Equal

OFFICIAL PUBLICATION OF THE MINNESOTA ASSOCIATION OF ASSESSING OFFICERS MNMAAO.ORG FALL 2022 VOLUME 44 NUMBER 169

Eyes Global Assessment - Iceland

2 FALL 2022 / Equal Eyes MAAO LEADERSHIP EDITORIAL COMMITTEE INDEX Lori Thingvold, SAMA Wright County Managing Editor Jason Jorgensen, SAMA Mille Lacs County Associate Editor Committee Chair Jamie Freeman, SAMA Hubbard County Amber Swenson- Hill, SAMA Polk County Jake Pidde, SAMA Stearns County Nancy Gunderson SAMA Clay County President’s Perspective Commissioner’s Comments MAAP Update Classifieds Top 10 What You Get For Out of the Past Transitions Tax Court SBA Minutes 5 6 8 11 16 30 31 32 35 44 Vision Government Solutions has maintained a reputation as an innovative provider of CAMA software and services for Assessing Departments since 1975. Vision North Star CAMA is specifically designed for Minnesota and integrates with any Tax System, providing you with the flexibility to choose a combination of best in class solutions for your community.

*

of the Minnesota Association of

Officers.

Executive Officers

President Patrick Chapman, SAMA

1st Vice President Tim Bulger, SAMA

2nd Vice President Mark Peterson, SAMA

Financial Officer Chase Peloquin, SAMA

Past President Patrick Chapman, SAMA

Regional Directors

Region 1 Ryan DeCook, SAMA

Region 2 Jennifer Flicek, SAMA

Region 3 Tina Diedrich-VonEschen, SAMA

Region 4 Amber Peratalo, SAMA

Region 5 David Parsons, SAMA

Region 6 Doug Bruns, SAMA

Region 7 Kevin Scheidecker, SAMA

Region 8 Jill Murray, SAMA

Region 9 Joshua Hoogland, SAMA

Committee Chairs

Agricultural Mark Koehn, CMA

GIS Randy Lahr, SAMA

Conference Content Jean Popp, SAMA

Editorial Jason Jorgensen, SAMA

Information Systems Michael Neimeyer, CMA

Legislative Mark Peterson, SAMA

Nominating/Research/Planning Lena Schaefer, CMA

Residential John Conway, SAMA

Rules and Resolutions Mark Peterson, SAMA

Sales Ratio Ashley Gunderson, SAMA

Scholarship Erin Kastner, AMA

Secretary Penny Vikre, SAMA

Site Selection Lisa Thompson-Clarke, CMA

Strategic Planning Patrick Chapman, SAMA

Tax Court / Valuations Brett Hall/Ann Miller, SAMA

Treasurer Reed Heidelberger, SAMA

U40/10 Troy Halter, CMA

Educational Workgroups

Designation Committee

Patrick Chapman, SAMA

Conference Content Jean Popp, SAMA

Curriculum & Assessor Standards Jessi Glancey, SAMA/Ben Bedard, AMA

Steering Committee Mike Wacker, SAMA

FALL 2022 / Equal Eyes 3

The statements made or opinions expressed by authors in Equal Eyes do not necessarily represent a policy position

Assessing

nothing fishy about these worms 14 global assessment: iceland 25

4 FALL 2022 / Equal Eyes Announcing The Equal Eyes Photo Contest “Minnesota Ice” Deadline to enter: December 1st, 2022 email your original, high resolution photo to: editor@mnmaao.org 1st Place $100 2nd Place $75 3rd Place $50 winners announced in the winter issue

president’s perspective

Patrick Chapman, SAMA Ramsey County MAAO President

Keep trying. Stay Humble. Trust your instincts. Most Importantly act. When you come to a fork in the road, take it. – Yogi Berra.

Thank you all!

I wanted to thank you all for supporting me during my time as your president. What a great couple of years it has been. Together we have covered a lot of ground. We went from all in person to all virtual and back. As an organization we thrived during this time. A lot of you did some wonderful work to keep this going I will list a few of you but there are too many to mention you all.

First off: Mike Neimeyer, Amanda Dutcher, Jean Popp, Dawn Klein, and Paul Knutson. Way to keep our conferences going and bring them back to in person. Great work on keeping the cases interesting and even in a virtual environment kept thi ngs running.

I would like to say thank to my support team including Kyle Holmes, Daryl Moeller, and Mark Peterson. Thank you for all the insight and help during the most difficult of times in and out of the pandemic.

Those of you that know MAAO know that the person who really runs it (much like that Cass County Assessor’s office) is Penny Vikre. I could have not done this last two years without you. The support and guidance to keep us in line and moving have just been outstanding. Thank you so much.

I leave knowing that we have a talented team with Tim Bulger, Mark Peterson, and Alex Guggenberger in place a great group of people to keep MAAO going. Support them like you supported me.

The members of MAAO thank you all. I have never felt so humbled as I did at fall conference this year. Your support has made me so glad that I am a part of this organization. Stick together and we can accomplish anything.

Lastly, I would like to thank my wife, Lena Chapman, for being my champion and rock through all of this over the last two years. I really could not have done this without you.

Have a great fall and winter and I will see you all around the MAAO campfire somewhere, sometime.

Patrick Chapman, SAMA Past Past President

FALL 2022 / Equal Eyes 5

Commissioner’s Comments

By Lee Ho Deputy MN Revenue Commissioner

Committ ing to Engagement Amid Change

Lee Ho, Deputy Commissioner of Revenue

Anyone who works with property taxes understands that change is one of life’s few constants. At the Department of Revenue, our work stays interesting thanks to state and federal law changes, leadership transitions, and advancing technology not to mention Minnesota’s evolving economy, population, and workforce.

Today I want to discuss some recent changes at Revenue Former commissioner Robert Doty left the department in September to become CFO and vice president of infrastructure at the Science Museum of Minnesota. I will serve as temporary commissioner until a successor is named.

The department, our partners and the rest of Minnesota navigated through some uniquely challenging times due largely to the COVID 19 pandemic during Robert’s two years as commissioner.

Revenue played a key role in distributing COVID 19 aid and providing tax relief for Minnesotans and our state’s businesses, cities, and counties. These measures included American Rescue Plan Act (ARPA) funds, COVID 19 business relief payments and Tribal Relations Grants, and Frontline Worker Payments.

We will miss Robert and his boundless energy for public engagement with all our customers, even as we benefit from the team that he assembled to strengthen this aspect of our public role.

One example: Earlier this year, we created a new Office of Public Engagement, led by Public Engagement Director Audel Shokohzadeh You may have met Audel during his presentation at the MAAO Fall Conference. His office will build on relationships with partners like MAAO while also engaging with community leaders and underrepresented populations to promote equity in the state tax code . This effort:

• Helps us listen, learn, and respond to concerns or questions from communities affected by but rarely engaged around state tax policies.

• Ensures equity is part of the conversation when policymakers look at new and existing tax laws, policies, and proposals.

• Complements our existing outreach and education efforts for taxpayers, communities, MAAO, and other partners.

As Audel mentioned in his session, engagement goes well beyond only gathering and sharing information. It requires each of us to collaborate with partners and communities to set common goals, then work together to create and implement solutions that meet those goals in ways that benefit everyone.

If that seems like an ambitious journey, know that it can begin with a simple step. Spend a few minutes answering these questions: Who is most impacted by tax policies ? What people or groups have

6 FALL 2022 / Equal Eyes

commissioner’s comments, continued

In fact, Audel asked people at his conference session to do just that, and your responses will help as he builds out Revenue’s public engagement plan. Even if you did not attend the conference, I encourage you to do this little exercise it cannot help but broaden your view of the people and communities you serve.

Thoughtful engagement means more people can have a voice in discussions on tax policies that impact them. Their input will help policymakers improve our tax laws, policies , and procedures to better serve all Minnesotans.

This type of public service is an essential part of Revenue’s mission: Working together to fund the future for all of Minnesota. We take the “together” piece of that mission seriously and, as partners, we rely on your work, ideas, and feedback.

As the department prepares for the 2023 legislative session, we appreciate how MAAO, its members, and other local officials support and improve our state property tax system . We look forward to working with you on our common issues and ways to ensure consistent property assessments across our state.

On behalf of everyone at Revenue, thank you for your partnership.

Lee Ho is deputy commissioner of the Minnesota Department of Revenue.

FALL 2022 / Equal Eyes 7

Learn about IAAO IAAO NEWS

2022 MAAP Summer Conference

Written by J Jenna Takemoto W Washington County MAAP President 2020 2026

Written by J Jenna Takemoto W Washington County MAAP President 2020 2026

The annual Summer Conference was held on August 18th 19th, 2022 at Courtyard by Marriott Hotel & Event Center in Mankato, MN. We went back to our traditional ways as an in person Conference.

Topics covered this year:

• DOR Updates/Hot Topics Updates on how the 2022 legislative session went, update on the changes that could be reintroduced in 2023, DOR staff updates, and an update on projects/policies DOR is working on.

• Legal Descriptions

Presented by Josh Schoen, Rice County This presentation is designed to help better understand legal descriptions. The discussion will include aliquot portions of a section, metes and bounds, platted lots, assumed bearings vs. county coordinate systems, strip descriptions, exceptions, area descriptions, riparian lots, Torrens vs. Abstract, and more.

• Assessing the Person This course includes a variety of topics related to personal data used by assessors’ offices when administering programs, homesteads, and classifications. The learner will have the opportunity to work through real life scenarios related to these classifications and programs. This course covers topics including:

o Class 1b Residential Blind/Disabled Homestead

o The Homestead Exclusion for Veteran's with a Disability program

o Data Privacy

• Homesteads Hot topics

o Duplicate homestead process reporting, what we use it for and why, how counties should be using the information and what they should be doing with the information.

o SSN vs ITIN

o Multiple owners application requirements, fractional homestead administration

o Exclusion calculation

o PTR & special PTR

o Tax shift related to values increasing/decreasing

• eCRV Presented by Annie Brooks This session will include an overview of what sales verification is, who does it, and why it’s important. We will also review the standards/expectations for sales verification.

• Online tools and Resources

This session will include a live tour of a variety of websites and online tools that are important to utilize for all property tax administrators. Websites that will be included are DOR property tax webpages, specific county websites that offer online homestead applications, MAAO’s website, Virtual Room, and much more. We will also have the group participate in this portion by sharing helpful resources they use in their daily jobs.

8 FALL 2022 / Equal Eyes

MAAP UPDATE, Continued

This year at the business meeting the Current Board Members presented new By Laws. Everyone who registered received both the old By Laws revamped in 2011 and the new By Laws revamped in 2022 in an email one week prior to the Conference for voting.

