EIC02 ▪ Summer ’24

Published by: ETH Investors Club, July 2024

Minting Address (Base and Mainnet): eicdeployer.eth

Donations: eic.eth

EIC02 ▪ Summer ’24

Published by: ETH Investors Club, July 2024

Minting Address (Base and Mainnet): eicdeployer.eth

Donations: eic.eth

This content is for informational purposes only and is not legal, tax, investment, financial, or other advice. You should not take, or refrain from taking, any action based on any information contained herein, or any other information that we make available at any time, including content such as blog posts, data, articles, links to thirdparty content, discord content, news feeds, tutorials, tweets, and videos. Before you make any financial, legal, technical, or other decisions, you should seek independent professional advice from a licensed and qualified individual or firm in the area for which such advice would be appropriate. This information is not intended to address of be comprehensive of all aspects of EIC or its products. There is additional documentation on the ETH Investors Club website about how EIC and its community function.

Riley Blackwell Founder, Cloudscouts rileybeans.eth

Hong Kim CTO, Bitwise Asset Mgmt. @hongkim__

Andrew Hong Headmaster, Dune Analytics @andrewhong5297

Benji Leibowitz COO, Molecule @benjileibo

Nathan Howard Partner, Switchpoint Strategies @fallow8Defi

David Phelps Founder, JokeRace @divine_economy

Tomu Founder, Overgie&MintGate tomu.eth

Hunter Horsley CEO, Bitwise Asset Mgmt. @HHorsley

Vivek Raman Managing Director, BitOoda VivekVentures.eth

Cooper Turley Founder, Coop Records @Cooopahtroopa

Maika Isogawa CEO, Webacy @MaikaIsogawa

Alex Soong Core Contributor, ZKP2P alexsoong.eth

Cooper Turley @Cooopahtroopa

Ryan Berckmans ryanb.eth

Kevin Owocki owocki.eth

Jack Stewart @jackthepine

Brian Flynn @Flynnjamm

Otherworld @otherworld_xx

Abhishek Punia @puniaviision

Joey Santoro @joeysantoro_eth

Benjamin Desprets bendr.eth

iDecentralized HomeValidator.eth

Sealaunch @sealaunch_

Spreek @spreekaway

Consome consome.eth

Notmycircus.eth

Evolution of Onchain Media

Cooper Turley Culture Corner

Inside Base

Onchain Summer EIC Culture Corner

Rethinking Collect as the Like Button

Tomu.eth Culture Corner

Reinventing Biotech with Onchain Intellectual Property Benji Leibowitz Surfing the Chain

Permission as Tradeoff, Not Blasphemy Nathan Howard

Enthusiam is All You Need

Riley Blackwell Culture Corner

FrenPet Is More Complex Than It Looks

Benoit.Tokyo Culture Corner

The Social App Thesis

David Phelps Culture Corner

A Social and Financial Study of Memecoins

How should we try to model Ethereum’s valuation? Is it like an app store, a tokenization platform, a nation, or even money?

The sheer breadth of Ethereum’s potential makes simple analogies challenging. Ethereum, along with the innovations built on top of it, represents global software that enhances cooperation and coordination among private entities. This has given rise to a new “internet” built on Ethereum, where privacy, markets, and property rights are paramount.

In EIC02, we’ll explore the solidification of Ethereum as a parallel internet and its expansion into cultural and social applications, spearheaded by Base, Coinbase’s Layer-2 solution, which is soon celebrating its first anniversary. We will discuss how ETH, the asset, powers Ethereum, establishing it as the first truly internet-native bearer asset. Additionally, we’ll hear from Bitwise Asset Management’s CEO, Hunter Horsley, and CTO, Hong Kim, about why bringing Ethereum to Wall Street is a story not just for the present but for the foreseeable future.

So, how should we value this new internet? Or its native asset, ETH? Should we see it as an app store, a tokenization platform, a nation, or money? The answer may well shape the future of our digital economy.

Peter Vecchiarelli Editor-in-Chief

Vivian Vecchiarelli Creative Director

Data Editor

Copyeditor: Logan Miller

Cover Photography: Marissa Rocke

Technology Partners: IYK, Zora, thirdweb

Art Partners: Basepaint

AI Models: Adobe Firefly

To contact the editor, email: peter@ethinvestorsclub.com

Cooper Turley Founder, Coop Records

NFTs are dead.

Or that’s what the headlines say at least.

In this article we’re going to look at how onchain media has evolved over the past few years and what this means for content creators and collectors exploring the new frontier of the internet.

But before we dive in, a bit of background. My name is Cooper, the founder of Coop Records. We’re building an onchain record label where we’ve released nearly 300 songs from 70 artists over the course of the last year. I’m the guy who was spearheading that crazy “Music NFTs” meme you may have seen on Twitter and thought was a complete joke.

And to tell you the truth, most of it was. However, in the past three to four months we’ve found a model that has allowed us to drive over a quarter million mints back to our artists, earning them more than 100 ETH in onchain earnings without a single secondary sale, 100x, airdrop, or any other number of incentives we’ve commonly seen be the core driver of usage in crypto. Don’t believe me? See for yourself here.

Now you may be thinking, “Why should I care? Why should I care that a niche record label releasing collectible songs has something to say about onchain media?”

Well, because this article is using the same playbook that I’ll be covering in depth in this essay.

“And what is that playbook?” you ask. Onchain ads, baby. Sweet, sweet ads. However, they look a little different. You can collect this article on boost.xyz and earn a reward for doing so. This might not sound sexy on the surface, but I believe what we’re talking about here is the way in which creators, companies, and organizations will drive impressions (or, as we say now, “mints”) in a net new way.

And this playbook is critical because it will create a system that unlocks the missing ingredient that’s been necessary for creator tokens to work: recurring onchain revenue.

Anyway, we’re getting a little ahead of ourselves, so let’s set the stage.

Let’s go back to 2018.

The term “NFT” could only be found being whispered about at small meetups and conferences around the country. The earliest NFT NYC was nothing more than a small group of people passionate about continuing the excitement that emerged for a project called CryptoKitties.

Crypto art was in its infancy, and platforms like SuperRare were the destination for internet explorers to spend money on 1/1 pieces from, at the time, relatively unknown names like XCOPY, Coldie, and Hackatao.

It was a niche community, but the interest was apparent. Here, you had a piece of artwork that was limited to one collector and established an immediate bond with its creator.

Simply put,collect a 1/1 and have a high likelihood of meeting the artist and getting to form a personal relationship with them.

Fast forward to early 2020, and a new concept started to emerge: editions.

If the earliest collectible pieces were limited to one edition, the new meta expanded to a much wider audience: 10,000 editions.

Thanks to projects like CryptoPunks and BoredApes and platforms like NiftyGateway or Topshot, we quickly saw a rotation away from hyper-scarce 1/1s to limited collections with supplies of 1,000 or 10,000 editions.

The value prop was also very straightforward; there’s a fixed number of tokens in a collection, and if you want to buy one, you had to get it from someone else who had it.

This brought on the craziest cycle crypto has seen to date, and I won’t bore you guys with the obvious details of what happened.

Floor prices and rarity traits became all the rage, and for a few years we lived in a world where artificial scarcity was the core driver of value accrual for new brands and collections that managed to tap into a wider demographic of users than the space had seen before.

The same held true for music.

In its earliest days, we saw the rise of platforms like Catalog - a 1/1 marketplace for songs.

This was followed by Sound, a then curated platform that let artists sell 25 editions of a given song.

The market believed it; there was a strong belief in the idea that all items could have a limited supply, and if you were early enough, you would be able to purchase something that you could sell for a higher price later on.

But this is where things started to break. NFTs were no longer cool.

All this belief that a given avatar or piece of art was worth 10s of thousands of dollars went out the door. Floor prices plummeted as people got tired of the same ideas being replicated over and over.

And once more the industry was forced to evolve. At this point in time we started to see the birth of L2s like Optimism, Arbitrum, and Base.

These chains made it cheaper to collect, which naturally made it possible to start selling editions at much lower prices.

