w w w . r i s e n e n e r g y . c o m

VOLUME 15

OWNER : FirstSource Energy

India Private Limited

PLACE OF PUBLICATION : 95-C, Sampat Farms, 7th Cross Road, Bicholi Mardana Distt-Indore 452016, Madhya Pradesh, INDIA Tel. + 91 96441 22268 www.EQMagPro.com

EDITOR & CEO : ANAND GUPTA anand.gupta@EQmag.net

PUBLISHER : ANAND GUPTA

PRINTER : ANAND GUPTA

PUBLISHING COMPANY DIRECTORS: ANIL GUPTA

ANITA GUPTA

CONSULTING EDITOR : SURENDRA BAJPAI

HEAD SALES & MARKETING

MUKUL HARODE sales@EQmag.net

GRAPHICS & LAYOUT BY : RATNESH JOSHI

SUBSCRIPTIONS : RISHABH CHOUHAN admin@eqmag.net

Disclaimer,Limitations of Liability

While every efforts has been made to ensure the high quality and accuracy of EQ international and all our authors research articles with the greatest of care and attention ,we make no warranty concerning its content,and the magazine is provided on an>> as is <<basis.EQ international contains advertising and third –party contents.EQ International is not liable for any third- party content or error,omission or inaccuracy in any advertising material ,nor is it responsible for the availability of external web sites or their contents

The data and information presented in this magazine is provided for informational purpose only.neither EQ INTERNATINAL ,Its affiliates,Information providers nor content providers shall have any liability for investment decisions based up on or the results obtained from the information provided. Nothing contained in this magazine should be construed as a recommendation to buy or sale any securities. The facts and opinions stated in this magazine do not constitute an offer on the part of EQ International for the sale or purchase of any securities, nor any such offer intended or implied

Restriction on use

The material in this magazine is protected by international copyright and trademark laws. You may not modify,copy,reproduce,republish,post,transmit, or distribute any part of the magazine in any way.you may only use material for your personall,Non-Commercial use, provided you keep intact all copyright and other proprietary notices. want to use material for any non-personel,non commercial purpose,you need written permission from EQ International.

INDIA

POWER AVAILABILITY IN RURAL AREAS HAS GONE UP TO 22.5 HOURS IN INDIA: MINISTER R K SINGH

RENEWABLE ENERGY

FOURTH PARTNER ENERGY COMMISSIONS ITS FIRST WIND-SOLAR HYBRID PROJECT IN GUJARAT

RENEWABLE ENERGY

SOLINTEG EXPANDS ITS LOW-CARBON DEVELOPMENT BLUEPRINT TO INDIA

PV MANUFACTURING

SAATVIK GROUPS EXTENDS RETAIL ARMS IN EASTERN INDIA BY APPOINTING SOLARTRON AS ITS DISTRIBUTOR FOR SOLAR PV MODULES

45

09 43

INTERNATIONAL

Issue 06 CONTENT

63

CLEANTECH SOLAR ENTERS A LONG-TERM PARTNERSHIP WITH KONICA MINOLTA IN MALAYSIA, COMMISSIONS A 3.4 MWP ON-SITE ROOFTOP SOLAR PV SYSTEM

PIXON COLLABORATES WITH YES BANK TO ACCELERATE ADOPTION OF SOLAR SOLUTIONS AND GREEN ENERGY PRODUCTS IN INDIA

AUSTRALIA – INDIA PARTNERSHIP TOWARDS NET ZERO FUTURE

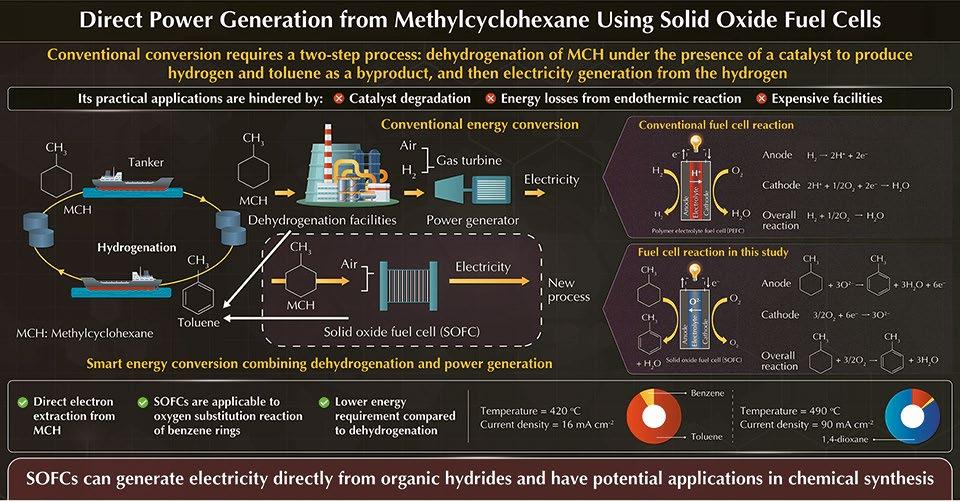

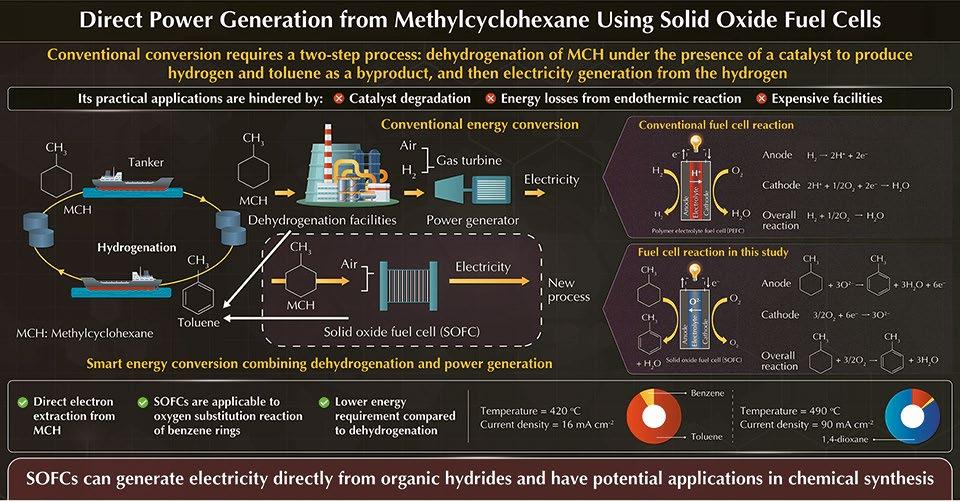

DIRECT POWER GENERATION FROM METHYLCYCLOHEXANE USING SOLID OXIDE FUEL CELLS

GROWATT TO SHOWCASE SMART ENERGY SOLUTIONS AND INNOVATIONS AT REI EXPO 2023

INDIA NEW METRO LINES, EV CHARGING POINTS TO PUSH UP MUMBAI’S POWER DEMAND BY 150 MW IN A YEAR

HARISH MANIKIREDDY

13 14 16 18 41 27 54 57 60

EQ News

INTERVIEW PRODUCT

RENEWABLE ENERGY BUSINESS & FINANCE Pg.08-75

INTERVIEW

TECHNOLOGY

DECARBONISATION INTERVIEW

MR. KETAN VORA WAA Cables Pvt. Ltd.

Dr. Vikas Almadi VNT

MR.

Sungrow India

Founded in 2005, JA Solar is a manufacturer of high-performance photovoltaic products. With 12 manufacturing bases and more than 20 branches around the world, the company’s business covers silicon wafers, cells, modules and photovoltaic power stations. JA Solar products are available in over 120 countries and regions.

INDIA’S FIRST TRANS-NATIONAL POWER PLANT OF 1,600 MW CAPACITY COMMISSIONED BY ADANI GROUP

Electricity supplied from Godda will replace costly power generated in Bangladesh using liquid fuel. Gautam Adani, Chairman of the Adani Group, recently visited Bangladesh Prime Minister Sheikh Hasina in Dhaka to mark the successful commencement of full power supply from the Group’s Ultra SuperCritical Thermal Power Plant (USCTPP) in Godda, India. The Godda USCTPP is Adani Group’s first venture into transnational power projects and, notably, the first commissioned transnational power project in India, where 100% of the generated power is supplied to another nation.

Following the meeting, Gautam Adani expressed his honour in a tweet, acknowledging the completion and handover of the 1600 MW Ultra Super-Critical Godda Power Plant. He commended the dedicated teams from India and Bangladesh who, despite the challenges posed by the COVID-19 pandemic, successfully commissioned the plant in a remarkable time of three-and-a-half years. Adani Power Jharkhand Ltd (APJL), a wholly-owned subsidiary of Adani Power Ltd, recently completed the dependable capacity test for the Godda plant, fulfilling the mandatory requirement under the power purchase agreement (PPA) with Bangladesh. The two units of the plant commenced commercial operations on April 6th and June 26th, with a combined capacity of 1600 MW. APJL will supply 1,496 MW from the Godda USCTPP to the Bangladesh Power Development Board through a dedicated transmission system connected to the Bangladesh grid. The successful commissioning of the Godda USCTPP showcases the Adani Group’s exceptional project management and asset management capabilities. Despite logistical challenges, including the establishment of a 105 km-long transmission line, construction of a private railway line, and implementation of an extensive water pipeline, the project was completed in a record time of 42 months after achieving financial closure. Notably, the project was executed during the COVID-19 pandemic, and Adani’s engineering team adapted to the circumstances by conducting testing and commissioning remotely.

