waaree@waaree.com www.waaree.com Unveiling Highest Reliability & Enhanced Crack Tolerance 12BB Solar Module Best in Class Thermal Coefficients Better Weak Light Performance Excellent PID Resistance Hall 02, Booth No. J101 Helipad Exhibition Centre Gandhinagar, Gujarat Visit us at 7-9 December 2022

SALES & MARKETING MUKUL HARODE sales@EQmag.net

SALES & MARKETING MUKUL HARODE sales@EQmag.net

SUBSCRIPTIONS :

Disclaimer,Limitations of Liability

While every efforts has been made to ensure the high quality and accuracy of EQ international and all our authors research articles with the greatest of care and attention ,we make no warranty concerning its content,and the magazine is provided on an>> as is <<basis.EQ international contains advertising and third –party contents.EQ International is not liable for any thirdparty content or error,omission or inaccuracy in any advertising material ,nor is it responsible for the availability of external web sites or their contents

The data and information presented in this magazine is provided for informational purpose only.neither EQ INTERNATINAL ,Its affiliates,Information providers nor content providers shall have any liability for investment decisions based up on or the results obtained from the information provided. Nothing contained in this magazine should be construed as a recommendation to buy or sale any securities. The facts and opinions stated in this magazine do not constitute an offer on the part of EQ International for the sale or purchase of any securities, nor any such offer intended or implied

Restriction on use

The material in this magazine is protected by international copyright and trademark laws. You may not modify,copy,reproduce,republish,post,transmit,or distribute any part of the magazine in any way.you may only use material for your personall,NonCommercial use, provided you keep intact all copyright and other proprietary notices. want to use material for any non-personel,non commercial purpose,you need written permission from EQ International.

OWNER : FirstSource Energy India Private Limited PLACE OF PUBLICATION : 95-C, Sampat Farms, 7th Cross Road, Bicholi Mardana Distt-Indore 452016, Madhya Pradesh, INDIA Tel. + 91 96441 22268 www.EQMagPro.com EDITOR & CEO : ANAND GUPTA anand.gupta@EQmag.net PUBLISHER : ANAND GUPTA PRINTER : ANAND GUPTA TRENDS & ANALYSIS MOHAN GUPTA isearch@EQmag.net PUBLISHING COMPANY DIRECTORS: ANIL GUPTA ANITA GUPTA CONSULTING EDITOR : SURENDRA BAJPAI SR. GRAPHICS & LAYOUT DESIGNER : RATNESH JOSHI GRAPHICS DESIGNER : ABHISHEK SARAI

VOLUME 14 Issue 11 CONTENT 14 43 48 63 INTERNATIONAL

RISHABH CHOUHAN admin@eqmag.net

FEATURED INDIA RESEARCH & ANALYSIS BUSINESS & FINANCE LEADING CELL MANUFACTURER SOLARSPACE INAUGURATES 16GW TOPCON SOLAR CELL PLANT ADANI NEW INDUSTRIES SETS UP INDIA’S TALLEST WIND TURBINE IN GUJARAT SERVOTECH POWER SYSTEMS BAGS RS 46 CR ORDER FROM BPCL TO SUPPLY EV CHARGERS ICONIC WORLD HERITAGE GLACIERS TO DISAPPEAR BY 2050, WARNS UNESCO

HEAD

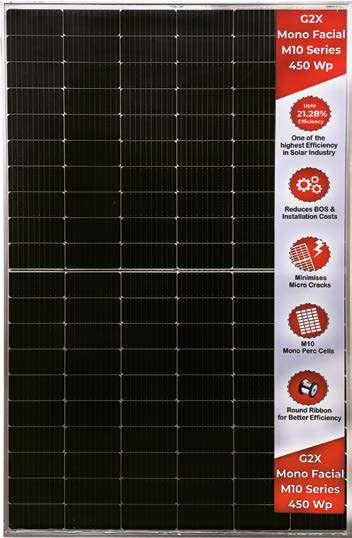

22 16 24 65 79 FEATURED INTERVIEW INTERVIEW ELECTRIC VEHICLE TECHNOLOGY Pg. 08-70 EQ News MR. ASHOK DM, CEO & MD EnerMAN Technologies SunSource Energy doubles its solar energy target to one gigawatt by 2027 MR. VINEET MITTAL, Director & Co-founder Navitas Solar GAUTAM SOLAR LAUNCHES G2X 450 WP M10 HIGH-EFFICIENCY MODULES TO REVOLUTIONIZE ROOFTOP SOLAR PROJECTS MAHINDRA TIES UP WITH THREE EV INFRA PLAYERS FOR CHARGING SOLU TIONS

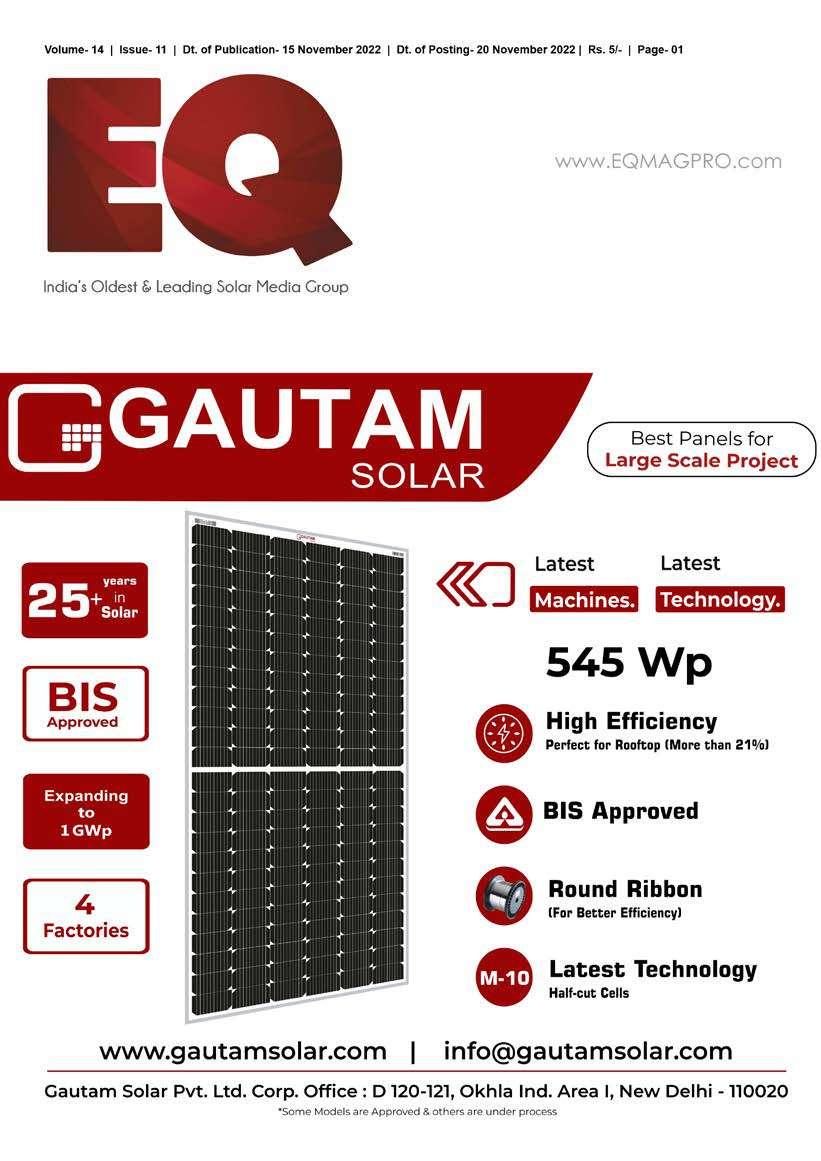

Gautam Solar is a 25+ yrs. experienced Solar Module Manufacturer with 250 MW Solar Module manufacturing capacity, expanding to 1 GW. It manufactures ALMM & BIS approved Solar PV Modules that are deployed in Utility & Rooftop Solar Power plants. It has various IP’s (Patents/ Design Registrations) and a well-equipped R&D centre for continuous development of new products.

Tel.: +86 (10) 63611888 E-Mail: sales@jasolar.com marketing@jasolar.com www.jasolar.com

12 EQ NOVEMBER 2022 www.EQMagPro.com www.renewx.in SOLAR ENERGY | DECENTRALISED RENEWABLE ENERGY | GREEN HYDROGEN | E-MOBILITY & ENERGY STORAGE | BIO ENERGY HIGHLIGHTS CONFERENCE TRACKS WITH INDUSTRY EXPERTS PRODUCT SHOWCASE BY MARKET TRUSTED BRANDS CEO ROUNDTABLE WITH INDUSTRY INFLUENCERS COUNTRY PAVILIONS & AWARDS PROFILED BUYER’S FROM C&I SEGMENT GREEN HYDROGEN EV & INFRASTRUCTURE ZONE BIO ENERGY UNLOCKING THE ERA TO NET ZERO EMISSIONS… AMITAVA SARKAR M: +91 93792 29397 E: amitava.sarkar@informa.com JULIAN THOMAS M: +91 99404 59444 E: julian.thomas@informa.com IYER NARAYANAN M: +91 99673 53437 E: iyer.narayanan@informa.com FOR BOOKING, CONTACT SUPPORTING ASSOCIATIONS & PARTNERS NODAL AGENCY PARTNER STATE GOVT. OF TELANGANA

“ “

LEADING CELL MANUFACTURER SOLARSPACE INAUGURATES 16GW TOPCON SOLAR CELL PLANT

The project will produce 16GW of N-type cells in two phases. In the first phase, we plan to build 16 production lines, which will generate an annual production capacity of 8GW large-size TopCon cells. With the commencement of the new 16GW TOPCon cell plant, Solarspace will also introduce highly- efficient TOPCon solar modules in begin of 2023.