The standard mint prices (for music at least) dropped from 0.1 ETH for 25 editions to the

introduction of “Free Mints” and a new industry standard of 0.000777 ETH to collect.

Note: This is very important to zoom in on because this “Free Mint” meta is the underlying theme that ties together this entire essay.

Platforms like Sound introduced pricing mechanics like Sound Swap, a bonding-curve based AMM that allowed for a natural price appreciation to occur after a defined mintwindow closed.

These ideas were genuinely novel; however, they lacked a major aspect… demand.

Across the board, we saw projects struggling to see even a fraction of the amount of sales that they were once seeing. And with that dip in sales, a generation of 2021 founders scrambled to keep their business afloat due to being based on the assumption that people would want to buy and sell limited edition collections.

And that brings us to the meat and potatoes of this article… the birth and evolution of the Free Mint.

A Free Mint is the most standard mint format that exists in crypto today.

This means the creator is not charging a price to collect, so it gives the allure of being “free.”

But here’s the catch, it’s not actually free. Under the hood, the platform being used to mint the edition charges a Protocol Fee, that sweet,

sweet 0.000777 ETH number we mentioned above.

Due to its nature as something “free,” it also challenged creators to abandon this idea of scarce limited editions. If something is free, why should it ever close?

At some point during 2022 and 2023, we saw a subtle shift away from the idea that editions were to be scarce and limited to the new mentality of them being unlimited and broadly accessible.

The game shifted from trying to sell 1000 limited editions to trying to reach 1M “free” editions.

And why does this matter?

Because creators get paid on every mint. In the case of a platform like Sound, Pods, or Zora, that 0.000777 ETH mint fee gets shared directly with the creator. A “free” edition on Sound now incurs the following breakdown:

▪ 0.000555 ETH ($1.94) - to the creator + collaborators

▪ 0.000222 ETH ($0.777) - to the platform (Sound)

To paint a picture, collectors were used to paying hundreds if not thousands of dollars to collect artificially inflated avatars that more often than not resulted in negative ROI and unfulfilled promises. Think fanny packs, empty IRL meetups, and founders taking “mental health” breaks.

What’s it to someone to spend $3 to pick up an edition of a song, podcast, or article they enjoy? It’s a tip. Nothing more. Nothing less. No expectation of utility. No expectation of 100x profit. They’re just giving back to support something they liked.

Or, at least, that’s the idea.

And this, my friends, is the birth of the new meta. The foundation for onchain media to achieve giant levels of scale.

All right, setting the stage, it’s 2023 and people are completely burnt out on NFTs. They don’t think they’re valuable, and they think they’re a waste of time.

Now you have a new generation of creators (like myself) starting to panhandle “free” editions.

For the sweet price of a McDouble, you too can collect an edition of this digital collectible that gives you a free download of a song and the ability to comment as a member of the audience. Sounds great… right?

Let’s be honest: no one wants to buy $3 editions of a theoretically infinite-supply asset unless there is one of two things in place:

*The promise of a reward for collecting (coming next)

*The speculation of a perceived future airdrop

This is why you see projects like Base, Zora, and other chains achieve hundreds of thousands of mints on “commemorative” mints.

Among the airdrop community, there is a commonly held belief that being active on a chain and collecting canonical cultural moments will be rewarded in the form of future tokens. And who’s to blame for this? We saw airdrops to communities like Pudgy Penguins and Miladys all the time. Why not reward the people who collected the first NFT celebrating the launch of a major milestone on a new chain? Anyways, that’s a much deeper question, so let’s get back to the root here.

Unlimited (or open) editions are the new foundation creators have used to monetize their work for the better half of 2024.

But keep in mind that no one really wants to collect these things in and of themselves. Think of it like posting a video on Tiktok or a picture on Instagram. Sure, you might have a couple close friends who are willing to support you and what you do, but if you drop something into the blue ocean of the internet, the long tail of content has very few likes and very little engagement.

This is the exact same with crypto, but on steroids. Crypto already suffers from having such a small number of people in it that just dropping a mint on Zora, Sound, Pods, or whatever platform you choose is like shouting into the void. No one is going to collect it because no one sees it or cares. You can see this by browsing pretty much every creator economy app and looking at the freshly minted works. You’ll see dozens of songs, artworks, and podcasts scraping by with zero, one, maybe five mints.

Now, you may be thinking, “OK, if these platforms are getting no mints, then they must be dead.” Not quite.

This is where companies like Coop Records come into the mix.

The single most valuable resource on the internet is distribution. This is no different onchain from how it is in the traditional world.

When we started Coop Records, we saw this all play out first hand. We onboarded artists and tried to get them sales under the assumption that if we sold 25 limited editions for the cheap price of $10 a pop that people would want to collect them.

Wrong. There was no demand for limited editions because there was no audience. No one cared about collecting something on Sound because there was no cultural cache attached.

So while the whole world shifted their attention to brighter horizons, we doubled down.

We quickly realized that if we wanted our artists to get mints (which gets them paid) we would have to go out and get them.

Enter platforms like Boost, Layer3, and Coinvise, the central hub for onchain distribution.

Here’s how it works:

▪ I sell an edition on Sound for 0.000777 ETH ($3)

▪ I give you a reward for collecting 1 OP ($2)

▪ You end up spending $1 in total and the creator makes $1 in profit

Sounds pretty straightforward, right?

Stated another way, we have now created onchain ads. Only instead of paying for impressions,you’re paying for mints.

This is what we did at Coop Records. We started running onchain ads on every single song.

And it started to work.

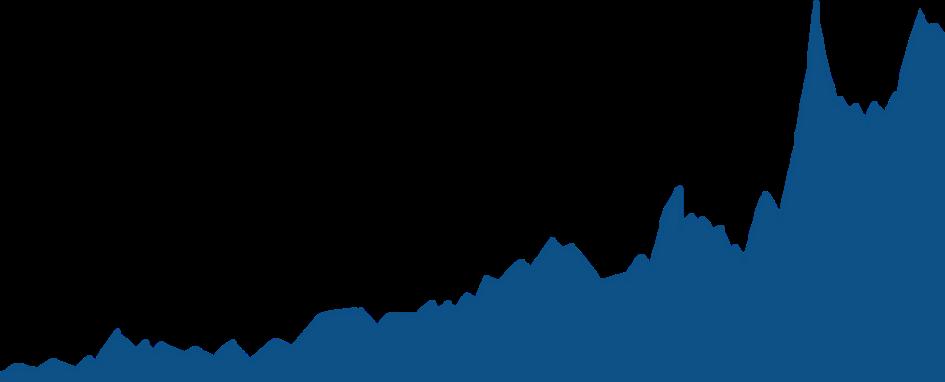

Powered by @coop_records on Dune

Over the past few months, we started to see a major spike in mints thanks to the campaigns we were running across the platforms mentioned above.

These methods have created ~60 ETH in onchain earnings to our record label since May, with the vast majority of that being driven through quests.

But why does this matter?

When running a Boost, you can choose to reward users with whatever token you’d like.

This usually started out with Optimism (OP), which was granted to organizations like ours through RetroPGF for driving impact to the network.

This was essentially a way for us to convert the tokens we earned for driving value to the Superchain (i.e. Optimism and Base) into ad dollars to drive mints to our music.

But it didn’t stop there. In recent weeks we’ve been experimenting with tokens like DEGEN and HIGHER that are more speculative in nature.

What you now have is a way to accomplish the best of both worlds.

The creator gets paid in mints, and the collector gets paid in memecoins. You’re meeting the market where it’s at and giving both sides an opportunity to see the results they want.

For creators, they no longer have to worry about speculation around their art because there was never an expectation of it to begin with.

For collectors, they get put onto curated tokens and start to build loyalty with the distribution platform (Boost or Layer3), the curator (Coop Records), the artist (Daniel Allan), and the token (HIGHER).

Going back to our original thesis of why people want to collect, they’re hitting every box; they get a reward for collecting AND they get to speculate on potential future airdrops.