The power supplied from the Godda plant will positively impact Bangladesh’s power situation, replacing costly liquid fuel-generated power and reducing the average cost of purchased electricity. The Godda power plant sets a precedent by being the first in India to operate with 100% flue gas desulphurization (FGD), selective catalytic reconverter (SCR), and zero water discharge systems, ensuring environmentally friendly operations in alignment with government norms. The commissioning of the Godda USCTPP signifies an important milestone for the Adani Group, the Bangladesh Power Development Board, and the strong economic ties between the two nations. Adani Power’s partnership in Bangladesh’s economic growth aims to provide uninterrupted and reliable electricity at a competitive tariff, fostering industrial development and strengthening the Bangladesh economy.

Source: PTI

INDIA’S RENEWABLE

ENERGY INSTALLATIONS TO REACH

45 GW IN NEXT TWO YEARS: CARE EDGE RATINGS

Annual renewable energy (RE) installations in FY24 are to be around 20 GW, led by the solar sub-segment, CareEdge Ratings said.

This is based on the healthy pipeline of over 55 GW assets under development. The subsequent year is expected to see installations of 25 plus GW, leading to a cumulative increase of 45 GW over the next two fiscal, the rating agency said in a sectoral note. The solar sub-segment is expected to lead the way in terms of installations, followed by wind and hybrid capacity. The commercial and industrial segment is also expected to contribute significantly to future capacity additions. These projections are based on the government’s commitment to ensuring the bidding of approximately 50 GW of annual capacity for the next five years to facilitate the achievement of the target of 500 GW capacity through non-fossil fuel sources by 2030.

This will require annual RE installations to exceed 40 plus GW. The trajectory for FY24 includes 10 GW of wind capacity and 40 GW collectively from solar, hybrid, and storage-based capacity. Additionally, key states like Gujarat, Maharashtra, and Karnataka, among others, are actively conducting state-specific auctions to support further capacity additions. Meanwhile, the report stated that the Indian government has awarded a PLI (Production Linked Incentive) scheme of over Rs 18,000 crore to encourage private investment in the solar module supply chain. This is expected to lead to the establishment of a fully integrated module manufacturing capacity of 27.4 GW, a deeply integrated module manufacturing capacity of 16.8 GW, and a partially integrated module manufacturing capacity of 7.4 GW. This capacity is expected to be commissioned between FY24 and FY27. The commissioning of this domestic capacity is anticipated to result in annual forex savings of approximately Rs 90,000 crore.

Source: PTI

8 EQ JULY-AUGUST2023 www.EQMagPro.com INDIA

POWER AVAILABILITY IN RURAL AREAS HAS GONE UP TO 22.5 HOURS IN INDIA: MINISTER R K SINGH

The average electricity availability in rural areas has gone up from 12:30 hours in 2014 to 22:30 hours at present and it also increased to 23:30 hours in cities from 22.30 hours nine years ago, said Union Power Minister R K Singh.

Singh said this during a Review Planning & Monitoring (RPM) meeting with states and state power utilities, which was convened on 10th & 11th July 2023 in the capital, under the minister’s chairmanship, stated a power ministry statement. The minister mentioned that over the past 7-8 years the government has brought about a sea change in the country’s power sector. “We have added 185 GW of capacity transforming our country from power deficit to power surplus. We have connected the whole country with a single unified grid capable of transferring 1,12,000 MW from one corner of the country to another,” he said.

The government has strengthened the distribution system under DDUGJY and IPDS as well as SAUBHAGYA; constructed more that 2,900 substations, upgraded more than 3,900 substations, he informed. The government has added 8,50,000 ckt kms (circuit kilometres) of HT & LT (high and low tension) lines, 7,50,000 transformers and 1,12,000 ckt kms of agricultural feeders. “As a result of all this the power availability in rural areas has gone up from 12:30 hrs in 2014 to 22:30 hrs today; while in urban areas the national average availability is 23:30 hrs,” he highlighted. The minister stated that together “we made the power sector viable. Today all current power purchase dues are paid on time, while the legacy overdues have come down from Rs 1,39,747 crore to Rs 69,957 crore.” He expressed satisfaction that most of the state/discoms have started implementing reform measures prescribed by the ministry of power under its various initiatives like the Revamped Distribution Sector Scheme (RDSS), Additional Prudential Norms and Late Payment Surcharge (LPS) Rules, 2022.

“As a result, the AT&C (aggregate technical and commercial) losses have reduced to 16.5 per cent from 22 per cent and ACS-ARR (Average Cost of Supply and Average Realizable Revenue) gap has come down to 15 paise/unit from 69 paise/unit,” he stated.

Various reforms recently undertaken in the power sector like Renewable Generation Obligation, mandatory resource adequacy planning and rationalisation of open access charges etc. were discussed during the meeting.

The minister pointed out that tariff should be reflective of cost and up to date and suggested that realistic/ prudent loss reduction trajectories should be adopted by regulatory commissions for discoms to be viable. All the states were advised to follow multi-year tariff regime going forward. He also emphasised on the importance of correct subsidy accounting by the discoms and timely payment of subsidy dues by respective state governments. Discoms were advised to undertake prepaid smart metering of government offices on priority to overcome the issue of outstanding government department dues. The ministry of power has already issued rules along with clear SOP for subsidy accounting and payments which shall be adhered mandatorily by all states/discoms. Nodal agencies (REC and PFC) for RDSS presented the status of progress in their respective states under the scheme. The status of tendering/award and progress of works sanctioned under RDSS was reviewed for all the participating discoms. Discoms were advised to expedite implementation of works and ensure quality of works being undertaken under the scheme. It was noted that most states/discoms were on track as regards to qualifying parameters and eligible to receive funding. In most states the tendering action has been completed and works have been awarded. Some states/discoms which were lagging were asked to expedite the finalisation of tenders and award of works. The minister expressed satisfaction over performance of the sector.

He expressed his belief that with concerted efforts we will be able to achieve further improvement in quality and reliability of power supply thus ensuring better quality of life for people of the country.

www.EQMagPro.com 9 EQ JULY-AUGUST2023 INDIA

UNION POWER MINISTER REVIEWS PROGRESS OF DEVELOPMENT OF INTER-STATE TRANSMISSION SYSTEM

uring the meeting here, emphasis was laid on completing the projects in a timebound manner across the country, according to an official statement. Besides this, the minister also stressed on how to strengthen the grid system, it said. Keeping in view the fact that Rajasthan has the highest installed capacity in the field of renewable energy, the existing and planned transmission network for evacuation of renewable energy from Rajasthan was discussed in detail, the statement said. The Union Minister for power, new and renewable energy took stock of issues, problems and options available for timely completion of projects related to transmission lines related to renewable energy generation in Rajasthan, it said. Officials of various departments related to the power projects attended the meeting.

Source: PTI

AHMEDABAD NEEDS RS 4.4 LAKH CRORE TO TURN NET ZERO CITY

BY 2070

In the span of one year, from 2021 to 2022, the residents of Ahmedabad released a staggering 15.1 million tonnes of carbon dioxide (CO2) into the atmosphere, resulting in a per capita burden of 2.1 tonnes of CO2. To transform Ahmedabad into a net zero city and mitigate greenhouse gas emissions, the city will need to allocate Rs 4.4 lakh crore over the next 47 years towards enhancing its infrastructure and systems.

These findings were outlined in a comprehensive report called the “Climate Resilient City Action Plan” (CRCAP), prepared for the Ahmedabad Municipal Corporation (AMC) with support from the CapaCITIES II project. The project is funded by the Swiss Agency for Development and Cooperation (SDC) and implemented by International Council for Local Environmental Initiatives (ICLEI) South Asia. Ahmedabad stands as one of the pioneering cities in India to develop such a comprehensive plan. At present, Ahmedabad consumes a substantial amount of energy, equivalent to 98.5 million gigajoules (GJ) per year, primarily derived from coal burned in thermal power plants and the usage of fuels like diesel and petrol. To put this in perspective, this energy consumption is comparable to burning 9.8 trillion 10watt LED light bulbs for an hour. A net zero city refers to one that balances its greenhouse gas emissions through the utilization of renewable energy sources and the implementation of carbon reduction practices. Key strategies to achieve this goal include the electrification of buildings and transportation, increased energy efficiency, and an overall reduction in energy consumption.

The CRCAP encompasses six key sectors: energy supply and demand, transportation, solid waste management, water supply and sanitation, urban greening and biodiversity, and disaster risk reduction. For each sector, the plan establishes targets, indicators, actions, timelines, responsibilities, costs, and benefits necessary to attain net zero resilience by 2070. For instance, in the energy sector, Ahmedabad aims to reduce its total energy consumption by 30% and increase the share of renewable energy to 50% by 2030. To achieve this, the city plans to implement energy efficiency measures in buildings, industries, and street lighting, encourage rooftop solar installations, and explore waste-to-energy projects. In the transportation sector, Ahmedabad aims to reduce greenhouse gas emissions by 40% and increase the share of public transport to 60% by 2030. This will entail expanding the Bus Rapid Transit System (BRTS), introducing electric buses and vehicles, and enhancing pedestrian and cycling infrastructure, as stated in the CRCAP report.

10 EQ JULY-AUGUST2023 www.EQMagPro.com

Union Minister for Power RK Singh chaired a meeting to review the progress of development of the inter-state transmission system.

D

INDIA

INDIA’S POWER CONSUMPTION GROWS BY 4.4 PER CENT TO 139.23 BILLION UNITS IN JUNE

Power consumption grew by 4.4 per cent to 139.23 billion units in June this year compared to last year. In the year-ago period, power consumption stood at 133.26 billion units (BU), higher than 114.48 BU in June 2021, according to government data.