The new By Laws were passed by a majority vote with MAAP Members. Almost all terms went from 2 years to now a 4 year term. The new By Laws were proposed by MAAP Board Members from last years election. All these ladies worked very hard to ensure a more outl ine/routine to make the elections a better transition for upcoming future years. I can not say enough how thankful & blessed I am working with these ladies! They all have been working super hard for the past year!

New Officers were elected during the business meeting. Doris Huber was elected for 2022 term for Education Board Member at Large. Lynne Freezy was elected for 2022 term for Executive Board Member at Large. Next elections will be at the 2025 MAAP Summer Conference

Katie Koenings was elected as Directory last year. She will be transitioning to Secretary this year. In previous years, Secretary & Treasurer was one. It is now two separate titles, and the Directory is now non existent.

This year, we had David Parsons from City of Marshall, presenti ng the Partnership with MAAO. He did an outstanding job and MAAP members are very excited about this from the response we received from our Survey and Comment Cards that were turned into the Board & David at the end of Conference. We are super pumped to move forward on this!

We also want to give a huge THANK YOU to the DOR, Josh Schoen, Annie Brooks, & David Parsons!

Thank you, again, to MAAO for providing scholarships once again for our members to use towards the 2023 Summer Conference.

Thank you to MAAO for your continued support!

If anyone is interested in becoming a MAAP member, the annual membership fee is $25.00. Contact any MAAP Officer for more details.

FALL 2022 / Equal Eyes 9

MAAP UPDATE, Continued

MAAP Officers

Jenna Takemo to M Michelle Eason

President 2020 2026

Vice President 2021 2026

Washington County City of Maple Grove 651 430 6091 763 494 6250 Jenna.takemoto@co.washington.mn.us meason@maplegrovemn.gov

Angie Mann Katie Koenings

Treasurer 2021 2025 Secretary 2022 2026

Dakota County Kanabec County 651-438-4202 320-679-6420 Angela.mann@co.dakota.mn.us Katie.koenings@co.kanabec.mn.us

Lacy Standke Doris Huber

Education Board Member at Large Education Board Member at Large 2018-2026 2022-2026

Steele County City of Marshall 507 444 7438 507 537 6771 Lacy.standke@co.steele.mn.us Doris.huber@ci.marshall.mn.us

Lynne Freezy Sue Feldewerd

Executive Board Member at Large 2022 2026

Communicator Editor 2021 2025

Stearns County 651 275 8640 320 656 3693 lynne.freezy@co.washington.mn.us Susan.feldewerd@co.stearns.mn.us

Washington County

Marti Sip

Joanne Corrow

Historian Norman County

Conference Coordinator 2021 2025

Le Sueur County 218-784-5487 507-357-8213 Marti.sip@co.norman.mn.us jcorrow@co.le sueur.mn.us

10 FALL 2022 / Equal Eyes

Classifieds

Town

Amber Swenson-Hill, SAMA Polk County Editorial Committee Member

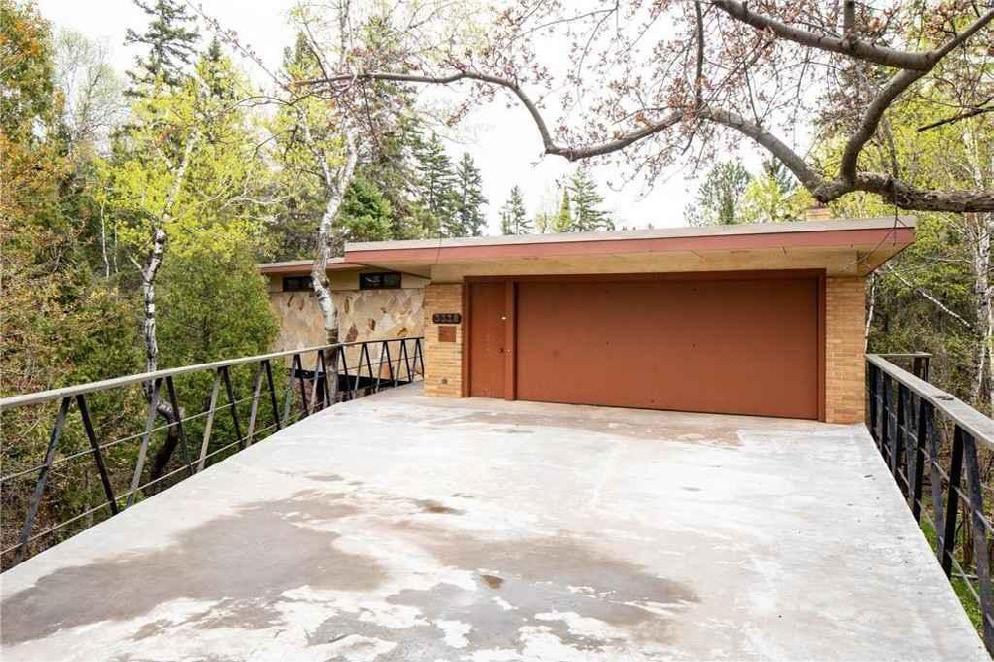

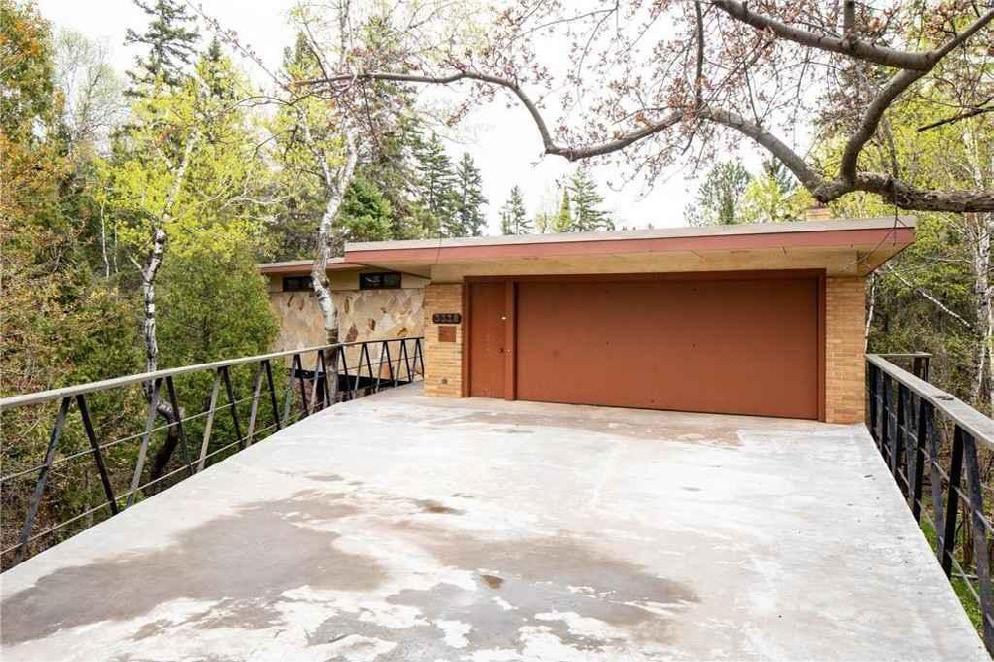

SUPERIOR ST, DULUTH

mid century modern home, known as the Erickson House, is built on top of a steel bridge spanning a creek that flows through the Congdon Estate to Lake Superior. Constructed in 1959 of steel, concrete, and slate this property is a step back in time. The forest views are breath taking through the wall of windows and below the garage create your own spa complete with already built pool and shower room.

FALL 2022 / Equal Eyes 11

Small

3 Bedroom 1 Full Bath 2 Half Bathrooms 2021 EMV: $368,300 2022 Taxes: $6,012 This

3328 E

$750,000

12 FALL 2022 / Equal Eyes Assessor Word Find Build your own custom worksheet at education.com/worksheet-generator © 2007 - 2022 Education.com Region4 QTSREPLHKHIZOVY FCHITASCAOGGLYV KAXTIIZIOCVBAEJ USUQXEDHPUCRRIQ GSNJLIYDHKSVDEK SPKOOCHICHINGTV BREHZDCARLTONKF ECOMPCFEBHJQSQN MIRYWIFUNAPSOZK SVVOSAINTLOUISO BGOUWPSCIMDVNHH UHGREWNCCJLCELJ BMOXOVIWOENBWAD JAITKINNFOLJGKR GAHTBAWCGAKSCEM KoochichingCrowWingSaintLouisCass AitkinItascaCookLake Carlton ®

Nothing Fishy About These Worms

Submitted by Mark Koehn, CMA Retired Senior Agricultural Appraiser - Stearns County

Submitted by Mark Koehn, CMA Retired Senior Agricultural Appraiser - Stearns County

Nothing Fishy About These Worms, continued

Since

Minnesota is know as the land of 10,000 lakes, we typically think of worms as bait. Not so in the small central Minnesota town of Brooten, the home of the Brut Worm Farms.

The owners, Mike and Karen Larson, started the Brut Worm Farms after retiring from their metro business. They were exploring other business opportunities.

They were intrigued by worm farming, and their next adventure began in 2018. They acquired a vacant light commercial property in the Brooten Industrial Park.

Brut Worm Farms has millions of worms which are used to produce worm castings. Worms consume and digest organic matter in the soil. Their waste is called castings. These castings are used as a soil amendment. The castings have minimal fertilizer value but add significant healthy microbes to soil, much like a probiotic for your garden. Healthy soil produces bigger, better, healthier vegetables and flowers.

the soil by adding worm castings.

The worms used by the Brut Worm Farms are African Night Crawlers. They are about 2/3 the size of the Canadian Night crawlers which are sold as fishing bait. These African Night crawlers are better suited for worm casting production in Minnesota. The Brut Worm Farms does not sell bait.

harvesting machine, called a trommel, is much like a traditional rotary combine. The material is dumped into a hopper and goes through a large rotary drum where separation occurs. The castings are harvested, and the worms are once again added to a tote with new peat soil and nutrients. This vermicomposting process is repeated every 2 weeks. The worm room temperature needs to be between 70 and 85 degrees.

