FEBRUARY 2026

FEBRUARY 2026

THE PSYCHOLOGY OF REO PRICING: WHY SOME BANK-OWNED HOMES STAY ON THE MARKET LONGER AND HOW BUYERS CAN CAPITALIZE

EDITOR'S NOTE

WHY REOBROKER?

PUBLISHER’S NOTE

MEMBERSHIP BENEFITS

STATES WE COVER REOBROKER TV

ABOUT REOBROKER

PODCAST LIVE ARTICLES

AGENT SPOTLIGHT ABOUT MIKE SAMBORN

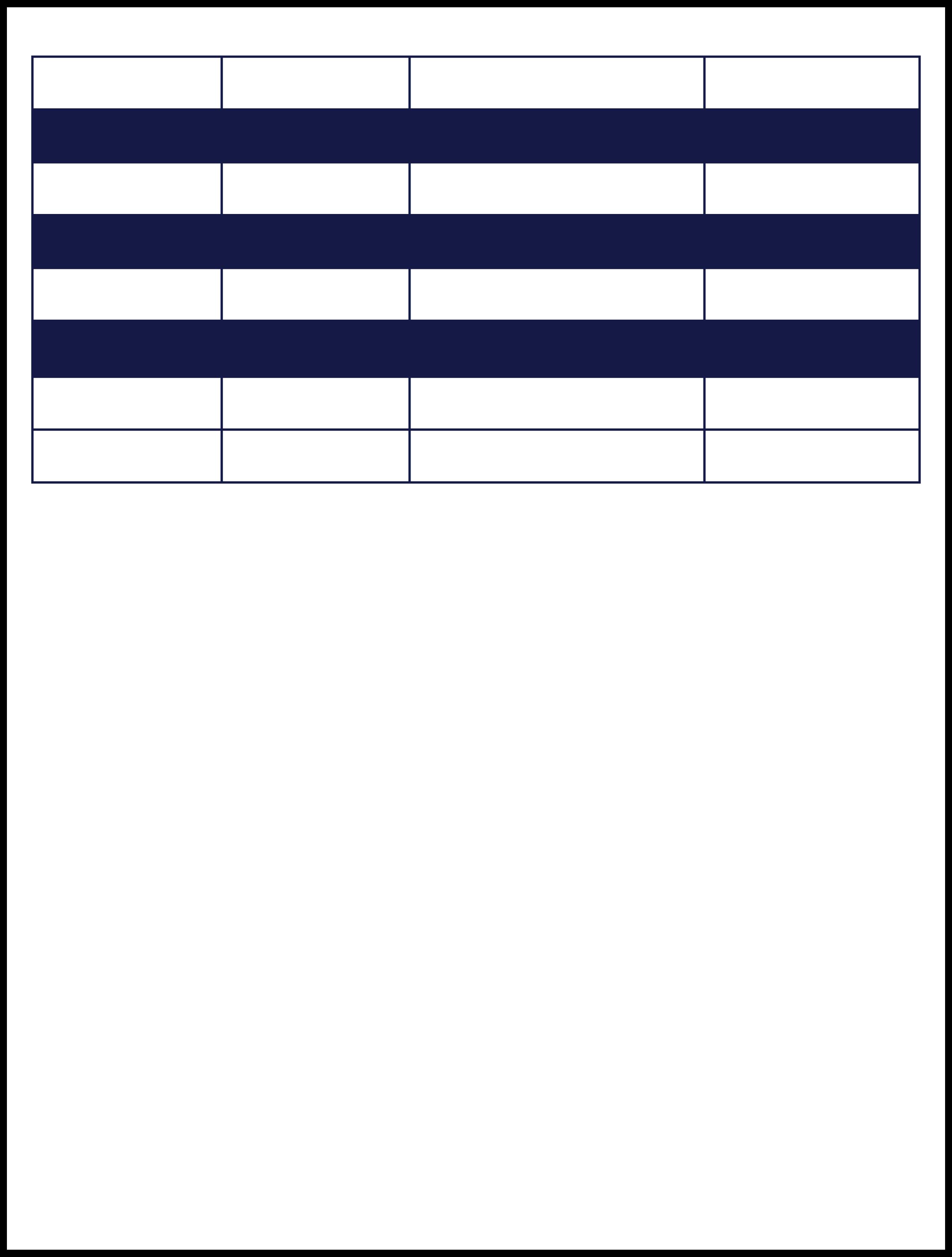

The Psychology of REOPricing: Why Some Bank-OwnedHomes Stay on the Market Longer —And How Buyers CanCapitalize The NewFinancing Playbook: Creative Loan Programs for REOBuyers in 2026

The Hidden Cost Advantage: HowBuying REOProperties Can Offset High Interest Rates

The Rise of “Second-Chance Housing”: REOHomes as a Fast Path to Homeownership

05

07

Why REOVolume Can Rise Without Triggering Price Crashes

The Post-Foreclosure Occupancy Problemin REOProperties

09 HowServicers Prioritize REOSales: Understanding Internal Triage Systems

11 HowPolitical Policies Are Reshapingthe REOMarket

Brandy Nelson PUBLISHER:

Executive Director

REOBroker com

Equity Union Broker

Associate 70115 Hwy 111 Rancho Mirage, CA 92270

Phone: 760-238-0552

Email: brandy@reobroker com

Mike Samborn

Executive Director

REOBroker.com

All Star Real Estate Broker/Owner

Phone: 989-922-6800

Email: Mike@mikesanborn com

Eric Lawrence Frazier

Administrator

Phone: 714) 475-8629 ext 703

Welcome to the February 2026 edition of The Real Estate Magazine, published by REOBroker.com. February is where the market stops theorizing and starts revealing its direction. The first wave of year-end reporting is complete, servicing teams are back in rhythm, and early-quarter inventory decisions begin to surface in pricing, timelines, and disposition strategy. For REO professionals and investors, this is the month when execution matters more than predictions.

