Spain

EUROFISH member country

pavilions at SEG, SPG

SMALL SCALE FISHERIES AND CLIMATE CHANGE

UKRAINIAN company exports dried fish to the EU and North America

DESPITE tax

Norway continues as EU’s primary salmon source

APRIL 2024/2 www.eurofish.dk

PUBLISHED BY

11 54 56

Register today with promo code EUROFISH24 to secure pre-event rates!

Online: seafoodexpo.com/global/reg

Tel: +31 88 205 7200

Interested in exhibiting at the largest seafood trade event in the world?

Contact the team at sales-global@seafoodexpo.com

Network with a global seafood audience

Seafood Expo Global/Seafood Processing Global is the world’s largest and most diverse seafood trade event bringing together industry professionals from around the globe for three days of sourcing products, networking and conducting business – all in one location!

+ F IND new products and suppliers from around the globe

+ CONNECT with industry professionals

+ HEAR from industry experts

Margar sem WF_427163_SEG19_InfoFish_QF.indd 1 12/3/19 2:39 PM seafoodexpo.com/global Produced by: A Member of: Official Media PART OF A GLOBAL SEAFOOD PORTFOLIO 23-25 APRIL 2024 / BARCELONA, SPAIN FIRA BARCELONA GRAN VIA VENUE

The #SEG24

GLOBALSeafood Marketplace

Spain’s small-scale fishers tackle climate change impacts

Spanish small-scale fisheries, like those in other countries, are suffering impacts of climate change such as unusually intense rainfall, warming waters, and invasive species. This matters because the segment provides livelihoods and high-quality animal protein and contributes to the community in social and cultural terms. How it responds to the threat posed by climate change can therefore have far-reaching consequences (page 32)

In Spain fishers are organised into guilds, bodies that offer similar advantages as associations with some additional social benefits. The guilds in turn can belong to federations of which the national federation is the largest. This organisation is responsible for coordinating its members’ interaction with federal ministries and other stakeholders at the national level. The national federation has other roles too, from promoting fish consumption, through supporting digitalisation, to combating ageing in the fishing sector (page 34)

An activity related to fishing that is closely associated with women, at least in Galicia in northwestern Spain, is net-making and mending. The women are organised into associations which in turn join to form a federation. In one of the associations, Atalaia, based in A Guarda the netmakers do not only make nets but use their skills to produce clothing accessories and items of jewellery from the remnants of the materials that go into the nets. The association also promotes itself and the work its members do to the public by conducting workshops and by extending open invitations to visit the facility and interact with the workers. This outreach effort is intended to generate interest in the work and also to push for better working conditions, social security, and remuneration (page 41)

Aquaculture is generally considered to be more sustainable than the production of other animal proteins. However, as production from aquaculture increases, traditional marine and freshwater fish farming face a challenge. The cultivation of fish introduces nutrients into the water in the form of faecal matter and uneaten feed, and if unchecked this can have consequences for the environment. A possible solution is growing mussels and algae which feed on nutrients in the water and may compensate for those emitted by fish farming (page 23)

Commercial fishing in Montenegro has a long history and is deeply embedded in the social and cultural fabric of local coastal communities. Fishers target several species in nearshore waters of the Adriatic Sea as well as in Lake Skadar. The aquaculture industry is more recent and is dominated by rainbow trout cultivation. An industry priority is to add more value to the production, a development that will be facilitated by EU membership (page 49)

Artificial reefs provide habitats for fish and other marine species offering shelter, spawning, and nursery areas. Bamboo, stone, and wood structures have been used since ancient times to aggregate fish, while today they can be purpose-built shapes using modern materials. In EU countries legislation on artificial reefs varies from state to state leading occasionally to contradictory rules. The advantages and disadvantages of reefs would be better understood if a coherent legal framework was in place to further their deployment (page 52)

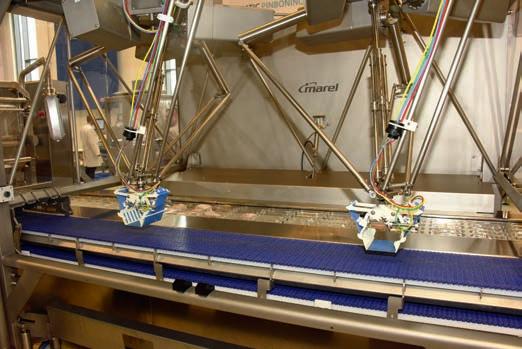

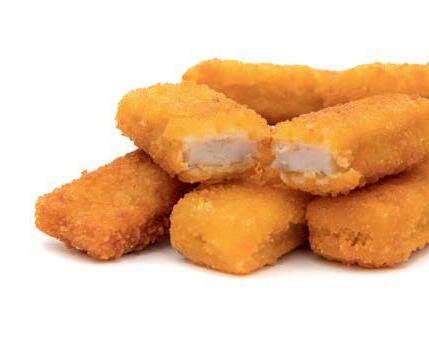

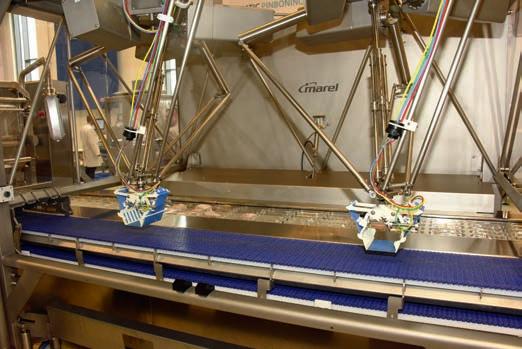

Robots are widely deployed in some industrial sectors, and they are even becoming more common in fish processing. Here, repetitive, monotonous work in cold and wet conditions is still often performed by human employees. Fish is a delicate product that need careful handling and its dimensions can vary significantly too. Dealing with this calls for sophisticated solutions to automate operations, says Dr Manfred Klinkhardt, and these are increasingly both available and affordable (page 60)

In this issue

EUROFISH Magazine 2 / 2024 3

Events

11 Seafood Expo Global, Seafood Processing Global, 23-25 April 2024, Barcelona The excitement is palpable

12 Croatia: 2E701 New farmed products and familiar favourites

12 Denmark: 3CC201, 3DD201, 3EE201, 3EE401, 3FF201, 3FF401 Several product launches at Seafood Processing Global 2024

14 Estonia, 2J401

A wide variety of products

14 Latvia: 4F501 Committed to quality and innovation

15 Poland: 4G301, 4G401

Seafood for every taste and budget

16 Türkiye: 2B601, 2B701, 2C601, 2D601, 2D701, plus in halls 1 and 5 Seabass and seabream are only a part of the offer

16 Aquaculture Congress, 28-29 June 2024, Athens Defining a resilient future

18 fish international, 25-27 February 2024, Bremen If all people thought alike, nobody would gamble

22 AquaFarm 2024, 14-15 February, Pordenone Solo, but stronger

Aquaculture

23 Nutrient resorption in algae and mussel cultures

Positive environmental impacts of farming extractive species

Spain

28 Mitigation measures must take social and economic factors into account

Ensuring sustainability in the face of climate change

32 Small-scale fisheries stand to gain and to lose from climate change

Adaptation is not straightforward

34 The Spanish National Federation of Fishers’ Guilds Defending the interests of fishers big and small

36 Small-scale fishers’ response to climate change depends on many factors

Building resilience is a long process

DK NO SE UK IR CZ NL BE FR CH AU IS PT SI LU MA DZ TN LY IT DE ES 4

News 6 International News

Table of

Front cover picture courtesy Kofradia Itsas Etxea

Contents

39 Attracting youngsters to a rapidly evolving industry

PO works to secure generational change

41 Netmakers see the benefits of being organised into an association

Women repairing fish nets is an old tradition

43 Spain’s biggest mussel PO seeks to sell under its own brand

Galicians should consume even more

45 Sustainability labels for fishing and experiments with new fuels

Port of Vigo contributes to the green transition

47 Port of Vigo—Spain’s biggest fisheries port A guarantee for quality and traceability

Montenegro

49 Fisheries and aquaculture in Montenegro EU accession should boost value

Environment

52 The lack of EU-wide legislation on artificial reefs creates uncertainty

An underused instrument to foster biodiversity

Ukraine

54 Ukraine’s seafood business: Impacts of Russia’s war against Ukraine

Niche products with long traditions and memories from childhood

Trade and Markets

56 Withholding tax has a negative impact on the Norwegian salmon industry

Where is the salmon market drifting?

