▪ Winter ’24 Published by: ETH Investors Club, February 2024 Innovative Print Solutions, LLC. Long Beach, CA Minting Address (Base and Mainnet): 0xb15E97EB6028A412a34a7796bBE99b77F524c31c

eic.eth

EIC01

Donations:

ETH INVESTORS CLUB ▪ WINTER 24 EIC01

DISCLAIMER:

This content is for informational purposes only and is not legal, tax, investment, financial, or other advice. You should not take, or refrain from taking, any action based on any information contained herein, or any other information that we make available at any time, including content such as blog posts, data, articles, links to thirdparty content, discord content, news feeds, tutorials, tweets, and videos. Before you make any financial, legal, technical, or other decisions, you should seek independent professional advice from a licensed and qualified individual or firm in the area for which such advice would be appropriate. This information is not intended to address of be comprehensive of all aspects of EIC or its products. There is additional documentation on the ETH Investors Club website about how EIC and its community function.

Letter from the Editors

Welcome to the first issue of ETH Investors Club Quarterly. Thank you for embarking on this journey with us. EIC01 traverses the expansive worlds of Ethereum, chronicling the re-imagination of two critical societal pillars:

The internet & property

In this issue, contributors from all of Ethereum’s corners and layers guide us on a trip through the onchain landscape. We examine the roles of Ethereum and ETH: One, a groundbreaking distributed computing platform that resembles a nation state—another, a vital asset within the former’s burgeoning economy.

ETH Investors Club isn’t just a movement about financial investment. It’s about the countless believers investing their time, attention, talent, resources, and effort into Ethereum. They are redefining our notions of money, property, and data sovereignty—serving as the backbone for a more free and prosperous future.

Art Partners

Cover: Illustrated with Tilix (E-Boy) on Phi

AI Models: DALL-E, Adobe Firefly

All layouts designed in house for EIC01

Technology Partners

NFC Chip: IYK

Mint Contracts: Manifold

Storage: Arweave

To contact the editor, email: peter@ethinvestorsclub.com

5

Peter Vecchiarelli Editor-in-Chief

Vivian Van-Vecchiarelli Creative Director

Anthony Sassano Executive Producer

contributors

Founder, 3cities.xyz

Ecosystems Lead, EigenLayer

Founder, Lombard Protocol

puniaviision

Deb

soubhik_deb

Artist

otherworld_xx

Creator, WASD

Head of Protocol Research, EigenLayer Hildobby

Partner, Switchpoint Strategies Cofounder, CommonBond & Alluvial

Founder, Ethereum Credit Guild

CEO & Founder, Maple Finance Senior Writer, Bankless

Founder, Fei Protocol Author, ERC-4626

Copywriter, VeeFriends

Founder, Pine Analytics

6 ETH INVESTORS CLUB

Kirk Hutchison

Mike Taormina

Other World

Arella Trustman

Jack Stewart

Ryan Berckmans

Sid Powell

William Peaster

Joey Santoro

Ben Giove

Jessy Spreek Abhishek Punia

arella_eth

BenGiove jackthepine

13yearoldvc joeysantoro_eth

OneTrueKirk

MikeTaormina

syrupsid

ryanberckmans

spreekaway

WPeaster

DeFi Veteran and Onchain Investigator

Soubhik

and many more...

hildobby Data, Dragonfly Data

contents 7 APPLICATION NATION CULTURE CORNER The Infinite Story Machine 09 Phi Land 15 Navigating the Waves of Onchain Music 16 From SuperRare to Sotheby’s 20 The Rise of Composable Worlds 28 Culture Corner Insights 35 FUTURE OF FINANCE A Blueprint for Real-World Asset Adoption 38 Scaling ERC-4626 Tokenized Vaults 48 The Future of Global Payments 53 The Rise of DeFi in Real-World Lending 60 Counterpoint: Institutional Dialect 73 The Stablecoin Revolution 77 Incredible Neutrality 84 Future of Finance Insights 89 STAKING AND SCALING SCALING ETHEREUM Scaling Ethereum Insights 92 STAKEONOMICS The EigenLayer Universe 97 Stakeonomics Insights 109 INVESTING IN ETH VALUATION THEORY: Valuation Theory Insights 114 STRATEGIES Managing the Risk of Onchain Interactions 118 WINTER 24

CULTURE CORNER

The Infinite STORY MACHINE

William Peaster Senior Writer, Bankless

William Peaster Senior Writer, Bankless

Storytelling is fundamental to human culture.

Stories are how we pass down our beliefs and values. They’re how we teach lessons and form communities, how we express our desires and entertain ourselves.

I have another more expansive conception of the word stories, though. It might be more accurately called “storymaking,” which I see as the universal becoming of things into reality and then into history, on and on.

I think it’s useful to consider Ethereum as a novel type of medium for both these senses of stories. This framing offers a new complement to traditional methods of valuing the network.

Of course, Ethereum has its own history, which Camila Russo did an amazing job chronicling the early days of in her book The Infinite Machine I really love that title. And when I think about Ethereum philosophically today, my slight remix would be: Ethereum is an Infinite Story Machine.

This metaphor operates on multiple levels. Firstly, Ethereum, fundamentally a ledger technology, is increasingly becoming like a new giant Book

9

WINTER 24

of Everything. The passing of its blocks are the filling and turning of its pages. Who did what and when. It’s like Borges’s Library of Babel begun in the real world.

The network’s far from encompassing all things yet, and navigating its early happenings can be labyrinthine, but no book’s organized instantly. And DeFi and NFT pioneers have already pointed toward a future where going onchain becomes much more common, so many more pages are certainly coming.

Furthermore, consider how Ethereum has become an open foundation for supporting external story machines—think L2 scaling solutions like Arbitrum and Optimism, which can in turn support their own L3 rollups, so on and so forth—while also being home to an evergrowing number of little story machines, i.e. app smart contracts.

For example, at the app layer one of my favorite projects is Zora. Zora actually calls its NFT creator suite, which is underpinned by Ethereum contracts, the Magic Machine. Beyond it’s technical architecture, it’s become a creative nexus of imagination and desire; put your art or memes or music or videos or writings in, i.e. your personal stories, to record and offer them up for ETH and for posterity.

In fact, Zora is also a hyperstructure, a crypto protocol that “can run for free and forever, without maintenance,” making it a great example of what I called a little story machine earlier. Its smart contracts will continue facilitating stories and storymaking atop Ethereum indefinitely, always having the potential for energies and dreams to flow through it and out of it in basically all directions.

Here, I’ll clarify that a set of contracts doesn’t have to be directly linked to creative efforts or NFT projects to be involved with storymaking. The ongoing facilitation and recording of DeFi protocol transactions and things like DeFi DAO votes are 100% storymaking, too, in that philosophical sense. It’s happenings made into history, on and on, onchain. Zora’s just a potent example since people directly use its smart contracts to create and share new cultural assets, i.e. stories.

All that said, Ethereum as the Infinite Story Machine with its ceaselessly churning landscape of smart contracts is ripe for fostering hypercultures, which ecosystem analyst LGHT has defined as a “crypto culture that can grow freely and forever [...] once it has entered the collective mind.” LGHT’s also asserted that “every creative entity that can put it’s context onchain has the opportunity to birth a hyperculture,” which I agree with, wholeheartedly.

Think about it: Ethereum metaphorically provides the pages that bind protocols like Zora together, Zora then helps birth hypercultures, and then hypercultures birth more content and protocols, for example Zora’s Noun Builder, and this eventually leads to more new cultures and more new content

ETH INVESTORS CLUB 10

and new protocols, ‘round and ‘round. A single creative act on the right smart contract can ripple out very far—that’s the cultural power of the Infinite Story Machine.

Zooming back out some to the level of people and groups, I’ll also note that Ethereum has literally become a hub for novel storytelling experiments, ranging from art to games and everything in between. Some have already come and gone, like the Cellarius worldbuilding project, or Chainspace, which was originally envisioned as a “cinematic wrapper” for the Ethereum ecosystem.

Yet some of these storytelling experiments are alive and well and poised to be around for a long time. I’m reminded here of the mesmerizing onchain virtual world project Terraforms, which is an example of runtime art. This means the world itself is generated entirely at the level of its code + the Ethereum Virtual Machine (EVM), and so it will live for as long as Ethereum lives.

That art is interactive, as its code beckons collectors to participate in the world’s story. They have the ability to shift their parcel NFTs into “Daydreaming” mode, which can slow or altogether stop the project’s hardcoded

11

obliteration. As Terraforms specialist Astrostl has previously explained:

“The smart contract code is set to begin a decay and eventual destruction of the castle unless ‘enough’ parcels are Daydreaming [...] Each Daydreamer forestalls this event by 10 years. If or when there are 500 dreamers, the collapse is forever prevented. Yay! At the time of this writing there are already 481, so this is delayed by 4,810 years and only needs 19 more to be safe for as long as the Ethereum blockchain exists.”

Another great but very different example would be Nouns DAO, which is creating a CC0 brand from the ground up. They’re forging their brand’s story by funding and deploying other stories, e.g. art, books, games, music, videos, etc. and they use Ethereum as their base of operations.

The Nouns are arguably the foremost collective storytelling experiment on Ethereum today, not to mention how their open, CC0 style has led to countless aesthetic and technical spinoff experiments at this point. The storytellers beget new stories, and those new stories beget new storytellers, and those new storytellers beget new stories, onward and outward evermore.

