europeanbusinessmagazine.com spring edition | 2024

AI Revolution in Business NAVIGATING THE FUTURE OF AUTOMATION Securing the Future: The Vision for a Cyber-Resilient World featuring BreachLock Founder & CEO, Seemant Sehgal

The

Bartosz Skwarczek- Founder of G2A.COM

Excuses, excuses 4 REASONS WHY CEOS FAIL TO PRIORITISE SUSTAINABLE GROWTH

THE VISIONARY LEADER WITHIN THE GLOBAL GAMING MARKETPLACE

IMAGINE TODAY. RE: THINK, RE: DUCE, RE: USE, RE: CYCLE. DISCOVER THE BMW iVISION CIRCULAR CONCEPT CAR. RE: THINK RE: DUCE RE:USE RE : C Y C L E ERKNIHT: ECUD:ER :ER ESU ELCYC:ER ER : HT I N K R E : DUCE RE:USE

RE:

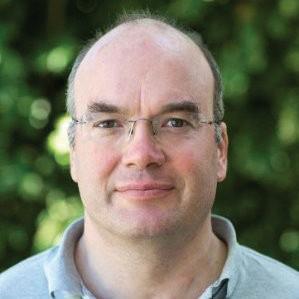

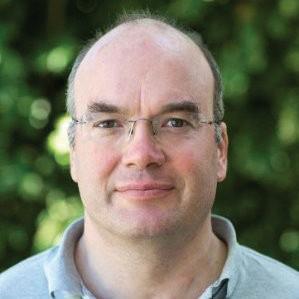

7 Dr. Thomas Becker

12 Making the most of your eSaaS environment through experience-led adoption

14 Empowering Success with Payment Partners

16 Ben Owen, Cloud Director at Cloudera

21 Maximising Profit Margins: How Duty Reclaim Can Bolster Your Bottom Line

22 Bartosz Skwarczek

26 AI Governance Alliance Calls for Inclusive Access to Advanced Artificial Intelligence

28 The challenges today for tomorrow’s currency

30 Mark Zuckerberg’s companies fined $2.8 billion for wrongful user data processing – GDPR report

32 A Glimpse into the Future of Efficient Supply Chain

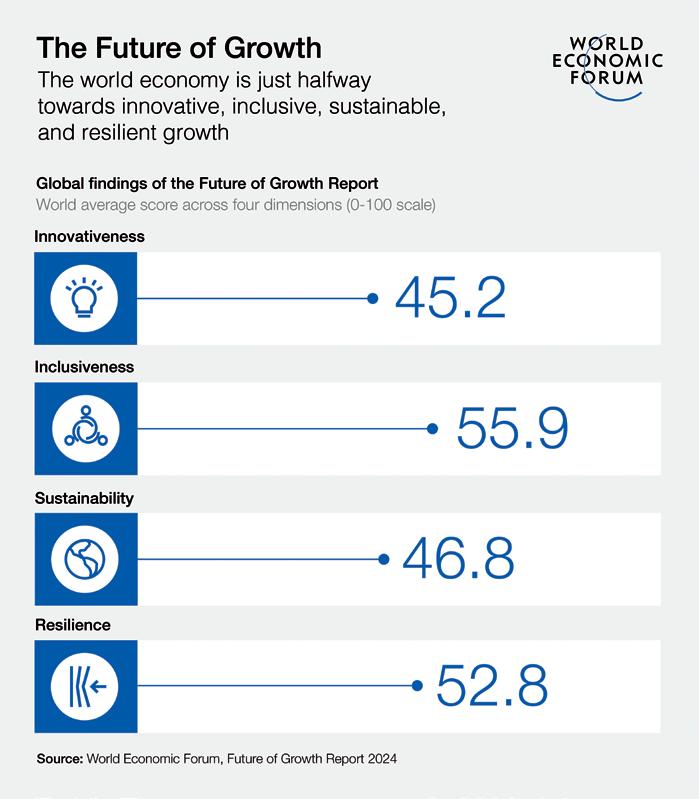

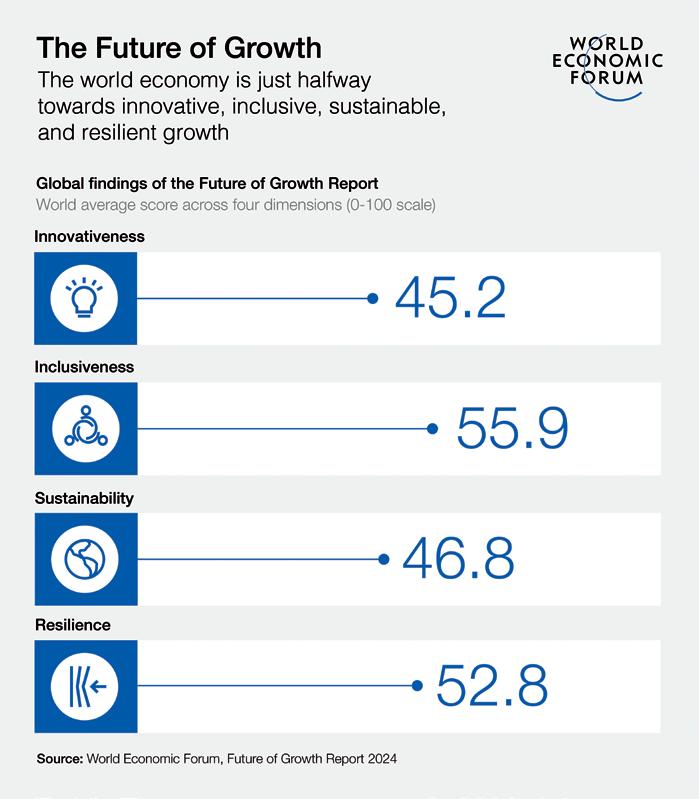

36 New Report Measures Quality of Growth for New Economic Era

39 Industrial control and factory automation is creating huge opportunity in the market

42 Seemant Sehgal

48 3 Ways Intelligent Automation Delivers Competitive Advantage to Wealth Managers

51 Green Data Center Market WORTH OVER USD 975 billion by 2036

52 How businesses can prevent digital transformation failure

56 Coll & ElSherbini to Headline Inaugural GillenMarkets London Squash Classic 2024

59 From Silicon to Supremacy in the AI Era

62 Stripe’s Valuation Rebounds to $65 Billion as Payments Giant Shrugs Off Pandemic Slump

64

66

europeanbusinessmagazine.com

MAGAZINE EUROPEAN BUSINESS

Publisher

Nick Staunton

Editor

Patricia Cullen

Deputy Editor

Anthony Gill

Associate Publisher

Brad Adams

Features Editor

Katie Winearls

Head of Production

Paul Rogers

Head of Design

Vladimir Mladenovski

Subscriptions Manager

Rebecca Hill

Head of Business Development

Paul Matthews

Advertising Sales

Brad Adams

Tara Duckworth

Advertising Sales

Tara Duckworth, Mike Ray, Andy Ellis, Mark Holburn

Contributing writers

Patricia Cullen, Richard Fitzpatrick, Bala Murali Krishna, Shilpa Meen, Argee Laraya, Aimee Ni Mhaolcraibhe, Gordana Ristic, Jonathan Hooker, Jose Ignacio Latorre

Head of Digital

Stephen Scott

Photographer

Ben Fisher

NST Publishing Ltd, 19 Leamington Spa (studio 1) Leamington Spa,Cv324tf, UK

The information contained has been contained from sources the proprietor believes to be wholly correct however no legal liability can be accepted for any errors. No part of this publication can be reproduced without consent of the publisher.

europeanbusinessmagazine.com

5

Table of Contents

Kraken Sets Sights on Institutional Investors with New Crypto Trading Arm

How to mitigate business risks and address the triple planetary crisis 68 Global Business Vanguards Aligning with 2045 Net Zero Goals 70 An Unsustainable Practice for the World’s Biggest Brands 72 Sustainability growing influence on financial due diligence process 74 Redefining Industries and Reshaping the Future 78 Business and Innovation Driving the European Gaming Industry 82 Gerry Zack

4 reasons why CEOs fail to prioritise sustainable growth 88 Clash of the AI Domain with Musk vs OpenAI 90 Getting ahead of APP fraud in the legal sector 92 How ecommerce is transforming international express courier services 94 Going beyond manual processes! The transformative impact of automation on your business operations 96 Demystifying the Governance of EHS and ESG 98 Navigating the Intricate Network of Trade Compliance Obligations 100 Preparing Your Organisation for the Future of AI

86

ELECTRIC. DIGITAL. CIRCULAR.

