City of FloridaTamarac,

F Y 2 0 2 4 ADOPT E D

BUDGET

Our Vision:

The City of Tamarac, Our Community of ChoiceLeading the nation in quality of life through safe neighborhoods, a vibrant economy, exceptional customer service and recognized excellence.

F Y 2 0 2 4 ADOPT E D

Our Vision:

The City of Tamarac, Our Community of ChoiceLeading the nation in quality of life through safe neighborhoods, a vibrant economy, exceptional customer service and recognized excellence.

Tamarac has been inducted into the International Palladium Balanced Scorecard Hall of Fame. The award is recognized as the worldwide gold standard of strategic performance management.

The City of Tamarac was recognized with the Public Sector HR Association Small Agency Award for Excellence for its mission, along with clear and comprehensive strategies in recruitment and onboarding, learning and development, compensation, recognition, and fostering a collaborative environment with impressive results, along with the Cigna 2022 Gold Level Healthy workforce designation and Florida Municipal Safety Excellence Initiative.

Tamarac received the Tree City USA designation for its urban forestry management efforts.

The City of Tamarac also received an Internationally Accredited Certificate.

The Center for Digital Government has recognized the City of Tamarac for leveraging data to improve city services, programs, transparency, and cybersecurity with Digital Cities.

For the Fiscal Year Beginning October 01, 202�2

Executive Director GOVERNMENT FINANCE OFFICERS ASSOCIATION

The Government Finance Officers Association of the United States and Canada (GFOA) has presented a Distinguished Budget Presentation Award to City of Tamarac, Florida for its annual budget for the fiscal year beginning October 1, 2022.

In order to receive this award, a governmental unit must publish a budget document that meets program criteria as a policy document, as a financial plan, as an operations guide, and as a communications device.

Levent Sucuoglu City Manager

Maxine Calloway

Assistant City Manager and Director of Community Development

Hans Ottinot City Attorney

George Folles Chief Building Official

Kimberly Dillon City Clerk

Christine Cajuste Director of Financial Services

Mike Annese Fire Chief

Lerenzo Calhoun Director of Human Resources

James Twigger Chief Information Officer

Melissa Petron Assistant Director of Parks & Recreation

Captain Jemeriah Cooper Broward Sheriffs Office

John Doherty Director of Public Services

Leading the nation in quality of life through safe neighborhoods, a vibrant economy, exceptional customer service and recognized excellence.

It is our job to foster and create an environment that: • Responds to the Customer • Creates and Innovates • Works as a Team

Achieves Results

Makes a Difference

Goal #1: Tamarac is Home

• Inclusive and Equitable • Well Maintained

• Parks and Infrastructure • Quality of Life • Convenient Transportation • ADA Accessibility • Great Education

Goal #2 : Tamarac is Safe and People Know It

• Quick Emergency Response • Low Crime Rate • Engaged First Responders

• Police, Fire and Medical Services • Visibility and Crime Prevention • Security Technology • Preparedness

Goal #3: Tamarac is Economically Resilient

• Business-Friendly • A Place to Thrive

• Development and Permitting • Economic Growth • Market Opportunities

Goal #4: Tamarac is Vibrant

• Attractive • Active and Fun • Green and Sustainable

• Appearance and Image

• Resilient • Healthy Lifestyle

Goal #5: Tamarac is Smart and Connected

• Tech Savvy • Neighborly

• Effective Communication • Smart City • Engaged • Celebrating Community

Goal #6: Tamarac is a Dynamic Workplace

• Attract and Retain Skilled Workforce • Promote a Culture of Excellence

• 5-Star Customer Service • Professional Development • Supportive Environment • Optimal Organization

1. Improve quality education opportunities for all Tamarac residents

1. Continue to review and update regulations to ensure excellent quality of life for all residents

1. Evaluate opportunities to expand the internship program we have with Career Source Broward to additional departments

1. Rewrite, update and implement Alarm Ordinance

1. Overnight Parking Regulation (2022 Consensus Priority)

1. Noise Ordinance (2022 Consensus Priority)

1. Continue to plan for, accurately estimate cost and required resources, maintain and upgrade our water, sewer, roadway and other infrastructure

1. Street Repaving, Restriping, Reflectors

1. Update the CIP Plan annually, which includes Utilities 20-year Master Plan

1. Evaluate Seawalls repair program options

1. Rate study for Water and Wastewater fees

1. Rate study for Fire Services Fees

1. East side water distribution system expansion; feasibility study to extend Tamarac water service

1. Construction of a new Water Treatment Plant Control Building

1. Woodlands land use map amendment, rezoning, development agreement & plat applications

1. Establish and foster transportation plans and partnerships to provide convenient and accessible means of transportation

1. Advocate for the additional Turnpike On/Off Ramp (Oakland Blvd/or Cypress)

1. Traffic Congestion

The City's interaction with Broward College representatives regarding internship opportunities is completed.

Not yet started. Staff will have a discussion with BSO before the rewrite.

Parking on the rights of way ordinance City Commission 1st reading 4/12/2023. This item is scheduled to come back to the Commission in Fall 2023.

Approved and adopted - 6/14/2023.

The ILA Funding Agreement for the Mainlands 1-5 Resurfacing project has been fully executed by the City and Broward County. The project went out for bid in January 2023. We are in the process of choosing a contractor. Staff is also preparing a Resurfacing Program budget to be included in the FY24 CIP budget. Award recommendation was approved by the City Commission at the August 23, 2023, Commission Meeting.

CIP Plan is updated annually. Ongoing.

Tamarac property owners now qualify for PACE funding to repair seawalls.

Rate Study to be completed in Fiscal Year 2023 with a possible effect on the existing rates starting on January 1, 2024.

A new study was commissioned in October 2022. The study is complete and findings of the study were presented to the City Commission on June 21, 2023. Preliminary rate from the study was approved.

SFWMD has approved the Water Use Permit needed to move this project into the design stage. We are forecasting 2.5 years from start of design to construction completion.

The design is complete. The request for qualification (RFQ) submittals were received in October 2022. Staff is working to obtain project costs from shortlisted firms and will prepare a contract for the City Commission review and approval.

Site Plan and Development Agreement - will be considered at a future City Commission meeting.

Monitoring the progress and staff continues to explore opportunities for the city to provide support for this project.

All the arterial roads where traffic congestion occurs are county or state-controlled roads. We are trying to partner with FDOT/BCE to install smart infrastructure to assist them in installing adaptive traffic lights within City limits. FDOT has adaptive traffic light control CIP for Commercial Boulevard from Pine Island Road to A1A in FY 2024.

1. Bus hub on property on Commercial Blvd. West of 75 Future Consideration.

1. Development of multimodal transportation plan funded by Surtax

1. Commit to Vision Zero and engage a Taskforce

1. Ensure equitable distribution of parks and recreation programs, services and facilities

1. East side Dog Park

1. Build Mainlands Park enhancements

1. Build Caporella park enhancements

1. Develop a park at Central Parc - Sabal Palm (2022 Consensus Priority)

1. Continue to monitor and enhance ADA compliance and accessibility

1. Continue to monitor the law and upgrade existing resources

1. Update building forms to ADA compliance

Alta Planning + Design selected. Kickoff meeting 04/17/ 2023. 1st Public Outreach meeting (District 2- May 31), 2nd Public Outreach meeting (District 3 - June 5). Next public outreach meeting scheduled Thursday, September 21, 2023.

Alta Planning and Design has been selected as the consultant for the Multimodal Transportation Plan, which includes the integration of Vision Zero as a component to eliminating traffic-related fatalities and injuries.

Included in conceptual plan for Sabal Palm Park.

Schedule in CIP for FY27.

Construction began November 28, 2022. Estimated completion Winter 2023.

Community meeting held.

Current consultant is working to develop a soil environmental mitigation plan to include in the development RFP.

Committee held a meeting on 6/28/23. Committee is presently researching vendors to convert online documents to the required accessible format or train employees to do this.

Allyant's (formerly A360) audit for website ADA compliance is completed and corrections are underway.

The City's ADA coordinator is looking into vendors to assist with this project.

