TRENDS REPORT, PART 2

Research focuses on retail media, budgeting, social commerce & more

P-O-P SHOWCASE

Best-in-class in-store activations

Research focuses on retail media, budgeting, social commerce & more

Best-in-class in-store activations

With in-house expertise in design and manufacturing, we bring your vision to life and transform an average shopping day into a memorable experience. Our innovative approach adapts to changing markets and shoppers’ needs with transformational displays from temporary to permanent.

Get started today 855.909.2053 or greatnortherninstore.com

The Path to Purchase Institute shines the spotlight on this year’s honorees: executives from Mattel, CVS Health and Treasury Wine Estates.

Part 2 of our Trends 2024 report focuses on a survey that includes retail media, social media, e-commerce, in-store and more.

Our latest display gallery presents a sampling of eye-catching and effective in-store activations representing a variety of product categories and seasons.

Every year, the Path to Purchase Institute conducts our annual Trends survey, polling our audience of CPG brand commerce marketers on everything from investment and budgeting to new strategies they’re leveraging and challenges they’re facing. This year, we split the survey into two parts: part 1 (which was released in the January/February edition of P2PI Magazine) asked respondents to rate the retailer media networks with which they work based on their relative strengths in targeting effectiveness, measurement capabilities, ROI, data sharing, sales growth, creative freedom and traffic-driving capabilities. This fi rst half of the survey also delved into retail media a bit deeper, polling our audience on investment and budget allocations, measurement, organizational mapping and predictions for the “next frontier” of retail media.

In this edition of the magazine, we now share the results from part 2 of the survey, which focuses on broader topics in commerce marketing, like overall budgeting, instore marketing, social media and artificial intelligence (AI), among other subjects. However, retail media still rose to the forefront of part 2 of the survey. When asked how their organization’s investment in certain areas had changed in 2023 vs. 2022, 70% of respondents said their investment in retailer media networks had increased, the most for any area we identified. Social media (66%), e-commerce content (58%), digital media other than retail media (55%) and insights & analytics (54%) were the other areas most identified as having increased.

Furthermore, when asked to select up to three strategies/tactics from our list that have been most important to their organizations in the last year, 40% identified retailer media networks. Only e-commerce content (48%) was selected more, while search (SEO/SEM) and social media garnered similar percentages to RMNs.

In addition to retail media, AI was also (unsurprisingly) at the top of our survey takers’ minds. Fifty-nine percent of respondents said their organizations were already leveraging AI in their 2023 marketing strategies — 48% qualified their use as minimal and 11% as moderate or extensive. For 2024, 87% said they will leverage it — 61% minimally and 26% moderately or extensively.

These are just some of the factoids you’ll fi nd in our report, which you can dig into further beginning on page 28. (Editor’s note: Members of P2PI also get access to the full research deck at P2PI.com).

Also in this issue, we bring you another longstanding P2PI tradition — our annual Hall of Fame inductees. Each year since 1994, the editors of the Path to Purchase Institute have selected three industry leaders for induction into the Hall of Fame. From their daily business practices to the work they produce, these honorees represent the very best of the commerce marketing industry. Collectively, these professionals have proven that they don’t just follow the path to purchase; rather, they help build it. The 2024 inductees are Tammy Ackerman, Treasury Wine Estates; Stephen Bettencourt, CVS Health; and Pamela Velarde, Mattel.

We profi le these inspiring individuals and their contributions to the commerce marketing industry starting on page 18. And this spring we’ll celebrate these honorees at an awards ceremony and reception during Future Forward, May 13-15 in Philadelphia.

As our industry rolls into the rest of 2024 after a very busy, fast-paced Q1, I think this advice from inductee Ackerman is particularly good to keep in mind: “Follow your passions with experiences and exposure to things, and then prioritize relationships, stay tech-savvy and always keep the consumer at the forefront of your decisions.”

Senior Vice President, Brand Director Eric Savitch esavitch@ensembleiq.com

Editorial Director Jessie Dowd jdowd@ensembleiq.com

Executive Editor Tim Binder tbinder@ensembleiq.com

Managing Editor Charlie Menchaca cmenchaca@ensembleiq.com

Digital Editor Jacqueline Barba jbarba@ensembleiq.com

Managing Editor, Member Content Cyndi Loza cloza@ensembleiq.com

Editor, Member Content Heidi Bitsoli hbitsoli@ensembleiq.com

Director, Events Content and Strategic Engagement

Lori Pugh lpugh@ensembleiq.com

Contributing Writers Michael Applebaum, Ed Finkel, Erika Flynn, Jenny Rebholz, Bill Schober

Associate Director, Brand Partnerships Arlene Schusteff 847.533.2697, aschusteff@ensembleiq.com

Regional Sales Manager Orlando Llerandi 678.591.8284, ollerandi@ensembleiq.com

Director of Retail Patrycja Malinowska pmalinowska@ensembleiq.com

Sr. Director, Membership Development Nicole Mitchell 203.434.5733, nmitchell@ensembleiq.com

Membership Experience Manager Ann Estey aestey@ensembleiq.com

Manager, Membership Development Brady O’Brien bobrien@ensembleiq.com

Membership Experience Manager Heather Kurtik 724.553.0093, hkurtik@ensembleiq.com

Art Director Catalina Gonzalez Carrasco cgonzalezcarrasco@ensembleiq.com

Production Director Michael Kimpton mkimpton@ensembleiq.com

Marketing Manager Mackenzie Fennell mfennell@ensembleiq.com

List Rental mbriganti@anteriad.com

Subscription Questions contact@pathtopurchase.com

Chief Executive Officer Jennifer Litterick

Chief Financial Officer Jane Volland

Chief People Officer Ann Jadown

Chief Strategy Officer Joe Territo

Chief Operating Officer Derek Estey

VALERIE L. WILLIAMS-SANCHEZ Vice President, Multicultural Relevance and Intelligence Blue Chip

VALERIE L. WILLIAMS-SANCHEZ Vice President, Multicultural Relevance and Intelligence Blue Chip

Main job responsibilities: I work as the agency’s multicultural strategist and subject matter expert across verticals. I am a member of the strategic planning and research team. Through research and data mining, I work to uncover multicultural insights that matter.

How you win with shoppers during uncertain economic times: We help clients get more from their existing marketing budgets by uncovering new consumer opportunities. To do it, we show them how cultural values they haven’t noticed or understood are informing consumer purchasing decisions. These values are gateways to brand connections that clients need to grow their businesses.

New marketing tactic that you use: Triangulation is powerful. By combining quantitative data, anecdotal narrative and observation, we create a congruence that takes the guesswork out of multicultural marketing. When the stories that people tell us about what they buy and why match our observations and data, we have clear direction and proof.

Best career advice you’ve received: Do what you love, and the rest will follow.

Memorable aha moment in your career: There have been many. Someone I’m interviewing tells me something about their life, and the wider opportunity crystallizes. Most recently, I was working on a campaign for military families. As retired Air Force lieutenant Marcenia Cofield told me about her deployment experiences, all the data we had on military families came to life. We needed to focus on their widely shared, lived experience.

What you are reading or watching right now: I’m always reading peer journal articles. And I’m deeply passionate about immersive, cultural storytelling. No surprise there, right? The “Shogun” TV series has recently captured my imagination.

Summer travel plans: Honestly, that feels light years away. I’m not exactly sure just yet. I have a couple of fun destinations in mind, though. Please wish me luck that I get to one of them.

MICHELLE BRANDON Vice President, Client Services Select

MICHELLE BRANDON Vice President, Client Services Select

Main job responsibilities: I work with our clients to make a brand impact. From concept to retail execution, my team is leading the charge to solve stubborn brand challenges with compelling creative, strategic point of sale (POS) and delivering to market utilizing our trade marketing operating system known as Brandhub.

How you win with shoppers during uncertain economic times: With our operating system, every user has the information they need to feel empowered and make good decisions. It helps marketers see how much they are spending on retail marketing, on what tactics, in what location and — most importantly — what results they are getting.

New marketing tactic that you use: We are really focused on solving for sustainability and waste that comes with the POS territory. Impactful displays are only impactful if they actually make it to the floor. We obtain the data our clients need to spend the right dollar amount on the right pieces that truly drive sales.

