• Why REOBroker?

• REOBroker Membership Form

• Editor’s Note

• About REOBroker

• Publisher’s Note

•REOBroker Media Benefit

• REOBroker Map

• REOBroker Services

• 50 States

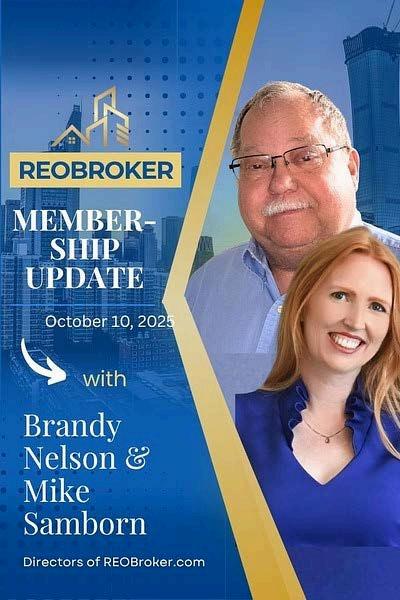

• About Brandy Nelson

• About Mike Samborn

• About REOBroker

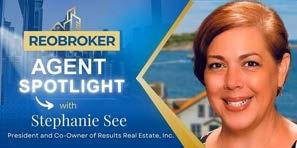

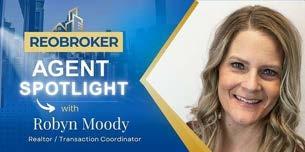

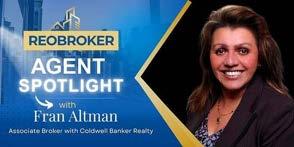

• Agent Spotlight

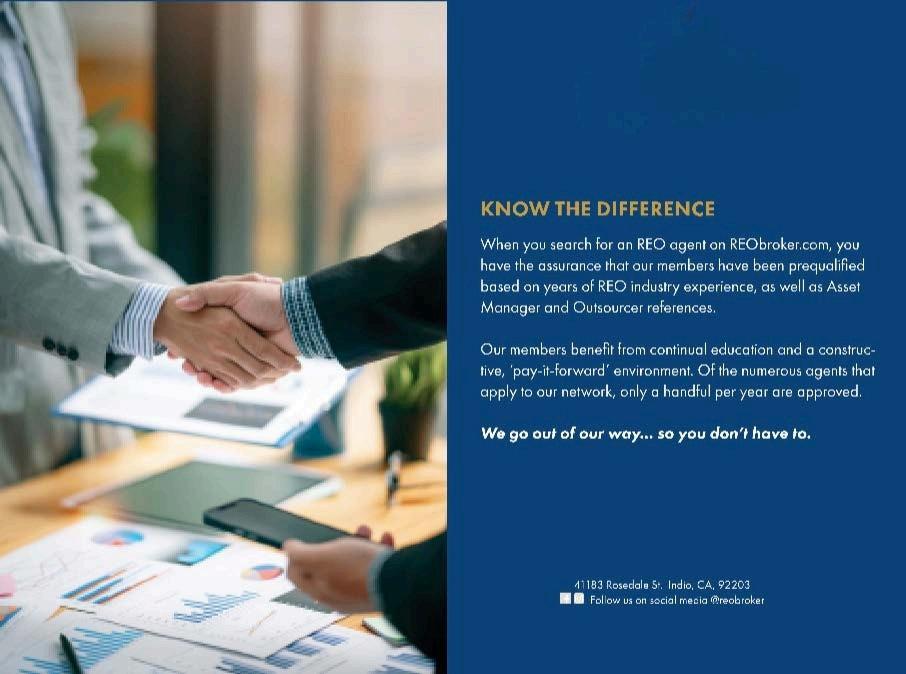

• Know the difference

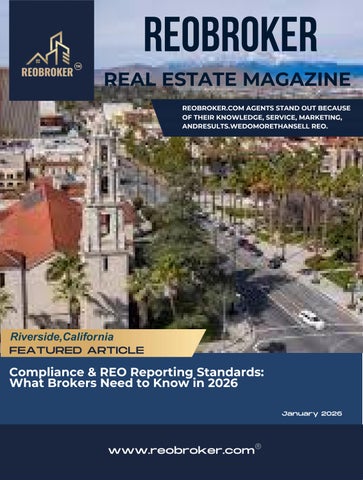

Compliance & REO Reporting Standards: What Brokers Need to Know in 2026

REO Data Tools Every Investor Should Know in 2026

Institutional REO Investing: How Larger Buyers Approach Bank-Owned Assets in 2026

REO Rehab & Resale Playbooks for 2026: Assessing Repair Costs vs. Return

REO Market Health: Interpreting Rising Foreclosure Filings Without a Housing Crisis

How REO Listings Are Influencing National Housing Inventory Trends in Early 2026

REO Flow vs. Foreclosure Starts: What Investors Need to Know About Market Lag Dynamics

Understanding Seasonality and REO Cycles: Why Distress Peaks Matter for 2026 Deals

How Rising REO Completions Signal Shifts in Distressed Supply for Investors in 2026

Why Bank-Owned REO Inventory Is Growing in 2025–26: Analysis of National Foreclosure Trends

PUBLISHER:

Brandy Nelson Executive Director

REOBroker.com

Equity Union Broker Associate 70115 Hwy 111 Rancho Mirage, CA 92270

Phone: 760-238-0552

Email: brandy@reobroker.com www.reobroker.com

Mike Samborn Executive Director

REOBroker.com

All Star Real Estate Broker/Owner

108 N. Henry Street Bay City, MI 48706

Phone: 989-922-6800

Email: Mike@mikesanborn.com

ADMINISTRATOR:

Eric Lawrence Frazier (714) 475-8629 ext 703

PRODUCTION TEAM:

•Thepowerisnowmedia.com

•Alvin Magua

•Leonna Rose Berame

•Sharon Rose Barellano

•Michael Mbugua

Welcome to the November edition of The Real EstateMagazine,published byREOBroker.com. As 2025 draws to a close, the real estate market finds itself at an inflection point—where data, discipline, and strategic vision matter more than ever. The decisions professionals make now will echo well into 2026, defining who is positioned to seize opportunity in a rapidly evolving housing and REO landscape. Signals Beneath the Surface While the broader market debates rate cuts and affordability,thoseofusintheREOandinvestmentsectorsknowthattherealstory isalwaysbeneaththesurface.

Behind the headlines, lenders are tightening loss-mitigation pipelines, servicers are recalibrating valuations, and investors are beginning to sort markets by long-term potential rather than short-term volatility. This month’s issue unpacks these underlying trends through a series of in-depth features designed to help you read the market before it moves. From regional REO surges to subtle lender behavior shifts, our contributors focus on what data and experience tell us about the next phaseofthecycle.

InsideThisIssue We begin with a national snapshot: TheREOMomentumIndex, a data-driven feature tracking year-over-year changes in foreclosure filings, bank repossessions, and asset dispositions. This piece identifies the metro areas showing early signs of inventory acceleration—often months before those trends reach mainstream analysis. Next, our article on “The Return of the Institutional Buyer” examines how hedge funds, private equity firms, and large-scale aggregators are quietly re-entering select markets. Their activity provides not just competition but also valuable signals about pricing floors and asset-class preferences.

Our coverage of servicer workflow dynamics reveals how end-of-year accounting pressures are influencing REO release patterns, with some lenders pushing properties to market before Q1, while others delay listings until after fiscal close. Understanding these internal pressures helps agents, brokers, and asset managers timetheiracquisitionsandmarketingstrategieseffectively.

On the valuation front, we investigate how appraisers and BPO providers are adapting to today’s hybrid pricing environment, where automated valuation models (AVMs) intersect with human expertise. The article breaks down how to challenge or validate valuation discrepancies that can make or break an REO deal. Beyond the Numbers This issue also steps beyond metrics to explore the human and operational side of distressed real estate. Our profile on several REO agents highlights the growing use of AI-driven CRMs, virtual walkthroughs, and automation in listing management —tools that are transforming how professionals handle highvolume pipelines with precision and transparency.

In “The New Frontier of REO Renovation,” we feature investors who are turning distressed assets into modern, sustainable homes through strategic design and adaptive reuse. These projects prove that profitability and community impact are not mutually exclusive—they are increasingly intertwined. We also confront the insurance and climate risk realities reshaping how distressed assets are underwritten and sold. As insurers retreat from high-risk zones and premiums climb, investors must adapt financing and exit models accordingly. This article offers frameworks for risk-adjusted acquisition planning in 2026.

