• Why REOBroker?

• REOBroker Membership Form

• Editor’s Note

• About REOBroker

• Publisher’s Note

•REOBroker Media Benefit

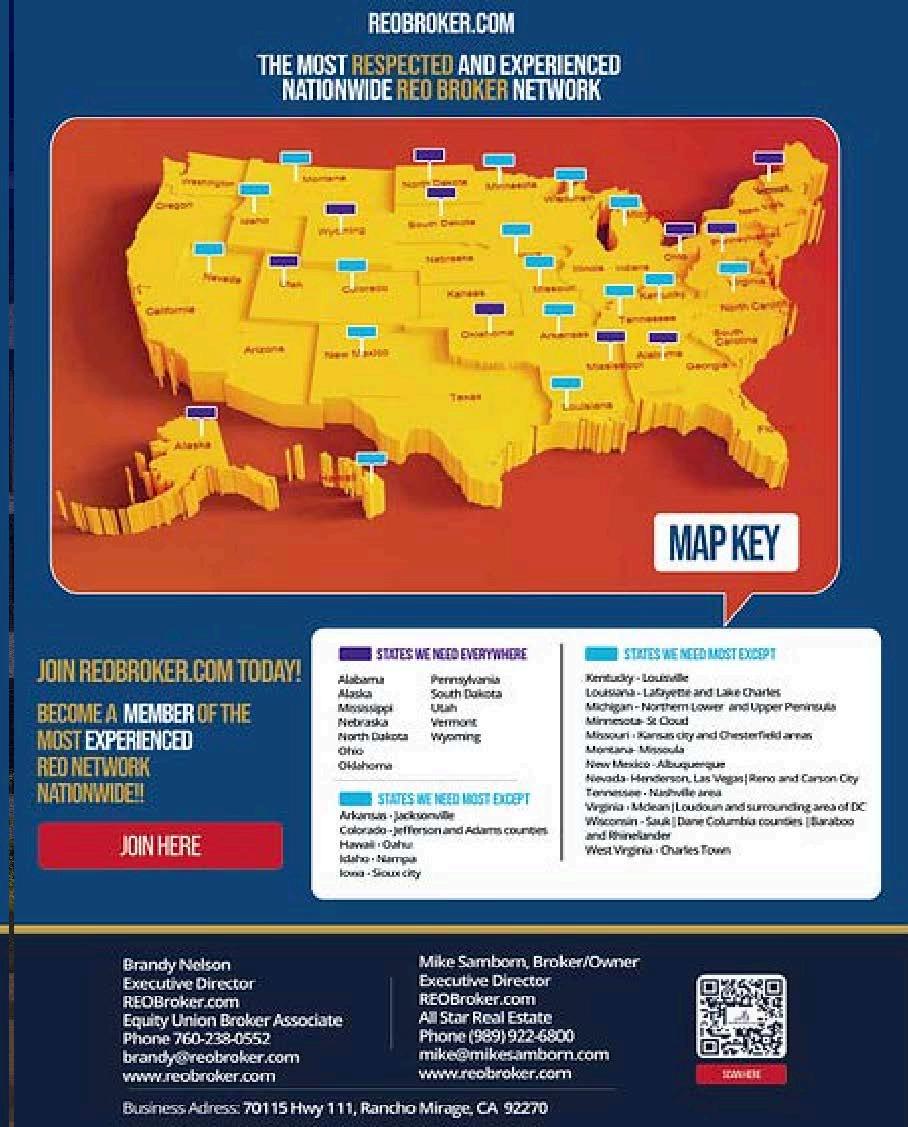

• REOBroker Map

• REOBroker Services

• 50 States

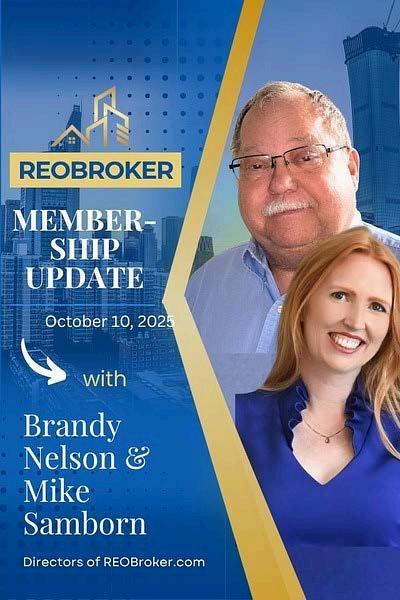

• About Brandy Nelson

• About Mike Samborn

• About REOBroker

• Agent Spotlight

• Know the difference

December Reset: Where Year-End Strategy Shapes the 2026 REO Landscape

December Stress Signals: The Quiet Build Toward 2026

End-of-Year Exits: Why December Accelerates Deeds, Discounts, and Foreclosure Decisions

Quiet Inventory: December’s Best Off-Market REO Deals Hide in Plain Sight

Quarter-End Crunch: Why December Sparks a Surge in REO Conversions

Cold Calculations: Why Winter Insurance Shifts Are Quietly Discounting REOs

Winter Clean-Up: Faster Title Resolutions for Year-End REO Deals

Mind Over Market: The Buyer Behaviors Driving REO Demand This Winter

Funding the Freeze: How Smart Capital Keeps REO Deals Alive in a High-Rate December

Behind the Winter Slowdown: The Hidden REO Supply Building for 2026

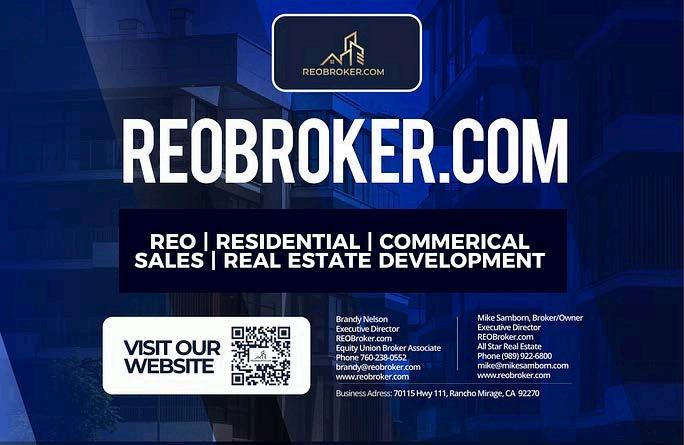

PUBLISHER:

