EXECUTIVE SUMMARY

Cheney Park Commons (CPC), located in Cheney, WA. The home of the Eastern Washington University. CPC is a mul -family, industrial style apartment campus that sits 2.55 acres, divided into 2 parcels. Four buildings, numbered A-D make up a total of 90 units. At this me 63 units are under lease. And 27 units are in the lease up phase for buildings C and D, which began in April 2023.

Cheney Park Commons

ASSET PROFILE

YEAR BUILT: 3 Phases 2019-2023

LOT SIZE: 2.55 Acres +/-

BUILDING STORIES: 3

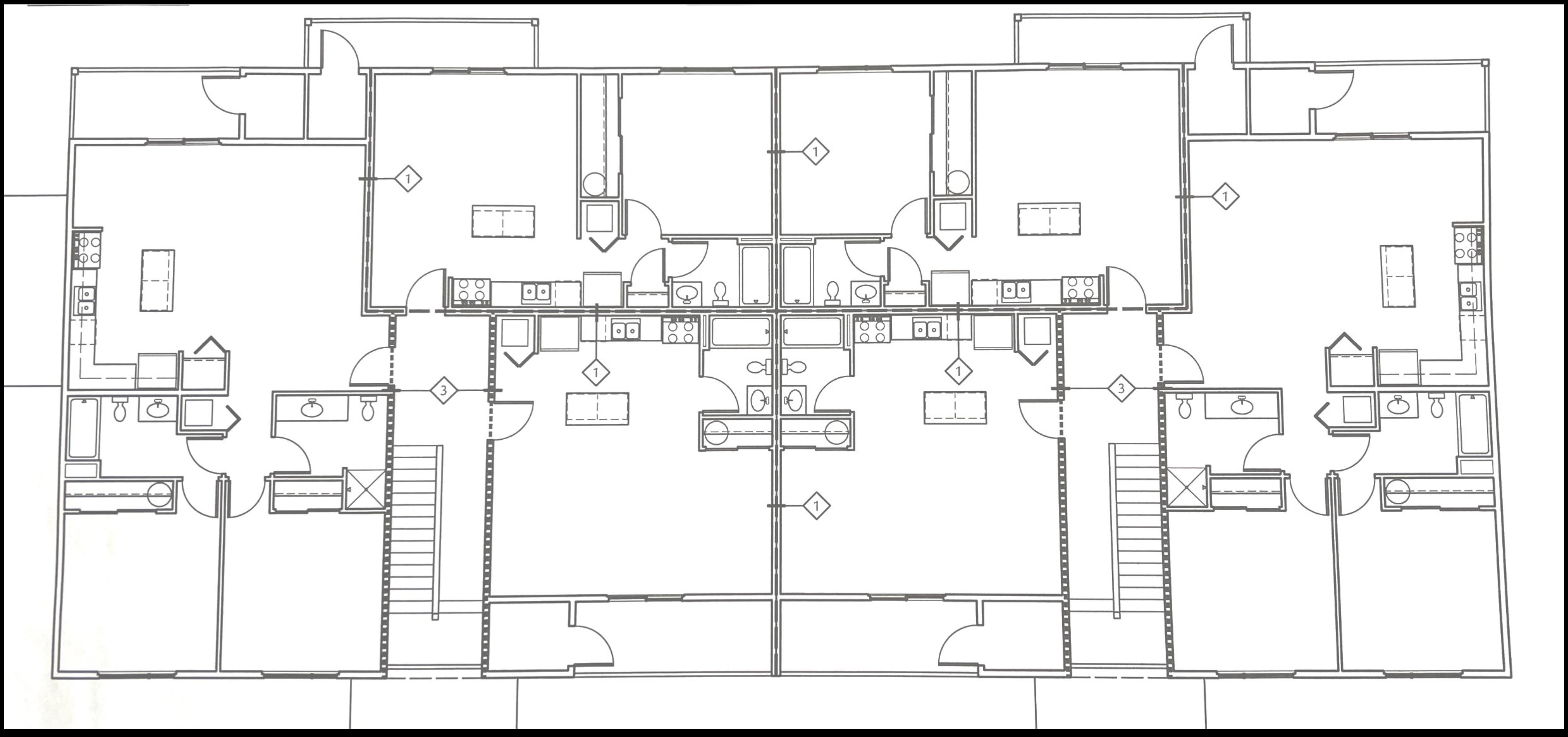

TOTAL UNITS: 90 30- Studio 30- 1 Bedroom 30- 2 Bedroom

BUILDING SPECS

Building A– 32,000 SqFt

36 Units

Building B– 7,635 SqFt

9 Units

Building C– 22,602 SqFt

27 Units

Building D– 15,120 SqFt

18 Units

· Salnave Park

· Salnave Elementary

· Exxon

· County Fire Sta on

· Mitchell’s Harvest Foods

·

Photo Gallery– Building A

Photo Gallery– Building A

Photo Gallery– Building C & D

Construc on photos taken on September 16, 2022.

Photo Gallery– Building C & D

Construc on photos taken on September 16, 2022.

Photo Gallery– Buildings B, C, & D

Photo Gallery– Buildings B, C, & D

Who Is Equilus Capital Partners?

Equilus Capital Partners, LLC is a wealth management company. We believe that the true essence of wealth is in crea ng income streams and minimizing taxes. Over the years, we have observed that investor por olios that had real estate outperformed those that didn’t by up to 30%. Equilus Capital Partners was formed out of the convic on that real estate is a key component to growing and protec ng investor wealth. We acquire income-producing commercial real estate and make it available for a frac on of the investment to qualified investors.

We sponsor Fund Offerings that include both short-term and long-term investment opportuni es in commercial real estate. This is in addi on to the sponsorship of our own Delaware Statutory Trust. Our targeted annual rate of return is five to six percent for our investors. Our investment proper es are sourced from commercial real estate sectors. Each property of interest is thoroughly ve ed prior to the acquisi on. The proper es in our funds are professionally managed and maintained to s mulate the appreciated value for the benefit of our investors.

Where Do We Invest?

Our management team sources investment opportuni es through income-producing proper es and joint-ventures with real estate developers to create a robust and diverse por olio. We choose from proper es such as:

· Mul -family rental units, planned unit developments, condominiums and townhouses

· Vaca on rentals, including hotels, condominiums and recrea onal facili es

· Commercial developments, including office, professional, medical and retail

Who Owns the Assets?

The real estate underlying assets are owned en rely by the investment membership base. In other words, members own por ons of the proper es rela ve to their investment. Income generated by the property is issued in quarterly dividends. Tax deduc ons from expenses and other tax benefits are also passed through to the members.

Intended for accredited investors only. Past performance is no guarantee of future results. The data in this flyer may be subject to change. Interested buyers or investors should further evaluate to determine the actual poten al.