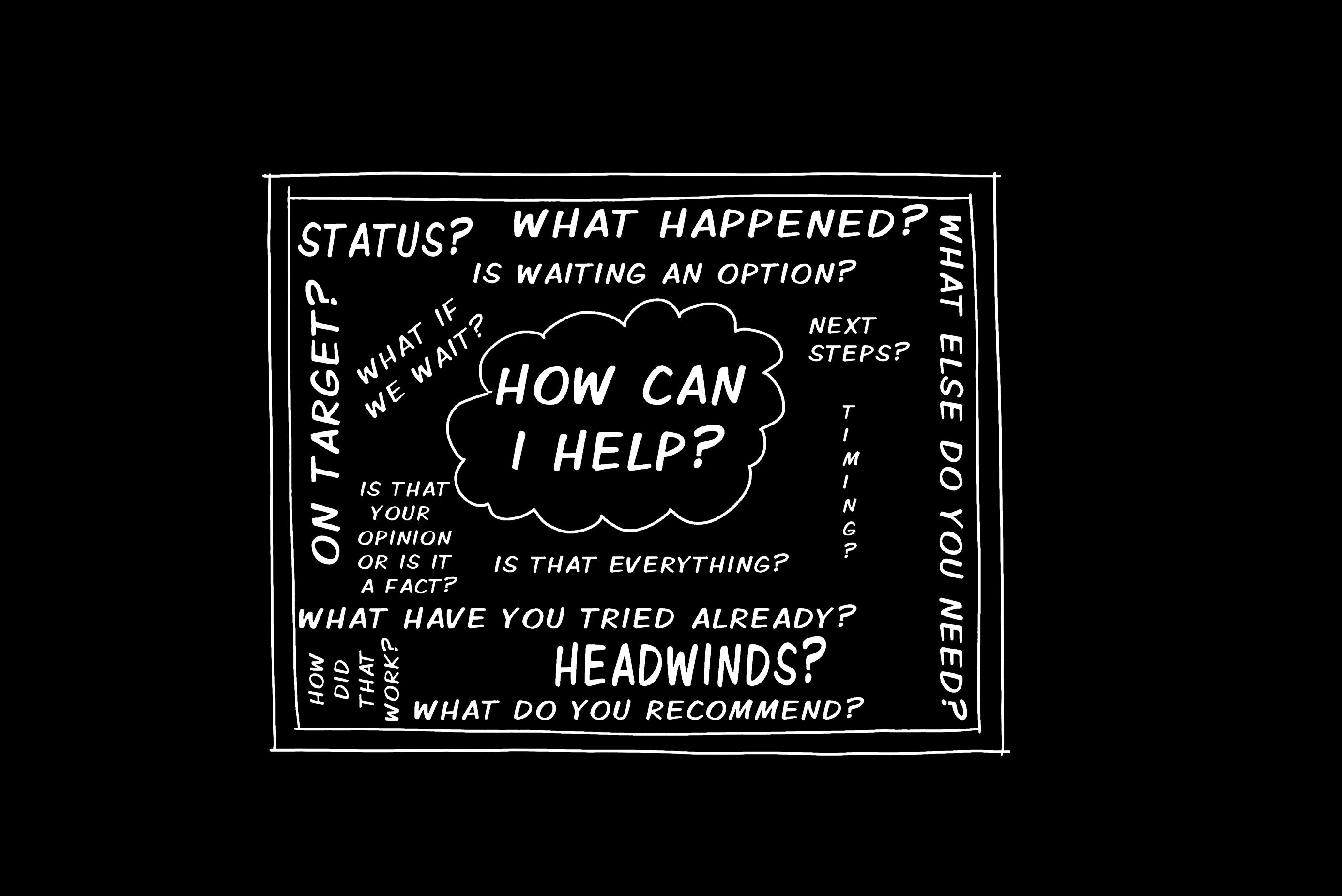

Managers are duty-bound to inspect progress toward commitments; their questions and inquiries should not be viewed as personal challenges or a lack of trust, but rather to clarify pace, remove obstacles, and minimize surprises. Hands-on management involves a lot of back-and-forth communication, listening, and asking questions. But asking lots of questions, should never be confused with micromanagement. Conversely, letting people just run free without adequate direction, support, or follow-up is very clearly mismanagement.

Like anything, there is a spectrum where instincts, experience, and recent results will inform a manager as to the appropriate level of follow-up and updates. Some executives who openly bristle at oversight, questions, or follow-up have learned that they can quickly put their managers back on their heels by simply suggesting that any question or inquiry is an overreach, a lack of trust, and micromanagement.

Interference, constant meddling, and very detailed step-by-step instructions are, of course, indicative of micromanagement tendencies, and should be avoided. However, following up, asking probing questions, getting updates, and reviewing progress at scheduled intervals is simply exhibiting good management practice. It is indeed the job of managers to follow up, to know what’s going on, to ask the tough questions, and to push around the edges to test and ensure that their people thought about potential issues, crosswinds, and Horizon Issues, and that they have sensible contingency plans.