Brandy Nelson Executive Director

REOBroker.com

Equity Union Broker Associate 70115 Hwy 111 Rancho Mirage, CA 92270

Phone: 760-238-0552

Email: brandy@reobroker.com www.reobroker.com

Mike Samborn Executive Director

REOBroker.com

All Star Real Estate Broker/Owner

108 N. Henry Street Bay City, MI 48706

Phone: 989-922-6800

Email: Mike@mikesanborn.com

ADMINISTRATOR:

Eric Lawrence Frazier (714) 475-8629 ext 703

PRODUCTION TEAM:

•Thepowerisnowmedia.com

•Alvin Magua

•Leonna Rose Berame

•Sharon Rose Barellano

•Michael Mbugua

Welcome to the November edition of The Real EstateMagazine,published byREOBroker.com. As 2025 draws to a close, the real estate market finds itselfataninflectionpoint—wheredata,discipline,andstrategicvisionmatter more than ever. The decisions professionals make now will echo well into 2026, defining who is positioned to seize opportunity in a rapidly evolving housing and REO landscape. Signals Beneath the Surface While the broader market debates rate cuts and affordability, those of us in the REO and investmentsectorsknowthattherealstoryisalwaysbeneaththesurface.

Behind the headlines, lenders are tightening loss-mitigation pipelines, servicers are recalibrating valuations, and investors are beginning to sort markets by long-term potential rather than short-term volatility. This month’s issue unpacks these underlying trends through a series of in-depth features designed to help you read the market before it moves. From regional REO surges to subtle lender behavior shifts, our contributors focus on what data andexperiencetellusaboutthenextphaseofthecycle.

We begin with a national snapshot: The REO Momentum Index, a data-driven feature tracking year-over-year changes in foreclosure filings, bank repossessions, and asset dispositions. This piece identifies the metro areas showing early signs of inventory acceleration—often months before those trends reach mainstream analysis. Next, our article on “The Return of the Institutional Buyer” examines how hedge funds, private equity firms, and large-scale aggregators are quietly re-entering select markets. Their activity provides not just competition but also valuable signals about pricingfloorsandasset-classpreferences.

Our coverage of servicer workflow dynamics reveals how end-of-year accounting pressures are influencing REO release patterns, with some lenders pushing properties to market before Q1, while others delay listings until after fiscal close. Understanding these internal pressures helps agents, brokers, and asset managers time their acquisitions and marketing strategies effectively.

Onthe valuationfront,weinvestigatehowappraisersandBPOproviders are adapting to today’s hybrid pricing environment, where automated valuation models (AVMs) intersect with human expertise. The article breaks down how to challenge or validate valuation discrepancies that can make or break an REO deal. Beyond the Numbers This issue also steps beyond metrics to explore the human and operational side of distressed real estate. Our profile on several REO agents highlights the growing use of AI-driven CRMs, virtual walkthroughs, and automation in listing management —tools that are transforming how professionals handlehigh-volumepipelineswithprecisionandtransparency.

In “TheNewFrontierofREORenovation,” we feature investors who are turning distressed assets into modern, sustainable homes through strategic design and adaptive reuse. These projects prove that profitability and community impact are not mutually exclusive—they are increasingly intertwined. We also confront the insurance and climate riskrealities reshapinghowdistressedassetsareunderwrittenandsold. As insurers retreat from high-risk zones and premiums climb, investors must adapt financing and exit models accordingly. This article offers frameworksforrisk-adjustedacquisitionplanningin2026.

The Year-End Mindset November is the month to take inventory—not just of properties, but of priorities. The most successful professionals in this business don’t wait for January to plan; they use Q4 to sharpen focus, strengthen relationships, and prepare for the next market turn. Our closing feature, “2026 Outlook: The Year of Strategic Repositioning,” offers forecasts on rate policy, credit markets, and distressed supply pipelines, drawing from economic data and interviews with leading analysts. The conclusion is clear: adaptability, liquidity, and knowledgewilldefinethewinnersofthenextphase.

A Word from REOBroker.com At REOBroker.com, we are committed to equipping our readers with the foresight and factual clarity needed to navigate the real estate market’s most complex corridors. Whether you are an agent, investor, lender, or asset manager, this publication exists to connect you with the data, ideas, and community that keep you ahead ofthecurve.

Thank you for being part of our readership and for making this growing communityaplacewhereexpertiseissharedandopportunityiscreated. May this November issue sharpen your insight and strengthen your strategy as you prepare to close the year with purpose—and step into 2026 ready to lead. Warmregards,TheEditorialTeamREOBroker.com Clarity.Insight.Opportunity

Asset Managers rely on REObroker.com to consistently find the nation's top REO specialists. We pre-screen our members for years of experience, training & certification, and asset manager references, holding each application to the highest standards. The Benefits of Membership In addition to the clear benefits of our referral network, REObroker.com members receive training, networking & advertising opportunities, and a wealth of pay-it-forward knowledge from our daily Member Discussion Forum.

REObroker.com is an esteemed designation and valuable association. Many of our members have stayed with us consistently through several REO cycles, realizing the long-term benefits.