Technology

60 Automatic systems – Effortless, fast and efficient Can robots be incorporated into fish processing?

64 Thermal processing of lying products with the REICH AIRMASTER® UKQ AIRJET

Smart airflow technology increases the quality and yield of fish products

FI CZ AU SL BY RO HU TR SI MT BA EL EG MK AM AZ GE KZ UZ IR IQ LY IL JO SA LB SY CY TM RS AL RU HR PL BG ME RU LV EE LT MD UA

EUROFISH Magazine 2 / 2024 5

(CC BY-SA 3.0) Map based onhttps://commons.wikimedia.org/wiki/File:Location_European_nation_states.svgby Hayden120 and NuclearVacuum

Diary Dates 66 Imprint, List of Advertisers

Service 65

Faroe Islandspage 9 Globalpage 8 Icelandpages 6, 8 Norwaypage 7 Polandpage 10 Spainpages 6, 7 UK page 10

Worldwide Fish News

Spain: GLOBALG.A.P. to hold the panel discussion on responsible aquaculture supply chains during Seafood Expo Global

On 23 April, during Seafood Expo Global in Barcelona, GLOBALG.A.P. c/o FoodPLUS GmbH will host a panel discussion on fostering responsible aquaculture production and supply chain transparency. The aim of the panel discussion is to explore the crucial topic of supply chain legislation in Europe, the European Union (EU), and beyond, as well as the role of certification in supporting responsible farming practices.

Featuring a range of industry experts, the discussion will be facilitated by an external moderator. The aim is to engage participants in a comprehensive exploration of the current challenges and solutions on the topic

of supply chain legislation and the transparency of responsible aquaculture production.

The panel discussion format will provide a platform for new and exclusive sector insights and offer the opportunity to exchange perspectives and targeted solutions with stakeholders from across the value chain.

Objectives of the discussion:

• Addressing key topics facing the aquaculture sector, such as supply chain legislation, evolving regulations, and their impacts

• Considering the role of voluntary certification solutions in responsible aquaculture practices across the supply chain

The target audience for the coming event are industry decision-makers: producers, suppliers, retailers, certification bodies, relevant authorities, media, and the general public.

• Identifying methods of crosssector collaboration and highlighting the role of data-driven traceability systems for responsible farming practices

Iceland: IceFish 2024 preparations gather speed

With just over six months to go until the doors open, stands are booking up fast at the 14th Icelandic Fisheries Exhibition (IceFish), preparations are well underway to welcome the participation of companies and professionals from all over the world and to ensure they have the ideal platform to showcase their products and services. Returning to the Smárinn, Fifan Halls Kópavogur, Iceland, on 18-20 September 2024, IceFish 2024 will again be a must-attend event for everyone connected to the commercial fishing, processing, seafood, and aquaculture sectors. As well as celebrating 40 years of IceFish— the country’s longest-running professional exhibition, this year’s show will look to the future by presenting the latest innovations from established enterprises and emerging start-ups. With Iceland’s seafood industry going from

strength to strength, and significant gains being seen throughout the country’s commercial fisheries, aquaculture, processing, and value-added sectors, there’s never been a better time to join IceFish: to network with peers, explore the latest market trends and build lasting relationships with stakeholders and industry leaders.

A packed exhibition centre will feature many long-term IceFish partners as well as several new companies from Iceland, Turkey, the Netherlands, Denmark, and Malta. Event organiser Mercator Media is anticipating the participation of 400 exhibitors and national pavilions, and the engagement of 12,000 business visitors from 40 countries. This year’s show will also feature Matchmaking Meetings, bringing buyers and sellers together, and a Small Business Zone with walk-on stands

Date and place of the event: 23 April 2024 2:00–2:45 p.m. Conference Center 5, Conference Room CC 5.2

Free admission

First held in 1984, IceFish has developed into a showcase of every aspect of the commercial fishing industry and seafood sector.

for first-time exhibitors. Another key part of the programme will be the 5th Fish Waste for Profit— The 100 Fish Conference—with presentations and sessions demonstrating some of the most innovative international developments in by-product utilisation and featuring some of the industry’s leading experts. A further returning

highlight will be the 9th Icelandic Fisheries Awards, which will recognise outstanding achievements in the International and Icelandic fishing, processing, and seafood sectors.

For more information on bookings, please contact info @icefish.is or tel: +44 1329 825335.

[ INTERNATIONAL NEWS ] 6

Norway: Government seeks to improve fish-farming environmental regulations

Norwegian fish farmers are getting some positive government attention for a change, as authorities are changing some of the rules attached to new applications for farm sites. The new changes will increase predictability and lessen confusion, according to the Ministry of Fisheries and Oceans.

Until now, successful site applications required an individual discharge permit – a time-intensive and costly procedure that required tailor-made regulatory conditions regarding pollution for each industry site. The rules now will provide for standard conditions and regulations industrywide.

The Fisheries and Oceans Minister explained that the new pollution regulations will become

more predictable and the same for breeders. The authorities’ application processing becomes more efficient while protecting the environment in the best possible way.

“It is good news for the industry, which has wanted this change.”

The Minister for Climate and Environment added that fish farming produces, among other things, emissions of nutrient salts, organic particles and environmentally hazardous substances that can pollute the environment around the facilities. “Many of today’s emission permits are old, and not necessarily adapted to today’s knowledge and technology,“ he said. The government recognizes the need to update the requirements for the operation of aquaculture facilities in the sea, so that these correspond

In 2022, the number of seawater sites in Norway was 989 for salmon and trout production, and 138 for molluscs, crustaceans, and echinoderms. The number of land-based sites amounted to 29 for freshwater and 29 for salt water fish.

to a greater extent with environmental requirements that apply to other industries.

A two-year transition period will keep existing emission permits in place before replacement with the improved standard ones. Brand new sites will be subject to the new rules in addition to those for carrying out preliminary investigations on the site.

Spain: The same crab is a scarce delicacy in Galicia, an invasive pest in Brittany

Spider crabs, Maja brachydactyla, represent an interesting example of a marine animal generating completely opposing opinions between two nearby regions in Europe.

In Spain, in Galicia particularly, spider crabs are a pricey delight for consumers and a tempting target of the region’s fishing industry. There, the crustacean is called “the King of seafood,” and consumers love its flavor and delicacy. Fishing for spider crab is so heavy that its population and its harvests have declined recently and prices have risen. During the most recent season, from November 2023 through February 2024, the volume of the spider crab harvest fell to twothirds the level of the previous two years. Prices at dockside have risen in response: the region’s turnover from this resource, totalling nearly EUR 4.4 million in the 2023-2024 season, was 16 and 12, respectively, over that of the previous two

seasons and the dockside price was 27 and 33 higher in the same timeframe.

Compare that with northern France, particularly Normandy, where spider crabs also have a target: on their despised little heads. There, spider crabs are a big problem – a “plague” – becoming yet another invasive species that gobbles up the valuable English Channel lobster resource upon which many Norman fishermen depend. There is no significant market for spider crab in Normandy, certainly nothing compared to the demand for lobster locally and elsewhere in France.

The solution should be obvious to many people: catch the crabs in Normandy and sell them in Galicia. Or not even as far as Galicia – there is a limited demand for spider crabs in neighboring Brittany, where for unknown

reasons consumers are fonder of this seafood than in Normandy. But while that demand is nearby Normandy, it is not enough to absorb the volume that must be extracted from the waters to save the lobster fishery.

Therefore, the Normandy fishing industry will have work harder – maybe with effective assistance from authorities –to catch and sell a crustacean that is hated to distant markets where it is loved.

Barnabas Davoti

European spider crabs (Maja brachydactyla) are crustaceans found in the northeastern Atlantic Ocean and the Mediterranean Sea. Known for their distinctive appearance and flavorful meat, they are a popular seafood delicacy enjoyed in various European cuisines.

[ INTERNATIONAL NEWS ] EUROFISH Magazine 2 / 2024 7

Iceland: Outdoor clothing company tries to ruin Iceland’s salmon-farming industry reputation

Patagonia, a distributor of personal outdoor gear and clothing, has released a video that tries to paint dark colors on Iceland’s salmon farming industry, in the hope that consumers will be shocked and government will ban the industry.