In the course of its commitment to build a sustainable low-carbon world, SolarSpace applied the highest standards to the construction of the new facility: The surrounding areas contain major green spaces and all buildings will be powered by solar modules manufactured by SolarSpace. Besides using the latest manufacturing equipment, SolarSpace maintains the strictest health and safety requirements at all its facilities.

14 EQ NOVEMBER 2022 www.EQMagPro.com FEATURED

On 20th Nov 2022, SolarSpace’s Chuzhou (Anhui province, China) Base embarked on the first phase of the 16GW TOPCon Solar Cell Project and commence the entry of production equipment. It marks a milestone for SolarSpace in its advancement towards highefficiency N-type technology, maintaining its position as a market leader in high-efficiency technology and lean manufacturing.

SunSource Energy doubles its solar energy target to one gigawatt by 2027

SunSource Energy, the Indian subsidiary of SHV Energy, announced that it will double its solar energy deployment target. The target will increase from 550 megawatts to one gigawatt by 2027.

The increased solar energy capacity will help to support a growing customer base across India that wishes to make the transition to cleaner, more sustainable power. To support the significant delivery scale-up, the India leadership team is also being expanded.

expansion, the company’s existing Managing Director, Kushagra Nandan, will take on the role of Chief Executive Officer, and Adarsh Das has been appointed Chief Commercial Officer to support the accelerated growth trajectory. Sytze Nijman will move from Netherlands-based SHV Energy to take on the role of Chief Operating Officer, and Pratik Adhikari has joined the company from professional services firm Alvarez & Marsal and will assume the role of Chief Financial Officer.

The current SunSource senior leadership team will continue to play a pivotal and active role over the long term in realising the company’s extended targets.

This investment to significantly bolster our solar energy delivery capacity reiterates SHV Energy’s commitment to India and to our solar subsidiary, SunSource Energy. Together with the expansion of our local management team, we will now be better equipped to address the evolving energy transition needs of commercial and industrial consumers in India and Southeast Asia,”said Bram Gräber, CEO of SHV Energy.

India-based SunSource Energy, a leading provider of distributed energy, will be100% owned by SHV Energy. As part of its leadership team

The demand for solar energy from commercial and industrial customers in India is growing rapidly and we are pleased to be able to help meet that need,” said Kushagra Nandan, Managing Director and CEO of SunSource Energy. “This expansion also enables us to continue to benefit from the global SHV Energy network and its vast expertise and resources.

16 EQ NOVEMBER 2022 www.EQMagPro.com FEATURED

SEMBCORP TO ACQUIRE VECTOR GREEN, ADDING 583MW OF RENEWABLE ASSETS IN INDIA

Completion of acquisition will bring the Group’ s gross renewable energy capacity to 8.5GW[1], closer to its 2025 target of 10GW of gross installed renewable capacity Sembcorp’s gross renewable energy portfolio installed and under development in India will grow to 3GW

Sembcorp Industries (Sembcorp) announces that its wholly-owned subsidiary, Sembcorp Green Infra Limited, has signed an agreement with India Infrastructure Fund II, a fund managed by Global Infrastructure Partners India Pvt Ltd, to acquire 100% interest in Vector Green Energy Private Limited (Vector Green) for a base equity consideration[2] of approximately INR27.8 billion (approximately S$474 million[3]). Vector Green is an Independent Power Producer with renewable power generation assets spread across 13 Indian states. The portfolio includes 495MW of solar capacity and 24MW of wind capacity in operation, with 64MW of solar projects under development. Including Vector Green, Sembcorp’s gross renewables portfolio installed and under development in India will total 3GW, comprising 1GW of solar assets and 2GW of wind assets.

transformation strategy. With the completion of this acquisition, Sembcorp’s gross renewable energy capacity will increase to 8.5GW[4], pushing us closer towards our 2025 target of 10GW.”

Vipul Tuli, CEO of South Asia, Sembcorp Industries added: “This acquisition brings significant utility-scale solar capacity to our India business, which will complement our existing wind portfolio. It also broadens and deepens our renewable energy capabilities and presence across states in India, and positions us well for further green growth in the country.”

Wong Kim Yin, Group President & CEO, Sembcorp Industries, said: “Sembcorp remains committed to growing its renewables portfolio in India, one of the fastest growing renewables markets in the world. This acquisition is aligned with the Group’s brown` to green

The acquisition will be funded through internal cash resources and external borrowings. Completion of the acquisition is subject to customary closing conditions and is expected by the first quarter of 2023. The acquisition is expected to be accretive to earnings upon completion. This acquisition is in the ordinary course of business of Sembcorp Industries and is not expected to have a material impact on the earnings per share and net asset value per share of Sembcorp Industries for the financial year ending December 31, 2022.

www.EQMagPro.com FEATURED

TOWARD A SUSTAINABLE, INCLUSIVE, GROWING FUTURE: THE ROLE OF BUSINESS

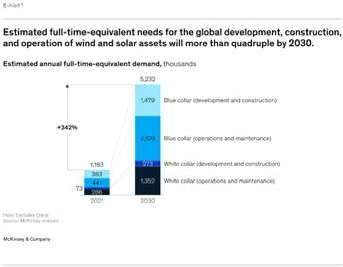

To make the world as sustainable and inclusive as we hope, a certain kind of economic growth will be necessary—and companies will play a vital role in generating it.

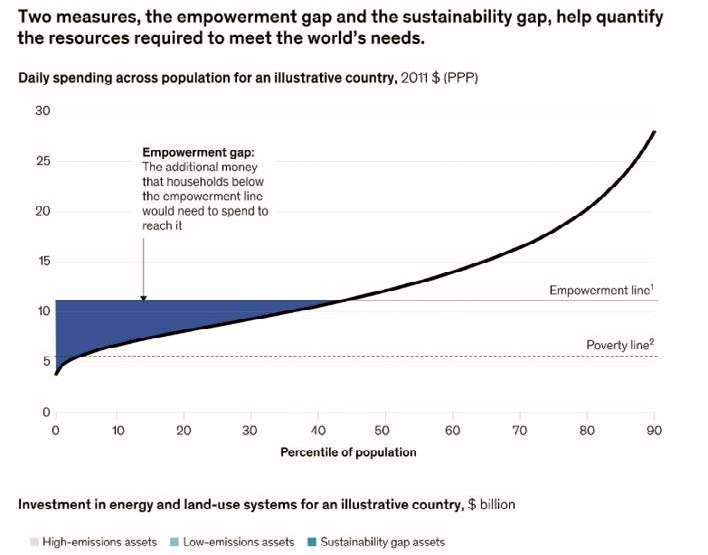

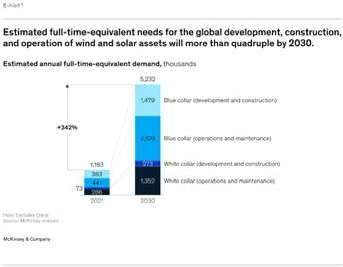

How should the world confront its most pressing environmental and social challenges? An answer lies in sustainable, inclusive growth—that is, economic growth that provides the financial resources needed to contain climate change, promote natural capital and biodiversity, empower households, and promote equitable opportunity. Any effort to usher in such growth will need many stakeholders, but businesses, which drive more than 70 percent of global GDP, will be a key player. The challenges to sustainability and inclusion are large and urgent. On the sustainability side, energy efficiency is reducing emissions of CO2 and other

greenhouse gases in some countries, but worldwide emissions continue to rise, accelerating climate change and its attendant physical risks. The world is therefore on track to exhaust its “carbon budget,” the amount of greenhouse gases it can emit without triggering dangerous levels of warming, by 2030. As for inclusion, though in some ways the world has become more inclusive over the past few decades, billions of people still live in countries that could do far better on such measures as life expectancy, child mortality, and gender parity in labor force participation. The current decade will determine whether we opt for sustainable, inclusive growth or for dangerous warming and large segments of society left behind. In this research, which was presented at the 2022 B20 summit in

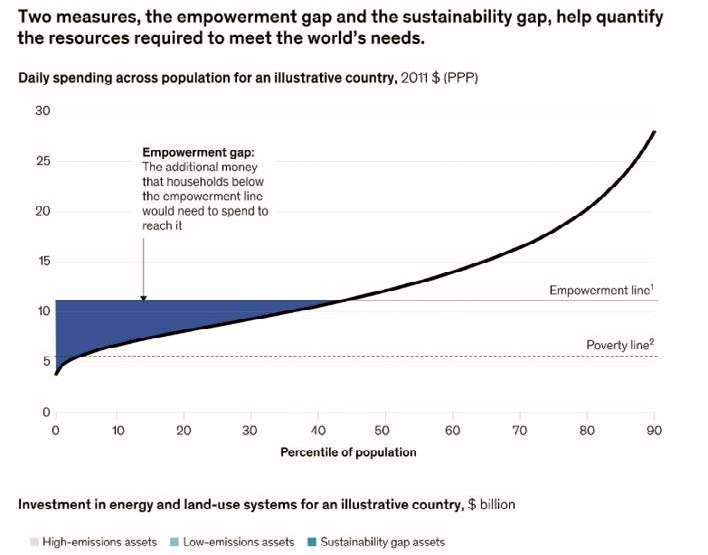

Indonesia, we use two measures to quantify what the world needs within this decade to become as inclusive and sustainable as we hope (Exhibit 1). The empowerment gap is the spending capability that all households in a given country would require in order to meet basic needs, have discretionary income, and be able to weather emergencies—in effect, to join the middle class. The sustainability gap is the amount of additional annual investment in low-emissions technologies that a country would need to make in order to move the world to a pathway resulting in net-zero emissions by 2050. The size of the gaps varies from country to country, but they are enormous everywhere

www.EQMagPro.com FEATURED

To fill those gaps, the world must experience solid and sustained economic growth. Growth is necessary because it creates income for people—who must either spend the income, save it, or invest it. Some of the income that is consumed will raise households to empowered levels of spending, and some that is saved or invested will help build the infrastructure needed for the net-zero transition.