Minimumof2(BD) BrokerDevelopmentSeminarsayear

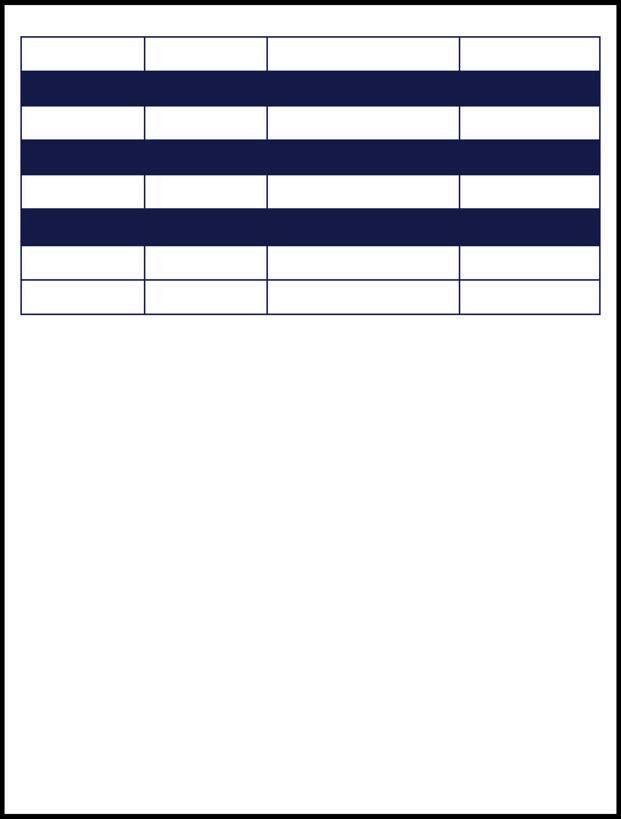

REOBroker.com Member Benefits

Minimum of 2 (BD) Broker Development Seminars a year

Access to a Minimum of 2 Zoom mastermind/training calls a month

Access to asset management company Roster

Access to Private Lender Roster

The internal chat line provides access to a wealth of knowledge and support through our diverse membership.

REOBroker.com does sponsorships with NADP, 5 Star, and other related Events.

National Exposure to asset managers and companies

Included on the REOBroker.com website with contact information and areas served

Included in REOBroker.com online HUD and Real Estate Magazines and National Campaigns

Opportunities to submit market updates and real estate articles in the magazines.

Membership benefit pricing for additional advertising in the following:

REOBroker.com HUD Magazines | REO Broker Real Estate Magazine | REOBroker TV | and Podcast.

Bob Zachmeier

Clay Strawn

Jeff Miller

Julie Bruckner

602-810-1561

480-250-0131

909-226-8038

602-810-1561

John Mason

Bob Siegmeth

Brandy Nelson

Darrell Isaacs

David Roth

Deanna Lantieri

Dennis Mulvihill

Don Kelber

Elysia Moon

Gina Bocage

James Outland

Joe Mayol

John Costigan

Justin Potier

Mike Potier

501-985-0755

818-425-0330

760-238-0552

209-649-8593

707-446-1211

760-924-5091

408-489-2904

805-338-9682

949-212-6474

510-552-6480

805-748-2262

661-618-1442

619-990-3044

562-480-9884

562-708-0870

Chandler Mesa Tempe

Phoenix

Lake Havasu

Pulaski Lonoke & Surrounding

Porter Ranch

Palm Desert/Palm Springs

Stockton/San Joaquin County

Vacaville

Mammoth Lakes

Los Gatos

Westlake Village

South Orange County

Fremont / East Bay

Pismo Beach

Lancastor

San Diego / El Cajon

Los Angeles County

Long Bch South Bay

Nat

Timm

Tom

Whythefinalmonthoftheyearquietlydetermineswhichmarkets,investors,and servicersgaintheearlyadvantageinthenextdistressedcycle.

Real estate slows down in December—but the distressed market accelerates. While traditional agents exit into holiday mode, the REO ecosystem is at its most active. Servicers finalize audits, lenders reconcile nonperforming loan buckets, and investors close strategic positions before the fiscal clock resets.

This “quiet” month is anything but. December is the invisible hinge between two REO cycles: the last push of the current year, and the earliest signals of inventory that will shape 2025 and 2026.

Professionals who understand this annual shift value December not as downtime, but as decision time.

Behind closed doors, financial institutions make portfolio decisions that define what hits the market in Q1:

1. Regulatory and Audit Deadlines

Banks must finalize their NPL and REO positions for year-end reporting, creating pressure to resolve aging assets quickly. This results in:

Faster approvals

Greater negotiability

More “as-is” dispositions

Both lenders and investors adjust holdings to minimize liability. This often triggers:

Sell-offs of nonperforming notes

End-of-year price reductions

Offloading of high-maintenance REOs

Servicers close out loss-mitigation cycles, escalate unresolved defaults, and queue foreclosures for early Q1 processing. The inventory that appears in spring often has its origin in December decisions.

Simply put, December determines which assets leave portfolios—and which will be forced into them in the coming year.

Investor Behavior: The December Pivot

Sophisticated investors know December is the most leverage-rich period of the cycle.

Many use the month to:

Liquidate stale inventory

Reallocate capital from flips to rentals or notes

Lock in year-end gains or losses

Build cash reserves before Q1 bidding competition increases

This creates a temporary window where sellers are motivated, lenders are flexible, and competition drops—an ideal environment for REO buyers who move quickly.

For brokers, December is also prime time to reconnect with asset managers, renew vendor credentials, and position for the next assignment cycle.

December’s impact varies significantly by region, and savvy professionals tailor strategy accordingly.

Cold-Weather Markets (Midwest, Northeast)

Retail activity drops sharply

REO discounts increase

Fewer competing buyers

These areas become value-rich for investors willing to transact in winter.

Sun Belt Markets (TX, FL, GA, AZ)

Year-round buyer activity

Strong investor migration

Higher velocity of REO turnover

These markets often release more assets late in the year as lenders calculate climate risk, insurance shifts, and regional migration data.

Climate-Exposed Regions

Insurer reevaluations peak in Q4, often triggering:

Late-year asset releases

Adjusted valuations

Investor hesitation

Opportunity exists for those who understand mitigation and insurance navigation.

December Strategies for REO Professionals

1. Treat December Like Q1

This month is not the end—it is the setup.

2. Prioritize Liquidity

Lenders prefer quick, clean, low-contingency closings.

Bring servicers delinquency heat maps, trustee sale results, and regional NPL metrics to support your bids.

4. Re-Engage With Your Network

December is the month when 2025 REO assignments are quietly locked in.

5. Position for Early 2026 Inventory

Defaults rising today will become REO assets in 12–18 months. Track:

FHA/VA stress

Insurance-driven migration

Regional affordability shifts

NPL acceleration

Conclusion: December Doesn’t Close a Cycle — It Opens One

In distressed real estate, December is not a cooldown; it is a recalibration.

The decisions made in this month—by lenders, investors, and servicers—shape the inventory map of the entire next year.

Those who step back in December will spend early 2025 trying to catch up.

Those who step forward will enter the new year already positioned, already connected, and already ahead.

The year may end in December, but the next REO cycle begins right here.