And with the world always evolving around us, the ways that Ethereum facilitates stories will evolve, too. As more people onboard to metaverse spaces in the decades ahead, Ethereum will underpin much of the associated cultural and economic activities therein. As AI agents become more commonplace, more onchain storymaking will come via virtual agents interacting with smart contracts, other AI, and humans. And validity proofs and coprocessors will likely see 1,000s of chains bloom atop Ethereum over time, the becoming of an ultimate machine of story machines.

Why is this conception of Ethereum as a new technological medium for stories and collective storymaking worthwhile, then? Because it hones in on and takes into account Ethereum’s immense creative, qi-like power in a way that other traditional framings—think “Ethereum as an alternative financial layer” or “Ethereum as a new internet of value”—haven’t.

Additionally, this understanding leads to two new ways to see Ethereum as valuable, one economic in nature and the other political. With regard to the former, stories and storymaking are like oxygen to people. We’re all weaving our own stories constantly or watching others do the same. This is a fundamental aspect of the human experience.

That said, recall the old sales axiom, “sell aspirin, not vitamins,” as people always need aspirin but only periodically buy vitamins. Ethereum’s aspirin, then, is storymaking. Its blockspace sells because of the need for storymaking, which is basically all-encompassing and will never go away as long as humans exist. We do, and we’re going to do more and more onchain. So ETH can gain in value if Ethereum can continue to widen as a gravity well of storymaking in the world. In my opinion, that blackhole’s already been opened.

As for the political dimension, consider how traditional institutions—from cable TV to the U.S. Treasury department—colonize our desires, they colonize the ways we can experience stories. In other words, they constantly hail us into their status quos and call on us to experience the world on their terms.

Fair enough, but Ethereum in contrast is neutral, opt-in, and like a giant “choose your own adventure” computer, constantly churning,

12 ETH INVESTORS CLUB

constantly open. It’s a Shakespearean foil to domineering institutions.

As such, Ethereum as an Infinite Story Machine is fundamentally a liberational technology. It offers us flights of escape from top-down, heavilymanaged mainstream storymaking to bottomup, liberated storymaking, whether personal or collective. It’s a juke out of the constant interpellation by corporate and state actors, which are fine in most cases but nightmarish in the worst, into new territories of freedom.

And here on the other side, here in open Ethereum, things are more untamed and experimental and remixable. As ClubNFT’s Artnome recently put it, “When you allow everyone to [create] whenever they like and as frequently as they like, without curation or censorship, you encounter all kinds of fascinating and unpredictable art.”

Accordingly, unpredictable media leads to multiplicitous cultures, and multiplicitous cultures lead to more storymaking proliferating out atop Ethereum in all directions, and on and on and on the new Book of Everything expands along.

In this way, yes, I see Ethereum as an Infinite Story Machine, and I see this machine as like a rising rhizomatic structure, akin to the roots it metaphorically resembles. Each of its points of connection have the potential to branch off and proliferate into new directions. Instead of a centralized hierarchy, it instead presents a vast, interconnected web of narratives that grow organically and intertwine. Each transaction, each smart contract is a node in this sprawling structure, ceaselessly leading to new collaborations and unexpected offshoots.

13 CULTURE CORNER WINTER 24

“ BEYOND THAT, I BELIEVE THE CEILING IS INFINITY.

Here we become nomads, wandering the living machine, living our lives. Another major wrinkle of intrigue here is the ownership potential—what Chris Dixon calls the new Read Write Own paradigm for us nomads along these infinite pathways of storymaking and interaction. Everything from collecting an Art Blocks NFT to aping into the GROK memecoin occurs along these ways, and while there may be onchain dangers here and there, the machine offers us that awesome freedom to try.

In the meta sense, this movement to build out something different in Ethereum, this kind of technology as a story of stories, is something I find noble. It’s the good fight, and advances the interests of people everywhere. And this conceptual framing helps me better see Ethereum for what it is, a titanic, productive engine of financial and cultural creation.

Ultimately, then, Ethereum will be a success so long as many people are storymaking on it. Like with Terraforms, a minimum number of folks dreaming here will prevent Ethereum’s collapse forever. Beyond that, I believe the ceiling is infinity.

14

ETH INVESTORS CLUB

”

PHI LAND

tldr;Phiturnsyouronchainhistoryintothe building blocks for a Sims City-style social gaming experience.

Phi is an onchain world where users craft their metaverse plot, called Phi Land, with objects that are earned from their past wallet activity or by completing new actions. Built on Polygon, Phi combines the onchain history you already have with an engaging isometric pixel world to gamify the process of building your onchain identity. Phi’s Pixel art designers—a group of pixel artists and developers known as E-Boy—created Phi’s modular pixel art system, Tilix. E-Boy are also cofounders of Nouns Dao.

Get started with Phi by connecting your wallet (requirement: ENS Name). Objects are the components—branded structures and buildings—used to build on your Phi Land. You are eligible for objects based on your wallet activity. You can even connect web2 accounts like Instagram to earn new objects and build a full stack depiction of your identity. If you wanted

to delve further into building your plot, you can complete new quests and adventures from 3rdparty developers. Earn new objects to customize your Phi Land and illustrate who you are onchain— your activity, your achievements, taste, and more.

A marketplace for projects to tap in to Phi has also emerged. These projects can use the platform to generate engaging campaigns— quests and custom object art—for growing and retaining their user bases. Earning and flexing luxury and rare objects becomes the incentive for users to complete quests and adventures from 3rd party developers within the Phi platform.

Phi is pioneering an innovative approach to showcasing credentials and onchain identity. Give it a try for yourself!

Story by EIC editorial staff.

15

NAVIGATING THE WAVES OF ONCHAIN MUSIC

Arella Trustman Copywriter, VeeFriends

Arella Trustman Copywriter, VeeFriends

ETH INVESTORS CLUB

Late 2021 and early 2022 saw the onchain music scene thrive, buoyed by the NFT summer bull run’s momentum. During this period, music artists who had never made a dime off their music were finally seeing monetary recognition for their craft, with some making significant profits. As with any evolving market, dynamics have shifted, and the financial landscape for musicians has changed. However, the barrier to entry into this emerging industry has lowered, making onchain music an enticing frontier for artists of all backgrounds.

The Rise of Music NFTs

Music NFTs didn’t materialize out of thin air; visionary musicians and music enthusiasts, all tech-savvy and forward-thinking, seized the opportunity presented by the PFP NFT wave. Early adopters such as RAC, Daniel Allen, Verite, and even Snoop Dogg paved the way. The onchain music space gained traction, reaching a new pinnacle with the launch of Sound.xyz in early 2022. Artists on this platform were not just creating music; they were making history, enjoying the thrill of a booming market that forever etched its mark.

The Bear Market Challenge

The abrupt crash of $LUNA, coupled with the FTX meltdown mere months later, dealt a severe blow to the market. In this tumultuous period, NFTs also earned an unfavorable reputation, rendering most collections obsolete. These events marked a significant turning point in the sentiment surrounding onchain music. Artists faced unprecedented challenges as music NFTs struggled to find buyers, resulting in a substantial decline in income. Despite these adversities, the onchain music space exhibited remarkable resilience. With a strategic rebrand to “onchain music” with “digital collectibles,” and the introduction of innovative platforms for minting and streaming, the space not only survived but laid the foundation for a creative resurgence, poised to flourish in the next bullish market.

The setback prompted a necessary reevaluation of strategies within the community. The onchain music ecosystem became more than a market; it evolved into a collective effort to weather the storm and emerge stronger on the other side.

Building Back Stronger

WINTER 24 CULTURE CORNER

communities of super fans and creatives alike. Recognizing the imperative to make onchain activities more accessible, platforms like Sound. xyz took proactive measures. Opening their doors to the public in July 2023, they have consistently implemented crucial improvements. These enhancements include the integration of Optimism to alleviate gas fees, the provision of custodial wallets, and the facilitation of credit card payments, catering to both artists and fans less inclined to navigate the complexities of crypto. In a recent stride, they introduced gasless uploads, further dismantling entry barriers and fostering a more inclusive onchain music ecosystem.

The contraction of the space was not merely a consequence of market dynamics; it was an opportunity to redefine the onchain music community. Artists and enthusiasts, united by a common passion for this evolving form of artistic expression, built a support system that transcended traditional market fluctuations. In this more intimate environment, the essence of onchain music flourished, unencumbered

by external pressures. To this day, the space continues to be highly active with new artists seeing success daily.

Navigating the Path Forward for Onchain Music

In stark contrast to conventional streaming platforms, onchain music ecosystems thrive on community-driven curation, relying on factors such as volume, mints, and playlist inclusion to spotlight the finest releases. Embracing the fundamental tenet of decentralization in blockchain technology, this shift towards exclusive community curation places the reins firmly in the hands of music enthusiasts. It marks a significant departure from the norms of traditional streaming services, rendering onchain music an even more captivating frontier.

For music aficionados this paradigm shift offers a golden opportunity to shape the trajectory of emerging musical trends. The allure lies in the power vested in fans to influence the next big

ETH INVESTORS CLUB

wave of popular music. This compelling prospect should be a pivotal reason for fans to engage proactively. Presently, the landscape invites enthusiasts to delve into the expansive onchain music catalog, actively contributing to an artist’s growth not just through digital collectible purchases but also by curating playlists and establishing themselves as influencers of “good music.” While this is a very exciting feature of the onchain music space, it has largely not caught on to the greater music scene.

Additionally, with the barrier to entry significantly lowered, one might expect onchain music to be on the rise, and fast! However, a significant hurdle remains—attracting fans. Wallet fatigue has set in amongst existing paying participants, evident in the overall volume and reduced pricing of onchain music. While this price drop may not align with artists’ wishes, it creates favorable conditions, along with aforementioned opportunity, for fans to enter the space. At this point, improving the technology will only drive incremental success. In order for onchain music to revolutionize the industry, the more necessary

work is on awareness. It’s not just about making music; it’s about making a cultural shift that requires collective public facing efforts.