The peak power demand met, which is the highest supply in a day, rose to 223.23 GW in June 2023. The peak power supply stood at 211.72 GW in June 2022 and 191.24 GW in June 2021. The power ministry had estimated the country’s electricity demand to touch 229 GW during the summer season. But the demand did not reach the projected level in April-May this year due to unseasonal rains.

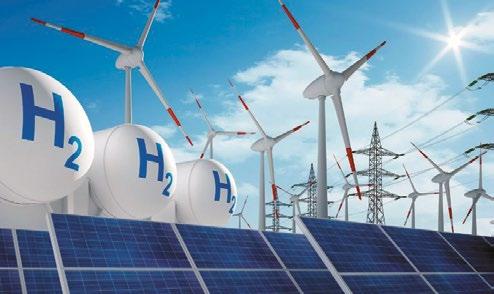

INDIA’S GREEN HYDROGEN PUSH AND CHALLENGES

India wants to become a global hub for the production of green hydrogen, manufactured by splitting water molecules using renewable energy. It is an ambitious plan for a country whose hydrogen consumed currently is produced mostly with fossil fuels. Although first production is expected only in 2026, India has been negotiating bilateral agreements with the European Union, Japan and other countries to start exporting the fuel. Below are some details about India’s green hydrogen push and challenges.

Power consumption was affected in March, April and May this year due to widespread rains in the country. Experts said that unseasonal rains in March, April and May affected the power consumption in the country. However, they stated that the power consumption growth was not that bad in June this year. Rains reduced the demand for electricity as people used fewer cooling appliances compared to the previous year, according to experts.

Source: PTI

PRODUCTION TARGET GOVERNMENT SUPPORT

India aims for annual production of 5 million metric tons of green hydrogen by 2030, which would cut about 50 million metric tons of carbon emissions and save more than $12 billion on fossil fuel imports. Indian companies including Reliance Industries, Indian Oil, NTPC, Adani Enterprises, JSW Energy, ReNew Power and Acme Solar have made announcements for setting up a cumulative annual green hydrogen manufacturing capacity of 3.5 million metric tons. As of now, most of the 5 million metric tons of hydrogen consumed in the country is produced with fossil fuels.

In January, India approved an incentive plan of 174.9 billion rupees ($2.11 billion) to promote green hydrogen. This would be atleast 10% of the cost to produce green hydrogen. New Delhi has also extended a waiver of transmission fees for renewable power to hydrogen manufacturing plants commissioned before January 2031.

AUCTIONS CHALLENGES

The government has kicked off auctions under its incentive programme for manufacturing electrolysers used to make green hydrogen. Bidding for support for green hydrogen production has yet to start. Five states including industrialised ones like Maharashtra and Gujarat have announced benefits like concessional electricity and duty-reimbursements on production of green hydrogen and its derivatives.

Green hydrogen is currently more expensive to produce than hydrogen made using fossil fuels, costing about $2 more per kilogram. The other issue is that renewable energy is not available round-the-clock and battery storage is still not economical. The country expects a requirement of 125 gigawatts of renewable energy by 2030 for production linked only to the incentive programme. India’s current installed renewable base is 127 gigawatts. Europe, Korea and Japan, being renewable resourcedeficient, are likely to be the key markets for green hydrogen but trade barriers are a major worry. India has raised its concerns with Germany on barriers imposed in a global green hydrogen tender called by that country last December. India also faces competition from heavily subsidised markets like China and the United States.

Source: Reuters

12 EQ JULY-AUGUST2023 www.EQMagPro.com INDIA

NEW METRO LINES, EV CHARGING POINTS TO PUSH UP MUMBAI’S POWER DEMAND BY 150 MW IN A YEAR

Mumbai’s power demand is growing day by day and the latest estimates show the rise in electric vehicle (EV) charging stations and the introduction of new Metro lines in a year will push the demand by 150MW.

Power experts said the government should push existing projects of transmission corridors to bring additional power to the city. One such project–the 400 KV Kharghar-Vikhroli line by Adani Transmission–is on the verge of completion before the year-end and is likely to bring 1,000MW to Mumbai. Experts said all clearances and assistance should be given for expediting other transmission corridor projects, the Kudus Aarey transmission corridor by Adani Transmission (1,000MW) and the Mumbai Urja Marg by Sterlite Power (2,000MW).

Mumbai’s peak power demand has been recorded at 4,129MW and is expected to increase to 5,000MW by 2025, requiring additional transmission corridors to meet the rising demand. “Mumbai’s embedded power generation is limited to 1,800MW as on date, with the balance demand being drawn from the National Grid for which the existing transmission corridors have a limited capacity of about 2,200 MW,” pointed out an official from Adani Electricity which serves over 60% of city consumers.

Power expert Ashok Pendse warned that “we cannot be lax and will have to bring additional power from outside, which is why the new transmission corridors should come up on priority”. He further said apart from new corridors, the main transmission network of the state also needs to be strengthened. “In the past, at Talegaon, a few state feeders had tripped and led to blackouts in Mumbai. This should be avoided,” he added.

Tata Power president (T&D) Sanjay Banga said: “Mumbai has witnessed unprecedented growth in its power demand this year. We recognise the immense potential and significance of new consumer segments, with EV charging stations spearheading the adoption of electric vehicles in the city, Metro Railways acting as lifelines of transportation and fostering sustainable urban development, and data centers being the pillars of digital transformation and these segments have resulted in a spurt in the overall demand. We observed an increase in peak demand amongst our consumer base this summer season and have been able to meet the load effectively through our PPAs of 1,400MW.”

When contacted, an Adani Electricity spokesperson said: “The Metro lines presently served by us consume 20MW electricity and this will increase to around 80MW in a few years. In the case of our electric vehicle charging stations, the 50MW demand will increase to over 200MW over the next few years. We are geared up to meet the growing demand from electric vehicles and mass transit systems through sustainable and competitive electricity supply.”

Devanand Pallikuth, head of Power System Control Centre at Tata Power, said in case of EV charging done overnight (as observed in several housing societies), there will be no problems at all as peak demand is usually low at night. “We have to see how much power is consumed during the day time at public and private charging of EVs and the running of new Metro corridors,” he said.

A V Shenoy, member of Urja Prabodhan Kendra, a power sector think-tank, said with the major shift to EVs in the past couple of years and a 40 times increase in registrations across Mumbai, the overall demand for power will certainly go up. “It is the government’s responsibility to strengthen the system and infrastructure of the transmission grid so that more power can be wheeled to Mumbai,” he said.

Pendse said apart from EVs and the Metro, there is a general 4% to 5% rise in power demand annually due to new power connections from new housing colonies and commercial establishments, malls and shops across Mumbai.

www.EQMagPro.com 13 EQ JULY-AUGUST2023 INDIA

MR. KETAN VORA

Managing Director & CEO

WAA Cables Pvt. Ltd.

EQ: What is the opportunity in India currently ,---in terms of projects in tender , pipeline etc..opportunities in manufacturing etc .?

KV: Opportunity in Renewable energy sector: The opportunity in India for Renewable sector projects and other allied businesses like Inverter, Battery, Pump – Motor, cables and wires, Thermal etc and it’s manufacturing is huge right now as India's energy demand is expected to accelerate faster than any other country in the coming decades due to its sheer size and enormous potential for growth and development. Therefore, it is imperative that most of this new energy demand is met by low-carbon, renewable sources. India's announcement that it intends to achieve net zero carbon emissions by 2070 and to meet 50% of its electricity needs from renewable sources by 2030 marks a historic point in the global effort to combat climate change. With increased support from the Government in policies and economics – allocation of Rs. 19,500 Crore (US$2.57 billion) for a PLI scheme to boost manufacturing of high –efficiency solar modules. , this sector has become attractive from an investors perspective and working towards achieving goal to achieve net zero carbon emission.

The domestic cables and wires industry has registered robust growth over the last five years led by the government’s focus on providing power to all and gradual pickup from the housing market. The wire and cables market in India has the potential to grow by USD 1.65 billion during 2021-2025, and the market’s growth momentum will accelerate at a CAGR of 3.80%. The development of infrastructural projects by the government and investment is driving the growth of the wire and cable market in India.

EQ: What type of market do you anticipate in 2023 in terms of Utility / C&I, Residential?

KV: Decarbonisation efforts have taken centre stage in India since our Hon’ble Prime Minister announced India’s Net Zero goals by 2070. India’s leadership of the International Solar Alliance has also brought considerable focus on solar energy. All this has resulted in a significant addition of Renewable Energy (RE) capacity in India in the last few years. However, as far as solar energy is concerned, the majority of the

capacity addition has been in the utility-scale segment – large plants that supply green energy directly to the grid. The Utility, C&I and residential sector struggled in 2022 due to rise in solar module import prices, and demand, which caused delay in projects. However, as government has introduced new policies to promote domestic manufacturing, this industry is hopeful for strong rebound in 2023. A key expectation in 2023 is from the Commercial and Industrial sector (C&I) sector. The sector is largely expected to pick a significant part of the slack from the utility scale projects that faced challenges of pricing or other aspects.

As Commercial and Industrial (C&I) customers consume close to 50% of the power produced in India, thereby being the single largest segment. There are some major reasons driving C&I segment, like-

1. More awareness in the industrial segment about the environment impact of their operations and companies have started taking steps towards incorporating sustainable methods.

2. Fall in the tariffs of renewable energy, making it more clear for those industries which are energy intensive, to go for renewable energy as it helps them to save larger amount on their electricity bill.

3. Also, technological advancement and business model also helps in growth.

4. As India aims to increase its non-fossil fuel based power capacity to 50% of total capacity by 2030, more RE capacity will get added.

EQ: Which region or states looks most promising to you for 2023?