How winter credit fatigue, flattening home values, and tightening liquidity are shaping the next phase of the REO landscape.

Winter’sWarning:WhenStabilityStartstoBend

December brings more than seasonal slowdowns—it exposes financial fractures that stay hidden in stronger months. As households face holiday spending, annual tax pressures, and the lingering weight of inflation, earlystagedelinquenciestendtorise.Thisyear,thosesignalsaresharper.

Nationally, 30-day mortgage late payments have increased for four consecutive months, and credit card charge-offs are climbing at the fastest pace since 2012. While these shifts remain subtle to most consumers, they are clear to REO and asset management professionals: pressure is tightening,noteasing.

Unlike previous cycles where speculative lending drove volatility, today’s strain is structural. Borrowers are not failing due to impulsive borrowing— they’refailingbecausethefinancialfloorbeneaththemisthinning.

TheHolidayCreditSqueeze:WhyDecemberMatters

Historically, Q4 has been one of the most predictive periods for early delinquency trends. This year:

Credit card utilization is near record highs, with households relying on revolving debt to offset rising cost of living. Personal savings rates sit at multi-year lows, reducing borrower resilience.

Sub-$450,000 mortgages—especially FHA and VA—are showing the strongest delinquency acceleration, mirroring patterns from the 2018–2019pre-cyclewindow.

With interest rates still elevated, refinance relief remains out of reach for most owners. Mobility is frozen. Liquidity is shrinking. And the market is quietlyrecalibratingfor2026.

TheSlowDriftTowardDistress

DecemberdatasuggeststhesametrendwesawforminginNovember—but deeper.

Servicersarereporting:

A steady rise in forbearance inquiries, even among borrowers who remainedstablethrough2023.

More cases of non-responsive borrowers—the early hallmark of silent default.

An uptick in partial payments, often the first stage in the delinquency curvebeforefulldefaultappears.

These micro-indicators rarely make headlines, but they shape the REO supplychainlongbeforeforeclosurefilingsappear.

If November whispered a shift, December is speaking clearly: the distressedpipelinefor2026iswidening.

MarketFrictionPointsThatWillDefine2025

Several conditions distinguish this cycle from those in the past:

1. Insurance Pressure in Key Markets

States like Florida, Texas, and California continue to face insurer exits and rising premiums, pushing affordability to the edge. These costs are now influencing default rates almost as much as interest rates.

2. Investor Retraction

Short-term rental investors and small landlords who bought at peak valuations are confronting flat rents, higher taxes, and rising maintenance costs. Strategic exits—and strategic defaults—are already beginning.

Household income growth has slowed, but essential cost categories— insurance, utilities, food, and transportation—continue to rise. The gap funnels many borrowers into short-term debt traps.

Combined, these pressures create a landscape primed for increased REO activity by late 2025 and early 2026.

The December Opportunity: Preparing for What’s

Professionals who act now—before the market recalibrates—will be best positioned.

Counties with high FHA concentration, low liquidity, and elevated insurance burdens will move first.

December is historically a planning period for asset managers. Establishing those relationships now can mean early access to 2025 assets.

Private lenders and cash-rich investors will be the fastest to capture opportunities as inventory expands.

Expect price softening in markets with heavy investor ownership, slowing inmigration, or outsized climate risk.

The emerging REO cycle won’t resemble the crash of 2008. Instead, it will unfold quietly—through incremental distress, tightened liquidity, and thousands of individual borrower tipping points.

December doesn’t just close the year. It opens the next chapter in a market defined more by slow pressure than sudden collapse.

And for those watching carefully, the opportunities of 2026 are already visible in the data.

Exploreourin-depthconversationswithleading realestateprofessionals,insightfulmarket analyses,andvaluabletipsfornavigatingthe realestatelandscape.Tuneintostayupdated onthelatesttrendsandsuccessstoriesinthe realestateworld.

Decemberforceslenderstoclearthebalancesheet— makingexitstrategythemostvaluableskillindistressed realestate.

As the year closes, lenders face a perfect convergence of pressure points: regulatory reporting deadlines tax obligations rising insurance renewals nonperforming loan scorecards resetting on Jan 1

That combination forces servicers to speed up decisions on how each distressed asset exits: deed in lieu, short sale, or full foreclosure. December becomes less about process—and more about prioritization.

When time matters more than recovery, deeds in lieu rise to the top. They allow lenders to close the file before year-end, avoid court delays, and take control of the property in cleaner condition.

The catch: subordinate liens. If they’re unresolved, a deed in lieu stalls. But when title is clear, December produces a surge of “quiet handovers” that enter REO pipelines faster—and often in superior shape.

ShortSalesGetFasterWhentheCalendarDoes

Shortsalesusuallydrag,butDecemberchangesthemath.

Lenders would rather accept a discounted payoff than carry a nonperforming loan into nextyear’sbooks.

Thiscreatesararewindowwhere: approvalsmovequicker valuationsgetmoreflexible investorscannegotiatewithgreatercertainty

For brokers, December’s short-sale market rewards speed and precision above everythingelse.

TheForeclosureTrigger:WhenCarryCostsSpike

Decemberalsopushesborderlineassetsintostrategicforeclosure.

When taxes, insurance renewals, or repair risks climb, servicers run loss projections— andmanyassetspassthebreak-evenpoint.

Once carrying the property into January costs more than liquidating it, foreclosure becomestheinevitablemove.

This is where savvy investors gain leverage by understanding the lender’s “loss minimizationthreshold.”

KeyDecemberPlaybookMoves

Trackyear-endNODandauctioncancellations—they predict which assets lenders will force through.

Engageservicersearly—December rewards professionals who reduce friction. Presentfinanciallygroundedoffers—not emotional appeals Verifytitleearly—clean conveyances move first.

BottomLine:DecemberIsanExitMarket

The final month of the year compresses timelines, shifts priorities, and accelerates distressed-asset exits.

Those who understand why lenders choose a deed, a discount, or a foreclosure—not just how—gain first access to the best REO opportunities of the coming year.

Exit strategy isn’t the last step of the process.

In December, it is the market.

Why year-end pressure turns shadow inventories into silent opportunities for prepared buyers.

December is the month when lenders quietly clean their books.

