MARKET INTELLIGENCE

ENGEL & VÖLKERS

ENGEL & VÖLKERS

ENGEL & VÖLKERS

ENGEL & VÖLKERS

The past three years in the real estate industry have brought us a series of ups and downs. We finally believe we have reached a sense of normalcy again and are back to a more balanced market across Georgia.

The first half of 2022 saw an extension of the hot market of 2021, with a cooling off that settled in for the second half of the year. This was fueled by rising interest rates, inflation, the lack of affordability and market uncertainty. Without question, 2020 and 2021 were outlier years in real estate where we saw less travel, very low interest rates, and an increased focus on home life. Because these years were such outliers, real estate trends in 2019 are also referenced throughout this report as a a comparison to a more typical year.

The recent decline in sales began in June of 2022 when rates moved over 5.25%. These rising interest rates increased the cost of home ownership for buyers, pricing many would-be buyers out of the market and forcing others to consider homes at a lower price point than they may have been exploring earlier in the year.

Market inventory is rising but still low with 2.1 months of inventory in Metro Atlanta overall at year end. Demand is down, but so is supply, which is helping to limit significant price declines. While prices are down slightly compared to the summer peak, this reflects an accelerated version of normal seasonal price fluctuations. Notably, the average sales price in Metro Atlanta in the second half of 2022 was still up 9.9% year over year. New listings have been down every month since June, which is, again, an accelerated version of a normal seasonal trend. Inventory reached its lowest level in a decade in December of 2022.

Although national forecasts call for home prices to stabilize or decline in some markets next year, Atlanta is rated the #1 top real estate market for 2023 by the National Association of REALTORS, with home prices expected to increase at least 5% in 2023.

Consumers demand is shifting and home quality matters again. Houses that are well designed, located in desirable areas, and priced well continue to sell. Those with less desirable characteristics are staying on the market longer and in some cases selling below asking price.

There is still latent demand as many people have been in “wait mode,” hoping that interest rates fall and more inventory comes to market. Market uncertainty is still compelling buyers to wait to buy until things look more favorable, which they perceive to be right around the corner. Buyers and sellers are just beginning to realize we are not going to snap back to the same market as a year ago, are adjusting to new interest rates, and are finally making buying and selling decisions again.

Christa Huffstickler Founder & CEO Engel & Volkers Atlanta

Interested in getting to know the Atlanta real estate market? See how this guide is structured and learn about key indicators to help you make sense of what is happening in the market.

This report is designed as a guide to the Metro Atlanta real estate market, helping savvy homebuyers and sellers make informed, strategic decisions in the year to come. Whether you’re an Atlanta native or new to the area, this guide will give you the intel you need to understand what is happening in the market overall and hone in on the best options for you and your family.

This report has three sections, beginning with an overview of the market before getting into specifics about home types and submarkets within Metro Atlanta:

Take a deep dive into broader market and economic trends driving the real estate market, including interest rates, inventory levels, price trends, and the Atlanta economy, framed through our seller and buyer clients’ top FAQs this season.

Beginning on page 14.

Are you selling or looking for a single-family home, townhome, or condominium? Check out what’s happening market-wide for each home type and how prices and products in different neighborhoods compare.

Beginning on page 30.

Metro Atlanta has many neighborhoods, homes, and lifestyles to offer. See what’s happening across each submarket and what new development is on its way to the neighborhoods on your mind.

Beginning on page 75.

Data referenced throughout this report comes primarily from the First Multiple Listing Service (FMLS), TrendGraphix, and MarketNsight. Sources are noted with tables and charts, or as endnotes compiled at the end of this report. This report is focused on the second half of 2022 and most data refers to Q3 and Q4 overall (July 1, 2022 to December 31, 2022), or select months where specified.

First Multiple Listing Service is a regional real estate database for the Atlanta area, with data on most of the active, pending, and closed sales in the area. Additional off-market transactions may have occurred, but are not included in FMLS data.

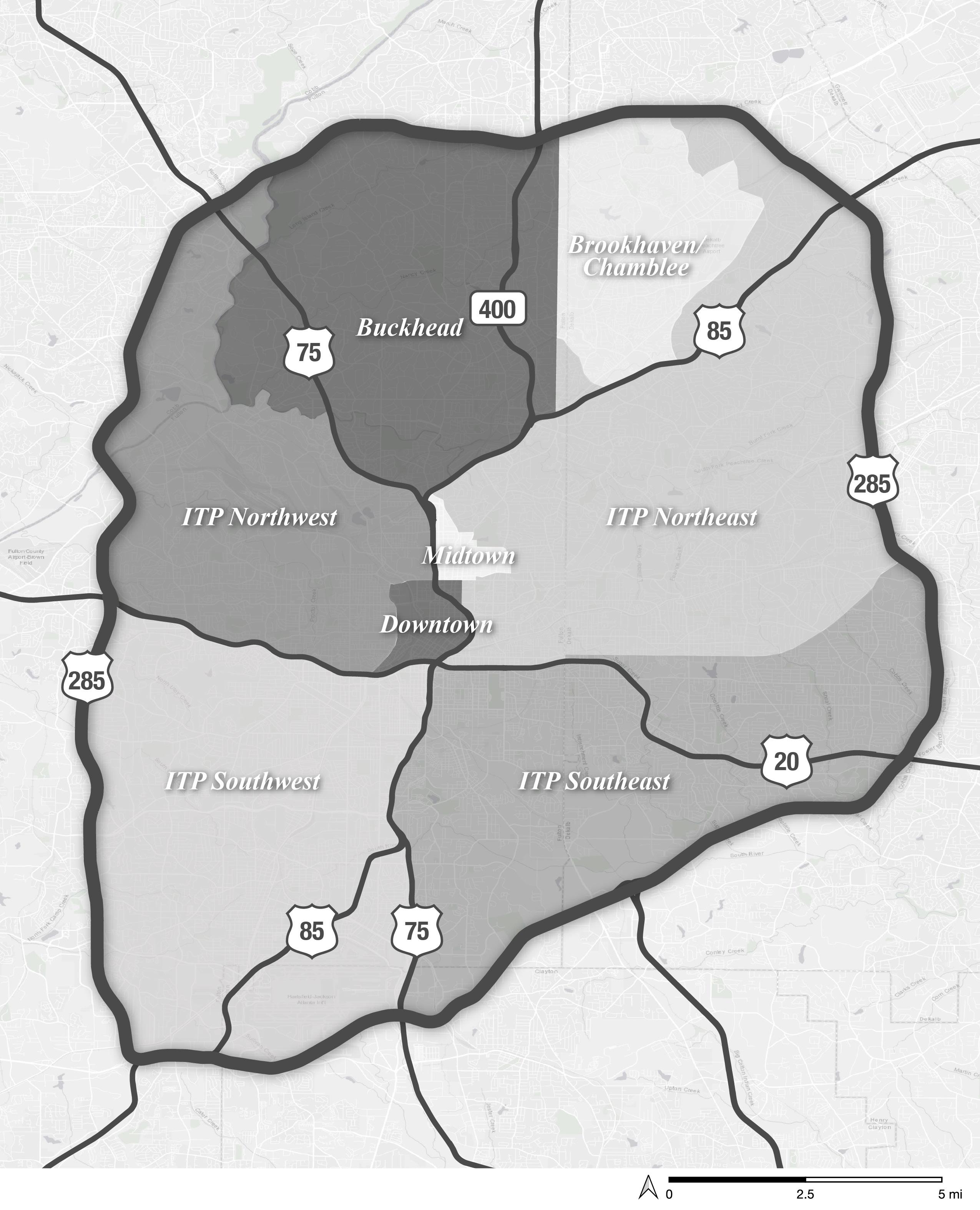

This report discusses the market from the metro level down to specific neighborhoods. Here’s how we define the geographies referenced throughout the report:

This 11-county area includes Cherokee, Clayton, Cobb, DeKalb, Douglas, Fayette, Forsyth, Fulton, Gwinnett, Henry, and Rockdale Counties. Some of our data sources use the term “Greater Atlanta Area” to refer to this same geography.

Interstate 285 (I-285) forms a ring around Atlanta known as The Perimeter. Neighborhoods inside the perimeter are called “ITP.” This includes most of the City of Atlanta and nearby places like Brookhaven, part of Sandy Springs, Chamblee, Vinings, East Point, College Park, Hapeville, and Decatur.

Neighborhoods and cities outside the I-285 perimeter are “OTP.” This area covers most of suburban Atlanta.

The four quadrants of Atlanta are a way to organize the city by subareas. They are delineated by major streets in the center of the city. Peachtree Street runs north-south and generally aligns with where Interstates 75 and 85 (I75/85) run outside of the center of the city. This line distinguishes “west” from “east” neighborhoods. Interstate 20 (I-20) runs east-west through the metro just south of Downtown. It delineates the “north” part of the metro from the “south” part.

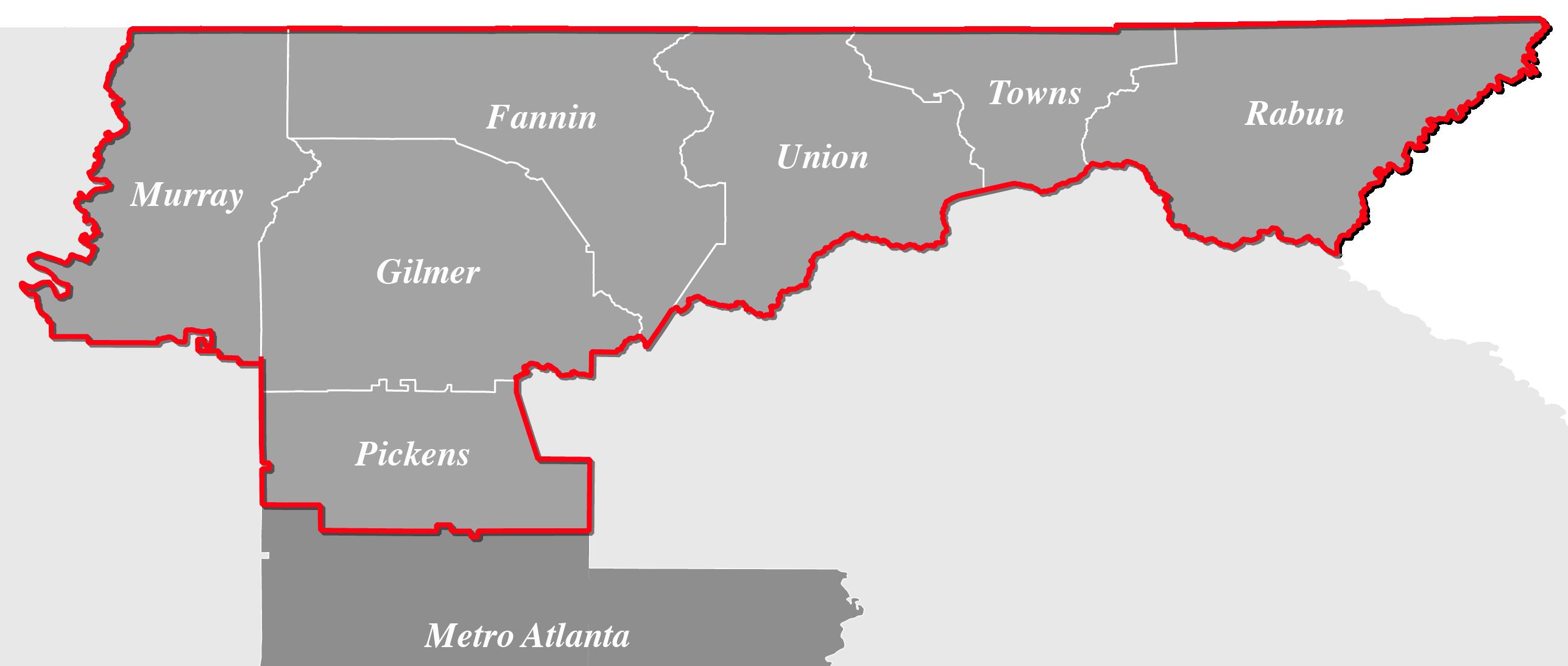

The North Georgia market has close ties to Metro Atlanta as a nearby escape to nature, surrounded by the hills and mountains. It includes places like Blue Ridge, Ellijay, and Helen in Clay, Fannin, Gilmer, Murray, Pickens, Rabun, Towns, and Union Counties.

The following key indicators are used throughout this report to describe market trends:

Properties that are currently listed for sale on FMLS. Additional properties may be for sale at any given time— such as for-sale by owner homes or off-market listings— but are not included in the count of “active listings” in this report if they are not in the FMLS database.

New listings are those that have been added to FMLS in a given month. They do not include active listings that were entered in previous months.

Closed sales represent homes that have sold and transactions have been finalized. This indicator tends to lag market trends slightly because properties typically close one to two months after an offer has been accepted and buyers have locked their interest rates.