As we stand at the intersection of past challenges and future possibilities, the onchain music community has the opportunity to redefine its narrative. The journey, marked by highs and lows, has been a testament to the resilience and creativity inherent in this space. The path forward is one of collaboration, innovation, and a shared commitment to propelling onchain music into a new era of artistic exploration. The waves of onchain music continue to surge, and with each rise and fall, the community charts its course towards a future where the possibilities are as boundless as the digital realm itself.

~~~

WINTER 24 CULTURE CORNER

From SuperRare to Sotheby's

Other World has earned a seat at the table as one of the most prolific artists distributing their work onchain. Since beginning in 2020, he’s created works culminating in over $1m raised, exhibits at Art Basel (2022), and having his NFTs auctioned through Christie’s (2023) and Sotheby’s (2024). Other World’s signature style is a collage of psychedelic, digitally-enabled color spectrums depicting scenes pouring with human condition—often using iconic works as a base layer. In this interview, we spoke about the state of Other World in early 2024.

Other World, it’s a pleasure to speak with you. I guess I’ll just start by asking about your upbringing and background as an artist.

I’ve always enjoyed creating art. I did it as just a hobby for most of my life. I didn’t ever think of it as a realistic career choice. I remember there was a time when I wanted to be a cartoonist as a kid, but other than that I pursued science. Both my parents are artistic, but my mother was the one who was more involved in art when I was growing up. A major life moment for me was moving out for college and then later being accepted into the PhD program I am in today. It really felt like I solidified my career trajectory up until I found my way back into art. During the Covid lockdown, I found myself with some more free time and decided to pick up digital art. I initially created using a quick collage approach with minimal illustrating. This was very fun as I could make a piece every day or two and used music as big inspiration during this time. Over time, I wanted to create art that I can see being displayed in galleries and museums one day, so I started adding more details and illustrating

more. Naturally, the art progressed to where it is today, and continues to grow and change.

You’ve now sold dozens of works onchain across platforms from SuperRare to Sotheby’s–How did you discover the ability to distribute your art onchain?

I came across crypto art and onchain distribution through Twitter. Minting and distributing art is an amazing thing in the digital world. It seems like life is getting more and more digitized and being able to own and trade art (and other digital goods) freely onchain is the next logical step.

SuperRare was the first place where I heard of NFTs. Back in the second half of 2020, SuperRare was the place to be for most artists and being accepted was difficult. Before applying, I gave myself some time to create 5 worthy artworks for the application. Only 1/5 of these artworks have been minted. The one minted is my genesis and it was sold to Zack from SuperRare (who has been a great mentor in this field).

OTHER WORLD

Till Death Do Us Part: April 5, 2022 | JPEG, 6000x7200 px | SuperRare | Last Sold: 30Ξ Description: I Hope It Does... Based on Boreas Abducting Oreithyia by

Solimena

Francesco

The Fall: December 6, 2022 | JPEG, 6000x7200 px | SuperRare | Last Sold: 66

Description: Play your hand... Based on art by Vincenzo Camuccini and Jan Van Eyck

Ξ

That’s a legendary arc. You are one of a handful of artists who simultaneously have made a relatively high onchain artwork value (>$1m) but a low quantity of pieces.

How do you think about saturation with releases vs. maximizing a moment?

I think that my quantity of art being lower than most artists has been due to my approach. In the beginning, I primarily focused on 1/1 art. I tried to experiment and advance my skills with each creation and focused on quality over quantity. Apart from this, I was also (and still am) limited in the time I can put into art because of school.

These two things together naturally resulted in my art being released at a slower pace. The market determines the demand of art and the main thing I try to focus on is the art itself. If the art is improving and in demand, then the market will show that. I think art is subjective in terms of what types of art some people may like vs others, but I believe good art in each genre and medium is objective in nature. There’s a science behind what makes good art and what is widely accepted by humans as good art.

Your works feature classic paintings as a base layer, but you make them distinctly original, inflecting vibrant, psychedelic colors and emotionally stirring characters. In some ways your collage style feels reminiscent of music sampling and remixing, is that a conscious inspiration?

Music sampling itself is similar in idea to how I do my collage style, but its not an inspiration itself. However, music itself is a huge inspiration for my art. I listen to music most of the time while making art

and it greatly impacts my workflow and direction in art. Sometimes I try to capture the feeling of a song and other times a single lyric will inspire a piece.

Which classical artists or paintings influenced your style the most? How do you decide which artworks to remix?

I’ve made works based on artworks from JacquesLouis David, Caravaggio, Vincenzo Camuccini, Ilya Repin, and many others. I always include this information in the description when I mint. I don’t have a specific way of how I decide on which artwork to remix. It’s simply just what I see would make a good scene and just comes naturally. Looking at an artwork, I try to imagine if I could do something special with and honor that piece with my own rendition and creation of a new artwork with a different meaning that is personal to me.

Can you walk us through your process, tools and techniques?

I don’t use many fancy tools for my collaging approach. Just the features in Procreate on the iPad. I cut out pieces I want to use, refine them, illustrate on top and combine with other parts of different paintings to create a new scene and setting.

How did you hone your style?

It’s always a balance to keep the works related to each other while still experimenting and advancing the art. Throughout my artworks, I tried to draw the fiends slightly differently for some pieces, or to zoom out and create larger artworks. I’ve also added more detail to the fiends in more recent works compared to my earlier pieces. These

The Last Passage | January 15, 2021 | JPEG, 5191x2747 px | SuperRare | Last Sold: 13.500Ξ

Description: What’s going on here? (Based on The Last Supper by Leonardo da Vinci)

The Last Prayer: February 17, 2021 | JPEG, 3200x4000 px

Christie’s | Last Sold: 23Ξ

Description: Based on the painting “Sermon on the Mount” by Carl Bloch

The Dancers: March 22, 2021 | JPEG, 3200x4000 px

SuperRare | Last Sold: 7Ξ

Description: Just passing the time... Based on “The Calling of Saint Matthew” by Caravaggio and “A Perspective View of the Courtyard of a House” by Samuel Dirksz van Hoogstraten

changes have kept the familiar themes of my art while showing an improved outcome aesthetically, especially in the detail.

Fiends are one of your more recognizable signatures—What do they represent?

Fiends represent the darker side of humans. They are mischievous, violent, and not trustworthy. This being said, they are just as natural as the “good” side of humans. I like for the viewers to come up with their own interpretations as well.

You are also doing your PhD in biomedical engineering, what’s the story there?

Science has always interested me since I was a kid. Figuring out how the world around us works and using this knowledge to advance man-kind. The combination of engineering and biology piqued my interest and I decided to pursue a PhD in this field. This being said, most science and papers that come out are boring to me, but the area of research I am in currently is very “sci-fi” which is why I’ve enjoyed my program even though the day to day process of being a scientist is very tiresome and demanding. Novel experiments in the lab take multiple days to set up and fail 4/5 times through the development stage. This has taught me a lot about time management, patience, and planning. This has undoubtedly helped my art career.

That’s pretty incredible. So getting close to the end here, has the scale of the success surprised you? You’ve now done Sotheby’s and Christie’s auctions, Art Basel exhibitions, etc.

The success was great to see of course and a bit surprising, but I always try to keep a level head through it. I know nothing is guaranteed and that I have to continue to advance and work on my art in order to achieve the goals I have set for myself. I’m still at the very beginning of my art career and have a long way to go before I feel like I’ve made my mark.

