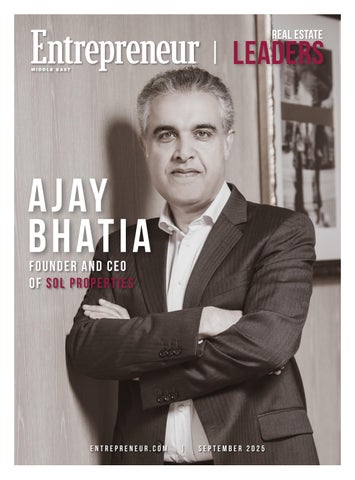

AJAY BHATIA

Founder and

CEO

of SOL Properties

Shaping Skylines, Shaping Lives: The vision of Ajay Bhatia

From bold architectural statements to wellnessdriven communities, SOL Properties’ CEO Ajay Bhatia is reimagining what “home” means in Dubai’s everevolving landscape.

The Red Sea Project

Welcome to Red Sea Global (RSG), where luxury, sustainability, and innovation converge to redefine how development is done.

The Future of Vertical Living in the Gulf

It isn’t just NEOM – the entire Gulf region is embracing new concepts of vertical living.

Miori by the Sea

A coastal world shaped by salt, light, and effortless belonging.

Beyond the Ledger: How Blockchain Is Reshaping Real Estate in the Gulf

Real estate transactions are already complex. Does Blockchain make them even more difficult or ease the process?

Kuwait’s Real Estate Market at a Turning Point

Kuwait’s Vision 2035 is having a radical impact on the growth of real estate in the country.

The Real Estate Surge Reshaping São Paulo

Brazil’s biggest city is seeing a surge in real estate development across smaller neighbourhoods.

The vision of Ajay Bhatia SHAPING LIVES Shaping Skylines,

From bold architectural statements to wellness-driven communities, SOL Properties’ CEO Ajay Bhatia is reimagining what “home” means in Dubai’s ever-evolving landscape.

Dubai has never been a city of half-measures. From its iconic palm-shaped islands to the tallest building in the world, it has long been a place where imagination meets execution. It is against this backdrop that Ajay Bhatia, CEO of SOL Properties, is making his mark.

“Dubai is a city built on audacious dreams and SOL Properties is proud to be part of that journey,” Bhatia reflects. “But what makes our vision stand tall is not just our scale, but our soul. We don’t just construct buildings; we create experiences that resonate deeply with the human spirit.”

In a skyline crowded with architectural marvels, Bhatia’s words set a different tone: one of purpose and people. “What distinguishes us in a skyline filled with architectural marvels is our ability to fuse luxury with liveability, innovation with intimacy,” he explains. “While others may focus on making statements, we focus on making a difference in how people feel, interact, and thrive within our spaces. Our vision isn’t just about shaping skylines, it’s about shaping lives with purpose, integrity, and enduring value.”

This philosophy has turned SOL Properties from a new entrant in Dubai’s luxury real estate market into a defining force, one that embodies the city’s forward-looking energy while grounding it in authenticity.

In Dubai, where luxury is often equated with spectacle, Bhatia insists on a different definition.

Behind SOL Properties lies the deep legacy of Bhatia General Contracting Company (BGCC), a company that has helped shape Dubai’s built environment and is now celebrating their 50 year anniversary.

“The Fairmont Residences Solara Tower Dubai was only possible because of the foundation laid by our parent company, Bhatia General Contracting,” Bhatia explains. “From large-scale housing developments like 1,050 villas in Al Khawaneej and 232 villas in Oud Al Muteena, to iconic public infrastructure like the Dubai Waterfront Market, Bhatia General Contracting’s reputation for quality, timely

delivery, and construction excellence gave us the platform and confidence to think bigger and build bolder under SOL Properties.”

That credibility became the launchpad for SOL’s bold ambitions. “Equally significant in our growth story has been the success of our hospitality ventures, the Dubai EDITION Hotel in Downtown Dubai and the Radisson Beach Resort on Palm Jumeirah,” Bhatia adds. “Entering an entirely new vertical during the peak of a global pandemic was a bold move, but we not only executed both projects to perfection, we opened them within a year of each other.”

Entering an entirely new vertical during the peak of a global pandemic was a bold move, but we not only executed both projects to perfection, we opened them within a year of each other.

This heritage underscores something profound: SOL Properties is not just about new buildings, but about continuing a family tradition of building trust in Dubai.

In Dubai, where luxury is often equated with spectacle, Bhatia insists on a different definition.

“Luxury, as we see it, is not defined by extravagance, but by meticulously crafted refinement,” he says. “Our signature design approach is rooted in timeless elegance, intelligent space planning, and a thoughtful interplay of texture, tone, and natural light. At SOL Properties, we don’t follow fleeting

trends, we embrace enduring design philosophies that elevate the everyday living experience.”

Take the Fairmont Residences Solara Tower Dubai: “We partnered with renowned architects and interior designers to ensure every element—from the Japanese tatamiinspired façade, which expands in footprint as it ascends to capture the most prime views of Downtown Dubai, to the carefully curated material specifications highlighting the finishes of the highest luxury standards embodies our vision: sophisticated yet serene, bold yet beautifully balanced.”

Shaping Skylines, Shaping Lives: The vision of Ajay Bhatia

He pauses, before adding: “At the heart of our design philosophy is a commitment to crafting spaces that resonate emotionally. True elegance is found not only in striking statements but in the quiet, considered details that reflect quality, intentionality, and care, creating homes that are as meaningful to inhabit as they are magnificent to behold.”

This philosophy is echoed in the Palm Jumeirah West Crescent project, which Bhatia describes as “a tribute to Italian design heritage, with a strong emphasis on artisanal detail, elegant proportions, and breathtaking views of the Arabian Gulf.”

Among the many developments in SOL’s portfolio, one project stands above the rest.

“The Fairmont Residences Solara Tower Dubai stands as a defining milestone in our journey not just as a project, but as a powerful statement of SOL Properties’ evolution from a trusted developer to a visionary brand,” Bhatia notes.

“It encapsulates everything we stand for: an exceptional location, timeless and intelligent design, wellness-integrated living, sustainable features, and an uncompromising commitment to quality.”

Notably, almost 80% of its buyers are end-users, something Bhatia sees as validation of trust. “It’s not just about ROI, it’s about creating long-term value and stability in the market.”

The hospitality launches during COVID were equally formative. “These developments were more than just business expansions; they were acts of belief, showcasing our resilience, discipline, and deep-rooted expertise across both construction and development,” Bhatia recalls.

Together, these projects reflect a brand unafraid to dream and deliver.

If there is one theme that defines SOL Properties today, it is the transformation of what “home” means.

“The definition of ‘home’ has undergone a seismic shift in recent years,” says Bhatia. “Today, people seek more than just shelter they desire spaces that nurture wellness, enhance productivity, and provide a sanctuary from the noise of the world.”

With landmark projects on Palm Jumeirah, Sheikh Zayed Road, and JVC, SOL is shaping the future of luxury living. What lies ahead will inspire admiration, set new milestones, and leave a lasting legacy in the city we proudly call home—Dubai.

At SOL LEVANTE in Jumeirah Village Triangle, residents can enjoy a 50,000-square-foot wellness environment: “From outdoor cinemas and meditation decks to co-working spaces, padel, tennis, mini golf and children’s play areas, we are responding to what modern families truly need,” Bhatia explains. “In this new era, ‘home’ must support the full spectrum of life and that is precisely what our developments are designed to deliver.”

The philosophy also guides the Sheikh Zayed Road mixed-use tower, one of their upcoming projects. “This landmark project combines exceptional connectivity with an iconic address,

reinforcing Dubai’s status as a global hub for both living and working,” he says.

While the word “sustainability” is sometimes overused, Bhatia stresses that for SOL it is not a buzzword, it’s a mandate.

“We don’t see sustainability as optional; it is integral,” he says. “Our developments integrate smart energy management, EV infrastructure, and biophilic elements that reduce environmental impact while enhancing human well-being. The goal is to create communities that thrive not just today, but for decades to come.”

He adds, “Sustainability must be lived, not marketed. That means durability of materials, long-term energy efficiency, and communities designed for connectivity and resilience. Our commitment is to build developments that serve the planet as much as they serve people.”

Technology is another pillar of SOL’s identity.“Technology should elevate life not complicate it,” Bhatia emphasizes. “From integrated smart home automation to app-enabled community management platforms, we’re putting control in the hands of our residents without overwhelming them with complexity.”