The central message of the video is that farmed salmon, especially those in sea-based pens, pose an existential threat to wild salmon. The threat – very real and in the industry view exaggerated – comes from the possibility that escapements will allow farmed and wild salmon to mingle and breed, leading to new generations of feeblebrain salmonids that won’t be able to find their own breeding ground and in any case will have

inferior-tasting meat sold at low prices in supermarkets, wiping out wild salmon with a double blow.

The video is co-produced by a pair of musicians who also led a protest against salmon farming last year in Reykjavik, and also features the land commissioner of the U.S. state of Washington who proposed a controversial ban in that state on salmon farming, an action opposed by salmon companies and Native American tribes. Patagonia had previously released a video about salmon farming in Puget Sound, Washington, with the same basic points about the industry and its product’s alleged environmental threats.

Salmon farming in Iceland is a rapidly growing sector. In 2022, the production volumes reached almost 45 thousand tonnes – a 15-fold increase compared to 2013.

Patagonia’s actions have gotten the desired attention of consumers of fish and of mountain-climbing backpacks, and from Iceland government officials. The Icelandic

National Audit Office has said that the extraordinary growth of the salmon farming sector suggests the sector might need greater oversight.

World: The benefits of Omega-3 emphasised in annual promotion

By now, every health-conscious person has heard of, if not yet tried, Omega-3, a group of fatty acids that play a role in maintaining and improving human health. Omega-3 is reported to help reduce the risk of cardiovascular disease and associated outcomes such as heart attacks and strokes.

What many people don’t know is where to find Omega-3. It is not synthesized (manufactured) in the human body, it must be consumed as part of a well-rounded diet. The type of Omega-3 that comes from plants is usually plentiful in the foods we eat. The type from marine-based sources is usually not and must be consciously supplemented in diet. It is well known to come from seafood made of fatty fish such as sardines and herring, and Omega-3 capsules in pharmacies typically contain oils sourced from marine animals and plants.

Improving consumer awareness of the importance of Omega-3 in our diets is the goal of International Omega-3 Awareness Day, celebrated each year on March 3 (of course). This annual effort began in 2010, originating by Dr. Carol Locke, founder of the nonprofit organization OmegaBright, which supports education in, and knowledge of, the benefits of Omega-3.

Now renamed Global Omega-3 Day but still held on the 3rd day of the 3rd month, this effort promotes many important positives about Omega-3, such as:

• Omega-3s are key to the structure of every cell in the body.

• These nutrients act as an energy source to keep the major organs working properly.

• Omega-3s are particularly important to the eyes as well as the brain.

Seaweed is a lesser-known but valuable plant-based source of omega-3 fatty acids, particularly in the form of ALA (alpha-linolenic acid). Incorporating seaweed into the diet can provide a plant-based alternative for those seeking to increase their omega-3 intake, particularly for individuals following vegetarian or vegan diets.

• These fatty acids are vital in supporting pregnancies so babies can grow in a healthy manner.

While fish and seafood continue to be promoted as Omega-3 sources, seaweed is often vastly underappreciated, because many people don’t think of seaweed as a food. In a serving of salad, for

example, the seaweed (in any of its colorful red, green, and brown varieties) typically contains 4 fat, 50 of which is Omega-3. (It is nearly “bad-fat” free!)

Therefore, Global Omega-3 Day this year and in the future will shine a light on an extremely underutilized source of an extremely important dietary ingredient, Omega-3.

[ INTERNATIONAL NEWS ] 8

Faroe Islands: Europe’s leading seaweed conference takes place June 18-20 in Thorshavn

The Seagriculture EU conference has built up a reputation as the leading seaweed conference for Europe. The theme of Seagriculture EU 2024, Bridging Continents, transcends borders and oceans to unite seaweed enthusiasts from diverse corners of the world. We’ll delve deep into the global landscape of seaweed cultivation, harvesting, and innovation, learning from the unique experiences and perspectives of experts and enthusiasts from various countries and continents. Get ready to build connections, share insights, and uncover the potential of seaweed on a global scale. Seagriculture EU 2024 is where the world of seaweed meets, exchanges, and thrives.

Find out more about the conference program: https://seagriculture.eu/ conference-program-2024/

Don’t miss out and join the exclusive site visit during Seagriculture EU 2024! The site visit is a full day trip to Ocean Rainforest and will take place on 18th June. Embark on a breathtaking boat journey to explore the cultivation site of Ocean Rainforest. Witness their innovative processing plant and experience a scenic drive on the Faroe Islands. Seagriculture EU 2024 is a Limited Edition as there is only a limited number of places for the site visit available.

Register now at www.seagriculture.eu

Seagriculture conferences are pivotal for driving the sustainable growth of the seaweed industry and acknowledging its potential as a significant crop with a positive impact on climate change mitigation.

More about Seagriculture EU:

Seaweed cultivation in Europe is showing promise in terms of growth, however challenges in regulations, cost, and market viability could affect the pace of this growth in the future. The Seagriculture

conferences focus on addressing those challenges in the seaweed industry, fostering collaboration among various stakeholders, and emphasizing the importance of sustainable practices, innovation, research, and regulatory adaptability for long-term success.

2024

28-29 June 2024

Organized by With the support of

a Resilient Future Tel. +30 210 9219 948

Megaron Athens International Conference Centre Defining

info@ambio.gr

Athens, Greece www.aquaculture-congress.com

[ INTERNATIONAL NEWS ] EUROFISH Magazine 2 / 2024 9

Poland: Industry worried about proposed EU hygiene requirements in salmon processing

Draft EU regulations pertaining to fish processing unfairly favor competitors in France and other countries compared to Polish salmon processors -- according to Polish industry, the parliamentarians who represent them in Brussels, and even Norwegian exporters that supply the raw material for Poland’s largest seafood export.

The proposed regulations govern the stiffening time for meat and the maximum temperature ranges during the cutting process – rules designed to block the bacteria listeria, a dangerous infection, especially for pregnant women and others with weakened immune systems. In the case of salmon, the stiffening time could be 96 hours and the temperature could be -3 degrees C, which Poland argues is so different from current Polish

industry practice that competitors will be able to operate at lower cost and threaten the viability of Polish processed salmon throughout the European market.

Currently, Polish processors freeze their fish to-4 to -7 degrees C before slicing it, which helps give their product its famous reputation for quality. If other countries can cut their fish at higher temperatures, it is argued, Poland’s advantage will be lost.

Of greater concern, however, is Poland’s complaint of secrecy in the EU legislative process. “The act carried out in a certain silence and lack of transparency will be the subject of debate in the EP,” stated Polish MEP Anna Fotyga. We are dealing with a not entirely clean competitive fight on the part

of producers representing other Member States, she emphasized, adding that in this area, Polish MPs from various factions work beyond political divisions to defend the interests of our country. Fotyga and other parliamentarians allege that scientific studies do not back up the rule changes and point out that a minuscule number of listeria cases

(2 out of 144 cases since 2018) originate from Polish processing plants.

Further investigation into the role of scientific studies and into the question of whether or not Polish parliamentarians were kept in the dark during development of the legislation will be continuing, officials said.

UK: New harvesting technique holds promise for reducing sea turtle bycatch

Every year, fishing gear accidentally traps and kills many thousands of sea turtles and other nontarget animals around the world, including some 40,000 turtles in the Mediterranean alone. Most species of sea turtles, such as green and loggerheads, are classified as endangered -- some critically so -- and their loss poses a risk of species extinction and damage to ecosystems. Tools to avert this loss include changes to net meshes, adjustments in hauling practices, and most commonly, time or area restrictions on harvesting activities. Moreover, the fisheries usually connected to turtles are typically small scale and harvesting unwanted bycatch damages relatively costly gear.

A new tool to protect sea turtles has emerged from efforts by British scientists at the University of Exeter and researchers at the Society for Protection of Turtles, in collaboration with the fishing industry in Cyprus. In a “why didn’t we think of this before?” innovation, these people developed and are testing a device called a “Netlight” that is attached to the net’s lines and shines a broad beam of light on the net to warn turtles about the imminent disaster.

The results of testing in Cyprus are very promising. The accidental catch of sea turtles dropped by more than 40 with the Netlight, according to a report by the scientists in the journal Fisheries Research, and there have been reduced catches of other

About 40,000 turtles are caught in nets annually.

endangered and nontarget species as well.