What has been the most interesting or unexpected reaction to your work?

I always love to hear how my art has inspired others. It never gets old and is a very big perk of being an artist. Hearing sincere words from others of how my art has changed their life in small or big way is very special.

What’s next for Other World?

Bigger art projects in areas and mediums that I have yet to explore.

Interview by EIC editorial staff.

Edited for clarity and brevity.

Garden | November 30, 2021 | JPEG, 9600 x 5400 px | Sotheby’s | Last Sold: $50,800 USD Description: A plentiful harvest...based on The Last Day of Pompeii by Karl Bryullov

The

THE rise of composable worlds

Ben Giove Creator, WASD

Ben Giove Creator, WASD

Today I want to explain why I think composable worlds are one of the most interesting, exciting, and powerful niches within the fastgrowing onchain gaming space.

We’ll dive into:

• The affordances composable worlds provide to developers

• In-production examples of them

• The implications of their creation

By the end, you’ll be as composable world pilled as I am.

Now…let’s get to it!

Note: This article expands and builds upon many of the concepts outlined in Baz’s Piece. It’s a great read; I’d highly recommend you check it out here.

AFFORDANCES OF COMPOSABLE WORLDS

Before diving into the projects building them, let’s take a moment to understand the affordances composable worlds provide to developers.

As they live entirely on a blockchain, composable worlds inherit all of the attributes of standalone onchain games like transparency, persistence, hardness, and (of course) composability.

However, by acting as a shared base layer, composable worlds provide additional benefits, including:

Standardization

Similar to (or in tandem with) engines like MUD and Dojo, developers building on top of a composable world are doing so an existing set of standards. This streamlines the development process, as they won’t need to architect underlying infrastructure themselves.

Supercharged Composability and Interoperability

As previously mentioned, all onchain games can leverage composability.

Games in composable worlds, however, offer greater interoperability with other in-world creations, enhancing integration and interaction.

Network Effects

Projects within composable worlds can benefit from strong network effects, as they tap into its existing users, developers, and infrastructure.

Incentive Alignment

The inhabitants of a composable world have naturally aligned incentives because they reap the rewards of its growth.

Autonomy

Because their logic lives on onchain, projects built in a composable world have reduced platform risk, as (at maturity) they will not be beholden to the whims of a centralized authority.

COMPOSABLE WORLDS IN PROD

Now that we understand the theoretical opportunities of composable worlds, let’s look at how they fare in practice. To do so, we’ll explore three of them: Downstream, Briq, and PixelLAW.

the rise oF COMPOSABLE

DOWNSTREAM ��

The TLDR: Downstream is an onchain MMO (massively multiplayer online game) built by Playmint. Developed using their own custom engine, Downstream is set in Hexwood, a 3D universe filled with (surprise, surprise) hexagons.

Hexwood is ruled by an AGI known as MORTON, who aims to develop his domain by using woodland creatures known as units. You’ll become one of these unit when you play Downstream, where you’ll be able to explore, battle, build, complete quests, and more.

Downstream has placed a heavy emphasis on composability. For instance, players can design and deploy structures in Hexwood through an in-game UI. This is code-free – Meaning that anyone can do so with ease.

Downstream is still in development, though players can sign up for their waitlist via email.

Examples of Composability:

Downstream’s composability extends not just to creating user-generated structures, but entire games and experiences.

COMPOSABLE WORLDS

A Look at Hexwood

A prime example of this is Tonk Attack, a game built in Downstream by the aforementioned Tonk team. Tonk Attack is similar to an onchain version of Among Us. In it, players will aim to overthrow MORTON by forming an alliance (known as the Tonk Alliance) to corrupt the AGI’s training data.

However,MORTONisnopushover.

They’ll attempt to counter this coup by brainwashing one player’s unit, causing them to go rogue and look to kill members of the Alliance.

Like Among Us, players will have to identify and defeat this brainwashed unit. Tonk Attack is set to begin playtesting soon.

Despite limited public footage, the game’s GitHub provides clues as to how it will leverage Downstream’s composability. For instance, players can access the game by

entering a structure within Hexwood known as the Botnet Tower and then crafting a “Tonk Item.”

I’m excited to try out Tonk Attack, and think it’s a very intriguing use of Downstream’s composability.

BRIQ ��

The TDLR: Briq is a Starknet-based onchain construction protocol that (as of last week) is built in Dojo.In Briq, users can create objects, games, or experiences within a 3D voxel world using blocks known as (you guessed it) briqs. Anyone can access Briq and begin creating without a wallet.

However, users can mint their design as an NFT, with the cost to do so based on the number of briqs used. Briq is often compared to “onchain legos,” and for good reason. This is because, aside from its simple UX, each design can be assembled,

ETH INVESTORS CLUB 32

Ducks Everywhere PFP collection on Briq

disassembled, and re-assembled. Furthermore, creators can add instruction manuals that show users how to put designs together after they buy them.

All in all, this architecture enables Briq to be highly composable, customizable, and interoperable.

Examples of Composability:

Briq has begun to power a n assortment of different applications.

For instance, the protocol has been used to create PFP collections like Ducks Everywhere, a set of 265 different ducks. It’s been used for other art projects as well, such as to create portraits and host a design competition for the Realms community.

There are also several games built using a

combination of Briq and Unity, including ones in which you traverse through a recreation of London, fly in a spaceship, and race cars.

While these games are simplistic, they demonstrate Briq’s capabilities and potential to be a design primitive for all sorts of assets, games, and experiences.

PixelLAW ��

The TLDR: PixelLAW is a primitive built in Dojo on Starknet.

Conceived during the ETHGlobal Paris Hackathon in July 2023, PixelLAW consists of a shared grid of pixels. Each pixel in the grid has coordinates, and six properties (app, color, owner, text, alert, and timestamp).

33

CULTURE CORNER WINTER

The PixelLAW UI

PixelLAW is highly programmable, as developers can tweak said properties in all sorts of ways to create novel games and experiences.

Furthermore, given that they exist in the same, shared grid, these games can interoperate with one another.

Examples of Composability:

There have already been several games developed within PixelLAW.

This includes Paint, a game where players can color in pixels, Snake, where players attempt to complete a maze, and Rock Paper Scissors, an onchain version of the meatspace game. However, the most interesting creation I’ve seen so far is TicTacToe.

Developed last month during the ETHGlobal Istanbul hackathon, TicTacToe is a PixeLAW’d version of the namesake game that utilizes a machine learning (ML) agent to allow players to play against, what’s in essence, an onchain CPU.

The team that built PixelLAW (which includes its co-founder JK), won the $3000 first-place prize from Starknet during the event.

I think TicTacToe is incredibly cool, and illustrates that PixelLAW can serve as a sandbox for experimentation and creation with not just onchain games, but all sorts of emerging technologies.

The New Worlds Are Rising

As you can see, composable worlds have a ton of potential, providing builders with affordances like standardization, heightened composability, network effects, autonomy, and more.

Furthermore, these benefits are being put to use today with games, art, PFPs, and more being built in worlds like Downstream, Briq, and PixelLAW.

We’re just getting started, as we’ll likely see many novel experiences be created, and interproject relationships form, as these worlds develop and grow over the coming years.

All in all, I’m incredibly excited to track the progress of composable worlds.

To (kind of) of quote Tony Montana:

“The *composable* world is yours.”

What will you build in it?

Hop in our WASD Collector Telegram Chat and follow us on X to stay current on all things WASD.

This essay was originally published by WASD.

Inisights up next

34 ETH INVESTORS CLUB

Top NFT Collections

NFTs are digital onchain assets that represent ownership or proof of authenticity of a unique item or piece of content. Some of the most popular NFT brands are released as collections under a category called ‘PFPs’, where owners may display an asset as their profile picture on a social network to acquire or retain social status. A collection’s floor price is the cost to obtain its lowest-priced asset.