The Year-End Mindset November is the month to take inventory—not just of properties, but of priorities. The most successful professionals in this business don’t wait for January to plan; they use Q4 to sharpen focus, strengthen relationships, and prepare for the next market turn. Our closing feature, “2026 Outlook: The Year of Strategic Repositioning,” offers forecasts on rate policy, credit markets, and distressed supply pipelines, drawing from economic data and interviews with leading analysts. The conclusion is clear: adaptability, liquidity, and knowledge will define the winners of the next phase.

A Word from REOBroker.com At REOBroker.com, we are committed to equipping our readers with the foresight and factual clarity needed to navigate the real estate market’s most complex corridors. Whether you are an agent, investor, lender, or asset manager, this publication exists to connect you with the data, ideas, and community that keep you ahead of the curve.

Thank you for being part of our readership and for making this growing community a place where expertise is shared and opportunity is created. May this November issue sharpen your insight and strengthen your strategy as you prepare to close the year with purpose—and step into 2026 ready to lead. Warmregards,TheEditorialTeam REOBroker.com Clarity. Insight. Opportunity

Asset Managers rely on REObroker.com to consistently find the nation's top REO specialists. We pre-screen our members for years of experience, training & certification, and asset manager references, holding each application to the highest standards. The Benefits of Membership In addition to the clear benefits of our referral network, REObroker.com members receive training, networking & advertising opportunities, and a wealth of pay-it-forward knowledge from our daily Member Discussion Forum.

REObroker.com is an esteemed designation and valuable association. Many of our members have stayed with us consistently through several REO cycles, realizing the long-term benefits.

Minimumof2(BD) BrokerDevelopmentSeminarsayear

REOBroker.com Member Benefits

Minimum of 2 (BD) Broker Development Seminars a year

Access to a Minimum of 2 Zoom mastermind/training calls a month

Access to asset management company Roster

Access to Private Lender Roster

The internal chat line provides access to a wealth of knowledge and support through our diverse membership.

REOBroker.com does sponsorships with NADP, 5 Star, and other related Events.

National Exposure to asset managers and companies

Included on the REOBroker.com website with contact information and areas served

Included in REOBroker.com online HUD and Real Estate Magazines and National Campaigns

Opportunities to submit market updates and real estate articles in the magazines.

Membership benefit pricing for additional advertising in the following:

REOBroker.com HUD Magazines | REO Broker Real Estate Magazine | REOBroker TV | and Podcast.

Bob Zachmeier

Clay Strawn

Jeff Miller

Julie Bruckner

602-810-1561

480-250-0131

909-226-8038

602-810-1561

John Mason

Bob Siegmeth

Brandy Nelson

Darrell Isaacs

David Roth

Deanna Lantieri

Dennis Mulvihill

Don Kelber

Elysia Moon

Gina Bocage

James Outland

Joe Mayol

John Costigan

Justin Potier

Mike Potier

501-985-0755

818-425-0330

760-238-0552

209-649-8593

707-446-1211

760-924-5091

408-489-2904

805-338-9682

949-212-6474

510-552-6480

805-748-2262

661-618-1442

619-990-3044

562-480-9884

562-708-0870

Chandler Mesa Tempe

Phoenix

Lake Havasu

Pulaski Lonoke & Surrounding

Porter Ranch

Palm Desert/Palm Springs

Stockton/San Joaquin County

Vacaville

Mammoth Lakes

Los Gatos

Westlake Village

South Orange County

Fremont / East Bay

Pismo Beach

Lancastor

San Diego / El Cajon

Los Angeles County

Long Bch South Bay

Nat

Pete

Timm

Tom

Warren

As the REO market continues to expand in 2026, brokers face increasing responsibility to maintain compliance and adhere to reporting standards. Lendercontrolled properties come with unique regulatory requirements, and brokers handling these transactions must be vigilant in tracking ownership, legal status, and disclosure obligations. Staying informed ensures not only adherence to federal and state regulations but also protects the broker, clients, and investors frompotentiallegalorfinancialrisks.

Foreclosure activity rose steadily in 2025, contributing to a growing inventory of bank-owned properties nationwide. With more properties entering the market, accurate reporting and documentation have become critical for managing transactions efficiently and transparently. Brokers who understand compliance and reporting standards can better serve their clients while reducing exposure to errorsorregulatoryscrutiny.

ThisguidehighlightskeyREOcomplianceconsiderations,reportingpractices,and bestpracticesforbrokersnavigatingtheincreasinglycomplexREOmarket.

REO transactions involve distinct compliance requirements compared to traditional real estate sales. Brokers must ensure all property records are accurate, including title information, foreclosure history, and any liens or encumbrances. Federal and state regulations require that disclosure obligations be met for each REO property, including notifying prospective buyers of material defects,structuralissues,orlegallimitations.

Attention to detail is crucial. Mistakes in reporting or failing to comply with disclosure rules can lead to legal disputes, financial penalties, or reputational damage. Using standardized reporting procedures and checklists helps brokers maintainconsistencyacrosstransactions.

Effective reporting involves accurate and up-to-date tracking of key property information.Brokersshouldmonitor:

Foreclosure history and completion dates: Understanding when a property transitionedtolenderownershipensuresproperlistingtimelines.

Titlestatusandliens:Clearownershiprecordspreventdisputesduringsale.

Property condition documentation: Detailed reports on physical and legal aspectsofthepropertyhelpbuyersmakeinformeddecisions.

Market analytics: Data on pricing trends, regional foreclosure activity, and REO supplysupportaccuratevaluationandlistingstrategies.

Leveraging robust data tools ensures brokers can access reliable, comprehensive information. Platforms that consolidate property, ownership, and market data help reduceerrorsandmaintaincompliancewhileimprovingefficiency.

Brokers working with REO properties should adopt several best practices to maintaincomplianceandenhancereportingaccuracy:

1.Standardizedocumentation: Use consistent templates and checklists for every REOlisting.

2.Regularly update property data: Track changes in ownership, liens, and propertyconditiontopreventdiscrepancies.

3.Leverage centralized reporting tools: Integrated platforms allow brokers to consolidatepropertyhistory,legalrecords,andmarkettrendsinonesystem.

4.Stay informed on regulatory changes: Laws and reporting standards can vary bystate,socontinuouseducationandprofessionaldevelopmentareessential.

5.Communicate clearly with clients: Transparent reporting builds trust and reducestheriskofdisputesduringtransactions.

Adhering to these practices ensures brokers manage REO transactions efficiently while mitigating risk in an increasingly active market.

With foreclosure activity increasing nationwide, the volume of REO listings will continue to grow. Brokers who implement strong compliance and reporting practices position themselves as reliable partners for investors, buyers, and lenders. Proper reporting also facilitates faster transaction processing, smoother closings, and a stronger reputation in the marketplace.

As the REO market evolves in 2026, brokers who prioritize compliance and data accuracy will be better equipped to navigate complex transactions, support investor decision-making, and capitalize on opportunities within bank-owned inventory.

Maintaining compliance and adhering to REO reporting standards is essential for brokers in 2026. Accurate property records, detailed documentation, and awareness of federal and state regulations safeguard transactions and reduce legal risk. Brokers who adopt standardized reporting procedures and leverage data tools will be able to manage REO properties efficiently, support clients effectively, and navigate the growing lender-owned market with confidence.

REObroker.com offers brokers comprehensive tools and resources to ensure compliance and streamline REO reporting. By providing access to up-to-date property data, foreclosure information, and standardized reporting systems, REObroker.com helps brokers manage lender-controlled listings efficiently and confidently. Visit https://www.reobroker.com to access REO tools and listings, email info@reobroker.com for guidance, or call 760-238-0552 to learn how to stay compliant while navigating the REO market in 2026.

ATTOM Data Solutions. U.S. Foreclosure Activity Increases in 2025. Retrieved January 20, 2026, from

https://www.attomdata.com/news/markettrends/foreclosures/2025-year-end-foreclosuremarket-report/ PropertyShark. Top 10 Best Foreclosure Websites. Retrieved January 20, 2026, from https://www.propertyshark.com/Real-EstateReports/top-10-foreclosure-websites/

Access to reliable data is essential for successful REO investing in 2026. With bank-owned properties increasing nationwide, investors need the right tools to identify opportunities, analyze markets, and make informed decisions. Accurate and timely information allows for strategic acquisitions, precise budgeting, and efficient timing, all critical to maximizing returns.