For ages, people have noticed that healthy soil has lots of worms. Soil scientists, farmers, and gardeners have looked for ways to improve soil health, by increasing the number of worms within the soil. The more organic matter within soil, the higher the worm population and the higher the productivity of the soil. A gardener could just add large amounts of worms to improve soil health, but our cold climate makes that challenging. A great alternative is to amend

The worms are raised in metal tote box-like containers. The totes are about 3 feet wide, 4 feet long, and 1 foot deep. The medium is locally mined Reed Sedge peat soil. This peat soil is harvested in winter and is unique as it is typically under water and has a 50%-75% level of organic matter. As point of reference most farm fields have organic matter from 1%-4%. This peat is very wet and needs to be dried down to a manageable level. The peat is stored in hooptype buildings where the excess water drains out. Each tote contains peat soil, a ground organic grain product, and minerals along with the worms. Each tote contains about 15 pounds or about 6,500 worms. These totes are harvested every 2 weeks. Harvesting separates the worms from the castings. The

The night crawlers are asexual meaning they reproduce themselves. Worms have a tan collar called a clitellum, which is shed and

14 FALL 2022 / Equal Eyes

Nothing Fishy About These Worms, continued

contains the eggs. These eggs hatch and are raised in separate totes and added as needed to maintain the population.

The castings are put into large plastic bags holding 200 pounds. These large bags are shipped to a local company to be bagged. That operation is highly mechanized and can bag the castings more cost effectively. The Brut Worm Farms operation employs 2 full time workers and a half-time seasonal worker in addition to the owners. Their primary product is worm castings, but they also sell some pre-mixed potting soil. They are developing a liquid product called worm

tea, which is brewed from castings.

Their products can be purchased directly, but nearly all their production is sold online through Amazon. They are the often the number 1 or 2 worm casting company on Amazon. The product is sold in several sizes for about $32 for a 30-pound bag, including shipping.

Their peak season runs from November through May, but production is year round. Labor, heat, and shipping are their largest expenses. The business has experienced steady growth and the future looks promising. The increased interest in growing your own healthy food has increased during and postCovid. Marketing through Amazon has increased and streamlined the operation.

Check out their products at brutwormfarms. com. A fascinating business, a great product, produced by great people, in greater Minnesota.

Who would have thought that in Minnesota worms would be used for something other than fishing?

FALL 2022 / Equal Eyes 15

THE TOP 10

Top 10

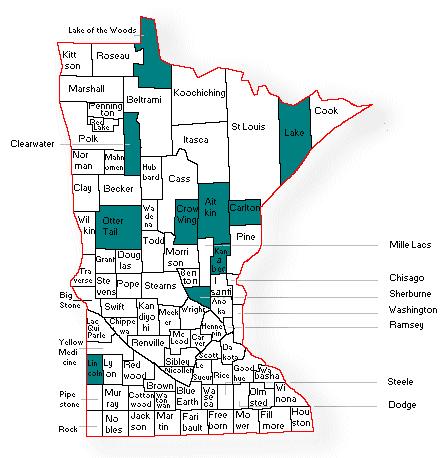

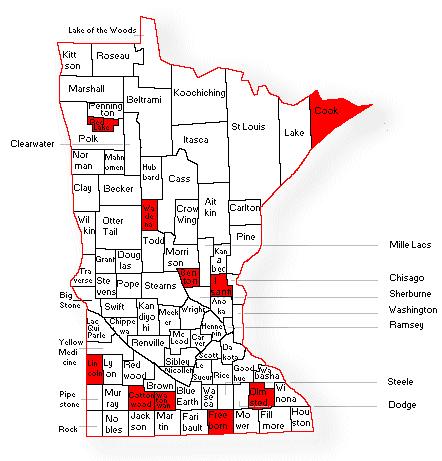

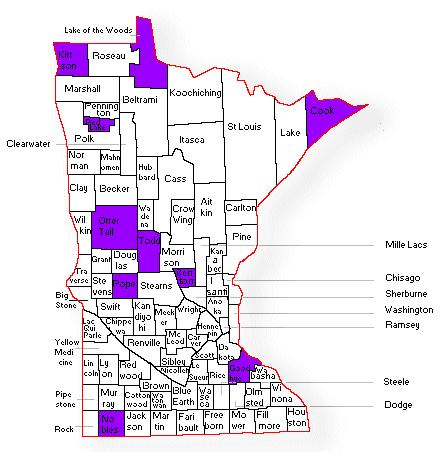

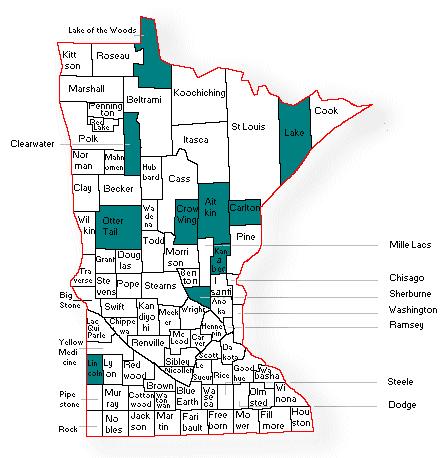

2022 Estimated Market Value Percentage Change by County

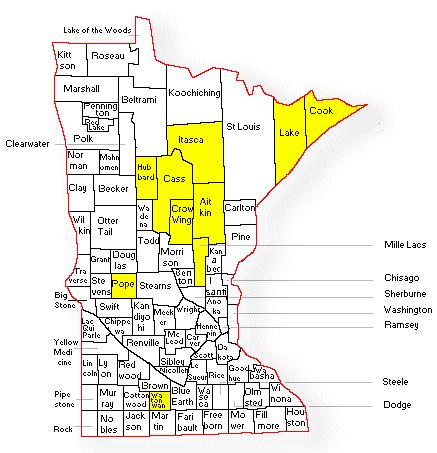

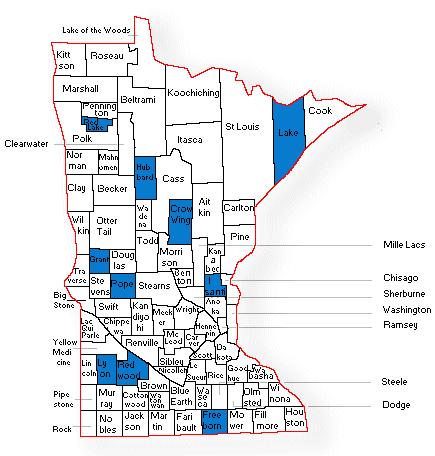

Mark Vagts, Property Tax Compliance Officer, recently provided the 2022 Percent Change map for all assessing offices and the Minnesota Department of Revenue staff.

The map can be a valuable resource as it provides a visual of percentage changes across the state from the 2021 assessment to the 2022 assessment.

Jamie Freeman, SAMA Hubbard County Editorial Committee Member

It is important to note that the data supporting the map has been aggregated to a county level and parcels with land types deemed impractical to separate may cause the aggregated values to be different than county assessment office calculations. Percentages may be different than county calculations due to classification changes, or other similar shifts from assessment 2021 to 2022.

The information provided within this map is for illustrative pur poses only. Please confirm data with respective county assessing offices before relying upon data in decision making.

The following is a list of the top 10 Minnesota counties with the highest percentage changes for each individual property type.

16 FALL 2022 / Equal Eyes

Lake of the Woods

Lincoln 40.4%

Sherburne 38.3%

Aitkin 29.5%

Kanabec 28.6%

Carlton 26.2%

Otter Tail 25.2%

Clearwater 24.7%

Lake 24.3%

Crow Wing 24.0%

Agricultural:

FALL 2022 / Equal Eyes 17 Top 10: 2022 Estimated Market Value Percentage Change By County, continued

1.

41.1% 2.

3.

4.

5.

6.

7.

8.

9.

10.

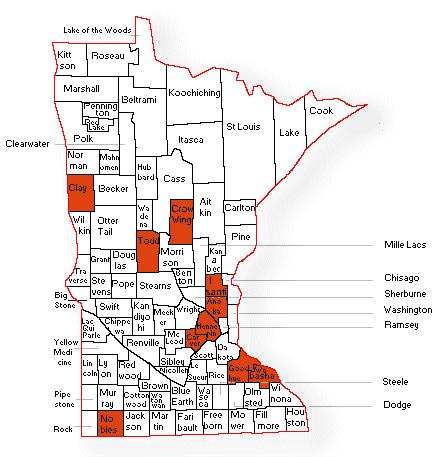

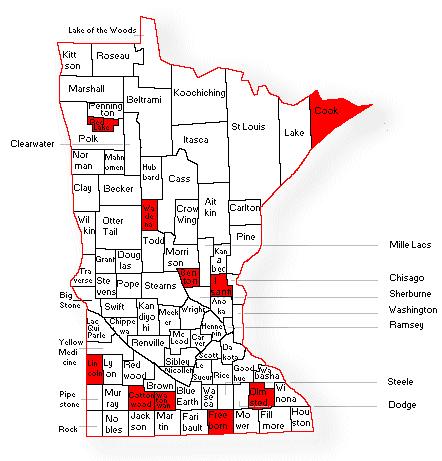

Lincoln 72.1%

Freeborn 34.0%

Watonwan 29.4%

Cook 29.3%

Red Lake 27.0%

Cottonwood 24.7%

Wadena 23.6%

Isanti 23.4%

Benton 21.7%

Olmsted 21.5%

Apartment:

18 FALL 2022 / Equal Eyes

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Top 10: 2022 Estimated Market Value Percentage Change By County, continued

Cook

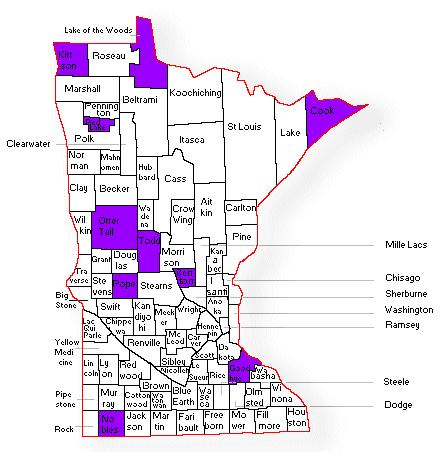

Kittson 29.8%

Todd 26.6%

Otter Tail 17.9%

Benton 17.6%

Pope 17.3%

Goodhue 16.2%

Red Lake 13.4%

Lake of the Woods 13.2%

Nobles

FALL 2022 / Equal Eyes 19 Commercial: 1.

54.0% 2.

3.

4.

5.

6.

7.

8.

9.

10.