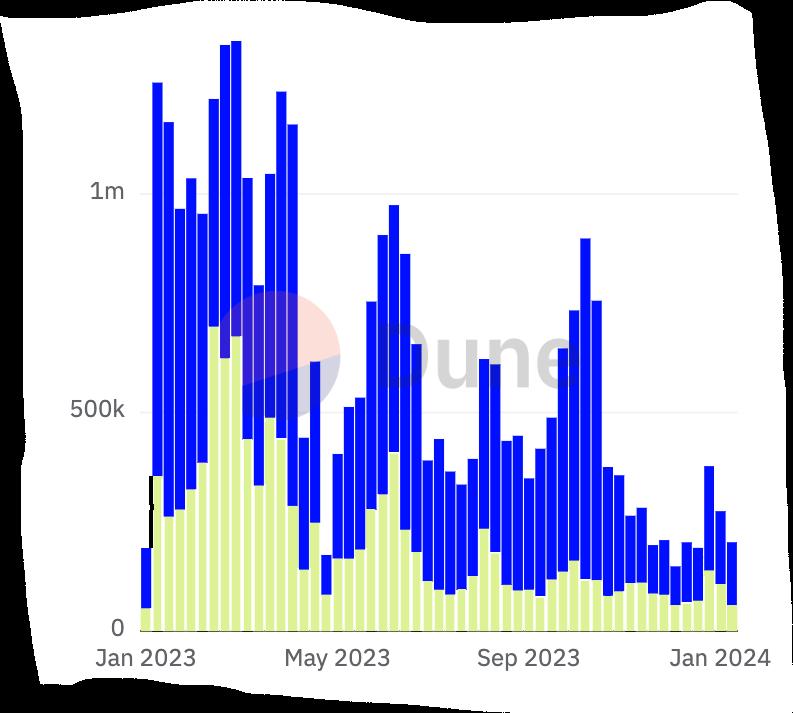

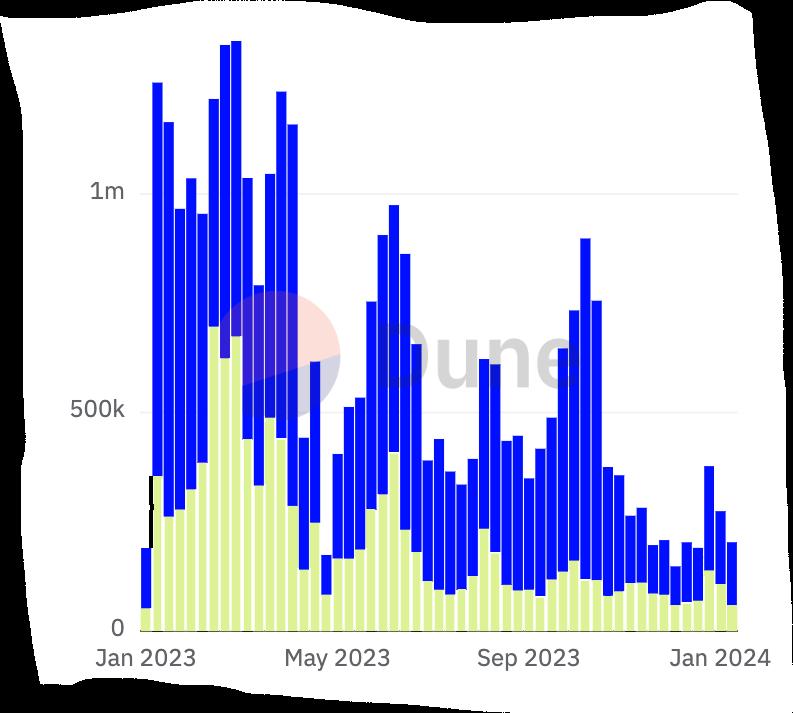

NFT Marketplaces

NFT Marketplaces are suites of smart contracts that facilitate peer-to-peer exchange of NFT assets. Both USD volumes and trader counts have been in a downtrend since the last bull market peak. Notably, over two years OpenSea has relinquished their dominance of important marketplace metrics to the upstart Blur.

ETH INVESTORS CLUB EIC CULTURE CORNER 35 FOR INFORMATIONAL PURPOSES ONLY, EIC01 WINTER 24. ALL DATA AS OF FEBRUARY, 14 2024.

by

by: @hildobby on Dune. Powered by: @hildobby on Dune. Marketplace USD Volume / Share Marketplace Traders Blur OpenSea CryptoPunks $108.7m / 74.7% $29.8m / 20.5% $3.7m / 2.5% OpenSea Blur X2Y2 32,783 22,132 1,430

Powered

CoinGecko. Powered

36 FOR INFORMATIONAL PURPOSES ONLY, EIC01 WINTER 24. ALL DATA AS OF FEBRUARY 14, 2024.

CULTURE CORNER

FUTURE OF FINANCE

Mike Taormina Partner, Switchpoint Strategies Co-Founder, CommonBond & Alluvial

Mike Taormina Partner, Switchpoint Strategies Co-Founder, CommonBond & Alluvial

A BLUEPRINT FOR REAL-WORLD ASSET ADOPTION

ETH INVESTORS CLUB 38

Many within crypto have a personal eureka story — the moment when they truly grasped the potential of blockchain technology. For me, it was when a good friend from graduate school was getting married in Asia. I couldn’t make the wedding but wanted to send a gift. I could have used the traditional banking system, but doing so would have incurred foreign exchange fees, wire fees, processing delays, etc. I didn’t take this path.

Instead, I sent USDC straight to his Ethereum wallet.

The funds arrived nearly instantaneously. My friend could easily swap the USDC and offramp the funds using his local exchange. I then imagined a not-too-distant future where enough merchants offered the ability to pay for goods

and services in crypto that users wouldn’t want or need to off-ramp funds.

At that moment, I saw blockchain technology’s potential for revolutionizing finance. And it wasn’t through bitcoin, a Bored Ape NFT, or the millionth fork of some Ponzi such as OHM — but rather with a simple real-world asset — a digitized dollar, traveling on more efficient blockchain rails. From then on, I saw tokenization powered by blockchains as finance’s future.

Real-world Assets

Real-world assets — or RWAs — are traditional financial assets (e.g., currency, private credit, art, real estate, stocks, bonds, etc.) represented (or tokenized) on a blockchain. Tokenization has

39

existed since the earliest days of crypto as a concept but has been a growing trend over the last two years. The typical arguments for tokenization are improved access, transparency, liquidity, and widespread efficiency — a wholesale revolution of financial markets.

Many can imagine that end state and how that world would be a step function change better than today’s status quo. To that end, reputable firms such as BCG, BlackRock, and S&P have estimated that trillions of dollars of value will be tokenized in the coming years.

However, there are a slew of obstacles that must be overcome on the road to that future. As a result, while there has been some early traction, the figures still pale in comparison to traditional global financial markets. As such, people working on RWA initiatives today talk about adoption over decades, not months or years.

Is there any way to accelerate this change?

In Switchpoint’s view, the pathway to meaningful RWA adoption necessarily involves compromise to realize the promise of tokenization. The purpose of this post is to outline the various issues holding back adoption and lay out a common-sense approach for RWA experimentation to overcome these roadblocks and ultimately unlock a wave of participation.

LET’S DIG IN.

Traction to Date

First, let’s review the current state of play. RWA traction to date has been a mixed bag.

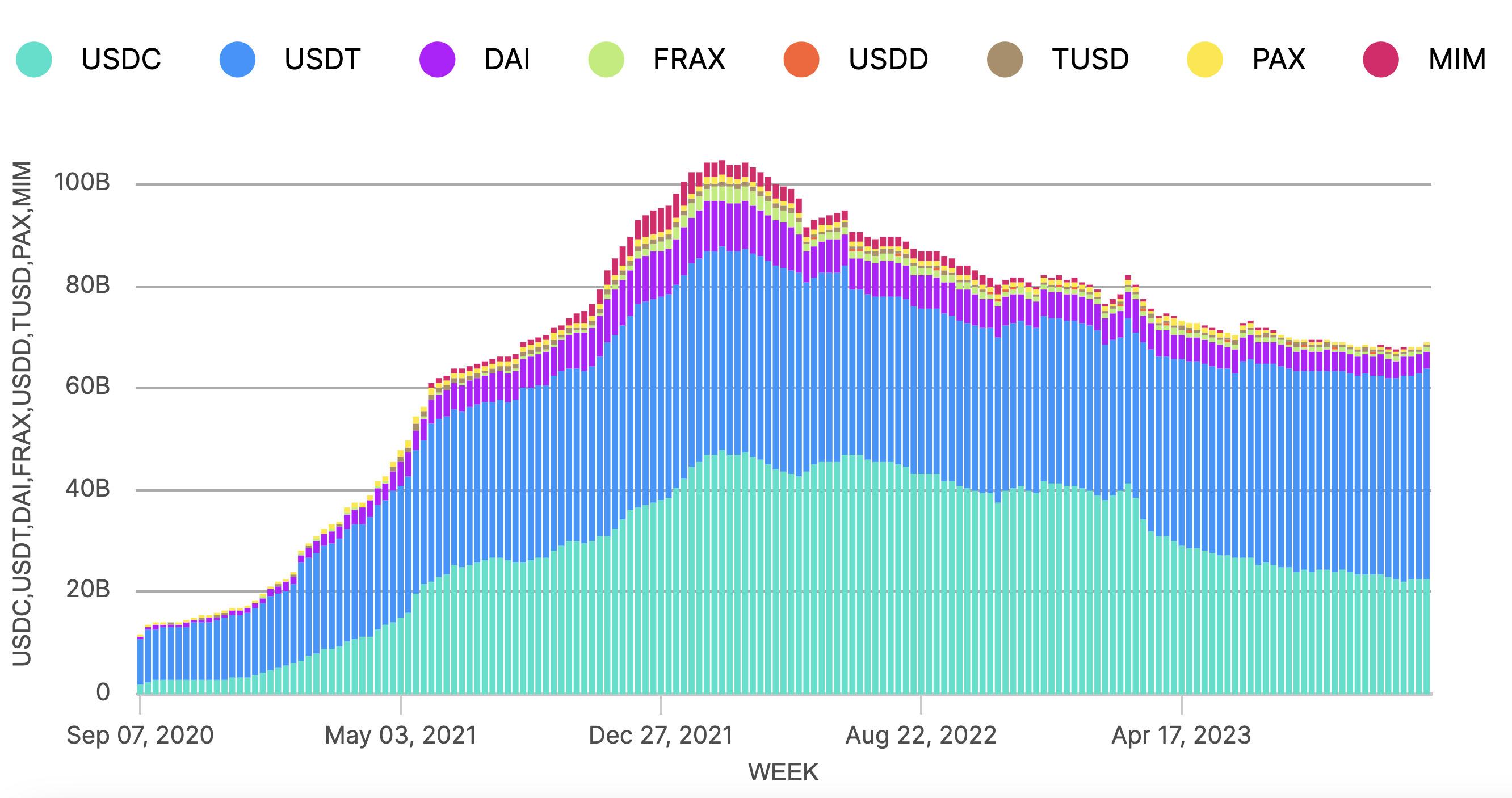

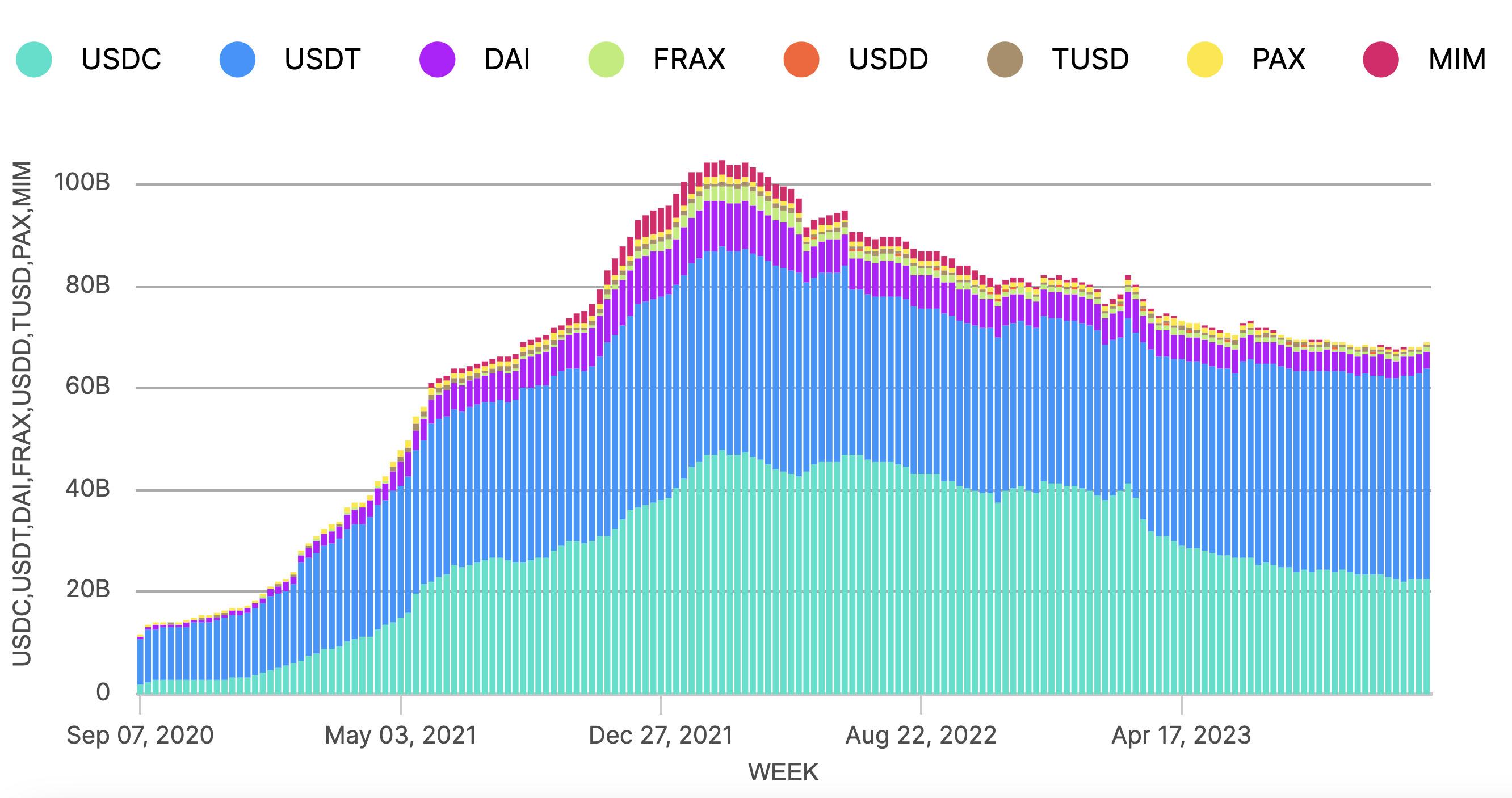

Stablecoins — typically the 1-for-1 tokenization of a U.S. dollar — represent one of the most powerful innovations in crypto. The 3rd and 8th largest digital assets by market value are stablecoins USDT and USDC, which hold over $125bn in value, the vast majority of the $140bn stablecoin market.¹ Stablecoins allow for easy, fast payments, are ideal for cross-border activity, and unlock borrowing and savings opportunities in DeFi. Arguably, DeFi owes its existence today to these critical RWAs. Stablecoins have been a colossal success.

Outside of stablecoins, however, the adoption is still relatively nascent.

U.S. Treasuries. Once risk-free U.S. government rates surged higher than stablecoin rates in DeFi, a wave of tokenized U.S. Treasury offerings flooded the market from players such as Ondo, Matrixdock, Backed, Maple, and Open Eden, as well as traditional financial institutions such as Franklin Templeton and WisdomTree. The aggregate tokenized Treasury market is just shy of $700mm as of this writing.²

ETH INVESTORS CLUB 40

Tokenized Treasuries allow holders to earn a yield they wouldn’t otherwise passively via popular stablecoins such as USDC (where yield is purposefully not passed along to tokenholders). DeFi platform Flux Finance allows Ondo $OUSG tokenholders to leverage their Treasury position to earn even more yield. These offerings often involve a KYC/AML check and incorporate traditional legal agreements and structures, such as special purpose vehicles. Only certain investors can participate; it is therefore permissioned, not permissionless.

In the wake of early traction with tokenized Treasuries, other tokenized fixed incomeofferings are coming to the market, offering exposure to

money market funds and short-duration bond instruments.

Private Credit. The third largest RWA bucket includes various lending protocols such as Maple, Credix, Centrifuge, and Goldfinch. These platforms vary in target borrower (institutional vs. retail) and lender segments (corporate, emerging market, etc.), as well as capital stack structuring. The common themes across these platforms are 1) harnessing smart contacts to create lending pool infrastructure and ABS-like tranches to slice risk and return more efficiently and 2) crowdsourcing capital from users via a blockchain. There have been over $4.5bn of originations to date, but active

ETH INVESTORS CLUB 42

Tokenized U.S. Treasury offerings with at least $1mm of TVL. Source: RWA.xyz as of February 22, 2024.

loans only total around $615mm,² due in part to adverse selection issues and the de-levering of the crypto economy since 2021.

Other Assets. Proponents of tokenization — including BCG in its 2022 report — often point to more illiquid or esoteric assets like real estate, art, royalties, funds, etc., as targets for tokenization. The truth is that not much has taken place in this bucket outside of a few one-off experiments. We don’t expect that to change anytime soon. Making an illiquid asset slightly less illiquid doesn’t remove its illiquidity risk.

No one is buying a fractionalized apartment, even if a blockchain provides a technical avenue to do so. In 2024, this type of tokenization activity is still a pipe dream.

Roadblocks to RWA Adoption

Many of these issues facing greater RWA adoption fall under the umbrella of switching costs. Imagine that we could create and agree upon the most perfect replacement for the

traditional financial system. Even then, it would still take an incredible effort to convince the current financial system to move en masse to this “perfect” alternative, not to mention training front-line workers who are used to legacy systems on our new perfect alternative. Now consider the practical reality that the state of blockchain technology today is far from perfect. The switching costs are only magnified because there is greater risk.

Meaningful cost considerations, barriers, and risks include, but are not limited to:

Lack of Regulatory Clarity. This is the greatest impediment to adoption. Blockchains like Ethereum may have established a technological standard, but to unlock meaningful institutional adoption, we will also need to see more consensus around a complementary regulatory standard to provide firms with the clarity that they are not risking major legal liability through experimentation. Europe’s MiCA regulation and Switzerland’s DLT Act offer the beginnings of a regulatory framework. By contrast, the United States has taken an antagonistic stance, and

WINTER 24 43

FUTURE OF FINANCE

Private credit protocols with at least $1mm of TVL. Source: RWA.xyz as of February 22, 2024.

sadly, that weighs heavily on the minds of institutions interested in RWA innovation. In addition, without a defining legal standard, it’s unclear how tokenized representations of ownership will be honored by various jurisdictions when issues inevitably arise.