Today, people seek more than just shelter they desire spaces that nurture wellness, enhance productivity, and provide a sanctuary from the noise of the world.

Shaping Skylines, Shaping Lives: The vision of Ajay Bhatia

True aspiration must be rooted in authenticity, every project we undertake begins with a deep understanding of the community.

Whether it is contactless access, EV charging points, or app-based community platforms, the goal remains the same: to make life easier and more connected.

“Innovation is not just about gadgets it’s about creating environments where technology enables deeper human connection, greater comfort, and peace of mind.”

As Dubai continues to evolve, SOL Properties intends to be at the forefront of its transformation.

“Dubai is evolving into one of the world’s most dynamic, inclusive, and future-forward cities,” Bhatia says. “As His Highness Sheikh Mohammed bin Rashid Al Maktoum once said, ‘The future belongs to those who can imagine it, design it, and execute it.’ This visionary mindset shapes the foundation of everything we do.”

“With landmark projects on Palm Jumeirah, Sheikh Zayed Road, and JVC, SOL is shaping the future of luxury living. What lies ahead will inspire admiration, set new milestones, and leave a lasting legacy in the city we proudly call home—Dubai,” Bhatia promises.

Ultimately, SOL Properties reflects its leader. Ajay Bhatia’s leadership blends tradition with daring innovation, grounded in his family’s five decades of construction heritage.

“True aspiration must be rooted in authenticity,” he concludes. “Every project we undertake begins with a deep understanding of the community, the cultural context, and the evolving expectations of modern residents. While we aim high with our ambitions, creating environments that inspire, rejuvenate, and elevate daily life, we never compromise on the real, human aspects of living.”

Shaping Skylines, Shaping Lives: The vision of Ajay Bhatia

The road to success is always under construction.

Lily Tomlin

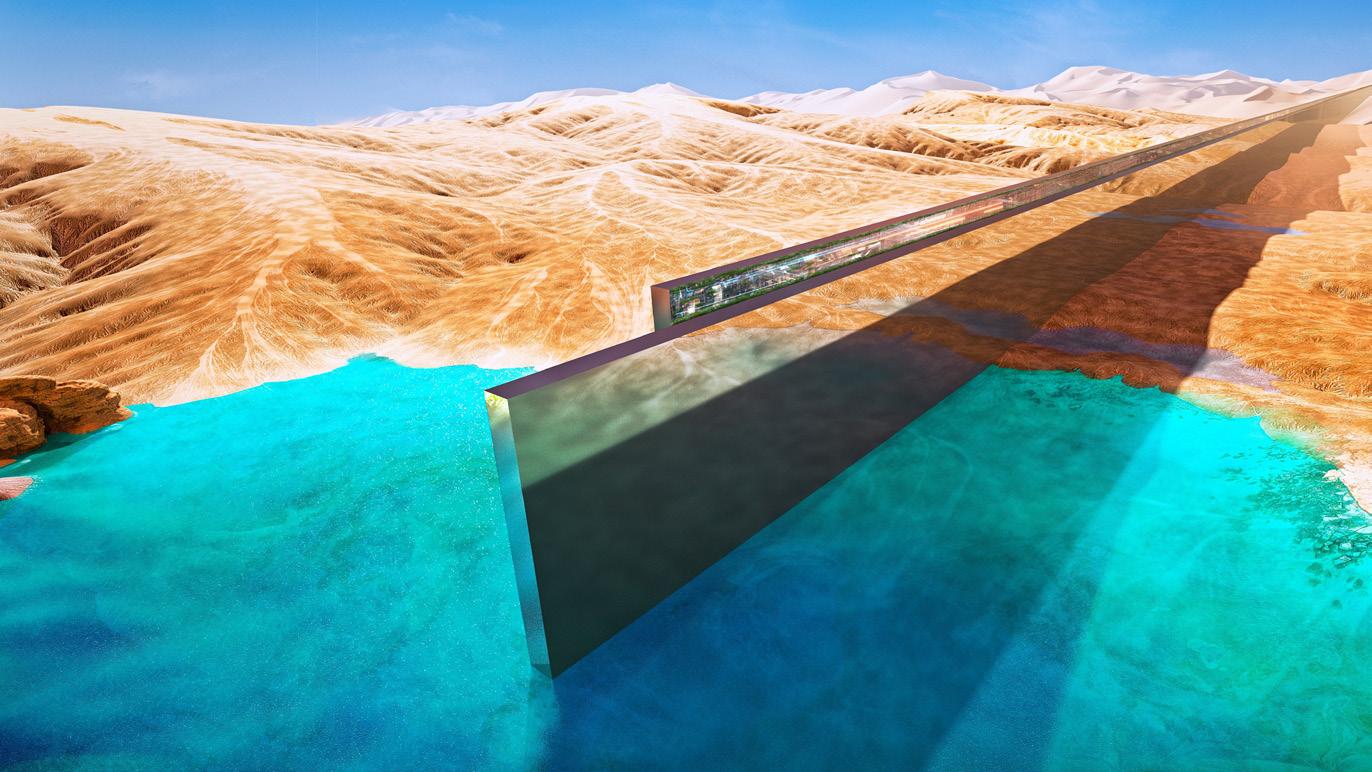

THE RED SEA PROJECT

Welcome to Red Sea Global (RSG), where luxury, sustainability, and innovation converge to redefine how development is done.

It includes six world-leading destinations along Saudi Arabia’s west coast. The Red Sea destination opened its first resort in 2023, will continue opening the 16 resorts of its first phase over 2024/2025, and will be completed in 2030 with 50 resorts. Thuwal Private Retreat opened as a single-hotel destination in 2024, while AMAALA’s first phase with eight resorts is due

to open in 2025 and will be completed in 2030 with 30 resorts.

These responsible tourism destinations will collectively enhance Saudi Arabia’s luxury tourism and sustainability offerings, going above and beyond to protect the natural environment and enhance it for future generations. RSG is working on new projects along the same coastline that will be announced soon.

Owned by the Public Investment Fund (PIF) of Saudi

Image courtesy of thuwalretreat.sa

Arabia and chaired by HRH Crown Prince Mohammad bin Salman bin Abdulaziz Al-Saud, RSG is a cornerstone of Saudi Vision 2030, helping to transform the nation,

creating significant economic opportunities for the people of Saudi Arabia, and actively enhancing the Kingdom’s rich environmental and cultural heritage.

These responsible tourism destinations will collectively enhance Saudi Arabia’s luxury tourism and sustainability offerings.

Image courtesy of Ali Lajami

Don’t aim for success if you want it; just do what you love and believe in, and it will come naturally.

David Frost

IN THE GULF THE FUTURE OF VERTICAL LIVING

It isn’t just NEOM – the entire Gulf region is embracing new concepts of vertical living.

The skyline of the Gulf has always told a story—one of ambition, identity, and transformation. From the shimmering towers of Dubai to the ambitious megaprojects rising from the sands of Saudi Arabia, vertical living has evolved from a symbol of prestige into a strategic necessity. But the Gulf’s love affair with height is changing. What was once defined by scale and luxury is now being reshaped by technology, sustainability, shifting demographics, and the lived realities of a post-pandemic world. The vertical life of the future isn’t just about going up—it’s about moving forward.

For decades, high-rise living in the Gulf reflected both rapid urbanization and a hunger for global recognition. Towers were monuments to modernity, density, and aspiration. In cities like Dubai, where land near coastlines and urban cores was limited, building upward wasn’t just an aesthetic choice—it was a practical one. Skyscrapers bundled residential, commercial, and retail experiences into compact footprints. People lived above malls, worked in cloud-kissing offices, and dined in rotating restaurants overlooking skylines. Luxury was vertically embedded into the Gulf’s DNA.

Yet the forces shaping the next generation of vertical living are fundamentally different. Urban populations across the Gulf are growing steadily. Cities such as Riyadh, Jeddah, Abu Dhabi, and Doha are experiencing not only natural demographic expansion but also intentional economic diversification strategies that attract new industries, workers, and expatriates. As governments push to create knowledge economies and global tourism hubs, demand for centrally located, high-quality housing is accelerating. And with harsh climates and limited infrastructure budgets, horizontal sprawl is increasingly untenable. Vertical living offers efficiency, resilience, and sustainability.

People lived above malls, worked in cloud-kissing offices, and dined in rotating restaurants overlooking skylines. Luxury was vertically embedded into the Gulf’s DNA.