The genesis of uncomfortable “accountability conversations” is often rooted in 11th Hour surprises, inadequate updates, and failure to deliver as expected. This can largely be avoided by periodic updates with the manager.

You Can’t Handle the Truth!

Some CEOs have a reputation for not wanting to hear bad news. So, people don’t come forward with problems, and the CEO is left in a cocoon where they only receive cheerful, sunny updates. In such cases, it’s widely known throughout the company that you shouldn’t bring bad news to the CEO.

Often, this is due to corporate lore where someone once had a bad experience bringing a surprise to the CEO. Yet when I talk to CEOs with such reputations, they are often shocked and can’t believe they have this reputation. They didn’t realize that there was a widespread view that they were unapproachable when it comes to reporting challenges, surprises, setbacks, and outright bad news.

No reasonable person could ever argue that it’s a good business practice to keep the CEO in the dark and only deliver sunny updates. However, there are rare cases where it’s true: there are well-known examples where executives have been terminated for surprising their CEO. Naturally, those are the stories that become corporate lore, so the precedent is set: only bring positive, “happy updates for happy ears.” As a CEO, you should never hope to have such a reputation, and if you do, you should work to promptly crush that perception!

It’s my strongest conviction that CEOs must be open and approachable about headwinds, problems, setbacks, surprises, unacceptable behavior, risk, and bad news.

Remember, the CEO is the one person who is ultimately accountable for everything that happens within the company. Therefore, the CEO must be informed and face the hard, unvarnished truth about significant issues, risks, setbacks, delays, and problems.

“If

you can’t handle the truth, you’re not CEO material.