Best career advice you’ve received: Do what you say you are going to do and don’t be afraid to take a risk.

What you are reading or watching right now: My free time is mostly dedicated to my two daughters’ busy schedules — from hockey to soccer, and dance to track. I’m soaking in every minute and will catch up on binging some good Netfl ix shows in a few years.

In 2022, the U.S. digital coupons market was estimated to be $150.8 billion, and expected to grow by 18.5% over the next five years. Changing consumer preferences, new technologies and a shifting digital landscape are driving rapid growth and innovation in this market.

Digital coupons are delivered through retailers, on coupon platforms and savings apps. As a result of this growth rate, it comes as no surprise that other industries with high consumer engagement seek ways to participate.

In addition to having fi rst-party shopping data from roughly 200 million consumers, U.S. consumer banks have strong engagement: 66% of their customers open their apps at least once each week and often visit their banks’ rewards programs. These programs are designed to drive card spend by offering deals from major retailers. However, there is one major limitation. The offers are not funded by brands or applied to specific SKUs.

Moreover, these deals don’t include everyday purchases such as groceries, primarily because banks cannot track item-level spending, limiting offers to percentages off the entire basket. Thus, consumer packaged goods (CPG) brands have been locked out of this valuable market opportunity.

It was always our ultimate goal to provide 100% attribution from CPG ad impression to in-store purchase, and then price it so the media buyer only pays when the shopper purchases the product. Our journey took years of trials and several challenges to overcome. In the end, we overachieved through a series of unexpected triumphs.

Companies such as Snipp Interactive have worked with CPG brands for more than a decade to drive shopper acquisition, retention and engagement. There are tools for tracking proof of purchases made in-store. The detailed basket data that is captured by these platforms is a critical value add.

We couldn’t help but wonder, after years of supporting customers’ campaigns when placed in third-party audiences, how could it be made better? While 100% attribution is essential, brands also wanted to reach all types of shoppers, not just coupon seekers. A fortuitous and unique relationship between Snipp management and several tier-one U.S. consumer banks came into play. What if we combined core technical capabilities with fi nancial institutions’ massive and loyal cardholder base? All the pieces fell into place. There is a mountain of fi rst-party shopping data, an engaged and untapped user base, a trusted and secure environment, and a broad targetable demographic and psychographic audience that no CPG was ever able to reach.

After several decades creating and deploying innovative digital media and loyalty products, you learn that the dogs don’t always eat the dog food, no matter how good the chef. Thankfully we partnered with banks, and the effort proved consumers were indeed hungry for the offers. In March 2024,

There is a mountain of first-party shopping data, an engaged and untapped user base, a trusted and secure environment, and a broad targetable demographic and psychographic audience that no CPG was ever able to reach.

Snipp’s new payments media network launched to 70 million active and loyal shoppers. Solutions like these do not only provide access to a massive and loyal cardholder base. They also offer a secure and trusted environment for consumers. By combining cutting-edge technology with a broad range of data, we have paved the way for the next era of shopper acquisition, engagement and attribution.

Tom J. Burgess, president, Snipp Media, is a serial entrepreneur and innovator with a career spanning more than 20 years focused on advertising, digital media technology, data and loyalty. He has been granted multiple patents for his pioneering work in these fields. Burgess is an active board member and advisor with a focus on sales acceleration, guerrilla marketing, culture management, corporate development and investor relations.

A special thank you to our sponsors: Platinum Launch Partner

Premier Sponsor: PRN, a Stratacache Company Networking Break Sponsor: Walmart Connect

The Path to Purchase Institute brought its popular Retail Media Summit to Canada in February. Retailers, brand marketers and solution providers alike gathered on Feb. 6 at the Toronto Congress Centre to unpack the retail media challenges and opportunities unique to Canada as well as across the globe.

Topics and themes from P2PI’s inaugural Retail Media Summit Canada ranged from the importance of closed-loop measurement and an omnichannel approach, to organizational mapping and enhancing a shopper’s experience across the path to purchase. Read on for some of the highlights from the day.

The numbers surrounding retail media’s growing influence and power in the marketing industry are usually huge across the globe, and it’s no different in Canada. Retail media ad spend is expected to reach 5 billion Canadian dollars by 2027 (a huge jump from 2 billion Canadian dollars in 2022) and, in fewer than three years, will double the ad spend of traditional TV.

While it continues to grow in importance, retail media has also become commonplace in the commerce marketing industry. “This is no longer an emerging media format. [Retail media] is here,” said Jeremy Vianna, vice president and general manager, audience and ad products, Advance powered by Loblaw, noting retail media will account for 1 in 5 digital ad dollars spent in Canada this year. “It’s not in the startup phase anymore. It’s a trusted part of a marketer’s playbook.”

In his session kicking off the event, Vianna urged attendees to consider a few key practices and trends to inform and advance their retail media strategies and campaigns. Among them, Vianna suggested taking into consideration both the e-commerce shopper journey (opening email, browsing deals in a digital circular, checking out online, etc.) as well as the in-store purchase journey (hear or see an in-store ad, etc.). Analyzing campaigns run though the retailer, Vianna said advertisers that are layering tactics across different modalities (onsite and offsite) are seeing major lift in their conversion success (versus those activating offsite media alone).

“People move in and out of different buying behaviors,” he said. “When you think about the myriad and drastic increase in marketing touchpoints that you have available, you have to have a plan to be able to address all these things. The idea is not to think about the physical journey or the digital journey as an ‘or’ but to think of them as an ‘and.’”

Another trend Vianna highlighted was the adoption of connected TV and streaming platforms among consumers, and that connected TV ad spend in the country is projected to reach nearly 1 billion Canadian dollars by 2025. Responding to this shift as well as the deprecation of third-party cookies, retail media networks are partnering with streaming and connected TV platforms to align with consumer habits embracing streaming and smart TVs and offer better, measurable solutions to advertisers.

[Retail media] is no longer an emerging media format. It’s not in the startup phase anymore. It’s a trusted part of a marketer’s playbook.

Jeremy Vianna, Advance powered by Loblaw

Lastly, Vianna spoke about three key measurement requirements to unlock the opportunity of the next wave of retail media:

• Credible. We don’t want RMNs grading their own homework, like platforms have done in the past, explained Vianna. Third-party verified data is foundational to building trust.

• Scalable. Lack of measurement standardization hurts scale. Simple metric defi nitions and consistency across networks will allow marketers to speak the same language, Vianna said.

• Actionable. Moving from purchase attribution to telling the story of incremental sales.

Retail media is akin to a very high-level sport, said Claire Wyatt, reflecting on her career with retail media network Roundel and now with Albertsons Media Collective as vice president of business strategy and marketing science. “It feels like you have to show up every day and be very aggressive [and] you kind of fall a lot,” she said.

If you examine retail media’s emergence and evolution over the years, the fi rst wave of retail media in the U.S. began with a focus on monetizing a retailer’s own digital properties (solutions like onsite search and display) and driving gross margin. “Retail media 2.0” was a pivot to retailers operating more like a media publisher.

“Retail media 3.0 is a complete integration of the entire business that perpetuates the flywheel of retail media,” Wyatt said. “It is ... [about] how do you gather as much data about your customers, in a very privacy-focused way, as quickly as possible, and then use that data to then monetize what we now call retail media — but my expectation is, in the future, it’ll be something different and something even more data-centric.”

Expanding on this, Wyatt highlights how retail media is not just a media channel (with solutions on retailer-owned properties), but also a layer that supports other channels. First-party data from RMNs can be leveraged for targeting and attribution on digital ad channels such as Roku, Facebook and Google.

Retail media is not just a media channel, but also a layer that supports other channels, says Albertsons Media Collective’s Claire Wyatt.

“When we talk about spend shifting into retail media, it is somewhat shifting to retail media from other channels, but it is actually really a different way to activate those channels,” Wyatt explained.