Environmental priorities are also rewriting the rulebook. The UAE has pledged net-zero emissions by 2050, while Saudi Arabia has set its own deadline for 2060. That commitment translates directly into how buildings are constructed, maintained, and lived in. Future towers are expected to meet far stricter energy, water, and emissions benchmarks. We’re seeing the rise of facades that breathe, surfaces that generate solar energy, and internal systems that recycle graywater or optimize power use through AI. The smart tower isn’t a gimmick— it’s a requirement.

Technology, more broadly, is playing a transformative role. The integration of smart systems into homes and buildings is already standard practice in many Gulf developments, but the next iteration goes deeper. Towers are being designed from the ground up to support endto-end digital ecosystems—centralized platforms that manage everything from access control and parking to predictive maintenance and resident engagement. High-rise residents increasingly expect facial recognition entry, app-based concierge services, automated deliveries, and seamless connectivity across devices. As PropTech continues to mature, vertical living is becoming both more convenient and more efficient.

Perhaps the most dramatic cultural shift is how residents now perceive home. The COVID-19 pandemic catalyzed a reevaluation of what it means to feel safe, comfortable, and connected in one’s living space. In response, vertical housing is adapting. Balconies, which were once architectural afterthoughts, are now essential. Coworking lounges, wellness zones, and flexible apartment layouts that can morph from living room to office to gym are becoming standard in new builds. The line between private and communal space is blurring, giving rise to buildings that function as small vertical communities. The emphasis is no longer just on individual luxury—it’s on collective quality of life.

Developers are responding with imaginative new concepts. Vertical villages—towers that prioritize human connection—are becoming a design priority. Expect to see more sky gardens, shared kitchens, rooftop cinemas, and yoga decks perched 30 floors up. In many cases, these aren’t just amenity add-ons; they are baked into the building’s social fabric. Residents are encouraged to engage, to belong, to live not just near each other, but with each other. In a region where urban loneliness is on the rise, these vertical communities offer a hopeful counterpoint.

This philosophy is being pushed even further through hybrid-use developments. Rather than zoning by function, forward-looking towers blend uses in intuitive

ways. One can live on the 35th floor, work in a shared office space on the 10th, send their child to daycare on the 6th, and shop for groceries in the lobby—all without stepping outside. Developments like Dubai’s One Za’abeel are perfect examples, fusing residential, commercial, hospitality, and entertainment into a seamless vertical experience. And then there’s Saudi Arabia’s most ambitious vision: The Line, part of the NEOM megacity, which reimagines vertical urbanism entirely—not just a tower, but an entire 170-kilometer linear city built upward instead of outward.

Image courtesy of Gordon Tarpley

Image courtesy of Nicolas Lannuzel

Qatar, especially in Doha’s Lusail and West Bay, is leaning heavily into vertical luxury paired with hospitality, a trend accelerated by the 2022 FIFA World Cup.

Health and well-being, once overlooked in dense urban design, are now central. Biophilic design is taking hold across the region. Buildings incorporate greenery on multiple levels, drawing on research that shows access to nature improves mental health and reduces stress. Glass walls bring in sunlight; vertical farms provide herbs for community kitchens. Towers now include hydrotherapy spas, air purification systems, meditation rooms, and even running tracks that loop around sky terraces. For a population increasingly concerned with holistic wellness, these features are not luxuries—they’re essentials.

Of course, this evolution isn’t uniform across the region. The UAE remains the most mature high-rise market in the Gulf, particularly in terms of luxury living and smart technology integration. But Saudi Arabia is catching up fast. Under Vision 2030, cities like Riyadh, Jeddah, and NEOM are positioning themselves as global hubs for next-generation vertical living, often backed by sovereign wealth funding and a blankslate approach to city-building. Meanwhile, Qatar, especially in Doha’s Lusail and West Bay, is leaning heavily into vertical luxury paired with hospitality, a trend accelerated by the 2022 FIFA World Cup. Bahrain and Kuwait are more measured in their approach, but both are seeing a rise in high-rise projects targeted at young professionals and expats.

Still, challenges remain. Affordability is a concern. Many towers cater to the upper-middle and luxury segments, leaving a gap for middle-income residents seeking vertical convenience without elite pricing. Developers will need to innovate on cost, modular construction, and unit design to broaden appeal. Cultural expectations also pose questions: how do you preserve privacy, gender separation, and space for extended families within a vertical framework? And then there’s infrastructure. High-rises place significant strain on utilities, waste systems, and transportation networks. Municipalities will need to plan accordingly—and act proactively.

There are also regulatory hurdles. Not all city planning departments are equipped to assess or manage the complexities of next-generation towers. Building codes, zoning laws, and service frameworks need to evolve just as quickly as the towers themselves. Education, coordination, and cross-sector collaboration will be key.

Yet, despite these issues, the direction is clear. The vertical lifestyle is not a trend; it’s the foundation of the Gulf’s urban future. Speaking with Khalid Al Suwaidi, a senior executive at a UAE-based real estate firm, his view is clear: “People used to view towers as luxury icons. Today, they’re about lifestyle,

convenience, and sustainability. The demand is shifting. We’re no longer just selling a view—we’re selling a vertical experience.”

That experience, increasingly, is one of holistic, techenabled, community-oriented, sustainable living. Towers are no longer isolated monoliths—they are integrated, living systems. They reflect not just where people want to live, but how they want to live. And in the Gulf, where rapid growth and visionary leadership often go hand in hand, the tower of tomorrow is already breaking ground today.

As these new structures rise, they carry with them the aspirations of a region redefining its cities from the sky down. The Gulf’s future isn’t just above ground—it’s above expectations.

Image courtesy of Allan Donque

Profit is not the purpose of a business, but rather the test of its validity.

Peter Drucker

BY THE SEA MIORI

A coastal world shaped by salt, light, and effortless belonging

BY SEYMONE L. MOODEY

There are places that ask for your attention, and then there are places like MIORI by the Sea, where nature does all the talking.

This new coastal destination redefines what it means to escape. From the moment you arrive by boat, which is the only way to reach it, everything changes. The water is crystal clear. The colours shift from pale turquoise to deep sapphire. The pace slows. And the world fades behind you.

Set within the quiet elegance of Bedri Rahmi Bay, MIORI by the Sea is a new opening, a benchmark. A place that honours its surroundings without overpowering them. A new chapter for coastal hospitality in Türkiye.

The view alone is enough to stop you midsentence. Pine-covered hills rise behind you. The bay stretches wide ahead. And in between, a destination that feels perfectly placed.

MIORI doesn’t interrupt the landscape. It blends into it. Light wood, natural stone, crisp white linens. Nothing imposed. Nothing unnecessary. Just design that lets the sea do the talking.

There’s no grand entrance. No gates. Just a soft landing.

A welcome that comes not through words but feeling.

The journey doesn’t start at MIORI. It starts at XO Cape Arnna.

Set on the Aegean coast in Sarigerme, this flagship resort sprawls across over 100,000 square metres of smart Mediterranean design. It's clean, contemporary, and intentional, a space that never overwhelms, yet constantly impresses. Thoughtful texture, refined tones and spaces that allow you to exhale.

Guests staying in The Club, XO Cape Arnna’s adults-only section, will find a careful balance of polished service and laid-back ease. The team are attentive, sincere, and engaging, striking the right tone between professionalism and warmth.

The overall atmosphere at XO Cape Arnna feels finely tuned. Everything flows smoothly and intuitively, from the design of the rooms to the rhythm of the poolside experience.

The transfer from XO Cape Arnna to MIORI wasn’t just scenic, it was symbolic. There’s no road access to MIORI. You arrive by sea, as if slipping into a secret only those with access know about.

And then it appears. Folded quietly into the protected cove of Bedri Rahmi Bay.

There’s no neon signage. No manicured photo wall. What you get instead is soft, natural wood, the sound of water against the deck, and a layout that lets the coastline speak for itself. The design of MIORI blends into its surroundings. It’s intentional without being overly architectural. Its design is rooted in the elements: warm wood, sun-washed stone, soft linen, and an architectural rhythm that mirrors the flow of the sea. The layout breathes. Every corner is shaped by light, view and purpose. From the sea deck to the walkways, every detail is intentional and yet, nothing feels staged.

The mood is calm but confident. This is not about extravagance. This is about elegance without excess. Everything that needs to be there, is. Nothing more. Nothing less.

Bedri Rahmi Bay has always been a special place, a painter’s dream, a sailor’s escape, a hidden cove where time stretches. And now, with the arrival of MIORI, it has something it never had before: a destination that amplifies its beauty while protecting its soul.