Pending sales are properties that have accepted an offer from a buyer and is in the due diligence period. The sales transaction has not happened yet. This is a leading indicator because it give us insight

The sale price is the final amount paid for a home. It is measured as either an average or a median, with the average price tending to be skewed higher by the highest priced homes. It does not reflect seller concessions, such as closing costs that may have been paid.

The sale price to list price ratio (SP/LP) indicates if a home sold at (100%), above (>100%), or below (<100%) the listed asking price. The sale price to original list price ratio (SP/OLP) compares the sale price to the original asking price, as the current asking price may have reflected price changes.

Days on market (DOM) measures how long it takes from the time a home is listed until the owner signs a contract for the sale of a property. This tends to vary based on the desirability of a given property, market conditions, and season.

Months of inventory indicates how long it would likely take to sell currently listed homes, if no new inventory were added. It is measured as a ratio of active listings to homes sold. 5 to 6 months of inventory is considered a balanced market. Less than 6 months supply tends to favor sellers, and more tends to favor buyers.

Learn about the factors that shaped the Metro Atlanta housing market in the second half of 2022 and what it means for real estate in 2023.

Over the past year, macro trends like rising interest rates and tight housing inventories have shaped the way buyers and sellers have approached the real estate market. Check out what has been happening with these key trends with our clients’ top FAQs and see how they’re shaping the market ahead in 2023.

• What’s next for interest rates?

(page 16)

• Market Trend: Rate Buydowns

(page 17)

Inventory

• Is supply beginning to exceed demand? (page 18)

• Why are there more listings but it still doesn’t feel like there are any good homes to choose from?

(page 19)

• Will there be an influx of foreclosed homes like in the Great Recession? (page 19)

• Are there more new construction homes on the way? (page 19)

• What is normal for price appreciation?

(page 20)

• Has normal seasonality returned?(page 21)

• How do sale prices align with appraised values? (page 22)

• Will home prices drop dramatically this year? (page 23)

• Which price points had the most sales?

(page 25)

• Can Atlantans afford current homes?

(page 26)

• How is Atlanta’s economy doing? (page 27)

• Where are people who move to Atlanta coming from? (page 27)

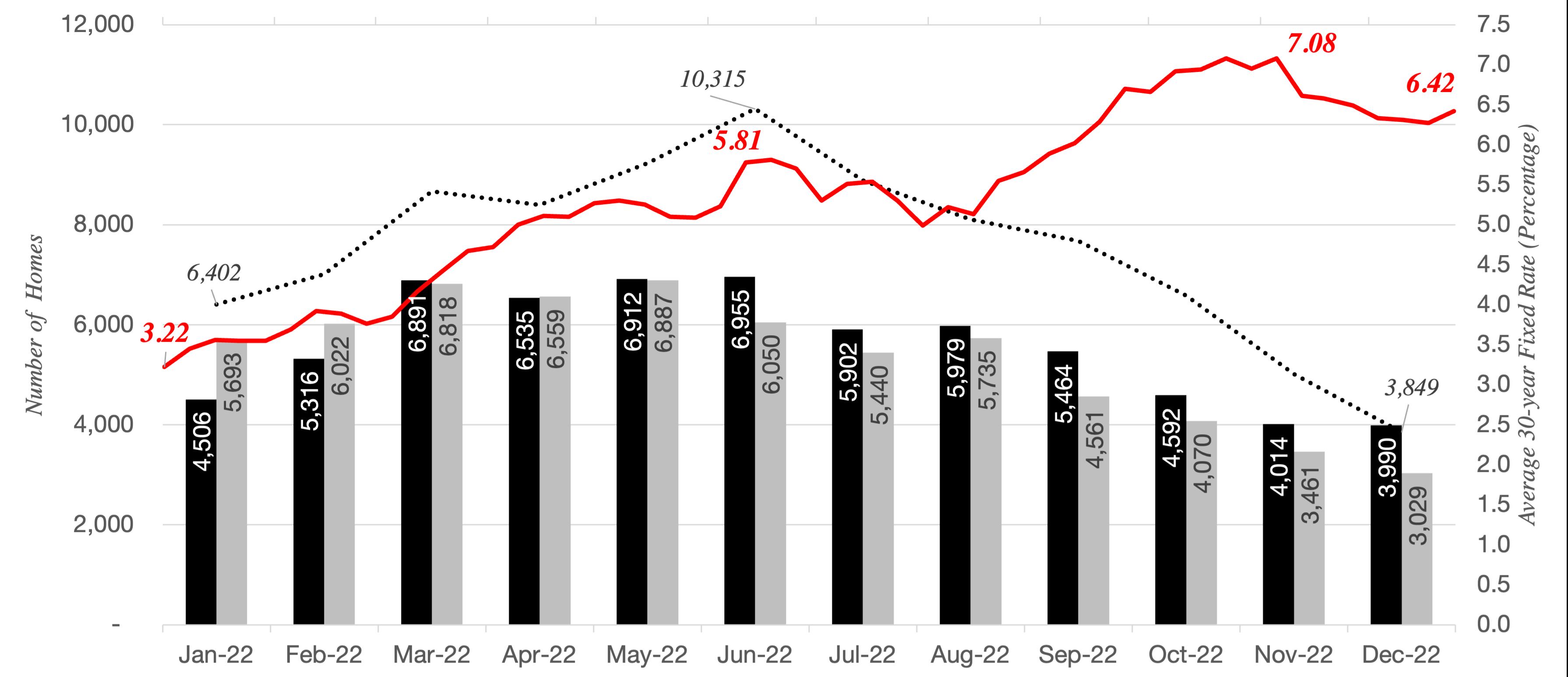

Mortgage interest rates have been a driving force in the housing market in 2022. The year started with near record low rates for a 30-year fixed rate mortgage, which averaged 3.22% nationally at the start of the year.1 At the same time, inflation was on the rise globally and home prices were rising rapidly as low borrowing costs enticed buyers and contributed to stiff competition for a limited inventory of homes. To reign in inflation, the Federal Reserve began raising its benchmark interest rates in the spring, a factor leading to an increase in mortgage rates. The Fed’s goal in raising interest rates was to cool demand and slow price

increases, an effect that has been felt in the housing market more than in most sectors of the economy.

Mortgage interest rates more than doubled over the course of 2022, the largest single-year increase since the early 1980s. By June, the average rate for a 30-year fixed-rate mortgage exceeded 5.25%, which proved to be a sensitivity threshold above which buyer demand dampened, leading to declines in home sales beginning in late summer. The average interest rate for a 30-year fixed-rate mortgage reached a 20-year high of 7.08% in November, which most economists

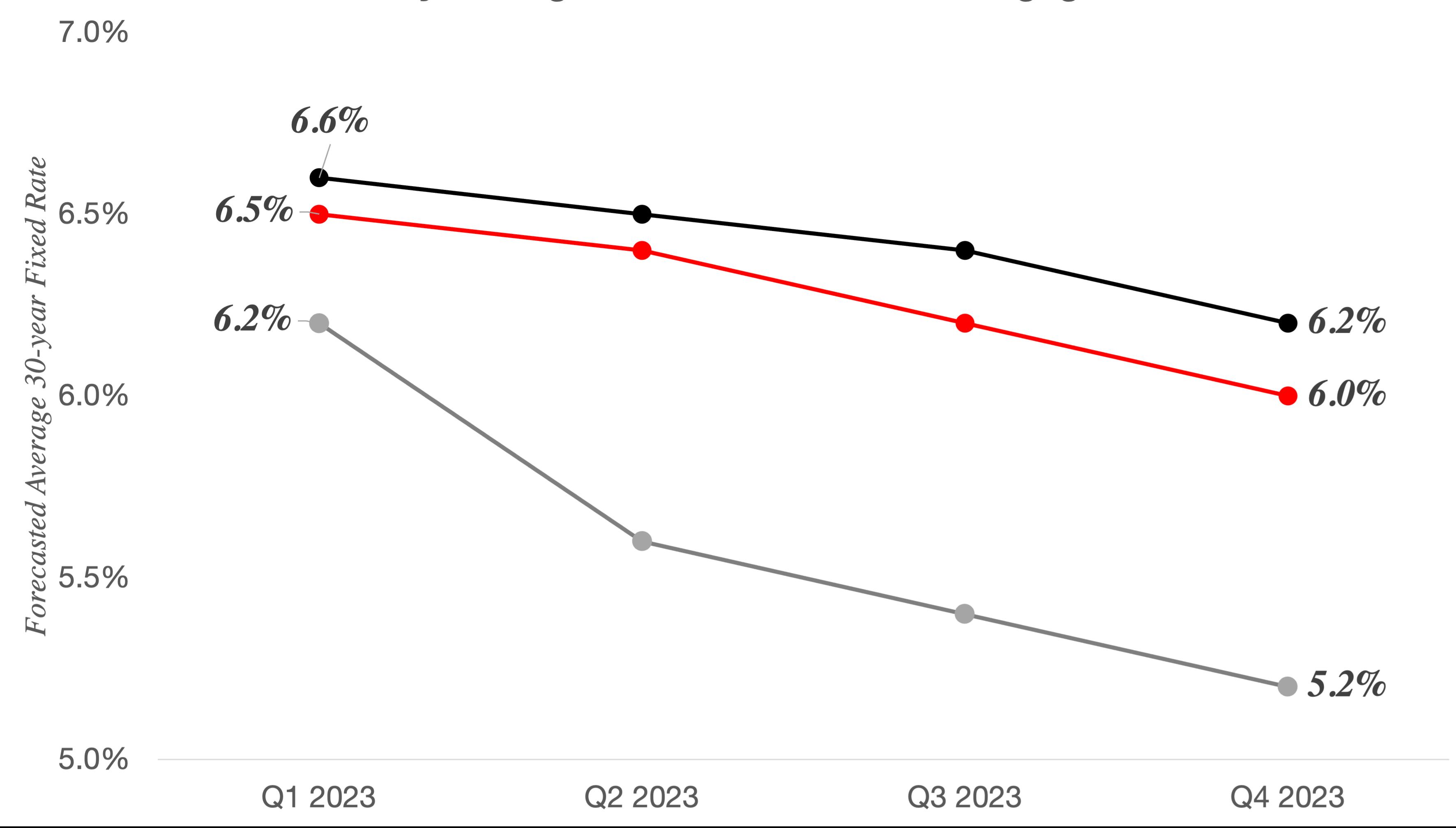

Most economists believe mortgage interest rates for this cycle peaked in November 2022 and will stabilize in 2023, ranging from about 6.5% to 5.5%.

believe to be the peak rate for this cycle. It declined to 6.42% by the end of the year,2 returning to a level typical in the early 2000s, but still above levels that are likely needed to bring significantly more buyers into the market.

(Seasonal#SalesandNewListingsDecline Trend+InterestRates)

The Federal Reserve has stated its intent to continue restricting monetary policy until it believes inflation is under control. This means that although mortgage interest rates are expected to decline slightly

in 2023, they are not likely to return to the 3% range in the next couple of years. The Federal Reserve has not yet made a clear statement about their policy for rates in 2023. Most economists are forecasting that inflation and mortgage interest rates already peaked for this cycle in late 2022.

Forecasts for mortgage interest rates next year vary,3, 4, 5 typically stabilizing near current levels (6% to 6.5%) in the first half of 2023, with a slight decline in the latter half of the year. Buyers interested in making a purchase over the next year will need to adjust to mortgage rates staying within the 5.5% to 6.5% range.

“It is likely that restoring price stability will require holding policy at a restrictive level for some time. We will stay the course until the job is done.”

-Federal Reserve Chairman

Jerome PowellFreddie Mac Forecast Fannie Mae Forecast Mortgage Bankers Association Forecast

In the new construction market, some homebuilders have begun to work around the prevailing interest rates by offering incentives like rate buydowns to attract buyers who are sitting on the sidelines waiting for rates to drop. In certain cases, individual homeowners have offered similar rate buydown incentives as well.

Rate buydowns allow a seller to pay an upfront fee to reduce the buyer’s interest rate by a set amount for a set period of time, before returning to a fixed rate. The most common types are 2/1 buydowns—which reduce the interest rate by 2% in the

first year and by 1% in the second year—and 3/1 buydowns, which reduce the interest rate by 3% in the first year, 2% in the second year, and 1% in the third year. With these temporary buydowns, buyers typically hope that interest rates will decline in the next few years, at which point they can refinance their loans at a lower rate, generally for a fee. For a permanent reduction, the seller may pay discount points to reduce the interest rate over the life of the loan, at a higher cost.

For more information about these trending tools, check with your mortgage provider for available programs and terms.