Project/Initiative Comments

2. Increase visibility and address emerging crime trends through operational plans and pro-active policing

2. Enhance safety and security throughout City Parks and Facilities by deploying technology

2. Select a vendor and implement the first phase of improvements recommended by the Security Master Plan (SMP)

2. Implement the future phases of security improvements

2. Continue to identify partnerships, resources and other solutions to ensure response to fire and medical emergencies within 8 minutes or less 90% of the time

2. Be prepared to respond to all hazards

2. Continue inclusive and positive interactions with various community groups and individuals

2. Monitor response time data and continue to identify partnerships, resources and other solutions to address the areas in need

2. Attend community meetings and events engaging with various community groups

All tasks for Security Master Plan (SMP) Phase 1 have been completed. The City is awaiting the final payment application, closeout documents, and warranty information to be provided by Johnson Controls.

Security Master Plan (SMP) Phase 2 included in the FY2023 budget.

Step 1 will be to first identify qualified firms. Bid document has been provided to Purchasing, and is awaiting advertisement.

Ongoing. Response data reports are run every month and is monitored. Data is available withing the Fire Department monthly reports.

2. Community policing/policecommunity relations

July 8th

Attended Kings Point Caribbean American Club meeting.

July 22

Attended City of Tamarac Youth Summit at Boyd Anderson High School.

Attended Christmas in July car show event.

July 3

Welcome Home Initiative - Burglary Prevention Sands Point Community.

July 4

Attended All American Celebration.

3. Continue to evaluate and improve developing, permitting and procurement processes to enable businesses to open up quickly, grow and succeed

3. Update permitting Systems/TrackitOneSolution

3. Apply for Building Department accreditation through the International Accreditation Service

3. Identify and pursue high-quality market-driven redevelopment opportunities

3. Implement Developer Incentive Program to Revitalize Commercial Plazas/Corridors (Real Estate Development Accelerator (REDA) Grant and Facade & Exterior Improvement Grant for Commerical Plaza Owners)

3. Conduct a feasibility study for Redevelopment of Public Safety/Municipal Complex; Evaluate P3 opportunities

3. Foster Retailers & Restaurant Attraction.

3. Promote economic development

3. "Uptown Tamarac"/redevelopment of SR7/ Commercial Blvd. corridor

3. Shaker Village revitalization and community partnerships (2022 Consensus Priority)

TRAKiT Go Live planned for Fall 2023.

Awaiting configuration of TRAKiT Cashiering credit card processing / merchant accounts, so that cashiering can be fully done thru TRAKiT instead of Common Cash Receipts (CCR).

The City of Tamarac's Building Department has achieved the International Accreditation Service certificate, effective May 17, 2023, and valid up to June 1, 2024. This certificate is granted to organizations that demonstrate exceptional quality and adherence to industry standards. Tamarac is the only building department in Broward County to earn the IAS Accreditation.

Ongoing. Developer Incentive Program approved by the City Commission and launched October 2021. Two projects approved; 4 applications pending. Ongoing promotion to plaza owners and developers through program expiration, December 2023.

McNab Plaza (7015-23 N. University Drive) Façade Grant Application was approved by the Commission on July 13, 2022. McNab Plaza (8005 W. McNab Road) Façade Grant Application was approved by the Commission on December 14, 2022.

Evaluating feasibility.

Engaged a retail restaurant consultant to enhance recruitment efforts, City Commission approved May 2023.

Launched Tamarac Village Restaurant Retail Development opportunity RFP, August 2023.

Tamarac at International Council of Shopping Centers (ICSC) Orlando Retail Trade Show, August 2023.

Redevelopment planning underway with real estate firm. Key strategic acquisitions complete along SR7.

Property purchase approved by City Commission on July 12, 2023, meeting. Development of parcel included in CIP for FY 25.

3. Proactively seeking grants for capital projects Ongoing effort.

3. Implement Pilot Placemaking Projects

3. Evaluate the establishment of Sister Cities program in Tamarac, starting with a “friendship” city relationship

3. Continue efforts to enhance spend for Small, Minority, Local and Veteran Businesses

Placemaking is one of considerations for the recently approved façade improvement/development incentive programs. Ongoing.

The committee meets monthly. The last meeting was August 17, 2023, and the next meeting is scheduled for September 21, 2023.

While no significant awards were made during the months of May or June, there are several bids and proposals yet to be awarded where it is anticipated that award recommendations will be made to award to Small, Minority, Local and Veteran Businesses. The City did renew an Agreement for crossing guards for a two (2) year period with a Veteran-owned business.

4. Continue to provide and enhance opportunities for active, healthy and fun lifestyle

4. Park improvements/additional dog parks

4. Indigenous people's day

4. Continue and enhance the City beautification programs

4. Improvements and enhancements to City parks including projects at Sunset Point Park, and Veteran's Park.

4. Improvements and enhancement to Caporella Park

Area along 108th Terrace to be enhanced with benches, mutt mitt stations and trash receptacles for FY24.

Commission Proclamation - October 2023. Recognize Indigenous Heritage with existing programming.

Improvements are ongoing.

The Groundbreaking Ceremony took place on December 12, 2022. Expected completion is October 2023.

4. Implement neighborhood signage program Ongoing. Received 10 applications since 9/ 2022.

Two recent neighborhood sign installations -Wedgewood Community & Vanguard Village.

4. Buffer wall program implementation & update

4. Install directional/wayfinding and community facilities signage Citywide

4. Implement landscaping in medians and ROW’s

The Citywide Buffer Wall Program Phase VI Project, Prospect Road, was approved at the October 12, 2022, City Commission meeting. This project is ongoing with completion scheduled for Spring 2024.

Wayfinding Steering Committe Meeting 5/17/ 2023. Recommendations sent to consultant for incorporation in study.

Landscaping Master Plan is complete. Active median beautification projects include improvements on University Drive between Southgate Boulevard and 78th Street; 108th Terrace/80th Street between McNab Road and Nob Hill Road; and 70th Avenue/82nd Street between McNab Road and Nob Hill Road. Community Development has several proposed median beautification projects in the FY24 CIP Budget.

4. 78th St./University Dr. landscaping; signage on both South & North side of NW 78th Street

4. Public Art: MLK memorial, District 1

4. HOA beautification grants

4. Public art significant sculpture installs:

On June 28, 2023, the City Landscaping and Tree Preservation Ordinance was approved. All applications will adhere to the established City guidelines and be processed accordingly.

Ongoing.

Ongoing.

Fire Station 36 Sculpture - in progress

Sunset Park Viewing Platform - in progress

Tamarac Village (Splash Pad, Theatre, Sculpture) - canceled

Tamarac Village Social Justice Wall - in progress

Tamarac 60th Anniversary Celebrationcompleted

Sports Complex Skate Park Wall Murals - in progress

4. Continue to refine and promote the City’s identity

4. Secure funding for development of corridor plans

4. Replace bus benches with shelters, add locations

4. Public Art - civil rights wall

4. Continuation of robust marketing strategy and increased events marketing; telling Tamarac Story

Ongoing.

City bus benches and shelters awaiting Broward County's implementation process. ILA for bus shelters in forthcoming.

Amendment to agreement approved by CC on 5/24/2023 $100K to $145K. Expected date of completion September 2023.

We continue to use Tam-A-Gram, social media, digital marquees, and other forms of communication to tell the Tamarac story. In July we promoted Family Re'Union Events, Patriotic Splash, All-American Celebration, Shine Bright Like A Diamond, Party Like It's 1963, Summer Splash With Santa, Back To School Splash, Food Truck Fridays, Farmers Market, Parks And Recreation Month, Tamarac Fitness Classes, Summer Teen Summit, Splash Pad Temporarily Closed/ Reopening, Summer Safety Tips, Code Compliance, Citywide Public Input Workshop, Commission Meeting Agendas, Electeds’ Editorials, BSO Welcome Home Outreach Initiative, Tax-Free Holiday, Small Business Webinar, Roadwork.

4. Evaluate and promote green policies

4. Review citywide resiliency plans and update as needed

4. Evaluate the need for additional sustainability/resiliency and business continuity plans (as a part of SMART Masterplan)

4. The implementation of GASB 87 (leases) and major update to the Fixed Asset Policy

Bid document / Scope of Work provided to City Manager's Office for review on 7/20/2023, and now awaiting their approval before sending to Purchasing for advertisement.