But growth on its own will not be enough. For example, assume that in the United States, the economy grows for the rest of this decade at a baseline rate of 2.1 percent per year, and the current pattern of resource allocation does not change. (We make that conservative assumption so that we can illustrate the shifts needed from today, even though reallocations are already under way on the sustainability front.) In that case, only 36 percent of the country’s empowerment gap and 7 percent of its sustainability gap will be filled by 2030. The numbers vary among the countries and regions that we studied, but baseline growth would fill more than half of the empowerment gap in only two—India and China—and more than half of the sustainability gap in none. Two remaining ingredients are necessary to fill the gaps entirely (Exhibit 3).

One is government intervention, which can steer incentives and public resources to sustainability and inclusion. The other is business-led innovation. Such innovation can accelerate growth beyond our baseline, leading to still more spending, saving, and investing. It can make inclusion and sustainability more “affordable” by reducing the cost of products and services that further those goals.

FEATURED

Continue....

On sustainability, for example, as the unit costs of low-emissions alternatives (such as electric vehicles, renewable energy, and heat pumps) come down, they will attract more private capital, reducing the total investment need. And when innovation makes low-emissions technology cheaper, it can help close the sustainability gap further by shifting consumers’ preferences toward that technology.

Such advances can also affect inclusion if they reduce any medium-term rise in costs associated with the large transition outlays needed. When accompanied by strategies and public policy that enable education, training, childcare, healthcare, and inclusive hiring, business-led innovation can also help close the empowerment gap by boosting workers’ incomes.

20 EQ NOVEMBER 2022 www.EQMagPro.com

FEATURED

Business-led innovation is a major reason that companies will be crucial in any successful undertaking for sustainable, inclusive growth. Another reason is that companies are sometimes linked to existing challenges; for example, the share of their income that goes to their workers has fallen over the last two decades. The problem is that it is difficult for an individual company to resist market incentives. Take the case of a company that emits large quantities of CO2. If reducing those emissions would put it at a disadvantage with its competitors, it has little financial reason to proceed.

In this discussion paper, we provide a framework for businesses to help them start determining which challenges they can tackle while realizing the financial returns that attract capital. Two main approaches are possible: acting through existing market opportunities and helping shape new ones. Within each approach are two subcategories, so that companies can choose among four distinct paths that require progressively more collaboration: acting independently, collaborating with each other to shape industry standards, partnering with governments to execute specific projects or programs, and working with governments to craft the markets of the future.

Companies that are trying to sort potential projects into that framework could usefully ask three questions about each:

How great are the societal returns, and how long will it take to realize them? Projects that yield extremely high societal returns over long periods may be good candidates for collaborations and partnerships rather than individual action.

What degree of orchestration is needed? If a great deal is necessary—because complementary capabilities among

companies, government, and the social sector are needed, and because the beneficiaries are dispersed—that is another sign that a project is ripe for collaboration.

Where can public and philanthropic capital catalyze larger flows of private financing? There is no shortage of such financing, so the answer could well determine where trillions of dollars flow.

The need for a more sustainable, inclusive, and growing world is pressing. So is the need to prioritize the tasks that would bring about such a world. We hope that this research and framework will help companies do the important work of setting priorities and convening the right partnerships so that they can move swiftly from aspiration to action.

Source: mckinsey

FEATURED

MR. ASHOK DM

CEO & MD, EnerMAN Technologies

EQ: Could you please tell us about the company?

AD: EnerMAN Technologies is founded in 2019, with the vision to Provide innovative digital products to manage energy and decarbonise the world. EnerMAN provides IoT based AI & ML driven, Energy Management products and solutions at affordable price to Renewable Energy Industry. EnerMAN’s IoT based platform which can be easily interfaced with energy generation & consumption equipment to get real time data that can be further analysed for performance improvement & predictive maintenance. EnerMAN’s ETi series products help you acquire data from the equipment/sensor in the solar ¬PV plants / rooftops, process and store the data in the cloud/local server and present you with user friendly dashboards to monitor, control and analyse the performance.

EQ: What have been some key business highlights for EnerMAN Technologies in the past years?

AD: EnerMAN has successfully deployed IoT SCADA ETi-SOL® in the countries like South Africa, Nepal, Dubai, Rwanda, Sri Lanka, and Poland apart from India. and planning to deploy ETi-SOL® -Remote Monitoring SCADA solution for other countries. Currently our SCADA installation portfolio surpassed a remarkable milestone of 1.4 GW (1,400 MW) across the world. We have also installed our IoT SCADA product in some of the prestigious Govt organizations like BHEL, BEL, NTPC, HAL, MES, NFC, AIIMS & IISc. We are glad to share that our PPC solution has implemented to 350MW single largest plant in Kurnool, and it has also proven and tested for 26MW of Solar-Wind hybrid power plants in Karnataka.

EQ: Please tell us how important is real time remote monitoring of solar plants?

AD: The performance of Solar Power Plants needs to be monitored on real time to ensure the maximum yield of Solar PV Plant and notify the breakdown of equipment immediately for technicians attend the breakdowns to reduce loss of generation. To ensure that all the equipment at Solar Plant is performing as per the design, to get energy generation as expected to achieve desired ROI. Real time Remote Monitoring is essential to maximise the plant performance, which provides equipment ranking, performance reports and guidelines to onsite O&M team to schedule maintenance activities, spare parts management, and module cleaning activities.

EQ: How important is IoT as a technology in the solar industry? Could you explain your IoT-based monitoring solutions offerings in brief?

AD: IoT technologies helps in digitizing Solar PV plants (Digital Twin) and get real time data to cloud platforms or Servers at HQ. The expert team at HQ can analyse the Solar plant and equipment performance data and come up with guidelines to improve the plant performance, reduce the breakdowns, spare management, Energy scheduling and inputs to new plant design for optimal performance of Solar PV plants. We provide all types of products and solutions to Solar PV plants/rooftops for

22 EQ NOVEMBER 2022 www.EQMagPro.com INTERVEIW

Performance Monitoring, Controlling, Analysis and Reporting at an affordable price using in-house developed Hardware, Firmware and Software. Our Software product is hardware agnostic; it can work with 3rd party Data logger. ETi-SOL®: is a cloud-based software product which collects data from the field IoT devices for Monitoring, Controlling, Analysis and Reporting of Solar PV plants / rooftops. ETiSOL® is an end-to-end solution, made in India product to cater to global market at an affordable price since it uses inhouse developed Hardware, Firmware and Software. IT is also Centralized monitoring platform -Integrate multiple SCADA into single dashboard. User can monitor threough mobil app, both, Android and iOS are now available. ETiSOL® Edge: is a software product which can be installed in Local PCs/Servers at PV plants/Rooftops and can collect data from the data loggers connected to the PV Plant equipment to Monitor, Control, Analyse and Report the Solar PV plant’s performance.

ETi-PPC (Plant Power Controller): Software logic-based control system can be installed in local server to control active power, reactive power, and power factor of Inverters of Solar & Hybrid (Solar-Wind power Plants) as per as per Govt. regulatory guidelines. Some of the ETi-PPC features are:

1. Interactive dashboard for Solar Monitoring/Control

2. Automatic/Manual Control Operations.

3. Operations Scheduling.

4. Active Power/Reactive Power/Power factor Control.

ETi-LOG: is an IIoT Data logger, which collects the data through RS 485 (RTU/TCP) from PV plants' end equipment and sends data to Local PC/Servers or to the cloud Servers through RS485 (RTU/TCP) or RF or Wi-Fi. We will ensure that there is no data loss through local storage in our ETi-LOG IoT datalogger during any communication issues at the plant.

EQ: What are some of the recent technology advancements EnerMAN Technologies have made?

AD: We have developed a software product, ETi-SLDC, which can be installed in local PCs/Servers to collect data from the Solar PV plant’s equipment and can send important processed clean data to SLDC in a few seconds as per SLDC guidelines. We have developed another software product, ETi-ZES, which will ensure Zero Export from Solar PV plants / Rooftops to Grid, as per DISCOM policy guidelines, to avoid penalty. This product collects the data from Solar PV plants' end-equipment and controls/limits the outgoing power of Solar Inverters based on its load/consumption. We have developed yet another software product ETi-LMS: Load Management System: An IoT Solution for DG-Sync which is a universal Solution for all Inverter brands (Supports Heterogenous Make) Controls Active Power of Inverter’s.

EQ: What are your business development and growth plans for 2022?

AD: We are planning to expand our products entry to more countries in Asia Pacific, Africa and Middle East, and increase our product deployment by 100% in 2023. EnerMAN has proven track record in providing solution for Remote Monitoring, Local Monitoring, and Integration with third party Scada using REST APIs or FTP server or OPC interface.

INTERVEIW

MR. VINEET MITTAL Director & Co-founder, Navitas Solar

EQ: Please describe in brief about your company, directors, vision and mission.

VM: Navitas Green Solutions Pvt. Ltd.(Navitas Solar) strives to provide one of the best solutions for sustainable solar lectric power with one of the most advanced production lines in India. With total installed capacity of 500 MW p.a. for solar module production, Navitas Solar stands among the largest solar module manufacturers in India. This translates into high quality, reliability and longevity of the solar modules produced. We are four directors Sunay Shah, Ankit Singhania, Aditya Singhania and myself.

This is a company with a young team having all the well-educated promoters and that helps a lot for understanding the market quickly and adapting the new changes much faster. Our vision is to Emerge as India’s Most Trusted Solar Company by 2025. Our mission is to collaborate with the world’s best solar companies to develop and deliver the most reliable and efficient solar products & services, and to bring awareness & collaborate with likeminded institutes & individuals to stride towards a sustainable future.