The mortgage interest rate is reduced by 2% in the first year and by 1% in the second year

The mortgage interest rate is reduced by 3% in the first year, 2% in the second year, and 1% in the third year

Fee paid to permanently reduce a fixed interest rate

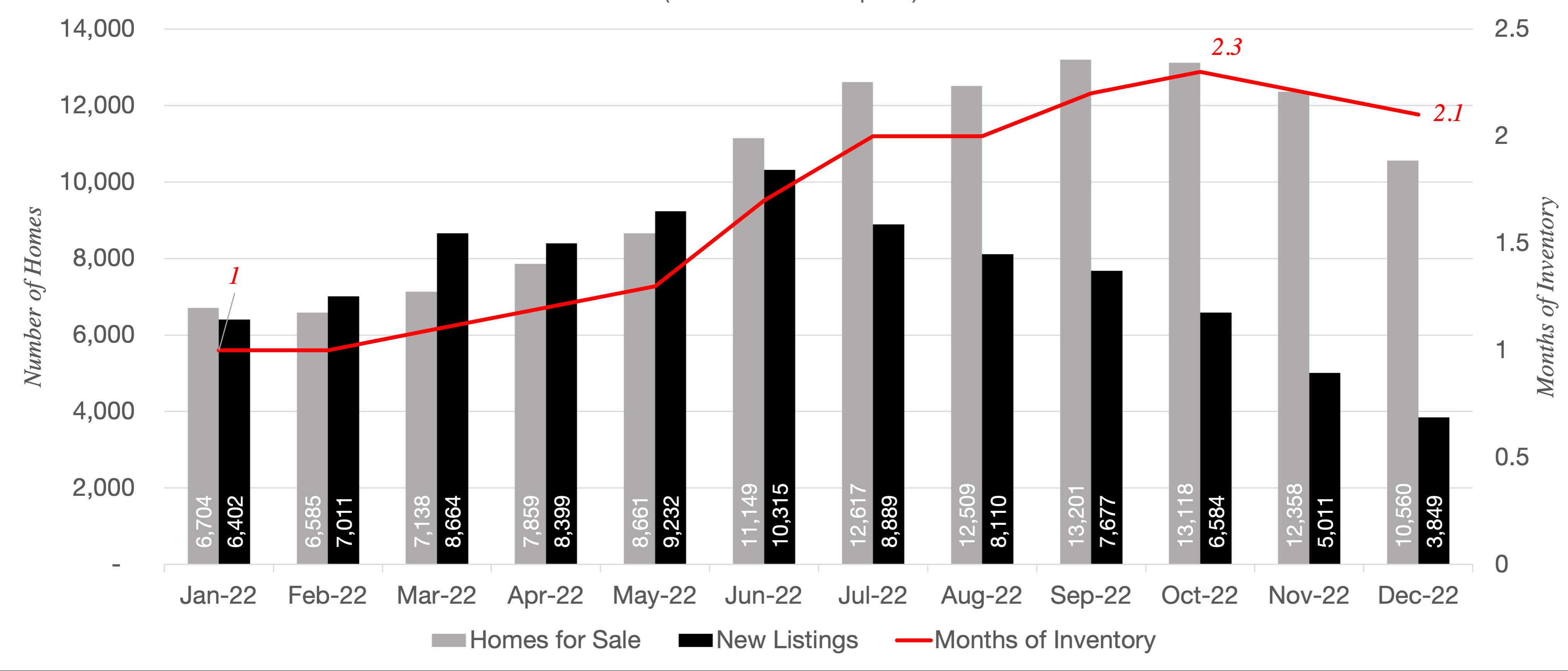

Demand continues to outpace supply in Atlanta. In January 2022, home inventory was at a record low of 1 month of supply. Although it has risen significantly since then, there was still only a 2.1-month supply of homes for sale by year end.6

At the start of 2022, the very limited number of available homes in Atlanta could not match pandemic era buyer demand in a time with low mortgage rates and an increased focus on life at home. This inventory shortage contributed to competitive conditions that heavily favored sellers and led to bidding wars, rapidly rising home prices, and ultrafast timelines, with most homes selling in less than a week.

Home inventory is measured as “months of inventory,” a term that describes how long it would likely take for all the actively listed homes to sell, if no new homes were listed, based on the recent pace of home sales. A 6-month supply is considered a balanced market, with fewer months of inventory favoring sellers and more favoring buyers.

summer, buyer demand declined, but so did new listings, with current homeowners hesitant to give up their low interest rates. Atlanta reached a peak of 2.3 months of supply in October and dropped back to just 2 months in December, following a typical seasonal slowdown in the winter.

Supply ticked up heading into the spring market as more homes were listed, a normal seasonal trend. As mortgage interest rates rose over the Metro Atlanta 2022 Monthly Home Inventory

Despite lower demand, the Atlanta market remains at less than half of the supply that would be considered a balanced market (6 months of inventory), with select submarkets approaching a balanced market. Assuming interest rates peaked in November and demand bottomed out at that time, months of supply in spring and summer 2023 are not expected to go above 3 months.

Much of the increase in home inventory in late 2022 can be attributed to homes taking longer to sell than they did early in the year, rather than a major increase in the number of homes buyers can choose from. After lightning fast sales in early 2022, the time it takes to sell the average home also increased in the second half of the year, a return to normal seasonality after an unusually hot market in 2020 and 2021. By December, the median days on market rose to 23 days in the Greater Atlanta Area, still a week faster than in December 2019, a typical year when the median days on market was 30 days.7

Buyers feel like they have more to choose from when new listings that fit their criteria are added. New listings in Metro Atlanta declined every month from June to December, slightly outpacing the normal seasonal trend of fewer new listings in the second half of the year. The number of new listings in December 2022 was the lowest of any month in a decade. Just 3,849 new listings were added, about a third of the new listings added in June 2022 and 29% lower than the average of Decembers in 2017 to 2021.8 Fewer homeowners are choosing to sell, discouraged by higher interest rates and limited inventory. As of November 2022, 99% of U.S. homeowners with mortgages had rates below 6%,9 which disincentivizes them from selling their current home to buy another at a higher rate, leading to

stagnation in home inventory and limited choices for buyers.

In January 2023, the number of new listings went up for the first time since June 2022, with 45% more new listings than December. Although new listings were still below average for January, this uptick is a sign that sellers who have been waiting are beginning to get off the fence.

Current homeowners often have a significant amount of equity in their homes due to recent price appreciation. Combined with a strong labor market and less risky loan underwriting in recent years, this means they are not likely to be forced into a sale for financial reasons, as was the case for some homeowners during the Great Recession. Several indicators show current homeowners in a strong financial position with a low likelihood of a wave of foreclosures:

• The foreclosure rate today is at a historical low of 0.6% nationally.10

• Significant price appreciation in past two years has given homeowners stronger equity positions in their investments. In the third quarter of 2022, the average U.S. loan-tovalue (LTV) ratio was 43.6%, significantly lower than the average 71.3% LTV heading into the great recession in Q1 2010.11

• Nationally, distressed property sales made up just 2% of all sales in November 2022, well below the 30% mark seen during the Great Recession.12

• Mortgage delinquency is also low at 3.6%, compared to 10.1% during the Great Recession.13

• The national unemployment rate is at 3.4%, the lowest in 53 years14

New homes are under construction, but not enough to meet demand. As of January 2023, the Atlanta market had an annual housing deficit of 62,000 units,15 with just 13,000 new homes expected to be constructed over the next 12 months.16 As builders begin to pull back on new starts due to economic conditions, we may see even fewer of these homes actually completed this year, furthering the deficit. This low level of inventory is one of the factors that has shielded Atlanta from the kind of significant price reductions that some buyers may have expected to coincide with a significant increase in mortgage interest rates.

Why are there more listings but it still doesn’t feel like there are many good homes to choose from?

Homes in the Metro Atlanta appreciated in value at record pace in 2020, 2021, and the first half of 2022 before returning to a more typical pace of appreciation in the second half of 2022.

In the last three years—between December 2019 and December 2022—the average sale price in Metro Atlanta rose by 40% from $335,948 to $461,667, an increase of $125,719. That rapid growth was more than double the pace of the previous 3-year period from December 2016 to 2019, when prices rose 17%, or an average of $50,804.17 As a result, many homeowners have significant amounts of equity in their homes from price appreciation, but the cost of buying a new home is higher than ever.

The average sale price varies by home type. In Q3 and Q4 2022 the average sale prices in Metro Atlanta for each type were:

• Single-Family Home: $499,874

• Townhome: $391,205

• Condominium: $323,137

For the past 47 years, the Atlanta market has averaged 4.6% annual home price appreciation.18

After a few of years with historically high levels of price appreciation, we are returning to these more moderate levels of price growth. As of December 2022, the average Metro

“Metro Atlanta home price appreciation in December 2022 was 4.2% year-over-year, near the 47-year average of 4.6% annual price growth.”

Atlanta home price of $461,598 was up 4.2% year-over-year, near that historic norm. For Q3 and Q4 overall, average prices were up 9.9% yearover-year, with an average sale price of $477,682.

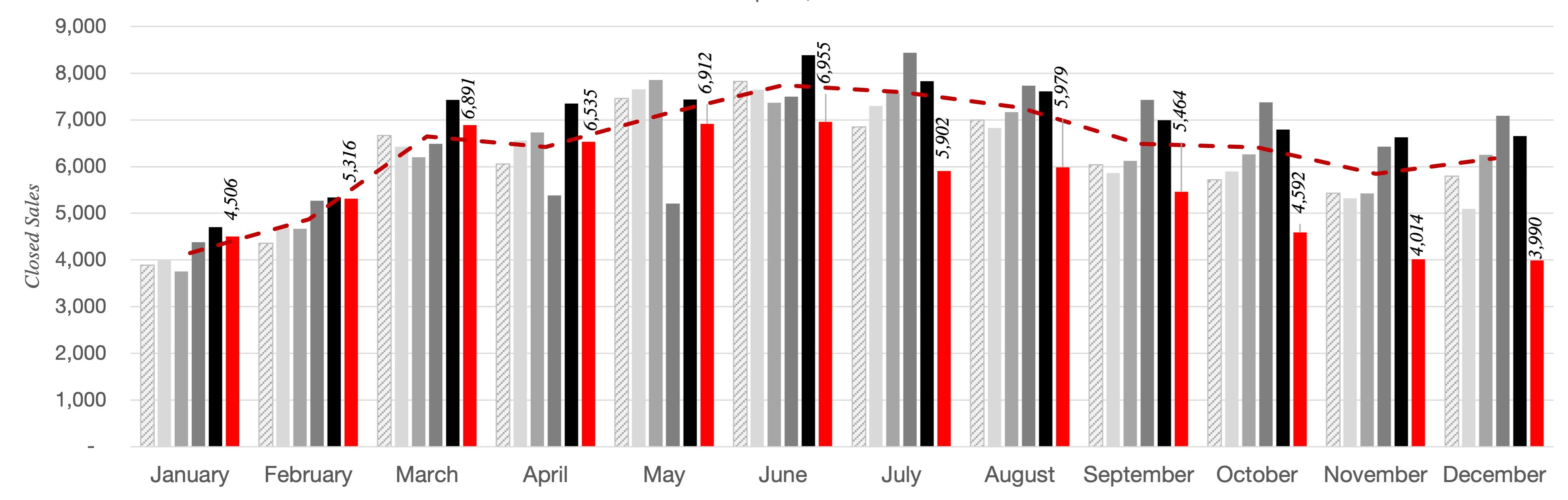

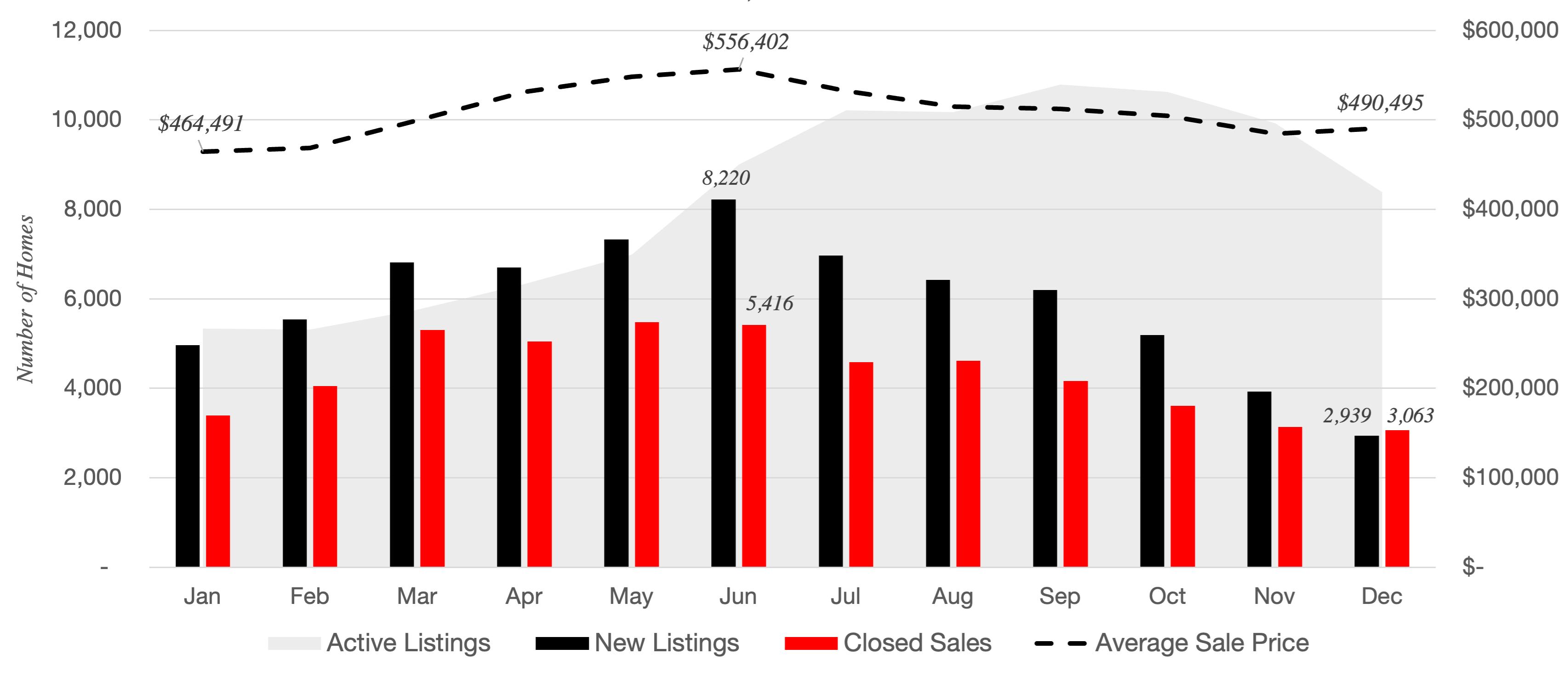

Homes sales—and sale prices—tend to ebb and flow with the seasons of life, with the greatest demand in the spring and summer and a natural slowdown in the winter months. In Atlanta, home prices typically rise throughout the spring market, peak in June, decline in the second half of the year, see a slight end-of-year bump in December. With frenzied demand in 2020 and 2021, that

normal historical pattern did not occur, and prices continue to rise through much of the fall and winter.