The broader housing conversation still circles rates, affordability, and “soft landing” narratives but distressed real estate rarely follows headlines on schedule. Beneath the surface, servicers are refining vendor performance standards, valuation challenges are becoming more frequent in volatile submarkets, and timelines are tightening in places where carry costs are climbing. This month’s issue is built to help you operate inside that reality: not with hype, but with practical insight.

We focus on the core mechanics that decide profitability and performance in 2026:

Valuation Discipline: A deep dive into reducing spread risk between AVMs, BPOs, and field appraisals—plus how to document disputes effectively when pricing doesn’t match asset condition or neighborhood trend shifts.

Operational Velocity: A feature on building faster, cleaner REO pipelines —work orders, inspections, occupancy status, vendor coordination, and listing readiness because the fastest teams are winning the margin battle.

FEBRUARY 2026 2026

REOBroker.com exists to equip agents, investors, servicers, a managers with credible insight and actionable strategy across ecosystem. This publication is designed to help you see what matte what doesn’t, and operate with confidence especially when the feels uncertain.

Thank you for reading and for being part of this growing pr community. May this February issue sharpen your decision-ma strengthen your execution as 2026 continues to unfold.

WELCOMETO

REOBROKER

REOBroker.com is built for professionals working in REO, default servicing, and distressed real estate We connect the industry through education, visibility, and a network designed to support performance

REO is a performance business Success depends on consistent execution tight timelines, clean reporting, strong vendor coordination, and risk-aware decisionmaking. REOBroker.com supports the professionals who operate in this space by bringing community, education, and visibility into one platform.

You’ll find a network designed around REO and default servicing—not generic real estate. The goal is simple: help professionals build credibility, sharpen workflow, and stay connected to the people and ideas shaping the distressed market.

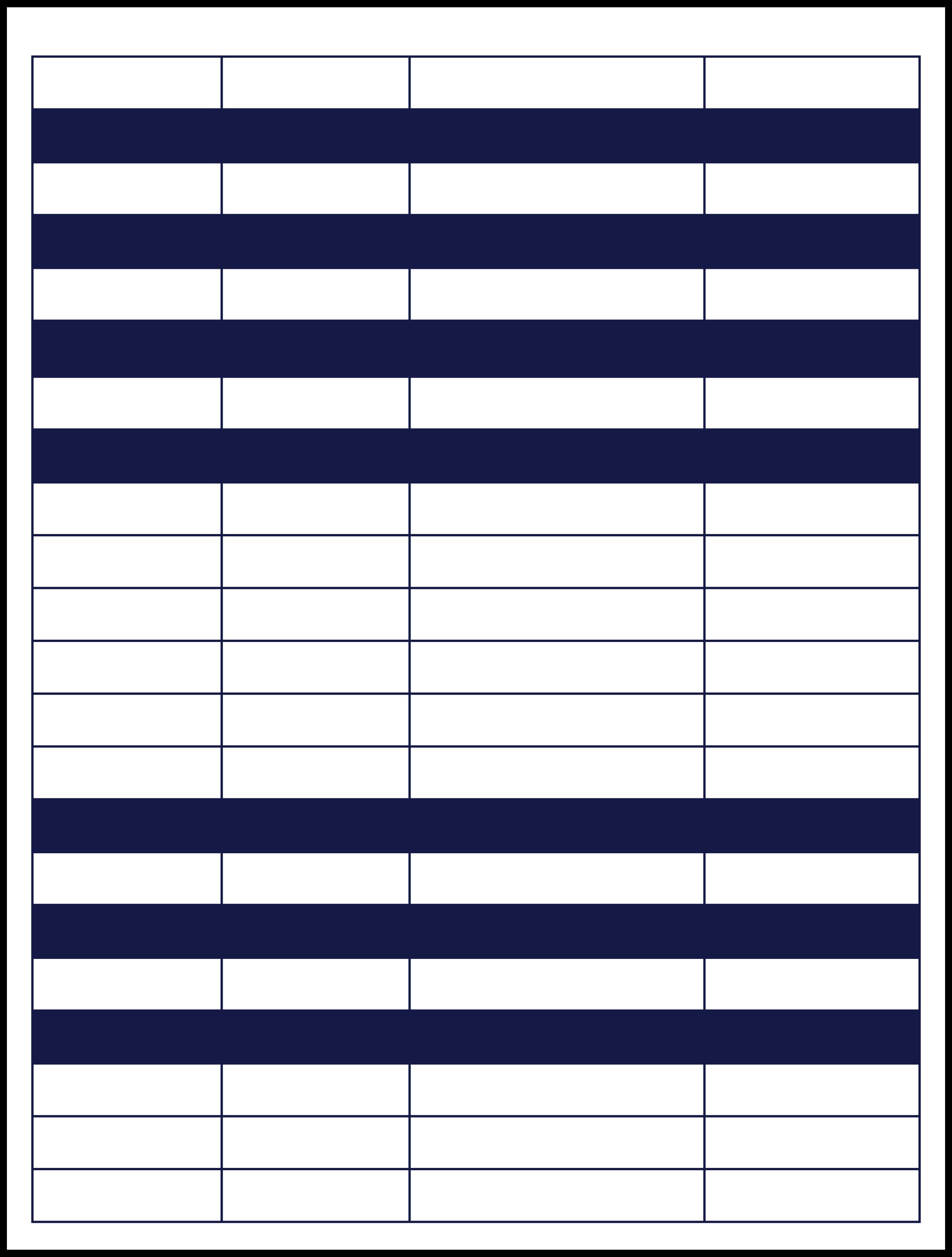

Broker Development (BD) Seminars: Attend a minimum of two (2) BD seminars each year.