Rising foreclosure activity has expanded lender-controlled inventory, making it increasingly important to have comprehensive insights into property status, local trends, and potential resale value. Understanding how to leverage available data tools ensures investors can act quickly, reduce risk, and make investment decisions with confidence.

Effective data tools provide more than property listings. Key capabilities include:

Property ownership and lien history: Ensures legal clarity and reduces risk of unexpected complications.

Listing status and availability: Timely updates on REO properties help investors act quickly.

Property condition insights: Helps estimate renovation costs and potential returns.

Market analytics: Trends in local pricing, sales volume, and foreclosure activity support smarter investment decisions.

Mapping and regional analysis: Visualizes clusters of distressed properties and identifies high-potential areas for investment.

These features empower investors to filter opportunities by risk, cost, and potential profit while monitoring markets strategically.

Combining multiple data points allows investors to evaluate both the property and its broader market context. For example, analyzing foreclosure concentrations in specific neighborhoods alongside historical property trends can identify areas with the highest potential for profitable acquisitions. Accurate data also supports budgeting for repairs and estimating resale value, minimizing the risk of overpaying or undercapitalizing on investments.

Timely information is critical. Frequent updates on REO listings, market changes, and local inventory fluctuations ensure investors can respond quickly to opportunities and maintain a competitive edge.

REOBroker.com provides access to robust nationwide REO data and analytics designed specifically for investors. The platform offers:

Real-time listings of bank-owned properties.

Detailed property history and ownership information. Market insights and analytics to evaluate investment potential. Tools to streamline property evaluation and acquisition planning.

By using these resources, investors can efficiently identify properties, assess potential returns, and make well-informed decisions, all within a single, reliable platform. REOBroker.com ensures that investors have the data they need to act confidently and strategically in 2026.

Mastering REO data tools is crucial for maximizing investment opportunities in 2026. Access to accurate property information, market analytics, and comprehensive REO listings enables investors to evaluate risks, plan budgets, and identify high-potential acquisitions efficiently. Using REOBroker.com’s data tools ensures investors have the resources to make strategic decisions, stay competitive, and optimize returns in a market with growing bank-owned inventory.

Investors seeking expert support and access to nationwide REO listings can rely on REOBroker.com. The team atREOBroker.com provides comprehensive data tools, property insights, and guidance to help you evaluate opportunities and make informed investment decisions. Visit https://www.reobroker.com to explore available properties, email info@reobroker.com for personalized assistance, or call 760-238-0552 to learn how REOBroker.com can enhance your REO investment strategy in 2026.

PropertyShroker. Top 10 Best Foreclosure Websites. Retrieved January 20, 2026, from https://www.propertyshark.com/Real-Estate-Reports/top-10foreclosure-websites/

BiggerPockets. Bank-Owned Properties Are Up 41% From Last Year. Retrieved January 20, 2026, from https://www.biggerpockets.com/blog/bank-owned-properties-are-up-41percent-year-over-year-august-2025

REOBroker.com research team https://reobroker.com

Exploreourin-depthconversationswithleading realestateprofessionals,insightfulmarket analyses,andvaluabletipsfornavigatingthe realestatelandscape.Tuneintostayupdated onthelatesttrendsandsuccessstoriesinthe realestateworld.

The growing presence of lender-controlled properties is reshaping the investment landscape in 2026. Institutional buyers — including private equity firms, real estate investment trusts, and large-scale developers — are increasingly active in acquiring bank-owned assets. Unlike individual investors, these larger players approach REO opportunities with a combination of scale, data-driven strategy, and long-term planning, which allows them to capitalize on market trends more efficiently.

Foreclosure activity has risen steadily over the past year, creating a noticeable increase in available REO inventory. Recent reports show that bank-owned properties grew by more than 40 percent year-over-year, while certain metropolitan areas continue to report the highest foreclosure rates nationwide. For institutional investors, this combination of expanding inventory and regional concentration presents opportunities to deploy significant capital strategically, acquire properties in bulk, and influence local housing markets.

Understanding how institutional buyers operate, what factors they prioritize, and how they mitigate risk provides insight into broader REO market dynamics and the growing role of larger players in shaping 2026 housing inventory.

Institutional investors approach bank-owned assets with a focus on volume and efficiency. They often negotiate bulk acquisitions directly with banks or servicers, purchasing large portfolios of properties in a single transaction. This approach reduces transaction costs, accelerates acquisition timelines, and allows institutions to manage multiple assets under centralized management systems.

Data analysis is central to these strategies. Investors use foreclosure reports, local housing trends, and property condition data to identify markets with high potential returns. Areas with consistently elevated foreclosure activity, such as certain metro regions identified in recent national reports, are often targeted for acquisition due to predictable REO supply and favorable pricing relative to market value.

Acquiring REO properties at scale carries inherent risks. Institutional buyers prioritize due diligence, evaluating property conditions, title issues, and legal timelines before purchase. This diligence allows investors to avoid unforeseen repair costs, liens, or other complications that can erode returns.

In addition, institutions often deploy standardized processes for renovation and resale. Properties are typically assessed, rehabilitated, and marketed systematically to align with local demand, creating a repeatable model that maximizes return on investment. This level of operational efficiency distinguishes larger buyers from smaller investors who may rely on ad hoc strategies.

The concentration of foreclosures in certain areas directly informs institutional investment decisions. Markets with the highest foreclosure rates not only provide greater access to bank-owned assets but also allow large investors to influence local housing inventory. By acquiring multiple properties in the same region, institutions can stabilize pricing, accelerate sales cycles, and manage market absorption more effectively.

This strategic targeting also reflects broader macroeconomic conditions, including employment trends, affordability, and housing demand. Investors who align acquisitions with favorable economic indicators increase the likelihood of profitable outcomes while minimizing exposure to markets with slower absorption or declining demand.

Institutional participation in the REO sector has important implications for smaller investors and homebuyers. Larger buyers can create competition for high-quality bank-owned properties, driving pricing pressures in regions with concentrated inventory. At the same time, their operational efficiency can improve market liquidity, as properties are rehabilitated and reintroduced to the market more quickly than individual efforts might allow.

For local housing markets, this activity may also help balance supply and demand, particularly in areas where foreclosure-driven inventory has grown substantially. As a result, institutional involvement can indirectly benefit buyers by creating more consistently available properties while maintaining orderly resale processes.

The presence of institutional investors in the REO market is reshaping how bank-owned assets are acquired and managed in 2026. By leveraging scale, data-driven analysis, and streamlined operations, larger buyers can capitalize on growing foreclosure-driven inventory while mitigating risk and influencing local housing trends. Markets with high foreclosure activity are particularly attractive due to predictable supply and favorable acquisition conditions. Understanding these approaches highlights the evolving dynamics of REO investing and the significant role that institutional players now occupy in shaping regional housing markets.

REObroker.com provides tools and expertise for buyers seeking access to lendercontrolled properties, whether for individual investment or in partnership with larger-scale strategies. The team at REObroker.com helps investors evaluate opportunities, understand market trends, and access available REO listings nationwide. Visit https://www.reobroker.com to explore properties, emailinfo@reobroker.comfor guidance, or call 760-238-0552 to learn how institutional approaches to REO investing can inform your strategy in 2026.

References

BiggerPockets. Bank-Owned Properties Are Up 41% From Last Year. Retrieved January 20, 2026, from https://www.biggerpockets.com/blog/bank-owned-properties-are-up-41percent-year-over-year-august-2025

Realtor.com Trends. Foreclosures Continue to Rise Across the U.S. Retrieved January 20, 2026, from https://www.realtor.com/news/trends/10-metros-with-the-highest-foreclosurerates-in-the-country/

Investors looking to maximize returns in 2026 are increasingly turning their attention to lender-controlled properties. REO properties can offer significant potential for profit through strategic rehabilitation and resale, but success requires careful planning, precise budgeting, and a clear understanding of potential returns. Unlike standard home purchases, REO investments often involve additional risks, including deferred maintenance, unclear property history, or legal complications that can affect timelines and costs.

For investors who prepare appropriately, these challenges can translate into opportunity. Properly assessing repair needs and balancing expenses against expected resale value is critical to ensuring that the investment is financially viable. The stakes are high: underestimating rehab costs or overestimating resale potential can quickly erode margins. Conversely, applying proven strategies for evaluation, renovation, and resale allows investors to capture value efficiently.