2022 largely brought a return to seasonality, with prices peaking in June and declining heading into the fall. However, the declines in home prices between June and December 2022 were greater than a typical historical decline for this period. From 2009 to 2019, the average sale price for all homes in the Greater Atlanta Area typically declined between June and December, ranging from -1.9% to -14.5%, averaging

-4.8%. In 2022, the average sale price declined -9.7% from June to December, outpacing normal seasonality for most years, but still less than the maximum decline during this period, which occurred in 2011. The most significant price declines in 2022 occurred between June and August—when normal seasonality coincided with mortgage interest rates first exceeding 5.25%—and leveled off toward the end of the year.19

Earlier this year, home prices were rising rapidly due to intense buyer competition and homes were often appraising below the contract price, requiring buyers to pay the appraisal gap in cash. In April 2022,

a record high 20% of homes had an appraisal gap. As mortgage interest rates rose and demand cooled over the summer, offers began to more closely align with appraised home values. By October 22, just 6.3% of homes were appraised below the contract sales price,20 reflecting a market more in line with actual home values.

The question on everyone’s minds as of late has been how far—if at all—homes prices can be expected to drop in 2023. Home price growth in 2023 will vary significantly by region. In Atlanta, there are several fundamental conditions that have prevented dramatic price declines even as interest rates doubled over the course of a year, including:

• Low inventory levels;

• Low construction activity;

• A strong economy; and

• A growing population.

These fundamentals are so strong that the National Association of Realtors (NAR) named Atlanta the #1 housing market in the U.S. with the most potential for growth in 2023. It was also ranked #9 on Zillow’s list of the hottest housing markets for 2023.

Home price forecasts vary widely and are adjusted often, and actual prices will depend on factors like inflation, prevailing mortgage interest rates, unemployment levels, submarket, and individual home quality. Despite forecasts of home prices plateauing or declining slightly on a national level in 2023,21, 22, 23 , 24, 25, 26 the Atlanta market is forecasted to see home prices grow by at least 5% this year.27

Mortgage interest rates are also expected to level off in the first half of 2023 and gradually decline in the second half of the year, with many economists anticipating rates stabilizing below 6% later in the year. This rate reduction and stabilization would lower the cost of home ownership and increase the sense of certainty in the market, increasing demand by widening the pool of eligible buyers and enabling buyers of all kinds to get more for their money.

“The Atlanta market is rated the #1 real estate market to watch in the U.S. in 2023, with home prices forecasted to grow by at least 5% this year.”according to the National Association of Realtors forecast Zillow Regional Home Values Forecast (November 2022 to November 2023) Map and Data Source: Lance Lambert, Zillow, 20 January 2023

Fewer people have been buying and selling homes since higher interest rates set in during summer 2022. Pending sales are a leading indicator of sales activity— typically about a month ahead of closings— and had a strong relationship to ongoing interest rate changes in 2022.

Pending sales began to decline in April, as interest rates first began to rise and more significantly in June, when they rose above 5.25%. Pending sales continued to decrease throughout most of the second half of the year, in keeping with seasonal trends accelerated by rising interest rates.

August was the only month that did not post month-over-month declines in pending sales. When interest rates dipped to 4.99% in early August, there was an uptick in transactions, with 5.4% more pending sales than July. Pending sales reached what is believed to be the low point for this cycle in November, when interest rates peaked at 7.08%.

In December, interest rates came down for six consecutive weeks and pending sales bounced slightly.28

In early January 2023, they continued to pick up. Although they were still down year-over-year (YOY), they were down 16% YOY (and just -5% compared to 2019) the third week of January, an improvement over the low point in November when pending sales were down 45% YOY,29 showing signs of buyers returning as rates stabilize. That same week, mortgage applications nationally were up 7% over the previous week, another sign of buyers getting ready to enter the spring market.30

As of the week of February 2nd, the average 30-year fixed rate mortgage rate was at 6.09%.31 With interest rates expected to land in the 5.5% to 6.5% range for most of 2023, the total number of homes sold in 2023 is expected to be lower than in 2022. Nationally, the NAR is forecasting a 7% decline in home sales for 2023 compared to 2022.32

67,095 homes were sold in all of 2022 (13% fewer than the annual average for 2017-2021)

17,345 homes were sold in Q3 (19% fewer than the average for the same period 2017-2021)

12,596 homes were sold in Q4 (32% fewer than the average for the same period 2017-2021)

7% fewer homes expected to be sold in 2023 than in 2022 according to the National Asssociation of Realtors

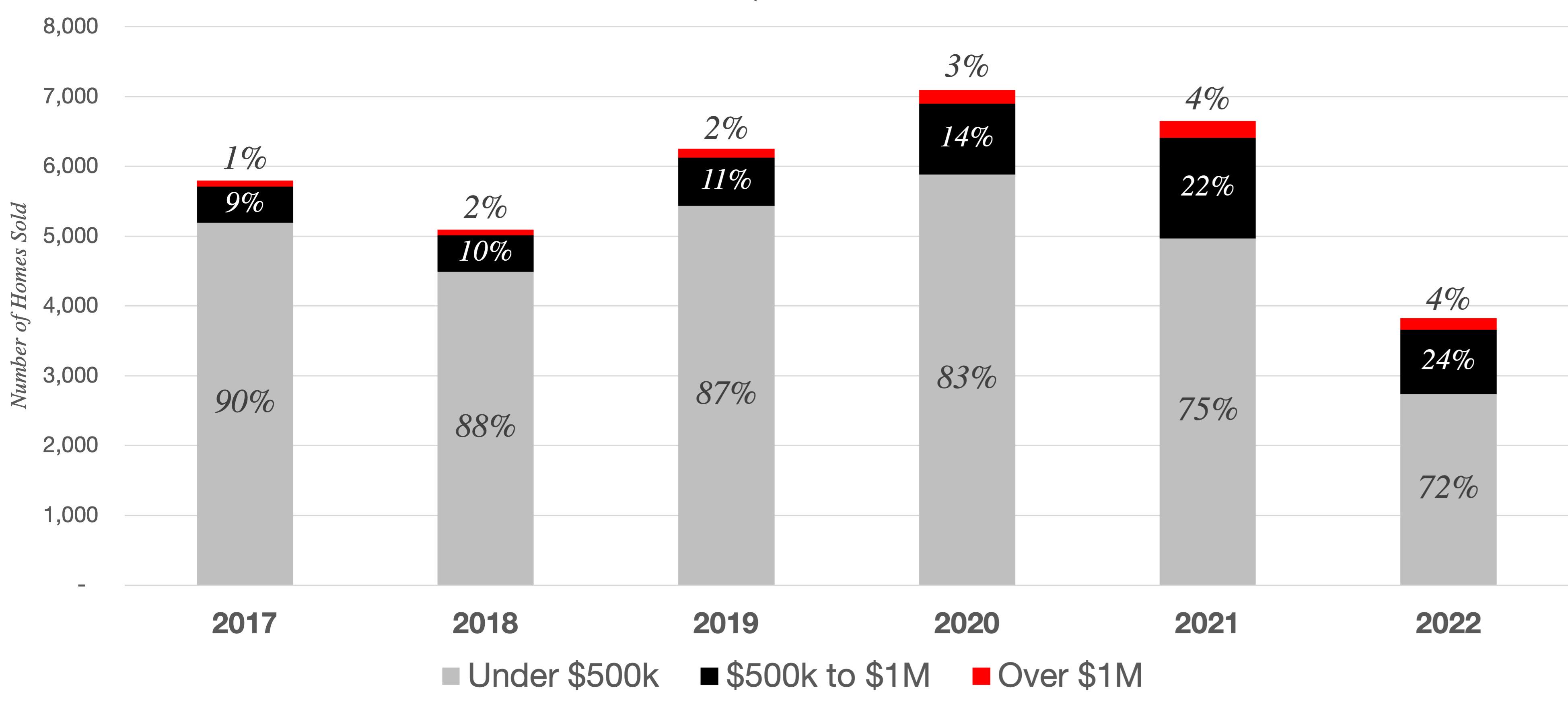

Entry level homes continue to make up the bulk of sales, but have taken the biggest hit in transaction volume declines since higher interest rates set in during summer 2022:

Most homes sold in the Greater Atlanta Area have been under $500,000, both historically and in 2022. However, the share of homes priced under $500,000 has declined in the last several years as prices overall have risen and more homes now fall into higher price brackets. In December 2022, only 72% of homes in the Greater Atlanta Area sold for less than $500,000 compared to 90% of homes in 2017.33

In December, there were 2,739 homes sold for less than $500,000 in the Greater Atlanta area, 47% fewer sales than the average for the previous five Decembers, and down 45% compared to December 2021. This was a greater decline in transaction volume than higher price points, reflecting fewer homes for sale in this price range and potentially that entry level buyers may be more price sensitive and experiencing greater constraints from the higher mortgage rate environment.

Move-up buyers—those purchasing homes priced between $500,000 and $1 million, often upgrading from an entry level home—have also been affected by increased interest rates. Closed sales in this price range were down 36% yearover-year in December 2022, a less dramatic decline in sales than entry level homes. This may be in part due to rising prices, which pushed more homes into this price range.

Luxury buyers were the least responsive to the higher interest rate environment of the past year. There was a 30% decline in closed sales for homes over $1 million in December 2022 compared to December 2021, the smallest decline of any price bracket. Even with this slower pace of sales, about twice as many homes sold for over $1 million in December 2022 as in December 2017, largely due to the overall escalation of home prices in Atlanta over the past five years.

Although Atlanta remains more affordable than many major cities, continued home price growth and rising mortgage rates have led to an increased cost of homeownership that has outpaced income growth in the past few years, making it more difficult for some Atlantans to afford to buy a home and leading some buyers to consider a wider range of potential homes that fit their budgets.

Decreased affordability leads to a smaller pool of potential buyers and therefore fewer total transactions. The average sale price for a home in Metro Atlanta increased by 44% between December 2019

and December 2022.34 The typical monthly payment for the average home increased even more* due to higher interest rates. Meanwhile, the monthly take home pay for the median household increased by 11% from 2019 to 2021 (2022 data is not yet available).35

In December 2017, the monthly payment for the average priced home in the Atlanta area cost about 39% of the net monthly income for a family earning the median household income. By December 2022, a typical monthly mortgage payment for the average priced home reached 59% of the median household’s monthly budget. This increased cost has pushed some would-be buyers to wait to buy a home.

There would need to be a change in dynamics for a greater share of

Atlantans to comfortably afford home ownership— and for the number of home sales to rise signficantly— such as a reduction in mortgage interest rates, more affordable home prices, or an increase in income.

For those who are able to purchase a home, some may choose to lower their target price range to account for a higher interest rate. To meet their financial goals, some buyers today are expanding their searches to different types of homes—such as a smaller home, a townhome, or a condominium— or considering a wider range of neighborhoods, allowing them to find homes that meet their lifestyle goals while fitting their budget. Others are taking advantage of mortgage rate buydown programs to lower their initial payments, with plans to refinance at a lower rate.