24 EQ NOVEMBER 2022 www.EQMagPro.com INTERVEIW

EQ: Please tell us about how you manage to shine out from your competitors in the industry.

VM: Navitas Solar is among the few solar manufacturing companies in the country to have backward and forward integration, distinguishing usfrom our competitors. Backward integration is provided by our subsidiary company, Navitas Alpha Renewables Pvt. Ltd. (NARPL), which manufactures EVA Sheets. In this way, we manufacture our own raw material that no one does so that we have full control on the value chain. In addition, we have fully automatic setup in manufacturing. In addition, we have in-house labs and we are hugely benefited from it. We are in this business since last 10 years, so we have been here for long term. All the listed points makes us different from our other competitors.

EQ: Please name key achievements of Navitas solar for the year 2022?

VM: The year 2022 has been fantastic for us. In this year, we have made some big achievements and we are very humbled to list up all of them. We have expanded our solar module manufacturing capacity to 500 MW p.a. and we have launched Bonito Module seriesMono PERC half cut modules that can generate up to 600 watts per panel. Navitas Group has clocked 200 cr of revenue this year and we aim to clock 250 Cr in FY 23. We have raised 8 Cr in Navitas Alpha Renewables Pvt. Ltd.(NARPL) in seed funding round and we are close to raise series A round funding at Navitas Solar from senior investors. In addition, we have launched “Fintech for Cleantech” for end user financing of small-scale rooftop solar installations.

EQ: How are you looking forward in the New Year 2023?

VM: New Year will bring new opportunities for us. We want to grow residential rooftop solar’s adoption in the country as Residential sector has a huge potential to grow in future. Therefore, accelerating residential solar financing model will be our priority. In addition, we are lining up project of installing open access solar parks. Carbon market, agrivoltaics are some of the potential areas in solar sector and we look forward to deep dive into these areas. We intend to move our focus to large-scale supply, residential solar financing, solar parks and industrial EPC with up to 10 MW of single projects

EQ: Would you like to name few trending solar applications?

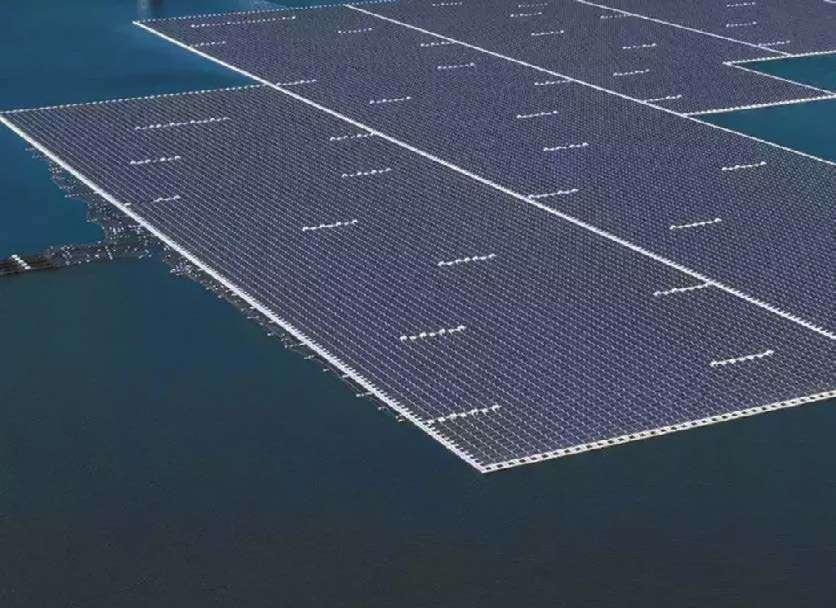

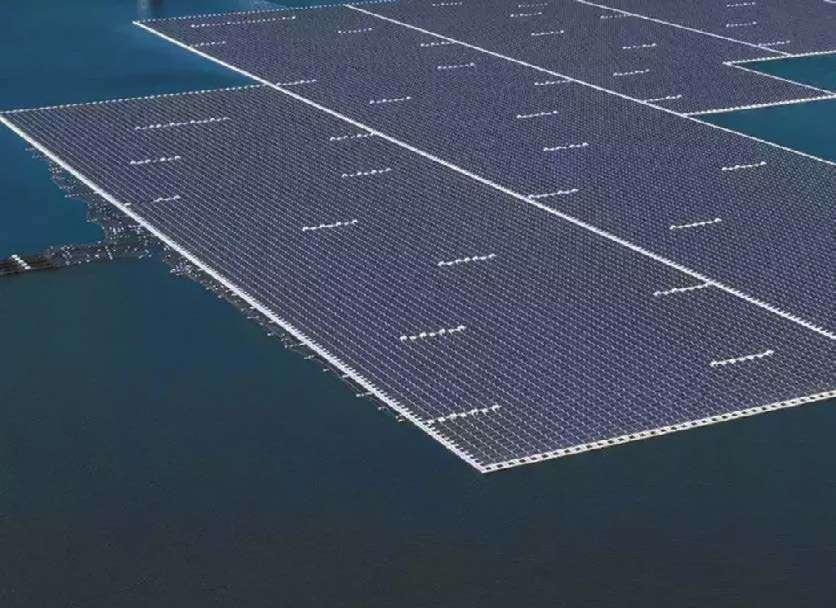

VM: Actually there are many but according to me, carport with bifacial panels, agrivoltaics, floating solar, wind-solar hybrid and solar with storage applications are trending nowadays. Although, some of them are in early stage but they will evolve largely in future.

EQ: What is your expectation from COP 27 and how do you foresee its impact on clean tech businesses?

VM: Actually, I have visited COP27 this time. It was very first experience for me and it has been amazing. I have interacted with many people who are doing great in accelerating sustainability and make world a better place to live in! I have attended events at COP 27 and believe me, the experience is just fantastic. People are much more aware about mindful consumption. The event will surely accelerate renewable energy’s penetration in India.

EQ: What are your thoughts on carbon neutrality?

VM: Nowadays, corporate sustainability is not a mere point of talk but it has converted into actions. Stakeholders and investors want to know how the organization is affecting the environment and that is why the awareness amongst the corporates has also increased with the time. We are extremely delighted to announce that Navitas Solar has become a Carbon Neutral organization. We have achieved a “Silver” level for 2021 from the United Nations Framework Convention on Climate Change (UNFCCC) on climate reporting under the ‘Climate Neutral Now’ initiative. With this step, we urge industry colleagues to minimize their emissions and work towards achieving carbon neutrality.

EQ: What kind of Pricing and Technology Roadmap do you see coming through in the Industry?

VM: We see that many consumers are adopting MBB (Multi BusBars) modules and the demand of MBB modules is increasing day by day. Looking at the overall picture, we see that bifacial modules will also be among the choice of the consumers in future.

EQ: Kindly highlight your product technology and company USPs, distinctive advantages.

VM: Our USP is a young team who can adapt the changes in technology quickly. We are focusing on new technology while improving the product continuously. Our new lines are at par with the best technology, which will be able to provide world-class multi bus bar panels. We are backed with a very strong in house QA and QC lab. We also have technically sound QA & QC team as well as R&D team that are continuously dedicated towards improving the quality.

EQ: Kindly enlighten our reader on the performance of your modules in India in various geographical region's customers' feedback.

VM: Until now, in the Indian module market we have not received any recall of our modules. Our modules are giving excellent output since last 9 years. Even after 2015, our modules are giving supreme performance than other competitors. Our modules are ideal for large scale and rooftop installations as they provide optimum generation and efficiency. We are supplying all over India successfully because of our good service and installation. All the customers from pan India are satisfied with our service. We believe to provide the best quality modules, as we truly believe, “Quality is remembered long after the price is forgotten”

www.EQMagPro.com 25 EQ NOVEMBER 2022 INTERVEIW

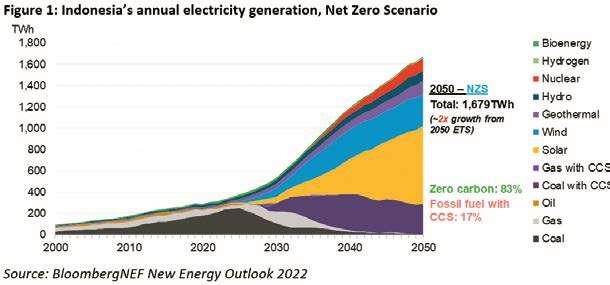

NET-ZERO TRANSITION POTENTIALLY A $3.5 TRILLION INVESTMENT OPPORTUNITY FOR INDONESIA

Accelerated deployment of renewables within this decade combined with post-2030 deployments of nuclear and carbon capture and storage can enable Indonesia to achieve net-zero emissions by 2050

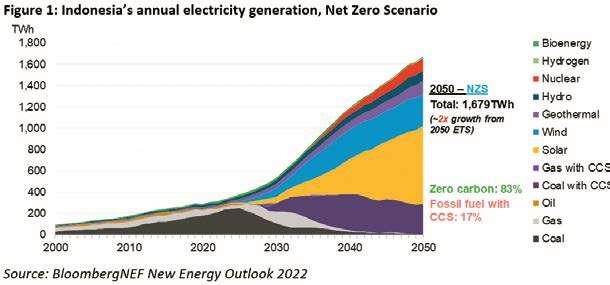

The global net zero transition can represent a $3.5 trillion investment opportunity for Indonesia, according to a new report published at the BNEF Summit Bali by research company BloombergNEF (BNEF) entitled Net-Zero Transition: Opportunities for Indonesia. Based on BNEF’s New Energy Outlook, its annual longterm scenario analysis on the future of the energy economy, the report examines how Indonesia’s energy supply may evolve under BNEF’s Economic Transition Scenario (ETS) as well as a Net Zero Scenario (NZS) compliant with the goals of the Paris Agreement. Both scenarios expect that growth in electricity demand can primarily be met by deployment of renewables such as solar, thanks to their falling costs. Under the ETS, Indonesia’s electricity demand is set to triple by 2050 to reach 919 terawatt-hours compared with 306 terawatt-hours in 2021. Today, coal-fired plants meet more than 60% of Indonesia’s power demand. Under the ETS, coal’s share rises to a peak of 74% by 2027 and then declines to 24% in 2050. By then, the combined share of renewables in electricity supply reaches 74%.