Monthly Mastermind & Training Calls: Access at least two (2) Zoom mastermind/training sessions every month

Asset Management Company Roster: Direct access to our curated asset management company roster.

Private Lender Roster: Access to a private lender roster to support financing and deal flow.

Members-Only Chat Support: An internal chat line that connects you with experienced professionals for real-time insight, resources, and problem-solving.

Event Sponsorship & Visibility: REOBroker com sponsors NADP, Five Star, and other industry events creating additional exposure opportunities for members.

National Exposure: Increased visibility to asset managers and related companies across the country.

Website Listing: Featured on REOBroker com with your contact information and areas served.

Magazine & Campaign Inclusion: Included in REOBroker.com

online HUD and Real Estate magazines, plus national marketing campaigns.

Content Submission Opportunities: Submit market updates and real estate articles for publication in the magazines.

Member Advertising Rates: Preferred pricing on additional advertising across: REOBroker.com HUD Magazines

REO Broker Real Estate Magazine REOBroker TV Podcast

REOBroker.com is a national platform built specifically for REO and default real estate professionals. We serve the people working on the front lines of distressed property disposition—REO agents and brokers, investors, asset managers, and service providers—by combining education, community, and industry visibility in one place.

Our mission is to help members perform at a higher level through consistent training, mastermind-style learning, and access to curated industry rosters. Just as importantly, we support credibility and exposure by featuring members on REOBroker.com and through national media channels, including our online HUD and Real Estate magazines, REOBroker TV, podcasts, and broader marketing campaigns.

REO is a relationship-driven, process-heavy space where results depend on compliance, speed, and communication. REOBroker.com exists to connect the right professionals, share practical insight, and create opportunities that help members grow their pipeline, strengthen their brand, and stay ahead of the market.

www.reobroker.com

February 2026: pricing, financing, and servicer strategy are defining REO outcomes. this month focus

REO pricing missteps buyers can capitalize on Financing playbook updates for 2026 acquisitions

Buyer-profile shifts as borrowing costs rise

What happens after an REO fails to sell

Second-chance housing and new paths to homeownership

Welcome to the February 2026 edition of The Real Estate Magazine by REOBroker.com. This is the month when the market stops speculating and starts showing direction servicers settle into Q1 cadence, timelines tighten, and pricing decisions reflect real carry-cost pressure.

REO is not traditional real estate. Performance depends on process: accurate valuations, clean documentation, strong vendor coordination, and consistent communication. In this issue, we focus on the operational and strategic moves that protect margins and reduce risk in today’s environment.

REOBroker.com exists to connect the professionals driving outcomes in default and distressed real estate—agents, investors, asset managers, and vendors through education, visibility, and community. Thank you for being part of a network built on standards, insight, and opportunity.

MIKE SAMBORN MIKE SAMBORN

LISTEN ON:

Not all bank-owned properties sell quickly, even in competitive markets. Behavioral factors and outdated pricing strategies often influence why some REO homes linger on the market longer than others. Understanding the psychology behind REO pricing can give buyers and brokers a strategic edge, enabling them to identify opportunities for negotiation and maximize value.

Asset managers, servicers, and banks sometimes rely on historical valuations or conservative pricing methods that fail to reflect current demand or local market dynamics. These pricing decisions can inadvertently create opportunities for informed buyers who recognize when a property is mispriced or overestimated.

This article explores the behavioral pricing trends in REO management, examines why some bank-owned homes remain unsold, and highlights strategies buyers and brokers can use to capitalize on these inefficiencies. By understanding the psychology of pricing, market participants can approach REO transactions with insight, timing, and strategic advantage.

Many banks and servicers rely on standardized pricing models that may not fully account for local market conditions, recent comparable sales, or neighborhood-specific trends. While these models aim to mitigate risk, they can unintentionally result in properties being listed above their optimal market price.

Additionally, asset managers may exhibit behavioral biases, such as anchoring to previous valuations or resisting reductions in listing prices despite limited buyer interest. These tendencies influence how quickly a property moves and whether it attracts competitive offers.

REO properties may linger due to a combination of market, property, and psychological factors:

Outdated Valuations: Prices based on historical market peaks can be unrealistic in current conditions.

Limited Marketing Adjustments: Servicers may delay relisting or fail to refresh listings, reducing buyer visibility.

Conservative Risk Management: Banks often avoid aggressive price reductions to protect asset value, slowing sales.

For buyers, understanding these patterns can reveal which properties are potentially overpriced and open to negotiation.

Extended listing times can create leverage for strategic buyers. Properties that remain unsold longer may be more amenable to offers below the initial listing price, particularly if the servicer is motivated to reduce holding costs.

Brokers can assist buyers by monitoring listing duration, researching comparable sales, and advising on optimal offer strategies. Informed negotiation tactics can help secure REO properties at favorable terms while mitigating risk.

Brokers and investors should track REO inventory closely, focusing on market psychology and pricing inefficiencies. Understanding how servicers perceive asset value, the timing of price reductions, and regional demand patterns can help identify hidden opportunities.

Additionally, comprehensive due diligence including property inspections, repair estimates, and local market research—ensures buyers can confidently capitalize on pricing inefficiencies while avoiding potential pitfalls.