12.8% Top 10: 2022 Estimated Market Value Percentage Change By County, continued

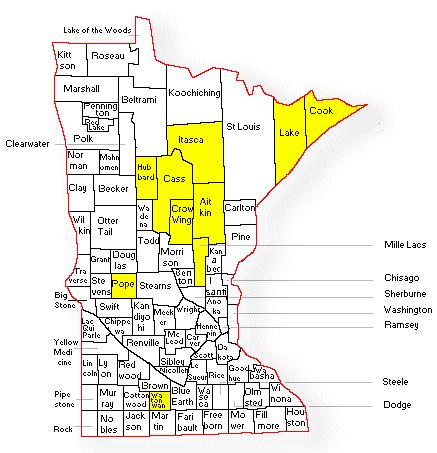

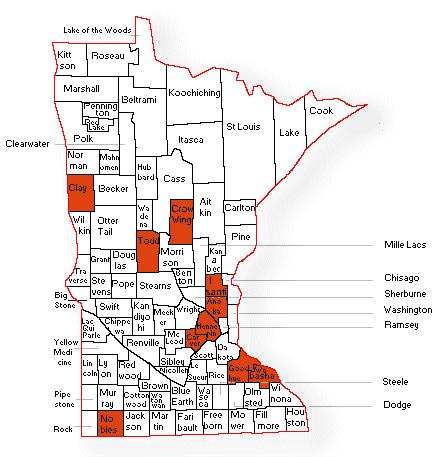

Todd 41.4%

Crow Wing 37.1%

Goodhue 27.3%

Carver 20.9%

Clay 20.8%

Isanti 17.5%

Anoka 16.7%

Hennepin 15.8%

Nobles 15.3%

Wabasha 15.2%

Industrial:

20 FALL 2022 / Equal Eyes

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Top 10: 2022 Estimated Market Value Percentage Change By County, continued

Pope 37.3%

Crow Wing 34.3%

Lake 33.7%

Watonwan 33.7%

Aitkin 31.7%

Itasca 31.4%

Mille Lacs 31.0%

Cass 29.8%

Hubbard 28.9%

Cook 28.4%

FALL 2022 / Equal Eyes 21 Residential: 1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Top 10: 2022 Estimated Market Value Percentage Change By County, continued

Rural Vacant Land:

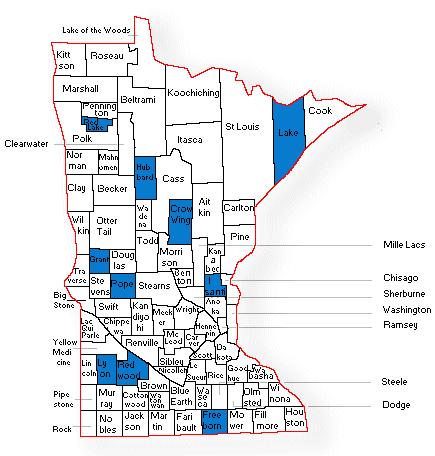

Wilkin 177.0%

Nicollet 48.2%

Red Lake 39.1%

Faribault 38.5%

Benton 37.7%

Waseca 37.6%

Pine 37.5%

Wabasha 34.7%

Aitkin 34.2%

Big Stone 33.1%

22 FALL 2022 / Equal Eyes

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Top 10: 2022 Estimated Market Value Percentage Change By County, continued

Wing

FALL 2022 / Equal Eyes 23 Seasonal Residential Recreational: 1. Redwood 72.8% 2. Red Lake 56.6% 3. Isanti 49.6% 4. Grant 39.9% 5. Freeborn 39.0% 6. Lyon 38.9% 7. Crow

34.4% 8. Pope 33.0% 9. Hubbard 32.4% 10. Lake 32.2% Top 10: 2022 Estimated Market Value Percentage Change By County, continued

24 FALL 2022 / Equal Eyes We’re Hiring! Earn $200.00 for qualifying Equal Eyes articles Email editor@mnmaao.org for details