Under the NZS, Indonesia’s electricity demand is set to grow fivefold by 2050, as electricity accounts for a greater proportion of final energy demand, for example by replacing oil as road transport fuel. The NZS forecasts that 75% of electricity supply by mid-century would come from renewable energy, with the remainder supplied by coal power plants equipped with carbon capture and storage (17%) as well as supply from nuclear (7%).

Caroline Chua, BNEF’s Southeast Asia clean power lead analyst, said: “Under the Net Zero Scenario, as demand for Indonesia’s coal exports decline by more than 60%, domestic coal power plants equipped with carbon capture and storage could provide a just transition pathway for the country’s coal industry. On the other hand, Indonesia also needs to consider measures to accelerate the growth of renewables within this decade.”

The global net-zero transition also represents new export opportunities for Indonesia, as lithium-ion battery demand for electric vehicles is set to rise to more than 2 terawatt-hours annually by the latter half of this decade. Thanks to its wealth of nickel resources, Indonesia has already attracted plans for 25 gigawatt-hours of battery manufacturing capacity.

Allen Tom Abraham, BNEF’s Asia-Pacific lead transport analyst, said: “As the country with the world’s largest nickel reserves, Indonesia has significant opportunity to scale up lithium-ion battery manufacturing capacity. To do so, it will need to improve the environmental performance of its mining sector as well as increase domestic battery demand by accelerating the electrification of mobility.”

To finance the energy transition, Indonesia will need just under $2 trillion of investment in BNEF’s ETS and as much as $3.5 trillion under the NZS.

26 EQ NOVEMBER 2022 www.EQMagPro.com

FEATURED

CHINA’S BATTERY SUPPLY CHAIN TOPS

BNEF RANKING FOR THIRD CONSECUTIVE TIME, WITH CANADA A CLOSE SECOND

Canada’s recent investment in its upstream clean energy supply and increasing demand in the US-Mexico-Canada Agreement (USMCA) region increases the country’s competitiveness

China continues to dominate BloombergNEF’s (BNEF) global lithium-ion battery supply chain ranking, for the third time in a row, for both 2022 and its projection for 2027, thanks to continued support for the electric vehicle demand and raw materials investments. China currently hosts 75% of all battery cell manufacturing capacity and 90% of anode and electrolyte production. The increasing prices of lithium has also led to higher investments in carbonate and hydroxide refinery facilities in the country, making it the leading refiner of battery metals globally. Despite this growth, other countries are enforcing policies to create battery demand and secure raw materials needed to support their transition to electric vehicles.

Published at the BNEF Summit Bali, the ranking sees Canada rise to the second spot this year, which reflects its large raw material resources and mining activity, as well as its good positioning in environmental, social and governance factors (ESG) and infrastructure, innovation, and industry. A lack of significant cell and component manufacturing capacity means that most of the value of these resources is realized outside of the country, although recent announcements from the likes of BASF, General Motors and Posco show an increase in battery investments.

Allan Ray Restauro, metals and mining analyst at BNEF and lead author of the report said: “This year, the changes in the overall rankings were mostly driven by the greater access to several key raw materials and manufacturing capacities domestically. Countries that are not necessarily the largest producers or manufacturers but have significant presence across several areas in battery metals and minerals extraction, as well as manufacturing, fared better than countries that excel mostly in a single commodity or component. Success in the battery supply chain is increasingly determined by more than one category or metric. A solid foundation on domestically realized resource wealth, bolstered by responsible and ethical production, is the main theme of the rankings this year as countries and the industry strive for a sustainable supply chain.”

The US dropped to third in the rankings despite the strong growth in battery demand due to the Inflation Reduction Act. The US placed in the top 10 for all categories except for ESG, where it ranked 16th. Strong battery demand for stationary storage and rapidly accelerating passenger vehicle sales (rising from 5% in 2022 to 34% by 2027) ensure that it places high on the leaderboard. Despite the US recording the biggest improvement among all countries in raw materials for 2022, it will still be reliant on raw material imports for batteries, especially from its free-trade partners, such as Australia.

28 EQ NOVEMBER 2022 www.EQMagPro.com FEATURED

Yayoi Sekine, head of energy storage at BNEF, said: “The Inflation Reduction Act is a major upside for battery demand in the US but, more importantly, it will change the supply landscape in the coming years. The law is the closest thing to industrial policy for batteries that the US has ever had and makes this the most exciting decade yet for the American battery industry. Companies are looking to maximize battery cell, module and material production incentives and comply with electric-vehicle credit requirements, which will bring more capacity to the country and its allies.”

Most European countries declined in their overall performance this year with Finland and Czechia being the only exceptions. Finland placed the highest in Europe and was ranked fourth in the overall rankings. The country’s growing battery metals supply chain, relatively clean grid and quality infrastructure favorably positions it among top lithium-ion battery countries. Germany and Sweden’s lack of domestic raw materials led to a drop in their rankings in 2022. Despite the continent’s low raw materials scores, its battery manufacturing is growing. Germany and Hungary will increase their battery manufacturing capability to match Poland, as cell and component plants come online in coming years.

China, South Korea and Japan were the top three countries across all battery manufacturing metrics. They have historically had the most established manufacturing bases, with supportive industrial policies. US cell production capacity surpassed Japan in 2014 and South Korea in 2016. Most operational multi-gigawatt-hour cell manufacturing facilities in the world are owned by a Chinese, Japanese or Korean company (Tesla’s Nevada Gigafactory was jointly developed with Panasonic). In 2022, South Korea and Japan each announced domestic and overseas expansions of cell production capacity as well as supply chain strategies to secure key materials.

In BNEF’s 2027 rankings, countries in South America see the biggest declines, notably Brazil and Bolivia. Brazil remains a strong contender given its raw materials strength but dropped to 21st in the 2022 rankings due to poor performance in ESG. Bolivia was at the bottom of the rankings this year. It only performed well in 2021 in raw materials due to its massive lithium reserves.

Ellie Gomes-Callus, metals and mining analyst at BNEF said: “Many European countries are successfully capitalizing on their supply chain potential but the trend of decline in the region this year indicates that growth in Europe is starting to be outpaced by North American and Asian countries. European countries such as Czechia, Hungary and Poland, continue to have advantages in their ability to provide cleaner and more sustainable supply chains. This will reinforce their growth ambitions and further their case as preferred destinations for investments in batteries manufacturing.”

Most resource-rich countries rank low in the overall score as they generally lack a domestic battery manufacturing capabilities and electric vehicle demand. Countries such as Indonesia, Chile, South Africa and the Democratic Republic of Congo are looking to reverse this trend by using their raw materials competitiveness as an advantage to attract downstream investment across the supply chain. Policy incentives to drive EV adoption, clean energy supply as well as industrial infrastructure will help these resource-rich countries to attract the downstream investment needed to build domestic lithium-ion battery supply chains.

In the report, BNEF ranks 30 leading countries across the lithium-ion battery supply chain based on 45 metrics across five key themes: availability and supply of key raw materials; manufacturing of battery cells and components; local demand for electric vehicles and energy storage; infrastructure, innovation, and industry as well as ESG considerations. The report includes a current ranking for 2022 as well as a forward-looking one to 2027.

www.EQMagPro.com 29 EQ NOVEMBER 2022

FEATURED

INDIA’S 1ST ONLINEBIO-FUEL MARKETPLACE, BUYOFUEL RAISES 11.5 CR IN A PRE-SERIES A ROUND

LED

BY INFLECTION POINT VENTURES

Online alternate fuel marketplace Buyofuel has raised over Rs 11.5 Cr in a PreSeries A round led by Inflection Point Ventures (IPV). The round also saw participation from Venture Catalysts, LetsVenture, Lead Angels Fund, and GruhasProptech. The funds raised will be utilised towards expanding the services across geographies, development of product offerings as well as technology. The startup has the largest supply base of quality assured-biofuels and fuel consumers, offering economic prices for wastes and biofuels. Buyer-base with buy capacity of more than 6,00,000 metric tonnes/month and Seller-base with sell capacity of more than 2,00,000 metric tonnes/month. For sellers, registering with the platform is a seamless experience as all the customers who visit the platform are 100% verified. The team at Buyofuel ensures 100% transparency with the customers, updating them with real time progress throughout the order execution. The consignment is tracked from loading to unloading point to ensure timely delivery.

Buyofuel is the only online marketplace for all types of quality assured biofuels and wastes with a complete digitized interface. The Company has emerged with the largest seller and buyer base in the alternate fuel category. It is helping non-renewable fuel consumers to switch to low or zero emission fuel options and helping them to cut their carbon emissions by moving to biofuels. Buyofuel currently has over 1600 verified registered users, with a supply of biodiesel, solid biofuels and organic waste on a per-day basis. Their clients include large, reputed companies like Aditya Birla, JSW, TVS Tyres, Ramco Cements, Dalmia cements, Thermax and many others are registered users of Buyofuel. The company has recorded a monthly revenue of over Rs 2 Cr.

Ankur Mittal, Co-founder & COO, Inflection Point Ventures says, “Biofuels are a powerful alternative fuel substitute for most of the mainstream fossil fuel options whether diesel, petrol or even CNG. Buyofuel has an ambition to scale its business and make the adoption of clean fuel options seamless and more efficient. At IPV, we are keenly watching the ESG and Cleantech segment and have made

across different business models. We back the vision of

want to help them scale up faster.”