The value proposition of a retail media network is closedloop measurement and audience data, Wyatt said. When it comes to measurement, there are three key considerations for Albertsons:

• Closed-Loop Measurement. The importance of being able to tie the advertising (inclusive of online and in-store) to a sale. (If this is an issue, Wyatt advised leveraging third-party partners for help.)

• Incrementality. Incremental return on ad spend (ROAS) showcases the true impact of media. There are various methodologies to incrementality measurement but, the most important is not which is employed, but rather an RMN’s transparency with its clients, Wyatt said.

• Key performance indicators (KPIs) tied to objective As retail media moves up the funnel, it’s important to add more KPIs than just ROAS. KPIs like “new customer” or “customer lifetime value” will become more popular as retail media networks expand into more awareness channels.

When considering campaign objectives, such as awareness and sales, there are related and appropriate strategies, channels and KPIs. A campaign with an upper-funnel, awareness objective, for example, should not have ROAS as a KPI, but instead a KPI such as “new to brand,” Wyatt said.

When it comes to in-store retail media, the shopper experience needs to be top priority, according to Chris Riegel, chief executive officer of Stratacache, a global in-store retail media, digital signage and advanced sensor solution provider.

“We walk into retailers around the globe all the time [asking,] what are you trying to accomplish? ‘I want more money.’ Cool. Wrong, but cool. How are you going to improve that customer’s journey ... should be the question,” Riegel said. “Improve her experience in-store. Help her achieve that strategic goal and give her a reason to come back to your store more frequently to have a better experience.”

Riegel highlighted a few solutions and examples to engage with shoppers in-store, including entryway kiosks displaying a

touch-enabled circular and custom promotional content, and digital, interactive fi xtures that offer product comparison, selection, and education similar to an e-commerce site.

He also shared a retail media three-point plan for retailers to consider. First, they should decide on whether they want to build a shopper marketing or digital out of home network. There are categories where DOOH makes sense (billboards, etc.), but if they want to build a shopper marketing network, they need to own that customer journey, Riegel said.

“I ask retailers all the time, ‘Who is your competition when you’re selling a shopper marketing network?’ It’s not Loblaws

Who is your competition when you’re selling a shopper marketing network? ... You’re competing with TikTok, you’re competing with Meta, you’re competing with Google.

Chris Riegel, Stratacachecompeting with Sobeys or Kroger competing with Walmart competing with Target. You’re competing with TikTok, you’re competing with Meta, you’re competing with Google,” Riegel said. “The difference is you have the shopper in your store and you have the product on your shelf and the ability to convert that sale. They do not.”

Additionally, Riegel emphasized having digital screens instore is simply not enough and a measurement infrastructure needs to be in place from the start. He also encouraged executives to start having dialogues with their loyalty and shopper insights teams to implement a streaming/CTV strategy.

Wrapping up his takeaways for the audience, he highlighted:

• Embrace customers as audiences in store and at home.

• The use of in-store media networks onsite and CTV offsite can open new paths to high-margin revenue that can significantly impact a company’s bottom line.

• All uses of media should enhance a shopper’s experience and yield a more successful journey.

There’s no question that retail media has become the media darling. Sharing results from a “Canada Retail Media 2024” study eMarketer produced in conjunction with the IAB Canada, Sonia Carreno, IAB Canada president, highlighted a few insights that painted a picture of the current Canadian retail media landscape:

• Search will account for 65% of retail media ad spend this year. (“That’s no surprise,” Carreno said. “We’re very

comfortable with the fact that retail media plays a lower-funnel role in most of our media spending and it feels like the sure thing. It feels like it’s contextually relevant. It feels like it’s going to have a high ROAS, and I think that’s a very Canadian approach.”)

• 35% of retail media ad spend will be directed to display and video in 2024.

As part of the study, the top media buyers in Canada were also asked what the most important attributes are when buying ads in retail media.

“Traffic quality” was cited as the most important attribute, Carreno said. “I suspect that Canadians are looking at this from a lower formal opportunity lens,” she added.

Among some of the opportunities and challenges to work through within the Canadian market:

• Conservative attachment to lower-funnel performance advertising.

• First-party data jitters with new regulations in Quebec requiring consents and more rules to come.

• Tech stack limitations (self-serve platforms are coming, Carreno said, but not at the speed and scale of the U.S.).

From organization mapping to emerging trends and strategies in the space, executives from Threefold, Keurig Dr Pepper and Google Canada shared their insights and positions on a variety of topics for a panel discussion examining the current retail media landscape in the U.S., Canada and across the globe.

Considering retail media’s defi nition, Richard Rodgers, Keurig Dr Pepper Canada’s marketing director – Keurig, said he approaches it as an

enabler for a seamless omnichannel experience, allowing for personalized consumer experiences when they’re in the shopping mindset. Building on Rodgers’ comments, Sean Crawford, managing director, North America, Threefold, emphasized the shopper is (or at least should be) at the heart of retail media.

“Retail media is not ad sales,” Crawford said. “I think if we put shoppers at the heart of everything that we’re doing, that’s the true defi nition of retail media. And it’s important that any marketing we do helps, absolutely, enhance their experience — whether that is in store or on [a retailer’s] website.”

As far as organizational mapping, Rodgers shared omnichannel efforts were being pushed internally at his company even before the COVID-19 pandemic, which only accelerated and forced the issue. Traditional shopper marketing and digital shelf teams merged and, most recently, the brand marketing team was brought into the mix (keeping the function separate but under one leadership).

I think if we put shoppers at the heart of everything that we’re doing, that’s the true definition of retail media.

— Sean Crawford, Threefold

“I think there’s a lot of organizations that are interested in doing that or exploring that,” Rodgers said. “We’re lucky enough to [have taken] that plunge, and it’s been very successful for us and we anticipate other companies will follow.”

Emphasizing the importance of brand presences and engaging shoppers across the path to purchase, John Fanous, head of omnichannel retail, Google Canada, shared that during the course of the 40-minute panel there will be 7,300 searches for shampoo and 3,000 videos viewed on YouTube on how to get lustrous hair. Moreover, he also shared that a third of Canadian consumers are actively seeking out an alternate brand to the one that they are used to buying.

“That means a lot of opportunities. Also, means a lot of risk,” Fanous said. “Retail media’s ability to actually leverage the knowledge of the customer to essentially bring the right message to the right customer has never been more important.”

Gen Z is a unique demographic and more multicultural compared to previous generations. They grew up in the age of the internet and social media. Many understand AI and the problems facing their future, like climate change and social issues, and their behavior as consumers is shaped by the reality and cultures they’ve grown up with.

While the majority of consumers think clean labels are important, Gen Z (along with Millennials) are the strongest advocates. Gen Zers plan to buy more of these products in the future, support more legislation and want retailers to provide these products and defi ne what “clean” means.

According to Acosta Group’s 2024 Clean Label Insights study focused on the food/beverages category, some notable stats include:

• 55% of shoppers (72% of Gen Z) believe more regulations are needed.

• Gen Z and Millennials particularly value natural or certified organic products.

• Younger consumers primarily cite health benefits as the driving force to these products.

• 70% of all shoppers want retailers to help them understand clean label products.

In terms of clean beauty/personal care products, Ulta’s latest ESG report (2022) indicated that:

• Over 50% of Gen Z look closely at ingredients prior to making a purchase.

CURRENT AGE RANGE: 11-26

DISPOSABLE INCOME:

PERCENT OF U.S. POPULATION: about 21% $360 billion (as of 2021, per Bloomberg)

• 90% of Gen Z and younger Millennials are interested in purchasing clean beauty products in the future.

Gen Z consumers are also leading another pivotal shift. According to a U.S. consumer study from marketing platform SOCi Inc., traditional search engines like Google and Bing no longer reign supreme among this age demographic. Instead:

• 67% of Gen Zers (or in this study’s case, 18- to 24-year-olds) favor Instagram.

• 62% favor TikTok.

• 61% favor Google Search, which is still the undisputed search engine champ for older generations.

• 58% of Gen Z in the U.S. begin their online product searches on Amazon and 43% start on Walmart.com, according to a February 2023 Jungle Scout survey.

• One in three Gen Zers have bought from an influencer-founded brand in the past year, according to eMarketer.

