CITY

OF TAMARAC, FLORIDA 2026

ADOPTED BUDGET

OF TAMARAC, FLORIDA 2026

ADOPTED BUDGET

Tamarac has been inducted into the International Palladium Balanced Scorecard Hall of Fame. The award is recognized as the worldwide gold standard of strategic performance management.

Tamarac has been inducted into the ti The award is recognized as the worldwide gold standard of strategic performance management.

• Florida League of Mayors (FLM)Municipal Innovation Award Winner Selected as 2025 Winner in the Service Delivery Improvement Category for our Amazon Connect Omni-Channel Call Center Solution which transformed Municipal Service Delivery.

• FLGISA Technology Achievement Award for Innovative Use of Technology to Serve the Public

• Digital Cities Award – Center for Digital Government The Center for Digital Government has recognized the City of Tamarac for leveraging data to improve city services, programs, transparency, and cybersecurity with Digital Cities.

• Tamarac received the Tree City USA designation for its urban forestry management

• The City of Tamarac also received an efforts. Internationally Accredited Certificate demonstrating a commitment to service, safety, and continuous improvement.

• The National Fire Protection Association recognized the Division Chief/Fire Marshal for Tamarac, FL, Fire Rescue as the NFPA Fire Marshal of the Year. He has led a transformation in Tamarac Fire Rescue’s approach to fire prevention—shifting the focus from enforcement alone to a st rategy centered on community education and cooperative compliance.

• ISO Class 1 – re- assignation 4/10/2025

• The Commission on Fire Accreditation International (CFAI) an approved authority through the Center for Public Safety of Excellence (CPSE) awarded accredited status to Tamarac Fire Rescue

• The City of Tamarac was selected as a w inner by the Center for Digital Government and Amazon Web Services (AWS) forinnovation and impact through cloud technologies.

• Government Experience Project Award - Center for Digital Government for showcasing the latest trends, best practices and ideas around the evolving experience of government and recognizing the states, cities and counties at the forefront of the government experience movement.

• The City of Tamarac received the Cigna Healthy Workforce Designation, recognizing the organization for setting the standard in whole-organization health through strong foundations, population health programs, supportive policies and accommodations, and additional well-being program components.

GOVERNMENT FINANCE OFFICERS ASSOCIATION

PRESENTED TO

For the Fiscal Year Beginning October 01, 2024

Executive Director

The Government Finance Officers Association of the United States and Canada (GFOA) has presented a Distinguished Budget Presentation Award to City of Tamarac, Florida for its annual budget for the fiscal year beginning October 1, 2024

In order to receive this award, a governmental unit must publish a budget document that meets program criteria as a policy document, as a financial plan, as an operations guide, and as a communications device.

Levent Sucuoglu City Manager

Maxine Calloway Deputy City Manager

Hans Ottinot City Attorney

Tony Palacios Building Director/ Chief Building Official

Kimberly Dillon City Clerk

Christine Cajuste Director of Financial Services

Jonathan Frasher Fire Chief

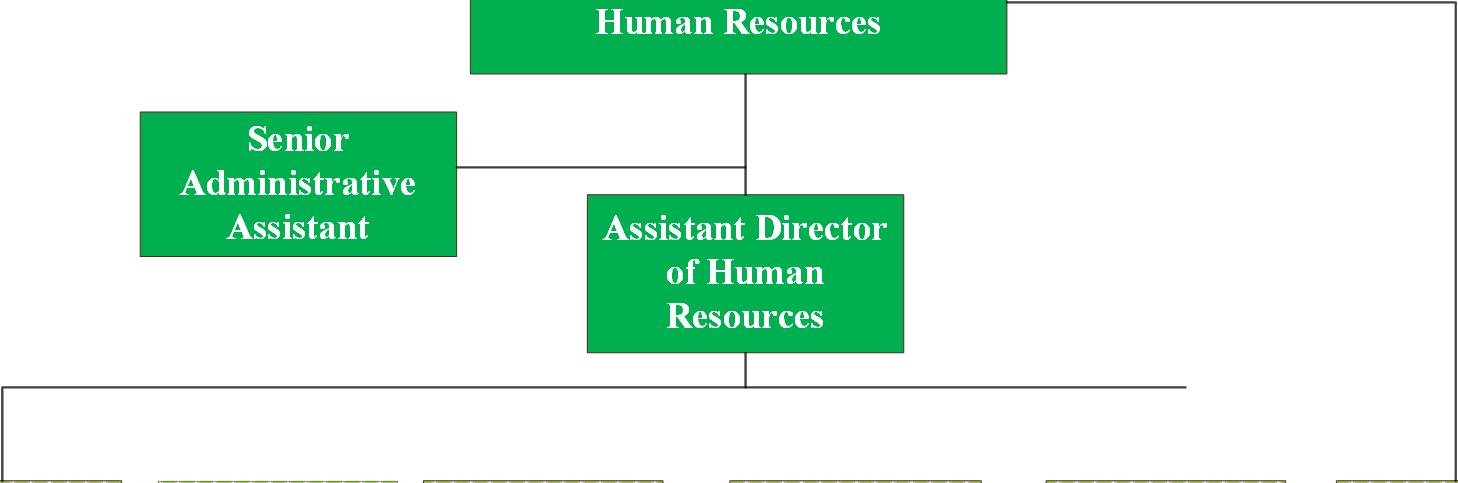

Danielle Durgan Director of Human Resources

James Twigger Chief Information Officer

Melissa Petron Director of Parks & Recreation

David Franks Captain Broward Sheriff’s Office

Mustafa Albassam Director of Public Services

Leading the nation in quality of life through safe neighborhoods, a vibrant economy, exceptional customer service and recognized excellence.

It is our job to foster and create an environment that

n n n Responds to the Customer Creates and Innovates Works as a Team n n Achieves Results Makes a Difference

Goal #1: Tamarac is Home

n Inclusive and Equitable n Well Maintained

n Parks and Infrastructure n Quality of Life n Convenient Transportation n ADA Accessibility n Great Education

Goal #2 : Tamarac is Safe and People Know It

n n Quick Emergency Response Low Crime Rate n Engaged First Responders

n n Police, Fire and Medical Services n Visibility and Crime Prevention Security Technology n Preparedness

Goal #3: Tamarac is Economically Resilient

n Business-Friendly n A Place to Thrive

n Development and Permitting n Economic Growth n Market Opportunities

Goal #4: Tamarac is Vibrant

n Attractive n Active and Fun n Green and Sustainable

n Appearance and Image n Resilient n Healthy Lifestyle

Goal #5: Tamarac is Smart and Connected

n Tech Savvy n Neighborly

n Effective Communication n Smart City n Engaged n Celebrating Community

Goal #6: Tamarac is a Dynamic Workplace

n Attract and Retain Skilled Workforce n Promote a Culture of Excellence

n 5-Star Customer Service n Professional Development n Supportive Environment n Optimal Organization

Projects/Initiatives

STRATEGIC ACTION ITEMS

1. Improve quality education opportunities for all Tamarac residents

STRATEGIC ACTION ITEMS

Project/Initiative Comments

1. Continue to review and update regulations to ensure excellent quality of life for all residents

1. Beautification – Plaza Revitalization (Certificate of Use Ordinance)

1. Explore regulatory measures for fishing in canals

1. Tree Ordinance

STRATEGIC ACTION ITEMS

This program is now up and running and in full implementation.

Regulating Fishing under a No Trespassing on Waterways Ordinance was not approved by the City Commission (Feb 12, 2025).

Update to the LDC Landscaping and Tree Preservation Ordinance approved by City Commission on 2nd reading on Sep 10, 2025

1. Continue to plan for, accurately estimate cost and required resources, maintain and upgrade our water, sewer, roadway and other infrastructure

1. Street Repaving, Restriping, Refectors

The contractor has completed Phase 2 and has commenced with the Phase 3 work within the Mainlands Section 10 area. Commercial Boulevard has been completed.

1. Update the CIP Plan annually, which includes Utilities20-year Master Plan CIP Plan is updated annually. Ongoing.

1. Evaluate Seawalls repair program options

1. Eastside water distribution system expansion; feasibility study to extend Tamarac water service

1. Construction of a new Water Treatment Plant Control Building

While state and federal programs don’t allow the City to provide grants to private homeowners for seawall repairs, residents may qualify for up to $3,000 through the City’s Curb Appeal Program or explore financing through the PACE program.

Discussion on the Eastside water distribution system expansion is scheduled for the January 2026 workshop.

The competitive bidding process closed in April 2025. Currently in the review process by staff.

1. Installing EV Charging Stations at City facilities

1. Guard Rail (Southgate & Pine Island )

STRATEGIC ACTION ITEMS

The City was awarded a $125,590 Energy Efficiency and Conser vation Block Grant (EECBG) from the U.S. Department of Energy in December 2024, to suppor t the purchase and installation of electric vehicle (EV) charging stations at the Caporella Park overflow parking lot and the Caporella Aquatic Center. During this reporting period, there was no project-related activity; the project has not yet started.

Public Services will conduct a safety assessment and submit a Capital Improvement Project (CIP) request for FY26/FY27.

1. Establish and foster transportation plans and partnerships to provide convenient and accessible means of transportation

1. Advocate for the additional Turnpike On/Off Ramp (Oakland Blvd/or Cypress)

1. Traffic Congestion

1. Bus hub on property on Commercial Blvd. West of 75

STRATEGIC ACTION ITEMS

Ongoing. Tracking the project's advancement closely, staff remains proactive in seeking ways for the city to lend its support to this initiative

Commercial Boulevard - AIA to University

Overall Project Timeline: on schedule for completion by August 2026.

Scope of Work:

• Directional boring for communications and CCTV connections

• Installation of new mast arms, including a key location on Woodlands Blvd in Tamarac

• Installation of new CCTV cameras on existing mast arms at intersections from Rock Island Road to Prospect Road

The County’s Tamarac Bus Stop Improvement Project is scheduled to begin in mid-November 2025 with the installation of benches, trash cans, and bicycle racks. Covered shelter installations are expected to follow in January 2026.

1. Ensure equitable distribution of parks and recreation programs, services and facilities

1. East side Dog Park

1. Build Mainlands Park enhancements

1. Develop a park at Central Parc - Sabal Palm

STRATEGIC ACTION ITEMS

1. Continue to monitor and enhance ADA compliance and accessibility

1. Continue to monitor the law and upgrade existing resources

1. Update building forms to ADA compliance

Included in conceptual plan for Sabal Palm Park.

Included in the FY2027 budget.

Community workshops will be needed to gather input on desired features for the park.

Step 2 on the design/build bidding process was issued to qualified teams. Proposal were received and reviewed.

The project was advertised and closed on July 18, 2025. Vendors presented at the Commission Workshop in September 2025. Franjo Construction was selected at the September 10, 2025 Commission meeting, and the contract and design negotiations are currently underway.

Developed an interactive process for coordinating ADA and employment leave, including the creation of standardized templates and HR staff education.

IT completed training to allow in house creation of ADA compliant documents, removing the need for separate conversions. Implementation of ADA forms is underway, and all non ADA forms have been removed.

Projects/Initiatives

STRATEGIC ACTION ITEMS

Project/Initiative Comments

2. Increase visibility and address emerging crime trends through operational plans and pro-active policing

2. Automated License Plate Readers (ALPRs)

For the larger ALPR project thru Vetted:

All but one (1) location have been installed, commissioned, and sending alerts to BSO.

The one (1) location below in yellow are awaiting power from the city.

• Commercial WB at the Turnpike (Near the fire station)

The City is currently working with FPL to provide power to locations.

For the Parks ALPR project thru Flock Safety:

8 locations installs complete; awaiting completion of 2 remaining locations. Still awaiting issuance of permits by Broward County.

2. Increase Police Presence - Adding 9 BSO Deputies Completed.

2. Zero Tolerance Corridor Traffic Enforcement/ Speeding/Littering| Speeding Ticket Enforcement throughout the entire City

2. Public Safety (more community policing initiatives, Domestic Violence Program, Substance Abuse Program, Steering Committee)

STRATEGIC ACTION ITEMS

BSO continues aggressive enforcement of traffic laws via both its Patrol and Traffic units. They are currently on pace to exceed last years numbers.

BSO Upcoming Events:

Citywide Welcome Home Initiatives

October 4 - Domestic Violence Summit at Tamarac Community Center.

October 10 - Coffee with a cop

October 16 - Crafting with deputies

October 18 - National Night Out at BSO District Office.

November 5 - Explorer Interest Meeting

2. Enhance safety and security throughout City Parks and Facilities by deploying technology

Projects/Initiatives

2. Select a vendor and implement the first phase of improvements recommended by the Security Master Plan (SMP)

2. Implement the future phases of security improvements

STRATEGIC ACTION ITEMS

Project/Initiative Comments

All tasks for Security Master Plan (SMP) Phase 1 have been completed. The City received the final closeout documents, and warranty information from Johnson Controls on 2/27/2025.

Final Letter of Completion issued to Johnson Controls on 4/22/2025.

With the help of the City Attorney, a settlement was negotiated and approved by City Commission 0n 11/12/2025.

Security Master Plan (SMP) Phase 2 was approved by the City Commission on April 23, 2025.

Purchase Order issued on July 15, 2025.

Notice to Proceed issued on July 24, 2025.

Expected project Final Completion on June 1, 2026.

Miller Electric has began working at various facilities as of August 25th.

2. Identify partnerships, resources & other solutions to ensure response to fire and medical emergencies within 8 min. or less 90% of the time

2. Monitor response time data and continue to identify partnerships, resources and other solutions to address the areas in need

STRATEGIC ACTION ITEMS

2. Be prepared to respond to all hazards

2. Emergency Management Data

STRATEGIC ACTION ITEMS

September monthly report is available with data analysis.

FROC (Florida Recovery Obligation Calculation) training class hosted on October 6th at FS15 with other municipalities and Tamarac employees for a total of 31 participants.

Revisions are underway to update the City’s emergency plan, and the final update for State Senate Bill 180 related to emergencies is due December 8.

2. Continue inclusive and positive interactions with various community groups and individuals

2. Attend community meetings and events engaging with various community groups

2. Community policing/police-community relations

Community Meetings Attended by BSO:

9/3 City of Tamarac Code Hearing

9/8 & 9/22 City of Tamarac Staff Agenda meeting

9/10 & 9/24 City of Tamarac Commission meetings

9/12 & 9/24 City of Tamarac Public Budget meeting

9/17 City of Tamarac Building hearing

BSO Community Policing:

9/9 & Kings Point Tuesday Tables

9/10 Meet & Greet the new Captain

9/11 Sunflower HOA

9/16 Mayor Gomez Protect your home

9/17 Grab a Bite with BSO

9/18 Commissioner Patterson Springlake HOA meeting

9/19, 9/22, 9/23, 9/24, 9/25,9/26 Welcome Home Initiative City Wide

9/19 Hispanic Heritage Event

9/27 Commissioner on your Block event

2. Increased Police Visibility

Combining the newly acquired staffing with existing personnel, BSO Tamarac is engaging in a number of high visibility activities, including: Welcome Home initiatives, Operations plans for High Visibility Traffic Enforcement on main/major thoroughfares and regular, documented area checks conducted by patrol of neighborhoods, shopping plazas, commercial areas and city parks.

2. BSO Substation - Explore options for renting space on Eastside Currently in the research stage.

Projects/Initiatives

STRATEGIC ACTION ITEMS

Project/Initiative Comments

3. Continue to evaluate and improve developing, permitting and procurement processes to enable businesses to open up quickly, grow and succeed

3. Update permitting Systems/TRAKiT-OneSolution

STRATEGIC ACTION ITEMS

The City has canceled its contract with Central Square Technologies for the migration to Finance Enterprise, Community Development TRAKiT, and Common Cash Receipts (CCR). The City is currently exploring alternative solutions.

3. Identify and pursue high-quality market-driven redevelopment opportunities

3. Developer Incentive Program to Revitalize Commercial Plazas/Corridors

The City of Tamarac administers three incentive programs that support commercial plaza revitalization.

Commercial Facade Grant:

Former Winn Dixie site is nearing completion with final approvals expected by the end of November

The owner at 6412 North University Drive has requested a phased approach and updated quotes are pending.

Additional interested plazas include Cypress Commons, Three Lakes Plaza, Tamarac Marketplace, and Midway Plaza.

Tenant Improvement and Interior Buildout Grant:

Provides up to $100,000 in reimbursement for interior upgrades by new businesses.

• Touch of Serling (Beauty Supply): Recommended for Grant Review Committee.

• Xaymaca Coffee Traders (Retail Merchant): Under review.

Commercial Plaza Recovery Program:

Provides Plaza owners with assistance to help bring their properties back into compliance, while encouraging the integration of small businesses within their redevelopment projects. No active projects at this time.

3. Conduct a feasibility study for Redevelopment of Public Safety/Municipal

The City received two proposals in response to the Request for Proposals for a Complex; Evaluate P3 opportunities long-term ground lease involving a new municipal building and mixed-use development, which opened on June and closed in September. Minor question revisions were sent to the proposers, and presentations are being planned tentatively for January.

3. "Uptown Tamarac"/redevelopment of SR7/Commercial Blvd. corridor

3. Revitalization and community partnerships (East-side Community Center)

3. Proactively seeking grants for capital projects

3. Greater High & Density on Major Thoroughfares (Commercial, University, 441 & McNab)

STRATEGIC ACTION ITEMS

3. Promote economic development

3. Implement Pilot Placemaking Projects

3. Evaluate the establishment of Sister Cities program in Tamarac, starting with a “friendship” city relationship

Project/Initiative

Comments

The City has acquired 4969 N. State Road 7, adding to properties at 4949 and 4959 N. State Road 7, creating a 1.79-acre contiguous site for redevelopment along the SR 7 Corridor. This strategic assembly enhances the City’s ability to guide highquality, catalytic projects.

Additionally, the City acquired 3650–3660 W. Commercial Boulevard, opening another redevelopment opportunity and is in early negotiations with Bedding Barn (8201 W. Commercial Blvd.) for potential acquisition.

Awaiting FCT approval (Fall 2025) BID will be issued following FCT approval.

Eastside Community Park (District 1)

The City completed the property acquisition on January 30, 2025 and submitted the required Management Plan to FCT; reimbursements can begin once both plans are approved and must be completed before the grant expires on July 7, 2026.

Gateway Landscape Project (Commercial Blvd.)

The City submitted the FDOT Highway Beautification Grant application. Tentative award notification is January 6, 2026.

Culvert and Headwall Improvements, Phase VII

The project was advertised in August with a pre-bid conference held on September 16, 2025. The bid opening date was rescheduled for October 15, 2025. The City received one bid, which is currently under evaluation

Water Treatment Plant Control Building

Contractor procurement is underway for the new control building supported by state appropriations, with the grant active through December 31, 2027.

Tamarac Park Safety and Health Enhancements

The City received the fully executed grant agreement for new lighting at Tamarac Park, with project completion required by April 30, 2028.

Canal Culvert Gate and Headwall Improvements (Nob Hill and Hiatus)

Design was completed and the project is preparing for construction under a fully executed reimbursement agreement.

Tamarac Roadway Urban Forestry Project

The project was re scoped to tree planting along NW 57th Street and the City began procurement for a design consultant; design and construction have not yet started.

Incorporated in the City’s 2050 Comprehensive Plan. Adopted on 2nd Reading at the City Commission Nov 12, 2025.

This action plan is still ongoing as Economic Development is coordinating with the appropriate departments to identify placemaking opportunities that can enhance the appeal and long-term success of these sites.

The next Sister Cities Committee Meetings are scheduled for:

November 20, 2025

December 11, 2025

3. Continue efforts to enhance spend for Small, Minority, Local and Veteran Businesses

Sept 2025: $10,396.49 awarded to small, minority, local, women, and veteran-owned businesses.