* Assumptions: Annual median household income from U.S. Census American Community Survey estimates as net monthly household income (based on the ADP Gross to Net Calculator for a Georgia resident); FMLS InfoSparks average sale price (all home types) for the Greater Atlanta Area in December of each year; Average 30-year fixed rate mortgage interest rate from Freddie Mac Primary Mortgage Market Survey for the given month.

a) U.S. Census American Community Survey, Atlanta-Sandy Springs-Roswell MSA, 2017 to 2021

b) 2022 Median Household Income had not yet been published at t he time of this report; 2021 data shown for reference

c) Net monthly income estimated using the ADP Gross to Net Calculator for a Georgia resident

d) FMLS InfoSparks average sale price (all home types) for the Greater Atlanta Area in December of each year

e) Freddie Mac Primary Mortgage Market Survey, average of weekly average rates for December of each year

f) Assumes a 20 percent down payment and no PMI; includes estimated property taxes and insurance, but not HOA dues

Atlanta continues to hold its position as the economic powerhouse of the Southeast, attracting new companies and residents with its culture, climate, and relative affordability. Metro Atlanta grew by 64,940 people in the past year, bringing the 11-county area to 5.1 million residents (+1.3%). About 10% of metro area residents live in the City of Atlanta (507,015 people).36

Each of the 11 counties grew this year, with the greatest number of new residents in Gwinnett (13,460), Fulton (11,200), Cobb (6,900), and Cherokee (6,890) Counties. As a percent of its total population, the northern edge counties saw the greatest rates of population growth, with Forsyth County growing by 2.6% and Cherokee County growing by 2.5% year-over-year.37

Atlanta’s strong job market and growing population are key reasons it is expected to be the #1 top U.S. real estate market to watch in 2023.38 In addition to growth in staple industries like life sciences and manufacturing, Georgia’s growing film industry and a number of major West Coast companies—including Apple, Microsoft, and Visa—opening

large offices in Atlanta have also brought new residents to the metro. The number of jobs in Metro Atlanta was up 6.7% year-over-year, making it #2 of all large metros for job growth in 2022. The unemployment rate was just 2.7% in November 2022, below the national average of 3.4%.39 Atlanta workers are more likely to be working from home, with 24% telecommuting, three times as many teleworkers as there were prepandemic.40

This job growth has resulted in population growth to fuel demand for housing. Metro Atlanta was the #5 moving destination in the country in 2021.41 People are choosing to move to our region from all over the country and the world. In the U.S., the metro areas around New York City, Miami/Fort Lauderdale, Chicago, Washington, D.C., Los Angeles, and Orlando were among the top feeder markets for people relocating to Atlanta in recent years. Fellow Georgians are also migrating to Atlanta from places like Athens, Gainesville, and Savannah.42

Across Metro Atlanta, home sales slowed in the second half of 2022, reflecting normal seasonal trends at an accelerated pace due to higher interest rates and uncertain economic conditions. The number of homes sold was down about 30% marketwide compared to Q3 and Q4 2021, and down 22.7% compared to the same period in 2019, a more normal year.

Although new listings declined consistently, the total number of listings went up as homes stayed on the market longer than they did in the hot early 2022 market. went up as homes stayed on the market longer than they did in the hot early 2022 market. Homes averaged

25 days on market in Q3 and Q4 2022. More affordable homes were typically scooped up faster than the more expensive inventory, and townhomes and condominiums sold faster than single-family homes. Inventory remained low at just 2.1 months of supply. This limited

inventory helped to stabilize home prices despite a decline in demand. The average sale price was up 9.9 % year-over-year, and up 44.8% from the same period in 2019, with an average increase of $147,969 since 2019 (including $18,593 last year).

Source: FMLS InfoSparks, Greater Atlanta Area/City of Atlanta/ITP, All home types, All price points, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

$400,000 median sale price

$477,701 average sale price

2.1 months of inventory

Single-Family Homes: 2.2 months

Townhomes: 1.9 months

Condominiums: 1.7 months

Source: FMLS InfoSparks, Greater Atlanta Area, All Home Types, January to December 2022

Metro Atlanta 2022 Supply Dynamics - Single-Family Homes

Source: FMLS InfoSparks, Greater Atlanta Area, Single-Family Homes, January to December 2022

Metro Atlanta 2022 Supply Dynamics - Townhomes

Source: FMLS InfoSparks, Greater Atlanta Area, Townhomes, January to December 2022

Metro Atlanta 2022 Supply Dynamics - Condominiums

Source: FMLS InfoSparks, Greater Atlanta Area, Condominiums, January to December 2022

Metro Atlanta Market Summary by Price Point - All Home Types (Q3 & Q4 2022)

Source: FMLS InfoSparks, Greater Atlanta Area, All home types, Rolling 6-months as of December 2022 (year-over-year change com

pared to rolling 6-months as of December 2021)

Metro Atlanta Market Summary by Price Point - Single-Family Homes (Q3 & Q4 2022)

Source: FMLS InfoSparks, Greater Atlanta Area, Detached Single-family homes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Metro Atlanta Market Summary by Price Point - Townhomes (Q3 & Q4 2022)

Source: FMLS InfoSparks, Greater Atlanta Area, Townhomes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

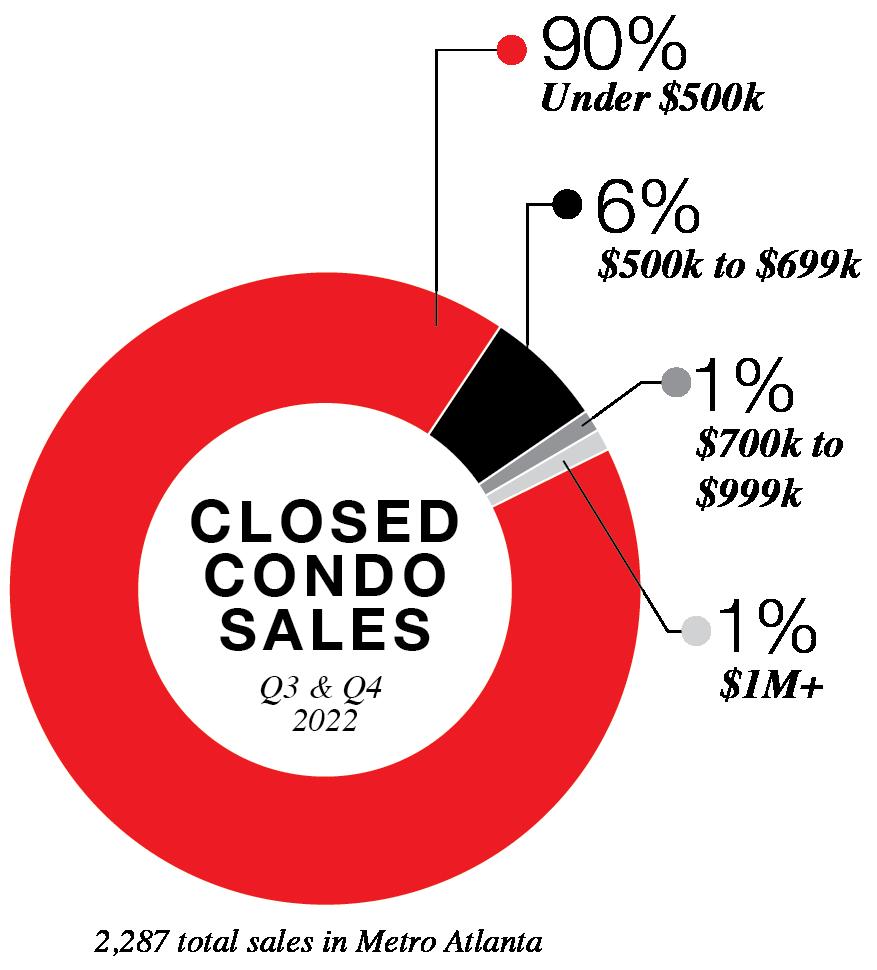

Metro Atlanta Market Summary by Price Point - Condominiums (Q3 & Q4 2022)

Source: FMLS InfoSparks, Greater Atlanta Area, Condominiums, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

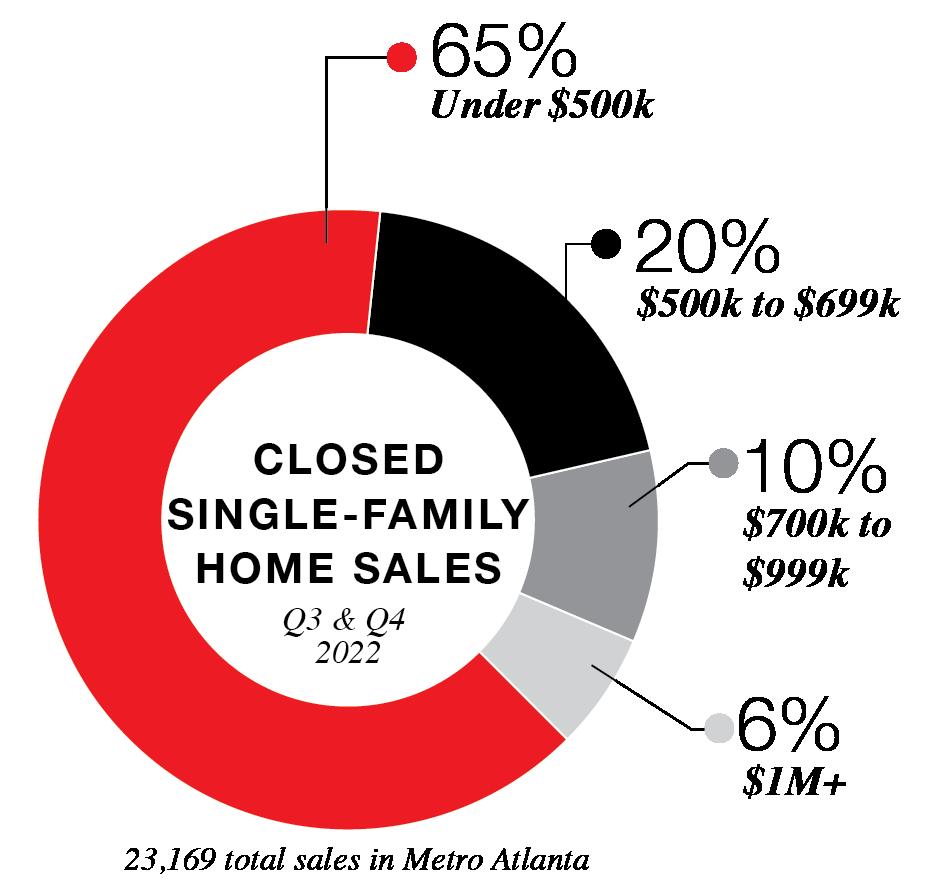

In 2022, most homes sold in Metro Atlanta were detached single-family homes (77%). There were 51,855 single-family homes sold last year, the fewest of any 12-month period since 2015. Like the market overall, there were about 30% fewer singlefamily homes sold in the second half

of 2022 (23,169 homes) compared to the same period in 2021, a trend related to higher mortgage interest rates.

The average single-family home in Metro Atlanta sold for $509,136 in Q3 and Q4 2022, up 10% year-

Metro Atlanta Single-Family Home Summary (Q3 & Q4 2022)

over year. Since the same period in 2019, the average sale price was 49% ($167,570), resulting in significant equity for existing homeowners. While negotiation and some seller concessions became more common than early in the year, sellers continued to get close to

Source: FMLS InfoSparks, Greater Atlanta Area, Single-family homes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

their asking price in late 2022, with an average sale price to original list price of 97.2%.

The tight inventory of single-family homes for sale (2.2 months of inventory) is a key reason prices have continued to rise even as higher interest rates dampened demand.

Single-family home sales under $500,000 (-36.9%) were down more than higher priced homes in late 2022. This is in part because rising home prices overall pushed more homes into higher price brackets.

Source: FMLS InfoSparks, Greater Atlanta Area, Single-family homes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Source: FMLS InfoSparks, Greater Atlanta Area, Single-family homes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Homebuyers looking for a singlefamily home ITP paid an average of $682,681 in the second half of 2022, up 7.3% from the same period in 2021. Intown living commanded a substantial premium compared to more suburban locations, with an average price $173,545 (34%) higher for ITP homes compared to the metro average.

Although prices continued to grow year-over-year, the market was quieter in the second half of 2022, with 32.6% fewer single-family homes sold ITP compared to the same period last year. Homes priced between $700,000 and $1 million kept the closest pace to 2021 (-4.8% fewer sales), likely because these more affluent buyers may be less sensitive to interest rates, more homes were priced in this range, and buyers previously looking at homes priced over $1 million may have shifted their search to this range.

Continued price growth has reduced the number of single-family homes

available at an entry level price point in Metro Atlanta. In the second half of 2022, just 65% of single-family homes sold for less than $500,000. This is down from the same period in 2021, when 72% of homes sold for less than $500,000. In 2019, it was 86%. This trend was even more pronounced ITP. In the second half of 2022, less than half of all singlefamily homes (47%) ITP sold for less than $500,000.

Fewer homes have been listed in Metro Atlanta each month since summer 2022, reflecting seasonal trends and rising interest rates that have made current homeowners hesitant to move. In the ITP singlefamily home market, this trend held up for homes under $500,000. There were 14% fewer new listings in the second half of 2022 compared to the same period in 2021, a decline that outpaced the dwindling share of homes sold for less than $500,000. Homeowners in this price range may be more sensitive to rising interest rates, less willing to move, or may be listing their homes at higher prices. At higher price points, the number of listings rose compared to the same period in 2021, with 20% to 22% more homes for sale in 2022.