• Nearly a third of Gen Zers bought or planned to buy their 2023 holiday gifts on TikTok Shops, per CivicScience research.

• 67% of Gen Z fi nd brand purpose important or critically important to maintaining brand loyalty, according to Marigold’s 2024 Consumer Trends Index.

• 52% of Gen Zers in the U.S. and U.K. say they are likely to switch retailers for checkout-free stores, according to 2023 research from Avery Dennison.

• That same study found that 49% say they would likely spend more at a retailer with a connected or automated checkout experience.

Bob’s Red Mill customized its approach with key retailers this year in a cohesive campaign for its rolled oats products.

The “Start with the Best Oats” campaign, which ran from Jan. 10 through March 24, combined the brand’s media and shopper marketing efforts for the fi rst time. The program was created by agency Blue Chip with the goal of increasing sales with high potential shoppers and priority retailers such as Albertsons Cos., Kroger and Walmart.

The brand sought health-conscious women ages 25 to 54 with a high propensity to be future Bob’s Red Mill consumers in the Florida cities of Miami and Orlando as well as locales such as Baltimore, Boston and Hartford, Connecticut.

“We can grow substantially by outsmarting, not outspending, our category competitors,” says Ally Borozan, Bob’s Red Mill chief growth officer and leader of the brand’s revamp. “We are unifying our marketing to give our best consumers a consistent, relevant brand experience that supports their complete product journey. One audience, one agency team and one focus give us significantly more punch.”

The brand’s integrated media strategy relied on video to tell the story, audio to drive traffic and paid Facebook and Instagram placements for food curiosity and inspiration. Offsite display ads on websites such as Allrecipes.com were used for retargeting. Near-store and in-store media rounded out the mix to drive sales.

Photo and video creative from the Bob’s Red Mill team highlighted the value of the oats’ premium taste and texture. In Kroger chains, a SmartSource shelf talker positioned next to Bob’s SKUs had detailed oatmeal imagery and “the best breakfast is in the blue bag” messaging. The campaign’s offsite display ads were used to court curated audience segments based on fi rst-party data from 84.51.

Bob’s prioritized incentive-based platforms such as Prodege for Walmart’s price-conscious shoppers. Then at Albertsons, an ongoing sales lift study will test iROAS for future campaign considerations.

“Engaging potential consumers from their kitchen to the breakfast aisle is key to growing household penetration in the crowded breakfast category,” says Erich Parker, senior vice president, integrated media, at Blue Chip. “By meeting consumers wherever they are on their path to the aisle, we can build brand health, motivate purchase and increase the lifetime value of Bob’s Red Mill consumers.”

Engaging potential consumers from their kitchen to the breakfast aisle is key to growing household penetration in the crowded breakfast category.

Erich Parker, Blue Chip

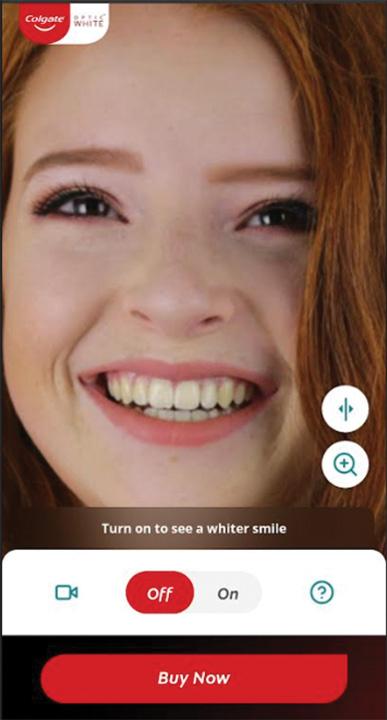

THE BRAND HAS PARTNERED WITH PERFECT CORP. TO ENGAGE CONSUMERS ON SMARTPHONES.

BY CHARLIE MENCHACAColgate-Palmolive plans to expand use of an augmented reality tool that goes beyond superficial claims of whiter teeth.

Colgate worked with Perfect Corp., a beauty and fashion tech solutions provider, to launch its Teeth Whitening Virtual Experience in the fall of 2022. Since then, the manufacturer has seen a more than 40% increase in consumers clicking “Buy Now” buttons associated with the product, according to a written case study.

The AR-powered function simulates results that might be achieved from using the Colgate Optic White overnight teeth whitening pen after two weeks.

“As a science-based company, Colgate wanted to provide consumers with a realistic augmented reality experience so they could see for themselves the difference that our whitening products can make for their own teeth,” said Gary Binstock, director of technology, strategic innovation and technology alliances, at Colgate-Palmolive, in the case study. “We needed an AR system that reflected what our researchers had found in laboratory settings.”

The experience was developed through extensive research and collaboration between Colgate scientists and Perfect Corp.’s engineers. Perfect worked with the scientists to integrate a specialized algorithm to bring vivid results to life through AR simulation.

While most consumers access the virtual experience through Colgate’s website, the company also is expanding access on an omnichannel basis, including on-pack QR codes. The tool was initially promoted in earned media coverage and on Colgate’s corporate news blog.

“We can embed access through our URL on retailer websites or by placing QR codes on product packaging, or on retail shelves and displays,” Binstock said in the study. “We have many ways to invite consumers into our virtual experience.”

The intent to purchase actions have been strong compared to any kind of standard engagement. Colgate found consumers stay on the company’s Whitening Hub website longer when they engage with the virtual tool.

“Our AR experience captivates consumers and they are spending more time on our site, including reading about products and watching videos,” Binstock said in the study. “All of this makes it easier for them to decide on making a purchase.”

Colgate looks to extend the virtual experience to other Optic White products and roll the AR visualization out to additional global customers.

As a science-based company, Colgate wanted to provide consumers with a realistic augmented reality experience so they could see for themselves the difference that our whitening products can make for their own teeth.

Gary Binstock, Colgate-Palmolive

Heartland Food Product Group’s Splenda is leveraging hot and timely topics for successful results across channels.

The brand worked with The Krazy Coupon Lady (KCL) to promote its Peel & Pour product in various campaigns over the past year. Although the campaigns last only one or two weeks at a time, they center on trends that keep Splenda top of mind for consumers.

“We use KCL as a way to endorse our products through authentic content and drive trial,” said Olivia Malatestinic, Heartland social media specialist, in a written case study. “When we need to not only drive awareness but also get in front of consumers who are ready to take action, we turn to KCL.”

A campaign for Splenda Peel & Pour in June last year set out to bolster brand recognition, generate sales and increase foot traffic at Giant, H-E-B, Publix and ShopRite stores. The brand offered a SmartSource coupon for $3 off any Peel & Pour six-pack. There was also in-store signage in more than 6,000 stores and an FSI with “try for $0.99” messaging.

The KCL editorial team wrote a post for the campaign to align Splenda with #Watertok, a trend that debuted on the TikTok social media platform in April 2023. The focus is on enhancing water with flavorings to encourage consumption. The campaign utilized Facebook, Instagram, email and text messages.

Instagram story posts tied to the campaign delivered 769,000 impressions, four times the original estimate, according to the case study. A Facebook post for the campaign

delivered 476,000 impressions, and the editorial post delivered 386,000 impressions. In all, the program saw a 48% sales lift, says Summer Beale, Heartland associate shopper marketing manager.

A two-week campaign this February to promote Peel & Pour at Walmart had a 214% sales lift. This time, KCL tied in to Galentine’s Day, which is a holiday dedicated to celebrating female friendship and a play on Valentine’s Day. The content encouraged consumers to make day drinks using Peel & Pour products and sip them from the popular Stanley brand of tumblers.

KCL’s content also plugged a monthlong deal ending March 1. Shoppers that purchased six-count packs of Peel & Pour at Walmart received $5 cash back after scanning their receipt in the Ibotta app.

Although the Galentine’s Day campaign did not have any in-store activations, the campaign had a presence across text messages, newsletter, Facebook, Pinterest and TikTok, Beale says.

BY THE NUMBERS

The demographic reach of The Krazy Coupon Lady’s June 2023 Splenda campaign was:

89% 30% 33%

Women Ages 35-44 Ages 45-54

Marlborough, Massachusetts-based BJ’s Wholesale Club is the third largest warehouse club chain in the U.S., operating 244 clubs and 175 BJ’s Gas locations across 20 states (as of March 7).