The Netlight is simple and affordable for small-scale fishermen, the type that most often run into turtles, as it is easily attached to the gear and is powered by two AA batteries. It is, therefore, a promising investment in marine ecology and in small-scale fishermen’s livelihoods.

Philipp Kanstinger01

Poland and France are the major destinations for Norway’s salmon exports with about 15 and 11% of volumes respectively. However, the exports of processed salmon from Poland are five times higher than those from France.

[ INTERNATIONAL NEWS ] 10

The excitement is palpable

Organised by Diversified Communications, the biggest and most international seafood show in the world will open shortly for the third time in Barcelona and the thirtieth overall.

Seafood Expo Global and Seafood Processing Global are known for the range of seafood products, services, and processing equipment that will be exhibited. In addition, exhibitors and visitors can look forward to a comprehensive programme of workshops and

seminars addressing sustainability, IUU fishing, traceability and transparency, and climate change among other topics. So far seventy-nine countries will be represented at the event with still five weeks to go. Companies from many of the Eurofish member countries will also be

exhibiting seeking markets for their products and suppliers of the raw materials they need (see following pages). Once again, the best seafood products at the event will be awarded the Seafood Excellence Global Awards on 23 April, an honour that generates wide publicity

and recognition. Seafood is seen as a climate friendly source of healthful protein and could even contribute to mitigating some of the impacts of climate change. Greater awareness of the merits of seafood is good for the industry, but perhaps also the planet (continued on next page).

Seafood Expo Global, Seafood Processing Global, 23-25 April 2024, Barcelona

[ EVENTS ] EUROFISHMagazine 2/202411

Croatia: 2E701

New farmed products and familiar favourites

Croatia’s fisheries sector includes capture fisheries for small pelagics, primarily sardines and anchovies, and for demersal species (fish, crustaceans, and cephalopods). Fish farming can be divided into marine (seabass, seabream, meagre, dentex, greater amberjack) and freshwater (common carp and rainbow trout). Another important activity is the fattening of bluefin tuna in sea cages. Here, fish are caught in the wild transferred to cages and raised to 30 or more kilos for sale primarily to Japan.

The Croatian fish processing sector comprises some 50 companies employing about 1,400 people and most of the products manufactured are based on domestically sourced raw material. Eleven of these companies, all active on export markets, will be present at the Croatian pavilion which, as in previous years, is organised by the Croatian Chamber

of Economy. The exhibitors represent a variety of commercial activities including canning, tuna fattening, farming of marine species and of freshwater fish, salting, and marinating. Many of the products will be well-known favourites such as canned sardines and salted and marinated anchovies, says Zoran Radan from the Chamber of Economy, but a fish farming company will be bringing two new species, dentex and greater amberjack. The company, Cromaris, has already established a name for itself as a supplier of seabass, seabream, and meagre, which it sells whole fresh, and as fresh fillets, but also processed into value-added products, such as smoked and marinated items. The company also offers a line of bio products.

All four of Croatia’s canning companies, Conex Trade, Mardesic, Podravka, and Sardina, will present canned products at the event.

Denmark: 3CC201, 3DD201, 3EE201, 3EE401,

Visitors to the Croatian pavilion at Seafood Export Global will find salted and marinated anchovies, canned sardines, tuna products, seabass and seabream, and value added carp items among others (archive photo).

Mardesic and Conex Trade also manufacture salted and marinated anchovies, while Sardina has tuna fattening activities, as well as seabass and seabream production. Another company, Arbacommerce, with a long tradition of salting and marinating anchovies will tempt visitors with samples of these products. It also has production lines for individually or block frozen sardines and anchovies. Seabass and seabream are also the speciality of Orada Adriatic, which cultivates and processes the fish for export to several countries in Europe. PP Orahovica specialises in carp farming and in the

3FF201, 3FF401

manufacture of value-added carp products. As consumer preferences evolve producers must adapt and nowhere is this more apparent than in the market for freshwater fish. The days when carp could be sold live to a customer are now history and companies like PP Orahovica are creating innovative products that appeal to today’s consumers. Apart from the products that the companies bring, a further attraction is the presence of chefs at Cromaris, PP Orahovica, and Pelagos Net Farma, a tuna fattening company, who will be preparing fresh samples at regular intervals.

Several product launches at Seafood Processing Global 2024

Exhibiting at a trade show is always a good opportunity not only to meet the key stakeholders of the industry but also to showcase brand-new products and solutions. At Seafood Processing Global (SPG) this year, 36 Danish companies join the Pavilion of Denmark to showcase their solutions for seafood processing, aquaculture, and fishing, bringing some of the most innovative, sustainable, and energy-efficient solutions to the global industry. For several Danish companies this will be the first time they join SPG in Barcelona.

One of these companies is Beritech A/S, which, until recently, focused primarily on production for the food and pharmaceutical industries but has now expanded into the seafood processing sector as well. The company will showcase its seafood processing equipment, introducing brand-new and innovative products and solutions that have not yet hit the market.

Another new company to the Pavilion of Denmark is LSM Pumps. The company manufactures hose pumps for different industries, including

[ EVENTS ] 12

Pavilion of Denmark will be buzzing with activity, new exhibitors, and exciting product launches at Seafood Processing Global 2024.

We look forward to welcoming you in September

The Icelandic Fisheries. Seafood & Aqua Exhibition hosts the latest developments from the industry showcasing new and innovative products and services, covering every aspect of the commercial fishing industry from catching and locating to processing and packaging, right through to marketing and distribution of the final product.

For more information about exhibiting, visiting or sponsoring, contact the events team

Visit: Icefish.is

Contact: +44 1329 825 335 or Email: info@icefish.is

Media Partner: 18 20

Smárinn

Organised by:

TO

Kópavogur Iceland 2024 SEP

#Icefish

Book your stand now!

bioenergy, aquaculture, and fishing, where product needs to be moved gently and efficiently.

LSM Pumps bring a brand new peristaltic hose pump for the fishing and aquaculture industry to SPG. The pump, which is a bit smaller than some of the other

Estonia, 2J401

models from LSM, is not even on the market yet but has been tested at aquaculture facilities in Denmark. Director Leo Sørensen looks forward to presenting the new pump and to meeting new business partners in Barcelona. Our pumps are highly energy efficient due to the technology we use that really

A wide variety of products

The Estonian fishing sector consists of three different segments: trawling and coastal fishing in the Baltic Sea, high seas fishing in north-western and southwestern parts of the Atlantic Ocean, and inland fishing. Total marine fishing volumes in 2022 reached over 71 thousand tonnes, of which catches from the Baltic Sea represented about 80% of the total. Inland fisheries yielded around two thousand tonnes, and about 90% consisted of catches from Lake Peipus. The aquaculture sector comprises over 30 freshwater farms breeding rainbow

Latvia: 4F501

trout, crayfish, carp, and European eel. In 2022 the total farmed volumes reached over 800 tonnes of which 85% were rainbow trout. There are over 70 fish processing units in the country. The major part of the production is exported: frozen and spiced fish products go to East European markets, chilled and fresh fillets to Western Europe, while salmon and trout fillets, and smoked/dried/salted fish are sold in many countries. Together, Estonian fish processors exported their production to about 60 countries worldwide for over EUR200m in 2023.

stands out from the competition. It saves up to 80 percent of the energy and reduces emissions, says Mr Sørensen.

Pavilion of Denmark is organized by the Danish Export Association and is supported by the Danish Trade Council.

For more information please contact:

Martin Winkel Lilleoere, Head of Fish Tech, Danish Export Association, +45 6020 8557, maw@danishexport.dk

Mette Kristensen, PR & Communications Consultant, Danish Export Association, +45 2885 6430, mek@danishexport.dk

Estonia’s national pavilion at SEG will host 13 of the country’s 70 processing companies.

This year the Estonian pavilion at Seafood Expo Global will host 13 companies and the range of products will include processed salmon, sprats, Baltic herring, trout and trout caviar, shrimps, pike-perch,

Committed to quality and innovation

Latvia will be represented in Seafood Expo Global 2024 by a consortium of fish processors with a shared booth. For 15 years, Latvian fish processors have participated in the Seafood Expo Global, marking it as the most significant annual event for them. The show serves as a hub for industry specialists worldwide, providing an excellent opportunity to meet suppliers and clients, learn about the latest production equipment, network with industry professionals, and assess competitors’ growth. This year, Latvia’s joint booth will feature 14 companies, some attending for the 15th time and others making their debut. The booth will also host several professional chefs who will prepare samples for tasting, providing attendees with a glimpse of

Latvia’s culinary expertise. Additionally, visitors can indulge in Latvian beer at the booth!