Implemented with FY22 audit.

5. Develop a SMART City Master plan to meet community needs and provide a technology road map

5. Consultant to complete a SmartCity Strategic Plan

5. Fiber Network Expansion Phase II

5. OneSolution – Work Management Systems Module (Work Orders / Facility Maintenance / Fleet Maintenance / Asset Management)

5. OneSolution – HR / Financials Module

5. OneSolution – Customer Service / Utility Billing Module

5. Reanalyze and start a possible move to Smart Meters for Water Service

5. Further enhance community engagement and communications

5. City to recognize honor roll students who live in Tamarac.

5. Transition from MyCivic to SeeClickFix

5. Determine potential to expand Digital Signage to display live bus schedules, promote local community and events

MPO Smart City Plan received. Evaluation validates and confirms the need for a Smart City Plan. Planning is underway for the Smart City Plan next steps.

Bid document / Scope of Work provided to City Manager's Office for review on 7/20/2023, and now awaiting their approval before sending to Purchasing for advertisement.

Change Order 5, for fiber cut repairs, was approved by the City Commission on February 8, 2023;

Fiber Network Expansion (Phase 2) completion now expected by Summer 2023.

Awaiting completion of GIS map to be provided as part of Automated Meter Reading project, required in order to integrate Lucity with NaviLine Work Order/Utility Billing.

Finance Enterprise (Finance / HR / Payroll) Migration project to be restarted once all TRAKiT-related items are complete.

Planning underway with CST to complete an abbreviated Business Process Analysis (BPA) to review configuration already completed with Finance / HR modules.

Central Square Technologies (CST) recently informed the City that CST will no longer continue development of, and recommend customers migrate to their Finance Enterprise Utility Billing module. Instead, CST will continue investing into, and improving, their NaviLine Utility Billing Module. As such, the City will remain on the NaviLine Utility Billing Module.

The original proposal for new water meters has been cancelled, and the City is in the process of engaging a consultant who will provide assistance in designing a new Request for Proposal which reflects the technology available in the industry today. Once the RFP is designed, we will re-solicit for water meters with advanced technology.

Staff will coordinate for student recognition to begin November 2023.

Completed SeeClickFix Go Live in September 2022;

Only remaining item is to migrate past historical data from MyCivic to SeeClickFix. Data was provided to CivicPlus again in July 2023, and we are now awaiting final completion/import of the data by CivicPlus.

Funding not provided in FY2023 budget.

Funding to be re-requested in future budget years.

5. Build community by bringing community together to celebrate Tamarac’s multicultural and unique character

5. Increase community outreach/awareness of programs

Social Media Posts: Family Re'Union Events, Patriotic Splash, All-American Celebration, Shine Bright Like A Diamond, Party Like It's 1963, Summer Splash With Santa, Back To School Splash, Food Truck Fridays, Farmers Market, Parks And Recreation Month, Tamarac Fitness Classes, Summer Teen Summit, Splash Pad Temporarily Closed/Reopening, Summer Safety Tips, Code Compliance, Citywide Public Input Workshop, Commission Meeting Agendas, Electeds’ Editorials, BSO Welcome Home Outreach Initiative, Tax-Free Holiday, Small Business Webinar, Roadwork.

Recaps: All-American Celebration, Shine Bright Like a Diamond Bash, Party Like It’s 1963, Summer Splash With Santa

Electronic Signs For: Family Re'Union Events, Patriotic Splash, All-American Celebration, Shine Bright Like A Diamond, Party Like It's 1963, Summer Splash With Santa, Back To School Splash, Food Truck Fridays, Extoic Car Show, Move With The Mayor

Paid ads:

• All-American Celebration (Caribbean National Weekly, Caribbean Today, Cox, En USA, iHeart, South Florida Caribbean News, South Florida Family Life, Sun Sentinel)

5. Expansion of Building Department customerfocused practices (e.g. expired open permit program, staff training & support)

5. Add community events including Art in the Park at Tamarac Village

5. Develop a process to define the original/ historic Tamarac district and designate the name for it to create a distinctive identity; invite residents of the district to a Commission meeting to receive a proclamation

Current practices on open/expired permits and staff cross-training are being reviewed for future changes.

Currently on hold. The facility is substantially complete, but it hasn't been turned over to the City yet. Estimated start date January 10, 2024.

The Public Information Office continued to follow up with departments to investigate this opportunity, partnering with other departments as necessary to identify a historic area for designation.

6.Continue supporting positive work environment

6.Travel Policy Review - Rental of electric vehicles

6.Continue to pursue the award for Excellence in Financial Reporting

Not yet started. The policy will be amended to specifically address electric vehicles - Internal Process.

The City received the award for FY2020. The application for FY2021 Financial Statements was submitted in April 2022, and notification was received on February 2, 2023, that we were awarded again for the 34th consecutive year. Application for FY2022 was submitted on April 28, 2023. We are awaiting the application results, expected in November or December this year.

6.Expand and support employee professional development opportunities

6.5-star customer service

6.Celebrate successes and enhance employee recognition

6.Develop a formal CM evaluation process/ instruments Under review.

6.College to job internship pipeline

Discussions with Florida Memorial University will continue regarding a partnership. Lerenzo Calhoun and Karen Clarke will re-initiate conversations with Dr. Hardrick, University President, to gauge interest.

6.Refresh customer service standards and goals Staff internal process.

6.Refresh citywide recognition programs

Task Force and Recognition Review Committee are meeting bi-monthly to plan the Fall event and update Program criteria.

A thriving, multicultural, and multigenerational community, the City of Tamarac is a great place to build a family, business, and life.

Young families, retirees, and businesses are all drawn to Tamarac, which boasts a top rated fire department and is rated the 49th out of the top 50 safest cities in the entire state of Florida by Safewise.com in 2022.

In the middle of everything, yet a world away, Tamarac offers an exceptional quality of life at an affordable price.

Tamarac's residential neighborhoods abound with waterways the City contains over 500 acres of freshwater canals and lakes and plenty of open spaces.

Residents enjoy amenities such as the City owned Colony West Golf Club, which offers 36 holes of golf, and 12 parks that cover 416 acres, including a dog park and a skate park.

Originally a bedroom community favored by retirees, Tamarac is growing younger as the City grows older. Our current median age is 43.7.

Tamarac's residential population has grown by 15% since 2015 to more than 72,000 today. The City welcomes more and more neighbors who have chosen Tamarac for our community's quality of life and proximity to South Florida's beaches, the Everglades, shopping, nightlife, regional sports, cultural events, and the arts.

Tamarac offers programs for people of all ages and stages of life at parks and facilities throughout the City, including our 32,000 square foot community center, our recreation center, and the Caporella Aquatic Complex.

There is always something to celebrate with more than 30 annual community events including the Tamarac Turkey Trot and the One Tamarac Multicultural Festival.

The 13th largest city in Broward County and the 42nd largest in Florida, Tamarac is home to a growing business community. We offer an excellent location at the epicenter of South Florida, the 9th largest metropolitan statistical area in the U.S. by population, and easy access to five major highways and three world ranked airports and seaports. The 500 acre Tamarac Commerce Park is home to approximately 80 companies, including Amazon, City Furniture, New Vision Pharmaceuticals, Genex Services, and Publix.

We're primed for smart growth with a new form based code that ensures the right development at the right place. The construction of a new mixed use downtown named Tamarac Village is underway. It and the renovation of Colony West will serve as economic

drivers for the City.

As we look toward the Tamarac of tomorrow, maintaining infrastructure and preparing for future demands remain top priorities to ensure the quality of essential services like potable water and stormwater management. We will also continue focusing on revitalizing our commercial corridors and aging and underutilized shopping centers to serve our vibrant community better.

Introduction

The first critical reading of the Fiscal Year 2024 Adopted Budget is the City Manager's Transmittal Letter. The reader will gain an understanding of the City Manager's vision, critical issues, recommended policy and operational changes, and financial plan.

This section provides the reader with the basic components that comprise the development of the Fiscal Year 2024 Adopted Budget. This section includes explanations of the type of government and budget, a description of the budget process, the Budget Calendar, budgetary highlights, and the Fiscal Year 2024 Personnel Complement.