As servicers reconcile delinquent notes, update tax obligations, and prepare regulatory filings, a surprising amount of distressed property moves behind the scenes—long before any MLS listing appears.

These aren’t failed listings or stale assets. They’re pre-REO opportunities: properties in default, foreclosure, or post-foreclosure status that servicers want resolved quickly to avoid carrying them into the new year.

For those watching closely, December becomes a rare window into the invisible inventory.

Several forces push off-market deals forward at yearend:

Servicer scorecards reset on Jan 1, incentivizing faster resolutions.

Tax and insurance renewals raise carry costs, making quick liquidations appealing.

Internal balance sheets close, pressuring lenders to reduce nonperforming assets.

Holiday buyer slowdown lowers competition, creating more flexible negotiations.

Together, these dynamics cause a spike in “quiet releases”—properties shared only with a lender’s trusted brokers, investors, or pre-marketing lists.

Most December opportunities come from:

Canceled trustee sales, often precursors to repossession

Pending REO transfers stuck in title or occupancy clearance

Non-performing loans that institutions want off the books before year-end

Internal pre-list packets circulated to vetted agents for rapid offers

These assets rarely go public unless no private buyer steps forward.

Even in a data-driven industry, relationships control visibility.

Asset managers and servicers reward professionals who:

deliver accurate BPOs close on schedule maintain confidentiality communicate cleanly and consistently

That reliability earns a place on December “quiet lists”—where the best pricing often appears because banks are motivated and calendar-driven.

You don’t need insider status to predict upcoming REOs. In December, monitor:

clusters of new NOD/Lis Pendens filings abrupt auction postponements surges in lender-recorded deeds counties with year-end tax levies due

These signals often indicate assets about to surface privately.

Bottom Line: December Rewards the Prepared

December’s market isn’t slow—it’s silent. Behind the holiday lull, lenders push distressed assets through internal channels at the fastest rate of the year.

Professionals who combine public data, private relationships, and consistent follow-up can capitalize on these hidden pipelines long before the MLS catches up.

In off-market REO, success favors the ones who look between the lines— and December is when the margins are widest.

Whenreportingdeadlinescollidewithrisingcarrycosts,lendersmove assetsfaster—andsmarter—intoREOstatus.

Every winter, servicers face the same pressure: reconcile nonperforming loans before fiscal close.

By December, the clock isn’t just ticking—it’s dictating strategy.

Carrying a delinquent property into the new year means higher taxes, updated insurance premiums, and increased reserve requirements. For many lenders, the math becomes simple: clear the pipeline now, or pay more later.

While foreclosure laws set the framework, it’s internal financial thresholds that decide when a property becomes bank-owned. In December, those thresholds tighten. Servicers accelerate conversions when:

updated tax bills hit their books insurance renewals spike exposure end-of-quarter scorecards threaten compensation regulators require NPL cleanup before filing

This creates a short, predictable wave of REO transfers even in slow markets.

December REOs don’t appear out of nowhere—there are tells.

Watch for:

canceled trustee sales, often a prelude to repossession recorded assignments shifting servicing rights auction postponements near quarter-end clusters of bank-filed deeds after mid-December

These signals reveal which assets will enter REO channels before they hit MLS or asset-manager queues.

Lenders want resolutions, not carryovers.

Investors who understand December’s operational pressure can negotiate better pricing, faster approvals, and more flexible concessions—because the bank’s priority is closure, not optimization.

In winter, timing is leverage.

Bottom Line

December remains the most strategic month for predicting—and capturing—REO inventory.

As Q4 deadlines tighten, servicers shift from caution to conversion, releasing assets that would otherwise sit in limbo for months.

For 2026, the advantage belongs to those who can read the cycle, anticipate the pressure, and move when the banks must move.

As insurers reset premiums for 2026, winter becomes the best season for identifying underpriced risk.

Every December, insurers update their catastrophe models—flood, fire, and wind-risk assumptions that determine next year’s premium levels.

For the REO market, these recalibrations create a brief window where properties are priced on last year’s risk, but insured on next year’s reality.

That gap can be costly—or profitable—depending on how quickly investors respond.

Year-end adjustments most often affect:

Fire-prone Western corridors facing higher deductibles

Coastal states where windstorm coverage is being capped

Flood-zone expansions after fall storm assessments

The result: some REOs quietly lose insurability overnight, forcing lenders to discount simply to exit before Q1.

In December, a fast insurance scan is just as important as a repair estimate. Investors should:

pull updated FEMA flood maps, request preliminary premium quotes, check wind and fire-zone changes that take effect Jan 1, and confirm whether surplus-line carriers still write in that ZIP code.

These five-minute checks prevent surprises that kill margins.

Servicers want assets off the books before year-end. When a property’s insurance cost jumps but hasn’t yet been reflected in the list price, buyers who understand the new risk environment can negotiate—from a position of data, not fear.

In winter, knowledge becomes leverage.

Insurance volatility isn’t slowing down—but December gives disciplined investors a rare ability to price tomorrow’s risk at today’s values.

Those who track winter rate shifts will consistently outmaneuver competitors in 2026’s climate-sensitive REO market.

In distressed real estate, clean title—not discount pricing— is what keeps December deals alive.

As 2025 closes out, the biggest threat to REO profitability isn’t rehab cost or buyer demand—it’s title defects that stall closings during the busiest recording season of the year.

Unreleased liens, old judgments, municipal fines, and clerical errors can push a 30-day escrow into the new year—where carrying costs rise and buyer timelines collapse.

In December, title clarity becomes the deciding factor between deals that close and deals that freeze.

Even simple defects become amplified at year-end due to holiday staffing and slower municipal response times. The most frequent problems include:

Unreleased mortgages or HELOCs still showing as active

Unpaid code violations or utility liens that survive foreclosure

Tax delinquencies or HOA super-liens requiring priority review

Clerical errors like misindexed deeds or missing satisfactions

Each issue adds days—sometimes weeks—to the closing calendar.

1. Escrow Holdbacks

When liens have clear dollar amounts, a holdback allows closing now while attorneys settle the balance post-transfer.

Servicers often approve indemnity endorsements for minor historical defects, keeping the deal moving despite incomplete records.

Many December delays come from simple errors. A proactive title officer can often secure a re-recording or corrected release in hours—not weeks.