Fish and seafood exports from Latvia have increased steadily since 2020 to over EUR153m in 2023. This increasing trend was even more marked for imports which reached close to EUR224m in 2023. For the companies Seafood Expo Global is thus an opportunity to strike deals with suppliers of the raw materials they need to process and to explore new markets. Several companies will introduce new products to their clients. For instance, Brīvais Vilnis will present their innovative fried sprats in unagi sauce, which has already garnered attention in the United Arab Emirates

bream, pike, and perch. The pavilion is organised by the Estonian Association of Fishery and will host 13 companies. For more information, contact Valdur Noormagi, kalaliit @online.ee

Latvian companies will show several innovative products including vegan salmon at this year’s edition of the seafood show.

[ EVENTS ] 14

and Japan. And, Atlantika International will debut their vegan salmon. The participation of Latvian fish processors in Seafood Expo Global

Poland: 4G301, 4G401

2024 underscores their commitment to innovation, quality, and market expansion. As they showcase their products and introduce new offerings,

Seafood for every taste and budget

Poland hosts a large fish processing industry. Approximately 230 companies with some 18 thousand employees supply the domestic and foreign markets with products worth over EUR3bn. Fish and seafood from Poland are exported to one hundred countries around the world. This vast market is testimony to the high hygiene and veterinary standards of the products. Salmonid products and smoked fish, the raw materials for which are imported, dominate the

export portfolio. The Polish processing industry is a major buyer of Norwegian salmon ranking just behind Sweden and Denmark. Companies producing a range of products including ready-tocook or ready-to-heat meals, caviar, fish marinades, salted fish, fish salads and spreads, canned fish, and frozen products, will be among those exhibiting at the stand. These products are packaged using the latest technologies including modified atmosphere, vacuum, skin, thermoformable trays, as well as glass

they aim to strengthen their presence in the global seafood market and explore new business opportunities. This collective effort highlights

Latvia’s position as a key player in the international seafood industry, contributing to its ongoing growth and development.

The Polish pavilion will host over 20 fish processing companies producing a huge variety of products in all kinds of packaging. Monika

Pain /

polfishfair.pl INTERNATIONAL FAIR OF FISH AND FOOD PRODUCTS GDAŃSK, POLAND [ EVENTS ] EUROFISH Magazine 2 / 2024 15

Project manager monika.pain@amberexpo.pl amberexpo.pl

jars. Many companies manufacture the private label products of major retail chains both in Poland and abroad and their facilities are certified to BRC and IFS standards and often to other standards such as MSC or GlobalG.A.P. as well. The importance of international trade for Polish seafood processors is among the reasons a large delegation will be present at Seafood Expo Global, where Poland will have a 400 sq. m pavilion. The pavilion will be divided

Türkiye: 2B601,

into individual booths for the attending companies with one reserved for representatives from the Ministry of Agriculture and Rural Development, who will be there to show their support to the industry.

For the companies the seafood show offers an opportunity to meet existing and potential customers and suppliers. They will also get an idea of the latest trends, innovations, and products that

2B701, 2C601,

animate the European seafood market and can analyse the products and strategies of their competitors. Moreover, as they will be in close proximity to each other in the pavilion, they can have face to face meetings with their Polish colleagues from the industry to exchange experiences. As in previous years the Polish Association of Fish Processors organises the pavilion together with the Polish Fish Producers Association and with support from

2D601, 2D701, plus in halls 1 and 5

the European Maritime, Fisheries, and Aquaculture Fund. The support is for finding new markets and to improve conditions to market fishery and aquaculture products. Most of the companies at the pavilion this year were also exhibiting last year indicating the popularity of the seafood show. More would join the pavilion but space is limited and so the association is mulling steps to increase the stand size to include more exhibitors.

Seabass and seabream are only a part of the offer

Output from Turkish aquaculture reached 515,000 tonnes in 2022 of which 251 thousand tonnes worth USD1.65bn were exported. This volume represented a 41% increase over 2018. Turkish aquaculture, both production and exports, has expanded rapidly over the years thanks to a stable legal framework, sound management, strong research capabilities, as well as global demand for fish. Developments in production, processing, and preservation techniques have also boosted growth in the sector. Türkiye is the leading producer of farmed fish in the Mediterranean and the world’s largest producer each of seabass and seabream, and the second largest

Aquaculture

producer of rainbow trout. These three species are the country’s main seafood exports, but by no means the only ones. Small quantities of other Mediterranean species including red porgy, pink dentex, and sharp snout seabream are also produced in Türkiye. Bluefin tuna fattened in cages is exported mainly to Japan and the country also exports products based on wild-caught fish species. However, another fish that has generated a buzz is designated Turkish Salmon which is raised in the Black Sea. This fish can be grown to 5 kg but a market size of 2-3 kg is more common. Rainbow trout are grown on land to 250 to 300 g and then introduced into cages in the Black Sea, where they

Congress, 28-29 June 2024, Athens

Thirty companies will be present at the seafood show, most of them in the Turkish pavilion in Hall 2.

grow rapidly for six to eight months. The fish has proved popular in Russia and Japan because it is versatile— lending itself to be prepared in many ways. As the EU is the main market for Turkish exporters the sector will

Defining a resilient future

be well represented at the seafood show, where some 30 companies will be represented, the majority hosted at the Turkish pavilion organised by the Istanbul Fishery and Animal Products Exporters’ Association.

Greek aquaculture production has grown significantly in recent years. In total (fish and aquatic plants, and all water types), the production volume grew from just under 130 thousand tonnes in 2019 to 142 thousand tonnes in 2022, an increase of 10%. Production value during this period grew from EUR508 million to EUR853 million, a growth of 68%. Saltwater products dominate the industry’s output, accounting for 98% by both volume and value of total production during all of the 2019-2022 period. The overwhelming majority comprises gilthead sea bream, European sea bass, and Mediterranean mussel, while the balance is made up of smaller volumes of several species of fish and aquatic plants.

The Greek aquaculture sector is set to take center stage once again as it prepares to host the 3rd Aquaculture Congress 2024. The leading aquaculture producer among European Union member states, Greece has continually demonstrated its prowess in the industry, driven by its strategic location, skilled workforce, and commitment to sustainability.

Organised by AMBIO S.A., a consulting company in the aquaculture sector, in collaboration with the Hellenic Aquaculture Producers Organization, the 3rd Aquaculture Congress 2024 aims to serve as a vital platform for

[ EVENTS ] 16

ANGLING FOR SUCCESS WITH PLASTIC & METAL CONVEYOR BELTS

EXACTASTACK®

Flexible belt stackers that deliver cost-effective, high quality food processing solutions.

SPIRALSURF®

Customize to meet individual requirements for cooling, and freezer applications. Perfect for tight transfers and small products.

OMNI-GRID 360®

Increase capacity while minimizing maintenance and downtime in the most demanding applications.

Contact us today to let us help you move your business forward. Call +31-20-581-3220

stakeholders across the aquaculture spectrum, fostering dialogue, innovation, and collaboration.

Forging a path towards sustainable aquaculture

The inaugural congress in 2018 and its subsequent iteration in 2022 underscored the need for a unified forum to connect stakeholders including producers, suppliers, investors, researchers, and public bodies. The 3rd Aquaculture Congress 2024 is poised to address pressing challenges while exploring avenues for sustainable growth and development within the sector.

Empowering aquaculture through collaboration

The presence and participation of all stakeholders is vital for advancing the development of a resilient industry and exchanging ideas, while promoting the principles of responsible and innovative practices in aquaculture.

Under the theme “Defining a resilient future,” the congress will examine issues such as regulatory frameworks, climate change, technological innovation, and global market dynamics. By fostering discussions, B2B meetings, and forging partnerships, the congress endeavors to chart a course toward a more resilient and sustainable future for aquaculture in Greece, the Mediterranean, the Arab countries, and beyond.

Despite facing challenges such as an ongoing economic crisis, rising energy costs, and wars, the aquaculture industry remains resilient and continues to grow.