Liquidity Risk. It sounds innovative to take an illiquid asset like art, real estate, and apparently, even uranium — and tokenize

it to potentially increase access and liquidity. However, the level of liquidity to get most institutional buyers comfortable is far greater than the liquidity we see in these secondary markets today.

Education Gap. “Going down the rabbit hole” to learn about crypto and blockchain is not an evenly distributed experience. The crypto rabbit hole is deep, and many — particularly institutions — don’t get

44 ETH INVESTORS CLUB

far enough down it to feel comfortable enough with new considerations like wallet security and smart contract risk.

Adverse Selection. The earliest RWA experiments have been prone to adverse selection. As Switchpoint wrote here, the Goldfinch platform has notably suffered from recent borrower defaults. This was unsurprising, at least to anyone who has worked in credit. There are enough risks with utilizing a new technology. Adding meaningful credit risk only complicates matters, and the ecosystem hasn’t earned the trust that it knows how to assess these financial risks to the standard that institutions demand.

User Experience. Blockchain technology today makes some things better but also introduces novel risks and is still clunky to use. A popular startup tenet is that a new product needs to be 10x better than the existing solutions to overcome switching costs. Well, if we’re being honest with ourselves, crypto today is better in some ways, but while it holds the promise to be vastly better in the future, it is not a 10x better experience today. Institutions must shoulder new operational issues (wallet & key management, smart contract risks, extra reporting, disaster recovery, etc.) that they do not have in TradFi. We’re still (too) early on this front.

Ideological Rigidity. Too many people in crypto espouse a religious zeal for

certain deeply held tenets, attimes mocking anything resembling compromise. Purity tests are not helpful for attracting mainstream adoption and can appear outof-touch to anyone outside crypto. It’s not just the laser-eyed Bitcoiners but highly credible people in the DeFi ecosystem. Purely decentralized, crypto-native apps and solutions can co-exist with tokenized real-world assets. Experimentation, even when the experiment doesn’t perfectly conform to ecosystem ideals, should be encouraged.

Public Narrative. 2020–2022 was something to behold. We witnessed Ponzi schemes, mismanagement, and outright fraud from the likes of FTX, 3AC, Terra, etc. Those in the space rightfully saw those events as the same centralization-goneamok that has plagued traditional finance forever. Unfortunately, the industry did not win the PR war, and too many outside of crypto today associate decentralized technology with these centralized frauds. This may tragically be Sam BankmanFried’s enduring gift to the space, and it will take a long time to regain trust, particularly among institutions.

An Emerging Blueprint

That’s a lot of issues to work through. The good news is that the recent wave of tokenization has increasingly pursued Circle’s USDC playbook to create constructs

WINTER 24 45 FUTURE OF FINANCE

that help to mitigate these concerns and spark greater RWA adoption by embracing:

Simplicity. The more complex an RWA offering, the greater the switching costs involved because of the heightened due diligence burden. It shouldn’t be surprising that 1:1 USD stablecoins have meaningful traction or that Treasury-based offerings have seen the second-most traction. They’re simpler to understand for participants relative to, say, a multi-tranche emerging market loan securitization. RWA projects should deliberately tokenize simple, plain vanilla assets and achieve product-market fit there before focusing on more complex offerings that are less likely to gain traction today.

Low-risk Assets. This is similar to simplicity. This industry will only get to the point of tokenizing illiquid, higher-risk assets if RWA models are first proven with the most liquid, well-understood markets in traditional finance. Institutions are professional risk managers. Asking them to take a technology risk (alone) is a much lower bar than asking them to participate in a construct that also includes substantive liquidity and/or credit risk. Earn the right to move into riskier, more illiquid asset classes by first getting tokenization right where burdensome liquidity and credit premia aren’t a holdup for participating.

Compliance. Permissioned chains and compliant apps/solutions are not the end of decentralization. At Switchpoint, we believe institutional participation in any type of blockchain (private, permissioned, or public) is a rising tide that lifts all boats. Given the uncertain regulatory environment, a concerted effort to create a compliant structure (i.e., by incorporating KYC/AML) is a foundational requirement for institutional participation and not a sign our “hearts are not in it” (see following reference). These are regulated entities, and protocols need to be mindful of such user

constraints to successfully target an institutional segment.

Compromise: The Ultimate Key to Greater RWA Adoption

Ultimately, the key unlock for greater RWA adoption is to make pragmatic trade-offs to gain traction and realize the promise of blockchain technology. RWA adoption will increase with more solutions that compromise where zealous fanatics will not:

Not fully decentralized. Successful RWA efforts will carry some degree of centralization. For instance, today’s tokenized Treasury solutions set up special purpose vehicles — limited liability entities incorporated in a particular jurisdiction like the State of Delaware — that hold real-world assets like U.S. Treasuries in a bankruptcy remote fashion. This is a due diligence requirement for most institutions and, therefore, essential for onboarding more institutions.

Not fully permissionless. This is where compliance comes in. As noted above, KYC/AML is table stakes for institutional adoption in many jurisdictions. By definition, this means there must be some degree of permissioning and (limited) privacy give-up.

46 ETH INVESTORS CLUB

Recognition that TradFi isn’t always the enemy. There has been a sticky good vs. evil narrative in Crypto Twitter when it comes to TradFi. We should view TradFi not as a villain to eradicate but rather as potential partners and customers. That’s the mainstream market if we actually care about achieving product-market fit.

Acknowledgement that regulation isn’t (all) evil. You could be forgiven thinking that all governments are on a mission to eradicate blockchain-based activity, given the United States’ posture. At Switchpoint, we view the U.S. stance as a form of Innovator’s Dilemma — protecting a system that most benefits the incumbent (in this case, the U.S. and its financial sector). The Innovator’s Dilemma framing anticipates competitors coming to take a shot at the market leader by being more open to crypto, and that’s exactly what we’re fortunately seeing from others like Europe with its MiCA.

I can feel the hardliners’ heads exploding. This is short-sighted. If they’re right about opensource, permissionless transacting producing a better financial system, they shouldn’t fear institutions trying a different way to get their feet wet. Many with this concern aren’t truly afraid that institutions will co-opt a movement. Rather, they’re afraid that they’re wrong that these values are a necessity for an improved financial system.

As noted above, we believe more RWA adoption on permissioned chains/apps will bring more adoption across crypto, including on permissionless, fully decentralized finance. We’ve already seen this in practice with Circle and Tether, the centralized entities behind the RWAs largely powering decentralized finance.

The irony of making compromises to enable ring-fenced, permissioned RWA offerings is that subsequent adoption will inevitably lift activity that reflects the deeply held tenets of the crypto community and gives blockchain its best chance to realize the promise of a better financial system.

¹ DeFi Llama ² RWA.xyz

This essay was originally published by Switchpoint in Q4 2023. Figures have been updated as of February 2024.

WINTER 24 47

FUTURE OF FINANCE

THE ROAD TO $10 BILLION: SCALING ERC-4626 TOKENIZED VAULTS

Joey Santoro

Author, ERC-4626; Founder, Fei

Joey Santoro

Author, ERC-4626; Founder, Fei

DeFi is the financial layer of the internet. DeFi protocols interact with tokens to provide financial utility— liquidity for exchanging between tokens, borrowing a token against another collateral token, lending for yield, and more. These protocols can only exist because they support token standards such as ERC-20 (fungible tokens) and ERC-721 (NFTs).

Without standards, these protocols would need to be constantly rewritten or upgraded to handle each new token. The complexity and friction caused by the absence of token standards would make DeFi itself impossible.