This section answers the question: What's new in the Budget? In this section, you will find a list of new or reclassed staff, new or enhanced programs, and capital outlay not previously forecasted.

This section provides schedules of detailed revenue sources and expenditures for the General Fund and for all funds combined for a total Fiscal Year 2024 Adopted Budget. Like a person with multiple checking accounts, a municipality categorizes revenue and expenditures into separate funds according to purpose. This section also includes a comparison of major revenue sources, the full cost allocation study, an overview of financial management policies, and a brief description of each fund.

This section explains the diverse services offered by the City of Tamarac. Each department's division has identified a mission statement, a program description, and strategic goals for the upcoming year. In addition, the Fiscal Year 2024 Adopted Budget includes performance measures for each division. Performance Measurement is an ongoing process to evaluate and report how well the City delivers its services.

Each Department and Division is responsible for goal setting and performance benchmarking to ensure alignment with the City's Strategic Plan. The measures reflect the City's effort to improve service, check performance quality, and make changes when necessary.

Reporting of performance measures differs from standard goals and objectives because it goes beyond simply reporting achieved or not achieved; it provides an ongoing method for measurement and allows for gauging performance against internal, external, local, and national standards.

This section includes the City's Asset Management plan, which provides a comprehensive listing and explanation of the capital requirements and associated funding for the City for the current and next five years.

Appendix

This section contains debt management information and a glossary of commonly used terms.

Source: Broward County Property Appaiser

The City ForYour Life

Levent Sucuoglu City Manager

October3, 2023

The Honorable Mayorand Members ofthe CityCommission CityofTamarac

7525NW 88Avenue Tamarac,FL33321

The HonorableMayorand MembersoftheCityCommission:

It ismypleasure to transmit to you the official budget document for fiscal year (FY) 2024 adopted by the City Commission on September 26, 2023. The final budget was establishedupon the completion ofyour review andacceptance.

Following the release oftheCity Manager's Proposed BudgetonJune19, 2023aworkshopwasheldwith the CityCommissiononJune 21,2023 todiscuss theproposedbudget,programs and funding. Below isa summaryofthe FY2024ProposedandFinalAdoptedBudgets:

The netincrease to the General Fundof$767,747 results fromthe following: (1) anetincrease to the City Commission budget of$28,144; (2) a net increase to the City Manager budget of$107,000; (3) a net increasetoPolice Servicesbudgetof$379,209;(4)anetincreasetoPublic Servicesrecyclingof$175,000: andanetincrease to theNon-Departmentalbudgetof$78,394.

Thenetincrease to the Debt ServiceFundsof$9,000resultsfom budgetingthecostoftheretainer forthe new Financial Advisor.

ThenetdecreasetotheCapitalFundsof$200,000resultsfromremovingfundingintendedforacomponent ofa Capital ImprovementProjectwhichisno longerneeded.

ThenetdecreasetotheUtilitiesOperatingFundof$3,150,000fromremovingfundingformeetingtheEPA Lead andCopper ServiceLine Inventoryidentificationrequirementwhich Public Servicesadviseswill no longerbeneeded in FY2024.

The net increase to the Internal Service Funds of$I60,000 results from increasing property liability premiums based on recent updated advice received by Risk Management from the insurance account executive.

Iwouldliketothankthe MayorandCommissionersforyour foresightandsupportofthe budgetaswellas your continued suppo1t ofthe Financial Policies for long-term financial planning. As we are all aware, a budgetencapsulatestheplansandinitiativesneededtohelpdriveoursuccessbothtodayandintothefuture. As the adoption phase ofthis budget cycle has ended and theplanning for theupcoming cyclebegins, the workputintothisFY2024AdoptedBudgetcontinuestoprovideasolidfoundationforthe"Sustainability" ofour future.

Sincerely, '

June 13, 2023

The Honorable Mayor and Members of the City Commission City of Tamarac

7525 NW 88 Avenue

Tamarac, FL 33321

Mayor and Members of the City Commission:

Pursuant to the Citys Charter, it is my privilege to submit to you the City of Tamarac Proposed Budget for Fiscal Year 2024 and the FY 2024 - FY 2029 Asset Management Program Budgets. In Florida, although a city can prepare budgets on a multi-year cycle, the City can only adopt a single year budget. The current process involves the preparation of a single year budget for adoption and two forecast year budgets.

During budget preparation, staff evaluates costs, the updated Strategic Plan and all programs in crafting a budget and forecast that meet the City Commissions goals. Fiscal policies adopted by the City Commission continue to ensure a sustainable future for the City. Rating agency, Fitch, in a recent ratings update, commented that The affirmation of Tamaracs Issuer Default Rating (IDR) and rating of 'AA-' on capital improvement revenue bonds reflects the City's strong financial resilience and superior inherent budget flexibility supported by its solid revenue and expenditure controls. The City has exceptionally strong gapclosing capacity, positioning it well to withstand future economic downturns.

This years budget process was undertaken in the post pandemic era but still with economic disruption challenges across the globe, including stubbornly high rates of inflation, elevated prices for gas and diesel coupled with supply chain issues caused by product shortages.

The FY 2024 Proposed Budget keeps the millage rate flat at 7.0000 mills. The proposed budget includes an updated Asset Management Plan that takes into account long-term financial planning for the Citys assets, and one-time expenditures. I have also provided examples of how the proposed millage rate will impact property owners under Save Our Homes various value levels.

Legislative changes governing how millage rates are established were enacted during the 2007 legislative session and additional changes were made via a referendum in 2008 affecting FY 2010 and beyond. The referendum increased the homestead exemptions from $25,000 to $50,000 and rules for portability of the Save Our Homes values were approved. In addition, there is an annual 10% cap on assessed value increases for non-homesteaded property (both residential and commercial). The 10% cap on nonhomesteaded property referenced above, which was originally set to expire is now permanently adopted via referendum as a constitutional amendment. The table below illustrates the total taxable assessed value history.

City Total Taxable Value projected to increase by 4.0% for FY 2025 and 3% for FY 2026 due to potential lagging economic impacts of COVID-19 pandemic and other future uncertainties stemming from prevailing economic conditions

The FY 2024 proposed budget maintains the general operating millage rate of 7.000 mills resulting in higher overall tax revenue due to an increase in taxable value of 9.88% (preliminary valuation distributed by the Broward County Property Appraiser as of June 1, 2023). The FY 2024 proposed budget for all funds totals $256,689,741 which is $4,499,189 less than the FY 2023 amended budget of $261,188,930, a decrease of 1.72%.

The decrease from the amended budget is due primarily to the FY 2023 first budget amendment including expense appropriations and related transfers for: (1) transferring a large portion of the second half of the American Rescue Plan Act (ARPA) funding and (2) the repayment of the Stormwater Fund inter-fund loan by the Colony West Golf Course Fund. These two items alone result in an approximate $16 million upward change to the FY 2023 adopted total budget. The FY 2023 first budget amendment also included an appropriation in the Utilities Operating Fund of $2,273,000 for the acquisition of real property located at 6115 NW 77th Way.

The summary chart for expenditures by category provided below identifies changes in costs for personal services, operating expenditures, capital/infrastructure expenditures, and other categories for all funds. Per the Citys Financial Policies, capital projects are budgeted on a life- of-the-project basis until completed or de-obligated by the City Commission, and therefore not re-appropriated annually.

Personal Services costs represent 24.19% of the total proposed budget and 27.71% of the General Fund proposed budget. The FY 2024 Proposed Budget reflects adjustments based on the current FPE Union Contract and Fire Union Contract. Staff has provided an estimate of wages pursuant to the performancebased pay system in the personnel policy for non-represented employees. Elected and Appointed officials have also been provided for in the proposed budget.

Pension contributions for all three active plans were projected using the contribution rates based on actual payroll as follows: 20.37% for the Employees Pension Plan, 31.34% for the Elected and Appointed Officers and Non-Represented Employees Retirement Plan, and 41.06% for the Firefighters Pension Plan.

The FY 2024 Proposed Budget includes additional staffing as listed in the table below necessary to maintain the Citys current level and quality of service delivery.

The FY 2024 proposed General Fund budget is $89.722,190, which is $8,730,599 or 10.78% more than the FY 2023 amended budget of $80,991,591.