The pricing of bank-owned homes is influenced by both market dynamics and behavioral factors, often resulting in properties staying on the market longer than necessary. By understanding the psychology behind REO pricing, buyers and brokers can identify opportunities for negotiation and strategic acquisition.

Properties with extended listing times may offer significant value for informed buyers who approach transactions with market insight, comparative research, and careful due diligence. For brokers, recognizing these behavioral trends enables them to guide clients effectively, capitalize on pricing inefficiencies, and create win-win outcomes in a competitive REO market.

REObroker.com helps buyers and brokers navigate REO pricing strategies and capitalize on market inefficiencies. Whether you’re looking for properties that have lingered on the market or need guidance on negotiation tactics, REObroker.com provides nationwide expertise to maximize value and minimize risk. 2026 www.reobroker.com

Visit https://www.reobroker.com to explore current listings, email info@reobroker.com for personalized insights, or call 760‑238‑0552 to speak with professionals who can help you understand REO pricing psychology and secure the best possible outcomes in bank-owned property transactions.

Federal Housing Finance Agency. REO Market Reports and Asset Management Trends. Retrieved February 6, 2026, from https://www.fhfa.gov /DataTools/Downloa ds/Pages/REOReports.aspx

Urban Institute. Behavioral Insights in Bank-Owned Property Pricing. Retrieved February 6, 2026, from https://www.urban.o rg/research/publicati on/behavioralinsights-reo-pricing

As the REO market evolves, traditional mortgages are no longer the only option for buyers pursuing bank-owned properties. In 2026, a growing range of creative loan programs is helping investors, first-time buyers, and owner-occupants overcome common REO challenges especially property condition issues, renovation costs, and financing limits in higher-priced markets.

These programs are designed to reduce upfront barriers and expand the number of REO deals that can realistically close. The most common options fall into three categories:

Renovation-inclusive loans allow buyers to finance the purchase and the repair costs in one mortgage. This approach reduces out-of-pocket spending for major improvements and helps move distressed properties from “unfinanceable” to market-ready faster. For brokers and investors, it opens more inventory and can speed up turn time.

Community reinvestment programs encourage buyers to purchase in targeted revitalization areas. They often provide favorable terms such as down payment assistance, lower interest rates, or special lending support for eligible locations. Buyers gain affordability while supporting neighborhood stabilization, and brokers can leverage program criteria to market properties strategically.

Some lenders offer incentives to move REO inventory faster, including reduced closing costs, interest-rate discounts, or flexible terms on foreclosed properties sold directly by banks. These incentives benefit buyers through lower transaction costs and help servicers reduce holding time and exposure.

Creative financing can be powerful, but it requires careful due diligence. Buyers and brokers should confirm eligibility rules, review loan terms closely, and validate property condition and renovation budgets. Brokers play a critical role in matching clients to the right program and reducing risk throughout the transaction.

Overall, 2026 offers more flexible financing paths for REO acquisitions. By combining the right loan structure with smart property selection, buyers can reduce upfront costs, unlock value, and compete more effectively in today’s REO market.

Rising mortgage rates have made traditional homebuying more expensive, creating challenges for buyers across the country. However, REO properties offer a unique financial advantage: discounted pricing that can help offset the burden of higher borrowing costs. For investors, first-time buyers, and brokers, understanding how REO pricing interacts with interest rates is critical for making informed decisions.

Bank-owned homes often sell below market value, providing an immediate equity advantage and reducing the overall cost of ownership. When combined with careful financial planning, these discounted prices can mitigate the impact of elevated mortgage payments, making homeownership attainable even in a high-rate environment.

We explore how REO purchases can offset high interest rates through financial modeling and real-case examples. We’ll examine cost comparisons, potential equity gains, and strategies for buyers and brokers to leverage REO properties as a practical solution in today’s challenging housing market.

The primary advantage of REO properties is their below-market pricing. In many metro areas, REOs are listed 10–30% below comparable traditional sales, depending on condition and market demand.

For example, consider a $400,000 traditional property versus a $340,000 REO in the same neighborhood. Even with a 6.75% mortgage on the REO, the monthly payment may be comparable—or even lower than a 5.5% mortgage on a full-priced property. This demonstrates how the initial price discount can offset higher borrowing costs, reducing financial strain for buyers.

Financial models show that REO pricing can create a net savings advantage. Key considerations include:

Initial Purchase Price: Lower upfront cost reduces the total loan amount.

Equity Potential: Immediate equity gain provides a cushion against market fluctuations.

Carrying Costs: REO buyers should account for property taxes, insurance, and maintenance, which are often comparable to nonREO homes.

Resale and Appreciation: In appreciating markets, discounted REO properties can deliver accelerated returns relative to traditional purchases.

Real-world scenarios reveal that buyers who strategically target REOs in high-demand areas can save tens of thousands over the life of a mortgage, even at elevated rates.

While REOs offer cost advantages, buyers must consider potential risks, including property condition, repair costs, and post-sale obligations. Proper inspections, thorough due diligence, and professional guidance are essential.

Brokers can assist by identifying REO inventory, evaluating pricing relative to interest rate impact, and guiding clients through financing and negotiation strategies to maximize financial benefit.

The ability of REO discounts to offset high interest rates contributes to sustained demand in the REO market. Investors and first-time buyers are increasingly using REOs as a tool to navigate affordability challenges without waiting for rates to drop. For brokers, understanding the hidden cost advantage positions them to advise clients effectively and capture opportunities in competitive markets.

REO properties provide a strategic advantage in today’s high-interestrate environment. By offering below-market pricing, these homes help buyers offset elevated borrowing costs, preserve financial flexibility, and achieve homeownership sooner.