The fi rst BJ’s club opened in New England in 1984. It remained unique to the East/Southeastern Coast up until the early 2000s, when it expanded into parts of the Midwest, (i.e., Ohio, Michigan and Indiana). More recently, BJ’s expanded further in the South, opening clubs in Tennessee and Alabama for the fi rst time in 2023, while also continuing to grow its footprint in existing territories. In early 2025, BJ’s plans to open its fi rst Kentucky location in Louisville.

BJ’s clubs range in size from 44,000-177,000 square feet, usually based on how dense/populated a market is, though the typical size is around 100,000 square feet. The clubs carry a notably slimmer product selection compared to supermarkets or supercenters, roughly 7,000 SKUs, comprising both brand name and private-label items.

BJ’s clubs offer two divisions: grocery and general merchandise/services. Grocery makes up about 85% of the retailer’s annual sales, while general merchandise and services (e.g., small appliances, TVs, electronics, seasonal goods, etc.) make up about 15%.

The Path to Purchase Institute recently visited a few BJ’s locations in Florida. The clubs offer ample fresh foods and produce, a full-service deli, household essentials and pet supplies as well as a selection of local products.

While most clubs follow a similar format, they do differ from Costco and Sam’s Club. For instance, the retailer sells 50% more fresh food per member each year than its channel rivals. It also heavily promotes its food and household offerings in an effort to compete more directly with supermarkets.

BJ’s also has enhanced its product assortment in recent years after reinventing its fresh offerings in 2022. The retailer also made moves to drive own-brands penetration and expand into high-demand categories, including better-for-you snacks, fitness, recreation and seasonal products.

Also, unlike channel rival Sam’s Club, pallet skirts are still very prevalent in BJ’s stores. (Sam’s banned pallet base wraps in 2018 due to low ROI.) Many BJ’s pallets are also typically slightly shorter than a traditional 52-inch pallet to stack a larger variety of products.

BJ’s also generally accepts more manufacturer-supplied P-O-P materials than Sam’s Club and Costco, including pallet displays/skirts, stanchion signs, shelf trays, demonstration/sampling kits, neckhangers, take-one dispensers, wall banners, floorstands and inflatables.

One popular and plentiful space for brands to take over are display rolling racks positioned on the side of endcaps, facing the aisle, usually coupled with a branded sign and shelf trays/cases. These spots are often used as secondary

merchandising space, usually stocking a smaller number of SKUs, and sometimes featuring account-specific signage.

Some account-specific displays also depict QR codes linking to branded sites or BJs.com, including one spotted during our visit from General Mills’ Blue Buffalo that linked to a product video via a BJ’s QR code.

There are not only rolling racks, but sometimes other displays, including one permanent co-branded metal display rack by BJ’s and Procter & Gamble’s Gillette stocking Gillette razors with branded shelf trays and signs.

Additionally, in-aisle merchandising space can be used to showcase out-of-box products next to boxed SKUs.

BJ’s also runs routine retailer-led promotions incorporating brand involvement and account-specific activations in stores, providing an opportunity to dangle savings to members.

In other 2023 activity, BJ’s teamed with Simbe Robotics to roll out the tech company’s Tally inventory analysis robots chainwide. The robot’s cameras and AI roam the stores and collect real-time data, ensuring products are stocked, shelved correctly and priced accurately.

Each year since 1994, the editors of the Path to Purchase Institute have selected three industry leaders for induction into the Hall of Fame. From their daily business practices to the work they produce, these honorees represent the very best of the commerce marketing industry. Collectively, these professionals have proven that they don’t just follow the path to purchase; rather, they help build it. The 2024 inductees are:

Tammy Ackerman, Treasury Wine Estates

Stephen Bettencourt, CVS Health (page 22)

Pamela Velarde, Mattel (page 25)

For a complete list of Hall of Fame inductees, visit P2PI.com/HallofFame

Tammy Ackerman believes in the power of storytelling. It’s a skill she learned while in college, and one she has continued to master throughout her professional journey.

Over the past three years at Treasury Wine Estates, Ackerman has led entrepreneurial efforts to build the foundational knowledge, digital infrastructure and continuous process of testing, learning and sharing retail e-commerce best practices, while creating a strong bond among crossfunctional teams and fostering progress within the company.

She tells stories through her work to affect change, and she encourages those around her to do the same. “In business, storytelling is the catalyst that transforms ideas into impact, connects brands to hearts, and turns vision into reality,” she says.

Ackerman is the company’s vice president of retail e-commerce, responsible for leading a three-tier e-commerce department that includes strategy, insights, activation, performance media and trade business planning.

Ackerman’s personal journey began in Taipei, Taiwan, where she was the oldest child born to hard-working parents. She and her family moved to Los Angeles when she was 6, and along with learning English before she could go to kindergarten, she recalls navigating cultural differences throughout her childhood — an experience that heightened her awareness of diverse backgrounds and perspectives.

Her journey into the workforce began in high school. From her fi rst job at a movie rental store, she says she “found the appeal of working, earning and gaining independence irresistible.”

Ackerman was the fi rst of her large immigrant Chinese family to go to college when she entered UC San Diego to study political science. “The program’s emphasis on writing assignments significantly honed my writing and storytelling skills that I still use today,” she says. She then went on to earn an MBA in marketing from the University of San Diego.

Ackerman’s post-graduate career took her into the world of fi nancial services at John Hancock for a few years before she took a job as an expansion coordinator for her collegiate co-ed business fraternity, and then as an events coordinator for the Senior Olympics.

She briefly considered pursuing other nonprofit work, but something still didn’t hit home. These “detours,” as she calls them today, helped her understand where she didn’t want to land long term, and gave her a basis for mentoring others in their own search.

Ackerman’s next move was as a marketing associate at San Diego beer wholesaler Mesa Distributing Co., where she gained experience collaborating with suppliers such as Miller Brewing, Sam Adams, Heineken and Tecate.

It was the beginning of her work in beverages and her fi rst role that focused on the consumer journey. “I just fell in love with the whole process of how to get a product marketed and distributed to a consumer at the end,” she says.

After a few years, she joined Miller Brewing Co., fi rst as an on-premise sales manager in California and later as a local marketing manager in Pennsylvania, which became the top-performing designated market area in the U.S., earning her team the Frederick Miller President’s Award in 2006. “Despite not being a major market at the time, we surpassed much larger markets, making it a momentous win for the entire team,” she notes.

Her next stop at PepsiCo broadened her consumer and retail expertise when she was charged with overseeing brands such as Pepsi and Mountain Dew across 14 states on the East Coast. Her responsibilities included aligning franchise bottlers on forecasting as well as merchandising,

Follow your passions with experiences and exposure to things, and then prioritize relationships, stay tech-savvy and always keep the consumer at the forefront of your decisions.

innovation product launches, and achieving core portfolio sales targets. “Collectively, these roles equipped me with the skills to adeptly partner with wholesalers, drive profitable growth for both established and emerging brands, and execute large-scale and grassroots marketing campaigns,” she says.

In 2010, wanting to transition from the East Coast back to California, Ackerman joined Treasury Wine Estates as a trade marketing director. Her passion for wine combined with her marketing experience made it a great fit. She held the role for two years and then assumed two brand management positions, one in innovation and then a global role for the company’s Beringer brand.

In this role, her team was faced with the challenge of demystifying wine for shoppers. Collaborations with agency TwinOaks to develop the Beringer Taste Station — a non-alcoholic wine sampling station at shelf dispensing taste strips — drove double-digit category growth, increased shelf dwell time and attracted new wine

consumers. For its efforts, the team earned a 2016 North American Effie.

Her next roles within TWE were director of marketing services and then senior director marketing strategy and capability, leading efforts in strategic planning, insights, innovation, process and capability across eight brand marketing teams.

At the end of 2017, she left the company to join Mezzetta, take on a new challenge of building their shopper and e-commerce capabilities, and broaden her expertise in a category outside of CPG.