Fiscal Year-to-Date FY25: $3,484,591.86 awarded, representing 10.31% of total contracts awarded for FY25.

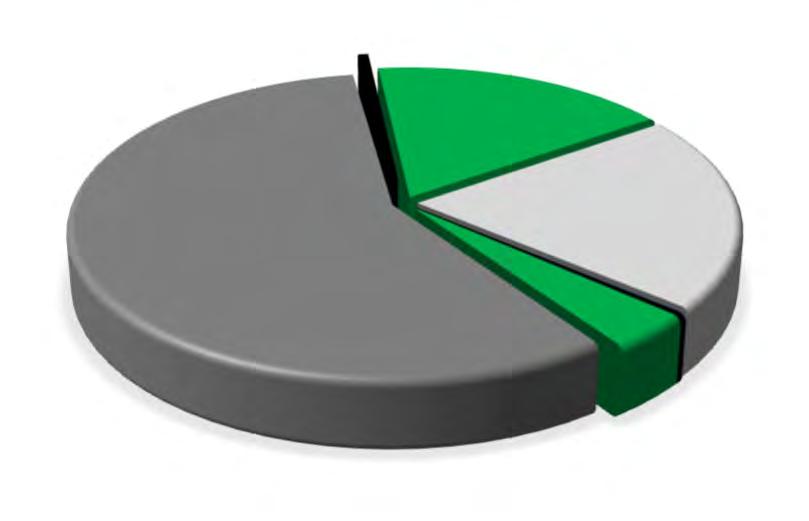

• TOTAL LOCAL, CBE, M/WBE & VETERAN SPEND - $3,484,591.86

• TOTAL SPEND FY 25 - $33,808,781.62

• % of CBE Vendor Spend - 1.14%

• % of Tamarac Local Vendor Spend - 0.86%

• % of Veteran Owned Vendor Spend - 0.09%

• % of MBE Awarded Vendor Spend - 7.94%

• % of WBE Awarded Vendor Spend - 2.99%

• Total Percent - 13.02%

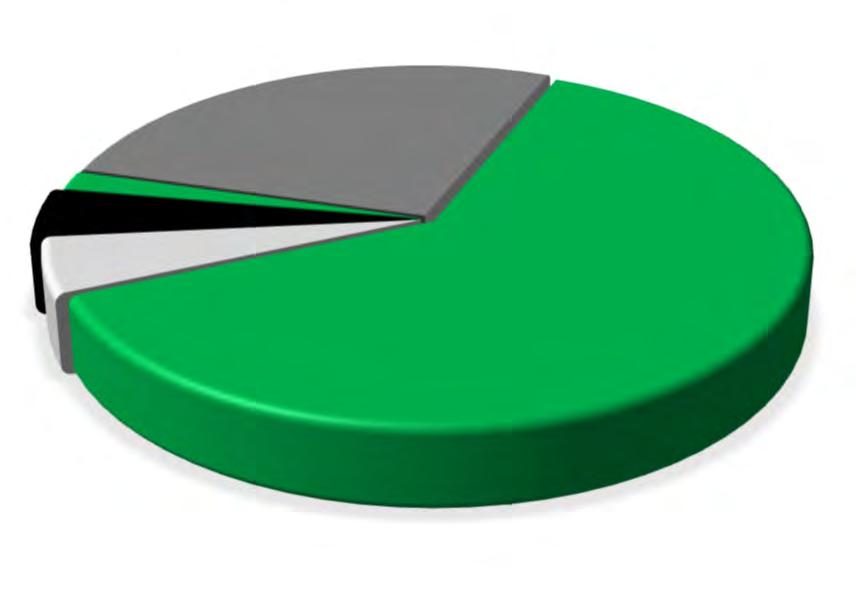

TOTAL MINORITY SPEND FY25

• % Minority Asian Spend - 1.81%

• % Minority Black / African American Spend - 6.46%

• % Minority Hispanic Spend - 0.44%

3. Small Business Support

1. Attraction of restaurants (Dining & Entertainment Options)

The City continues to expand support for small businesses through programs, partnerships, and new initiatives.

Small Business Directory

The City launched its first public business directory, allowing users to search Tamarac businesses with real time updates linked to Google profiles.

Active Grant Programs

Small Business Micro Grant: Up to $10,000 reimbursement for eligible expenses.

• Launched June 27, 2025.

• 83 applications received; 30 approved, totaling $150,000+ awarded.

Workshops and Partnerships

The City continues to expand business support through workshops and collaborations with the Black Chamber, Tamarac Nor th Lauderdale Chamber, CareerSource Broward, SCORE, and SBA.

Upcoming MOUs

Upcoming MOUs with the Urban League and CareerSource Broward will enhance entrepreneurship support and workforce development, with the Urban League MOU already drafted for future Commission consideration.

The City is actively recruiting new dining and entertainment options. Staff collected fourteen restaurant and entertainment leads at the ICSC event and shared them with Retail Strategies for follow up. Several new restaurants have opened recently, with others currently in permitting or expanding. Prospective Brands:

Cracker Barrel, Keke’s Breakfast Café, Jersey Mike’s Subs, Marco’s Pizza, Panda Express, QDOBA Mexican Eats, Smoothie King, The Great Greek Mediterranean Grill, Tropical Smoothie Café, Buffalo Wild Wings, Jimmy John’s, WOW Works, Nothing Bundt Cakes, and Books-A-Million.

New Restaurant Activity (Aug–Oct 2025):

• Larry’s Boardwalk Café – Newly opened.

• La Toxica – Newly opened.

• Nuria Investments Inc. – Newly opened.

• Boca Chica Seafood Restaurant (Dominican Cuisine, Midway Plaza) – New business not yet registered; currently in the licensing and permitting process.

• El Buen Gusto Restaurant & Bakery (Tamarac Square West) – Expanding to occupy a larger footprint.

3. Include Nob Hill Overlay for Government Campus in Comprehensive Plan Included in 2050 Comprehensive Plan.

3. Business Attraction (Building Retail and Large Businesses)

The City is implementing a multi-faceted approach to attract new investment and strengthen Tamarac’s business environment.

Process Improvement: Business Concierge streamlines communication and permitting to enhance Tamarac’s business-friendly reputation.

Marketing & Advertising: Promoted Tamarac’s economic initiatives in Shopping Center Business, Greater Fort Lauderdale Alliance Economic Sourcebook, and Florida Trend

Broward County Incentives: Partnering with the Greater Fort Lauderdale Alliance to attract larger firms and provide new tools for local business support.

City Incentives: Leveraging Tamarac’s grant programs to attract and retain businesses.

Land Acquisition: Strategic property purchases to facilitate public-private partnerships for catalytic developments such as restaurants and retail.

Retail Strategies Partnership: Sharing available properties via CoStar to fill vacancies with desired restaurants and retail concepts.

Projects/Initiatives

STRATEGIC ACTION ITEMS

Project/Initiative Comments

4. Continue to provide and enhance opportunities for active, healthy and fun lifestyle

4. Improvements and enhancements to City parks including projects at Sunset Point Park, and Veteran's Park.

4. Environment friendly illumination at parks

4. Dog friendly park along108th Terrace

4. Diverse Entertainment/Events (Add a Latin and Hispanic Event)

4. Programming in Partnership with HOAs

4. ASL Programing Promote Local Programs

4. Occupy Caporella – Annex Park (Aerobic Classes)

4. Tamarac Sports Complex - Add crosswalk to get to park.

4. Tamarac Spor ts Complex - Add Benches & Trees

4. Citywide Santa Caravan Parade

4. Study of Multi-Purpose Complex(Options for Best Use ofProperty)

4. Budget to construct - Increase funds for East Side Community Center

4. Yard on the Lawn | Included with Caribbean June Event

Completed.

Public Services assessed the lighting in City parks and determined that current levels are adequate.

No Commission consensus to move the project forward.

Held on September 19,2025.

Staff contacted six HOAs and attended three meetings, but no interest in a partnership was expressed.

City promoting local programs.

The following programs have been added:

• Tamarac Titans - Teen program

• Yoga fitness program

• Partnership with Millennium Middle

The design has been completed. The Engineering Division is currently working with Broward County Traffic Engineers to address County comments.

Phase 4 of 5 of the waling path trail is currently in progress. Once completed, benches will be ordered for installation. Public Art working with artist for benches.

Added to City Budget for FY26.

Staff working on event.

A Capital Improvement Project (CIP) has been established to address building roof repairs and minor maintenance needs. Funding for design and a complex site plan feasibility study is included in the FY2026 budget.

Included in FY26 Budget.

Held June 28, 2025.

4. Gym/Workout Classes for Families (workout classes for 8 years old+ with parents, Research aftercare workout programs, Resident / Employees)

4. United States of America 250th Birthday Celebration (7/4/2026)

STRATEGIC ACTION ITEMS

4. Continue and enhance the City beautification programs

4. Beautification Plan along Bailey Rd & Sabal Palm Blvd (Landscaping)

4. Implement neighborhood signage program

4. Buffer wall program implementation & update

Completed and ongoing.

Plans are currently being discussed to incorporate the celebration of American's 250th birthday in 2026 into the City's annual Fourth of July festivities. While details are still being developed, some ideas under consideration include adding a brief drone show as part of the evening fireworks display, introducing a large "250"themed inflatable as a photo opportunity, and creating social media content to help educate the public about this historic milestone.

The new Landscaping Maintenance Contractor has been directed to provide extra care and attention to Bailey Road and Sabal Palm Blvd. A Landscape Beautification CIP will be planned for FY 26.

As of September 22, 2025: Ongoing Comprehensive Sign Projects:

• Heathgate Sunflower

• Lakeside at Tamarac

• Mainlands 10 at Tamarac

• Santa Monica at Tamarac

• Shaker Village

• Sunset Isles 13 - Clubhouse

• The Pines at Woodmont

• The Pines III at Woodmont

• The Pointe at Tamarac

• The Villas at Woodmont

• Woodmont Country Club Golf and Tennis

The Citywide Buffer Wall Program Phase 6 Project, Prospect Road, is complete. The Commercial Boulevard/Rock Island Road and Pine Island Road North Buffer Wall Project has successfully progressed through the competitive bidding process. This project has been through the City’s competitive bidding process and is in design.

4. Install directional/wayfinding and community facilities signage Citywide Ongoing. Wayfinding Committee to submit final recommendation (expected Dec 2025).

4. Implement landscaping in medians and ROW’s

4. 78th St./University Dr. landscaping

4. Public art: Social Justice Wall

4. HOA beautification grants

4. Public art significant sculpture installs:

4. Secure funding for development of corridor plans

4. Replace bus benches with shelters, add locations

4. Buffer Wall: 81st from Pine Island to McNab

4.

of Carriage Hill

Landscaping Master Plan is complete. Community Development has several proposed median beautification projects in the FY25 CIP Budget.

Project completed 11.6.25 with final light installation.

Completed.

Ongoing.

The sculpture for Fire Station 15 installed.

Ongoing.

The Tamarac Bus Stop Improvement Project, coordinated through Broward County, is progressing. Installation of new bus stop amenities, including benches, trash cans, and bicycle racks is expected to begin around the second week of November 2025.

Installation of the covered shelters is anticipated to start in January 2026.

The construction phase of this project is slated for funding in FY26. Survey is completed. Our team will prepare the Design-Build RFP to ensure that construction commences as scheduled in FY26.

The construction phase of this project is scheduled for funding in FY26. Public Services staff is collaborating with Community Development to secure wall easement acquisitions and maintenance agreements in advance of FY26.

The construction phase of this project is scheduled for funding in FY26. Public Services staff is collaborating with Community Development to secure wall easement acquisitions and maintenance agreements in advance of FY26.

4. Buffer Wall: 81st St from Pine Island to Nob Hill (Northside)

4. Increase Pressure Cleaning Efforts Yearly (Sidewalks on County & FDOT Right of Way)

STRATEGIC ACTION ITEMS

4. Continue to refine and promote the City’s identity

4. Continuation of robust marketing strategy and increased events marketing; telling Tamarac Story

4. Proactive Beautification Efforts

4. More Code Enforcement - Additional Code Officer

The construction phase of this project is slated for funding in FY26. Survey is completed. Our team will prepare the Design-Build RFP to ensure that construction commences as scheduled in FY26.

This has been appropriately included in the FY26 budget.

The Public Information Office (PIO) continues to market the City’s special events through a comprehensive marketing strategy that includes print and digital advertising, radio ads with Cox Media Group, e-blasts to our over 35,000 subscribers and original content creation, including flyers, video and social media campaigns.

These efforts feature engaging carousels, event countdowns and reminders, photo recaps from previous events, and collaborations with event performers who provide promotional videos to help reach both their audiences and ours.

The Gateway Landscaping Improvement Project is currently under permitting. This project includes Gateway Landscaping Improvements at Pine Island Road and Commercial Boulevard; Rock Island Road and Bailey Road; and University Drive and Southgate Boulevard.

Adopted in the budget for Fiscal Year 2025. Fully Staffed - Completed.

4. Park Safety - Additional Full-Time Park Ranger Completed.

4. Code Enforcement Comprehensive Review In progress.

STRATEGIC ACTION ITEMS

4. Evaluate and promote green policies

4. Tamarac's Sustainability Strategy Program

STRATEGIC ACTION ITEMS

4. Review citywide resiliency plans and update as needed

4. Tamarac Comprehensive Vulnerability Assessment

The City is working with WM’s Sustainability Advising Services to develop a new sustainability initiative aimed at improving quality of life and strengthening community resilience. The project began with a comprehensive review of local and regional data, followed by year one engagement with staff, elected officials, residents, businesses, and neighboring communities. The next strategy team meeting is scheduled for November 17, 2025 to review progress and the drafted year one report.

This project is ongoing and tentatively scheduled to be completed by Fall 2025. The second public outreach workshop was held in August 2025. Currently, the project is in the final completion phase.

Projects/Initiatives

STRATEGIC ACTION ITEMS

Project/Initiative Comments

5. Develop a SMART City Master plan to meet community needs and provide a technology road map

5. Consultant to complete a SmartCity Strategic Plan

5. Fiber Network Expansion Phase II

5. OneSolution – Work Management Systems Module(Work Orders / Facility Maintenance / Fleet Maintenance /Asset Management)

5. OneSolution – HR / Financials Module

Project cancelled.

Fiber Network Expansion (Phase 2) work has been completed.

A GIS map was to be provided as part of Automated Meter Reading project, which is required in order to integrate Lucity with NaviLine Work Order/Utility Billing.

CST now has an integration of Lucity with NaviLine Utility Billing. Received SOW and Proposal from CST on 1/10/2025.

Received all necessary approvals to proceed on July 22, 2025.

Purchase Order issued.

The City decided to cancel its contract with Central Square Technologies (CST) for the migration to Finance Enterprise (formerly known as ONESolution), Community Development TRAKiT and Common Cash Receipts (CCR).

5. Solicitation RFP 22-09RPfor Smart Meters for Water Service Completed.

STRATEGIC ACTION ITEMS

5. Further enhance community engagement and communications

5. Transition from MyCivic to SeeClickFix

5. Determine potential to expand Digital Signage to display live bus schedules, promote local community and events

Completed SeeClickFix Go Live in September 2022; Past historical data migration/import from MyCivic to SeeClickFix is now complete.

Not funded in the FY2026 budget. This project is now being handled by Broward County, which will be providing digital signage at bus stops.

5. Increase community outreach/awareness of programs

Project/Initiative Comments

Recent events, including Hispanic Heritage Month, the Fourth of July Celebration, and the Juneteenth Festival, have all experienced excellent attendance. The upcoming Turkey Trot sold out last year, and we anticipate the possibility of another sellout this year.

PIO’s efforts have also garnered recognition from external platforms, including social media event calendars such as @TodoWithKidsBroward and NBC’s Community Connection.

Looking ahead to the holiday season, we’ll continue our “Spend the Holidays in Tamarac” campaign, promoting festive events such as Santa’s Community Ride Parade, the Holiday Lighting Ceremony, and the Neighborhood Holiday Lights Contest, while showcasing the beautiful seasonal décor throughout the City.

5. Expansion of Building Department customer-focused practices (e.g. expired open permit program, staff training & support)

Current procedures for handling open/expired permits and staff cross-training are under review for potential changes.

5. Re-establish District Office [Lease East of 64th] Establish pro forma for employee and rent costs In research stage.

5. Public Safety & PIO Collaboration: Information Tips

STRATEGIC ACTION ITEMS

The Public Information Office (PIO) continues to collaborate with the Broward Sheriff’s Office (BSO) by providing promotional support and partnership opportunities through the sharing of their events and initiatives. While BSO develops its own branded materials, PIO supports its efforts by amplifying and promoting its content across the City’s communication platforms.

5. Build community by bringing community together to celebrate Tamarac’s multi-cultural and unique character

5. Add community events including Art in the Park at Tamarac Village Added two food truck events a month starting in August.

5. Develop program to bridge gap between seniors and young residents Programs offered year round through Senior Program and Summer Camp.

Projects/Initiatives

6. Continue supporting positive work environment

Project/Initiative

6. Travel Policy Review - Rental of electric vehicles Completed.

6. Continue to pursue the award for Excellence in Financial Reporting Awaiting the results from GFOA.

6. Honor the Stripes (Fire and BSO) Ongoing.

6. Welcome Video from CM and Commissioners

STRATEGIC ACTION ITEMS

6. Expand and support employee professional development opportunities

6. College to job internship pipeline

6. Employee Tuition Reimbursement Program

6. 5-star customer service

All elected officials who expressed interest in participating in the welcome video have recorded their segments.

The Internship Program was refreshed and internship positions were approved in the FY2025 budget process for Public Services, Community Development and Financial Services departments. The City partners with educational institutions to fill these internship positions.

The tuition reimbursement program remains unchanged and is available to employees on a first come first served basis.