Through careful financial analysis, inspection, and guidance from experienced brokers, buyers can capitalize on REO opportunities while mitigating risk. In competitive markets, understanding how discounted REO pricing interacts with interest rates empowers investors and first-time buyers to make informed, cost-effective decisions, ensuring that high mortgage rates do not prevent access to valuable property opportunities.

REObroker.com offers expert insights into REO properties and strategies to offset high interest rates. Whether you’re an investor evaluating discounted bank-owned homes or a first-time buyer seeking financial efficiency, REObroker.com provides nationwide expertise to help you maximize opportunities. Visit https://www.reobroker.com to explore current listings and resources, email info@reobroker.com for personalized guidance, or call 760 238 0552 to speak directly with professionals who can help you leverage REO pricing advantages and navigate today’s housing market efficiently and strategically.

References

Federal Housing Finance Agency. REO Sales and Market Impact Reports. Retrieved February 6,2026, from https://www.fhfa.gov/DataTools/Downloads/Pages/REOReports.aspx

Urban Institute. Financial Strategies for Purchasing Bank-Owned Properties in High-Rate Markets. Retrieved February 6, 2026, from https://www.urban.org/research/publication/financial-strategiesreo-high-rate-markets

In many high-cost metro areas, rising mortgage rates and housing affordability challenges are pushing first-time buyers to explore alternative entry points into the market. Bank-owned properties, or REOs, are increasingly serving as a “second-chance” option, offering buyers opportunities to purchase homes at below-market prices or in areas previously out of reach.

These properties provide a unique path to homeownership for individuals and families who may otherwise struggle with high down payments, limited inventory, or competitive bidding in traditional sales. While REO purchases can involve additional considerations—such as property condition or postsale processes the benefits often outweigh the challenges, especially in markets where traditional affordability is limited.

This article explores how REO homes are quietly reshaping homeownership opportunities in high-cost cities. We analyze metro areas where institutional inventory meets first-time buyer demand, examine the factors driving this trend, and highlight strategies for buyers and brokers seeking to leverage these opportunities effectively.

Sustained higher mortgage rates have made conventional homeownership increasingly challenging for first-time buyers. Monthly payments rise with interest rates, reducing purchasing power and limiting access to competitive neighborhoods. REO homes, often priced below market value, provide an alternative pathway for buyers constrained by traditional financing

These properties allow buyers to enter homeownership earlier than would otherwise be possible, offering a financial foothold in expensive metro areas while avoiding prolonged rent payments that can exceed mortgage costs.

The term “second-chance housing” reflects how REOs can offer buyers opportunities that were previously out of reach. Many bank-owned homes have been renovated, maintained, or priced to move quickly, providing accessible options for buyers who may have been previously sidelined by affordability or credit constraints.

Additionally, REO transactions can be faster than new construction, providing a more immediate route to ownership. For first-time buyers, this can mean starting to build equity sooner while entering neighborhoods that might otherwise be inaccessible.

Certain high-cost metro areas have seen a noticeable uptick in REO purchases among first-time buyers. Cities with strong employment centers, limited housing inventory, and historically high prices such as San Francisco, Los Angeles, Seattle, and Boston demonstrate the impact of bank-owned homes on affordability trends.

In these markets, institutional sellers strategically release REO inventory, absorbing high buyer demand and stabilizing price fluctuations. Buyers and brokers who track these releases can capitalize on limited opportunities before properties are absorbed by investors or cash buyers. www.reobroker.com

While REOs provide opportunities, buyers must account for potential property condition issues, inspections, and post-sale processes. Engaging experienced brokers, performing thorough due diligence, and understanding local market dynamics are essential.

For brokers, identifying REO inventory early, monitoring servicer releases, and guiding first-time buyers through financing and post-sale processes ensures smoother transactions and maximizes the benefits of second-chance homeownership.

Bank-owned properties are increasingly providing first-time buyers with a viable path to homeownership in high-cost cities. Rising mortgage rates and limited affordability make traditional purchases challenging, but REO homes offer a second-chance solution, allowing buyers to enter the market sooner and build equity over time.

Brokers and market participants who understand REO inventory trends, metro-specific demand, and post-sale considerations can help first-time buyers navigate these opportunities effectively. As second-chance housing continues to grow, REO properties are quietly reshaping affordability patterns and expanding access to homeownership in markets where conventional options remain limited.

REObroker.com connects first-time buyers and brokers with REO opportunities in high-cost cities, offering expert guidance on navigating secondchance homeownership. Whether you’re looking for available bank-owned homes, need support with inspections and financing, or want advice on leveraging REO inventory for fast-track ownership, REObroker.com provides nationwide expertise tailored to your needs. Visit https://www.reobroker.com to explore current listings, email info@reobroker.com for personalized insights, or call 760‑238‑0552 to speak with professionals who can help you access REO opportunities and secure homeownership in competitive markets.

References

Federal Housing Finance Agency. REO Market Reports and Affordability Insights. Retrieved February 6, 2026, from https://www.fhfa.gov/DataTools/Down loads/Pages/REO-Reports.aspx Urban Institute. Bank-Owned Properties and Homeownership Access for FirstTime Buyers. Retrieved February 6, 2026, from https://www.urban.org/research/publi cation/bank-owned-propertieshomeownership-access

www.reobroker.com

Closing on an REO property does not mean the work ends. Post-sale responsibilities often continue for brokers, investors, and servicers especially when disputes, compliance reviews, or contractual risks emerge after escrow. Compared to traditional transactions, REO deals carry more post-closing exposure because buyers may raise concerns about condition or documentation, and servicers must remain audit-ready under federal and state oversight.