Just over a year later, a new opportunity arose at TWE that Ackerman couldn’t pass up. Michelle Terry, then global CMO, created a marketing and sales execution role for her that was the largest team leadership opportunity of her career, overseeing a total of 32 professionals across five departments. She was in this role for less than a year when the pandemic hit. A staunch advocate for increasing the company’s e-commerce activities, Ackerman credits Carl Evans, CMO, and Ben Dollard, president of the Americas, with contributing thought leadership, allocating dedicated resources and underscoring the significance of three-tier e-commerce in the company’s overall sales and marketing strategy.

It was then that Ackerman assumed her current post.

Today, Ackerman says her most impactful work involves leading highperforming and diverse teams across various marketing disciplines as well as building on the development of TWE’s e-commerce capabilities. “This journey, marked by personal and professional growth, involved collaboration with key internal and external team members to create a new capability from scratch, significantly impacting our overall business,” she says.

Ackerman has served on the BevAlc Commerce Initiative (BACi) Advisory Board since its inception. The Path to Purchase Institute industry share group was established to unite thought leaders in the BevAlc industry, fostering a comprehensive understanding of integrated omni-commerce strategies. She has witnessed the group’s evolution in addressing the intricacies of marketing in the three-tier system.

“In the fiercely competitive BevAlc industry, having a dedicated forum to discuss industry-wide impacts is invaluable,” she says.

Although still in its early stages, the group’s potential for growth is vast, Ackerman believes. “What excites me is our members driving the agenda, positioning our group at the forefront of identifying trends, capabilities, and best practices for enhanced shopper engagement and brand growth opportunities,” she says.

This year will bring with it proprietary research, learning labs, discussions and an in-person meeting — all in an effort to shape the future of the industry through collaboration, shared insights and innovation. She is committed to actively contributing to the momentum of BACi, engaging with senior leaders across beer, wine and spirits categories to establish online marketing standards and best practices that will elevate the entire sector.

Going forward, Ackerman will continue to work to enhance TWE’s internal omnichannel commerce capabilities. “The evolving market landscape, coupled with shifting consumer behaviors, necessitates a seamless integration of physical and digital activations for a unified brand engagement,” she says. “Addressing where, how and when consumers purchase wine, as well as their dynamic expectations for brand content, is crucial for our success.”

She is also committed to sharing her knowledge and experiences with others coming up in the industry. As a senior leader, she sees mentorship as essential and says witnessing professionals grow through this process is highly rewarding.

Her biggest pieces of advice are this: cultivate continuous learning and development. In other words, continuously ask questions, seek knowledge and be aware of emerging trends. “Construct a personal development plan that transcends mere title advancements, measuring your career progression by the exposure to projects and experiences that challenge you, allowing for continuous skill expansion,” she says.

Also important is to embrace non-linear paths. Forget the job title, she says, and be open to career trajectories that may not seem straightforward because roles on crossfunctional teams can significantly broaden anyone’s skill set and enhance overall business acumen. “Follow your passions with experiences and exposure to things, and then prioritize relationships, stay tech-savvy and always keep the consumer at the forefront of your decisions.”

TITLE: Vice President, Retail E-Commerce COMPANY: Treasury Wine Estates

Team Member: Kelly Winkler, retail e-commerce manager.

Career Path:

Treasury Wine Estates, Vice President, Retail E-Commerce (2020-present); Vice President, Marketing & Sales Execution (2019-2020)

Mezzetta, Director, Shopper Marketing & E-Commerce (2018-2019)

Treasury Wine Estates, Senior Director, Marketing Strategy & Capability (2017); Director, Marketing Services (2015-2017); Senior Global Brand Manager, Beringer (2013-2015); Senior Brand Manager, Innovation (2012-2013); Trade Marketing Director (2010-2012)

PepsiCo, Northeast Marketing Manager (2008-2010)

Miller Brewing Co., Local Marketing Manager (2006-2008); On-Premise Sales Manager (2005-2006)

Mesa Distributing Co., Marketing Associate (2003-2005)

Velocity Investment Group, Director, Sales & Marketing (2001-2003)

Alpha Kappa Psi Professional Business Fraternity, Expansion Coordinator (1998-1999)

John Hancock Life Insurance Co., Marketing & Compliance Officer (1996-1998)

Industry Activities:

BACi Advisory Board Member

Conference Speaker at P2PI Live & Groceryshop

Volunteer at Marin Foster Care Association

Room Parent at her son’s school

Education: UC San Diego, Bachelor’s, Political Science; University of San Diego, Master’s, Marketing.

Stephen Bettencourt fully appreciates the power of rebranding. Although he has both undergrad and graduate degrees in management science, a college professor opened his eyes to the world of marketing research, and from then on, he had a new passion.

His career has taken him to both the brand and retailer side, and he’s leaned heavily on insights to lead companies’ positioning efforts, often a momentous task that he takes very seriously. “It is intended to be the North Star that everything is built off of,” he says. “It informs everyone internally on the key audience(s), what the brand stands for, and how we go to business.”

As CVS Health’s executive director of enterprise brands and retail insights, Bettencourt is charged with overseeing the brand identity, creative and advertising testing for the CVS Health family of brands as well as consumer insights for the CVS Pharmacy retail stores that are in local communities across the United States.

Bettencourt grew up in a small town in Massachusetts in a three-generation household that included his grandmother, his parents and two siblings. He describes his childhood as a “simple, happy life where our parents taught us the value of honesty, trust, kindness and hard work.” His dad worked for the Norfolk County Sheriff ’s department, and his mom in the local elementary school.

His teenage years consisted of mowing lawns, watching neighborhood pets and then working at a local grocery store and a nursing home. But his next job at Lifeworks Inc., a workshop and group home that provided jobs, housing and recreation for adults with development and intellectual disabilities, made an indelible impression on his life.

First hired at the workshop, Bettencourt went on to work at the group home in Foxboro, Massachusetts, for 13 years. He worked full time at the group home while attending Bridgewater State University, then moved to a part-time position and weekends only after he graduated. The home was situated in a residential neighborhood, and he says it was a fun and fulfi lling job caring for the men who lived there. “They were simply living their life and just needed a little help, support and compassion as they moved through their day,” he says.

It wasn’t until he was an upperclassman at Bridgewater State that he took a marketing research course and worked with his classmates on a local research project. Urged to take a sales course the next semester with the same professor, Bettencourt was able to fi nish the research project and, from that point on, knew that he wanted to target research roles in his career.

Bettencourt’s fi rst stop was at Hill Holliday in an entry-level research manager role. It was through connections there that he grew his early career, he notes. After four years, he went to Arnold Worldwide as an account planner for a short time, and then landed at FleetBoston Financial in brand/consumer insights for nearly seven years. It wasn’t until the company was purchased by Bank of America and all senior level positions were moving to North Carolina that he started looking for his next opportunity. At the time, Stop & Shop was repositioning and reinvigorating its

Using insights to build, refine and pressure-test the brand positioning is so important. Every word matters, and it all conveys the purpose and meaning behind the brand.

brand. He joined the company with a handful of others to make a new insights team, and started his fi rst foray into retail.

This was where the proverbial rubber met the road for Bettencourt. From what became his fi rst of two tenures at Stop & Shop, he has spent his career looking through a retail lens, “understanding consumers, how they shop, how they navigate and what is important to them,” he says.

And while the same tenets are still in place that have always been — the right price, the right assortment, ease of shopping — from an insights standpoint there are so many more ways to “get at it,” he notes. “Technology is playing a much larger role, and over time as I started integrating eye tracking, galvanic skin testing, facial coding, etc., it really started to lead us to different answers and understanding different parts of the store and their role.”

After five years, Bettencourt seized an opportunity at The Hershey Co. “They were putting together an entire crossfunctional team to work on CVS,” he says, including sales, category management and shopper marketing. “They wanted shopper insights to round out the CVS team and help them drive not only the confection but total customer satisfaction.”

Bettencourt joined Bob Goodpaster and Susan LaPointe, who were starting up a new department focused on shopper insights. “This insights role worked between Hershey and many of the major retailers in the U.S.,” he says. “My goal was to help retailers understand their shoppers and the in-store experience, and identify opportunities to please shoppers, enhance the experience and grow the retailer’s total confection business.”