Many protocols enhance their base-layer utility by making the deposit receipt itself a token (i.e., Compound cTokens). This practice has allowed for superfluid collateral and rehypothecation of all types. However, for the early history of DeFi, there was no standard at all for interacting with these types of deposit receipts. This led DeFi protocols higher in the stack to develop custom connections between different yield sources. These custom integrations increased complexity, development time and hack risks.

Enter ERC-4626.

ETH INVESTORS CLUB

48

Why Are ERC-4626 Tokenized Vaults So Important?

Note: I will refer to ERC-4626 and Tokenized Vaults or just Vaults relatively interchangeably, with the former emphasizing the standard and the latter emphasizing its usage and utility.

The ERC-4626 standard was born out of a need to standardize the common situation of issuing a deposit receipt for some tokenized yield opportunity.

ERC-4626 functions as a containerization standard for DeFi. A Tokenized Vault literally acts like a container for your tokens when deposited into another protocol. While your tokens are in the Vault providing financial utility, you maintain a liquid representation of that deposit which you can then use as collateral in DeFi, increasing capital efficiency and composability.

Because ERC-4626 defines a standard interface, new protocols and UIs can rely on the standard to have safer integrations, tooling, and automations. The safety comes from the fact that all of the ideal

security properties of a Vault can be enumerated and tested for in a systematic way, such as with the existing security tooling suites. For example, the $130m CREAM hack exploited the share price of a non-standardized vault to inflate the value and borrow without sufficient real collateral backing. ERC-4626 standardizes the exchange rate oracle of a vault and provides out of the box testing to ensure that this scenario is not exploitable in the future. Tokenized Vaults are essential to the safety and composability of DeFi, and will play a part in the institutional and global scale adoption of DeFi.

First Class Usage

ERC-4626 has already surpassed $2.6 billion in TVL as of publication. It has been less than two years since ERC-4626 was created. Reaching multi-billion dollar scale within two years is a comparable adoption curve to other great token standards such as ERC-20 (fungible tokens) and ERC-721 (NFTs).

Tokenized Vaults are quickly being adopted by the largest DeFi protocols across a wide variety of use cases including lending, protocol native

“

Tokenized Vaults are essential to the safety and composability of DeFi, and will play a part in the institutional and global scale adoption of DeFi.

50

” ETH INVESTORS CLUB

yield, and LP rehypothecation. Some protocols using the standard are:

ERC-4626 is an ideal candidate to standardize the deposit and withdrawal of an ERC-20 token into an underlying yield strategy for any protocol, as highlighted by the diverse examples above.

This article is highlighting the current and future developments in the ERC-4626 ecosystem which will help bring ERC-4626 from the current ~$2.6bn in TVL to $10bn and beyond.

Extending the Standard: ERC-7535 ETH Vaults and ERC-7540 Async Vaults

Now that ERC-4626 has been battle tested extensively with billions of dollars, there is an opportunity to further standardize the most common use cases for token vaults. I coauthored the first two of these (ERC-7535 and ERC-7540), which are currently published for review and are making their way through the ERC process.

ERC-7535: Native Asset Tokenized Vaults standardize vaults where the underlying asset is Ether instead of an ERC-20. This is critical because Ether is not in fact an ERC-20 token even though it behaves like a “token”. It is useful for Liquid Staking Tokens and upgrading Wrapped Ether.

ERC-7540: Async Tokenized Vaults standardize vaults which require a 2-step deposit OR withdrawal process. These are common when there is some backend processing which may not be fully liquid, or an element of the mechanism design which requires a delay to deposit or withdraw. It is useful for Real World Assets (RWAs), Liquid Staking Tokens, and Fixed Term or Undercollateralized Lending.

Adoption of these new extensions will further the already exponential adoption of ERC-4626, especially in the Liquid Staking and Re-staking use case which is highlighted below.

Liquid (Re-)Staking as a Driver for TVL

Liquid staking has quickly become a major component of DeFi due to the increased liquidity and yield on ETH it provides. It is an multi billion dollar market with no signs of slowing growth.

As a category, it suffers from the same issues with ERC-20 yield opportunities that Tokenized Vaults aims to solve. The various Liquid Staking Tokens (LSTs) do not have any kind of standard interface for depositing or withdrawing ETH, or accruing yield and determining the exchange rate between the LST and ETH.

Together, ERC-7535 and ERC-7540 create a liquid staking standard. ERC-7535 handles the deposit, withdrawal and conversion functionality with ETH as the underlying asset. ERC-7540 handles the

WINTER 24 51

FUTURE OF FINANCE

delay on depositing and withdrawing to handle any queueing at the Ethereum protocol level.

Having standardization at this level makes integrations even easier for higher level protocols such as liquid staking aggregators and re-staking protocols such as Eigenlayer. Standardization will improve security and composability for existing tokens, and reduce friction for the market to support a more robust variety of LSTs.

Pushing ERC-4626 Forward

There are so many ways in which ERC-4626 and its extensions are changing the DeFi experience for the better:

• Several security tooling suites

• Extension development for specific use cases (more to come)

• Data around adoption of existing vaults

• A growing community of ERC-4626 developers via the 4626 Alliance

Tokenized Vaults increase the security and composability of protocols, all with a reduction in development and integration effort. As the ecosystem matures, the TVL in Tokenized Vaults will continue to reflexively grow with DeFi itself.

If you want to keep up with or help improve the ERC4626 ecosystem, join the 4626 Alliance telegram and follow us on twitter

ThankyoutoCampbellHarvey,JesseWalden,Storm Slivkoff and Caleb Ditchfield for contributing their insights and feedback to enrich this piece.

ERC-4626

Call for Contributors:

EIC01 is a proof of concept for something much bigger.

EIC can one day realize itself as an autonomous onchain entity crafting immersive, captivating multimedia stories that celebrate Ethereum.

We need you

Authors ▪ Editors ▪ Data Wizards ▪ Developers ▪ Designers

Get involved below:

Farcaster /eic

Alternatively email your portfolio or best work samples to: peter@ethinvestorsclub.com

��

ETH INVESTORS CLUB ▪ SPRING 24 EIC02 ETH INVESTORS CLUB ETH INVESTORS CLUB ETH

Ryan Berckmans Founder, 3cities.xyz

Ryan Berckmans Founder, 3cities.xyz

THE FUTURE OF

GLOBAL PAYMENTS

OF

In the evolving landscape of financial transactions, the future of payments is rapidly shifting towards a model defined by zero fees and pure softwarebased systems.

This shift is primarily driven by the advent of public blockchains, which offer the potential to replicate and enhance the high-level user experience of platforms like Stripe and PayPal, without the constraints of centralized gatekeepers and the burden of fees.

This essay explores the trajectory of this evolution, illustrating how a decentralized, open-source approach to payment processing could revolutionize the way we handle financial transactions.

The Stripe Revolution

The journey towards this new paradigm can be traced back to the emergence of Stripe in 2010.

At its inception, Stripe distinguished itself by offering an online credit card payment API that was not only well-designed and well-documented but also reliable and user-friendly. This revolutionized digital payments in tradfi, setting a new standard for what businesses and customers could expect from payment processing services.

Interestingly, Stripe initially perceived its service as catering to niche companies, and did not anticipate widespread adoption by major corporations. However, this perception was proven wrong when giants like Amazon started using Stripe in 2017, highlighting the scalability and broad appeal of well-constructed payment platforms.

The Emergence of Wallet-to-Wallet Payment Software

Similar to Stripe’s impact in tradfi, wallet-to-wallet payment software in the blockchain space initially seemed esoteric and niche.

Today, most of the focus in crypto payments is on integrations with tradfi, such as embedded onramps and the ability to choose between paying with crypto or by credit card.

However, as the global adoption of wallets increases and the advantages of cryptocurrency become more pronounced, a parallel shift is occurring.

The increasing convenience and diminishing drawbacks of crypto pave the way for an open, decentralized, zero-fee wallet-to-wallet payment protocol. Such a system is poised to capture a significant share of global payments, emulating and one day surpassing the growth trajectory of platforms like Stripe.