6. Refresh customer service standards and goals Completed.

STRATEGIC ACTION ITEMS

6. Celebrate successes and enhance employee recognition

6. BRAVO Program Completed.

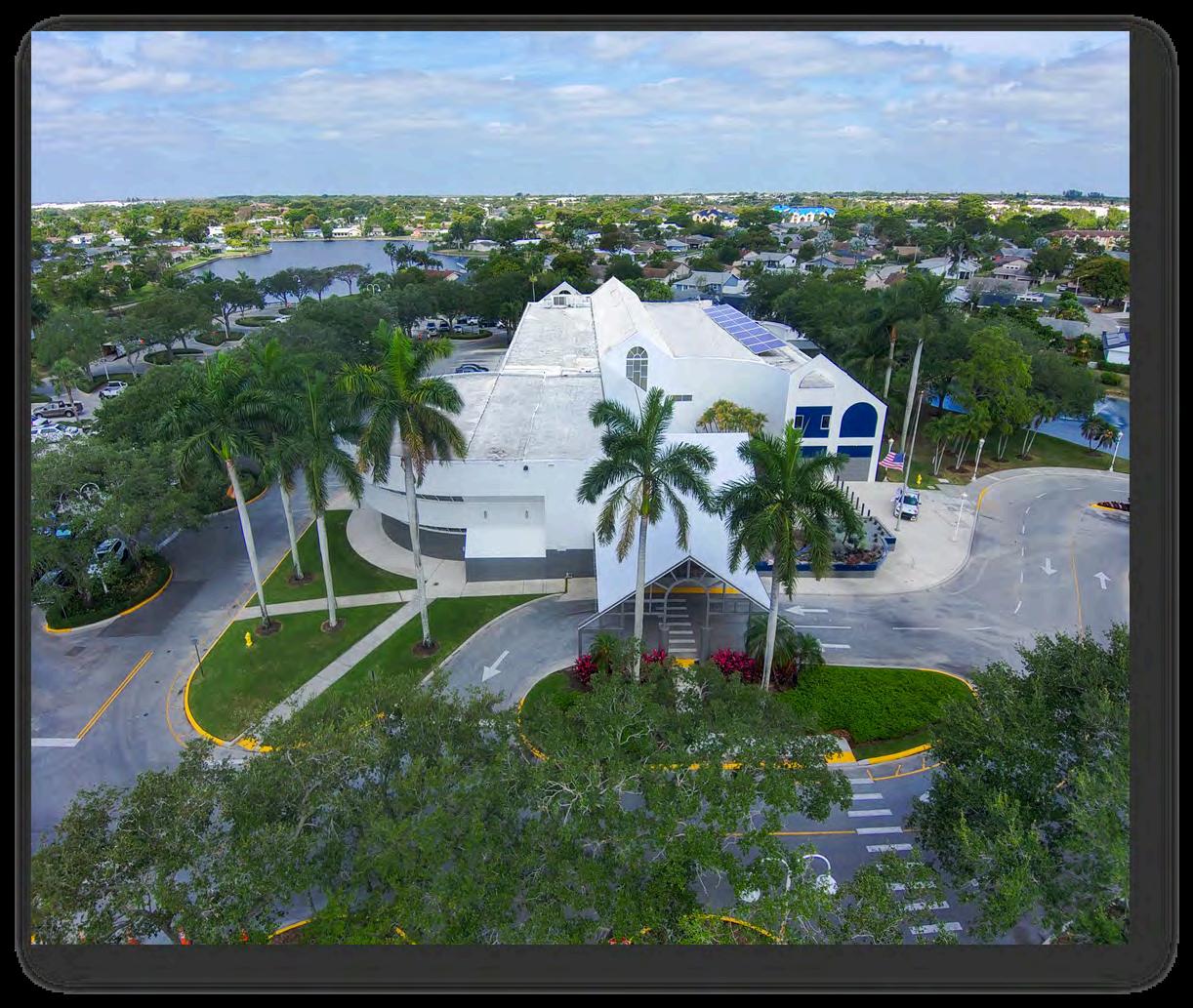

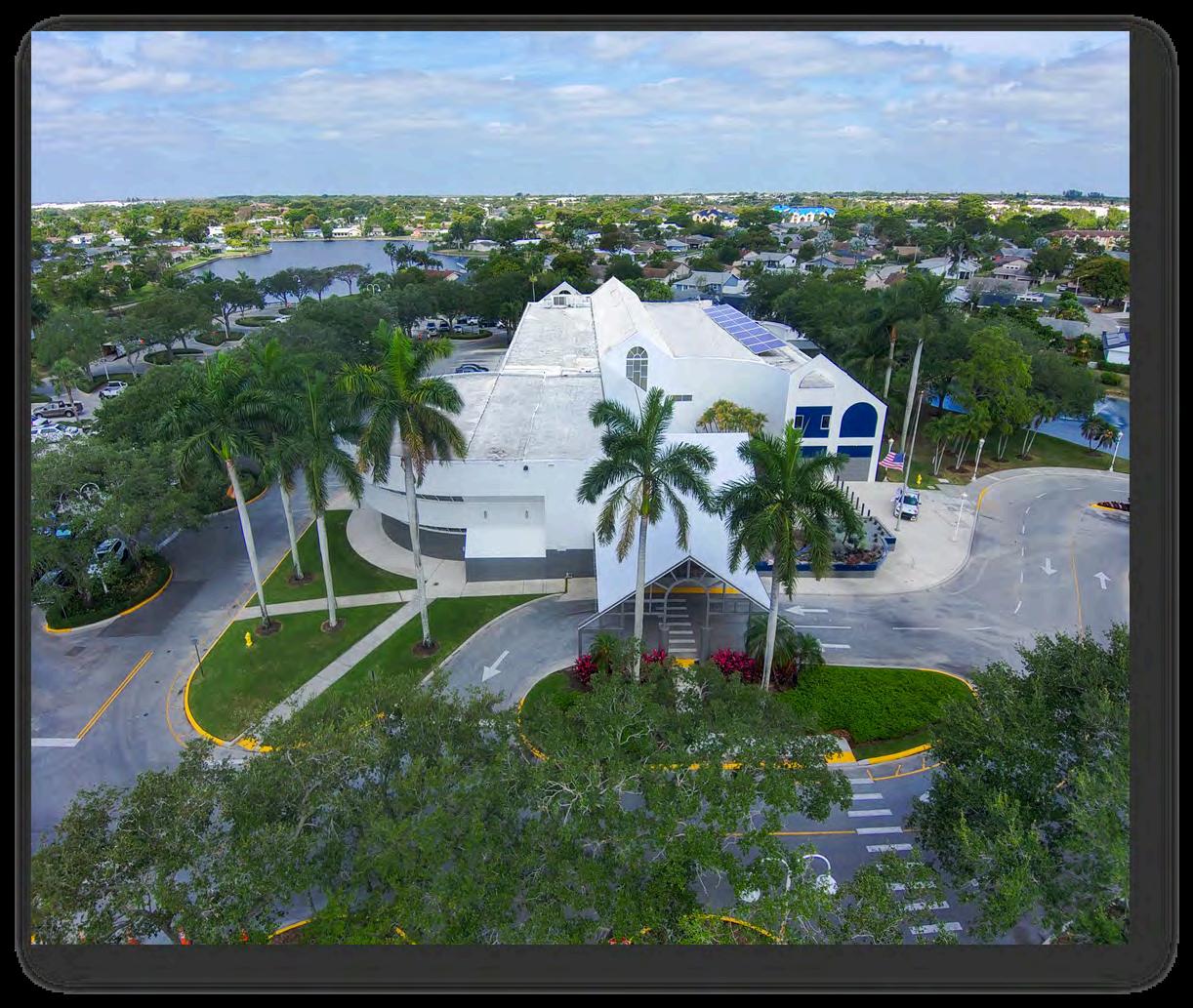

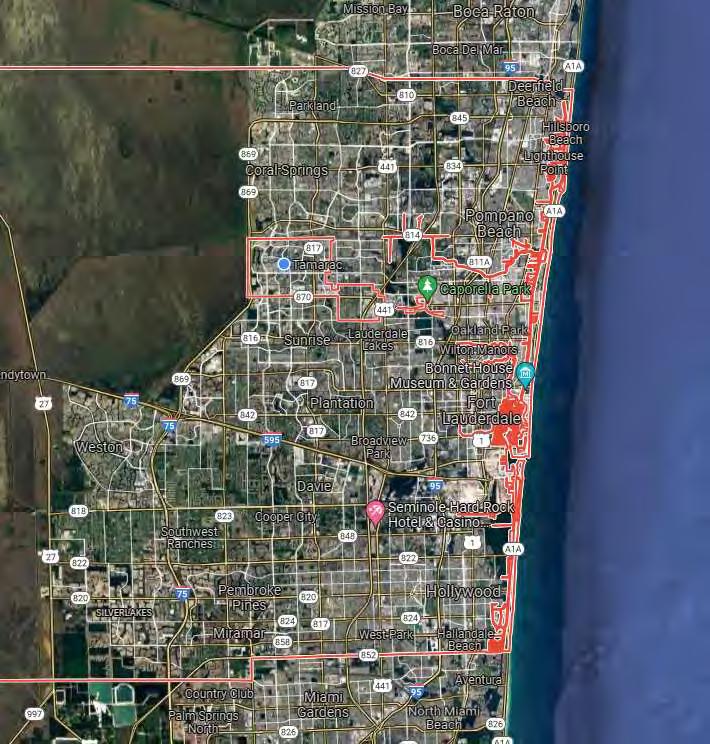

A thriving, multicultural, and multigenerational community, the City of Tamarac is a great place to build a family, business, and life

Young families, retirees, and businesses are all drawn to Tamarac, which boasts a top-rated fire department and is rated the 49th out of the top 50 safest cities in the entire state of Florida by Safewise.com in 2022.

In the middle of everything, yet a world away, Tamarac offers an exceptional quality of life at an affordable price.

Tamarac’s residential neighborhoods abound with waterways – the City contains over 500 acres of freshwater canals and lakes – and plenty of open spaces.

Residents enjoy amenities such as the City-owned Caporella Park Colony West Golf Club, which offers 36 holes of golf, and 12 parks that cover 416 acres, including a dog park and a skate park.

Originally a bedroom community favored by retirees, Tamarac is growing younger as the City grows older. Our current median age is 43.7.

Tamarac’s residential population has grown by 16% since 2015 to more than 73,000 today. The City welcomes more and more neighbors who have chosen Tamarac for our community’s quality of life and proximity to South Florida’s beaches, the Everglades, shopping, nightlife, regional sports, cultural events, and the arts.

Tamarac offers programs for people of all ages and stages of life at parks and facilities throughout the City, including our 32,000square-foot community center, our recreation center, and the Caporella Aquatic Complex

There is always something to celebrate with more than 30 annual community events –including the Tamarac Turkey Trot and the One Tamarac Multicultural Festival.

The 13th largest city in Broward County and the 42nd largest in Florida, Tamarac is home to a growing business community. We offer an excellent location at the epicenter of South Florida, the 9th largest metropolitan statistical area in the U.S. by population, and easy access to five major highways and three world-ranked airports and seaports. The 500-acre Tamarac Commerce Park is home to approximately 80 companies, including Amazon, City Furniture, New Vision Pharmaceuticals, Genex Services, and Publix.

We’re primed for smart growth with a new form-based code that ensures the right development at the right place Construction of a mixed-use downtown called Tamarac Village is ongoing. It and the renovation of Colony West will serve as economic drivers for the City.

As we look toward the Tamarac of tomorrow, maintaining infrastructure, beautification efforts, and preparing for future demands remain top priorities to ensure the quality of essential services like potable water and stormwater management. We will also continue focusing on revitalizing our commercial corridors and aging and underutilized shopping centers to serve our vibrant community better

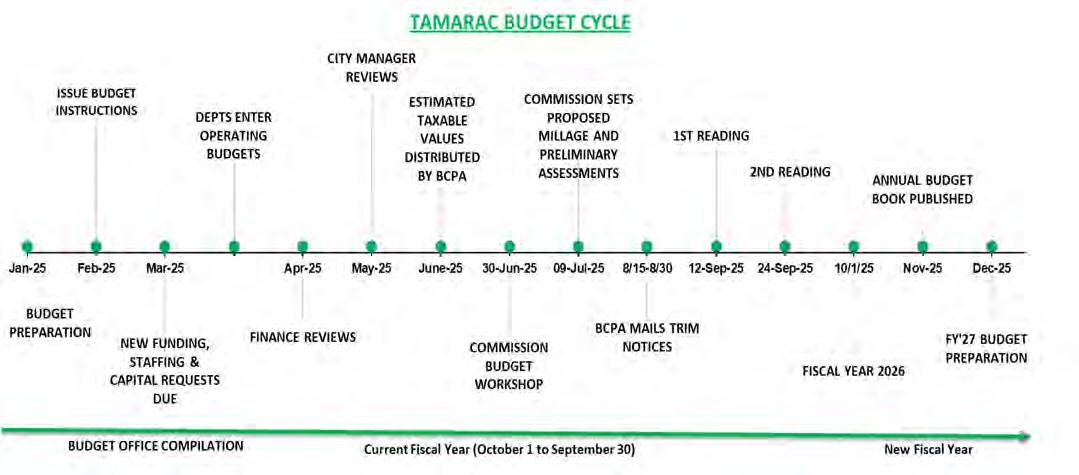

The first critical reading of the Fiscal Year 2026 Adopted Budget is the City Manager’s Transmittal Letter. The reader will gain an understanding of the City Manager’s vision, critical issues, recommended policy and operational changes, and financial plan.

This section provides the reader with the basic components that comprise the development of the Fiscal Year 2026 Adopted Budget. This section includes explanations of the type of government and budget, a description of the budget process, the Budget Calendar, budgetary highlights, and the Fiscal Year 2026 Personnel Complement.

This section answers the question: “What’s new in the Budget?” In this section, you will find a list of new or reclassed staff, new or enhanced programs, and capital outlay not previously forecasted.

