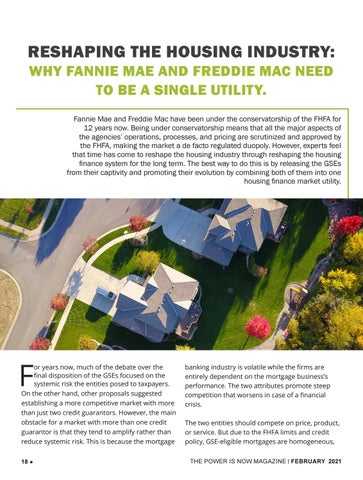

RESHAPING THE HOUSING INDUSTRY: WHY FANNIE MAE AND FREDDIE MAC NEED TO BE A SINGLE UTILITY.

Fannie Mae and Freddie Mac have been under the conservatorship of the FHFA for 12 years now. Being under conservatorship means that all the major aspects of the agencies’ operations, processes, and pricing are scrutinized and approved by the FHFA, making the market a de facto regulated duopoly. However, experts feel that time has come to reshape the housing industry through reshaping the housing finance system for the long term. The best way to do this is by releasing the GSEs from their captivity and promoting their evolution by combining both of them into one housing finance market utility.

F

or years now, much of the debate over the final disposition of the GSEs focused on the systemic risk the entities posed to taxpayers. On the other hand, other proposals suggested establishing a more competitive market with more than just two credit guarantors. However, the main obstacle for a market with more than one credit guarantor is that they tend to amplify rather than reduce systemic risk. This is because the mortgage 18

l

banking industry is volatile while the firms are entirely dependent on the mortgage business’s performance. The two attributes promote steep competition that worsens in case of a financial crisis. The two entities should compete on price, product, or service. But due to the FHFA limits and credit policy, GSE-eligible mortgages are homogeneous, THE POWER IS NOW MAGAZINE | FEBRUARY 2021