Here, days unfold in layers, gentle and generous. Guests move not by schedule, but by instinct. There are no hard lines. Just moments that ease into each other. A soft breakfast leads to a long swim. A shaded lunch becomes an afternoon on the deck. A cocktail turns into dinner. Then music. Then stars.

“A soft breakfast leads to a long swim. A shaded lunch becomes an afternoon on the deck. A cocktail turns into

dinner. Then music. Then stars.

YIGIT SEZGIN, Founder & Managing Partner, Clé & Partners

“MIORI doesn’t interrupt the landscape. It blends into it. Light wood, natural stone, crisp white linens. Nothing imposed. Nothing unnecessary. Just design that lets the sea do the talking.

The property is home to six distinctive culinary concepts, each designed to honour a different part of the coastal experience. But they are not separate worlds, they are chapters of the same story.

The property is home to six distinctive culinary concepts, each designed to honour a different part of the coastal experience. But they are not separate worlds; they are chapters of the same story. From The KITCHEN’s seamless shift from daytime ease to hidden speakeasy, to the coastal Italian energy of Isabel’s, the precise omakase storytelling at OKO, the artisanal calm of the BAKERY, and the new launch of Riva Lounge, MIORI’s culinary world is cohesive, soulful, and confident.

THE KITCHEN is where it all begins. In the morning, it’s calm and bright Turkish breakfasts are served with warm bread, fresh herbs, honeycombs and sun-soft tomatoes. As the day progresses, the space evolves. By night, a hidden speakeasy behind its walls reveals itself to be intimate, moody, and magnetic.

THE BAKERY is where morning rituals take root. Croissants warm from the oven. Perfect espresso. Light conversation.

ISABEL’S brings the Mediterranean to Göcek in a way that feels completely in place. The Italian spirit is alive in the details: hand-rolled pastas, olive oil that glows golden in the light, seafood that tastes like it was caught just hours before.

OKO, the Japanese omakase concept, is a quiet standout.

A three-act dining experience that speaks through simplicity. There’s reverence in every plate, balance, technique and story.

RIVA LOUNGE, now open for the first time in Türkiye, brings elevated energy to the MIORI experience. Its shoreline setting, international cocktail program, and sunset soundtrack make it an anchor for evenings that ease into night.

The July 4th launch was elegant and smooth. The entertainment, Solange, SinCasa, and Yakuza was carefully curated to support the atmosphere, drinks were flowing (Don Julio 1942, 71 Gin, XO Cape Arnna wines). The guest list included Francesco Missoni, Ralph Lauren Middle East

Managing Director Yassine Sibari, globally renowned entrepreneur Nicolas Brochet, Meta Facebook executive Ahmad Shehada and many others of similar stature. A legacy crowd. Global reach. Regional respect. People who see hospitality as more than a transaction. Everyone looked relaxed, comfortable and present.

To understand why MIORI feels so considered, you need to look at the person behind it. Yigit Sezgin, Founder & Managing Partner of Clé & Partners, isn’t new to hospitality, he’s helped shape it. With over three decades of global experience across the luxury and lifestyle space, Sezgin’s resume includes senior leadership roles at Raffles, Fairmont, SLS, Banyan Tree, Regent, Missoni, and Ritz-Carlton, as well as Bilgili Holding. Previously Global Chief of Brand & Commercial at Fairmont and later CCO of Accor Group, he led global portfolios across 40+ countries, establishing brand platforms, lifestyle frameworks, and strategic growth models. He

also served as CEO of Bilgili Holding, managing partnerships with Aman, Peninsula, W Hotels, Soho House and others.

When I think back on that weekend from XO Cape Arnna’s slow mornings to MIORI’s candlelit evenings, what I remember most is the rhythm. Nothing felt rushed. Nothing screamed for attention. And yet, everything hit exactly the right note.

This is a rare thing in hospitality: a brand that knows who it’s for, speaks to them clearly, and delivers without overpromising. It isn’t about theatrics. It’s about trust.

MIORI invites you into something that’s already been built with care. It gives you room to breathe, space to connect and a reason to return.

Good food, good mood and a destination that makes you want to keep coming back.

A business that makes nothing but money is a poor kind of business.

Henry Ford

How Blockchain Is Reshaping Real Estate in the Gulf BEYOND THE LEDGER

Real estate transactions are already complex. Does Blockchain make them even more difficult or ease the process?

In a region where innovation often moves faster than regulation, the Middle East—particularly the Gulf—has never shied away from embracing the bold, the disruptive, or the futuristic. From driverless taxis to AI-driven smart cities, the GCC has earned its reputation as a testbed for tomorrow. And now, another disruptive force is working its way through the region’s real estate sector: blockchain.

At first glance, blockchain—the digital ledger technology best known for powering cryptocurrencies like Bitcoin—might seem an unlikely match for the conservative, document-heavy world of property. But beneath the buzzwords lies a tool with the potential to address some of the most persistent

inefficiencies in real estate: lack of transparency, fraud-prone paper trails, prolonged transaction times, and fragmented ownership records. For a sector that touches everything from sovereign investment to suburban apartment rentals, the implications are profound.

In the Gulf, where real estate is a cornerstone of national economic strategies, the integration of blockchain is not a theoretical exercise. Governments, developers, and tech firms are already testing its limits. What’s emerging is a picture of a market cautiously but deliberately laying the groundwork for a more digital, more secure, and more frictionless real estate ecosystem.

In the Gulf, where real estate is a cornerstone of national economic strategies, the integration of blockchain is not a theoretical exercise. Governments, developers, and tech firms are already testing its limits.

Real estate transactions in the Gulf are notoriously complex. Multiple layers of approvals, notaries, escrow processes, and manual verification can stretch what should be a straightforward sale into a bureaucratic labyrinth. In many jurisdictions, property title verification still relies on paper archives or siloed databases that aren’t easily accessible to the public. This opacity can increase the risk of double-selling, title fraud, or delayed handovers—all of which undermine investor confidence.

Blockchain offers a direct remedy. At its core, it is an immutable digital ledger that records transactions in a decentralized system. Once a transaction is added to the blockchain, it cannot be altered or erased. That permanence makes it ideally suited to property records, where trust and clarity are paramount. When property deeds, ownership changes, and title histories are recorded on blockchain, verification becomes nearly instantaneous. There’s no need to chase paperwork or cross-reference archives; the information is secured, transparent, and tamper-proof.

Several governments in the Gulf are already exploring this use case. The Dubai Land Department (DLD), often a first mover in real estate innovation, launched its blockchain strategy as early as 2017. Since then, it has worked with local partners to digitize tenancy contracts, link property records to utility accounts, and even test smart contracts—self-executing digital agreements that release payments or ownership once certain conditions are met. By moving these traditionally paper-based functions onto blockchain, the DLD aims to create a

“fully digital real estate market” in line with Dubai’s ambitious paperless government initiative.

The results are starting to show. Today, landlords in Dubai can register lease agreements through blockchain-integrated portals, automatically linking tenancy details to DEWA (Dubai Electricity and Water Authority) and other service providers. This not only streamlines the rental process for residents and owners alike, but also strengthens the city’s data ecosystem. As more property transactions are logged on blockchain, regulators gain better visibility into market activity—enabling more informed policy decisions and early identification of speculative bubbles.

Beyond public registries, blockchain is also transforming private sector workflows. Developers and brokers are using it to enhance trust during off-plan sales, where buyers traditionally worry about escrow mismanagement or project delays. With smart contracts, a buyer’s payment can be programmed to release to a developer only when agreed milestones are met—such as the completion of a foundation or structural works. This conditional flow of funds reduces risk on both sides and fosters accountability without the need for an intermediary.

One of the most compelling promises of blockchain in real estate is its ability to fractionalize ownership. In traditional models, owning a property requires substantial

capital and navigating a host of legal and logistical hurdles. But blockchain makes it possible to tokenize real estate assets—dividing a property into digital shares that can be bought, sold, or traded like stocks. These tokens represent ownership rights, and because they live on the blockchain, their provenance and value can be easily verified.

This concept has exciting implications in the Gulf, especially for attracting retail and foreign investors. A young professional in Singapore, for example, could own a fraction of a Dubai apartment and receive rental income from it— without ever stepping foot in the UAE. Bahraini pension funds could diversify portfolios by acquiring digital stakes in Riyadh office buildings. For developers, tokenization opens new funding

channels. Instead of seeking one large investor, they can raise capital from a distributed pool of micro-investors worldwide.