KV: In India, several regions and states have shown significant potential and promise in the renewal energy sector. However, this Industry is dynamic and its development is subject to various factors such as government policies, infrastructure development, and solar resource availability.

14 EQ JULY-AUGUST2023 www.EQMagPro.com

Opportunity in Cables & wires Industry:

The top 6 states for installed renewable capacity in India are Rajasthan, Gujarat, Maharashtra, Karnataka, Tamil Nadu and Telangana. The reason behind is their climate, state government initiative and improved policies, State and Central government’s approved budget and many projects for enormous capacity of solar energy production.

Rajasthan with 16.4 GW Installed Capacity, has the highest solar power generation potential of any state in the country. Rajasthan plans to install 30,000 MW of solar energy capacity by 2025. Whereas, Gujarat with 8.8 GW Installed capacity, has recently identified 1,00,000 hectares of wasteland in the Kutch district to build the world’s largest renewable energy park with a 30,000 MW capacity. This project would be a mix of solar and wind power. Maharashtra with Installed Capacity 16 GW, has recently signed MoUs to add projects to generate 5,220 MW of renewable energy for Rs 41,000 crore

If we look at Southern India, Karnataka with 8.1 GW Installed Capacity,is the third largest producer of solar energy in India. Karnataka has 1,000 MW of projects in the queue. Tamilnadu having 6.5 GW Installed Capacity-has immense renewable energy potential, with access to sources such as wind, solar, biomass, biogas, hydropower, etc. The Tamil Nadu Generation and Distribution Corporation is planning to install solar power plants with a total capacity of 20,000 MW by 2030 and also planning to develop district level solar parks. India’s southernmost state Telangana with 4.6 GW installed capacity, ranks fifth in terms of solar power generation capacity. The state also chose a distributed solar installation plan, which has resulted in savings of almost 450 crores. The state is also home to the largest floating solar PV plant in India with a 100 MW capacity.

EQ: How much manufacturing capacity India has in terms of Solar Modules, Inverters, Cells etc and what’s your anticipation in capacity addition in 2023?

KV: India has solar cell manufacturing capacity of approximately 4.7 GW as of September 2022. This is expected to increase by seven fold by the end of CY 2024.

India's solar photovoltaic (PV) module manufacturing capacity exceeded 39 GW at the end of September 2022 and is expected to reach around 110 gigawatts (GW) by the financial year (FY) 2026, which will make the country selfsufficient.

As far as anticipation in manufacturing capacity addition in 2023, the positive market developments in the first months of 2023 promise another solar boom year, expected to result in 341 GW of newly-added solar to the grid, by the end of the year – equal to 43% growth. India’s cumulative module manufacturing nameplate capacity has more than doubled from 18 GW in March 2022 to 38 GW in March 2023. Compared to FY2022, Indian PV exports (by value) have already risen by more than 5x in FY2023. Between 2020 and 2023, the nameplate capacity for both cells and modules more than doubled in India. We estimate that the operational capacity for both cells and modules is between 50-60% for most manufacturers.

EQ: What kind of growth do you see coming in the residential sector demand ?

KV: Power consumption grew 9.5 per cent to 1,503.65 billion units year-on-year in 2022-23, mainly due to higher demand amid a rise in economic activities, showed government data. India has emerged as a major player in the global energy market, with the country ranking third in the world for primary energy consumption, according to the India Energy Outlook 2021 report by the International Energy Agency (IEA). The residential sector has been a significant driver of solar energy demand in many countries, and it is expected to continue experiencing growth in the coming years. It can be influenced by factors specific to each market, including local economic conditions, utility regulations, consumer preferences, and government support. Continued innovation, favourable policies, and public awareness will play significant roles in shaping the growth of the residential sector’s demand for solar energy.

INTERVIEW

VRINDA NANO TECHNOLOGIES... EMERGING COMPANY, BUILDING A BETTER & GREENER TOMORROW

Dr. Vikas Almadi Managing Director

Dr. Vikas Almadi Managing Director

VNT offers solutions ranging from highly efficient telecom power systems and power management systems, to wireless solar string monitoring solutions, earthing and lightning protections, and state-of-the-art fire protection solutions. VNT offers Safety Audit services to various industries and helps Renewable energy developers do the power systems study. VNT is connecting India through its telecom solutions. Our Super High-Efficiency SMPS is powering the telecom towers all over our country even in remote areas, enabling telecom connectivity for the end-user and enriching their lives. We empower solar farms with an array of energy-efficient and sustainable solar solutions. Solar String Combiner Boxes with Monitoring from VNT are a plug-and-play solution for solar installations that makes supervision easy. We develop accessible power generation resources and assist with utility-scale and rooftop projects for businesses in India and abroad by leveraging our ingenuity, portfolio, and commitment.

Aligned with the UN SDGs, our Sustainable Development Agenda is to pioneer solutions that aid in the utilisation of renewable energy in the domains of telecommunication, fire safety, asset monitoring, and lightning and surge protection. VNT is contributing to India’s goal of becoming carbon neutral by 2070. Our vision is "To help the world become greener, connected, and protected." And mission is in line with our. Vision "To simplify and provide innovative and efficient energy systems" . We are currently diversified into five main verticals: telecom, Solar and BESS, EV. Utilities+ Industries In the Climate Change Space, we see strong emergence of e-Mobility, Energy Storage. Our unwavering passion for harnessing innovative technologies has propelled us to spearhead the delivery of cutting-edge solutions. At VNT, we are fully committed to meeting your present needs while strategically planning for future business endeavours. With an unwavering focus on safety and quality control, we strive to provide unmatched solutions that cater to the ever-evolving requirements of the critical sectors we support. Integrity and a strong dedication to serving others form the cornerstone of our holistic approach.

We prioritize addressing critical priorities and developing comprehensive strategies that align with your business objectives. As we continue on this path, we remain steadfast in our mission to deliver unparalleled solutions that expand horizons and elevate business utility. Join us as we embark on an exciting journey of technological advancement, anticipating your needs and paving the way for a successful future...Our enthusiasm for leveraging innovative technologies has bolstered us in spearheading the delivery of solutions by harnessing technological advancement. We are committed to increasing business utility by anticipating your present needs and planning future business strategies.

We deliver unparalleled solutions in their scope of expandability to cater to the ever-challenging needs of the critical sectors we support, with safety and quality control as our highest priorities. Our integrity and willingness to serve underpin our holistic approach to addressing critical priorities and developing comprehensive strategies.

16 EQ JULY-AUGUST2023 www.EQMagPro.com INTERVIEW

What is your market share of string monitoring boxes and string combiner boxes in India?

VNT has been manufacturing string combiner boxes and string monitoring boxes for last seven years. We have supplied more than 25 GW of solar power plants in PAN India, and have approx. 50% market share as of today’s date and emerged as clear leaders. We strive to acquire 60-70% market share in 2–3 years.

You have been in the market for a long time and are growing a lot. What has been your strategy for growth and success?

We are glad to inform that Vrinda Nano Technologies has supplied power management solutions to more than a 100,000 telecom sites and supplied combiner boxes, monitoring devices in more than 25 GW of solar power plants, and started successfully with EV charger solutions for various sectors. We have started various new verticals catering to consumer, industrial, railway, and defense sectors, and developed new high efficiency rectifiers and SMPS for telecom. VNT was incorporated in 2003 with the vision of providing reliable solutions and comprehensive services of the highest quality in order to ensure customer satisfaction.

Due to our vast experience with evolving technologies , we design our soutions as per field requirements. We have capacity to deliver large capacities with well controlled processes. We offer package of products and irreplicable knowledge on site solutions and safety, We have willingness to serve the customer needs and keep the uptime as high as possible. The company brings decades of expertise to its clients' businesses through its integrated approach that meets stringent expectations for power management solutions, energy conservation, fire safety, lightning and surge protection, and asset monitoring.

In the ever-challenging business sectors such as telecommunications, renewable energy, defense, railways, and others, the company constantly seeks new and innovative ways to make every operation reliable, flexible, safe, and sustainable. It focuses on enhancing business utility and intervention to work for a client, anticipating client needs today, and preparing business strategies for tomorrow. With a dedicated team of technical experts and certified professionals, our maintenance services allow businesses to manage unforeseen risks. We place a high value on comprehensive earthing audits, electrical health and safety audits, energy audits, and more, from visual inspections to comprehensive risk consulting. Our long-term vision and commitments put the resilience and reliability of our services to the test.

What are your plans for overseas expansion? Currently, you are operating in all markets; what’s the future plan?

We have started our operations in the Philippines, UAE, Indonesia, and Saudi Arabia. We will soon be entering in the North American market. We are always committed to providing worldclass products with an aspiration of Indian roots and a global mindset.

What are your views on the same, and how do you plan to tap this growing opportunity?

VNT is taking a bold step into the flourishing EV market in India, recognising the tremendous potential of the EV ecosystem. With electric vehicle sales in India predicted to hit a whopping 1.7 million units in FY 2023 and sales surging at an impressive rate of 130 percent YoY and a projected 153 percent growth in FY 2023, VNT has already bagged many orders for EV charger solutions and is confident of growing the EV vertical in line with the growth of emobility in the country.

www.EQMagPro.com 17 EQ JULY-AUGUST2023

INTERVIEW

MR. HARISH MANIKIREDDY

Senior Manager- Operations

Sungrow India

EQ: How did Sungrow overcome Covid lockdown for supply chain activities for production at factory?

HM: We as a global company have lots of supply chain activities involved in production and we are also faced with difficulties during the covid lockdown period like all others, but we take this lockdown period as challenge and worked proactively with our Suppliers, Logistics partners and internal cross functional teams. We planned raw materials purchase both locally and imported during lockdown with the support of our suppliers and logistics partners. We followed government regulations strictly on social distance. Day to day we interact in meetings, understand situations outside, take necessary steps to achieve our target to complete the production and dispatches on time without any delays.