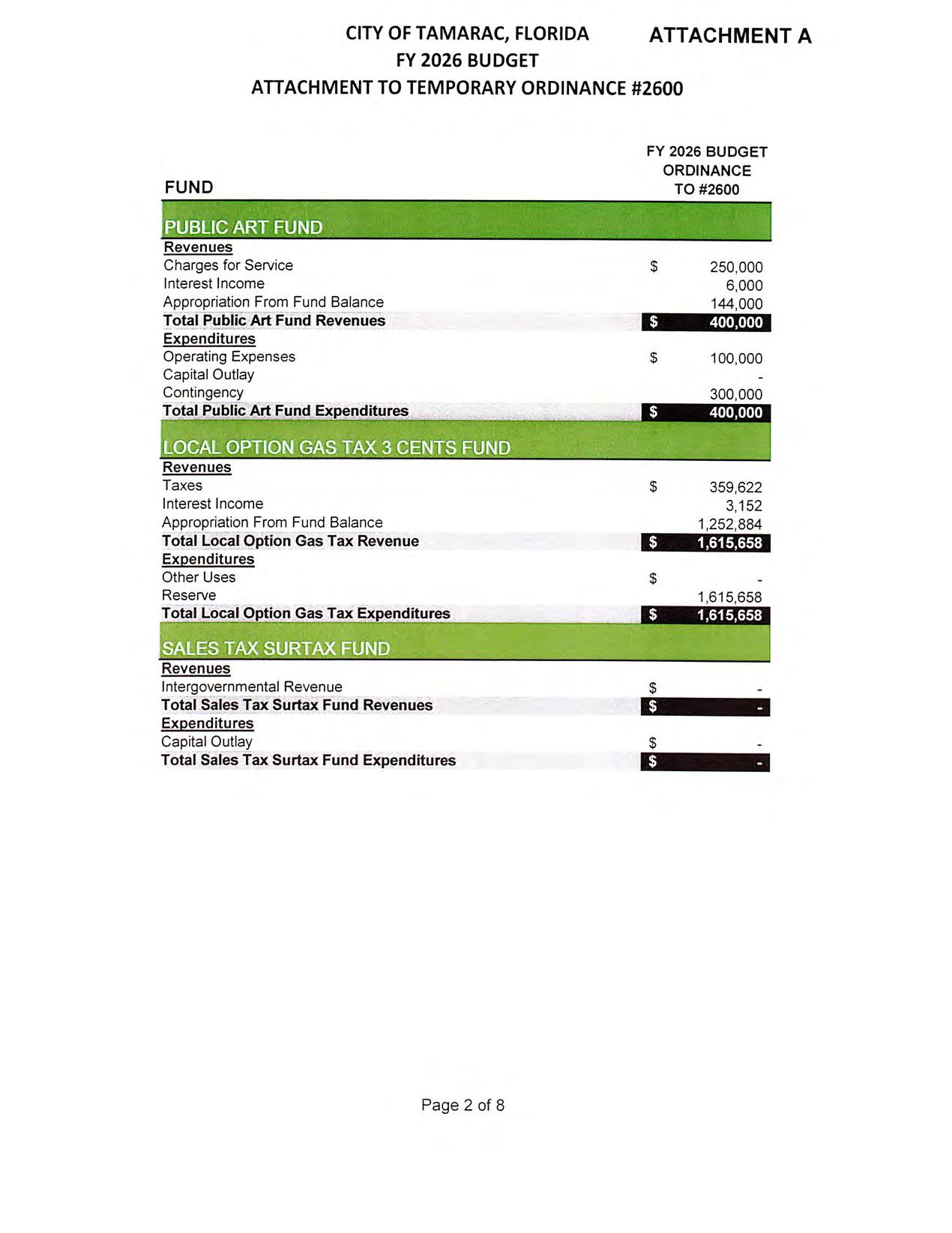

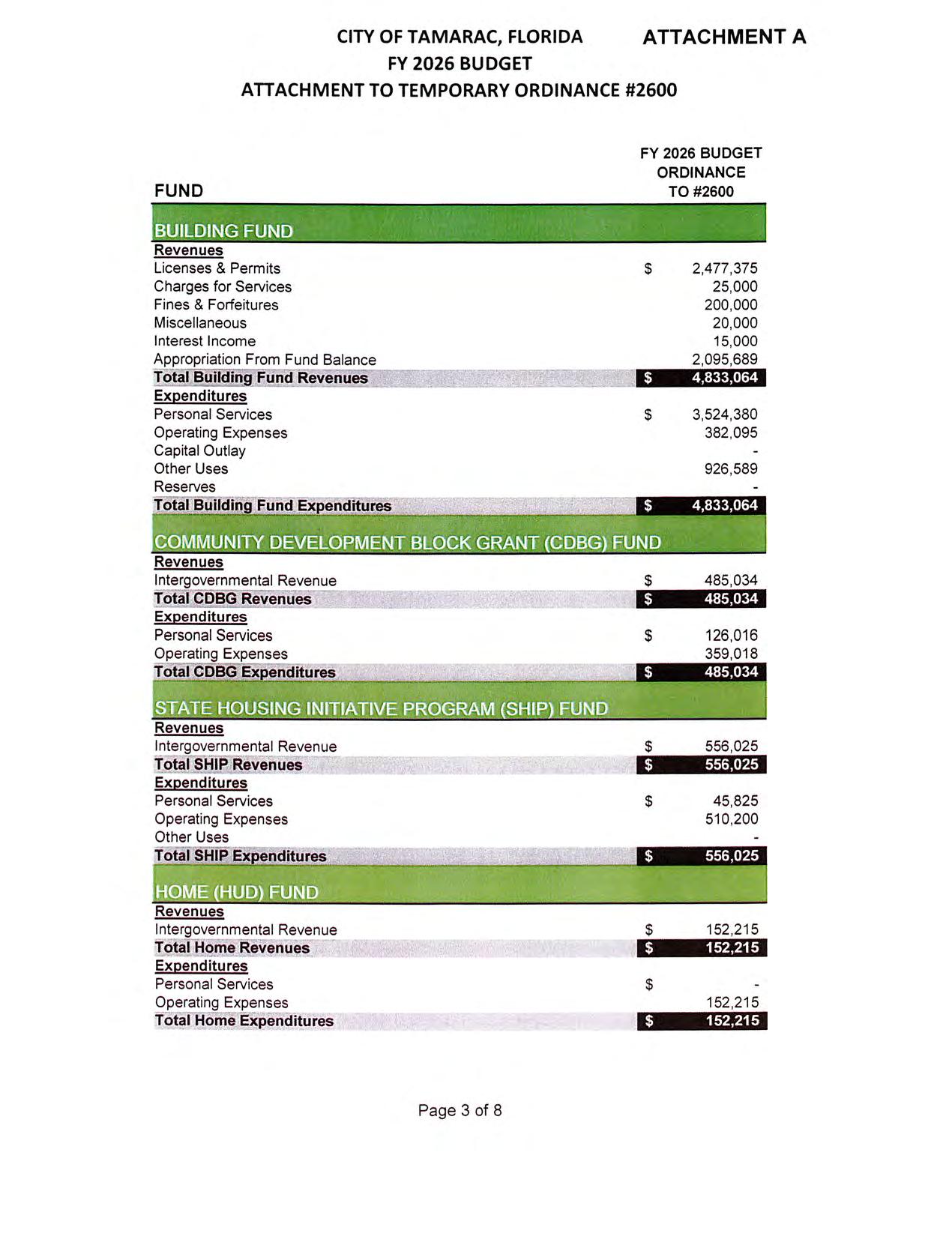

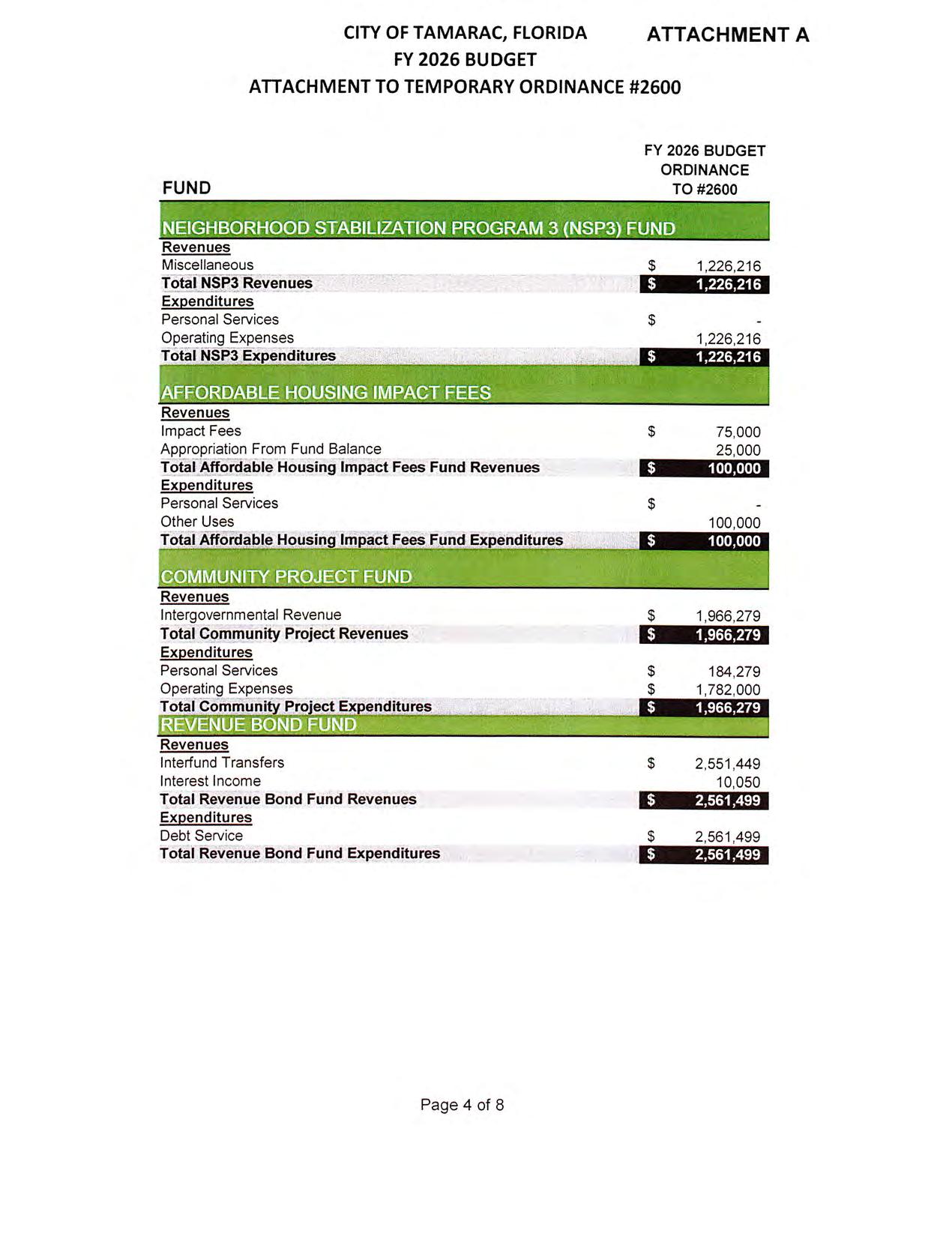

This section provides schedules of detailed revenue sources and expenditures for the General Fund and for all funds combined for a total Fiscal Year 2026 Adopted Budget. Like a person with multiple checking accounts, a municipality categorizes revenue and expenditures into separate funds according to purpose. This section also includes a comparison of major revenue sources, the full cost allocation study, an overview of financial management policies, and a brief description of each fund.

This section explains the diverse services offered by the City of Tamarac. Each department's division has identified a mission statement, a program description, and strategic goals for the upcoming year. In addition, the Fiscal Year 2026 Adopted Budget includes performance measures for each division. Performance Measurement is an ongoing process to evaluate and report how well the City delivers its services.

Each Department and Division is responsible for goal setting and performance benchmarking to ensure alignment with the City’s Strategic Plan. The measures reflect the City’s effort to improve service, check performance quality, and make changes when necessary.

Reporting of performance measures differs from standard goals and objectives because it goes beyond simply reporting “achieved” or “not achieved”; it provides an ongoing method for measurement and allows for gauging performance against internal, external, local, and national standards.

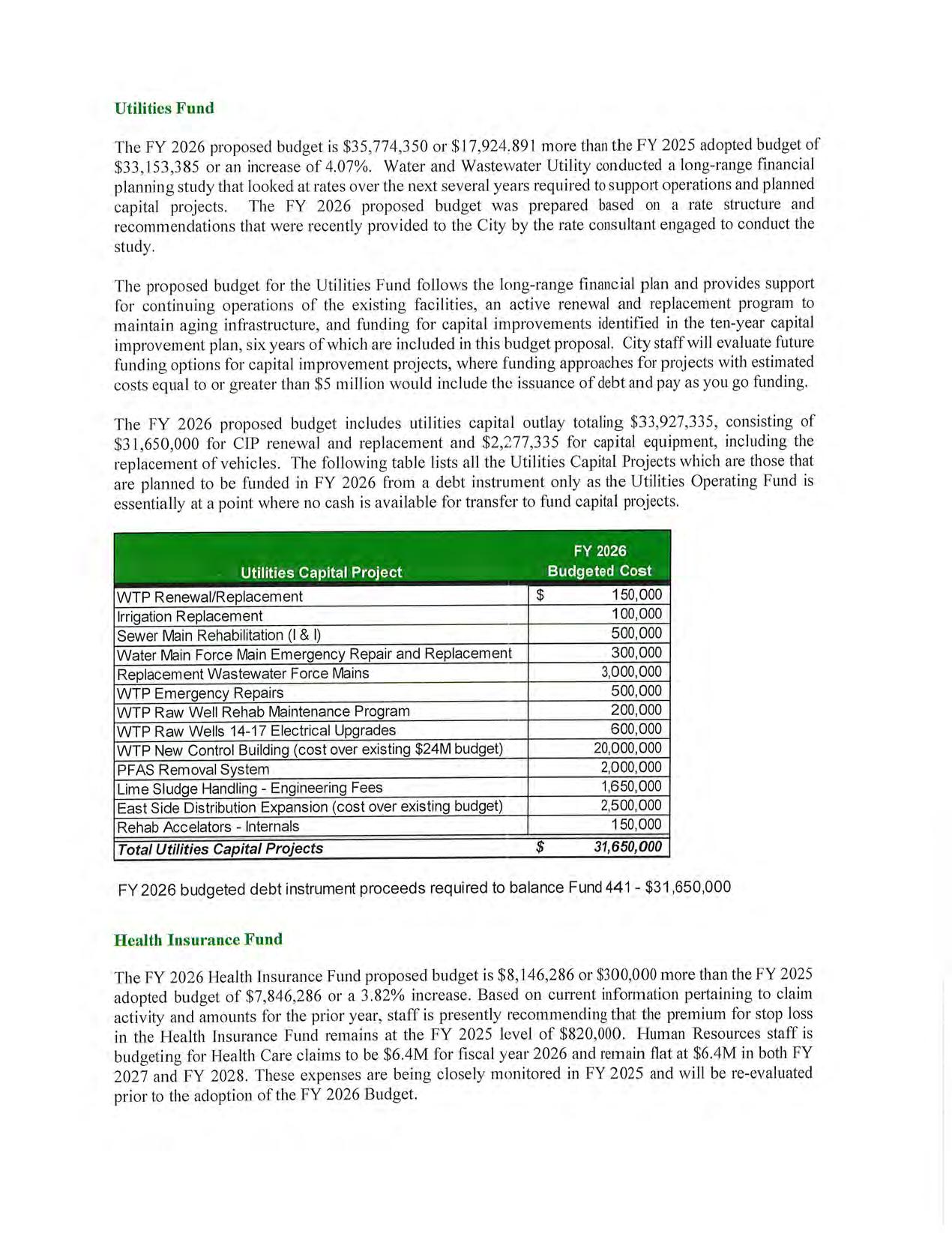

This section includes the City’s Asset Management plan, which provides a comprehensive listing and explanation of the capital requirements and associated funding for the City for the current and next five years.

This section contains debt management information and a glossary of commonly used terms.

COUNTY

October 31, 2025

The Honorable Mayor and Members of the City Commission City of Tamarac 7525 NW 88 Avenue Tamarac, FL 33321

The Honorable Mayor and Members of the City Commission:

It is my pleasure to transmit to you the official budget document for fiscal year (FY) 2026 adopted by the City Commission on September 24, 2025.

Below is a summary of the FY 2026 Adopted Budget:

Thank you for your foresight and support of the budget as well as your continued support of the Financial Policies for long-term financial planning. As we are all aware, a budget encapsulates the plans and initiatives needed to help drive our success both today and into the future. As the adoption phase of this budget cycle has ended and the planning for the upcoming cycle begins, the work put into this FY 2026 Adopted Budget continues to provide a solid foundation for the “Sustainability” of our future.

Sincerely,

Levent Sucuoglu City Manager

The City of Tamarac is governed by a Commission/Manager form of government, which combines the political leadership of elected officials with the managerial experience of an appointed administrator. The City Commission consists of five members: Th e Mayor, chief elected official-at-large, and four commission members elected from each of the four districts in the City. The legislative powers of the City are vested in and exercised by the City Commissi on, consistent with the United States Constitution, the Florida Constitution, laws of the State of Florida, the City Charter, and City ordinances. The City Commission is vested with policy-setting authority, adopting the annual budget, formulating goals and objectives, and making decisions that affect the quality of life in the community.

The City Manager is appointed by and directly responsible to the City Commission. As the administrative head of the City, the City Manager carries out policies made by the Commission and directs and coordinates the work of all City departments.

The Program/Performance Budget is an effective budget model which focuses on policy planning and resource allocation. It assumes that in an environment of scarce resources, el ected officials must choose between different and competing items. This method expands on the basic line item budget concept giving residents, commissioners, management and employees a better understanding of government's role in the community. The Program/Performance B udget improves the quality of decision-making and provides a mechanism to increase the efficiency and effectiveness of City operations. Our Budget has four objectives.

1. Policy Document

The City’s budget process is conducted within the framework of the Strategic Plan, providing financial management policies, financial trends and fiscal forecasts. The information contained in these documents gives policy makers an opportunity to review policies and goals that address long-term concerns and issues of the City and evaluate City services.

2. Operations Guide

The budget describes activities, services and functions carried out through departmental goals and objectives and a continuation/enhancement of performance indicators. The document includes an organizational layout for the City and a three-year analysis of staffing.

3. Financial Plan

The budget presents the City’s fiscal resources through a process of needs analysis, service delivery priorities, and contingency planning. The document includes the current and long-term debt obligations along with a comprehensive list of capital improvements (included in an asset management program) and the basis of budgeting for all funds.

4. Communications Device

The budget communicates summary information, including an overview of significant budgetary issues, trends and resource choices, to a diverse audience. It describes the process for preparing, reviewing and adopting the budget for the ensuing fiscal year.

Per Florida Statute 166-241(2), all municipalities must adopt a balanced budget, defined as “the amount available from taxation and other sources, including am ounts carried over from prior fiscal years, must equal the total appropriations fo r expenditures and reserves.”

Adopting the budget is the culmination of a process that integrates financial planning, trend analysis, accounting enhancements, goals and objectives, and strategic planning, into service delivery. Pursuant to Florida Statutes, total estimated expenditures shall not exceed total estimated revenue and appropriated fund balance. The City also adopts and maintains a capital improvement plan.

The City Charter requires the City Manager to submit a proposed budget to the City Commission by July 30th of each year. The City Commission holds budget wo rkshops with City staff and the public. Pursuant to Florida Statutes, two public hearings are held in September. The first public hearing is for the adoption of a tentative millage and tentative budg et. The second public hearing adopts the final operating and debt service millage rates along with the annual budget and capital improvement plan.

Florida law provides general guidelines regarding budget amendment policies. Appropriation of additional unanticipated revenue is allowed by law in all fund categories for many types of revenue at public City Commission meetings. The law allows approp riation increases of any nature to occur through a supplemental budget process requiring advertised public hearings.

Formal appropriation by the City Commission is at the department level for the General Fund and at the fund level for all other funds. Amendments to these appropriations are adopted twice each fiscal year, reflecting actions approved by the City Commission, allocation of encumbrances, transfer of funds from a non-departmental account to other departments in the General Fund, and additional capital improvements. Budget transfers not requiring an increase in a fund total or department total are granted within guidelines to various levels of management.

All government funds are accounted for using the modified accrual basis of accounting. Revenues are recognized in the period when they become measurable and available to pay liabilities of the current period. Property taxes, utility taxes, franchise fees, intergovernmental revenues, and charges for services may be accrued when collected depending on the billings to which they pertain. Property taxes are recognized as revenue in the fiscal year for which they are levied. Investment earnings are recorded as earned. Permits, fines, forfeitures and contributions are not subject to accrual because, generally, they are not measurable until received in cash. Revenues collected in advance of the year to which they apply are recorded as deferred revenues.

Expenditures under the modified accrual basis of accounting are generally recognized when the related fund liability is incurred and expected to be liquidated with available reso urces. Exceptions to this rule include principal and interest on general long-term debt, which are recognized when due.

All proprietary fund types and the Pension and None xpendable Trust Funds are accounted for using the accrual basis of accounting. Revenue is recognized when earned, expenses recognized when incurred.

Agency funds are custodial in nature and are not a di rect result of operations. They are accounted for under the modified accrual basis of accounting. Assets and liabilities are recognized on the modified accrual basis.

The budget follows the basis of accounting, meaning general government type funds are prepared on a modified accrual basis. Obligations of the City of Tamarac are budgeted as expenses, but revenues are recognized when they are actually received.

The budget is a balanced budget which means that estimated revenues are equal to estimated expenditures. All appropriations lapse at year e nd, except capital improvement projects that are budgeted on a life of the project basis. Some encumbrances are carried forward to the next fiscal year which include the capital improvement program encumbrances.

The Annual Comprehensive Financial Report (ACFR) shows the status of the City of Tamarac’s finances on the basis of “generally accepted accounting principles” (GAAP) and fund expenditures and revenues on both a GAAP and budget basis for comparison purposes.

•Depts begin conducting internal/cross dept budget prep meetings

•HTE Budget Data Entry Access OPENED (Immediately after Budget Training)

•New Position requests due to HR

•Utilities 20-Year Plan Capital Projects List due

•Program Modifications/Capital Outlay/Capital Maintenance/Equipment/Vehicles due

March

Jan 2nd

•HTE Budget Data Entry Access CLOSED

•New Capital Requests for FY 2026/2027/2028 (CIP Ranking Forms) due

•Clearpoint mission, description, and goals updates are due

April

•Departmental Budget Review meetings

•Budget enters adjustments based on meeting outcomes

•City Manager Budget Review meetings

•Budget enters adjustments based on meeting outcomes

•Estimated Taxable Values distributed by Property Appraiser

•Proposed Budget delivered to City Commission

•Commission Budget Workshop

•Certified Taxable Values distributed by Property Appraiser (Day 1 TRIM compliance)

•Commission sets Proposed Property Tax Millage/Assessment rates

•City certifies DR420 Form to Property Appraiser (Day 35 TRIM compliance)

Nov

Feb 3rd

Feb 14th

Feb 21st

Feb 24th

Mar 13th

Mar 13th

Mar 24th

March 26th-April 3rd

May 15th & 19th

June 1st

June 13th

June 30th

July 1st

July 9th

•Truth-in-Millage (TRIM) notices sent to property owners (Day 55 TRIM compliance) by Aug 3rd by Aug 22nd

•1st Public Hearing Tentative Budget Adoption Special Commission Meeting (Day 65-80 TRIM compliance)

•Published Advertisement for 2nd Public Hearing

•2nd Public Hearing Final Budget Special Commission Meeting (Day 95 TRIM compliance)

•Adopted Resolution & Ordinance to Prop Appr & Tax Collector (Day 97-100 TRIM compliance)

•New Fiscal year begins

•Certification of Compliance/DR487(within 30 days of Final Public Hearing)

•1st Reading of FY 2024 2nd Budget Amendment (amending last year's budget)

•2nd Reading (Hearing) of FY 2024 2nd Budget Amendment

•FY 2025 Adopted Budget Finalized for Print/Submitted to GFOA (within 90 days of adoption)