By Jason Jorgensen, SAMA Mille Lacs County Assessor Equal Eyes Associate Editor

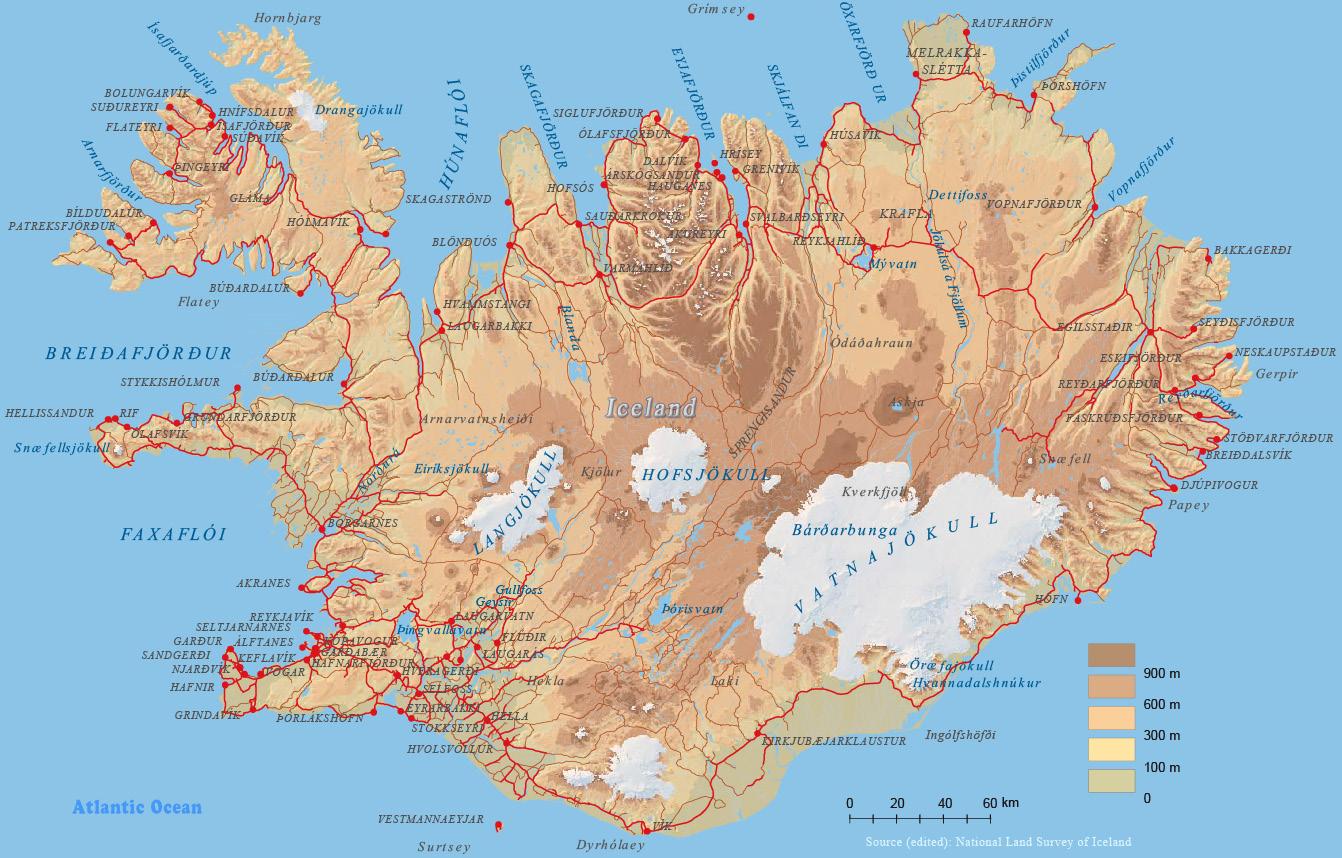

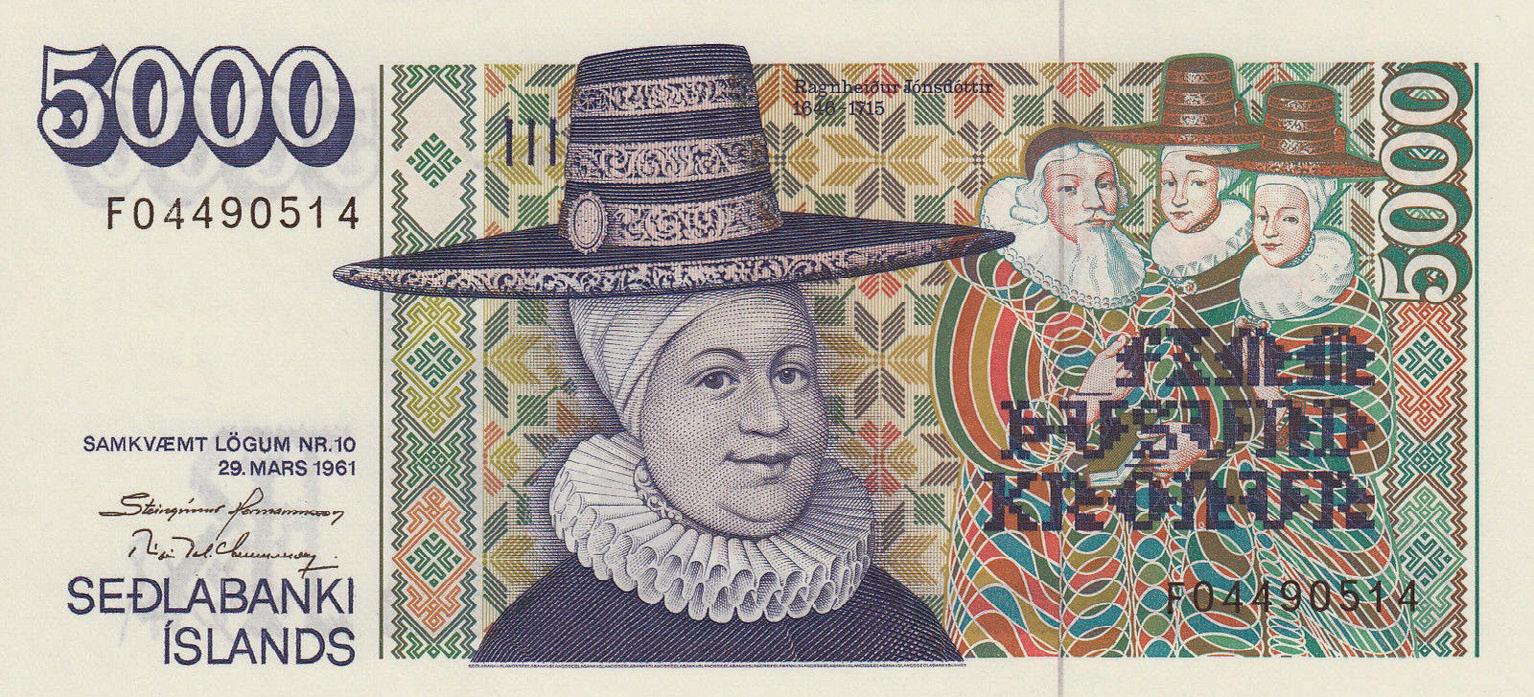

Global Assessment: Iceland

“petta reddast” - It will all work out okay

Introduction

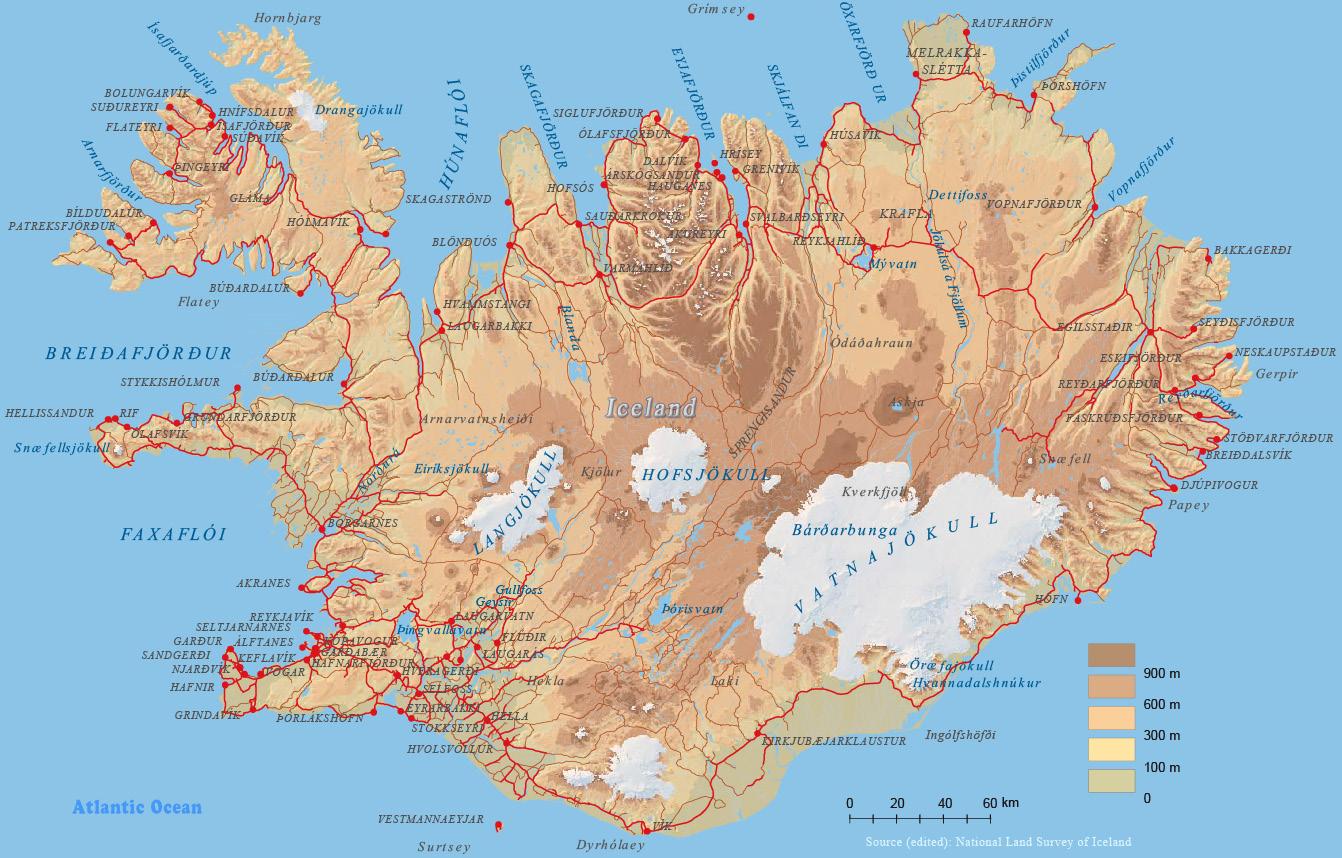

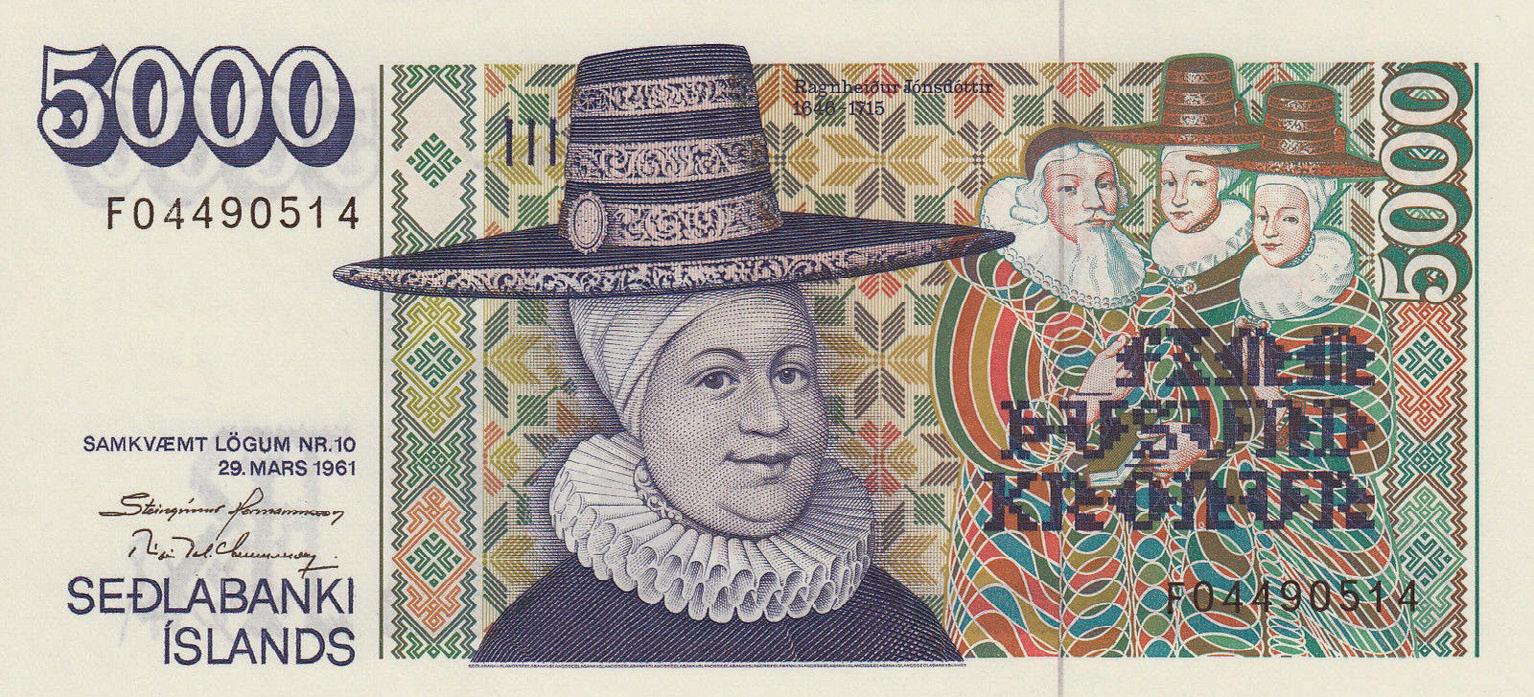

Sitting in the Middle of the North Atlantic Ocean between Greenland and Europe, is an active volcanic plateau that has pushed its way up out of the ocean creating the island of Iceland.

Population

Iceland has the smallest population in all of Europe. As of 2022, the population of this remote island reached an all-time high at approximately 376,248 people.

Which, according to current statistics, puts the island’sgrowth rate at around 1.65 percent.

Administrative divisions

Iceland was originally set up with administrative divisions called farthings in 965 A.D. by the cardinal’s orders. These farthings were then broken down further into 3-4 local assemblies. Currently Iceland is set up in eight regions which are used by the court for jurisdictional proceedings. These eight divisions are broken up further into 24

sheriffs which represent county operations.

Geography

Iceland is the second largest island in Europe and is approximately the size of Kentucky and Virginia combined, covering an area of 40,000 square miles. The island is one of the newest land masses on the planet and has 3088 miles of coastline. It sits on the largest geothermal volcanic fissure in the Mid-Atlantic ridge, where the American and Eurasian plates meet. Iceland has had several volcanic eruptions over the last twelve years.

26 FALL 2022 / Equal Eyes

Global Assessment - Iceland

Even though the island is highly volcanic, 11 percent of it is still covered in glaciers. Hvannadalshnjúkur is the country’s highest point and rises to a height of 6852 feet above sea level. Iceland has many characteristics of volcanic mountainous terrain such as deep fjords, glaciers, waterfalls, geysers, volcanoes, black sand beaches and steaming lava fields. Around 80 percent of the island is not inhabited by people due to the country’s rugged terrain. The capital city of Iceland is Reykjavík, and is located in the southwestern portion of the country with a population of 131,000.

Economy

Tourism is Iceland’s largest source of income, accounting for more than 33 percent of the country’s GDP. In recent years tourism has accounted for up to 42 percent of the country’s income. Tourism has recently surpassed the country’s once number one fishing market, as the most valuable income stream. The geothermal and hydroelectric

benefits of the island allow it to lead the world in electricity production per capita. Aluminum is another main economic factor for the Island. Smelting plants for aluminum have been set up in three main locations around the island and they produce over 850,000 metric tons of aluminum per year. The fisheries industry employs 9000 people and accounts for about 5 percent of the country’s workforce. Iceland’s fishing industry has moved into second place in the Northeast Atlantic region, only second to Norway. The waters around the island are lush with fish, providing an annual yield of 1.1 - 1.4 million tons of cod, blue whiting and other types of fish. Iceland’s GDP is expected to reach $24.1 billion by the end of 2022. Even through the hard times of the recent pandemic the country’s motto remained the same, “petta reddast” It will all work out okay.

Agriculture

Much of Iceland’s land is rendered

agriculturally unproductive, only about 1 percent of the land is actually used for growing crops. Within that, 99 percent of it is used for growing hay and other feeder crops. The other 1 percent is used to grow potatoes, turnips, and feeder plant roots. Cattle and sheep are grazed on the areas of the island where the soil allows plant growth. Some farmers have moved to poultry and pigs as a source of income. These types of products allow the island to be self-sufficient for meat and egg products.