Below is a summary of the General Fund for the operating departments and non-departmental including reserves.

The demand letter submitted to the City by the Broward County Sherriffs Office (BSO) pursuant to our contract requests $19,111,915 for Police Protection Services as compared to the $18,402,913 contained in the Adopted FY 2023 Budget, representing an increase of 3.85%.

The FY 2024 proposed General Fund budget includes an appropriation from fund balance of $14,937,647 for purposes of funding transfers to capital funds such as, $8,679,205 to the General Capital Improvement Fund; $401,000 to the Capital Maintenance Fund; $3,928,917 to the Roadway & Median Improvement Fund: and $3,848,224 to the Corridor Improvement Fund. In addition, $1,850,000 is included to fund a contingency and $250,000 is included for potential encumbrances (purchase orders that have not been completed by year end that are carried into the next fiscal year). The contingency amount includes $1,100,000 for an estimate of the financial impact to the General Fund from expected Class and Compensation Study recommendations. That estimate, escalated by 5% each year, is included in the FY 2025 and FY 2026 General Fund contingencies also.

The FY 2024 proposed budget for the Fire Rescue Fund is $31,588,411 which is $2,804,423 more than the FY 2023 amended budget of $28,783,988 or a 9.74% increase. The Fire Rescue Proposed Budget was developed using a proposed Fire Rescue Assessment Fee at $420 per residential unit. The $420 represents approximately 93.5% of the maximum amount that can be charged based upon the study that was just completed. At the current rate, an appropriation of $5,491,352 from fund balance is needed to balance the budget.

The appropriation from fund balance is primarily associated with funding for the scheduled replacement of vehicles and equipment. The Fire Rescue Assessment Fee revenue can only be used for fire related expenses, thus the other major source of revenue for the Fire Rescue Fund is a transfer from the General Fund in the amount of $6,921,736 for FY 2024.

The FY 2024 proposed Fire Rescue budget includes planned capital outlay requests for equipment replacements through FY 2029. Each year the Fire Department sets aside funding for proposed replacements that will take place in future years such as fire apparatus and equipment. For FY 2024, the Fire Rescue Fund also has equipment replacement requests that include major appliances and fitness equipment for stations, thermal imagers, hydraulic stretchers, AEDs Citywide, extrication units and CPR devices.

The FY 2024 Building Fund proposed budget is $4,025,880 or $145,000 more than the FY 2023 amended budget of $3,880,880 or a 3.74% increase. The proposed budget has been prepared in support of continuing operations. Staffing and contractual arrangements have been made in support of new residential development that began coming online in FY 2015 and is anticipated to continue, at least into the very near future. Additional revenue has been provided in support of this anticipated new construction. Building permit fee revenue budgeted for FY 2024 and the two forecast years is based on expected activity and supported by the recently increased Building Department approved fee schedule.

The Public Art Fund has been budgeted in the amount of $400,000 which includes available funds received in prior years but not yet expended. In FY 2024 a $50,000 appropriation is included for work to be done by Public Art consultants, Gadson & Ravitz, a $50,000 appropriation is included for repair and maintenance of public artwork and $300,000 of the FY 2024 proposed budget has been set aside as a reserve for future public art projects and/or unplanned expenditures related to existing art projects.

The Asset Management Program Capital Improvement Plan (CIP) is included in a six-year format beginning with FY 2024 and the five years following for planning purposes. Other components of the Asset Management Program include: (1) a Capital Maintenance Plan; (2) a Capital Vehicle Replacement Plan; and (3) a Capital Equipment Plan.

The proposed Capital Improvement Plan budget in the amount of $18,741,346 is as follows:

The FY 2024 proposed budget is $8,954,779 or $722,335 more than the FY 2023 amended budget of $8,232,444 or an increase of 8.77%. The primary revenue source for this fund is the Stormwater Utility Management Fee Assessment that is charged on a per equivalent residential unit (ERU) basis for improved and undeveloped property.

The FY 2024 stormwater fee assessment is expected to provide $7,344,557 in revenue to support operations and stormwater related capital improvements. An increase to the stormwater assessment from the current $154.45 to $160.61 would be proposed for FY 2024 based on the May 2023 CPI. The increase of $6.16 is 4.0% more than the prior year, which is consistent with Section 22-254, Code of Ordinances. The FY 2024 Stormwater Fund budget includes $1,481,737 for CIP and $682,624 in funding for the replacement of a JetVac and $50,000 for the purchase of two (2) new Jon Boats. The following table lists the Stormwater Capital Projects.

The FY 2024 proposed budget is $54,228,276 or $6,258,111 less than the FY 2023 amended budget of $60,486,387 or a decrease of 10.35%. The Water and Wastewater Utility conducted a long-range financial planning study in fiscal year 2015 that looked at rates over the next ten years. The Commission adopted the recommended rate structure through an amendment to Chapter 22 of the Utilities Ordinance. The FY 2024 proposed budget was prepared assuming no rate adjustment. City staff will likely be conducting a rate study in the very near future.

The proposed budget for the Utilities Fund follows the long-range financial plan and provides support for continuing operations of the existing facilities, an active renewal and replacement program to maintain aging infrastructure, and funding for capital improvements identified in the ten-year capital improvement plan, six years of which are included in this budget proposal. City staff will evaluate future funding options for capital improvement projects, where funding approaches for projects with estimated costs equal to or greater than $5 million would include the issuance of debt and pay as you go funding. The FY 2024 proposed budget includes capital outlay totaling $24,634,240, consisting of $22,950,000 for CIP renewal and replacement and $1,684,240 for capital equipment. The following table lists all the Utilities Capital Projects and some major capital equipment purchases.

Health Insurance Fund

The FY 2024 Health Insurance Fund proposed budget is $7,546,286 or $435,243 more than the FY 2023 amended budget of $7,111,043 or a 6.12% increase. Based on current information pertaining to claim activity and amounts for the prior year, staff is presently budgeting for an increase in the premium for stop loss in the Health Insurance Fund, increasing it from $600,000 to $820,000. Human Resources staff is budgeting for Health Care claims to be $5.8M for fiscal year 2024 and be adjusted upward to $6.1M in 2025 and to $6.4M in 2026. These expenses are being closely monitored in FY 2023 and will be reevaluated prior to the adoption of the FY 2024 Budget.

The FY 2024 Risk Management Fund proposed budget is $3,976,575 or $300,192 more than the FY 2023 amended budget of $3,676,383, a 8.17% increase. Based on current information for workers compensation rates recently established by the Florida legislature, staff is recommending: (1) premiums for workers compensation be increased from $334,750 to $358,361 for fiscal year 2024 and then held steady for fiscal years 2025 and 2026; and (2) claims for workers compensation be reduced from $196,245 to $175,000 for fiscal year 2024 and then held steady for fiscal years 2025 and 2026.

Based on the most current information available regarding property liability, staff is recommending that premiums for property liability be increased from $1,140,700 to $1,534,865 for fiscal year 2024 and then be adjusted upward to $1,559,865 for both fiscal years 2025 and 2026.

Based on the most current information available regarding automobile accident activity and the automobile insurance market, staff is recommending that claims for automobiles be increased from $83,750 to $135,525 for fiscal year 2024 and then held steady for fiscal years 2025 and 2026, Lastly, staff is recommending contingency be brought back down to from $500,000 to $250,000 for fiscal years 2024, 2025 and 2026.

This proposed budget has been prepared to provide funding for the City of Tamaracs Strategic Plan and the associated departmental work plans to achieve the outlined goals. A dedicated section of the proposed budget book and this Executive Summary provide comparative benchmarks associated with the progress made with respect to the strategies.

The millage rate recommendation of 7.0000 is the same as FY 2023 given an overall increase in taxable value of approximately 9.88%, new construction of $49,346,670 and $3,503,738 in additional budgeted revenue based upon the June 1 preliminary taxable value estimate and shown in the table below. The additional revenue essentially only funds current ongoing operation expenses, while capital projects are funded by nearly all fund balance or savings

This budget proposes a millage rate of 7.0000 mills, the same as the current millage rate subject to minor modifications following receipt of the certified values from the Property Appraiser on July 1, 2023. This millage rate will generate budgeted property tax revenue of $38,966,889 for FY 2024 which is 95% of the total tax levy of $41,017,778, as required by Florida Statutes.