Here, we outline key strategies for approaching REO rehab projects in 2026, emphasize best practices for estimating repair costs, and explore how to align renovation expenditures with expected market returns to optimize profits.

The first step in any successful REO investment is a comprehensive property assessment. Many foreclosed homes have experienced deferred maintenance, ranging from minor cosmetic issues to more serious structural concerns. Investors should consider obtaining professional inspections that examine roofing, plumbing, electrical systems, HVAC, and foundation integrity.

Historical data and case studies show that unanticipated repair costs are a common pitfall for first-time REO buyers. According to Investopedia, buyers often underestimate the scope of work required, which can reduce profitability if not carefully accounted for. Knowing the extent of repairs in advance allows investors to make informed offers that reflect realistic potentialreturns.

Oncethepropertyconditionisevaluated,thenextcriticalstepisdeveloping adetailedrepairbudget.Thisinvolvesnotonlyestimatingmaterialsandlabor costs but also accounting for contingencies, permits, and inspection fees. QuickenLoansemphasizesthatsuccessfulREObuyersplanforunexpected issuesbyincludinga10–15percentbufferintheirrenovationbudget.

Balancing repair costs against expected resale value is key. The goal is to maximize the return on investment without overcapitalizing. Market research on comparable sales, neighborhood trends, and buyer preferences informs these calculations. For instance, investing heavily in luxury finishes in a middle-market area may not increase resale value proportionally, whereas functional upgrades like kitchen and bathroom remodels often yield higher returnsrelativetocost.

Not all repairs carry equal weight in terms of resale potential. Investors in 2026 should prioritize improvements that enhance market appeal and addresscriticalfunctionalneedsfirst.Examplesinclude:

Updating kitchens and bathrooms, which historically drive higher resale premiums.

Repairing structural or mechanical issues that could delay the sale or requiredisclosure.

Enhancingcurbappealthroughlandscaping,painting,andexteriorrepairs toattractbuyersquickly.

Minor cosmetic updates, such as fresh paint or flooring replacement, can improvemarketabilitywithrelativelylowinvestment.Aligningrepairpriorities with buyer expectations ensures that every dollar spent contributes to potentialprofit.

The pace at which the property is rehabbed and returned to market also affects overall return. Extended renovations can tie up capital, increase carrying costs, and expose the property to market fluctuations. Efficient project management and coordination with contractors are therefore essential.

Investors should also consider regional market conditions. Areas with higher foreclosure rates may present more opportunities but also higher competition, affecting resale timelines and pricing. Conversely, markets with stable demand and low inventory may allow for faster sales and higher margins even with modest renovations.

REO rehab and resale strategies in 2026 require a disciplined approach that balances repair costs against projected returns. Thorough property evaluation, realistic budgeting, targeted renovations, and strategic market timing all contribute to maximizing profitability. By understanding common pitfalls and applying methodical playbooks, investors can turn lendercontrolled properties into rewarding investment opportunities while managing risk effectively.

If you are looking to capitalize on REO properties while managing repair costs and maximizing resale returns, REObroker.com offers expert guidance and access to nationwide lender-controlled listings. The team at REObroker.com can help you evaluate potential acquisitions, plan renovations, and execute profitable investment strategies. Visit https://www.reobroker.com to view available properties, email info@reobroker.com for personalized advice, or call 760-238-0552 to explore REO rehab opportunities for 2026.

References

Investopedia. Buying a Foreclosed House: Top 5 Pitfalls. Retrieved January 20, 2026, from https://www.investopedia.com/articles/mortgages-realestate/08/foreclosures.asp

Quicken Loans. How to Buy Foreclosed Homes. Retrieved January 20, 2026, from https://www.quickenloans.com/learn/how-to-buy-foreclosed-home

As 2026 begins, rising foreclosure filings are attracting attention from investors, homeowners, and market observers alike. Headlines highlighting increases in distressed properties can create concern, but a closer look reveals that higher foreclosure activity does not automatically signal a housing crisis. Instead, these trends reflect the natural ebb and flow of a market responding to economic pressures, policychanges,andregionalvariationsinaffordability.

In 2025, foreclosure filings rose notably in several states, with Florida leading in the total number of filings. At the same time, nationwide data shows a steady increase in completed foreclosures, contributing to lender-controlled inventory. However, these numbers remain well below historical peaks seen during the last major housing downturn, indicatingthatthemarketisadjustingratherthancollapsing.

This article examines the current REO market health, explores why rising foreclosure filings do not equate to a crisis, and discusses what investors and buyers should understand about lender-controlled inventorytrendsasthemarketmovesthrough2026.

Recent data reveal that foreclosure activity has increased steadily throughout 2025. Nationwide, thousands of properties entered the foreclosure process, a year-over-year rise of approximately 14 percent. Certain states experienced more pronounced growth, with Florida reporting the highest number of foreclosures during the year. This increase drew attention from both media outlets and market participants.

Whiletheupwardtrendmayseemconcerningatfirstglance,contextiskey. Foreclosurelevelsremainsignificantlybelowthepeaksseeninthe2008-2010 period,andmosthomeownersfacingchallengesstillhaveaccesstoalternatives, includingrefinancing,loanmodifications,orshortsales.Inmanycases,risingfilings areareflectionofincreasedmonitoringandreportingratherthanasurgeinmarket distresssevereenoughtothreatenoverallstability.

Foreclosureactivityisnotuniformacrossthecountry.Economicconditions, employmenttrends,andhousingaffordabilityallinfluencethelikelihoodofproperties enteringdistress.Forexample,Florida’shighforeclosurenumberscorrelatewith rapidhomepricegrowthoverrecentyearsandahighervolumeofmortgageresets thatcoincidedwithrisinginterestrates.Otherstateswithmoderategrowthinfilings experiencedfarfewerforeclosures,demonstratingthatthemarket’sstressisuneven andconcentratedinspecificareas.

Understandingtheseregionaldifferencesiscrucialforinvestors.Marketswithhigher foreclosureactivityoftenpresentopportunitiesforstrategicacquisitions,whileareas withloweractivityindicatestabilityinhousingsupplyandpricing.Thelocalizednature offoreclosuretrendsunderscoresthatnationalincreasesdonotautomatically translateintowidespreadmarketinstability.

Anotherimportantconsiderationishowtheserisingforeclosurefilingstranslateinto lender-controlledinventory.Whilecompletedforeclosuresincreasedin2025,they didsograduallyandrepresentonlyasmallfractionofthetotalhousingstock.The slowbutsteadygrowthofREOlistingsprovidesadditionalsupplyforbuyersand investorswithoutoverwhelmingthemarket.

In practical terms, this means that while investors may find more opportunities to acquire bank-owned properties, the broader housing market is absorbing these additions without extreme price volatility or supply shortages. The gradual addition of inventory can even help ease tight markets, creating more balance between supply and demand.

For buyers, understanding that rising foreclosure filings do not equate to a housing crisis is essential. Increased inventory from REO properties can provide more choices and negotiating leverage, particularly in high-demand regions.

Investors can benefit from tracking both filings and completions. Foreclosure filings provide a forward-looking indicator of potential supply, while completed REO properties represent immediate acquisition opportunities. Aligning investment strategies with this data allows for better timing, improved due diligence, and more informed decision-making throughout 2026.

Rising foreclosure filings in 2025 highlight market stress in specific regions but do not signal a nationwide housing crisis. The gradual increase in lender-controlled inventory and the uneven distribution of foreclosures across states suggest that the market remains resilient. Investors and buyers who understand the nuances of foreclosure data and REO trends can leverage these opportunities strategically, while maintaining confidence in the overall health of the housing market.

If you are looking to navigate the growing pool of lender-controlled properties while understanding market trends, REObroker.com provides the insight and resources you need. The experts at REObroker.com help buyers and investors access REO opportunities nationwide, offering guidance to make informed decisions in a changing market. Visit https://www.reobroker.com to explore available listings, email info@reobroker.com for personalized assistance, or call 760-238-0552 to learn how rising foreclosure filings can create strategic opportunities without signaling a housing crisis.