(Q3 & Q4 2022)

• $682,681 average sale price (+7.3% YOY)

• 14% of all single-family home sales were ITP

• 18% of all single-family home listings were ITP

• ITP homes sold at the same pace as the metro average (26 days on market)

• Homes sold for 97.9% of the original list price on average

Inventory levels remained relatively low at 2.1 months of supply for homes between $500,000 and $999,999 and 3.3 months of supply for homes over $1 million.

Most Expensive Area to Buy a Single-Family Home ITP Chastain Park (Average sale price of $2,281,660)

Fastest Growing Average Single-Family Home Prices ITP

Brookwood Hills (+29.9% Q3/Q4 average closed sale price in 2022 vs. 2021)

Highest Price Per Square Foot for Single-Family Homes ITP Cabbagetown (Average $449/SF)

Shortest Average Days on Market ITP Inman Park (Average 10 days on market)

Less than $499,999

Cascade East

Cascade West

College Park

East Atlanta

East Point

Hapeville

Summerhill

West End/

Capitol View

$500,000 to $699,999 $700,000 to $1 million Over $1 million

Avondale Estates

Cabbagetown

Chamblee

East Lake

Edgewood

Grant Park/ Glenwood Park

Kirkwood

Ormewood Park

Reynoldstown

West Midtown/ Underwood Hills

Brookhaven

Collier Hills/ Ardmore Park

Decatur

Druid Hills/ Emory

Lake Claire/Little

Five Points

Oakhurst

Old Fourth Ward

Peachtree Hills

Vinings

Ansley Park/ Sherwood Forest

Brookwood Hills

Buckhead

Chastain Park

Garden Hills

Inman Park

Virginia

Highlands/ MorningsideLenox Park

Source: FMLS InfoSparks,Single-family homes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Almost all the single-family homes sold ITP were resale. Of the 3,297 detached single-family homes sold ITP in the second half of 2022, only 160 were new construction, representing just 4.9% of sales. Most were “infill” homes built on a lot in an established neighborhood, rather than as new subdivisions as seen in many OTP areas. They ranged from $279,000 for a 2-bedroom, 742-square-foot home in English Avenue to $5,779,000 for a custom 7-bedroom home with more than 11,000 square feet in Mount Paran.

Most were priced under $600,000 (59%); however, a significant number of homes priced over $1 million (23%) brought the average sale price for a new home ITP to $931,134. New homes priced under $600,000 were typically located on the south and west sides in places like Pittsburgh, Oakland City, Mozley Park, Bankhead, and Hapeville. Homes over $1 million were typically located on the north and east sides of town in places like Oakhurst, Buckhead, and Brookhaven.

Single-family homes continue to be the primary type of housing outside the perimeter. Homes in suburban areas tend to offer more space at a lower cost per square foot, an appealing option for families and other buyers looking to get more for their money. However, the relative savings of OTP living has been declining in recent years. A decade ago, ITP homes cost 64% more per square foot (PPSF) than the average home in Metro Atlanta ($123/SF ITP compared to $75/SF on average). In late 2022, that premium had declined

to 39% ($276/SF ITP compared to $198/SF on average). This may reflect factors like an increase in the share of homes built OTP since 2012 (which tend to be smaller than those built in previous decades), an increasing share of new homes in the suburbs (which tend to cost more per square foot than resale), rising property values as suburban cities have developed their own town centers and amenities, or shifting preferences toward suburban living since the COVID-19 pandemic, which accelerated the shrinking gap between intown and suburban PPSF.

Still, homes in suburban Atlanta remain relatively affordable, and many places have average home prices below the national average.

OTP

(Q3 & Q4 2022)

• 86% of all single-family home sales were OTP

• 82% of all single-family home listings were OTP

Metro Atlanta vs. ITP Price Per Square Foot - Single-Family Homes (Q3 & Q4, 2012 to 2022)

Most Expensive Area to Buy a Single-Family Home OTP

Fastest Growing Average Single-Family Home Prices OTP

Highest Price Per Square Foot for Single-Family Homes OTP

Shortest Average Days on Market OTP

Milton (Average Q3/Q4 sale price $1,315,685)

Milton (+24.3% Q3/Q4 average closed sale price in 2022 vs. 2021)

Chattahoochee Hills (Average $397/SF)

Tied between Dunwoody, McDonough, and Tucker (Average 19 days on market)

Less than $499,999 $500,000 to $699,999 $700,000 to $1 million Over $1 million

Acworth

Clarkston

Douglasville

Fairburn

Fayetteville

Kennesaw

Lawrenceville

Mableton

McDonough

Norcross

Snellville

South Fulton

Sugar Hill

Tucker

Union City

Woodstock

Canton

Cumming

Duluth

Dunwoody

East Cobb

Marietta

Peachtree City

Peachtree

Corners

Smyrna

Suwanee

Alpharetta

Chattahoochee Hills

Johns Creek

Roswell

Milton Sandy Springs

Source: FMLS InfoSparks, Single-family homes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

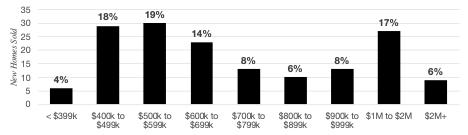

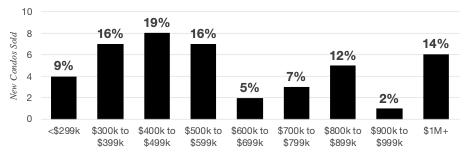

There were 1,891 new construction single-family homes sold in Metro Atlanta in Q3 and Q4 2022. They sold for an average of $638,025, or $216 per square foot. Most single-family home construction in Atlanta is happening in the suburbs, particularly those north of Atlanta. Although some of these new homes were built as infill on lots in existing neighborhoods as is typical ITP, many were constructed as part of new subdivisions in suburban areas.

Gwinnett County had the most new construction single-family homes sold in late 2022 (393 homes), followed by Fulton (327), Cobb (224), Cherokee (219), and Forsyth (218) Counties.

The top cities for new singlefamily construction sales OTP were in the outer ring of the metro: Cumming, Canton, Loganville, and Fairburn. Marietta had the most new construction sales of closer in cities, with an average sale price of nearly $1 million for new single-family homes.

About 10% of new construction single-family homes sold in late 2022 were luxury homes priced at $1 million or higher. Most were in Fulton (45%), Cobb (21%), or DeKalb (16%) Counties. The most popular OTP cities for new homes over $1 million were Marietta (32 homes), Milton (20 homes), Alpharetta (16 homes), Canton (10 homes), and Johns Creek (10 homes).

The most affordable cities for new construction homes were all located south of Atlanta: Jonesboro ($290,000 average sale price), South Fulton ($312,495), Lovejoy ($379,066), East Point ($379,066), and Villa Rica ($382,463).

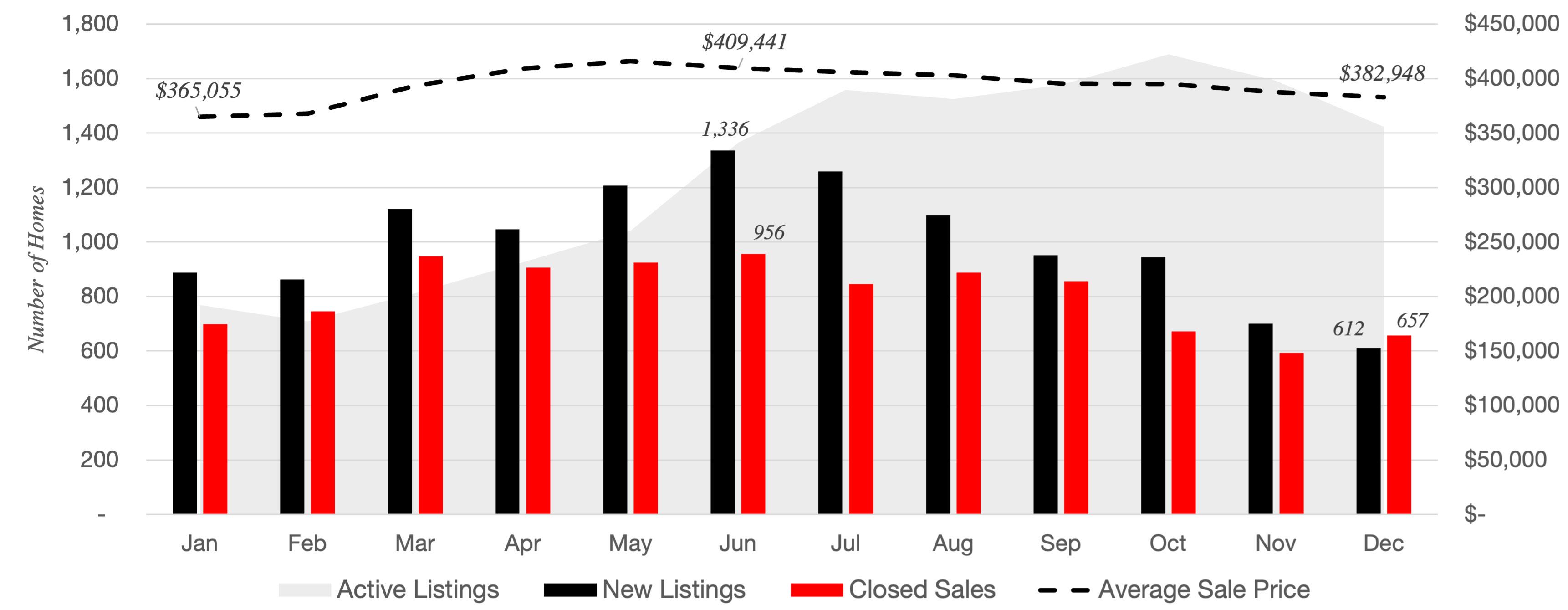

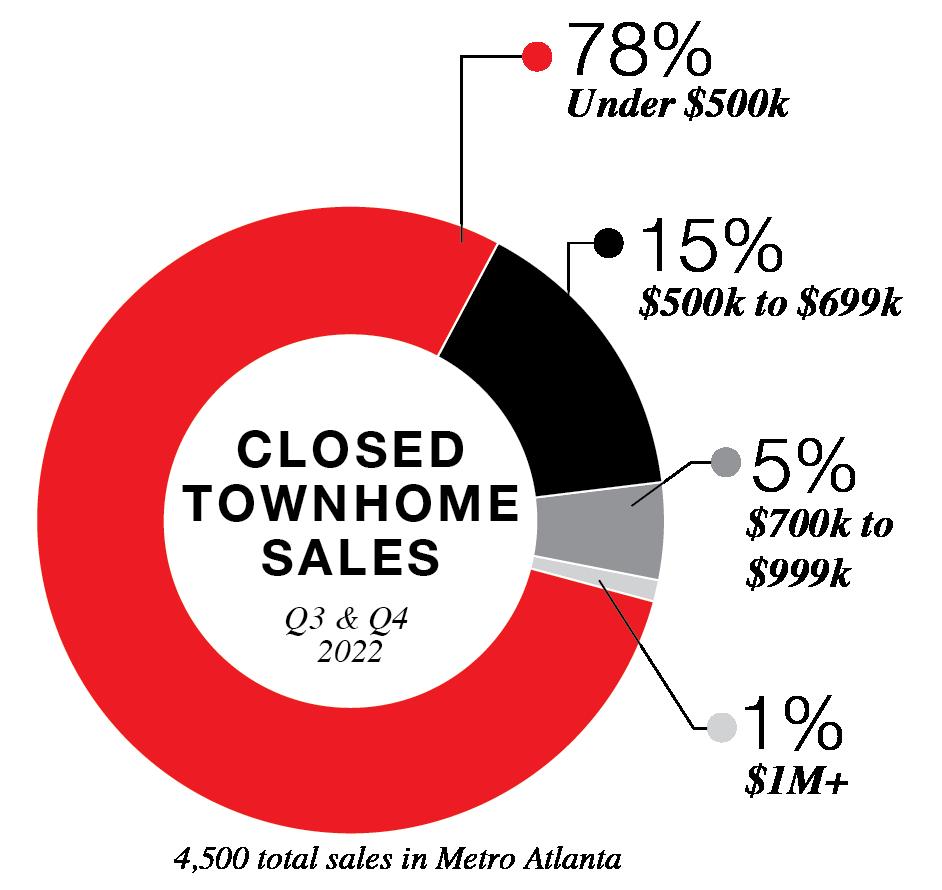

There were 9,689 townhomes sold in Metro Atlanta in 2022, lower than the record sales of the pandemic era due to a slower second half of the year, but still 1% higher than in 2019.

Townhomes have become an increasingly popular choice for Metro Atlanta homebuilders and buyers over the past decade, offering many of the perks of a single-family home with a lower price tag and less exterior maintenance. In late 2012, 10.5% of all homes purchased in the metro were townhomes. In the second half of 2022, about 15% of Metro Atlanta homebuyers opted for townhomes, with 4,500 total sales in Q3 and Q4.