For us at Coop Records, we now have a clear and essential game to be played.

It’s our job to source quality tokens to give to our users as rewards. This is best exemplified by a recent campaign we ran for ATRIP’s latest song “Ginger” in partnership with the Higher Collective.

The Higher Collective gave Coop Records a 300k HIGHER grant (~$5k) to use as ad spend to drive mints to the ATRIP song on Sound. We ran a quest on Layer3 and a Boost campaign and directed all the referral fees (or 0.000222 ETH per mint) back to the Higher treasury.

While it’s nothing crazy, the system here is what’s worth paying attention to.

Most token projects suffer from two main pain points: liquidity and distribution.

The system we described above improves both:

*Referral fees create a consistent inflow of ETH to a treasury to be used as liquidity

*The distribution of a reward for collecting creates an influx of new wallets which are being exposed to a token for the first time.

Due to the modern pricing mechanics, token projects can now expose collectors to their ticker symbol for the small price of $1/mint.

Compare this to airdrops granting holders hundreds of millions of dollars of value at once, and you instead have a system that is much more sustainable and achievable across a much wider time horizon.

A $50k token grant to the right curator can now land you 50,000 new token holders, most of whom have likely never heard of your token in the first place.

Now, I’m not going to sit here and say they’re going to be long-term holders, but the ability to get your token in the hands of 50,000 new users for potentially only $50k worth of sell pressure is worth paying attention to.

But what happens when you start to align these incentives on all fronts?

Now imagine a system as follows.

A new artist (let’s call them Bob) decides to launch a Bob token.

He’s interested in building a community and finding a way to align incentives with his collectors.

We’ve seen historically that it’s impossible to assume that there will be a strong market for every single song that Bob releases.

Instead he decides to leverage the playbook we mentioned above; however, this time he’s doing it with his own tokens.

Everytime Bob releases a song onchain, he sets up a Boost.

Collect Bob’s song for $3, get back $1.50 in BOB token.

Using that $3 in earnings, Bob can now direct his earnings back to a shared treasury or, better yet, directly into a liquidity pool.

What you’ve now created is a system where every mint creates a shared upside for holders. It doesn’t matter if you hold song one, five or ten. Every time a new mint happens, you get rewarded as a holder of BOB.

Now the market can start to speculate on the price of BOB, rather than the price of the underlying token.

The content can exist as an unlimited edition that is meant to reach as far and wide as possible. It gives an opportunity for broadscale distribution without needing to worry about the floor price or utility.

It also creates a system for onchain earnings such that the creator can consistently add liquidity back into the pool, creating the ability for holders to buy and sell as they please.

There’s a ton of nuance here, and for all intents and purposes, we’re getting a little far out on the risk curve now.

So where is this all today?

We recently made our first distribution to Coop Records Club, our onchain subscription using a platform called Hypersub.

Thanks to the launch of their new protocol, we can now automatically make deposits to a contract which distributes those earnings to our subscribers based on the length of their donation.

We started with a deposit of 0.5 ETH, but are aiming to make weekly distributions back into this pool every week.

Subscribers get an airdropped edition of every release (distribution) and exposure to our onchain earnings (liquidity). While there’s no token in place yet, we’re setting the foundation for a much stronger premise:

Being a part of a community owned record label with exposure to every artist, song, and mint.

we feel fortunate to be the first team to make a rewards distribution on Hypersub V2 and think it’s an extremely powerful premise for what’s to come. If you want to learn more about Hypersub V2, check out this podcast we recorded with their founder this week.

With that you’re pretty much caught up to speed.

I could go on a whole tangent about the trials and tribulations of running an onchain label, but instead I’ll point you towards a few other key ideas worth focusing on.

Interfaces that surface viral mints as recommendations based on your onchain activity.

Keep a close eye on Daylight, MintFun and Zerion.

A developing token standard that combines fungible and non-fungible tokens.

Keep a close eye on the /louder channel on Farcaster or the Album project from PleasrDAO.

Easily create tokens for any tokenized community on Farcaster.

Keep a close eye on FarTerminal, Sonata and Scoop.

Tie it all together and you have the foundation for what I would consider to be the most modern evolution of onchain media.

If there’s one great thing about crypto, it’s that it’s always evolving.

I would be willing to bet that the concepts in this article are outdated even a year after reading them, but it’s important to document them to mark the time.

If you found the concepts in this essay interesting, I recommend keeping a close eye on the following accounts:

> Adam Levy (@levy) - founder of the Mint Podcast

> David Beiner (@db3045) - founder of Hume and /louder

> Lucas Campbell (@0xl) - founder of Pods

I’m in the trenches with these guys every day, and we’re constantly finding new ways to improve the concepts presented here.

And last but not least, make sure to stay up with Coop Records on Warpcast (@cooprecs) and to subscribe to the Coop Records Club.

We have some exciting developments on the way and hope to tie these ideas together over the months and years to come.

Here’s to the future of onchain media and to bringing the world onchain!

▪ Open Edition, 1-month Mint on Base

▪ Redeemable for limited edition physical magazine

▪ Equipped with IYK NFC-Chips for future drops

▪ Includes one season of EIC community membership

0.029 Open Edition

▪ Open Edition, 1-month Mint on Ethereum

▪ Redeemable for Premium limited edition physical magazine with Holographic Cover

▪ Equipped with IYK NFC-Chips for future drops

▪ Includes two seasons of EIC Founder’s Club membership + producer credit in EIC03 and complimentary EIC02 founder’s club NFT

Onchain is the new internet - a new way to own what we create, get rewarded for what we share, and collect what we like.

Tomu Founder, Overgie & Mintgate

We are shaping our digital identity based on our transactions and collections, even if this identity is spread across multiple wallets and apps. But do we need to put everything onchain, or are we overdoing it?

What began as exclusive jpegs that would give you some status within our ecosystem has evolved into any digital content having its onchain version. Every time we see a new design or screenshot essay, the first reply on a cast is, “Where’s the mint button?” We’ve fostered a culture of collecting onchain media, a culture that wants to show off that we were there on day one, that we discovered artists before they got famous, that we liked a product in its early days,

or that we support a community or something that resonates with us.

We collect digital content to have a copy of something significant - attending a concert, joining an event, supporting an artist, or being part of a community. But collecting isn’t for everyone, and one big problems is its cost. Why collect a picture of friends if it requires a payment? I’m glad you went on vacation, but that doesn’t need to be displayed in my gallery.

Take podcasts, for example. If you want to create your own “podcast gallery,” showcasing your minted podcasts instead of played episodes on Spotify

makes sense. It offers social knowledge you can share. However, collecting those is not cheap.

Free mints aren’t truly free; there’s always a fee, typically around $3. Even if consumer apps don’t use Zora as a default option, each mint click has a fee. I know those are mints with rewards where creators and curators benefit, but if you, as a fan, purely collect content because you liked it, it’s a lot of money. Just do the math if you collect more than 100 onchain media contents, most of which won’t provide any return or access to a community.

Not everything on social media needs to be onchain. While we have fun in our web3 bubble, and we spend our ETH like casino chips, normies don’t see it the same way. Would you pay the fees with your credit card every time you want to collect something? That would make you think twice before clicking on the mint button.

Collecting should be an addition for the user, one focused on quality, one focused on shaping our onchain profiles.

Even if paying fees is not a barrier and we achieve seamless onboarding, where users unknowingly create wallets and use apps without needing funds, there must be a

distinction between onchain and offchain content.

I might like a lot of content, but only collect pieces that define my interests and onchain identity. Just as we selectively showcase a few NFTs in a gallery we should treat the content we collect. Sponsoring fees is a temporary solution; even if a consumer platform decides to sponsor all fees for mass adoption, it would lead to chaotic and expensive profiles. The focus should be on curating content that truly reflects our interests.

What differentiates a collect from a like is that it represents a deeper engagement with the content, shifting from passive consumption to active curation and investment.

Not everything we like should be minted. The Collect button should be reserved for culturally significant pieces that reflect personal interests and onchain identity. While there are significant benefits for creators to put their content onchain, fans will resonate with only a portion of it.