Real estate

The real estate market on the island started to boom about 10 years ago, and it is still continuing. The market average has seen a 22.88 percent increase over the last year. These are the strongest increases since the third quarter of 2017. Homes outside the capital city almost tripled the year prior from 8.19 percent to 23.75 percent. The housing market there is similar to what we are seeing here in the states, there is a

FALL 2022 / Equal Eyes 27

Global Assessment - Iceland, continued

limited supply, and the prices are going up. According to the Housing and Construction Authority, apartments are also in very high demand, dropping from 900 units available to just over 70 units in just a short time frame. Since 2010 home prices have surged upward 154 percent, which is about 12.83 percent a year. The forecast is calling for continued double digit increases through the rest of this year. The median home value in the capital city is around $300,000. For an averaged sized home. Rental properties with 1-3 bedrooms, currently have a median rent of $825-$2480 per month.

72 percent of the population belong to the Evangelical Lutheran Church of Iceland. The median age in Iceland is 36.5 years of age, with a total life expectancy of 83.1 years of age.

Property Tax

Real estate taxes are levied at the municipal level. The tax is based on the assessed value of the property, these rates vary depending on which municipality the property is located. The maximum real estate tax rate is capped at 1.65 percent

Income Tax

Each municipality also levies their own taxes on income. The rate varies according to the municipality, with the average municipal income tax at 14.44 percent.

Capital Gains

Demographics

Since the records of population began officially in 1703, the population of Iceland has grown from 50,358 to 376,248 in January 2022. Approximately 86,000 of these are from foreign descent. The urban areas with greater than 200 people account for 99 percent of the population. The majority of the current population are descendants that came over from Norway, Ireland, and Scotland as slaves in the ninth century. Recent DNA testing shows that 66 percent of the males were from a Norse culture, while 60 percent the females were from a Celtic culture. From the 1870’s- 1914 a large number of Icelanders came to North America in search of a new life. Icelanders find themselves to be fairly religious, around

Gains that come from private real estate property sales, are considered as investment income, and taxed at a flat rate of 22 percent. If the property that was sold was business property, then the gains will be considered as business income and taxed as ordinary income.

taken into consideration when calculating earned income. When calculating taxable capital gains, depreciated book value is deducted from selling price or market value of the property.

Sales Tax

Iceland also administers a sales tax rate 24 percent on certain items that are imported into the country.

Corporate Tax

Companies are taxed at a flat rate of 20 percent on all income and capital gains earned. Typical expense deductions are

Employment

Employment Rate in Iceland decreased to 76.10 percent in July from 76.50 percent in June of 2022. Iceland’s job market took an especially hard hit during the Covid-19 pandemic. Many people work in the tourism industry, while others work in the industries, like, aluminum smelting, geothermal power, fish processing, hydropower, and medical and pharmaceutical products. Iceland is currently facing a large skills shortage that has created a demand for employees in these fields.

Tourism

Typically, Iceland sees about 2.3 million overnight visitors a year. The tourism industry for the island has dropped off by about 75 percent since the pandemic in 2020. In 2020 only 486,000 people visited the island and in 2021 it recovered slightly more with numbers up to 700,000. This is still a far cry from pre-pandemic numbers and has drastically affected the overall tourism industry for the island. From 2010 to 2018 tourism grew 400 percent. Iceland has made a change in its approach to tourism recently and is now promoting high-end tourism vs. mass tourism due to the demand for exclusive and luxury experiences. Winters on the island average 32 degrees whereas,

28 FALL 2022 / Equal Eyes

Global Assessment - Iceland, continued

summer temperatures average 57 degrees, with peaks around 80 once in a while. The winter months offer very little daylight hours, and the summer months offer almost round- the-clock daylight.

Check out this short video tour: Everything You NEED TO KNOW Visiting Iceland 2022 - Bing video

Transportation

The island offers several ways of public transportation. There are no trains that run

through Iceland, so the number one source of public transit is the bus system. The one bad thing about the bus system is that it is expensive. Some of these bus services also offer island tours to the popular tourist attractions, along with a 1–3-day pass, which allow tourists to enjoy the sights for one time purchase. Ferries run back and forth between the islands year-round but offer more options during the summer months.

Taxis and Ubers are also a popular way to get from one place to another. Personal travel by car or truck around the island is still by far the most popular way to get around. Winter travel can get quite difficult due to ice and snow on the roads. The Island also offers the option of flying to several main airports throughout the island, which is convenient in the winter months. cording to 4 sources

FALL 2022 / Equal Eyes 29

Global Assessment - Iceland, continued

What You Get For

a library

Amber Swenson- Hill, SAMA Polk County Editorial Committee Member

100 University Ave SE Minneapolis, Hennepin County

Sold: August 2022 Sale Price: $3,239,500

The Pillsbury Branch Library was designed by architect Charles Aldrich and opened in 1904. It was the idea of John S. Pillsbury who passed in 1901, but was carried out by his heirs. The building boasts a Beaux Arts-style. In 1967 the library closed. After closing the property was then used by the Doctors Diagnostic Laboratories and the Dolly Fiterman Fine Arts Gallery before the Philips Family Foundation took over most of the building. The project of reinventing the Pillsbury Library won the 2008 Minneapolis Heritage Preservation Award for Historic Restoration and is also registered with the USGBC to receive LEED Gold certification. Most recently though this historic building sold and will become the Pritzker Hageman offices.

Estimated market value of January 2, 2021: $3,531,000

Total 2022 taxes: $119,007.48

30 FALL 2022 / Equal Eyes

out of the past

Remembering Yesterday

Amber Swenson-Hill, SAMA Polk County Editorial Committee Member

5 Years Ago—2017

For the first time, law change information was through online webinars.

The Bahamas were featured in Global Assessment. The average Bahamas property prices have seen a 20% decline in the market, while some of the other areas are seeing up to a 60% decline. They are not calling it a crisis, but some of the investors are beginning to worry. The market is flooded with homes, and from 2015 to 2016 property investments fell from $250.3 million to $163.2 million as foreign buyers start to pull out of the marketplace

10 Years Ago 2012

In June Steve Carlson was hired as Becker County Assessor and featured in the fall “let’s Get Acquainted”.

In June, Northeast Minnesota received nearly 15” of rain in a five day period causing major flooding and damage to areas.

15 Years Ago 2007

The popular TV show “Extreme Makeover Edition” featured the seven day rebuild of a home in Minnetonka.

Robert Wagner of Polk County wrote his last “President’s Post”.

20 Years Ago —2002

In a study developed by Beacon Hill Institute, Minnesota ranked ninth among 50 states in an economic competitiveness survey.

Roseau County Assessor Jim Hanson led the disaster reassessment of properties damaged from summer flooding.

Commissioner of Revenue, Matt Smith wrote about the 2003 scheduled expiration of the popular “This Old House” value exclusion program.

25 Years Ago 1997

The 50th annual MAAO Fall Conference was held in Minneapolis where DOR Property Tax Division Director Mike Wandmacher discussed the need for uniformity in applying property tax laws.

30 Years Ago 1992

The Mall of America opened on August 11, 1992. The question from the Bloomington City Assessor’s Offices was “Will it be successful, and how are we going to value it?”.

The Mystic Lake casino complex was opened on 248 acres of tribal land.

35 Years Ago – 1987

The first “Income Demonstration Appraisal Workshop” is offered by MAAO. The workshop was developed by Scott Renne and Steve Behrenbrinker

45 Years Ago 1977

August Ralph Samuelson, the acknowledged father of water skiing, died on Pine Island, Minnesota.

50 Years Ago - 1972

A new valuation notice entitled “the Increase in Value Notice” was used for the first time. This notice reported both the new value and the amount of increase. This resulted in the City of Minneapolis having 2,580 people at their local board of review. At the time, normal attendance was around 50 people.

MAAO recommended to the State Legislature that the State Board of Assessors be given the authority to establish minimum salary requirements for assessors throughout the state.

65 Years Ago 1957

A group of teachers near Lake Minnetonka created a toy dump truck named Tonka trucks in honor of the nearby lake.

FALL 2022 / Equal Eyes 31

transitions Best Wishes Upon Retirement

Nancy Gunderson, SAMA, Clay County Editorial Committee Member

News from

REGION 3 …

Jane Grossinger

recently retired from St. Michael after serving as the City Assessor. Here are some thoughts and comments from Jane:

Retirement! What a wonderful time it will be! They said you would know when the time was right, and it hit me this spring and I haven’t looked back, at least not yet. We will see what winter brings.

Gary and I live on a small hobby farm near Kingston, where Gary has a large garden, so we will do our best to feed the world with vegetables, canned goods, eggs, and beef. Plans have already been made to expand the Scottish Highlander herd. When we are caught up with the chores we fit in a bit of fishing and running to the cabin for fun and relaxation.

With fall sports starting we will be watching grandchildren playing football and volleyball. I have been gymnastics official for the High School League for many years and will continue to do that, I have always said it’s my favorite job and

makes the winter months go by a bit faster.

My assessing career began in 1983 in Kittson County, moving on to Kandiyohi County, then to Meeker County as the County Assessor. Followed by ten years in the private sector with BRC/ACS. Then to my most recent position with the City of St. Michael that lasted 17 years. It has been a great ride! We have made so many friends over the years!

Thanks to MAAO!!

I will continue to be a contract assessor in Meeker County and stay on the State Board of Assessors so you may still see me around.

Jeff Johnson

retired from Stearns County. Jeff last served as Property Service Director.

Mark Koehn

recently retired from Stearns County. Mark served as an appraiser.

News from

REGION 6…

Darla Schwendemann

retired from Swift County recently.

News from

REGION 8…

Effective October 1st, 2022,

Russ Steer

will be retiring as the County Assessor of Marshall County:

I began the role of County Assessor the fall of 2008 on an interim basis. I accepted the role with only a

32 FALL 2022 / Equal Eyes

Jane Grossinger

Transitions

continued

CMA incomed qualified license based on approval by the DOR of a strict schedule to obtain the full SAMA designation. Obtained my SAMA designation spring of 2011. John Hagen and crew were all very supportive.

I began my employment as an appraiser for the county January 11th, 1999. I also continued to farm and raise cattle. Part of my retirement plan is to continue work on the farm which my sons operate now.

Most importantly I will have time to spend with my wife Laurie and the family we have accumulated in our 47 years of marriage. We have four sons and daughter in laws, Jason & Brooke, Jerod & Katie, Nathan & Abby and Joshua & Miranda. From that crew we currently have fourteen grandchildren with two more on the way. Each family will then have four children. Amazing gifts that will fill retirement with life to keep Laurie and I entertained in our retirement. I will hopefully still find time to chase cows at my convenience.

It has been a great gift and experience to serve the patrons of Marshall County. I am truly humbled by the respect and understanding I have received serving first in the position of appraiser and then as County Assessor. I will forever treasure the many friendships I have made over the last 23 years.