Pulling preliminary title before submitting offers prevents surprises and provides leverage when negotiating with banks or asset managers.

Investors who review county records before bidding or offering avoid the seasonal slowdown entirely. Knowing what defects exist—and which cures are fastest—allows buyers to:

negotiate accurate discounts request precise servicer concessions close faster than competing investors

In December, legal knowledge becomes the strongest negotiation tool.

Time is money—especially in December. Prioritize defects by how long each cure takes. Get ahead of the recorder’s office. Early title pulls beat holiday backlogs. Use holdbacks and endorsements creatively. These tools keep deals from freezing. Work with REO-specialized title companies. Experience cuts timelines dramatically.

December REO deals reward the professionals who can solve legal issues fast. In a month defined by delays, clarity becomes a competitive edge. The investors who master title discipline now will enter 2026 with cleaner books, faster closings, and stronger returns.

In distressed real estate, emotion drives action—and understanding perception is as valuable as understanding price.

2025 has revealed a simple truth: buyers don’t respond to data—they respond to narratives.

Rates are high, inventory is shifting, and distressed assets remain a misunderstood segment of the market. Yet REO demand continues to strengthen not because conditions are ideal, but because buyer psychology has changed.

REO buyers in 2025 are motivated less by discount hunting and more by control, opportunity, and timing.

Understanding those motivations is the new competitive edge.

With traditional inventory tight and home prices remaining firm, many buyers see REOs as one of the last opportunities for attainable investment.

Even when properties need work, the perception of accessibility fuels activity:

“I can get in at a lower entry price.”

“I can force appreciation with renovations.”

“I can build equity faster than buying turnkey.”

The belief—not the math—is often what moves them.

Distressed listings trigger powerful emotions:

Risk Perception

REOs feel unpredictable: unknown repairs, title questions, delays. For new buyers, these risks loom larger than the actual costs.

Reward Perception

Seasoned investors focus on potential: equity upside, rental conversion, resale spreads. Their confidence comes from experience, not comfort.

The agents and investors who win deals are the ones who shift buyers from risk-focused thinking to reward-based thinking.

Buyers don’t just buy properties—they buy possibility. Framing matters.

A boarded-up asset can be presented as:

a high-risk project or a high-upside opportunity with cost-controlled renovation

A title delay can be seen as:

a deal-breaking complication or a brief obstacle before acquiring below-market property

The narrative is the difference between hesitation and offer.

In 2025, REO professionals who communicate clearly—and visually—move inventory faster than those who rely on MLS data alone.

When buyers see an REO, they mentally anchor to the worst-case scenario:

“This will be expensive to fix.”

“The bank must know something I don’t.”

Smart investors re-anchor the conversation around:

comparable ARV values

rental potential

renovation timelines

neighborhood appreciation

Controlling the anchor controls the negotiation.

Distressed deals come with built-in uncertainty. Buyers move forward not because the property is perfect, but because their team is trusted.

Agents, lenders, preservation vendors, and contractors collectively shape the buyer’s comfort level.

The stronger the ecosystem, the faster buyers convert fear into action.

In 2025, deals are less about property and more about confidence.

Perception guides demand. Buyers act emotionally, rationalize later. Narratives matter. The way an REO is framed determines how it’s valued.

Focus on upside. Investors respond to opportunity, not obstacles. Manage anchoring. Set expectations early and clearly. Build trust. A reliable team eliminates hesitation.

Conclusion: Psychology Is the New Deal-Maker

In REO markets, numbers close the file, but psychology starts the offer.

Understanding how buyers think—what they fear, what they value, what they believe—is one of the most powerful tools of 2025.

Those who master the mindset behind the market will continue to win, even when conditions shift.

Astheyearcloses,themostsuccessfulREObuyersaren’t waitingforratecuts—they’reengineeringnewwaystofund deals.

Year-End Liquidity: Tight but Full of Openings

December 2025 closes out another year of expensive borrowing and cautious underwriting. Rates remain elevated, banks are still protective, and many retail buyers remain sidelined. But the REO sector continues to expand, and the investors who thrive are the ones who adjust—not the ones who pause

In a high-rate winter, financing REO deals isn’t about cheaper debt.

It’s about smarter capital.

Private & Portfolio Lenders: The Real Deal Maker

With traditional lending slow, private lenders and small portfolio banks continue to lead the REO space. Their advantage is simple:

Speed over strict underwriting Flexibility over conformity

They lend on asset value and potential, not W-2s and perfect comps—making them the preferred choice when properties need work or time is limited

In December, when big banks slow down for year-end reporting, these lenders become even more essential.

For REO agents, keeping them close isn’t networking—it’s survival strategy.

Short-term bridge financing remains a powerful December tool. Investors rely on these 6–12 month, interest-only loans to acquire distressed assets now and refinance once rehab is complete and valuations improve in 2026.

The key is planning the exit before the entry: every bridge should have a clear refi or resale path identified at closing.

As institutions prepare their books for January, some prefer to move assets off balance sheets with creative structures:

Carryback notes

Discounted pricing in exchange for performance

Shared-appreciation models

These deals cut holding time for lenders and reduce upfront capital needs for buyers—a win-win scenario especially common at year-end.

Crowdfunding platforms, private syndicates, and small investor groups continue to transform the distressed market. December often brings:

new fund allocations, year-end repositioning, and investors seeking to place capital before tax deadlines.

For REO professionals, this opens a broader base of buyers—people who want to invest in deals, not necessarily own the property themselves.

203(k), Homestyle, and private rehab loans remain underused but powerful tools.

In December, when inventory is leaner and competition lightens, these programs allow buyers to take on properties others skip.

With careful budgeting and contractor discipline, these loans convert distressed properties into equity—inside a single loan cycle.

Certainty beats cheaper rates. A fast close at a higher rate is still better than losing the deal.

Diversify capital partners. Private, portfolio, and bridge lenders each fit different opportunities.

Always underwrite the exit. Entry cost matters, but exit timing determines profit.

Use renovation financing proactively. Organized borrowers get approvals faster.

Think like a capital strategist, not just an agent. REO success now comes from financial architecture, not just negotiation.

High rates haven’t stopped REO opportunities—they’ve clarified who is prepared to compete. The end of the year rewards professionals who blend speed, structure, and ingenuity.