I don’t think we will replace the Like button; instead, we’ll add a Collect button to generate immutable digital copies of what we truly like and value - pieces that shape our internet culture and that we want to own.

Riley Blackwell Founder, Cloudscouts

The angelic, sacred text of fandom is mystical, filled with subtext, full of whimsy and make-believe. Here, a fandom’s stories are enthusiastically injected with passion shared by millions… This is the power of media we love tapping into.

I’ve been wandering through past loves lately, spending time rewatching TV shows I was obsessed with from 2010 to 2017, sitting with the imagination of those

stories we once shared. In my opinion, this was truly a golden age of social media, TV, the internet, and renewed support for comics.

When you step away for a bit, you get a rare opportunity to zoom out and see the holes you can fill, unbothered by the noise of whatever space you frequent. This most recent time away from web3 has allowed me to consider whether

there’s a viable opportunity to bring fandom to the “New Internet” in a responsible way. I now think it’s possible, with a few caveats, that is, if we collectively want meaning making to get away from ridiculous, overintellectualized VC-led concepts like “scenecoins.”

When I look across the vastness of the onchain space over the past three years, I’ve seen a lot of experiments, from PFP collections that attempted to share a collective identity between 10,000 hopeful members to memecoins that hijack cultural moments with objectively horrendous art and fratlike behavior by 20-somethings.

While NFTs have made an impact on a small, albeit often obnoxiously loud part of the internet, we find that not only have we lost the plot when it comes to community building, but along the way, we have also missed an opportunity to create fan communities where interaction doesn’t constantly rely on financialized PvP games.

We tainted our systems with outstanding hubris when we created communities with money at their core rather than connection, care, and human decency. Even DAOs, in their attempt to upend governance, often resort to PvP and not-sopositive-sum games. Maybe it’s time to try some PvE (player vs environment) experiments, thereby bringing stories to life that fans can connect with.

I will acknowledge here that artists and developers have been presented with new open protocols for receiving recognition and greater financial rewards for their work. These protocols are some of the greatest innovations of our time, as extensions of the web. These experiments should continue.

What may be obvious to some—namely community builders, content creators, and marketers—isn’t so obvious to the rest of the space, which is largely made up of developers. When we hoist developers onto a pedestal simply because they’re the people writing code, we invariably leave out the sound voices of the web’s creators and caretakers who are screaming for connection.

This week, Bankless Podcast co-host Ryan Adams started the conversation re: web3 social with hundreds of responses. Most of these boiled down to a need for better content rather than focusing on money, solving UX problems, and loosening the grip on niche experiences, not to mention that social apps become sticky only with difficulty.

Many people pointed to Farcaster, a protocol I’ve been a big proponent of. I’m still fairly optimistic about the long-term impact of the network there. Still, it certainly has glaring issues that deserve addressing but that will be more difficult to resolve in the short term.

The crypto crowd needs to understand that financialized social experiences don’t actually lead to richer cultural landmarks that stick around. In

fact, they are typically only as good as the time it takes for a number on a chart to go up.

Capitalism is fine for most use cases of the internet, which has allowed technology to thrive thus far. However, it’s increasingly clear that connections between real people require pockets of comfort, narrative, and a long view of stories people agree to care about together. This is where aligned incentives come in, something web3 has largely yet to agree on, despite its values saying otherwise.

People using social media care about the story behind a meme (hello, Know Your Meme historians or meme pages on IG), be it lore in the form of serialization or the relationships between artists and their fans. Plus, it’s just nice to have a place to chat with or make new friends. History and friendships take time to build. That’s the whole purpose of a slow burn. People aren’t built for short-term, meaningless relationships; even if ephemeral experiences are becoming popular, they still need help to create a narrative worth remembering.

On the June show for The State of People, I talked about how fandoms often solve loneliness problems. I was part of or helped manage multiple fan communities in a past life. These spaces were intentionally wildly different from how the onchain space operates, while at the same time having a natural, organic, decentralized feel to them, all without tokenization.

Fandom has an inherent permissionless behavior built in that isn’t to be ignored by creators onchain. Here are some things that I, along with many other incredible builders, have

done as a community builder to help bring fans together online.

As part of the Carol Corps community for Captain Marvel during comic writer Kelly Sue Deconnick’s run, we created the Carol Corps Yarn Brigade, a sub-community of craft girls who made knitted hats, scarves, cross stitches, socks, and other items. (on Ravelry here). Rather than selling items to each other, they were made for and by fellow fans all over the world out of love. We also helped other fans who needed tips with their cosplay, even hosting panels at conventions just for Captain Marvel cosplayers. Another community member and I were approached to be put in charge of adding fancreated crafts and cosplay to central Pinterest boards, where fans could see their creations for years to come.

I don’t claim responsibility for the unprecedented success of the Carol Corps; I was one small part of what was made of many amazing women.

We were all fans of Captain Marvel because Kelly Sue was writing a story we connected with and cared about together. Maybe the alcoholism in Carol Danvers’ past wasn’t so relatable to us, but her tenacity, stubbornness, and feminist leanings certainly were. We could relate to moments when her powers were stolen, even by a friend. This is the universal girl experience. Again, subtext isn’t to be forgotten in these spaces, so much so that when we came together at conventions, we knew we all had something in common: we shared a clear narrative with characters that was undeniably ours. We had breakfast walks together before conventions. We shared in-jokes and incentives to buy the next book to see how the story would unfold. The community wasn’t financialized

in any way other than buying the material, and the community certainly didn’t obsess over vanity metrics like points for a potential airdrop.

The thing to remember here is that when we were building this enthusiasm, we weren’t concerned about being called community managers or anything of the like, even if that is what we were doing. No, again, we were simply creators exploring a passion for a shared story.

We learned that fandom takes time and a lot of effort. Brie Larson, who starred in the 2019 Captain Marvel film, even went on to don a BFF NFT profile pic—still up to this day— where I was on the community team. Talk about a full-circle type of coincidence.

During the period from 2011 to 2016, I was also part of a few other fandoms for TV shows like Continuum, Warehouse 13, Eureka, Orphan Black, Battlestar Galactica, and Lost Girl. In a recent rewatch of Lost Girl from start to finish, I was reminded of how that community also created fan connections.

I remember walking into a 2013 Dragon Con panel room full of Lost Girl cosplayers donning leather gear, fake swords, and long brunette wigs. The room was energized by pure love for a TV show that exemplified what it means to build a story with adventure, whimsy, and mystery around such magical characters and their settings. No one was talking about the tech used on set; they were talking about their passion for a storyline with themes, mythology, or the LGBTQ+ representation on TV made them feel seen in a time when it wasn’t so prevalent. There were Lost Girl panels all weekend long, talking specifics

about these things regular people were enthusiastic about by fans who, in their spare time, made fan edits or fanfic online and found awkward, nerdy comfort in person.

That weekend in a hotel lobby, I happened to meet Paul Amos, who played the character Vex on the show. We had both stopped for a drink and struck up a conversation. Besides being a fantastic actor, he’s a regular guy; though, yes, he is very cool and gothy in person too (or was at the time). This was yet another wholesome fan connection that tied together how artists connect with their work in normal, not-weird ways I’ll always remember.

Fan communities like the ones I’ve described here have yet to have their time in the sun onchain due to how few cohesive stories are being shared. The narrative that PFP collections have typically spouted is one of IP or brand-building for the individual instead of in favor of shared storytelling. From 2021 to late 2022, users were advised to buy a PFP to turn into an identity marker rather than a character to share an adventure alongside. We were told to make a business out of a singular digital piece of art on which someone spent thousands of dollars worth of ETH. This clearly didn’t work as intended.

I say all this not to necessarily encourage content creators or fandoms to immediately rush to financialize love for stories and their IP, but to at least consider the possibility of using blockchains for archiving and social sharing.

The prevailing solution until now has been to create a large number of artworks that all look

similar, leaving it up to buyers to decide what to do with them. This gave collectors a few options: trade, hold, sell, or otherwise speculate on their value. To me, these actions are eternally boring.