Kishan Karunakaran, Founder and CEO, Buyofuelsays, “Buyofuel looks to mainstream biofuels as a major fuel in India’s energy mix by ensuring that biofuels contribute to more than 10% of India’s fuel consumption, Buyofuel’s journey for a green India has been tremendously supported by IPV. IPV has continuously engaged with Buyofuel on a regular basis and has played a big part in the growth of Buyofuel. We are glad that Buyofuel got to benefit from the tremendous experience that IPV team brings with it.”

Buyofuel functions in the large energy & fuels market of India. India is currently the 3rd largest consumer of energy in the world, importing more than 80% of its fuel requirements while generating more than 350mn MT of organic wastes within India. Buyofuel aims to make India energysecure and meet its emission goals by substituting fossil fuel consumption with biofuels manufactured within India, from wastes generated within India. Biofuels is a $110 Bn market globally today with the Indian biofuels market being about $10 Bn currently, Indian Biofuels market is growing rapidly and likely to be a $50 Bn market over the next few years.

30 EQ NOVEMBER 2022 www.EQMagPro.com

Buyofuel is an online marketplace for all types of biofuels and wastes which completely digitizes buying and selling biofuels and wastes.

Buyofuel was selected as ‘Top 10 Startups of Tamil Nadu’ by Startup TN, Tamil Nadu Government in 2021

IPV has so far invested over Rs. 550 Cr across 140+ deals

bets

Buyofuel founders and

FEATURED

ZERO-EMISSION VEHICLE ADOPTION IS ACCELERATING, BUT STRONGER PUSH IS NEEDED TO STAY ON TRACK

FOR NET ZERO

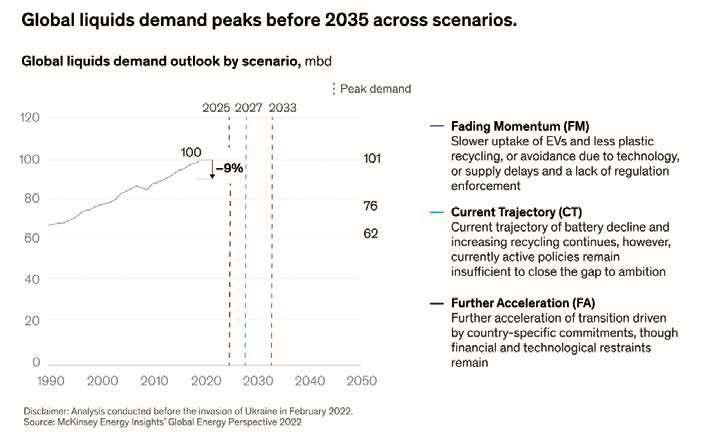

Actions from policymakers, manufacturers and consumers are already having an impact, avoiding almost 1.7 million barrels of oil per day in 2022

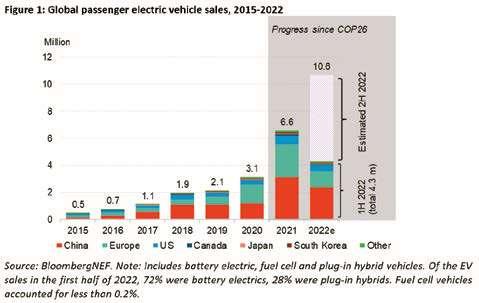

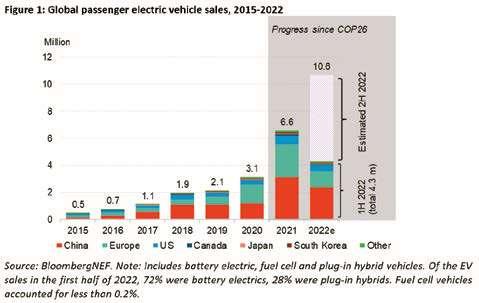

Adoption of zero-emission vehicles accelerated in the past year across almost all markets and vehicle segments, according to the 2022 Zero-Emission Vehicles Factbook published by research company BloombergNEF (BNEF) at COP27 in Egypt. The ZEV Factbook finds that global momentum toward zero-emission road transport has

continued to accelerate in 2022, with passenger electric vehicle sales on track for more than 10 million units, up from 6.6 million in 2021. Over 13% of new car sales globally in the first half of 2022 were electric, rising from 8.7% for all of 2021. Global lithium-ion battery manufacturing capacity also increased 38% since 2021 and overall spending on clean road transport worldwide is set to exceed $450 billion this year.

The ZEV Factbook has been produced by BNEF in cooperation with the Accelerating to Zero Coalition and in partnership with Bloomberg Philanthropies, to coincide with COP27 – the 2022 United Nations Climate Change Conference. The first ZeroEmission Vehicles Factbook was released at COP26 in Glasgow and the updated 2022 publication tracks the progress that has been made toward achieving global net-zero emission in the road transport sector.

The adoption of zero-emission vehicles has already reduced oil consumption and carbon dioxide emissions. Electric vehicles of all types – including cars, buses, motorcycles, scooters, vans and trucks – are expected to avoid almost 1.7 million barrels of oil use per day in 2022, up from 1.5 million barrels per day in 2021. These vehicles are currently eliminating 152 million metric tons of CO2 per year, with the biggest contribution coming from the large fleet of electric two- and three-wheelers in Asia.

The ZEV Factbook was warmly welcomed by Alok Sharma, COP26 President. “The BNEF Factbook shows that, despite the global energy crisis, the zero-emission vehicle transition has continued to accelerate since we launched the ZEV declaration at COP26. It also highlights that the ZEV transition is key to permanently ending our dependence on oil,” said Sharma.

However, the report also sounds a note of caution as progress on new commitments to ZEVs from both automakers and governments has slowed over the past year. National ZEV targets and internal combustion engine (ICE) phase-out targets cover nearly 41% of the global passenger vehicle market by 2035, similar to a year ago. Automakers with 2035 ICE phase-out targets account for 23% of the market, a slight increase from 19% a year ago. This increases to 30% if automakers’ targets for 2040 are included.

www.EQMagPro.com 31 EQ NOVEMBER 2022

FEATURED

COP27: BUSINESSES URGED TO STEP UP FIGHT AGAINST CLIMATE CHANGE

With the growing climate uncertainties and mounting financial needs for climate adaptation and mitigation, member countries across the Commonwealth are keen to see businesses take up a greater role in the fight against climate change.

An official side event co-organised by the Commonwealth Secretariat and the Governments of Saint Lucia, Namibia and Zambia at the United Nations Climate Change Conference (COP27) was held in Egypt this week on 10 November to tackle the issue. Senior government officials, international experts and members of the business community discussed ways to “unlock” private sector finance to bolster climate action in small and other vulnerable countries.

The Commonwealth Secretary-General, the Rt Hon Patricia Scotland KC, outlined the challenge:

“To address the impacts of climate change and meet ambitious targets to reduce carbon emissions to netzero, we will need an estimated US$4 trillion each year by 2030. This includes unprecedented investment for the deployment of technologies to speed the energy transition.

“Yet climate finance flows in 2021 reach around US$632 billion: just a sixth of what is required. We cannot fill this gap without the private sector.”a

In his remarks, the Minister of Education, Sustainable Development, Innovation, Science, Technology and Vocational Training of Saint Lucia, Hon. Shawn Edward, highlighted the devastating climate disasters that small island states recurrently face – and the vast amounts of debt that governments must accrue to finance recovery efforts. He said: “To deal with the impacts of climate change, small island developing states (SIDS) like Saint Lucia have to go out and search of resources on a continuous basis. Hundreds of millions of dollars in climate finance have been pledged and promised by developed countries. Those monies are not forthcoming. Consequently, we SIDS have to borrow to deal with our climate change issues, creating a situation where we are saddled with debt that is not sustainable.”

32 EQ NOVEMBER 2022 www.EQMagPro.com FEATURED

The Minister of Green Economy and Environment of Zambia, Hon. Collins Nzovu MP, emphasised that while vulnerable countries are responsible for just 4 percent of global greenhouse gas emissions, they are the most affected by climate change. Many are also charged above-average interest rates on loans, due to their “high risk” classification, leading to further debt-distress. Hon. Nzovu added: “At the same time, many of these countries are endowed with abundant natural resources, which represent huge investment opportunities. So we are not only interested in concessional funding and soft loans; we are also looking at the private sector. How can international firms come to our countries to work with us in public-private partnerships, where we can work with you to de-risk those investments?”

The event featured presentations by the Director of the Eswatini Meteorological Services at the Ministry of Tourism and Environmental Affairs, Duduzile Nhlengethwa-Masina on the work undertaken by the Commonwealth Climate Finance Access Hub in the Government of Eswatini to develop a private sector engagement strategy for climate action, as well as the Executive Director of the Ocean Risk and Resilience Action Alliance, Karen Sack. This was followed by a panel discussion that highlighted the role of multinational companies in raising climate

finance, the opportunities and challenges for green investments in developing countries, as well as innovative financing solutions, such as debt-for-nature swaps.

Speakers such as Veronica Jakarasi of the Africa Enterprise Challenge Fund underlined the importance of trusting businesses in Africa and investing in them to enable growth. Young entrepreneur and co-ordinator of the Commonwealth Sustainable Energy Transition (CSET) Youth Action Group, Christopher Chukwunta, called for more engagement of young people – who make up 60 percent of the combined population of the Commonwealth – in the mobilisation, allocation and deployment of climate finance.

Other panel members included: CEO of Caribbean Climate Smart Accelerator, Racquel Moses; CEO of the Environmental Investment Fund of Namibia, Benedict Libanda; Manager of the Climate and Environment Finance Division of the African Development Bank, Gareth Philips; Manager of the Coral Reefs & the Blue Economy and the Building Back Blue Programme at UNDP, Vineil Narayan; Head of the Independent Evaluation Unit at the Green Climate Fund, Andreas Reumann; and Head of Oceans and Natural Resources at the Commonwealth Secretariat, Dr Nicholas Hardman-Mountford.