Homeowners surveyed regret waiting to sell. If you’ve been holding off, take this as your sign. Don’t let “I wish I sold sooner” become part of your story.

As the year closes, what banks delay today will shape the market tomorrow.

Every December, real estate slows—but not because the distressed market disappears. In 2025, the nation enters the winter season with a significant stockpile of REOs and delinquent assets that remain unseen by most buyers. This “winter shadow inventory” represents properties already in the hands of lenders or servicers but intentionally withheld until the new year.

To the general public, December appears calm: fewer listings, softer marketing, and reduced competition. To industry insiders, the quiet is misleading. Banks and institutional holders often pause dispositions during the last quarter, creating a silent buildup that re-emerges in Q1.

Understanding this December freeze—and what sits behind it—is key for investors preparing for early 2026 opportunities.

Shadow inventory in winter isn’t accidental. It’s tactical. Banks, GSEs, and private funds delay REO releases in December for three primary reasons:

Many institutions avoid posting losses in Q4. Pushing REO sales into January allows them to enter the next year with cleaner books and more favorable optics.

Buyer activity drops in December, reducing competition and pricing. Servicers prefer listing during stronger cycles—January through June—when absorption rates spike.

Evictions, title cures, winterization, and occupancy checks often pause during holiday staffing reductions. Servicers simply don’t move inventory when critical vendors are offline.

The result? A backlog that quietly grows while public MLS numbers appear flat.

Shadow inventory doesn’t sit in one place—it moves through stages. Professionals who understand these stages can spot off-market assets months before they appear.

• Completed foreclosures waiting for first-quarter release

Trustee sales that closed in September–November often have 60–120 days of processing time. Many will be January listings.

• Occupied (but foreclosed) properties in eviction hold

Holiday eviction moratoriums extend timelines, keeping assets off-market through December.

• Servicer-managed homes pending title fixes

Lien clearance, boundary surveys, and insurance claims slow dramatically during winter months.

When these signals combine, December becomes the high-water mark of unseen supply.

Large private-equity REO holders treat December as a restructuring month. Instead of public listings, they engage in:

Bulk off-market sales

Silent JV restructures

Packaging of aging assets for Q1 liquidation

Re-evaluating non-performing loan pools

These activities rarely touch the MLS. Instead, they move through private brokers, asset managers, and specialty funds.

For brokers and small investors who establish relationships now, December can unlock first access to Q1 dispositions.

Shadow inventory requires reading clues—not listings. Professionals look at:

1. Foreclosure Completion vs. MLS Ratio

If county data shows surged foreclosure completions but inventory remains flat, the gap is hidden supply.

Fannie Mae, HUD, and major servicers release year-end summaries that reveal backlog volumes significantly larger than public listings.

3. On-the-ground indicators

fresh tarp or winterization tags maintained lawns or snow removal at vacant homes newly posted “no trespassing—under property preservation” signs boarded windows with updated notices

These are signs of REOs held for future release.

Field intel remains one of December’s strongest advantages.

Government Reporting Lag: Winter Makes It Worse

Federal disclosures run slow year-round, but holiday backlogs worsen delays.

HUD, GSEs, and county offices often post data 60–120 days behind reality.

That lag means December is the least accurate month for understanding real-time distressed supply.

Professionals who track:

county transfers to asset managers

trustee deed recordings servicer assignment changes

can project the coming wave long before January releases hit the MLS.

Turning December Insight Into January Advantage

December is preparation season. The investors and brokers who act now secure greater leverage when the Q1 market opens.

Ways to capitalize:

Submit pre-market offers to servicers for unlisted REOs nearing disposition. Position yourself as a January release partner—servicers look for fast, compliant local teams.

Build relationships with preservation vendors who see properties before anyone else.

Monitor bulk-sales chatter among funds preparing for year-end balance adjustments.

Prepare capital, contractors, and title partners to demonstrate readiness.

Banks don’t want secrecy—they want efficiency. If you bring solutions in December, you become the first call in January.

The winter slowdown hides—not removes—distressed supply. Foreclosure completions rising while MLS stays flat signals build-up. Late-year accounting strategies delay REO releases into Q1.

Institutional investors quietly reposition portfolios off-market. Field observations matter more when listings freeze.

Conclusion: December’s Stillness Is an Illusion

The calm of December isn’t the market cooling—it’s the market preparing. Shadow inventory grows most during the months when the public thinks nothing is happening.

The professionals who use December to analyze, anticipate, and align will lead the first quarter of 2026.

In real estate, the advantage is rarely in what’s listed. It’s in what’s coming.