EQ: What kind of impact faced by Sungrow on BIS certification notification on raw materials / finished goods at the time of customs clearance?

HM: Sungrow India has not much impacted due to BIS certification. The number of testing laboratories are not many in India for the variants or models that are offered by Sungrow, and it takes lot of time for getting BIS certifications. However, we have faced little difficulties in terms of customs clearance process. MNRE is very aware of the situation about testing laboratories in India and delays of getting certifications, So given exemptions notification on quarterly basis to customs which has supported us to custom clear our products using self-declarations.

EQ: How was the impact on Imported FG Inverters because of 20% customs duty hike on BCD (basic Customs duty from 10% to 20%)?

HM: The BCD Increase from 10% to 20% on inverters has impacted on sales majorly for all the Inverters suppliers. As we have seen, most of the customers are not ready to take the hit due to the extra cost of 10%. Fortunately, Sungrow have strategically planned to the local manufacturing facility in India which over comes this challenge easily and we are top in the competition where customers have shown interest in our Made in India inverters products. We are proud to say that we are contributing to “Atmanirbhar Bharat mission” as part of our Prime Minister top priorities in Renewable Energy industry and contributing to improve the Indian economy and providing clean power for all.

EQ: What is the Role of Logistics in Supply Chain Management?

HM: The entire process of monitoring the transportation of goods and services from one place to its intended destination

is termed as “logistics.” The term logistics was originally used to refer to the transportation of equipment to military armies on the ground. However, in modern times, logistics is not just limited to its definition. It can shapeshift very easily to fit into the demands of an organization. It is more than just delivering the final goods to the consumers. The logistics department is also tasked with the responsibility of warehousing, managing outbound and inbound transportation, planning to meet demands, and handling materials. They are also in charge of inventory management, transport management, and fulfilment of orders.

EQ: What is the Difference Between Supply Chain Management and Logistics?

HM: Supply chain management and logistics are two very different processes. While supply chain management is confined to the bigger picture, logistics is comparatively small.

a. Logistics is all about producing the goods in one organization and distributing them amongst the consumers who demand the goods.

b. Supply chain management, on the other hand, is a group of organizations that strive to distribute goods in voluminous quantities among their consumers. In this sense, it is a large-scale operation involving multiple moving parts.

EQ: What are the Main Challenges Related to the Supply Chain that Solar Companies are Currently Facing?

HM: The supply chain is a vast and fruitful field, brimming with immense opportunities for exploration and experimentation. In the present competitive market, companies that do not invest in supply chain management end up paying a hefty price.

These companies fail to consider many crucial factors like:

a. Rising costs throughout the supply chain.

b. Consumer demands for improved delivery speed and customer satisfaction.

c. Volatile risks in the supply chain such as market fluctuations, trade disputes, etc.

d. The complexities of risk and cost management.

18 EQ JULY-AUGUST2023 www.EQMagPro.com

INTERVIEW

MAHAPREIT AND GEAPP LAUNCH SOLARISATION OF AGRICULTURAL IRRIGATION INITIATIVE IN INDIA

MAHAPREIT and GEAPP launch a 500 MW agriculture solarization programme, which will attract an investment of INR 2500 crores in solar energy for the state of Maharashtra.

The 500 MW solarisation programme will benefit 100,000 farmers over the next two years.

Mahatma Phule Renewable Energy and Infrastructure Technology Limited (MAHAPREIT) and the Global Energy Alliance for People and Planet (GEAPP) have held a successful partner meeting in Mumbai. The meeting focused on the upcoming 500 megawatts (MW) tender in Maharashtra, building on the partnership established earlier this year through a Memorandum of Intent (MoI). The MoI aims to accelerate the adoption of renewable energy and promote sustainable development in India. The partner's meeting served as a platform for MAHAPREIT and GEAPP to strategies and collaborate on the implementation of renewable energy initiatives. During the meeting, MAHAPREIT and GEAPP drew the roadmap for the implementation of the 500 MW tender for PM-KUSUM C/Mukhyamantri Saur Krushi Vahini Yojana. This will benefit the state in three ways - bringing an investment of INR 2500 crores in solar energy, reducing CO2 emissions by 400,000 tonnes annually, and supporting 100,000 farmers.

Today's meeting is a step forward in our collaborative effort with GEAPP to drive the clean energy transition in Maharashtra. We are positive that through this partnership, we will enable the state target of 7000 MW solar power generation by the end of 2025, as per the Mukhyamantri Saur Urja Krishi Vahini 2.0, said Mr Bipin Shrimali, Chairman and Managing Director, MAHAPREIT.

GEAPP in India is supporting MAHAPREIT by appointing a Project Management Unit (PMU), which will help MAHAPREIT conduct land surveys, identify land parcels, aggregate demand, and conduct tenders to onboard EPC players. PMU will also monitor the programme execution and liaise across government departments on behalf of MAHAPREIT. Within a month’s time, MAHAPREIT and GEAPP plan to launch a cluster-led SME solarisation initiative with an objective of 500 MW of decentralised solar. Sangli, Nasik, Ichakranji, and Kolhapur have been identified as the focus districts for the first leg of the programme. Discussions with local MSME associations have been initiated. Post the success of the first phase; the programme will be scaled across other districts of Maharashtra.

Mr. Saurabh Kumar, Vice President-India, GEAPP, said, “The roadmap that we have prepared in our meeting today is a step towards the collective goal of MAHAPREIT and GEAPP. The Government of India has introduced many schemes & programmes targeted towards improving the earnings of farmers and small enterprises between 2017 & 2019 and has been focused on their welfare. GEAPP has already started discussions with local MSME associations, and the PMU will support the effective and efficient roll-out of the programme. GEAPP in India is also working with a facility manager to create a credit guarantee mechanism to unlock financial linkages for this sector”.

Senior officials from MAHAJENCO, MSEDCL, MEDA and MERC attended the meeting.

www.EQMagPro.com 19 EQ JULY-AUGUST2023 SOLAR INITIATIVE

GROWATT SHINES BRIGHT WITH SHINE ELITE INDIA - HYDERABAD EDITION AND LAUNCHES INNOVATIVE

PV INVERTER

Hyderabad, India - July 28, 2023 - Growatt, a global leader in the renewable energy industry, organized the prestigious SHINE ELITE INDIA - HYDERABAD EDITION Solar Technical Program at Hotel Raddison Blue on July 27, 2023. The event witnessed the launch of the much-anticipated MID 33-50KTL3-X2 PV inverter and garnered participation from esteemed guests and key distributors from all over India.

The event was graced by prominent personalities, including Shri N. Janaiah, VC & MD of TSREDCO, who was the Guest of Honor, and Shri Y. Satish Reddy, Chairman of TSREDCO, who presided as the Chief Guest. Also in attendance was GV Prasad, GM at TSREDCO. The esteemed presence of these dignitaries reflects the significance of the event and Growatt's commitment to promoting solar awareness and sustainable energy solutions in the region. The highlight of the occasion was the launch of the MID 33-50KTL3-X2 PV inverter. With features like higher yields, maximum efficiency of 98.8%, and the maximum DC input current reaches 16A for each string, making it an ideal match for high-power and bi-facial solar modules. With a maximum 50kW per unit, the MID 33-50KTL3-X2 establishes a new record in power density innovation. Moreover, the inverter's safe and reliable design, including IP66 protection degree, fuse-free design, and Type II SPD on DC&AC side, ensures superior performance and safety for customers.

Speaking at the event, Shri Y. Satish Reddy appreciated Growatt's efforts in the renewable energy sector and extended the support of the Telangana Government and TSREDCO for all the company's initiatives and expansion plans in the state. This collaboration signifies a vital step towards promoting clean and sustainable energy solutions in Telangana.

Shri N. Janaiah emphasized the tremendous growth in Telangana's renewable energy sector over the past 6-7 years and reaffirmed TSREDCO's commitment to creating promotional activities that increase solar awareness among the people. He assured full support from TSREDCO for Growatt's future endeavors in the region.

Key members of the Growatt team present at the event were Mr. Shantanu Sirsath (Technical Head India), Mr. Abhishek Samaiya (General Manager India - Sales), Mr. Bhaskar Reddy (Key Account Manager - Sales - South India), and Mr. Sunesh Menon (Product Engineer India). Their expertise and dedication reflect Growatt's commitment to providing smart and innovative PV solutions. The SHINE ELITE INDIA - HYDERABAD EDITION was a resounding success, showcasing Growatt's commitment to driving solar adoption and sustainable energy solutions across the country. With the launch of the MID 33-50KTL3-X2 PV inverter, Growatt further solidifies its position as a pioneering force in the renewable energy sector.

20 EQ JULY-AUGUST2023 www.EQMagPro.com SOLAR INVERTER

RENEW ANNOUNCES APPOINTMENT OF THREE INDEPENDENT DIRECTORS

New Board members to replace retiring Directors.

Will increase gender diversity of the Independent Board.