The session ended with a statement by Head of Climate Change at the Commonwealth Secretariat, Unnikrishnan Nair, who shared a five-point agenda on engaging the private sector in the work of the Commonwealth Finance Access Hub (CCFAH). The CCFAH supports small and other vulnerable states to raise funding for climate projects. Working directly with line ministries in member governments, the CCFAH has helped to secure around US$53 million in climate finance for at least 12 countries, and trained more than 2000 government officials in developing robust funding proposals

FEATURED

KEEPING THE SEMICONDUCTOR INDUSTRY ON THE PATH TO NET ZERO

Growing demand for semiconductors means industry emissions are likely to increase. Semiconductor companies are making sustainability commitments, but more is needed to achieve net zero.

For the past few years, semiconductor companies have focused on addressing the chip shortage and directed their energies into increasing supply. But another customer imperative, as well as the health of the planet, now requires increasing attention: the need for greater sustainability. Many end customers are already asking their suppliers, including semiconductor companies, to step up their efforts to reduce greenhouse-gas (GHG) emissions to achieve net-zero carbon emissions along their entire supply chain (see sidebar “Semiconductor companies respond to global warming with ambitious sustainability commitments”). Suppliers are taking heed of these requests, both to retain business and to join in the fight against global warming. The urgent need to increase sustainability efforts comes just as semiconductor production ramps up to meet growing demand and more sophisticated chip designs are required for leading-edge mobility, computing, and connectivity applications. As production increases, however, so do emissions. Even with major semiconductor companies’ latest commitments, which are more stringent than past measures, the industry is not on track to limit emissions to the extent required under the 2016 Paris Agreement, which aims to restrict the mean rise in global temperature to 1.5°C from preindustrial levels.

Some semiconductor companies have recently set more aspirational emissions-reductions targets, but getting the industry to net zero will require more comprehensive action. This article offers a coherent, industry-wide road map that could be considered by semiconductor device makers seeking to achieve a 1.5°C trajectory by 2030 and net-zero emissions by 2050.1 In addition to describing how companies can apply existing levers to reduce emissions, the road map highlights the importance of developing new or improved decarbonization technologies—a lengthy process—and increasing the supply of renewable energy. Our analysis builds on the findings in a related McKinsey article, “Sustainability in semiconductor operations: Toward net-zero production,” which describes the decarbonization levers for semiconductor front-end fabs.

A MULTIFACETED EMISSIONS PROBLEM

Emissions from semiconductor device makers fall into different categories:

Scope 1 emissions arise directly from fabs, primarily from process gases with high global warming potential (GWP) that are used during wafer etching, chamber cleaning, and other tasks; they can also come from high-GWP heat-transfer fluids that may leak into the atmosphere when fabs use them in chillers.

Scope 2 emissions arise directly from purchased electricity, steam, heating, and cooling equipment; the major sources include production tools and facilities/utilities.

Scope 3 emissions include all other indirect emissions in a company’s value chain; upstream emissions are those generated by suppliers or their products, while downstream emissions are related to the usage of products containing semiconductors.

By aggregating emissions data from key semiconductor device makers, the percentage of emissions classified as Scope 1, 2, or 3 upstream can be determined (Exhibit 1).2 Our research revealed that 35 percent of emissions at a typical semiconductor fab fall into the Scope 1 category, compared with 45 percent for Scope 2, and 20 percent for Scope 3 upstream. This breakdown can vary by fab, however, based on various factors, including the amount of renewable energy used and the extent to which process-gas-abatement systems have been implemented. This article focuses on reducing Scope 1 and 2 emissions at semiconductor device makers, since these represent the largest share of emissions and are under direct control of semiconductor fabs. In a separate article, we will investigate how the semiconductor industry can reduce Scope 3 emissions.

MODELING OF SCOPE 1 AND 2 EMISSIONS

The steps that semiconductor companies are now taking will not be enough to get the industry on a 1.5°C trajectory by 2030. In fact, Scope 1 and 2 emissions may rise significantly above current levels as semiconductor production volume increases and the industry moves to advanced nodes with higher expected emissions intensity.

To gain more clarity about the extent of the increase, we created three different scenarios to estimate future emissions. The assumptions underlying each scenario are as follows:

Scenario 1 (conservative). All semiconductor companies continue their current decarbonization efforts and do not pursue more ambitious goals or initiatives, even if they have publicly announced plans to do so.

Scenario 2 (optimistic). All companies that have announced decarbonization goals deliver on their commitments, while companies that have not announced decarbonization ambitions continue business as usual.

Scenario 3 (ambitious). All companies undertake the actions needed to achieve 1.5°C trajectory by 2030.

In the conservative scenario, carbon dioxide equivalent (CO2e) would increase from 93 million tons in 2020 to 183 million tons by 2030, reaching 73 million tons for Scope 1 and 110 million tons for Scope 2 (Exhibit 2).3

In the more optimistic scenario, where some companies step up their decarbonization efforts as announced, Scope 1 and 2 emissions increase at a slower rate and reach 116 million tons by 2030. In the ambitious scenario, emissions are at 54 million tons that year—lower than the levels recorded in 2020. (For more information on our model, see sidebar “Our methodology for projecting Scope 1 and 2 emissions.”)

A potential road map to help the semiconductor industry reach a 1.5°C trajectory by 2030

Based on our modeling, Scope 1 and 2 emissions would amount to 89 million tons of CO2e in 2030, even if companies apply all levers to the fullest extent now possible (Exhibit 3). While this is about half of the 183 million tons projected in the conservative scenario, it would fall short of the 54 million tons needed to remain on track for net zero.

34 EQ NOVEMBER 2022 www.EQMagPro.com

FEATURED

NEAR-TERM ACTIONS

To get on a net-zero trajectory by 2030, the semiconductor industry would benefit from a coordinated effort to apply current strategies in full while simultaneously developing and adopting new technologies. These steps would be required to reach netzero emissions by 2050—a goal that would call for the industry to reduce Scope 1 and 2 emissions by 95 percent from the 2020 level depicted in the conservative scenario. For Scope 1 emissions, all semiconductor players would need to double down on their commitment to reduce emissions. This goal would require them to implement existing technologies to a significant extent. Consider the following:

Process gas. Semiconductor fabs could feasibly install gasabatement systems that cover 90 percent of tools on average. Processing gas chemistry would have to be optimized to lower GHG usage, such as by replacing nitrogen trifluoride (NF3) and tetraflouromethane (CF4) with fluorine (F2) gas, which has zero global warming potential.

Heat transfer fluid (HTF). At least 70 percent of HTF would need to be replaced with low GWP options. Semiconductor fabs would also need to reduce chiller leakage.

Fuel consumption. Semiconductor companies would need to replace the current fuel supply with clean options, such as hydrogen/biomass.

With Scope 2 emissions, all players would need to continue reducing energy consumption per wafer year over year, but they can also go beyond that by increasing their share of renewable energy. Overall, the industry would need to increase its renewable-energy share to a level that is 1.4 times higher than the current share in local grids. In many geographies, this will require ambitious and truly breakthrough approaches, such as importing renewable energy or building renewable-energygeneration plants.

LONG-TERM STEPS

To stay on a net-zero pathway until 2050, every semiconductor company would need to shift toward a more proactive and innovative approach—and that means making a greater investment in decarbonization and showing a willingness to experiment. For instance, the semiconductor industry can learn from other industries by introducing innovative solutions to fabs as they become available. As noted earlier, companies would benefit

from investigating new solutions now, given development timelines, and some key players have already done so. Companies could also develop early-stage decarbonization technologies in partnership with leading start-ups and academic labs. Innovation will involve some risk, since not every idea will lead to real solutions that meaningfully reduce emissions.

For Scope 1 emissions, companies could continue to develop and implement alternative gas chemistry. New abatement solutions could also be implemented to enable more efficient gas removal. Simultaneously, companies could explore innovative technologies for recycling and reusing process gas that cannot be eliminated because of technical challenges.

With Scope 2 emissions, companies could increase the use of renewable energy. To do so, the industry would need to continue implementing the innovation solutions to increase supply, such as importing energy to locations with supply constraints.

THE BENEFITS OF GREATER COLLABORATION

To implement a road map for net zero, collaboration among semiconductor companies and other players along the value chain may be critical.

When reducing Scope 1 emissions, for instance, companies would benefit by reducing process-gas emissions in fab operations. Achieving this goal might be easier if they work with various specialty suppliers—gas/material, equipment, and abatement—to improve existing solutions and develop innovations, including those related to replacement, abatement, and recycling. Companies could also look for collaborative opportunities along the value chain to identify future gas/material requirements and define a common road map to chart their course forward. For example, chemical and tool suppliers could work jointly with semiconductor fabs to optimize processing recipes to lower emissions. Similarly, abatement tool suppliers could work closely with manufacturing equipment suppliers, fab operations, and chemical suppliers to ensure that they fulfill new abatement requirements.

To reduce Scope 2 emissions, companies would benefit from addressing challenges in sourcing renewable energy, and a joint effort with local electricity consumers could help increase availability.

Source: mckinsey

FEATURED

SUNGROW

DEVELOPMENT GOALS WITH ALIGNMENT OF CONFERENCE OF THE PARTIES

SHARM EL-SHEIKH EGYPT 2022

pon the arrival of the 27th Conference of the Parties of the UNFCCC (COP 27) in Sharm El-Sheikh, Egypt, Sungrow, the global leading inverter and energy storage supplier for renewables, in cooperation with the official distributor Arab Consulting Office (ACO), announced the formal delivery of a package of solar projects in this host city, altogether generating over 80GWh clean electricity and reducing about 55 thousand ton CO2 per year. These projects will also power business, transport, and tourism facilities such as hotels, airports, official buildings, conference centres etc. that will be used during COP27 and help transform Sharm el-Sheikh into a green city.