With the MTV News website shutting down this week and no archive available, it’s clearer than ever that we need a way to preserve our cultures. We know blockchain solves this problem, but what about fan communities? We can responsibly build fandoms to facilitate human connection to media in a New Internet era.

First, we must slow down, recognizing that storytelling and mythmaking take time. For more on how we design cultures in an ontological, more holistic context, check out this article from FWB on Designing For Desire

We must also give creators collaborative spaces in the form of connective apps that allow them to share and grow their creative works into mythologies. With more diverse tools to bring works to life, there will be more opportunities for fan-making. Yes, beyond Twitter, and I’m not sold on a new Farcaster client solving for this at the moment.

This is where my complaint against quests and seasons comes into play. See, many startups and small collectives operate in the onchain space in seasons, or they try to squish quests into their systems for airdrops or cheap shots at “partnerships” that don’t actually do anything significant for community members. This is flatout extractive behavior that needs to stop.

As we’ve seen in forms of media like comics, TV shows, and book series, the path to fandom relies on a shared journey. A quest that asks disconnected people to sign up for an app or

spend money does nothing to create a communal experience. A season that marks the completion of an experiment without shared episodes (rituals), any sort of plotline, or a lesson/moral to be learned doesn’t make for a memorable experience.

And yes, while it’s more difficult, building fandom for a product or tool is possible. Fandom or fan communities are not exclusive to media companies. Developers and founders should work to move away from click-to-earn airdrop farming and instead move toward connection or narrative building. We’ve all seen how lifestyle brand enthusiasts react when launching new products. Again, this takes time and well-designed products people want to use.

Thus, the solution is to find something that people can universally find endless enthusiasm for, which is neither extractive nor pay-to-win. Love and shared narrative, specifically, should always be free.

Your task, should you choose to accept it, is to create a story (marketing) people can grasp onto. Design a story that people care about (community), a journey they easily gravitate towards when they need connection, both in person and onchain.

Benoit.Tokyo Digital Culture Producer

This article was first written for Lens Protocol’s creative initiative and published on t2.

Because Y2K culture and (tech) nostalgia are indeed big trends within the Web3 space, and because we all LOVE virtual pets, FrenPet was just meant to grab attention within the community, at least for the most degen and sentimental of us.

But don’t be fooled by its super simple graphics— this gem is far more intricate than it lets on.

Drawing inspiration from the Bandai’s Tamagotchi of the mid ‘90s, along with the vibes of the OG Game Boy Pokemon release, FrenPet evokes a sense of nostalgia while using blockchain tech to create a unique experience. “Themainvisionbehind FrenPet was to develop something engaging and interactive that allows players to care for and bond with their pixelated companions while leveraging the benefits of the blockchain for ownership and rewards,” explains Adam, one of the two project founders.

In FrenPet, players evolve through an on-chain (Base), playful yet hyper-financialized environment where they can rake in both ETH and $FP (the app’s native tokens) by looking after and caring for their minted lil’ pals. The play-to-earn (P2E) model here is well-designed and meticulously crafted. It runs on a straightforward and solid incentive structure that’s smooth. “There is a 4% tax every time someone buys or sells $FP tokens on UniSwap. Once the smart contract accrues 50 $FP tokens from taxes, they get automatically swapped into ETH and distributed as follows: 2% goes to the players of the game as rewards, 1% goes to the developers of Fren Pet, 1% gets added back as liquidity provision to support the $FP economy,” Adam says. “The player rewards are distributed according to your share of in-game points in relation to the total points of all pets in the game.”

Feeding, nurturing, virtually cleaning up poops, and tightening bonds with the digi-pets keep them happy and healthy, extending their lifespan and contributing to the game experience. Moreover, FrenPet offers more than basic care. Players can participate in minigames and challenges, earning points that provide rewards (part of the trading fees) and enhance their FrenPet’s attributes. It’s a rich ecosystem where almost every interaction matters.

While it may look easy, players need to strategize to maximize their gains. They can use high-reward items like beer for quick points, spin the wheel daily for up to 2000 free points, collect monsters as tokens, and engage in pet battles (affectionately known as

“bonking”) with higher-level playmates. The odds are set at a 60/40 win rate, adding an element of risk and reward.

Although FrenPet is undeniably captivating with its compelling game and rewards structure and eyecatching aesthetics (for those into pixel art), its appeal extends beyond the fun and the tokenomics. Deeper emotional components come into play, driven by parasocial interactions and psychological ownership. As players cherish their crypto-pets—from birth to growth, life, and eventual passing—they invest time, effort, and sometimes ca$h. This investment elicits a range of emotions, testing the depth of their kinship and love for these virtual companions.

The community aspect is equally vibrant. Some players connect through private channels, sharing stories of their pets’ growth, achievements, and memorable moments. The focus surpasses the game dynamics to bring up connections and celebrate each other’s achievements. “Our community thrives on platforms like Twitter and Discord, growing organically! The game itself encourages social interaction, with players frequently sharing screenshots of their pets and participating in friendly competitions,” Adam elaborates. “In our private channels, members enthusiastically share their pet’s records, strategies for optimal care, and even humorous anecdotes. It’s heartwarming to see how deeply invested our players are in their virtual companions.”

Additionally, community-driven initiatives such as frenpet.dievardump.com and http://fpanalytica.

tech serve as additional hubs for enthusiasts. These platforms enhance engagement, strengthen the community’s vibe, and create an active and supportive place for all participants.

And the adventure never stops. Actually, it’s the other way around. FrenPet evolves continuously, with regular updates that keep the experience fresh and exciting. Updates could include new content and core systems, offer enticing in-game rewards, and enrich visual elements to maintain the level of attraction.

“FrenPet has an exciting roadmap ahead, including new features, partnerships, and expansions,” Adam concludes. “Upcoming plans include additional pet evolutions, gameplay mechanics such as introducing a farming game and land, and collaborations with other innovative projects in the space.”

This commitment to ongoing development ensures that players always have something new to explore. Whether it’s discovering a new setting, mastering

new gameplay mechanics, or attending collaborative events/actions, FrenPet offers a moving adventure that keeps players captivated, connected, and eagerly invested in what’s next for FP.

WHY EVERY WINNING ONCHAIN APP WILL BE SOCIAL

David Phelps Founder, JokeRace

1Once you see it, you can’t unsee it: the influencer living off Prada gift bags in a rat-infested studio in the Lower East Side, the musician from the streets whose beat stops hitting the moment he becomes an over-orchestrated superstar, the rich husband bursting out of his shrunken, wrinkled button-down next to his zealously coiffured, haute couture wife. It’s everywhere.

What I mean is the inverse correlation between financial capital and social capital— between our contemporary merchant class (the financiers) and religious class (the tastemaking kulturati).

This is a bit of a taboo subject, I think, in a world where capitalism has trained its adherents and detractors alike to believe that money can buy anything. Instead, we find that to be rich not only means gaining one type of cultural power in political influence, for sure, but losing another type of cultural power in the blindness of privilege. The cost of controlling society is to become, well, something of a social loser within its norms.

If you are one of those poor people afflicted by billions of dollars of life savings, I know you may be fretting when you hear this. Please don’t. In theory, you still have the three classic ways of alchemizing financial capital into social capital. You can build a relationship with someone cool (by marrying), you can invest in something cool (by buying art), or, you know, you can do both at once (by becoming a Consumer Venture Capitalist). In theory, this hoary playbook remains as useful for you today as it did in the late 19th century. All you need to do—you bursting buttoneddown financier, you—is to pull some baddie

with taste in linens and jewels who can help you to sprinkle a George Condo or Vik Muniz on their walls. All you need to do is invest in the hottest new disposable audio app that every kid in America will be using for the next 7-to-12 days. And then, surely, you’ll be cool.

Right?

Right?

The only thing is that in practice…

When the investor renowned for their money gets in cahoots with a tastemaker renowned for their status, it is the reputation of the tastemaker that remains intact. The tastemaker might get the investor’s money, but the investor can never get the tastemaker’s status.