Of course, the idea of tokenized real estate is still in its infancy. Legal frameworks around ownership, custody, taxation, and cross-border transferability vary widely across jurisdictions. Regulators in the GCC have responded with cautious optimism. Bahrain’s Economic Development Board has made early moves toward blockchain regulation, while the Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) are studying tokenized securities with an eye toward compliance and investor protection. The UAE’s Securities and Commodities Authority (SCA) has also issued guidance on digital assets, a necessary first step before real estate tokens can be traded at scale.

Despite the enthusiasm, challenges remain. One of the biggest is interoperability—how blockchain platforms integrate with existing legal and regulatory systems. In many Gulf countries, property laws are based on civil or Islamic legal traditions that weren’t built with decentralization in mind. Updating these frameworks to recognize blockchain-based records as legally binding titles or to allow smart contracts to replace notaries requires careful reform.

Image courtesy of Francisco Anzola

There’s also the question of accessibility. While blockchain promises efficiency, its current interfaces can be technically intimidating. Mass adoption will depend on user-friendly platforms that abstract away the complexity. It must be just as easy for a landlord in Muscat or a buyer in Jeddah to complete a transaction on blockchain as it is to sign a traditional contract— ideally easier.

Security, too, is a double-edged sword. Blockchain’s immutability is a powerful safeguard, but it also means mistakes are permanent. A smart contract coded incorrectly or a wallet key lost forever can result in irretrievable assets. As blockchain use increases, so will the need for clear dispute resolution mechanisms, digital identity standards, and robust consumer protections.

Still, for all its complexities, the momentum is unmistakable. The region’s real estate sector is evolving—and blockchain is part of the blueprint. As more governments and developers digitize their workflows, early adoption will likely give way

to mainstream integration. Future buyers may not walk into a brokerage office, but log into a platform, browse blockchain-certified properties, and complete transactions with a few biometric scans. A rental agreement might be signed, registered, and linked to utility accounts in minutes—all without paper or inperson verification.

In this future, title fraud becomes virtually impossible. Middlemen are reduced or redefined. Transparency is the norm, not the exception. And the property market becomes not just smarter, but more accessible, efficient, and trusted.

In the words of Laila Al Haddad, a technology advisor to several Gulf property developers, “Blockchain won’t replace the real estate industry—but it will reshape how the industry operates. It’s not just about speed or savings. It’s about building trust at scale.”

And trust, in a sector as foundational as real estate, may prove to be blockchain’s greatest legacy.

Blockchain won’t replace the real estate industry, but it will reshape how the industry operates.

Laila Al Haddad, Technology advisor to several Gulf property developers

The function of leadership is to produce more leaders, not more followers.

Ralph Nader

Kuwait’s Real Estate Market at a Turning Point

Kuwait’s Vision 2035 is having a radical impact on the growth of real estate in the country

In the heart of the Arabian Gulf, Kuwait has long held a reputation for stability, wealth, and conservatism. Its skyline, while modest compared to the high-rise spectacles of Dubai or Doha, is marked by quiet confidence rather than architectural bravado. Yet beneath this reserved surface, Kuwait’s real estate sector is undergoing a gradual but undeniable shift. Spurred by demographic changes, economic diversification, regulatory reform, and shifting investor sentiment, the market is beginning to chart a new course—one that

reflects the country’s complex present and cautiously optimistic future.

Kuwait’s property market has always been distinctive in the Gulf. Unlike its neighbors, where foreign investment and speculative development dominate headlines, Kuwait has historically favored a more inward-looking, locally driven model. Much of the country’s land is state-owned, and strict regulations—particularly around foreign ownership—have limited the participation of international

buyers and developers. Residential real estate is heavily skewed toward citizens, with expatriates largely confined to rental markets and investment avenues carefully regulated.

But in recent years, that model has come under pressure. Population growth, urban congestion, and an economy tied tightly to oil have exposed structural weaknesses in the real estate ecosystem. The COVID-19 pandemic intensified many of these challenges, leading to a

temporary softening in demand, a glut in office and retail spaces, and growing calls for modernization. At the same time, Kuwait’s Vision 2035—a long-term development strategy aimed at transforming the country into a regional financial and commercial hub—has placed infrastructure, housing, and urban development at the center of national policy.

The result is a market in transition: not booming, not collapsing, but recalibrating.

One of the most visible shifts is taking place in the residential sector. For decades, Kuwait’s housing model has revolved around large, single-family homes on generous plots—especially in areas designated for citizens such as Mishref, Rumaithiya, and Adailiya. But as land availability tightens and property prices climb, younger Kuwaitis are finding it harder to access these traditional models of homeownership. Demand is growing for smaller, more affordable units, including apartments and townhouses, particularly in the private sector zones of Salmiya, Hawalli, and Mahboula.

To meet this changing demand, developers have begun exploring vertical residential formats, a relatively new concept in the Kuwaiti context. While high-rise living is still not widespread among Kuwaitis—many of whom value privacy and space— there is increasing acceptance, particularly among younger generations and dual-income households. Projects such as the Tamdeen Group’s developments in Sabah Al Ahmad Sea City and the new urban expansions near South Al Mutlaa are starting to blend high-density living with lifestyle amenities, green spaces, and smart infrastructure.

Parallel to this, the rental market is facing a correction. During the pandemic, many expatriates left the country, leading to an oversupply of vacant units, particularly in the mid-tier apartment segment. Landlords were forced to reduce rents or offer incentives to retain tenants. While demand has partially recovered as borders reopened and business activity resumed, rental yields remain under pressure. Vacancy rates are still elevated in some districts, particularly those dominated by older buildings lacking modern amenities.

Yet in pockets of the market, opportunity is emerging. Coastal properties in Salwa, Messilah, and parts of Sabah

Al Salem continue to attract high-income expatriates and GCC nationals, particularly as landlords upgrade facilities and reposition assets as lifestyle-centric residences. There is also growing interest in branded residences and serviced apartments, especially in areas close to business hubs, malls, and schools.

The commercial sector presents a more complicated picture. Office space in Kuwait City and surrounding business districts continues to face sluggish demand, exacerbated by the rise of remote work and the slow recovery of some sectors. New Grade A projects have struggled to achieve full occupancy, leading to increased competition and softening rental rates. However, demand for flexible workspaces, coworking offices, and business centers is on the rise, reflecting a broader global trend that has now taken root in Kuwait as well.

Retail, long a pillar of Kuwait’s real estate scene, is also evolving. The country boasts some of the most successful malls in the region, including The Avenues, Marina Mall, and 360 Mall—each of which functions not just as a shopping destination but as a social and entertainment hub. While e-commerce has grown, particularly during the pandemic, Kuwaitis continue to favor physical retail experiences, especially when tied to dining, leisure, and family-friendly attractions. Developers are responding by pivoting toward experiential retail. Recent mall expansions have prioritized open-air promenades, wellness zones, community events, and integrated hospitality. The upcoming Al Khiran Hybrid Outlet Mall, billed as the first hybrid outlet and lifestyle destination in the region, exemplifies this shift. Combining luxury outlets with entertainment and waterfront experiences, it aims to reimagine the role of retail in a post-pandemic world.

During the pandemic, many expatriates left the country, leading to an oversupply of vacant units, particularly in the mid-tier apartment segment.

On the investment side, the landscape is cautiously optimistic. Kuwaiti investors remain active domestically, although many continue to favor income-generating assets abroad, particularly in Europe, Turkey, and Southeast Asia. Within Kuwait, income-generating properties in established districts still attract attention, but the appetite for risk remains low. Investors are watching policy developments closely— particularly around taxation, regulation, and foreign ownership rights.

Which brings us to one of the most critical levers of real estate reform: regulation. Over the past two years, policymakers have begun reassessing Kuwait’s real estate governance, with a focus on transparency, market stability, and long-term affordability. Proposals have been floated to digitize land registries, streamline permitting processes, and introduce real estate taxation on certain property classes—measures aimed at curbing speculative activity and encouraging institutional investment.

In 2022, the Kuwaiti government passed Law No. 5, introducing a Real Estate Regulatory Authority tasked with overseeing sector activity, licensing developers and brokers, and publishing market data. While the authority is still ramping up operations, stakeholders view it as a long-overdue step toward better market governance. Greater data transparency, in particular, is seen as vital for attracting both domestic and foreign capital.

Foreign ownership remains one of the biggest open questions. Currently, non-GCC nationals are not permitted to own

property in Kuwait. Even GCC citizens face limitations. This has long been a barrier to foreign investment, especially in the residential and hospitality sectors. There are ongoing discussions within government circles about relaxing these restrictions—potentially allowing foreign ownership in designated zones or developments—but no concrete legislation has yet been enacted. If and when it is, the market could see a wave of new capital, albeit likely accompanied by tight regulatory controls.

Despite the barriers, innovation is slowly gaining ground. Kuwaiti developers are beginning to explore technologies such as smart home integration, energy-efficient construction, and digital property management platforms. There is even early interest in blockchain applications for property records and transactions, although widespread adoption remains distant. The introduction of green building codes, though still voluntary, has nudged some firms toward more sustainable design practices, especially in government-led projects.

All of this points to a market at a crossroads. Kuwait’s real estate sector is not racing ahead like some of its Gulf peers, nor is it stagnant. Instead, it is recalibrating—balancing tradition with modernity, regulation with opportunity, and caution with creativity. It remains deeply shaped by local customs, state intervention, and cultural preferences, yet is increasingly responsive to the forces of globalization, technology, and demographic change.

As Kuwait continues to invest in infrastructure, diversify its economy, and respond to the housing needs of a young

Within Kuwait, income-generating properties in established districts still attract attention, but the appetite for risk remains low.

and growing population, real estate will remain a vital component of its national story. But the way that story unfolds will depend on how successfully the sector adapts—not just to market forces, but to the aspirations of the people it ultimately serves.

In a region known for its bold real estate ambitions, Kuwait’s evolution may be more deliberate, more grounded. But make no mistake: it is happening. And in that quiet transformation lies the potential for a market that is more inclusive, more sustainable, and more resilient than ever before.

A leader is one who knows the way, goes the way, and shows the way.

John C. Maxwell

The Real Estate Surge Reshaping

SÃO PAULO

Brazil’s biggest city is seeing a surge in real estate development across smaller neighbourhoods

From the air, São Paulo appears as a sprawling sea of concrete, stretching to the horizon in every direction. But at street level, in neighborhoods like Vila Madalena, Itaim Bibi, and Brooklin, a quieter revolution is taking place—one defined by construction cranes, sleek towers, and a new generation of urban dwellers. This is not just the largest city in South America—it is one of the most dynamic, complex, and rapidly transforming real estate markets in the world.

Long known for its vast scale, economic clout, and persistent inequality, São Paulo has always been a city of contrasts. Wealth and poverty sit side by side; colonial architecture coexists with glass skyscrapers; informal housing sprawls near gated communities. But in recent years, a convergence of forces—demographic shifts, digital transformation, rising domestic demand, and policy reform— has triggered a new phase of real estate growth. It’s a surge defined not just by quantity, but by quality, innovation, and intent.

At the heart of this transformation is urban densification. For decades, São Paulo’s rapid expansion was horizontal, driven by highways, suburbanization, and the logic of distance. But now, the logic is reversing. In a city plagued by traffic congestion, strained infrastructure, and long commutes, proximity is the new luxury. People want to live closer to where they work, shop, study, and socialize. This has sparked a wave of vertical development in central neighborhoods—smaller units, taller buildings, and smarter designs.

Developers have responded with agility. Compact residential units, often under 40 square meters, have surged in popularity

among young professionals, singles, and downsizing retirees. These micro-apartments are typically located near metro stations, coworking hubs, and entertainment districts, offering lifestyle over square footage. While critics worry about over-density and shrinking living standards, proponents see an urban fabric better suited to the realities of modern life: mobility, flexibility, and access.

Nowhere is this trend more visible than in districts like Pinheiros and Moema, where traditional low-rise buildings are being replaced by glass-and-steel towers offering rooftop pools, shared workspaces, smart home features, and fitness

studios. In many cases, these are not luxury products, but accessible urban dwellings aimed at middle-income buyers seeking quality of life over status. The appeal lies in walkability, design, and the promise of less time spent in traffic.

The city’s changing skyline also reflects a shift in mindset. Younger Brazilians are more likely to rent, more open to coliving models, and more willing to trade space for location. This is encouraging the rise of build-to-rent (BTR) platforms, often backed by institutional investors and private equity funds. These developments offer long-term leases,

Younger Brazilians are more likely to rent, more open to co-living models, and more willing to trade space for location.

professional property management, and curated amenities—effectively rebranding renting as a lifestyle choice rather than a fallback.

On the commercial side, the picture is equally dynamic. After a brief slowdown during the COVID-19 pandemic, São Paulo’s office market is rebounding, albeit with a redefined focus. While older commercial towers in the city’s center struggle with high vacancy rates, new Class A buildings in regions like Faria Lima and Chucri Zaidan are seeing strong demand. Tenants are seeking flexible layouts, sustainability certifications, and post-pandemic amenities—such as air purification systems, touchless access, and outdoor common areas.

The post-pandemic reconfiguration of workspaces is also feeding into new mixed-use formats. Developers are blending offices, residences, retail, and leisure into single, vertical ecosystems. The result is a wave of “urban islands” that offer nearly everything within walking distance. These developments are increasingly appealing not just to tech firms and creative startups, but to large multinationals eager to offer talent-rich, work-live-play environments.

Retail, long seen as vulnerable to e-commerce, is evolving in parallel. While traditional malls have struggled, neighborhood high streets and experience-driven retail spaces are gaining traction. Food halls, wellness centers, and hybrid stores—where retail blends with community events

or entertainment—are reshaping the consumer experience. In affluent zones like Jardins or Vila Nova Conceição, real estate value is increasingly tied to the vibrancy of the surrounding public realm.

Meanwhile, logistics and industrial real estate are undergoing a quiet boom.

As e-commerce penetration deepens across Brazil, demand for last-mile delivery hubs, fulfillment centers, and modern warehouses near São Paulo’s metropolitan belt has surged. This sector, once overlooked by major investors, is now attracting international funds and REITs drawn to its stable yields and long-term growth prospects.

But beyond the headlines, challenges remain. São Paulo is a city with deep structural inequalities and a complex regulatory environment. The very densification that is breathing new life into central districts is also raising concerns about displacement, gentrification, and affordability. Longterm residents of working-class neighborhoods are being priced out as upscale towers take their place. Informal settlements, or favelas, continue to expand on the city’s periphery, often without access to basic infrastructure or legal protections. In response, some developers and architects are exploring inclusive housing models. Social housing initiatives, mixed-income developments, and public-private partnerships are being tested, albeit at a limited scale.

Ultimately, the story of São Paulo real estate is a story of reinvention. It’s a deeper, systemic recalibration of how Latin America’s largest city sees itself.

The city’s master plan has also introduced incentives for affordable housing and transitoriented development, rewarding projects that offer social benefits with greater building rights. Still, enforcement is uneven, and political will fluctuates.

Financing, too, is a double-edged sword. On one hand, Brazil’s central bank has kept interest rates high in its fight against inflation, making mortgage credit more expensive. This has cooled parts of the residential sales market and increased the burden on first-time buyers. On the other hand, inflation-linked leases have protected returns for landlords and made real estate an attractive hedge for wealthy investors amid broader market volatility.

Yet despite the macroeconomic noise, international interest in São Paulo real estate is steadily rising. Global funds and institutional investors, particularly from North America, Europe, and the Middle East, are entering the market—either through direct acquisitions or joint ventures with Brazilian developers. Their focus is increasingly on niche sectors: logistics, data centers, co-living, BTR, and green-certified commercial buildings.

Sustainability is becoming a differentiator. ESG (Environmental, Social, and Governance) considerations are moving from optional to expected. New commercial buildings are being

designed with LEED and EDGE certifications, solar energy systems, water reuse infrastructure, and mobility-friendly features like bike storage and EV charging. Some developers are even using low-carbon concrete and green rooftops as selling points. For a city grappling with pollution, flooding, and a warming climate, these efforts are both symbolic and urgent.

Technology is also playing a role in reshaping the real estate transaction itself. PropTech startups in São Paulo are streamlining property searches, enabling virtual tours, digitizing legal documents, and even offering blockchainbased rental platforms. Digital brokers, fractional ownership platforms, and automated property management tools are lowering barriers to entry and pushing the sector toward transparency and efficiency.

Still, the future depends on governance. Bureaucracy, outdated zoning laws, and inconsistent enforcement continue to slow project approvals and add to development costs. Land titling issues, especially in informal zones, remain unresolved. But there are signs of institutional learning. São Paulo’s city government has introduced digital permitting systems, expedited approvals for certain zones, and continues to experiment with urban planning tools like CEPACs (Certificates for Additional Building Potential), which allow private developers to pay for the right to build beyond standard limits—often funding public improvements in the process.

Ultimately, the story of São Paulo real estate is a story of reinvention. It’s not just a response to population growth, inflation, or shifting consumer habits. It’s a deeper, systemic recalibration of how Latin America’s largest city sees itself. It is reclaiming density not as a problem, but as a solution. It is testing new models of ownership, mobility, and sustainability. And in doing so, it is quietly becoming a laboratory for urban innovation—one whose lessons may resonate far beyond Brazil.

As cranes rise across its skyline and old warehouses give way to green towers, São Paulo is proving that real estate growth doesn’t have to mean more of the same. It can mean smarter, fairer, and more future-proof development—if the city chooses to rise to that challenge.

Innovation distinguishes between a leader and a follower.

Steve Jobs

Are Buying Homes Today And Why WHERE FOREIGNERS

Foreign ownership is the new normal in major cities. But which are the best locations?

The modern expatriate no longer fits the stereotype. Today’s globally mobile professional is not just a corporate transferee on a short-term posting. They might be a tech entrepreneur splitting their time between Singapore and Lisbon, a crypto investor setting up shop in Dubai, a retiree eyeing a beachside condo in Valencia, or a remote worker seeking lifestyle and affordability in Tulum or Bali. And unlike generations past, many are not simply renting short-term—they’re buying homes.

Across continents, a quiet shift is unfolding: expats are investing in real estate—not just as a place to live, but as a strategic foothold in countries offering residency perks, favorable tax regimes, digital nomad visas, and a better quality of life. These new enclaves are forming in places once considered off the radar for foreign ownership. The motivations are varied—citizenship pathways, investment diversification, lifestyle upgrades—but the trend is clear. Global mobility has become global permanence.

Nowhere is this shift more apparent than in the Middle East. In cities like Dubai, Abu Dhabi, and increasingly Riyadh, foreign homeownership is no longer an anomaly—it’s a core part of national growth strategies. Over the past five years, Dubai in particular has emerged as the world’s most sought-after destination for expat buyers, combining zero income tax, sun-drenched luxury, and property prices still favorable compared to global peers. With new visa reforms, including long-term Golden Visas tied to property investment, the emirate has made it easier than ever for foreigners to plant roots.

According to Knight Frank, foreign nationals accounted for more than 60% of prime property transactions in Dubai in 2024. Many buyers come from traditional feeder markets—India, Pakistan, the UK, and Russia—but there is growing interest from emerging wealth corridors: Nigeria, South Africa, China, and the US. What’s attracting them is not just the lifestyle, but the infrastructure. Gated waterfront communities, smart home technology, international schools, and seamless airport access have transformed

Towns like Tulum, Playa del Carmen, and San Miguel de Allende have morphed into global expat enclaves—equal parts yoga retreat, tech hub, and real estate goldmine.

Dubai from a transient expat hub into a permanent base.

But Dubai is far from alone. Across the Mediterranean, the allure of lifestyleled investment is redrawing property maps. Portugal’s Algarve coast, once the preserve of European retirees, now attracts American tech workers and remote professionals lured by mild weather, affordable healthcare, and digital nomad visas. Though Portugal’s Golden Visa program was recently tightened,

property demand remains robust, especially in second-tier cities like Porto and coastal towns like Lagos, where historic charm meets surf culture.

Spain is seeing a similar transformation. From the cultural energy of Barcelona to the low-key elegance of Valencia, international buyers are staking their claim. In 2023, foreign buyers represented nearly 15% of all home purchases in Spain, according to official government data. Many are not just investing—they’re relocating. Flexible work, EU mobility, and lifestyle appeal are proving irresistible. In southern Spain’s Costa del Sol, British, Scandinavian, and increasingly Middle Eastern buyers are reshaping local markets, driving a new wave of upscale villa and apartment developments.

In the Americas, Mexico is one of the most dramatic case studies. Towns like Tulum, Playa del Carmen, and San Miguel de Allende have morphed into global expat enclaves—equal parts yoga retreat, tech hub, and real estate goldmine. The appeal is easy to grasp: low cost of living, cultural depth, access to North America, and a laid-back lifestyle. Developers are responding with eco-conscious condo

projects, wellness-focused communities, and seamless digital transactions aimed at foreign buyers. Yet the surge also raises questions: about pricing locals out, about infrastructure strain, and about what it means for communities to be transformed by seasonal residents.

Asia, too, is in the midst of a residential reset. Thailand’s Phuket and Bangkok remain enduring favorites among expatriates, especially retirees and entrepreneurs. But Vietnam’s Da Nang and Ho Chi Minh City are increasingly on the radar, thanks to robust growth, affordable luxury, and rising digital nomad infrastructure. Though foreign ownership laws remain complex in many Asian countries, workarounds via leasehold structures, local partnerships, or condo purchases under regulated caps are keeping the wheels turning.

Then there’s the wildcard: Eastern Europe. Countries like Georgia, Montenegro, and Albania are becoming unexpected magnets for adventurous expats and remote investors. In Tbilisi and Batumi, property prices remain astonishingly low by Western standards, while residency paths are relatively simple. Montenegro’s nowsunsetted citizenship-by-investment program brought a wave of high-end development to the Adriatic coast, much of it now being snapped up by European, Russian, and Middle Eastern buyers.

Perhaps the most surprising entrant in the new global property game is Saudi Arabia. Long closed to private foreign ownership, the Kingdom is now pivoting sharply under Vision 2030. New economic zones like NEOM and the Red Sea Project are not just luring investors—they’re building entire cities designed to attract global residents. With reforms allowing foreign freehold ownership in select zones and long-term visas linked to property investment, Saudi Arabia is laying the legal and economic groundwork to become a player in the expat real estate market. The pace is early, but the ambition is clear.

Across all of these markets, one theme ties the trend together: countries are no longer just tolerating foreign real estate

buyers—they are courting them. The global competition for mobile talent and capital is reshaping immigration, taxation, and property law. Citizenship-by-investment programs, once controversial, are now mainstream tools for attracting wealth. Digital nomad visas, once a novelty, are now issued by over 40 countries. Real estate is the entry ticket—and often the anchor—for this new mobility.

For the expats themselves, motivations vary. Some are pursuing better education and healthcare systems for their families. Others are diversifying assets across borders in response to political or economic uncertainty at home. Many are simply chasing a better lifestyle—more space, more sun, more time. And unlike investors of the past, who might have bought second homes for vacation or rental yield, today’s buyers are increasingly buying with the intention to live, even if part-time.

But the rise of expat enclaves also raises important questions. How are local communities affected by rising prices and foreign demand? Are governments balancing investor incentives with protections for local residents? Can the influx of foreign capital truly fuel inclusive growth—or does it deepen divides?

Some markets are responding proactively. Portugal’s decision to end its real estate-linked Golden Visa was driven by fears of housing inflation. Thailand is experimenting with new rules to curb speculation. Others, like the UAE, are doubling down—offering new property-linked visas and streamlining residency pathways for international investors.

Ultimately, this global movement is not about foreigners displacing locals—it’s about the redrawing of what home means in a post-national world. In a time when work, capital, and culture move freely, the physical home has become both a place and a strategy: for wealth preservation, legal access, lifestyle curation, and personal freedom.

For developers and investors, the implications are huge. The market for globally mobile homeowners is no longer niche—it is the new mainstream. But catering to it requires more than luxury brochures and ocean views. It means understanding the complexities of cross-border finance, residency law, and lifestyle expectations. It means building

not just homes, but ecosystems: communities with healthcare, education, security, and connectivity.

In the end, the rise of new expat enclaves is not a story about property—it’s a story about people. People seeking not just a place to stay, but a place to live. A place to belong. And whether that place is a villa in Marbella, a high-rise in Dubai, or a loft in Mexico City, one thing is clear: the world’s homebuyers are no longer bound by borders—they’re guided by possibility.

The market for globally mobile homeowners is no longer niche—it is the new mainstream. But catering to it requires more than luxury brochures and ocean views.

Chase the vision, not the money; the money will end up following you.

Tony Hsieh

Dubai property market hits new records

Dubai’s residential property market continues to set records, with Q2 2025 marking a historic high in both transaction volumes and values. According to the latest analysis from global property consultancy Knight Frank, residential prices are now 13.7% higher than a year ago, with villas leading the charge - up 16% year-on-year.

Dubai’s dynamic market continues to grow, with no signs of a slowdown in activity. In Q2, the city recorded over 51,000 home sales - the highest quarterly figure on record. This brings total H1 2025 sales to more than 94,000, putting the market firmly on track to exceed the 169,000 transactions recorded in 2024.

The total value of residential sales in H1 reached AED 268 billion, a 41% increase compared to the same period last year. With this momentum, 2025 is poised to surpass the AED 367 billion achieved in 2024.

Citywide residential prices rose by 3.4% in Q2 2025, reaching an average of AED 1,809 per square foot. This places current values 21.6% above the previous market peak recorded in 2014.

Faisal Durrani, Partner – Head of Research, MENA, said: “The sustained growth in prices - now approaching five consecutive years since the current cycle began in November 2020 - is a clear sign of a more stable and predictable market environment. This is precisely the kind of consistency that global investors seek.Knight Frank’s forecasts for 2025 remain unchanged, with 8% growth expected in the mainstream market and 5% in the prime segment.

A segment to watch remains the villa market. Just 20% of the planned housing supply through to the end of 2029 will fall in the villa category and with demand remaining

centred on stand-alone family homes, the delta between villa and apartment price performance may well continue to widen.”

Villas continued to outperform the broader market, with values climbing to AED 2,172 per square foot - a 4% increase over the quarter and a 49.3% rise since 2014. The prime segment also scaled new heights, with prime residential values across ten key communities rising by 16% over the past 12 months. The average prime transacted price now stands at AED 3,850 per square foot.

Off-plan sales account for nearly 70% of all transactions in Q2, reflecting growing investor confidence and the appeal of new developments across the city. Prime residential areas such as Palm Jumeirah, Emirates Hills, Jumeirah Bay Island, and Dubai Hills Estate remain the most sought-after locations, particularly among international high-net-worth individuals.

Sales of homes priced above US$ 10 million reached AED 9.5 billion in Q2 2025, the highest quarterly figure on record. Notably, for the first time since Q2 2023, apartments outpaced villas in the US$ 10 million+ segment, with 80 apartment sales compared to 63 villas.

Will McKintosh, Regional Partner – Head of Residential, MENA, said: “The market is increasingly being shaped by genuine buyers rather than speculators, with resale activity within 12 months of purchase now at just 4–5%, compared to 25% in 2008. This shift toward end-user activity is a positive indicator of the market’s growing maturity and long-term sustainability.

As we approach the fifth year of Dubai’s current growth cycle in November 2025, we are seeing the property market mature and align with global norms in a meaningful way. It has become more stable, more transparent and is underpinned by solid fundamentals. This shift is drawing in more long-term investors and end-users and is helping to strengthen Dubai’s position as one of the most attractive residential markets globally.”

Knight Frank’s annual Destination Dubai 2025 report also highlights the emergence of ‘accidental millionaires’ - homeowners whose properties have appreciated beyond US$ 1 million due to market inflation. As of Q2 2025, there are 110,000 such homes in Dubai, with 37,000 owned by individuals who originally purchased below the milliondollar threshold.

Binghatti opens its London boutique marking larger international presence

Binghatti, one of the UAE’s fastest-growing leading property developers, has officially launched its first International Sales Boutique in the United Kingdom. The landmark opening took place on July 16th, 2025, in the prestigious district of Knightsbridge on Brompton Road, part of the South Kensington Estate. The ceremony featured a symbolic ribbon-cutting led by Binghatti’s Founder Dr. Hussain Binghatti Aljbori, and Chairman Muhammad Binghatti celebrating a pivotal step in the brand’s global expansion journey

With a development portfolio exceeding AED 50 billion, over 80 projects, and more than 11,000 residential units delivered across Dubai, Binghatti’s entry into the UK market represents a strategic move to facilitate international investment into the UAE’s thriving real estate sector. The London Boutique, will serve as a centralized hub for global investors, offering direct access to Binghatti’s premium Dubai developments and personalized investment advisory services.

Binghatti’s name is synonymous with architectural distinction and global partnerships.

The developer has launched several acclaimed branded residences in collaboration with iconic names such as Bugatti, Mercedes-Benz, and Jacob&Co.. Amongst Binghatti’s record-breaking branded residences are the Bugatti Residences by Binghatti, Mercedes-Benz Places by Binghatti, and the Burj Binghatti Jacob&Co. Residences, set to become the world’s tallest branded residential tower.

These developments have garnered worldwide recognition and attracted high-profile clientele, including global footballer Neymar Jr., opera legend Andrea Bocelli, footballer Aymeric Laporte, and most recently, Hollywood actor Terry Crews, who acquired a residence at Binghatti Aquarise in early 2025.

The Binghatti London Boutique will not only highlight Binghatti’s latest real estate offerings but will also serve as a dedicated investment platform for international buyers. A team of real estate experts and sales professionals will be on-site to provide endto-end client services, including property showcases, investment consultations, and sales transactions.

Chairman Muhammad Binghatti commented “Our presence in London marks a strategic evolution in our vision to make world-class real estate accessible to international investors. At Binghatti, we are committed to delivering architectural excellence and investment value to a global clientele, allowing them to connect directly with Dubai’s most prestigious opportunities right from their own cities.”

The Binghatti London Boutique Grand Opening served as a high-level networking event for investors, real estate professionals, and institutional partners. This milestone affirms Binghatti’s continued commitment to global market integration, design-led development, and the future of international real estate investment.

Dubai set to host world’s tallest hotel as luxury market booms

Dubai is poised to cement its status as global architecture and luxury capital with the forthcoming Ciel Hotel, slated to become the world’s tallest hotel upon completion.

Developed by The First Group and situated in Dubai Marina, the shimmering tower will rise 1,197 feet across 82 floors, overtaking the current record held by the Gevora Hotel at 1,169 feet. With 1,004 rooms including 147 suites, the Ciel will offer panoramic Persian Gulf vistas, a sky high infinity pool on level 76, a sky restaurant at 1,158 feet, and an atrium sky garden spanning 12 levels.

Construction is well underway: the lobby is 65% complete and guest room fit out is at 45%. The project will host ten bars and restaurants, including the flagship Tattu Dubai on the 74th floor, alongside

observation decks and lounges on upper levels.

The development underscores Dubai’s unrelenting push into ultra-luxury hospitality and branded real estate. Nearby, a new Trump International Hotel & Tower is set for completion around 2031, offering luxury residences, crypto-payment options, and the world’s highest outdoor swimming pool for a premium $2 billion price point. The Trump brand commands an average 42% price premium over comparable non branded units.

Luxury villa construction has also surged: nearly 9,000 villas are set to be completed by end 2024, with an additional 19,700 in 2025 to alleviate shortages at the ultra prime end of the market. Demand for upscale homes remains high, and prime neighbourhood prices continue to rise despite global headwinds.

Dubai accelerates emirati housing dispute resolution with new law

Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister of the UAE and Ruler of Dubai, has enacted a landmark law to expedite resolution of disputes arising from citizen housing construction contracts. The legislation— scheduled to take effect on 1 January 2026—represents a key initiative to bolster family stability, legal certainty, and housing-sector efficiency, particularly within Dubai’s growing Emirati home ownership landscape.

The law establishes a specialised branch within the Centre for Amicable Settlement of Disputes, dedicated exclusively to disputes involving citizen housing building contracts. Its purpose: to resolve conflicts without halting project delivery. Under the framework:

> Mediation: A preliminary mediation process must be completed within 20 days, extendable by mutual agreement for another 20 days.

> Adjudication: If mediation fails, a panel consisting of one judge and two industry experts is required to issue a decision within 30 days, also extendable once by the committee head.

> Appeals: Parties may challenge committee rulings at the Court of First Instance within 30 days of issuance.

This legislation is part of a series of recent reforms including an earlier 30,000-unit housing initiative for young Emirati families and the March 2025 Home First municipality program to streamline housing access.

By prioritising alternative dispute resolution and structured timelines, the law aims to prevent construction delays, promote amicable settlements, and advance the timely delivery of homes—a cornerstone of Dubai’s housing strategy for citizens.

Image courtesy of Krista

JVC leads Dubai’s rental market

Jumeirah Village Circle (JVC) has emerged as Dubai’s most sought-after area for rental apartments, according to data from PropertyFinder, with the community garnering 214,607 page views on the property portal’s platform.

The figures, published by PropertyFinder, highlight Dubai’s continued dominance in the UAE’s rental landscape as the emirate with the highest search volume for rental properties.

JVC’s popularity appears linked to its combination of affordability and amenities. According to PropertyFinder’s data, the community offers rental apartments at an average of AED 78,000 per year. This positions it among the more affordable options in the city, especially for families.

The area is described in the PropertyFinder report as “a

thriving residential area known for its affordable housing options” that is “well-connected to major highways, including Al Khail Road and Sheikh Mohammed Bin Zayed Road, making it one of the most accessible areas in the city.”