The rolled-back rate calculation based upon the June 1 preliminary taxable value estimate is 6.3635 mills. The rolled-back rate represents a millage rate that when applied to an amount that is equal to the total taxable value less the taxable value contributed by new construction results in the same tax revenue as the previous year. The tax revenue from the rolled-back rate that would be generated is $35,423,686 at 95% of the tax levy or a decrease of $39,465 from the FY 2023 tax revenue that was budgeted.

FY 2024 based on June 1, 2023 Estimated Values FY 2023 based on July 1, 2022 Certified Values

At the proposed millage rate of 7.0000 mills based upon June 1, 2023 preliminary taxable values, the burden, (relative reliance on for generating property tax revenue) on single-family residential, multi-family residential and condominiums has increased stemming from new units and related valuations being added to the tax rolls, while the burden on improved commercial has decreased and the burden on improved industrial has increased. As residential is the largest class of property in the City, now making up approximately 78.6% of the entire City tax base and provided with the majority of services, it is expected that as values increase the burden will increase as well. This is also a function of the cap on taxable value growth of nonresidential and commercial values at ten percent per year. Based upon preliminary values by class, the taxable assessed value (i.e. resulting value after applying Save Our Homes protection and any qualified exemptions) of all the classes of property increased from the prior year as follows: single family residential by 12.00%, multi-family residential by 8.67%, condominiums by 13.30%, improved commercial by 3.20%, improved industrial by 12.30%, while all others (includes all vacant land) increased by 2.25%.

The table below compares market values, Save Our Homes values and taxable values along with the related FY 2023 and FY 2024 averages for single family properties and condominiums. The difference in the Just or Market Value increases were as follows: single family residential by 16.90%, condominiums by 21.60%.

The average taxable value of a single family residential unit has increased 11.70% from $152,698 to $170,507 and condominiums have increased 13.30% from $69,927 to $79,233. These averages include the Save Our Homes (SOH) limitations and all exemptions. Turnover in properties within the City seems to be the driver of these changes since SOH was limited to 3.0% and non-homesteaded (i.e. rentals and investment properties) was limited to 10%.

As a result of the recapture rule, as well as the normal changes in values for certain areas in the City, those properties that have Save Our Homes protection will experience a 3.0% increase in taxable assessed value even though there may have been a greater increase in the just (market) value of the property. Commercial and non-residential properties are limited to a 10% increase in taxable value. Overall, the Save Our Homes differential, i.e. the amount not subject to taxation increased 33.9% on a

(single

and condominiums) basis to $3.029 billion for FY 2024.

The following table provides the comparison of the FY 2023 and FY 2024 ad valorem levy for homesteaded residential properties at various values. The chart assumes changes in assessed value at 3.0% year over year. The median single family home taxable value in Tamarac, based the June 1 preliminary taxable value estimate was $160,325.

Assessed

As stated previously, the FY 2024 proposed General Fund budget is $89,722,190, including ad valorem revenue using an estimated millage rate of 7.0000 mills.

The following table demonstrates the relationship between millage rates and property taxes levied. The rapid decline in taxable assessed values caused by the Great Recession reached its lowest point in calendar year 2012 or FY 2013, at which time total taxable value had sunk to $2,453,271,755. The table below illustrates the Citys decade long recovery in taxable assessed values and property tax collections. It was not until calendar year 2020 or FY 2021 that taxable assessed values reached or exceeded the levels experienced in calendar year 2007 or FY 2008 just prior to the start of the rapid decline when the total taxable value was $4,402,093,105.

The City of Tamarac Proposed Budget for FY 2024 is to maintain the overall current level of services while enhancing service levels in areas such as technology, economic development, infrastructure and the physical appearance of the City. The FY 2024 proposed millage rate of 7.0000 mills in addition to other revenue sources preserve core services within the General Fund and other operating funds to execute strategic objectives outlined by the community, City Commission, and City Management.

The City of Tamarac has experienced a resurgence in taxable property values, approximately 7.29% in FY 2022, 12.29% in FY 2023 and now 9.88% in FY 2023; however, the City will continue to face challenges due to slow and/or moderate increases in other revenues. There are limited alternatives for new revenue sources and at the same time historic increases in the cost of goods, services, and construction materials. What we have learned over the past couple of years is that it is very difficult to fully assess the economic impacts of the COVID-19 pandemic. Some of the resulting residual economic conditions including further COVID related shutdowns, job losses and supply chain issues may permeate the real estate market at any time.

Legislative and constitutional measures have limited growth in taxable values through the years. Therefore, new construction is critical to provide additional revenue as new housing and commercial development is added to the tax rolls. New construction provided less of a boost to taxable values for FY 2024, amounting to $49.3 million, as compared to the $63.1 million contribution from new construction the City experienced for FY 2023.

As a result, due to the pandemic and its lingering impacts on various operational costs, it is anticipated that property tax revenue, with the millage rate held at 7.0000 mills, will increase enough as a percentage of total General Fund Revenue only for FY 2024. Over time, in order to keep pace with the increased cost of operations while providing the needed funding for planned capital improvement projects, further costcutting or austerity measures may become necessary unless some of the burden currently borne by property tax revenue can be shifted to other General Fund revenue sources. Bear in mind that future large scale general capital improvement projects are shown in the Six Year Capital Improvement Plan (CIP) but not actually funded beyond FY 2024. Change in

The City of Tamarac is governed by a Commission/Manager form of government, which combines the political leadership of elected officials with the managerial experience of an appointed administrator. The City Commission consists of five members: The Mayor, chief elected official-at-large, and four commission members elected from each of the four districts in the City. The legislative powers of the City are vested in and exercised by the City Commission, consistent with the United States Constitution, the Florida Constitution, laws of the State of Florida, the City Charter, and City ordinances. The City Commission is vested with policy-setting authority, adopting the annual budget, formulating goals and objectives, and making decisions that affect the quality of life in the community.

The City Manager is appointed by and directly responsible to the City Commission. As the administrative head of the City, the City Manager carries out policies made by the Commission and directs and coordinates the work of all City departments.

The Program/Performance Budget is an effective budget model which focuses on policy planning and resource allocation. It assumes that in an environment of scarce resources, elected officials must choose between different and competing items. This method expands on the basic line item budget concept giving residents, commissioners, management and employees a better understanding of government's role in the community. The Program/Performance Budget improves the quality of decision-making and provides a mechanism to increase the efficiency and effectiveness of City operations. Our Budget has four objectives.

1. Policy Document

The City’s budget process is conducted within the framework of the Strategic Plan, providing financial management policies, financial trends and fiscal forecasts. The information contained in these documents gives policy makers an opportunity to review policies and goals that address long-term concerns and issues of the City and evaluate City services.

2. Operations Guide

The budget describes activities, services and functions carried out through departmental goals and objectives and a continuation/enhancement of performance indicators. The document includes an organizational layout for the City and a three-year analysis of staffing.

3. Financial Plan

The budget presents the City’s fiscal resources through a process of needs analysis, service delivery priorities, and contingency planning. The document includes the current and long-term debt obligations along with a comprehensive list of capital improvements (included in an asset management program) and the basis of budgeting for all funds.

4. Communications Device

The budget communicates summary information, including an overview of significant budgetary issues, trends and resource choices, to a diverse audience. It describes the process for preparing, reviewing and adopting the budget for the ensuing fiscal year.

Per Florida Statute 166-241(2), all municipalities must adopt a balanced budget, defined as “the amount available from taxation and other sources, including amounts carried over from prior fiscal years, must equal the total appropriations for expenditures and reserves.”

Adopting the budget is the culmination of a process that integrates financial planning, trend analysis, accounting enhancements, goals and objectives, and strategic planning, into service delivery. Pursuant to Florida Statutes, total estimated expenditures shall not exceed total estimated revenue and appropriated fund balance. The City also adopts and maintains a capital improvement plan.

The City Charter requires the City Manager to submit a proposed budget to the City Commission by July 30th of each year. The City Commission holds budget workshops with City staff and the public. Pursuant to Florida Statutes, two public hearings are held in September. The first public hearing is for the adoption of a tentative millage and tentative budget. The second public hearing adopts the final operating and debt service millage rates along with the annual budget and capital improvement plan.