The new holistic approach brought with it a steep learning curve. “It wasn’t enough to just do great marketing research,” he says. “The role required that we put ourselves out there because we needed to show the retailers the power of the role and the type of insights that could be generated to significantly grow their business.”

The team started to make a large impact on both the retailers’ and Hershey’s business. With that, the insights function grew

quickly, and so did Bettencourt’s responsibilities. He started as the shopper insights lead on CVS and Kroger, then within two years had additional responsibility for the dollar channel and all retailers in Canada. Eventually as director of shopper insights, he led a team that was dedicated to the largest retailers in North America.

With an opportunity to build yet another insights department, Bettencourt made his way back to Stop & Shop after eight years at Hershey. He served as director of consumer insights for four years before becoming the consumer insights lead for Stop & Shop at Peapod Digital Labs through consolidation efforts within Ahold Delhaize. Less than a year into that role, he moved on.

At this point in his career, Bettencourt was an experienced leader in helping companies rebrand and reposition themselves. A role opened at CVS Health for an insights lead on CVS Pharmacy that would focus on retail insights for the company. Bettencourt assumed his current post in January 2022, helping the retailer redefi ne the role of retail and how it can enable health and wellness and even help redefi ne healthcare, he says. “CVS has an ambitious focus on customers, patients and colleagues and working toward evolving healthcare.”

Today, his insights teams fall under one of three umbrellas: enterprise brands, front of store, and pharmacy. His main focus is on looking across the CVS Health brands to understand their overall positionings and value propositions, stressing that the brand personality and voice needs to be clear and consistent.

“Using insights to build, refi ne and pressure-test the brand positioning is so important,” he says. “Every word matters, and it all conveys the purpose and meaning behind the brand.” The goal of any rebranding effort is to communicate the focus to everyone who touches the brand. “The weight of trying

TITLE: Executive Director of Enterprise Brands and Retail Insights COMPANY: CVS Health

Team Members: Direct reports: Whitney Orwig, Director of Front Store Retail Insights; Caron Merrill, Director Pharmacy and OTC Insights; Emily Hodges, Director Enterprise Brands; eight team members total.

Career Path:

CVS Health, Executive Director of Enterprise Brands and Retail Insights (2022-present)

Peapod Digital Labs, Consumer Insights Lead, Stop & Shop (2021-2022)

Stop & Shop, Director of Consumer Insights (2018-2021)

The Hershey Co., Director, Shopper Insights, U.S. and Canada (2015-2018); Shopper Insights, U.S. & Canada (2010-2015)

Stop & Shop, Brand/Consumer Insights (2005-2010)

Bank of America, Brand/Consumer Insights (1998-2005)

Arnold Worldwide, Account Planner (1997-1998)

Hill Holliday, Project Director, Marketing Research (1994-1997))

Industry Activities:

Member, Advisory Board, Path to Purchase Institute

Member, Advisory Board, Chadwick Martin Bailey

Organizer, Trend Days

Member of share groups with CPG companies, subscribing to Coogan Partners

Volunteer, Eliot Human Service of Boston

“Neat Neighbor Award” recipient from the City of Quincy, Massachusetts

Education: Bridgewater State University, Bachelor’s, Management Science; Eastern Nazarene College, Master’s, Science Management, Management Leadership.

to get that really right, clear and impactful is a challenge, but exciting,” he says.

He is most proud of the work his team has done to help marketing, store design, merchandising and senior leaders develop a deeper understanding of CVS Health’s retail consumers. One way his team is doing that is through customer immersion sessions between senior executives and customers/ patients. “We take off our business hats and they stay in their consumer role,” he says. Pairs go on shopping missions and reconvene to share experiences or listen to speakers on a variety of topics to understand what the company could be doing in the places it offers care.

Bettencourt has repeatedly seen the lasting impression these sessions have on senior leadership. “It helps them stay very closely aligned to the mindset of our audiences,” he says. “We’ve helped to develop an internal understanding of what motivates shoppers, who our competitive set is, and what we need to do to win shoppers and grow the business.”

The company is responding with changes across the business, with his team embedded throughout the process, Bettencourt says. “It’s gratifying to see the changes that CVS is creating are working. Consumers are responding favorably, and many are resulting in increased trips and unit movement — a fi rst indicator that consumers are recognizing and appreciating how CVS Pharmacy is evolving.”

Bettencourt says his team is increasingly adding technology into its insights work, most recently incorporating neuroscience to understand the impact store changes have had on nonconscious perceptions of the CVS Pharmacy brand. The team is collaborating with research company partners to discuss the role of AI and how it can start to incorporate the technology into overall concept testing and message development. “It’s feedback that consumers can’t articulate,” he says. “Even if they tried to guess, they’d lead us in a different direction.”

He and his team are also working with the neuroscience team at NielsenIQ, using EEG caps to monitor consumers’ brain activity in relation to their work. “We can tell what elements of our new store are really driving a brand connection,” he says. “That’s just something you can never ask consumers.”

Pamela Velarde is a longtime believer that change is the only

constant. It’s a guiding mantra for her in many ways.

A classically trained engineer, she found success in her early career working as a product engineer. But she lacked a true passion for her work. She knew her strengths in numbers and analytics, and used business school as her fi rst step in a new direction.

Today, as vice president of omnichannel retail marketing at Mattel, Velarde leads the team that is responsible for retail strategy and promotional strategy/execution across all retailers in both stores and dot-com (commerce through Mattel’s websites), e-commerce and retail media, as well as instore space analysis and optimization — work that she says is changing every day.

A native of Cusco, Peru, Velarde was raised by a civil engineer father and an educator mother who opened her own school, combining her love of teaching and her entrepreneurial nature. The oldest of three children, Velarde was the fi rst to move away from her hometown, initially to the capital city of Lima, but then to the U.S. amidst terrorism occurring in Lima at the time.

Extended family took her to California, where she earned her computer engineering degree from UC Irvine and held internships that included programming Johnson & Johnson sterilization machines and writing code to solve the Y2K problem for an auto loan provider. After graduating, she began a seven-year tenure at Skyworks Solutions as a product engineer and earned a master’s degree in electrical engineering, also from UC Irvine.

With business school in her sights, Velarde secured a full fellowship to The Wharton School at the University of Pennsylvania. She earned an MBA in strategy and marketing and then worked as a consultant at The Boston Consulting Group in New York, where she honed strategic skills while working in many different industries.

But a part of her always wanted to get back to Los Angeles, in part because her parents and brother had also moved from Peru to Orange County by that time, in search of a better life for her disabled brother.

Looking back, Velarde says she’s always been intrigued by big brands. Barbie dolls were a favorite childhood toy, and she’d always seen toy giant Mattel as a dream job. When a position opened in international strategy, she jumped in with both feet and moved across the country once again.

Velarde’s fi rst work at Mattel was a broad international strategy assignment that took her to China to visit homes and conduct interviews, and it resulted in partnering with the Mattel Barbie marketing team to launch the fi rst Chinese localized Barbie line. “We worked to understand shoppers and consumers, what they wanted, and found that we needed to be

tailoring the brand’s product and messaging to the shopper,” she says. “Many times, you don’t see strategy’s results right away, but that really cemented my love for the brand, shopper and product.”

From there, Velarde moved onto the product and marketing team as a manager for Barbie global marketing. After a few years, she transitioned to omnichannel retail marketing in the U.S., starting with growth channels and eventually taking responsibility to lead all channels. In her nearly 14-year tenure, Velarde has held nine positions of increasing responsibility within the company, the last five in customer/retail marketing.

For Velarde, change — as well as the biggest business challenges of late — are two factors that motivate her daily. As the retail, media and channel landscapes change, so does the shopper, as evidenced by adult collectors driving growth in the toy business last year. “Even what we think about the traditional shopper is changing,” she notes. “We continue to refi ne our strategy year after year, and although that can be a challenge, it is also what keeps me interested in the role because that’s the kind of thing I love to do.”