Although the total number of townhomes sold was down in the second half of 2022 (-26% compared to the same period in 2021) sale prices continued to rise. The average price for a townhome in Metro Atlanta

was $395,933 in Q3 and Q4, 10% higher than the same period in 2021, in part because of limited inventory. 78% of townhomes sold for less than $500,000. Even with growing prices, townhomes remain a more affordable option than detached single-family homes, which sold on average for $113,149 more than the average townhome.

This relative cost savings is a key factor in the growing popularity of townhomes. There were just 1.9 months of townhome inventory in late 2022, a slightly tighter supply than the market overall. They went under contract in 22 days on average, faster than single-family homes or condominiums.

Most townhome sales were in suburban areas outside the perimeter, with about a quarter of townhome sales ITP. Threebedroom townhomes were the

Townhomes

(Q3 & Q4 2022)

• $395,933 average sale price (+10.1% YOY)

• 15% of all homes sold were townhomes

• Townhomes sold 3 days faster than average (22 days on market)

• Townhomes sold for 98.7% of the original list price on average, the highest of any home type

most purchased category, making up 62% of all townhome sales and averaging $403,020. Although they made up a smaller share of the market, 2-bedroom townhomes have the highest relative demand, with just 1.5 months of supply in Metro Atlanta.

While luxury townhomes continue to be a small portion of the overall townhome market (less than 2% of sales), there were 14% more townhomes sold for $1 million or more in the second half of 2022

compared to 2021. This shows a growing number of luxury buyers interested in a low-maintenance townhome lifestyle and an expanding portfolio of new luxury townhomes to choose from. With a smaller pool of luxury buyers, these townhomes tended to stay on the market about twice as long as more affordable townhomes, averaging 44 days on the market.

Source: FMLS InfoSparks, Greater Atlanta Area, Townhomes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Source: FMLS InfoSparks, Greater Atlanta Area, Townhomes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Source: FMLS InfoSparks, Greater Atlanta Area, Townhomes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

The growing trend toward townhomes has been even stronger ITP than in the metro overall. In the late 2012, 13% of all homes sold ITP were townhomes. By the second half of 2022, 18% were townhomes (1,023 sales). The cost savings compared to a detached single-family home was greater too. In Q3 and Q4 2022, the average ITP townhome cost $517,902, about $164,355 (24%) cheaper than the average detached single-family home. About 55% of ITP townhomes sold for less than $500,000, a higher share than the 47% of ITP single-family homes in the same price range.

Like the market overall, the total number of townhomes sold ITP was down in the second half of 2022 compared to the same period in 2021 (-34%). As with single-family homes, intown sales for townhomes under $500,000 were down more

than those at higher price points (-43.3%), reflecting greater buyer sensitivity to rising interest rates in the entry level price range.

The ITP luxury townhome market is small but growing. Townhomes priced over $1 million were the only price range with more ITP sales in late 2022 compared to 2021 (+2.7%) but remained a fraction of the market with just 38 sales. Though small, that is 475% more luxury townhomes sold than a decade ago. The number of new listings for townhomes over $1 million ITP is up significantly (+41.2% compared to late 2021) while new listings at lower price points is down (-22.6%), reflecting fewer of the less expensive resale townhomes being listed and higher price tags for new construction townhomes being delivered in a period with high construction costs.

(Q3 & Q4 2022)

• $517,902 average sale price (+11.1% YOY)

• 18% of all ITP homes sold were townhomes

• 23% of all townhome sales were ITP

• 26% of all townhome listings were ITP

• 22% ITP townhomes sold were new construction

• ITP homes sold a little slower than the metro average (26 days on market)

• Homes sold for 98.7% of the original list price on average

Most Expensive Area to Buy a Townhome ITP

Fastest Growing Average Townhome Prices ITP

Highest Price Per Square Foot for Townhomes ITP

Shortest Average Days on Market ITP

Inman Park ($1,215,599 average Q3/Q4 sale price)

Inman Park (+74.3% Q3/Q4 average closed sale price in 2022 vs. 2021)

Inman Park (Average $428/SF)

Tied between Avondale Estates and East Atlanta (Average 4 days on market)

Less than $300,000

Cascade East College Park

East Point

West End/ Adair Park/ Capitol View/Sylvan Hills

$300,000 to $499,999

Avondale Estates

Collier Hills/ Ardmore Park

Grant Park

Glenwood Park

Peoplestown/ Chosewood Park/

Lakewood Heights

Vinings

West Midtown/ Underwood Hills

$500,000 to $699,999

Brookhaven

Buckhead

Chamblee

Chastain Park

Decatur

Druid Hills/ Emory

East Atlanta

Edgewood

Garden Hills

Kirkwood

Oakhurst

Ormewood Park

Reynoldstown

Summerhill

$700,000 to $1 million Over $1 million

East Lake

Lake Claire/ Little Five Points

Midtown

Old Fourth Ward

Peachtree Hills

Ansley Park/ Sherwood Forest

Inman Park

Nearly half (49%) of all new homes sold ITP in Q3 and Q4 2022 were townhomes (227 homes). This was greater than the number of singlefamily homes sold (195 homes), showing a growing trend toward intown townhome development, with designs that uses land more efficiently and often can be sold at a more attainable price point. Townhomes purchased in late 2022 were also more likely to be new builds compared to other types of homes. Although new construction made up just 8% of all ITP home sales in Q3 and Q4, 22% of all townhomes sold ITP were new construction.

These new townhomes were most often located on the west side from West Midtown to the Chattahoochee River; in east side neighborhoods like Old Fourth Ward, Edgewood, Kirkwood, and Summerhill. Unlike new single-family homes ITP, most new construction townhomes

are part of small townhome developments, by nature of their attached design.

New construction townhomes ranged from $248,500 for a modest 3-bedroom, 1,800-square foot townhome at Browns Mill Village to $1,960,000 for a gut renovation

of a historic estate in Druid Hills that was converted to multiple homes, including this 4-bedroom, 4,574-square-foot townhome. Most were priced under $600,000 (56%), with an average sale price of $618,826 ($309 per square foot).46

Townhomes were a popular choice for buyers in all parts of suburban Atlanta, from Canton in the north to Fayetteville in the south. Most of the townhomes sold in the second half of 2022 were located OTP (77%).

The highest concentrations of townhome sales were in centrally located Fulton, DeKalb, and Cobb Counties, followed by the northern suburban counties. Fewer townhomes were sold in suburban counties south of Atlanta, where the housing stock leans more heavily toward single-family homes.

Fayette County had the fewest townhome sales in late 2022, with just 12 sales, but the highest average sale price of all Metro Atlanta counties. The average price for a townhome in Fayette County was driven by the fact that most sales were custom built townhomes in the new Trilith development, a master planned community next to Trilith Studios and designed to attracted film industry employees with convenient, high-end homes.

OTP Townhomes (Q3 & Q4 2022)

• 77% of all townhome sales were OTP

• 74% of all townhome listings were OTP

Most Expensive Area to Buy a Townhome OTP

Fastest Growing Average Townhome Prices OTP

Chattahoochee Hills ($838,908 average Q3/Q4 sale price)

Fayetteville (+161.9% Q3/Q4 average closed sale price in 2022 vs. 2021)

Highest Price Per Square Foot for Townhomes OTP Chattahoochee Hills (Average $431/SF)

Shortest Average Days on Market OTP Fairburn (Average 3 days on market)

Source: FMLS InfoSparks, Rolling 6-months as of December 2022

Clarkston

Douglasville

Fairburn

McDonough

Norcross

South Fulton

Tucker

Union City

Acworth

Canton

Duluth

East Cobb

Johns Creek

Kennesaw

Lawrenceville

Mableton

Marietta

Peachtree City

Peachtree

Corners

Sandy Springs

Smyrna

Snellville

Sugar Hill

Suwanee

Woodstock

Alpharetta

Dunwoody

Fayetteville

Milton

Source: FMLS InfoSparks, Townhomes, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021) q Down YOY p Up YOY

q Down YOY p Up YOY s Below TH Market Average r Above TH Market Average w Equal to TH Market Average

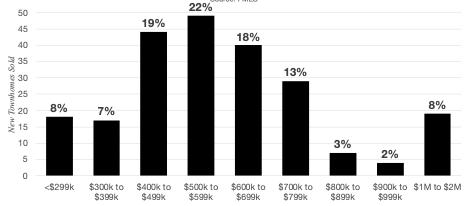

There were 1,037 new construction townhomes sold in Metro Atlanta in Q3 and Q4 2022.47 They sold for an average of $471,488— about $167,000 less than the cost of the average new single-family home, making townhomes a more affordable option for buyers looking for new construction. Most new townhomes were constructed outside of the perimeter, often around the historic and emerging town centers of suburban cities.

Fulton County had the most new construction townhomes sold in late 2022 (401 homes), followed by Gwinnett (199 homes), DeKalb (183 homes), Cobb (112 homes), and Cherokee (109 homes) Counties. In Fulton County, there were more new construction sales for townhomes than for single-family homes (327 homes) in Q3 and Q4 2022. Few new construction townhomes were sold on counties in the south Metro area, with just 21 new townhomes sold between Clayton, Henry, Fayette, Rockdale, and Douglas Counties.

The top cities for new construction townhome sales OTP were spread across the north and south sides of the metro, typically in cities that have been working on establishing more defined town centers: Fairburn, Woodstock, Suwanee, Stonecrest, Lithonia, and Peachtree Corners.

Luxury townhomes—priced at $1 million or higher—are an emerging part of the townhome market, offering a low-maintenance option for high-end buyers. About 2% of new construction townhomes sold in late 2022 were more than $1 million,

all located in Fulton or DeKalb Counties, and mostly within the City of Atlanta. The only OTP cities with new construction townhome sales over $1 million were Alpharetta and Milton.

As with new single-family homes, the most affordable cities for new construction homes were all located south of Atlanta: Morrow ($231,475 average sale price), South Fulton ($261,049), Stockbridge ($284,123), Lithonia ($294,817), and Fairburn ($296,179).

Condominiums offer a convenient, low-maintenance, lifestyle that appeals to everyone from firsttime homeowners looking for an affordable place of their own to high-end buyers in search of resortstyle living. They have become an increasingly popular choice for Atlantans over the past decade as walkability became more top of mind and more condominiums were constructed. 1.4 times as many people bought condos in Metro Atlanta in 2022 than in 2012, shifting from 7% of all homes purchased in 2012 to 8% in 2022.

During the height of the pandemic, condominium sales slowed more than sales for single-family homes or townhomes, as many people sought extra space in a time of social distancing. They rebounded significantly in 2021 as vaccines rolled out and excitement for vibrant city living returned. In 2021, a record 7,205 condominiums sold in Metro Atlanta. In 2022, 5,545 condominiums were sold, down 23% year-over-year but still 3% higher

than the number of condominiums sold in 2019.

Like other home types, there were fewer condominiums in Q3 and Q4 2022 than there were in the first half of the year. There were the fewest condominiums sold in a 6-month period since 2015. Condominium buyers who are taking out mortgages may be more affected by rising interest rates than buyers of other home types, as the interest rate for a condominium is typically slightly higher.

The average condominium in Metro Atlanta sold for $323,036 in Q3 and Q4 2022, up 6.1% year-overyear. Prices for condominiums—like other types of homes— increased significantly over the past three years. The average condominium cost 20% ($53,297) more in late 2022 than it did in the same period in 2019.

Most condominiums in Metro Atlanta sold in late 2022 were priced under $500,000 (90%). Compared to the

Metro Atlanta Condominiums

(Q3 & Q4 2022)

• $323,036 average sale price (+6.1% YOY)

• 8% of all homes sold were condominiums

• Condominiums sold 2 days faster than average (23 days on market)

• Condominiums sold for 98.1% of the original list price on average

• Condominiums sold for more per square foot than any other home type, averaging $272/SF

demand for condominiums in this entry-level price range, the number of homes for sale is limited. There were just 1.4 months of inventory for condominiums under $500,000 and they sold in three weeks on average, two to five weeks faster than higher priced condominiums.

Luxury condominiums (priced over $1 million) tend to feature high-end finishes, skyline views, and resortstyle building amenities. They make up a small share of the overall condominium market, with just 32 sales in Q3 and Q4 2022. With a smaller pool of potential buyers in the luxury segment, these homes tend to sell slower than lower priced homes, averaging 57 days on the market. Luxury condominiums have experienced the greatest decline in sales volume of any price point since the peak last summer, with

transactions down 56% since June 2022. However, they continue to sell near asking price, with an average sale price to original list price ratio of 96%.

Most condominiums are located in intown neighborhoods or near the town centers of suburban cities, offering a walkable lifestyle for residents. 64% of condominium sales in Q3 and Q4 2022 were ITP, and an even greater share of true condominiums were located intown, as many of the properties classified as condominiums in OTP locations are actually townhome condominiums.