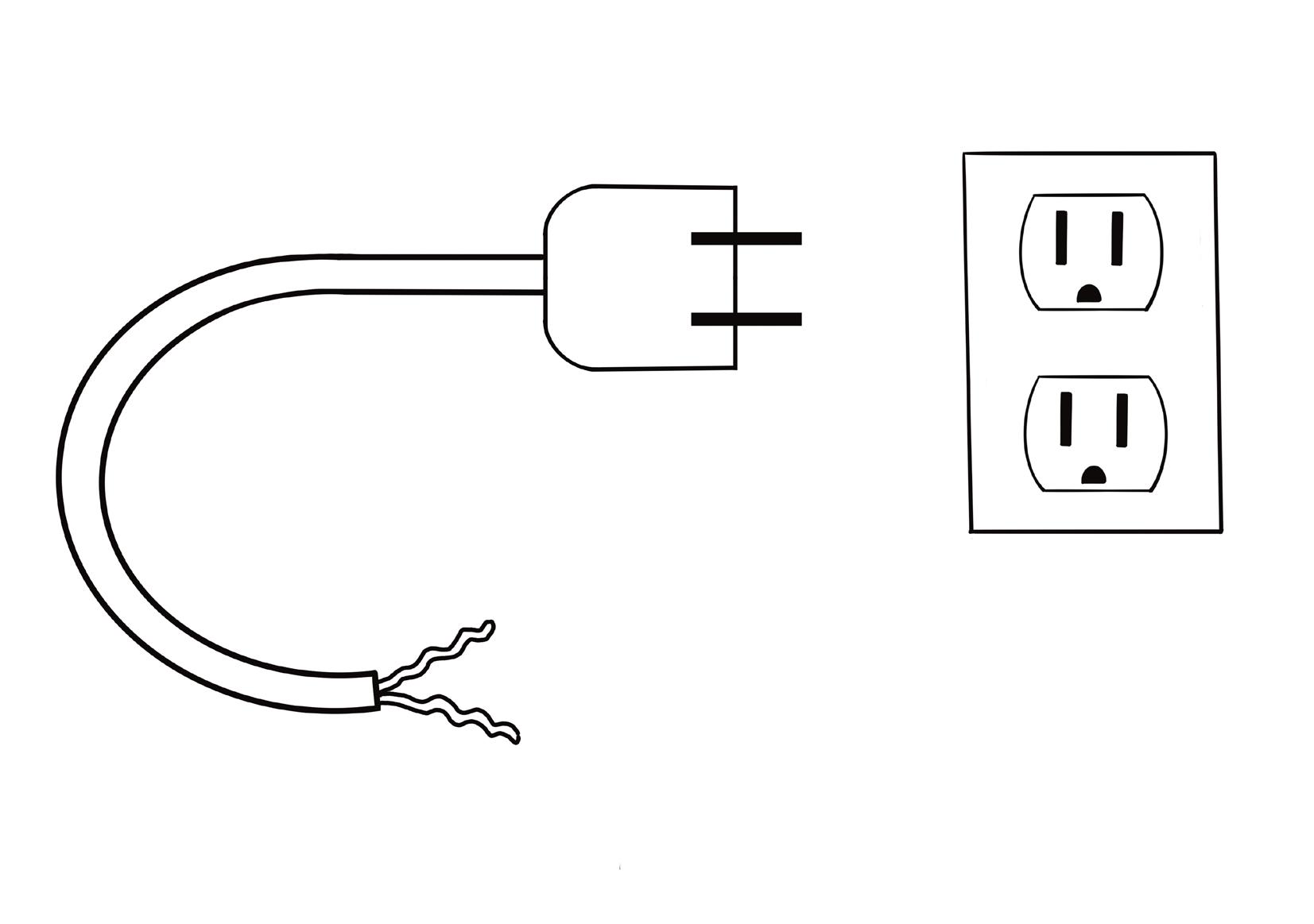

Pivotal to shaping a company’s culture is the selection, development, and mentoring of senior leaders; these activities should be a top priority of all CEOs and C-Suite executives. But it’s not enough to just hire top talent and let them run free; there must be a commitment to spend and invest time with your people. Your greatest leverage as a CEO is your executive team, your direct reports, and your executive assistant. Keep in mind that any weakness on your executive team will reduce your effectiveness and impact as CEO.

Despite a thorough screening and vetting process when interviewing, there will come a time when you recognize that someone on your executive team is just not going to work out. When you’ve finally reached the point where it’s clear that the person must go, don’t delay any further, don’t pass the buck, and don’t transfer the person to a faraway outpost. Remember, you are on stage here, everyone knows that you have a weak link, and they are watching to see how it will be handled.

When the time has come to part ways and pull the plug, keep it short and decisive. You’ve already done everything you can, so this is not the time for negotiation. Don’t waffle or dither. Don’t be long-winded—the words you use to communicate this message should be simple, clear, precise, and right to the point; don’t obfuscate. At the same time, show humanity, recognizing that this is an incredibly difficult and stressful situation for anyone in this position.

Lemons to Lemonade: a Billion Dollar CEO client hired a C-Suite executive, and in very short order it became evident that this person was not going to fit with the organization. The CEO approached the Board and acknowledged that a hiring mistake had been made; he owned it and accepted full responsibility a mere 90 days into the hire. But rather than criticize their CEO for a bad hire and costly mistake, the Board congratulated him for recognizing the situation early, exhibiting the humility to own the situation, and for having the courage to pull the plug.

The Board’s confidence in their CEO grew even stronger that day.

As a confidential advisor to CEOs and Boards from venture-backed start-ups to unicorn IPOs through trillion-dollar multinationals, Mr. Callos brings decades of insights from his insider’s access observing the leadership practices of the world’s most successful CEOs, notably in the high tech, life sciences, biopharma, and financial services industries.

Mr. Callos guides CEOs through the complex relationships and communication dynamics between investors, Boards, CEOs, and the C-Suite, to ensure that surprises are minimized, commitments are met, and critical milestone timelines are achieved. This work includes preparing CEOs for eventual IPOs, investor and Board presentations, succession planning, improving executive team and Board dynamics, and helping transform scientists/engineers into C-Suite leaders.

A graduate from USC’s combined Marshall School of Business and its Lloyd Greif Center for Entrepreneurial Studies, Callos enjoyed a distinguished career in banking prior to developing his high-profile CEO advisory practice.

Callos attained considerable recognition in the ultra-endurance community as a sponsored athlete in the 320-mile Ultraman Triathlon World Championships in Hawaii and the 155-mile Marathon Des Sables in Morocco’s Sahara Desert, recognized as the “toughest footrace on earth.” Now retired from ultra-endurance, he spends his private moments as a fledgling vintner and olive oil producer in the Santa Barbara wine country, which is the perfect location to engage in one of his passions . . . driving his mercurial, vintage Porsches on the winding backcountry roads through the vineyards.

John can be contacted at: www.TheBillionDollarCEO.com

“ W hile work ing w it h John, we built out our ent ire C - Suite team, more t han doubled t he company in size, and ult imately sold for Billions.”

As a confidential advisor to Billion Dollar CEOs for more than two decades, I’ve had a front row seat to the leadership corridors of many of the world’s largest, most respected, and successful private and public companies, from venturebacked star t-ups to unicorn IP Os through trillion-dollar multinationals.

This book includes stories, ideas, and approaches that my CEO clients have used to build and enhance their multibilliondollar companies on my watch. These clients span many industries, but what they have in common is the unique ability to separate signal from noise, vital from urgent, and strategic from mundane. They excel at directing limited resources toward the greatest opportunities, they understand the power of leverage and the incredible advantage of crisp execution around a narrow set of objectives, while minimizing surprises and wasted ef for t.

These pages are filled with actionable leadership ideas that VCs, Boards, investors, CEOs, and C-Suite executives can quickly and profitably incorporate for their advantage.