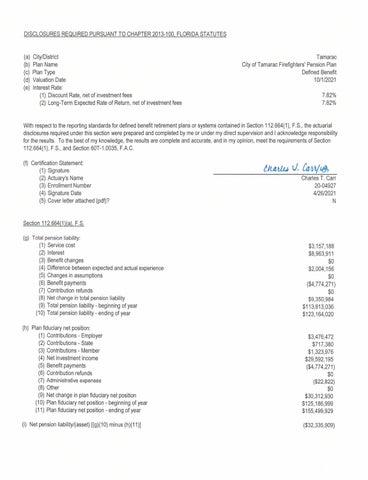

(a)City/District

(b)PlanName

(c)PlanType

(d)ValuationDate

(e)InterestRate:

(1)DiscountRate,netofinvestmentfees

(2)Long-TermExpectedRateofReturn,netofinvestmentfees

WithrespecttothereportingstandardsfordefinedbenefitretirementplansorsystemscontainedinSection112.664(1),F.S.,theactuarial disclosuresrequiredunderthissectionwerepreparedandcompletedbymeorundermydirectsupervisionandIacknowledgeresponsibility fortheresults.Tothebestofmyknowledge,theresultsarecompleteandaccurate,andinmyopinion,meettherequirementsofSection 112664(1),FS.,andSection60T-1.0035,F.A.C

(DCertificationStatement:

(1)Signature

(2)Actuary'sName

(3)EnrollmentNumber

(4)SignatureDate

(5)Coverletterattached(pdD?

Section112.664(1)(a),FS

(g)Totalpensionliability:

(1)Servicecost

(2)Interest

(3)Benefitchanges

(4)Differencebetweenexpectedandactualexperience

(5)Changesinassumptions

(6)Benefitpayments

(7)Contributionrefunds

(8)Netchangeintotalpensionliability

(9)Totalpensionliability-beginningofyear

(10)Totalpensionliability-endingofyear

(h)Planfiduciarynetposition:

(1)Contributions-Employer

(2)Contributions-State

(3)Contributions-Member

(4)Netinvestmentincome

(5)Benefitpayments

(6)Contributionrefunds

(7)Administrativeexpenses

(8)Other

(9)Netchangeinplanfiduciarynetposition

(10)Planfiduciarynetposition-beginningofyear

(11)Planfiduciarynetposition-endingofyear

(i)Netpensionliability/(asset)((g)(10)minus(h}(11)]

20-04927 4/26/2021 N

$3,157,188 $8,963,911 $0 $2,004,156 $0 ($4,774,271) $0 $9,350,984 $113,813,036 $123,164,020 $3,476,472 $717,380 $1,323,976 $29,592,195 ($4,774,271) $0 ($22,822) $0 $30,312,930 $125,186,999 $155,499,929 ($32,335,909)