Sept 12th

Sept 21st

Sept 24th within 3 days of hearing

Oct 1st

Oct 23rd

Oct 22nd

Nov 12th TBD

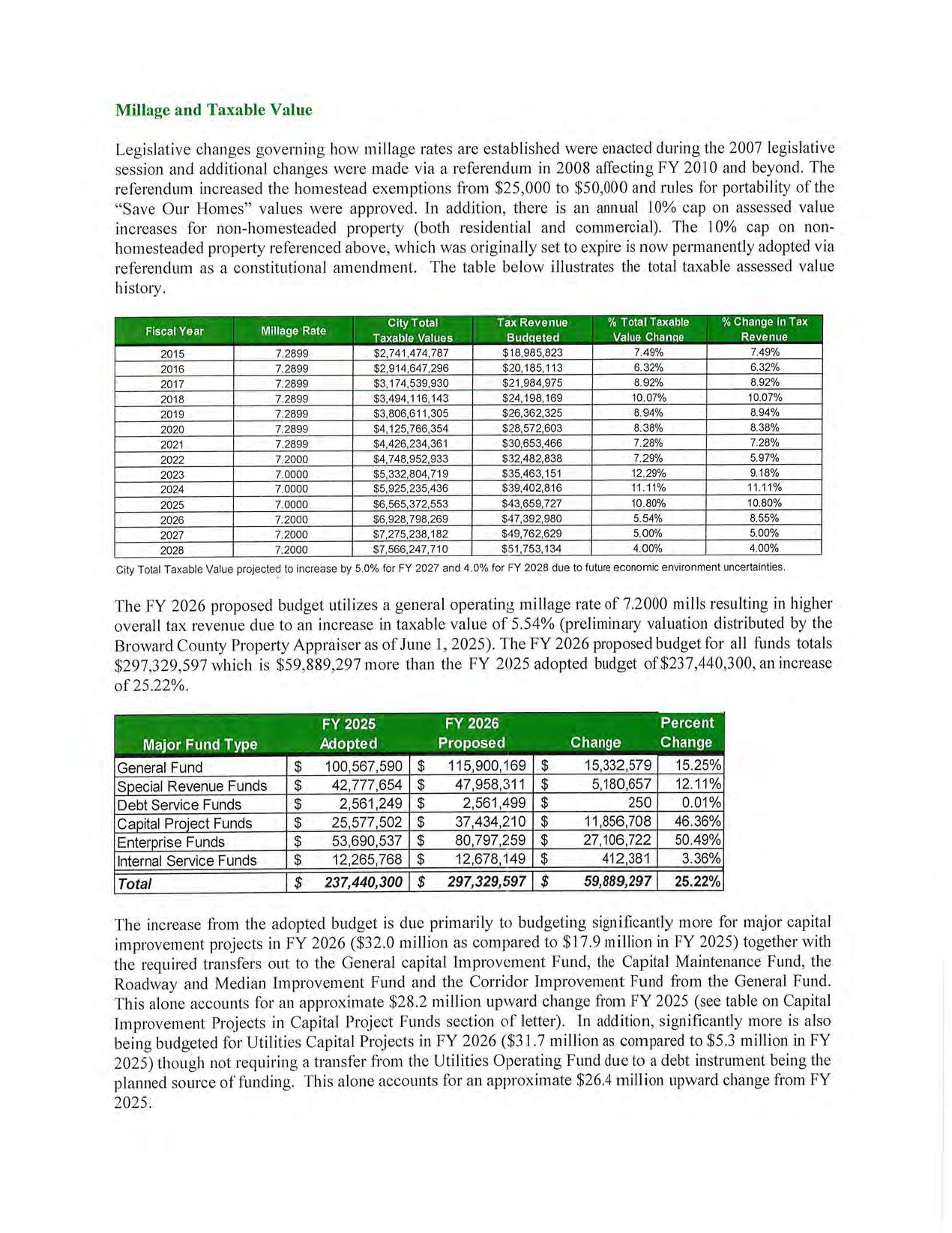

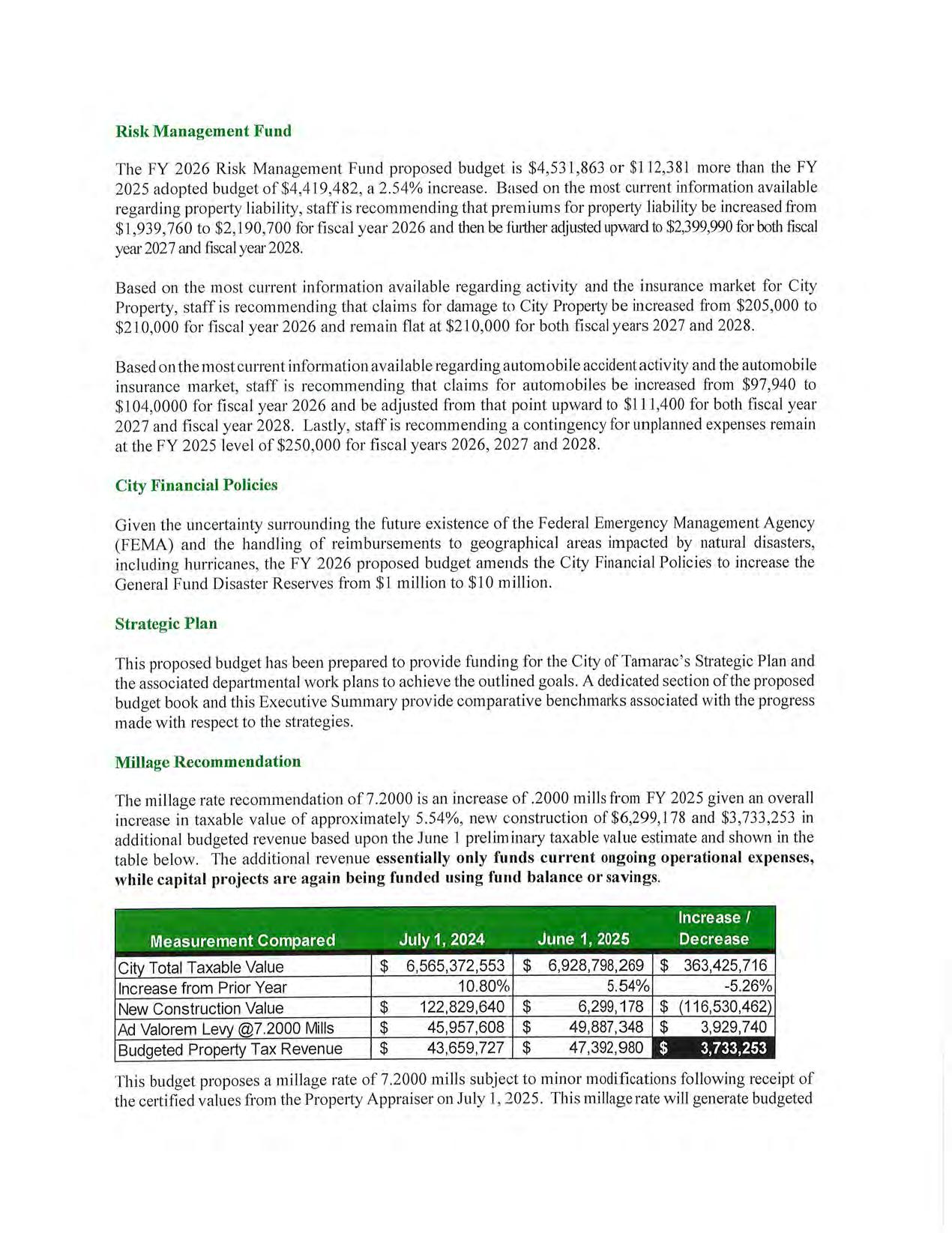

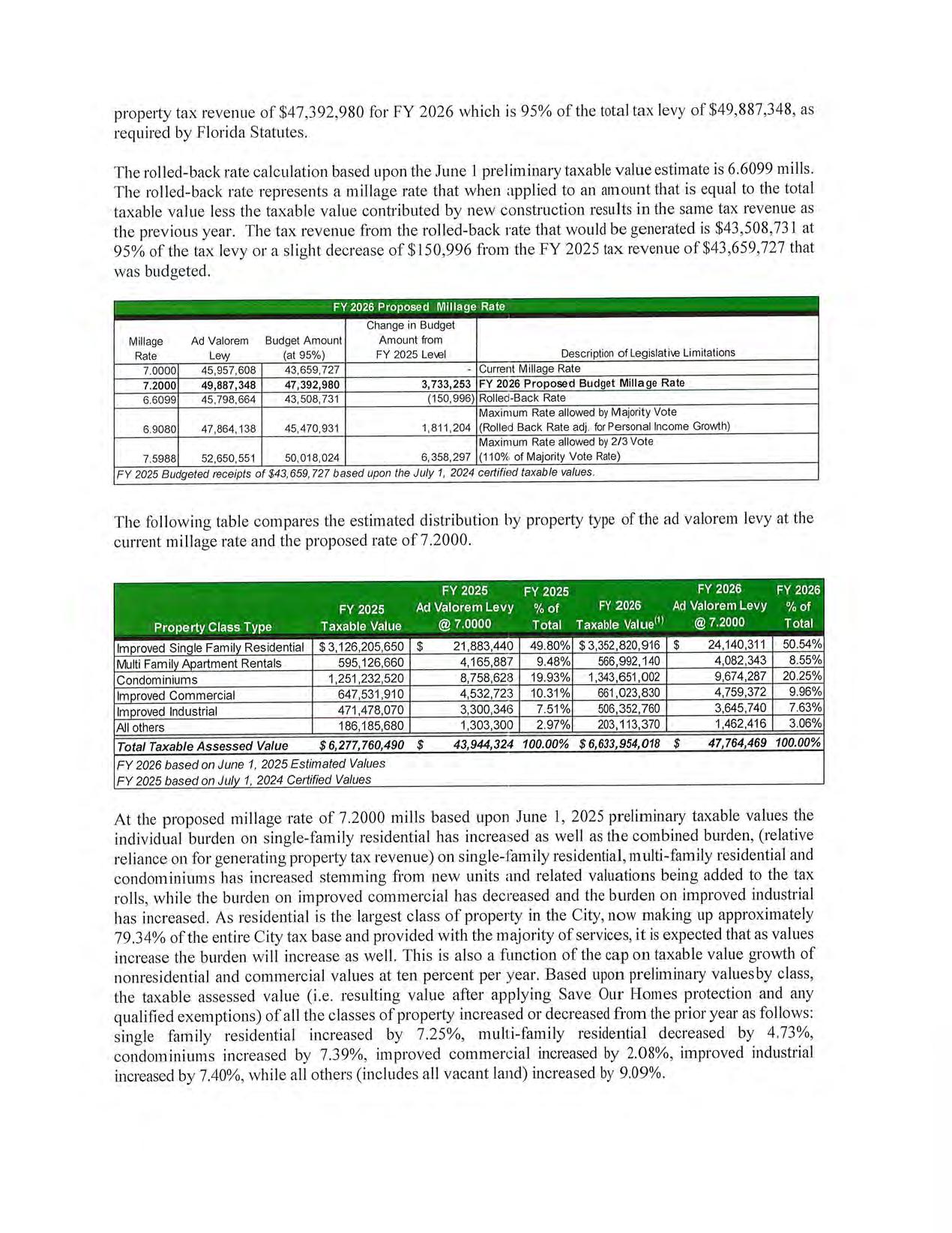

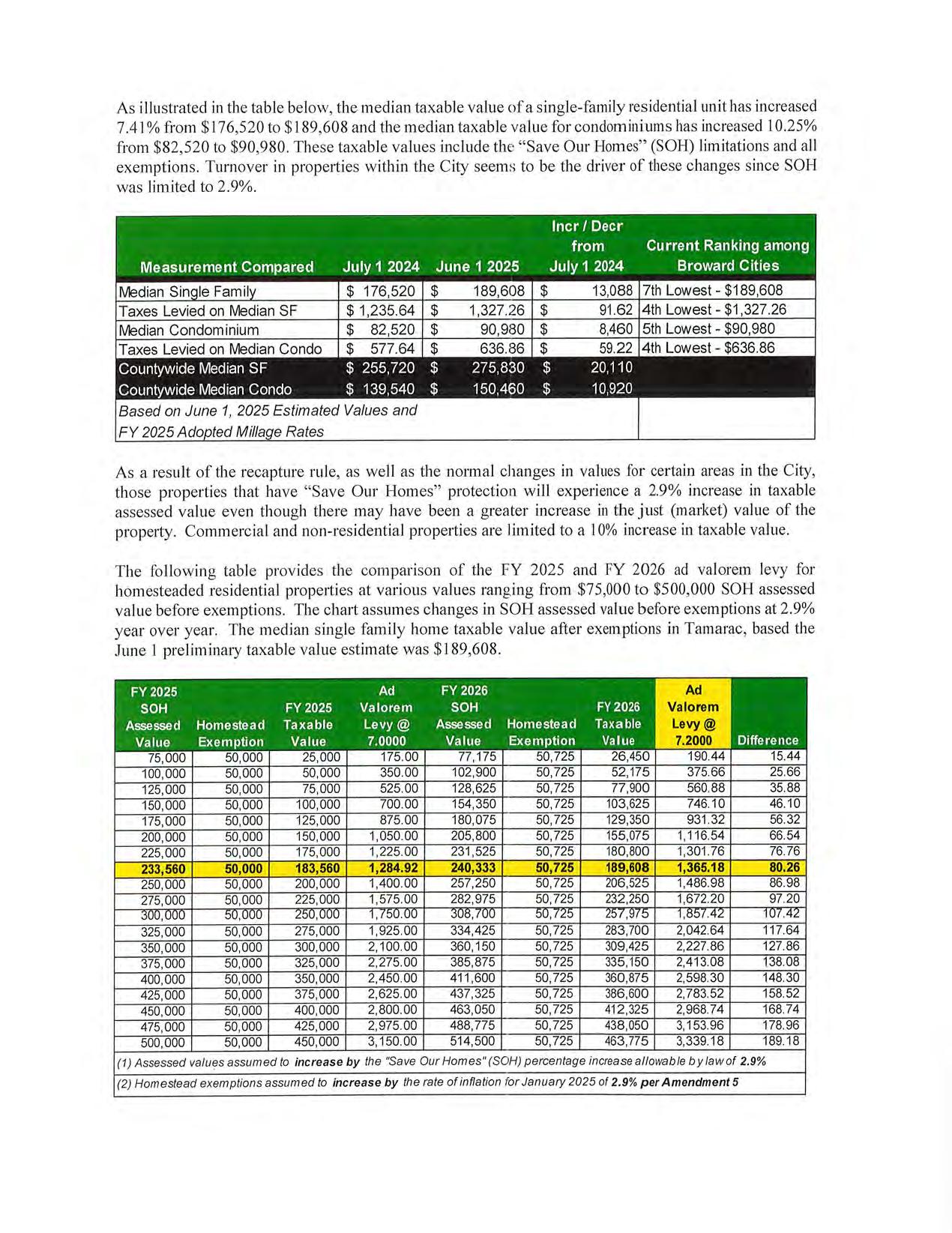

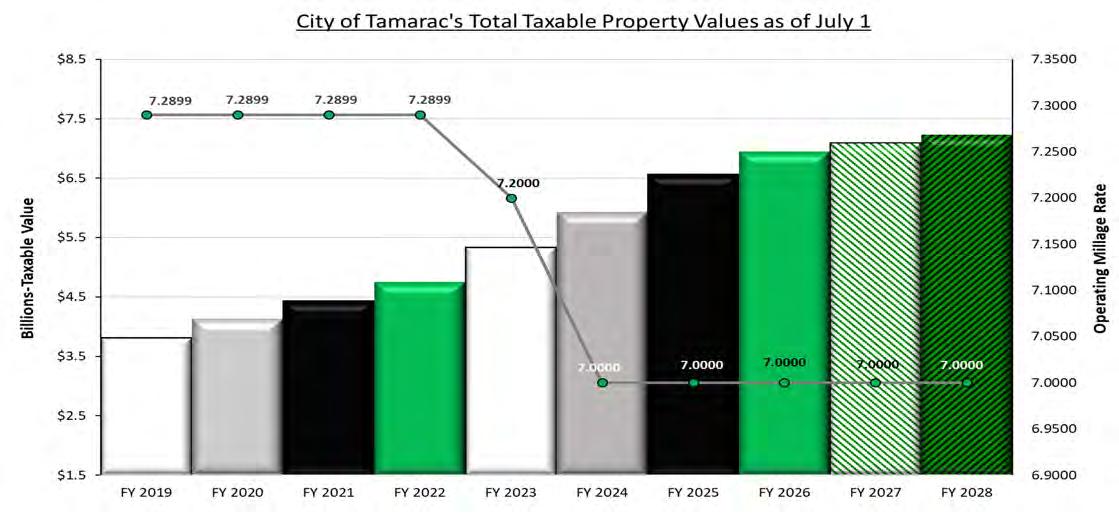

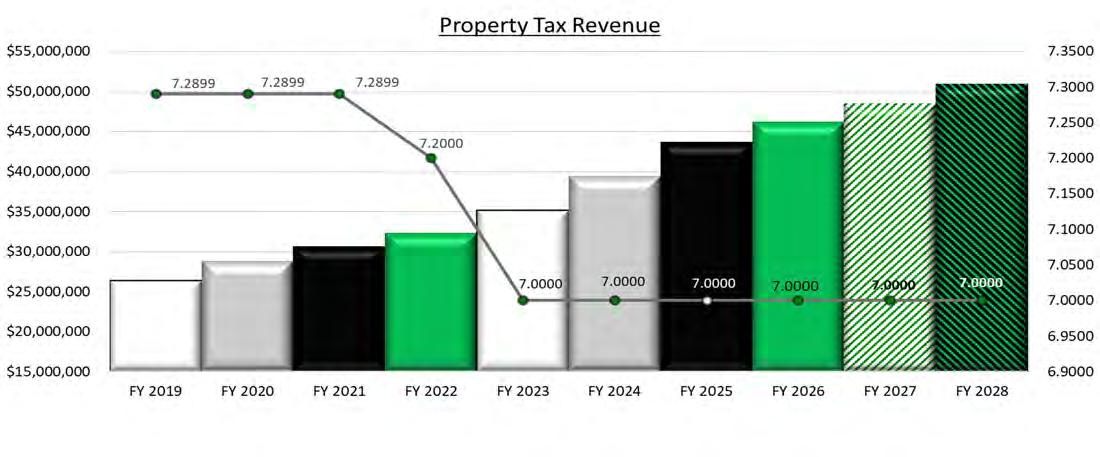

The State of Florida does not have a state income ta x. The primary source of funds for cities, counties, and school boards are property taxes, which are regulated by the state via the TRIM (Truth in Millage) process. Property taxes are an ad valorem tax, meani ng they are allocated to each property according to its value. The City of Tamarac sets a property tax rate, called a millage rate, to help fund the operations of the City. This millage rate is multiplied by the taxa ble value of each property to arrive at the property taxes due to the City.

As part of the TRIM process, the City is required to announce a Rolled Back Rate. This is a millage rate which will provide the same ad valorem tax revenue to the city that was received last year. Florida statutes require the City to use the Rolled Back Rate as a benchmark against which to measure the millage rate being adopted for the upcoming budget year. If the Adopted Rate is greater than the Rolled Back Rate, the City must declare a property tax increase.

The Broward County Property Appraiser (BCPA) establishes the taxable value of every parcel of property in our city. BCPA determines the just, or market, value of each property as of January 1. Then they apply all eligible exemptions to determine the property’s taxable value and provide this information to the City each year, initially at June 1 to set the proposed budget and again at July 1. The July 1 values are what the City must use to calculate the primary City revenue, ad valorem taxes, for the adopted budget.

*Based on July 1,2025 Certified Taxable Values

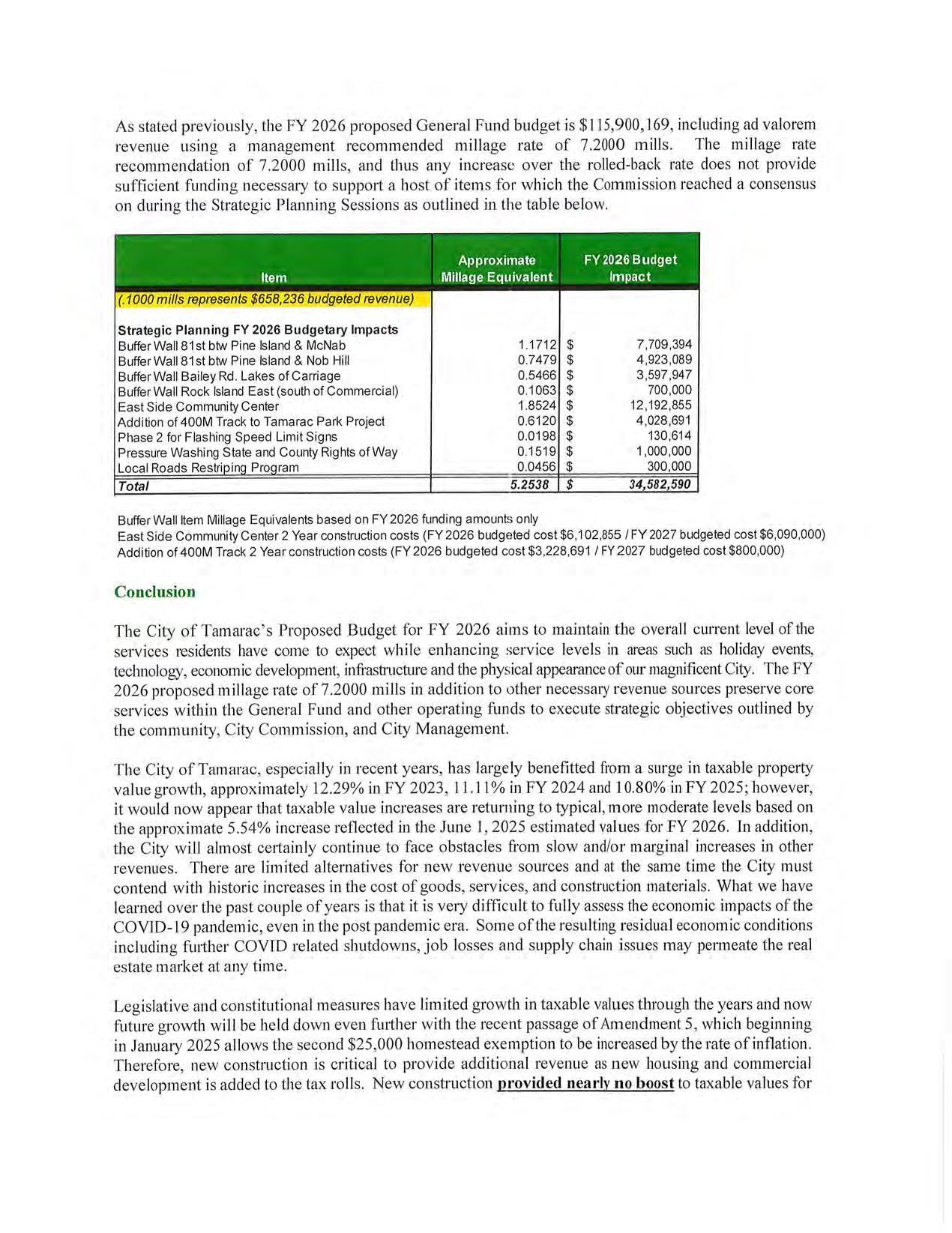

Florida offers a Homestead Exemption to ease the burden on taxpayers by exempting property taxes on up to $50,000 of a homeowner’s residence. The firs t $25,000 applies to all taxing authorities. The second $25,000 does not apply to all taxing authoritie s and only applies to the portion of the home’s value between $50,000 and $75,000. A further protection for taxpayers is “Save Our Homes" (SOH). “Save Our Homes” caps the annual increase in assessed value on homesteaded properties to the lesser of 3% or the increase in the Consumer Price Inde x (CPI). For 2025, the SOH maximum increase is 2.9%.