A NEW ERA OF MOBILITY.

DISCOVER THE BMW VISION NEUE KLASSE CONCEPT CAR.

WITH Dr. Thomas Becker

Vice President Sustainability and Mobility Strategy BMW Group

Decarbonization Strategy: “Can you share insights into BMW Group’s decarbonization journey in the transport industry? How has the company approached this transformation, and what key milestones have been achieved so far?”

BMW Group is part of the Business Ambition for 1.5°C and the United Nations’ Race to Zero, ensuring we’re responsible for our part in meeting the commitments set out in the Paris Agreement. Sustainability is at the centre of our strategic direction.

To give you a sense of where we are in our decarbonization journey – by 2030, we will reduce CO2 emissions per car per kilometre driven by half from 2019 levels, with at least half of all cars we sell worldwide being fully electric in the same timeframe. We also look at the whole lifecycle of our vehicles. Our target is to reduce CO2 emissions per vehicle by 40% across the range and throughout the entire lifecycle, from the supply chain through production to the end of the use phase.

Technological innovation has been a significant part of our transformation and decarbonization. In 2025 we will introduce our NEUE KLASSE to the market, with a new generation of batteries that use more secondary material and have higher energy density, charging speed and range, as well as generating less CO2 in their production than today’s batteries.

Our focus on circularity and closedloop systems has already reduced our need for raw materials and the associated emissions. Our ‘Secondary First’ approach aims to successively increase this figure to 50 per cent. In our manufacturing plants, we’re striving to replace natural gas as fast as possible with renewable energies. And we’re making progress with our supply partners towards delivering on our ambitious decarbonization targets.

We don’t yet have all the answers and there’s no doubt that decarbonizing in the urgent time frame required is a major task, but we’re hungry to get there and to keep developing new and pioneering ways to reduce our carbon footprint – from EVs, to hydrogen to recycled materials.

EV Technological Innovations:

“Given the rapid evolution of electric vehicle (EV) technology, how is BMW Group innovating to stay at the forefront? Could you discuss any specific technological advancements or features that set BMW’s electric vehicles apart, emphasizing transparency in communicating these innovations to consumers?”

From 2025 onwards, our NEUE KLASSE range of cars will have a new generation of battery and a trailblazing approach to both the use of recycled parts and ultimate vehicle recyclability. It will include a new concept that will allow us to tailor-make batteries to fit any model, as well as recently developed component recycling techniques. This year, around two-thirds of our investments will flow into future technologies such as electromobility, including hydrogen. For us, the next technical step is a second generation of the hydrogen fuel cell drive train for our BMW iX5 Hydrogen model (based on our BMW X5 model) that was first produced in 2022. Our pilot fleet of iX5 hydrogen cars is currently being tested all around the world, and we’re investigating the possibility of launching a mass production hydrogen car before the end of this decade. As a premium manufacturer, it’s important we’re clear in communicating these innovations with our customers. We want to take them on our decarbonization journey with us because we believe premium and sustainability will be inseparable in the future. Transparency is key here, especially when it comes to explaining how these innovations will help us with our targets and net zero commitments.

europeanbusinessmagazine.com 7

LEADERSHIP INTERVIEW

WRITTEN

Hydrogen’s Potential: “Hydrogen is gaining attention as a potential green energy source. How does BMW Group view the role of hydrogen in the decarbonization of the transport industry, and what implications might this have for EU markets in the coming years?”

With bold emissions targets on the horizon, we can’t leave hydrogen behind. It’s important that we pursue all available avenues in the green transition and the opportunities presented by hydrogen – together with EVs – are huge.

We believe it will play a role as a fuel in EU markets in the future – and that hydrogen will create more zero and low emission choices for consumers and play a critical role in road transport decarbonisation.

Hydrogen fuel cell technology could become a key pillar in the BMW Group’s portfolio of drive trains –the group of components that deliver

mechanical power. The reduced charging time and increased range offer a practical solution for vehicles – both HGVs and passenger vehicles –where electric batteries don’t support all the mobility needs of users. And with over 40 years of experience in hydrogen technology and more than 20 years in hydrogen fuel cell technology, we’re in a strong position to share what we’ve learnt to drive wider positive change.

Technology Openness: “In the pursuit of decarbonization, collaboration and openness to new technologies are crucial. How is BMW Group fostering collaboration and embracing technological openness, both within the company and through external partnerships, to drive sustainable solutions in the transport sector?”

At BMW Group, we take an open technology and innovation approach to deliver new mobility solutions. This means we unlock the innovation

potential of startups, cross industry technologies and entrepreneurs. This is essential not just for finding new solutions but keeping on the path to meeting our decarbonisation and circularity commitments.

Another key element to our open technology approach is the use of different drive trains. Electrification is very much the focus for the next few years, not least as it will help ensure carbon reduction targets for 2030 are met, but we expect hydrogen to have a role in the future too, particularly with haulage, longer distance and for locations where the electric charging infrastructure is less developed.

The upcoming NEUE KLASSE will be a major technological leap forward for the BMW Group in electric drive systems. It is the clear focal point of our investments for the future and integrates the next-generation electric drive train, as well as the electrical system/electronics infrastructure, demonstrating technology’s role in new mobility solutions.

europeanbusinessmagazine.com 8

Challenges and Opportunities:

“As the transport industry undergoes a significant transformation, what challenges and opportunities does BMW Group foresee in the decarbonization journey? How is the company navigating potential obstacles and leveraging opportunities to drive positive change?”

The new technologies we’re developing are just one piece of the decarbonization puzzle. The other pieces are mileage. Data shows that at the moment that in markets like Europe, the average age of the car on the road is going up and not down.

This means that policies that accelerate the migration to newer technologies are highly important, alongside finding ways to lower the CO2 footprint of the fuels that will still be going into combustion engine cars for a long time to come. It’s not an either / or situation. We need all of it combined. We have to work in partnership. Just to give one crucial example, infrastructure. If you look at the pace of electrification in different markets, you find a direct relationship with availability of public charging infrastructure. Through our IONITY joint venture together with other car makers, we’re helping to take fast, high-powered charging to the main motorways. But we can’t bring it to the roadside in inner cities, for example. So here we need other players to take responsibilities too.

The need for government and business to work more closely together to develop infrastructure is urgent. In the EU, we have a big difference in EV uptake between countries. We need a stronger collaboration in those markets that aren’t as fast as they could be, to make it clear that electric driving is a choice that’s supported, not just in terms of financial incentives but also in terms of certainty that you can use it on a day to day basis.

Consumer Adoption and Education: “Consumer awareness and education play a crucial role in the widespread adoption of electric vehicles. How is BMW Group working to educate consumers about the benefits of electric mobility, and what initiatives are in place to encourage broader acceptance and understanding?”

From 2021 to 2022, BMW Group increased sales of fully electric vehicles as a percentage of total sales by +107.8%. By 2030, 50% of all the cars we sell will be electric.

In our efforts to increase take up of EVs, we’re working across the lifecycle of our vehicles to improve efficiencies in production and the supply chain to help bring the cost of EVs down. We’re investing in charging infrastructure across the world. And we’re offering higher discounts for employees when choosing EVs, and boosting company travel for employees, including an electric shuttle bus service at our plants.

BMW Group is also assuring it will not lose a single employee in the transition from combustion engines to electric models. And we’re investing heavily in our communities and people across the world. In 2021, the BMW Group invested around €389 million in training and development for its employees. More than 75,000 attendees developed skills in fields related to sustainability, empowering them to help shape our green transformation. We view the green transition as an opportunity to provide existing employees with new skills and the chance to learn new trades, and to create jobs that give young people opportunities to develop in an evolving sector.

europeanbusinessmagazine.com 9

FIRST UK CROSS-BORDER TRANSMISSION

AGREEMENT ON LARGE-SCALE

DECARBONISED GAS NETWORKS MARKS

25 YEARS OF NORTH SEA INTERCONNECTION

The British and Belgian gas transmission networks have signed a pioneering agreement today which enables collaboration on decarbonising gas infrastructure, developing carbon capture usage and storage (CCUS) and harnessing North Sea energy resources such as offshore wind and hydrogen production.