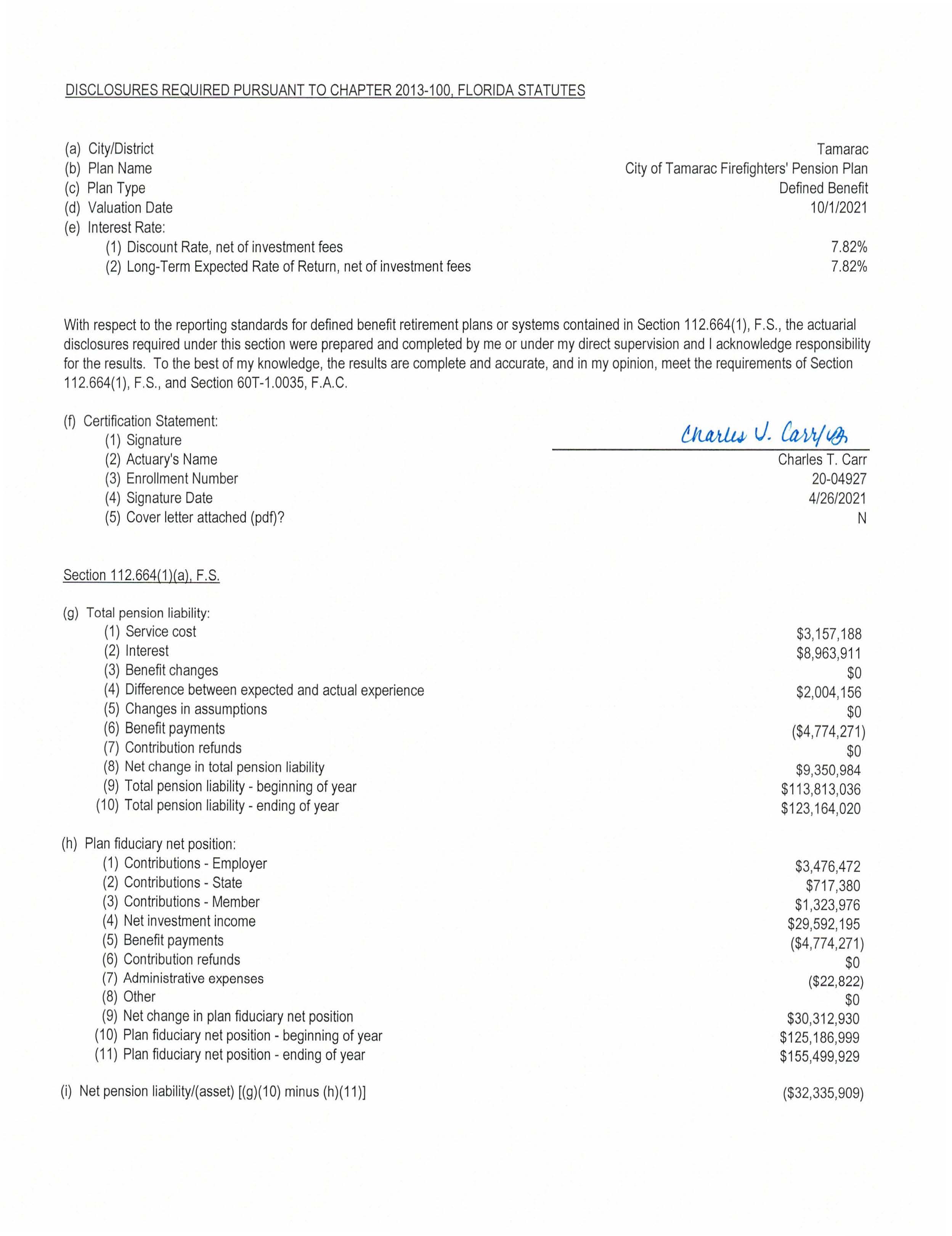

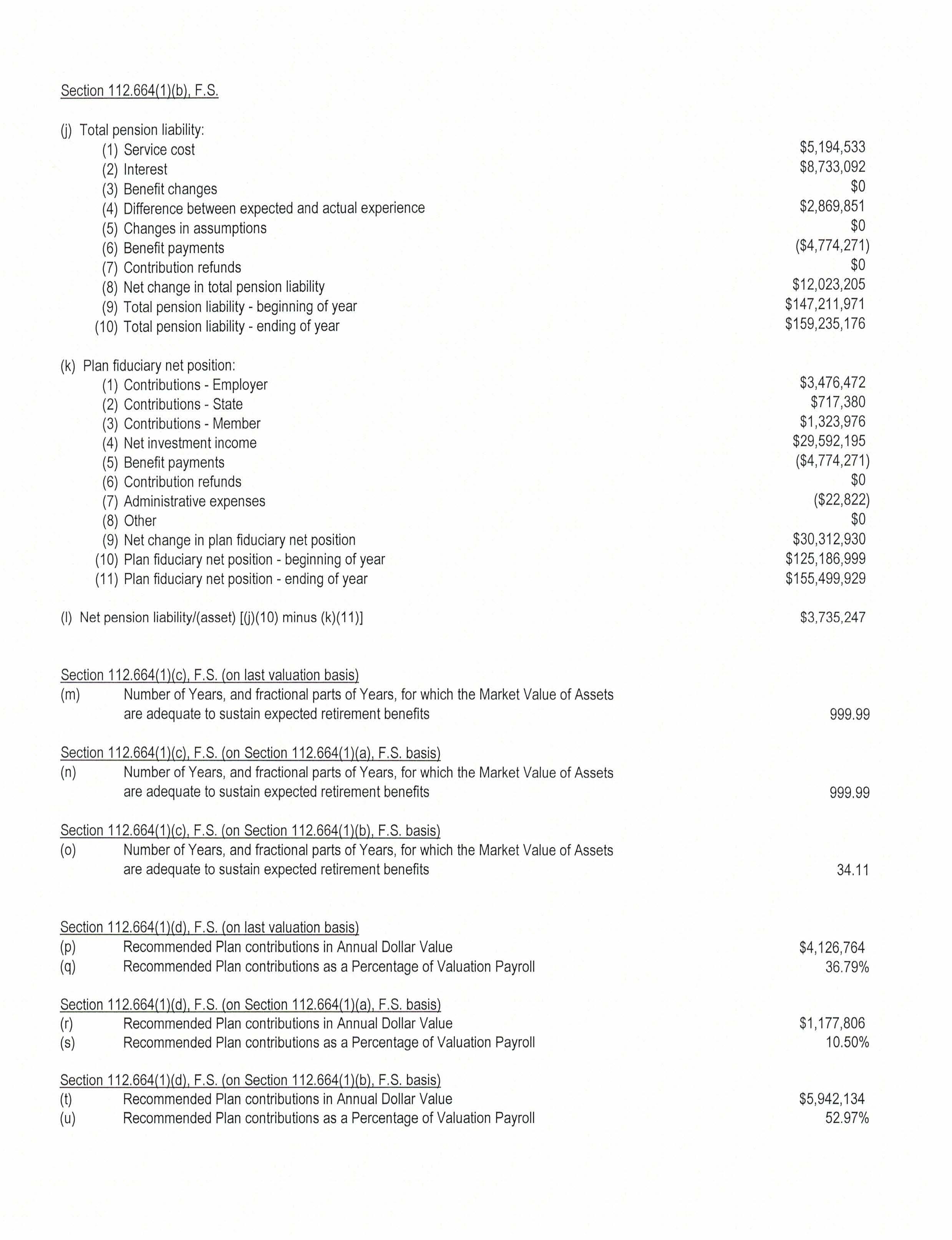

Section112.664(1)(b),F.S.

U)Totalpensionliability:

(1)Servicecost

(2)Interest

(3)Benefitchanges

(4)Differencebetweenexpectedandactualexperience

(5)Changesinassumptions

(6)Benefitpayments

(7)Contributionrefunds

(8)Netchangeintotalpensionliability

(9)Totalpensionliability-beginningofyear (10)Totalpensionliability-endingofyear

(k)Planfiduciarynetposition:

(1)Contributions-Employer

(2)Contributions-State (3)Contributions-Member (4)Netinvestmentincome

(5)Benefitpayments

(6)Contributionrefunds

(7)Administrativeexpenses

(8)Other

(9)Netchangeinplanfiduciarynetposition

(10)Planfiduciarynetposition-beginningofyear (11)Planfiduciarynetposition-endingofyear

(I)Netpensionliability/(asset)[U)(10)minus(k)(11)]

Section112664(1)(c),FS.(onlastvaluationbasis)

(m)NumberofYears,andfractionalpartsofYears,forwhichtheMarketValueofAssets areadequatetosustainexpectedretirementbenefits

Section112664(1)(c),FS.(onSection112.664(1)(a),FSbasis)

(n)NumberofYears,andfractionalpartsofYears,forwhichtheMarketValueofAssets areadequatetosustainexpectedretirementbenefits

Section112664(1)(c),F.S.(onSection112664(1)(b),FSbasis)

(o)NumberofYears,andfractionalpartsofYears,forwhichtheMarketValueofAssets areadequatetosustainexpectedretirementbenefits

Section112.664(1)(d),FS(onlastvaluationbasis)

(p)RecommendedPlancontributionsinAnnualDollarValue

(q)RecommendedPlancontributionsasaPercentageofValuationPayroll

Section112.664(1)(d),F.S.(onSection112.664(1)(a),F.S.basis)

(r)RecommendedPlancontributionsinAnnualDollarValue

(s)RecommendedPlancontributionsasaPercentageofValuationPayroll

Section112.664(1)(d),F.S.(onSection112.664(1)(b),F.S.basis)

(t)RecommendedPlancontributionsinAnnualDollarValue

$1,177,806

$5,942,134

(u)RecommendedPlancontributionsasaPercentageofValuationPayroll $5,194,533 $8,733,092 $0 $2,869,851 $0 ($4,774,271) $0 $12,023,205 $147,211,971 $159,235,176 $3,476,472 $717,380 $1,323,976 $29,592,195 ($4,774,271) $0 ($22,822) $0 $30,312,930 $125,186,999 $155,499,929 $3,735,247 99999 999.99 3411 $4,126,764