InfoSparks, Greater Atlanta Area, Condominiums, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Source: FMLS InfoSparks, Greater Atlanta Area, Condominiums, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Source: FMLS InfoSparks, Greater Atlanta Area, Condominiums, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

q Down YOY p Up YOY

Intown buyers were more likely to choose a condominium than the metro buyers on average. 25% of homes sold ITP in Q3 and Q4 2022 were condominiums compared to 8% of homes in Metro Atlanta.

Even with their relative popularity for intown buyers, the number of sales for intown condominiums were down 40% year-over-year in the second half of 2022, with 1,443 sales. This was a more significant slowdown than homes in Metro Atlanta in general (down 30% yearover-year) or all ITP homes (down 35% year-over-year).

Despite fewer sales, intown condominium prices continued to rise. The average sale price for an ITP condominium was $353,177 in late 2022, up 4.6% year-over-year, on par with the average annual home price growth in Metro Atlanta for the past 47 years. The price per square foot was up even higher, up 9.1% year-over-year. At an average of $312 per square foot, intown condominiums commanded a 15% premium compared to the average

price per square foot for all Metro Atlanta condominiums ($272 per square foot).

Smaller, more affordable ITP condominiums had the greatest price growth in late 2022. 1-bedroom and studio condominiums were up 7.4% year-over-year (selling for $259,347 on average) and 2-bedroom condominiums were up 6.6% (selling for $390,179 on average).

The majority of units sold ITP in Q3 and Q4 2022 were older. The average year built for condos sold during this period was 1986. Just 5% of sales were in buildings built in 2010 or later. This was down slightly from the first half of the year when 7% of sales were in these newer buildings, but a typical pre-pandemic share.

Most intown condominiums sold in late 2022 were less than 1,500 square feet (86%), a slightly higher share than in recent years (2 to 4% more). Condominiums less than 1,500 square feet were less expensive, but appreciated at a higher rate than larger condominiums (+7.9% year-over-year). This is related to the higher demand for these smaller and more affordable units. There were 1.6 months of

(Q3 & Q4 2022)

• $353,177 average sale price (+4.6% YOY)

• $312/SF (+9.1% YOY)

• 25% of all homes sold ITP were condominiums

• Condominiums sold 1 day faster than average (25 days on market)

• ITP condominiums sold for 98% of the original list price on average

• Average Year Built: 1986

• Buckhead had the most condominium sales of any ITP submarket (430 homes), followed by Midtown (262 homes)

inventory for ITP condominiums less than 1,500 square feet compared to 3.3 months of inventory for larger condominiums.

Most Expensive Area to Buy a Condominium ITP Ansley Park/Sherwood Forest ($543,385 average Q3/Q4 sale price)

Fastest Growing Average Condominium Price ITP

East Point (+96.0% Q3/Q4 average closed sale price in 2022 vs. 2021)

Highest Price Per Square Foot for Condominiums ITP Inman Park (Average $432/SF)

Shortest Average Days on Market ITP East Point (Average 1 day on the market)

Source: FMLS InfoSparks, Rolling 6-months as of December 2022

Less than $300,000 $300,000 to $499,999

Avondale Estates

Brookhaven

Cascade East

Cascade West

Chastain Park

College Park

Decatur

Downtown

Hapeville

Peachtree Hills

Peoplestown/ Chosewood Park/ Lakewood Heights

West End/Adair

Park/Pittsburgh/

Sylvan Hills

Brookwood Hills

Buckhead

Cabbagetown

Collier Hills/Ardmore Park

Druid Hills/Emory

East Point

Edgewood

Garden Hills

Grant Park/Glenwood Park

Inman Park

Kirkwood

Lake Claire

Little Five Points

Midtown

Old Fourth Ward

Ormewood Park

Reynoldstown

Vinings

Virginia Highlands/Morningside

West Midtown/Underwood Hills

$500,000 to $699,999

Price brackets based on 6-month rolling average sale price in analyzed area as of December 2022 from FMLS

Most new construction condominium sales (56%) have been intown, typically in walkable neighborhoods where buyers can take advantage of the conveniences of city living. With 43 new condominiums sold ITP in late 2022, condos make up the smallest share of the ITP new home market (9% of new homes sold). In some cases, new construction sales are not recorded in FMLS and the actual number may be higher.

New condominiums ranged from $185,000 for the gut renovation of a historic 2-bedroom at Willow Park in Decatur to $8,250,000 for a 4-bedroom penthouse at Graydon Buckhead. Most were priced under $600,000 (60%), but the average sale price—$737,219 ($451 per square foot)—was skewed higher by a few luxury condominium sales.48

Most new condominiums sold in 2022 were located in high rises in Midtown, West Midtown, or Buckhead. These buildings typically completed construction in 2020 or

2021. These included 40 West 12th , 788 West, J5, Graydon Buckhead, and The Atlantic. The Dillon is also pre-selling luxury units in a high rise building under construction in Buckhead that is expected to be completed in 2024.

The number of cranes in the sky around Midtown and Buckhead are not a sign of more condominiums on the way. Almost all of these are for apartments or commercial projects. New condominiums completed in 2022 or currently under construction have trended toward smaller

buildings in east side neighborhoods like Old Fourth Ward, Grant Park, Virginia Highlands, Edgewood, and Decatur rather than high rises in the core. Most are four stories or less with 40 units or fewer. They offer a lock-and-leave lifestyle with new construction in quieter residential neighborhoods. In many ways a return to Atlanta’s traditional, smaller multifamily buildings of the early 1900s, but with modern designs, floorplans, and amenities.

Most of the condominiums sold in Q3 and Q4 were located intown, but condo living has a place in the suburbs as well. About 37% of condominiums were sold OTP in late 2022. In many cases, properties classified as condominiums OTP are townhome condominiums rather than traditional, singlelevel condominiums in multifamily buildings.

Traditional condominiums OTP are typically located in mid-rise buildings in the town centers of places like Sandy Springs, Dunwoody, Cumberland, Alpharetta, Woodstock, along with some low-rise buildings in places like Stonecrest.

Condominiums outside the perimeter are typically more affordable and slightly larger than intown condominiums.

Stats

Condominiums (Q3 & Q4 2022)

• 37% of all condominium sales were OTP

• 29% of all condominium listings were OTP

Most Expensive Area to Buy a Condominium OTP

Fastest Growing Average Condominium Price OTP

Highest Price Per Square Foot for Condominiums OTP

Shortest Average Days on Market OTP

Suwanee ($544,000 average Q3/Q4 sale price)

McDonough (+119.2% Q3/Q4 average closed sale price in 2022 vs. 2021)

Chattahoochee Hills ($591 per square foot)

Chattahoochee Hills (Average 1 day on market)

Less than $300,000 $300,000 to $499,999

Clarkston

Douglasville

East Cobb

Fayetteville

Lawrenceville

Mableton

Marietta

Norcross

Peachtree City

Peachtree Corners

Sandy Springs

Smyrna

Snellville

South Fulton

Tucker

Acworth

Alpharetta

Canton

Cumming

Duluth

Dunwoody

Johns Creek

Kennesaw

McDonough

Milton

Roswell

Chattahoochee Hills

Suwanee

There were 76 new construction condominiums sold in Metro Atlanta in Q3 and Q4 2022. Nearly half of new condominiums were located outside the perimeter; however, many of the homes categorized as condominiums OTP are townhome condominiums. The only new construction, true condominiums OTP sales included Bentley Ridge (Marietta), The Maxwell (Alpharetta),

Atley (Alpharetta), and Gatherings at Herrington (Cumming) (active adult community), with 20 total sales in these communities, averaging $485,585. The most expensive new condominium sold OTP in late 2022 was a 3-bedroom, age restricted unit at the Gatherings at Herrington in Cumming, which sold for $560,000. There were no new construction, true condominiums sold in other OTP locations in late 2022.

See what’s happening in your neighborhood or the area you have your eye on, including recent market trends and upcoming development.

This section has a quick reference guide for each submarket in Metro Atlanta. It includes key metrics for each housing market overall, singlefamily homes, townhomes, and condominiums. Atlanta is a city of many neighborhoods. To organize

them, neighborhoods inside the perimeter are grouped as Midtown, Buckhead, Downtown, Brookhaven/ Chamblee, ITP Northwest, ITP Northeast, ITP Southwest, and ITP Southeast. Data for each of the 11 counties in Metro Atlanta

• Midtown (page 78)

• Buckhead (page 79)

• Downtown (page 80)

• Brookhaven/Chamblee (page 81)

• ITP Northwest (page 82)

• ITP Northeast (page 83)

• ITP Southwest (page 84)

• ITP Southeast (page 85)

is also provided, including Fulton, Cobb, Cherokee, Clayton, DeKalb, Douglas, Fayette, Forsyth, Gwinnett, Henry, and Rockdale Counties. North Georgia counties are included in the next section.

• Fulton (page 86)

• Cobb (page 87)

• Cherokee (page 88)

• Clayton (page 89)

• DeKalb (page 90)

• Douglas (page 91)

• Fayette (page 92)

• Forsyth (page 93)

• Gwinnett (page 94)

• Henry (page 95)

• Rockdale (page 96)

With Piedmont Park, Georgia Tech, plenty of restaurants, major events, the BeltLine, and thousands of jobs within walking distance, living in Midtown is a lifestyle decision for those looking for vibrant city living. Its central location and great transit access make it easy to get to many places in Metro Atlanta.

Most homes in Midtown are condominiums, ranging from older low-rise buildings to luxury high rises with skyline views. Compared to many major cities, an average sale price of $411,674 makes owning

a condo in the heart of the city relatively attainable. In the eastern part of Midtown— the Garden District— single-family homes and townhomes offer lower density housing close to the action, often commanding some of the highest prices in the city, with single-family homes often selling over $1 million.

More than $3 billion in development projects are underway in the growing district. Plans include the Winship Cancer Center at Emory Hospital Midtown, office towers like Spring Quarter and the Campanile

expansion, and several apartment buildings and student housing with ground floor retail. Street design projects, the Art Walk, and small parks and plazas are also planned to enhance Midtown’s public realm.

Source: FMLS InfoSparks, Midtown, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Buckhead is a collection of neighborhoods in northern Atlanta including the mostly residential areas of Brookwood, Ardmore Park, Collier Hills, West Paces Ferry, Chastain Park, Lindbergh, Garden Hills, and Peachtree Hills. The Buckhead Village, North Buckhead, and Lenox areas offer a mix of high-rise condominiums, shops and restaurants, office towers, and hotels.

The Buckhead area is popular for homeowners looking for tree-lined streets, traditional architecture,

convenience, and often highend homes. Most neighborhoods have access to greenspace within walking distance, ranging from small neighborhood parks to Chastain Park, Bobby Jones Golf Course, and the Northwest BeltLine.

Although most of the land in Buckhead is dedicated to singlefamily homes (often on large lots), most of the homes sold in late 2022 were condominiums, typically found along primary streets like Peachtree Street or near Buckhead Village and Lindbergh.

Several projects are planned in Buckhead, including expansions at The Shepherd Center and Phipps Plaza, The Dillon condominiums, several new apartment buildings, and extensions of the BeltLine and PATH 400 trail.

Source: FMLS InfoSparks, Buckhead, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Downtown Atlanta is anchored by the Georgia State Capitol, Georgia State University, and event venues like the Mercedes-Benz Stadium and Georgia World Congress Center. It is home to thousands of office workers, dozens of hotels, and residents who take advantage of its central location and affordable housing costs. Most homes Downtown are condominiums or apartments, with some townhomes along the edges. Downtown has multiple MARTA stations and easy highway access, making it well connected to the rest of the region.

Several ongoing and planned projects could shift momentum Downtown in the coming years. Newport has been gradually restoring historic buildings in South Downtown and has announced plans for adjacent new development featuring 650 apartments and ground floor retail. At the Gulch, the first phase of Centennial Yards is underway, with a 291-room hotel and a 300-unit apartment building. A total of 8 million square feet of development are planned for the site. Nearby, another 973-room hotel is being constructed by Hilton. Several office to residential conversions are in the

works at buildings like The Grant Building and 2 Peachtree Street. Infrastructure projects like major renovations to Five Points MARTA

redesigns, and The

over part of The

Source: FMLS InfoSparks, Downtown, Rolling 6-months as of December 2022 (year-over-year change compared to rolling 6-months as of December 2021)

Brookhaven and Chamblee are intown cities in northeast Atlanta. Brookhaven is known for Ogelthorpe University, great parks and trails, a growing downtown, and familyfriendly neighborhoods with mostly single-family homes and townhomes. Next door, Chamblee is known for its rail-oriented downtown, antique shops, and one of the best selections of international restaurants on Buford Highway. It has a mix of single-family homes on large lots,

townhomes, and condominiums, often at a more afforable price point. Both downtowns have their own MARTA rail stations, offering convenient commute options.

Upcoming projects will bring more jobs and residents to this area. Children’s Hospital of Atlanta is expanding just south of Brookhaven, a mixed-use film studio campus is being constructed at Assembly, in nearby Doraville, and commercial