References

New York Post. Florida had the most foreclosures in the US in 2025. Retrieved January 20, 2026, from https://nypost.com/2026/01/15/real-estate/florida-had-themost-foreclosures-in-the-us-in-2025-reports-claim/

ATTOM Data Solutions. U.S. Foreclosure Activity Increases in 2025. Retrieved January 20, 2026, from https://www.attomdata.com/news/markettrends/foreclosures/2025-year-end-foreclosure-market-report/

As the housing market moves into early 2026, one of the most notable shifts is the growing influence of lender-owned (REO) listings on overall housing inventory. Inventory levels have been a persistent topic of concern for buyers, sellers, and investors in recent years, and even modest increases can have far-reaching effects on market dynamics. While there are many factors influencing supply — including builders’ production, homeowners’ decisions to list, and seasonal trends — the expansion of REO listings is beginning to play a more visible role in shapinghousingavailability.

Foreclosure activity, which had been historically low during much of the pandemic era, increased in 2025, according to recent data from leading real estate analytics providers. This uptick has translated into more properties completing the foreclosure process and moving into bank ownership. As a result, REO inventory is gradually adding to the overall numberofhomesavailableonthemarket.

Understanding how REO listings interact with broader housing inventory trends can help buyers and investors assess opportunity and anticipate where supply pressures may ease or intensify in key areas. This article explores the data behind rising foreclosure activity and looks at how these lender-controlled properties are influencing housing inventory as 2026unfolds.

Foreclosure activity increased in 2025, with more properties entering some stage of the process compared to the prior year. According to a year-end report from a leading property data provider, total foreclosure filings — including default notices, scheduled auctions, and lender repossessions — rose by roughly 14 percent over the course of 2025. This represented more than 367,000 properties experiencing foreclosure activity during the year. While these levels remain well below the peaks seen in historical housing downturns, they do indicate a shift from the unusually low levels of recent years back toward normalizedmarketconditions.

The presence of REO inventory can also have subtle effects on pricing and negotiation dynamics. In markets where REO properties are more prevalent, buyers may have more options and negotiating power, especially if these listings remain on the market longer than traditional homes. This can contribute to a more balanced supply-demand environment,whichmayeasepricepressureincertainareas.

For buyers and investors, the growing influence of REO listings offers both opportunities and considerations. On one hand, an increased numberoflender-ownedhomesaddstotheoverallsupplyofproperties that can be purchased, which may improve access in competitive markets. Investors who specialize in REO sales will likely find more inventory to evaluate as foreclosure activity from the prior year continuestobecompleted.

On the other hand, buyers should be aware that REO listings often require thorough due diligence, and competition for high-quality distressed properties can remain strong. For traditional buyers, the addition of REO inventory can provide alternatives to standard listings, potentiallyalleviatingsomepressurefromtightmarkets.

Overall, the combined effect of rising foreclosure activity and broader inventory growth suggests a housing market in transition. As we move further into 2026, monitoring how REO listings continue to influence supply will be essential for making informed buying and investing decisions.

The increase in foreclosure activity observed in 2025 is gradually influencing housing inventory trends in early 2026 through the addition of lender-owned listings. While overall foreclosure levels remain below historical norms, the year-over-year rise in completed foreclosures feeds into inventory and contributes to a more accessible supply of homes.Regionalvariationsinforeclosureratesmeanthatsomemarkets will feel the impact more than others, shaping local availability and competition.

For buyers and investors alike, understanding the role of REO listings in thebroaderinventorypictureprovidesvaluableinsightintowheresupply is growing and where opportunities might emerge. As the market continues to balance supply and demand in 2026, the influence of REO propertieswillremainanimportantpieceofthehousinglandscape.

The presence of REO inventory can also have subtle effects on pricing and negotiation dynamics. In markets where REO properties are more prevalent, buyers may have more options and negotiating power, especially if these listings remain on the market longer than traditional homes. This can contribute to a more balanced supply-demand environment,whichmayeasepricepressureincertainareas.

For buyers and investors, the growing influence of REO listings offers both opportunities and considerations. On one hand, an increased numberoflender-ownedhomesaddstotheoverallsupplyofproperties that can be purchased, which may improve access in competitive markets. Investors who specialize in REO sales will likely find more inventory to evaluate as foreclosure activity from the prior year continuestobecompleted.

On the other hand, buyers should be aware that REO listings often require thorough due diligence, and competition for high-quality distressed properties can remain strong. For traditional buyers, the addition of REO inventory can provide alternatives to standard listings, potentiallyalleviatingsomepressurefromtightmarkets.

Overall, the combined effect of rising foreclosure activity and broader inventory growth suggests a housing market in transition. As we move further into 2026, monitoring how REO listings continue to influence supply will be essential for making informed buying and investing decisions.

The increase in foreclosure activity observed in 2025 is gradually influencing housing inventory trends in early 2026 through the addition of lender-owned listings. While overall foreclosure levels remain below historical norms, the year-over-year rise in completed foreclosures feeds into inventory and contributes to a more accessible supply of homes.Regionalvariationsinforeclosureratesmeanthatsomemarkets will feel the impact more than others, shaping local availability and competition.

For buyers and investors alike, understanding the role of REO listings in thebroaderinventorypictureprovidesvaluableinsightintowheresupply is growing and where opportunities might emerge. As the market continues to balance supply and demand in 2026, the influence of REO propertieswillremainanimportantpieceofthehousinglandscape.

If you are tracking how housing inventory trends are evolving and want expert support in identifying opportunities within lender-owned listings or broader market supply, REObroker.com can guide you. The professionals at REObroker.com specialize in connecting buyers and investors with timely inventory insights and tailored property opportunities. Visit https://www.reobroker.com to explore available listings, email info@reobroker.com for personalized assistance, or call 760-238-0552 to learn how REO listings are shaping today’s housing market.

References

ATTOM Data Solutions. U.S. Foreclosure Activity Increases in 2025. Retrieved January 20, 2026, from https://www.attomdata.com/news/market-trends/foreclosures/2025year-end-foreclosure-market-report/

Realtor.com Trends. Foreclosures Continue to Rise Across the U.S. Retrieved January 20, 2026, from https://www.realtor.com/news/trends/10-metros-with-the-highestforeclosure-rates-in-the-country/

In real estate investing, timing often matters as much as pricing. One of the most common mistakes investors make is assuming that rising foreclosure starts immediately translate into available inventory. In reality, the relationship between foreclosure activity and lender-controlled property flow is shaped by time, process, and policy. Understanding this lag is critical for investors planning acquisitions in 2026.

Recent foreclosure data shows steady increases in filings and starts across multiple quarters, signaling growing financial stress among certain homeowners. However, the inventory investors ultimately pursue does not appear overnight. Properties must move through legal, administrative, and market-driven stages before they reach lender ownership and eventual resale channels. This delay creates a gap between what headlines report and what investors can actually buy.

This article explains the difference between foreclosure starts and REO flow, examines recent national data illustrating this lag, and outlines why investors who understand these dynamics are better positioned to anticipate opportunity rather than react to it.

Foreclosure starts represent the point at which lenders initiate the legal process after prolonged delinquency. Data from early 2025 shows that foreclosure starts increased quarter over quarter, continuing a trend that began the prior year. In the first quarter of 2025 alone, tens of thousands of properties entered foreclosure, reflecting rising borrower stress tied to affordability challenges and higher borrowing costs.

These early-stage indicators are important because they reveal pressure building beneath the surface of the housing market. However, they do not mean those properties will quickly become available to investors. Many cases remain unresolved for months, and some never reachcompletionduetorepaymentplans,loanmodifications,orpropertysales.

As a result, foreclosure starts are best viewed as a forward-looking signal rather than an immediatesourceofinventory.

The transition from foreclosure to lender possession takes time. National data shows that foreclosure timelines often extend several months, and in some jurisdictions, well over a year. Properties must pass through legal review, auction scheduling, and resolution phases beforeownershiptransferstothelender.

Year-end data from 2025 illustrates this lag clearly. While foreclosure filings rose by roughly 14 percent compared to the previous year, completed foreclosures increased at a much faster pace, closer to 27 percent. This divergence indicates that many of the completions recorded in 2025 originated from foreclosure starts that occurred much earlier.

For investors, this means current REO inventory reflects past conditions, not present ones. Rising foreclosure starts today suggest potential supply growth later, often two to four quartersdowntheline.

Because foreclosure starts receive early attention, investors often expect immediate increases in inventory that do not materialize right away. This misalignment can lead to frustration or missed planning opportunities. Those who understand the lag recognize that patienceandpreparationarepartofthestrategy.