I am trying to get at something uncomfortable here, something that the past two years of building a social-financial product has taught me over and over. It is easy to trade social capital for financial capital. But while you can cloak yourself in blue-chip designers all you like to impress your fellow financiers, it is extremely hard to trade financial capital for social capital.

You’ve seen this with every washed-up celebrity you know: when the coolest people become rich, even they can’t remain cool.

2What I’m trying to say is something that Web2 taught us long ago: for the masses of humanity, social incentives will always trump financial incentives. Most humans will happily let corporations harvest their data to the highest bidder if it gives them even the remotest chance of appearing

aspirational online. Privacy and civil rights advocates can complain, but most people will happily incur massive financial opportunity costs for the sake of social connection that can signal status. Those of us who work in crypto often forget this fact. Most people are normal, and they’d rather score someone who listens to them than score a million bucks.

And besides—please forgive me this dark thought—they know that accruing social capital is one of the few mobile paths to accruing financial capital in the attention economy.

Web2 knew this. And if you want to know why nearly every Web3 social app has failed, your answer is here: it’s because Web3 disastrously decided that Web2 was incorrect, that financial

incentives are strong enough to build retention, that people can buy their way into status. Of course, Web3 had decent reason to think that financial incentives were all that was needed to bootstrap a zealous user base. After all, the original blockchain communities of miners and validators were driven entirely by financial incentives, as were the communities of DeFi protocols. I mean, financial incentives were the whole original unlock of blockchains’ permissionless financial rails! And they seemed to work so, so well in speculative bull cycles as buyers aped into soaring prices to help them soar some more.

But with the advent of crypto apps, DAOs, and NFTs, it started to become clear that financial incentives were often deadly to building

meaningful social communities. To believe that blockchains were simply financial tools and that financial incentives were sufficient to bootstrap social communities—well, this was wrong.

It was wrong, first of all, that financial incentives could build retention. In fact, the reason financial incentives are so good at user acquisition is exactly the same reason they’re so bad at user retention: because a mercenary who will use an app to profit will leave it just as soon as the opportunity is better elsewhere. The same people who come for a price that goes up will leave for a price that goes down. Their loyalty means nothing unless you can continue to get them paid.

And it was wrong, above all, that people would be able to convert financial capital to social capital, that, as so many 2010s elite coworking spaces promised, people could buy their way to cool. Of course, it’s not wrong that some small mass of delusional buyers will always try to buy their way to being cool. But they’ll quickly kill their own investment, since there’s no club that genuinely cool people would like to be part of less than one whose membership can simply be bought. These clubs don’t just exclude the genuine builders and the marginalized voices that have built culture for millennia; they include (I’m sorry) anyone who’s ever decided to sell out.

If you want to know what crypto social apps keep failing, it’s this: you can’t buy status. In fact, the attempt to do so will only accomplish the opposite. It will mark you as kind of lame.

3None of this means, however, that financial incentives don’t play a crucial role in unlocking onchain social apps. Just as it’s popular to believe that financializing social activity is enough to produce a killer app, it’s equally popular to argue against the supposed degeneracy of a casino culture of mercenaries and gambling addicts. The latter view is a reasonable response to the former, but it reeks of snobbishness towards a global underclass that might actually want to make money to feed its family. And more importantly, it’s wrong.

Blockchains are financial rails, and their most radical value propositions for social apps are also their most boring: they let you perform microtransactions with every tap, they let you disintermediate credit card and app store fees, and they give you an open API in the form of onchain metadata for anyone to build on top of. Ideologically, all of this is far less exciting than the revolutionary vision of collective ownership, artist royalties, and decentralized work that inspired and exhausted us in 2021. Financially, all of this probably sounds a good deal less exciting than pure and simple speculation as well. Probably, it just sounds like technicalities.

But consider what this means. Blockchains transform both the ways that social apps can be built, as well as the kind of social apps that can be built, for a very simple reason: they let users monetize directly from other users. Think about the entire history of web2 social apps outside of gaming, and you won’t find a single major app for which this is true.

Financial sustainability for users alone is huge. In fact, it’s never really been done.

4Because here’s the real issue with Web2: it successfully monetized off of social behaviors. But its users didn’t.

So strong were the networks of friends, frenemies, bosses, colleagues, and lovers— and maybe most of all, the network of potential friends, frenemies, bosses, colleagues, and lovers—that it wasn’t only users who surrendered their data for the harvesting. Corporations themselves gave up the moats they would have had by hosting comms, forums, and job opportunities on their site.

This was the power of social networks: social incentives won, and they did so at the expense of financial and reputational incentives. No, you would not earn money from your valuable content; the social network would. No, you couldn’t programmatically own or access or share the reputation you were building as a star creator on a given platform; the social network alone could leverage it for new users and ads. The goal was to become famous on one platform in order to monetize anywhere else.

Another way to frame this, I think, is that web2 was an app era, which is to say that it was a closed-data era. An individual’s data lived in the siloes of a given app, and this model is what enabled the apps to monetize by selling this data to advertisers. In short, in closeddata eras, ads and apps will win. Everyone

needs to congregate on their platforms to be able to share their data with each other.

But then came crypto, and we entered the onchain era.

Crypto marked the start of a protocol era, or rather, an open-data era. Now an individual’s data could be ported freely between apps, and there was no proprietary data to sell in open-source onchain networks. In place of ads, a new model arose: tokenization. At their core, tokens offer a somewhat awkward solution to the real problems of permissionless technologies in that anyone can input any kind of data into a system. Tokens are, essentially, legitimacy technology for users to put up economic collateral attesting that one transaction is legitimate and another is not. You no longer make money selling the data to ads. You make money by putting down economic stakes to attest that the data is true.

The reason to participate in crypto from the start, in other words, was the financial incentives.

This blessing, never possible in web2, was also a curse. By this point in this piece, you know the problem: in every bull market (including this one), the quick gains would draw masses of mercenaries to spam chains, farm protocols, buy tokens, shill bags, and to launch new tokens, chains, and platforms. But the same financial fervor that overtook individuals during bull markets would turn to financial frigidity in the bear. Just as quickly as the prospect of getting the bag could pull

people in, the prospect of losing it would push them away.

There’s another problem here too, though, that’s much less-discussed. Financial incentives on their own tend to be zerosum at best. One person’s gain is another’s loss, and in the realm of pure speculation, you stand as much to gain in a bull as you stand to lose in a bear. This is why prediction markets—possibly the most-touted use cases for crypto apps for the past seven years—command a total market of only around 10,000 users during their most popular periods (election cycles). And many of these are probably bots. The expected return is zero, so users have to be quite confident that they know the future better than other users who are also confident that

they know the future better than them. Having deep insight doesn’t necessarily help you when you’re also competing against others with the same deep insight.

So how do prediction markets get users? Well, by appealing not to rational bets but irrational ones that are tribal in nature: namely, elections and sports games. People will bet on their own team winning because it matters to them. You see where I’m going with this: for financial products to truly make money, they have to tap into social incentives.

We knew this, of course.

Web2 had extraordinary social incentives, but awful financial and reputational incentives.

Web3 had extraordinary financial and reputational incentives, but awful social incentives.

Financial incentives were good for making quick money, but social incentives were necessary for building a long-lasting business.

Crypto wins when—and only when—it enables both.

5You might not believe me—I know far too many people in this space who think I’m wrong.

So let’s talk about a specific case study: Uniswap.

Uniswap’s protocol has clearly won: it’s used not just by Uniswap, but by Cowswap, 1inch, etc. And that’s the issue. Because it’s a fully

open protocol, it can be cannibalized by its competitors. Uniswap presents a uniquely crypto-native problem, the likes of which we’ve never really seen in tech: you can lose to your own product.

The issue here is that onchain apps don’t make fees on their protocol. Partly that’s for legal reasons. But a protocol with fees would also incentivize competitors to fork it and fragment liquidity for all parties. That might be worth it if there were no other way to make fees, but of course, there’s an obvious one.