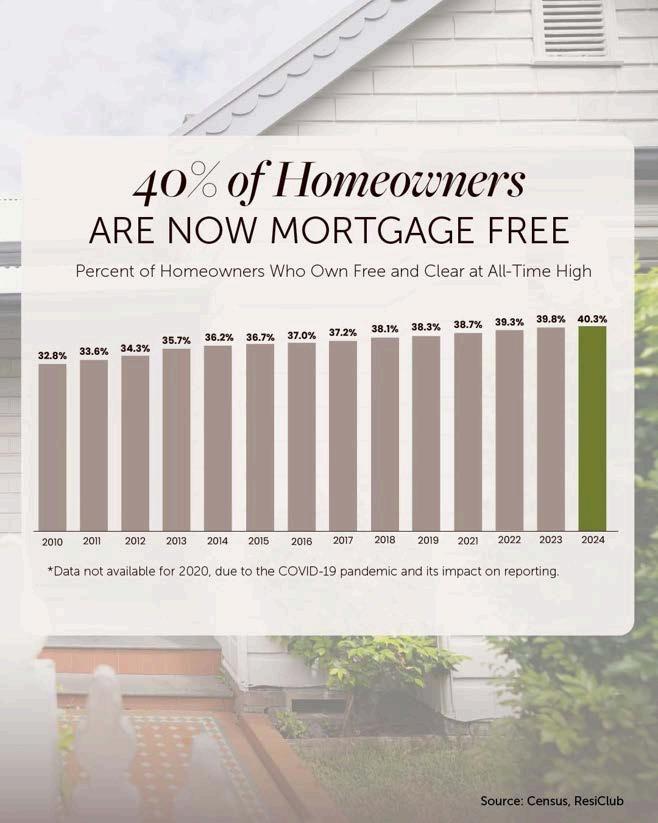

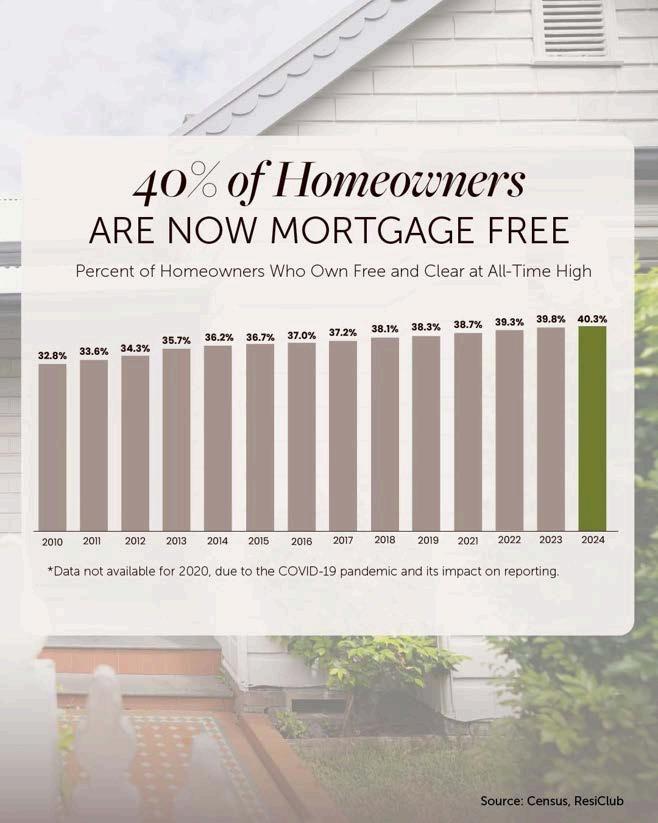

Did you know? A record 40% of U.S. homeowners now own their homes free and clear. That’s the highest share ever recorded.

And that’s an important stat if you’re considering downsizing.

Think about it. If you’ve been in your house for a long time, you may be able to sell and buy your next home in cash.

You could get a smaller, less expensive home that better fits your lifestyle today with lower bills, less upkeep, and no new mortgage in retirement.

Want to find out if this could be a possibility for you too? Contact me

If your home isn’t attracting the kind of offers you want -or any offers at allit may be time to reconsider your asking price.

If your house isn’t selling, it may be your price.

The #1 reason homes aren't bringing in offers today is because they’re priced too high for the current market, and that’s turning off buyers. But here’s the good news: you probably don’t need a big price cut to get results. Data shows the typical price reduction right now is only about 4%. And that small shift in your pricing strategy can make a real difference.

If you’re ready for something to change, you have to be willing to make a change. Ask your agent how much they recommend based on what’s selling in your neighborhood right now.

NADP Membership Chair 2025, Board Member 2017-2024

REOMAC Foundation Past President 2020-2021

AgentBio

7 27-580-6275

ssee@resultsreo.com www.ResultsREO.com

Stephanie D. See is the President and Co-Owner of Results Real Estate, Inc., a boutique brokerage in Largo, Florida. With over 20 years of experience and a broker’s license since 2013, she and her husband, John B. See, have closed more than 5,000 transactions across the Tampa Bay area. Stephanie is known for her integrity, attention to detail, and expertise in residential and REO markets. A dedicated industry leader, Stephanie has served on the Board of Directors for the National Association of Default Professionals (NADP) for eight years. She is committed to raising professional standards through education, mentorship, and collaboration. Under her leadership, Results Real Estate continues to deliver client-focused service in a wide range of market conditions.

With over 19 years as a licensed Realtor® and a lifetime of experience in property valuation and REO operations, Robyn Moody is one of Utah's most accomplished real estate professionals in the foreclosure and default services space. She began her career in 1998 working for a national Broker Price Opinion (BPO) outsourcing company, where she assigned property valuations, quality-checked reports, and developed critical relationships with agents and lenders across the U.S.

Her path into sales began when she joined a top-performing local REO agent who recognized her eye for valuation detail, commitment to accuracy, and exceptional organizational skills. After several years of managing and selling REO assets as a licensed assistant, Robyn earned the opportunity to acquire and lead the business herself—rebranding and growing it into what is now Salt Lake REO.

Lisa

https://www.linkedin.com/in/tomlazzaro/

Full-time professional Realtor for over 25 years. Proud member and former Master Broker of the NRBA (National REO Brokers Association). Also Member of ROBroker.com. Special focus on business development, REO/foreclosures. Sold bank-owned properties for over 20 years and have taught our unique local foreclosure process to others for longer than that. I am one of two top REO brokers in my region, based on volume and reputation. I am happy to provide as many current references as needed.

Berkshire Hathaway HomeServices Results Realty

AgentBio

2590 S BUMBY AVE. ORLANDO FL 32806

(407) 203-0007

joe@joedoher.com https://joedoher.com/

With 18+ years of REO experience, 7,500+ closed assets, and a CFK Success Rate of 97%, Joe Doher puts mortgage servicers and investors at ease knowing they have someone who is reliable, proactive, and will effectively manage every step of the process to ensure the maximum net recapture.

Joe Doher – Broker-Owner Berkshire Hathaway HomeServices Results Realty Orlando, Florida As someone who has lived and breathed real estate since childhood, it’s safe to say that it’s in my DNA. Growing up with a successful Canadian real estate broker like my father, I absorbed the industry’s nuances early on. In 1993, at the age of twenty-two, I officially entered the real estate business, and I’ve been fully immersed in the Orlando, Florida, real estate market ever since.

(504) 321-1511

Justin.Potier@Vylla.com https://www.vyllahome.com/

Dynamic and results-driven Real Estate Broker with extensive experience as an Area Vice President at Vylla Home, spearheading growth and delivering on the company's mission. Adept at empowering agents and transforming the real estate process. Specializing in institutional asset sales, risk mitigation, talent acquisition/retention, and marketing, with a strong background in leadership and growth-oriented roles within both for-profit and non-profit corporations. AgentBio