In order to showcase the official determination and supports to mitigate climate change, the Egypt government implemented a package of measures to build Sharm el-Sheikh into an integrated sustainable city, among which switching to clean power is a fundamental one. The green initiatives drove many RE players such as ENI, Hassan Allam Utilities, TAQA Arabia, Intro for sustainable resources, Altawakol Electric Gila & Solarize, etc. to develop solar projects to power local businesses and people with clean electricity. Sungrow has been selected to be the inverter provider for these significant projects, which include the largest clean energy solar plant in Sharm el-Sheikh of 20 MW with TAQA Arabia, supplying clean electricity to over 6,000 hotel rooms, which will accommodate distinguished guests of this global event. Sungrow’s industry-leading commercial inverter SG110CX is applied in these projects, which brings higher yield with multiple MPPTs and compatibility with bi-facial modules.

Besides, this premium inverter is equipped with IP66 and C5 anti-corrosion protection standards to ensure stable and long-term operation outdoors. The AFCI function also protects system safety as a whole. The local team stayed onsite during the construction period and succeed in delivering all of them before the opening of COP27. GW-level clean power will be generated to power this global summit and help reduce carbon emissions then, which contributes to advancing Egypt’s sustainability goals.

We believe these solar projects can strengthen Egypt’s clean energy transformation plan and make Sharm ElSheikh a green and smart city. After completing them, Sungrow achieved altogether 500MW installations there, occupying a dominating market share. To strategize the bright market in Egypt and North Africa region, Sungrow provides a comprehensive product portfolio which can be spread nationwide through our trustworthy distributors like Arab Consulting Office. We also own a mature team ready to serve and offer professional guidance. These advantages will help us achieve more milestones in the near future, said Moustafa Mohamed, Director of Sungrow North Africa Region.

36 EQ NOVEMBER 2022 www.EQMagPro.com

U

ADVANCES EGYPT’S SUSTAINABLE

(COP27)

SungrowAdvances Egypt’s Sustainable Development Goals with Alignment of Conference of the Parties (COP27) Sharm El-Sheikh Egypt 2022

FEATURED

IMPORT DUTY SOPS FOR RS 1.3 LAKH CRORE SOLAR PROJECTS WILL CONTINUE

Solar projects involving investments of Rs 1. 3 lakh crore bid out earlier than March 2021 will be exempted from the income division’s order scrapping decrease customs duty below the concessional mission import scheme for solar sector, energy and renewable vitality minister Raj Kumar Singh informed TOI.

The transfer will carry reprieve for 26,000 MW capability below varied levels of implementation by holding the doorways open for tools imports value Rs 60,000 crore at 5% duty, as a substitute of the 40% primary customs duty (BCD) that got here into impact from April 1. Singh stated the ministry has additionally determined to offer a 12-month extension to preMarch 2021 projects to make sure capability addition didn’t undergo.

We placed the (tax) issue before the finance ministry and asked them to include these projects in the concessional duty scheme. We have suggested the concessional duty be retained at the original 5% instead of 7. 5% now and sent a list of the projects, RK Singh stated. Singh stated the 5% concessional duty below the scheme will be allowed to be handed by means of to keep away from placing extra monetary burden on promoters.

The finance ministry didn’t favour the renewableenergy ministry’s preliminary strategies for a grant to offset the impression of greater import duty on these projects. Instead, it instructed duty refund. The income division had on October 20 amended the Project Imports Regulations of 1986 to take away solar from the mission imports scheme that allowed import of solar modules and cells wanted for organising new items or enlargement of an present unit at a concessional duty of 5%, later raised to 7. 5%. For promoters whose projects have been already underway when the federal government in March 2021 introduced its intent to impose 40% BCD on cells and modules from April 2022, the mission import scheme allowed safeguard for their investments.

Source: timesofindia.indiatimes

UN RELEASES REPORT OF HIGH-LEVEL EXPERT GROUP ON NET-ZERO COMMITMENTS

UN High-Level Expert Group will release a major report with recommendations on how to bring clarity and rigor to net-zero pledges from non-state actors, such as corporations, investors, and cities. The launch event will take place at COP27 in the Ibis room with Catherine McKenna and others.

“Companies must be held to a high bar to ensure their actions help tackle the climate crisis at the pace and scale necessary. The High-Level Expert Group’s report offers valuable insights on how businesses, investors, cities and others can set stronger and clearer net-zero emissions pledges and speed up implementation. The report lays out five clear principles that any one advocating for bold corporate climate action should closely consider.

“Nearly 1,500 companies are now committed to reach net-zero emissions according to the Science Based Targets initiative. This surge of interest from the corporate sector to zero out emissions is truly inspiring, but it is critical that companies’ plans are credible and backed up with bold, immediate ac tion and transparent reporting on progress. Any corporate net-zero targets with loopholes or weak guardrails would put our planet and billions of people in peril.”

www.EQMagPro.com FEATURED

FOLLOWING A STATEMENT FROM ANI DASGUPTA, PRESIDENT AND CEO, WORLD RESOURCES INSTITUTE:

NET-ZERO HEAT: LONG-DURATION ENERGY STORAGE TO ACCELERATE ENERGY SYSTEM DECARBONIZATION

Thermal energy storage has the potential to greatly contribute to decarbonizing global heat and power, while helping to ensure the energy system operates affordably, reliably, and efficiently.

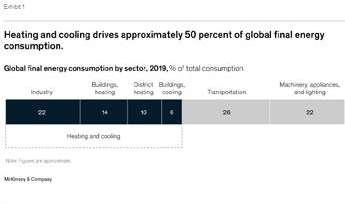

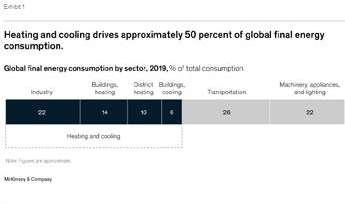

As efforts to decarbonize the global energy system gain momentum, attention is turning increasingly to the role played by one of the most vital of goods: heat. Heating and cooling—mainly for industry and buildings—accounts for no less than 50 percent of global final energy consumption and about 45 percent of all energy emissions (excluding power),1 so decarbonizing heat is central to the effort to achieve netzero emissions (Exhibit 1).

Less well understood is often the role that managing and storing heat can play in addressing a crucial challenge facing the power sector: how to increase the share of inherently variable renewable sources, such as wind and solar in the energy mix while ensuring supply matches demand. Thermal energy storage (TES) comprises a set of technologies that could both accelerate decarbonization of heat and help establish a stable, reliable electricity system predominantly powered by renewables. TES can be charged with renewable electricity or waste heat to discharge firm, clean heat to users such as industrial plants or buildings. A new industry report with insights and analysis by McKinsey shows how TES, along with other forms of long-duration energy storage (LDES), can provide “clean” flexibility by storing excess energy (electrical or thermal) at times of peak supply and releasing it as heat when demand requires. It shows that when heat cannot be directly generated with renewable electricity, TES can be a more cost-efficient and low-carbon way of fulfilling heat demand than delivering a steady electricity supply with stored renewable power. TES can cover a wide range of heat applications, including reaching the very high temperatures required in some industrial processes. The report is published together with the LDES Council, an executive-led organization formed to bring together the industry ecosystem and build a holistic fact base, thereby accelerating the cost reductions achievable through deployment of LDES solutions. LDES can offer a clean flexibility solution to secure reliable power and heat supply As discussed in the earlier netzero power report by the LDES Council, the energy system will likely need to operate more flexibly as the renewables’ share in

FEATURED

the power mix grows. Right now, the necessary flexibility is provided mainly by dispatchable fossil-fuel generation, but that is not a long-term solution that achieve climate targets. The more sustainable alternative will likely be a mix of flexibility solutions, including LDES (and TES). While direct electrification via renewables supports net-zero heat when the sun is shining and the wind is blowing, combining renewables with storage can help to complete the decarbonization of heating. Deploying TES can enable the provision of clean heat from renewables to industrial processes such as chemicals or food and beverage production All of these activities can help to match variable renewable electricity generation with demand and enable the system to operate at maximum efficiency, thus reducing the need to invest in infrastructure to cope with peaks and troughs. TES provides supply-side and demand-side storage and helps reduce the waste involved in curtailing renewable supplies at times of peak supply. It can improve overall grid utilization and reduce system stress, while in the process facilitating faster deployment of renewables. Some TES technologies are already commercially available and cost-competitive TES can enable the cost-efficient electrification of most heat applications including steam and hot air, two of the most common forms of heat used in industrial processes. It covers a spectrum of technologies that can address a wide range of storage durations (from intraday to seasonal) and temperatures (from subzero to 2,400°C). According to the LDES benchmarking results, TES could facilitate cost-efficient clean heat provision. Exhibit 2 illustrates one example and compares the levelized cost of delivering medium-pressure steam using TES to other fossil and clean technologies. Some TES technologies are already commercially available and can be easy to deploy and integrate with existing systems—for example, medium-pressure steam as applied in the chemicals and food and beverage industries. Innovative technologies that can help address highertemperature needs well above 1,000ºC are also on the way. The new report examines a number of use cases for TES and shows that they can potentially already be profitable, depending on local conditions and market design, with internal rates of return of up to 28 percent. The use cases assessed in the report include medium-pressure steam in a chemicals plant, district heating, high-pressure steam in an alumina refinery, and cogeneration for an off-grid greenhouse. The findings also demonstrate the importance of a supportive market design that provides some form of reward for the system flexibility TES creates, such as lower grid fees. TES is most likely to thrive, the report states, where there is access to abundant solar or wind power or to existing captive-heat supplies. In any case, the evidence suggests that TES, like other forms of LDES, is set to become more cost-competitive as the market matures and scales. The