Uniswap, like every other onchain app, makes its money on the front end. The front end is where it needs to win. Only the front end, not the protocol, is exclusive to a company in crypto. If projects can’t ultimately drive users to their site, they can’t monetize effectively.

And what drives users to a front end? Brand, features, UI/UX, all matter of course, but one of the great lessons of web2 was that the most important front end driver is user networks. You go to a site because other users are there to find—and to find you. Just as financial liquidity matters for bootstrapping a protocol, user liquidity matters for bootstrapping a front end.

Today, you can see that in every decision Uniswap is making. The wallets? The domain names? The acquisition of Crypto: The Game? These are all ways of making users loyal to its front end. These are all ways of turning Uniswap ever-so-slightly social.

I have no idea what Uniswap has in store, but I imagine we’ll see many similar features in the

upcoming year or two. Want to launch your own token? Uniswap could be the place for any LPs to congregate, join a chat, or launch campaigns for others to join in.

What I’m trying to get at is this: to win on the front end, you need to win on social.

To build a financially sustainable model at all in crypto, you need to win on social.

6I said before that this is a lesson I’ve been personally learning over the past year.

At Joke, we let anyone create an onchain contest for people to submit and vote on entries. Broadly speaking, contest players might win in any of three ways: they might win money, they might win status, and they might win friends. The money is the financial incentive, the status is the reputational incentive, and the friends are the social incentive. These are all the incentives there are.

For example, let’s say someone ran some kind of Shark Tank onchain. The top winner could earn prize money (financial incentives), all of the contestants could earn status from every vote they get (reputational incentives), and voters could form teams around

contestants to create an organic community backing them from the start, creating tribes and making friends (social incentives).

When I frame it that way, it should already be clear that financial incentives are the least compelling incentives at play. Only the winners earn money, and that’s far from guaranteed. But everyone can earn status by winning even a single vote. And everyone can make friends by creating teams.

Besides which, the act of building reputational and social profiles can lead to all sorts of financial benefits in terms of jobs, communities, and airdrops. The financial rewards can only offer money.

You can see why it’s popular to believe that to be money-motivated is to be superficial: it is. Your reputation and your friends represent your underlying values as a missionary for your cause. But your money represents, so often, your ability to sell these out as a mercenary for the highest-bidder.

If this sounds scandalous, crypto has proven it over and over again. One of Web2’s greatest lessons was that social incentives operate something like a marriage: slowburning, long-lasting, deepening over years

“Your reputation and your friends represent your underlying values as a missionary for your cause. But your money represents, so often, your ability to sell these out as a mercenary for the highest-bidder

of activating relationships for an hour or two a day.

Web3’s lesson, meanwhile, has been that financial incentives operate more like an affair: all-consuming, short-lived, incinerating itself in the ashes of its own passion until it finds a new hot opportunity to pursue. The airdropfarmers will float on the winds of the highest yield.

Of course, in a world where we all have to pay for food and shelter, we’re all somewhere on the mercenary spectrum, our attention open to the highest bidders. So I don’t mean to shade financial incentives. I simply mean that passion is a powerful tool for acquisition, but only if it can lead to the retention of a marriage. To recognize this means recognizing that blockchains are not simply tools for globally interoperable finance, but also for globally interoperable coordination and reputation as well. They are, in fact, the solution to their own problem, the top problem plaguing moats and monetization in this space that we need true social tools to solve: loyalty.

With special thanks to Daisy Alioto, Sophia Drew, Parker Jay-Pachirat, Sean McCaffery, Peter Pan, Kinjal Shah, and Seyi Taylor.

Base, Coinbase’s L2 solution, launched in August 2023 with a mission to bring the next billion users onchain. By leveraging advanced rollup technology, Base offloads transactions from Ethereum, providing a more efficient, costeffective, and user-friendly experience. This L2 supports developers across a broad application spectrum, from DeFi to gaming and collectibles,

reducing costs and increasing transaction speeds.

Seamlessly integrating with Ethereum’s security and decentralization, Base enables highperformance applications without sacrificing Ethereum’s core principles. This combination

results in faster, cheaper, and more reliable services on top of Ethereum.

As we explore Base’s diverse applications, it’s evident that this L2 sets a new standard for onboarding developers and users. Base is committed to building an onchain platform that is open source, free to use, and globally

accessible. It isn’t just enhancing Ethereum; it’s redefining what’s possible in the digital economy. Join us as we delve into this innovative landscape where technology meets practicality, forging the future of onchain applications.

Degen (DEGEN) started as a memecoin in January 2024 within the Farcaster community, initially serving as a reward token for active participants. It quickly evolved from its meme status to become a significant player on Base.

Degen Chain, built on Base, uses DEGEN as its native gas token. The tokenomics of DEGEN are designed to reward community engagement, where users can earn tokens through likes, comments, and reposts.

Within the first week of launch, Degen Chain acquired more than 100,000 users and reached $40 million in daily trading volume, signaling rapid adoption and the high demand for its services.

Higher Memecoin (HIGHER) is a communitydriven memecoin on Base that leverages the viral nature of meme culture. It allows users to create, share, and engage with meme content while earning native tokens.

Users earn HIGHER tokens through various community activities, such as voting on memes, tipping content creators, and participating in staking. This gamified approach to social interaction enhances community engagement and rewards active participants, making it a popular choice among meme enthusiasts.

Midnight Diner is an event series by Coop Records hosted on the first Wednesday of every month in Koreatown, LA. These events feature live performances from new Coop Records artists and provide an opportunity for music individuals to experience crypto in a familiar setting. The content is produced in real life and minted on-chain, allowing people to form real experiences around these moments, making collecting that much more meaningful.

Each event is exclusive to passholders who receive a free edition of each headline performance as a collectible after the event.

Gunna, the renowned rapper, has ventured onchain by leveraging the Base network to offer music collectibles.

Alongside his new album, Gunna introduces ONE OF WUN, a token powered by smart contracts that grants holders early access to the One of Wun universe, which includes music, merchandise, and behind-thescenes content. A portion of the mint sales will support working families in the South Fulton, Georgia area through ‘Gunna’s Great Giveaway.’

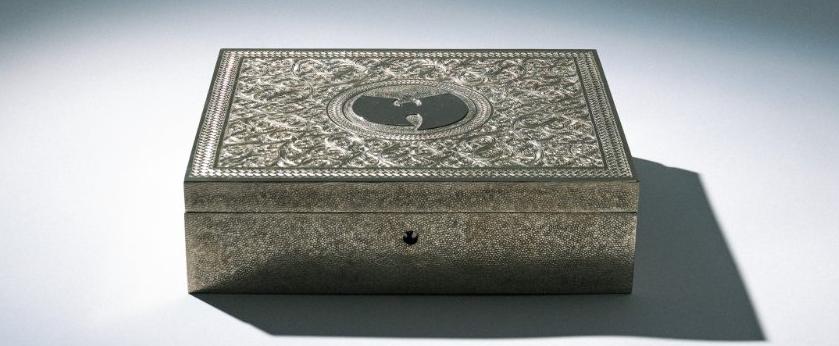

Wu-Tang Clan’s legendary album “Once Upon a Time in Shaolin” was acquired by PleasrDAO for $4 million, an onchain collective known for acquiring culturally significant items. This move aims to allow fans to purchase partial ownership, priced at just $1 per NFT.

Purchasing an NFT gives collectors access to an album sampler and also bumps up the album’s release 88 seconds at a time. The album will currently be available to the public in 2103.

The proceeds from the sales will benefit the artists involved, and the album’s tracks will be progressively decrypted and shared with the NFT holders.

Parallel TCG is an immersive and strategic trading card game set in a futuristic, dystopian world. Players choose from one of five factions, each with its unique set of cards and abilities, and build a 40-card deck to compete in 1v1 battles. The goal is to reduce the opponent’s health to zero by strategically playing units, relics, effects, and upgrades.

Players earn the game’s native token, PRIME, by winning matches and participating in various in-game activities.

Parallel TCG is free to play and offers both collectible and noncollectible cards.