Mark your calendars for June 28-29, 2024, at the Megaron Athens International Conference Centre, in Athens Greece. The congress anticipates the participation of approximately 750 delegates and the support of 40 sponsors.

fish international, 25-27 February 2024, Bremen

More information about the event can be found on the website:

https://aquaculture-congress. com/en/home-en/

For inquiries, please contact the organizers: paspaliari@ ambio.gr, kourakou@ambio. com.gr or call +30 210 9219948.

If all people thought alike, nobody would gamble

Organized biennially, fish international is Germany’s only seafood trade fair. The 19th edition combined with catering trade show GASTRO IVENT right next door, set a record of 13,729 attendees, up 33% from 10,302 people in 2022. Exhibitors numbered 322, unchanged from 2022, and came from some 30 countries in most of the world’s continents.

In the seafood world, fresh competes with frozen, wildcaught competes with farmraised, artisanal niche items compete with global brands, and in recent years, “fish-like” plant-based products compete with everything. fish international offered the full spectrum of fish—wild, farmed, and imitations—to fit the tastes and satisfy the curiosity of even the most demanding consumers.

Flat supply and growing demand for farmed salmon globally

Farmed fish, being a vital part of the solution to secure food security for the world’s growing population, has been on the rise for several decades globally. For salmon, Norway leads the global industry, providing between 1.2 and 1.4 million tonnes annually.

In terms of value Germany is the largest market for Norway, says Kristin Pettersen, the Norwegian Seafood Council’s director for Germany and it is also the largest market for Norway in terms of consumption. German consumers might not realize it though, as the Norwegian exports arrive in Germany from Poland, Denmark, and Holland, among others. This seafood enters Germany via big importers and not directly

through retailers. In this way, Germany is a kind of old-fashioned market in terms of the distribution structure. Yet, like in other countries, German consumers fall into different groups, some are willing to pay a lot for good food, price-conscious consumers buy frozen or convenience food, and in between you have a lot of people who buy private label, and this group has been on the rise.

[ EVENTS ] 18

BLUE FOOD CO-ORGANIZED BY W RLD AQUACULTURE Society GREEN SOLUTIONS August 26-30, 2024 Bella Centre, Copenhagen, Denmark .---Ill partners ., " I ' I •.:��- I I I I "' "' : ■I I I 1 •: : : ·::m·.■ ::::r�1� • • .DANISH ■ EXPORT & ASSOCIATION • ICES lnternationalCouncilfor theExplorationof theSea CI EM Conseil Internationalpour !'Explorationdela Mer DTU •• •• •• � \ ���N�fi!�� • UNIVERSITY OF COPENHAGEN FISHTECH was premier sponsors �� BLUE AQUA � (• ���ealth �R�,e ORGANISATION �SOY IJ.S.SOYBEANEXPORTCOONCIL Delivers �

Plans in Norway for a tax on salmon producers (read article on page 56 on the subject) have created a lot of noise but this was not the reason for recent price increases, according to Kristin Pettersen The development of prices is because production volume in Norway and Chile is flat while demand is increasing.

One cannot avoid mentioning Faroese output and exponential growth in Icelandic production. In terms of volume, however, these countries cannot compete with Norway’s and Chile’s industry giants. On the other hand, driven by higher prices they succeed in creating the image of a premium product.

Unlike wild-caught fish, salmon and other farmed fish species will continue their long-run growth and continue fulfilling their promise to feed the world’s growing demand.

Fresh fish is a busy business

Daniel Christen, from Swiss company Fish Scale which for 25 years has been selling fresh wild fish from New Zealand, describes his business as hectic. The catch is slaughtered immediately, and in the morning it arrives at the factory to be packed and sent to the airport immediately. At 10 in the morning, it is at the airport, and at 3 in the afternoon it flies to Europe, Dubai, Qatar, or Singapore, and the next morning reaches its final destination. The advantage is that the fish gets younger on the way—with a 12-hour time difference and the 26-hour journey, the fish caught 36 hours ago really gets “younger”.

Mr Christen doesn’t see much difference between German and other markets for fresh wild catch. I think every country has its own rules, traditions, and eating habits, he says. But we also have

globalisation in the fish industry and the market. Every restaurant can make sushi, make poke, make whatever. Seafood like shrimps and lobsters are eaten all over the world. It is a global sort of market. Besides a country’s national or traditional dishes, there is not much difference.

Nevertheless, Christen has his preferences for wild fish because he believes a wild fish has a better life than a farmed fish does. The jury is still out on this question.

Should seafood be made with fish, or is the “sea” part sufficient?

The usual questions about fish—is it wild? is it farmed?— will soon be joined by another one: is it fish?

Plant-based seafood, or fish substitutes, was another topic doing the rounds at fish international. Fish products that don’t contain any fish constitute a small but growing sector of the food industry and market, popular among consumers who for any number of reasons don’t want to eat fish meat and among producers who, at least in some cases, want to promote the consumption of seaweed.

Imitation tuna made from seaweed and other non-tuna ingredients is a convincing product from BettaF!sh, a Berlin-based company. Its founder and CEO, Deniz Ficicioglu, enthusiastically explained why they are making imitation tuna from seaweed: “It’s our Trojan horse, so to say, to make people eat seaweed. Hopefully, we’ll get to a point where people buy frozen seaweed in the supermarket, just like we buy spinach today.

Using seaweed rather than terrestrial plant ingredients could sway one of the main objections

to plant-based imitation seafood: the actual land required to grow the cereals and beans used to replace the fish raw material that can be saved is immense. A “veggie burger” may save cows but resources including land must be used to produce the ingredients of a veggie burger. The advantage of a seaweed-based burger is that the area for growing the main ingredient is available in abundance.

A problem with seaweed—a problem familiar to all promoters of fish consumption—is that consumers don’t know what to do with it. Before BettaF!sh’s imitation tuna, Deniz Ficicioglu tried marketing seaweed salad adding ingredients familiar to Western palates rather than Asian ones. Organic-oriented consumers liked it but others still reacted “ugh, seaweed!”. So, the approach switched to sneaking up on them with the Trojan horse “tuna” until consumers get used to the seaweed idea.

In addition to vegetarianism, there is another dietary trend that is older, but whose name is newer: flexitarianism, a word that entered America’s most popular dictionary only in 2012. Advocates of this diet focus their consumption on plant

foods, with limited or occasional inclusion of meat. It is by definition flexible, but the main idea is to eat less meat. For example, a flexitarian might eat meat only on certain days of the week.

Makers of seaweed-based meat alternatives think that flexitarians are serious candidates for these new products. This group of consumers, however vaguely defined, is open to trends, new ideas, and new products, which often is not unlike consumers who eat fish very often (pescatarians) who will eagerly sample seafoods that may be ancient traditions somewhere but are new to them. Whether it swims or waves its leaves in sunlight filtered through ocean water, seafood products of all sorts are the future and are good for consumers, producers, and the environment, and many were on display at fish international.

Optimism (even if limited) helps determine business trends

Exhibitors noticed a lot of returning visitors to the show—always an encouraging sign—yet some visitors held their purses closer to their chests than in the past, even as others seemed more optimistic.

Germany’s seafood trade show, fish international Bremen, is the place to gain insights into the EUR2bn German seafood market.

[ EVENTS ] 20

Eurofish

Werner Kuehl-Menk from Salmco, a Hamburg-based manufacturer of salmon slicing equipment, observed that while he had more visitors than at past shows, discussions about future business contracts after this year’s show were hampered by uncertainties about the general economy. The Covid-19 pandemic, he said, may be fading in memory, but Russia’s war against Ukraine is ongoing, still hurting general economic conditions in Europe. Salmco has partly made up for any lost sales in Europe by expanding sales abroad, including in the United States.

From Salmco’s perspective, one way to gauge his visitors’ situation is to see if they want to buy new equipment or spare parts. This time, there was a tendency towards the latter, he noted. The economic outlook may not justify expenditure on a new machine, so necessary spare parts for the old one will have to do. It’s all about expectations of the future.