ReNew Energy Global Plc (“ReNew”) (Nasdaq: RNW, RNWWW), India's leading renewable energy company and a preferred decarbonisation partner, announced that the Board of Directors has appointed Ms. Paula Gold-Williams, Ms. Nicoletta Giadrossi and Mr. Philip Graham New as Non-Executive Independent Directors with effect from August 23, 2023. The appointment is subject to the approval of the Company’s shareholders at the ensuing Annual General Meeting of the Company and, if approved, the respective term of office for each appointee will last until the Annual General Meeting scheduled to be held in the calendar year 2025. ReNew is committed to diversity and inclusion at all levels, and having more women directors on the Board is an important step towards the goal. The Company will continue to have majority of independent directors on its Board. Mr. Ram Charan and Ms. Michelle Robyn Grew, Independent Directors of the Company retire on August 22, 2023 due to expiry of their term. The tenure of Mr. Philip Kassin, MKC Investments LLC Nominee and Independent Director is expiring on August 22, 2023 in terms of the Articles of Association of the company due to expiration of the director nomination rights of MKC Investments LLC. The non continuation of the directors afore-mentioned was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

PROFILE OF NON-EXECUTIVE INDEPENDENT DIRECTORS

Paula

Gold-Williams

Ms. Gold-Williams is the former President and CEO of CPS Energy, a fully integrated electric and natural gas municipal utility based in San Antonio, Texas. Currently, she serves as a corporate director on the board of Emera, Inc., a utility holding company headquartered in Nova Scotia, Canada. Additionally, she is the Chair of the Keystone Policy Center, a board member, and Treasurer of EPIcenter, and an Energy Pillar Co-Chair of Dentons Global Smart Cities Communities Initiatives and Think Tank. She is part of the US Secretary of Energy’s Advisory Board (SEAB). Ms. Gold-Williams has held other board positions, including First Vice Chair of the Electric Power Resource Institute (EPRI) and Chair of the San Antonio Chamber of Commerce. Ms. Gold-Williams earned an Associate Degree in Fine Arts from San Antonio College, a BBA in accounting from St. Mary’s University, and a Finance and Accounting MBA from Regis University in Denver, Colorado. She is a Certified Public Accountant and a Chartered Global Management Accountant.

Nicoletta Giadrossi

Ms. Giadrossi holds various leadership roles in prominent companies. She is currently Chair of Gruppo FS Spa in Italy, Chair of MSX International Ltd, and Sustainability & HSE Committee Chair in TKE, Germany.

She also serves on the board of Royal Vopak N.V., Amsterdam, and participates in their Audit and Remuneration committee. Her past roles include being a board member of Brembo S.p.A., an Italian automotive components manufacturer, where she chaired the Remuneration Committee and was a member of the Audit, Risk & Sustainability Committee. Ms. Giadrossi has extensive experience in leading and participating in audit, risk, sustainability, and remuneration committees. Her executive career spans 30 years in energy, engineering, and capital goods. Notably, she served as President, Europe, Africa, India, for Technip from 2014 to 2016, and as EVP, Head of Operations, for Aker Solutions from 2012 to 2014. Prior to that, she held various executive positions at General Electric Company, including General Manager for GE’s Oil and Gas, Refinery & Petrochemicals Division. Ms. Giadrossi began her career at The Boston Consulting Group. She holds a BA in Economics and Mathematics from Yale University and an MBA from Harvard Business School. Solutions from 2012 to 2014. Prior to that, she held various executive positions at General Electric Company, including General Manager for GE’s Oil and Gas, Refinery & Petrochemicals Division. Ms. Giadrossi began her career at The Boston Consulting Group. She holds a BA in Economics and Mathematics from Yale University and an MBA from Harvard Business School.

Mr. New is a non-executive director at Norsk Hydro ASA since May 2022 and serves on its audit committee since June 2023. He also holds the position of non-executive director at Almar Water Solutions B.V. since March 2017. Previously, he was CEO of Energy Systems Catapult Limited from November 2015 to May 2022. Before that, he had a long career at BP p.l.c., where he led their bioenergy businesses and served as CEO of BP Alternative Energy, overseeing wind, solar, and technology venturing activities. Mr. New actively contributes to energy transition initiatives, holding positions on various advisory panels and committees related to energy transition, including the U.K. Automotive Council and the U.K. Research and Innovation’s Faraday Battery Challenge. He also chaired the U.K. Electric Vehicle Energy Taskforce for four years and conducted an independent review of the potential for a U.K. sustainable aviation fuel sector, commissioned by the U.K. Department for Transport. Mr. New holds a Master of Arts in Philosophy, Politics, and Economics from Oxford University.

www.EQMagPro.com 21 EQ JULY-AUGUST2023 ANNOUNCEMENT

Philip Graham New

ANNOUNCEMENT

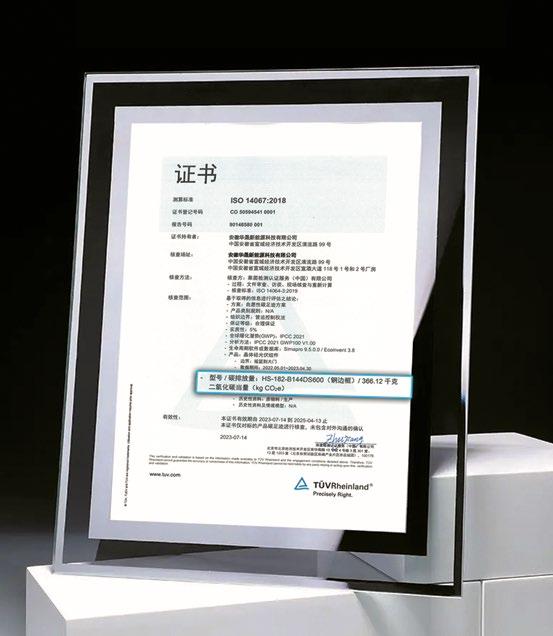

HUASUN ENERGY: THE LARGEST HJT PRODUCT MANUFACTURER’S FIRST SHOW IN INDIA!

Huasun will participate in Renewable Energy India Expo 2023(REI),which will be hold on Oct 4-6 in India Expo Center, Great Noida. As the largest HJT product manufacturer in the world, Huasun will display Himalaya series G10 and G12 high-efficiency HJT solar modules, as well as corresponding HJT cells and wafers, at booth #5.55 in hall 5.

Aiming at the current energy structure and climate features in India, Huasun chooses to show the high-performance products that can represent its latest technology. Delving into HJT 3.0 technology and putting it into large-scale production, the champion efficiency of Huasun’s HJT cells in mass production is 25.6% and the R&D highest efficiency exceeds 26.1%. The Himalaya G12 series modules which are based on HJT 3.0 cells achieve a peak power output of 730.55W with a maximum efficiency of 23.52%, solidifying its industry-leading position.

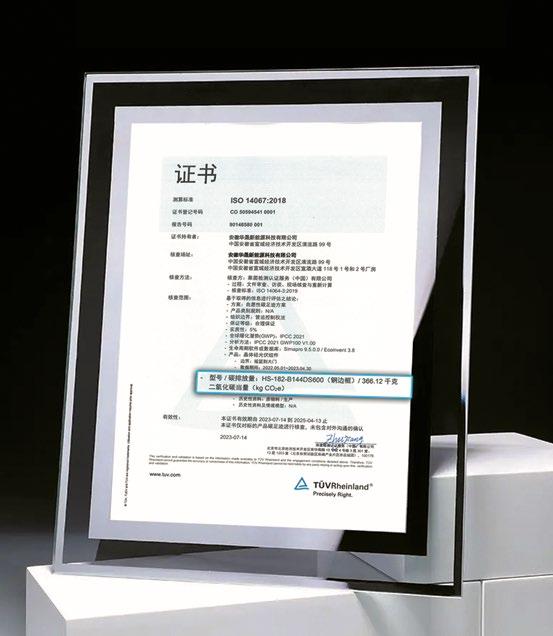

Besides, Huasun adhered to the net-zero goal. The lifecycle carbon footprint of G10-144 type module is merely 366.12g/W CO2e, marking the first time that a photovoltaic module can achieve lower than 400g/W CO2e, showcasing its significant advantage.

Huasun’s high-efficiency HJT modules have the advantages of ‘four highs’ (high efficiency, high power output, high bifaciality, high reliability) and ‘four lows’ (low temperature coefficient, low attenuation, low LCOE, low carbon emissions), as well as featuring a 15-year product warranty and 30-year industry-leading linear performance warranty. These features ensure that they can bring more stable power generation performance and higher reliability. Based on these merits, Huasun's HJT modules are suitable for various scenarios, from residential rooftop to utility-scale power station. REI 2023 will be Huasun’s first show in India. At this show, Huasun will start remarkable journey for different application scenarios and provide higher performance products for the market!

22 EQ JULY-AUGUST2023 www.EQMagPro.com

REPUTED CAPITAL MARKET INVESTORS LED BY ANIL KUMAR GOEL, PRASHANT JAIN AND NEERAJ GUPTA PARTICIPATE IN

ORIANA POWER'S PRE-IPO FUNDING

• Jaipur-based Manoj Agarwal and MSMEx’s Amit Kumar, too, pick up minority stakes.

• The company has recently introduced TrueRE as its corporate brand, highlighting the intent to further diversify into other renewable energy avenues – beyond solar.

The SME IPO-bound Oriana Power Limited has successfully closed its pre-IPO round, with the participation of several reputed stock market veterans. The marquee investors include Chennai-based Anil Kumar Goel, JSW Energy’s Prashant Jain, Meru’s founder Neeraj Gupta, Jaipur-based Manoj Agarwal and MSMEx’s Amit Kumar.