Market lag also explains why REO inventory can rise even when foreclosure starts appear to stabilize. Properties already in the pipeline continue advancing toward completion, creating inventory growth that may surprise unprepared buyers.

Investors who track both metrics together gain a clearer picture. Foreclosure starts indicate future supply pressure, while completed foreclosures reveal inventory that is closer to entering the market.

As 2026 approaches, investors who align their strategy with market lag dynamics will be better positioned to act. Rising foreclosure activity in 2025 suggests that additional lendercontrolled inventory may surface throughout 2026, even if filing rates moderate.

Preparation matters. Investors can use lag data to time capital deployment, refine acquisition criteria, and focus on markets where foreclosure starts have remained elevated. Understanding when supply is likely to arrive helps reduce competition risk and improves negotiation leverage.

Rather than reacting to inventory once it becomes visible, informed investors anticipate it.

The gap between foreclosure starts and REO flow is one of the most important timing dynamics in real estate investing. Foreclosure starts signal stress, but completed foreclosures determine supply. National data from 2025 confirms that this process unfolds over time, creating a predictable lag that shapes inventory availability.

Forinvestorsplanningfor2026,recognizingthisdelayallowsforsmarterpreparationand more disciplined decision-making. Those who track foreclosure activity with patience and context will be better equipped to identify opportunities as they emerge rather than chasingthemafterthefact.

If you want to stay ahead of market timing and understand how foreclosure trends translate into real acquisition opportunities, REObroker.com offers the expertise and access you need. REObroker.com works with investors nationwide to navigate lendercontrolled inventory using data-driven insight and strategic timing. Visit https://www.reobroker.com to explore current opportunities, contact the team at info@reobroker.com for personalized guidance, or call 760-238-0552 to learn how understandingmarketlagcanstrengthenyourinvestmentapproachintheyearahead.

References

ATTOM Data Solutions. U.S. Foreclosure Activity Increases in 2025. Retrieved January 19, 2026, from https://www.attomdata.com/news/market-trends/foreclosures/2025-yearend-foreclosure-market-report/

ATTOM Data Solutions. U.S. Foreclosure Activity Increases Quarterly in Q1 2025. Retrieved January 19, 2026, from https://www.attomdata.com/news/markettrends/foreclosures/q1-and-march-2025-foreclosure-market-report/

Seasonality has always influenced real estate activity, but its role in foreclosure patterns and lender-controlled inventory is gaining renewed attention as the market moves into 2026. Distress does not occur evenly throughout the year. Instead, it rises and falls in predictable cycles shaped by economic behavior, household finances, and legal timelines. Recognizing these patterns can help investors anticipate when supply will increase and whencompetitionmayintensify.

Recent foreclosure data shows that activity continues to trend upward, with noticeable peaks emerging during specific quarters. These shifts are not random. They reflect how missed payments accumulate, how lenders process cases, and how market momentum evolves across seasons. When foreclosure activity climbs during key periods, it often leads toadelayedsurgeinlender-heldinventorymonthslater.

This article explores how seasonality influences foreclosure cycles, explains why distress peaks translate into future REO supply, and highlights how investors can use these patterns toidentifysmarteracquisitionwindowsin2026.

Foreclosure activity often accelerates during late summer and early fall, driven by accumulated financial strain from earlier months. Data from the third quarter of 2025 confirms this trend, showing a measurable increase in foreclosure filings compared to previous quarters. More than 100,000 properties entered foreclosure during those three months,reflectingaconsistentupwardtrajectoryfromthestartoftheyear.

Foreclosure starts also rose during this timeframe, indicating that more homeowners entered the early stages of distress as economic pressure built. Completed foreclosures followed a similar upward direction, demonstrating that earlier cases were progressing throughthelegalprocessratherthanbeingresolvedthroughalternativeoutcomes.

This seasonal pattern matters because foreclosure timelines typically span several months. Activity that rises in late summer often results in lender-controlled inventory appearing in winter or early spring. Understanding this lag is essential for forecasting when distressed supplywillreachthemarket.

Seasonality does not affect all markets equally. Certain metropolitan areas consistently report higher foreclosure rates, reflecting local economic conditions, affordability levels, and employment stability. Recent data highlights several major cities where foreclosure rates exceeded national averages, underscoring the uneven distribution of distress across regions.

In these markets, foreclosure filings represent a higher share of total housing units, which means seasonal surges can produce significant inventory increases once cases are completed. Investors monitoring regional cycles often find that markets with recurring seasonal peaks generate predictable waves of lender-owned properties later in the year.

This geographic clustering also influences competition. When multiple properties enter inventory simultaneously, buyers gain leverage. When supply is limited between seasonal peaks, pricing pressure tends to rise.

Distress peaks represent the front end of the pipeline. When foreclosure filings rise during a specific season, the effects ripple forward. As cases move from filing to auction and finally to lender possession, each seasonal surge eventually becomes a measurable increaseinREOinventory.

Third-quarter data from 2025 demonstrates this progression. The quarter recorded a higher number of filings, foreclosure starts, and completedforeclosurescomparedtoearlierperiods,signalingasteady flowofpropertiesadvancingtowardlenderownership.Overtime,these completions accumulate, creating visible inventory growth that investorsseemonthslater.

This delayed response is why market observers often underestimate upcoming supply changes. By the time REO inventory appears in listings, the underlying foreclosure activity that created it may already beseveralmonthsold.

For investors, seasonality provides a strategic advantage. Recognizing whendistresspeaksoccurallowsbuyerstoanticipateinventorysurges rather than reacting after competition intensifies. Historical patterns suggest that properties entering foreclosure in late summer often becomeacquisitionopportunitiesinearlyormid-2026.

Seasonality also influences pricing behavior. During periods of rising inventory, lenders may prioritize faster disposition, creating opportunities for negotiation. During slower seasons, limited supply can drivestrongerbiddingandnarrowermargins.

Successful investors align acquisition timelines with these cycles, preparing capital and due diligence resources before inventory reaches themarketratherthanafteritbecomeswidelyvisible.

Seasonal foreclosure cycles shape the rhythm of distressed supply more than many market participants realize. When foreclosure activity peaks during specific quarters, it sets in motion a chain reaction that eventuallyincreaseslender-controlledinventory.Thethird-quarterrisein filings and completions during 2025 illustrates how seasonal momentumtranslatesintotangibleopportunitymonthslater.

For investors preparing for 2026, understanding these cycles is not optional. It is a practical tool for forecasting supply, timing acquisitions, and navigating competition with greater confidence. Those who track distress peaks today will be better positioned to act when tomorrow’s inventoryarrives.

If you want to stay ahead of seasonal shifts in lender-controlled inventory and identify opportunities before they reach the broader market, REObroker.com offers the insight and access you need. The team at REObroker.com specializes in connecting investors with datadriven opportunities across the nation, helping you align strategy with realmarketcycles.Visit https://www.reobroker.com toexploreavailable listings, email info@reobroker.com for personalized support, or call 760-238-0552 to speak with professionals who understand how seasonality and foreclosure trends shape profitable investment decisions.

The rise of completed foreclosures and the increase in lender-owned properties are shaping the investment landscape more noticeably in 2026 than at any point in recent years. Following a period where foreclosure activity remained unusually low and muted by broad economic support measures, recent market trends indicate a reversal: more properties are moving through the foreclosure process to completion and entering bank-controlled inventory. For investors tracking distressed supply, a key barometer of opportunity in housing markets, these developments matter. They offer insight into where supply pressures, pricing opportunities, and competitive dynamics are likely to shift.

Completed foreclosures represent not just an increase in homes lenders now control but also a potential influx of assets that investors often watch closely. Changes in this segment can influence overall market pricing, bidding behavior, and investment strategy decisions across regions. As the volume of lender-held properties grows, so too does the pool of residential real estate that investors can evaluate for acquisition, rehab, or rental potential.

This article examines the recent patterns behind rising REO completions, explains the forces driving this shift in distressed supply, and outlines what it may mean for investors observing market trends in 2026.

Recent foreclosure market data reveals that lenders are seeing an uptick in properties completing the foreclosure process and reverting to bank ownership. Foreclosure filings — which include default notices, scheduled auctions, and completed foreclosures — have increased year over year, with the total number of properties entering some stage of foreclosure rising by roughly 14% in the latest full-year market report compared to the prior year. Moreover, completed foreclosures — the point at which properties become lender-controlled inventory — are growingatanevenfasterpacethaninitialfilings.