Florida law provides general guidelines regarding budget amendment policies. Appropriation of additional unanticipated revenue is allowed by law in all fund categories for many types of revenue at public City Commission meetings. The law allows appropriation increases of any nature to occur through a supplemental budget process requiring advertised public hearings.

Formal appropriation by the City Commission is at the department level for the General Fund and at the fund level for all other funds. Amendments to these appropriations are adopted twice each fiscal year, reflecting actions approved by the City Commission, allocation of encumbrances, transfer of funds from a non-departmental account to other departments in the General Fund, and additional capital improvements. Budget transfers not requiring an increase in a fund total or department total are granted within guidelines to various levels of management.

All government funds are accounted for using the modified accrual basis of accounting. Revenues are recognized in the period when they become measurable and available to pay liabilities of the current period. Property taxes, utility taxes, franchise fees, intergovernmental revenues, and charges for services may be accrued when collected depending on the billings to which they pertain. Property taxes are recognized as revenue in the fiscal year for which they are levied. Investment earnings are recorded as earned. Permits, fines, forfeitures and contributions are not subject to accrual because, generally, they are not measurable until received in cash. Revenues collected in advance of the year to which they apply are recorded as deferred revenues.

Expenditures under the modified accrual basis of accounting are generally recognized when the related fund liability is incurred and expected to be liquidated with available resources. Exceptions to this rule include principal and interest on general long-term debt, which are recognized when due.

All proprietary fund types and the Pension and Nonexpendable Trust Funds are accounted for using the accrual basis of accounting. Revenue is recognized when earned, expenses recognized when incurred.

Agency funds are custodial in nature and are not a direct result of operations. They are accounted for under the modified accrual basis of accounting. Assets and liabilities are recognized on the modified accrual basis.

The budget follows the basis of accounting, meaning general government type funds are prepared on a modified accrual basis. Obligations of the City of Tamarac are budgeted as expenses, but revenues are recognized when they are actually received.

The budget is a balanced budget which means that estimated revenues are equal to estimated expenditures. All appropriations lapse at year end, except capital improvement projects that are budgeted on a life of the project basis. Some encumbrances are carried forward to the next fiscal year which include the capital improvement program encumbrances.

The Annual Comprehensive Financial Report (ACFR) shows the status of the City of Tamarac’s finances on the basis of “generally accepted accounting principles” (GAAP) and fund expenditures and revenues on both a GAAP and budget basis for comparison purposes.

January y

Depts begin conducting internal/cross dept budget prep meetings

New Capital Requests for FY 2023/2024/2025 (CIP Ranking Forms) due

Jan 2nd

Feb 9th

February y

March

New Position requests due to HR

Feb 17th

Utilities 20-Year Plan Capital Projects List due Feb 24th

Program Modifications/Capital Outlay/Capital Maintenance/Equipment/Vehicles due Feb 27th

HTE Budget Data Entry Access OPENED Feb 27th

HTE Budget Data Entry Access CLOSED Mar 14th

Clearpoint updates are due Mar 27th

April

Departmental Budget Review meetings March 29th-April 6th

Budget enters adjustments based on meeting outcomes

May

June

City Manager Budget Review meetings May 8th & 9th

Budget enters adjustments based on meeting outcomes

Estimated Taxable Values distributed by Property Appraiser

June 1st

Proposed Budget delivered to City Commission June 19th

Commission Budget Workshop June 21st

July

Certified Taxable Values distributed by Property Appraiser (Day 1 TRIM compliance)

July 1st

Commission sets Proposed Property Tax Millage/Assessment rates July 12th

August

Sept

October r

City certifies DR420 Form to Property Appraiser (Day 35 TRIM compliance) by Aug 4th

Truth-in-Millage (TRIM) notices sent to property owners (Day 55 TRIM compliance) by Aug 23rd

1st Public Hearing Tentative Budget Adoption Special Commission Meeting (Day 65-80 TRIM compliance)

Sept 14th

Published Advertisement for 2nd Public Hearing Sept 23rd

2nd Public Hearing Final Budget Special Commission Meeting (Day 95 TRIM compliance) Sept 26th

Adopted Resolution & Ordinance to Prop Appr & Tax Collec tor (Day 97-100 TRIM compliance) within 3 days of hearing

Nov

New Fiscal year begins

Certification of Compliance/DR487(within 30 days of Final Public Hearing)

1st Reading of FY 2022 2nd Budget Amendment (amending last year's budget)

Oct 1st

Oct 25th

Oct 25th

2nd Reading (Hearing) of FY 2022 2nd Budget Amendment

FY 2023 Adopted Budget Finalized for Print/Submitted to GFOA (within 90 days of adoption)

Nov 8th

TBD

* THE PROPOSED OPERATING BUDGET EXPENDITURES OF THE CITY

MORE THAN LAST YEAR'S TOTAL OPERATING EXPENDITURES.

The tentative, adopted, and/or final budgets are on file in the office of the above mentioned taxing authority as a public record.

The State of Florida does not have a state income tax. The primary source of funds for cities, counties, and school boards are property taxes, which are regulated by the state via the TRIM (Truth in Millage) process. Property taxes are an ad valorem tax, meaning they are allocated to each property according to its value. The City of Tamarac sets a property tax rate, called a millage rate, to help fund the operations of the City. This millage rate is multiplied by the taxable value of each property to arrive at the property taxes due to the City.

As part of the TRIM process, the City is required to announce a Rolled Back Rate. This is a millage rate which will provide the same ad valorem tax revenue to the city that was received last year. Florida statutes require the City to use the Rolled Back Rate as a benchmark against which to measure the millage rate being adopted for the upcoming budget year. If the Adopted Rate is greater than the Rolled Back Rate, the City must declare a property tax increase.

The Broward County Property Appraiser (BCPA) establishes the taxable value of every parcel of property in our city. BCPA determines the just, or market, value of each property as of January 1. Then they apply all eligible exemptions to determine the property's taxable value and provide this information to the City each year, initially at June 1 to set the proposed budget and again at July 1. The July 1 values are what the City must use to calculate the primary City revenue, ad valorem taxes, for the adopted budget.

*Based on July 1,2023 Certified Taxable Values

Florida offers a Homestead Exemption to ease the burden on taxpayers by exempting property taxes on up to $50,000 of a homeowner's residence. The first $25,000 applies to all taxing authorities. The second $25,000 does not apply to all taxing authorities and only applies to the portion of the home's value between $50,000 and $75,000. A further protection for taxpayers is Save Our Homes" (SOH). Save Our Homes caps the annual increase in assessed value on homesteaded properties to the lesser of 3% or the increase in the Consumer Price Index (CPI). For 2022, the SOH maximum increase is 3.0%.

City Property Taxes at 7.0000 Millage Rate

$175,000 $1,225 $875

$150,000 $1,050 $700

$125,000 $875 $525

$100,000 $700 $350

$75,000 $525 $175

$50,000 $350 $175

$25,000 $175

In addition to the Homestead Exemption, low income senior citizens in the City of Tamarac can claim an additional $25,000 exemption, which only applies to the County and City taxes. Beginning with Tax Year 2019 the City also offers the Senior Long Term Residency Exemption. This exemption grants full homesteaded property tax relief to low income seniors who have lived in their home for at least 25 years. This exemption eliminates the entire City and County portion of the tax bill for qualifying seniors.

5

6

7

8

Every year as part of the budget process, each department considers its staffing, operations, and capital needs for the upcoming fiscal year. Any need that would cause an increase to the budget is thoroughly vetted and discussed. The following tables summarize the requested additions to the City's budget, indicate those funded, and provide a snapshot of what's new. This same exercise is also done for the next two fiscal years to provide a longer term perspective on the impact on the budget.

The Fiscal Year 2024 Approved Budget austerity measures will continue due to the global economic disruption challenges, inflation, and post pandemic potential impacts on FY24 revenues, limiting new positions and only critically needed reclassifications/changes.

The City of Tamarac employs a practice of developing and adopting an annual budget and creating a detailed forecast projected for the next two years. This promotes forward thinking and fiscal responsibility by management and the Commission and provides consistency year over year. These forecasts provide a solid basis for next year's budget process.