Chennai-based Anil Kumar Goel, well-known for his sterling value-investing track record in sugar and textile stocks, led the pre-IPO round. Tikri Investments, the personal fund of JSW veteran Prashant Jain, also picked up a minority stake in the pre-IPO round. Meru’s founder Neeraj Gupta, the pioneer in the appbased taxi ecosystem and now a serial investor and advisor, also invested in his personal capacity. While other investors, including Jaipur-based renowned long-only veteran Manoj Agarwal and Amit Kumar, founder of MSMEx, India's largest Live Online Coaching and Handholding platform for MSME business owners, also participated in the round. Among India’s fastest-growing solar energy solution providers, Oriana Power recently filed Draft Red Herring Prospectus (DRHP) with NSE Emerge for its proposed initial public offering (IPO). The IPO comprises the issue of 50.55 lakh Equity Shares (Face Value Rs 10/) through the book-building route. The company has appointed Corporate CapitalVentures Private Ltd as Lead Manager for the issue, while Skyline Financial Service Private Ltd. will be the Registrar to the issue. As per the DRHP, the company will utilise issue proceeds from the IPO towards meeting its working capital requirements (Rs. 23 crore), investment in subsidiary companies (Rs. 20 crore), capital expenditure for expansion purposes (Rs. 2 crore) and general corporate expenses.

Co-founded by entrepreneurs Anirudh Saraswat, Rupal Gupta and Parveen Kumar Jangra, Oriana Power commenced operations in 2017. As per the DRHP, the three promoters currently hold 83.40% in the company. Post issue, the promoters' stake would stand reduced to 61.41% in the company. For the year ended March 31, 2023, the company's revenue stood at Rs. 134 crore compared to revenue of Rs. 101 crore in the same period of 2022. However, the company's profit after tax almost doubled to Rs 12.69 crore during the year ending March 31, 2023, from Rs 6.96 crore registered in the previous fiscal year, as per the DRHP. The company has recently introduced TrueRE as its corporate brand, highlighting the intent to further diversify into other renewable energy avenues – beyond solar.

Oriana Power is a company that specialises in providing solar energy solutions to industrial and commercial customers. The company offers low-carbon energy solutions by installing on-site solar projects such as rooftops, groundmounted systems, and off-site solar farms, i.e., Open access. Its business operations are primarily divided into two segments: Capital Expenditure (CAPEX) and Renewable Energy Service Company (RESCO). The company caters to marquee clients comprising eminent corporates, including Hindustan Petroleum Corporation, Hero Motocorp, Indraprastha Power Generation, JK Laxmi Cement Limited, Tata Memorial Hospital, Hindustan Copper, National High-Speed Rail Corporation, Modern Delhi Public School, Faridabad, Sarvodya Kanya Vidyalaya, Umang Dairies, Hero Cycle, Maral Overseas (Bhilwara group), Mrs Bector (Cremica), Mahindra CIE, Sona BLW, RACL Geartech, among others. In May 2023, the company successfully commissioned a 2.7 MWp single rooftop solar power plant at the Indian Oil Corporation Ltd (IOCL) refinery in Panipat, Haryana, for Indian Synthetic Rubber Private Limited (ISRPL). During April 2023, the company also successfully commissioned a novel 800kW AC/1MWp DC floating solar power plant at Dabok Mines of Udaipur, Rajasthan, for Udaipur Cement Works Limited (UCWL).

www.EQMagPro.com 23 EQ JULY-AUGUST2023 BUSINESS & FINANCE

BUSINESS & FINANCE

NORFUND ANNOUNCES REPEAT INVESTMENT INTO FOURTH PARTNER ENERGY; ADDITIONAL ₹350 CR TOWARDS EQUITY INFUSION

IFC TO ALSO PUMP IN ₹560 CR TO FINANCE

IN ATHARGA, KARNATAKA

Norwegian Investment Fund for developing countries – Norfund announced a fresh investment of ₹350 Cr into India’s leading renewable energy solutions platform, Fourth Partner Energy (4PEL). This is the second round of equity infusion by Norfund into 4PEL, following its $100 Mn investment in June 2021.

Speaking about this development, Anders Blom, Vice President at Norfund said, “the past 2 years has given us a thorough understanding of the technical prowess and execution capabilities at Fourth Partner Energy. We have also journeyed together in commencing wind power generation in Gujarat, while developing hybrid parks across Tamil Nadu and Karnataka. The company has grown from an asset base of 550 MW in 2021 to 1.35 GW today. 4PEL’s leadership team is determined to balance the planet with profitability – while adhering to the highest standards of integrity, ESG and health & safety norms. To further our partnership, Norfund is excited to infuse an additional ₹350 Cr into 4PEL as they inch closer to the 3.5 GW asset portfolio target by 2025.”

Echoing Norfund’s sentiment, Vivek Subramanian, Co-Founder & Executive Director at Fourth Partner Energy added, “India’s green energy ecosystem is entering into a transformative phase –corporate leaders today are no longer talking about merely adopting clean energy but ensuring RE100. This makes what we do at 4PEL essential as we are arguably, India’s only integrated Renewable Energy solutions provider with in-house capabilities in delivering end-to-end solar, wind, hybrid, battery storage and EV charging solutions on a single platform to the corporate client.

Norfund’s repeat investment is reflective of our strong partnership and our USP in today’s renewables marketplace – in fact all our investors since the inception of the firm including Chennai Angels, Infuse Ventures, TPG Capital have carried out multiple rounds of equity investment with 4PEL.” Throwing light on the company’s recent developments on debt funding, Vivek added, “On the debt side as well most lenders like BII, Oiko Credit, responsAbility, SBI, IREDA and TCCL have repeated their commitment. To fuel our business expansion, Fourth Partner has also tied up ₹560 Cr as project finance from IFC for execution of 90 MW of rooftop solar assets pan-India and our 75 MW solar park in Atharga, Karnataka. In Indonesia, we have raised $9 Mn from responsAbility for business expansion – our fourth tranche from the Swiss Climate Action fund, and the first for Indonesian operations.

Fourth Partner Energy has announced a 600 MW ISTS (Inter State Transmission System) project in Karnataka, on the back of commissioning its first Wind Solar Hybrid project in Gujarat last month. For this fiscal, company has off-site solar and wind projects under development in Tamil Nadu, Karnataka, Maharashtra and Uttar Pradesh, while continuing to bet big on on-site solar energy projects pan-India.

24 EQ JULY-AUGUST2023 www.EQMagPro.com

4PEL’S ROOFTOP SOLAR PROJECTS AND 75 MW SOLAR PARK

The company has an installed portfolio of 1.35 GW currently and is targeting a 3.5 GW asset base by 2025.

NEURON ENERGY SECURES INR 200 MILLION FUNDING LED BY EQUANIMITY INVESTMENTS AND RAJIV DADLANI GROUP

EV smart battery manufacturer Neuron Energy has successfully raised INR 200 million in their Pre-Series A Round. The investment was led by Equanimity Investments and the Rajiv Dadlani Group and also saw participation from Chona Family Office (Havmor Group) and Kayenne Ventures, alongwith reputed Family Offices and HNI investors.

This funding round marks a major milestone for the promising lithium-ion EV smart battery manufacturer, Neuron Energy, which has been rapidly growing since its inception in 2018. The Company plans to use the funds primarily to support key initiatives, such as obtaining essential ICAT Certifications and investing in mould development, along with strengthening the workforce by expanding the R&D team and hiring CXO’s and senior management. Furthermore, the funding will fuel Neuron’s expansion of Li-Ion smart batteries for EV 2W’s and 3W’s while aiding in the brand’s venture into drone batteries. The Company has a low capex and low opex business model, thereby enjoying high operating leverage, also have been growing profitably YoY and is on track to cross Rs. 100 Crores in Net Sales Revenue this year and is confident to achieve Net Sales of over Rs. 500 Crores, with robust profitability, over the next few years, highlighting the Company's strong desire, to capture a larger market share and its firm commitment, to achieving significant sales growth in the dynamic and rapidly growing EV industry. With a focus on producing high-quality smart batteries and offering the highest service standards, Neuron has established itself as a trusted and reliable brand among OEMs. The Company provides lithium-ion and lead-acid technology smart batteries for E-Bike, E-Rickshaws, and Golf Carts. Neuron Energy has a large export and domestic network, for sales in E-Bike smart batteries. Their branded products are sold through their extensive pan India network, of multiple Depots and Distributors. Neuron Energy has also increased its export footprint, to the Middle East, Europe, and South-East Asia

Rajesh Sehgal, Managing Partner of Equanimity Investments commented

“The EV landscape in India is evolving and is expected to gain pace in the coming years, as India moves towards a well-planned holistic trajectory by making significant progress towards an electric future. This also makes battery manufacturing a huge opportunity, as it is at the heart of the energy ecosystem transition. Our conviction in the founders' capabilities and the inherent robustness of the company, makes them well-positioned to contribute towards shaping the future of EVs in India.”

Commenting on the Fund raise, Pratik Kamdar, CEO & Co-Founder, Neuron Energy said, "This fundraise marks a crucial milestone in our company's growth journey. Our esteemed investors bring extensive expertise in scaling businesses and will play a pivotal role in guiding our expansion. The funds raised will not only enhance our manufacturing capabilities but also bolster our workforce across all levels. Neuron Energy is committed to serving a broader customer base with top-of-the-line, rigorously tested lithium-Ion smart battery packs, and this funding will undoubtedly propel us towards achieving that goal."

Rajiv Dadlani, from the Family Office of the Rajiv Dadlani Group, said "As long-term growth investors, we recognise the enormous opportunity of the EV industry. Neuron Energy demonstrates remarkable potential to become the market leader with their exceptional efficiency in delivering top-quality products. The Company and its Founders are highly committed to delivering rigorously tested and safe-to-use Li-Ion smart batteries, a key factor that has sparked significant investor interest. We are confident that with our guidance, support and long-term approach, Neuron Energy will continue to thrive and set new standards in the industry."