The Open-Source Advantage

The transformative potential of open-source software in payment processing cannot be overstated.

Open-source systems offer transparency, freedom (as in speech), and extensibility, allowing anyone to contribute and enhance the software. This model is well suited to the payment industry given its complexity and continual evolution.

By investing in a shared codebase, a community of users and developers can collaboratively improve and adapt the payment technology, each benefiting from the contributions of the others.

56 ETH INVESTORS CLUB

This phenomenon, seen in other successful open-source projects like Linux and Wikipedia, improves the tradeoff frontier by enabling maximal extensibility, quality, and cost efficiency.

Why Decentralized Payments?

The move towards decentralized payments is driven by both intuition and economics.

Decentralization eliminates intermediary rentseekers and, by being pure software solutions without the cost and risk of corporate service relationships, offers unprecedented scalability and embeddability in various contexts.

Being both open-source and decentralized is required to maximize a payment system’s credible neutrality, and in doing so, minimize adoption risk and friction.

This makes open-source decentralized payments not just an alternative, but arguably the best form of payment processing in the world.

The Inevitability of a Zero-Fee Payment Stack

The current global payment revenue, estimated at $2.2 trillion in 2022 (McKinsey), represents a significant cost burden just for moving money. Public blockchains introduce a paradigm shift, offering a payment stack where every component incurs zero or effectively zero fees. This makes traditional fee-charging models increasingly obsolete.

While traditional benefits such as rewards and chargebacks are perceived as valuable, they are

often compensations for a high-fee environment. A zero-fee payment stack could potentially eliminate the need for such compensations, offering direct cost savings to consumers. This is especially relevant in developing countries where the traditional perks of credit card transactions are less prevalent.

Ethereum: A Platform for Unified, Programmable Payments

Blockchain is not just a new payment method; it represents a fundamental change in how payment systems are conceived and implemented. Its programmability and general-purpose nature enable the creation of a single unified payment stack that can be adapted to a multitude of use cases, including payments, deposits, and transfers.

Envisioning the Future Payment Stack

The future payment stack, as envisioned, consists of three core components:

(1) A single, open-source payments core tech stack serving the global population

(2) Zero transaction fees, and

(3) Adaptable packaging of this payments core tech stack for various use cases.

This unified approach of using a single tech stack to power a myriad of use cases consolidates disparate industries and technologies in traditional finance. This enables greater extensibility, quality,

57 WINTER 24 FUTURE OF FINANCE

cost efficiency, and adaptability to an increasingly broader and deeper set of use cases.

The Promise of 3cities in the Future of Payments

I’m slightly biased but, I could see a world where 3cities.xyz emerges as a decentralized payment protocol exemplifying the transition towards more efficient, user-friendly, and inclusive payment systems. 3cities is designed around the three core components above and specializes in three areas:

(1) Payment Intents: Payments, deposits, and transfers are specified using high-level intents, which are then matched with sender and receiver preferences, and solved into one or more concrete transactions.

For example, instead of requesting a payment of 5 USDC on OP Mainnet, a 3cities user simply requests $5.

The higher-level request of $5 is bundled with sender and receiver preferences, including accepted chains and tokens, that may or may not include USDC and OP Mainnet.

Then, the 3cities protocol analyzes the payment intent, the sender’s latest multichain wallet balances, prevailing exchange rates, and more, and determines that USDC on OP Mainnet is the current optimal solution.

The 3cities request intent link builder is available in beta.

(2) Payment UI/UX: By focusing on creating a seamless and engaging 1-Click payment experience, 3cities addresses one of the most significant barriers to adoption – usability. This

is vital for maximizing conversion rates and welcoming crypto newcomers and, consequently, economic value.

Here’s an example 3cities payment request for $12.32. In decentralized fashion, the request details are stored only in the link, with no servers. The web app is pure client-side software loaded from a CDN or IPFS, and uses only commodity ethereum node data and open price feeds. When paying, 3cities automatically scans the sender’s wallet to find the best token and chain to complete the given payment.

(3) E-commerce Solutions: 3cities has been designed to accomodate a wide variety of commercial contexts. This flexibility is essential for widespread adoption and maximizing development efficiency and usefulness of the payments core tech stack.

3cities will gradually bring to market solutions in the areas of ecommerce checkout, in-person point-of-sale, interpersonal payments, donations/ tipping, paywalls, microtransactions, and deposits

58

ETH INVESTORS CLUB

and transfers for CEXes, defi protocols, and embedded wallets.

The Rise of Onchain Payment Preferences

During the ongoing Cambrian explosion of currencies, tokens, and chains, the concept of onchain payment preferences is poised to gain significant traction.

Publishing one’s payment preferences onchain helps solve fragmentation and acknowledges that preferences for accepting payments vary greatly among users and contexts. Understanding and accommodating these preferences is key to the continued growth and user-friendliness of decentralized payment systems.

Fragmentation of Preferences

Payment preferences in the crypto world are inherently fragmented due to the diverse nature of blockchain technology and its users. These preferences are influenced by factors like geographic location, regulatory environment, the kind of user or merchant, and the scenarios involved in payment. For instance:

An individual might accept stablecoins like USDC and DAI across various Layer 2 solutions, valuing the speed and lower transaction fees.

A merchant may prefer receiving payments in a broader range of stablecoins and ETH but restrict transactions to Layer 1 or a single L2 for security reasons.

Non-US users might lean towards yield-bearing stablecoins not accessible to US persons, such as USDM, to maximize their financial returns.

Users of multisig wallets like Gnosis Safe may have preferences narrowed to the specific chain on which their wallet operates, but accepting a wide mix of stablecoins, ETH, or LSTs.

Empowering Users to Publish Preferences

To navigate this complexity, there is a growing need for mechanisms that allow users to easily publish their payment preferences onchain. This could include specifying preferred currencies, tokens, and chains, as well as more nuanced conditions like preferred transaction speeds or fee thresholds.

By making these preferences secure, global, transparent, and easily accessible, users can frictionlessly engage in transactions that align with their unique requirements and constraints.

Enabling Frictionless Payments

On the other side, it is equally important for merchants, wallets, consumer apps, and other facilitators to have the tools to effortlessly consume these published preferences when initiating payments. This ensures that transactions are not only delightful and successful but also align with the expectations and needs of the recipient.

Such an ecosystem of published and consumed payment preferences fosters a more intuitive and frictionless payment experience, making the core payment tech stack more useful and valuable.

59

WINTER 24 FUTURE OF FINANCE

The Virtuous Cycle of Payment Preference Integration

As payment preferences are published onchain, these preferences help improve payment UX anywhere the protocol is used, and a virtuous cycle is created.

This cycle can be visualized as follows:

Revolutionizing Global Payments: The Shift to Decentralized, Zero-Fee Systems

The evolution of global payments, as illustrated by platforms like 3cities and the broader adoption of blockchain technologies, is more than just a technological shift; it represents a fundamental change in economic interaction.

This transition to decentralized, zero-fee, pure software-based payment systems is not an

60

The virtuous cycle for an open-source, decentralized payment protocol

ETH INVESTORS CLUB

isolated trend but a reflection of a larger movement towards greater financial inclusivity and efficiency. This transition is not just a theoretical possibility but an ongoing reality.