Celebrating 25 years of operation of the gas Interconnector between the UK and Belgium at the UK embassy in Brussels in the presence of UK Energy Minister Andrew Bowie and Belgian Minister for Energy Tinne Van der Straeten, the British and Belgian gas infrastructure partners National Gas and Fluxys Belgium signed a Memorandum of Understanding to step up their cooperation on decarbonisation infrastructure and supporting CCUS.

The Memorandum of Understanding between National Gas and Fluxys helps to put flesh on the bones of April’s Ostend declaration at the North Sea Summit between transmission system operators from northwest European countries. National Gas and Fluxys Belgium have already worked in harness to secure energy resilience via the gas Interconnector between Norfolk and Zeebrugge, which is marking 25 years of operation during an event at the UK Embassy in Brussels today.

Looking to the future, Fluxys Belgium is developing large-scale hydrogen and CO 2 corridors for transport in and through Belgium. Meanwhile in Great Britain, National Gas has initiated Project Union to connect hydrogen production sources to end users across power and industrial sectors. It is also involved in the Scottish Cluster, a collection of industrial carbon capture and CO2 transportation and storage infrastructure projects.

As supported by the recent UK National Infrastructure Assessment, hydrogen will also be essential to the resilience of future power generation and storage in Britain - and will be instrumental in decarbonising industry on both sides of the North Sea.

In accordance with the Memorandum of Understanding, Fluxys Belgium and National Gas will explore the benefits of a hydrogen link between their respective infrastructures, unlocking North Sea hydrogen for mainland Europe.

Based on their existing strong relationship and sharing the same strategy to play a key role in decarbonisation of industry and society, both partners will combine their complementarities, expertise, and common vision to develop large-scale, long-distance hydrogen transport. They will also explore the possibility to extend their collaboration to CCU (carbon capture and utilization) and CCS (carbon capture and storage).

UK Energy Minister

Andrew Bowie said:

“Today the UK cemented its position as a world-leader in green hydrogen production, backing new projects from the South West of England to the Scottish Highlands.

“This agreement between the British and Belgian national gas transmission networks will provide the essential infrastructure for transporting hydrogen and build on 25 years of collaboration to bolster the UK and Europe’s energy security for the coming decades.”

Belgian Minister for Energy Tinne Vander Straeten said:

“Today we celebrate a significant milestone in Belgian-UK relations. A silver jubilee marking 25 years of collaboration through the Interconnector and a 5 year celebration for Nemo Link, the first submarine power cable between

our two countries. It is a reflection on the past but also a testament to the forward-looking cooperation that will shape the next chapters of our energy ties. And the future looks promising. Today’s agreement between Fluxys Belgium and National Gas marks a significant stride forward in crucial hydrogen and CO2 infrastructure. It fosters a collaborative synergy that transcends national borders and

europeanbusinessmagazine.com 10

integrates the unique strengths of the UK and Belgium.”

Jon Butterworth, CEO of National Gas, said: “For the critical British businesses that we serve, this agreement with Fluxys will help to secure their future and fuel growth and innovation. We have all the components of a world-leading hydrogen industry,

and through Project Union we have the capability to connect hydrogen production and storage with end users through a hydrogen network of up to 2,000km - equivalent to 25% of Britain’s current methane transmission network.”

Pascal de Buck, CEO and Managing Director of Fluxys Belgium, said:

“Multiple strong partnerships are essential in our focus area of developing open-access infrastructure. We see an array of opportunities in pushing up our cooperation with National Gas for the development of infrastructure to further connect both markets in a decarbonised world, creating a hydrogen link between our systems and possibly other options for achieving large-scale decarbonisation.”

europeanbusinessmagazine.com 11

Making the most of your eSaaS environment through experience-led adoption

by Manish Tandon, CEO & MD, Zensar Technologies

Companies buy software platforms to solve specific problems, but do they really understand how each tool is best utilised across their enterprise software as a service (eSaaS) environment? The sprawling nature of a typical IT estate leads to a plethora of inefficiencies, which complicates a company’s ability to integrate, adopt, and maximise its investment when procuring additional licences or technologies.

The key to bridging these inefficiencies lies in the interplay between eSaaS applications and the associated skills employees use to leverage them. Companies who succeed in harnessing the power of technology through a skilled, adaptable, and informed workforce are positioned to fundamentally change the business landscape. By embracing the synergies of the technology-employee relationship, companies can stay agile,

meet evolving customer demands, and forge clear paths to competitive advantage.

Embrace an experience-led approach

To have a measurable impact, any enterprise tool or system must be developed and evangelised with employees in mind. That is, design, implementation, and adoption must be experience-led. If adoption never takes off or rapidly dwindles, you have a problem somewhere in the technology-employee relationship.

Employees are discerning customers who demand direct relevance between their technology and their daily lives, whether at work or home. Convincing them that an enterprise product, service, or tool is worthwhile is an experience design issue, even if

under the auspices of the CIO or technology leadership.

Of course, to optimise your eSaaS environment, you need to perform due diligence activities like rationalising maturity in terms of use, spend, adoption, and team structure. But to supercharge success, you must also lean into the principles of marketing, psychology, and human insight to help prioritise the jobs to be done in your digital estate. This connected way of thinking–coupling technology and experience to drive engagement–is the only way to influence return consistently.

Think like a retailer

The potential of eSaaS platforms is enormous, as are the complexities of rapid scale, changing customer demands, and new innovations. Often, costly tools are underutilised

europeanbusinessmagazine.com 12

or duplicated, and infrastructure grows unwieldy to accommodate short-lived, bespoke functionality.

To help unravel these complexities, focus on employee adoption. Get your employees on your side by marketing the technology to them; keep them engaged by evolving the systems to be as usable and engaging as possible without breaking the bank.

This means treating your employees like customers, orienting your eSaaS suite as if it were a range of products on the digital or physical shelves of the world’s best retailer. You need to run campaigns, diversify your communications, and strive to be both accurate and compelling.

Let insight lead the way

Using employee insight to guide the technology-employee relationship ensures the right tools are being deployed at the right time, helping to maximise return on investment. This requires taking an outside-in approach to gain a full understanding not only of what the technology can do but also of how your employees will use it. Start by creating internal research teams who know the intricacies of your eSaaS systems and who can spend time with employee user groups to uncover their existing pain points and workarounds, as well as their desired experience.

To drive effective adoption, research teams need to interact with employees both broadly and deeply. Communications should engage employees from across the organisation and keep them informed as the research unfolds. User groups should delve into the depths of a technology’s functionality to discover efficiencies that will lead to wide, ongoing engagement. Emphasising employee insight in your implementation and adoption plans allows you to decisively strengthen your enterprise systems while also enhancing your employees’ experience of them.

Train your teams

Targeted, tangible training brings all your rationalisation activities, user group research, and employee insight

to life. Because training is often your employees’ first hands-on interaction with a new tool or product, it is essential for making the most of your digital spend. This is particularly true for those trickier-to-grasp platforms and specialised processes that may be required for your operating model.

Exceptional training materials will speak to real pain points with existing systems, clearly articulate how new functionality will alleviate such issues, and demonstrate ease of use. Whether immersive walkthroughs or quick reference documents, these materials need to reflect the same approach and follow-through you have already established.

Call on additional support

Aligning eSaaS systems, employee experience, and ongoing engagement is a powerful force for experi ence-led adoption, but it does not stand alone. To complement a strong technology-employee relationship, consider investing in your busi ness process engineer ing teams. These people act as architects of suc cess by bringing together

technologies, various stakeholder groups, and financial decision-makers to promote optimisation.

These teams undertake regular and robust audits of your ever-expanding technology stack to ensure platform suites are being used to their full potential. With a focus on the needs of both the company and its employees, business process engineers lead the careful consolidation of technologies that are not working due to lack of engagement, poor usability, high cost, or redundancy.

Your employees mirror your customers

europeanbusinessmagazine.com 13

FACING M&A CASH FLOW CHALLENGES: Empowering Success with Payment Partners

By Andrew Hawkins, CEO, UK & Europe of Shieldpay

In the fast-paced world of mergers and acquisitions (M&A), the financial landscape is riddled with complexities. Multiple payments, varying currencies, and staggered or deferred payment schedules can turn a strategic business move into a financial labyrinth. The era in which in-house finance teams could bear this responsibility independently has come to an end.

M&A deals have typically proven to be a long and painful process to close. According to a Gartner report, the average time to close a deal is now 38 days, up 30% from 10 years ago However, specialised payment partners are now emerging as the unsung heroes of the M&A landscape, armed with unmatched expertise to simplify cash flow management and allow M&A lawyers to focus on the critical aspects of the deal. But what exactly does this look like?

Cash Flow Simplified

One of the most significant challenges in M&A transactions is managing cash flow effectively. With payments coming from various sources, in different currencies, and often following complex schedules, traditional financial management methods fall short. This is where specialised payment partners step in, armed with cutting-edge technology that can address the complexities of cash flow in M&A transactions.

That said, digital escrow services are a game-changer for M&A deals. These services act as intermediaries, holding funds in a secure account until specific conditions are met, ensuring that all parties involved in the transaction are protected. This not only streamlines the payment process and enhances efficiency but also adds a layer of indemnity, safeguarding against potential mistakes and offering a level

of security and transparency that traditional methods currently lack. Paying agent technology complements digital escrow services by facilitating the disbursement of funds in multiple currencies to various stakeholders. These technologies can automatically convert and distribute payments according to predefined rules, thereby not only eliminating the need for manual intervention, but also reducing the risk of errors.

Reducing Deal Time

With M&A deals, time is money, and as touched on earlier, the average deal time has been steadily climbing in recent years. This deal drag can be attributed to the increasing complexity of transactions, including regulatory hurdles and due diligence processes. WTW’s recent Q1 2023 report found that the median time to close deals

europeanbusinessmagazine.com 14

in this quarter has been the slowest since 2008, with 71% of all deals taking at least 70 days to complete. Legal teams find themselves bogged down by administrative tasks, leaving less time for strategic planning and negotiations. With digital escrow services and paying agent technology, legal teams can automate and streamline many of the time-consuming tasks associated with M&A transactions. For instance, escrow services can hold funds until key milestones are reached and regulatory approvals are secured, enabling the deal to progress seamlessly without the need for manual execution at each payment milestone.

These technologies provide real-time visibility into payment status and transaction progress, enabling legal teams to track the deal’s status more effectively. This allows for better decision-making and more efficient allocation of resources, which in turn contributes to a shorter deal timeline.

Simplifying Compliance

Due diligence is one of the most critical aspects of any M&A deal, ensuring that both parties have a clear understanding of the transaction’s risks and rewards, though it’s also one of the most complex and time-consuming parts of the process. Our research report highlighted that 42% of law professionals say the most time-intensive aspect of handling client funds and managing payments is due diligence (KYC/KYB)

checks

Both digital payment agents and escrow services shoulder the responsibility of conducting due diligence, tracking, and organising KYC information. The utilisation of automation tools ensures the efficient processing of these checks, while the prevalence of open banking facilitates swift verification of bank details.

As well as saving time, this process will also add a layer of security that

protects all parties and gives them peace of mind by having access to a centralised platform for managing and overseeing the funds flow.

Moving Forward with Payment Partners

The complexities of cash flow management in M&A transactions are undeniable. However, specialised payment partners armed with digital escrow services and paying agent technology are transforming the landscape.

As more organisations use payment partners, they will gain a competitive edge to optimise their process and close M&A deals faster. The M&A landscape continues to evolve, and embracing these technological innovations will become increasingly critical for success in this competitive arena.

europeanbusinessmagazine.com 15

INTERVIEW WITH Ben Owen, Cloud Director at Cloudera

European Business Magazine (EBM) caught up with Ben Owen (Pictured), Cloud Director at Cloudera spearheading Public Cloud business throughout the EMEA region (Europe, Middle East, and Africa). With a strategic focus on championing the advantages of cloud technology through the lens of trusted data, Ben plays a pivotal role in harnessing the power of Generative AI.

Tell me about the recent study Cloudera published?

We surveyed 850 IT decision-makers across the EMEA region, uncovering surprising insights about cloud which helps to lead to Generative AI adoption.

• Finding 1: 92% plan to increase their cloud data in 1-3 years, yet 76% are considering moving some data back on-premises.

• Finding 2: This dichotomy arises from concerns around data governance, fears around cloud lock-in, cybersecurity, performance, and costs. Interestingly, cost is the fifth most significant factor.

• Finding 3: The motives for cloud adoption include improved data accessibility, optimized storage and backup, cost reduction, faster innovation, and sustainability.

The two strategies of cloud migration and data repatriation complement each other. Migrating the right workloads to the cloud can be cost-effective, secure, and compliant, avoiding vendor lock-in. While at the same time taking advantage of the benefits of cloud such as flexibility, scalability, and agility. However, simply transferring existing applications to the cloud without optimization can be counterproductive due to the inefficiencies of legacy code not designed for modern cloud technologies. If unmanaged or, for example, not effectively secured, running in the cloud can actually be more costly and disruptive. So cloud first is not always the right answer, and organizations should instead focus on the workload first when determining where data sits. Having the capability to work both in the cloud (or multiple

clouds) and on-premise with the same optimized tooling is critical to a long term data, Advanced Analytics, and Generative AI strategy.

What are the primary challenges for businesses trying to adopt Generative AI?

When I meet with our customers and partners, the two main challenges to Generative AI adoption that stick out are a lack of trusted data, and cost - both the operational control that comes with Generative AI, and the high costs of entry.

The Need for Trusted Data: Quality data is essential for driving impactful insight from Generative AI. Many enterprises are still in the early stages of establishing control, security, and governance over their data. And data is often isolated in silos across an organization, hindering the ability to make informed decisions without costly integration. Utilizing unmanaged or irrelevant data not only risks inaccurate results (or “hallucinations“) but also fails to deliver value from business queries. Leveraging quality data helps to reduce hallucinations, but more

importantly provides the organizational context and information to add value. The main reason for trusted data comes down to the following three pillars; Relevance and Accuracy, Trust and Safety, and Risk and Compliance.

Implementing Generative AI in-house incurs substantial costs. Outsourcing this process can introduce risks and compliance issues. For perspective, consider the cost of cutting-edge GPUs like the Nvidia H100, essential for running large language models.

europeanbusinessmagazine.com 16

A single unit costs around $30,000, and training a model with 175 billion parameters might require over 2000 of these GPUs, amounting to tens of millions in investment. Of course this is a more extreme example as training a model requires substantially more horsepower than running a pre-built one. However having the capacity to run a farm of GPU resources can be an expensive investment.

The solution lies in leveraging cloud services. Cloud providers, with their vast GPU resources, offer a flexible and secure environment for businesses to experiment and run Generative AI. This approach enables companies to scale their use of resources and only pay for what they use, without committing to large upfront investments. As a business grows, it may choose to move some operations back in-house for cost efficiency, but the key is maintaining an open strategy with the ability to adapt as needed.

How can customers best adopt Generative AI assuming they are starting from scratch, is there a roadmap?

In the journey to adopt Generative AI effectively, businesses can follow the BRIESO model, which stands for Build, Refine, Identify, Experiment, Scale, and Optimize.

Build: The first step should be to construct a modern data architecture and create a universal enterprise data mesh. This enables organizations to gain control and effectively manage

their data, whether on-premises or in the cloud, establishing a unified ontology and strategy for mapping, securing, and ensuring compliance across all data silos. Choose tools that meet current needs and accommodate future growth, with a preference for opensource solutions for greater flexibility.

Refine: Next, refine and optimize data sets according to current business needs, while anticipating future requirements as accurately as possible. This is important as companies do not want to migrate useless data which will later increase costs.

Identify: Identify opportunities to leverage the cloud based technologies on specific workloads. Perform a workload analysis to determine where the most value can be derived. Connect data across locations, whether on-premises or in a multi-cloud environment, and consider potential use cases for development.

Experiment: Try out pre-built Generative AI frameworks offered by major cloud providers, like AWS’s Bedrock (Hugging Face), Azure’s OpenAI (ChatGPT), or GCP’s AI Platform (Vertex), among others. The key is not to commit to one platform prematurely; instead, find the one that aligns with your business needs. Ensure integration with trusted data, as the real value lies there, not just in the Generative AI model.

Scale and Optimize: Once a suitable platform is identified, pick one or two use cases to scale into a production model. Continuously optimize the process, whilst remaining mindful of the costs associated with GPU usage.

His responsibilities include fostering collaboration with industry giants such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform, with the ultimate goal of optimizing clients’ investments in the cloud. Join us as we delve into Ben’s insights on the intersection of cloud innovation, trusted data, and the transformative potential of Generative AI for businesses across the EMEA landscape.

As companies expand their Generative AI capabilities, look for opportunities for economical optimization. Flexibility in their chosen platform is crucial for long-term success.

You attended AWS Re:Invent in 2023. What were your key takeaways?

At AWS re:Invent 2023, the spotlight was unmistakably on Generative AI. Everywhere you looked, from the conference center to the Las Vegas Strip, Generative AI was a pervasive theme. However, it became clear that despite the widespread buzz, actual deployment of Generative AI in production remains limited. Many Independent Software Vendors (ISVs) were discussing future plans, showcasing prototypes, or conducting Proof of Concept (POC) projects. In contrast, Cloudera stands out as we already have clients successfully running Generative AI at scale, handling millions of transactions daily in real-world applications. This signifies a shift from mere potential to tangible, operational implementations of GenAI. The industry, as a whole, needs to pivot from the hype surrounding Generative AI to solving concrete business challenges. Another significant highlight from the event was the acknowledgment

Think of it like this: 25 exabytes is a really staggering amount of data. It’s as if you take every single cell in a person’s body - about 33 trillion cellsand then multiply that by the number of people living in a big city like Frankfurt or Amsterdam.

europeanbusinessmagazine.com 17

My professional journey encompasses diverse leadership experiences, from executive roles at SAP to the launch of a startup SaaS product, and an immersive exploration of the hyperscale domain during my tenure at AWS. Currently, at Cloudera, I find myself at the forefront of the upcoming IT transformation, with a distinct emphasis on harnessing trusted data to propel Generative AI. Despite my American roots, I’ve been based in Europe for nearly 19 years, including a period where I commuted to the Middle East for a year or two.”

This aids clients in reducing costs and risks, enhancing productive of Cloudera in AWS’s announcement of the new Amazon S3 Express One Zone service. This is testimony to our relationship with AWS, symbolizing the synergy and alignment between our teams. The S3 Express service enhances performance for our clients managing large data sets in the cloud. This announcement by AWS, coupled with our strategic collaboration agreement signed earlier in the year, is a testament to our growing partnerships not just with AWS but across the hyperscale landscape, including Microsoft Azure and Google Cloud Platform. This collaboration is the cornerstone of our go-to-market strategy and product development in the coming years, demonstrating the strength and depth of our industry alliances.

How is your company approaching generative AI?

Cloudera’s approach to Generative AI mirrors the role of merchants “selling the shovels” during the historic gold rushes: providing the crucial tools

and knowledge needed for success. As a pioneer in the open source data movement, Cloudera’s ethos revolves around enabling data access everywhere and integration anywhere. This has given us a head start on the Generative AI revolution as we truly believe with your own trusted data enables trust in your Generative AI. This approach ensures future-proof solutions, allowing customers the flexibility to switch processing engines, AI models, or cloud environments without losing control of their data.

The focus areas for Cloudera in the realm of Generative AI include addressing scale, costs, and security – key concerns for our customers.

• Scale: In the vast landscape of data, size and scope are paramount. Cloudera adeptly manages over 25 exabytes of data, equivalent to more than 25,000 peta bytes, showcasing our capability to handle data at an extraordinary scale. We have more data under management than many hosting providers.

• Costs: Balancing cost-efficiency with the need for innovation is a common challenge. Cloudera’s integrated

data services range from streaming to data cleansing, enabling clients to concentrate on business outcomes rather than the intricacies of technology.

• Security: In today’s data-driven world, security is a top priority. Cloudera stands out by offering comprehensive security and control over a wide array of data types, both on-premises and in AWS environments, through our open data lake house model. At its core, Cloudera empowers organizations to transform their data into trusted enterprise AI. This aids clients in reducing costs and risks, enhancing productivity, and expediting business performance. With Cloudera, companies can trust their data and the AI systems they deploy, paving the way for reliable and innovative solutions.

How are European companies adopting the cloud overall?

From what we see and according to the EC Statistics agency more than 42.5% of EU companies adopted some form of Cloud in 2023. This is up more than 4% since 2023 which is a large increase. For comparison American companies have just a slightly higher rate of adoption of 48%. So, the gap is closing rapidly. Our own data also shows a much larger percentage here in EMEA, as 92% plan to migrate some data to the public cloud within the next three years. Our customers typically lean towards the large enterprises as they have large data estates to manage, but regardless the growth is outstanding.

What are some example business outcomes your customers are getting from their data on Cloudera?

Cloudera’s customers are truly out in front of AI. We don’t just talk about the Generative AI – our customers are deploying it daily!

We also have a number of other benefits:

Speed of Innovation – Enabling Developers: One of our financial services customers has boosted developer

europeanbusinessmagazine.com 18

productivity by 20% by standardized code quality leading to faster innovation.

Productivity Improvements that Save Lives: In healthcare, we have customers like BeTheMatch (USA), which is able to speed up the complex process of searching for suitable bone marrow donors when trawling a database of more than 41 million records, with a large amount of computations. Cloudera on AWS streamlined the process and has sped up the search results by a factor of 10 times. This is impacting and saving lives and will only keep improving.

Providing a Foundation for Innovation: In the public sector, Norway’s IFE (Institute for Energy Technology) uses Cloudera to underpin its efforts as part of the My Digital City smart city program in Halden. This helps the population adapt to climate change and create new jobs by becoming a zero-emission society. IFE also uses Cloudera to support a data factory aligned with the EU’s Digital Single Market strategy to provide AI services for Norway’s public sector and SMEs. This enables a ‘test before invest’ infrastructure in the cloud.

Keeping our Roads Safe: Manufacturing company, Continental in Germany, is using Cloudera in the public cloud for ContiConnect. Continental can now manage its streaming engine, database, and related technologies

from one central point, and has seen improved interaction between services, alongside greater ease of use and security. Providing real-time insights through Cloudera’s data analytics capabilities has helped the fleet customers of Continental reduce breakdowns by 83% and achieve average monthly fuel savings of £1.646, with out of hours calls reduced by 95%. Continental also aims to also enable additional data driven, AI related use cases within the solution.

Helping Telcos prevent Outages : Fastweb Telecommunications in Italy wanted to enhance its service by answering business requests in real time and to leverage ML and AI to anticipate potential network disruptions. These two goals need to process large amounts of data in streaming, without network disruptions, while keeping costs low.

Leading the Way in Medical Drug Discovery: Large pharmaceutical companies like Abbvie in the USA are bringing life-saving drugs to market faster; with massive improvements in productivity in R&D to improve quality of life and health outcomes.

Building strong customer relationships: OCBC Bank in Singapore successfully seized the opportunity to personalize banking experiences. The bank’s team built Next Best Conversation, a centralized platform that uses

Generative AI, LLM and ML to analyze real-time contextual data from customer conversations related to sales, service and more.

The bank increased its revenue considerably and nearly doubled its campaign conversion rates. This was achieved by using the data to identify the most relevant information for each customer and curate personalized experiences across communication channels. With ML models, OCBC Bank could also send over 100 different personalized nudges on its mobile banking app. This notifies customers about financial opportunities including eligibility for a new credit card or loans—achieving up to 50% click through rates.

Banking customers also enjoyed faster and more efficient transactions. For instance, OCBC’s Banks data science teams developed chatbots that handled 10% of customer interactions on the website. The bank also used ML to predict the potential time to failure of several bank systems, ensuring that IT teams could take preemptive actions to keep data centers always up and running. The ML models have also helped the bank to reduce risk of losing sensitive customer data, such as financial details, and avoid costly regulatory fines from downtime. As part of its future strategy, the bank plans to make AI/ML available to more of its systems and users. Cloudera provides a strong and flexible foundation to help OCBC Bank integrate AI at scale throughout the organization and drive more customer innovation and operational efficiency.

Future – How does your team plan to use these services in the future to serve your customers? How do you foresee Generative AI evolving?

Cloudera is a leader in the top industries in the world like Financial Services, Telcos, Automotive, Energy, and Lif eSciences. We’re just scratching the surface of what we will build using Cloudera and Generative AI Cloud services. We have a roadmap of cloud integrations in our development pipeline, and are working with AWS, Microsoft Azure and Google Cloud Platform on advanced integrations.

europeanbusinessmagazine.com 19

Blue sky and clouds reflections on a glass building

Uncover the missing piece in retail

Boost your profit margins

Reclaiming duties means more money in your pocket. Discover how duty reclaim can significantly impact your bottom line, contributing to increased profitability.

Get the competitive edge

Stay ahead of the competition by understanding the importance of duty reclaim. Gain a competitive edge and attract more customers with lower prices without sacrificing quality.

Optimise cash flow

Duty reclaim is not just about savings; it’s about optimising your cash flow. Learn how this crucial piece of the puzzle can help you manage your finances more efficiently.

An effortless process, with maximum returns

Wondering about the complexity of duty reclaim? Discover the simplified process that ensures you get the maximum from returns with minimal effort. Let duty reclaim work for you!

ukpworldwide.com Get in touch for more information UKP Worldwide 01844 398880 info@ukpworldwide.com

Maximising Profit Margins: How Duty Reclaim Can Bolster Your Bottom Line

In the realm of eCommerce, where digital storefronts are open 24/7 and transactions span across borders, the intricacies of international trade are unavoidable. With the surge in online shopping, businesses face not only the challenge of managing logistics but also navigating the complexities of customs duties and taxes. As Finance Directors and eCommerce Directors strive to optimise operations and maximise profit margins, one aspect often overlooked is the potential for duty reclaim.

Duty reclaim, the process of recovering customs duties, tariffs, and taxes paid on imported goods that are returned or disposed of, represents a significant opportunity for businesses to bolster their bottom line. While eCommerce returns may seem like an inevitable cost of doing business, they also present an untapped source of cost reduction and cash flow improvement. This is where UKP Worldwide eCommerce shipping and customs clearance service steps in, offering a strategic solution for businesses engaged in cross-border trade between the EU and the UK.

The complexities of duty reclaim can be daunting, requiring a deep understanding of customs regulations and documentation. Many finance departments may find themselves ill-equipped to navigate this terrain effectively, leading to missed opportunities for cost reduction. However, with the expertise and support of UKPW, businesses can unlock the full potential of duty reclaim and transform returns into a source of cost reduction and cash flow improvement. Let’s delve deeper into how UKPW eCommerce services can help.

Comprehensive Solutions: UKPW offers tailored solutions designed to streamline the duty reclaim process, from initial assessment to documentation and submission. By leveraging their expertise in customs and trade compliance, businesses can ensure that every eligible duty is identified and reclaimed.

Efficiency and Accuracy: With a dedicated team of experts well-versed in customs regulations, UKPW ensures that duty reclaim submissions are accurate and compliant. By reducing

the risk of errors or omissions, businesses can expedite the reclaim process and minimise delays in receiving refunds. These usually average 45 days from when the claim is submitted.

Strategic Guidance: Beyond transactional support, UKPW provides strategic guidance to help businesses optimise their duty reclaims over the long term. By staying abreast of changes in customs regulations and market dynamics, UKPW empowers finance directors to make informed decisions that enhance profitability and improve cash flow.

Continuous Improvement: UKPW is committed to ongoing innovation and improvement, continually refining their processes to deliver maximum value to their clients. Through regular reviews and feedback sessions, businesses can ensure that their duty reclaim strategies remain aligned with their evolving needs and objectives.

In addition to the financial benefits, reclaiming duties on returned goods can also enhance customer satisfaction and loyalty. By streamlining the returns process and offering transparent policies, businesses can foster trust and confidence among their clientele, driving repeat purchases and positive word-of-mouth referrals.

As Finance Directors and eCommerce Directors evaluate their operational strategies and seek opportunities for growth, duty reclaim should not be overlooked.

In conclusion, duty reclaim represents a strategic opportunity for businesses to optimise their financial performance and enhance their competitive advantage. By reclaiming duties on returned goods, businesses can inject additional funds into their organisations, improve cash flow, and drive profitability. With the expertise and support of UKPW, finance directors can navigate the complexities of duty reclaim with confidence, knowing that they have a trusted partner by their side.

To learn more about how UKPW can help your business contact us at info@ ukpworldwide.com or visit ukpworldwide.com.

europeanbusinessmagazine.com 21

In the dynamic world of digital commerce

Bartosz Skwarczek

has carved out a formidable niche as the founder and President of the Supervisory Board G2A Capital Group, to which belongs G2A.COM, the global gaming marketplace. With an unwavering commitment to innovation and customer satisfaction, Bartosz Skwarczek (pictured) has propelled his company to the forefront of the industry. In this exclusive exchange with European Business Magazine (EBM), we delve into the mind of a visionary leader, uncovering the strategies that have fueled G2A’s meteoric rise and the challenges that lie ahead in an ever-evolving digital landscape. Brace for a thought-provoking discourse that could reshape the future of online gaming marketplaces.

G2A.COM has been described as a disruptive force in the e-commerce sector. How would you characterise the impact it has had on the traditional retail structures within the gaming industry?

G2A.COM brought the marketplace model to digital distribution.

I think showing that gaming e-commerce doesn’t have to be limited to just gaming platforms and stores, as it was before our business was created in 2010. So, G2A.COM was a regular online store at the very beginning with video games. And we noticed a very important trend, which we can observe still. A trend was the move from box distribution, into the world of digital in 2010, where almost 70% of the market was physical.

In 2014 G2A.COM became a marketplace and today it’s a globally recognised brand. I can say we have offices all over the world, with headquarters

in Amsterdam and Hong Kong. We have offerings, or digital items, and can process over 200 different digital payment methods through our marketplace. Since last year, we are also in a process of implementation and are working on enhancing our vision of the company.

We call the brand ‘Gate 2 Adventure’. So, it reads G2A: Gate to Adventure. So, we open this gate to adventure in digital entertainment, not only to hardcore gamers, as it was before, and that is our main audience. But we also have a new group, growing exponentially since the worldwide lockdowns, and can be described as casual gamers.

Can you elaborate on the specific aspects of G2A.COM’s business model that differentiate it from traditional retail approaches and contribute to its status as a gamechanger in the industry?

Jeff Bezos once said that marketplaces are eating the world. It’s a great saying. And with our business model, there’s a reason behind that because in my opinion, it’s the most user-friendly business model ever created. And when you look at the landscape of global e-commerce, you can see that most of the greatest companies dominating are marketplaces like Amazon, Alibaba, or Rakuten in Japan, eBay, and so forth.

So, the first thing we have is a very diverse and complex offering of digital entertainment. No matter if you’re a hardcore gamer looking for very sophisticated in-game items, or a casual person looking for video-on-demand or a Netflix subscription; or you’re a parent searching for a birthday present for a kid or an e-learning course, you can go to G2A. COM for digital offerings in a variety of categories. At G2A.COM you have the best digital adventures at your fingertips. This is how we like to think about it.

Another thing equally important is that our customers can purchase on a very safe and secure platform. Cyber security is one of our priorities, and there is a reason for that. Our comprehensive approach to security allowed us to keep our anti-fraud rate at the significantly lower level, than the industry average, which currently sits at 3.6%. We care about customer safety and customer satisfaction. Which is why we have an easy and fast path to purchase, with instant delivery.

europeanbusinessmagazine.com 22

As we note often, we have very attractive prices for our offerings. Our client is the most important aspect of our business, and this approach has allowed us to become the go-to marketplace for over 30 million users. Suppliers and clients all over the world, in almost 200 countries, put their trust in us for digital offerings. And last but not least, something we are very proud of over the last 14 years, is that e-commerce is in our DNA. It’s the culture of trust, feedback, appetite for growth, excellence, and diversity. So, this is who we are, and we are very proud of it because I believe it’s a very rare culture. Rare in the meaning that many companies only talk about diversity, whereas at G2A, 40% of our staff are women, and over 50% of our top management are women. It’s our belief that women are extremely good business personalities and thus informs our approach.

In what ways does G2A.COM address the evolving consumer behaviours and preferences within the gaming community, and how does this contribute to its success as a digital platform?

Consumers are always looking towards buying games digitally and most people have moved away from shopping at retailers. In 2010, almost 70% of products in this industry were physical, now it’s only 5%. And since Covid, even more people have become interested in the digital world.

Not only hardcore gamers, but casual ones are looking for offers that are available online. And that’s why we decided to expand and diversify our offer from games to also non-gaming categories like subscriptions, gift cards, software, and e-learning. And it’s also important to work with internet creators and I very much believe that we’re pioneers in the industry, having worked with creators like PewDiePie in 2015. We opened the gate for creators and influencers. And this creator economy is a big business opportunity. As evidenced in 2021, when The New York Times moved its creator economy coverage from the style section to the business section. So that was a milestone in perception, I think.

And, you know, 52% of social personalities identify as a creator. They prefer to be named creator, over 32% who preferred to be named as an influencer. And according to Zoe Scaman , a strategist, the difference between influencer and creator is an influencer has a big audience, stylised content, and brand deals; but the creator is more passionate about the content and has a very loyal community, willing to pay for access. That’s a big difference.

And another thing is global reach and local approach, which sounds like an oxymoron in one sentence. But our users, both buyers and sellers, come from all over the world. And the easiest solution would be to implement the global strategy to deal with all of

them. But we decided to go with the more difficult option: a local touch that allows us to reach our users and take care of them on every level, from marketing to payments.

Could you share some examples or case studies that illustrate how G2A.COM has effectively challenged and reshaped conventional practices within the gaming e-commerce landscape?

I’ll give you an example. If you’re from the United States, life is much easier when it comes to payments. You have PayPal or credit card available to use. But if you’re from Brazil, you need Boleto, or if you have clients in India, you need Paytm and so on. Every country has its favourite

europeanbusinessmagazine.com 23

payment methods. So, what we did was we implemented over 200 payment methods, and this is one of the ways we reach our clients locally and globally. That of course requires more engagement and work but yields really good results.

Does G2A.COM navigate regulatory challenges and concerns within the gaming industry, given its disruptive nature, and ensure a balance between innovation and compliance?

From the very first day, we knew that to scale the business globally, we had to be in line with the law. Therefore, for years now, we have been working with the best advisors in the world, on both legal and tax matters, and every point of regulatory.

And fantastic companies like PWC, Deloitte, KPMG, Ernst and Young, Hogan Lovells, Orrick, have worked with us. They are helping us take care of all the regulatory requirements. As a marketplace, G2A.COM has a responsibility to comply with many regulations from the e-commerce sector as well as making sure the payment process itself is held up to the highest standard. We take many steps to ensure that all the offers you find on the marketplace are as safe as possible. The most critical point is focusing on vetting the sellers themselves, and over the last few years we strengthened our AML — our anti-money laundering process and KYC.

So, know your clients’ procedures and of course, every bank loves it. But at the end of the day, I believe our AML and KYC process is one of the most demanding in the whole e-commerce industry. And our sellers have to go through a very strict business verification process before they can start selling. Even after that they have to present proof of purchase of any item they put up for sale.

And only once we see that they are legitimate, we allow them to grow and scale the business. We are also actively working with over 200 different payment methods with operators and payment service providers from all over the world. In order to keep those partnerships up, we undergo regular audits by them. Many auditing representatives, like Deloitte or PwC, have confirmed us as trustworthy.

The point is that if you’re not following the rules with payment providers or payment processors, they see your every transaction. You have to remember that. They just cut off your business in a second. So that is also important.

As a digital platform, G2A.COM operates in a rapidly changing technological landscape. How does the company stay ahead of the curve in terms of technology adoption and adaptation to maintain its position as a disruptor?

Technology is one of the most important success factors of G2A.COM and we put special pressure on constant growth and development. Our technology stack is evolving at a fast pace because the market is rapid and super dynamic. And I’m not just talking about AI, which has been very loud recently, but in general, over the last ten years, you can see this growing technology race between different

companies. And I believe we are ahead of the trends in the IT industry. And when you compare us to other companies who focused on a DevOps approach, we opted for a platform approach, where we focused on the platform, rather than the developers. What this means is in the past, we noticed modern technologies would burden our development teams and in time, would negatively influence marketplace growth. Our answer was to build our own platform. And with this platform, we wondered if we could reduce the cognitive load on developers and increase the efficiency of tech teams. And today I can see that it was a great decision.

Over time we saw that it was a great decision. And currently more and more companies started talking about this approach. Another technology [we] implemented is part of our tech strategy, which is our own search data platform. That is a platform that allows us to change the data

europeanbusinessmagazine.com 24

management structure from centralised to dispersed. And it is called data mesh architecture. The result of that was the change in data awareness with our DFT. So, since the ownership of the data was moved, it increased both the quality of data and the usage of data. Basically, we believe that ownership of something is good, but being responsible for something is good. We like the responsibility because then you [can] take care of the quality much more. All that points, I can say, towards me confidently claiming that we are a data driven organisation and I believe that this is just [the] very beginning of amazing technological journey that we will be observing over the next few years.

G2A.COM has collaborated with key players in the gaming industry. How do these collaborations contribute to the platform’s ability to drive innovation and maintain its disruptive influence in the e-commerce sector?

We believe in partnerships, and when it comes to collaborations with publishers and developers, we are actively cooperating with several big game publishers, like Microsoft, to name one of the most prominent. And apart from that, we are constantly working on our relationship with smaller and indie developers because we are involved in both worlds.

You have a titan on one side, and you have the smaller and indie developers who are trying to become a titan. And right now, we are in partnership with over 300 small developers, small and medium developers within the program we call G2A Direct. So that is a program that allows developers and gaming developers to offer their game keys directly on our marketplace with good conditions.

We allow them to gather royalties from other sellers [who are] selling their game. And that is very unique. I mean, nobody else in the world is doing that for developers and game developers.

We are also involved in the release of two indie games in the last couple of years. One of them was Rustler. So, we coordinated the release of the game with the developer, and we prepared special offers. And the second one that is very interesting was

Rosemary’s Faith. It was first released in Poland as a game for blind people, based on hearing and narrative. So previously radio players were created, in which a narrator talks about what is happening on the screen. And our game was different. No one said anything in the game. The player was alone in a dark room and had to draw conclusions and make decisions based on sounds like, for example, the creaking of doors or wind. So, we try to reflect as faithfully as possible what happens to people in life because there are a lot of people who live in very difficult circumstances and environments.

We are also moving on another front, moving out into the world of offline sports — offline, not online — opening our gate to adventure in the digital world to an audience and showing them digital alternatives for their favourite pastimes. So, a recent example [was] we became the primary partner of the Drift Masters European Championship competition, which is actually an amazing thing.

There is this crazy adrenaline. We have [had] a solid partnership for several years, and this year there will be a few events in Ireland, but the finals will be in Warsaw. And last year there was a record breaking 55,000 live audience in the national stadium, during the finals in Poland. And that made it the biggest non-gaming event we have partnered, which is also amazing, considering the adrenaline and the emotion.

But it’s also a family event because you see parents and kids together. And lastly, the events are on the multinational scale because there are six races around Europe, followed by the championship in Poland.

Can you give us an insight for the next 18 months for G2A.COM and what it is looking to achieve?

We are planning to expand our brand and communication efforts [by] looking for new partners in non-gaming events and partnering with themes of real life sports, not only in esports, but in regular sports. We have recently announced this partnership that I mentioned with the Drift Masters for the 2024 championship and the next year.