In addition to the funding, Neuron Energy actively seeks to establish a strategic partnership, with a leading EV two-wheeler manufacturer, to establish a dedicated state of the art facility. Furthermore, the company has strengthened its expertise by appointing Mr. Chandrasekhar for Strategy and Growth and Mr. Subramanian for Technology Development guidance to its advisory board, further reinforcing its capabilities and positioning in the market. Chandrasekhar Rajagopalan is a seasoned professional who was earlier associated with Essel Group as a President and President of Commercial & CFO of Reliance’s Petrochemical division. On the other hand, Ramki Subramanian is an experienced Senior Management professional who is the Managing Director and Global Director for Mobility with DowAksa USA LLC.

www.EQMagPro.com 25 EQ JULY-AUGUST2023 BUSINESS & FINANCE

CAPITAL OUTLAY ON ROADS, RENEWABLES SEEN RISING ~35% IN THIS AND NEXT FISCALS TO RS ~13 LAKH CR, BACKED BY STRONG EXECUTION PACE

The combined capital outlay1 on roads and renewables in the current and next fiscals is seen rising to Rs ~13 lakh crore, a whopping ~35% growth compared with the preceding two fiscals, backed by strong execution speed. The pace of construction of roads and capacity addition in renewables is seen increasing 25% (refer to chart 1 in annexure) and 33% (refer to chart 2 in annexure), respectively, over the current and next fiscals. This bodes well for the economy, given the high multiplier effect of road development and the critical role renewable energy can play in achieving India’s energy transition. The growth is expected to sustain over the medium term, supported by conducive policies, strong investor interest and healthy financial profiles, leading to stable credit quality of companies in the CRISIL Ratings portfolio in both sectors.

Says Gurpreet Chhatwal, Managing Director, CRISIL Ratings, “The pace of execution of renewable energy projects is set to increase 33% to ~20 GW per annum over current and next fiscals (~15 GW per annum in the past two fiscals) supported by a healthy executable pipeline of ~50 GW of projects as on March 31, 2023. Similarly, road construction is set to accelerate 25% to 12,500-13,0002 km per year over the current and next fiscals on continued healthy awarding of projects and step up in execution by road construction players.”

A supportive policy environment adds its own spurs. For instance, steps such as late payment surcharge has helped keep dues from discoms to renewable generators in check3 . In roads, the introduction of the hybrid annuity model (HAM) has speeded up execution and drawn in investments. Further, initiatives such as Atmanirbhar Bharat, forbearance during the pandemic, and emergence of infrastructure investment trusts (InvITs) have afforded a fillip to both sectors.

Says Manish Gupta, Senior Director and Deputy Chief Ratings Officer, “Investor interest has been encouraging, with Rs 75,000-80,000 crore raised through equity and asset monetisation in the past two fiscals in both sectors. Continued focus on asset monetisation and equity raising, along with healthy cash flows will keep the capital structure balanced in both sectors. So, despite higher capital outlays, rated renewables4 and road5 entities should have a healthy average debt service cushion of 1.2-1.3 times over the tenure of debt on their balance sheets, which supports their credit profiles.”

But challenges remain such as risks of aggressive bidding and execution by new entrants. Rationalisation in bidding strategies will be crucial to sustain profitability and maintaining quality. In the milieu, timely asset monetisation will remain important in the roads sector as InvITs continue to grow. For renewables, if geopolitical developments affect supply chains, it may impact the internal rate of return and pose a risk to our estimates.

26 EQ JULY-AUGUST2023 www.EQMagPro.com BUSINESS & FINANCE

Conducive policy milieu, healthy leverage, strong investor interest to keep credit profiles stable.

PIXON COLLABORATES WITH YES BANK TO ACCELERATE ADOPTION OF SOLAR SOLUTIONS AND GREEN ENERGY PRODUCTS IN INDIA

The partnership will contribute towards enabling the adoption of sustainable energy practices by MSMEs, while also helping them curtail their expenses towards power and fuel. It will also aid in the seamless distribution of PIXON's best-inclass quality products such as highly efficient solar panels and other technologically advanced products in the solar ecosystem. The collaboration is part of YES BANK’s YES KIRAN programme, an attractive lending proposition which aims to revolutionise the global initiative of adopting renewable sources of energy as a primary source.

Speaking about the partnership, Mr. Dhavan Shah, Country Head- SME Banking, YES BANK said, “At YES BANK, we are deeply committed to supporting small and mid-sized enterprises in their journey towards profitability and growth by curating propositions that can empower them to become energy efficient. Our partnership with PIXON is a testament to this effort. We are happy to join hands with team at PIXON to support the adoption of solar technologies and green energy products in India. Given our vast presence across the country, we aim to reach out to a wide network of customers and help them become early adopters of renewable sources of energy.”

Mr. Sumit Mehta, Co-founder & Director of PIXON said, "We are glad to partner with YES Bank and envisage strengthening our footprints across PAN India. With PIXON’s 1 GW state-of-the-art Solar Module manufacturing capacity and Yes Bank’s prominent financial support, this partnership will bring together our capabilities to accelerate solar adoption in India. Now our quest for sustainability gets more empowered through our green energy offerings, and we hope that it will help the nation to unlock and enable future energy by creating a truly Atmanirbhar India."

Established in 2019 as a prominent solar module manufacturing company, PIXON has emerged as a leader in the field. With its 1 GW European technology manufacturing line for solar modules and the upcoming Multi-Busbar Modules range, PIXON has achieved a significant milestone in establishing itself as a key player in the ever-growing renewable energy industry. Being the top 10 solar module manufacturing companies in India, we are dedicated to providing superior quality products and cost-effective solutions to our clients.

www.EQMagPro.com 27 EQ JULY-AUGUST2023 BUSINESS & FINANCE

PIXON, a leading solar module manufacturer announced that it has partnered with YES BANK, to bring forth innovative financial solutions for Micro Small and Medium Enterprises (MSME) who wish to install solar panels at their premises.

SOUTHEAST ASIA'S RENEWABLE INVESTMENT TO TOP $76 BILLION BY 2025, BOOSTING ENERGY INDEPENDENCE AND COMPETITIVENESS

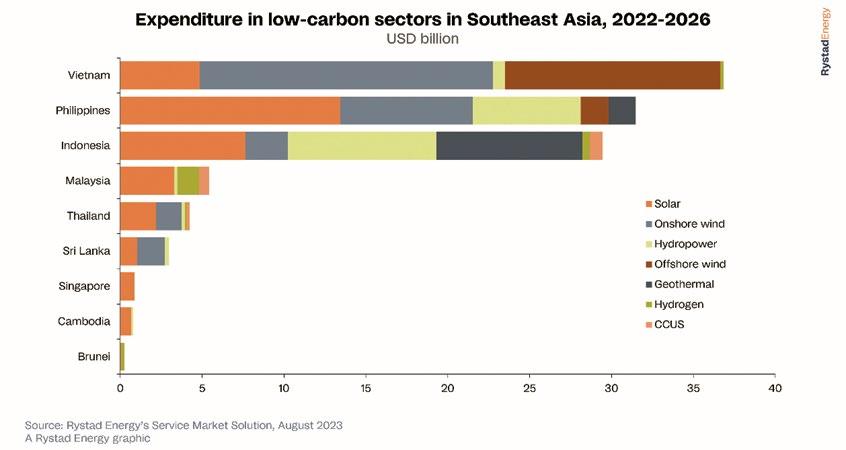

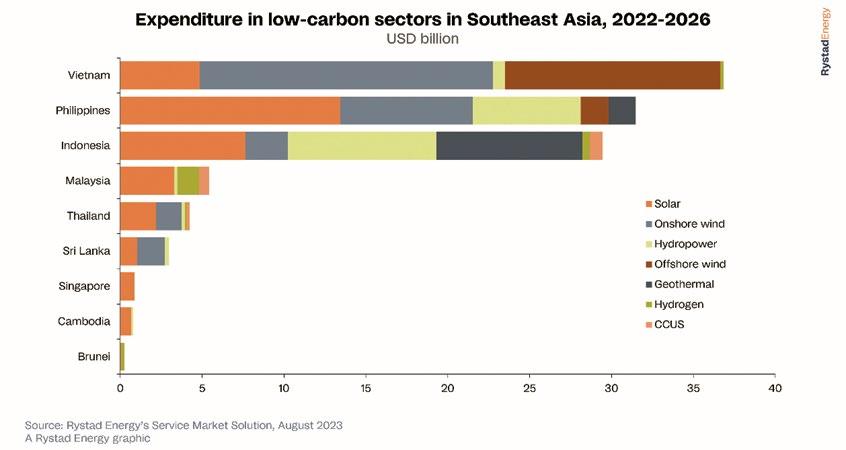

Southeast Asian national oil companies (NOCs) and traditional upstream players are progressively focusing on cleaner and more environmentally friendly energy initiatives. Rystad Energy's analysis reveals a consistent commitment to these initiatives in the years to come, with investments set to exceed $76 billion from 2023 to 2025. The upward trend is set to continue, with a projected total outlay of $119 billion by the end of 2027. This expenditure will be driven by investments in wind, solar and geothermal projects.

Regional NOCs like Indonesia’s Pertamina are expanding their participation in geothermal, while Malaysia’s Petronas aims to establish a notable presence in the carbon capture, utilization and storage (CCUS) market. The Malaysian NOC announced ambitious plans to build the world's largest dedicated facility by 2025, actively pursuing partnerships with international entities to unlock regional project potential. When fully operational, the initiative will have the capacity to capture 3.3 million tonnes per annum (MTPA) of carbon dioxide (CO2) and securely store the collected CO2 within the reservoirs of the Sarawak region over its 25-year operational lifespan. While the total project cost remains undisclosed, Rystad Energy’s estimates suggest it could reach $260 million by 2025. Similarly, Gentari, a wholly-owned subsidiary of Petronas, has made substantial investments in solar capabilities, seeking to harness the nation's considerable renewable energy potential.