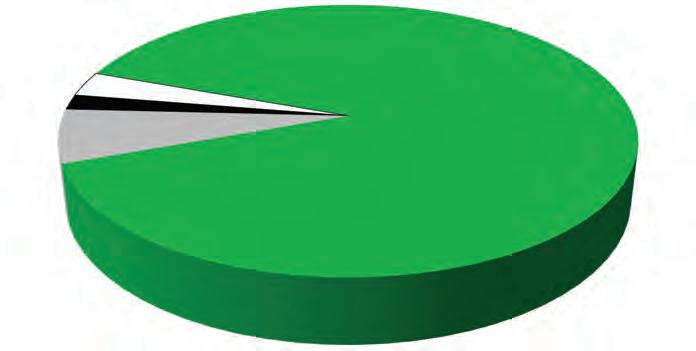

The FY 2024 Total Adopted Budget is $254,276,488 which includes $90,489,937 for General Fund expenditures. Summarized below are the changes broken out by fund type. The largest change is a decrease of $23.4 million in the Enterprise Funds, primarily due to a decrease in total cost for planned Utilities capital improvement projects together with the required transfer.

ALL FUNDS

FY 2024 ADOPTED BUDGET BY FUND TYPE $254,276,488

WHERE THE MONEY COMES FROM

The General Fund is the City's primary operating fund and is the largest fund. It accounts for all the financial resources needed to operate the City except for those required to be accounted for in a separate fund. The General Fund budget for FY 2024 totals

$90,489,937 which is an increase of 11.73% from last year's budget, as amended.

The General Fund (Fund 001) serves as the primary reporting vehicle for current operations. The major sources of revenue include ad valorem (property) taxes, utility taxes, communications services tax, franchise fees, user fees and charges for services, and intergovernmental revenues. The major departments funded within the General Fund are City Commission, City Manager, City Attorney, City Clerk, Financial Services, Human Resources, Community Development, Parks and Recreation, Information Technology, and Public Services. Police services are provided by contract with Broward County Sheriff's Office and are also funded in the General Fund.

These are the City's Operating Funds. The City of Tamarac has adopted a Fund Balance Policy. The purpose of the Fund Balance Policy is to provide enhanced financial stability by ensuring that the City maintains a prudent level of financial resources to protect against reducing service levels or raising taxes and fees because of temporary revenue shortfalls or unexpected one-time expenditures. The policy sets acceptable ranges of fund balance for each fund that contains operating revenues. The amounts set for each fund are based on the predictability of revenues, volatility of expenditures, and liquidity requirements of each fund. In some cases, the range of fund balance is determined by bond covenants. The policy also provides guidelines for actions that should be implemented should the fund balance either grow or diminish to amounts outside of the recommended ranges

The City's Budget seeks to preserve and build fund balances in each of the operating funds to continue implementation of the Fund Balance Policy. Budgeting was performed conservatively so that, for the most part, available revenues funded anticipated expenses and preserved fund balance levels.

Insurance Services Fund is Fund 502 & 504 combined All projected amounts are unaudited and based on preliminary FY 2023 year-end results. Future estimates are based on historic actual collection rates for revenues and expended budget percentages for expenditures.

Revenues

Expenditures-All Departments

Revenue Type Definitions:

(1) Variable-Discretionary/Restrictive - Relies solely on a tax increase to generate additional funds beyond growth.

(2) Variable-Discretionary means that it is adjustable by Home Rule to a certain extent.

(3) Variable-Non-Discretionary means it is received but not adjustable by the City due to certain factors such as, the rate is at the maximum percentage, it will take more than one year to adjust, and/or receipts are out of the City's control.

Underlying Assumptions:

(1) Revenues are forecasted in the General Fund using a conservative approach in accordance with the City's Financial Policies.

(2) Expenditures are forecasted conservatively with annual increases to Personal Services and Operating Expenditures aligned with inflation.

(3) At times when actual revenue exceeds estimates and actual expenditures are less than forecasted in the same year, the excess revenues are used to shore up the Citys Fund Balances and fund capital improvements.

Major General Fund revenue sources for the City of Tamarac are property taxes, utility taxes, franchise fees, sales and use taxes, telecommunication service taxes, and intergovernmental revenues.

The City's primary revenue source is property taxes. Property taxes are an ad valorem tax, meaning they are allocated to each property proportionately according to its value. The Broward County Property Appraiser (BCPA) establishes the value of property and exemptions within the City, and the City Commission sets the millage rate, which is applied against these values to calculate the expected amount of revenue. Although actual increases have ranged between 6% and 10% for the past five years, the City used a conservative projection of a 3 percent annual increase to forecast this revenue; projections remain modest for FY 2025 and FY 2026.

$50,000,000

$45,000,000

Franchise fees are negotiated fees the City charges a company or utility for the use of the City's rights‐of‐way (poles, lines, pipes, etc.) and could include the value of the right for the utility to be the exclusive provider of its services within the City. The City has franchise agreements for electricity and solid waste, with the largest revenue source being electric franchise fees. Electric franchise fees are based on the utility's revenues, which aren't expected to change significantly. A small growth rate of 0.5% is forecasted.

$3,950,000

$3,700,000

$3,450,000

$3,200,000

$2,950,000

$2,700,000

Communications Services Tax (CST) applies to telecommunications, cable, direct‐to‐home satellite, cellular telephone, and related services. The CST revenue is collected and distributed by the State of Florida and is a combination of two individual taxes: (1) the State of Florida communications services tax and (2) the local communications services tax. The economy, legislation, and technological changes have eroded the tax base for this revenue; a continued 0.5% annual growth rate is forecasted.

$2,750,000

$2,500,000

$2,250,000

$2,000,000

$1,750,000

$1,500,000

$1,250,000

A Public Service Tax is levied on the purchase of electricity, metered natural gas, liquefied petroleum gas, metered or bottled, manufactured gas, metered or bottled, and water service. This revenue was implemented by the City in Fiscal Year 2010 as a much‐needed effort to bridge the gap in other declining revenues, such as property taxes and other fees; forecasts are for minimal growth.

$5,500,000

$5,000,000

$4,500,000

$4,000,000

$3,500,000

$3,000,000

$2,500,000

Actual Revenues

Forecast : at a 0.5% growth

This category includes revenues received from federal, state, and other governmental sources in the form of shared revenues, the largest of which for the City of Tamarac are the Half‐Cent Sales Tax and Municipal Revenue Sharing. Half‐cent sales tax revenue is allocated to local governments based on a population‐derived formula for each county. The Municipal Revenue Share is allocated based on population, sales tax collections, and ability to raise revenue based on per capita taxable values. As of January 2019, an additional tax from natural gas was included in this Share. The forecast is skewed to the downside due to the risk associated with the national economic forecasts. As far as the overall uptick for FY'24 revenue goes, the numbers are based on collections that far exceeded expectations, and a key issue is that the increased prices related to inflation have helped boost sales‐tax collections.

$6,000,000

$5,500,000

$5,000,000

$4,500,000

$4,000,000

$3,500,000

$3,000,000

$2,500,000

$2,000,000

$1,500,000

$1,000,000

Fire suppression, prevention, and other fire services benefit all properties in the City by protecting the value and integrity of improvements to real property and protecting the use and enjoyment of such property. The City provides these services which reduce the cost of property insurance and enhances property values. The primary revenue used to fund these services is a non‐ad valorem special assessment levied on residential and commercial property owners. The amount of the assessment is calculated by a consultant using a calculation of recoverable costs, property types, and classifications.

$17,000,000

$16,000,000

$15,000,000

$14,000,000

$13,000,000

$12,000,000

$11,000,000

$10,000,000

The second significant revenue source in the Fire Rescue fund is transport fees collected from users of ambulance and rescue services, also known as Emergency Service Fees. Emergency service fee revenue is estimated by trend analysis, utilization of historical data, and input from the department on projected activity levels. In FY 2016, at the recommendation of the auditors, the City started deferring receivables taking a fairly large amount out of revenue and placing it in a balance sheet account, which going forward is to be adjusted each year based on a 60 day availability rule.

$3,000,000

$2,500,000

$2,000,000

$1,500,000

$1,000,000