City Property Taxes at 7.0000 Millage Rate

$175,000 $1,225 $875

$150,000 $1,050 $700

$125,000 $875 $525

$100,000 $700 $350

$75,000

$50,000

$25,000

In addition to the Homestead Exemption, low-income se nior citizens in the City of Tamarac can claim an additional $25,000 exemption, which only applies to th e County and City taxes. Beginning with Tax Year 2019 the City also offers the Senior Long-Term Residency Exemption. This exemption grants full homesteaded property tax relief to low-income seni ors who have lived in their home for at least 25 years. This exemption eliminates the entire City and County portion of the tax bill for qualifying seniors.

$1,700 $1,600

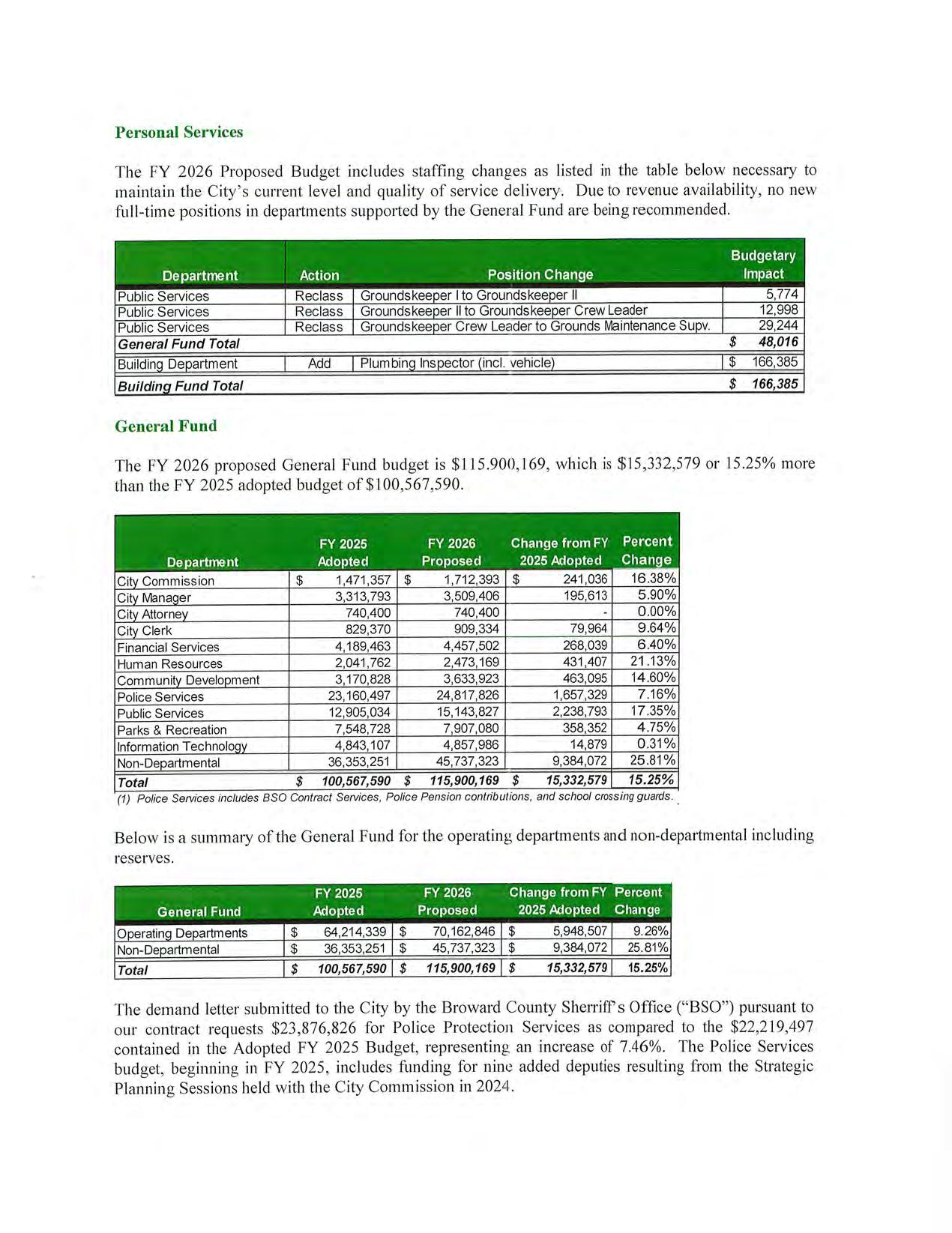

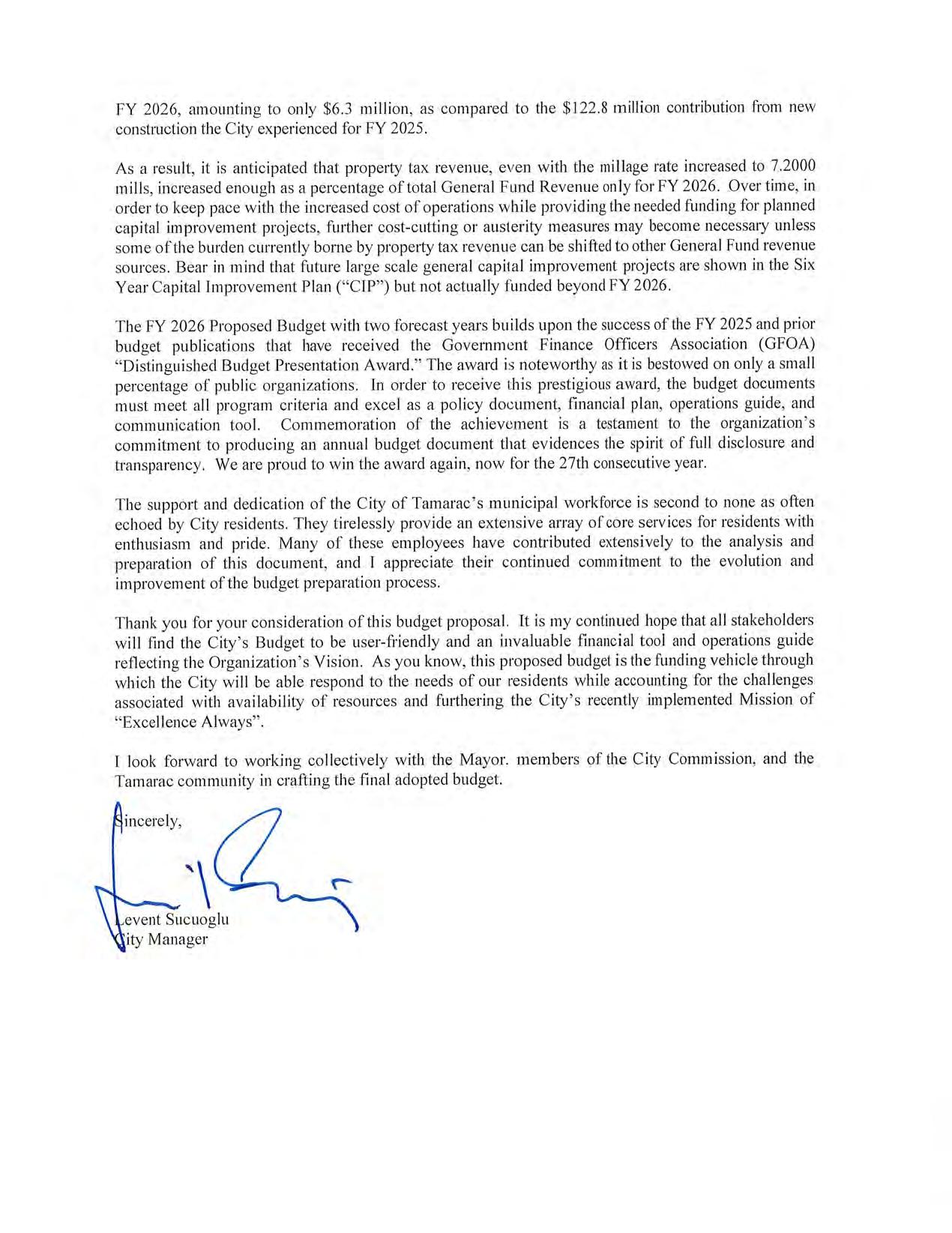

The City adopted Financial Management Policy #11 to minimize the financial burden on the taxpayers through systematic program r eviews and evaluation to improve the efficiency and effectiveness of City programs. Adds to staff are made judiciously. The Fiscal Year 2026 Budget added 1 (one) critically needed full-time position to the City.

FY 2025 Amendments and Changes: no budgetary impacts.

Added (1) New Mayor and Commission temporary Intern

Added (2) Community Aide (Full-time Temp) Commission

Removal (-1) Assistant Procurement & Contracts Manager in Financial Services

Added (1) Events Specialist added in Parks & Recreation and 1 Seasonal Recreational Assistant

Added (3) Part Time Recreation Assistants in Parks & Recreation and Removed 3 Seasonal Recreation Leaders II's.

Added (1) Community Aide (Full-time Temp) Parks Water Systems

Every year as part of the budget process, each department considers its staffing, operations, and capital needs for the upcoming fiscal year. Any need that would cause an increase to the budget is thoroughly vetted and discussed. The following tables summarize the requested additions to the City’s budget, indicate those funded, and provide a snapshot of what’s new. This same exercise is also done for the next two fiscal years to provide a longer-term perspective on the impact on the budget.

The Fiscal Year 2026 Approved Budget austerity measures will continue due to the global economic disruption challenges, inflation, and post-pandemic potential impacts on FY26 revenues, limiting new positions and only critically needed reclassifications/changes.