This shift toward more completed foreclosures reflects broader market conditions. As financial support programs and temporary relief measures from earlier years have diminished or expired, lenders are progressing more delinquent loans through the legal foreclosure process rather than engaging in prolonged mitigation efforts. Although foreclosure levels remain well below historical peaks, the steady, consecutive increases acrossmultiplequarterlyandmonthlyreportsindicateanimportanttrend: a growing number of distressed properties are fully transitioning into lendercontrol.

For investors, higher completion rates translate into more REO inventory. Thisinventory,heldbybanksandfinancialinstitutions,typicallyentersthe resale market through auctions, listed portfolios, or bulk sales to institutional buyers. While this shift does not signal a widespread market crisis, it expands distressed supply, a category familiar to investors as a potential source of below-market pricing and strategic acquisition opportunities.

Midyear market data from 2025 highlights the increasing share of REO completions relative to earlier phases of foreclosure activity. In August 2025, for example, completed foreclosures were up over 40% compared to the previous year. That increase was observed even as overall foreclosure filings — including early-stage defaults — increased by a more moderate rate. The disproportionate rise in completed foreclosures implies that many properties once in early stages of distress have moved deeper into the process.

Regionally, the greatest number of completed foreclosures continues to cluster in major states and metropolitan areas. Locations with significant foreclosure activity often coincide with larger housing markets where economic pressures, affordability constraints, or local employment shifts are more pronounced. These markets play an oversized role in shaping investor sentiment because they offer volume, diversity of property types, and comparative liquidity.

Furthermore, incremental increases in the average speed at which foreclosures are resolved — observed as decreasing timelines from filing to completion — suggest that market participants and legal systems are processing distressed properties more efficiently than in past years. This efficiency can expedite the flow of inventory into investor channels, contributing to a more immediate supply response.

For real estate investors, an expanding pool of REO inventory presents both opportunities and considerations. On the opportunity side, a growing supply of lender-owned properties can mean increased access to assets that may carry pricing advantages or require renovation and repositioning for profit.

On the cautionary side, rising foreclosure completions may reflect underlying economic pressures that influence broader housing market behavior. Persistent affordability challenges, elevated borrowing costs, and regional employment conditions continue to shape homeowner stability. A thoughtful investment strategy will take these factors into account rather than assuming that increased supply necessarily guarantees favorable outcomes.

In addition, as lender portfolios expand, competition among investors for high-quality distressed assets can intensify, especially in markets with emerging demand. This competitive dynamic may narrow pricing advantages and require stronger analytical frameworks to identify genuine value.

The increase in foreclosure completions and the resulting rise in lendercontrolled inventory points to a subtle but meaningful shift in the supply side of the housing market. While overall foreclosure levels remain modest compared to historical norms, the trend signals that more properties are completing the full legal process and entering bank-owned status. For investors, this means a broader set of distressed assets from which to source acquisitions, along with a need for informed strategy and diligent market analysis.

Understanding how and why this portion of the market is expanding — and its relationship to broader economic conditions — will help investors position themselves for opportunities in 2026. As the pace of completed foreclosures continues to adjust, so too will the landscape of supply available for strategic investment.

If you are seeking expert guidance and access to growing distressed inventory, REObroker.com is your strategic partner. Whether you are evaluating lender-owned properties for acquisition, expanding your investment portfolio, or seeking data-driven support to inform your decisions, the professionals at REObroker.com can help you navigate this segment with confidence. Visit https://www.reobroker.com to explore current opportunities, send questions to info@reobroker.com, or call 760238-0552 to connect with a team that understands how rising REO completions are shaping the investment landscape in 2026 and beyond.

References

BiggerPockets. Bank-Owned Properties Rise 25.7% Year-Over-Year

What This REO Surge Means for Real Estate Investors. Retrieved January 19, 2026, from https://www.biggerpockets.com/blog/bank-ownedproperties-rise-25-percent-year-over-year-what-this-reo-surge-means-forreal-estate-investors

ATTOM Data Solutions. U.S. Foreclosure Activity Increases in 2025. Retrieved January 19, 2026, from https://www.attomdata.com/news/market-trends/foreclosures/2025-yearend-foreclosure-market-report/

BiggerPockets. Bank-Owned Properties Are Up 41% From Last Year. Retrieved January 19, 2026, from https://www.biggerpockets.com/blog/bank-owned-properties-are-up-41percent-year-over-year-august-2025

Homeowners surveyed regret waiting to sell. If you’ve been holding off, take this as your sign. Don’t let “I wish I sold sooner” become part of your story.

After several years of historically low foreclosure activity, the real estate market is entering a new phase—one marked by a noticeable rise in bank-owned inventory. For homeowners, investors, lenders, and real estate professionals alike, this shift is drawing renewed attention to foreclosure trends and what they signal about broader market conditions. While the overall housing market has remained resilient, persistent affordability challenges, elevated interest rates, and changing household finances are reshaping outcomes for a segment of property owners.

In 2025, foreclosure activity began to climb at a pace not seen since before the pandemic-era relief measures were implemented. As more properties move through the foreclosure pipeline, lenders are increasingly taking possession of homes, resulting in a growing supply of bank-owned real estate entering the market. This increase does not point to a market collapse, but it does reflect underlying stress that has been building quietly over time.

This article examines why bank-owned REO inventory is rising in 2025–26, explores the national foreclosure data driving this growth, and explains what these trends mean for market participants navigating the current real estate environment.

Foreclosure filings increased meaningfully throughout 2025, reversing several years of post-crisis stability. Nationwide data shows that foreclosure activity rose by double digits compared to the prior year, with hundreds of thousands of properties entering some stage of the foreclosure process. More notably, completed foreclosures— where lenders take ownership of a property—rose at an even faster rate.

This pattern matters because it indicates not just financial distress, but progression. When foreclosures outpace resolutions such as loan modifications or property sales, more homes advance toward repossession. By the end of 2025, tens of thousands of properties had reverted to lender ownership, contributing directly to higher bankcontrolled inventory levels heading into 2026.

While foreclosure rates remain well below levels seen during the last housing crisis, the year-over-year growth underscores that household financial strain is becoming harder to offset through temporary relief or refinancing options.

One of the clearest indicators of this trend is the sharp increase in bank-owned properties reported during 2025. Midyear data showed that lender-held inventory jumped more than 40 percent compared to the same period the previous year. This growth reflects a lagging effect: foreclosures initiated months earlier are now reaching completion.

Several factors are contributing to this acceleration. Higher borrowing costs have made refinancing less accessible for distressed homeowners, while price growth has slowed in many markets, reducing opportunities to exit ownership through profitable sales. At the same time, lenders appear more willing to move properties through foreclosure ratherthanextendprolongedloss-mitigationefforts.

Geographically, the increase is not isolated. Large housing markets and fast-growing states accounted for a significant share of new bank-owned inventory, suggesting that populationgrowthalonedoesnotinsulatemarketsfromfinancialpressure.

The rise in bank-owned inventory introduces both challenges and opportunities. On one hand, it signals financial strain among certain homeowners and highlights affordability gaps that continue to affect the market. On the other hand, it adds supply to an environmentstillgrapplingwithlimitedhousingavailabilityinmanyregions.

For buyers and investors, increased bank-owned inventory can expand access to properties that might otherwise remain off-market. For lenders and servicers, the focus shifts toward efficient disposition strategies to manage carrying costs and market exposure. Importantly, the gradual pace of increase suggests adjustment rather than disruption,allowingthemarkettoabsorbinventorywithoutwidespreaddestabilization.

The growth of bank-owned REO inventory in 2025–26 is the result of rising foreclosure activity, not a sudden market breakdown. As more properties complete the foreclosure process, lenders are holding a larger share of residential real estate, reshaping supply dynamics across the market. While overall foreclosure levels remain historically moderate, the upward trend reflects real affordability and financial pressures facing households.

Understanding these patterns is essential for anyone engaged in real estate decisionmaking today. As foreclosure activity continues to normalize, bank-owned inventory will play a more visible role in shaping market opportunities, pricing strategies, and longtermhousingoutcomes.

As bank-owned inventory continues to expand, working with professionals who understand this segment of the market is more important than ever. REObroker.com specializes in connecting buyers, investors, and institutions with expert guidance and nationwide access to bank-owned opportunities. Whether you are seeking insight, inventory, or strategic support, the team at REObroker.com can help you navigate today’s market with confidence. Visit https://www.reobroker.com, reach out via email at info@reobroker.com, or call 760-238-0552 to learn how their experience and resources can support your real estate goals in this evolving environment.

References

ATTOM Data Solutions. U.S. Foreclosure Activity Increases in 2025. Retrieved January 18, 2026, from

https://www.attomdata.com/news/markettrends/foreclosures/2025-year-end-foreclosure-market-report/

BiggerPockets. Bank-Owned Properties Are Up 41% From Last Year. Retrieved January 18, 2026, from

https://www.biggerpockets.com/blog/bank-owned-propertiesare-up-41-percent-year-over-year-august-2025

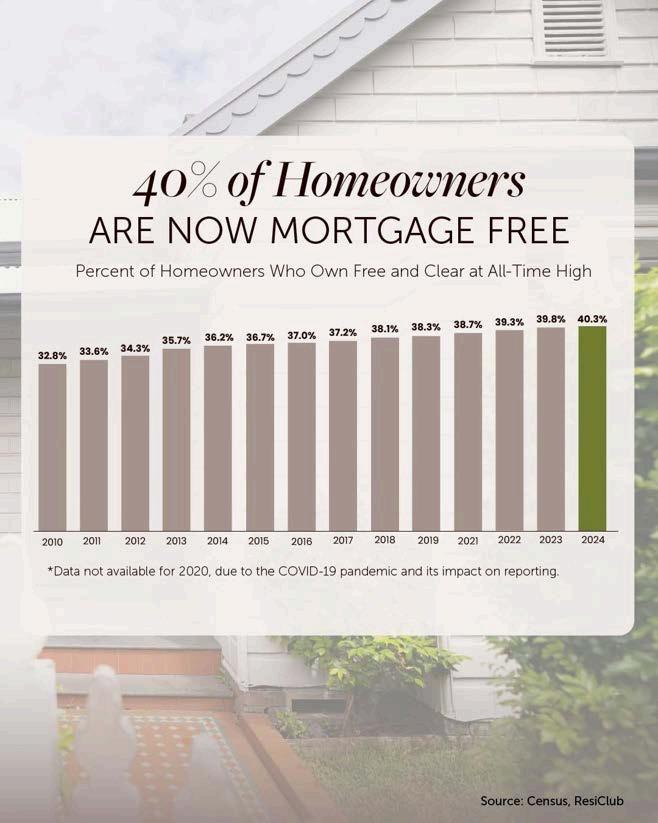

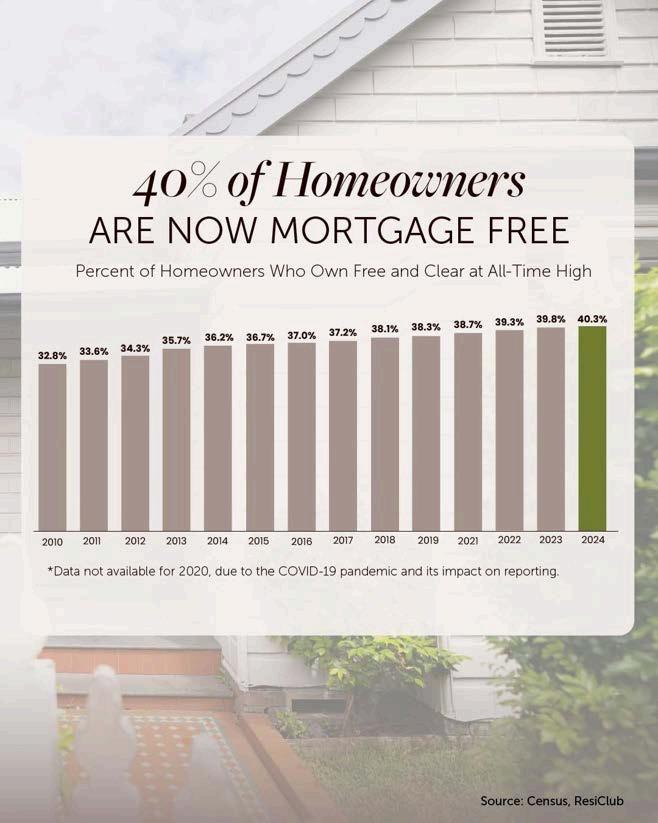

Did you know? A record 40% of U.S. homeowners now own their homes free and clear. That’s the highest share ever recorded.

And that’s an important stat if you’re considering downsizing.

Think about it. If you’ve been in your house for a long time, you may be able to sell and buy your next home in cash.

You could get a smaller, less expensive home that better fits your lifestyle today with lower bills, less upkeep, and no new mortgage in retirement.

Want to find out if this could be a possibility for you too? Contact me

If your home isn’t attracting the kind of offers you want -or any offers at allit may be time to reconsider your asking price.

If your house isn’t selling, it may be your price.

The #1 reason homes aren't bringing in offers today is because they’re priced too high for the current market, and that’s turning off buyers. But here’s the good news: you probably don’t need a big price cut to get results. Data shows the typical price reduction right now is only about 4%. And that small shift in your pricing strategy can make a real difference.

If you’re ready for something to change, you have to be willing to make a change. Ask your agent how much they recommend based on what’s selling in your neighborhood right now.

NADP Membership Chair 2025, Board Member 2017-2024

REOMAC Foundation Past President 2020-2021

AgentBio

7 27-580-6275

ssee@resultsreo.com www.ResultsREO.com

Stephanie D. See is the President and Co-Owner of Results Real Estate, Inc., a boutique brokerage in Largo, Florida. With over 20 years of experience and a broker’s license since 2013, she and her husband, John B. See, have closed more than 5,000 transactions across the Tampa Bay area. Stephanie is known for her integrity, attention to detail, and expertise in residential and REO markets. A dedicated industry leader, Stephanie has served on the Board of Directors for the National Association of Default Professionals (NADP) for eight years. She is committed to raising professional standards through education, mentorship, and collaboration. Under her leadership, Results Real Estate continues to deliver client-focused service in a wide range of market conditions.

With over 19 years as a licensed Realtor® and a lifetime of experience in property valuation and REO operations, Robyn Moody is one of Utah's most accomplished real estate professionals in the foreclosure and default services space. She began her career in 1998 working for a national Broker Price Opinion (BPO) outsourcing company, where she assigned property valuations, quality-checked reports, and developed critical relationships with agents and lenders across the U.S.

Her path into sales began when she joined a top-performing local REO agent who recognized her eye for valuation detail, commitment to accuracy, and exceptional organizational skills. After several years of managing and selling REO assets as a licensed assistant, Robyn earned the opportunity to acquire and lead the business herself—rebranding and growing it into what is now Salt Lake REO.

Lisa

https://www.linkedin.com/in/tomlazzaro/

Full-time professional Realtor for over 25 years. Proud member and former Master Broker of the NRBA (National REO Brokers Association). Also Member of ROBroker.com. Special focus on business development, REO/foreclosures. Sold bank-owned properties for over 20 years and have taught our unique local foreclosure process to others for longer than that. I am one of two top REO brokers in my region, based on volume and reputation. I am happy to provide as many current references as needed.

Berkshire Hathaway HomeServices Results Realty

AgentBio

2590 S BUMBY AVE. ORLANDO FL 32806

(407) 203-0007

joe@joedoher.com https://joedoher.com/

With 18+ years of REO experience, 7,500+ closed assets, and a CFK Success Rate of 97%, Joe Doher puts mortgage servicers and investors at ease knowing they have someone who is reliable, proactive, and will effectively manage every step of the process to ensure the maximum net recapture.

Joe Doher – Broker-Owner Berkshire Hathaway HomeServices Results Realty Orlando, Florida As someone who has lived and breathed real estate since childhood, it’s safe to say that it’s in my DNA. Growing up with a successful Canadian real estate broker like my father, I absorbed the industry’s nuances early on. In 1993, at the age of twenty-two, I officially entered the real estate business, and I’ve been fully immersed in the Orlando, Florida, real estate market ever since.

(504) 321-1511

Justin.Potier@Vylla.com https://www.vyllahome.com/

Dynamic and results-driven Real Estate Broker with extensive experience as an Area Vice President at Vylla Home, spearheading growth and delivering on the company's mission. Adept at empowering agents and transforming the real estate process. Specializing in institutional asset sales, risk mitigation, talent acquisition/retention, and marketing, with a strong background in leadership and growth-oriented roles within both for-profit and non-profit corporations. AgentBio