The Eurofish Business Platform featured a wide range of freshwater fish products

Eurofish International Organisation came to fish international with its traditional Business

packaging, as well as breaded carp products; Liu Fish from Estonia offered fresh pike, pike-perch, and perch—whole or filleted; Lithuanian Išlaužo žuvis came with their signature product— cold-smoked “ham” made of carp, and “carp pizza” made of spiced hot-smoked carp; Pastravul din

international. The fair has shown us that there are a still lot of unexplored streets in Europe, says Jakov Bešli Gadžo from Panona Mare, Europe is not too small for us—there is place for everyone.

If all people thought alike…

Platform—a joint booth that Eurofish provides to SMEs from its member countries. Here they could exhibit and promote their products and services, communicate with visitors and other exhibitors, arrange product samplings, and hold meetings with potential business partners. This year, the Business Platform hosted four companies from four member countries: Croatia, Estonia, Lithuania, and Romania; as well as Ukraine’s Association of Seafood Importers (UIFSA). Ukraine is not yet a member country of Eurofish, however, this exception was made in support of the country’s seafood sector which is suffering from the ongoing Russian invasion.

Consumers from Central and Eastern Europe have a long tradition of consuming freshwater fish, so it was not surprising that products from carp, trout, pike-perch, roach, and bream among others were showcased at the joint booth. The surprising part was that each participant came with unique products tailored to their own traditions and visions, preempting any competition between participants at the booth.

Panona Mare from Croatia showcased fresh carp fillets in MAP

Tara Ta from Romania displayed a wide range of trout products: hot-smoked fillets, caviar, pâtés, bites in oil, as well as their own version of the country’s famous zakusca—vegetable spread with chunks of fish in it; UIFSA presented dry- and salt-cured bream, roach, whitefish, rudd, and more.

The exhibitors at the Eurofish Business Platform showed overall satisfaction with the arrangement of the platform and with the opportunities offered by fish

…any seafood show would be boring and uninspiring. Creating your own unique product, sharing it with others, learning from others—these are the core points and major reasons for exhibiting at a trade fair. The next edition of fish international is scheduled for 8-10 February 2026. Look into the future and mark these dates in your calendar!

Aleksandra Petersen, aleksandra @eurofish.dk

Responsible aquaculture supply chains:

Addressing evolving transparency requirements from farm to consumer

Get the latest industry insights at the GLOBALG.A.P. panel discussion

www.globalgap.org

SEAFOOD EXPO

GLOBAL 2024

BARCELONA, SPAIN 23 APRIL

Scan the QR code to register now!

Representatives of SME associations from four Eurofish member countries and Ukraine promoted their products at the Eurofish Business Platform at fish international.

[ EVENTS ] EUROFISHMagazine 2/202421

Solo, but stronger

AquaFarm is an international conference and trade show on aquaculture and sustainable fishing, organized by Pordenone Fiere in collaboration with API—the Italian Fish Farmers Association, AMA—the Mediterranean Aquaculture Association, and Studio Comelli–Conferences & Communication, which takes care of conference content and the press office. The first edition of the event took place in 2017.

The 2024 edition of AquaFarm took place for the first time without the presence of the other two sections

NovelFarm and AlgaeFarm. The event covered almost 7,000 sq. m of exhibition area, attracted over 100 exhibitors—of which about a quarter came from 13 other countries, and hosted almost 2,000 visitors. The conference programme featured some 120 speakers.

Focus on fish and shellfish farming

This edition of AquaFarm saw several novelties, such as an expansion of two exhibition halls, inaugurated last year, which were added to Hall 5, the event’s historical venue. Furthermore, AquaFarm 2024 focused completely on fish and shellfish farming while AlgaeFarm and NovelFarm, which cover innovative plant crops, algae, and mushrooms, will run independently this year.

Despite these changes, the twoday event in Pordenone repeated last year’s numbers for the aquaculture and shellfish sectors, both in terms of visitors, exhibitors, and conferences. On the first day, apart from the opening session, the session on circularity and sustainability in feed production was well attended. On the second day, the most attended event was the session dedicated to the blue crab invasion and the studies and

policies implemented to reduce the phenomenon, which in the past year caused a 60 decrease in the national production of clams, with losses of up to 100 in some areas.

The change of the format improved the event

In terms of visitors and exhibitors the seventh edition of AquaFarm was excellent, remarked Renato Pujatti, President of Pordenone Fiere. There was wide speculation

about how the public would react to the change in format caused by making Algaefarm and NovelFarm independent events. The result was completely satisfactory and we will maintain this format for the next edition. The organisers were completely satisfied with the structure whereby the official conference programme was flanked with workshops held by institutions, associations, and companies, including an FAO project focused on the opportunities and challenges of rainbow

trout farming in the Mediterranean area. The next edition of AquaFarm will take place on 12 and 13 February 2025. Admission is free of charge by registering online at www.aquafarmexpo.it

For more information contact:

Aurora Marin, Studio Comelli, aurora@studiocomelli.eu, + 39 347 1722820

Simona Maldarelli, Pordenone Fiere, smaldarelli @fierapordenone.it, + 39 380 3133728

2024, 14-15 February, Pordenone

AquaFarm

The 7th edition of AquaFarm focused on production and marketing challenges, damage to fisheries and fish farms caused by climate change, as well as the opportunities waiting for producers that operate in sustainable environmental conditions.

AquaFarm

[ EVENTS ] 22

Positive environmental impacts of farming extractive species

Aquaculture makes a significant contribution to the global food supply. As the demand for healthy protein increases, its importance is likely to continue to grow. Unfortunately, this also exacerbates some environmental problems, as more intensive aquaculture introduces additional nutrients into aquatic ecosystems. Algae and mussel cultures, which extract many nutrients from water, offer a solution.

Global aquaculture produces more than fish, shellfish and algae for direct human consumption. Numerous products are also used as raw materials for animal feed, fuel, cosmetics, nutraceuticals and pharmaceuticals, as well as other products ranging from

enzymes to fish leather. Conventional aquaculture also produces various ‘wastes’ that can contaminate adjacent aquatic ecosystems. These are mainly uneaten feed and fish excrement, which are still rich in nutrients, especially nitrogen and phosphorus compounds.

Compared to the amount of agricultural nutrients that enter rivers from arable land and are washed out into the sea, the amount of nutrients from aquaculture is much lower, but still contributes to pollution or even eutrophication of coastal waters. According

to conservative estimates, nutrient inputs from Chinese aquaculture alone amounted to nearly 99,100 tonnes of total nitrogen and 16,100 tonnes of total phosphorus in 2017.

The aquaculture industry is paying increasing attention on this

profinet ALU

Setting the quality standard for years. The profinet ALU was developed many years ago in our company and is available in various mesh widths (5 mm, 10 mm, 15 mm, 20 mm).

profinet ALU TeleScopic

Available in two versions (length 170 cm, 240 cm) and can be easily varied in length

resorption in algae and mussel cultures

Nutrient

[ AQUACULTURE ]

it´s raining fish! ... made by professionals for professionals! www.fiap.com ACTIVE OxyFlow Versatile, adjustable water aerator. Compact. Powerful. Visually appealing. Floating pond aerator including built-in, switchable LED lighting.

THE WORLD OF AQUACULTURE

issue as it seeks to become more sustainable. Environmental laws and regulations are being tightened almost everywhere due to growing global concern about the potential environmental impacts of aquaculture activities. Major research projects are looking at ways to protect coastal ecosystems and the marine environment more effectively. At present, we know relatively little about what technologies can be used to reduce or, even better, prevent the environmental damage caused by open aquaculture. However, there are some possible interventions that could potentially help curb nutrient emissions. Dissolved inorganic nutrients produced during metabolism and excreted by fish through the gills, kidneys or intestines (NH4 and PO4) can hardly be removed by technical means. While this is partly possible with particulate organic nutrients in faeces and unused feed, it would be very timeconsuming and correspondingly expensive. Reduction in nutrient inputs can be achieved much more cost-effectively through optimised feed management Although this does not significantly reduce environmental pollution, it should still be pursued. Especially as it also benefits the fish farmers themselves – every gram of feed

not eaten is an economic loss for the business.