After closing, buyers may report issues such as undisclosed damage, incomplete repairs, or listing inaccuracies. If not handled carefully, these claims can create financial exposure and reputational risk. The strongest protection is proactive documentation inspection records, repair histories, clear disclosures, and dated photos so disputes can be resolved with evidence rather than opinion. Brokers often act as the go-between, coordinating communication and helping move issues toward resolution without breaking compliance requirements

REO sales can be reviewed after the fact through audits that check disclosure standards, anti-fraud controls, and record handling. This makes recordkeeping essential: contracts, inspections, communications, and transaction timelines should be organized and easy to produce. Audit readiness reduces the risk of penalties and supports transparency across the transaction.

Some REO transactions include clawback provisions, allowing corrective action or recovery if obligations were not met. Clawbacks can stem from pricing errors, misrepresented condition, or compliance failures. Managing this risk starts before closing—through accurate valuation support, disciplined disclosures, and complete documentation that proves the file was handled correctly.

Brokers may remain involved well after the sale supporting postclosing disputes, coordinating follow-up inspections or repairs, and assisting with compliance responses. The takeaway is simple: REO performance includes the post-sale phase. Professionals who document thoroughly, communicate clearly, and stay compliance-aware protect their clients and reduce exposure long term.

Not every REO sells during its first listing period. When a bank-owned property fails to sell, it typically enters a structured cycle that can include relisting, reassignment to a new agent, conversion to a rental, or disposition through investor channels. For brokers and investors, understanding this “after-market” process helps identify new listing windows, acquisition opportunities, and realistic client expectations.

When the listing period ends without a sale, servicers usually reassess key drivers: pricing, property condition, and marketing approach. In many cases, the property is relisted with updated strategy—sometimes after repairs, price adjustments, or a repositioned marketing push.

Some unsold REOs are reassigned to a different broker or agent who specializes in distressed assets. Reassignment often signals a “fresh start” strategy: improved photos, stronger investor outreach, revised remarks, and tighter follow-up with buyer pipelines. Brokers who track these files and maintain servicer communication can spot when a property is likely to return to market.

If the market is slow or price reductions would be too steep, some institutions choose rental conversion to generate cash flow while waiting for better conditions. This is most common in strong rental markets where holding the asset can preserve value and offset carrying costs. For investors, these cases can create long-term buy opportunities rather than quick flips.

www.reobroker.com

When inventory is difficult to absorb, servicers may shift to bulk disposition selling multiple REOs in a single transaction to investors. This clears inventory faster and reduces administrative burden, but it typically favors cash-ready buyers and portfolio operators. Brokers working with investor clients should watch for these announcements and understand which regions are most likely to see bulk activity.

After an REO fails to sell, expect a predictable sequence: re-evaluation → possible reassignment → potential rental hold → bulk sale if absorption remains weak. Knowing these paths helps brokers advise clients accurately, plan outreach, and position themselves for relistings or investor opportunities.

www.reobroker.com

An increase in REO transactions often raises fears of a broad housing price decline, but higher REO volume does not automatically mean values will fall. In many markets, transaction activity can grow while prices remain stable or even rise moderately because supply is managed and demand absorbs inventory efficiently.

Banks, servicers, and institutions rarely dump foreclosed inventory all at once. Instead, they typically stagger REO listings weekly or monthly based on local demand. This pacing prevents sudden inventory spikes that would otherwise pressure prices downward and helps maintain market balance while maximizing recovery.

Investor absorption reduces oversupply

A large share of REOs are purchased by cash or hybrid buyers (often investors) who can move quickly and acquire multiple properties. This “absorption effect” keeps excess inventory from sitting on the open market long enough to force major discounting. Investors also tend to target specific property types and neighborhoods where demand is strongest, which further supports pricing stability.

Markets don’t respond the same way to rising REO volume. Areas with strong job growth, population inflow, and tight housing supply can absorb more distressed inventory without price declines. Weakerdemand regions may see localized slowdowns, but that doesn’t automatically translate into a national crash. Because servicers and investors watch these regional indicators closely, strategies are often tailored market-by-market.

Media narratives often treat “more REOs” as “crash incoming,” but price movement depends on supply timing, buyer absorption, and local demand strength. When those factors remain supportive, higher REO volume can represent opportunity not systemic risk.

www.reobroker.com

One of the most misunderstood challenges in the REO pipeline isn’t title, valuation, or marketing—it’s possession. After foreclosure, many properties do not immediately become vacant and ready for sale. Instead, they can sit in a gray zone where the lender controls the asset on paper, but the home is still occupied by a former owner, tenant, family member, or an unauthorized occupant. This “occupancy limbo” can delay listing timelines, increase holding costs, and materially change how servicers prioritize assets for disposition.

Post-foreclosure occupancy generally falls into several categories, each with different legal and operational implications:

Former owners may remain in the home due to financial hardship, lack of relocation options, or a belief they can still negotiate. Some continue communication with the servicer; others simply delay leaving until formal action begins.

Tenants can be legitimate renters with existing lease agreements, or they may be occupants whose lease status is unclear. In some states, tenant protections and notice requirements extend timelines significantly, especially if the occupants are paying rent or have documented agreements.

Heirs or family members can create confusion when the original borrower has passed away or moved on, and multiple parties claim rights or residency. These situations can become slow-moving because they often involve documentation, probate issues, or local legal procedures.

Unauthorized occupants may enter properties that appear abandoned. This raises immediate risk—security, liability, potential damage and can require a different strategy than dealing with an owner or tenant.