IYK is a pioneering platform onchain that combines nearfield communication (NFC) chips with crypto to create token-enabled merchandise. This approach allows brands to embed NFC chips into apparel and other products, enabling consumers to authenticate items by simply tapping their smartphones. When scanned, these products provide access to digital certificates of authenticity, exclusive content, and community benefits.

The platform has gained traction with major brands, including Adidas, Atlantic Records, Billionaire Boys Club, and Johnnie Walker. It offers a self-serve model that allows brands to easily integrate IYK’s technology into their products, creating rich, digi-physical experiences without requiring specialized apps. Users can interact with these NFC-enabled products to unlock a wide range of digital content, verify authenticity, and engage with exclusive community activities.

Blackbird empowers creators, artists, and influencers to build stronger connections with their followers through social tokens. Creators can mint their own tokens, which fans can purchase, trade, or earn as rewards for engagement. These tokens can be used for exclusive content access, voting on future projects, or other community-driven activities. The platform’s integration with Base ensures low-cost transactions and fast interactions, making it easier for creators to monetize their work and for fans to actively participate in their favorite creators’ journeys.

Slice.so provides a fully decentralized and efficient commerce experience. By creating onchain stores, businesses can offer seamless and instant transactions with unparalleled security. The platform supports a variety of advanced features such as revenue splitting, instant settlement, multi-currency pricing, advanced discounts, and NFT minting.

One of the standout features of Slice.so is its one-click checkout process, which eliminates the need for sign-ups and tedious payment details, making purchases seamless and instant for customers. The integration with Base enhances the scalability and reliability of services, ensuring smooth operations even as transaction volumes grow.

Pods leverages Base to provide a decentralized podcasting platform, allowing content creators to publish and monetize their podcasts securely and transparently.

Creators can easily set up their podcasts on Pods, utilize features like one-click distribution to major podcast directories (e.g., Spotify, Apple Podcasts), and maintain full ownership of their content. Pods ensures that creators receive fair compensation through direct listener payments and microtransactions, enhancing the monetization opportunities for podcasters.

The platform supports advanced features such as token-gated content, allowing creators to offer exclusive episodes or bonus content to subscribers who hold specific tokens. This innovative approach not only secures the content but also fosters a more engaged and loyal listener base.

Fren Pet is a GameFi project built on Base, designed to evoke nostalgia from ‘90s and early 2000s virtual pet games like Tamagotchi. Players can adopt digital pets, take care of them by feeding, cleaning, and playing with them, and watch them grow and evolve. The game leverages low transaction fees on Base, making it accessible to a broad audience, including those from lower-income regions.

The game has a strong emphasis on deflationary tokenomics, where 90% of the in-game currency (FP) used is burned, and there are no investor allocations. This structure ensures that the tokens are evenly distributed and not controlled by a few large investors. Fren Pet has gained significant traction with a market cap of $53 million and daily transaction volumes exceeding $400,000

Read more about Fren Pet in the Culture Corner section of EIC02.

BasePaint is a unique collaborative pixel art application built on Base. The platform allows artists to come together daily to vote on themes and paint on a shared pixel-art canvas. Each day, the collective artwork is minted as a 24-hour open edition NFT. Once the mint concludes, the participating artists receive a share of the ETH generated from the minting process,

The platform was inspired by the internet phenomenon r/Place and was designed to provide a space where every pixel tells a story and every artist can reap rewards. BasePaint uses smart contracts to ensure fairness in pixel placement, allowing only a limited number of pixels to be placed per user daily. This system helps maintain the integrity of the platform and encourages creativity and collaboration among artists.

BasePaint plans to introduce a leaderboard to highlight artists based on their contributions and the value of their artwork, fostering a competitive and rewarding environment for both new and seasoned artists.

KIKI World connects consumers with brands, allowing them to participate in product development and earn rewards. The platform empowers users to vote on product designs, contribute ideas, and earn rewards for their engagement. This communitydriven approach fosters a deeper connection between consumers and brands, creating a more personalized and interactive shopping experience.

KIKI World recently announced a $7 million funding round led by a16z crypto and The Estée Lauder Companies’ New Incubation Ventures. This funding supports the development of KIKI’s digital and physical experiences, furthering its mission to reshape traditional consumer interactions by integrating onchain technologies.

Doodles, a prominent NFT-based entertainment brand, is migrating its “Stoodio” avatar customization platform from the Flow blockchain to Base in mid-July 2024. This strategic move aims to improve efficiency and expand user engagement.

While the original Doodles profile picture (PFP) collection will remain on Ethereum, the Stoodio and its various NFT wearables and character customizations will shift to Base.

This move coincides with the launch of an open edition Base NFT mint through Zora, which will unlock exclusive content within the Stoodio. Doodles plans to release a new animated short film, “Dullsville and the Doodleverse,” featuring music by Pharrell Williams and contributions from musicians like Lil Wayne and Coi Leray.

Adidas is integrating fashion with NFT technology. These initiatives offer digital ownership of products and exclusive content, enhancing the brand’s community engagement.

Through its collaboration with Base, Adidas has introduced several innovative projects that merge physical and digital experiences. One notable project is the “Virtual Gear” collection, which represents Adidas’ first venture into digital apparel, designed specifically for virtual worlds and the metaverse. This collection features unique digital wearables that users can purchase and use to style their avatars in various digital environments.

Unlonely integrates onchain elements into live streaming, offering unique features like streamer-specific tokens and live betting markets. It offers creators and viewers unique interactive features that go beyond traditional streaming. These features include the ability to launch streamer-specific tokens, which fans can buy and trade, and live betting markets where viewers can place bets on various outcomes during live streams.

One of Unlonely’s standout offerings is its show “Love on Leverage,” where participants go on live-streamed virtual dates, and viewers can bet on whether there will be a second date using ETH. This show has garnered significant attention, with thousands of viewers and substantial trading volume generated through the betting feature.

Aerodrome offers a robust DeFi platform that caters to both novice and experienced users. It includes features like decentralized exchanges (DEX) for trading various tokens, lending protocols where users can earn interest on their assets, and staking opportunities to participate in securing the network and earn rewards. Aerodrome’s user-friendly interface and comprehensive suite of tools aim to make DeFi accessible to a broader audience, ensuring that more people can benefit from decentralized financial services.

Uniswap’s deployment on Base brings its trusted, efficient, and usercentric DEX capabilities to the L2 environment. Users can trade ERC20 tokens directly from their wallets, providing liquidity to pools and earning fees in return. Base’s low transaction costs and high throughput enhance the Uniswap experience, making trades faster and cheaper while maintaining the security and decentralization principles that have made Uniswap a leading DeFi protocol. This integration aims to bring DeFi closer to mainstream adoption by improving accessibility and reducing barriers to entry.

Farcaster is a decentralized social network that prioritizes user control and data privacy. It uses a hybrid on-chain and off-chain architecture to provide a scalable and efficient platform for social interactions. Users can create profiles, post messages (called “casts”), and follow others, with full ownership of their accounts and social graphs. This means users can move their data freely between different applications built on the Farcaster protocol, ensuring a high degree of interoperability and user autonomy.

The protocol leverages Ethereum and Optimism for its on-chain components, such as user registration and data integrity, while using off-chain “Hubs” to manage data storage and replication, ensuring reliability and speed. This setup reduces the risk of censorship and enhances privacy by distributing control among multiple servers rather than a single entity.

Farcaster supports various onchain applications, with Warpcast being the flagship app. Warpcast offers a Twitterlike experience where users can post, interact with content, and showcase NFTs. Other notable onchain applications in the Farcaster ecosystem include Paragraph, a decentralized newsletter platform, and Kiwi News, a crypto media application.

To get started, users can download the Warpcast app on iOS or Android, create an account, and begin exploring the decentralized social media landscape. Farcaster also integrates with decentralized identity systems like ENS, allowing users to adopt multiple usernames and enhance their online identity management.

Mint.Fun simplifies minting and discovering NFTs, supporting ERC-721 and ERC-1155 contracts.