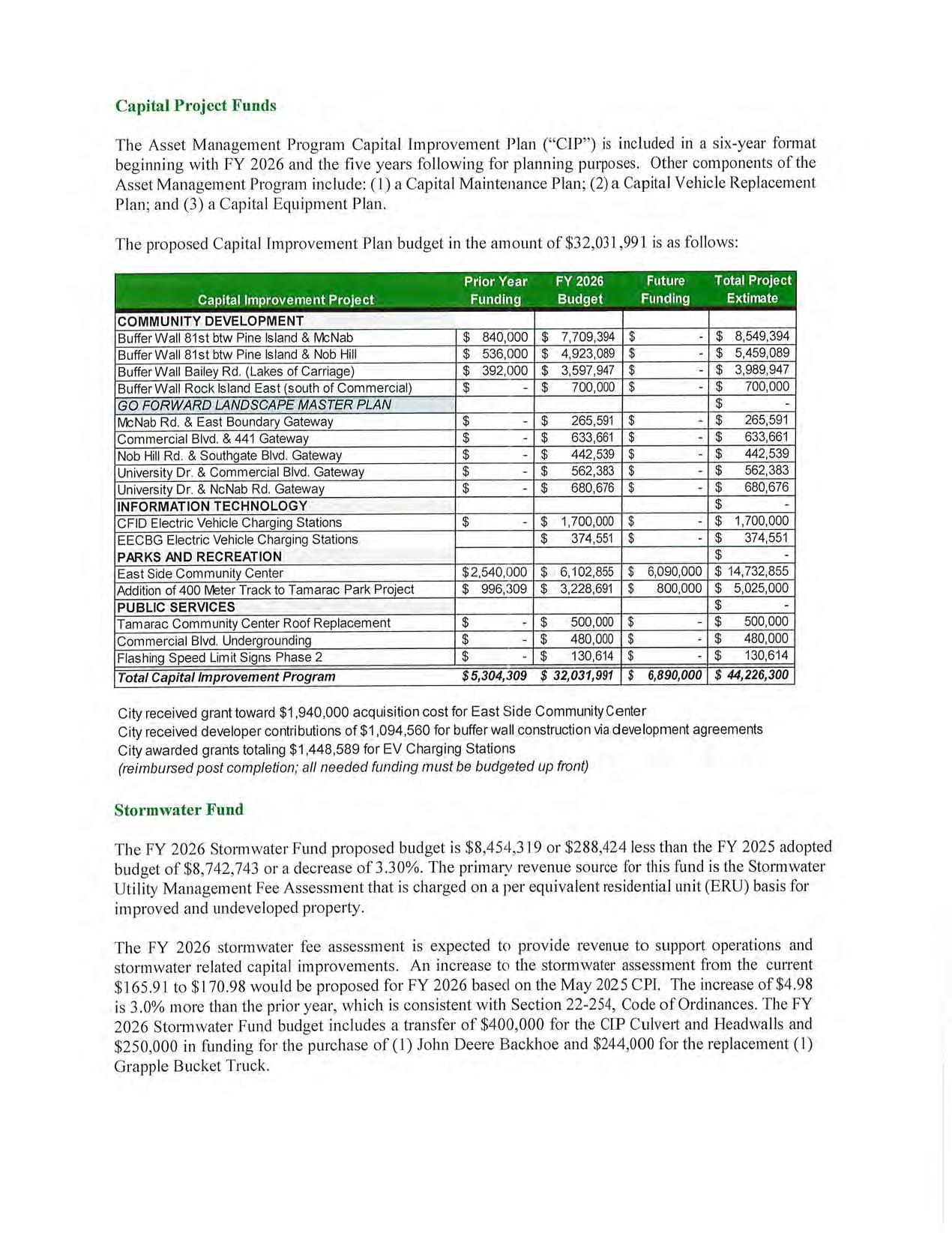

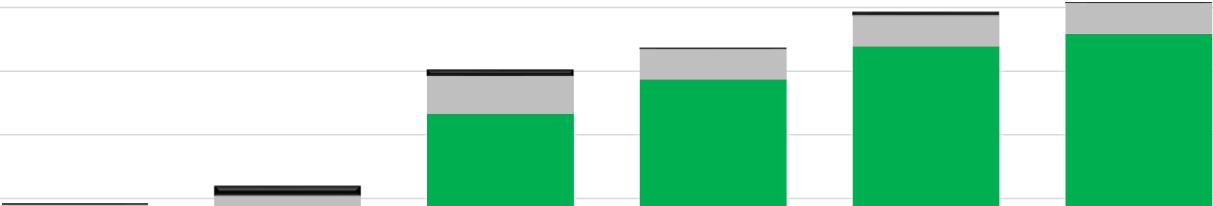

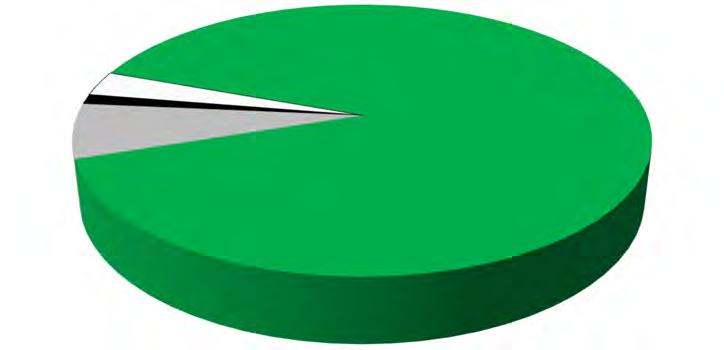

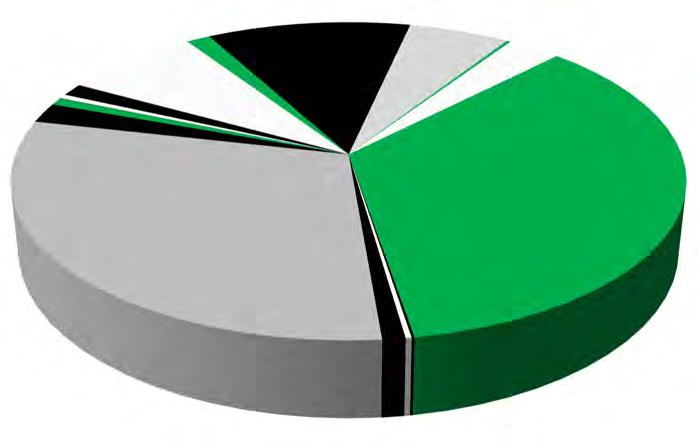

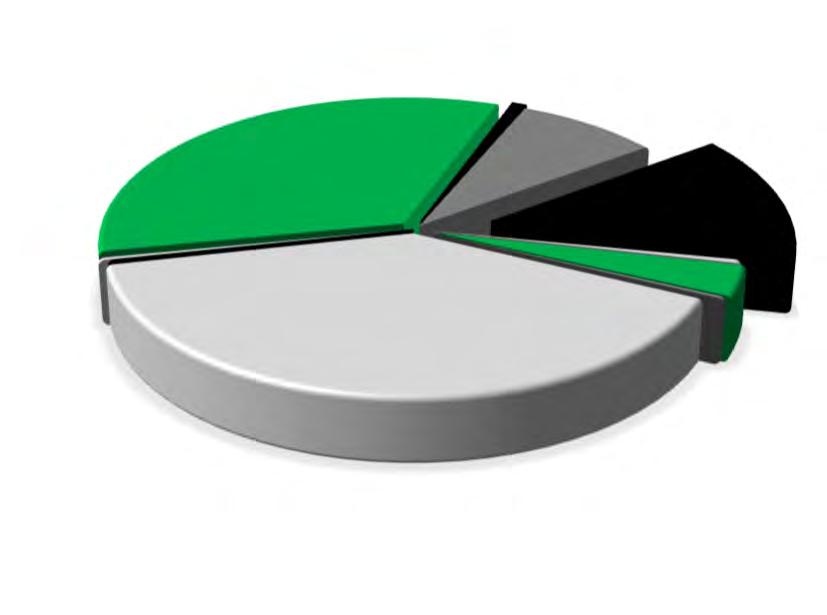

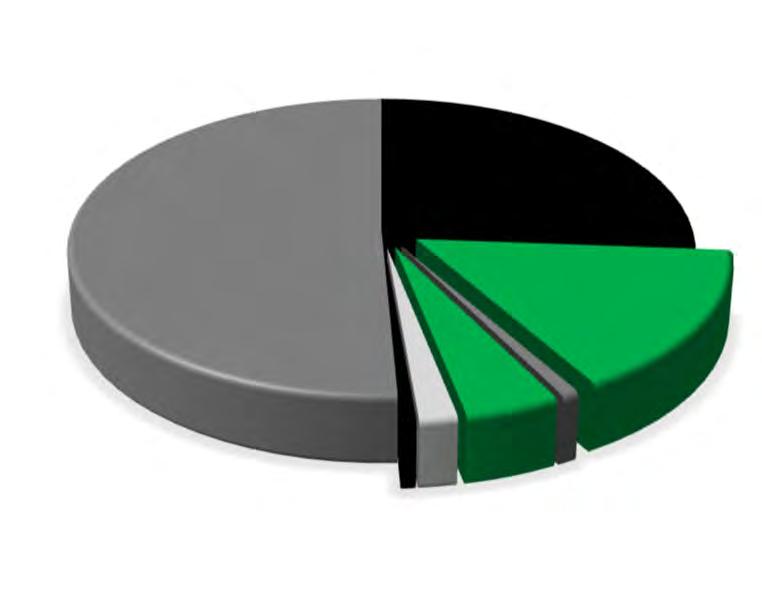

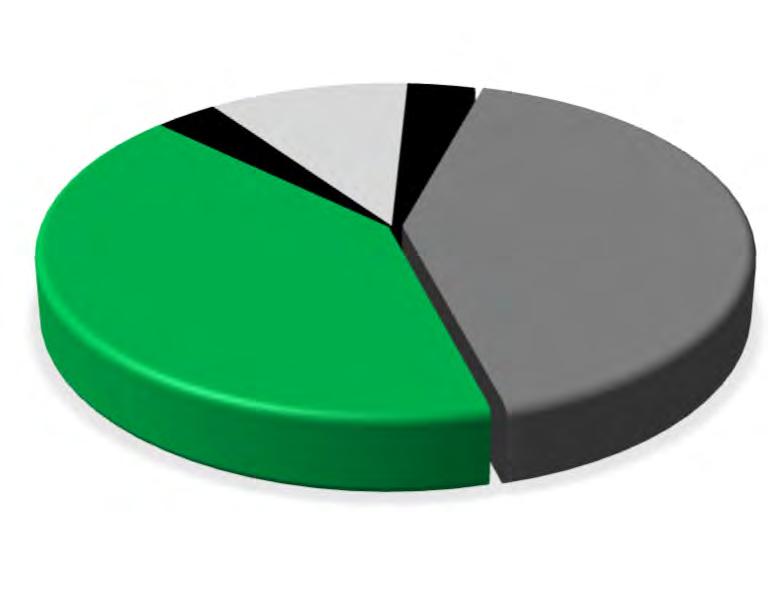

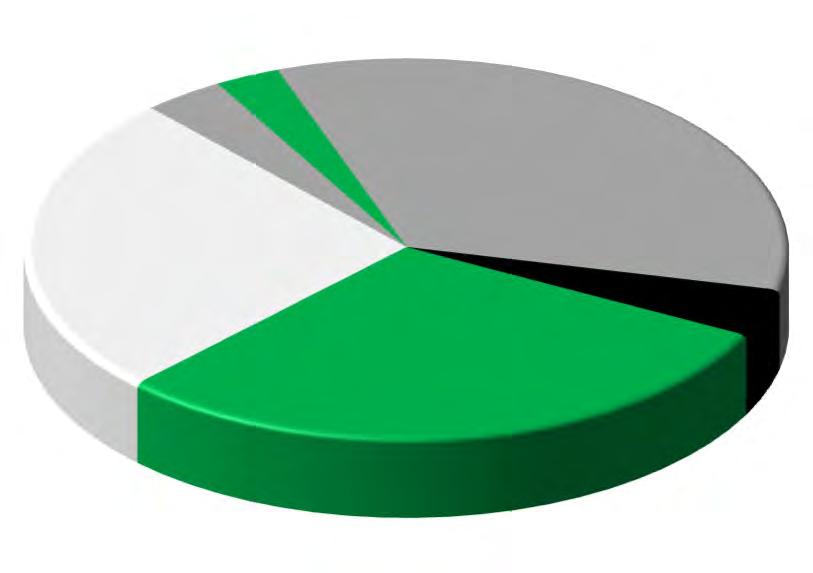

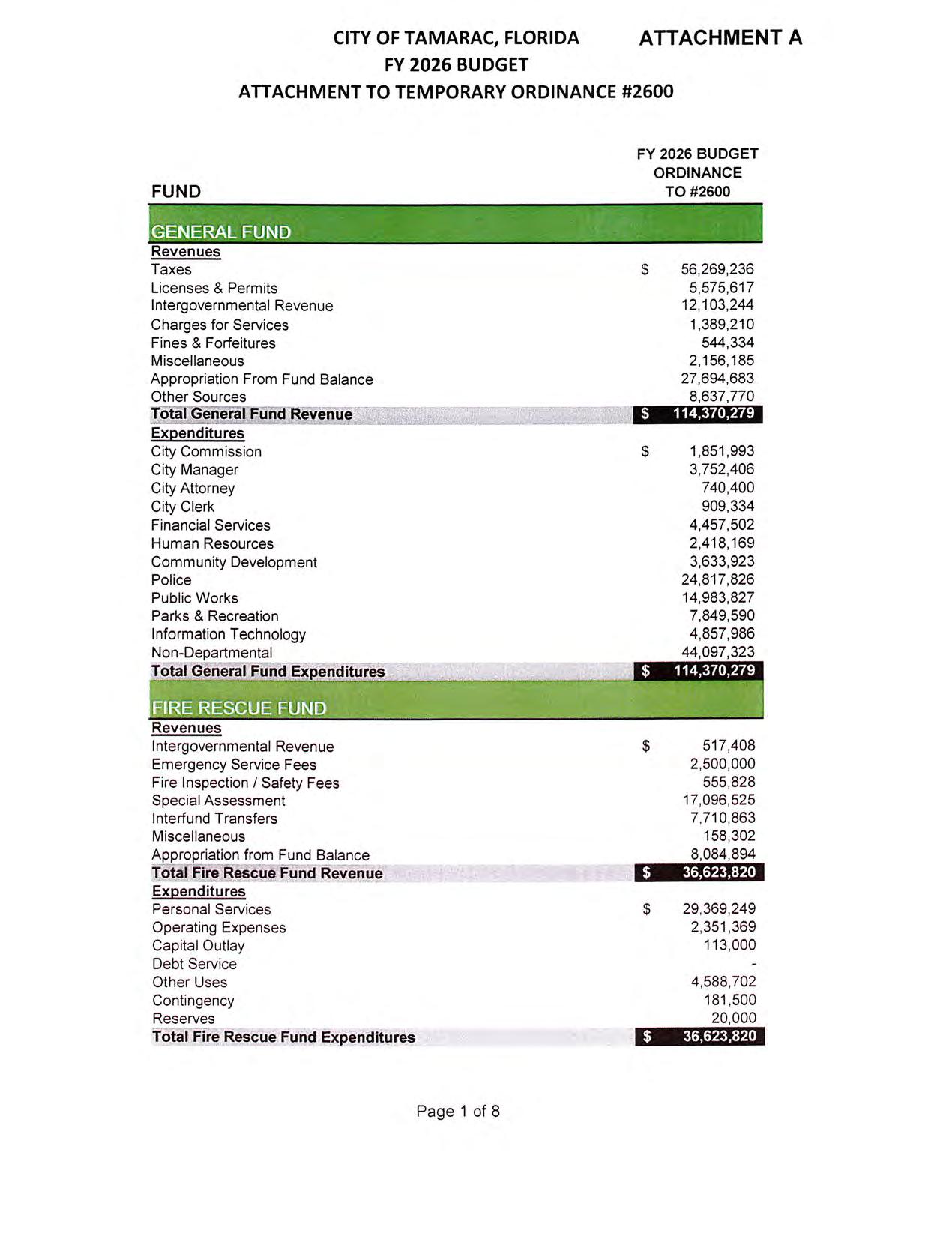

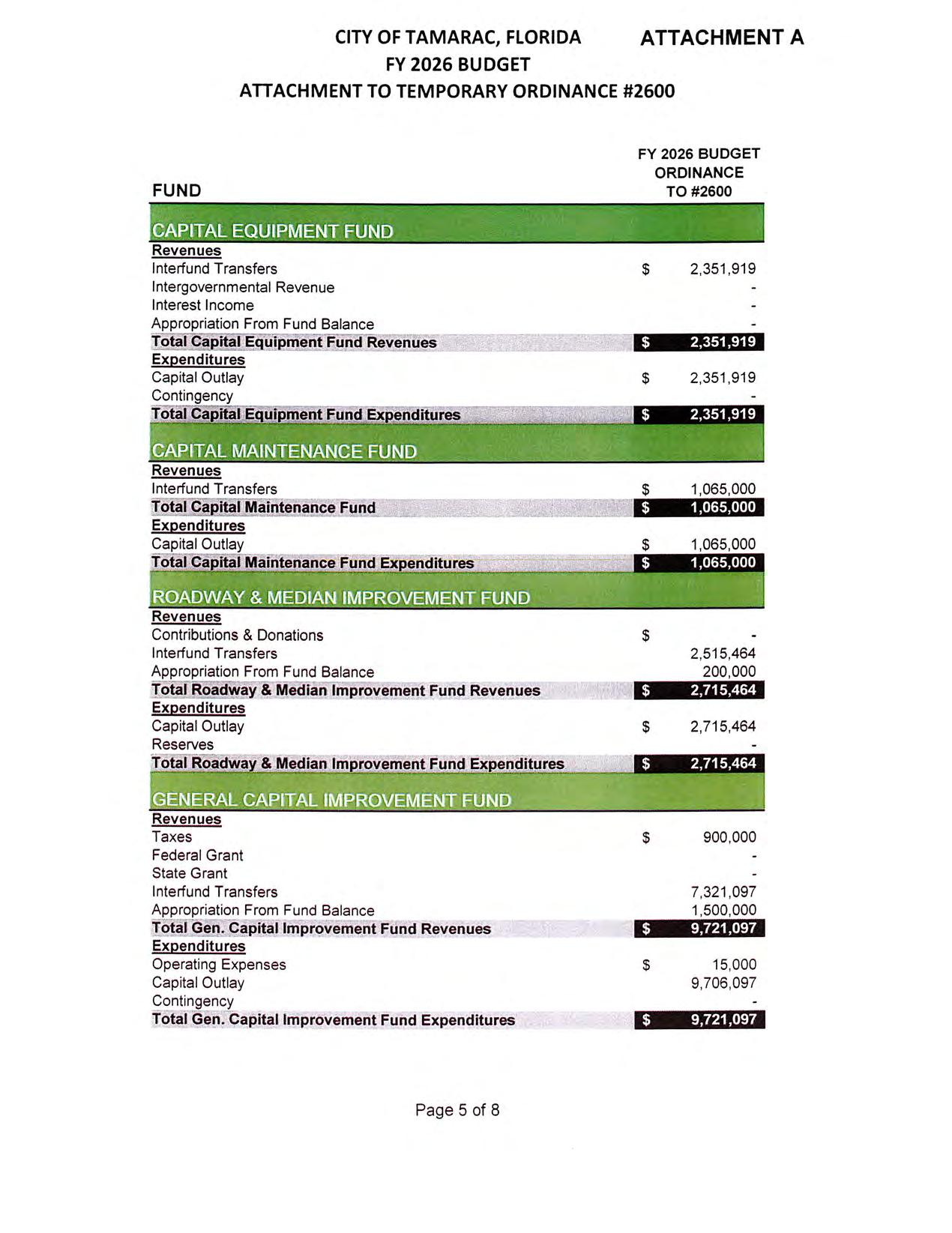

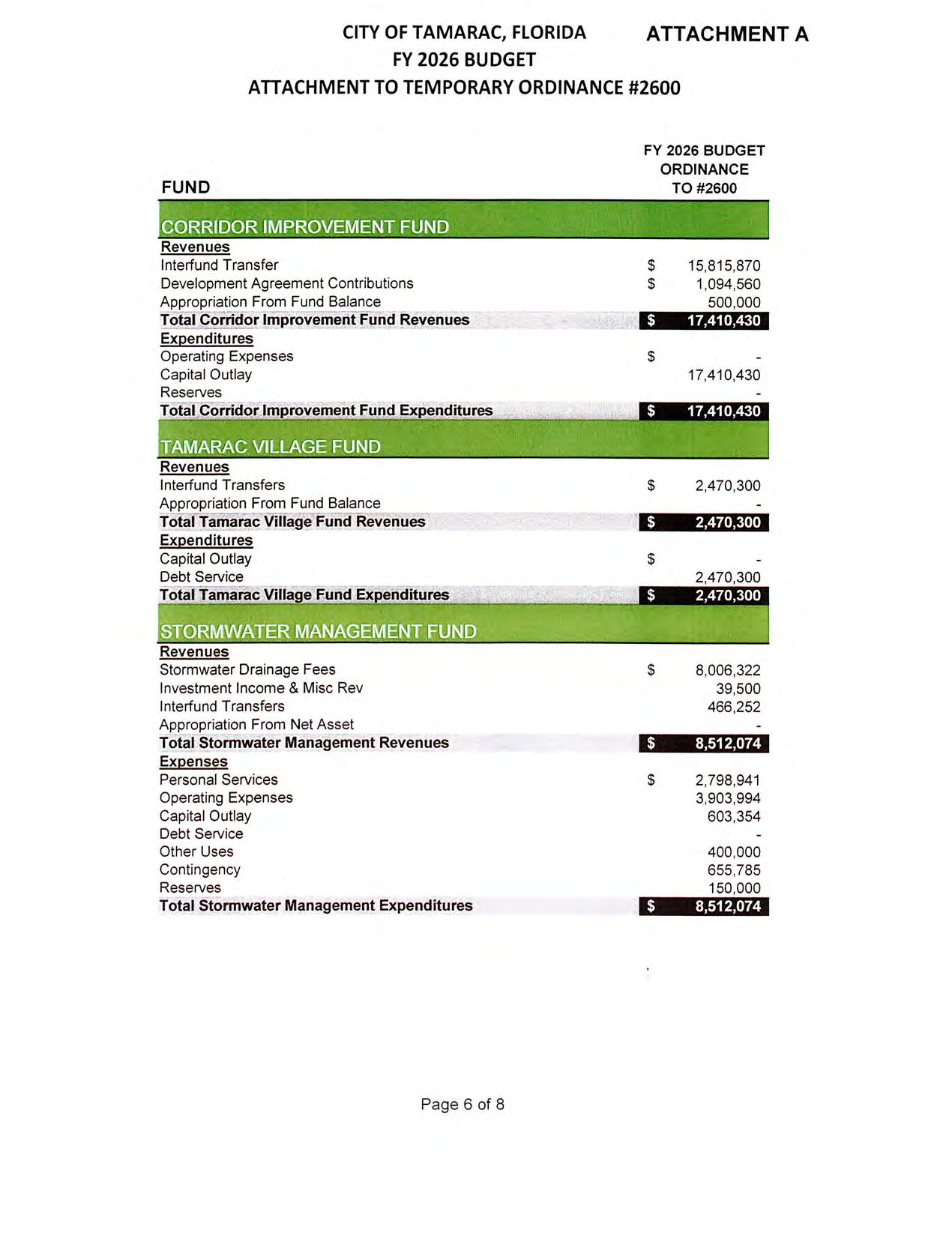

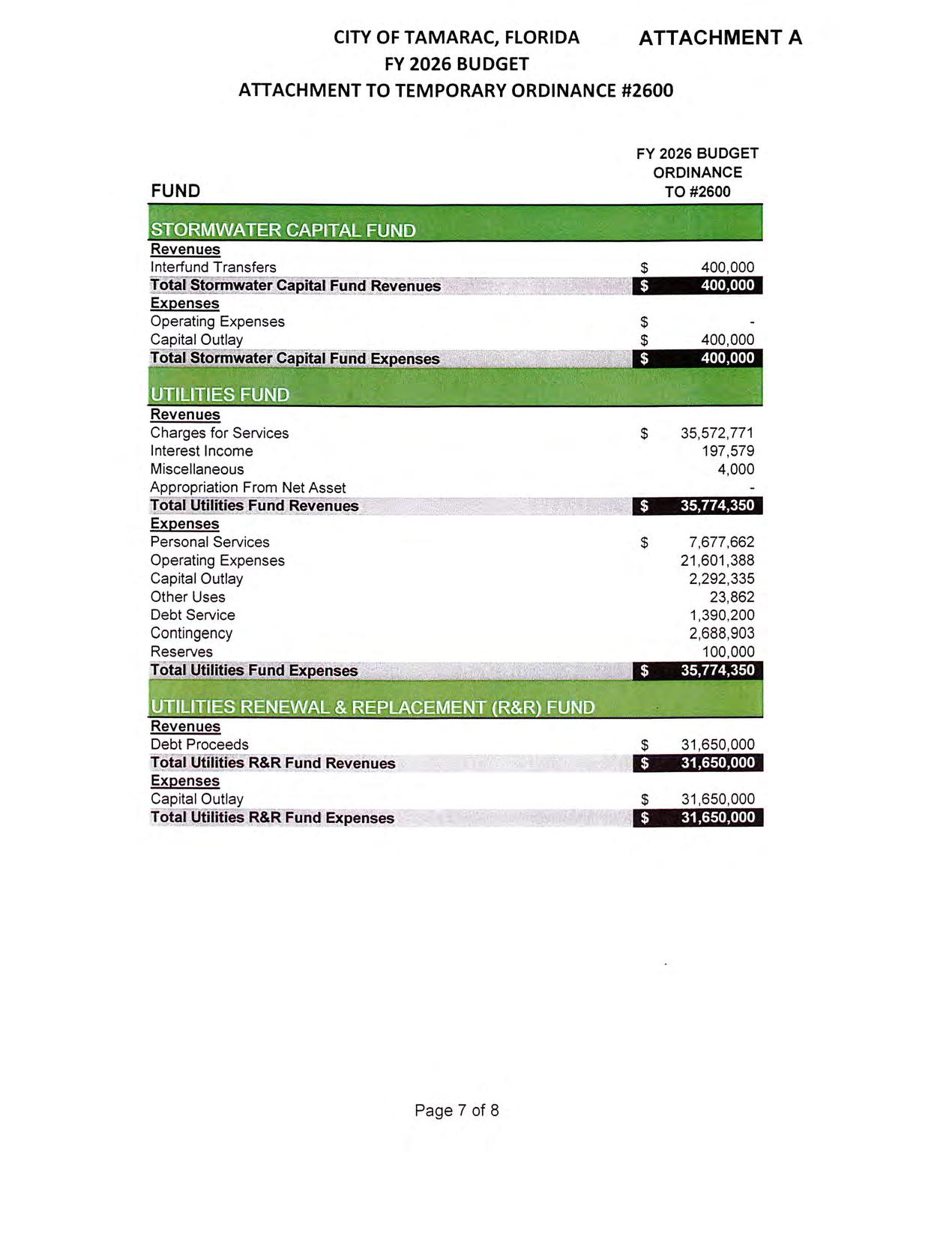

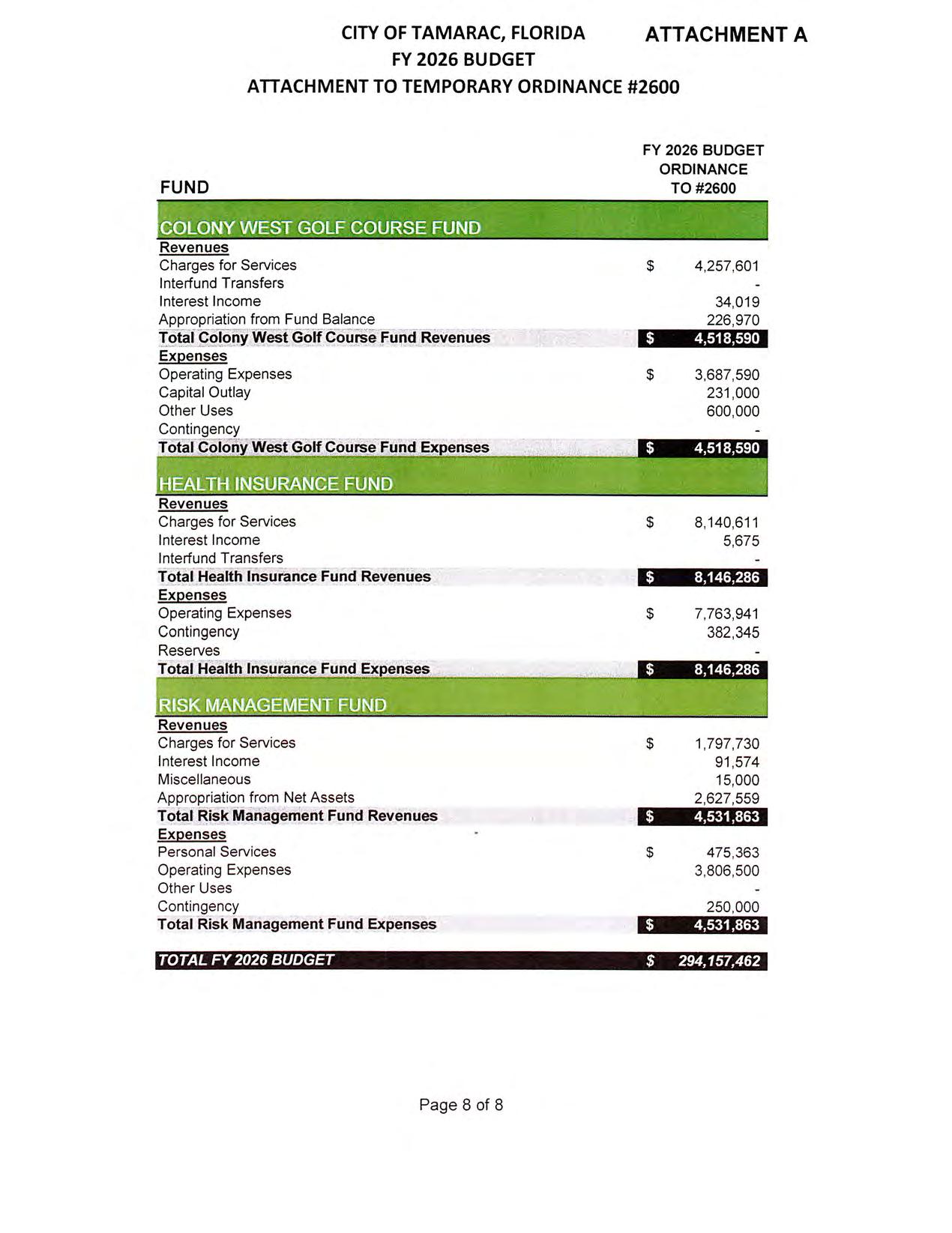

The FY 2026 Total Adopted Budget is $294,157,462 which includes $114,370,279 for General Fund expenditures. Summarized below are the changes broken out by fund type. The largest change is an increase of $26.1 million in the Enterprise Funds, primarily due to budgeting a much higher total amount for Utilities capital projects as compared to last year.