An occupied REO typically costs more and takes longer to stabilize. Even when occupants are cooperative, the lender and servicer are still responsible for risks tied to the asset:

Carrying costs continue: taxes, insurance, utilities (in some cases), HOA obligations, and property management oversight.

Property condition can deteriorate when routine maintenance is deferred, repairs are postponed, or damage occurs during prolonged occupancy.

Liability exposure increases, especially if the property is in poor condition, has safety hazards, or becomes the site of disputes. Marketability drops because buyers often avoid uncertainty around possession, condition, and timelines—forcing steeper discounts if the asset is sold “as-is, occupied.”

These costs push servicers to make strategic decisions about which properties to move first and which to delay until the path to vacancy becomes clearer.

Most institutions prefer outcomes that reduce time and conflict while remaining compliant. Common approaches include:

When appropriate, negotiated relocation assistance can be the fastest route to vacancy. It reduces legal costs, lowers the probability of property damage, and gives the occupant a structured exit timeline. These agreements also help the property move into rehab and listing status sooner.

When negotiations fail—or when the occupant is unauthorized— servicers may proceed through legal channels. Eviction rules vary by state and county, and tenant protections can extend timelines. This is where compliance discipline matters: documentation, notices, and correct procedure are essential.

Even while a property remains occupied, servicers may implement inspections, property preservation steps, and limited repairs where allowed. The goal is to prevent the asset from declining further and to reduce risk until possession is resolved.

Servicers often categorize assets into “quick-clear” versus “high-friction” properties. Homes likely to clear quickly may be pushed to market first, while complex occupancy files may be held until the legal or negotiated path is defined. This triage affects inventory timing—and it’s one reason distressed supply can feel uneven across regions.

For brokers, occupancy issues are not just a delay—they’re a timeline and expectation management problem. Clear communication with buyers and accurate notes in marketing remarks can prevent disputes later. For investors, occupancy status is a pricing input: it affects renovation timing, holding cost projections, and the realism of exit schedules.

The practical advantage goes to professionals who can quickly answer: Is it vacant, occupied, or unknown? If occupied, who is inside (owner, tenant, heir, unauthorized)? What is the likely timeline based on local rules? What costs should be budgeted while possession is resolved?

Post-foreclosure occupancy is one of the biggest reasons REO assets get stuck in limbo. It affects carrying costs, property condition, compliance risk, and the timing of inventory release. In 2026, professionals who understand occupancy categories, local processes, and resolution strategies will make better acquisition decisions, advise clients more accurately, and avoid surprises that can destroy margins.

Not every bank-owned property reaches the market at the same pace and it’s rarely random. Behind the scenes, servicers use a triage system to determine which REOs get listed quickly, which are delayed, and which are routed into alternative disposition channels. For agents, investors, and vendors, understanding this process matters because it explains why inventory “shows up” unevenly and why certain assets move faster than others.

The Core Objective: Recovery, Speed, and Risk Control

Servicers are balancing one primary goal: maximize recovery while minimizing time, cost, and exposure. Every decision whether to list now, hold, repair, or bundle—comes down to predictable execution. Properties that can be marketed and sold with fewer variables tend to rise to the top of the queue.

www.reobroker.com

Servicers evaluate how much they can realistically recover after transaction and holding costs. Assets that are more likely to sell near market value, require fewer repairs, and have cleaner timelines are typically prioritized. These are the files that reduce losses quickly and don’t consume disproportionate operational bandwidth.

Properties that need extensive rehab, have uncertain condition issues, or sit in weaker-demand pockets often move slower. The reason is simple: the longer an REO sits, the more it costs—taxes, insurance, utilities, maintenance, HOA exposure, and vendor oversight all add up.

Loss severity is a practical calculation: what is owed versus what can be recovered after costs. Servicers estimate expected sale proceeds and subtract the costs required to stabilize and sell the asset. If an REO is projected to produce a lower loss and a more predictable outcome, it tends to be released sooner.

High-uncertainty assets—where repair scope is unclear, local market demand is soft, or timeline risk is high—may be delayed until the servicer has better cost control or clearer strategy. As market conditions shift, these numbers get revisited, and priority order can change.

Even an attractive property can’t be pushed to market if it isn’t operationally ready. Servicers weigh whether inspections are complete, access is confirmed, title issues are resolved, and preservation work is handled. Assets already “market-ready” move faster; assets requiring multiple vendor cycles often move later, even if their value is strong.

This is one reason agents see sudden bursts of inventory: properties are released when readiness aligns with internal targets—not necessarily when foreclosure volume rises.

When holding costs climb or a portfolio includes multiple high-friction assets, servicers may shift from individual retail listings to bulk or investor-focused disposition. Bundling can move multiple properties in a single transaction, reduce administrative work, and shorten exposure. These channels often favor cash-ready or specialized buyers, but they can also create opportunity for investors equipped to handle complexity.

Understanding servicer triage helps professionals read the pipeline more accurately:

Early-release REOs are often in stronger demand areas or in better condition competitive opportunities where speed matters. Delayed or bundled assets may require better rehab planning, stronger financing, or more patience but can offer better pricing due to added complexity.

REO inventory is not released at random. It’s managed through triage: recovery potential, loss severity, operational readiness, and the need to control cost and risk. Professionals who track these signals—and align their strategy with what servicers value most—gain a real edge in 2026: predictable execution, clean documentation, and speed-to-sale.

www.reobroker.com

The REO market does not move on economics alone. In 2026, political priorities housing affordability, institutional ownership, and consumer protection are increasingly shaping how distressed assets are priced, marketed, and absorbed. Even before policy becomes law, the direction of government messaging and regulatory focus can change investor behavior and influence how quickly REO inventory clears.