Lastly, I need to directly thank my support crew. First my wife Laurie for her total support for all the roads she’s quietly allowed me to go down. Lastly, I will forever miss the amazing staff I have been blessed to work with. I leave the office in better hands than mine. To my entire Marshall County Courthouse family, thanks for a lifetime of memories and relationships I truly cherish.

News from our Property Tax Compliance Officers … Steve Hurni

retired in August from Department of Revenue after serving as a PTCO for counties within Region 6 and 7.

The membership of MAAO wish Jeff, Mark, Jane, Darla, Russ, and Steve the best in their retirements.

We will miss you.

FALL 2022 / Equal Eyes 33

,

Where Am I?

34 FALL 2022 / Equal Eyes

answer on back cover

TAX COURT

Jake Pidde, SAMA, Stearns County Editorial Committee Member

Jake Pidde, SAMA, Stearns County Editorial Committee Member

FALL 2022 / Equal Eyes 35

Forsons

investments llc and graham building llc vs. county of olmsted

STATE OF MINNESOTA TAX COURT

COUNTY OF OLMSTED REGULAR DIVISION

Forsons Investments LLC and Graham Building LLC, Petitioners, vs. County of Olmsted, Respondent.

ORDER GRANTING MOTIONS TO DISMISS

File Nos. 55-CV-21-2394 55 CV 21 2462 55 CV 21 2378

Filed: November 2, 2021

These matters came on for a consolidated motion to dismiss before The Honorable Jane N. Bowman, Judge of the Minnesota Tax Court.

John C. Beatty, Dunlap & Seeger, P.A., represents petitioners Forsons Investments LLC and Graham Building LLC.

Thomas M. Canan, Senior Assistant Olmsted County Attorney, represents respondent Olmsted County.

Respondent Olmsted County moves to dismiss these property tax cases on the ground that petitioners Forsons Investments LLC and Graham Building LLC failed to timely disclose income and expense information as required by Minn. Stat. § 278.05, subd. 6(a) (2021), Minnesota’s “mandatory disclosure rule.” Petitioners did not file responses, nor did they appear at the hearing. At the hearing with the consent of the County the court consolidated these matters for this motion only pursuant to Rule 42.01 of the Minnesota Rules of Civil Procedure. We grant the County’s motions.

The court, upon all the files, records, and proceedings herein, now makes the following:

36 FALL 2022 / Equal Eyes 1

ORDER

1. Respondent County of Olmsted’s motions to dismiss are granted.

2. The above captioned petitions are dismissed.

IT IS SO ORDERED. THIS IS A FINAL ORDER. LET JUDGMENT BE ENTERED ACCORDINGLY.

BY THE COURT:

Jane N. Bowman

Digitally signed by

Jane N. Bowman

Date: 2021.11.02 11:21:58 -05'00'

Jane N. Bowman, Judge MINNESOTA TAX COURT

Dated: November 2, 2021

MEMORANDUM

I. RECORD EVIDENCE

Petitioners Forsons Investments LLC and Graham Building LLC timely filed property tax petitions contesting the January 2, 2020 assessments (for taxes payable in 2021) for each respective property 1 As noted in petitioners’ tax appeals, the subject properties were income producing as of January 2, 2020 2

The County’s motions allege petitioners failed to timely provide income and expense information for the subject properties as required by law. 3 See Minn. Stat. § 278.05, subd. 6 (2021) (providing that one contesting the valuation of an income producing property must provide the

1 Pet. (55 CV 21 2394) (filed Apr. 28, 2021); Pet. (55 CV 21 2462) (filed Apr. 29, 2021); Pet. (55-CV-21-2378) (filed Apr. 28, 2021). The pleadings in these three motions are substantially similar. As such, future singular citations to the record will reference all three cases.

2 Pet.; Aff. Appraiser Thomas Reineke ¶ 2 (signed Sept. 20, 2021).

3 Resp’t’s Not. Mot. & Mot. Dismiss (filed Sept. 20, 2021); Resp’t’s Mem. Supp. Mot. Dismiss 2 3 (filed Sept. 20, 2021).

FALL 2022 / Equal Eyes 37 2

county assessor with income and expense information about the subject property by August 1 of the year in which the tax is payable); see also id. § 278.05, subd. 6(b) (providing that failure to timely provide the enumerated information requires dismissal). In support of its motions, the County submitted the affidavit of Thomas Reineke, a commercial appraiser supervisor with the Olmsted County Assessor’s Office. 4 The County sent petitioners’ counsel a courtesy letter on June 18, 2021, noting petitioners’ obligation to provide income and expense information for the subject properties by August 1, 2021. 5 On July 28, 2021, counsel for petitioners contacted Olmsted County, requesting a two month extension of the August 1 deadline, to which the County countered with a one week extension. 6 To date, however, the County has not received any income and expense information concerning the subject properties. 7

II. APPLICABLE LAW & ANALYSIS

The County moves to dismiss petitioners’ cases for failure to provide the income and expense information required by the mandatory disclosure rule. Under Minnesota law, when a property tax petitioner:

contests the valuation of income producing property, the following information must be provided to the county assessor no later than August 1 of the taxes payable year:

(1) a year end financial statement for the year prior to the assessment date; (2) a year end financial statement for the year of the assessment date; (3) a rent roll on or near the assessment date listing the tenant name, lease start and end dates, base rent, square footage leased and vacant space;

(4) identification of all lease agreements not disclosed on a rent roll in the response to clause (3), listing the tenant name, lease start and end dates, base rent, and square footage leased; (5) net rentable square footage of the building or buildings; and

4 Reineke Aff. ¶ 1.

5 Reineke Aff. ¶ 3, Ex. A (letter from Thomas M. Canan to Kendall J.A. Salter (June 10, 2021)).

6 Reineke Aff. ¶¶ 3 4, Exs. B C.

7 Reineke Aff. ¶ 8.

38 FALL 2022 / Equal Eyes 3

(6) anticipated income and expenses in the form of a proposed budget for the year subsequent to the year of the assessment date.

Minn. Stat. § 278.05, subd. 6(a). Failure to comply triggers dismissal of the petition. Id. § 278.05, subd. 6(b).

The “mandatory disclosure rule ensures that a property tax petitioner provides information to a county that would be useful to the determination of value, and provides an adequate, speedy, and simple remedy to petitioners who wish to contest a county’s assessment of property taxes.”

Wal Mart Real Est. Bus. Tr. v. Cnty. of Anoka, 931 N.W.2d 382, 386 (Minn. 2019) (cleaned up). Failure to disclose under the mandatory disclosure rule requires dismissal, Kmart Corp. v. Cnty. of Becker, 639 N.W.2d 856, 861 (Minn. 2002), even if that failure causes no prejudice to the county, BFW Co. v. Cnty. of Ramsey, 566 N.W.2d 702, 706 n.6 (Minn. 1997). Olmsted County has shown petitioners, challenging the assessments of income producing properties, failed to timely comply with the mandatory-disclosure rule. 8 Because petitioners failed to provide information pursuant to the mandatory disclosure rule, their petitions must be dismissed.

J.N.B.H.

FALL 2022 / Equal Eyes 39 4

8 Pet.; Reineke Aff. ¶¶ 2 8.

Fall

40 FALL 2022 / Equal Eyes

Conference September 25-28 Duluth, MN

FALL 2022 / Equal Eyes 41

42 FALL 2022 / Equal Eyes

FALL 2022 / Equal Eyes 43

State Board of Assessors Meeting Minutes

St. Michael City Center

Tuesday, July 12, 2022

Executive Secretary Andrea Fish called the meeting to order at 8:40 a.m. Mike Reed moved to open the meeting. Jane Grossinger seconded the motion. The motion carried. Board members in attendance:

Gary Amundson Charlie Blekre Andrea Fish

Jane Grossinger

Election of Officers

Mike Reed Lori Schwendemann Averi M Turner

• Nomination for Chair: Lori Schwendemann made a motion to nominate Jane Grossinger as chair. Mike Reed seconded the nomination. The motion carried . Jane Grossinger is the chair for 2022.

• Nomination for Vice Chair: Mike Reed made a motion to nominate Lori Schwendemann for vice chair. Andrea Fish seconded the nomination. The motion carried. Lori Schwendemann is the vice chair for 2022.

Agenda for the July 12, 2022 , meeting was reviewed. Andrea Fish moved to approve the agenda. Mike Reed seconded the motion. The motion carried.

Minutes of the May 10, 2022, meeting were reviewed. Andrea Fish moved to approve the minutes. Gary Amundson seconded the motion. The motion carried.

1, 2013

1, 2020

31,

31,

January 1, 2021 thru March 9,

March 10, 2021 thru May 11, 2021

12, 2021 thru July 13, 2021

14, 2021 thru September 21, 2021

22, 2021 thru November

17, 2021 thru December

2022

44 FALL 2022 / Equal Eyes

Updates • Form Report Update: Dates Submitted Reports Approved Reports Rejected Reports Reports being Graded July

December

2019 192 192 0 0 January

December

2020 41 41 0 0

2021 13 13 0 0

11 11 0 0 May

20 20 0 0 July

19 19 0 0 September

16, 2021 10 9 1 0 November

31, 2021 6 6 0 0 Totals for 2021 79 78 1 0 January 1,

July 12, 2022 51 46 2 3 Approved Reports (1/1/2021 7/12/2022) Received AMA Have not applied for AMA 124 105 19

Board

Updates (cont.)

• Form Report Chart: The board decided to stop tracking the form reports in the chart form. Updates will be provided at every board meeting, but more like the other updates.

• Mileage Rate Change: The mileage rate increased on July 1, 2022 from 58.5 cents per mil e to 62.5 cents per mile. This change was updated on the board members’ July meeting expense reports.

• CMA Expiration Email: An email was sent to 101 assessors who did not get their AMA license by July 1, 2022, with details about achieving the AMA in the f uture.

• MAAO Summer Seminars: Jane Grossinger provided the following update on the seminars she attended: Both the Barndominiums & Dollar Store seminars were good classes. The base of the data for the Barndominiums was good to teach the concept, even though the sample properties were from Texas, Kansas, and Oklahoma and the costs and dates were very old. Know ledgeable instructor from Polk County (Des Moines) Iowa. The Dollar Store class had lots of information on the world of Dollar Stores, cost to build, sale prices, incomes, cap rates, vacancy, etc. Taught by Mitch Simonson of Simons on Real Estate.