THE MONEY GOES

The General Fund is the City's primary operating fund and is the largest fund. It accounts for all the financial resources needed to operate the City except for those required to be accounted for in a separate fund. The General Fund budget for FY 2026 totals $114,370,279 which is an increase of 13.72% from last year's budget.

The General Fund (Fund 001) serves as the primary reporting vehicle for current operations. The major sources of revenue include ad valorem (property) taxes, utility taxes, communications services tax, franchise fees, user fees and charges for services, and intergovernmental revenues. The major departments funded within the General Fund are City Commission, City Manager, City Attorney, City Clerk, Financial Services, Human Resources, Community Development, Parks and Recreation, Information Technology, and Public Services. Police services are provided by contract with Broward County Sheriff's Office and are also funded in the General Fund.

These are the City's Operating Funds. The City of Tamarac has adopted a Fund Balance Policy. The purpose of the Fund Balance Policy is to provide enhanced financial stability by ensuring that the City maintains a prudent level of financial resources to protect against reducing service levels or raising taxes and fees because of temporary revenue shortfalls or unexpected one-time expenditures. The policy sets acceptable ranges of fund balance for each fund that contains operating revenues. The amounts set for each fund are based on the predictability of revenues, volatility of expenditures, and liquidity requirements of each fund. In some cases, the range of fund balance is determined by bond covenants. The policy also provides guidelines for actions that should be implemented should the fund balance either grow or diminish to amounts outside of the recommended ranges

The City's Budget seeks to preserve and build fund balances in each of the operating funds to continue implementation of the Fund Balance Policy. Budgeting was performed conservatively so that, for the most part, available revenues funded anticipated expenses and preserved fund balance levels.

Insurance Services Fund is Fund 502 & 504 combined All projected amounts are unaudited and based on preliminary FY 2025 year-end results. Future estimates are based on historic actual collection rates for revenues and expended budget percentages for expenditures.

Expenditures-All Departments

Revenue Type Definitions:

(1) Variable-Discretionary/Restrictive - Relies solely on a tax increase to generate additional funds beyond growth.

(2) Variable-Discretionary means that it is adjustable by Home Rule to a certain extent.

(3) Variable-Non-Discretionary means it is received but not adjustable by the City due to certain factors such as, the rate is at the maximum percentage, it will take more than one year to adjust, and/or receipts are out of the City's control.

Underlying Assumptions:

(1) Revenues are forecasted in the General Fund using a conservative approach in accordance with the City's Financial Policies.

(2) Expenditures are forecasted conservatively with annual increases to Personal Services and Operating Expenditures aligned with inflation.

(3) At times when actual revenue exceeds estimates and actual expenditures are less than forecasted in the same year, the excess revenues are used to shore up the City’s Fund Balances and fund capital improvements.

Major General Fund revenue sources for the City of Tamarac are property taxes, utility taxes, franchise fees, sales and use taxes, telecommunication service taxes, and intergovernmental revenues.

The City’s primary revenue source is property taxes. Property taxes are an ad valorem tax, meaning they are allocated to each property proportionately according to its value The Broward County Property Appraiser (BCPA) establishes the value of property and exemptions within the City, and the City Commission sets the millage rate, which is applied against these values to calculate the expected amount of revenue. Although actual increases have ranged between 6% and 10% for the past five years, the City used a conservative projection of a 3 percent annual increase to forecast this revenue; projections remain modest for FY 2027 and FY 2028.

Franchise fees are negotiated payments the City charges companies or utilities for the use of public rights-of-way (such as poles, lines, and pipes). These fees may also reflect the value of granting a utility the exclusive right to provide its services within the City. The City currently has franchise agreements for electricity and solid waste, with the largest revenue source generated from electric franchise fees. Electric franchise fees are based on the utility’s revenues. Although higher utility costs could, over time, influence local economic activity and development patterns, the magnitude of these effects on City revenues is difficult to quantify. Accordingly, a modest growth rate of 0.4% has been projected.

$4,500,000

$4,300,000

$4,100,000

$3,900,000

$3,700,000

$3,500,000

$3,300,000

$3,100,000

$2,900,000

$2,700,000

$2,500,000

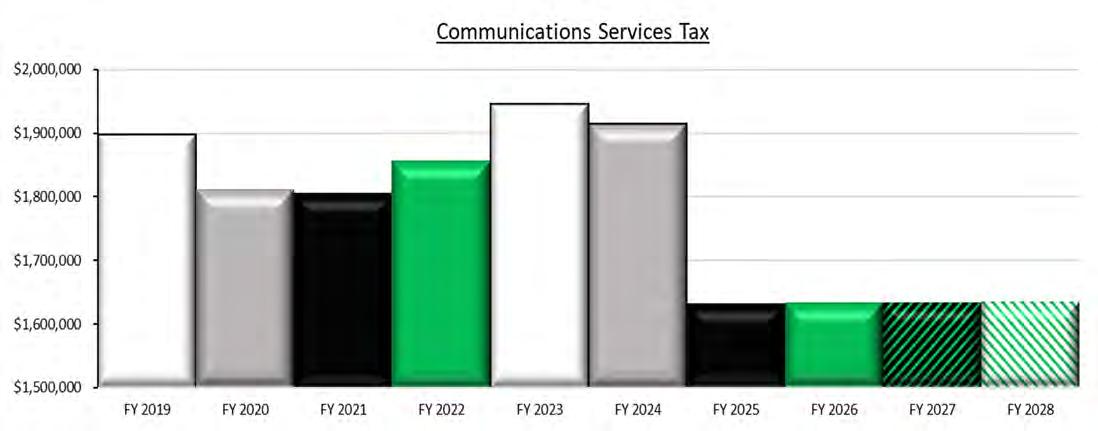

Communications Services Tax (CST) applies to telecommunications, cable, direct-to-home satellite, cellular telephone, and related services. The CST revenue is collected and distributed by the State of Florida and is a combination of two individual taxes: (1) the State of Florida communications services tax and (2) the local communications services tax. The economy, legislation, and technological changes have eroded the tax base for this revenue; a continued 0.5% annual growth rate is forecasted.

A Public Service Tax is levied on the purchase of electricity, metered natural gas, liquefied petroleum gas, metered or bottled, manufactured gas, metered or bottled, and water service. This revenue was implemented by the City in Fiscal Year 2010 as a much-needed effort to bridge the gap in other declining revenues, such as property taxes and other fees; forecasts are for minimal growth.

$6,500,000

$6,000,000

$5,500,000

$5,000,000

$4,500,000

$4,000,000

$3,500,000

This category includes revenues received from federal, state, and other governmental sources in the form of shared revenues, the largest of which for the City of Tamarac are the Half-Cent Sales Tax and Municipal Revenue Sharing. Half-cent sales tax revenue is allocated to local governments based on a population-derived formula for each county. The Municipal Revenue Share is allocated based on population, sales tax collections, and the ability to raise revenue based on per capita taxable values. As of January 2019, an additional tax on natural gas was included in this Share, and the forecasts are minimal for growth.

$6,500,000

$6,000,000

$5,500,000

$5,000,000

$4,500,000

$4,000,000

$3,500,000

$3,000,000

$2,500,000

$2,000,000

$1,500,000

Fire suppression, prevention, and other fire services benefit all properties in the City by protecting the value and integrity of improvements to real property and protecting the use and enjoyment of such property. The City provides these services, which reduce the cost of property insurance and enhance property values. The primary revenue used to fund these services is a non-ad valorem special assessment levied on residential and commercial property owners. The amount of the assessment is calculated by a consultant using a calculation of recoverable costs, property types, and classifications.

$18,000,000

$17,000,000

$16,000,000

$15,000,000

$14,000,000

$13,000,000

$12,000,000

$11,000,000

$10,000,000

The second significant revenue source in the Fire Rescue fund is transport fees collected from users of ambulance and rescue services, also known as Emergency Service Fees. Emergency service fee revenue is estimated by trend analysis, utilization of historical data, and input from the department on projected activity levels. In FY 2016, at the auditors' recommendation, the City began deferring receivables, deducting a substantial amount from revenue and placing it in a balance sheet account. This account is to be adjusted annually based on a 60-day availability rule going forward.

$3,000,000

$2,500,000

$2,000,000

$1,500,000

$1,000,000

The Building Department ensures code-compliant construction, provides inspections, and plan reviews to promote high standards for our residential and commercial sectors. The fees it charges for these services are meant to cover the cost of providing the service. Building permits have shown the greatest volatility, which reflects building “boom” cycles within the City. A revised fee structure was implemented in FY 2022, following the completion of a fee study conducted by MGT of America, Inc.

$4,000,000

$3,500,000

$3,000,000

$2,500,000

$2,000,000

$1,500,000

$1,000,000

The major revenue source for the Stormwater Fund, supporting 100% of operating and capital costs, is the Stormwater Fee, which is charged to all property owners for the services of the Stormwater Management Program. This fund was created to comply with the Na tional Pollutant Discharge Elimination System (NPDES). Property is classified as undeveloped, residential, or non-residential, and a fee is associated with each to fund the maintenance and operation of the City's public storm drainage systems.

$9,000,000

$8,500,000

$8,000,000

$7,500,000

$7,000,000

$6,500,000

$6,000,000

$5,500,000

$5,000,000

The Utilities Fund is funded through charges for services to residential and commercial customers for water and wastewater charges. The City provides water in a safe and efficient manner and transports the wastewater from these dwellings. The City pays Broward County for the wastewater disposal, as a participating member of the County’s North Regional Wastewater Treatment Plant. Charges for Services revenues provide approximately 99.7% of the revenues to support the operations of the Utilities division.

$19,000,000

$18,000,000

$17,000,000

$16,000,000

$15,000,000

$14,000,000

$13,000,000

$12,000,000

$11,000,000

$10,000,000

$9,000,000

$8,000,000

$7,000,000

$23,000,000

$22,000,000

$21,000,000

$20,000,000

$19,000,000

$18,000,000

$17,000,000

$16,000,000

$15,000,000

$14,000,000

$13,000,000

$12,000,000

The National Advisory Council on State and Local Budgeting (NACSLB) developed a comprehensive set of recommended budget practices that has been endorsed by the Government Finance Officers Association, ICMA, academia, etc. These recommended practices provide a framework for the budget process encompassing a broad scope of governmental planning and decision-making with regard to the use of resources.

NACSLB Principal 2, Element 4, “Adopt Financial Policies” addresses the need for jurisdictions to establish policies to help frame resource allocation decisions. As such, the following are five categories of recommended financial management policies developed within these guidelines with the associated measurable benchmarks for adoption by the City Commission. The five categories are Operating Management, Debt Management, Investment Management, Account Management and Financial Planning & Economic Resources and are detailed below:

Policy #1:

Revenue estimates for annual budget purposes should be conservative. In this light, General Fund revenues should be budgeted in the manner delineated below.

1.1. Property taxes should be budgeted at 95% of the Property Appraiser’s estimate as of July.

1.2. State shared revenues should be budgeted at 95% of the State Department of Revenue estimate. This includes the Communication Services Tax, Half -cent Sales Tax and State Revenue Sharing.

1.3. Franchise fee revenue should be budgeted at 95% of the maximum estimate prepared by Financial Services Department.

1.4 Public Service Taxes on Electric, Propane and Natural Gas should be budgeted at 95% of the maximum estimate prepared by the Financial Services Department.

Policy #2:

The annual budget should be maintained in such a manner as to avoid an operating fund deficit. The annual budget should show fiscal restraint. Expenditures should be managed to create a positive cash balance (surplus) in each fund at the end of the fiscal year.

Policy #3:

The City should maintain a prudent cash management and investment program in order to meet daily cash requirements, increase the amount available for investment, and earn the maximum rate of return on invested funds commensurate with appropriate security. The City will use the following performance benchmarks for its investment portfolio.

3.1 The Bank of America Merrill Lynch 1-3 Year US Treasury & Agency Index which is a subset of The Bank of America Merrill Lynch US Treasury & Agency Index including all securities with a remaining term to final maturity less than 3 years, will be used as a benchmark for the performance of funds designated as core funds and other non-operating funds that have a longer-term investment horizon. The index will be used as a benchmark to be compared to the portfolio’s total rate of return.

3.2. The S & P rated LGIP Index/All will be used as a benchmark as compared to the portfolio’s net book value rate of return for current operating funds.

Policy #4:

The City shall maintain a minimum undesignated fund balance in the General Fund equal to the greater of 16.67% or 2 months annual expenditures, including Interfund transfers out.

Reserve funds shall not be used to fund recurring expenditures. Fund balances should be maintained at fiscally sound levels in all funds. Such levels are delineated below.

Reserved/Designated: Economic Development

The designated Economic Development Reserve shall be established with one time initial funding of $5,000,000. The designated Economic Development Reserve will function as a revolving reserve account, where as initial funding is drawn down it will only be replenished through future recovery or recapture stemming from directly related Economic Development projects or activities.

Reserved/Designated: Disaster Reserve

The disaster reserves are to be used in emergency situations and as a match for Federal Emergency Management Agency (FEMA) funds.

Reserves shall be used to fund emergency replacements and/or damaged equipment vehicles only as categorized below:

$5,000,000 $5,000,000

After all general fund minimum reserve balances have been met; excess undesignated reserves may be set aside to provide additional funding in any designated reserve.

Water & Sewer Fund:

• An operating reserve balance of three months of operating and maintenance expenses or a minimum of $5,000,000.

• Any surplus revenue in excess of this operating reserve minimum balance target is utilized to pay for all or a portion of the cost of capital projects.

Stormwater Fund:

• A working capital reserve of 10% of annual revenues shall be budgeted in the annual budget for the then current fiscal year. This amount is not cumulative.

Policy #5:

The City shall maintain adequate protection from loss due to property damage or liabilities of the City. The City shall maintain a risk fund for workers’ compensation and property/liability and ensure adequate resources are available to support the value of incurred but not reported (IBNR) claims.

Policy #6:

The City will not commit itself to the full extent of its taxing authority.

Policy #7:

The City will not fund ordinary recurring municipal services with temporary or nonrecurring revenue sources

Policy #8:

The City will maintain a cost allocation process by which the General Fund is reimbursed for actual indirect costs associated with providing services to other operating funds.

Policy #9:

All fee schedules and user charges should be reviewed annually for adjustment to ensure that rates are equitable and cover the total cost of the service or that portion of the total cost established by policy of the Tamarac City Commission. The following framework is recommended by the administration to be applied to user fees:

9.1 Total Fee Support (100%):

Enterprise Funds: • Water/Sewer • Stormwater

Special Revenue Funds:

• Building Fund

9.2 Moderate Fee Support (40 - 100%)

General Fund:

• Planning

• Zoning

9.3 Parks & Recreation – Fees shall be established in accordance with Administrative Policy 04-03. Parks & Recreation Fees shall be adjusted annually to maintain, at a minimum, the same percentage of cost recovery as in the prior year.

Policy #10:

Payment in Lieu of Taxes shall be charged to the Utilities and Stormwater funds at the rate of 6% of revenue for the purpose of recovering the costs associated with administering the use of, maintenance of, and ensuring the safe use of its streets, rights-of-way and public owned properties used by the utilities and storm water funds in providing and furnishing services to its customers.

Policy #11:

The financial burden on the City’s taxpayers must be minimized through systematic annual program reviews and evaluation aimed at improving the efficiency and effectiveness of City programs. As such, the annual budget will be based on a City-wide work program of goals, implemented by departmental goals and objectives.

Policy #12:

The City's role in social service funding should be supplemental (addressing special or unique local needs) to the basic responsibilities of regional agencies. Funding shall first be derived from those funds provided through the Community Development Block Grant (“CDBG”) program.

Policy #13:

City management is responsible for recovery of budgeted and non-ad valorem revenues as planned for in the budget. Management shall maintain adequate billing and claiming processes in order to effectively manage their accounts receivable systems in conformance with the fiscal plan and sound business principles.

Policy #14:

The City will annually review the Capital Improvements Element of the Comprehensive Plan to ensure that required fiscal resources will be available to provide the public facilities needed to support the adopted level of service standards.

Policy #15:

The City will annually prepare a six-year asset management program. The asset management program will identify the source of funding for all projects, as well as the impact on future operating costs.

Policy #16:

Every appropriation, except an appropriation for capital improvement expenditures and multi-year grants, shall lapse at the close of the fiscal year to the extent that it has not been expended or encumbered. An appropriation for a capital improvement expenditure and a multi-year grant shall continue in force, i.e. not be required to be re-budgeted, until the purpose for which it was made has been accomplished or abandoned; the purpose of any such appropriation shall be deemed abandoned if three (3) years pass without any disbursement from or encumbrance of the appropriation unless extended by action of the City Commission.

Policy #17:

The City will issue and comply with a comprehensive debt management policy.

Policy #18:

The City will issue and comply with a comprehensive investment management policy.

Policy #19: