Holiday Entertaining Guide: Spring & Summer Edition BIG ON BACON Promote this favorite food across dayparts OPTIMAL FOOD SAFETY Win with tech-enabled, standards-based solutions MAKE SUSTAINABILITY PAY Find out the best ways to boost ROI through ESG March 2024 Volume 103, Number 3 www.progressivegrocer.com Shop Shifters How inflation is transforming shopper behavior 75 TH CONSUMER EXPENDITURES STUDY

PG’s 75 th Consumer Expenditures

goes directly to shoppers to explore not only what they’re buying in supermarkets, but also why they’re making certain decisions.

19

Sea of Convenience

Frozen and shelf-stable options should be promoted as great choices for inflation-weary and cooking-averse consumers.

22

Party Central

Grocers and brands offer a host of solutions for celebrations that draw shoppers

28

Bacon for All Occasions

Food retailers and brands find even more uses for this perennially favorite food.

34

How grocers can take advantage of the fast-growing retail foodservice segment.

38 GUEST VIEWPOINTS

Verifying Receipt for Food Traceability

Tech-enabled, standards-based solutions improve accuracy, enhance efficiency and ensure compliance.

42 FEATURE

Going Behind the ROI of Sustainability

Grocers know sustainability initiatives are crucial to their businesses, but how can they prove the return on investment of such programs?

53 EQUIPMENT & DESIGN

Focus on Fixtures

Find out how flexibility and mobility can change the game.

Features Contents 03.24 Volume 103 Issue 3 10 NIELSEN’S SHELF STOPPERS Salty Snacks 11 MINTEL GLOBAL NEW PRODUCTS Dairy and Nondairy Milk Departments 12 ALL’S WELLNESS Getting the Most Out of Health-and-Wellness Tech 58 AHEAD OF WHAT’S NEXT By Design

EDITOR’S NOTE Stopping Mergers Won’t Save Grocery Stores 8 IN-STORE EVENTS CALENDAR May 2024

STORY

Shifters

6

COVER

Shop

Study

14 PROGRESSIVE GROCER March 2024 3 12

SOLUTIONS

SOLUTIONS

SOLUTIONS

FRESH FOOD

Easy Eats

S1-S16 STORE BRANDS Special Section in the Digital Edition and in Limited Print Quantities Plus!

A Case of Mistaken Identity

8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631

Phone: 773-992-4450 Fax: 773-992-4455 www.ensembleiq.com

BRAND MANAGEMENT

VICE PRESIDENT & GROUP BRAND DIRECTOR

Paula Lashinsky 917-446-4117 plashinsky@ensembleiq.com

EDITORIAL EDITOR-IN-CHIEF Gina Acosta gacosta@ensembleiq.com

MANAGING EDITOR Bridget Goldschmidt bgoldschmidt@ensembleiq.com

SENIOR DIGITAL & TECHNOLOGY EDITOR Marian Zboraj mzboraj@ensembleiq.com

SENIOR EDITOR Lynn Petrak lpetrak@ensembleiq.com

MULTIMEDIA EDITOR Emily Crowe ecrowe@ensembleiq.com

CONTRIBUTING EDITORS

Jenny McTaggart, Barbara Sax, Greg Sleter and Frank Yiannas

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER (INTERNATIONAL, SOUTHWEST, MI) Tammy Rokowski 248-514-9500 trokowski@ensembleiq.com

REGIONAL SALES MANGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

Some people still think Southern CaseArts only produces the world’s best custom display cases. In reality, we offer a remarkable range of in-stock designs for every section of your store. Hot, Cold, Frozen, Ambient…whatever your need we have options that maximize packout and encourage sales. Bakery, Meat, Hot Foods & Soup, Beverages and more, discover today’s Southern CaseArts, where quality and reliability for the long-term is absolutely unmistakable.

PROJECT MANAGEMENT/PRODUCTION/ART

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com

MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com SUBSCRIPTION QUESTIONS contact@progressivegrocer.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly, except for July/August and November/December, which are double issues, by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Single copy price $17, except selected special issues. Foreign single copy price $20.40, except selected special issues. Subscription: $150 a year; $276 for a two year supscription; Canada/Mexico $204 for a one year supscription; $390 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $204 a one year supscrption; $390 for a two year supscription (call for air mail rates). Digital Subscription: $87 one year supscription; $161 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing offices.

Printed in USA. POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Copyright ©2024 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

southerncasearts.com | 800.552.6283

FROZEN

AMBIENT

HOT COLD

Premium. Outstanding. Authentic.

S tock GOYA® Extra Virgin Olive Oil , winner of the ChefsBest Excellence Award * . Your shoppers will taste the exceptional quality that sets our single-origin Spanish olive oil apart from the competition.

authenticity.

Award-winning

©2023 Goya Foods, Inc. Learn More! Contact your GOYA representative or email salesinfo@goya.com | trade.goya.com * Earned by products that surpass quality standards established by professional chefs.

By Gina Acosta

Stopping Mergers Won’t Save Grocery Stores

IT WILL, HOWEVER, HURT THE TRADITIONAL SUPERMARKET RETAILERS THAT WE ALL WANT TO SEE THRIVE.

rocery stores are the lifeblood of the community.

They are an essential service, like firefighters and hospitals.

So why is everyone suddenly attacking grocers as greedy profiteers looking to stomp on workers and consumers?

Well, it’s an election year. The Biden administration has made a national pastime of calling out retailers and consumer goods companies for postCOVID prices being higher and packages being smaller. Plus, the days of consumer love for grocery retailers being “heroes” (as during the pandemic) are far behind us. That’s my reaction to the news that the Federal Trade Commission has sued to block Kroger’s merger with Albertsons.

Anyone with a bit of business sense knows that this merger will allow the two companies to achieve greater scale to better compete with the discounters eating away at their shrinking share of grocery sales. The merger will also allow the new, larger company to consolidate operations, cut expenses, reduce costs and negotiate lower prices with suppliers — all of which will benefit consumers and workers.

Blocking this merger will not stop high prices, consolidation or job losses in the traditional grocery industry. But blocking this merger will hurt the traditional supermarket retailers that we all want to see thrive, including Kroger and Albertsons, to the detriment of workers and consumers.

As former U.S. Rep. Kurt Schrader, D-Ore., wrote in the Portland Tribune: “Competition is good for business and consumers, but there must be a level playing field. America’s supermarket grocers need to have the option to get bigger in order to better compete, drive down prices, and protect good-paying, American union jobs.”

Putting aside the political theater, the FTC, Kroger and Albertsons all have highly experienced legal teams fighting this out in court, and the transaction deserves intense scrutiny into whether monopolistic and restrictive trade practices might ensue with a merged company.

According to Reuters, the FTC’s lawsuit was assigned to U.S. District Judge Adrienne Nelson, a former Oregon Supreme Court justice who was confirmed to the federal bench in February 2023. Nelson was a public defender in the late 1990s and then worked in private practice from 1999 to 2004 at the worker-focused labor and employment firm Bennett Hartman, where her clients included labor unions. A Reuters search of U.S. court cases in Oregon didn’t yield records of any other antitrust cases before Nelson, who likely won’t be scheduling a hearing on the matter for months. A protracted litigation timeline seems certain.

In the end, I believe the two sides will eventually hash out terms seen as more beneficial for workers and consumers (divesting more stores, selling more assets, etc.), and the $24.6 billion deal will go through.

PG’s Editorial Advisory Board

Progressive Grocer has been fortunate for more than 100 years to cover this industry, and we want to see every grocery retailer thrive. With the Kroger-Albertsons deal — the biggest merger ever in the U.S. grocery sector — in the crosshairs, and so much other important news happening in this industry, PG is pleased to announce the creation of a new Editorial Advisory Board in 2024. The Editorial Advisory Board will bring highly respected and accomplished professionals in the grocery industry to advise and review the direction of PG content, with the aim of widening our reach and enhancing the quality of our offering to you, our cherished reader.

Progressive Grocer’s Editorial Advisory Board members are:

Lynette Ackley, Group VP Merchandising, HBC, Consumables and Hardlines, Meijer

Charles D’Amour, Executive Chairman, Big Y Foods

Ryan Draude, Head of Loyalty, Giant Food

Zachary Lane, Director of Retail Systems, Fareway Stores

Kevin Miller, Chief Marketing Of cer, The Fresh Market

Diana Marshall, Chief Growth Of cer, Sam’s Club

Ryan Roberts, EVP of Perishables, Hy-Vee

Rachel Shemirani, VP, Barons Markets

But we don’t just want to hear from our new board. We want to hear from you. Let us know what you think about the Kroger-Albertsons deal and other pressing issues of the day in grocery, as well as how we can do better in shining a light on them.

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

6 progressivegrocer.com EDITOR’S NOTE

Calendar 05.24

National Asparagus Month

National Dental Care Month

National Egg Month

National Hamburger Month

1 National Chocolate Parfait Day. Customers can dig into an easy-tomake version of this indulgent dessert.

5 Orthodox Easter. Have the traditional foodstuffs on hand for those who observe this joyous holiday according to the Julian calendar.

6

National Beverage Day. Increase your grab-and-go chilled displays to quench every thirst.

12

Mother’s Day. Encourage shoppers to show their love for Mom with flowers, candy, greeting cards and more.

19

Stepmother’s Day

For all of those people who get along great with their “bonus moms,” provide gifts they can bring with them on a visit.

13

Cough Drop Day. It’s smart to have these on hand in advance of cold and flu season.

20

World Bee Day. Spotlight the ways that you’re helping pollinator populations recover.

7

National Roast Leg of Lamb Day. Provide step-bystep instructions for nervous home cooks to get this classic dish right.

8 National Give Someone a Cupcake Day. Your in-store bakery is just the place to find a mouth-watering selection for gifting.

2

World Tuna Day. Make shoppers aware of your sustainable seafood sourcing practices.

3

National Military Appreciation Month

National Salad Month

National Salsa Month

National Strawberry Month

National Montana Day. Turn the spotlight on food and beverage suppliers from Big Sky Country.

9

10

4

Dave Brubeck Day. Encourage shoppers and associates alike to “Take Five” for the duration of this infectious jazz classic.

11

26

National Redhead Day. This is the time to celebrate gingers by birth or choice

14

15

National Dance Like a Chicken Day. We know our friends at Lowes Foods know how to do it!

21

World Meditation Day. Invite an instructor to teach your workforce how to lower stress and achieve calm through this time-honored practice.

National Safety Dose Day. Request that your pharmacy team explain to consumers the importance of adhering to correct medication amounts.

National Sleepover Day. Those spending the night with their besties can find their snacks, drinks and hair products in your aisles.

16

Supply Chain Professionals Day. They deserve our heartfelt appreciation for getting products to stores.

National Shrimp Day. Lure customers to the seafood counter with great deals on this beloved crustacean.

17

National Walnut Day. Bake with it, snack on it, sprinkle it on salads – it’s a nut for many occasions.

Stamp Out Hunger Food Drive Day. Enlist associates and the public to help their food-insecure neighbors with donations to area organizations.

18

National Cheese Soufflé Day. Present a product demo to show shoppers they shouldn’t be afraid to make one themselves.

22

23

24

27

Memorial Day

National Grape Popsicle Day. As the weather starts to heat up, these really hit the spot.

National Vanilla Pudding Day Those who don’t want to make one from scratch can use a time-saving mix.

28

World Passion Fruit Martini Day. Raise a glass to exotically flavored cocktails.

29

National Paperclip Day. It’s always a good idea to stock up on these – you never know when you’ll need one.

Lucky Penny Day. We know some people want to get rid of this denomination, but we always pick one up when we find one.

30

Fakesgiving. Consider it just another occasion to get together with friends and family.

National Cooler Day. Remind shoppers to fill theirs with soft drinks, beer and other items best consumed cold.

31

Web Designer Day. Thank yours for your awesome internet site.

25

National Italian Beef Day. When in Chicago, seek out this iconic delicacy.

S M T W T F S IN-STORE EVENTS

8 progressivegrocer.com

for all salty snack products, up 7.0% compared with a year ago

for variety packs, up 4.5% compared with a year ago

for meat snacks, up 8.2% compared with a year ago

for pita chips, up 8.6% compared with a year ago

Source:

10 progressivegrocer.com FRONT END Shelf Stoppers Salty Snacks Latest 52 WksW/E 01/29/24 Latest 52 WksW/E 01/29/24 Latest 52 Wks YAW/E 01/28//23 Latest 52 Wks YAW/E 01/28//23 Latest 52 Wks 2YAW/E 01/27/22 Latest 52 Wks 2YAW/E 01/27/22 Average Unit Prices

is the average unit price for salty snack products versus the year-ago period? Source: NIQ, Total U.S. (All outlets combined) – includes grocery stores, drug stores, mass merchandisers, select dollar stores, select warehouse clubs and military commissaries (DeCA)

What

NIQ, Total U.S. (All outlets combined) — includes grocery stores, drug stores, mass merchandisers, select dollar stores, select warehouse clubs and military commissaries (DeCA) Potato Chips Tortilla Chips Popcorn Variety Packs Cheese Snacks Total Department Performance Top Salty Snack Categories by Dollar Sales $35,761,927,683 $33,823,246,426 $29,662,711,646 Salty Snacks Generational Snapshot Which cohort is spending, on average, the most per trip on tortilla chips? Millennials $5.62 Gen Xers $5.49 Boomers $5.10 The Greatest Generation $4.86 Source: NielsenIQ Panel On Demand Homescan, Total U.S., 52 weeks ending Nov. 25, 2023 $3.94

$13.16

$5.28

$4.88

Index by Age and Presence of Children $9,000,000,000 8,000,000,000 7,000,000,000 6,000,000,000 5,000,000,000 4,000,000,000 3,000,000,000 2,000,000,000 1,000,000,000 0 Salty Potato Cheese Tortilla Snacks Chips Popcorn Snacks Chips Children Under 6 Only 96 84 85 106 101 Children 6-17 Only 137 126 125 129 162 Children Under 6 and 6-17 133 116 123 156 151 No Children 88 94 93 87 80

Dairy and Nondairy Milk

What You Need to Know

Consumers find value in dairy and nondairy milks, which drives consumption of both. Both categories are on the rise, finding their way into applications beyond traditional uses. Personalization is key as dairy and nondairy milks gain popularity for their versatility and ability to cater to varying dietary preferences.

Improved product attributes (other than low price) aren’t enough to increase usage for most. Opportunity lies in highlighting novel use cases to attract new consumers and expand reach. Developing formats for portability and highlighting milk use cases in skin care can add value to time- and money-strapped consumers.

Consumers see milk as a staple, but are increasingly price sensitive and willing to trade down to cheaper brands. Rising prices from inflation, exacerbated by supply-side issues related to climate change and increased production costs, may not force consumers out of the category, but they affect their milk shopping habits.

Consumer Trends: Key Takeaways

As inflation puts constraints on grocery spending, there’s a heightened emphasis on value. Within this category, the simplicity of dairy milk aids in regaining share lost to nondairy products. With its familiar taste and trusted health image, consumers, especially younger audiences, are increasingly turning back to dairy.

When consumers choose dairy or nondairy milks, the decision is an extension of their values. Brands on either side have the opportunity to partner with consumers on matters they care about. Whether it’s health or sustainability, consumers want clear communication about how milk can fill their needs and help them meet their goals.

Consumers opt for dairy and nondairy milks for diverse reasons, valuing both for their unique attributes. These sought-after options cater to consumer demands for health, sustainability, taste and allergenfree benefits, driving increased purchases of both varieties rather than that they choose one over the other.

Opportunities

Consumers are familiar with the versatility of milk, yet there’s still potential to expand on its possibilities. From incorporating milk into a face mask to using oatmilk in savory recipes, showcasing new applications can alleviate concerns about shelf life and higher prices while encouraging exploration of new milk-based experiences.

As consumers turn to dairy and nondairy milks for diverse reasons, it’s essential to shift marketing toward highlighting their unique qualities instead of promoting one as superior. By emphasizing their distinctive factors, both segments can thrive as separate high-value categories and cater to varying consumer preferences.

Position dairy and nondairy milks as specialty beverages that can meet a variety of needs to open up new markets. Target parents with milks containing nutrients for development, reach athletes with performance-based formulations and portable packaging, and support athome baristas with nondairy milks capable of frothing.

PROGRESSIVE GROCER March 2024 11 MINTEL CATEGORY INSIGHTS Global New Products Database

FOR MORE INFORMATION, VISIT WWW.MINTEL.COM OR CALL 800-932-0400

ALL’S WELLNESS

By Diane Quagliani, MBA, RDN, LDN

Getting the Most Out of Health-andWellness Tech

WITH HELP FROM RETAIL DIETITIANS, GROCERS CAN NOW SERVE UP PERSONALIZED INFORMATION.

hree important factors make the environment right for using health-andwellness technology to reach shoppers with personalized information. First, more than eight in 10, or 82% of, American consumers consider wellness a top or important priority in their everyday lives, according to the 2023 McKinsey

Future of Wellness Survey. Second, apps and wearable health-tracking devices are popular with American adults, with about 40% using apps and 35% using wearable devices, a 2023 Morning Consult survey found. Finally, nearly one in five American consumers and one in three American Millennials prefer personalized products and services, according to McKinsey.

Retailers on Board

Retail dietitians lend accuracy and credibility to the personalized nutrition data that shoppers receive via apps and websites.

An increasing number of retailers are delivering personalized health-and-wellness information to shoppers through their apps and websites.

One example is Albertsons Cos.’ Sincerely Health digital health-and-wellness platform, which encompasses several aspects of well-being. To start, shoppers complete a questionnaire that measures their personalized Health Score based on seven dimensions of well-being: nutrition, activity, sleep, physical health, mental well-being, mindfulness and healthy habits. Shoppers can link their activity trackers to the platform, and set and track health goals related to nutrition, activity, sleep and lifestyle. A nutrition insights tool calculates how many of a shopper’s food purchases meet USDA MyPlate dietary guidance, and provides personalized food recommendations, recipes and articles.

For signing up to Sincerely Health, shoppers receive an incentive of up to $25 off future grocery purchases. As shoppers reach their health goals, they receive Healthy Points to redeem for coupons on nutritious foods and beverages such as fresh and frozen fruits and vegetables, nuts, and bottled water. Shoppers may also link their pharmacy account to the platform.

Retail Dietitians a Ready Resource

Grocers can call on their retail dietitians whenever health-and-wellness tech channels include food and nutrition components. Retail dietitians are key for providing personalized information, both directly to shoppers through online consultations and classes, and indirectly as content advisors and developers.

For instance, H-E-B dietitians provide telehealth visits that offer shoppers interactive features like sharing their pantry or taking a virtual shopping tour. Meijer’s new virtual personalized nutrition coaching service gives shoppers

progressivegrocer.com

the convenience of receiving several nutrition services online from a Meijer registered dietitian. Depending on an individual’s needs, dietitians may provide assessment, monitoring and evaluation based on diet, lifestyle, medical history and nutritional needs, nutrition education and personalized meal plans, nutritional coaching for health conditions such as diabetes and cardiovascular issues, food allergy management, weight management, and behavior change support.

Behind the scenes, retail dietitians lend accuracy and credibility to the personalized nutrition data that shoppers receive via apps and websites. Among other things, dietitians work on the nutrition aspects of health scoring systems; create nutrition content for health platforms, including articles, meal plans, tips, shopping lists and recipes; provide specialized information for shoppers with health concerns (diabetes, heart health, weight management, etc.); and develop product nutrition criteria for foods and online product filters (gluten-free, high-protein, vegetarian, etc.).

Diane Quagliani, MBA, RDN, LDN, specializes in nutrition communications for consumer and health professional audiences. She has assisted national retailers and CPGs with nutrition strategy, web content development, trade show exhibiting, and the creation and implementation of shelf tag programs.

12

A SIP OF THE BTBSaratogasales@bluetriton.com Contact your BlueTriton account representative for more information or contact us directly. ©

75th Consumer Expenditures Study

PG’s 75th Consumer Expenditures Study goes directly to shoppers to explore not only what they’re buying in supermarkets, but also why they’re making certain decisions.

By Jenny McTaggart

raditionally, Progressive Grocer’s annual Consumer Expenditures Study (CES) has reported on the top-selling categories in supermarkets around the country, essentially looking at what consumers are buying in terms of dollars spent and units sold.

For the 75th CES, however, we’re doing things a bit differently. This time, we went directly to grocery shoppers — 1,001 of them, to be exact — to find out not only what they’re buying, but also where they’re buying groceries, why they choose the stores they do, what they like and don’t like about the shopping experience, and other factors that go into their decision-making. In this way, our updated study takes the pulse on consumers’ attitudes on their path to purchase. The 75th CES, as presented in the following pages, will be a benchmark study for the magazine going forward, with the aim of establishing a measurable baseline for understanding grocery shoppers’ preferences and behaviors in the years ahead.

In addition, the study takes a deep dive into generational insights, as well as differences between male and female

shoppers and among major geographical regions. For any grocery retailer operating today, it’s crucial to recognize these differences and to make sure that you’re offering different things for different shoppers. You can’t be one store to all people, so it’s important to reach shoppers differently at the various stages of their lives, ideally while presenting one unified brand message.

Methodology

The survey for Progressive Grocer’s 75 th Consumer Expenditures Study was fielded Jan. 10-15, 2024, and includes responses from 1,001 grocery store shoppers ages 18 and up. To qualify, respondents had to identify as U.S. residents who shop at grocery stores at least once a month and serve as the primary or shared decision-maker for grocery shopping in their households. The average household income of respondents was $68,230.

14 progressivegrocer.com COVER STORY

Major Themes of the 75th CES

Before we get into the details of the study, here are a few major recurring themes and key insights:

Inflation continues to have a big impact on shoppers’ behavior and has led them to buy less in the past year. Price is now their No. 1 factor in choosing where to shop, though product quality, finding items in stock and other attributes are still important.

The traditional grocery store is still the primary place where people regularly purchase groceries, but alternative formats — including online shopping — continue to gain steam. A little more than half admit that they shop at three stores regularly.

Prepared foods is a growth opportunity for retailers, and younger consumers in particular are interested in convenient meals and trying new things (but price still comes into play).

Most shoppers now self-identify as “health-conscious,” and some are willing to switch stores over sustainability issues.

The categories most frequently purchased at a grocery store within the past month include dairy, fresh produce, bread/bakery items, salty snacks and fresh meat/seafood. When it comes to private label, key categories are dairy, paper products, canned vegetables and fruits, bread/bakery items, and household products.

These are just a few of the study highlights — keep reading to learn more.

Store Preferences:

Traditional Chains Still Rule

With all of the talk regarding online retailing and alternative formats, it’s important to note that the traditional grocery chain still rules, at least among respondents to this survey, which was fielded in January. A huge number — 89% — visit a traditional grocery chain at least once a week (and the figure jumped to 92% among consumers living in the western United States). Mass merchandisers and supercenters are close behind, with 81% visiting at least once a week.

Still, nontraditional formats are definitely gaining ground nationwide. About half of those surveyed said that they purchase grocery items at dollar stores, drug stores or

Top Categories Purchased

What consumers tell us they’re purchasing matches up pretty closely with the latest sales data from NielsenIQ and other sources. In PG’s 75th CES, the categories most frequently purchased at a grocery store within the past month include dairy (milk, eggs and cheese), at 86%; fresh produce (85%); bread/bakery items (82%); salty snacks (78%); and fresh meat/seafood (75%). Looking at generational differences, Gen Zers and Millennials are more likely to have purchased prepared foods, energy drinks, functional beverages and baby food. Meanwhile, females overindexed on purchases of fresh produce, shelf-stable grains, cooking fats, baking supplies, confectionery and pet food, suggesting that many of them are likely still the bakers (and primary shoppers) in their households.

Edible Categories Purchased at a Grocery Store in the Past Month

pet food.

PROGRESSIVE GROCER March 2024 15 86% 85% 82% 78% 75% 68% 66% 62% 61% 60% 58% 58% 56% 55% 54% 50% 46% 46% 45% 40% 39% 32% 28% 23% 22% 17% 16% 9% 7% 3%

Gen Zers and Millennials are more likely than Gen Xers and Boomers to have purchased prepared foods, energy drinks, functional beverages and baby food. Females are more likely than males to have purchased fresh produce, shelf-stable grains, cooking fats, baking supplies, confectionery and

0% 20% 40% 60% 80% 100%

75th Consumer Expenditures Study

Nonedible Categories Purchased at a Grocery Store in the Past Month

with 2.5 average prepared food purchase occasions in the past month.

Types of Prepared Foods Purchased at a Grocery Store in the Past Month

Gen Zers and Millennials are significantly more likely than Boomers to purchase prepared cold entrées, prepared hot sides, prepared appetizers/snacks, prepared soups and prepared platters.

Today’s average spend for a grocery trip

discount grocery chains on a weekly basis, while 48% are shopping at club stores. Additionally, just under half of shoppers (47%) go online at least once a week for their grocery shop. Meanwhile, independent grocery stores are bringing in fewer shoppers than other formats (43%), although shoppers living in the eastern United States shop these stores a bit more (47% visit weekly).

Lower Prices Are Top of Mind as Inflation Lingers

With inflation on most Americans’ minds, it isn’t surprising that price comes in as the No. 1 factor for choosing where to shop, with four in five shoppers (83%) and an impressive 90% of Baby Boomers selecting this attribute. They still care about quality, too, though: Following price, other key factors include product quality (71%), freshness of products (69%), products in stock (69%), convenient location (64%), variety of products (64%), and sales and promotions (59%).

As for how shoppers today define value, while there are differing opinions, a solid onethird said that value is “a good-quality product for a good/fair price,” while 22% thought solely of “best/lowest price.” Meanwhile, 38% preferred a good price over product quality (for Gen Z shoppers, that number jumps to 55%).

Selecting Factor When Picking a Grocery

16 progressivegrocer.com

purchased prepared foods at grocery in the past month, 70% of shoppers agree with the statement: “I am health conscious.”

67%

66% 62% 58% 50% 37% 25% 24% 23% 11% 10% 10% 9% 5% 11% Gen Zers and Millennials are more likely than Gen Xers and Boomers to have purchased personal/household sanitizing products, pet supplies, toys/games, office supplies, books/ magazines and diapers/baby supplies.

more likely

males to have purchased personal/ household sanitizing products, beauty products, pet supplies and books/magazines. COVER STORY

Females are

than

Store Price 83% Product Quality 71% Freshness of Products 69% Products in Stock 69% Convenient Location 64% Variety of Products 64% Sales and Promotions 59% Store Cleanliness 58% Store-Brand Quality 53% Brands Offered 42% Helpful/Friendly Employees 40% Rewards/Loyalty Program 40% Organization of Store 32% Speed of Shopping Trip 29% Local Product Selection 26% Healthy/Better-for-You Products 25%

Prepared Hot Entrées (rotisserie/fried chicken, salmon, lasagna) 53% Baked Goods Baked In-Store (bread, rolls, pie, brownies) 33% Prepared Cold Sides (pasta salad, potato salad, bean salad) 26% Prepared Hot Sides (mac and cheese, mashed potatoes, French fries) 25% Prepared Appetizers/Snacks (wings, potstickers, egg rolls) 24% Prepared Cold Entrées (chicken, poke bowls, sushi) 21% Prepared Entrée Salads 16% Prepared Platters (cheese, fruit, vegetables) 13% Prepared Soups 12%

PROGRESSIVE GROCER March 2024 17 Grocery Shopping Frequency by Store Type Grocery Shopping Frequency by Store Type: Other Formats TRADITIONAL CHAIN GROCERY STORE DISCOUNT CHAIN GROCERY STORE MASS / SUPERCENTER INDEPENDENT GROCERY STORE 6% Never Shop 27% Never Shop 5% Never Shop 33% Never Shop 55% 53% 48% 47% 47% 43% 31% 31% 29% 34% 34% 20% 20% 31% Shop Once/Week+ Never Shop Shop Once/Week+ Never Shop drop in LIKE IT’S try all of our HOT NEW PRODUCTS & FLAVORS GLUTEN FREE NON-GMO *PRODUCT EXCLUSIONS APPLY BOOTH N904 EXPO WEST Anaheim, CA • March 13 -15 Contact Your Representative Today! 1 (855) 923-4299

75th Consumer Expenditures Study

Shopping Behaviors: Most Plan Ahead but Appreciate Meal Inspo

Today’s shoppers want it all: They prefer to plan ahead and stock up on their grocery runs, but they also want to get in and out of the store quickly. One-fifth admitted to being more of an “impulsive buyer,” with Gen Zers and Millennials significantly more likely to fall into this camp. Meanwhile, just over a third (35%) agreed that they like to take more time to browse the store. Looking ahead to 2025, shoppers didn’t anticipate significant changes in these behaviors.

An impressive 63% said that they make a shopping list, but at the same time they’re open to making additional purchases once they enter the store. (Only 20% don’t make a list.)

In-Store Versus Online

Nearly all respondents (95%) said that they had shopped in-store for groceries in the past month, but online shopping is proving to be a regular routine these days, with one-fifth purchasing online for in-person delivery or curbside pickup. Across all trips, on average, 79% are completed in the store. When asked if they have a preference for shopping in-store or online, 72% still gravitated toward the store, but a small percentage (14%) were leaning toward online purchases a year from now.

Over the next year, most expected their purchase methods to remain consistent, although one-fifth thought that they’ll do more in-store shopping and 11% expected their online usage to ramp up. Baby Boomers are the least likely to make the switch to online shopping, while Gen Zers and Millennials said that they’ll shop “more” in both the physical store and online, using both contactless delivery and in-store pickup.

Prepared Foods Presents Growth Opportunity

Prepared foods continued to account for a healthy part of the grocery business. The category was purchased by two-thirds of shoppers in the past month, with an average of 2.5 purchase occasions. Gen Zers and Millennials bought these foods significantly more than Gen Xers and Boomers, and shoppers in the

State of Food Inflation: Today Versus One Year from Now

In-store Versus Online: Anticipated Use One Year from Now

Gen Zers and Millennials are more likely than Gen Xers and Boomers to say that they will shop “more” one year from now these ways: in-store, online for contactless delivery, online for in-store pickup.

Boomers are more likely than all other generations to say that they will “not shop this way”: online for contactless delivery, online for in-store pickup, online for in-person delivery, online for curbside pickup.

Males are more likely than females to say that they will “not shop this way”: online for in-store pickup, online for curbside pickup.

West were also overindexing. Among those who didn’t purchase prepared foods, 44% find them too expensive, 39% prefer to purchase somewhere else or cook at home, and 37% just don’t have prepared foods in mind when they visit the supermarket.

Health and Sustainability Concerns Affect Decisions

In case anyone is still wondering, health and sustainability have definitely hit the mainstream among American shoppers. In this study, a substantial seven in 10 shoppers self-identified as “health conscious.” For Millennials and Boomers, that number jumped to 75%, and among shoppers living in the Northeast, the figure was 77%. The good news is that just over half of

health-conscious shoppers said that they’re either extremely or very satisfied with their store’s selection.

As for sustainability issues, most shoppers indicated interest in nearly all sustainable practices, with EVcharging stations being the exception (55% said that they’re “not concerned,” although Gen Zers, Millennials and males were more likely to show interest than other groups). More than half would like to see their stores donate food instead of throwing it out (54% saw this as a “really important” practice, with Gen Zers favoring it the most). In addition, recycling, ethical sourcing, and zero waste goals were viewed as “really important” by just over one-third of shoppers.

18 progressivegrocer.com

COVER STORY

2% 46% 48% 46% 49% Shopping in Store Today Versus Year Ago Predicted One Year From Now Buy Online/ Contactless Delivery Buy Online for In-Store Pickup Buy Online for Delivery Buy Online for Curbside Pickup 20% 12% 11% 11% 10% 71% 36% 36% 37% 35% 7% 7% 6% 7% 6% More About Same Less Will Not Shop This Way Better About Same Worse

58% 43% 12% 17% 30% 40%

Sea of Convenience

FROZEN AND SHELF-STABLE OPTIONS SHOULD BE PROMOTED AS GREAT CHOICES FOR INFLATION-WEARY AND COOKING-AVERSE CONSUMERS.

By Bridget Goldschmidt

hen consumers — and many retailers — think of seafood, they normally envision fresh departments stocked with just-caught product displayed on ice, but frozen and shelf-stable options can play a key role in boosting seafood sales, particularly at a time when shoppers are seeking value.

“The current economic situation has definitely opened up the opportunity for frozen and shelf-stable seafood items as consumers are oftentimes looking to buy in bulk,” affirms Lilani Dunn, the newly named executive director of the Anchorage, Alaska-based Bristol Bay Regional Seafood Development Association (BBRSDA), a fisherman-funded group. “Both frozen and shelf-stable seafood also are great options for trending consumer issues such as food waste and quickness of ease of meal preparation.”

“Frozen and shelf-stable saw great gains during the pandemic,” notes Kayla Bennett, media and communications manager at the National Fisheries Institute (NFI), a Reston, Va.-based industry trade group, who goes on to cite recent statistics from Circana and 210 Analytics. “We are seeing some headwinds across all seafood categories, attributed to inflation. But we’re head and shoulders above where we were pre-pandemic. Frozen is down 3.1% from 2022, but up 32.4% since 2019. Meanwhile, the shelf-stable side is up 13.1% from 2019 and increased 0.2% in 2023. We’re not seeing the explosive growth we saw in 2020 or 2021, but overall, we’re trending in a very positive direction.”

“A Matter of Perception”

To get the message across to consumers that frozen and shelf-stable seafood products are great choices, retailers must change shoppers’ ideas about such products.

“While we know that frozen and shelf-stable seafood increasingly delivers on both value and quality, and can be just as nutritious as fresh seafood, it truly is a matter of perception,” advises Athena Davis, marketing manager at the Wilmington, N.C.-based Aquaculture Stewardship Council (ASC) North America. “When it comes to marketing frozen and shelf-stable products, we think sustainable

Key Takeaways

The current economic situation, along with such consumer concerns as food waste and ease of preparation, has opened up the opportunity for frozen and shelfstable seafood items.

When marketing frozen and shelfstable seafood, retailers must change shoppers’ perceptions about these products.

Gen Alpha should be a main focus of forthcoming frozen and shelf-stable seafood product promotions.

PROGRESSIVE GROCER March 2024 19 SOLUTIONS Seafood Forecast

The Bristol Bay Regional Seafood Development Association has conducted chef demos at food retailers to highlight the ease of preparation of frozen sockeye salmon items.

Seafood Forecast

and responsible sourcing are key factors for brands looking to differentiate and communicate their product benefits to shoppers. We know firsthand that retailers and seafood producers are seeing increased demand for more traceable and responsibly sourced seafood products, and that ASC’s certification is a valuable marketing point for frozen and shelf-stable products.”

Among the retailers that are effectively promoting such products, ASC singles out one that it partnered with last October on a National Seafood Month promotion. “We think New Seasons Market, in Portland, Ore., does an excellent job of merchandising shelf-stable seafood,” says Davis. “When you walk up to their fresh seafood case, you’re met with a bold display of trendy, colorful and premium tinned seafood products right beside the case.”

“Tinned fish is having its moment with younger audiences,” notes NFI’s Bennett. “If you don’t understand the hype, you only have to go as far as TikTok to see this trend firsthand. Meanwhile, canned and

“Tinned fi sh is having its moment with younger audiences. If you don’t understand the hype, you only have to go as far as TikTok to see this trend fi rsthand.”

—Kayla Bennett, National Fisheries Institute

pouched products emphasize convenience and value, which are evergreen with consumers.”

In ASC’s work with brands across North America as part of a multiyear marketing campaign to build awareness and understanding of the value behind its certification and label, it has recently “seen a significant increase in producers and brands staking a bigger claim in shelf-stable and frozen spaces, whether through new product launches or brand extensions,” notes Davis.

Speaking of frozen, BBRSDA has “partnered with retailers across the country, conducting chef demos at Sprouts, Harris Teeter and QFC,” says Dunn. “These demos help educate consumers [about] the ease of prep, introduce them to frozen sockeye salmon items offered, and also are paired with printed and digital assets that lead to recipes, cooking tips and other differentiators of our Wild Sockeye Salmon from Bristol Bay, Alaska, such as nutrition, place of origin, and the support of local U.S. fishers.”

She adds: “A frozen side or portion of sockeye salmon is a perfect starting point for any skill level of the at-home

20 progressivegrocer.com SOLUTIONS

The tinned seafood segment has been offering a greater number of premium products of late.

Canned and pouched seafood products emphasize convenience and value, making them attractive to consumers.

cook. We have a collection of Fast, Wild and Easy recipes that have few ingredients, which are typically found in household pantries. We also have a Salmon Cooking Guide that includes various cooking methods, as well as tips on how to handle working with frozen salmon.”

Riding the Frozen and Shelf-Stable Wave

Regarding how to leverage future trends in the frozen and shelf-stable seafood segments, Dunn asserts: “Gen Alpha should be a main focus for forthcoming frozen and shelf-stable seafood products. Not only will they be the buyers for their own households, but the benefits of

Why Frozen and Shelf-Stable Seafood?

What makes frozen and shelf-stable seafood products particularly appropriate options for today’s consumers?

“Shoppers … may be looking for better price points, or being mindful that there’s less chance of food and food dollar waste when you buy frozen and shelf-stable proteins,” observes Athena Davis, marketing manager at the Wilmington, N.C.-based Aquaculture Stewardship Council North America.

Davis goes on to cite recent FMI seafood research highlighting several factors that may be contributing to this greater shopper appeal: At-home food commands more of the food dollar.

Lower-prep dinners are gaining in importance.

Value-added seafood is a major contributor

PROGRESSIVE GROCER March 2024 21

FRESH PRECUT ATLANTIC SALMON PORTIONS © 2024 MOWI USA, LLC. ALL RIGHTS RESERVED. MARINE HARVEST AND MOWI ARE REGISTERED TRADEMARKS OWNED BY MARINE HARVEST HOLDING AS.

Holiday Entertainment Guide

Party Central

GROCERS AND BRANDS OFFER A HOST OF SOLUTIONS FOR CELEBRATIONS THAT DRAW SHOPPERS

By Lynn Petrak

here’s pretty much an observance for everything these days — like National Melba Toast Day (March 23) and National Crayon Day (March 31) — but retailers do have several key opportunities to lift sales for popular upcoming holidays.

Following a busy February in which the Super Bowl, Mardi Gras, Ash Wednesday and Valentine’s Day took place in rapid succession, grocers are redirecting their assortments and promotions for spring and early-summer holidays that involve at-home entertaining. Looking ahead, plans are already in motion for the peak holiday season in the fourth quarter.

Party On

To be sure, U.S. consumers like special occasions. According to the “2024 Holiday Intentions” study from Chicago-based data and tech company Numerator, nearly all consumers said that they’ll buy something for holiday celebrations. Nine in 10 shoppers said that they’ll make a purchase related to a given holiday, and a third expected to spend between $50 and $100 per holiday throughout the year.

Numerator’s data also affirmed that supermarkets are top shopping destinations for holidays. As for what consumers are buying when they’re in stores or online, the insights company found that food is the most popular item that

shoppers intended to purchase for 10 of the 14 major holidays, followed by alcohol.

While they’re spending on food, drink and other supplies for holiday celebrations, shoppers remain mindful of elevated prices, even as inflation has declined from its 2022 peak. “Beyond inflation, 2023 was a difficult year for consumers,” observes Mike Scavuzzo, sales director, emerging brands at Numerator. “The end of SNAP benefits and the return of student loan payments put even more pressure on consumer spending that will likely carry into 2024.”

Mike Kostyo, VP at Chicago-based food industry consulting firm Menu Matters, agrees

Key Takeaways

To appeal to consumers planning to celebrate spring holidays with varying degrees of budgets, grocers offer a range of meal solutions and catering options.

Given the season, grilling and outdoor food and beverage staples are at the heart of retail features and promos.

Beyond the standard holidays, retailers can aim to boost sales by highlighting other occasions that warrant some kind of entertaining.

22 progressivegrocer.com SOLUTIONS

! Email sales@buzzballz com to learn more ©2024 BuzzBallz, LLC, Carrollton, TX Please Enjoy Responsibly ©2024 Southern Champion, Carrollton, TX Please Enjoy Responsibly Co nt a ct sa l es@sou t h e rn - ch a m p io n .co m fo r m o r e d et a i ls .

Holiday Entertainment Guide

that the industry isn’t out of the woods yet when it comes to price-related mindsets and behaviors, even among consumers keen on celebrating. “Inflation and high prices are absolutely still weighing on consumers’ minds ahead of big holidays and entertaining occasions,” affirms Kostyo. “As we were heading into this year, well over half of consumers said they had experienced sticker shock from a food purchase in the past year, and grocery prices continue to stay stubbornly high, so there’s hasn’t been much relief.”

“Retailers and brands that partner to prioritize affordability will win with consumers during the 2024 holiday season.”

—Mike Scavuzzo, Numerator

There are many ways for grocers and brands to connect with shoppers balancing price consciousness with an enthusiasm for entertaining. “Where we see favorability for consumers will be through increased frequency and depth of promotions to drive unit volume, which has been soft over the past 12 months,” says Scavuzzo, adding, “Retailers and brands that partner to prioritize affordability will win with consumers during the 2024 holiday season.”

Spring Ahead

The top spring holidays kick off in March with St. Patrick’s Day as grocers promote Irish meal staples like corned beef, fresh cabbage, potatoes and soda bread, along with adult beverages like beer and Irish whiskey. It may be a smaller holiday, mainly observed in areas with big Irish populations like New York City, Boston and Chicago, but March 17 still brings retailers some luck: According to the Washington, D.C.-based National Retail Federation (NRF), more consumers than ever celebrated St. Paddy’s Day in 2023, spending an average of $43.84.

Next up on the major spring holiday list are historically religious observances that bring shoppers to grocery stores as they get ready to entertain family and friends. Easter, set for March 31 this year, remains a major retail occasion, while Passover, starting on April 23, is a food-centric observance. The celebration of Eid al-Fitr, marking the end of the holy month of Ramadan, is a festive occasion that involves meals at home, too, along with sweets that are

popular after a period of fasting.

In a recent webinar on spring 2024 trends Jaclyn Marks, a “trendologist” at Chicago-based Datassential, said that those holidays are important for grocers. “Among consumers who celebrate Easter and Passover, 85% celebrate with meals at home,” she noted.

Recent data from Chicago-based insights firm Circana uncovered similar sentiments. According to a February Circana survey of primary grocery shoppers, a quarter of consumers planned to prepare a special meal for themselves or their household for Easter or Passover, and 19% said that they would host or attend a meal with extended family members who don’t live with them.

In its seasonal analysis of first-quarter holidays, New York-based Coresight Research noted that about twothirds of consumers planned to celebrate Easter this year. Grocers can take heart from another Coresight statistic: Nearly 32% of consumers who plan to mark the holiday intended to spend more than last year.

To appeal to consumers planning to celebrate these spring holidays with varying degrees of budgets, grocers offer a range of meal solutions and catering options, similar to their fall and winter holidays. Retailers such as Whole Foods Market, Wegmans and The Fresh Market, for example, offer a variety of seasonal prepared foods for Easter and Passover, and also share occasion-based recipes and entertaining tips.

Food retailers can carry over Easter brunch ideas for Mother’s Day, another prime holiday for entertaining at home. An overwhelming majority of 84% of U.S. adults celebrate that occasion, according to NRF. In addition to the perennially popular breakfast in bed or brunch meals for moms, grocers also ramp up promotions and offerings in the floral department as a way to celebrate mothers, grandmas and others who are maternal figures.

Another occasion that has been gaining steam in recent years is Cinco De Mayo. While many people go out for that occasion, grocers typically feature an array of Mexican and Latin American products for May 5, including food and beverages.

According to Kostyo, retailers can get creative with these holidays. “St. Patrick’s Day and Cinco de Mayo are social occasions, so create deal packs that serve multiple people and offer fun engagements that can grab attention,” he advises. “Can a retailer mark down everything green in their store for one day? Can you do an on-trend prepared food offering like birria tacos paired with a Mexican beer or tequila option, two of the fastest-growing categories in alcohol?”

Other late-spring and early-summer holidays are ripe for entertaining, with graduation season, Memorial Day, Father’s Day, Juneteenth and the Fourth of July often synonymous with get-togethers. Given the season, grilling and outdoor food and beverage staples are at the heart of

24 progressivegrocer.com SOLUTIONS

To appeal to shoppers who want to celebrate conveniently, grocers can promote heat-and-eat offerings like brioche waffles from St Pierre Groupe.

retail features and promotions. “The grilling category has come a long way, with consumers investing in elaborate pellet smokers and propane griddles, so are you making sure your offerings align with those consumer needs for Memorial Day or Father’s Day?” asks Kostyo.

Make a Day of It

In addition to gearing up for standard spring and summer holidays, retailers can take another shot at boosting sales by highlighting other occasions that warrant some kind of entertaining.

“Consumers today love to celebrate an occasion together,” asserts Kostyo. “Because of social media and the need for content, we see consumers getting excited about previously mundane holidays like Groundhog Day. Brands and grocers should use these as an opportunity.”

Other low-key occasions with some potential for sales lifts are sprinkled throughout the calendar.

Over the past few years, Pi Day (March 14) has garnered attention in the bakery and the dessert freezer case. Large parties aren’t the norm, but a shopper may want to purchase a celebratory pie, with ice cream to go with it, to commemorate this math-oriented day.

Meanwhile, Derby Day, set for May 4 this year, can inspire gatherings with relevant fare like mint juleps or Kentucky bourbon pie.

Scavuzzo says that grocers can pursue shoppers who are apt to celebrate such days more spontaneously. “Impulse, impulse impulse,” he

emphasizes, citing Numerator’s data showing that events like Cinco De Mayo have high purchase spontaneity. “What this says is that there is a willingness to spend, but it isn’t top of mind for consumers. Knowing that, it becomes crucial for retailers to provide prime in-store real estate to drive impulse purchases and brands to support it.”

That said, grocers and CPGs may want pick and choose promotions carefully. “It’s also important for brands not to overextend — today’s consumer is particularly adept at sniffing out inauthenticity,” cautions Scavuzzo.

PROGRESSIVE GROCER March 2024 25

Brands are making it easier for consumers to entertain by offering kits and bundles, like Hormel Foods' new spring-themed Honey Ham & Turkey tray.

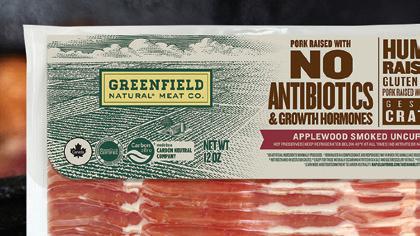

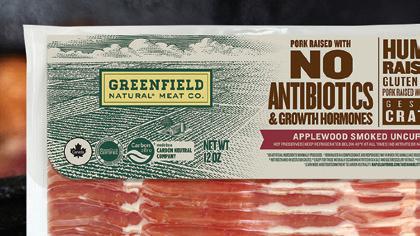

SCAN QR CODE TO LEARN MORE © 2024 Greenfield Natural Meat Co. All Rights Reserved.

MAKING MEAT RIGHT

THE GREENFIELD NATURAL MEAT CO.® DIFFERENCE

We are more than just a meat brand – we are a meat brand with a purpose. We exist to make a better world by making meat right – better food, better care for our animals, better communities, and a better planet.

That’s why our meat is always 100% antibiotic-free. That’s why we’ve reduced our carbon emissions where possible and offset our remaining emissions to be carbon zero. That’s why our animals are 100% vegetarian grain fed and humanely raised. We do all of this – and more –because we all deserve meat made right.

Proudly Carbon Neutral

Raised with NO antibiotics

Humanely raised

Bacon for All Occasions

FOOD RETAILERS AND BRANDS FIND EVEN MORE USES FOR THIS PERENNIALLY FAVORITE FOOD.

By Lynn Petrak

eople joke about their love of bacon, but it’s true that this is a foodstuff that appeals to consumers on many sensory levels and, as it turns out, on many occasions.

Over the years, public figures have weighed in on the ubiquitousness, usefulness and uniqueness of bacon. “You know, it’s hard to beat bacon at any time of day,” admits actor Nick Offerman. Comedian Jim Gaffigan draws laughs with the observation: “Bacon’s the best. Even the frying of bacon sounds like applause.” Famed chef and

Key Takeaways

Consumers are embracing thicker slices and flavored bacon varieties.

In addition to fresh bacon, other forms of bacon make it easy for consumers to add pork flavor to a wide range of dishes throughout the day.

In addition to carrying more and different bacon SKUs in the meat case and center store aisles, grocers can satisfy bacon-loving shoppers and grow their sales in other ways, including spotlighting premium bacon offerings in the service case.

28 progressivegrocer.com SOLUTIONS Bacon

cookbook author James Beard once said that his ideal last meal would consist of bacon and eggs, and noted, “There are few sights that appeal to me more than the streaks of lean and fat in a good side of bacon, or the lovely round of pinkish meat framed in delicate white fat that is Canadian bacon.”

Today’s food analysts agree that the allure of bacon extends across dayparts and applications. “Eighty percent of people say they like or love bacon,” asserts Patrick Fleming, new business development manager at Midan Marketing, in Chicago. “What else as a country can we agree on? Even when there are down-market conditions, demand stays strong. Bacon complements so many meals, it’s an ingredient, and it always delivers on flavor. I’ve done bacon interviews for a long time, and people will ask, ‘Is the bacon trend over?’ No, it will never be over. There is always innovation, a new daypart, new thickness, new flavor.”

Anne-Marie Roerink, principal and founder of San Antonio-based 210 Analytics LLC, agrees. “Bacon is quite unique in that it does have a strong indulgence role, but at the same time it also plays an important role in many ‘everyday’ meals, from a topping on a salad [to] the classic bacon and egg, or to enhance a burger,” she says.

According to Roerink’s insights, the bacon category has held its own. “Bacon prices spiked well before several of the other proteins started gearing up, but experienced deflation in 2023,” she notes. “This brought consumers back to bacon, resulting in a strong

“Bacon is quite unique in that it does have a strong indulgence role, but at the same time it also plays an important role in many ‘everyday’ meals.”

—Anne-Marie Roerink, 210 Analytics

pound performance in 2023, though the deflationary conditions meant that dollars were down year on year.”

Data from Circana OmniMarket Integrated Fresh, a Chicago-based market research company, affirms that bacon in many forms has remained in shopper baskets. For the 52 weeks ending Jan. 28, sales of fresh packaged bacon reached $5,898,880.631, while sales of deli service bacon hit $5,719,145 and sales of frozen bacon rang up $3,811,214. Salad toppings with bacon came in at $712,500,951, and refrigerated salad toppings/bacon bits reached $904,367 in that time frame.

BEEEEEEEEE BEEEEEEEEE

PROGRESSIVE GROCER March 2024 29

Other market research bears out the enduring appetite for bacon. According to Chicago-based insights firm Mintel, 61% of consumers continue to eat the same amount of bacon as they have before, and nearly half said that they’re interested in trying new products, preparations and flavors.

Bacon makers agree that bacon is a force to be reckoned with as a product and category. “Bacon continues to be such a beloved household staple in the U.S.,” notes Emma Pierce, brand manager for Daily’s Premium Meats, a 130-year-old brand that became part of Merriam, Kan.-based Seaboard Foods in 2005. “It has a very high household penetration.”

According to data cited by Pierce, penetration for bacon exceeds 70% of all households with members between the ages of 25 and 64 and comes in at 76.6% for households with members between the ages of 55 and 64. Even consumers under the age of 25 enjoy bacon, which enjoys 70% household penetration among that crucial demographic.

Add in the statistics on ready-to-cook and heat-and-eat bacon, and you come up with a food that’s versatile and available across several categories. Even the adult beverage and bakery departments have been known to offer items made with bacon.

New Takes on Tradition

As sales figures show, a majority of bacon is purchased in the form of fresh strips derived from pork belly. Many consumers still cook up raw bacon in traditional ways and for classic meals like omelets and BLT sandwiches, but some are experimenting with other recipes as they continue to cook a lot at home in the wake of the pandemic and during an inflationary era.

“It’s not just limited to a few strips of bacon with eggs for breakfast – we are seeing it incorporated in pizzas and even in doughnuts. Bacon can be added to anything savory and to sweet dishes as well,” observes Pierce, who points out that bacon is an easy and effective way to punch up the eating experience. “Being able to add bacon to a recipe gives it more variety.”

As people widen their recipe repertoire – often inspired by posts on social media platforms like TikTok – bacon brands are giving consumers more product options. “When you look at all of the different types of bacon offered in a retail grocery store, there’s a flavor and product for almost everyone,” says Midan’s Fleming, citing the advent of bacon offerings for those with certain dietary interests. “If it’s sugar, curing or whatever else was an obstacle, there’s now a bacon to meet that need.”

There are some trends in the category. As Daily’s expands its reach into the retail sector following a long history in foodservice, the brand finds that consumers are embracing thicker slices and flavored bacon varieties. “We use all-natural hardwood to smoke our product and smoke using slower cycles,” says Pierce. “We use premium ingredients for curing as well.”

One new offering has generated particular buzz among home chefs, she adds. “Most recently, we launched a steak-cut bacon, which has been really very exciting, and we have an ultra-thick bacon in the L-board format, which puts a different spin on bacon, with a

30 progressivegrocer.com SOLUTIONS

Bacon

The Daily's brand of bacon from Seaboard Foods continues to expand into the retail sector with trending products like steak-cut bacon.

meatier cut that’s perfect for people who love bacon,” she explains.

Other bacon brands have fared well with thicker cuts, flavorful smoking techniques and seasonings as shoppers look to do more with fresh bacon. Boar’s Head, based in Sarasota, Fla., offers a Butcher Craft Thick Cut Bacon as part of its collection, while Oscar Mayer, from Kraft Heinz, based in Chicago and Pittsburgh, touts its Naturally Hardwood Smoked Thick Cut Applewood bacon.

“There are a couple of things with thick-sliced or steak-cut bacon,” notes Fleming. “It delivers on more flavor because it’s thicker, and it usually results in less shrinkage, with a better bite. It also holds better if you add it as an ingredient, so it extends across dayparts.”

For its part, the venerable Jimmy Dean brand under the Tyson Foods Inc. umbrella includes Thick Cut Applewood Smoked and Hickory Smoked Premium Bacon varieties. Demand is so strong for these and other bacon products that Springdale, Ark.-based Tyson recently opened a new $355 million production facility in Bowling Green, Ky., to further innovate with new bacon flavors, cuts and products for brands such as Jimmy Dean and the fast-growing Wright label.

“Bacon is a growing category based on consumer demand, both at home and at restaurants, and our expanded production will enable us to lead this growth and drive innovation,” notes Melanie Boulden, Tyson’s group president of prepared foods and chief growth officer.

Retailers have also upped the ante in fresh bacon with their

“Bacon is a growing category based on consumer demand, both at home and at restaurants, and our expanded production will enable us to lead this growth and drive innovation.”

—Melanie Boulden, Tyson Foods EEEEEEEEEEEE. EEEEEEEEEEEE.

private label premium versions that inspire people to use bacon in a host of applications. The Good & Gather portfolio from Minneapolis-based Target includes a No Sugar Uncured Bacon; Monrovia, Calif.-based Trader Joe’s offers an Uncured Dry Rubbed Sliced Bacon; and the Frederik’s by Meijer premium store brand from Grand Rapids, Mich.-based Meijer includes a Naturally Hardwood-Smoked Thick Cut Bacon and a Double Smoked Center Cut Bacon.

PROGRESSIVE GROCER March 2024 31

SOLUTIONS Bacon

In addition to fresh bacon, other forms of bacon make it easy for consumers to add this bit of pork flavor to a wide range of dishes throughout the day. Microwaveable bacon has been on the market for decades now, and it has also expanded to include more premium varieties.

Likewise, bacon pieces and bits in both shelf-stable and refrigerated forms are a go-to ingredient for home cooks. Innovations continue in these segments, too, as evidenced by launches like Jimmy Dean’s Hardwood Smoked, Chopped, Uncooked Premium Bacon, ready to be pan-fried for an accompaniment or ingredient.

The plant-based boom of the past few years has included the introduction of bacon made from plant sources, which can likewise be incorporated into meal and snack occasions. Examples include Veggie Breakfast Meatless Bacon Strips from the MorningStar Farms division of Chicago-based Kellanova, and Smart Bacon from LightLife, of Turners Falls, Mass.

Of course, bacon has long been a star ingredient in foods and remains a go-to addition for products spanning dayparts and categories. Bacon-topped pizzas remain popular, with new items like a Gorgonzola & Bacon with Pear Chutney pizza from Albertsons Cos., based in Boise, Idaho, and a Sharp Cheddar and Uncured bacon stone-fired pizza from Tillamook County Creamery Association, of Tillamook County, Ore.

Egg bites and other heat-and-eat egg-based products are also big right now as high-protein foods remain in demand. The Applegate Farms LLC division of Hormel Foods, in Austin., Minn., has expanded into the breakfast segment with a new line of Applegate Natural Frittata bites, including one variety made with uncured bacon. Kraft Heinz’s Oscar Mayer brand has gotten into this space, too, with Oscar Mayer Scramblers featuring a Bacon and Velveeta option.

Bacon flavor makes its way into foods and beverages in unexpected ways as well. For instance, the Funky Buddha beer company, of Oakland Park, Fla., brews up a Maple Bacon Coffee Porter, while Bentonville, Ark.-based Walmart has carried a bacon peanut brittle product from Goodlettsville, Tenn.-based Brittle Brothers.

Doubling Down on Bacon

In addition to carrying more and different bacon SKUs in the meat case and center store aisles, grocers can satisfy bacon-loving shoppers and grow their sales in other ways, including spotlighting premium bacon offerings in the service case. “This allows people to buy as much or as little as they wish, but also provides a way for even greater in-house innovation and limited- time offers,” points out Roerink. “Additionally, by bringing it into the full-service case, the butcher has an opportunity to upsell by suggesting a bacon-wrapped variety of the meat people are purchasing.”

Bacon is a star ingredient in many packaged goods, too, like Oscar Mayer's new line of Scramblers.

Bacon is a star ingredient in many packaged goods, too, like Oscar Mayer's new line of Scramblers.

Regarding that point, because bacon has a reputation for making other foods better, retailers often add bacon to their prepared foods and in-store restaurant menu items. For instance, Rochester, N.Y.-based Wegmans Food Markets has offered ready-to-cook bacon-wrapped scallops, while The Giant Co., based in Carlisle, Pa., rolled out bacon-wrapped jalapeños stuffed with cream cheese.

To inspire consumers to think of bacon for more eating experiences, retailers can leverage merchandising tactics. “Bacon also tends to play a star role in cross-merchandising displays aimed at breakfast,” observes Roerink. “While most retailers focus on creating dinner cross-merchandising displays, some will rotate the items by time of day, and America’s love for bacon can certainly result in a nice upsell there.”

Kroger Co., based in Cincinnati, has posted recipes for preparing bacon candy, bacon-wrapped apricots and maple bacon popcorn.

Bacon can be added to many merchandising efforts, in fact. “That’s where retailers have a great opportunity to help ideate on usage occasions and be rewarded with extra sales,” says Roerink, sharing some examples: “A small independent [recently] featured a recipe of cabbage with kale [and bacon], made in the oven or air fryer as a carb-friendly, delicious way to make cabbage. Another put packaged bacon next to ground beef.”

Providing ideas also encompasses how-tos, and many retailers spotlight bacon as an ingredient in their company-developed recipes. Cleveland-based Heinen’s, for instance, has shared tips for making baked maple bacon mini donuts and a BLT dip, while The

Brands, too, give consumers food for thought when it comes to the many ways to prepare and enjoy bacon. “As we start to focus more on our retail presence, we know it’s important to inspire consumers on how to use our products, so we regularly share recipes on our website and social media platforms,” says Pierce. “We also partner with creators, like social media influencers, and challenge them to come up with new recipes.” Daily’s recipes cover a host of sweet and savory applications, including bacon risotto, honey jalapeño glazed bacon, savory bacon jam and a doughnut ice cream sandwich.

PROGRESSIVE GROCER March 2024 33

L.T. L.T. LEARN MORE ABOUT STEAK CUT BACON AT WE PUT BACON FIRST. © Daily’s Meats 2024

Easy Eats

HOW GROCERS CAN TAKE ADVANTAGE OF THE FAST-GROWING RETAIL FOODSERVICE SEGMENT.

By Barbara Sax

combination of higher restaurant prices, cooking fatigue and a quest for convenience is propelling foodservice at supermarkets, making the category one of the fastest-growing and most profitable segments for retailers.

“Foodservice at retail is increasingly replacing quick-service or fast-casual restaurant meals, and convenience plays into that,” notes Rick Stein, VP of fresh foods at Arlington, Va.-based FMI — The Food Industry Association. “Shoppers tell us they plan to eat more meals at home and, according to a September 2023 Harris Poll done for National Family Meals Month, nearly all (90%) strongly or somewhat agree that family meals at home are more economical than dining out.”

As a result, retailers are investing heavily in foodservice. “We’re seeing a renaissance in the foodservice department, with retailers investing in chefs and specialty staff, increasing space allocation, and enhancing variety in an effort to re-energize foodservice departments and make them more top of mind for consumers,” adds Stein.

Key Takeaways

In response to consumer demands for at-home meal convenience, retailers are investing heavily in foodservice, with future investment in the category expected to continue. There’s been an uptick in prepared food purchases centered on lunch.

Supermarkets should also consider building on the success of their signature foodservice items, partnering with local foodservice brands, adding new flavor profiles and on-trend cuisines, and harnessing technology such as interactive kiosks.

34 progressivegrocer.com FRESH FOOD Retail Foodservice Report

Price Chopper offers a New York-style deli experience at its stores.

Patrick Nycz, president of West Lafayette, Ind.-based NewPoint Marketing, sees more grocery stores capitalizing on the opportunity to provide customers with an “easy button” for the evening meal, as well as a way to differentiate themselves from their competitors. In fact, 82% of U.S. retailers are increasing space for fresh-prepared grab-and-go meals, according to Tammy Gonzales, senior marketing manager, deli and prepared entrées at Wayzata, Minn.-based Cargill.

For example, ShopRite, a banner of Keasbey, N.J.-based Wakefern Food Corp., is rolling out its Fresh to Table store-within-a-store concept, which includes a wide selection of readyto-cook, ready-to-heat and ready-to-eat meals, to additional locations. At its 135,000-square-foot Gretna, Neb., store, Hy-Vee recently expanded in-store dining offerings to include a large open Food Hall dining area that offers an expanded breakfast menu, as well as a variety of lunch and dinner options, including Mia Italian, HyChi and Hibachi, Nori Sushi, Market Grille Express, Long Island Deli, and Wahlburgers. The new store, the largest in the West Des Moines, Iowa-based chain to date, also includes a pub with a full sit-down bar, 32 taps and an outdoor patio.

Foodservice is also front and center at H-E-B’s rebranded H-E-B Fresh Bites convenience stores. The San Antonio-based retailer has added more prepared food and convenient meal options to its c-store locations, including its second True Texas Tacos restaurant, which features a salsa bar for spicy sauces and taco-appropriate condiments, and a South Flo Pizza in one of its San Antonio locations.

Tops Markets LLC is another chain expanding space for grab-and-go meals, sides, appetizers, and ready-to-heat and -eat sandwiches. The Williamsville, N.Y.-based chain is revamping seating areas and adding spots for plugging in and recharging devices to encourage customers to eat on the premises, as well as upgrading cooking equipment to convection ovens to allow the chain to expand variety and hot-food offerings.

Future investment in the category is expected to continue. “The sky is the limit for what supermarket retailers can offer regarding meal options for their consumers — the key is understanding the consumer and having a strategic approach to testing out products, meal combinations and pricing,” says Nycz.

Greater Lunch Opportunity

FMI’s report reveals an uptick in prepared food purchases centered on lunch, a trend that suggests there’s significant opportunity to offer new lunch solutions as consumers continue to work at home at least part of the time.

“We are seeing expanded lunch options and menus across categories, especially in urban and higher-income areas,” observes Nycz. “In the Midwest, we see this blossoming at Market District, Mariano’s and several high-end Krogers. Publix, Harris Teeter and H-E-B are all doing a killer job of it in the South.”

“We are exploring more handheld sandwiches and have tested some bowls to accommodate the ‘dashboard dining’ experience,” says Karri Zwirlein, director of bakery, deli and prepared foods at Tops. “We are always exploring new taste profiles, ethnic flavors and upcoming trends.”

Capitalize on Signature Items

According to FMI, supermarkets should also consider building on the success of their signature foodservice items. It’s a smart move, considering that FMI’s research indicates that 40% of shoppers say their

“We’re seeing a renaissance in the foodservice department, with retailers investing in chefs and specialty staff, increasing space allocation, and enhancing variety in an effort to re-energize foodservice departments and make them more top of mind for consumers.”

—Rick Stein, FMI

supermarkets are known for a particular foodservice item.

Dan De La Rosa, group VP of fresh merchandising at The Kroger Co., notes that Kroger brand deli and bakery products have long been basket staples that customers depend on as an affordable centerpiece of a meal, or as a side or finish to a weeknight dinner, family breakfast or game day spread. One example is the Cincinnati-based chain’s Home Chef Fried Chicken, premium double-breaded and hand-dipped, with a signature flavor boasting 18 spices. Kroger recently created new packaging to prolong crispiness.

“We used to think of rotisserie chicken as a high-convenience item, and it still is; however, now we are seeing consumers who want the next level of convenience,” adds Tops’ Zwirlein. “We are seeing a large amount of growth with our picked chicken — rotisserie chicken meat already removed from the bone — so the customer can skip that step and put it directly onto salads and into soups or other recipes.”

Meanwhile, smoked foods have been a success story at Schenectady, N.Y.-based Price Chopper. “We installed smokers in select stores about a decade ago and began smoking pork, brisket, ribs and chicken,” explains Mona Golub, Price Chopper’s VP

Price Chopper locations also feature generously stocked wing bars where consumers can serve themselves.

PROGRESSIVE GROCER March 2024 35

Retail Foodservice Report

of public relations and consumer services. “The output was so well received that we now offer ribs and pulled pork, accompanied by our house-made barbecue sauce, in all our stores.”

Additionally, Price Chopper has expanded its signature fried fish program for Lent, adding ready-to-cook stuffed fillets and casseroles made with crabmeat, as well as fresh store-made shrimp cocktail and seafood salad. According to Golub, the chain has had great success with special limited-time offers and is continually “looking for the next opportunity to meet the moment for our customers.”

Partner with Local Favorites

Supermarkets are increasingly partnering with local foodservice brands to broaden their offerings and cement their positioning as a destination. Nycz notes that Kroger’s partnership with a local fan-favorite chain, Arni’s, is a draw for shoppers. “That’s a competitive advantage, but it depends on knowing your consumer,” he explains. “Putting a Wahlburger’s in Hy-Vee or a Starbucks in a Target represents a calculated strategic move to serve a key demographic.”

Landover, Md.-based Giant Food has partnered with two local favorites in its latest Bethesda, Md., stores. The chain has teamed up with Ledo Pizza in its deli section to offer Ledo’s pastry-thin, square-crust and sweet tomato sauce pizza either as a Take and Bake Ledo Pizza to warm up at home or as a fresh hot-from-the-oven version. Giant has also partnered with