• MAAO Executive Board Meeting Update: Lori Schwendemann met remotely with the board on May 24, 2022. There was discussion about the Ethics class being a one hour virtual class. The Ad Hoc Committee had their first meeting on June 30, 2022. The committee consists of members from MAAO, MAAP, and the Board of Assessors. David Parsons is the chair for this comm ittee. The group agreed that the front office is very important, education is necessary for these people. The Board of Assessors survey showed that the clerical staff should have access to additional education. MAAP will get together with MAAO and work on tracking through the membership app. They are looking at having a certification in place of a license. Dave Parsons will attend the MAAP conference in August. Another meeting will be scheduled after the MAAP conference.

• Assessor Licensure Standards: Andrea Fish explained the new format of the standards and how they were combined. Lori Schwendemann created a new SAMA oral interview question based on standard 3. An email announcement about the standards went out to all licensed assessors on June 8, 2022

• Requirements for City Assessors: Gary Amundson talked to the PTCO section, and it was decided that it’s a good idea to have City Assessors follow the same requirements as the County Assessors, but they questioned how this would be applied. They suggested that it could be based on the complexity of the district and population , but there was still a question how would they be identified some may be obvious, but others are hard to say they need to have a SAMA. This change would also require a law change.

• Future Law Changes:

o Andrea Fish provide an update on the progress of the technical changes to 270C.9901 AMA, with getting rid of the waiver application timeline. The process for requesting law changes will start in the next couple weeks.

o Bobbi Spencer reported that the title change for Statute 270.44 related to license fees is being updated by the Office of the Revisor of Statutes .

FALL 2022 / Equal Eyes 45

of Assessors Meeting Minutes July 12, 2022 Page 2 of 6 2

• Complaint Summary: Since May 2022, the Department of Revenue has received three complaints, one regarding a homestead. The homestead complaint has been forwarded to the respective county for investigation. The remaining two complain ts are currently under review by our office.

Andrea Fish made a motion to appoint Averi M Turner to the board’s complaint committee. Gary Amundson seconded the motion. The motion carried.

• MAAO Curriculum & Assessor Standards Committee: Jessi Glancey provided th e following update at the May Executive Board meeting.

Action Items in Progress/Pending:

o Reviewing the LEAD course, specifically the format, style, and branding of the materials.

o Reviewing the Basic Apartments course, specifically looking at the content and if it is outdated or if it could be transitioned into a different course such as basic income.

o Helping with the update of Assessment Administration ; reviewing the modules as the developers finalize the material, formatting, and packaging the manual so that it looks like other MAAO course materials.

o Working on some small edits of Mass Appraisal material.

o Working on a policy for plagiarism and creating procedures on how to cite material from other sources that are used in MAAO courses.

Action Items Completed:

o Annalee Jones, Polk County, has agreed to take over as co chair at the end of this year. She will be replacing Jessi Glancey.

o Assessor standards have officially transitioned over to the state board of assessors. They are now fully responsible for the standards.

Questions for the Executive Board:

o Now that the standards are no longer housed under MAAO, should MAAO consider renaming this committee to the curriculum committee? The committee felt that at this time a name change is not needed. Their reason was that the CAS committee might not “own” the standards, but MAAO will use them with curriculum development/review and work with the SBA on possible updates/changes as they see fit.

• CMA Required Course Prerequisite: Mike Wacker responded to the board’s suggestion for putting a recommendation or prerequisite in the course descriptions, to take the CMA courses in a specific order. Mike reported that the Executive Board was very understanding of those struggling with some of these courses and potentially setting them up for a limited understanding of the material. They understood this could be different for each student and applying a one size fits all solution wouldn’t work but delaying some education for those without experience would benefit some. They agreed that getting the information out to those that are registering the new students might be a good start heading off some of the issues. President Chapman will take this up as his next article in Equal Eyes and point out some of the struggles being had and discuss the 3 year timeline.

46 FALL 2022 / Equal Eyes Board of Assessors Meeting Minutes July 12, 2022 Page 3 of 6 3

Discussion Items

• Oral Interview Questions: The board reviewed the new standard 3 question that was added to the SAMA oral interview questions.

• First Year Exposure Checklist: Jane Grossinger and Andrea Fish presented the revisions on the checklist. Everyone agreed to use the revised checklist for CMA applications.

• CEH Requests & Assessor Standards: Gary Amundson reported that he has changes to the standards after using them for reviewing CEH requests. Gary will send the changes to Andrea , so they can be added to the working standard document.

• Future Rule Change: The board reviewed the recommendations by the DOR attorney for Rule 1950.1090: Conduct & Discipline, Subp. 2, item (f) for refusal to grant license due to conviction of a felony. The board members agreed with the DOR attorneys’ suggestions for the rule change.

• MAAO Instructor Policy: The board members decided to reach out to Patrick Chapman to find out if MAAO has an instructor policy.

• Board Work Plan: The board reviewed the current work plan and made the following change to the assessor’s standards work plan item: The board will review the assessor’s standards at their May and November board meeting every year.

Approved Continuing Education Hours Requests

• Assessing Lakeshore Property: Jessi Glancey requested the board review this course, sponsored by Department of Revenue Property Tax Outreach , that will be offered for continuing education. The board’s continuing education committee approved this course for 4 continuing education hours. This seminar will be part of the PACE education requirement

• Disaster Strikes – Now What?: Jessi Glancey requested the board review this virtual course, sponsored by Department of Revenue Property Tax Outreach , that will be offered for continuing education. The board’s continuing education committee approved this course for 2 continuing education hours. This seminar will be part of the PACE education requirement .

• In Data We Trust: Jessi Glancey requested the board review this virtual course, sponsored by Department of Revenue Property Tax Outreach, that will be offered for continuing education. The board’s continuing education committee approved this course for 3 continuing education hours. This seminar will be part of the PACE education requirement.

• MAAP Summer Workshop: Lacy Standke requested the board review this workshop, sponsored by MAAP, that will be held on August 18 19, 2022, in Mankato, MN for continuing education . The board’s continuing education committee approved this workshop for 8 continuing education hours.

• Sales Verification – The Deep Dive: Jessi Glancey requested the board review this course, sponsored by Department of Revenue Property Tax Outreach, that will be offered for continuing education. The board’s continuing education committee approved this course for 4 continuing education hours. This seminar will be part of the PACE education requirement.

• Special Agricultural Homesteads : Jessi Glancey requested the board review this course, sponsored by Department of Revenue Property Tax Outreach , that will be offered for continuing education. The board’s continuing education committee approved this course for 4 continuing education hours. This seminar will be part of the PACE education requirement

FALL 2022 / Equal Eyes 47 Board of Assessors Meeting Minutes July 12, 2022 Page 4 of 6 4

Denied Continuing Education Hours Request

• Principles of Abstracting (MN Midwest Edition): Roxane Kraling requested the board review this course sponsored by Jeanne Johnson & Associates for continuing education. The board’s continuing education committee denied this course for 30 continuing education hours. The consensus of the committee was that the class did not have enough relevant assessment related education to consider it for continuing education.

Request for Licensure Education

• MN Assessment Administration: Amanda Dutcher is requesting the board review this course, sponsored by MAAO. MAAO has made some updates to this course and requests the board’s approval for licensure and continuing education.

Lori Schwendemann made a motion to approve this course for licensure and continuing education hours. Charlie Blekre seconded the motion . The motion carried.

Application for Certified Minnesota Assessor

• Andrew Beavers, Cook County

• Thomas Cooper, Carver County

• Dylan Felten, Houston County

• Andrew Hillery, Fillmore County

• Michael Lillibridge, Ramsey County

• Casey Martin, Sherburne County

Applications for Accredited Minnesota Assessor

• Craig Anton, Carver County

• Michael Busick, St. Louis County

• Debra Carter, Carlton County

• Franklin Carver, St. Louis County

• Larry Cote, Otter Tail County

• Andy Crego, Mille Lacs County

• John Curran, Waseca County

• Jeremy Farar, Dodge County

• Scott Hanfler, Morrison County

• Scott Hemmesch, Stearns County

• Jesse Jacobson, Redwood County

• Christopher Jeffords, Kandiyohi County

• Maria Kay, Benton County

• Mark Koehn, Stearns County

• Brian Kohorst, City of Bloomington

• Richard Koons, Chisago County

• Cynthia Large, Mahnomen County

• Lee Leichentritt, Southwest Assessing

48 FALL 2022 / Equal Eyes Board of Assessors Meeting Minutes July 12, 2022 Page 5 of 6 5

Applications for Accredited Minnesota Assessor (cont.)

• Lance Link, Scott County

• Timothy Marolt, St. Louis County

• Jean Meyer, Wabasha County

• Joy Michaelson, Stevens County

• Leonel Montes, City of Minneapolis

• Benjamin Nelsen, City of Minneapolis

• Brian Nelson, City of Minneapolis

• Benjamin Puthoff, Nobles County

• Dean Robinson, Ramsey County

• Kelly Rose, Sibley County

• Amanda Sill, Watonwan County

• Beth Sokoloski, St. Louis County

• Scott Stanley, City of Minneapolis

• David Vigdal, Mille Lacs County

• Michel Wetzel, Morrison County

• Laura Winter, Todd County

• Bradley Zimmer, Redwood County

Applications for Senior Accredited Minnesota Assessor

Mike Reed made a motion to award the Senior Accredited Minnesota Assessor license to the following individuals.

• Jacob Packer, City of Brooklyn Park

• Jonathan Packer, Ramsey County

Andrea Fish seconded the motion . The motion carried.

Gary Amundson made a motion to award the Senior Accredited Minnesota Assessor license to the following individual , with the stipulation that Patty’s SAMA license will not take effect until July 24, 2022.

• Patty Flaa, Polk County

Lori Schwendemann seconded the motion . The motion carried.

Next Board Meeting: Tuesday, September 13, 2022 , at the St. Michael City Center in St. Michael, MN at 8:30 am.

Averi M Turner made a motion to pay the expenses for the meeting. Charlie Blekre seconded the motion. The motion carried.

Mike Reed made a motion to adjourn the meeting. Averi M Turner seconded the motion. The motion carried.

FALL 2022 / Equal Eyes 49 Board of Assessors Meeting Minutes July 12, 2022 Page 6 of 6 6

Partner with a pioneer in the industry – a company who has supported appraisal and tax professionals for more than 80 years. We connect communities by empowering your organization to achieve increased efficiency, productivity, and accuracy. Take ownership of your future and succeed in delivering fair, equitable, and defendable taxation with Tyler.

The World’s Largest Turkey is located in Frazee, MN

50 FALL 2022 / Equal Eyes

Written by J Jenna Takemoto W Washington County MAAP President 2020 2026

Written by J Jenna Takemoto W Washington County MAAP President 2020 2026