In distressed real estate, confidence and clarity matter. When policymakers signal tighter oversight, new reporting requirements, or expanded tenant and homeowner protections, investors often respond by becoming more selective. That can mean slower acquisitions, stricter underwriting, or shifting activity to markets perceived as more stable and less regulated. The impact shows up quickly: fewer aggressive offers, longer decision cycles, and more conservative pricing assumptions

Large-scale investors continue to draw attention because of their influence on housing supply, rents, and neighborhood stability. When institutional ownership becomes a policy target, big buyers tend to adjust strategy—reducing exposure in certain cities, selling non-core assets, or focusing on properties that fit lower-risk profiles. In REO, this can reduce competition in some areas while increasing it in others, depending on where institutions choose to concentrate or exit.

A key issue is uncertainty itself. Investors and lenders price risk based on what they can predict. When rules around taxation, compliance, or property standards appear likely to change, capital becomes cautious. That caution can reduce liquidity and slow transaction velocity, especially for properties that already carry complexity—repairs, occupancy issues, or longer timelines. For servicers, slower demand may require sharper pricing strategy or alternative disposition routes to keep inventory moving.

www.reobroker.com

Public messaging also matters. Strong affordability narratives can increase political pressure on banks and investors to demonstrate transparency and fairness in REO disposition. At the same time, negative headlines can make buyers hesitant especially in markets where consumers worry about future restrictions or shifting costs. This influences how offers are structured, how long buyers stay active, and how quickly deals close.

In a policy-sensitive environment, the winning approach is flexibility. Investors should stress-test deals for shifting compliance and cost assumptions, avoid thin-margin strategies in uncertain jurisdictions, and build contingency plans into timelines. Brokers and vendors can protect performance by staying documentation-ready, communicating clearly, and understanding how local rules affect occupancy, repair expectations, and buyer eligibility.

Politics is not “background noise” in 2026—it is an operating variable. Policy direction affects where capital flows, how aggressively buyers bid, and how efficiently REO inventory clears. The professionals who track political signals alongside market data—and who can adapt strategy without overreacting will be best positioned to protect margins and capture opportunity as the landscape evolves.

www.reobroker.com

With over 30 years of experience, Nancy has built a powerhouse brokerage ranked in the RealTrends Top 1% of America’s Best Real Estate Agents, as featured in The Wall Street Journal. A trailblazer, award-winning leader, and fierce client advocate, Nancy is celebrated for her unmatched negotiating skills, dedication to community, and her bold service guarantee: “Your home sold in 60 days, or we’ll pay you $2,500.” She is more than a broker she’s a visionary, a philanthropist, and one of Charlotte’s Most Influential Women, as recognized by the Mecklenburg Times. Nancy’s story is one of excellence, resilience, and leadership in REO and beyond.

Fran Altman is an Associate Broker with Coldwell Banker Realty, proudly serving the St. Cloud, Minnesota area and surrounding communities. A true Minnesotan through and through, Fran was born and raised in central Minnesota and loves helping others find their place here. She graduated from Apollo High School in St. Cloud before earning her Bachelor of Arts in Organizational Management with a minor in Communications from Concordia College in St. Paul.

With over 19 years as a licensed Realtor® and a lifetime of experience in property valuation and REO Operations, Robyn Moody is one of Utah's most accomplished real estate professionals in the foreclosure and default services space. She began her career in 1998 working for a national Broker Price Opinion (BPO) outsourcing company, where she assigned property valuations, quality-checked reports, and developed critical relationships with agents and lenders across the U.S.

Her path into sales began when she joined a top-performing local REO agent who recognized her eye for valuation detail, commitment to accuracy, and exceptional organizational skills. After several years of managing and selling REO assets as a licensed assistant, Robyn earned the opportunity to acquire and lead the business herself—rebranding and growing it into what is now Salt Lake REO.

Stephanie D. See is the President and Co-Owner of Results Real Estate, Inc., a boutique brokerage in Largo, Florida. With over 20 years of experience and a broker’s license since 2013, she and her husband, John B. See, have closed more than 5,000 transactions across the Tampa Bay area. Stephanie is known for her integrity, attention to detail, and expertise in residential and REO markets. A dedicated industry leader, Stephanie has served on the Board of Directors for the National Association of Default Professionals (NADP) for eight years. She is committed to raising professional standards through education, mentorship, and collaboration. Under her leadership, Results Real Estate continues to deliver client-focused service in a wide range of market conditions.

With 18+ years of REO experience, 7,500+ closed assets, and a CFK Success Rate of 97%, Joe Doher puts mortgage servicers and investors at ease knowing they have someone who is reliable, proactive, and will effectively manage every step of the process to ensure the maximum net recapture. Joe Doher – Broker-Owner Berkshire Hathaway HomeServices Results Realty Orlando, Florida As someone who has lived and breathed real estate since childhood, it’s safe to say that it’s in my DNA. Growing up with a successful Canadian real estate broker like my father, I absorbed the industry’s nuances early on. In 1993, at the age of twenty-two, I officially entered the real estate business, and I’ve been fully immersed in the Orlando, Florida, real estate market ever since.

Dynamic and results-driven Real Estate Broker with extensive experience as an Area Vice President at Vylla Home, spearheading growth and delivering on the company's mission. Adept at empowering agents and transforming the real estate process. Specializing in institutional asset sales, risk mitigation, talent acquisition/retention, and marketing, with a strong background in leadership and growth-oriented roles within both for-profit and non-profit corporations.