Velarde says her “mix of strategy, analytics and product expertise” has been a key component in her success. Priorities today center around making sure that whatever product the company is creating will work at retail. “We are very prescriptive on what we need from both a product and marketing perspective to be able to succeed at retail,” she says, adding that she was instrumental in partnering with Mattel’s global team to change everything it does from a product development perspective.

“We’re undergoing significant changes this year to make sure that our global teams are developing product that makes sense for all channels,” she says. “It sounds simple but it really isn’t.” Data and analytics are the cornerstone in place to help them do just that. “We’re developing products for the channels as compared to developing product and then trying to pitch or sell up to the channels.”

Equally important in her daily work has been the growth of dot-com, which now represents a sizable portion of the company’s business. Along with educating the company on how dot-com works, driving processes and support for it, Velarde is in the process of creating a Center of Excellence.

“We’re refi ning strategy, establishing processes and the goal is to share these processes globally to grow in dot-com because we come from a brick-and-mortar world,” she says. “People often think things in brick and mortar translate exactly into dot-com and they couldn’t be more different, starting with how the shopper shops,” she says, noting that Mattel has made great

Through insights and collaboration, we want to make sure [every retailer sees] Mattel as their premier partner. That requires an understanding of who they are, providing value beyond what they know right now.

strides in its leadership in dot-com within the toy business since these efforts started last year.

Velarde points to mentors Howard Smith, a former shopper marketing executive and her fi rst boss on the commercial side at Mattel; Jason Horowitz, senior vice president and global head of marketing and media, also a former boss; and current boss, Mark McColgan, senior vice president and general manager, USA Commercial, as all having played instrumental roles throughout her career’s progression. She also credits Management Leadership for Tomorrow with helping her navigate graduate school and her early career.

Her data-driven engineering roots have translated well into the marketing space. “Every decision we make from a marketing perspective now can be data-driven,” Velarde says. “I work with fun brands, but to me the most fun part is that there is a wealth of data that we can base our decisions on rather than trying to guess or get creative in any given situation.”

The 2023 “Barbie” movie saw massive success not only in theaters, but also at retail. Velarde says the big win in stores and online came in the form of tailored programs for different retailers. In what she refers to as a “cultural phenomenon,” the retail marketing team worked in close collaboration with its retail partners to think bigger than a theatrical release. “What made it successful is that we played to the strengths of every retailer to really tailor programs for each account,” she says. “We collaborated with retailers for more than two years on programs that really drove ship and POS for us, not just what looked pretty at retail.”

Mattel’s top positioning as a toy company in the U.S. is something Velarde is proud to be a part of, and her mission is to be the No. 1 toy partner at every retailer. But not just in terms of sales: “Through insights and collaboration, we want to make sure they see Mattel as their premier partner,” she says. “That requires an understanding of who they are, providing value beyond what they know right now, and partnering very closely with them.”

Continuing to increase Mattel’s position in dot-com through her work in building the Center of Excellence as well as optimizing the online space every day, investing in retail media and other levers to create the best mix for the shopper, and fi nally, continuing to create the best team possible, are key growth areas for Velarde. “It’s not just about doing marketing in-store anymore,” she says. “My team is driving strategy at retail in partnership with the sales team, and I want to continue to do that as I manage this team.”

TITLE: Vice President of Omnichannel Retail Marketing

COMPANY: Mattel

Team Members: Alicia Crespin, Director, Omnichannel Retail Marketing, Walmart; Liz Buffum, Director, Omnichannel Retail Marketing, Amazon; Lisa Ou, Director, Omnichannel Retail Marketing, Target; Carrie McKenzie, Senior Manager, Space Insights; Nicole Sneider, Senior Manager, Omnichannel Retail Marketing Growth Channels; Laura Campos, Manager, Omnichannel Retail Marketing Licensed Entertainment.

Career Path:

Mattel, Vice President, Omnichannel Retail Marketing (2021-present); Senior Director, Omnichannel Retail Marketing (2020-2021); Senior Director, Customer Marketing: Emerging Channels, Walmart and Target (2018-2020); Director, Customer Marketing, Emerging Channels (2016-2018); Senior Manager, Customer Marketing, Toys ‘R’ Us (2015-2016); Senior Manager, Barbie Global Marketing - Barbie (2014-2015); Manager, Barbie Global Marketing - Barbie (2012-2014); Manager, International Strategic Planning (2011-2012); Senior Associate, International Strategic Planning (2010-2011)

The Boston Consulting Group, Consultant (2008-2010)

Skyworks Solutions Inc., Senior Product Engineer (2004-2006); Product Engineer (1999-2004)

Industry Activities:

Executive Sponsor, Unidos (Mattel Hispanic ERG)

Leader, Executive Women Lean In at Mattel

Member, Chief

Mentor, Wharton Venture Lab Mentoring Initiative

Mentor, Women in Toys

Creator and Co-Lead, Multicultural Night at Jefferson Elementary School

Education: UC Irvine, Bachelor’s, Computer Engineering; Master’s, Electrical Engineering; The Wharton School, Master’s of Business Administration, Strategy and Marketing.

The second part of our annual survey shines the spotlight on retail media, social media, e-commerce, in-store and more.BY TIM BINDER

There’s no denying that retail media has been and continues to be one of the hottest topics in commerce marketing. Look no further than part 2 of this year’s Trends survey to drive that point home.

For the 2024 version of the Path to Purchase Institute’s annual Trends survey, we decided to split our survey into two parts, with the fi rst part dedicated to retail media and the retailer networks (see the January/ February issue). Part 2 would be focused more on the general and traditional trends in commerce marketing, like budgeting and in-store marketing, as well as more futuristic topics such as artificial intelligence.

Well, despite that approach, after poring over the survey results, we felt inclined to bring retail media to the forefront of this report as well.

For part 2 of our survey, we interviewed 80 consumer product marketers from Dec. 19, 2023, through Jan. 22 of this year. More than 40% of respondents identified shopper marketing as their primary job function, with 33% indicating they were at the director level, and 48% at the manager level.

When asked how their organization’s investment in certain areas had changed in 2023 vs. 2022, 70% of respondents said their investment in retailer media networks had increased, the most for any area we identified. Social media (66%), e-commerce content (58%), digital media other than retail media (55%) and insights & analytics (54%) were the other areas most identified as having increased.

Furthermore, when asked to select up to three strategies/tactics from our list that have been most important to their organizations in the last

year, 40% identified retailer media networks. Only e-commerce content (48%) was selected more, while search (SEO/SEM) and social media garnered similar percentages to RMNs.

Asked to explain why they chose their three particular tactics, respondents who selected RMNs offered:

“We’ve invested more in retail media networks, in-store signage and promotion where possible, and digital media in general to increase brand awareness and increase market share.”

“We are investing further into retail media networks as a part of our total sales support package with key retail partners.”

“Increased focus on incrementality/efficiency with ROAS. Increased focus on in-store and retail media networks. Increased focus on profitability.”

And looking ahead to 2024, 29% of respondents said retailer media networks are one of their organization’s top three priorities from a list of tactics, again the most for any area we identified. And once again, e-commerce content, social media and search were the other tactics most prioritized.

Q. How has your organization’s investment (budgetary spend and/or attention) changed for the following areas this year (2023) compared to last year (2022)?

Q. Looking forward to your organization’s investment plans (budgetary spend and/or attention) for 2024, which of the following are the highest priorities? Rank the top three.

Q. What strategies/tactics have been most important to your organization over the last year?

When asked what their biggest business-related concern was heading into 2024, without us suggesting any potential answers, one-tenth of respondents mentioned retail media. “The cost of participating in retailer’s media programs, making my budget stretch as much as I can to drive strong topline sales for our brands,” answered one survey taker.

The impact of inflation on consumer spending was the most common theme among the business-related concern answers, with 34% mentioning that. Among the specific responses:

“Shoppers trading down to lower-price segments within categories, eroding brand loyalty.”

“Trying to drive growth in the current economic climate against significantly better funded competitors.”

The next strategy-related question we asked was if the survey takers were seeing a convergence of the brand and shopper marketing roles/ responsibilities at their organizations. Forty-one percent answered yes, a drop of 15% from when we asked the same question in last year’s survey.