Special Report 22-May-2018

Global markets at a glance US stocks rose on Monday and gains in industrials helped propel the Dow to a more than two-month closing high, after a truce between the United States and China calmed fears that a trade war might be imminent. U.S. Treasury Secretary Steven Mnuchin's comments over the weekend that the two countries had put the prospect of a trade war "on hold" and agreed to hold more talks to boost U.S. exports to China boosted stocks at the opening, with the Dow Jones Industrial Average leading the charge higher.

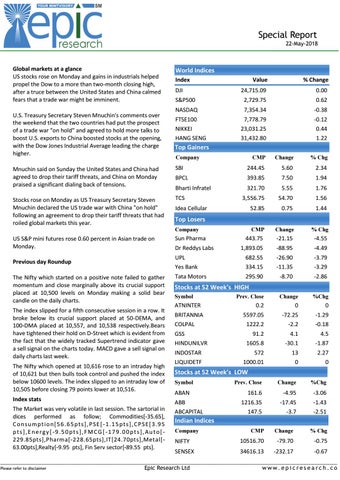

World Indices Index

Value

% Change

24,715.09

0.00

S&P500

2,729.75

0.62

NASDAQ

7,354.34

-0.38

FTSE100

7,778.79

-0.12

23,031.25 31,432.80

0.44 1.22

DJI

NIKKEI HANG SENG

Top Gainers Company

CMP

Change

% Chg

Mnuchin said on Sunday the United States and China had agreed to drop their tariff threats, and China on Monday praised a significant dialing back of tensions.

SBI

244.45

5.60

2.34

BPCL

393.85

7.50

1.94

Bharti Infratel

321.70

5.55

1.76

Stocks rose on Monday as US Treasury Secretary Steven Mnuchin declared the US trade war with China "on hold" following an agreement to drop their tariff threats that had roiled global markets this year.

TCS

3,556.75

54.70

1.56

52.85

0.75

1.44

CMP

Change

% Chg

443.75

-21.15

-4.55

1,893.05

-88.95

-4.49

UPL

682.55

-26.90

-3.79

Yes Bank

334.15

-11.35

-3.29

Tata Motors

295.90

-8.70

-2.86

Prev. Close

Change

%Chg

0.2

0

0

5597.05 1222.2

-72.25 -2.2

-1.29 -0.18

91.2

4.1

4.5

1605.8 572 1000.01

-30.1 13 0

-1.87 2.27 0

US S&P mini futures rose 0.60 percent in Asian trade on Monday. Previous day Roundup The Nifty which started on a positive note failed to gather momentum and close marginally above its crucial support placed at 10,500 levels on Monday making a solid bear candle on the daily charts. The index slipped for a fifth consecutive session in a row. It broke below its crucial support placed at 50-DEMA, and 100-DMA placed at 10,557, and 10,538 respectively.Bears have tightened their hold on D-Street which is evident from the fact that the widely tracked Supertrend indicator gave a sell signal on the charts today. MACD gave a sell signal on daily charts last week. The Nifty which opened at 10,616 rose to an intraday high of 10,621 but then bulls took control and pushed the index below 10600 levels. The index slipped to an intraday low of 10,505 before closing 79 points lower at 10,516. Index stats The Market was very volatile in last session. The sartorial in dices performed as follow; Commodities[-35.65], C o n s um pt io n[5 6 . 6 5 pts ] ,P SE [ -1 .1 5 pt s ], CP S E[ 3 .9 5 pts],Energy[-9.50pts],FMCG[-179.00pts],Auto[229.85pts],Pharma[-228.65pts],IT[24.70pts],Metal[63.00pts],Realty[-9.95 pts], Fin Serv sector[-89.55 pts].

Idea Cellular

Top Losers Company

Sun Pharma Dr Reddys Labs

Stocks at 52 Week’s HIGH Symbol

ATNINTER BRITANNIA COLPAL GSS HINDUNILVR INDOSTAR LIQUIDETF

ARVSMART Stocks at 52 Week’s LOW Symbol

ABAN ABB ABCAPITAL

Prev. Close

Change

%Chg

161.6

-4.95

-3.06

1216.35 147.5

-17.45 -3.7

-1.43 -2.51

Indian Indices Company

CMP

Change

% Chg

NIFTY

10516.70

-79.70

-0.75

SENSEX

34616.13

-232.17

-0.67

_____________________________________________________________________________________________________________________ Please refer to disclaimer Epic Research Ltd www.epicresearch.co