Nutrient inputs are usually greater than nutrient removals

Reducing nutrient inputs into water lessens some problems, but does not solve them. Perhaps nature can serve as an example because it uses two strategies at once. One is the dilution effect caused by hydrodynamic turbulence in the water. Wind, waves and currents tend to disperse the nutrients quickly in the surrounding area. Although this does not eliminate them, their negative effects are less pronounced because the concentration has been reduced. In comparison, the second strategy is much more effective as it relies on the introduction of nutrients into the marine food chains. The solid particles of nutrients sediment are deposited on the bottom, where they are usually eaten by benthic animals. This works relatively well as long as the amount of sediment does not exceed the uptake capacity of bottom-dwelling organisms. The dissolved nutrients also quickly find consumers in nature. These are primarily algae, which can be

roughly categorised into microalgae and macroalgae according to their size. While microalgae, which mostly float freely in the water like phytoplankton, are tiny and can only be detected under a microscope, macroalgae are much larger. They grow on the sea floor and solid structures down to the water depths where light is able to penetrate. What both groups of algae have in common is the ability to photosynthesise and convert carbon into energyrich compounds. This ability puts micro- and macroalgae at the very beginning of aquatic food chains. They are the ‘primary producers’ on which almost all aquatic life relies, from zooplankton to apex predators. However, algae also need nutrients from aquaculture for photosynthesis. This realisation closes the circle: algae cultures can help extract some nutrients from the water and use them for their own development. They act as natural ‘treatment plants’ that reduce the nutrients in the water, thereby purifying it.

Due to their purification function, algae play a vital role in aquatic ecosystems. But it is not that simple, because algae, especially microscopic microalgae, can be both a curse and a blessing. On the one hand, as primary producers, they are the foundation of aquatic life and even offer us the opportunity to reduce environmental problems due to their ‘nutrient hunger’. On the other hand, they can themselves become a danger if masses of algae, known as algal blooms, develop in overfertilised and therefore extremely nutrient-rich (eutrophic) marine areas. Dense carpets of algae then often float on the surface, depriving plants at the bottom of light for photosynthesis and threatening the lives of many bottom-dwelling animals. Particularly dangerous are blooms of toxic algae, which produce poisonous

substances and can sicken or even kill many aquatic animals, including fish. It is just as dangerous when the microalgae die at some point and the bloom collapses and sinks to the sea floor. The putrefactive bacteria then immediately set to work on the nutrient-rich ‘algae graveyard’. In their decomposing activity, they draw so much oxygen out of the water that anoxic, oxygen-free zones can form near the bottom.

The potential of algae is far from exhausted

Almost 40 species of algae, mostly macroalgae, are cultivated in large quantities in aquaculture worldwide. Almost all of them are used directly or indirectly for human consumption. For example, edible algae such as the Porphyra species (Nori), which we know as the wrapping for sushi rolls, are used directly. Indirect use means that valuable ingredients such as agaragar or carrageenan are extracted from the algae and used for many products in the food industry and other applications.

Unlike macroalgae cultures, microalgae production has only recently attracted greater interest. This trend is driven by the demand for the valuable ingredients in microalgae, containing protein, carbohydrates and fats, micronutrients and bioactive or functional substances. These include the essential omega-3 fatty acids EPA and DHA, as well as carotenoids, which are essential for animal and human nutrition. Algae, algae extracts and algae ingredients are used as feed additives in animal nutrition. They are said to strengthen the immune system and improve resistance to disease, increase growth performance and have antioxidant and anti-inflammatory effects. Almost all of the

[ AQUACULTURE ] 24

Algae absorb nutrients from the water, such as those produced by fish farms, and thus help to keep shallow coastal waters clean.

EXPERTS IN FISH SMOKING AND DRYING

Perfect product quality and maximum yield: Smoking and drying systems from REICH for lying or hanging fish optimize your products and your profit.

Today, REICH is a global leader of thermal processing systems for fish. Convince yourself in our technology center in Germany!

www.reich-germany.de Visit

taste engineering

us at

–

3,

701

SPG Barcelona 23.

25.4.2024, Hall

Booth KK

projections also assume that microalgae will be able to replace fishmeal and fish oil in aquaculture feeds in the future. Microalgae in suspension are already used extensively as a supplement to ‘spice up’ the poor nutritional value of Artemia nauplii, which hatcheries often use to feed fish and shrimp larvae. This method, known as ‘enrichment’, provides the larvae with an extra portion of vitamins, fatty acids and trace elements, which ensures a significantly higher survival rate.

Utilising ecological ‘services’ in a more targeted way

Although algal cultures, with their nutrient resorption, make a significant contribution to water purification and the health of aquatic ecosystems, this free ecosystem service has hardly been utilised until now. This environmentally friendly option lends itself to use, as the cultivation of algae requires relatively little effort and is comparatively inexpensive. Moreover, the beneficial effects of algae go far beyond nutrient resorption, as they also produce high levels of oxygen, stabilise pH levels, inhibit harmful bacteria, act as natural biofilters and serve as cover and

food for fish. These benefits are already being used in a targeted manner in the rearing of fish and shrimp larvae in green water, which contains high concentrations of microalgae. Compared to almost clinically pure clear water, rearing success under these conditions is significantly higher.

While the potential of algae as an ‘environmental service provider’ has been recognised, it has not yet been fully exploited. However, work is already underway to develop suitable technologies to utilise microalgae and macroalgae for wastewater treatment. The natural method used by algae to remove nutrients from water is nothing short of ingenious: nitrogen compounds and phosphates are converted into biomass, which is relatively easy to remove from the system and can often even be economically used. It could hardly be more sustainable. In addition, algae can be grown at sea or in space-saving bioreactors, so it does not compete with the very limited arable land available.

However, it is not only algae that have nutrient-absorbing and water-purifying abilities, but also other species groups. These include filter-feeding fish and

numerous molluscs such as oysters and other Bivalvia. While algae only absorb dissolved inorganic nutrients, mussels and filterfeeding fish use their gill filters to sieve nutrient-rich organic particles out of the water. Mostly plankton, but also detritus. And because they do this non-selectively, rather than by food types, they are also known as ‘suspension feeders’. With their filter-feeding behaviour, farmed suspension feeders significantly reduce the feed balance in aquaculture, as they grow without supplementary feed. Although the relative share of non-fed species in global aquaculture production has fallen from more than 40 before 2000 to 27.8 in 2020, this is only a mathematical effect, because while the absolute production has remained at almost the same level, global aquaculture production has more than tripled. In 2020, 24.3 million tonnes of non-fed animal species were produced in aquaculture worldwide. Of these, 8.2 million tonnes were filter-feeding fish (mainly silver and bighead carp) and 16.2 million tonnes were aquatic invertebrates, mainly marine mussel species.

Water treatment with mussel cultures?

Mussels are particularly efficient as suspension feeders. Some species filter even tiny particles that are only 0.004 millimetres in size out of the water with their gill sieve, thus significantly reducing the turbidity of the water body. The collected nutrient-rich algae mush is then converted into body tissues and shells. This is why mussel beds are often referred to as ‘self-emptying vacuums’ or ‘the guts of the aquatic ecosystem’. However, in individual cases, their cleaning performance depends on how much water passes through the gills per hour or day. This value may vary from animal to animal and depends, among

other things, on the size of the animal and its position in the mussel bed. Literature data for individual adult oysters range from 75 to 120 litres per day. The filtration capacity of mussels is about 2 litres per day (but also between 1 and 5 litres per hour). Although the figures vary greatly, it is clear how important a role these ‘natural filters’ can play in keeping local ecosystems clean. This is compounded by their economic value, as many species, from oysters and clams to scallops and mussels, can be used as high-quality food for human consumption or in processed form as animal feed.

Provided, of course, that the shellfish do not contain any heavy metals, pathogenic germs or toxic substances. This is the essential issue of their non-selective filtration: they filter out the valuable and nutrient-rich substances from the water as well as useless waste and toxins. Mussels are efficient purification systems and at the same time robust survival artists that can cope with almost all environmental conditions and rarely become ill even in polluted water. This discovery has led some scientists to believe that mussels can be used not only to remove nutrients from aquatic systems, but also to filter out pollutants and microplastics from wastewater, i.e. for complete purification. An obvious idea. Because mussels filter all kinds of environmental pollutants out of the water and accumulate them in their body tissues, they are often used as indicators of water quality at their growing sites. Contaminated mussel beds are an early warning sign of pollution problems. Initial trials of the biological treatment of water with mussels have shown that this approach works and is feasible. Of course, such contaminated mussels are completely unfit for consumption and must be disposed of. However, the purification effect and clean

[ AQUACULTURE ] 26

Mussel cultures not only produce high-quality food, but also filter a lot of plankton and detritus from the water.