And gamers are very important to us; we develop and expand our core gaming offer to make sure they can find everything they need on our marketplace, like diversified offerings, including the whole variety of digital items, the latest premieres, the classic legends, all the different kinds of items. What I mentioned not only includes games, but also subscriptions, gift cards, software, e-learning. And we will be expanding our non-gaming offer in order to open this gate to adventure in even more areas of digital entertainment. But right now, we already have a lot of TV, music, food subscriptions, even fashion clothing choices. And in the future, who knows? There are audiobooks, eBooks, and so much more to explore, and this is definitely something we’ll look at. And last but not least, our platform: G2A.COM. Our website is the main touchpoint for our clients, buyers, and sellers on both sides. Therefore, our major focus is always on increasing the quality of our service for them. So, to give you a hint, on our roadmap, we have over 150 features ready to be implemented on our website, so stay tuned. We are coming strong. I can say it’s good.

europeanbusinessmagazine.com 25

AI Governance Alliance Calls for Inclusive Access to Advanced Artificial Intelligence

Davos-Klosters, Switzerland, 18 January 2024 – The AI Governance Alliance (AIGA) released today a series of three new reports on advanced artificial intelligence (AI). The papers focus on generative AI governance, unlocking its value and a framework for responsible AI development and deployment.

The alliance brings together governments, businesses and experts to shape responsible AI development applications and governance, and to ensure equitable distribution and

enhanced access to this path-departing technology worldwide.

“The AI Governance Alliance is uniquely positioned to play a crucial role in furthering greater access to AI-related resources, thereby contributing to a more equitable and responsible AI ecosystem globally,” says Cathy Li, Head, AI, Data and Metaverse, World Economic Forum. “We must collaborate among governments, the private sector and local communities to ensure the future of AI benefits all.”

AIGA is calling upon experts from various sectors to address several key areas. This includes improving data quality and availability across nations, boosting access to computational resources, and adapting foundation models to suit local needs and challenges. There is also a strong emphasis on education and the development of local expertise to create and navigate local AI ecosystems effectively. In line with these goals, there is a need to establish new institutional frameworks and public-private

europeanbusinessmagazine.com 26

partnerships along with implementing multilateral controls to aid and enhance these efforts.

While AI holds the potential to address global challenges, it also poses risks of widening existing digital divides or creating new ones. These and other topics are explored in a new briefing paper series, released today and crafted by AIGA’s three core workstreams, in collaboration with IBM Consulting and Accenture. As AI technology evolves at a rapid pace and developed nations race to capitalize on AI innovation, the

urgency to address the digital divide is critical to ensure that billions of people in developing countries are not left behind.

On international cooperation and inclusive access in AI development and deployment, Generative AI Governance: Shaping Our Collective Global Future –from the Resilient Governance and Regulation track – evaluates national approaches, addresses key debates on generative AI, and advocates for international coordination and standards to prevent fragmentation.

Unlocking Value from Generative AI: Guidance for Responsible Transformation – from the Responsible Applications and Transformation track – provides guidance on the responsible adoption of generative AI, emphasizing use case-based evaluation, multistakeholder governance, transparent communication, operational structures, and value-based change management for scalable and responsible integration into organizations. In addition, for optimized AI development and deployment, a new Presidio AI Framework: Towards Safe Generative AI Models – from the Safe Systems and Technologies track – addresses the need for standardized perspectives on the model lifecycle by creating a framework for shared responsibility and proactive risk management. AIGA also seeks to mobilize resources for exploring AI benefits in key sectors, including healthcare and education.

Quotes from the initiative:

“As we witness the rapid evolution of artificial Intelligence globally, the UAE stands committed to fostering an inclusive AI environment, both within our nation and throughout the world. Our collaboration with the World Economic Forum’s AI Governance Alliance is instrumental in making AI benefits universally accessible, ensuring no community is left behind. We are dedicated to developing a comprehensive and forward-thinking AI and digital economy roadmap, not just for the UAE but for the global good. This roadmap is a testament to our belief in AI as a tool for universal progress and equality, and it

embodies our commitment to a future where technology serves humanity in its entirety.” – H.E. Omar Sultan Al Olama, Minister of State for Artificial Intelligence, Digital Economy and Remote Work Applications of the United Arab Emirates.

“Rwanda’s participation in the AI Governance Alliance aims to ensure Rwanda and the region do not play catch up in shaping the future of AI governance and accessibility. In line with these efforts, Rwanda’s Centre for the Fourth Industrial Revolution, in collaboration with the World Economic Forum, will host a high-level summit on AI in Africa towards the end of 2024, creating a platform to engage in focused and collaborative dialogue on the role of AI shaping Africa’s future. The event’s primary goal will be to align African countries on common risks, barriers, and opportunities and, ultimately, devise a unified strategy for AI in Africa.” –Paula Ingabire, Minister of Information Communication Technology and Innovation of Rwanda.

“IBM continues to drive responsible AI and governance. We all have an obligation to collaborate globally across corporations, governments and civil society to create ethical guardrails and policy frameworks that will inform how generative AI is designed and deployed. IBM is proud to work with the Forum’s AI Governance Alliance as the knowledge partner for this paper series.” – Gary Cohn, IBM Vice-Chairman

“The evolution of AI is unique in that the technology, regulation and business adoption are all accelerating exponentially at the same time. It’s critical that the public and private sector come together to share insights, resources and best practices for building and scaling AI responsibly. Leaders in this space must prioritize inclusive AI so that the benefits of this technology are shared in all parts of the world, including emerging markets. The Forum’s three-part briefing paper series offers insightful considerations across responsible applications, governance and safety to empower businesses, respect people and benefit society.” – Paul Daugherty, Chief Technology Innovation Officer, Accenture

27

europeanbusinessmagazine.com

DIGITAL EURO:

The challenges today for tomorrow’s currency

by Johannes Kolbeinsson, CEO and co-founder of PAYSTRAX

‘Trusted, accessible, and easy to use’ were the words UK Chancellor, Jeremy Hunt, used to describe the benefits of the digital pound, or ‘Britcoin’ - the new virtual currency the Bank of England is considering introducing to the UK.

While it may be some time before we see its adoption, across the channel, the European Central Bank (ECB) is moving now into its ‘ preparation stage’ for its own digital Euro, aiming to become the first of the G7 central banks to introduce a digital currency.

The move is part of a global trend of countries developing centralised digital currencies, with more than 100 national governments globally considering similar plans.

However, with 65% of people in a Bank of Spain report saying that they

europeanbusinessmagazine.com 28

wouldn’t use a digital euro, many are still far off being convinced that the ECB can achieve its goals of providing a secure, private, and accessible digital currency.

What is the digital euro?

A central bank digital currency (CBDC), such as the digital euro, would function as a digital asset that represents the physical form of the currency. In development with the ECB, the intention is to modernise the Euro’s financial structures while retaining the security of a currency backed by a central bank.

This direct guarantee from the bank differentiates a CBDC from other digital formats, such as cryptocurrencies.

In theory, this would also ease concerns that have been highlighted in recent months surrounding the viability and security of digital financial systems, as the digital euro would always keep the same value as physical cash.

Although there are doubts around the general appetite for using the currency, the ECB describes the need for a digital euro as having emerged from the increasingly digital age. It notes that in 2021, 240 trillion euros worth of electronic payments were madea significant increase from the 184.2 trillion made four years earlier.

In practical terms, a digital euro would simply function as an online wallet or bank account, except it is both free to use and guaranteed by a public bank, rather than a private company. Customers would be able to use it in-store or online to make payments, pay bills, or send money to other accounts, providing the same convenience they enjoy today.

The stumbling bloc

But as another form of financial centralisation, the digital euro faces the considerable issue of both private and public sector trust when dealing with its implementation. Indeed, public perception and trust are perhaps the largest barriers to the digital euro, with 60% of Germans concerned that the implementation of the digital euro is the first step towards the abolition of money.

Widespread scepticism of governments monitoring financial payments, fueled by stories on China’s ‘digital yuan’, is also playing a part in the worries regarding the implementation of a CBDC. With inflation remaining high and recessionary concerns still lingering, trust in banks is low as it is right now, and the general public would be highly adverse to having their spending data viewed, even if it is only for internal use.

The plans have also raised concerns around accessibility and digital exclusion. While the ECB plans to roll out a detailed support system for the disabled and elderly through public entities such as post offices, there are real concerns that such a drastic revolution will leave behind those who still rely on cash.